Grundläggande statistik

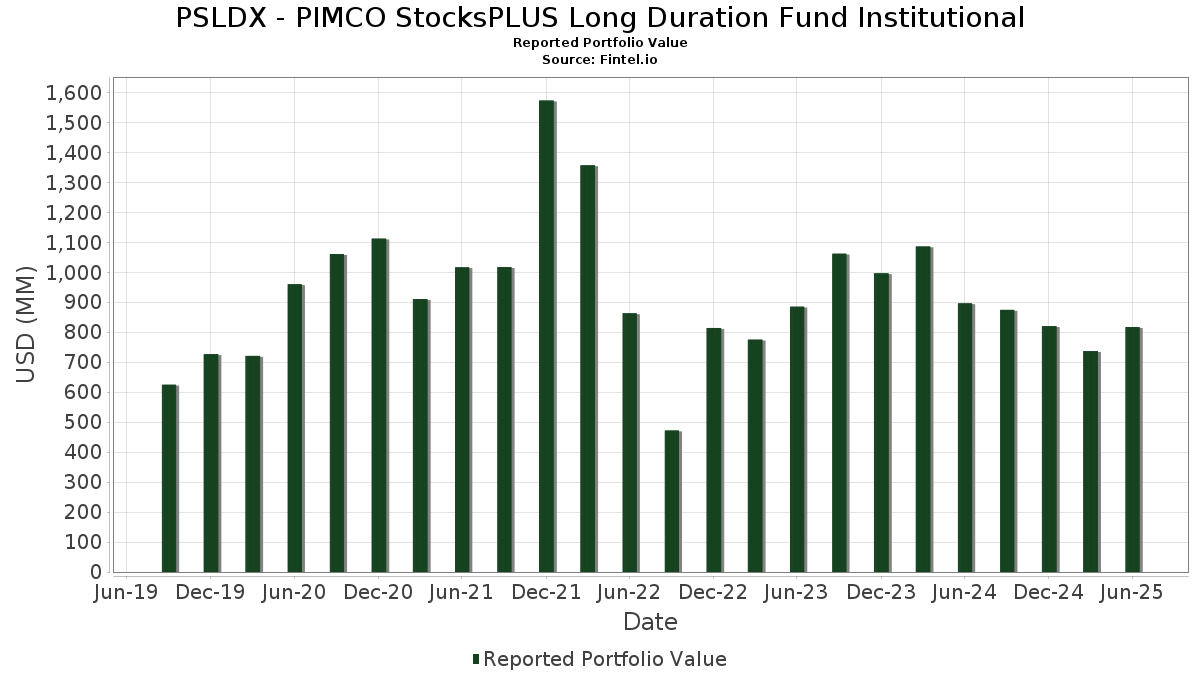

| Portföljvärde | $ 817 202 300 |

| Aktuella positioner | 838 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

PSLDX - PIMCO StocksPLUS Long Duration Fund Institutional har redovisat 838 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 817 202 300 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). PSLDX - PIMCO StocksPLUS Long Duration Fund Institutionals största innehav är United States Treasury Note/Bond (US:US912810TC27) , United States Treasury Note/Bond (US:US912810SW99) , United States Treasury Note/Bond (US:US912810SY55) , Edwards Lifesciences Corporation (US:EW) , and UMBS TBA (US:US01F0506844) . PSLDX - PIMCO StocksPLUS Long Duration Fund Institutionals nya positioner inkluderar United States Treasury Note/Bond (US:US912810TC27) , United States Treasury Note/Bond (US:US912810SW99) , United States Treasury Note/Bond (US:US912810SY55) , Edwards Lifesciences Corporation (US:EW) , and UMBS TBA (US:US01F0506844) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 41,29 | 7,2918 | 7,1392 | ||

| 37,20 | 6,5697 | 6,2967 | ||

| 33,52 | 5,9192 | 5,9192 | ||

| 31,32 | 5,5323 | 5,5323 | ||

| 36,34 | 6,4180 | 2,9349 | ||

| 20,18 | 3,5632 | 2,6247 | ||

| 3,25 | 0,5748 | 0,6758 | ||

| 3,78 | 0,6678 | 0,6678 | ||

| 3,78 | 0,6678 | 0,6678 | ||

| 3,78 | 0,6676 | 0,6676 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| −83,61 | −14,7670 | −14,7670 | ||

| −64,75 | −11,4355 | −11,4355 | ||

| −40,90 | −7,2241 | −7,2241 | ||

| −33,43 | −5,9041 | −5,9041 | ||

| 13,82 | 2,4412 | −4,5754 | ||

| −15,80 | −2,7904 | −2,7904 | ||

| 6,73 | 1,1878 | −1,9322 | ||

| 6,73 | 1,1878 | −1,9322 | ||

| 74,65 | 13,1846 | −1,2539 | ||

| 65,92 | 11,6426 | −1,2365 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-29 för rapporteringsperioden 2025-06-30. Denna investerare har inte offentliggjort värdepapper som räknas i aktier, så de aktierelaterade kolumnerna i tabellen nedan har utelämnats. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|

| US912810TC27 / United States Treasury Note/Bond | 74,65 | −2,11 | 13,1846 | −1,2539 | ||

| US912810SW99 / United States Treasury Note/Bond | 65,92 | −3,09 | 11,6426 | −1,2365 | ||

| US TREASURY N/B 02/55 4.625 / DBT (US912810UG12) | 41,29 | 5 028,82 | 7,2918 | 7,1392 | ||

| US912810SY55 / United States Treasury Note/Bond | 37,49 | −2,02 | 6,6213 | −0,6235 | ||

| EW / Edwards Lifesciences Corporation | 37,20 | 1 733,32 | 6,5697 | 6,2967 | ||

| US01F0506844 / UMBS TBA | 36,34 | 40,31 | 6,4180 | 2,9349 | ||

| US TREASURY N/B 05/55 4.75 / DBT (US912810UK24) | 33,52 | 5,9192 | 5,9192 | |||

| EW / Edwards Lifesciences Corporation | 31,95 | −14,10 | 5,6432 | −0,9265 | ||

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 31,32 | 5,5323 | 5,5323 | |||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 31,17 | −31,29 | 5,5050 | −0,5960 | ||

| US912810TS78 / United States Treasury Note/Bond | 27,65 | −2,14 | 4,8841 | −0,4666 | ||

| US01F0426811 / UMBS TBA | 20,18 | 189,12 | 3,5632 | 2,6247 | ||

| US912810TH14 / United States Treasury Note/Bond | 19,95 | −6,37 | 3,5226 | −0,5108 | ||

| US912810QZ49 / United States Treas Bds Bond | 13,92 | −2,03 | 2,4580 | −0,2315 | ||

| US TREASURY N/B 11/54 4.5 / DBT (US912810UE63) | 13,82 | −62,70 | 2,4412 | −4,5754 | ||

| US912810TW80 / United States Treasury Note/Bond | 11,49 | −2,22 | 2,0295 | −0,1955 | ||

| US912810SA79 / United States Treas Bds Bond | 11,30 | 3,61 | 1,9954 | −0,0691 | ||

| US912810SV17 / United States Treasury Inflation Indexed Bonds | 11,15 | −4,37 | 1,9695 | −0,2382 | ||

| US31359MEB54 / FNMA | 11,13 | −0,96 | 1,9653 | −0,1619 | ||

| US912810SJ88 / United States Treas Bds Bond | 11,11 | 3,70 | 1,9619 | −0,0662 | ||

| US912810ST60 / TREASURY BOND | 9,56 | −9,25 | 1,6885 | −0,3061 | ||

| US31358DDS09 / Fannie Mae Principal Strips | 8,62 | 2,22 | 1,5229 | −0,0742 | ||

| GB00BMV7TC88 / United Kingdom Gilt | 8,14 | 6,43 | 1,4373 | −0,0104 | ||

| RFR USD SOFR/1.75000 06/15/22-10Y CME / DIR (EZQ6DKJXZ1C9) | 6,73 | −59,19 | 1,1878 | −1,9322 | ||

| RFR USD SOFR/1.75000 06/15/22-10Y CME / DIR (EZQ6DKJXZ1C9) | 6,73 | −59,19 | 1,1878 | −1,9322 | ||

| XS0765596357 / Morgan Stanley | 5,97 | 3,43 | 1,0543 | −0,0385 | ||

| US912803DP52 / United States Treasury Strip Principal | 5,96 | −2,22 | 1,0518 | −0,1013 | ||

| US912810SE91 / United States Treas Bds Bond | 5,86 | 9,29 | 1,0343 | 0,0197 | ||

| US912810SF66 / Us Treasury Bond | 4,86 | −2,56 | 0,8592 | −0,0861 | ||

| US912810SK51 / United States Treasury Note/Bond | 4,57 | −2,77 | 0,8069 | −0,0828 | ||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 4,35 | 1,40 | 0,7680 | −0,0439 | ||

| US87165BAR42 / Synchrony Financial | 4,25 | 2,58 | 0,7513 | −0,0338 | ||

| US23302JAA34 / DAE Sukuk Difc Ltd | 4,17 | 0,07 | 0,7370 | −0,0524 | ||

| US654744AD34 / Nissan Motor Co Ltd | 4,13 | −3,41 | 0,7297 | −0,0801 | ||

| US TREASURY N/B 08/44 4.125 / DBT (US912810UD80) | 3,85 | −2,21 | 0,6798 | −0,0655 | ||

| SPTR TRS EQUITY SOFR+59 CIB / DE (000000000) | 3,78 | 0,6678 | 0,6678 | |||

| SPTR TRS EQUITY SOFR+59 CIB / DE (000000000) | 3,78 | 0,6678 | 0,6678 | |||

| S+P500 EMINI FUT SEP25 XCME 20250919 / DE (000000000) | 3,78 | 0,6676 | 0,6676 | |||

| US TREASURY N/B 08/54 4.25 / DBT (US912810UC08) | 3,65 | −3,23 | 0,6453 | −0,0697 | ||

| US928563AL97 / VMware Inc | 3,65 | 2,10 | 0,6441 | −0,0322 | ||

| US76116FAC14 / Resol Fnd Ser B 2030 Bonds Prin Comp 04/15/30 | 3,38 | 1,65 | 0,5975 | −0,0327 | ||

| US21H0406734 / Ginnie Mae | 3,25 | −442,53 | 0,5748 | 0,6758 | ||

| US25160PAG28 / Deutsche Bank AG/New York NY | 3,24 | 2,43 | 0,5725 | −0,0267 | ||

| US07274EAL74 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.5% 11-21-33 | 3,22 | 2,06 | 0,5683 | −0,0287 | ||

| US01F0306781 / UMBS TBA | 3,20 | 0,5655 | 0,5655 | |||

| US361841AR08 / GLP Capital LP / GLP Financing II Inc | 3,08 | 1,68 | 0,5445 | −0,0297 | ||

| IRS EUR 0.00000 03/17/23-30Y LCH / DIR (EZW4VS361M00) | 2,98 | 14,06 | 0,5258 | 0,0315 | ||

| US161175CC60 / CHARTER COMMUNICATIONS OPERATING LLC / CHARTER COMMUNICATIONS OPERATING CAPITAL 4.4% 12/01/2061 | 2,95 | 5,59 | 0,5205 | −0,0079 | ||

| US715638BY77 / REPUBLIC OF PERU SR UNSECURED 144A 08/32 6.15 | 2,92 | 6,80 | 0,5157 | −0,0021 | ||

| CAPITAL FOUR US CLO C4US 2022 1A AR 144A / ABS-CBDO (US14016CAN65) | 2,91 | −0,10 | 0,5141 | −0,0374 | ||

| US37940XAH52 / Global Payments Inc | 2,74 | 0,96 | 0,4845 | −0,0300 | ||

| US46188BAC63 / INVITATION HOMES OP REGD 2.70000000 | 2,73 | 1,49 | 0,4820 | −0,0271 | ||

| US90931GAA76 / United Airlines 2020-1 Class A Pass Through Trust | 2,72 | −6,56 | 0,4804 | −0,0707 | ||

| US74365PAJ75 / Prosus NV | 2,63 | −0,79 | 0,4637 | −0,0374 | ||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 2,57 | 1,50 | 0,4534 | −0,0256 | ||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 2,57 | 1,50 | 0,4534 | −0,0256 | ||

| US912810TF57 / TREASURY BOND | 2,55 | −1,96 | 0,4499 | −0,0422 | ||

| SPTR TRS EQUITY SOFR+46 CIB / DE (000000000) | 2,53 | 0,4462 | 0,4462 | |||

| US880451AZ24 / TENNESSEE GAS PIPELINE REGD 144A P/P 2.90000000 | 2,49 | 1,22 | 0,4406 | −0,0260 | ||

| US912810SM18 / US TII .25 02/15/2050 (TIPS) | 2,47 | −3,93 | 0,4356 | −0,0505 | ||

| US626207YF57 / MUNI ELEC AUTH OF GEORGIA | 2,46 | −2,69 | 0,4343 | −0,0442 | ||

| US21H0506723 / Ginnie Mae | 2,46 | 0,4338 | 0,4338 | |||

| US37959GAB32 / Global Atlantic Fin Co | 2,44 | 0,74 | 0,4317 | −0,0278 | ||

| US912803EC31 / United States Treasury Strip Principal | 2,44 | −2,90 | 0,4317 | −0,0450 | ||

| US03027XBS80 / American Tower Corp | 2,43 | 1,42 | 0,4293 | −0,0244 | ||

| US862121AD28 / STORE Capital Corp. | 2,38 | 0,17 | 0,4199 | −0,0295 | ||

| US02379KAA25 / American Airlines 2021-1 Class A Pass Through Trust | 2,37 | 0,34 | 0,4187 | −0,0286 | ||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 2,37 | −48,87 | 0,4185 | −0,4588 | ||

| US694308KC03 / Pacific Gas and Electric Co | 2,35 | 0,21 | 0,4145 | −0,0289 | ||

