Barclays Maintains Arch Capital Group (ACGL) Overweight Recommendation

Fintel reports that on April 28, 2023, Barclays maintained coverage of Arch Capital Group (NASDAQ:ACGL) with a Overweight recommendation.

Analyst Price Forecast Suggests 5.89% Upside

As of April 24, 2023, the average one-year price target for Arch Capital Group is 78.23. The forecasts range from a low of 65.65 to a high of $85.05. The average price target represents an increase of 5.89% from its latest reported closing price of 73.88.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Arch Capital Group is 11,833MM, an increase of 9.15%. The projected annual non-GAAP EPS is 5.59.

What is the Fund Sentiment?

There are 1305 funds or institutions reporting positions in Arch Capital Group.

This is an increase

of

260

owner(s) or 24.88% in the last quarter.

Average portfolio weight of all funds dedicated to ACGL is 0.54%,

an increase

of 8.16%.

Total shares owned by institutions increased

in the last three months by 0.75% to 440,330K shares.

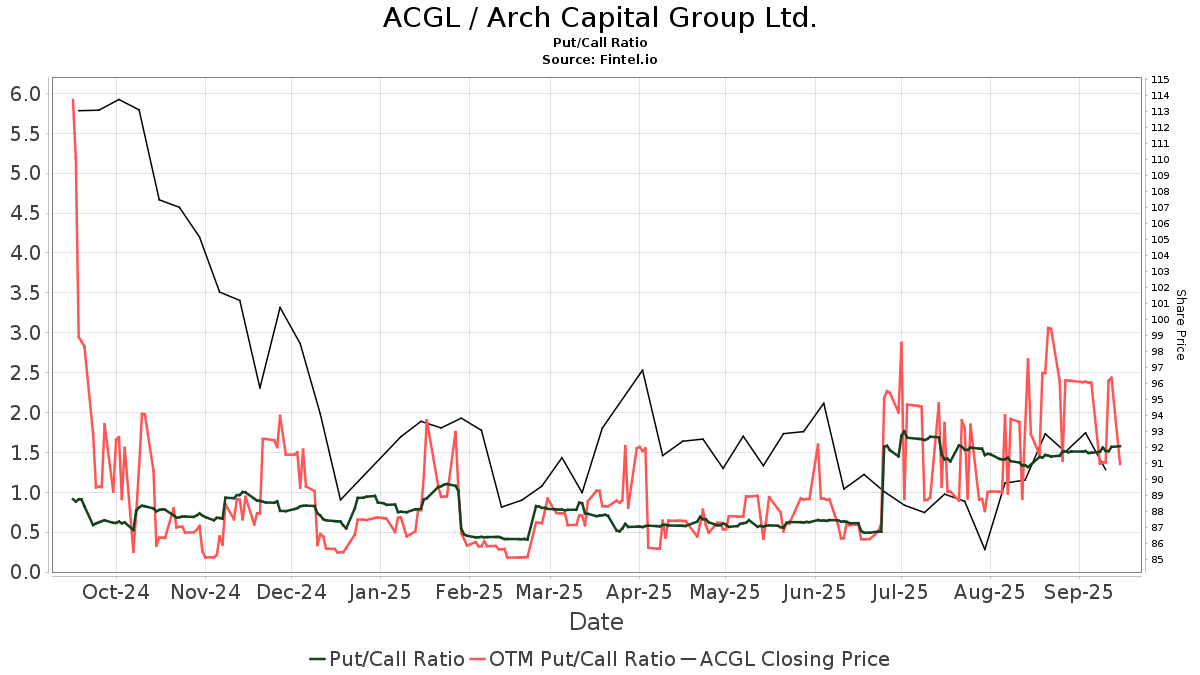

The put/call ratio of ACGL is 5.86, indicating a

bearish

outlook.

The put/call ratio of ACGL is 5.86, indicating a

bearish

outlook.

What are Other Shareholders Doing?

Artisan Partners Limited Partnership holds 31,135K shares representing 8.36% ownership of the company. In it's prior filing, the firm reported owning 35,254K shares, representing a decrease of 13.23%. The firm increased its portfolio allocation in ACGL by 22.45% over the last quarter.

Bamco holds 21,416K shares representing 5.75% ownership of the company. In it's prior filing, the firm reported owning 21,493K shares, representing a decrease of 0.36%. The firm increased its portfolio allocation in ACGL by 42.77% over the last quarter.

ARTKX - Artisan International Value Fund Investor Shares holds 21,095K shares representing 5.66% ownership of the company. In it's prior filing, the firm reported owning 23,073K shares, representing a decrease of 9.38%. The firm increased its portfolio allocation in ACGL by 10.35% over the last quarter.

Capital World Investors holds 19,256K shares representing 5.17% ownership of the company. In it's prior filing, the firm reported owning 19,212K shares, representing an increase of 0.23%. The firm increased its portfolio allocation in ACGL by 31.19% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 10,667K shares representing 2.86% ownership of the company. In it's prior filing, the firm reported owning 10,478K shares, representing an increase of 1.77%. The firm increased its portfolio allocation in ACGL by 29.60% over the last quarter.

Arch Capital Group Background Information

(This description is provided by the company.)

Arch Capital Group Ltd., a Bermuda-based company with approximately $15.2 billion in capital at Sept. 30, 2020, provides insurance, reinsurance and mortgage insurance on a worldwide basis through its wholly owned subsidiaries.

See all Arch Capital Group regulatory filings.