IAMGOLD (IAG) Price Target Increased by 19.07% to 9.47

The average one-year price target for IAMGOLD (NYSE:IAG) has been revised to $9.47 / share. This is an increase of 19.07% from the prior estimate of $7.95 dated April 1, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $7.59 to a high of $12.63 / share. The average price target represents an increase of 31.11% from the latest reported closing price of $7.22 / share.

What is the Fund Sentiment?

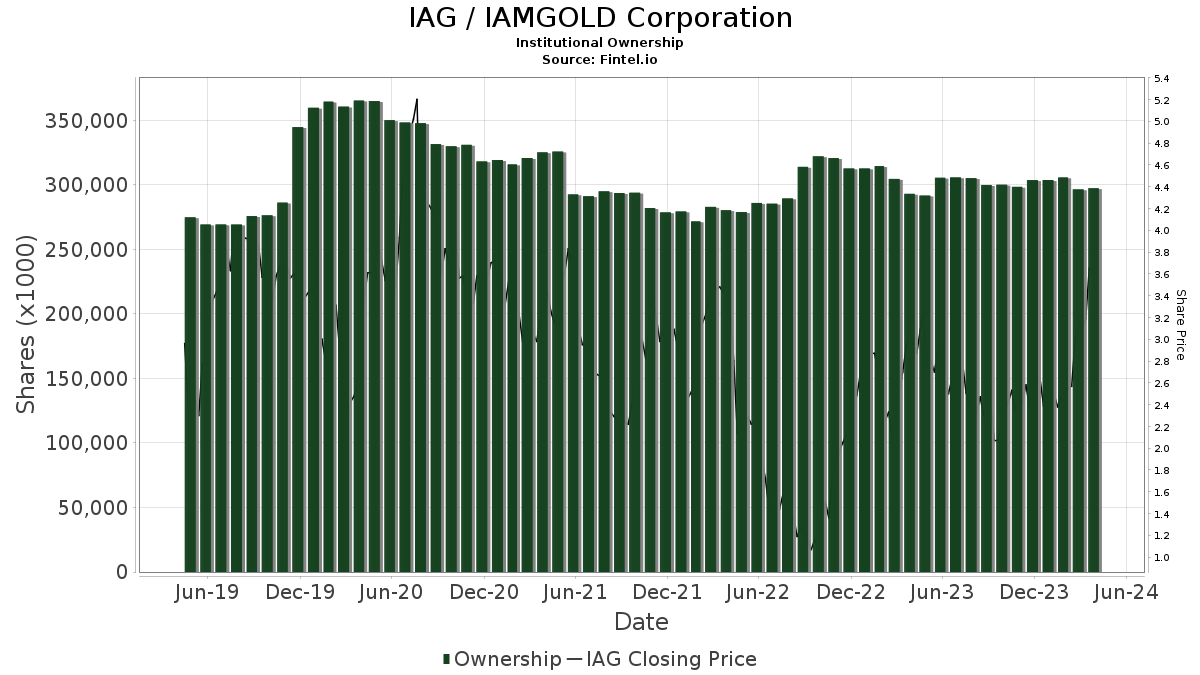

There are 306 funds or institutions reporting positions in IAMGOLD.

This is an increase of 39 owner(s) or 14.61% in the last quarter.

Average portfolio weight of all funds dedicated to IAG is 0.25%, an increase of 6.22%.

Total shares owned by institutions increased in the last three months by 5.67% to 411,172K shares.

