DA Davidson Maintains Cars.com (CARS) Buy Recommendation

Fintel reports that on May 5, 2023, DA Davidson maintained coverage of Cars.com (NYSE:CARS) with a Buy recommendation.

Analyst Price Forecast Suggests 31.40% Upside

As of April 24, 2023, the average one-year price target for Cars.com is 22.48. The forecasts range from a low of 16.16 to a high of $26.25. The average price target represents an increase of 31.40% from its latest reported closing price of 17.11.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Cars.com is 702MM, an increase of 5.88%. The projected annual non-GAAP EPS is 0.55.

What is the Fund Sentiment?

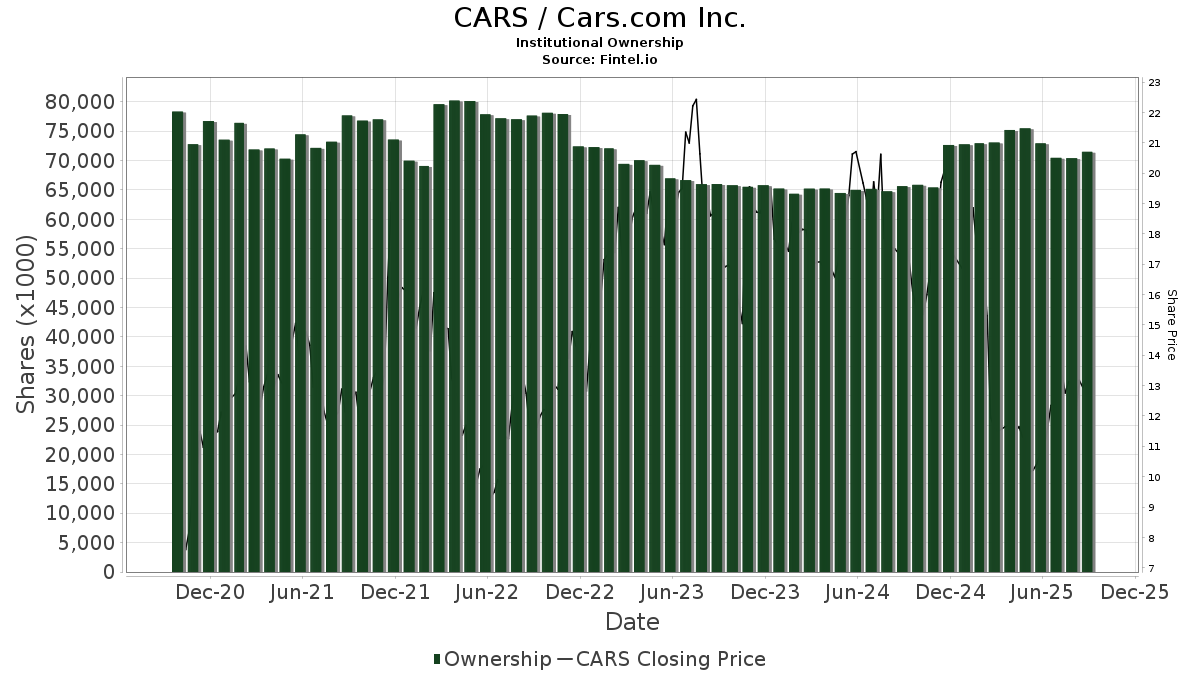

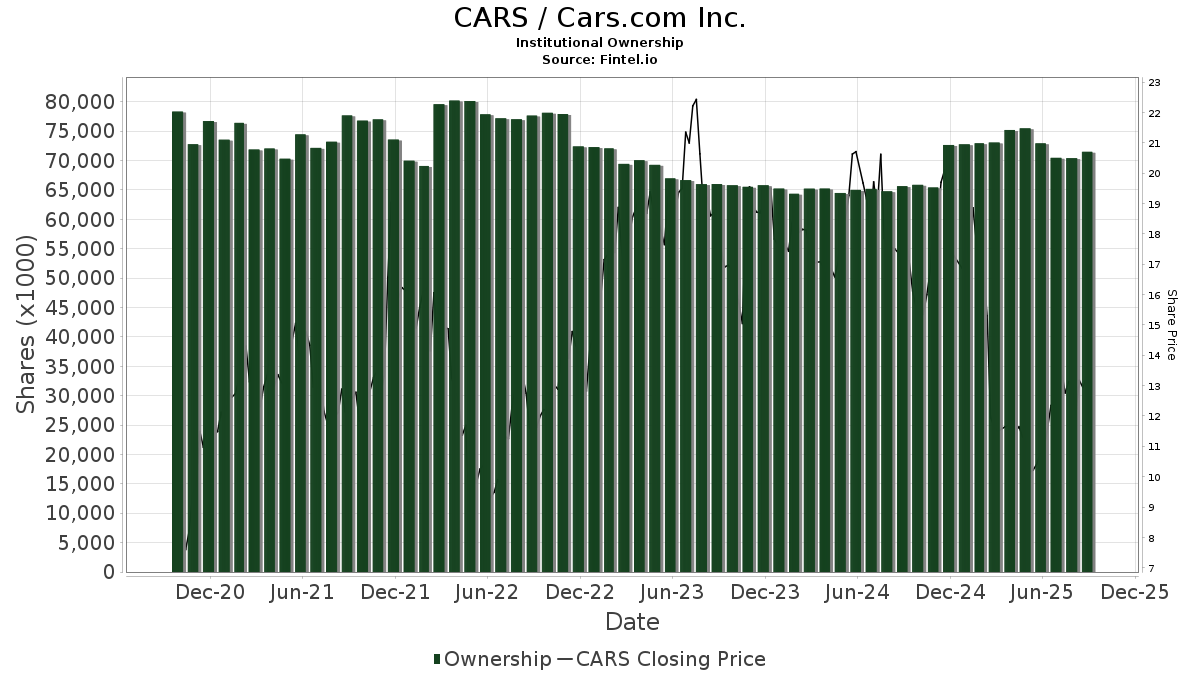

There are 462 funds or institutions reporting positions in Cars.com.

