Oppenheimer Initiates Coverage of Galecto (GLTO) with Outperform Recommendation

Fintel reports that on June 20, 2023, Oppenheimer initiated coverage of Galecto (NASDAQ:GLTO) with a Outperform recommendation.

Analyst Price Forecast Suggests 295.07% Upside

As of June 2, 2023, the average one-year price target for Galecto is 11.22. The forecasts range from a low of 6.06 to a high of $17.85. The average price target represents an increase of 295.07% from its latest reported closing price of 2.84.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Galecto is 3MM. The projected annual non-GAAP EPS is -1.86.

What is the Fund Sentiment?

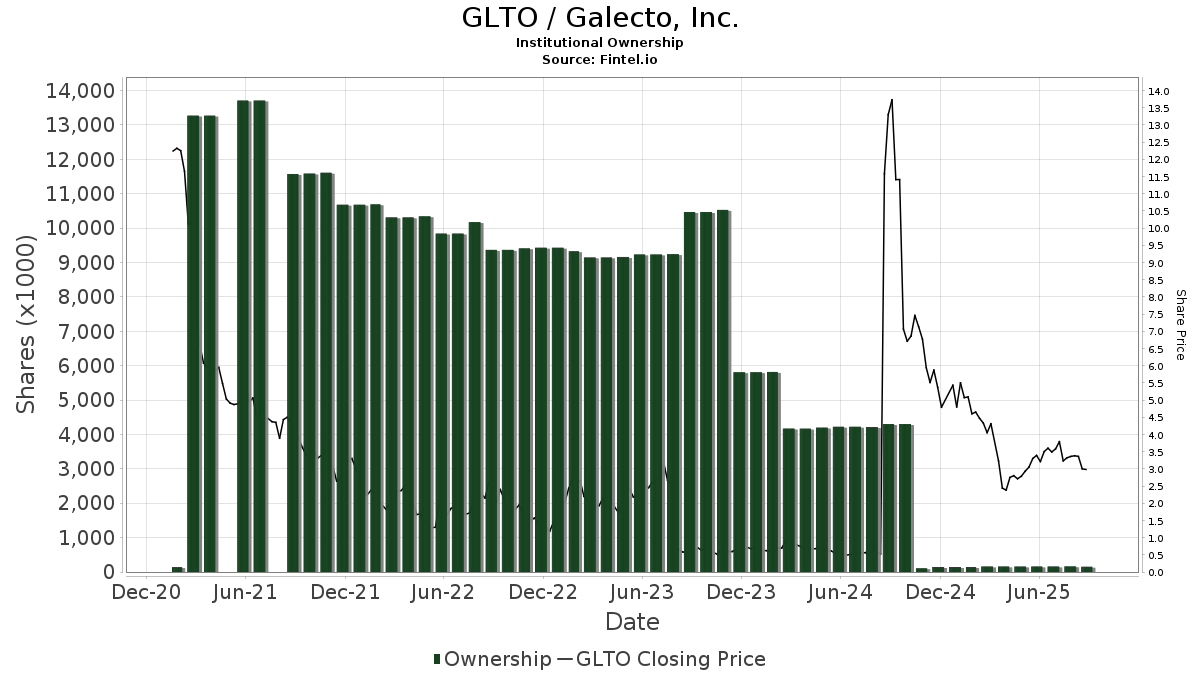

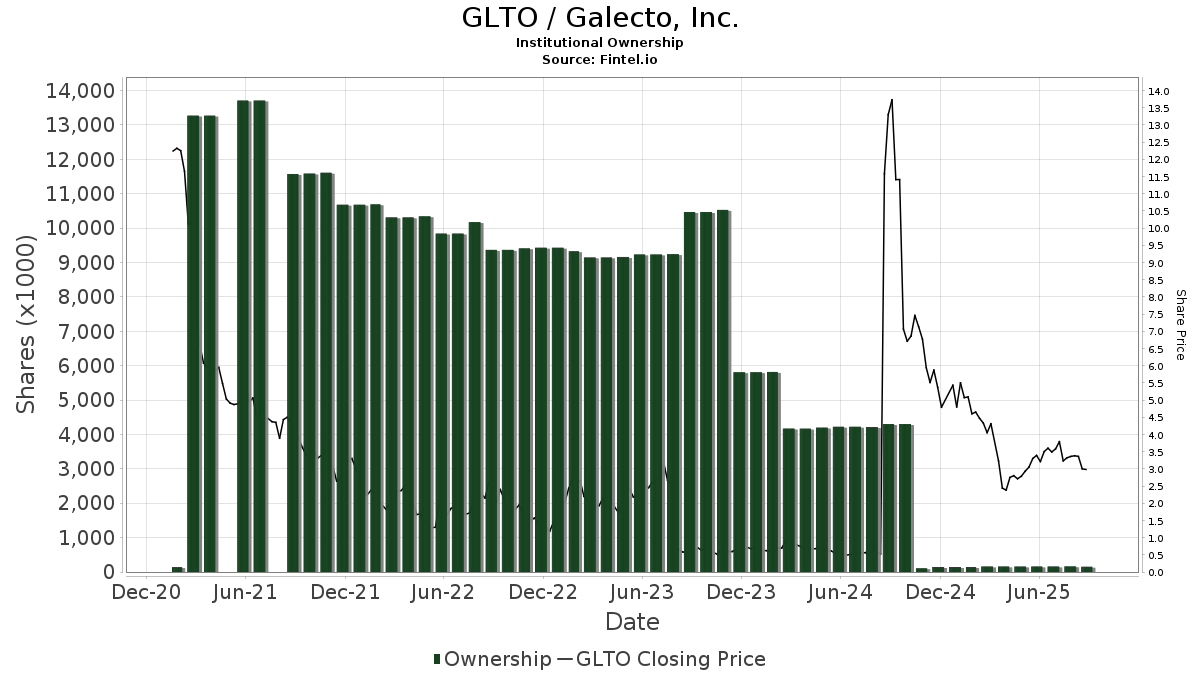

There are 35 funds or institutions reporting positions in Galecto.

This is an increase

of

5

owner(s) or 16.67% in the last quarter.

Average portfolio weight of all funds dedicated to GLTO is 0.02%,

a decrease

of 19.52%.

Total shares owned by institutions increased

in the last three months by 0.95% to 9,232K shares.

The put/call ratio of GLTO is 0.05, indicating a

bullish

outlook.

The put/call ratio of GLTO is 0.05, indicating a

bullish

outlook.

What are Other Shareholders Doing?

Orbimed Advisors holds 4,091K shares representing 15.93% ownership of the company. No change in the last quarter.

Novo Holdings A holds 2,498K shares representing 9.73% ownership of the company. No change in the last quarter.

Cormorant Asset Management holds 1,020K shares representing 3.97% ownership of the company. No change in the last quarter.

MAI Capital Management holds 255K shares representing 1.00% ownership of the company. In it's prior filing, the firm reported owning 233K shares, representing an increase of 8.68%. The firm increased its portfolio allocation in GLTO by 76.02% over the last quarter.

Laurion Capital Management holds 191K shares representing 0.74% ownership of the company. No change in the last quarter.

Galecto Background Information

(This description is provided by the company.)

Galecto is a clinical stage biotechnology company committed to the development of novel small molecule therapeutics directed at biological targets which are at the heart of fibrosis, inflammation, and cancer. Galecto was founded by leading fibrosis-focused scientists and biotech executives and is built on more than 10 years of research into galectin and fibrosis modulators. The Company's team has developed a deep understanding of the galectin family of proteins and the LOXL2 enzyme, and how both influence multiple biological pathways of these complex, often devastating, diseases.

Key filings for this company: