Grundläggande statistik

| Portföljvärde | $ 349 101 197 |

| Aktuella positioner | 282 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

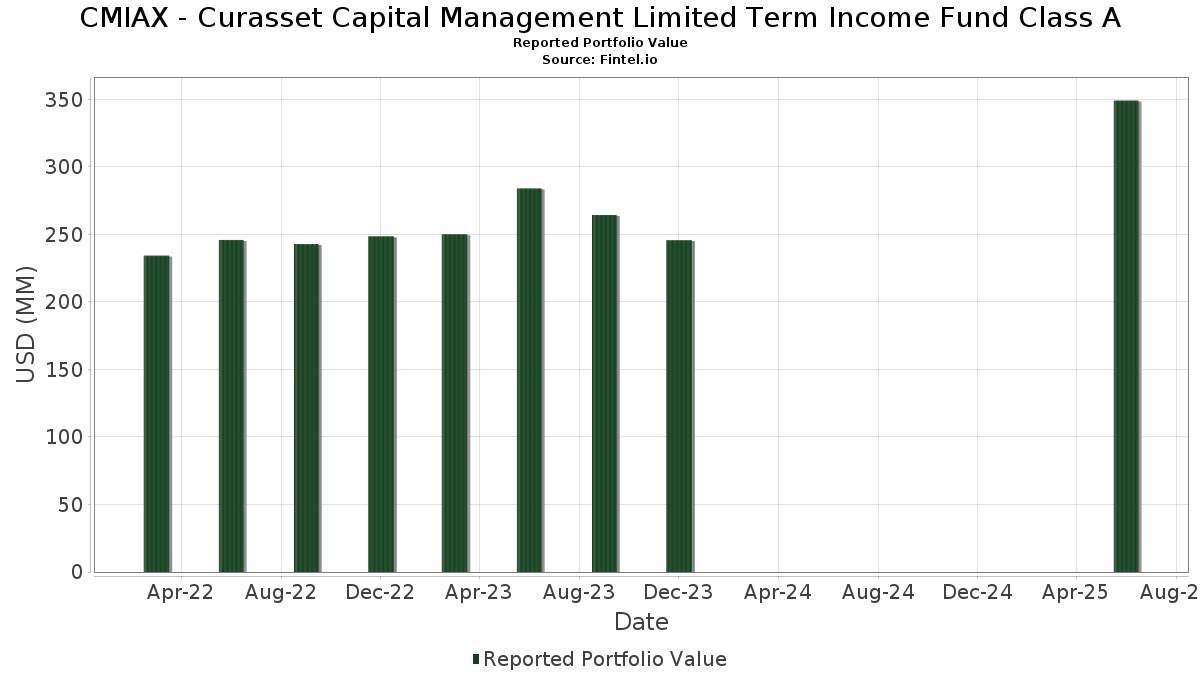

CMIAX - Curasset Capital Management Limited Term Income Fund Class A har redovisat 282 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 349 101 197 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). CMIAX - Curasset Capital Management Limited Term Income Fund Class As största innehav är Federated Hermes Money Market Obligations Trust - Federated Hermes Gov Oblig Fd Inst Shs USD (US:GOIXX) , US TREASURY I/L 2.375% 10-15-28 (US:US91282CJH51) , Fannie Mae Connecticut Avenue Securities (US:US20753XAB01) , United States Treasury Note/Bond (US:US91282CJP77) , and iShares Trust - iShares Fallen Angels USD Bond ETF (US:FALN) . CMIAX - Curasset Capital Management Limited Term Income Fund Class As nya positioner inkluderar US TREASURY I/L 2.375% 10-15-28 (US:US91282CJH51) , Fannie Mae Connecticut Avenue Securities (US:US20753XAB01) , United States Treasury Note/Bond (US:US91282CJP77) , iShares Trust - iShares Fallen Angels USD Bond ETF (US:FALN) , and iShares Trust - iShares BB Rated Corporate Bond ETF (US:HYBB) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 62,75 | 17,9790 | 17,9790 | ||

| 21,05 | 6,0310 | 6,0310 | ||

| 18,74 | 18,74 | 5,3700 | 4,8862 | |

| 10,07 | 2,8855 | 2,8855 | ||

| 8,47 | 2,4272 | 2,4272 | ||

| 5,63 | 1,6128 | 1,6128 | ||

| 5,34 | 1,5308 | 1,5308 | ||

| 5,11 | 1,4645 | 1,4645 | ||

| 4,02 | 1,1527 | 1,1527 | ||

| 4,02 | 1,1515 | 1,1515 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 0,37 | 0,1049 | −0,6914 | ||

| 5,04 | 1,4432 | −0,5969 | ||

| 1,17 | 0,3352 | −0,4546 | ||

| 0,15 | 0,0424 | −0,4451 | ||

| 0,26 | 0,0758 | −0,4373 | ||

| 1,31 | 0,3759 | −0,3913 | ||

| 1,29 | 0,3690 | −0,3572 | ||

| 0,12 | 0,0341 | −0,3551 | ||

| 0,39 | 0,1124 | −0,3508 | ||

| 0,23 | 0,0651 | −0,3363 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-07 för rapporteringsperioden 2025-06-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TREASURY 08/31/2026 3.75% / DBT (US91282CLH24) | 62,75 | 17,9790 | 17,9790 | ||||||

| US Treasury 01/15/2027 4.000% / DBT (US91282CJT99) | 21,05 | 6,0310 | 6,0310 | ||||||

| GOIXX / Federated Hermes Money Market Obligations Trust - Federated Hermes Gov Oblig Fd Inst Shs USD | 18,74 | 1 465,60 | 18,74 | 1 465,75 | 5,3700 | 4,8862 | |||

| US Treasury N/B 05/31/2026 4.875% / DBT (US91282CKS97) | 10,07 | 2,8855 | 2,8855 | ||||||

| US91282CJH51 / US TREASURY I/L 2.375% 10-15-28 | 8,47 | 2,4272 | 2,4272 | ||||||

| US Treasury N/B 02/28/2027 4.125% / DBT (US91282CMP31) | 5,63 | 1,6128 | 1,6128 | ||||||

| US Treasury N/B 12/31/2026 4.25% / DBT (US91282CME83) | 5,34 | 1,5308 | 1,5308 | ||||||

| US20753XAB01 / Fannie Mae Connecticut Avenue Securities | 5,11 | 1,4645 | 1,4645 | ||||||

| US91282CJP77 / United States Treasury Note/Bond | 5,04 | −0,22 | 1,4432 | −0,5969 | |||||

| US Treasury N/B 06/30/2026 4.625% / DBT (US91282CKY65) | 4,02 | 1,1527 | 1,1527 | ||||||

| US Treasury 02/15/2027 4.000% / DBT (US91282CKA89) | 4,02 | 1,1515 | 1,1515 | ||||||

| US TREASURY N/B 04/30/2027 3.75% / DBT (US91282CMY48) | 3,90 | 1,1172 | 1,1172 | ||||||

| FALN / iShares Trust - iShares Fallen Angels USD Bond ETF | 0,13 | 3,55 | 1,0165 | 1,0165 | |||||

| HYBB / iShares Trust - iShares BB Rated Corporate Bond ETF | 0,07 | 3,43 | 0,9831 | 0,9831 | |||||

| US TREASURY N/B 11/15/2027 4.125% / DBT (US91282CLX73) | 3,34 | 0,9559 | 0,9559 | ||||||

| US20755DAB29 / Fannie Mae Connecticut Avenue Securities | 3,11 | 1 090,80 | 0,8906 | 0,7848 | |||||

| US35564KWT23 / STACR_22-DNA4 | 2,98 | 0,8544 | 0,8544 | ||||||

| US35564K2G38 / Freddie Mac Structured Agency Credit Risk Debt Notes | 2,86 | 0,8206 | 0,8206 | ||||||

| US35564KH446 / FHLMC STACR REMIC Trust, Series 2022-DNA6, Class M1B | 2,81 | 0,8062 | 0,8062 | ||||||

| ANGL / VanEck ETF Trust - VanEck Fallen Angel High Yield Bond ETF | 0,09 | 2,69 | 0,7700 | 0,7700 | |||||

| US35564KRF83 / Freddie Mac Structured Agency Credit Risk Debt Notes | 2,65 | 0,7579 | 0,7579 | ||||||

| US20753AAA25 / Connecticut Avenue Securities Trust 2023-R03 | 2,50 | 0,7175 | 0,7175 | ||||||

| Generate CLO Ltd 07/22/2037 VAR% 144A / ABS-MBS (US37148XAA00) | 2,39 | 0,6859 | 0,6859 | ||||||

| US20754AAB98 / Fannie Mae Connecticut Avenue Securities | 2,22 | 0,6369 | 0,6369 | ||||||

| US12663BAD01 / CPS AUTO TRUST 08/15/2028 5.19% MTGE | 2,20 | 2,37 | 0,6309 | −0,2380 | |||||

| US20754RAF38 / Connecticut Avenue Securities Trust 2021-R01 | 2,15 | 0,6162 | 0,6162 | ||||||

| US91282CJN20 / US TREASURY N/B 4.375% 11-30-28 | 2,14 | 0,6145 | 0,6145 | ||||||

| ING27 / ING Groep NV | 1,99 | 2,90 | 0,5703 | −0,2116 | |||||

| US22535WAH07 / Credit Agricole SA | 1,96 | 6,52 | 0,5621 | −0,1820 | |||||

| US30166QAF63 / Exeter Automobile Receivables Trust 2022-2 | 1,93 | 237,52 | 0,5543 | 0,3226 | |||||

| US06675FAY34 / Banque Federative du Credit Mutuel SA | 1,93 | 5,69 | 0,5535 | −0,1851 | |||||

| US92512VAD10 / Veros Auto Receivables Trust 2022-1 | 1,91 | 2,30 | 0,5476 | −0,2073 | |||||

| US Treasury N/B 07/15/2027 4.375% / DBT (US91282CKZ31) | 1,82 | 0,5221 | 0,5221 | ||||||

| US Treasury N/B 12/15/2027 4.00% / DBT (US91282CMB45) | 1,67 | 0,4777 | 0,4777 | ||||||

| US36265NAE31 / GLS Auto Receivables Issuer Trust 2022-2 | 1,61 | 0,4625 | 0,4625 | ||||||

| Gov. National Mortgage 11/20/2051 3.00% / ABS-MBS (US38383DP362) | 1,61 | 0,4614 | 0,4614 | ||||||

| US912810FS25 / United States Treasury Inflation Indexed Bonds | 1,58 | 0,4522 | 0,4522 | ||||||

| Freddie Mac STACR 08/25/2044 VAR% 144A / ABS-MBS (35564NEC3) | 1,52 | 0,4366 | 0,4366 | ||||||

| US207932AA28 / Fannie Mae Connecticut Avenue Securities | 1,51 | 0,4334 | 0,4334 | ||||||

| US35564KQC61 / Freddie Mac STACR REMIC Trust 2022-DNA1 | 1,37 | 0,3938 | 0,3938 | ||||||

| Voya CLO Ltd 10/15/2037 VAR% 144A / ABS-MBS (US92944YAA91) | 1,37 | 0,3937 | 0,3937 | ||||||

| US30167JAF12 / Exeter Automobile Receivables Trust | 1,32 | −17,58 | 0,3789 | −0,2694 | |||||

| US20753ACJ16 / Connecticut Avenue Securities Trust, Series 2023-R03, Class 2M1 | 1,31 | −30,87 | 0,3759 | −0,3913 | |||||

| US35564KWS40 / STACR_22-DNA4 | 1,29 | −28,34 | 0,3690 | −0,3572 | |||||

| US89352LAG59 / Trans-canada Pipelines 7.7% Notes 6/15/29 | 1,27 | 0,00 | 0,3641 | −0,1493 | |||||

| US35564KL497 / FREDDIE MAC STACR REMIC TRUST 2022-DNA7 SER 2022-DNA7 CL M1B V/R REGD 144A P/P 7.37618000 | 1,26 | 0,3609 | 0,3609 | ||||||