| FED HM LN PC POOL SD8494 FR 01/55 FIXED 5.5 / ABS-MBS (US3132DWNK52) | 2,33 | −2,35 | 0,4120 | −0,0402 | ||

| US71654QDF63 / Petroleos Mexicanos | 2,32 | 5,26 | 0,4100 | −0,0075 | ||

| US45866FAP99 / INTERCONTINENTAL EXCHANGE INC 2.65% 09/15/2040 | 2,31 | 0,74 | 0,4079 | −0,0261 | ||

| US21H0426799 / Ginnie Mae | 2,30 | 0,4058 | 0,4058 | |||

| US682691AB63 / OneMain Finance Corp | 2,25 | 2,18 | 0,3979 | −0,0197 | ||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 2,23 | −25,74 | 0,3945 | −0,0100 | ||

| US912803DN05 / United States Treasury Strip Principal | 2,23 | −2,11 | 0,3937 | −0,0374 | ||

| US05551JAA88 / BAMLL Commercial Mortgage Securities Trust 2020-BOC | 2,19 | −2,06 | 0,3872 | −0,0366 | ||

| US882384AE01 / TEXAS EASTERN TRANSMISSI SR UNSECURED 144A 01/48 4.15 | 2,18 | −0,78 | 0,3842 | −0,0309 | ||

| US3134A4AA29 / Federal Home Loan Mortgage Corp. | 2,17 | 0,51 | 0,3841 | −0,0254 | ||

| US03835VAJ52 / Aptiv PLC | 2,17 | 2,66 | 0,3825 | −0,0170 | ||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 2,16 | 0,89 | 0,3810 | −0,0239 | ||

| US912810SD19 / United States Treas Bds Bond | 2,15 | −2,59 | 0,3789 | −0,0382 | ||

| US33939HAA77 / FLEX INTERMEDIATE HOLDCO LLC | 2,13 | 0,90 | 0,3770 | −0,0235 | ||

| US12665UAA25 / CVS Pass-Through Trust, Series 2013 | 2,04 | −2,63 | 0,3603 | −0,0365 | ||

| US65535HBA68 / Nomura Holdings Inc | 2,04 | 1,44 | 0,3599 | −0,0203 | ||

| US02765UEJ97 / AMERICAN MUNI PWR-OHIO INC OH REVENUE | 2,02 | −0,83 | 0,3568 | −0,0290 | ||

| US853254CH12 / Standard Chartered PLC | 2,00 | 2,94 | 0,3531 | −0,0147 | ||

| R2035 / South Africa - Corporate Bond/Note | 1,98 | 8,07 | 0,3503 | 0,0027 | ||

| US976656CJ54 / Wisconsin Electric Power Co | 1,98 | −0,70 | 0,3490 | −0,0278 | ||

| US054989AB41 / BAT CAPITAL CORP 6.421000% 08/02/2033 | 1,96 | 1,72 | 0,3454 | −0,0185 | ||

| US43284MAB46 / Hilton Grand Vacations Borrower Escrow LLC / Hilton Grand Vacations Borrower Esc | 1,94 | 4,93 | 0,3420 | −0,0075 | ||

| US212015AU57 / Continental Resources Inc/OK | 1,93 | 0,78 | 0,3415 | −0,0217 | ||

| US11043XAA19 / British Airways Pass Through Trust, Series 2019-1, Class AA | 1,88 | −2,23 | 0,3325 | −0,0321 | ||

| BBV / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 1,88 | 1,40 | 0,3316 | −0,0189 | ||

| US00206RMN97 / AT&T Inc | 1,88 | −0,32 | 0,3316 | −0,0250 | ||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 1,87 | 1,80 | 0,3303 | −0,0176 | ||

| TSNF34 / Tyson Foods, Inc. - Depositary Receipt (Common Stock) | 1,86 | 1,03 | 0,3293 | −0,0201 | ||

| SPTR TRS EQUITY SOFR+43 CIB / DE (000000000) | 1,85 | 0,3272 | 0,3272 | |||

| SPTR TRS EQUITY SOFR+43 CIB / DE (000000000) | 1,85 | 0,3272 | 0,3272 | |||

| US46647PDR47 / JPMorgan Chase & Co | 1,85 | 1,20 | 0,3272 | −0,0193 | ||

| US096630AH15 / Boardwalk Pipelines LP | 1,85 | 1,37 | 0,3265 | −0,0187 | ||

| US23371DAG97 / DAE Funding LLC | 1,83 | 0,94 | 0,3231 | −0,0201 | ||

| US225401BG25 / UBS Group AG | 1,83 | 1,05 | 0,3226 | −0,0197 | ||

| XS2345035963 / Wabtec Transportation Netherlands BV | 1,83 | 9,68 | 0,3224 | 0,0073 | ||

| US008513AD57 / Agree LP | 1,78 | 1,31 | 0,3146 | −0,0183 | ||

| SPTR TRS EQUITY SOFR+35 TOR / DE (000000000) | 1,76 | 0,3104 | 0,3104 | |||

| SPTR TRS EQUITY SOFR+53 BRC / DE (000000000) | 1,75 | 0,3094 | 0,3094 | |||

| 69511JD28 / PACIFICORP | 1,75 | 0,92 | 0,3094 | −0,0192 | ||

| US06738ECL74 / Barclays PLC | 1,75 | 1,81 | 0,3086 | −0,0163 | ||

| BANK OF AMERICA CORP BANK OF AMERICA CORP / DBT (US06051GMA49) | 1,75 | 1,28 | 0,3086 | −0,0181 | ||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 1,74 | 0,75 | 0,3076 | −0,0197 | ||

| ASHTEAD CAPITAL INC ASHTEAD CAPITAL INC / DBT (US045054AS24) | 1,74 | 1,69 | 0,3074 | −0,0165 | ||

| US22003BAP13 / CORPORATE OFFICE PPTYS LP 2.9% 12/01/2033 | 1,73 | 1,47 | 0,3050 | −0,0174 | ||

| TSY INFL IX N/B 02/54 2.125 / DBT (US912810TY47) | 1,72 | −3,64 | 0,3043 | −0,0344 | ||

| US3140F9Q402 / FNMA POOL BD2274 FN 08/46 FIXED 3.5 | 1,72 | −0,35 | 0,3037 | −0,0231 | ||

| US404280DV88 / HSBC Holdings PLC | 1,71 | 1,18 | 0,3025 | −0,0179 | ||

| 4020 / Saudi Real Estate Company | 1,70 | 0,89 | 0,3011 | −0,0188 | ||

| US06738EBN40 / Barclays PLC | 1,70 | 0,12 | 0,3007 | −0,0213 | ||

| US138616AM99 / Cantor Fitzgerald LP | 1,70 | 0,65 | 0,3001 | −0,0197 | ||

| US912810RL44 / United States Treasury Inflation Indexed Bonds | 1,69 | −2,81 | 0,2988 | −0,0309 | ||

| US11135FBP53 / SR UNSECURED 144A 11/35 3.137 | 1,69 | 1,81 | 0,2987 | −0,0160 | ||

| US225401AF50 / Credit Suisse Group AG | 1,67 | 0,84 | 0,2957 | −0,0188 | ||

| S56431109 / Northam Platinum Holdings Ltd | 1,67 | 0,91 | 0,2949 | −0,0185 | ||

