Goldman Sachs Maintains Transdigm Group (TDG) Buy Recommendation

Fintel reports that on May 10, 2023, Goldman Sachs maintained coverage of Transdigm Group (NYSE:TDG) with a Buy recommendation.

Analyst Price Forecast Suggests 6.57% Upside

As of May 11, 2023, the average one-year price target for Transdigm Group is 863.28. The forecasts range from a low of 732.25 to a high of $1,008.00. The average price target represents an increase of 6.57% from its latest reported closing price of 810.08.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Transdigm Group is 6,154MM, an increase of 4.36%. The projected annual non-GAAP EPS is 22.03.

What is the Fund Sentiment?

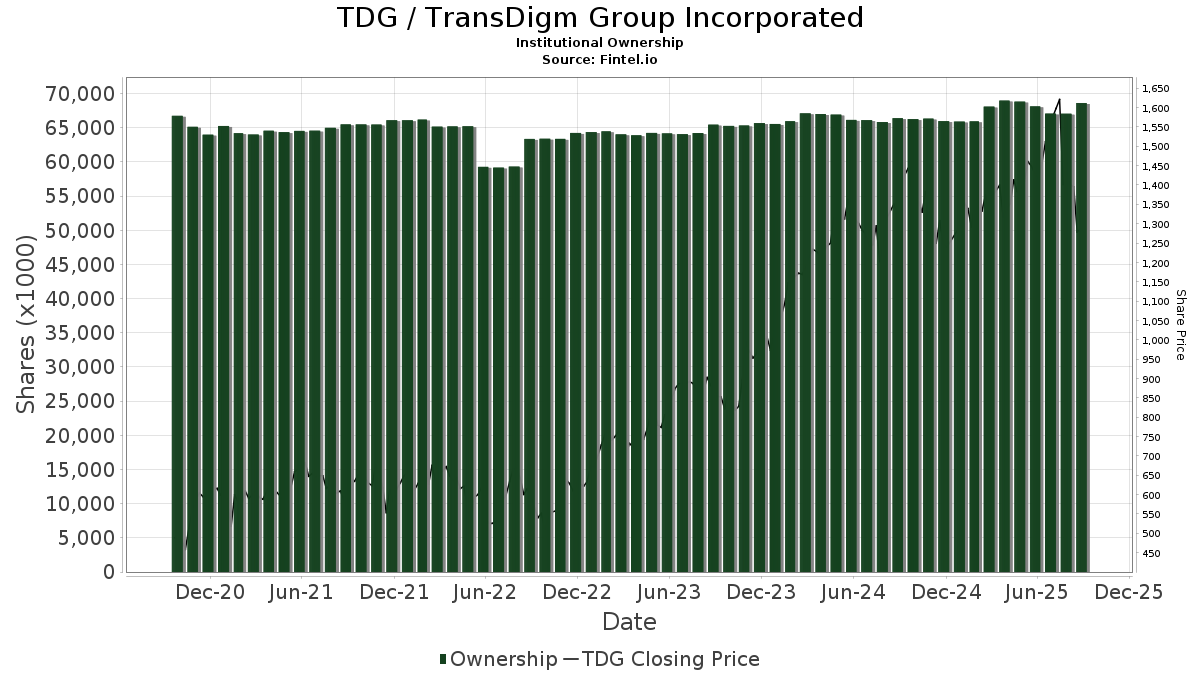

There are 1381 funds or institutions reporting positions in Transdigm Group.

This is an increase

of

75

owner(s) or 5.74% in the last quarter.

Average portfolio weight of all funds dedicated to TDG is 0.76%,

an increase

of 3.45%.

Total shares owned by institutions decreased

in the last three months by 0.73% to 63,808K shares.

