Introduktion

Den här sidan ger en omfattande analys av den kända insiderhandelshistoriken för Daniel R Revers. Insiders är tjänstemän, styrelseledamöter eller betydande investerare i ett företag. Det är olagligt för insiders att göra affärer i sina företag baserat på specifik, icke-offentlig information. Detta betyder inte att det är olagligt för dem att göra några affärer i sina egna företag. De måste dock rapportera alla affärer till SEC via ett formulär 4. Trots dessa restriktioner tyder akademisk forskning på att insiders – i allmänhet – tenderar att överträffa marknaden i sina egna företag.

Genomsnittlig handelslönsamhet

Den genomsnittliga handelslönsamheten är den genomsnittliga avkastningen av alla köp på den öppna marknaden som insidern gjort under de senaste tre åren. För att beräkna detta undersöker vi alla oplanerade köp på öppen marknad som görs av insidern, exklusive alla affärer som markerats som en del av en 10b5-1-handelsplan. Vi beräknar sedan den genomsnittliga prestandan för dessa affärer under 3, 6 och 12 månader, med ett genomsnitt av var och en av dessa varaktigheter för att generera ett slutgiltigt resultatmått för varje affär. Slutligen tar vi ett genomsnitt av alla prestationsmått för att beräkna ett prestationsmått för insidern. Denna lista inkluderar endast insiders som har gjort minst tre affärer under de senaste två åren.

Om lönsamheten för denna insiderhandel är "N/A", så har insidern antingen inte gjort några köp på den öppna marknaden under de senaste tre åren, eller så är affärerna de har gjort för nya för att kunna beräkna ett tillförlitligt resultatmått.

Uppdateringsfrekvens: Dagligen

Företag med rapporterade insiderpositioner

SEC-anmälningarna visar att Daniel R Revers har rapporterat innehav eller affärer i följande företag:

| Värdepapper | Titel | Senaste rapporterade innehav |

|---|---|---|

| US:OPAL / OPAL Fuels Inc. | 10% Owner | 1 776 117 |

| US:PTRA / Proterra Inc | Director, 10% Owner | 7 550 000 |

| US:AMID / EA Series Trust - Argent Mid Cap ETF | Director, 10% Owner | 0 |

| US:ENBL / Enable Midstream Partners LP - Unit | 10% Owner | 43 238 773 |

| US:JPEP / JP Energy Partners LP | Director | 0 |

| US:US89376VAA89 / TransMontaigne Partners Limited Partnership / TLP Finance Corp. | Director, 10% Owner | 3 166 704 |

Hur man tolkar diagrammen

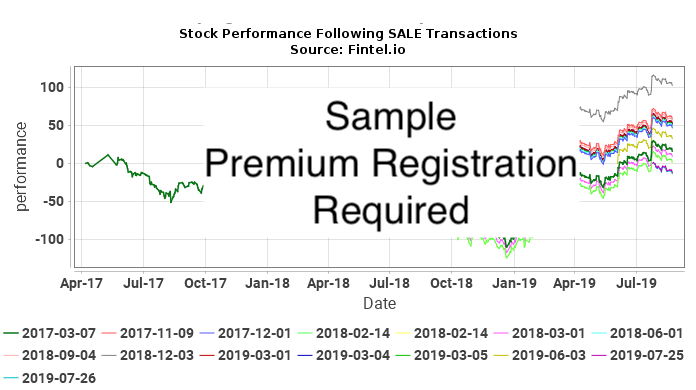

Följande diagram visar aktieutvecklingen för värdepapper efter varje icke-planerad handel på öppen marknad som görs av Daniel R Revers. Icke-planerad handel är affärer som inte gjordes som en del av en 10b5-1-handelsplan. Aktieutvecklingen visas som kumulativ procentuell förändring av aktiekursen. Till exempel, om en insiderhandel gjordes den 1 januari 2019, kommer diagrammet att visa den dagliga procentuella förändringen av värdepapperet fram till idag. Om aktiekursen skulle gå från $10 till $15 under denna tid, skulle den kumulativa procentuella förändringen i aktiekursen vara 50%. En förändring i priset från 10 USD till 20 USD skulle vara 100 % och en prisändring på 10 USD till 5 USD skulle vara -50 %.

I slutändan försöker vi avgöra hur nära insiders affärer korrelerar med överavkastning (positiv eller negativ) i aktiekursen för att se om insidern tar tid för sina affärer att dra nytta av insiderinformation. Tänk på situationen där en insider gjorde detta. I den här situationen förväntar vi oss antingen (a) positiv avkastning efter köp eller (b) negativ avkastning efter försäljning. I fallet med (a) skulle KÖP-diagrammet visa en serie uppåtlutande kurvor, vilket indikerar positiv avkastning efter varje köptransaktion. I fallet med (b) skulle SALE-diagrammet visa en serie nedåtlutande kurvor, vilket indikerar negativ avkastning efter varje försäljningstransaktion.

Detta är dock inte tillräckligt för att dra slutsatser. Om till exempel aktiekursen i bolaget var i en icke-cyklisk stigning under många år, skulle vi förvänta oss att alla tomter efter köpet skulle vara uppåtlutande. Likaså skulle icke-cykliska nedgångar under många år resultera i nedåtlutande post-trade tomter. Inget av dessa diagram skulle tyda på insiderhandel.

Den starkaste indikatorn skulle vara en situation där aktiekursen var extremt cyklisk, och det fanns både positiva signaler i KÖP-diagrammet och negativa plotter på SALE-diagrammet. Denna situation skulle i hög grad tyda på en insider som tog tid för affärer till sin ekonomiska fördel.

