New Gold (TSX:NGD) Price Target Increased by 10.10% to 7.85

The average one-year price target for New Gold (TSX:NGD) has been revised to $7.85 / share. This is an increase of 10.10% from the prior estimate of $7.13 dated July 15, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $4.54 to a high of $9.45 / share. The average price target represents an increase of 33.47% from the latest reported closing price of $5.88 / share.

What is the Fund Sentiment?

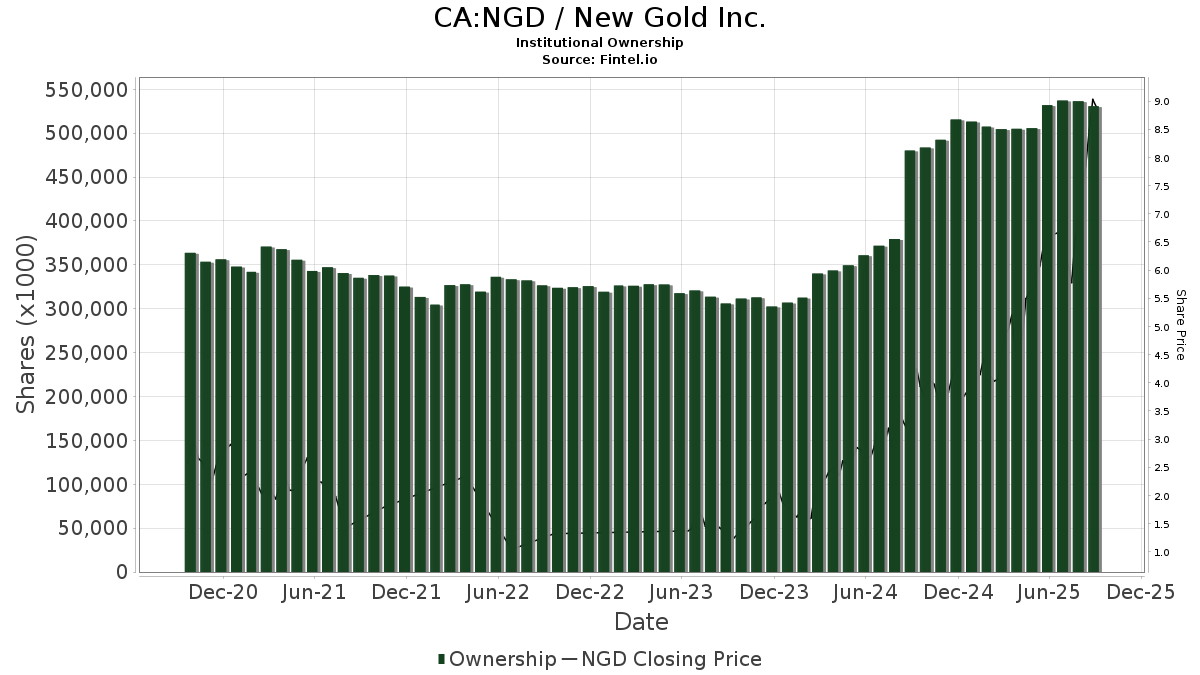

There are 341 funds or institutions reporting positions in New Gold. This is an increase of 26 owner(s) or 8.25% in the last quarter. Average portfolio weight of all funds dedicated to NGD is 0.39%, an increase of 10.85%. Total shares owned by institutions increased in the last three months by 3.76% to 523,288K shares.

What are Other Shareholders Doing?

Van Eck Associates holds 56,726K shares representing 7.17% ownership of the company. In its prior filing, the firm reported owning 64,703K shares , representing a decrease of 14.06%. The firm increased its portfolio allocation in NGD by 32.41% over the last quarter.

Condire Management holds 32,740K shares representing 4.14% ownership of the company. No change in the last quarter.

GDX - VanEck Vectors Gold Miners ETF holds 28,409K shares representing 3.59% ownership of the company. In its prior filing, the firm reported owning 33,149K shares , representing a decrease of 16.68%. The firm increased its portfolio allocation in NGD by 9.50% over the last quarter.

Renaissance Technologies holds 28,082K shares representing 3.55% ownership of the company. In its prior filing, the firm reported owning 25,146K shares , representing an increase of 10.46%. The firm increased its portfolio allocation in NGD by 70.81% over the last quarter.

GDXJ - VanEck Vectors Junior Gold Miners ETF holds 25,052K shares representing 3.16% ownership of the company. In its prior filing, the firm reported owning 28,152K shares , representing a decrease of 12.37%. The firm increased its portfolio allocation in NGD by 10.27% over the last quarter.