This is a decrease

of

4

owner(s) or 0.86% in the last quarter.

Average portfolio weight of all funds dedicated to CARS is 0.13%,

an increase

of 4.76%.

Total shares owned by institutions decreased

in the last three months by 3.94% to 69,192K shares.

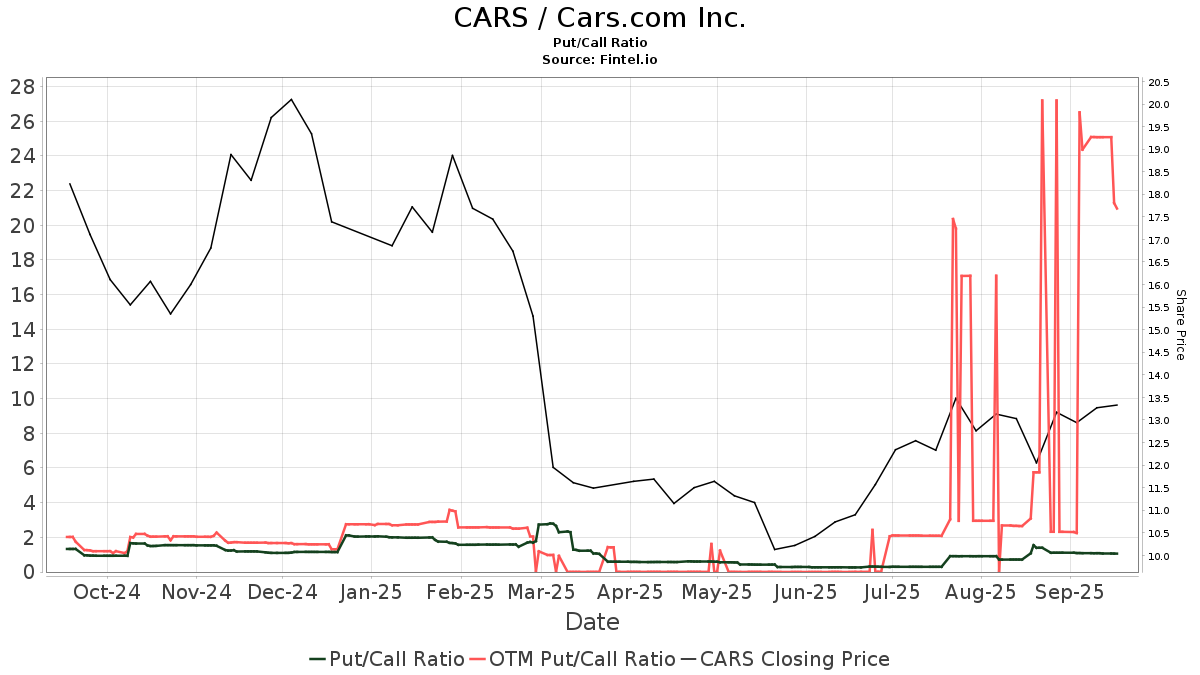

The put/call ratio of CARS is 5.39, indicating a

bearish

outlook.

The put/call ratio of CARS is 5.39, indicating a

bearish

outlook.

What are Other Shareholders Doing?

Greenvale Capital LLP holds 5,428K shares representing 8.12% ownership of the company. In it's prior filing, the firm reported owning 5,400K shares, representing an increase of 0.52%. The firm increased its portfolio allocation in CARS by 4.14% over the last quarter.

IJR - iShares Core S&P Small-Cap ETF holds 4,591K shares representing 6.87% ownership of the company. In it's prior filing, the firm reported owning 4,627K shares, representing a decrease of 0.78%. The firm increased its portfolio allocation in CARS by 8.09% over the last quarter.

Ninety One UK holds 3,161K shares representing 4.73% ownership of the company. In it's prior filing, the firm reported owning 3,330K shares, representing a decrease of 5.32%. The firm increased its portfolio allocation in CARS by 29.30% over the last quarter.

Boston Private Wealth holds 2,501K shares representing 3.74% ownership of the company. In it's prior filing, the firm reported owning 2,502K shares, representing a decrease of 0.06%. The firm increased its portfolio allocation in CARS by 10.62% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 1,947K shares representing 2.91% ownership of the company. No change in the last quarter.

Cars.com Background Information

(This description is provided by the company.)

Cars.com Inc. is a leading digital marketplace and solutions provider for the automotive industry that connects car shoppers with sellers. Launched in 1998 with the flagship marketplace site Cars.com and headquartered in Chicago, the Company empowers shoppers with the data, resources and digital tools needed to make informed buying decisions and seamlessly connect with automotive retailers. In a rapidly changing market, CARS enables dealerships and OEMs with innovative technical solutions and data-driven intelligence to better reach and influence ready-to-buy shoppers, increase inventory turn and gain market share.

See all Cars.com regulatory filings.