| US35564KMH94 / Freddie Mac Structured Agency Credit Risk Debt Notes | 1,23 | 0,3525 | 0,3525 | ||||||

| US35564KX799 / Freddie Mac STACR REMIC Trust 2023-HQA1 | 1,17 | −40,17 | 0,3352 | −0,4546 | |||||

| US35564KX872 / Freddie Mac STACR REMIC Trust 2023-HQA1 | 1,16 | 0,3329 | 0,3329 | ||||||

| US35564NAA19 / Freddie Mac, Series 2023-HQA3, Class M2 | 1,16 | 0,3325 | 0,3325 | ||||||

| US96042WAG24 / WLAKE 22-1A D 144A 3.49% 3-15-27/1-15-25 | 1,13 | 141,36 | 0,3246 | 0,1348 | |||||

| US345277AE74 / Ford Holdings 9.3% Guaranteed 3/1/30 | 1,12 | 0,3223 | 0,3223 | ||||||

| NGC Ltd 04/20/2038 VAR% 144A / ABS-MBS (US652942AA15) | 1,12 | 0,3207 | 0,3207 | ||||||

| US12663BAE83 / CPS AUTO TRUST 10/15/2029 7.14% MTGE | 1,12 | 4,88 | 0,3201 | −0,1102 | |||||

| US20755DAA46 / Fannie Mae Connecticut Avenue Securities | 1,12 | 0,3201 | 0,3201 | ||||||

| US35564KT581 / FHLMC Structured Agency Credit Risk Debt Notes, Series 2023-DNA2, Class M1A | 1,11 | 7,25 | 0,3182 | −0,1003 | |||||

| Fannie Mae Cas 02/25/20244 VAR% 144A / DBT (US20754GAE08) | 1,11 | 0,3178 | 0,3178 | ||||||

| US92328XBF50 / Venture XV CLO Ltd | 1,11 | 0,3175 | 0,3175 | ||||||

| Fannie Mae - CAS 05/25/2044 VAR% 144A / DBT (US20753GAC50) | 1,11 | 0,3167 | 0,3167 | ||||||

| Freddie Mac Stacr 05/25/2044 VAR% 144A / DBT (US35564NDA81) | 1,11 | 0,3166 | 0,3166 | ||||||

| US33844WAJ99 / Flagship Credit Auto Trust | 1,10 | 0,3163 | 0,3163 | ||||||

| Fannie Mae 07/25/2044 VAR% 144A / DBT (US20754XAC74) | 1,10 | 0,3163 | 0,3163 | ||||||

| Lendbuzz Sec 05/15/2030 5.18% 144A / ABS-MBS (US52611JAB61) | 1,10 | 0,3159 | 0,3159 | ||||||

| Tricolor Auto 01/16/2029 5.12% / ABS-MBS (US89617QAA85) | 1,10 | 0,3155 | 0,3155 | ||||||

| Crossroads Asset Trusts 06/22/2026 4.73% 144A / ABS-MBS (US22767VAA61) | 1,10 | 0,3152 | 0,3152 | ||||||

| Golun Capital Partners 04/25/2034 VAR% 144A / ABS-MBS (US38180UAA34) | 1,10 | 0,3152 | 0,3152 | ||||||

| US74736KAJ07 / Qorvo, Inc. | 1,09 | 0,3134 | 0,3134 | ||||||

| Generate CLO 07/20/2037 VAR% 144A / ABS-MBS (US37148BAA89) | 1,09 | 0,3127 | 0,3127 | ||||||

| US30711XY321 / CORP CMO | 1,09 | 0,74 | 0,3124 | −0,1252 | |||||

| US35564K2F54 / FHLMC Structured Agency Credit Risk Debt Notes, Series 2023-HQA2, Class M1A | 1,08 | −8,81 | 0,3088 | −0,1688 | |||||

| US35564KKY46 / Freddie Mac STACR REMIC Trust 2021-DNA6 | 1,07 | 0,3065 | 0,3065 | ||||||

| Crown City CLO 07/15/2037 VAR% 144A / ABS-MBS (US22823EAN85) | 1,07 | 0,3064 | 0,3064 | ||||||

| US20755CAA62 / Connecticut Avenue Securities Trust 2023-R08 | 1,07 | 11,03 | 0,3059 | −0,0824 | |||||

| US912828Z781 / United States Treasury Note/Bond | 1,07 | 3,89 | 0,3059 | −0,1093 | |||||

| US443510AH55 / Hubbell Inc. | 1,05 | 3,13 | 0,3017 | −0,1109 | |||||

| Helmerich & Payne Inc 12/01/2029 4.85% 144A / DBT (US423452AJ06) | 1,05 | 0,3005 | 0,3005 | ||||||

| US40538TAC71 / Halcyon Loan Advisors Funding 2018-1 Ltd | 1,04 | 0,2992 | 0,2992 | ||||||

| Polus Capital Management 10/20/2037 VAR% 144A / ABS-MBS (US73163EAA73) | 1,04 | 0,2986 | 0,2986 | ||||||

| US20754EAB11 / Connecticut Avenue Securities Trust, Series 2023-R06, Class 1M2 | 1,03 | 0,2957 | 0,2957 | ||||||

| US31959XAA19 / First Citizens BancShares, Inc., Series B | 1,03 | 1,47 | 0,2957 | −0,1154 | |||||

| US924933AC82 / Veros Auto Receivables Trust 2023-1 | 1,03 | 0,2941 | 0,2941 | ||||||

| US93884PCJ75 / Washington Gas Lt Co Mtns Be Put 6.82% 10/09/26 | 1,02 | −0,49 | 0,2936 | −0,1223 | |||||

| Shackleton CLO Ltd 08/15/2030 VAR% 144A / ABS-MBS (US81883EAJ01) | 1,01 | 0,2907 | 0,2907 | ||||||

| US20754MCB19 / Connecticut Avenue Securities Trust 2022-R07 | 1,01 | 0,2902 | 0,2902 | ||||||

