Oppenheimer Initiates Coverage of Pulse Biosciences (PLSE) with Outperform Recommendation

Fintel reports that on July 7, 2025, Oppenheimer initiated coverage of Pulse Biosciences (NasdaqCM:PLSE) with a Outperform recommendation.

Analyst Price Forecast Suggests 74.21% Downside

As of March 27, 2023, the average one-year price target for Pulse Biosciences is $4.08/share. The forecasts range from a low of $3.03 to a high of $5.25. The average price target represents a decrease of 74.21% from its latest reported closing price of $15.82 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual non-GAAP EPS is -1.08.

What is the Fund Sentiment?

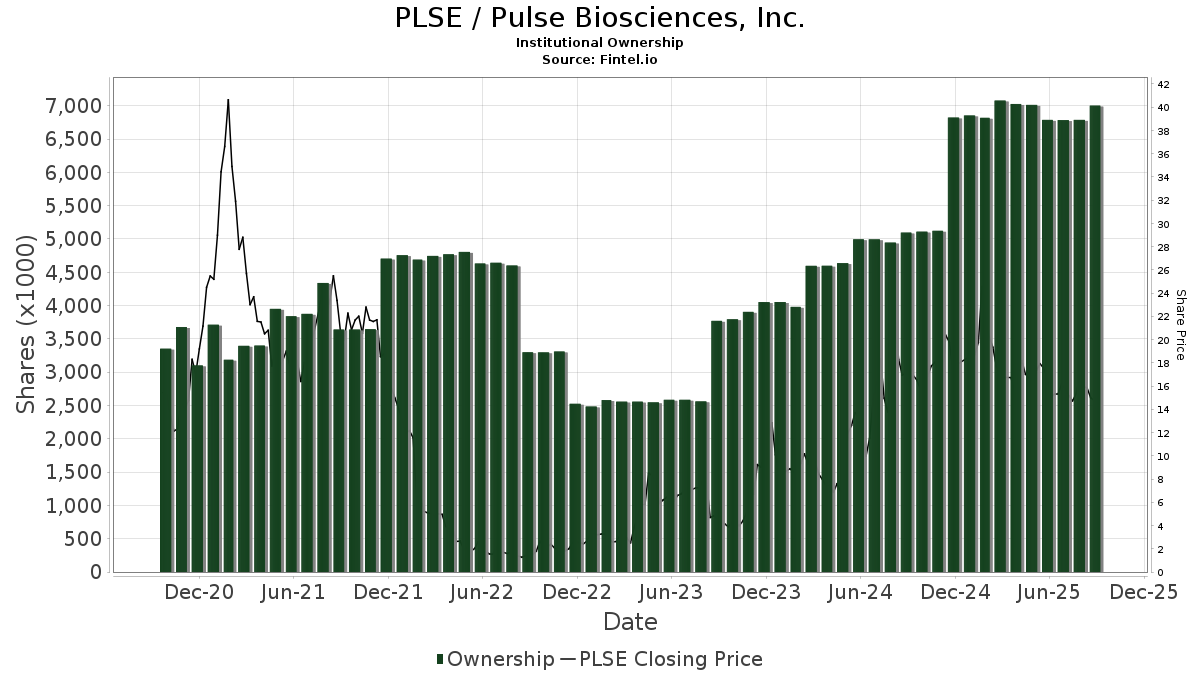

There are 192 funds or institutions reporting positions in Pulse Biosciences.

This is an increase of 15 owner(s) or 8.47% in the last quarter.

Average portfolio weight of all funds dedicated to PLSE is 0.02%, an increase of 35.93%.

Total shares owned by institutions decreased in the last three months by 3.44% to 6,785K shares.

