Grundläggande statistik

| Portföljvärde | $ 278 159 880 |

| Aktuella positioner | 341 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

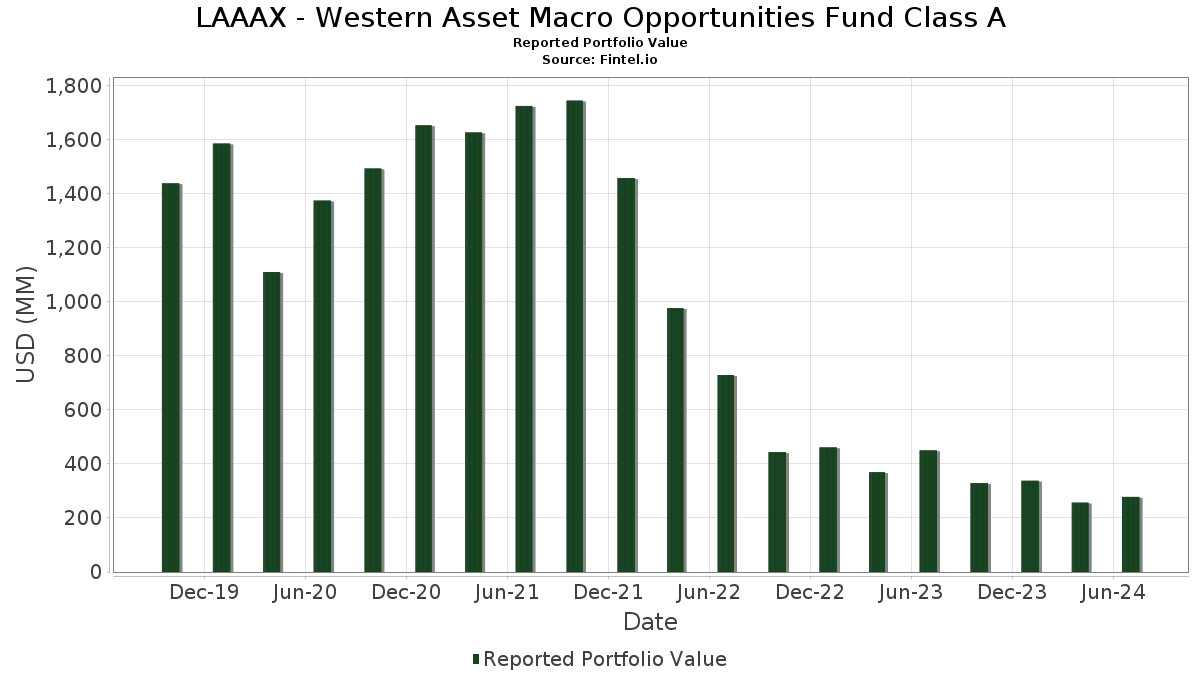

LAAAX - Western Asset Macro Opportunities Fund Class A har redovisat 341 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 278 159 880 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). LAAAX - Western Asset Macro Opportunities Fund Class As största innehav är Republic of Poland Government Bond (PL:PL0000113783) , WA Premier Institutional Government Reserves - Premium Shares (US:US52470G4947) , South Africa - Sovereign or Government Agency Debt (ZA:R209) , Indonesia Treasury Bond (ID:IDG000015207) , and Mexican Bonos (MX:MX0MGO0000R8) . LAAAX - Western Asset Macro Opportunities Fund Class As nya positioner inkluderar Republic of Poland Government Bond (PL:PL0000113783) , South Africa - Sovereign or Government Agency Debt (ZA:R209) , Indonesia Treasury Bond (ID:IDG000015207) , Mexican Bonos (MX:MX0MGO0000R8) , and United States Treasury Note/Bond (US:US91282CGP05) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 4,61 | 1,8100 | 4,3531 | ||

| 11,61 | 11,61 | 4,5607 | 4,2185 | |

| 6,37 | 2,5027 | 2,5027 | ||

| 5,34 | 2,0980 | 2,0980 | ||

| 5,34 | 2,0980 | 2,0980 | ||

| 3,82 | 1,5007 | 1,5007 | ||

| 2,35 | 0,9243 | 0,9243 | ||

| 2,35 | 0,9243 | 0,9243 | ||

| 2,03 | 0,7982 | 0,7982 | ||

| 1,92 | 0,7533 | 0,7533 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 2,69 | 1,0551 | −3,7418 | ||

| 7,96 | 3,1261 | −3,3214 | ||

| −6,35 | −2,4951 | −2,4951 | ||

| −6,35 | −2,4951 | −2,4951 | ||

| 3,65 | 1,4344 | −2,1196 | ||

| −4,91 | −1,9282 | −1,9282 | ||

| 2,21 | 0,8669 | −1,6779 | ||

| −0,41 | −0,1594 | −1,5938 | ||

| 0,07 | 0,0262 | −0,6763 | ||

| −0,79 | −0,3108 | −0,6216 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2024-09-26 för rapporteringsperioden 2024-07-31. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| PL0000113783 / Republic of Poland Government Bond | 13,49 | 6,02 | 5,2978 | 0,4386 | |||||

| Inter-American Development Bank / DBT (XS2608242108) | 12,45 | −2,06 | 4,8891 | 0,0345 | |||||

| Inter-American Development Bank / DBT (XS2608242108) | 12,45 | −2,06 | 4,8891 | 0,0345 | |||||

| US52470G4947 / WA Premier Institutional Government Reserves - Premium Shares | 11,61 | 937,85 | 11,61 | 938,46 | 4,5607 | 4,2185 | |||

| R209 / South Africa - Sovereign or Government Agency Debt | 9,71 | 13,60 | 3,8154 | 0,5490 | |||||