| US126670MJ49 / COUNTRYWIDE ASSET BACKED CERTI CWL 2005 15 M2 | 1,66 | 0,85 | 0,2938 | −0,0185 | ||

| US2350367A26 / DALLAS-FORT WORTH TX INTERNATIONAL ARPT REVENUE | 1,66 | −0,72 | 0,2936 | −0,0234 | ||

| US573874AC88 / Marvell Technology Inc | 1,66 | 0,73 | 0,2935 | −0,0189 | ||

| US91412GHA67 / UNIV OF CALIFORNIA CA REVENUES | 1,66 | −3,60 | 0,2934 | −0,0329 | ||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 1,66 | 0,91 | 0,2925 | −0,0182 | ||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 1,66 | 0,91 | 0,2925 | −0,0182 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 1,63 | 0,18 | 0,2883 | −0,0202 | ||

| US38379GW781 / GOVERNMENT NATIONAL MORTGAGE A GNR 2014 174 EZ | 1,63 | 0,93 | 0,2875 | −0,0179 | ||

| US54473ENT72 / Los Angeles County Public Works Financing Authority, California, Lease Revenue Bonds, Mulitple Capital Projects I, Build America Taxable Bond Series 2 | 1,62 | 0,12 | 0,2856 | −0,0202 | ||

| US980236AN36 / Woodside Finance Ltd | 1,58 | 0,25 | 0,2798 | −0,0195 | ||

| US44891ACA34 / Hyundai Capital America | 1,57 | 1,42 | 0,2771 | −0,0158 | ||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 1,56 | 0,90 | 0,2758 | −0,0172 | ||

| S1MF34 / Sumitomo Mitsui Financial Group, Inc. - Depositary Receipt (Common Stock) | 1,56 | 0,97 | 0,2750 | −0,0170 | ||

| US404280CN71 / HSBC Holdings PLC | 1,55 | 3,05 | 0,2743 | −0,0111 | ||

| US126650EA42 / CVS HEALTH CORP | 1,53 | 1,26 | 0,2704 | −0,0158 | ||

| US87162WAH34 / TD SYNNEX Corp | 1,50 | 1,42 | 0,2648 | −0,0151 | ||

| E1IX34 / Edison International - Depositary Receipt (Common Stock) | 1,48 | 0,27 | 0,2621 | −0,0183 | ||

| US031162DE75 / Amgen Inc | 1,48 | 1,51 | 0,2618 | −0,0147 | ||

| US95000U2J10 / WELLS FARGO and CO NEW 2.572/VAR 02/11/2031 | 1,47 | 1,66 | 0,2589 | −0,0142 | ||

| US681936BM17 / Omega Healthcare Investors Inc | 1,46 | 1,39 | 0,2587 | −0,0147 | ||

| US87264ABL89 / CORPORATE BONDS | 1,46 | 0,90 | 0,2586 | −0,0163 | ||

| US404280CH04 / HSBC Holdings PLC | 1,46 | 1,74 | 0,2583 | −0,0139 | ||

| US57421CAW47 / MARYLAND ST HLTH & HGR EDUCTNL MARYLAND HEALTH & HIGHER EDUCATIONAL FACILITIES AU | 1,46 | −3,64 | 0,2577 | −0,0290 | ||

| US879385AD49 / Telefonica Europe Bv 8.25% Guaranteed Notes 9/15/30 | 1,45 | 0,56 | 0,2553 | −0,0168 | ||

| XS2264968665 / Ivory Coast Government International Bond | 1,44 | 12,38 | 0,2549 | 0,0118 | ||

| H1UM34 / Humana Inc. - Depositary Receipt (Common Stock) | 1,43 | 1,49 | 0,2530 | −0,0142 | ||

| T MOBILE USA INC COMPANY GUAR 04/34 5.15 / DBT (US87264ADF93) | 1,42 | 1,14 | 0,2505 | −0,0150 | ||

| US035240AG57 / Anheuser-Busch InBev Worldwide Inc | 1,42 | 0,14 | 0,2501 | −0,0177 | ||

| US94973VBB27 / Anthem Inc | 1,41 | −0,35 | 0,2482 | −0,0188 | ||

| XS2326512618 / HARVEST CLO HARVT 21A A1R 144A | 1,40 | 1,59 | 0,2477 | −0,0137 | ||

| US69291QAA31 / PFP III PFP 2022 9 A 144A | 1,40 | −21,87 | 0,2473 | −0,0920 | ||

| US80281LAM72 / Santander UK Group Holdings PLC | 1,39 | 0,87 | 0,2461 | −0,0154 | ||

| US958102AQ89 / Western Digital Corp | 1,39 | 2,66 | 0,2458 | −0,0109 | ||

| US80281LAR69 / Santander UK Group Holdings PLC | 1,36 | 0,74 | 0,2395 | −0,0154 | ||

| US912810SL35 / United States Treasury Note/Bond | 1,35 | −2,95 | 0,2387 | −0,0250 | ||

| US001192AK93 / Southern Co. Gas Capital Corp. | 1,35 | −0,88 | 0,2382 | −0,0194 | ||

| TSNF34 / Tyson Foods, Inc. - Depositary Receipt (Common Stock) | 1,34 | 0,83 | 0,2368 | −0,0150 | ||

| US76116EHP88 / Resol Fnd Ser B 2030 Bonds Int Comp 04/15/30 | 1,32 | 1,69 | 0,2332 | −0,0128 | ||

| IRB / IRB Infrastructure Developers Limited | 1,30 | −0,69 | 0,2305 | −0,0183 | ||

| H / Hyatt Hotels Corporation | 1,30 | 1,80 | 0,2302 | −0,0122 | ||

| US05401AAK79 / Avolon Holdings Funding Ltd | 1,30 | −0,23 | 0,2300 | −0,0172 | ||

| US15135BAY74 / Centene Corp | 1,30 | 1,80 | 0,2298 | −0,0123 | ||

| US268317AV61 / Electricite de France SA | 1,30 | 1,33 | 0,2288 | −0,0133 | ||

| FCT / Fincantieri S.p.A. | 1,29 | 0,94 | 0,2282 | −0,0143 | ||

| US78445QAE17 / SLM Private Education Loan Trust 2010-C | 1,29 | −3,94 | 0,2281 | −0,0264 | ||

| US42225UAD63 / Healthcare Trust of America Holdings, L.P. | 1,28 | 0,39 | 0,2268 | −0,0154 | ||

| XS2356076625 / SIRIUS REAL ESTATE LTD 1.125% 06/22/2026 REGS | 1,27 | 9,56 | 0,2247 | 0,0048 | ||

| US225401AU28 / Credit Suisse Group AG | 1,27 | 2,01 | 0,2245 | −0,0115 | ||

| US694308JM04 / PACIFIC GAS and ELECTRIC CO 4.55% 07/01/2030 | 1,27 | 0,87 | 0,2242 | −0,0141 | ||

| US02005NBU37 / Ally Financial Inc | 1,27 | 1,12 | 0,2238 | −0,0135 | ||

| US912810RB61 / United States Treas Bds Bond | 1,26 | −2,09 | 0,2229 | −0,0213 | ||