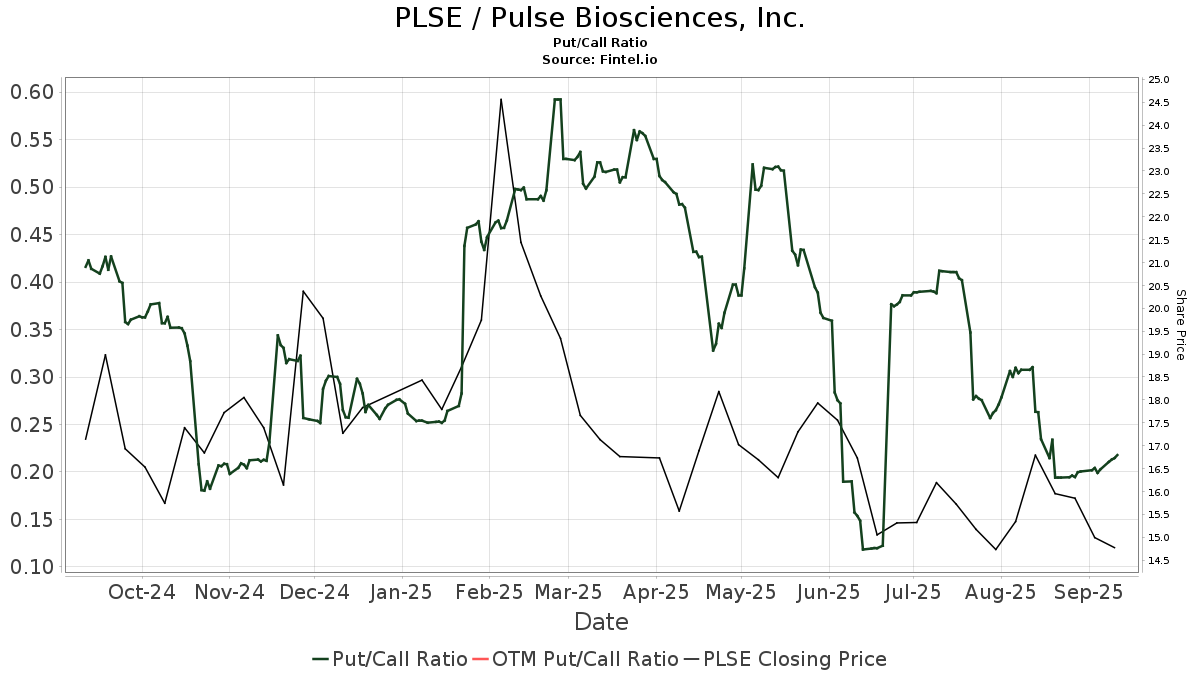

The put/call ratio of PLSE is 0.39, indicating a

bullish outlook.

The put/call ratio of PLSE is 0.39, indicating a

bullish outlook.

What are Other Shareholders Doing?

Bank Of America holds 778K shares representing 1.16% ownership of the company. In its prior filing, the firm reported owning 788K shares , representing a decrease of 1.37%. The firm decreased its portfolio allocation in PLSE by 78.11% over the last quarter.

IWM - iShares Russell 2000 ETF holds 493K shares representing 0.73% ownership of the company. In its prior filing, the firm reported owning 503K shares , representing a decrease of 2.05%. The firm increased its portfolio allocation in PLSE by 2.33% over the last quarter.

Geode Capital Management holds 466K shares representing 0.69% ownership of the company. In its prior filing, the firm reported owning 461K shares , representing an increase of 1.06%. The firm decreased its portfolio allocation in PLSE by 5.23% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 293K shares representing 0.44% ownership of the company. In its prior filing, the firm reported owning 571K shares , representing a decrease of 94.91%. The firm decreased its portfolio allocation in PLSE by 50.54% over the last quarter.

VEXMX - Vanguard Extended Market Index Fund Investor Shares holds 292K shares representing 0.43% ownership of the company. In its prior filing, the firm reported owning 277K shares , representing an increase of 5.07%. The firm increased its portfolio allocation in PLSE by 6.60% over the last quarter.

Pulse Biosciences Background Information

(This description is provided by the company.)

Pulse Biosciences is a novel bioelectric medicine company committed to health innovation that has the potential to improve the quality of life for patients. The CellFX® System is the first commercial product to harness the distinctive advantages of the Company's proprietary Nano-Pulse Stimulation™ (NPS™) technology, such as the ability to non-thermally clear cells while sparing non-cellular tissue, to treat a variety of applications for which an optimal solution remains unfulfilled. Nano-Pulse Stimulation technology delivers nano-second pulses of electrical energy. The initial commercial use of the CellFX System is to address a range of dermatologic conditions that share high demand among patients and practitioners for improved dermatologic outcomes. Designed as a multi-application platform, the CellFX System offers customer value with a utilization-based revenue model.