Siemens Energy (XTRA:ENR) Price Target Increased by 15.06% to 74.64

The average one-year price target for Siemens Energy (XTRA:ENR) has been revised to 74,64 € / share. This is an increase of 15.06% from the prior estimate of 64,87 € dated May 4, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 37,37 € to a high of 107,62 € / share. The average price target represents a decrease of 12.83% from the latest reported closing price of 85,62 € / share.

Siemens Energy Maintains 0.12% Dividend Yield

At the most recent price, the company’s dividend yield is 0.12%.

Additionally, the company’s dividend payout ratio is 0.40. The payout ratio tells us how much of a company’s income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company’s income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company has not increased its dividend in the last three years.

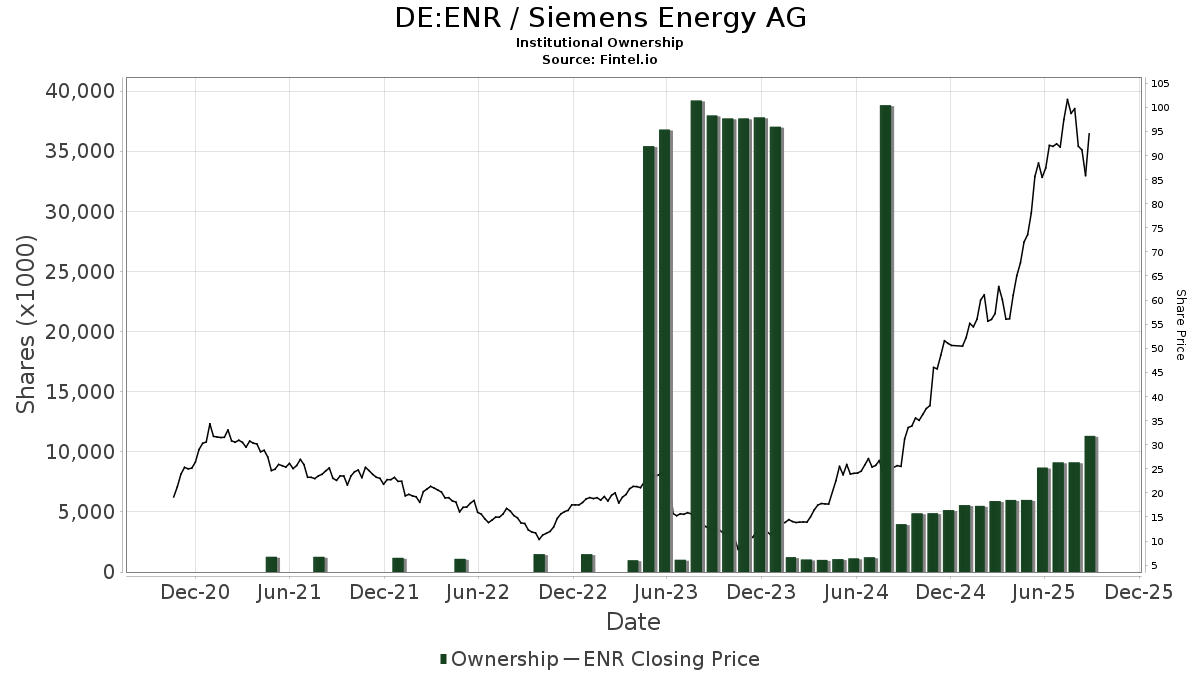

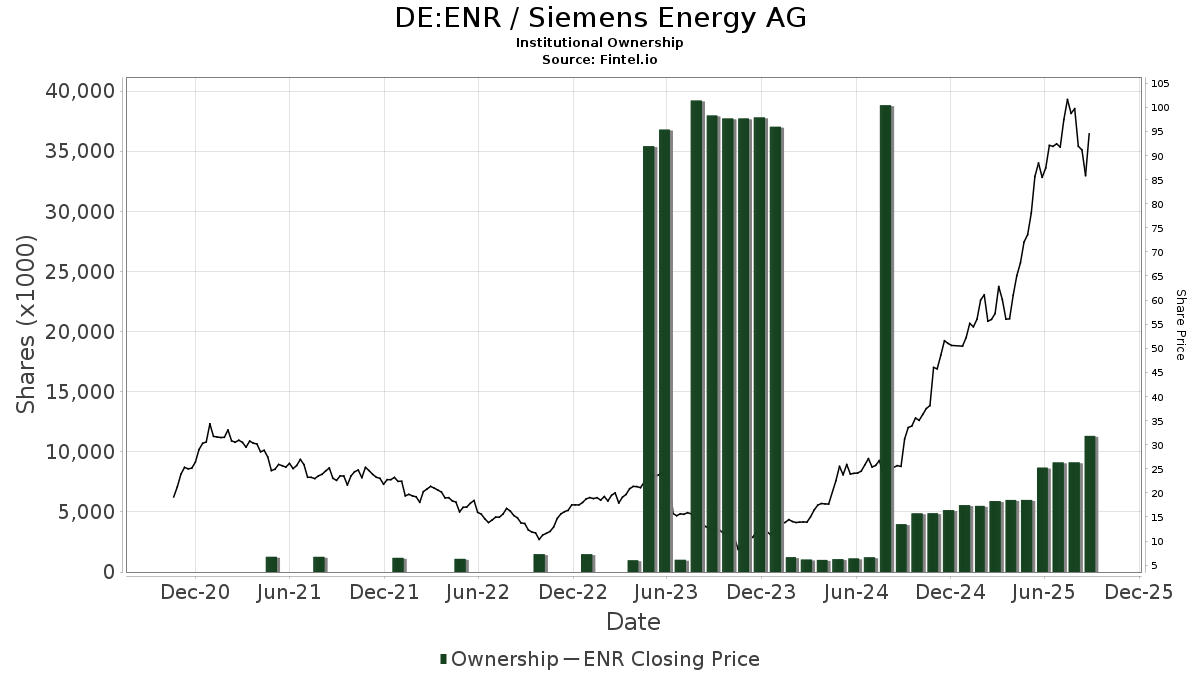

What is the Fund Sentiment?

There are 41 funds or institutions reporting positions in Siemens Energy. This is an increase of 7 owner(s) or 20.59% in the last quarter. Average portfolio weight of all funds dedicated to ENR is 0.74%, an increase of 81.94%. Total shares owned by institutions increased in the last three months by 47.10% to 8,678K shares.

What are Other Shareholders Doing?

BBIEX - Bridge Builder International Equity Fund holds 1,795K shares representing 0.23% ownership of the company. In its prior filing, the firm reported owning 1,471K shares , representing an increase of 18.05%. The firm increased its portfolio allocation in ENR by 30.34% over the last quarter.

JOHIX - JOHCM International Select Fund Institutional Shares holds 1,444K shares representing 0.18% ownership of the company.

TCIEX - TIAA-CREF International Equity Index Fund Institutional Class holds 1,069K shares representing 0.14% ownership of the company. In its prior filing, the firm reported owning 1,038K shares , representing an increase of 2.98%. The firm increased its portfolio allocation in ENR by 39.92% over the last quarter.

CIUEX - Six Circles International Unconstrained Equity Fund holds 862K shares representing 0.11% ownership of the company. In its prior filing, the firm reported owning 842K shares , representing an increase of 2.34%. The firm increased its portfolio allocation in ENR by 2.35% over the last quarter.

QCSTRX - Stock Account Class R1 holds 731K shares representing 0.09% ownership of the company. In its prior filing, the firm reported owning 785K shares , representing a decrease of 7.38%. The firm increased its portfolio allocation in ENR by 9.36% over the last quarter.