| IDG000015207 / Indonesia Treasury Bond | 8,12 | 2,55 | 3,1898 | 0,1651 | |||||

| MX0MGO0000R8 / Mexican Bonos | 7,96 | −52,85 | 3,1261 | −3,3214 | |||||

| US91282CGP05 / United States Treasury Note/Bond | 6,50 | −5,70 | 2,5529 | −0,0798 | |||||

| US01F0306864 / FNMA 30YR TBA 3.0% AUG 20 TO BE ANNOUNCED 3.00000000 | 6,37 | 2,5027 | 2,5027 | ||||||

| XS2665173782 / European Bank for Reconstruction and Development | 5,87 | 2,33 | 2,3075 | 0,1147 | |||||

| United States Treasury Note/Bond / DBT (US912810UB25) | 5,34 | 2,0980 | 2,0980 | ||||||

| United States Treasury Note/Bond / DBT (US912810UB25) | 5,34 | 2,0980 | 2,0980 | ||||||

| MX0MGO000102 / Mexican Bonos | 4,96 | −7,94 | 1,9501 | −0,1099 | |||||

| US172967JM45 / Citigroup, Inc. Bond | 4,94 | −0,22 | 1,9408 | 0,0493 | |||||

| TEVA/46 / Teva Pharmaceutical Finance Netherlands III BV | 4,88 | 5,67 | 1,9169 | 0,1530 | |||||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 4,61 | −142,96 | 1,8100 | 4,3531 | |||||

| US29001RAC25 / Elmwood CLO II Ltd., Series 2019-2A, Class SUB | 4,39 | −4,74 | 1,7228 | −0,0359 | |||||

| US TREASURY LONG BOND / DIR (000000000) | 3,82 | 1,5007 | 1,5007 | ||||||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 3,65 | −75,64 | 1,4344 | −2,1196 | |||||

| IDG000020801 / Indonesia Treasury Bond | 3,50 | 0,66 | 1,3742 | 0,0467 | |||||

| US674599CN34 / Occidental Petroleum Corp | 3,48 | 5,82 | 1,3651 | 0,1102 | |||||

| US912810TT51 / United States Treasury Note/Bond | 3,44 | 7,39 | 1,3528 | 0,1278 | |||||

| US023135BJ40 / Amazon.com Inc | 3,42 | 5,26 | 1,3451 | 0,1023 | |||||

| US29273VAJ98 / PERPETUAL BONDS | 3,40 | 6,69 | 1,3338 | 0,1182 | |||||

| BHC / Bausch Health Companies Inc. | 3,19 | 20,85 | 1,2524 | 0,2447 | |||||

| US09630LAE20 / BlueMountain CLO XXIX Ltd | 2,93 | −31,91 | 1,1519 | −0,4931 | |||||

| US91282CGT27 / United States Treasury Note/Bond | 2,69 | −78,61 | 1,0551 | −3,7418 | |||||

| US05608RAQ83 / BX TR 2021-ARIA G 1ML+320 10/15/2036 144A | 2,51 | 1,33 | 0,9857 | 0,0395 | |||||

| US060505FL38 / Bank of America Corp | 2,37 | 2,82 | 0,9308 | 0,0503 | |||||

| US 5 YEAR TREASURY NOTE / DIR (000000000) | 2,35 | 0,9243 | 0,9243 | ||||||

| US 5 YEAR TREASURY NOTE / DIR (000000000) | 2,35 | 0,9243 | 0,9243 | ||||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 2,31 | −9,51 | 0,9083 | −0,0680 | |||||

| XS2393635391 / European Bank for Reconstruction and Development | 2,27 | 0,98 | 0,8924 | 0,0329 | |||||

| US21H0526861 / Ginnie Mae | 2,21 | −79,45 | 0,8669 | −1,6779 | |||||

| XS2353100402 / Credit Agricole SA | 2,17 | 3,74 | 0,8508 | 0,0535 | |||||

| US43103QAA67 / Highlands Holdings Bond Issuer Ltd / Highlands Holdings Bond Co-Issuer Inc | 2,10 | 1,50 | 0,8255 | 0,0346 | |||||

| XS2385150417 / Provincia de Buenos Aires/Government Bonds | 2,09 | 0,34 | 0,8194 | 0,0252 | |||||

| US143658BS00 / Carnival Corp | 2,07 | 0,10 | 0,8117 | 0,0230 | |||||

| US 2YR NOTE (CBT) / DIR (000000000) | 2,03 | 0,7982 | 0,7982 | ||||||

| US21H0606895 / Ginnie Mae | 2,02 | −64,04 | 0,7950 | −0,5392 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 1,97 | 2,92 | 0,7758 | 0,0427 | |||||

| US780153BK72 / Royal Caribbean Cruises Ltd | 1,96 | 2,14 | 0,7698 | 0,0369 | |||||

| US958254AD64 / Western Midstream Operating LP | 1,95 | 4,17 | 0,7656 | 0,0510 | |||||

| IRS USD / DIR (000000000) | 1,92 | 0,7533 | 0,7533 | ||||||

| IRS USD / DIR (000000000) | 1,92 | 0,7533 | 0,7533 | ||||||

| US262485AC97 / Dryden 95 CLO Ltd | 1,85 | −8,61 | 0,7254 | −0,0463 | |||||

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 1,85 | 0,7252 | 0,7252 | ||||||

| US912810TR95 / United States Treasury Note/Bond | 1,76 | 7,52 | 0,6906 | 0,0660 | |||||

| US29268BAF85 / Enel Finance International NV | 1,74 | 6,62 | 0,6833 | 0,0602 | |||||