| US88947EAS90 / Toll Brothers Inc Bond | 1,00 | 0,91 | 0,2874 | −0,1143 | |||||

| US23345YAJ01 / DT Auto Owner Trust, Series 2022-1A, Class E | 1,00 | 0,2855 | 0,2855 | ||||||

| US759509AF91 / Reliance Steel & Aluminum Co. | 1,00 | 6,42 | 0,2852 | −0,0927 | |||||

| CoreVest American Finance Trust 10/15/2054 2.911% 144A / ABS-MBS (US21873NAJ81) | 0,99 | 0,2829 | 0,2829 | ||||||

| US35564KT664 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0,94 | 0,2702 | 0,2702 | ||||||

| US20754EAA38 / Connecticut Avenue Securities Trust, Series 2023-R06, Class 1M1 | 0,94 | −34,47 | 0,2698 | −0,3106 | |||||

| GoldenTree Loan Management 07/20/2037 VAR% 144A / ABS-MBS (US38139MAA36) | 0,94 | 0,2681 | 0,2681 | ||||||

| US92916XAL10 / INGIM_13-3A | 0,91 | 0,2610 | 0,2610 | ||||||

| US05368QAC15 / Avid Automobile Receivables Trust 2023-1 | 0,90 | 0,33 | 0,2589 | −0,1049 | |||||

| Benefit Street Partners 07/15/2037 VAR% 144A / ABS-MBS (US08179MAL37) | 0,90 | 0,2577 | 0,2577 | ||||||

| US30166QAG47 / EXETER AUTOMOBILE RECEIVABLES TRUST 2022-2 EART 2022-2A E | 0,89 | −0,22 | 0,2551 | −0,1055 | |||||

| Freddie Mac 05/25/2045 VAR% 144A / DBT (US35564NHZ96) | 0,88 | 0,2529 | 0,2529 | ||||||

| US35564KAH23 / Freddie Mac STACR REMIC Trust 2021-DNA1 | 0,87 | 0,2501 | 0,2501 | ||||||

| Transamerica Capital II / DBT (US893472AA88) | 0,85 | 0,60 | 0,2422 | −0,0975 | |||||

| US418056AH08 / Hasbro Inc Debenture - Unsecure Bond | 0,84 | 0,84 | 0,2406 | −0,0957 | |||||

| US20754LAF67 / Fannie Mae Connecticut Avenue Securities | 0,82 | 0,2353 | 0,2353 | ||||||

| US19767QAQ82 / Columbia/hca 7.58% Senior Notes 09/15/25 | 0,82 | −2,50 | 0,2352 | −0,1049 | |||||

| US858119BF68 / Steel Dynamics Inc | 0,81 | −0,73 | 0,2327 | −0,0979 | |||||

| US30165XAF24 / Exeter Automobile Receivables Trust, Series 2021-2A, Class D | 0,81 | 0,2310 | 0,2310 | ||||||

| US30166AAF12 / EART_21-3A | 0,81 | 0,2309 | 0,2309 | ||||||

| US20754NAB10 / Connecticut Avenue Securities Trust 2022-R06 | 0,80 | 0,2304 | 0,2304 | ||||||

| Ballyrock Ltd 07/20/2037 VAR% 144A / ABS-MBS (US05874XAJ81) | 0,75 | 0,2143 | 0,2143 | ||||||

| US501687AC11 / LADAR 22-1 C 144A 6.85% 04-15-30/03-16-26 | 0,74 | 1,10 | 0,2111 | −0,0833 | |||||

| US35564KPV51 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0,73 | 0,2083 | 0,2083 | ||||||

| US20755AAB89 / Connecticut Avenue Securities Trust 2023-R02 | 0,72 | 47,95 | 0,2071 | 0,0098 | |||||

| US Treasury 11/30/2026 4.25% / DBT (US91282CLY56) | 0,72 | 0,2058 | 0,2058 | ||||||

| US35564KP373 / Freddie Mac STACR REMIC Trust 2023-DNA1 | 0,70 | 0,2012 | 0,2012 | ||||||

| Lendbuzz Sec 07/15/2026 4.759% 144A / ABS-MBS (US52611JAA88) | 0,70 | 0,1991 | 0,1991 | ||||||

| US23344QAD16 / DT Auto Owner Trust, Series 2021-3A, Class D | 0,69 | −37,94 | 0,1984 | −0,2525 | |||||

| US20754LAB53 / Fannie Mae Connecticut Avenue Securities | 0,69 | 175,60 | 0,1976 | 0,0964 | |||||

| US98373XBD12 / X-Caliber Funding LLC 11/01/2024 8.580% | 0,69 | −42,80 | 0,1969 | −0,2888 | |||||

| Freddie Mac-Star 05/25/2044 Var% / ABS-MBS (US35564NCX93) | 0,67 | 0,1908 | 0,1908 | ||||||

| US099724AC03 / Borg Warner Automotive 7.125% Notes 02/15/29 | 0,65 | −0,46 | 0,1856 | −0,0772 | |||||

| US78449UAB44 / SMB Private Education Loan Trust 2020-A | 0,65 | −35,18 | 0,1850 | −0,2172 | |||||

| US89616KAE47 / TRICOLOR AUOT 06/15/2028 13.45% | 0,64 | 2,72 | 0,1840 | −0,0686 | |||||

| US90944DAJ00 / UNITED AUTO CREDIT 11/10/2028 5% | 0,62 | −20,49 | 0,1769 | −0,1369 | |||||

| US74388JAA34 / PFMT 2021-2 A1 2.5% 4/25/2051 | 0,62 | −8,62 | 0,1763 | −0,0957 | |||||

| US35564K3G29 / Freddie Mac Stacr Remic Trust 2023-Hqa3 | 0,61 | −37,45 | 0,1744 | −0,2186 | |||||

| US87166FAD50 / Synchrony Bank | 0,60 | 1,53 | 0,1719 | −0,0669 | |||||

| US29273VAJ98 / PERPETUAL BONDS | 0,60 | 19,40 | 0,1711 | −0,0313 | |||||

| US35105JAF57 / FOURSIGHT CAPITAL AUTOMOBILE RECEIVABLES TRUST 202 FCRT 2022-1 D | 0,60 | 6,63 | 0,1706 | −0,0552 | |||||