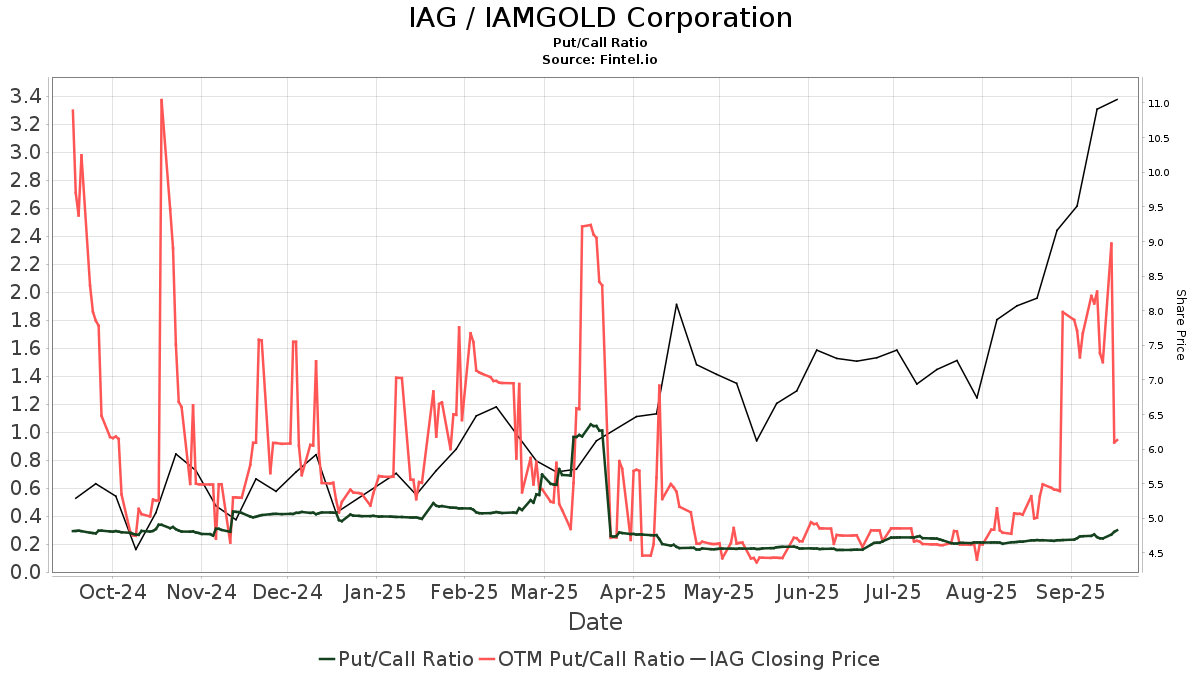

The put/call ratio of IAG is 0.17, indicating a

bullish outlook.

The put/call ratio of IAG is 0.17, indicating a

bullish outlook.

What are Other Shareholders Doing?

Van Eck Associates holds 49,852K shares representing 8.71% ownership of the company. In its prior filing, the firm reported owning 52,895K shares , representing a decrease of 6.10%. The firm decreased its portfolio allocation in IAG by 15.91% over the last quarter.

Donald Smith holds 31,234K shares representing 5.46% ownership of the company. In its prior filing, the firm reported owning 31,017K shares , representing an increase of 0.69%. The firm increased its portfolio allocation in IAG by 0.67% over the last quarter.

RCF Management L.L.C. holds 24,840K shares representing 4.34% ownership of the company.

GDX - VanEck Vectors Gold Miners ETF holds 23,941K shares representing 4.18% ownership of the company. In its prior filing, the firm reported owning 26,102K shares , representing a decrease of 9.03%. The firm increased its portfolio allocation in IAG by 9.80% over the last quarter.

GDXJ - VanEck Vectors Junior Gold Miners ETF holds 20,822K shares representing 3.64% ownership of the company. In its prior filing, the firm reported owning 21,489K shares , representing a decrease of 3.20%. The firm increased its portfolio allocation in IAG by 20.30% over the last quarter.

Iamgold Background Information

(This description is provided by the company.)

IAMGOLD is a mid-tier mining company with three gold mines on three continents, including the Essakane mine in Burkina Faso, the Rosebel mine in Suriname, and the Westwood mine in Canada. A solid base of strategic assets is complemented by the Côté Gold development project in Canada, the Boto Gold development project in Senegal, as well as greenfield and brownfield exploration projects in various countries located in West Africa and the Americas. IAMGOLD is committed to maintaining its culture of accountable mining through high standards of ESG practices and employs approximately 5,000 people. IAMGOLD's commitment is to Zero Harm, in every aspect of its business. IAMGOLD is one of the companies on the JSI index.