Insiderköp AMID / EA Series Trust - Argent Mid Cap ETF - Analys av kortsiktig vinst

I det här avsnittet analyserar vi lönsamheten för varje oplanerat insiderköp på en öppen marknad som görs i AMID / EA Series Trust - Argent Mid Cap ETF. Denna analys hjälper till att förstå om insidern konsekvent genererar onormal avkastning och är värd att följa. Denna analys är för ett år efter varje handel, och resultaten är teoretiska .

Tabellen nedan visar de senaste öppna marknadsköpen som inte var en del av en automatisk handelsplan.

Det justerade prisetär det justerade priset efter split. Justerade aktier er de split-justerade aktier.

Insiderförsäljning - Analys av kortsiktig förlust

I det här avsnittet analyserar vi det kortsiktiga undvikandet av förluster för varje oplanerad insiderförsäljning på öppen marknad som görs i AMID / EA Series Trust - Argent Mid Cap ETF. Ett konsekvent mönster för att undvika förluster kan tyda på att framtida försäljningstransaktioner kan förutsäga prisnedgångar. Denna analys är för ett år efter varje handel, och resultaten är teoretiska .

Följande tabell visar de senaste försäljningarna på den öppna marknaden som inte ingick i en automatisk handelsplan.

| Handelsdatum | Ticker | Insider | Rapporterade aktier |

Rapporterad pris |

Justerade aktier |

Justerat pris |

Kostnadsgrund | Dagar till min |

Pris vid min |

Maximal förlust undvikits ($) |

Maximal förlust undvikits ($) |

|---|---|---|---|---|---|---|---|

| Det finns inga kända oplanerade öppna marknadstransaktioner för denna insider |

Det justerade prisetär det justerade priset efter split. Justerade aktier er de split-justerade aktier.

Insiderköp OPAL / OPAL Fuels Inc. - Analys av kortsiktig vinst

I det här avsnittet analyserar vi lönsamheten för varje oplanerat insiderköp på en öppen marknad som görs i AMID / EA Series Trust - Argent Mid Cap ETF. Denna analys hjälper till att förstå om insidern konsekvent genererar onormal avkastning och är värd att följa. Denna analys är för ett år efter varje handel, och resultaten är teoretiska .

Tabellen nedan visar de senaste öppna marknadsköpen som inte var en del av en automatisk handelsplan.

| Handelsdatum | Ticker | Insider | Rapporterade aktier |

Rapporterad pris |

Justerade aktier |

Justerat pris |

Kostnadsgrund | Dagar till max |

Pris vid max |

Max vinst ($) |

Maximal avkastning (%) |

|---|---|---|---|---|---|---|---|

| Det finns inga kända oplanerade öppna marknadstransaktioner för denna insider |

Det justerade prisetär det justerade priset efter split. Justerade aktier er de split-justerade aktier.

Insiderförsäljning - Analys av kortsiktig förlust

I det här avsnittet analyserar vi det kortsiktiga undvikandet av förluster för varje oplanerad insiderförsäljning på öppen marknad som görs i AMID / EA Series Trust - Argent Mid Cap ETF. Ett konsekvent mönster för att undvika förluster kan tyda på att framtida försäljningstransaktioner kan förutsäga prisnedgångar. Denna analys är för ett år efter varje handel, och resultaten är teoretiska .

Följande tabell visar de senaste försäljningarna på den öppna marknaden som inte ingick i en automatisk handelsplan.

Det justerade prisetär det justerade priset efter split. Justerade aktier er de split-justerade aktier.

Insiderhandelshistorik

Den här tabellen visar den fullständiga listan över insideraffärer gjorda av Daniel R Revers som avslöjats för Securities Exchange Commission (SEC).

| Fildatum | Transaktionsdatum | Schema | Ticker | Värdepapper | Kode | Aktier | Återstående aktier | Procentuell förandring | Aktie pris |

Transaktionsvärde | Återstående värde |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2023-12-19 |

|

4 | OPAL |

OPAL Fuels Inc.

Class A Common Stock |

S - Sale | −838 556 | 1 776 117 | −32,07 | ||||

| 2023-12-19 |

|

4 | OPAL |

OPAL Fuels Inc.

Class A Common Stock |

S - Sale | −661 444 | 619 731 | −51,63 | ||||

| 2023-10-26 |

|

4 | OPAL |

OPAL Fuels Inc.

Class A Common Stock |

J - Other | −47 765 | 2 611 673 | −1,80 | ||||

| 2023-10-19 |

|

4 | OPAL |

OPAL Fuels Inc.

Class A Common Stock |

S - Sale | −11 466 | 386 341 | −2,88 | ||||

| 2023-10-19 |

|

4 | OPAL |

OPAL Fuels Inc.

Class A Common Stock |

S - Sale | −35 213 | 2 273 097 | −1,53 | ||||

| 2023-10-19 |

|

4 | OPAL |

OPAL Fuels Inc.

Class A Common Stock |

S - Sale | −35 213 | 2 273 097 | −1,53 | ||||

| 2023-06-12 |

|

4 | OPAL |

OPAL Fuels Inc.

Class A Common Stock |

S - Sale | −4 402 | 487 776 | −0,89 | ||||

| 2023-06-12 |

|

4 | OPAL |

OPAL Fuels Inc.

