Morgan Stanley Maintains Bank Of New York Mellon (BK) Underweight Recommendation

Fintel reports that on April 19, 2023, Morgan Stanley maintained coverage of Bank Of New York Mellon (NYSE:BK) with a Underweight recommendation.

Analyst Price Forecast Suggests 22.80% Upside

As of April 6, 2023, the average one-year price target for Bank Of New York Mellon is $55.56. The forecasts range from a low of $44.44 to a high of $67.20. The average price target represents an increase of 22.80% from its latest reported closing price of $45.24.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Bank Of New York Mellon is $17,799MM, an increase of 6.26%. The projected annual non-GAAP EPS is $4.84.

What are Other Shareholders Doing?

Cinctive Capital Management holds 111K shares representing 0.01% ownership of the company.

UBS Group holds 1,792K shares representing 0.22% ownership of the company. In it's prior filing, the firm reported owning 1,216K shares, representing an increase of 32.13%. The firm increased its portfolio allocation in BK by 48.28% over the last quarter.

QDF - FlexShares Quality Dividend Index Fund holds 202K shares representing 0.03% ownership of the company.

Quantbot Technologies holds 17K shares representing 0.00% ownership of the company. In it's prior filing, the firm reported owning 163K shares, representing a decrease of 853.63%. The firm decreased its portfolio allocation in BK by 99.99% over the last quarter.

VTMFX - Vanguard Tax-Managed Balanced Fund Admiral Shares holds 78K shares representing 0.01% ownership of the company. In it's prior filing, the firm reported owning 68K shares, representing an increase of 13.77%. The firm increased its portfolio allocation in BK by 30.81% over the last quarter.

What is the Fund Sentiment?