| US11135FAS02 / BROADCOM INC 4.3% 11/15/2032 | 1,26 | 1,61 | 0,2228 | −0,0122 | ||

| US12644VAD01 / CSN Resources SA | 1,26 | 1,53 | 0,2227 | −0,0123 | ||

| US92564RAL96 / VICI Properties LP / VICI Note Co., Inc. | 1,26 | 1,29 | 0,2222 | −0,0131 | ||

| US60687YBH18 / Mizuho Financial Group Inc | 1,25 | 1,88 | 0,2203 | −0,0115 | ||

| US02376AAA79 / American Airlines Pass Through Trust, Series 2017-2, Class AA | 1,24 | −3,87 | 0,2196 | −0,0253 | ||

| GA GLOBAL FUNDING TRUST SR SECURED 144A 01/29 5.5 / DBT (US36143L2L80) | 1,23 | 0,49 | 0,2173 | −0,0146 | ||

| US76169XAA28 / Rexford Industrial Realty LP | 1,22 | 1,25 | 0,2152 | −0,0127 | ||

| US78009PEH01 / NatWest Group PLC | 1,22 | 0,83 | 0,2151 | −0,0136 | ||

| US067316AF68 / Bacardi Ltd | 1,20 | 0,84 | 0,2127 | −0,0133 | ||

| US251526CF47 / Deutsche Bank AG/New York NY | 1,19 | −44,84 | 0,2104 | −0,1984 | ||

| US29365TAN46 / ENTERGY TEXAS INC | 1,18 | −1,58 | 0,2093 | −0,0186 | ||

| US345397B777 / Ford Motor Credit Co LLC | 1,17 | 0,95 | 0,2064 | −0,0128 | ||

| US09659W2U76 / BNP Paribas SA | 1,16 | 2,12 | 0,2045 | −0,0101 | ||

| US03666HAE18 / Antares Holdings LP | 1,15 | 0,61 | 0,2038 | −0,0134 | ||

| US38122ND583 / Golden State Tobacco Securitization Corp. | 1,15 | 0,26 | 0,2028 | −0,0141 | ||

| US87266GAA85 / TMS Issuer Sarl | 1,14 | 0,44 | 0,2008 | −0,0134 | ||

| US161175BL78 / Charter Communications Operating LLC / Charter Communications Operating Capital | 1,13 | 4,73 | 0,1994 | −0,0047 | ||

| US477164AA59 / JetBlue 2020-1 Class A Pass Through Trust | 1,13 | −4,50 | 0,1988 | −0,0244 | ||

| US63859WAE93 / Nationwide Building Society | 1,12 | 0,45 | 0,1981 | −0,0133 | ||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 1,12 | 0,1974 | 0,1974 | |||

| US775109CH22 / Rogers Communications Inc | 1,12 | 2,39 | 0,1970 | −0,0093 | ||

| US74730DAE31 / Qatar Petroleum | 1,11 | −1,33 | 0,1959 | −0,0170 | ||

| MARS INC SR UNSECURED 144A 05/45 5.65 / DBT (US571676BB09) | 1,10 | 0,00 | 0,1949 | −0,0140 | ||

| XS2390152986 / Altice France SA/France | 1,09 | 14,50 | 0,1926 | 0,0123 | ||

| US05526DBD66 / BAT Capital Corp | 1,07 | 1,80 | 0,1896 | −0,0100 | ||

| US620076BT59 / Motorola Solutions Inc | 1,07 | 1,53 | 0,1882 | −0,0104 | ||

| CDX IG44 5Y ICE / DCR (EZPF6RHH0ZV8) | 1,06 | 348,10 | 0,1876 | 0,1426 | ||

| US202712BL88 / Commonwealth Bank of Australia | 1,06 | −0,09 | 0,1872 | −0,0135 | ||

| US14310FAA03 / Carlyle Holdings II Finance LLC | 1,05 | −2,23 | 0,1863 | −0,0179 | ||

| US205887CD22 / Conagra Brands, Inc. | 1,05 | 0,57 | 0,1861 | −0,0122 | ||

| US85855CAA80 / Stellantis Finance US Inc | 1,05 | 0,96 | 0,1854 | −0,0114 | ||

| US629377CP59 / NRG Energy Inc | 1,04 | 1,16 | 0,1845 | −0,0110 | ||

| US75886FAE79 / Regeneron Pharmaceuticals Inc | 1,04 | 1,86 | 0,1841 | −0,0097 | ||

| US06760GAA94 / Barings CLO Ltd 2018-I | 1,04 | −8,33 | 0,1829 | −0,0308 | ||

| CROWL / VESSEL MANAGEMENT SERVIC US GOVT GUAR 08/36 3.432 | 1,03 | 1,08 | 0,1810 | −0,0111 | ||

| W1BD34 / Warner Bros. Discovery, Inc. - Depositary Receipt (Common Stock) | 1,02 | 0,1804 | 0,1804 | |||

| US912810SG40 / United States Treasury Inflation Indexed Bonds | 1,02 | −3,69 | 0,1799 | −0,0204 | ||

| US21H0606895 / Ginnie Mae | 1,01 | 0,1790 | 0,1790 | |||

| US12513GBJ76 / CDW LLC / CDW Finance Corp | 1,01 | 1,91 | 0,1789 | −0,0094 | ||

| US25466AAP66 / Discover Bank | 1,01 | 1,41 | 0,1776 | −0,0101 | ||

| AU0000101792 / AUSTRALIAN GOVERNMENT BONDS REGS 11/31 1 | 1,00 | 8,55 | 0,1772 | 0,0021 | ||

| RFR USD SOFR/3.25000 06/18/25-30Y LCH / DIR (EZVR6JLJ0ZB5) | 0,99 | 0,1754 | 0,1754 | |||

| US878091BD86 / Teachers Insurance & Annuity Association of America | 0,99 | 0,20 | 0,1748 | −0,0122 | ||

| US02401LAA26 / American Assets Trust LP | 0,99 | 1,55 | 0,1741 | −0,0098 | ||

| US418751AE33 / HAT Holdings I LLC / HAT Holdings II LLC | 0,98 | 0,93 | 0,1730 | −0,0108 | ||

| US023770AA81 / American Airlin Bond | 0,97 | −4,23 | 0,1721 | −0,0206 | ||

| NEWMONT / NEWCREST FIN COMPANY GUAR 11/41 5.75 / DBT (US65163LAD10) | 0,96 | 0,84 | 0,1701 | −0,0108 | ||

| NEWMONT / NEWCREST FIN COMPANY GUAR 11/41 5.75 / DBT (US65163LAD10) | 0,96 | 0,84 | 0,1701 | −0,0108 | ||

| SPTR TRS EQUITY FEDL01+72 CIB / DE (000000000) | 0,96 | 0,1700 | 0,1700 | |||

| US36143L2H78 / GA Global Funding Trust | 0,96 | 0,94 | 0,1699 | −0,0105 | ||

| US58547DAD12 / Melco Resorts Finance Ltd | 0,94 | 1,85 | 0,1658 | −0,0087 | ||

| US79588TAD28 / Sammons Financial Group Inc | 0,92 | 2,57 | 0,1623 | −0,0074 | ||

