Synchronoss Technologies (SNCR) Price Target Decreased by 16.98% to 22.44

The average one-year price target for Synchronoss Technologies (NasdaqCM:SNCR) has been revised to $22.44 / share. This is a decrease of 16.98% from the prior estimate of $27.03 dated August 30, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $13.13 to a high of $42.00 / share. The average price target represents an increase of 285.57% from the latest reported closing price of $5.82 / share.

What is the Fund Sentiment?

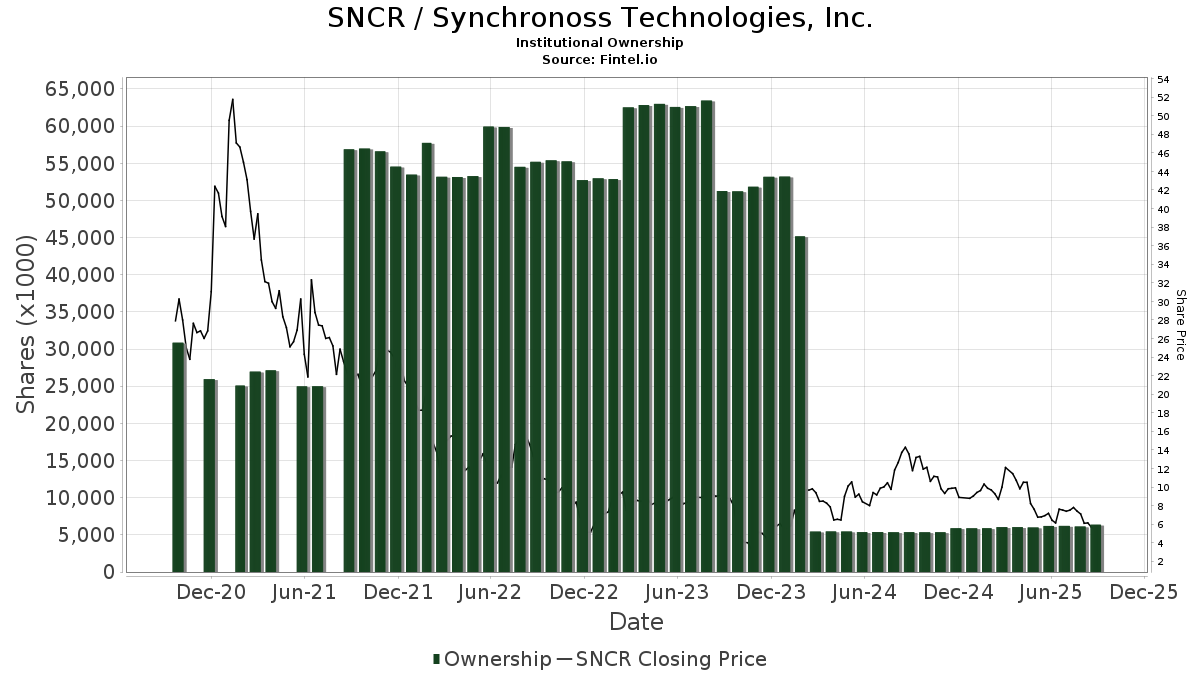

There are 135 funds or institutions reporting positions in Synchronoss Technologies.

This is an increase of 32 owner(s) or 31.07% in the last quarter.

Average portfolio weight of all funds dedicated to SNCR is 0.11%, an increase of 62.20%.

Total shares owned by institutions increased in the last three months by 2.72% to 6,365K shares.

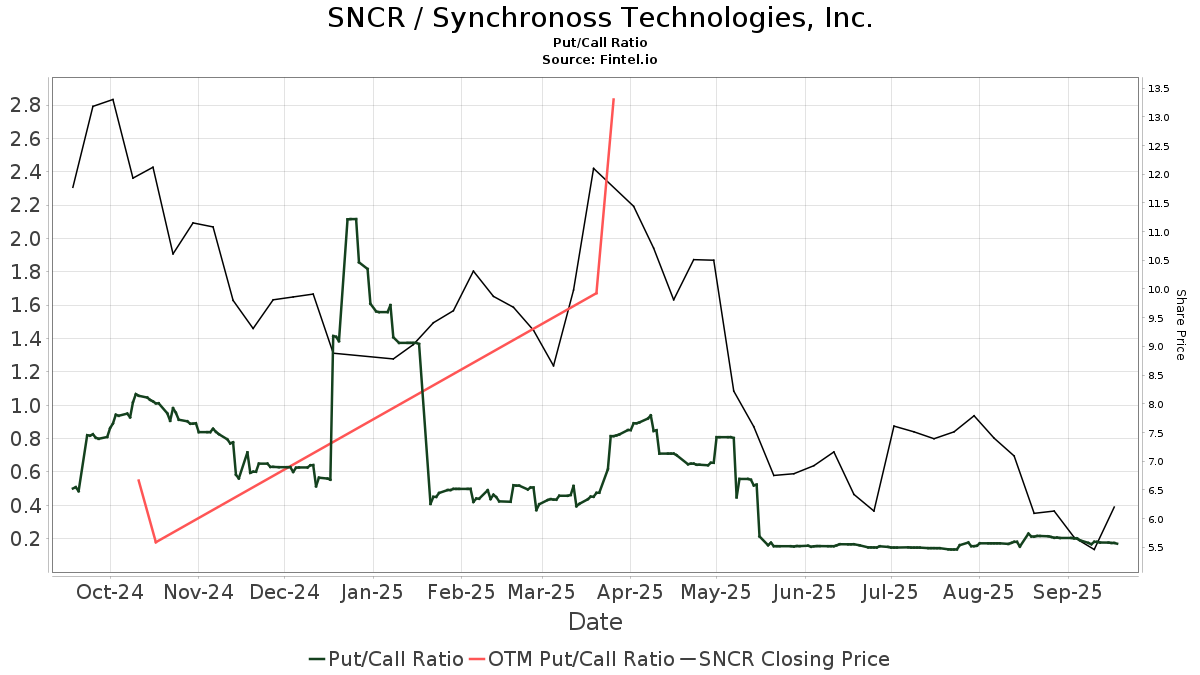

The put/call ratio of SNCR is 0.18, indicating a

bullish outlook.

The put/call ratio of SNCR is 0.18, indicating a

bullish outlook.

What are Other Shareholders Doing?

180 Degree Capital holds 867K shares representing 8.04% ownership of the company. In its prior filing, the firm reported owning 855K shares , representing an increase of 1.38%. The firm decreased its portfolio allocation in SNCR by 41.27% over the last quarter.

Allspring Global Investments Holdings holds 541K shares representing 5.02% ownership of the company. In its prior filing, the firm reported owning 547K shares , representing a decrease of 1.09%. The firm decreased its portfolio allocation in SNCR by 41.83% over the last quarter.

AWM Investment holds 466K shares representing 4.32% ownership of the company. In its prior filing, the firm reported owning 451K shares , representing an increase of 3.26%. The firm decreased its portfolio allocation in SNCR by 47.06% over the last quarter.

ESPAX - Wells Fargo Special Small Cap Value Fund holds 423K shares representing 3.92% ownership of the company. In its prior filing, the firm reported owning 428K shares , representing a decrease of 1.18%. The firm decreased its portfolio allocation in SNCR by 34.21% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 276K shares representing 2.56% ownership of the company. No change in the last quarter.