| US3137G0FM65 / Freddie Mac Structured Agency Credit Risk Debt Notes | 1,60 | −0,68 | 0,6275 | 0,0129 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 1,47 | 3,16 | 0,5782 | 0,0331 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 1,47 | 3,16 | 0,5782 | 0,0331 | |||||

| US845467AT68 / Southwestern Energy Co | 1,46 | 3,77 | 0,5730 | 0,0359 | |||||

| XS1781710543 / Kenya Government International Bond | 1,45 | −3,91 | 0,5703 | −0,0069 | |||||

| US12612WAB00 / Cnf Inc Senior Debentures 6.7% 05/01/34 | 1,42 | 3,28 | 0,5577 | 0,0326 | |||||

| US36255TAL61 / GS Mortgage Securities Corp II | 1,41 | 23,92 | 0,5538 | 0,1192 | |||||

| US197677AH07 / HCA Inc | 1,40 | 4,26 | 0,5488 | 0,0369 | |||||

| US12433RAA05 / BX Trust 2018-GW MZ | 1,38 | 0,14 | 0,5437 | 0,0156 | |||||

| US29273VAL45 / Energy Transfer LP | 1,36 | 1,64 | 0,5360 | 0,0233 | |||||

| US040114HU71 / Argentine Republic Government International Bond | 1,32 | −9,99 | 0,5205 | −0,0418 | |||||

| US969457BM15 / Williams Companies 8.75% Notes 3/15/32 | 1,32 | 3,93 | 0,5201 | 0,0336 | |||||

| BRSTNCNTF204 / Brazil Notas do Tesouro Nacional Serie F | 1,30 | −8,96 | 0,5112 | −0,0350 | |||||

| WYNMY / Wynn Macau, Limited - Depositary Receipt (Common Stock) | 1,30 | 1,25 | 0,5102 | 0,0204 | |||||

| EC26 / Ecopetrol SA | 1,29 | 1,34 | 0,5048 | 0,0203 | |||||

| US16117LCB36 / Charter Communications Operating, LLC 2023 Term Loan B4 | 1,25 | −4,93 | 0,4925 | −0,0114 | |||||

| US78448YAL56 / SMB Private Education Loan Trust 2021-A | 1,25 | −1,19 | 0,4902 | 0,0081 | |||||

| 5727 / Sands China Ltd. - Corporate Bond/Note | 1,20 | 0,42 | 0,4722 | 0,0148 | |||||

| US07325DAJ37 / Bayview Financial Mortgage Pass-Through Trust 2006-C | 1,20 | −0,42 | 0,4710 | 0,0107 | |||||

| US77340RAM97 / Rockies Express Pipeline LLC | 1,16 | 3,48 | 0,4562 | 0,0274 | |||||

| US45255RAZ01 / Impac Secured Assets Trust 2006-3 | 1,11 | −2,55 | 0,4355 | 0,0009 | |||||

| US225313AJ46 / Credit Agricole SA | 1,07 | 0,66 | 0,4212 | 0,0140 | |||||

| US21H0626851 / Ginnie Mae | 1,02 | 0,4002 | 0,4002 | ||||||

| US36256AAS15 / GS Mortgage Securities Corp Trust 2018-LUAU | 1,02 | 0,00 | 0,3994 | 0,0112 | |||||

| US25714PEW41 / Dominican Republic International Bond | 1,01 | −1,46 | 0,3986 | 0,0053 | |||||

| US040114HS26 / Argentine Republic Government International Bond | 0,98 | −45,29 | 0,3854 | −0,2998 | |||||

| US345370DB39 / Ford Motor Co. | 0,97 | 3,08 | 0,3818 | 0,0219 | |||||

| XS2384698994 / Nigeria Government International Bond | 0,95 | −0,42 | 0,3735 | 0,0089 | |||||

| US674599DJ13 / Occidental Petroleum Corp | 0,95 | 3,61 | 0,3718 | 0,0228 | |||||

| LONG GILT / DIR (000000000) | 0,94 | 0,3711 | 0,3711 | ||||||

| LONG GILT / DIR (000000000) | 0,94 | 0,3711 | 0,3711 | ||||||

| XS2241075014 / Egypt Government International Bond | 0,94 | 2,63 | 0,3674 | 0,0190 | |||||

| US78432WAG87 / SFO_21-555 | 0,90 | −1,10 | 0,3532 | 0,0060 | |||||

| US74365PAD06 / Prosus NV | 0,89 | 8,81 | 0,3496 | 0,0375 | |||||

| US80007RAN52 / Sands China Ltd | 0,88 | 2,09 | 0,3465 | 0,0165 | |||||

| US92922F7W25 / WaMu Mortgage Pass-Through Certificates Series 2005-AR17 Trust | 0,87 | −1,25 | 0,3424 | 0,0051 | |||||

| US88163VAD10 / Teva Pharmaceutical Finance Co LLC | 0,85 | 4,67 | 0,3346 | 0,0237 | |||||

| US674599CJ22 / Occidental Petroleum Corp | 0,85 | 4,43 | 0,3335 | 0,0233 | |||||

| US35564KWA32 / Freddie Mac STACR REMIC Trust, Series 2022-DNA3, Class B1 | 0,85 | 0,00 | 0,3328 | 0,0091 | |||||

| US21H0206837 / Ginnie Mae | 0,83 | 0,3257 | 0,3257 | ||||||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 0,82 | 2,38 | 0,3207 | 0,0160 | |||||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 0,82 | 2,38 | 0,3207 | 0,0160 | |||||

| US74408DAE40 / GOVERNMENT BOND | 0,80 | 4,82 | 0,3158 | 0,0225 | |||||

| US958254AL80 / Western Midstream Operating LP | 0,80 | 6,50 | 0,3155 | 0,0272 | |||||