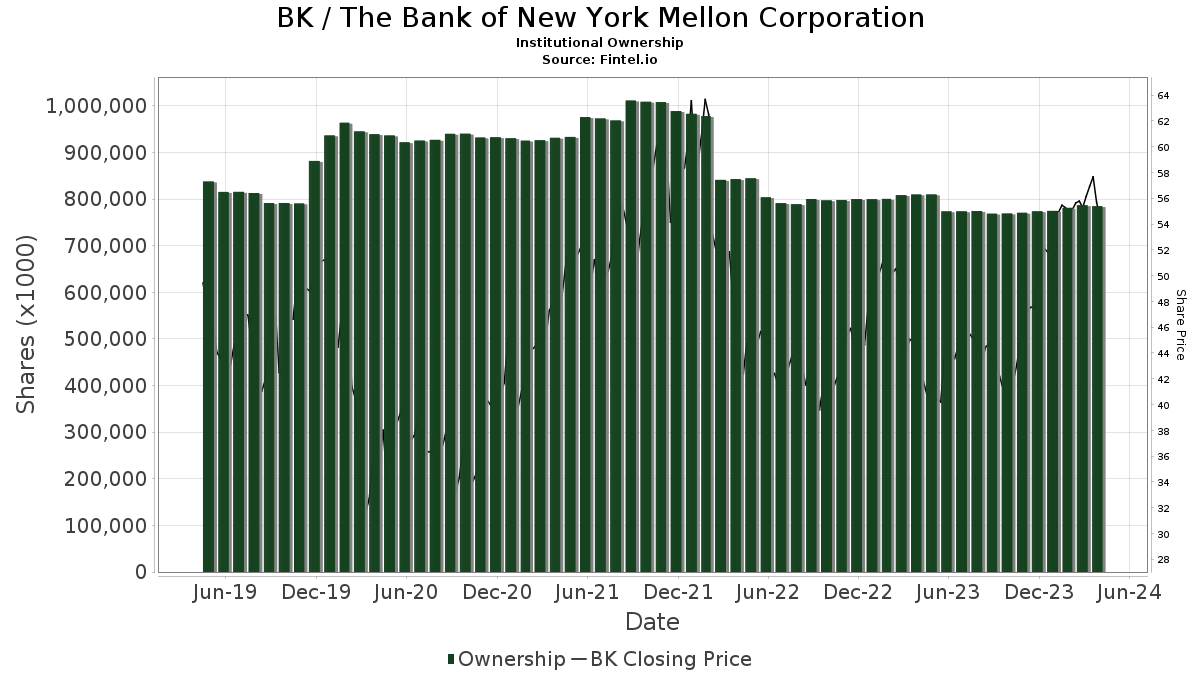

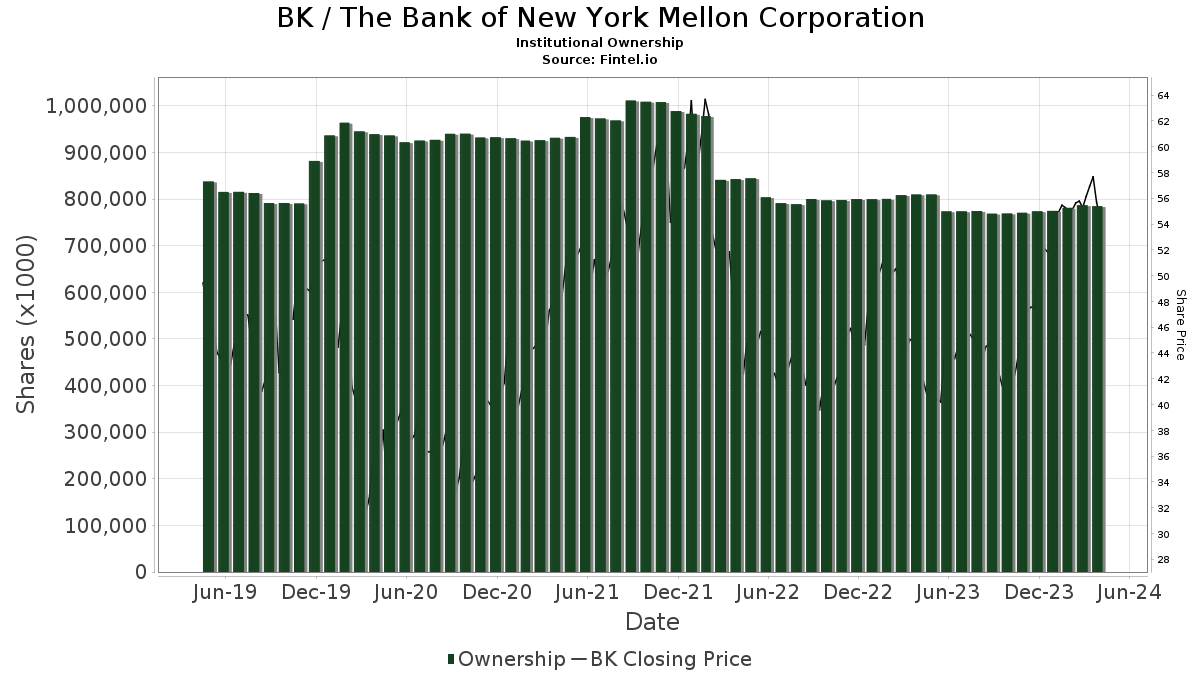

There are 1953 funds or institutions reporting positions in Bank Of New York Mellon.

This is an increase

of

93

owner(s) or 5.00% in the last quarter.

Average portfolio weight of all funds dedicated to BK is 0.43%,

an increase

of 23.51%.

Total shares owned by institutions increased

in the last three months by 1.25% to 809,692K shares.

The put/call ratio of BK is 1.08, indicating a

bearish

outlook.

The put/call ratio of BK is 1.08, indicating a

bearish

outlook.

Bank Of New York Mellon Background Information

(This description is provided by the company.)

BNY Mellon is a global investments company dedicated to helping its clients manage and service their financial assets throughout the investment lifecycle. Whether providing financial services for institutions, corporations or individual investors, BNY Mellon delivers informed investment and wealth management and investment services in 35 countries. As of Sept. 30, 2020, BNY Mellon had $38.6 trillionin assets under custody and/or administration, and $2.0 trillionin assets under management. BNY Mellon can act as a single point of contact for clients looking to create, trade, hold, manage, service, distribute or restructure investments. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation.

See all Bank Of New York Mellon regulatory filings.