Class A Common Stock |

S - Sale | −7 274 | 1 316 388 | −0,55 | ||||

| 2023-06-08 |

|

4 | OPAL |

OPAL Fuels Inc.

Class A Common Stock |

S - Sale | −5 000 | 492 178 | −1,01 | ||||

| 2023-06-08 |

|

4 | OPAL |

OPAL Fuels Inc.

Class A Common Stock |

S - Sale | −10 000 | 1 323 662 | −0,75 | ||||

| 2023-06-08 |

|

4 | OPAL |

OPAL Fuels Inc.

Class A Common Stock |

S - Sale | −3 000 | 497 178 | −0,60 | ||||

| 2023-06-08 |

|

4 | OPAL |

OPAL Fuels Inc.

Class A Common Stock |

S - Sale | −6 000 | 1 333 662 | −0,45 | ||||

| 2022-02-03 |

|

4/A | ACTDU |

ArcLight Clean Transition Corp. II

Class B ordinary shares |

J - Other | −127 174 | 7 639 076 | −1,64 | ||||

| 2021-06-16 |

|

4 | PTRA |

ArcLight Clean Transition Corp.

Warrants |

J - Other | 7 550 000 | 7 550 000 | |||||

| 2021-06-16 |

|

4 | PTRA |

ArcLight Clean Transition Corp.

Class B Ordinary Shares |

C - Conversion | −6 797 500 | 0 | −100,00 | ||||

| 2021-06-16 |

|

4 | PTRA |

ArcLight Clean Transition Corp.

Common Stock |

J - Other | 600 000 | 7 397 072 | 8,83 | ||||

| 2021-06-16 |

|

4 | PTRA |

ArcLight Clean Transition Corp.

Common Stock |

J - Other | −428 | 6 797 072 | −0,01 | ||||

| 2021-06-16 |

|

4 | PTRA |

ArcLight Clean Transition Corp.

Common Stock |

C - Conversion | 6 797 500 | 6 797 500 | |||||

| 2021-05-10 |

|

4 | ACTDU |

ArcLight Clean Transition Corp. II

Class B ordinary shares |

J - Other | −127 174 | 6 920 326 | −1,80 | ||||

| 2020-11-12 |

|

4 | ACTCU |

ArcLight Clean Transition Corp.

Class B ordinary shares |

J - Other | −250 000 | 6 797 500 | −3,55 | ||||

| 2019-07-24 |

|

4 | AMID |

Third Coast Midstream, LLC

Common Units (limited partner interests) |

D - Sale to Issuer | −42 514 126 | 0 | −100,00 | ||||

| 2019-05-15 |

|

4 | AMID |

American Midstream Partners, LP

Series C Convertible Preferred Units |

A - Award | 280 734 | 9 808 777 | 2,95 | 13,98 | 3 924 661 | 137 126 702 | |

| 2019-05-15 |

|

4 | AMID |

American Midstream Partners, LP

Series A-2 Convertible Preferred Units |

A - Award | 102 729 | 4 489 748 | 2,34 | 13,66 | 1 403 278 | 61 329 958 | |

| 2019-05-15 |

|

4 | AMID |

American Midstream Partners, LP

Series A-1 Convertible Preferred Units |

A - Award | 239 779 | 10 479 528 | 2,34 | 13,66 | 3 275 381 | 143 150 352 | |

| 2019-02-19 |

|

4 | AMID |

American Midstream Partners, LP

Series C Convertible Preferred Untis |

A - Award | 272 688 | 9 514 330 | 2,95 | 13,98 | 3 812 178 | 133 010 333 | |

| 2019-02-19 |

|

4 | AMID |

American Midstream Partners, LP

SerieA-2 Convertible Preferred Units |

A - Award | 99 717 | 3 401 875 | 3,02 | 13,66 | 1 362 134 | 46 469 612 | |

| 2019-02-19 |

|

4 | AMID |

American Midstream Partners, LP

Series A-1 Convertible Preferred Units |

A - Award | 232 751 | 7 940 322 | 3,02 | 13,66 | 3 179 379 | 108 464 799 | |

| 2018-12-11 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (limited partner interests) |

A - Award | 810 517 | 15 385 954 | 5,56 | ||||

| 2018-08-17 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (limited partner interests) |

P - Purchase | 2 500 | 14 575 437 | 0,02 | 6,25 | 15 625 | 91 096 481 | |

| 2018-08-17 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (limited partner interests) |