| US037411BG97 / Apache Corp | 0,80 | 4,84 | 0,3151 | 0,0228 | |||||

| US726503AE55 / Plains All American Pipeline, LP | 0,80 | 0,88 | 0,3149 | 0,0112 | |||||

| US126307AS68 / CSC Holdings LLC | 0,79 | 0,3123 | 0,3123 | ||||||

| US21H0506806 / GNMA | 0,79 | 0,3108 | 0,3108 | ||||||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 0,79 | 3,81 | 0,3106 | 0,0195 | |||||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 0,79 | 3,81 | 0,3106 | 0,0195 | |||||

| US04002PAE43 / AREIT 2021-CRE5 Trust | 0,79 | 0,13 | 0,3099 | 0,0089 | |||||

| US08580BAA44 / Berry Petroleum Co LLC | 0,77 | −0,13 | 0,3036 | 0,0079 | |||||

| US25714PEE43 / Dominican Republic International Bond | 0,75 | −27,36 | 0,2965 | −0,1002 | |||||

| 1011778 BC ULC / LON (XAC6901LAM90) | 0,74 | 0,2890 | 0,2890 | ||||||

| BANORT / Banco Mercantil del Norte SA/Grand Cayman | 0,73 | −47,67 | 0,2870 | −0,2460 | |||||

| US254010AE13 / Dignity Health | 0,72 | 6,98 | 0,2831 | 0,0258 | |||||

| US912810TP30 / US TREASURY I/L 1.5% 02-15-53 | 0,72 | 8,64 | 0,2817 | 0,0295 | |||||

| US90932LAH06 / United Airlines Inc | 0,68 | 2,56 | 0,2675 | 0,0137 | |||||

| US ULTRA BOND CBT / DIR (000000000) | 0,67 | 0,2634 | 0,2634 | ||||||

| US55293AAN72 / MHC Trust 2021-MHC2 | 0,67 | −0,45 | 0,2626 | 0,0061 | |||||

| XS1819680288 / Angolan Government International Bond | 0,66 | 0,45 | 0,2610 | 0,0082 | |||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 0,66 | 4,26 | 0,2598 | 0,0173 | |||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 0,66 | 4,26 | 0,2598 | 0,0173 | |||||

| US404280AT69 / HSBC Holdings Plc Bond | 0,66 | 1,07 | 0,2593 | 0,0098 | |||||

| JAPAN YEN CURR / DFE (000000000) | 0,66 | 0,2584 | 0,2584 | ||||||

| US91832VAA26 / VOC ESCROW LTD | 0,65 | 2,35 | 0,2570 | 0,0128 | |||||

| US1248EPCP61 / CCO Holdings LLC / CCO Holdings Capital Corp | 0,64 | 9,03 | 0,2516 | 0,0271 | |||||

| 53219LAH2 / LifePoint Health, Inc. Bond | 0,63 | 0,2484 | 0,2484 | ||||||

| 53219LAH2 / LifePoint Health, Inc. Bond | 0,63 | 0,2484 | 0,2484 | ||||||

| US08162QAQ29 / Benchmark 2020-IG3 Mortgage Trust | 0,63 | 2,77 | 0,2476 | 0,0131 | |||||

| US71647NAN93 / Petrobras Global Finance BV | 0,62 | −33,33 | 0,2436 | −0,1118 | |||||

| US44965TAA51 / ILFC E-Capital Trust I | 0,62 | 5,30 | 0,2420 | 0,0182 | |||||

| US984245AL47 / YPF SA | 0,61 | 2,36 | 0,2392 | 0,0121 | |||||

| US72650RAM43 / Plains All Amern Pipeline L P Senior Notes 6.7% 05/15/36 | 0,60 | 5,24 | 0,2371 | 0,0179 | |||||

| US92943EAB20 / GTCR W MERGER SUB LLC | 0,60 | 0,00 | 0,2366 | 0,0063 | |||||

| AMBP / Ardagh Metal Packaging S.A. | 0,59 | 255,15 | 0,2305 | 0,1675 | |||||

| TRT130733T17 / Turkey Government Bond | 0,58 | 0,2289 | 0,2289 | ||||||

| XS1632632037 / Ivory Coast Government International Bond | 0,58 | 2,48 | 0,2274 | 0,0116 | |||||

| US92858RAB69 / Vmed O2 UK Financing I PLC | 0,58 | 3,04 | 0,2263 | 0,0125 | |||||

| US674599DL68 / Occidental Petroleum Corp | 0,58 | 3,42 | 0,2261 | 0,0135 | |||||

| US74408DAD66 / Provincia de Cordoba | 0,57 | 10,00 | 0,2247 | 0,0260 | |||||

| US01F0406854 / UMBS TBA | 0,56 | −200,00 | 0,2209 | 0,4418 | |||||

| US80007RAQ83 / Sands China Ltd | 0,56 | 2,59 | 0,2184 | 0,0114 | |||||

| US21H0326882 / Ginnie Mae | 0,55 | 0,2167 | 0,2167 | ||||||

| US902613BF40 / UBS Group AG | 0,55 | 2,06 | 0,2143 | 0,0100 | |||||

| US04649VBC37 / Asurion LLC, Term Loan B | 0,54 | 1,89 | 0,2122 | 0,0094 | |||||

| 3 MONTH SOFR / DIR (000000000) | 0,53 | 0,2098 | 0,2098 | ||||||

| 3 MONTH SOFR / DIR (000000000) | 0,53 | 0,2098 | 0,2098 | ||||||

| US037411AY13 / Apache Corp 5.25% Senior Notes 02/01/42 | 0,53 | −47,22 | 0,2089 | −0,1756 | |||||