| US78432MAA36 / SBL HOLDINGS LLC/KANSAS 144A 5.125000% 11/13/2026 | 0,59 | 5,32 | 0,1704 | −0,0578 | |||||

| US36263LAG41 / GCAR_21-3A | 0,59 | 0,1689 | 0,1689 | ||||||

| Alliance Res Op/Finance 06/15/29 8.625% 144A / DBT (US01879NAC92) | 0,58 | 0,1675 | 0,1675 | ||||||

| US36263DAD93 / GLS Auto Receivables Issuer Trust, Series 2021-4A, Class D | 0,57 | 0,1640 | 0,1640 | ||||||

| Atlas Senior Loan Fund LTD 04/22/2031 VAR% 144A / ABS-MBS (US04942VBA17) | 0,56 | 0,1613 | 0,1613 | ||||||

| Saratoga Invest Corp 04/20/2033 Var% 144A / ABS-MBS (US80349BBF31) | 0,56 | 0,1599 | 0,1599 | ||||||

| US91683VAB09 / Upstart Securitization Trust 2023-2 | 0,56 | 0,1593 | 0,1593 | ||||||

| Pagaya AI Debt Selection Trust 07/15/2031 VAR% 144A / ABS-MBS (US69548RAC88) | 0,56 | 0,1591 | 0,1591 | ||||||

| Switch ABS Issuer 06/25/2054 6.20% 144A / ABS-MBS (US871044AG87) | 0,55 | 0,1590 | 0,1590 | ||||||

| Venture CDO Ltd 10/20/2034 VAR% 144A / ABS-MBS (US92331DBL10) | 0,55 | 0,1589 | 0,1589 | ||||||

| Saluda Grace Alternative Mortgage 02/25/2030 7.500% 144A / ABS-MBS (US79584CAA99) | 0,55 | 0,1585 | 0,1585 | ||||||

| X-Caliber Funding LLC 08/04/2027 12.000% 144A / ABS-MBS (US98373XBP42) | 0,55 | 0,1585 | 0,1585 | ||||||

| PEAC Solutions Rec 10/20/2031 4.65%144A / ABS-MBS (US69392BAC00) | 0,55 | 0,1582 | 0,1582 | ||||||

| Sofi Consumer Loan Pro 06/25/2034 4.82% 144A / ABS-MBS (US83407HAA59) | 0,55 | 0,1578 | 0,1578 | ||||||

| US29265AAS50 / Energen Corp. 7.125% Mtns 2/15/28 | 0,55 | 0,1578 | 0,1578 | ||||||

| US20754MBZ95 / Connecticut Avenue Securities Trust 2022-R07 | 0,55 | 623,68 | 0,1577 | 0,1267 | |||||

| US576323AQ25 / MasTec Inc | 0,55 | 0,1576 | 0,1576 | ||||||

| US440407AA21 / Horizon Bancorp Inc/IN | 0,55 | 0,1575 | 0,1575 | ||||||

| Carvana Auto Rec Trust 01/10/2031 4.74% / ABS-MBS (US146919AF20) | 0,55 | 0,1565 | 0,1565 | ||||||

| US23344QAE98 / DT Auto Owner Trust, Series 2021-3A, Class E | 0,54 | 0,1552 | 0,1552 | ||||||

| US20754DAA54 / CAS_22-R05 | 0,54 | 0,1538 | 0,1538 | ||||||

| US83607EAC66 / Sound Point CLO V-R LTD | 0,54 | 0,1537 | 0,1537 | ||||||

| ZAIS CLO 01/20/2032 VAR% / ABS-MBS (US98887YAQ08) | 0,53 | 0,1525 | 0,1525 | ||||||

| ICG US CLO Ltd 01/15/2031 VAR / ABS-MBS (USG47077AN53) | 0,53 | 0,1524 | 0,1524 | ||||||

| Allegro CLO Ltd 01/19/2033 VAR% 144A / ABS-MBS (US01750HAU68) | 0,53 | 0,1519 | 0,1519 | ||||||

| US35564KPP83 / Freddie Mac STACR REMIC Trust 2021-HQA4 | 0,53 | 0,1516 | 0,1516 | ||||||

| US20753XAA28 / Fannie Mae Connecticut Avenue Securities | 0,53 | −34,98 | 0,1509 | −0,1761 | |||||

| US Treasury 01/31/2026 4.250% / DBT (US91282CJV46) | 0,52 | 0,1504 | 0,1504 | ||||||

| US09629EAE14 / BLUEM_17-2A | 0,52 | 0,1504 | 0,1504 | ||||||

| Zais Matrix 04/15/2032 VAR% / ABS-MBS (US98888BBN55) | 0,52 | 0,1504 | 0,1504 | ||||||

| US79582GAA22 / Saluda Grade Alternative Mortgage Trust, Series 2023-SEQ3, Class A1 | 0,52 | −41,45 | 0,1504 | −0,2115 | |||||

| US12648HBC88 / CSMC 2014-IVR2 B2 | 0,52 | −36,61 | 0,1500 | −0,1834 | |||||

| Jamestown CLO Ltd 04/20/2032 VAR% 144A / ABS-MBS (US47047JAN46) | 0,52 | 0,1496 | 0,1496 | ||||||

| US04047AAE47 / Arivo Acceptance Auto Loan Receivables Trust 2021-1 | 0,52 | 0,1493 | 0,1493 | ||||||

| ARTFI 12/22/2031 VAR% 144A / ABS-MBS (US83589CAB46) | 0,52 | 0,1491 | 0,1491 | ||||||

| Fanniemae Strip 02/25/2037 1.5000% / ABS-MBS (US31423XPH88) | 0,52 | 0,1488 | 0,1488 | ||||||

| US92332YAA91 / Venture Global LNG, Inc. | 0,52 | 0,1481 | 0,1481 | ||||||

| US718549AF57 / Phillips 66 Partners LP | 0,52 | 8,63 | 0,1480 | −0,0441 | |||||