P - Purchase | 595 228 | 14 572 937 | 4,26 | 6,16 | 3 666 604 | 89 769 292 | |

| 2018-02-16 |

|

4 | AMID |

American Midstream Partners, LP

Series C Convertible Preferred Units |

A - Award | 276 195 | 9 241 642 | 3,08 | 13,39 | 3 698 251 | 123 745 586 | |

| 2018-02-16 |

|

4 | AMID |

American Midstream Partners, LP

Series A-2 Convertible Preferred Units |

A - Award | 87 079 | 3 302 158 | 2,71 | 15,23 | 1 326 213 | 50 291 866 | |

| 2018-02-16 |

|

4 | AMID |

American Midstream Partners, LP

Series A-1 Convertible Preferred Units |

A - Award | 203 252 | 7 707 571 | 2,71 | 15,23 | 3 095 528 | 117 386 306 | |

| 2017-11-16 |

|

4 | AMID |

American Midstream Partners, LP

Series C Convertible Preferred Units |

A - Award | 173 242 | 8 965 447 | 1,97 | 13,40 | 2 321 443 | 120 136 990 | |

| 2017-11-16 |

|

4 | AMID |

American Midstream Partners, LP

Series A-2 Convertible Preferred Units |

A - Award | 54 732 | 3 215 079 | 1,73 | 15,24 | 834 116 | 48 997 804 | |

| 2017-11-16 |

|

4 | AMID |

American Midstream Partners, LP

Series A-1 Convertible Preferred Units |

A - Award | 127 751 | 7 504 319 | 1,73 | 15,24 | 1 946 925 | 114 365 822 | |

| 2017-10-04 |

|

4 | AMID |

American Midstream Partners, LP

Series D Convertible Preferred Units |

D - Sale to Issuer | −2 333 333 | 0 | −100,00 | ||||

| 2017-08-22 |

|

4/A | AMID |

American Midstream Partners, LP

Series A-2 Convertible Preferred Units |

J - Other | 41 001 | 3 160 347 | 1,31 | 15,69 | 643 306 | 49 585 844 | |

| 2017-08-22 |

|

4/A | AMID |

American Midstream Partners, LP

Series A-1 Convertible Preferred Units |

J - Other | 95 701 | 7 376 568 | 1,31 | 15,69 | 1 501 549 | 115 738 352 | |

| 2017-08-16 |

|

4 | AMID |

American Midstream Partners, LP

Series A-2 Convertible Preferred Units |

J - Other | 41 001 | 3 160 347 | 1,31 | 15,69 | 643 306 | 49 585 844 | |

| 2017-08-16 |

|

4 | AMID |

American Midstream Partners, LP

Series A-1 Convertible Preferred Units |

J - Other | 95 701 | 7 376 568 | 1,31 | 15,69 | 1 501 549 | 115 738 352 | |

| 2017-07-20 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −4 000 | 43 238 773 | −0,01 | 16,00 | −64 000 | 691 820 368 | |

| 2017-07-05 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −20 526 | 43 242 773 | −0,05 | 16,00 | −328 416 | 691 884 368 | |

| 2017-07-05 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −165 | 43 263 299 | 0,00 | 16,01 | −2 642 | 692 645 417 | |

| 2017-06-30 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −3 879 | 43 263 464 | −0,01 | 16,01 | −62 103 | 692 648 059 | |

| 2017-06-30 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −1 031 | 43 267 343 | 0,00 | 16,01 | −16 506 | 692 710 161 | |

| 2017-05-30 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −2 701 | 43 268 374 | −0,01 | 16,03 | −43 297 | 693 592 035 | |

| 2017-05-30 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −8 289 | 43 271 075 | −0,02 | 16,02 | −132 790 | 693 202 622 | |

| 2017-05-25 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −12 105 | 43 279 364 | −0,03 | 16,22 | −196 343 | 701 991 284 | |

| 2017-05-25 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −18 393 | 43 291 469 | −0,04 | 16,30 | −299 806 | 705 650 945 | |

| 2017-05-23 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −16 283 | 43 309 862 | −0,04 | 16,20 | −263 785 | 701 619 764 | |

| 2017-05-23 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −17 919 | 43 326 145 | −0,04 | 16,17 | −289 750 | 700 583 765 | |

| 2017-05-19 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −10 765 | 43 344 064 | −0,02 | 16,02 | −172 455 | 694 371 905 | |

| 2017-05-19 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −11 810 | 43 354 829 | −0,03 | 16,23 | −191 676 | 703 648 875 | |

| 2017-05-17 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −18 532 | 43 366 639 | −0,04 | 16,41 | −304 110 | 711 646 546 | |

| 2017-05-17 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −10 860 | 43 385 171 | −0,03 | 16,77 | −182 122 | 727 569 318 | |

| 2017-05-16 |

|

4 | AMID |

American Midstream Partners, LP

Series A-2 Convertible Preferred Units |

J - Other | 40 062 | 3 119 346 | 1,30 | 15,70 | 628 973 | 48 973 732 | |

| 2017-05-16 |

|

4 | AMID |

American Midstream Partners, LP

Series A-1 Convertible Preferred Units |

J - Other | 93 509 | 7 280 867 | 1,30 | 15,70 | 1 468 091 | 114 309 612 | |

| 2017-05-15 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −12 067 | 43 396 031 | −0,03 | 16,74 | −202 002 | 726 449 559 | |

| 2017-05-15 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −9 778 | 43 408 098 | −0,02 | 16,81 | −164 368 | 729 690 127 | |

| 2017-05-11 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −19 839 | 43 417 876 | −0,05 | 16,77 | −332 700 | 728 117 781 | |

| 2017-05-11 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −28 968 | 43 437 715 | −0,07 | 16,50 | −477 972 | 716 722 298 | |

| 2017-05-09 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −31 833 | 43 466 683 | −0,07 | 16,42 | −522 698 | 713 722 935 | |

| 2017-05-09 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −20 102 | 43 498 516 | −0,05 | 16,28 | −327 261 | 708 155 840 | |

| 2017-05-05 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −33 566 | 43 518 618 | −0,08 | 16,19 | −543 434 | 704 566 425 | |

| 2017-05-05 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −33 742 | 43 552 184 | −0,08 | 16,27 | −548 982 | 708 594 034 | |

