Morgan Stanley Maintains Bright Health Group (BHG) Underweight Recommendation

Fintel reports that on May 19, 2023, Morgan Stanley maintained coverage of Bright Health Group (NYSE:BHG) with a Underweight recommendation.

Analyst Price Forecast Suggests 633.81% Upside

As of May 11, 2023, the average one-year price target for Bright Health Group is 1.53. The forecasts range from a low of 0.50 to a high of $4.20. The average price target represents an increase of 633.81% from its latest reported closing price of 0.21.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Bright Health Group is 3,130MM, an increase of 22.50%. The projected annual non-GAAP EPS is -0.31.

What is the Fund Sentiment?

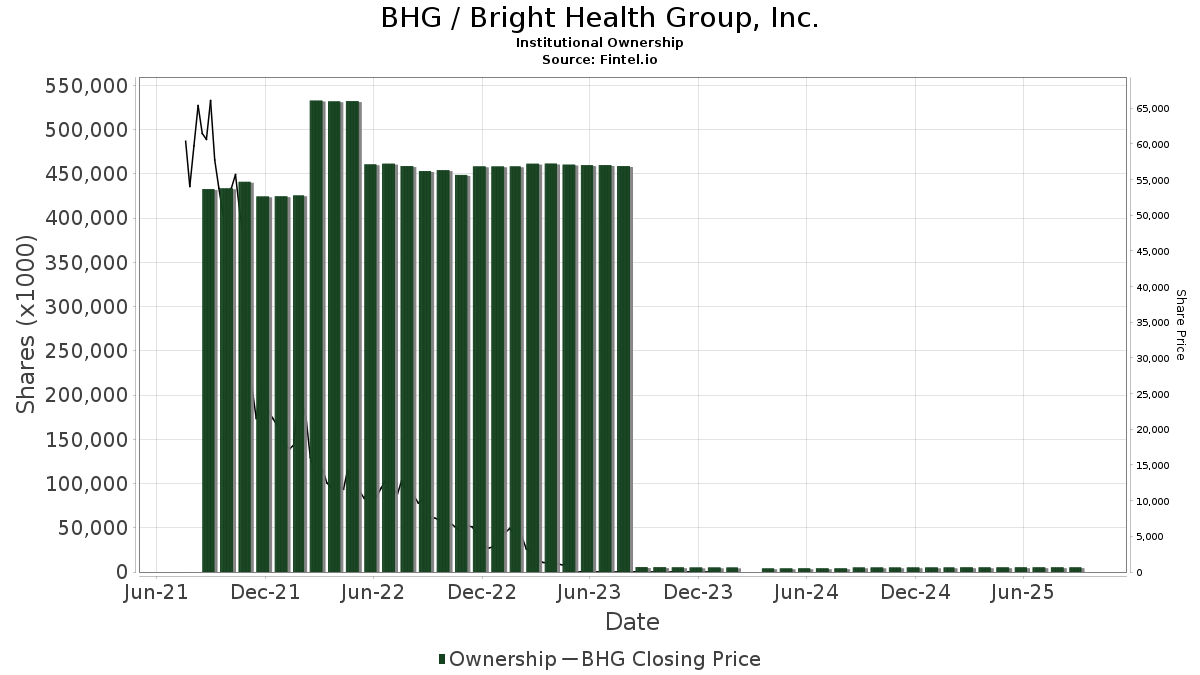

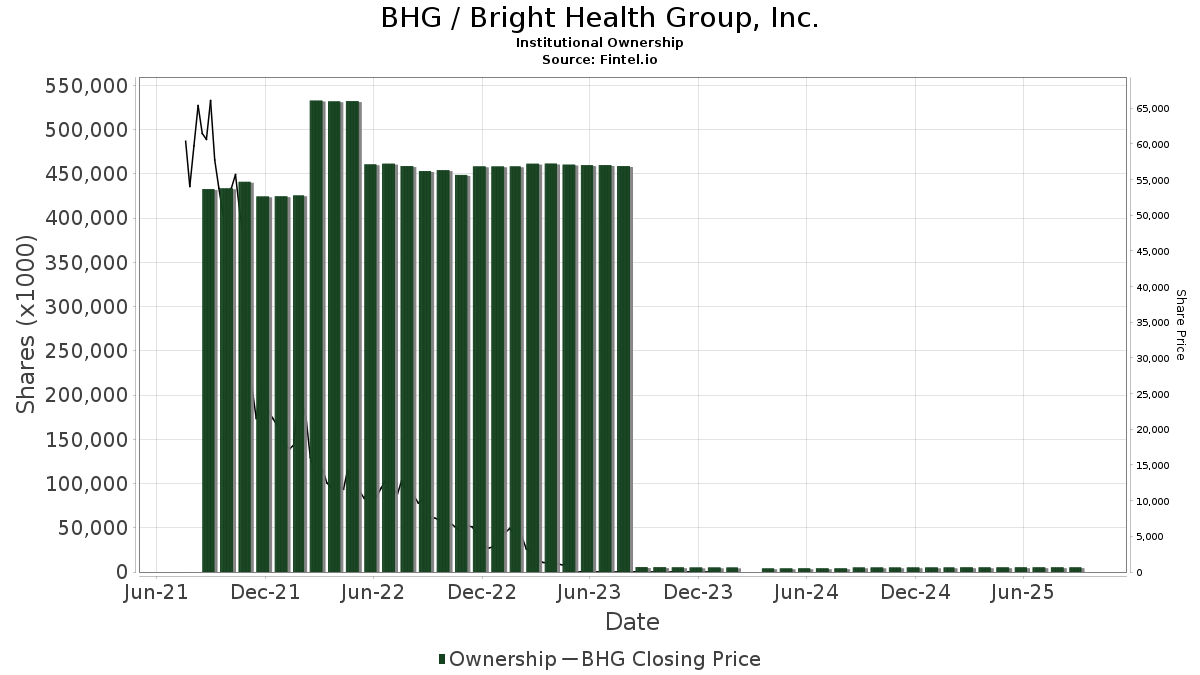

There are 213 funds or institutions reporting positions in Bright Health Group.

This is a decrease

of

8

owner(s) or 3.62% in the last quarter.

Average portfolio weight of all funds dedicated to BHG is 0.06%,

a decrease

of 60.89%.

Total shares owned by institutions increased

in the last three months by 0.23% to 460,010K shares.

The put/call ratio of BHG is 0.02, indicating a

bullish

outlook.

The put/call ratio of BHG is 0.02, indicating a

bullish

outlook.

What are Other Shareholders Doing?

NEA Management Company holds 218,154K shares representing 34.43% ownership of the company. No change in the last quarter.

Deer Management Co. holds 79,938K shares representing 12.62% ownership of the company. No change in the last quarter.

StepStone Group holds 42,020K shares representing 6.63% ownership of the company. In it's prior filing, the firm reported owning 42,022K shares, representing a decrease of 0.00%. The firm decreased its portfolio allocation in BHG by 51.80% over the last quarter.

Redpoint Management holds 15,170K shares representing 2.39% ownership of the company. No change in the last quarter.

Greycroft holds 11,068K shares representing 1.75% ownership of the company. No change in the last quarter.

Bright Health Group Background Information

(This description is provided by the company.)

Bright Health Group is built upon the belief that by aligning the best local resources in healthcare delivery with the financing of care, the company can drive a superior consumer experience, optimize clinical outcomes, reduce systemic waste and lower costs. Bright Health is a healthcare company that is building a national, integrated system of care, in close partnership with its Care Partners. Its differentiated approach is: Built on Alignment, Focused on the Consumer, and Powered by Technology. Bright Health have two market facing businesses: NeueHealth and Bright HealthCare. Through NeueHealth the company delivers high-quality virtual and in-person clinical care to nearly 75,000 unique patients through its 61 affiliated risk-bearing primary care clinics. Through Bright HealthCare the company offers Medicare and Commercial health plan products to approximately 623,000 consumers in 14 states and 99 markets.

Key filings for this company: