Grundläggande statistik

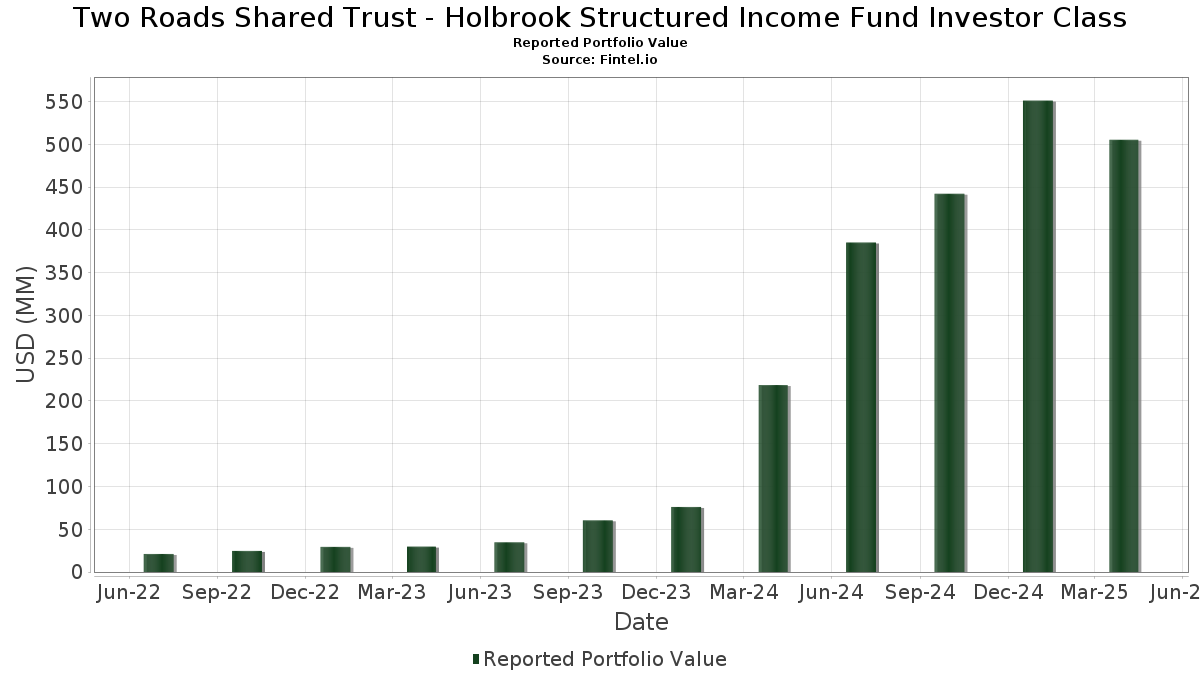

| Portföljvärde | $ 505 402 987 |

| Aktuella positioner | 149 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

Two Roads Shared Trust - Holbrook Structured Income Fund Investor Class har redovisat 149 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 505 402 987 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). Two Roads Shared Trust - Holbrook Structured Income Fund Investor Classs största innehav är First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , Sound Point Clo XVI Ltd (KY:US83610KAG85) , BXHPP Trust 2021-FILM (US:US05609JAA07) , HLA 18-2 C CLO 144A FRN (L+340) 01-22-31 (US:US40490AAJ97) , and Battalion CLO IX Ltd (US:US07132EAQ89) . Two Roads Shared Trust - Holbrook Structured Income Fund Investor Classs nya positioner inkluderar First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , Sound Point Clo XVI Ltd (KY:US83610KAG85) , BXHPP Trust 2021-FILM (US:US05609JAA07) , HLA 18-2 C CLO 144A FRN (L+340) 01-22-31 (US:US40490AAJ97) , and Battalion CLO IX Ltd (US:US07132EAQ89) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 22,54 | 4,4700 | 4,4700 | ||

| 21,06 | 4,1769 | 4,1769 | ||

| 13,32 | 2,6404 | 2,6404 | ||

| 8,98 | 1,7802 | 1,7802 | ||

| 7,49 | 1,4854 | 1,4854 | ||

| 7,60 | 1,5079 | 1,3208 | ||

| 6,29 | 1,2475 | 1,2475 | ||

| 6,11 | 1,2122 | 1,2122 | ||

| 5,90 | 1,1696 | 1,1696 | ||

| 5,73 | 1,1353 | 1,1353 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 5,38 | 1,0660 | −1,5145 | ||

| 26,17 | 5,1901 | −1,2585 | ||

| 4,86 | 0,9631 | −1,0117 | ||

| 17,35 | 3,4410 | −0,3834 | ||

| 0,55 | 0,1088 | −0,3760 | ||

| 1,86 | 0,3685 | −0,3759 | ||

| 1,98 | 0,3931 | −0,2666 | ||

| 1,97 | 0,3899 | −0,1142 | ||

| 1,96 | 0,3889 | −0,0950 | ||

| 0,34 | 0,0665 | −0,0776 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-06-26 för rapporteringsperioden 2025-04-30. Denna investerare har inte offentliggjort värdepapper som räknas i aktier, så de aktierelaterade kolumnerna i tabellen nedan har utelämnats. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 26,17 | −24,29 | 5,1901 | −1,2585 | ||

| US83610KAG85 / Sound Point Clo XVI Ltd | 22,54 | 4,4700 | 4,4700 | |||

| US05609JAA07 / BXHPP Trust 2021-FILM | 21,06 | 4,1769 | 4,1769 | |||

| US40490AAJ97 / HLA 18-2 C CLO 144A FRN (L+340) 01-22-31 | 17,90 | −0,43 | 3,5495 | 0,1960 | ||

| US07132EAQ89 / Battalion CLO IX Ltd | 17,35 | −15,36 | 3,4410 | −0,3834 | ||

| WINDR 2015-1A DR / ABS-CBDO (US88432FBG37) | 16,03 | −0,50 | 3,1794 | 0,1737 | ||

| US05549GAS03 / BHMS 2018-MZB | 13,32 | 2,6404 | 2,6404 | |||

| CFGMS 2025-31 B / ABS-O (US14023CAB37) | 13,07 | 0,57 | 2,5926 | 0,1677 | ||

| 66860CAJ2 / Northwoods Capital XI-B Ltd. and Northwoods Capital XI-B LLC Series 2018-14BA Class D (3-Month U.S. LIBOR plus 340 bps) | 12,49 | −0,51 | 2,4763 | 0,1350 | ||

| US14311DBU90 / Carlyle Global Market Strategies CLO 2015-1 Ltd | 11,95 | 7,87 | 2,3689 | 0,3030 | ||

| US66858CAJ62 / Northwoods Capital XII-B Ltd | 10,31 | −0,82 | 2,0444 | 0,1055 | ||

| WINDR 2014-3KRA D / ABS-CBDO (US88390BAJ70) | 9,99 | −0,82 | 1,9810 | 0,1020 | ||

| US12551JAS50 / CIFC 2017-4A CR | 8,98 | 1,7802 | 1,7802 | |||

| US52111PAM32 / LCM XXIII Ltd | 7,60 | 658,88 | 1,5079 | 1,3208 | ||

| US92539GAA94 / Verus Securitization Trust 2023-3 | 7,49 | 1,4854 | 1,4854 | |||

| US44330DAL47 / Highbridge Loan Management 2013-2 Ltd | 7,47 | 86,24 | 1,4817 | 0,7331 | ||

| ZAIS7 2017-2A D / ABS-CBDO (US98887VAG86) | 7,02 | 39,08 | 1,3910 | 0,4501 | ||

| US15033AAA43 / Cedar Funding VII CLO Ltd., Series 2018-7A, Class E | 7,00 | 54,88 | 1,3875 | 0,5449 | ||

| US14889DAS71 / Catamaran CLO 2014-1 Ltd | 6,39 | 340,36 | 1,2679 | 0,9969 | ||

| MSC 2024-BPR2 E / ABS-O (US61776EAL74) | 6,29 | 1,2475 | 1,2475 | |||

| MSC 2024-BPR2 C / ABS-O (US61776EAG89) | 6,19 | 0,42 | 1,2268 | 0,0776 | ||

| OBX 2024-NQM12 A1 / ABS-O (US67448PAA12) | 6,11 | 1,2122 | 1,2122 | |||

| US04942JAJ07 / Atlas Senior Loan Fund X Ltd., Series 2018-10A, Class D | 5,90 | 1,1696 | 1,1696 | |||

| US67112MAG06 / OZLM XX Ltd | 5,73 | 1,1353 | 1,1353 | |||

| ZAIS6 2017-1A D / ABS-CBDO (US98887TAE82) | 5,59 | −0,29 | 1,1084 | 0,0628 | ||

| US14022TAB70 / MCFMT 2022-PM01 B | 5,38 | −61,14 | 1,0660 | −1,5145 | ||

| US92916MAD39 / Voya CLO LTD VOYA 2017 1A C 144A | 5,10 | 1,0109 | 1,0109 | |||

| XCAL 2024-SURF A / ABS-O (US98373XBP42) | 5,06 | 0,00 | 1,0041 | 0,0595 | ||

| US13876JAJ16 / Canyon Capital CLO 2012-1 R Ltd | 5,04 | −0,41 | 1,0000 | 0,0555 | ||

| US67590ABX90 / Octagon Investment Partners XIV Ltd | 5,01 | 0,9936 | 0,9936 | |||

| US67515EAX40 / Ocean Trails CLO V | 4,99 | 0,9887 | 0,9887 | |||

| US05608BAQ32 / BX Commercial Mortgage Trust 2019-IMC | 4,86 | −54,12 | 0,9631 | −1,0117 | ||

| US88432DBL73 / Wind River 2014-3 CLO Ltd | 4,75 | −0,61 | 0,9410 | 0,0504 | ||

| MFRA 2024-NQM3 A1 / ABS-O (US55287GAA04) | 4,69 | 0,9308 | 0,9308 | |||

| US50189GAJ13 / LCM XXII Ltd | 4,60 | 0,9129 | 0,9129 | |||

| XCAL 2023-HOAKS A / ABS-O (US98373XBG43) | 4,59 | −0,11 | 0,9095 | 0,0531 | ||

| US92329FAV94 / Venture XVIII CLO Ltd | 4,49 | −0,40 | 0,8907 | 0,0495 | ||

| US92331MAD02 / Venture XXVI CLO Ltd | 4,39 | −0,45 | 0,8708 | 0,0480 | ||

| CFGMS 2024-28 B / ABS-O (US14022BAB62) | 4,28 | −0,07 | 0,8493 | 0,0498 | ||

| US28622VAJ98 / Elevation CLO 2017-8 Ltd | 4,24 | 100,66 | 0,8417 | 0,4470 | ||

| US98370NAC92 / XCAL 2021-7 B1 | 4,16 | 0,27 | 0,8251 | 0,0511 | ||

| US81883EAD31 / Shackleton 2017-XI Clo Ltd | 4,01 | −0,67 | 0,7944 | 0,0420 | ||

| CFGMS 2024-29 B / ABS-O (US14022JAB98) | 4,01 | −0,25 | 0,7943 | 0,0454 | ||

| XCAL 2024-OPAL A / ABS-O (US98373XBS80) | 4,00 | −0,12 | 0,7936 | 0,0461 | ||

| US88432CBE57 / THL Credit Wind River 2014-1 CLO Ltd | 4,00 | −0,67 | 0,7927 | 0,0419 | ||

| US09202VAN82 / Black Diamond Clo 2017-1 Ltd | 3,91 | −0,48 | 0,7759 | 0,0425 | ||

| US78458MAL81 / SMR 2022-IND Mortgage Trust | 3,85 | −0,67 | 0,7626 | 0,0404 | ||

| US69355DAG25 / PPM CLO 2018-1 Ltd | 3,74 | −0,74 | 0,7418 | 0,0386 | ||

| XCAL 2023-DMNK B1 / ABS-O (US98373XBM11) | 3,32 | −0,15 | 0,6587 | 0,0382 | ||

| BRAVO 2025-NQM2 A1 / ABS-O (US10569NAC56) | 2,96 | 0,5872 | 0,5872 | |||

| MP15 2019-1A E / ABS-CBDO (US56606XAA54) | 2,95 | 0,5850 | 0,5850 | |||

| US81881QAY26 / Shackleton 2013-III CLO Ltd | 2,89 | 33,98 | 0,5740 | 0,1711 | ||

| VERUS 2024-9 A1 / ABS-O (US92540RAC88) | 2,89 | 0,5735 | 0,5735 | |||

| GSMS 2024-FAIR D / ABS-O (US36270JAG04) | 2,84 | 37,45 | 0,5635 | 0,1779 | ||

| US83607HAG02 / SOUND POINT CLO VIII-R LTD | 2,70 | 0,5349 | 0,5349 | |||

| ADMT 2024-NQM3 A1 / ABS-O (US00039HAA59) | 2,67 | −3,76 | 0,5286 | 0,0120 | ||

| US98373XAY67 / XCALFD 11 03/01/25 | 2,64 | 0,15 | 0,5234 | 0,0318 | ||

| CFGMS 2025-P05 B / ABS-O (US139917AB47) | 2,53 | −0,16 | 0,5008 | 0,0290 | ||

| KSTAT 2022-1A ER2 / ABS-CBDO (US48255RAE18) | 2,49 | −1,39 | 0,4943 | 0,0229 | ||

| XCAL 2024-OPAL B1 / ABS-O (US98373XBT63) | 2,45 | −0,16 | 0,4863 | 0,0282 | ||

| HSLT 2024-1 C / DBT (US41756NAC39) | 2,35 | −1,34 | 0,4657 | 0,0217 | ||

| US28851QAL77 / Ellington Clo I Ltd | 2,32 | −8,35 | 0,4592 | −0,0121 | ||

| US69702JAA25 / Palmer Square Loan Funding Ltd | 2,25 | −0,04 | 0,4467 | 0,0263 | ||

| OBX 2024-NQM4 A1 / ABS-O (US67118TAA25) | 2,06 | 0,4082 | 0,4082 | |||

| US13875LAU26 / Canyon Capital CLO 2014-1 Ltd | 2,00 | −0,60 | 0,3960 | 0,0211 | ||

| US85816VAD82 / Steele Creek Clo 2017-1 Ltd | 1,99 | 0,3956 | 0,3956 | |||

| US30297MAU45 / FREMF 2018-K733 Mortgage Trust | 1,98 | −43,95 | 0,3931 | −0,2666 | ||

| US30296XAG25 / FREMF Mortgage Trust, Series 2018-K78, Class B | 1,97 | −27,24 | 0,3899 | −0,1142 | ||

| US30305EAE86 / FREMF Mortgage Trust, Series 2017-K68, Class B | 1,97 | 1,97 | 0,3897 | 0,0302 | ||

| US30298MAC38 / FREMF 2019-K736 Mortgage Trust | 1,96 | −24,40 | 0,3889 | −0,0950 | ||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,89 | −0,26 | 0,3757 | 0,0214 | ||

| US00002DAA72 / A&D Mortgage Trust 2023-NQM2 | 1,86 | 0,3688 | 0,3688 | |||

| JPMMT 2024-12 A4 / ABS-O (US46658TAD63) | 1,86 | −53,43 | 0,3685 | −0,3759 | ||

| US67111NAJ37 / OZLM XVII, Ltd. | 1,84 | −0,70 | 0,3641 | 0,0191 | ||

| US48250GAW06 / KKR 10 DR | 1,77 | −0,34 | 0,3517 | 0,0197 | ||

| XCAL 2024-MSD B1 / ABS-O (US98373XBX75) | 1,75 | 0,00 | 0,3467 | 0,0205 | ||

| MVEW 2017-2A D / ABS-CBDO (US62432LAG68) | 1,72 | −0,69 | 0,3420 | 0,0181 | ||

| US30316EAE59 / FREMF Mortgage Trust, Series 2020-KF76, Class B | 1,71 | −0,70 | 0,3387 | 0,0177 | ||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,63 | −3,77 | 0,3240 | 0,0072 | ||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,60 | 11,34 | 0,3175 | 0,0493 | ||

| US30313LAG77 / FREMF 2019-KF69 B | 1,54 | 0,3058 | 0,3058 | |||

| US12570GAC33 / CIM Trust 2023-R3 | 1,54 | −0,90 | 0,3049 | 0,0156 | ||

| DFS 2025-RTL1 M / ABS-O (US25746DAC11) | 1,50 | 0,2982 | 0,2982 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 1,50 | −8,94 | 0,2969 | −0,0099 | ||

| US01750CAJ27 / Allegro CLO VII Ltd | 1,50 | 0,2967 | 0,2967 | |||

| CEDF 2016-5A DR / ABS-CBDO (US15032AAW71) | 1,49 | −0,73 | 0,2963 | 0,0154 | ||

| US67112AAG67 / OZLM XXI Ltd | 1,49 | −0,86 | 0,2963 | 0,0151 | ||

| HSLT 2024-1 B / DBT (US41756NAB55) | 1,46 | −0,75 | 0,2889 | 0,0149 | ||

| US693984AA42 / PRKCM Trust, Series 2023-AFC3, Class A1 | 1,42 | −4,77 | 0,2814 | 0,0035 | ||

| JPMMT 2024-11 A6 / ABS-O (US46659AAJ34) | 1,28 | −6,72 | 0,2534 | −0,0022 | ||

| US69702LAC37 / PSTAT 2022-1A E | 1,26 | −0,08 | 0,2490 | 0,0147 | ||

| US26244QAU76 / Dryden 49 Senior Loan Fund | 1,25 | 0,2474 | 0,2474 | |||

| US30296PAS39 / FREMF 2018-K75 Mortgage Trust | 1,21 | 2,97 | 0,2407 | 0,0207 | ||

| OLIT 2024-HB2 M4 / ABS-O (US68278DAE31) | 1,13 | 1,81 | 0,2234 | 0,0171 | ||

| US09629VAJ26 / BLUEM 18-2 D CLO 144A FRN (TSFR3M + 341.16) 08-15-31 | 1,10 | 0,2175 | 0,2175 | |||

| US44422PBY79 / HUDSONS BAY SIMON JV TRUST 2015-HBS SER 2015-HB10 CL C10 V/R REGD 144A P/P 5.44700000 | 1,04 | 4,93 | 0,2070 | 0,0215 | ||

| MFRA 2024-NQM2 A1 / ABS-O (US58004JAA07) | 1,04 | 0,2069 | 0,2069 | |||

| VERUS 2025-3 A1 / ABS-O (US924928AA24) | 1,00 | 0,1989 | 0,1989 | |||

| XCALFD 25 09/01/25 / ABS-O (US98373XAE04) | 1,00 | −0,10 | 0,1983 | 0,0115 | ||

| US70016RAJ41 / Park Avenue Institutional Advisers CLO Ltd 2018-1 3.52 | 1,00 | 0,1982 | 0,1982 | |||

| US92915PAR64 / Voya CLO Ltd., Series 2014-1A, Class CR2 | 1,00 | 0,1982 | 0,1982 | |||

| OCT27 / Octagon Investment Partners 27 Ltd | 1,00 | 0,1981 | 0,1981 | |||

| US65023PAU49 / Newark BSL CLO 2 Ltd | 1,00 | 0,1980 | 0,1980 | |||

| US92913UAW62 / Voya CLO 2015-3 Ltd | 1,00 | 0,1975 | 0,1975 | |||

| US67591VAJ44 / Octagon Investment Partners 37 Ltd | 1,00 | 0,1975 | 0,1975 | |||

| US88432ABC36 / THL Credit Wind River 2013-2 CLO Ltd | 0,99 | 0,1972 | 0,1972 | |||

| US35708WAU45 / FREMF Mortgage Trust, Series 2017-K71, Class C | 0,98 | 1,77 | 0,1933 | 0,0145 | ||

| GNR 2024-76 KA / ABS-O (US38384NTQ87) | 0,96 | −19,92 | 0,1899 | −0,0331 | ||

| OLIT 2024-HB2 M3 / ABS-O (US68278DAD57) | 0,94 | 1,40 | 0,1869 | 0,0136 | ||

| CFMT 2024-HB15 M3 / ABS-O (US15723AAD37) | 0,94 | 1,52 | 0,1859 | 0,0137 | ||

| US465986AK33 / JP Morgan Mortgage Trust 2023-10 | 0,91 | −17,02 | 0,1799 | −0,0240 | ||

| BRAVO 2024-NQM3 A1 / ABS-O (US10569LAA35) | 0,80 | 0,1580 | 0,1580 | |||

| SEMT 2024-3 A4 / ABS-O (US81749JAD63) | 0,76 | −6,29 | 0,1508 | −0,0006 | ||

| ATCLO 2017-8A C / ABS-CBDO (US04943AAG40) | 0,75 | −0,13 | 0,1490 | 0,0087 | ||

| US88432VAJ35 / THL CREDIT WIND RIVER 2018-1 CLO LTD | 0,70 | −0,43 | 0,1386 | 0,0076 | ||

| US12549BAW81 / CIFC Funding 2013-II Ltd | 0,62 | −0,48 | 0,1239 | 0,0068 | ||

| US28853RAG48 / Ellington CLO IV Ltd | 0,55 | −78,91 | 0,1088 | −0,3760 | ||

| LLP 2024-4 B / ABS-O (US55068XAB64) | 0,54 | 0,19 | 0,1074 | 0,0066 | ||

| BRAVO 2024-NQM2 A1 / ABS-O (US10569KAA51) | 0,54 | 0,1067 | 0,1067 | |||

| CRMN 2018-1A D / ABS-CBDO (US14900CAJ45) | 0,50 | 0,0997 | 0,0997 | |||

| US27830TAJ43 / Eaton Vance CLO 2014-1R Ltd. | 0,50 | −0,80 | 0,0987 | 0,0051 | ||