| US05518VAA35 / Bac Capital Trust Xiv Fixed-to-flt Pfd Hits | 0,52 | 2,78 | 0,2036 | 0,0110 | |||||

| US949746RN35 / Wells Fargo Bk N Bond | 0,50 | 0,40 | 0,1949 | 0,0059 | |||||

| US35564KBD00 / Freddie Mac STACR REMIC Trust 2021-DNA1 | 0,49 | 0,1922 | 0,1922 | ||||||

| US958254AJ35 / Western Midstream Operating LP | 0,48 | 5,22 | 0,1903 | 0,0145 | |||||

| US20754EAB11 / Connecticut Avenue Securities Trust, Series 2023-R06, Class 1M2 | 0,47 | 0,1849 | 0,1849 | ||||||

| US674599CY98 / Occidental Petroleum Corp | 0,46 | 5,29 | 0,1802 | 0,0139 | |||||

| JAPAN YEN CURRENCY 9AM / DFE (000000000) | 0,44 | 0,1732 | 0,1732 | ||||||

| US86765BAH24 / Sunoco Logistics Partners Senior Notes 6.85% 02/15/40 | 0,43 | 5,68 | 0,1681 | 0,0133 | |||||

| US02156LAC54 / Altice France SA/France | 0,43 | 8,42 | 0,1670 | 0,0171 | |||||

| US037411AR61 / Apache Corporation 6% Notes 1/15/37 | 0,42 | 5,28 | 0,1646 | 0,0125 | |||||

| US01F0206874 / UMBS TBA 30YR 2% AUG 20 TO BE ANNOUNCED 2.00000000 | 0,40 | −200,00 | 0,1580 | 0,3161 | |||||

| EURO-BUXL 30Y BND / DIR (000000000) | 0,40 | 0,1560 | 0,1560 | ||||||

| EURO-BUXL 30Y BND / DIR (000000000) | 0,40 | 0,1560 | 0,1560 | ||||||

| US251799AA02 / Devon Energy 7.95% Debs 4/15/32 | 0,40 | 3,66 | 0,1557 | 0,0095 | |||||

| US335934AT24 / First Quantum Minerals Ltd | 0,39 | 2,08 | 0,1546 | 0,0075 | |||||

| US617734AG30 / Morongo Band of Mission Indians/The | 0,39 | 6,28 | 0,1530 | 0,0132 | |||||

| FLUTTER FINANCING BV / LON (XAN3313EAB64) | 0,39 | −0,26 | 0,1528 | 0,0038 | |||||

| XS1631415400 / Ivory Coast Government International Bond | 0,37 | −69,69 | 0,1469 | −0,3245 | |||||

| US98462YAD22 / Yamana Gold Inc | 0,37 | 2,47 | 0,1466 | 0,0074 | |||||

| US61772TBN37 / Morgan Stanley Capital I Trust 2021-L7 | 0,36 | −2,17 | 0,1416 | 0,0010 | |||||

| US035198AF76 / Angolan Government International Bond | 0,36 | −1,10 | 0,1409 | 0,0023 | |||||

| 3MTH SONIA / DIR (000000000) | 0,35 | 0,1374 | 0,1374 | ||||||

| 3MTH SONIA / DIR (000000000) | 0,35 | 0,1374 | 0,1374 | ||||||

| XAG9368PBC77 / Virgin Media Bristol LLC USD Term Loan N | 0,35 | −1,70 | 0,1365 | 0,0014 | |||||

| United Rentals North America Inc / DBT (US911365BR47) | 0,34 | 1 700,00 | 0,1344 | 0,1269 | |||||

| US01F0226831 / FEDERAL NATIONAL MORTGAGE ASSOCIATION 30YR TBA AUG | 0,34 | 0,1318 | 0,1318 | ||||||

| US29273VAM28 / Energy Transfer LP | 0,32 | 3,85 | 0,1276 | 0,0081 | |||||

| JANE STREET GROUP LLC / LON (US47077DAH35) | 0,32 | 0,00 | 0,1271 | 0,0033 | |||||

| JANE STREET GROUP LLC / LON (US47077DAH35) | 0,32 | 0,00 | 0,1271 | 0,0033 | |||||

| CREDIT SUISSE ESCROW CL / DBT (000000000) | 0,32 | 0,1250 | 0,1250 | ||||||

| BNP / BNP Paribas SA | 0,31 | 3,69 | 0,1214 | 0,0072 | |||||

| BNP / BNP Paribas SA | 0,31 | 3,69 | 0,1214 | 0,0072 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0,29 | 2,13 | 0,1133 | 0,0053 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0,29 | 2,13 | 0,1133 | 0,0053 | |||||

| US902613BE74 / UBS Group AG | 0,28 | 3,28 | 0,1114 | 0,0063 | |||||

| US21H0406817 / Ginnie Mae | 0,28 | 0,1113 | 0,1113 | ||||||

| US911363AM11 / United Rentals North America Inc | 0,28 | 2,94 | 0,1101 | 0,0062 | |||||

| 46090K109 / Intrawest Resorts Holdings, Inc. | 0,28 | 0,1091 | 0,1091 | ||||||

| 46090K109 / Intrawest Resorts Holdings, Inc. | 0,28 | 0,1091 | 0,1091 | ||||||

| PHOENIX GUARANTOR INC / LON (US71913BAJ17) | 0,27 | 0,75 | 0,1050 | 0,0034 | |||||

| PHOENIX GUARANTOR INC / LON (US71913BAJ17) | 0,27 | 0,75 | 0,1050 | 0,0034 | |||||

| BHC / Bausch Health Companies Inc. | 0,26 | 20,19 | 0,1007 | 0,0191 | |||||

| US25179SAD27 / Devon Financing 7.875% Due 9/30/31 | 0,25 | 3,67 | 0,0999 | 0,0060 | |||||

