Morgan Stanley Upgrades Globalstar (GSAT)

Fintel reports that on May 3, 2023, Morgan Stanley upgraded their outlook for Globalstar (AMEX:GSAT) from Underweight to Equal-Weight .

Analyst Price Forecast Suggests 308.89% Upside

As of April 24, 2023, the average one-year price target for Globalstar is 3.57. The forecasts range from a low of 1.77 to a high of $5.25. The average price target represents an increase of 308.89% from its latest reported closing price of 0.87.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Globalstar is 207MM, an increase of 39.59%. The projected annual non-GAAP EPS is -0.02.

What is the Fund Sentiment?

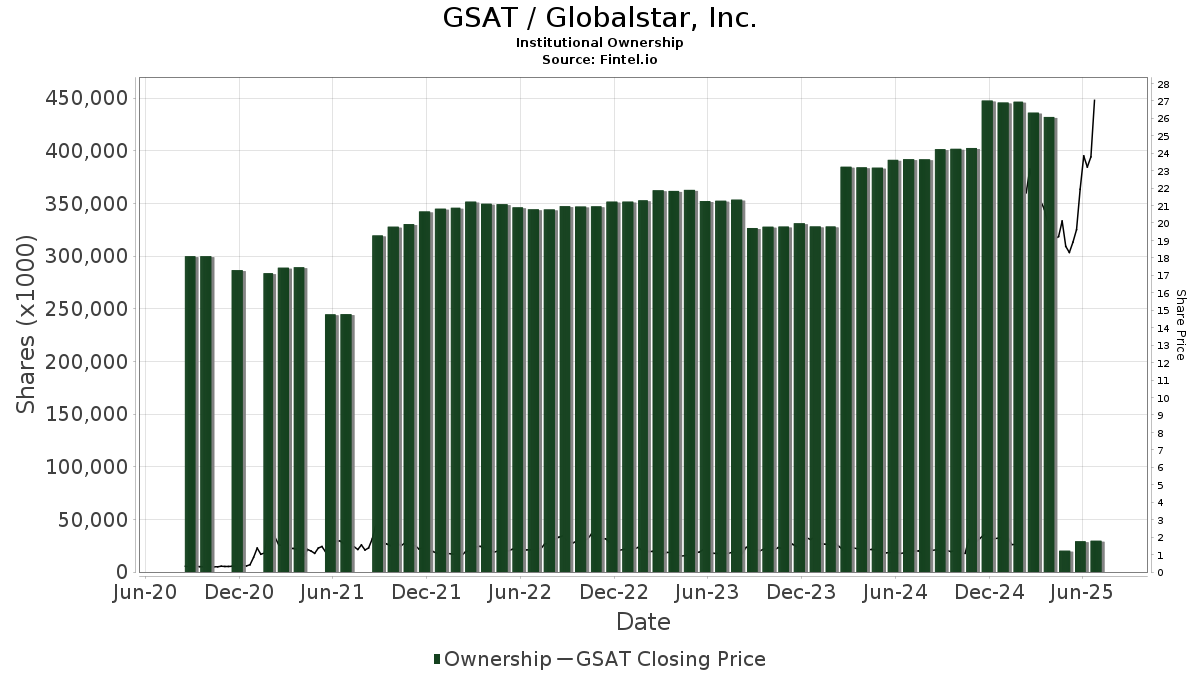

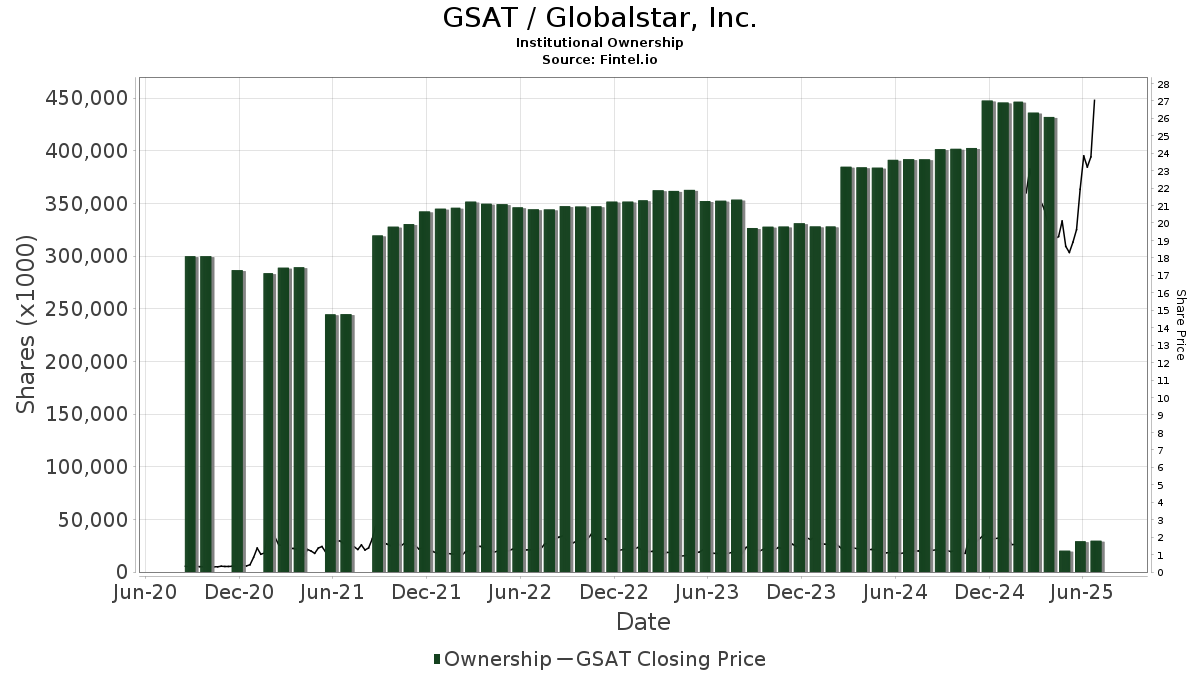

There are 363 funds or institutions reporting positions in Globalstar.