| US98373XAD21 / XCALFD 11 09/24/24 | 0,50 | −0,60 | 0,0986 | 0,0054 | ||

| GUGG4 2016-1A CR / ABS-CBDO (US282523BF53) | 0,49 | −0,60 | 0,0980 | 0,0054 | ||

| US35708YAS54 / FREMF 2018-K733 Mortgage Trust | 0,49 | 0,0973 | 0,0973 | |||

| US46652BBJ70 / JP Morgan Chase Commercial Mortgage Securities Trust 2020-NNN | 0,49 | −2,21 | 0,0965 | 0,0038 | ||

| US98372NAC74 / XCALI 2020-1 Mortgage Trust | 0,47 | 0,21 | 0,0929 | 0,0056 | ||

| CFMT 2025-HB16 M3 / ABS-O (US12531BAD01) | 0,46 | 0,0913 | 0,0913 | |||

| US30288LAN38 / FREMF Mortgage Trust, Series 2016-K53, Class B | 0,45 | 0,0884 | 0,0884 | |||

| US08763QAG73 / Betony CLO 2 Ltd | 0,42 | −0,48 | 0,0824 | 0,0045 | ||

| US98401JAB35 / XCALI 2020-5 Mortgage Trust | 0,37 | −0,80 | 0,0739 | 0,0039 | ||

| MSRM 2024-NQM3 A1 / ABS-O (US61776UAA51) | 0,35 | 0,0702 | 0,0702 | |||

| US30311LAG95 / FREMF 2019-KF61 B | 0,35 | 0,0702 | 0,0702 | |||

| US98875LAG41 / Zais CLO 5 Ltd | 0,34 | −56,61 | 0,0665 | −0,0776 | ||

| US92539TAA16 / Verus Securitization Trust, Series 2023-4, Class A1 | 0,29 | 0,0567 | 0,0567 | |||

| PAID 2024-1 A / ABS-O (US69548AAA97) | 0,26 | −16,46 | 0,0525 | −0,0066 | ||

| US69702HAG39 / Palmer Square Loan Funding Ltd., Series 2021-4A, Class C | 0,25 | −0,40 | 0,0494 | 0,0027 | ||

| US87231BAJ26 / TFLAT 2017-1A D | 0,25 | −0,40 | 0,0494 | 0,0026 | ||

| US46650RAC07 / J.P. Morgan Chase Commercial Mortgage Securities Trust 2019-ICON | 0,24 | −19,19 | 0,0477 | −0,0078 | ||

| BRAVO 2024-NQM5 A1 / ABS-O (US105925AA98) | 0,24 | 0,0473 | 0,0473 | |||

| REACH 2024-1A A / ABS-O (US75526PAA93) | 0,23 | −32,95 | 0,0462 | −0,0185 | ||

| US06540RAF10 / BANK 2017-BNK9 | 0,22 | 0,0430 | 0,0430 | |||

| US05608BAS97 / BX TRUST 2019-IMC G 1ML+360 04/15/2034 144A | 0,19 | −0,53 | 0,0373 | 0,0020 | ||

| US17327FBG00 / Citigroup Commercial Mortgage Trust 2018-B2 | 0,13 | 0,0264 | 0,0264 | |||

| JPMCC 2019-ICON XB / ABS-O (US46650RAE62) | 0,09 | −32,85 | 0,0184 | −0,0072 | ||

| US26844QAB32 / EFMT 2023-1 | 0,07 | −4,11 | 0,0140 | 0,0003 | ||

| US98373XBE94 / XCAL 2023-MF9 B1 | 0,06 | −85,44 | 0,0122 | −0,0660 | ||

| US87265XAA28 / TRK_22-INV2 | 0,05 | 0,0098 | 0,0098 | |||

| US12594PAX96 / COMMERCIAL MORT BACKED SEC IO | 0,03 | −30,56 | 0,0050 | −0,0018 | ||

| US94989TBC71 / WELLS FARGO COMMERCIAL MORTGAGE TRUST 2015-LC22 SER 2015-LC22 CL XA V/R REGD 0.98385900 | 0,00 | −100,00 | 0,0002 | −0,0009 |