| 2017-03-10 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

J - Other | 9 753 425 | 13 977 709 | 230,89 | ||||

| 2017-03-09 |

|

4 | JPEP |

JP Energy Partners LP

SUBORDINATED UNITS (LIMITED PARTNER INTERESTS) |

D - Sale to Issuer | −14 992 654 | 0 | −100,00 | ||||

| 2017-03-09 |

|

4 | JPEP |

JP Energy Partners LP

COMMON UNITS (LIMITED PARTNER INTERESTS) |

D - Sale to Issuer | −3 674 187 | 0 | −100,00 | ||||

| 2017-02-15 |

|

4 | AMID |

American Midstream Partners, LP

Series A-2 Convertible Preferred Units |

J - Other | 47 742 | 3 079 284 | 1,57 | 15,87 | 757 666 | 48 868 237 | |

| 2017-02-15 |

|

4 | AMID |

American Midstream Partners, LP

Series A-1 Convertible Preferred Units |

J - Other | 111 436 | 7 187 358 | 1,57 | 15,87 | 1 768 489 | 114 063 371 | |

| 2016-12-05 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | 626 304 | 4 224 284 | 17,41 | 14,32 | 8 968 673 | 60 491 747 | |

| 2016-12-01 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −1 424 281 | 43 585 926 | −3,16 | 14,00 | −19 939 934 | 610 202 964 | |

| 2016-11-16 |

|

4 | AMID |

American Midstream Partners, LP

Series C Convertible Preferred Units |

J - Other | 127 737 | 8 792 205 | 1,47 | 13,99 | 1 787 041 | 123 002 948 | |

| 2016-11-16 |

|

4 | AMID |

American Midstream Partners, LP

Series A-2 Convertible Preferred Units |

J - Other | 46 870 | 3 031 542 | 1,57 | 15,92 | 746 170 | 48 262 149 | |

| 2016-11-16 |

|

4 | AMID |

American Midstream Partners, LP

Series A-1 Convertible Preferred Units |

J - Other | 109 399 | 7 075 922 | 1,57 | 15,92 | 1 741 632 | 112 648 678 | |

| 2016-11-07 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −14 198 | 45 010 207 | −0,03 | 14,46 | −205 303 | 650 847 593 | |

| 2016-11-03 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −706 793 | 45 024 405 | −1,55 | 14,49 | −10 241 431 | 652 403 628 | |

| 2016-11-03 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −43 206 | 45 731 198 | −0,09 | 14,48 | −625 623 | 662 187 747 | |

| 2016-11-02 |

|

4 | AMID |

American Midstream Partners, LP

Series D Convertible Preferred Units |

P - Purchase | 2 333 333 | 2 333 333 | 15,00 | 34 999 995 | 34 999 995 | ||

| 2016-11-02 |

|

4 | AMID |

American Midstream Partners, LP

Series C Convertible Preferred Units |

J - Other | 93 039 | 8 664 468 | 1,09 | 14,00 | 1 302 546 | 121 302 552 | |

| 2016-11-02 |

|

4 | AMID |

American Midstream Partners, LP

Series A-2 Convertible Preferred Units |

J - Other | 46 145 | 2 984 672 | 1,57 | 15,94 | 735 551 | 47 575 672 | |

| 2016-11-02 |

|

4 | AMID |

American Midstream Partners, LP

Series A-1 Convertible Preferred Units |

J - Other | 107 708 | 6 966 523 | 1,57 | 15,94 | 1 716 866 | 111 046 377 | |

| 2016-11-01 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −32 710 | 45 774 404 | −0,07 | 14,59 | −477 239 | 667 848 554 | |

| 2016-11-01 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −25 615 | 45 807 114 | −0,06 | 14,89 | −381 407 | 682 067 927 | |

| 2016-10-28 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −10 939 | 45 832 729 | −0,02 | 14,93 | −163 319 | 684 282 644 | |

| 2016-10-28 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −7 537 | 45 843 668 | −0,02 | 15,01 | −113 130 | 688 113 457 | |

| 2016-10-26 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −12 224 | 45 851 205 | −0,03 | 15,07 | −184 216 | 690 977 659 | |

| 2016-10-26 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −24 683 | 45 863 429 | −0,05 | 15,10 | −372 713 | 692 537 778 | |

| 2016-10-24 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −18 689 | 45 888 112 | −0,04 | 15,28 | −285 568 | 701 170 351 | |

| 2016-10-24 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −45 485 | 45 906 801 | −0,10 | 15,49 | −704 563 | 711 096 347 | |

| 2016-10-20 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −21 600 | 45 952 286 | −0,05 | 15,59 | −336 744 | 716 396 139 | |

| 2016-10-20 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −22 319 | 45 973 886 | −0,05 | 15,43 | −344 382 | 709 377 061 | |

| 2016-10-18 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −41 113 | 45 996 205 | −0,09 | 15,18 | −624 095 | 698 222 392 | |

| 2016-10-18 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −10 888 | 46 037 318 | −0,02 | 15,39 | −167 566 | 708 514 324 | |

| 2016-10-17 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −21 506 | 46 048 206 | −0,05 | 15,60 | −335 494 | 718 352 014 | |

| 2016-10-17 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −12 053 | 46 069 712 | −0,03 | 15,70 | −189 232 | 723 294 478 | |

| 2016-10-14 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −21 506 | 46 048 206 | −0,05 | 15,60 | −335 494 | 718 352 014 | |

| 2016-10-14 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −12 053 | 46 069 712 | −0,03 | 15,70 | −189 232 | 723 294 478 | |

| 2016-08-04 |

|

4/A | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −631 221 | 46 545 219 | −1,34 | 14,17 | −8 944 402 | 659 545 753 | |

| 2016-08-04 |

|

4/A | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −32 974 | 47 176 440 | −0,07 | 14,05 | −463 285 | 662 828 982 | |