| US14686GAE61 / Carvana Auto Receivables Trust 2022-N1 | 0,51 | −3,76 | 0,1470 | −0,0682 | |||||

| US87612BBQ41 / CORPORATE BONDS | 0,51 | 1,60 | 0,1454 | −0,0566 | |||||

| US88738TAA88 / Timken Co/The | 0,51 | 1,20 | 0,1452 | −0,0572 | |||||

| US35564K3F46 / Freddie Mac Stacr Remic Trust 2023-Hqa3 | 0,50 | 0,1446 | 0,1446 | ||||||

| US887389AK07 / Timken Co. | 0,50 | 3,09 | 0,1435 | −0,0530 | |||||

| US16411RAK59 / Cheniere Energy Inc | 0,50 | 0,1431 | 0,1431 | ||||||

| US12664WAE12 / CPS AUTO TRUST 11/15/2030 10.72% | 0,50 | 4,62 | 0,1427 | −0,0499 | |||||

| US66977WAR07 / NOVA Chemicals Corp | 0,50 | 0,1425 | 0,1425 | ||||||

| US87470LAD38 / Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp | 0,50 | 0,1424 | 0,1424 | ||||||

| US172967MU24 / CITIGROUP INC JR SUBORDINA 12/99 VAR | 0,50 | 7,83 | 0,1422 | −0,0437 | |||||

| US13805AAA51 / CANPACK SA / Eastern PA Land Investment Holding LLC | 0,50 | 4,65 | 0,1420 | −0,0494 | |||||

| US32057KAE01 / First Investors Auto Owner Trust 2022-1 | 0,49 | 6,71 | 0,1414 | −0,0456 | |||||

| US37045XCA28 / General Motors Finl Co Bond | 0,49 | 11,29 | 0,1414 | −0,0378 | |||||

| US784033AL62 / SCF Equipment Leasing LLC, Series 2022-1A, Class E | 0,49 | 9,33 | 0,1411 | −0,0409 | |||||

| US38144GAG64 / Goldman Sachs Group Inc/The | 0,49 | 10,38 | 0,1402 | −0,0389 | |||||

| US59980YAB11 / Mill City Mortgage Loan Trust 2018-4 | 0,47 | −27,34 | 0,1358 | −0,1275 | |||||

| US35566CAH88 / Freddie Mac STACR REMIC Trust 2020-DNA6 | 0,46 | −34,29 | 0,1318 | −0,1512 | |||||

| US67112GAA67 / OZLM XVIII Ltd | 0,46 | 0,1309 | 0,1309 | ||||||

| US23345YAG61 / DT Auto Owner Trust, Series 2022-1A, Class D | 0,45 | 0,1288 | 0,1288 | ||||||

| US12648HBE45 / CSMC TRUST 2014-IVR2 SER 2014-IVR2 CL B4 V/R REGD 144A P/P 3.76105700 | 0,45 | −18,43 | 0,1283 | −0,0933 | |||||

| Ocwen Loan Investment Trust 02/25/2037 3.000% 144A / ABS-MBS (US675952AE50) | 0,45 | 0,1279 | 0,1279 | ||||||

| US551925AB68 / M&T Equipment 2023-LEAF1 Notes | 0,43 | 0,1234 | 0,1234 | ||||||

| US02530BAG59 / AMERICAN CREDIT ACCEPTANCE RECEIVABLES TRUST 2022- ACAR 2022-2 D | 0,43 | −60,35 | 0,1225 | −0,3128 | |||||

| US 5YR NOTE (CBT) Sep25 / DIR (N/A) | 0,42 | 0,1213 | 0,1213 | ||||||

| US207942AA18 / Fannie Mae Connecticut Avenue Securities | 0,41 | −16,50 | 0,1177 | −0,0810 | |||||

| Carmax Select Rec 04/15/2026 4.774% / ABS-MBS (US14319UAA88) | 0,41 | 0,1177 | 0,1177 | ||||||

| Volkswagen Auto 03/20/2026 4.451% / ABS-MBS (US92868MAA71) | 0,40 | 0,1149 | 0,1149 | ||||||

| BreanAsset Backed Sec 01/25/2065 5.0000% 144A / ABS-MBS (US10638FAC95) | 0,40 | 0,1140 | 0,1140 | ||||||

| Tricolor Auto Securitization Trust 02/15/2028 6.570% 144A / ABS-MBS (US89616PAB94) | 0,39 | 0,1128 | 0,1128 | ||||||

| US80287EAF25 / Santander Drive Auto Receivables Trust 2021-3 | 0,39 | −65,79 | 0,1124 | −0,3508 | |||||

| US80290CBB90 / Santander Bank Auto Credit-Linked Notes Series 2022-B | 0,39 | 0,1109 | 0,1109 | ||||||

| Exeter Auto Rec 04/15/2026 4.536% / ABS-MBS (US30168JAA16) | 0,38 | 0,1097 | 0,1097 | ||||||

| Lendbuzz Securitization Trust 05/15/2029 5.990% 144A / ABS-MBS (US525920AB00) | 0,37 | 0,1068 | 0,1068 | ||||||

| US41755NAA81 / HARVEST SBA LOAN TRUST 06/26/2047 VAR% | 0,37 | −40,55 | 0,1055 | −0,1448 | |||||

| US23345AAE38 / DTAOT 22-2A C 144A 4.72% 03-15-28/07-15-25 | 0,37 | −81,47 | 0,1049 | −0,6914 | |||||

| US 2YR NOTE (CBT) Sep25 / DIR (N/A) | 0,36 | 0,1034 | 0,1034 | ||||||

| US675232AB89 / OCEANEERING INTL INC SR UNSECURED 02/28 6 | 0,35 | 0,1011 | 0,1011 | ||||||

| US422704AH97 / Hecla Mining Co | 0,35 | 0,1011 | 0,1011 | ||||||

| US21039CAA27 / Constellium SE | 0,35 | 0,0997 | 0,0997 | ||||||

| US20753DAA63 / Connecticut Avenue Securities Trust 2022-R09 | 0,33 | −39,52 | 0,0935 | −0,1245 | |||||

