TD Cowen Initiates Coverage of Markel Group (MKL) with Buy Recommendation

Fintel reports that on July 9, 2024, TD Cowen initiated coverage of Markel Group (NYSE:MKL) with a Buy recommendation.

Analyst Price Forecast Suggests 5.78% Upside

As of July 3, 2024, the average one-year price target for Markel Group is $1,640.50/share. The forecasts range from a low of $1,449.35 to a high of $1,837.50. The average price target represents an increase of 5.78% from its latest reported closing price of $1,550.81 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Markel Group is 14,533MM, a decrease of 12.59%. The projected annual non-GAAP EPS is 90.57.

What is the Fund Sentiment?

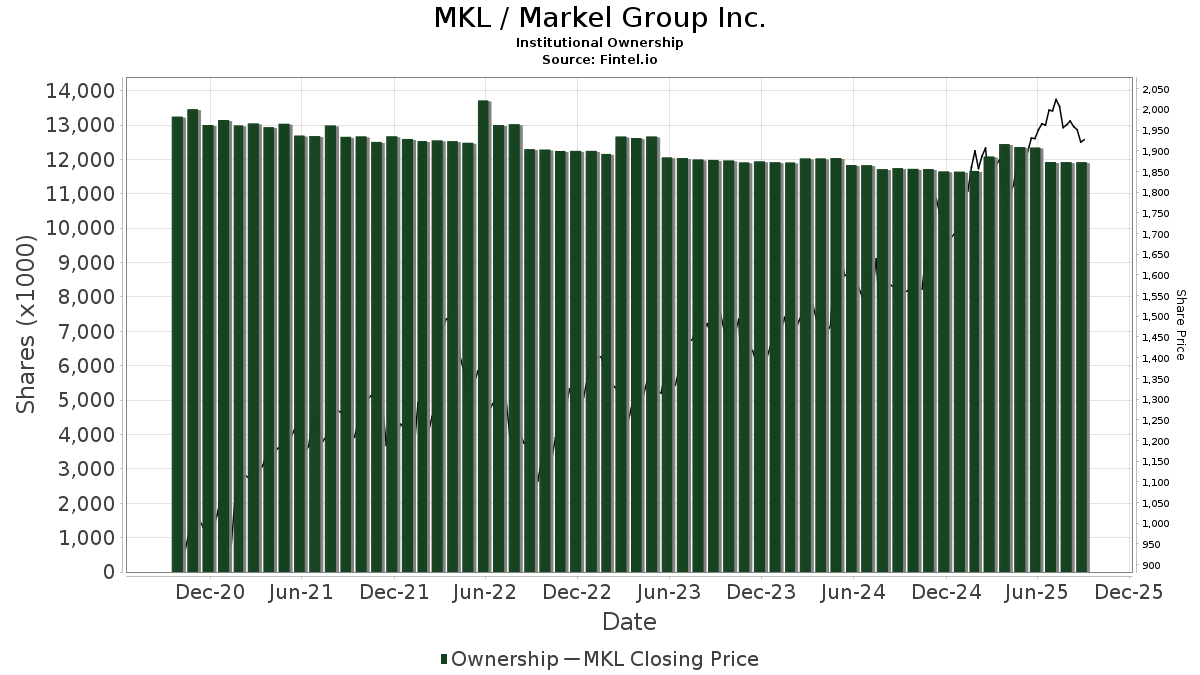

There are 1,161 funds or institutions reporting positions in Markel Group.

This is an decrease of 6 owner(s) or 0.51% in the last quarter.

Average portfolio weight of all funds dedicated to MKL is 0.47%, an increase of 7.76%.

Total shares owned by institutions decreased in the last three months by 0.87% to 11,832K shares.