| 2016-07-25 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −3 473 | 46 048 791 | −0,01 | 14,04 | −48 761 | 646 525 026 | |

| 2016-07-25 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −21 139 | 46 052 264 | −0,05 | 14,30 | −302 288 | 658 547 375 | |

| 2016-07-21 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −100 652 | 46 073 403 | −0,22 | 14,33 | −1 442 343 | 660 231 865 | |

| 2016-07-21 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −26 009 | 46 174 055 | −0,06 | 14,55 | −378 431 | 671 832 500 | |

| 2016-07-19 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −17 081 | 46 200 064 | −0,04 | 14,59 | −249 212 | 674 058 934 | |

| 2016-07-19 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −8 269 | 46 217 145 | −0,02 | 14,61 | −120 810 | 675 232 488 | |

| 2016-07-15 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −31 799 | 46 225 414 | −0,07 | 14,73 | −468 399 | 680 900 348 | |

| 2016-07-15 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −22 686 | 46 257 213 | −0,05 | 14,68 | −333 030 | 679 055 887 | |

| 2016-07-13 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −73 216 | 46 279 899 | −0,16 | 14,88 | −1 089 454 | 688 644 897 | |

| 2016-07-13 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −44 509 | 46 353 115 | −0,10 | 14,23 | −633 363 | 659 604 826 | |

| 2016-06-24 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −38 704 | 46 397 624 | −0,08 | 14,08 | −544 952 | 653 278 546 | |

| 2016-06-24 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −4 200 | 46 436 328 | −0,01 | 14,00 | −58 800 | 650 108 592 | |

| 2016-06-22 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −21 521 | 46 440 528 | −0,05 | 14,02 | −301 724 | 651 096 203 | |

| 2016-06-22 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −50 196 | 46 462 049 | −0,11 | 14,18 | −711 779 | 658 831 855 | |

| 2016-06-20 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −631 221 | 46 512 245 | −1,34 | 14,17 | −8 944 402 | 659 078 512 | |

| 2016-06-20 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −65 948 | 47 143 466 | −0,14 | 14,05 | −926 569 | 662 365 697 | |

| 2016-06-16 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −4 158 | 47 209 414 | −0,01 | 14,01 | −58 254 | 661 403 890 | |

| 2016-06-16 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −3 923 | 47 213 572 | −0,01 | 14,11 | −55 354 | 666 183 501 | |

| 2016-06-14 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −45 444 | 47 217 495 | −0,10 | 14,22 | −646 214 | 671 432 779 | |

| 2016-06-14 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −73 701 | 47 262 939 | −0,16 | 14,34 | −1 056 872 | 677 750 545 | |

| 2016-06-10 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −66 753 | 47 336 640 | −0,14 | 14,43 | −963 246 | 683 067 715 | |

| 2016-06-10 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −87 017 | 47 403 393 | −0,18 | 15,25 | −1 327 009 | 722 901 743 | |

| 2016-06-10 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −163 975 | 47 490 410 | −0,34 | 14,47 | −2 372 718 | 687 186 233 | |

| 2016-06-08 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −51 331 | 47 654 385 | −0,11 | 15,93 | −817 703 | 759 134 353 | |

| 2016-06-08 |

|

4 | ENBL |

Enable Midstream Partners, LP

Common Units representing limited partners interests |

S - Sale | −72 014 | 47 705 716 | −0,15 | 16,11 | −1 160 146 | 768 539 085 | |

| 2016-05-17 |

|

4 | AMID |

American Midstream Partners, LP

Series A-2 Convertible Preferred Units |

J - Other | 89 371 | 2 938 527 | 3,14 | 15,94 | 1 424 574 | 46 840 120 | |

| 2016-05-17 |

|

4 | AMID |

American Midstream Partners, LP

Series A-1 Convertible Preferred Units |

J - Other | 208 601 | 6 858 815 | 3,14 | 15,94 | 3 325 100 | 109 329 511 | |

| 2016-04-27 |

|

4 | AMID |

American Midstream Partners, LP

Warrant |

P - Purchase | 800 000 | 800 000 | |||||

| 2016-04-27 |

|

4 | AMID |

American Midstream Partners, LP

Series C Convertible Preferred Units |

P - Purchase | 8 571 429 | 8 571 429 | 14,00 | 120 000 006 | 120 000 006 | ||

| 2016-04-06 |

|

4 | TLP |

TransMontaigne Partners L.P.

Common Units representing limited partner interests |

P - Purchase | 3 166 704 | 3 166 704 | 35,50 | 112 417 992 | 112 417 992 | ||

| 2016-02-24 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | X | 300 | 3 597 980 | 0,01 | 5,98 | 1 794 | 21 515 920 |

| 2016-02-16 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | X | 112 000 | 3 566 809 | 3,24 | 5,93 | 664 160 | 21 151 177 |

| 2016-02-16 |

|

4/A | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | X | 112 000 | 3 597 680 | 3,21 | 5,93 | 664 160 | 21 334 242 |

| 2016-02-10 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | X | 30 871 | 3 458 680 | 0,90 | 6,04 | 186 461 | 20 890 427 |

| 2016-02-10 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | X | 94 626 | 3 454 809 | 2,82 | 6,29 | 595 198 | 21 730 749 |

| 2016-02-10 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | X | 90 943 | 3 360 183 | 2,78 | 6,93 | 630 235 | 23 286 068 |