| US525931AB72 / Lendbuzz Securitization Trust 2023-3 | 0,33 | −46,55 | 0,0932 | −0,1526 | |||||

| US35564KH362 / Freddie Mac STACR REMIC Trust 2022-DNA6 | 0,32 | 0,0921 | 0,0921 | ||||||

| US654740BT54 / Nissan Motor Acceptance Corp | 0,32 | 0,0915 | 0,0915 | ||||||

| US36260CAE21 / GLS Auto Receivables Issuer Trust 2020-3 | 0,32 | −55,26 | 0,0915 | −0,1967 | |||||

| US Treasury 09/30/2026 3.50% / DBT (US91282CLP40) | 0,32 | 0,0904 | 0,0904 | ||||||

| US33846QAE17 / Flagship Credit Auto Trust, Series 2021-3, Class C | 0,29 | −11,04 | 0,0832 | −0,0487 | |||||

| US15089QAP90 / Celanese US Holdings LLC | 0,29 | 0,0826 | 0,0826 | ||||||

| US90944KAF21 / United Auto Credit Securitization Trust, Series 2022-2, Class E | 0,28 | −48,36 | 0,0811 | −0,1406 | |||||

| US30711XBU72 / Fannie Mae Connecticut Avenue Securities | 0,28 | 0,0805 | 0,0805 | ||||||

| US04047JAA34 / Arivo Acceptance Auto Loan Receivables Trust 2022-2 | 0,28 | −58,20 | 0,0797 | −0,1890 | |||||

| EICB / Eagle Point Income Company Inc. - Preferred Stock | 0,01 | 0,28 | 0,0796 | 0,0796 | |||||

| Crossroads Asset Trusts 08/20/2032 8.32% 144A / ABS-MBS (US22767VAF58) | 0,27 | 0,0788 | 0,0788 | ||||||

| US1248EPCB75 / CCO Holdings LLC / CCO Holdings Capital Corp 5.375% 06/01/2029 144A | 0,27 | 0,0785 | 0,0785 | ||||||

| US02005NBM11 / Ally Financial Inc | 0,27 | 0,0761 | 0,0761 | ||||||

| US35564KTJ87 / Freddie Mac STACR REMIC Trust 2022-HQA1 | 0,27 | 0,0760 | 0,0760 | ||||||

| US23345EAG08 / DTAOT 21-2A D 144A 1.5% 02-16-27/01-15-25 | 0,26 | −79,20 | 0,0758 | −0,4373 | |||||

| US36261EAE77 / GLS Auto Receivables Issuer Trust 2020-4, Class E | 0,26 | 0,0757 | 0,0757 | ||||||

| Saluda Grace Alternative Mortgage 04/25/2030 VAR% 144A / ABS-MBS (US795935AA37) | 0,26 | 0,0750 | 0,0750 | ||||||

| US83367TBR95 / Societe Generale SA | 0,25 | 2,46 | 0,0716 | −0,0273 | |||||

| Brean Asset Backed 05/25/2065 4.7500% 144A / ABS-MBS (US10638GAG82) | 0,25 | 0,0707 | 0,0707 | ||||||

| US30711XSX39 / CORP CMO | 0,25 | 0,0702 | 0,0702 | ||||||

| US20754RAB24 / Connecticut Avenue Securities Trust 2021-R01 | 0,24 | 0,0702 | 0,0702 | ||||||

| US68785AAD72 / OSCAR_21-1A | 0,23 | −77,14 | 0,0651 | −0,3363 | |||||

| Freddie Mac Stacr 03/25/2044 VAR% / DBT (US35564NBX03) | 0,22 | 0,0638 | 0,0638 | ||||||

| US74113XAE67 / Prestige Auto Receivables Trust 2021-1 | 0,22 | −72,14 | 0,0630 | −0,2546 | |||||

| US26884UAE91 / EPR Properties | 0,22 | 5,29 | 0,0629 | −0,0214 | |||||

| Crossroads Asset Trusts 08/20/2030 5.90% / ABS-MBS (US227927AB63) | 0,20 | 0,0574 | 0,0574 | ||||||

| US92259HAA59 / Velocity Commercial Capital Loan Trust | 0,18 | −40,00 | 0,0525 | −0,0711 | |||||

| US038413AA82 / AQFIT_20-AA | 0,18 | −54,02 | 0,0525 | −0,1086 | |||||

| Ocwen Loan Investment Trust 02/25/2037 3.000% 144A / ABS-MBS (US675952AA39) | 0,18 | 0,0523 | 0,0523 | ||||||

| US3137G0LU18 / Freddie Mac, Series 2016-HQA4, Class M3 | 0,18 | 0,0515 | 0,0515 | ||||||

| US14686MAF05 / CARVANA AUTO REC. 11/10/2028 5.54% | 0,18 | 3,49 | 0,0510 | −0,0186 | |||||

| US20753YCH36 / Connecticut Avenue Securities Trust 2022-R04 | 0,17 | 0,0475 | 0,0475 | ||||||

| US76088UAA60 / RPM_23-4A | 0,15 | −46,38 | 0,0424 | −0,0693 | |||||

| US96041AAC09 / WESTLAKE AUTOMOBILE RECEIVABLES TRUST 2023-4 SER 2023-4A CL A2 REGD 144A P/P 6.23000000 | 0,15 | −87,81 | 0,0424 | −0,4451 | |||||

| US35564KRE19 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0,15 | 48,98 | 0,0421 | 0,0021 | |||||

| US14686KAB35 / Carvana Auto Receivables Trust 2021-N2 | 0,14 | −60,56 | 0,0409 | −0,1047 | |||||

| Avis Budget Rental Car 08/20/2029 5.87% 144A / ABS-MBS (US05377RKN34) | 0,14 | 0,0405 | 0,0405 | ||||||

| US14687HAC79 / Carvana Auto Receivables Trust 2021-N4 | 0,14 | −48,72 | 0,0403 | −0,0704 | |||||