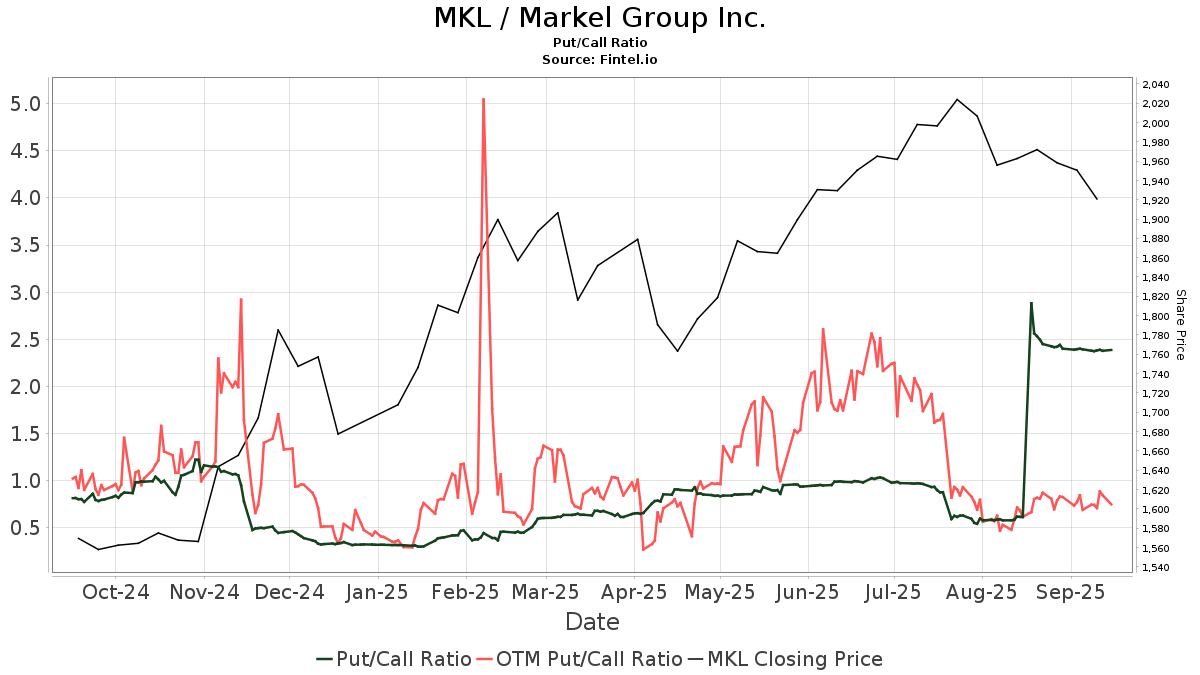

The put/call ratio of MKL is 1.96, indicating a

bearish outlook.

The put/call ratio of MKL is 1.96, indicating a

bearish outlook.

What are Other Shareholders Doing?

Principal Financial Group holds 561K shares representing 4.32% ownership of the company. In its prior filing, the firm reported owning 565K shares , representing a decrease of 0.55%. The firm decreased its portfolio allocation in MKL by 1.77% over the last quarter.

PMSBX - MidCap Fund (f holds 417K shares representing 3.21% ownership of the company. In its prior filing, the firm reported owning 415K shares , representing an increase of 0.54%. The firm decreased its portfolio allocation in MKL by 6.59% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 392K shares representing 3.02% ownership of the company. In its prior filing, the firm reported owning 394K shares , representing a decrease of 0.56%. The firm decreased its portfolio allocation in MKL by 2.85% over the last quarter.

Davis Selected Advisers holds 286K shares representing 2.20% ownership of the company. In its prior filing, the firm reported owning 301K shares , representing a decrease of 5.07%. The firm increased its portfolio allocation in MKL by 1.15% over the last quarter.

Baillie Gifford holds 273K shares representing 2.10% ownership of the company. In its prior filing, the firm reported owning 290K shares , representing a decrease of 6.36%. The firm decreased its portfolio allocation in MKL by 1.11% over the last quarter.

Markel Background Information

(This description is provided by the company.)

Markel Corporation is a diverse financial holding company serving a variety of niche markets. The Company's principal business markets and underwrites specialty insurance products. In each of the Company's businesses, it seeks to provide quality products and excellent customer service so that it can be a market leader. The financial goals of the Company are to earn consistent underwriting and operating profits and superior investment returns to build shareholder value.