Barclays Maintains Syneos Health (SYNH) Underweight Recommendation

On April 4, 2023, Barclays maintained coverage of Syneos Health with a Underweight recommendation.

Analyst Price Forecast Suggests 21.96% Upside

As of March 30, 2023, the average one-year price target for Syneos Health is $42.95. The forecasts range from a low of $37.37 to a high of $53.55. The average price target represents an increase of 21.96% from its latest reported closing price of $35.22.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Syneos Health is $5,295MM, a decrease of 1.82%. The projected annual non-GAAP EPS is $4.18.

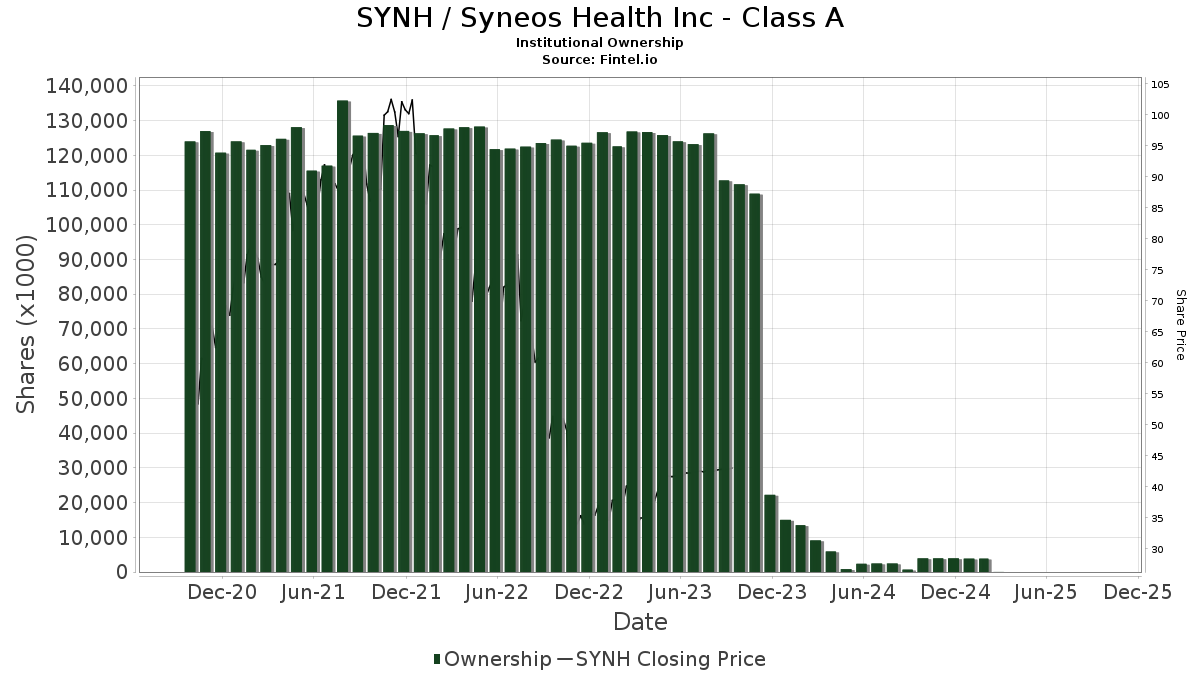

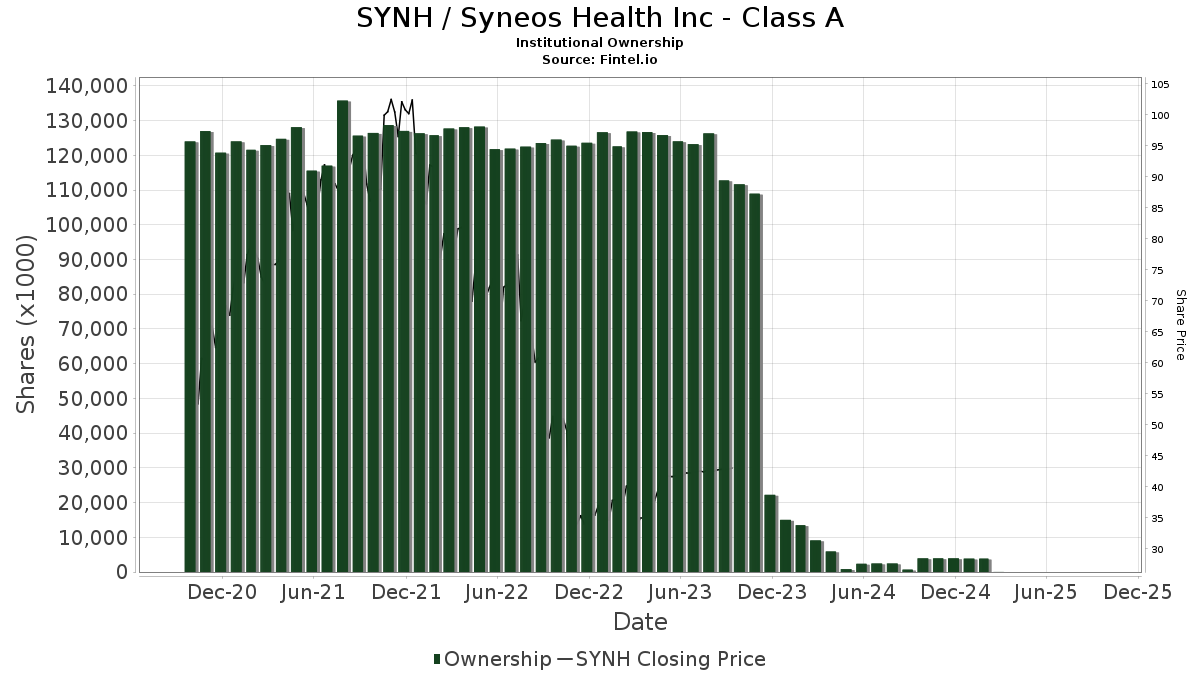

What are Large Shareholders Doing?

Wellington Management Group Llp holds 9,880K shares representing 9.57% ownership of the company. In it's prior filing, the firm reported owning 9,452K shares, representing an increase of 4.33%. The firm decreased its portfolio allocation in SYNH by 23.45% over the last quarter.

Clearbridge Investments holds 4,146K shares representing 4.02% ownership of the company. In it's prior filing, the firm reported owning 4,208K shares, representing a decrease of 1.48%. The firm decreased its portfolio allocation in SYNH by 24.92% over the last quarter.

Goldman Sachs Group holds 3,880K shares representing 3.76% ownership of the company. In it's prior filing, the firm reported owning 715K shares, representing an increase of 81.57%. The firm increased its portfolio allocation in SYNH by 308.79% over the last quarter.

Massachusetts Financial Services holds 3,735K shares representing 3.62% ownership of the company. In it's prior filing, the firm reported owning 3,468K shares, representing an increase of 7.13%. The firm decreased its portfolio allocation in SYNH by 99.99% over the last quarter.

