Unusual Put Option Trade in Day One Biopharmaceuticals (DAWN) Worth $116.90K

On May 8, 2023 at 13:13:16 ET an unusually large $116.90K block of Put contracts in Day One Biopharmaceuticals (DAWN) was bought, with a strike price of $12.50 / share, expiring in 39 day(s) (on June 16, 2023).

This trade was first picked up on Fintel's real time Options Flow tool, where unusual option trades are highlighted.

What is the Fund Sentiment?

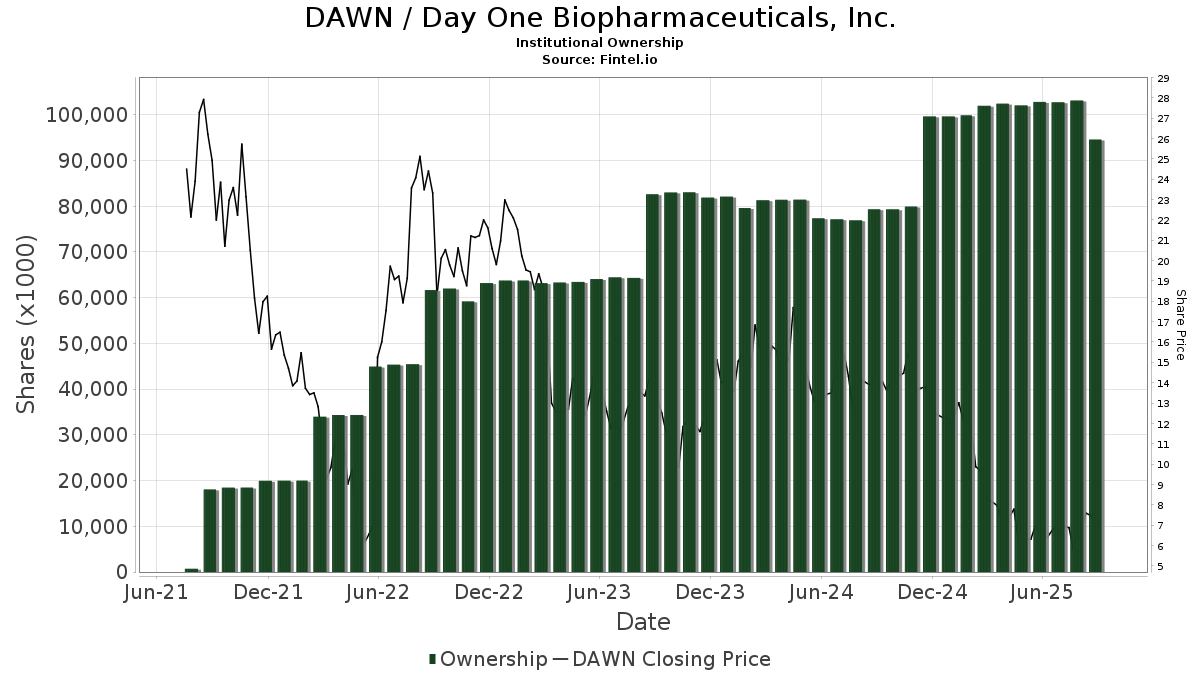

There are 288 funds or institutions reporting positions in Day One Biopharmaceuticals.

This is an increase

of

32

owner(s) or 12.50% in the last quarter.

Average portfolio weight of all funds dedicated to DAWN is 0.28%,

a decrease

of 6.00%.

Total shares owned by institutions increased

in the last three months by 7.05% to 63,475K shares.

The put/call ratio of DAWN is 0.10, indicating a

bullish

outlook.

The put/call ratio of DAWN is 0.10, indicating a

bullish

outlook.

Analyst Price Forecast Suggests 219.79% Upside

As of April 24, 2023, the average one-year price target for Day One Biopharmaceuticals is 43.75. The forecasts range from a low of 34.34 to a high of $67.20. The average price target represents an increase of 219.79% from its latest reported closing price of 13.68.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Day One Biopharmaceuticals is 1MM. The projected annual non-GAAP EPS is -2.24.

What are Other Shareholders Doing?

Atlas Venture Life Science Advisors holds 7,568K shares representing 10.29% ownership of the company. In it's prior filing, the firm reported owning 8,169K shares, representing a decrease of 7.94%. The firm increased its portfolio allocation in DAWN by 8.64% over the last quarter.

Ra Capital Management holds 7,041K shares representing 9.57% ownership of the company. No change in the last quarter.

Adage Capital Partners Gp, L.l.c. holds 3,300K shares representing 4.49% ownership of the company. In it's prior filing, the firm reported owning 3,040K shares, representing an increase of 7.88%. The firm increased its portfolio allocation in DAWN by 12.49% over the last quarter.

Canaan Partners XI holds 2,548K shares representing 3.46% ownership of the company. No change in the last quarter.

Franklin Resources holds 2,473K shares representing 3.36% ownership of the company. In it's prior filing, the firm reported owning 2,477K shares, representing a decrease of 0.16%. The firm increased its portfolio allocation in DAWN by 2.32% over the last quarter.

Day One Biopharmaceuticals Background Information

(This description is provided by the company.)

Day One Biopharmaceuticals is a clinical-stage biopharmaceutical company dedicated to developing and commercializing targeted therapies for patients of all ages with genomically defined cancers. Day One was founded to address a critical unmet need: children with cancer are being left behind in a cancer drug development revolution. Its name was inspired by the “The Day One Talk”1 that physicians have with patients and their families about an initial cancer diagnosis and treatment plan. The company aims to re-envision cancer drug development and redefine what’s possible for all people living with cancer—regardless of age—starting from Day One. Day One partners with leading clinical oncologists, families, and scientists to identify, acquire, and develop important emerging cancer treatments. The Company’s lead product candidate, DAY101, is an oral, highly-selective type II pan-RAF kinase inhibitor, and is being evaluated in a pivotal Phase 2 clinical trial (FIREFLY-1) in pediatric, adolescent and young adult patients with recurrent or progressive low-grade glioma (pLGG). The Company’s pipeline also includes the investigational agent pimasertib, a clinical-stage, oral, small molecule found to selectively inhibit mitogen-activated protein kinase kinases 1 and 2 (MEK). Through Day One and its collaborators, cancer drug development comes of age. Day One is based in South San Francisco.

See all Day One Biopharmaceuticals regulatory filings.