| 2016-02-03 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | X | 1 | 3 269 240 | 0,00 | 7,75 | 8 | 25 336 610 |

| 2016-02-03 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | X | 77 974 | 3 269 239 | 2,44 | 7,36 | 573 889 | 24 061 599 |

| 2016-02-03 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | X | 117 900 | 3 191 265 | 3,84 | 7,74 | 912 546 | 24 700 391 |

| 2016-02-01 |

|

4 | AMID |

American Midstream Partners, LP

Series B Convertible Preferred Units |

C - Conversion | −1 349 609 | 0 | −100,00 | ||||

| 2016-02-01 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

C - Conversion | 1 349 609 | 3 073 365 | 78,29 | ||||

| 2016-02-01 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | X | 108 600 | 1 723 756 | 6,72 | 8,10 | 879 660 | 13 962 424 |

| 2016-01-28 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | X | 108 600 | 1 615 156 | 7,21 | 7,64 | 829 704 | 12 339 792 |

| 2016-01-28 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | X | 108 600 | 1 506 556 | 7,77 | 7,32 | 794 952 | 11 027 990 |

| 2016-01-28 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | X | 108 600 | 1 397 956 | 8,42 | 6,70 | 727 620 | 9 366 305 |

| 2016-01-08 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | 103 763 | 1 289 356 | 8,75 | 8,03 | 833 217 | 10 353 529 | |

| 2016-01-08 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | 194 700 | 1 185 593 | 19,65 | 8,08 | 1 573 176 | 9 579 591 | |

| 2016-01-08 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | 194 700 | 990 893 | 24,45 | 7,99 | 1 555 653 | 7 917 235 | |

| 2016-01-06 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | 86 200 | 796 193 | 12,14 | 7,69 | 662 878 | 6 122 724 | |

| 2016-01-06 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | 16 000 | 709 993 | 2,31 | 8,02 | 128 320 | 5 694 144 | |