IJH - iShares Core S&P Mid-Cap ETF holds 3,178K shares representing 3.08% ownership of the company. In it's prior filing, the firm reported owning 3,000K shares, representing an increase of 5.60%. The firm decreased its portfolio allocation in SYNH by 28.07% over the last quarter.

What is the Fund Sentiment?

There are 889 funds or institutions reporting positions in Syneos Health. This is a decrease of 24 owner(s) or 2.63% in the last quarter. Average portfolio weight of all funds dedicated to SYNH is 0.20%, a decrease of 27.19%. Total shares owned by institutions increased in the last three months by 3.36% to 126,694K shares. The put/call ratio of SYNH is 0.42, indicating a bullish outlook.

Syneos Health Background Information

(This description is provided by the company.)

Syneos Health is the only fully integrated biopharmaceutical solutions organization. Our company, including a Contract Research Organization (CRO) and Contract Commercial Organization (CCO), is purpose-built to accelerate customer performance to address modern market realities. Created through the merger of two industry leading companies – INC Research and inVentiv Health – we bring together approximately 24,000 clinical and commercial minds with the ability to support customers in more than 110 countries. Together we share insights, use the latest technologies and apply advanced business practices to speed our customers’ delivery of important therapies to patients. To learn more about how we are shortening the distance from lab to life® visit syneoshealth.com.