| US01166VAA70 / Alaska Airlines 2020-1 Class A Pass Through Trust | 0,91 | 0,44 | 0,1603 | −0,0108 | ||

| US909318AA56 / United Airlines Pass Through Trust, Series 2018-1, Class AA | 0,90 | −0,77 | 0,1588 | −0,0129 | ||

| US55037AAB44 / Lundin Energy Finance BV | 0,89 | 1,48 | 0,1578 | −0,0090 | ||

| US636180BR19 / National Fuel Gas Co | 0,89 | 0,56 | 0,1577 | −0,0104 | ||

| SPTR TRS EQUITY FEDL01+75 CIB / DE (000000000) | 0,89 | 0,1567 | 0,1567 | |||

| US70052LAC72 / Park Intermediate Holdings LLC / PK Domestic Property LLC / PK Finance Co-Issuer | 0,87 | 3,81 | 0,1541 | −0,0051 | ||

| US3134A4AB02 / FHLMC | 0,87 | 2,23 | 0,1538 | −0,0073 | ||

| US92857WBS89 / Vodafone Group PLC | 0,86 | 0,94 | 0,1521 | −0,0095 | ||

| R2037 / South Africa - Sovereign or Government Agency Debt | 0,85 | 8,42 | 0,1502 | 0,0017 | ||

| US695114CG18 / Pacificorp 6.250000% 10/15/2037 Bond | 0,85 | 0,12 | 0,1494 | −0,0105 | ||

| US008513AB91 / AGREE LP 2% 06/15/2028 | 0,84 | 1,81 | 0,1491 | −0,0079 | ||

| US803014AA74 / Santos Finance Ltd | 0,84 | 2,70 | 0,1481 | −0,0065 | ||

| US62954HAN89 / NXP BV / NXP Funding LLC / NXP USA Inc | 0,84 | −0,59 | 0,1478 | −0,0115 | ||

| US797440BQ65 / SAN DIEGO GAS & ELECTRIC SEC 4.3% 04-01-42 | 0,83 | 0,00 | 0,1472 | −0,0106 | ||

| US45262BAF04 / Imperial Brands Finance PLC | 0,83 | 0,24 | 0,1459 | −0,0103 | ||

| XS0800185174 / THAMES WATER UTC | 0,81 | −5,92 | 0,1434 | −0,0200 | ||

| US11043HAA68 / British Airways 2018-1 Class A Pass Through Trust | 0,80 | −3,15 | 0,1413 | −0,0152 | ||

| US345397B280 / FORD MTR CR CO LLC 3.375% 11/13/2025 | 0,79 | 0,51 | 0,1404 | −0,0093 | ||

| US87162WAF77 / TD SYNNEX Corp. | 0,77 | 0,91 | 0,1367 | −0,0085 | ||

| US912834KP23 / United States Treasury Strip Coupon | 0,77 | −1,40 | 0,1366 | −0,0118 | ||

| US264399ED44 / Duke Energy Corp 6.450% Senior Notes 10/15/32 | 0,77 | 0,65 | 0,1360 | −0,0087 | ||

| US63111XAE13 / Nasdaq Inc | 0,76 | 1,33 | 0,1347 | −0,0077 | ||

| US35564CEE30 / SLST 19-3 A1C 2.75% 11-25-2029 | 0,75 | −3,62 | 0,1318 | −0,0148 | ||

| US45668RAC25 / IndyMac INDX Mortgage Loan Trust 2007-FLX2 | 0,73 | −3,31 | 0,1292 | −0,0141 | ||

| ING / ING Groep N.V. - Depositary Receipt (Common Stock) | 0,72 | 1,56 | 0,1266 | −0,0070 | ||

| US63633DAF15 / National Health Investors, Inc. | 0,71 | 2,45 | 0,1255 | −0,0058 | ||

| US04273WAC55 / Arrow Electronics Inc | 0,70 | 2,48 | 0,1242 | −0,0057 | ||

| US00131LAK17 / AIA Group Ltd | 0,69 | −0,14 | 0,1224 | −0,0089 | ||

| US980236AQ66 / Woodside Finance Ltd | 0,69 | 0,14 | 0,1221 | −0,0086 | ||

| CVS / CVS Health Corporation | 0,69 | 1,17 | 0,1221 | −0,0072 | ||

| US292480AM22 / Enable Midstream Partners LP | 0,69 | 1,32 | 0,1220 | −0,0071 | ||

| US38375LUQ12 / GOVERNMENT NATIONAL MORTGAGE A GNR 2007 57 Z | 0,68 | −4,34 | 0,1209 | −0,0146 | ||

| SPTR TRS EQUITY FEDL01+70 RBC / DE (000000000) | 0,68 | 0,1197 | 0,1197 | |||

| US00909DAA19 / Air Canada 2020-2 Class A Pass Through Trust | 0,67 | −9,25 | 0,1179 | −0,0213 | ||

| US71567PAP53 / Perusahaan Penerbit SBSN Indonesia III | 0,65 | 2,69 | 0,1147 | −0,0050 | ||

| US83370RAA68 / Societe Generale SA | 0,64 | 4,39 | 0,1134 | −0,0031 | ||

| US432833AN19 / HILTON DOMESTIC OPERATING CO INC 3.625% 02/15/2032 144A | 0,63 | 3,26 | 0,1121 | −0,0042 | ||

| US55336VBQ23 / MPLX LP | 0,63 | 1,61 | 0,1119 | −0,0061 | ||

| US649840CV58 / NEW YORK STATE ELECTRIC & GAS CORP | 0,63 | 0,80 | 0,1113 | −0,0072 | ||

| US06684QAB86 / Baptist Healthcare System Obligated Group | 0,62 | −4,93 | 0,1091 | −0,0140 | ||

| US097023CJ22 / BOEING CO SR UNSECURED 05/34 3.6 | 0,62 | 2,49 | 0,1090 | −0,0051 | ||

| US05401AAR23 / Avolon Holdings Funding Ltd | 0,61 | 1,66 | 0,1085 | −0,0060 | ||

| US816851BR98 / Sempra Energy | 0,61 | 1,32 | 0,1082 | −0,0063 | ||

| US00108WAR16 / AEP Texas Inc | 0,61 | 1,00 | 0,1076 | −0,0068 | ||

| US35805BAB45 / Fresenius Medical Care US Finance III Inc | 0,61 | 2,20 | 0,1070 | −0,0052 | ||

| US303901BF83 / Fairfax Financial Holdings Ltd | 0,60 | 0,84 | 0,1055 | −0,0067 | ||

| US22822VAP67 / Crown Castle International Corp | 0,59 | −0,67 | 0,1042 | −0,0083 | ||