| XS2385150334 / PROVINCIA DE BUENOS AIRES 3.90% 9-1-37 | 0,24 | 0,41 | 0,0962 | 0,0030 | |||||

| US470160CF77 / Jamaica Government International Bond | 0,24 | 0,42 | 0,0950 | 0,0033 | |||||

| US126307BB25 / CSC HOLDINGS LLC COMPANY GUAR 144A 12/30 4.125 | 0,22 | 8,87 | 0,0872 | 0,0094 | |||||

| US89117F8Z56 / Toronto-Dominion Bank/The | 0,22 | 1,39 | 0,0862 | 0,0035 | |||||

| JAPAN YEN CURRENCY 9AM / DFE (000000000) | 0,22 | 0,0860 | 0,0860 | ||||||

| JAPAN 10Y BOND(OSE) / DIR (000000000) | 0,22 | 0,0860 | 0,0860 | ||||||

| JAPAN 10Y BOND(OSE) / DIR (000000000) | 0,22 | 0,0860 | 0,0860 | ||||||

| US05565AS207 / BNP Paribas SA | 0,22 | 1,42 | 0,0845 | 0,0034 | |||||

| FM / First Quantum Minerals Ltd. | 0,21 | 1,94 | 0,0827 | 0,0037 | |||||

| US03746AAA88 / Apache Finance Can 7.75% Notes 12/15/2029 | 0,21 | 2,94 | 0,0826 | 0,0045 | |||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | 0,21 | 0,0824 | 0,0824 | ||||||

| ISNPY / Intesa Sanpaolo S.p.A. - Depositary Receipt (Common Stock) | 0,21 | 1,46 | 0,0824 | 0,0034 | |||||

| US917288BL51 / Uruguay Government International Bond | 0,21 | −5,96 | 0,0806 | −0,0030 | |||||

| US212015AQ46 / Continental Resources Inc/OK | 0,20 | 4,66 | 0,0797 | 0,0057 | |||||

| US05565AGF49 / BNP Paribas SA | 0,20 | 2,55 | 0,0790 | 0,0039 | |||||

| US25470XBE40 / DISH DBS Corp | 0,20 | 5,82 | 0,0786 | 0,0064 | |||||

| US88732JAN81 / Time Warner Cable 7.3% Senior Notes 7/1/38 | 0,20 | 7,61 | 0,0779 | 0,0073 | |||||

| U.S. TREASURY BOND / DIR (000000000) | 0,19 | 0,0742 | 0,0742 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | 0,19 | 0,0742 | 0,0742 | ||||||

| JAPAN YEN CURRENCY 9AM / DFE (000000000) | 0,18 | 0,0716 | 0,0716 | ||||||

| US345397B934 / Ford Motor Credit Co., LLC | 0,18 | 4,07 | 0,0705 | 0,0045 | |||||

| AUDUSD CRNCY / DFE (000000000) | 0,18 | 0,0702 | 0,0702 | ||||||

| AUDUSD CRNCY / DFE (000000000) | 0,18 | 0,0702 | 0,0702 | ||||||

| US25470XBD66 / CORP. NOTE | 0,18 | 4,14 | 0,0693 | 0,0047 | |||||

| US02154CAH60 / Altice Financing SA | 0,17 | 2,45 | 0,0657 | 0,0031 | |||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | 0,16 | 0,0612 | 0,0612 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | 0,15 | 0,0601 | 0,0601 | ||||||

| US71647NAY58 / Petrobras Global Finance BV | 0,15 | 0,67 | 0,0592 | 0,0020 | |||||

| US00764MAW73 / Aegis Asset Backed Sec Corp Mort Pass Thr Certs Series 2003-3 | 0,15 | 2,80 | 0,0581 | 0,0031 | |||||

| US694308JH19 / Pacific Gas and Electric Co | 0,15 | 5,04 | 0,0575 | 0,0042 | |||||

| US023771T402 / American Airlines, Inc. | 0,14 | −0,69 | 0,0567 | 0,0009 | |||||

| US674599DK85 / Occidental Petroleum Corp | 0,14 | 5,15 | 0,0563 | 0,0042 | |||||

| US45660L4B25 / Residential Asset Securitization Trust 2005-A15 | 0,14 | 44,21 | 0,0541 | 0,0177 | |||||

| US912810SN90 / UNITED STATES TREASURY BOND 1.25% 05/15/2050 | 0,13 | 6,78 | 0,0499 | 0,0047 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,12 | 3,39 | 0,0481 | 0,0029 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,12 | 3,39 | 0,0481 | 0,0029 | |||||

| US037411AM74 / Apache Corporation 7.375% Debentures 08/15/47 | 0,10 | 5,05 | 0,0412 | 0,0030 | |||||

| US381427AA15 / Goldman Sachs Capital Ii 5.793% Fixed-to-floating Rate Normal Automatic Pfd Enhanced Capital Securities 6/1/2043 | 0,09 | 0,00 | 0,0364 | 0,0010 | |||||

| IRS MXN / DIR (000000000) | 0,09 | 0,0358 | 0,0358 | ||||||

| IRS MXN / DIR (000000000) | 0,09 | 0,0358 | 0,0358 | ||||||

| US01F0326821 / Fannie Mae or Freddie Mac | 0,09 | −200,00 | 0,0356 | 0,0713 | |||||

| THREE-MONTH SOFR / DIR (000000000) | 0,08 | 0,0308 | 0,0308 | ||||||

| US494550AW68 / Kinder Morgan Energy Partners 6.95% Senior Notes 1/15/38 | 0,08 | 5,41 | 0,0307 | 0,0022 | |||||