| 2015-12-23 |

|

4 | AMID |

American Midstream Partners, LP

Common Units (Limited Partner Interests) |

P - Purchase | 75 072 | 693 993 | 12,13 | 5,79 | 434 667 | 4 018 219 | |

| 2015-11-17 |

|

4 | AMID |

American Midstream Partners, LP

Series B Convertible Preferred Units |

J - Other | 24 384 | 1 349 609 | 1,84 | ||||

| 2015-11-17 |

|

4 | AMID |

American Midstream Partners, LP

Series A-2 Convertible Preferred Units |

J - Other | 84 018 | 2 762 503 | 3,14 | ||||

| 2015-11-17 |

|

4 | AMID |

American Midstream Partners, LP

Series A-1 Convertible Preferred Units |

J - Other | 196 106 | 6 447 957 | 3,14 | ||||

| 2015-09-17 |

|

4 | AMID |

American Midstream Partners, LP

Common Units |

J - Other | 618 921 | 618 921 | 11,31 | 6 999 997 | 6 999 997 | ||

| 2015-08-18 |

|

4 | AMID |

American Midstream Partners, LP

Series B Convertible Preferred Units |

J - Other | 23 943 | 1 325 225 | 1,84 | 17,50 | 419 002 | 23 191 438 | |

| 2015-08-18 |

|

4 | AMID |

American Midstream Partners, LP

Series A-2 Convertible Preferred Units |

J - Other | 74 402 | 2 678 485 | 2,86 | 17,50 | 1 302 035 | 46 873 488 | |

| 2015-08-18 |

|

4 | AMID |

American Midstream Partners, LP

Series A-1 Convertible Preferred Units |

J - Other | 173 663 | 6 251 851 | 2,86 | 17,50 | 3 039 102 | 109 407 392 | |

| 2015-07-02 |

|

4 | AMID |

American Midstream Partners, LP

Series A-2 Convertible Preferred Units |

J - Other | 1 428 572 | 2 604 083 | 121,53 | 17,50 | 25 000 010 | 45 571 452 | |

| 2015-05-19 |

|

4 | AMID |

American Midstream Partners, LP

Series B Convertible Preferred Units |

J - Other | 23 510 | 1 301 282 | 1,84 | ||||

| 2015-05-19 |

|

4 | AMID |

American Midstream Partners, LP

Series A-2 Convertible Preferred Units |

J - Other | 32 653 | 1 175 511 | 2,86 | ||||

| 2015-05-19 |

|

4 | AMID |

American Midstream Partners, LP

Series A-1 Convertible Preferred Units |

J - Other | 168 839 | 6 078 188 | 2,86 | ||||

| 2015-04-01 |

|

4 | AMID |

American Midstream Partners, LP

Series A-2 Convertible Preferred Units |

P - Purchase | 1 142 858 | 1 142 858 | 17,50 | 20 000 015 | 20 000 015 | ||

| 2015-02-17 |

|

4 | AMID |

American Midstream Partners, LP

Series B Convertible Preferred Units |

J - Other | 23 086 | 1 277 772 | 1,84 | ||||

| 2015-02-17 |

|

4 | AMID |

American Midstream Partners, LP

Series A Convertible Preferred Units |

J - Other | 164 149 | 5 909 349 | 2,86 | ||||

| 2014-11-14 |

|

4 | AMID |

American Midstream Partners, LP

Series B Convertible Preferred Units |

J - Other | 22 669 | 1 254 686 | 1,84 | ||||

| 2014-11-14 |

|

4 | AMID |

American Midstream Partners, LP

Series A Convertible Preferred Units |

J - Other | 159 589 | 5 745 200 | 2,86 | ||||

| 2014-11-14 |

|

4 | AMID |

American Midstream Partners, LP

Series B Convertible Preferred Units |

J - Other | 21 796 | 1 232 017 | 1,80 | ||||

| 2014-11-14 |

|

4 | AMID |

American Midstream Partners, LP

Series A Convertible Preferred Units |

J - Other | 155 156 | 5 585 611 | 2,86 | ||||

| 2014-11-14 |

|

4 | AMID |

American Midstream Partners, LP

Series B Convertible Preferred Units |

J - Other | 21 411 | 1 210 221 | 1,80 | ||||

| 2014-11-14 |

|

4 | AMID |

American Midstream Partners, LP

Series A Convertible Preferred Units |

J - Other | 76 485 | 5 430 455 | 1,43 | ||||

| 2014-11-14 |

|

4 | AMID |

American Midstream Partners, LP

Series B Convertible Preferred Units |

J - Other | 20 585 | 1 188 810 | 1,76 | ||||

| 2014-11-14 |

|

4 | AMID |

American Midstream Partners, LP

Series A Convertible Preferred Units |

J - Other | 75 408 | 5 353 970 | 1,43 | ||||

| 2014-11-14 |

|

4 | AMID |

American Midstream Partners, LP

Series B Convertible Preferred Units |

A - Award | 1 168 225 | 1 168 225 | |||||

| 2014-11-14 |

|

4 | AMID |

American Midstream Partners, LP

Series A Convertible Preferred Units |

J - Other | 74 356 | 5 278 562 | 1,43 | ||||

| 2014-11-14 |

|

4 | AMID |

American Midstream Partners, LP

Series A Convertible Preferred Units |

J - Other | 61 359 | 5 204 216 | 1,19 | ||||

| 2014-11-14 |

|

4 | AMID |

American Midstream Partners, LP

Subordinated Units |

D - Sale to Issuer | −4 526 066 | 0 | −100,00 | ||||

| 2014-10-08 |

|

4 | JPEP |

JP Energy Partners LP

SUBORDINATED UNITS (LIMITED PARTNER INTERESTS) |

C - Conversion | 649 921 | 649 921 | |||||

| 2014-10-08 |

|

4 | JPEP |

JP Energy Partners LP

SUBORDINATED UNITS (LIMITED PARTNER INTERESTS) |

C - Conversion | 14 342 733 | 14 342 733 | |||||

| 2014-10-08 |

|

4 | JPEP |

JP Energy Partners LP

SERIES D PREFERRED UNITS (LIMITED PARTNER INTERESTS) |

C - Conversion | −1 928 909 | 0 | −100,00 | ||||

| 2014-10-08 |

|

4 | JPEP |

JP Energy Partners LP

COMMON UNITS (LIMITED PARTNER INTERESTS) |

C - Conversion | 159 273 | 159 273 | |||||

| 2014-10-08 |

|

4 | JPEP |

JP Energy Partners LP

CLASS A COMMON (LIMITED PARTNER INTERESTS) |

C - Conversion | −809 195 | 0 | −100,00 | ||||

| 2014-10-08 |

|

4 | JPEP |

JP Energy Partners LP

COMMON UNITS (LIMITED PARTNER INTERESTS) |

C - Conversion | 3 514 914 | 3 514 914 | |||||

| 2014-10-08 |

|

4 | JPEP |

JP Energy Partners LP

CLASS C COMMON (LIMITED PARTNER INTERESTS) |

C - Conversion | −37 615 | 0 | −100,00 | ||||

| 2014-10-08 |

|

4 | JPEP |

JP Energy Partners LP

CLASS A COMMON (LIMITED PARTNER INTERESTS) |

C - Conversion | −17 820 028 | 0 | −100,00 | ||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS A COMMON UNITS (LIMITED PARTNER INTERESTS) |

40 987 130 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS A COMMON UNITS (LIMITED PARTNER INTERESTS) |

21 878 192 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS C COMMON UNITS (LIMITED PARTNER INTERESTS) |

21 011 446 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS A COMMON UNITS (LIMITED PARTNER INTERESTS) |

40 987 130 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS A COMMON UNITS (LIMITED PARTNER INTERESTS) |

21 878 192 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS C COMMON UNITS (LIMITED PARTNER INTERESTS) |

21 011 446 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS A COMMON UNITS (LIMITED PARTNER INTERESTS) |

40 987 130 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS A COMMON UNITS (LIMITED PARTNER INTERESTS) |

21 878 192 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS C COMMON UNITS (LIMITED PARTNER INTERESTS) |

21 011 446 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS A COMMON UNITS (LIMITED PARTNER INTERESTS) |

40 987 130 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS A COMMON UNITS (LIMITED PARTNER INTERESTS) |

21 878 192 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS C COMMON UNITS (LIMITED PARTNER INTERESTS) |

21 011 446 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS A COMMON UNITS (LIMITED PARTNER INTERESTS) |

40 987 130 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS A COMMON UNITS (LIMITED PARTNER INTERESTS) |

21 878 192 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS C COMMON UNITS (LIMITED PARTNER INTERESTS) |

21 011 446 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS A COMMON UNITS (LIMITED PARTNER INTERESTS) |

40 987 130 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS A COMMON UNITS (LIMITED PARTNER INTERESTS) |

21 878 192 | ||||||||

| 2014-10-01 | 3 | JPEP |

JP Energy Partners LP

CLASS C COMMON UNITS (LIMITED PARTNER INTERESTS) |

21 011 446 |