| US097023CP81 / Boeing Co/The | 0,59 | 2,26 | 0,1042 | −0,0050 | ||

| DK0009528424 / NYKREDIT REALKREDIT AS COVERED REGS 10/53 1.5 | 0,59 | 9,29 | 0,1039 | 0,0019 | ||

| US58547DAE94 / Melco Resorts Finance Ltd | 0,59 | 1,73 | 0,1038 | −0,0055 | ||

| US76116EGR53 / Resol Fnd Ser A 2030 Bonds Int Comp 01/15/30 | 0,58 | 1,92 | 0,1032 | −0,0053 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,58 | 1,57 | 0,1032 | −0,0058 | ||

| SPTR TRS EQUITY FEDL01+72 RBC / DE (000000000) | 0,56 | 0,0984 | 0,0984 | |||

| SPTR TRS EQUITY FEDL01+72 RBC / DE (000000000) | 0,56 | 0,0984 | 0,0984 | |||

| IRS EUR 2.25000 09/17/25-30Y LCH / DIR (EZV4L1QCFM97) | 0,55 | 22,99 | 0,0973 | 0,0124 | ||

| SPTR TRS EQUITY FEDL01+81 RBC / DE (000000000) | 0,55 | 0,0963 | 0,0963 | |||

| US22160NAA72 / CoStar Group Inc | 0,54 | 1,69 | 0,0959 | −0,0053 | ||

| US29273RAF64 / Energy Transfer 6.625% Senior Notes 10/15/36 | 0,54 | 0,37 | 0,0953 | −0,0065 | ||

| US694308JU20 / Pacific Gas and Electric Co | 0,54 | −3,58 | 0,0952 | −0,0105 | ||

| US606822BU78 / Mitsubishi UFJ Financial Group Inc | 0,53 | 2,11 | 0,0941 | −0,0048 | ||

| US902613AD01 / UBS Group AG | 0,53 | 3,11 | 0,0939 | −0,0036 | ||

| US912810RA88 / United States Treasury Inflation Indexed Bonds | 0,52 | −2,45 | 0,0916 | −0,0090 | ||

| US02660TGN72 / American Home Mortgage Investment Trust 2005-4 | 0,51 | −6,04 | 0,0908 | −0,0127 | ||

| COUSINS PROPERTIES LP COMPANY GUAR 07/30 5.25 / DBT (US222793AC56) | 0,51 | 0,0900 | 0,0900 | |||

| US912834KH07 / United States Treasury Strip Coupon | 0,51 | −1,17 | 0,0897 | −0,0077 | ||

| US816851AP42 / Sempra Energy Notes 6% 10/15/39 | 0,51 | 0,40 | 0,0896 | −0,0061 | ||

| US11042TAA16 / British Airways Pass-Through Trust, Series 2018-1, Class AA | 0,50 | −3,66 | 0,0884 | −0,0100 | ||

| US98313RAG11 / Wynn Macau Ltd | 0,50 | 0,81 | 0,0884 | −0,0057 | ||

| US097023CQ64 / Boeing Co/The | 0,49 | 0,61 | 0,0874 | −0,0056 | ||

| US80386WAC91 / Sasol Financing USA LLC | 0,49 | 1,86 | 0,0871 | −0,0046 | ||

| US15135BAT89 / CORPORATE BONDS | 0,49 | 1,46 | 0,0859 | −0,0048 | ||

| US694308HW04 / PACIFIC GAS + ELECTRIC SR UNSECURED 12/27 3.3 | 0,48 | 0,84 | 0,0855 | −0,0054 | ||

| US745310AK84 / Puget Energy Inc | 0,48 | 1,05 | 0,0853 | −0,0052 | ||

| US64830NAA90 / New Residential Mortgage Loan Trust 2019-RPL3 | 0,48 | −5,36 | 0,0844 | −0,0112 | ||

| US709599BH60 / Penske Truck Leasing Co Lp / PTL Finance Corp | 0,48 | 2,15 | 0,0842 | −0,0041 | ||

| US3623413V99 / GSMPS MORTGAGE LOAN TRUST GSMPS 2006 RP1 1AF2 144A | 0,48 | −3,05 | 0,0842 | −0,0088 | ||

| US44701QBE17 / Huntsman International LLC | 0,47 | −1,04 | 0,0838 | −0,0070 | ||

| US29445UAN54 / Equifirst Loan Securitization Trust 2007-1 | 0,47 | −3,89 | 0,0831 | −0,0096 | ||

| US65535HAQ20 / Nomura Holdings Inc | 0,47 | 1,30 | 0,0825 | −0,0048 | ||

| XS2080766475 / Standard Industries Inc/NJ | 0,47 | 10,69 | 0,0825 | 0,0027 | ||

| US337932AJ65 / FirstEnergy Corp | 0,46 | −0,64 | 0,0819 | −0,0064 | ||

| US912810QX90 / United States Treas Bds Bond | 0,46 | −1,92 | 0,0811 | −0,0076 | ||

| US86389QAG73 / Studio City Finance Ltd | 0,46 | 2,00 | 0,0811 | −0,0042 | ||

| US29273RAJ86 / Energy Transfer Partners 7.5% Senior Notes 7/1/38 | 0,46 | 0,44 | 0,0809 | −0,0055 | ||

| SPTR TRS EQUITY SOFR+50 TOR / DE (000000000) | 0,46 | 0,0806 | 0,0806 | |||

| SPTR TRS EQUITY SOFR+55 RBC / DE (000000000) | 0,46 | 0,0806 | 0,0806 | |||

| US92922FYJ10 / WAMU MORTGAGE PASS THROUGH CER WAMU 2004 RP1 1F 144A | 0,45 | −2,80 | 0,0798 | −0,0082 | ||

| US90932PAA66 / United Airlines 2014-1 Class A Pass Through Trust | 0,45 | −5,25 | 0,0797 | −0,0104 | ||

| US638612AM35 / Nationwide Financial Services, Inc. | 0,45 | −1,32 | 0,0792 | −0,0068 | ||

| US529043AE19 / Lexington Realty Trust | 0,45 | 1,82 | 0,0792 | −0,0042 | ||

| SPTR TRS EQUITY FEDL01+74 RBC / DE (000000000) | 0,44 | 0,0784 | 0,0784 | |||

| US912810TE82 / United States Treasury Inflation Indexed Bonds | 0,43 | −4,65 | 0,0761 | −0,0096 | ||

| US912803EE96 / United States Treasury Strip Principal | 0,41 | −3,07 | 0,0724 | −0,0078 | ||

| US695114CD86 / PacifiCorp | 0,41 | 0,49 | 0,0720 | −0,0049 | ||

| US98310WAM01 / Wyndham Destinations Inc Note M/w Clbl Bond | 0,40 | 0,25 | 0,0709 | −0,0049 | ||

| US983130AX35 / Wynn Las Vegas LLC / Wynn Las Vegas Capital Corp | 0,40 | 1,01 | 0,0707 | −0,0042 | ||

| US05329WAQ50 / AUTONATION INC DEL 4.75% 06/01/2030 | 0,40 | 1,28 | 0,0703 | −0,0041 | ||

| US14448CAR51 / Carrier Global Corp | 0,40 | 1,02 | 0,0701 | −0,0044 | ||

| US927804FG41 / Virginia Electric & Power 8.875% Senior Notes 11/15/38 | 0,40 | 0,00 | 0,0701 | −0,0049 | ||