| IRS USD / DIR (000000000) | 0,08 | 0,0301 | 0,0301 | ||||||

| US88948ABQ94 / Toll Road Investors Partnership II LP | 0,07 | 12,50 | 0,0284 | 0,0038 | |||||

| USD/PLN FORWARD / DFE (000000000) | 0,07 | 0,0278 | 0,0278 | ||||||

| USD/PLN FORWARD / DFE (000000000) | 0,07 | 0,0278 | 0,0278 | ||||||

| ZAG000077488 / Republic of South Africa Government Bond | 0,07 | −96,41 | 0,0262 | −0,6763 | |||||

| THREE-MONTH SOFR / DIR (000000000) | 0,06 | 0,0230 | 0,0230 | ||||||

| US45660L3K33 / Residential Asset Securitization Trust 2005-A15 | 0,06 | 3,70 | 0,0222 | 0,0012 | |||||

| MXN CALL VERSUS USD PUT / DFE (000000000) | 0,05 | 0,0192 | 0,0192 | ||||||

| US517834AH06 / Las Vegas Sands Corp | 0,05 | 0,00 | 0,0192 | 0,0008 | |||||

| US912810TL26 / TREASURY BOND | 0,05 | 9,30 | 0,0185 | 0,0017 | |||||

| USD/BRL FORWARD / DFE (000000000) | 0,04 | 0,0141 | 0,0141 | ||||||

| USD/BRL FORWARD / DFE (000000000) | 0,04 | 0,0141 | 0,0141 | ||||||

| MXN CALL VERSUS USD PUT / DFE (000000000) | 0,03 | 0,0132 | 0,0132 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | 0,03 | 0,0129 | 0,0129 | ||||||

| FLYX.WS / flyExclusive, Inc. - Equity Warrant | 0,06 | 0,00 | 0,03 | 28,00 | 0,0127 | 0,0028 | |||

| USD/INR FORWARD / DFE (000000000) | 0,03 | 0,0126 | 0,0126 | ||||||

| USD/INR FORWARD / DFE (000000000) | 0,03 | 0,0126 | 0,0126 | ||||||

| US517834AE74 / Las Vegas Sands Corp | 0,03 | 0,00 | 0,0114 | 0,0006 | |||||

| EURO CURRENCY 9AM / DFE (000000000) | 0,03 | 0,0107 | 0,0107 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,03 | 0,0102 | 0,0102 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,03 | 0,0102 | 0,0102 | ||||||

| EURO CURRENCY 9AM / DFE (000000000) | 0,02 | 0,0096 | 0,0096 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,02 | 0,0093 | 0,0093 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,02 | 0,0093 | 0,0093 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,02 | 0,0087 | 0,0087 | ||||||

| US25470XBF15 / DISH DBS Corp. | 0,02 | 10,00 | 0,0087 | 0,0009 | |||||

| IDR/USD FORWARD / DFE (000000000) | 0,02 | 0,0061 | 0,0061 | ||||||

| IDR/USD FORWARD / DFE (000000000) | 0,02 | 0,0061 | 0,0061 | ||||||

| US279158AS81 / Ecopetrol SA | 0,01 | 0,00 | 0,0041 | 0,0002 | |||||

| EURO FX CURR / DFE (000000000) | 0,01 | 0,0032 | 0,0032 | ||||||

| EURO CURRENCY 9AM / DFE (000000000) | 0,01 | 0,0030 | 0,0030 | ||||||

| BRITISH POUND CURRENCY / DFE (000000000) | 0,01 | 0,0024 | 0,0024 | ||||||

| BRITISH POUND CURRENCY / DFE (000000000) | 0,01 | 0,0024 | 0,0024 | ||||||

| GBP/USD FORWARD / DFE (000000000) | 0,00 | 0,0018 | 0,0018 | ||||||

| GBP/USD FORWARD / DFE (000000000) | 0,00 | 0,0018 | 0,0018 | ||||||

| EURO CURRENCY 9AM / DFE (000000000) | 0,00 | 0,0009 | 0,0009 | ||||||

| US46650BAA98 / J.P. Morgan Chase Commercial Mortgage Securities Trust 2018-PHMZ | 0,00 | 0,00 | 0,0004 | 0,0000 | |||||

| CHME34 / CME Group Inc. - Depositary Receipt (Common Stock) | 0,00 | 0,0004 | 0,0004 | ||||||

| EURO CURRENCY 9AM / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | ||||||

| EURO CURRENCY 9AM / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | ||||||

| US85571XAS62 / Starwood Retail Property Trust 2014-STAR | 0,00 | −100,00 | 0,0002 | −0,0090 | |||||

| EURO CURRENCY 9AM / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | ||||||

| EURO CURRENCY 9AM / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | ||||||

| JAPAN YEN CURRENCY 9AM / DFE (000000000) | −0,00 | −0,0004 | −0,0004 | ||||||

| USD/ZAR FORWARD / DFE (000000000) | −0,00 | −0,0006 | −0,0006 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,00 | −0,0010 | −0,0010 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,00 | −0,0010 | −0,0010 | ||||||

| USD/MXN FORWARD / DFE (000000000) | −0,00 | −0,0016 | −0,0016 | ||||||

| USD/MXN FORWARD / DFE (000000000) | −0,00 | −0,0016 | −0,0016 | ||||||

| USD/GBP FORWARD / DFE (000000000) | −0,01 | −0,0022 | −0,0022 | ||||||

| MEXICAN PESO / DFE (000000000) | −0,01 | −0,0023 | −0,0023 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | −0,01 | −0,0026 | −0,0026 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,01 | −0,0026 | −0,0026 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,01 | −0,0026 | −0,0026 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | −0,01 | −0,0027 | −0,0027 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,01 | −0,0037 | −0,0037 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,01 | −0,0037 | −0,0037 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | −0,01 | −0,0038 | −0,0038 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | −0,01 | −0,0038 | −0,0038 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | −0,01 | −0,0056 | −0,0056 | ||||||