| US97655JCC45 / WIN 2016-1 B2 Mtge | 0,14 | −12,34 | 0,0388 | −0,0238 | |||||

| US924933AA27 / Veros Auto Receivables Trust, Series 2023-1, Class A | 0,13 | −79,05 | 0,0380 | −0,2167 | |||||

| US92537MAC47 / VERUS SECURITIZATION TRUST 2019-INV3 SER 2019-INV3 CL A1B V/R REGD 144A P/P 3.19200000 | 0,12 | −63,31 | 0,0358 | −0,1011 | |||||

| US060505GB47 / Bank of America Corp | 0,12 | 9,91 | 0,0351 | −0,0099 | |||||

| US14686KAD90 / Carvana Auto Receivables Trust 2021-N2 | 0,12 | −52,16 | 0,0351 | −0,0683 | |||||

| US80286XAF15 / Santander Drive Auto Receivables Trust 2021-2 | 0,12 | −87,75 | 0,0341 | −0,3551 | |||||

| US35564KPU78 / FHLMC STACR REMIC Trust, Series 2022-DNA1, Class M1A | 0,11 | 0,0326 | 0,0326 | ||||||

| US89657BAB09 / TRINITY RAIL LEASING 2019 LLC | 0,11 | −51,50 | 0,0326 | −0,0618 | |||||

| US20754PAC41 / Connecticut Avenue Securities Trust 2019-HRP1 | 0,11 | 0,0308 | 0,0308 | ||||||

| US45569KAA16 / Indigo Merger Sub Inc | 0,11 | 4,90 | 0,0308 | −0,0108 | |||||

| US36167YAA64 / GCAT 2021-NQM7 Trust | 0,11 | −19,08 | 0,0307 | −0,0225 | |||||

| US00175PAB94 / AMN Healthcare, Inc. | 0,11 | 1,92 | 0,0307 | −0,0114 | |||||

| Avis Budget Rental Car 08/20/2031 6.24% 144A / ABS-MBS (US05377RKS21) | 0,10 | 0,0293 | 0,0293 | ||||||

| US88167AAP66 / Teva Pharmaceutical Finance Netherlands III BV | 0,10 | 4,21 | 0,0286 | −0,0101 | |||||

| US70478JAA25 / Pearl Merger Sub Inc | 0,09 | 0,00 | 0,0260 | −0,0106 | |||||

| US3136AAL860 / Federal National Mortgage Assoc. 12/25/2032 2.00% | 0,09 | −27,97 | 0,0244 | −0,0234 | |||||

| US81748AAD63 / Sequoia Mortgage Trust 2020-3 | 0,08 | −50,31 | 0,0232 | −0,0421 | |||||

| US165183CZ56 / Chesapeake Funding II LLC, Series 2023-2A, Class A1 | 0,08 | 0,0225 | 0,0225 | ||||||

| US04047EAA47 / Arivo Acceptance Auto Loan Receivables Trust 2022-1 | 0,07 | −86,80 | 0,0211 | −0,2026 | |||||

| US3136AJGA83 / FNMA CMO IO | 0,07 | −16,87 | 0,0198 | −0,0138 | |||||

| Affirm Inc 05/15/2029 6.270% 144A / ABS-MBS (US00834XAA72) | 0,07 | 0,0195 | 0,0195 | ||||||

| US3136BNEW25 / FANNIE MAE 11/25/2046 VAR% | 0,06 | −26,32 | 0,0162 | −0,0147 | |||||

| US3136BMXV57 / FANNIE MAE 02/25/2046 VAR% | 0,06 | 0,00 | 0,0159 | −0,0064 | |||||

| US17328PAQ63 / Citigroup Mortgage Loan Trust Inc | 0,05 | −17,74 | 0,0147 | −0,0105 | |||||

| US3136BNFA95 / FANNIE MAE 02/25/2047 VAR | 0,05 | −7,27 | 0,0146 | −0,0078 | |||||

| US35564KHE29 / FHLMC STACR REMIC Trust, Series 2021-DNA5, Class M2 | 0,05 | 80,00 | 0,0131 | 0,0030 | |||||

| US14686KAF49 / Carvana Auto Receivables Trust 2021-N2 | 0,05 | −51,09 | 0,0129 | −0,0246 | |||||

| US03465CAA36 / Angel Oak Mortgage Trust 2021-1 | 0,04 | −21,43 | 0,0128 | −0,0098 | |||||

| US30711XBM56 / Fannie Mae Connecticut Avenue Securities | 0,04 | 0,0126 | 0,0126 | ||||||

| US46643KAA97 / JP Morgan Mortgage Trust 2014-5 | 0,04 | −52,63 | 0,0105 | −0,0205 | |||||

| US46591LAC54 / JP Morgan Mortgage Trust 2019-INV3 | 0,03 | −12,82 | 0,0098 | −0,0062 | |||||

| US53949FAA75 / Lobel Automobile Receivables Trust 2023-2 | 0,03 | −94,57 | 0,0087 | −0,2145 | |||||

| US35564KYN35 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0,03 | −40,00 | 0,0087 | −0,0117 | |||||

| US3137FGV368 / Freddie Mac REMICS | 0,02 | −92,00 | 0,0070 | −0,1144 | |||||

| US20048KAG22 / COMM 2018-HCLV Mortgage Trust | 0,02 | −54,76 | 0,0057 | −0,0115 | |||||

| US35566AAH23 / Freddie Mac STACR REMIC Trust 2020-DNA5 | 0,02 | −71,43 | 0,0046 | −0,0180 | |||||

| US46591XAF24 / JP Morgan Mortgage Trust 2020-7 | 0,01 | −88,60 | 0,0040 | −0,0424 | |||||

| US3137AQH359 / FHR 4046 LI Mtge | 0,01 | −80,43 | 0,0027 | −0,0162 | |||||

| US69546LAA70 / PAID_21-2 | 0,00 | −88,89 | 0,0006 | −0,0068 | |||||

| US00834TAA60 / AFFRM 21-Z2 A 144A 1.17% 11-16-26 | 0,00 | 0,0002 | 0,0002 |