This is an increase

of

20

owner(s) or 5.83% in the last quarter.

Average portfolio weight of all funds dedicated to GSAT is 0.20%,

a decrease

of 4.24%.

Total shares owned by institutions increased

in the last three months by 2.79% to 362,873K shares.

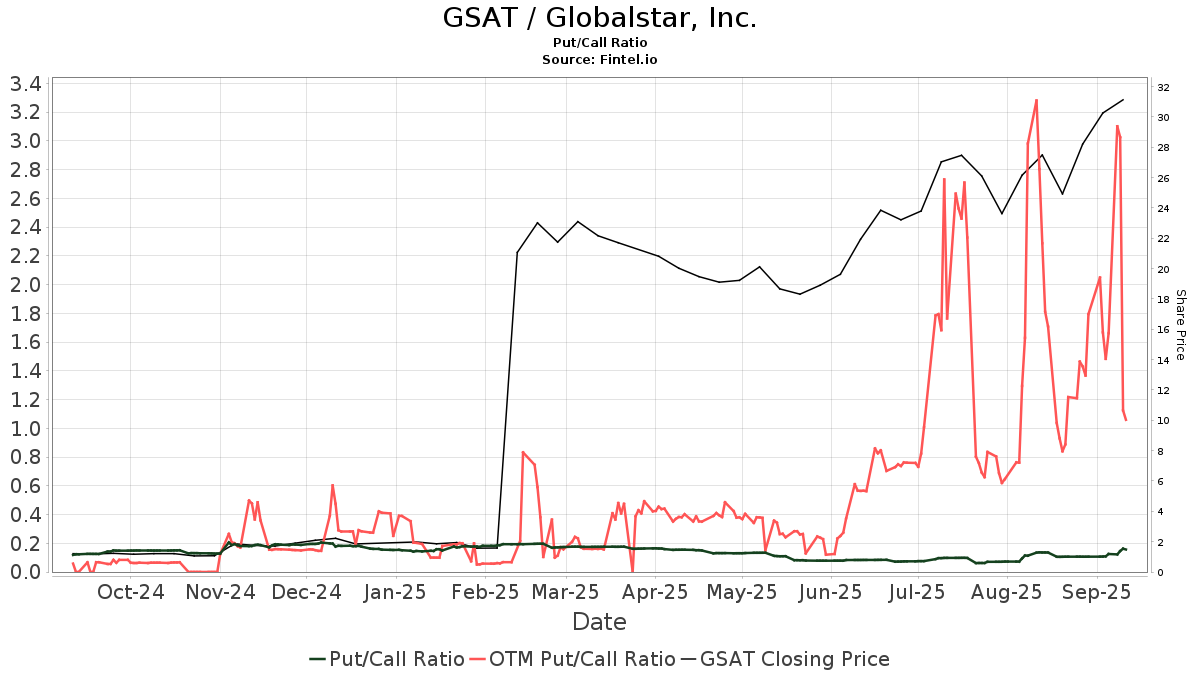

The put/call ratio of GSAT is 0.04, indicating a

bullish

outlook.

The put/call ratio of GSAT is 0.04, indicating a

bullish

outlook.

What are Other Shareholders Doing?

Mudrick Capital Management holds 86,839K shares representing 4.79% ownership of the company. In it's prior filing, the firm reported owning 86,839K shares, representing a decrease of 0.00%. The firm increased its portfolio allocation in GSAT by 19.21% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 21,677K shares representing 1.20% ownership of the company. In it's prior filing, the firm reported owning 21,438K shares, representing an increase of 1.10%. The firm decreased its portfolio allocation in GSAT by 21.89% over the last quarter.

Beck Mack & Oliver holds 18,739K shares representing 1.03% ownership of the company. In it's prior filing, the firm reported owning 18,767K shares, representing a decrease of 0.15%. The firm decreased its portfolio allocation in GSAT by 26.95% over the last quarter.

NAESX - Vanguard Small-Cap Index Fund Investor Shares holds 18,560K shares representing 1.02% ownership of the company. In it's prior filing, the firm reported owning 18,276K shares, representing an increase of 1.53%. The firm decreased its portfolio allocation in GSAT by 21.36% over the last quarter.

IWM - iShares Russell 2000 ETF holds 15,746K shares representing 0.87% ownership of the company. In it's prior filing, the firm reported owning 14,967K shares, representing an increase of 4.95%. The firm decreased its portfolio allocation in GSAT by 20.30% over the last quarter.

Globalstar Background Information

(This description is provided by the company.)

Globalstar is a leading provider of customizable Satellite IoT Solutions for customers around the world in industries such as oil and gas, transportation, emergency management, government, maritime and outdoor recreation. A pioneer of mobile satellite voice and data services, Globalstar solutions connect people to their devices and allow businesses to streamline operations providing safety and communication and enabling mobile assets to be monitored remotely via the Globalstar Satellite Network. The Company's Commercial IoT product portfolio includes industry-acclaimed SmartOne asset tracking products, Commercial IoT satellite transmitters and the SPOT® product line for personal safety, messaging and emergency response, all supported on SPOT My Globalstar, a robust cloud-based enhanced mapping solution.

See all Globalstar regulatory filings.