| ZAR/USD FORWARD / DFE (000000000) | −0,02 | −0,0059 | −0,0059 | ||||||

| ZAR/USD FORWARD / DFE (000000000) | −0,02 | −0,0059 | −0,0059 | ||||||

| 5 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,02 | −0,0060 | −0,0060 | ||||||

| 5 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,02 | −0,0060 | −0,0060 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,02 | −0,0088 | −0,0088 | ||||||

| USD/GBP FORWARD / DFE (000000000) | −0,03 | −0,0104 | −0,0104 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,03 | −0,0105 | −0,0105 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | −0,03 | −0,0111 | −0,0111 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | −0,03 | −0,0111 | −0,0111 | ||||||

| BP CURRENCY / DFE (000000000) | −0,03 | −0,0112 | −0,0112 | ||||||

| BP CURRENCY / DFE (000000000) | −0,03 | −0,0112 | −0,0112 | ||||||

| USD/BRL FORWARD / DFE (000000000) | −0,04 | −0,0141 | −0,0141 | ||||||

| USD/BRL FORWARD / DFE (000000000) | −0,04 | −0,0141 | −0,0141 | ||||||

| 5 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,04 | −0,0144 | −0,0144 | ||||||

| 5 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,04 | −0,0144 | −0,0144 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | −0,04 | −0,0164 | −0,0164 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | −0,05 | −0,0189 | −0,0189 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | −0,05 | −0,0189 | −0,0189 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | −0,05 | −0,0189 | −0,0189 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | −0,05 | −0,0214 | −0,0214 | ||||||

| US01F0326821 / Fannie Mae or Freddie Mac | −0,09 | −0,0356 | −0,0356 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,11 | −0,0419 | −0,0419 | ||||||

| JAPAN YEN CURRENCY 9AM / DFE (000000000) | −0,11 | −0,0451 | −0,0451 | ||||||

| JAPAN YEN CURRENCY 9AM / DFE (000000000) | −0,12 | −0,0480 | −0,0480 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,15 | −0,0578 | −0,0578 | ||||||

| 10 YEAR US TREASURY NOTE / DIR (000000000) | −0,17 | −0,0676 | −0,0676 | ||||||

| 5 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,18 | −0,0710 | −0,0710 | ||||||

| 5 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,18 | −0,0710 | −0,0710 | ||||||

| USD/MXN FORWARD / DFE (000000000) | −0,20 | −0,0780 | −0,0780 | ||||||

| USD/MXN FORWARD / DFE (000000000) | −0,20 | −0,0780 | −0,0780 | ||||||

| EURO-BTP / DIR (000000000) | −0,22 | −0,0856 | −0,0856 | ||||||

| EURO-BTP / DIR (000000000) | −0,22 | −0,0856 | −0,0856 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,22 | −0,0875 | −0,0875 | ||||||

| USD CALL VERSUS MXN PUT / DFE (000000000) | −0,26 | −0,1017 | −0,1017 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,33 | −0,1301 | −0,1301 | ||||||

| US01F0226831 / FEDERAL NATIONAL MORTGAGE ASSOCIATION 30YR TBA AUG | −0,34 | −200,00 | −0,1318 | −0,2636 | |||||

| BRL/USD FORWARD / DFE (000000000) | −0,36 | −0,1429 | −0,1429 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | −0,40 | −0,1559 | −0,1559 | ||||||

| EURO-BUND / DIR (000000000) | −0,40 | −0,1577 | −0,1577 | ||||||

| EURO-BUND / DIR (000000000) | −0,40 | −0,1577 | −0,1577 | ||||||

| US01F0206874 / UMBS TBA 30YR 2% AUG 20 TO BE ANNOUNCED 2.00000000 | −0,40 | −0,1580 | −0,1580 | ||||||

| USD/JPY FORWARD / DFE (000000000) | −0,40 | −0,1581 | −0,1581 | ||||||

| USD/JPY FORWARD / DFE (000000000) | −0,40 | −0,1581 | −0,1581 | ||||||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | −0,41 | −111,09 | −0,1594 | −1,5938 | |||||

| IRS MXN / DIR (000000000) | −0,42 | −0,1655 | −0,1655 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,43 | −0,1707 | −0,1707 | ||||||

| US21H0326882 / Ginnie Mae | −0,55 | −200,00 | −0,2167 | −0,4334 | |||||

| US01F0406854 / UMBS TBA | −0,56 | −0,2209 | −0,2209 | ||||||

| AUD/USD FORWARD / DFE (000000000) | −0,70 | −0,2757 | −0,2757 | ||||||

| AUD/USD FORWARD / DFE (000000000) | −0,70 | −0,2757 | −0,2757 | ||||||

| US21H0506806 / GNMA | −0,79 | −200,00 | −0,3108 | −0,6216 | |||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | −0,86 | −0,3397 | −0,3397 | ||||||

| IRS USD / DIR (000000000) | −1,43 | −0,5636 | −0,5636 | ||||||

| IRS USD / DIR (000000000) | −1,43 | −0,5636 | −0,5636 | ||||||

| IRS USD / DIR (000000000) | −4,91 | −1,9282 | −1,9282 | ||||||

| 10 YEAR US ULTRA TREASURY BOND / DIR (000000000) | −6,35 | −2,4951 | −2,4951 | ||||||

| 10 YEAR US ULTRA TREASURY BOND / DIR (000000000) | −6,35 | −2,4951 | −2,4951 |