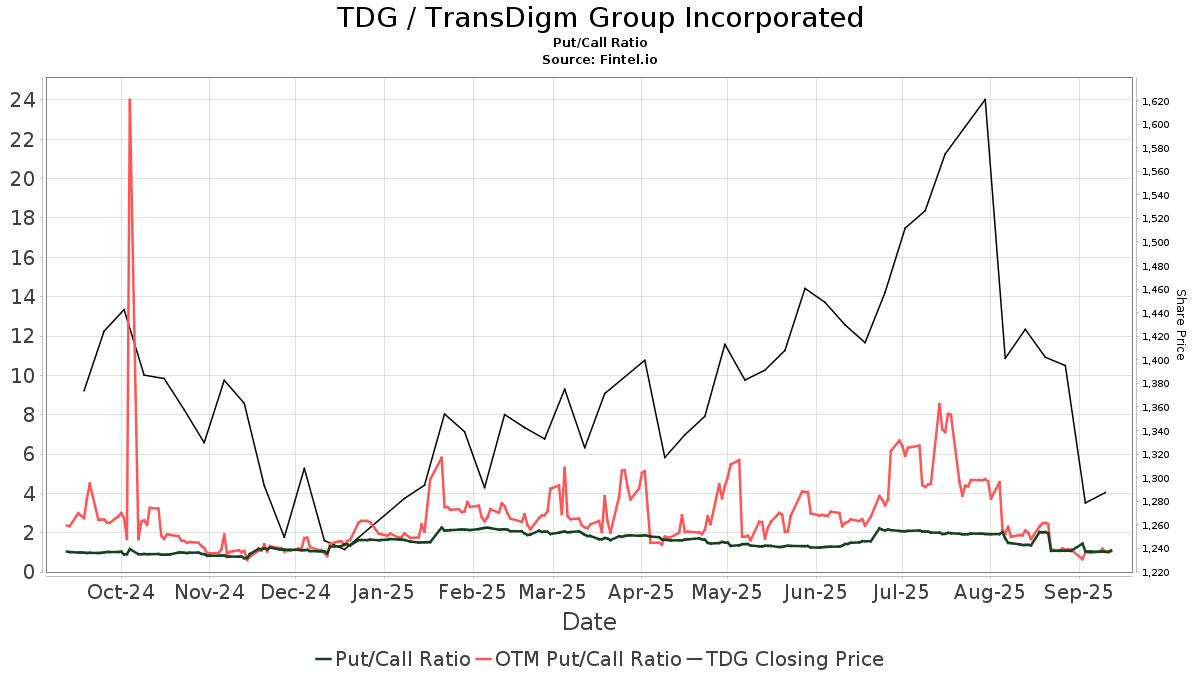

The put/call ratio of TDG is 3.02, indicating a

bearish

outlook.

The put/call ratio of TDG is 3.02, indicating a

bearish

outlook.

What are Other Shareholders Doing?

Capital International Investors holds 6,559K shares representing 12.01% ownership of the company. In it's prior filing, the firm reported owning 6,545K shares, representing an increase of 0.21%. The firm increased its portfolio allocation in TDG by 10.64% over the last quarter.

Principal Financial Group holds 2,828K shares representing 5.18% ownership of the company. In it's prior filing, the firm reported owning 3,119K shares, representing a decrease of 10.29%. The firm decreased its portfolio allocation in TDG by 42.83% over the last quarter.

AGTHX - GROWTH FUND OF AMERICA holds 2,634K shares representing 4.82% ownership of the company. In it's prior filing, the firm reported owning 2,360K shares, representing an increase of 10.39%. The firm increased its portfolio allocation in TDG by 33.79% over the last quarter.

AMCPX - AMCAP FUND holds 1,990K shares representing 3.64% ownership of the company. In it's prior filing, the firm reported owning 1,901K shares, representing an increase of 4.47%. The firm increased its portfolio allocation in TDG by 24.18% over the last quarter.

ANCFX - AMERICAN FUNDS FUNDAMENTAL INVESTORS holds 1,673K shares representing 3.06% ownership of the company. No change in the last quarter.

Transdigm Group Background Information

(This description is provided by the company.)

TransDigm Group, through its wholly-owned subsidiaries, is a leading global designer, producer and supplier of highly engineered aircraft components for use on nearly all commercial and military aircraft in service today. Major product offerings, substantially all of which are ultimately provided to end-users in the aerospace industry, include mechanical/electro-mechanical actuators and controls, ignition systems and engine technology, specialized pumps and valves, power conditioning devices, specialized AC/DC electric motors and generators, batteries and chargers, engineered latching and locking devices, engineered rods, engineered connectors and elastomer sealing solutions, databus and power controls, cockpit security components and systems, specialized and advanced cockpit displays, aircraft audio systems, specialized lavatory components, seat belts and safety restraints, engineered and customized interior surfaces and related components, advanced sensor products, switches and relay panels, thermal protection and insulation, lighting and control technology, parachutes, high performance hoists, winches and lifting devices, and cargo loading, handling and delivery systems.

See all Transdigm Group regulatory filings.