| US52532XAF24 / LEIDOS INC COMPANY GUAR 05/30 4.375 | 0,39 | 1,55 | 0,0696 | −0,0040 | ||

| US22822VAU52 / Crown Castle International Corp | 0,39 | 0,51 | 0,0692 | −0,0046 | ||

| US69370CAC47 / PTC INC | 0,39 | 1,04 | 0,0687 | −0,0042 | ||

| US87264ABF12 / CORP. NOTE | 0,39 | 1,31 | 0,0686 | −0,0040 | ||

| US88732JAY47 / Time Warner Cable Inc. 5.875% 11/15/40 | 0,38 | 4,63 | 0,0679 | −0,0016 | ||

| US314890AB05 / Ferguson Finance PLC | 0,38 | 1,90 | 0,0666 | −0,0035 | ||

| US694308HN05 / Pacific Gas & Electric Co | 0,37 | −4,11 | 0,0659 | −0,0079 | ||

| US01400EAC75 / Alcon Finance Corp | 0,37 | −0,80 | 0,0655 | −0,0053 | ||

| US37940XAD49 / Global Payments Inc | 0,37 | 1,38 | 0,0650 | −0,0037 | ||

| CDX ITRAXX XOV42 5Y 35-100% SP BPS / DCR (EZ2BLZ4YH9B3) | 0,36 | 0,0642 | 0,0642 | |||

| SPTR TRS EQUITY SOFR+53 RBC / DE (000000000) | 0,36 | 0,0633 | 0,0633 | |||

| XAF6628DAN49 / Numericable U.S. LLC, Term Loan B14 | 0,34 | 0,89 | 0,0602 | −0,0038 | ||

| US14918AAD19 / Catholic Health Services of Long Island Obligated Group | 0,34 | −1,45 | 0,0599 | −0,0052 | ||

| US933637AD24 / WAMU MORTGAGE PASS THROUGH CER WAMU 2006 AR18 2A2 | 0,32 | −5,93 | 0,0560 | −0,0079 | ||

| US404280DH94 / HSBC Holdings PLC | 0,31 | 1,32 | 0,0544 | −0,0031 | ||

| US98389BBA70 / XCEL ENERGY INC | 0,31 | 1,66 | 0,0541 | −0,0030 | ||

| US00108WAJ99 / AEP Texas Inc | 0,30 | −0,65 | 0,0538 | −0,0043 | ||

| US05367AAH68 / Aviation Capital Group LLC | 0,30 | 0,00 | 0,0530 | −0,0038 | ||

| US404280BK42 / HSBC Holdings PLC | 0,30 | 0,34 | 0,0526 | −0,0035 | ||

| US93363DAB38 / WaMu Mortgage Pass-Through Certificates Series 2006-AR9 Trust | 0,30 | −0,67 | 0,0523 | −0,0041 | ||

| US74340XBV29 / Prologis LP | 0,30 | 1,03 | 0,0521 | −0,0033 | ||

| WOODSIDE FINANCE LTD WOODSIDE FINANCE LTD / DBT (US980236AR40) | 0,29 | −0,34 | 0,0513 | −0,0038 | ||

| US023764AA14 / American Airlin Bond | 0,29 | −3,02 | 0,0510 | −0,0055 | ||

| SPTR TRS EQUITY SOFR+40 GST / DE (000000000) | 0,28 | 0,0503 | 0,0503 | |||

| SPTR TRS EQUITY SOFR+42 GST / DE (000000000) | 0,28 | 0,0503 | 0,0503 | |||

| SPTR TRS EQUITY SOFR+43 CBK / DE (000000000) | 0,28 | 0,0503 | 0,0503 | |||

| US714046AG46 / PerkinElmer Inc | 0,28 | 1,07 | 0,0502 | −0,0030 | ||

| US12646WAT18 / CREDIT SUISSE MORTGAGE TRUST CSMC 2013 IVR2 B3 144A | 0,28 | −9,29 | 0,0501 | −0,0090 | ||

| US91911TAQ67 / Vale Overseas Ltd | 0,28 | 1,44 | 0,0499 | −0,0029 | ||

| US89178BAA26 / TOWD POINT MORTGAGE TRUST TPMT 2019 4 A1 144A | 0,28 | −4,42 | 0,0498 | −0,0059 | ||

| US097023BV68 / Boeing Co. | 0,28 | 0,72 | 0,0494 | −0,0032 | ||

| US004375CG41 / Accredited Mortgage Loan Trust, Series 2004-4, Class M1 | 0,27 | −7,48 | 0,0481 | −0,0076 | ||

| WOODSIDE FINANCE LTD WOODSIDE FINANCE LTD / DBT (US980236AS23) | 0,27 | −3,21 | 0,0479 | −0,0051 | ||

| US912834KV90 / United States Treasury Strip Coupon | 0,27 | −1,47 | 0,0475 | −0,0042 | ||

| US78486LAA08 / SURA Asset Management SA | 0,27 | −79,29 | 0,0474 | −0,1977 | ||

| US05565ALQ49 / BNP Paribas SA | 0,27 | 2,30 | 0,0473 | −0,0021 | ||

| DK0009527616 / NYKREDIT REALKREDIT AS COVERED REGS 10/53 1.5 | 0,27 | 8,57 | 0,0470 | 0,0006 | ||

| US06051GKA66 / Bank of America Corp | 0,26 | 1,95 | 0,0462 | −0,0023 | ||

| US02209SBD45 / Altria Group Inc | 0,26 | 0,78 | 0,0461 | −0,0029 | ||

| US133434AB69 / Cameron LNG LLC | 0,26 | 1,18 | 0,0454 | −0,0027 | ||

| EQH.PRC / Equitable Holdings, Inc. - Preferred Stock | 0,26 | 1,19 | 0,0453 | −0,0026 | ||

| US225401AP33 / Credit Suisse Group AG | 0,24 | 1,24 | 0,0432 | −0,0024 | ||

| US03040WAV72 / American Water Capital Corp. | 0,24 | −0,41 | 0,0424 | −0,0033 | ||

| US750098AA35 / RACKSPACE HOSTING INC 5.375% 12/01/2028 144A | 0,24 | −6,61 | 0,0424 | −0,0064 | ||

| US13063A5E03 / State of California | 0,23 | 0,43 | 0,0410 | −0,0028 | ||

| US04621WAD20 / ASSURED GUARANTY US HOLDINGS INC | 0,23 | 1,76 | 0,0408 | −0,0023 | ||

| SPTR TRS EQUITY SOFR+46 RBC / DE (000000000) | 0,22 | 0,0393 | 0,0393 | |||

| SPTR TRS EQUITY SOFR+63 RBC / DE (000000000) | 0,22 | 0,0392 | 0,0392 | |||

| SPTR TRS EQUITY FEDL01+76 CIB / DE (000000000) | 0,22 | 0,0386 | 0,0386 | |||

| CDX ITRAXX XOV42 5Y 35-100% SP JPM / DCR (EZ2BLZ4YH9B3) | 0,21 | 0,0377 | 0,0377 | |||

| US842400EB53 / Southern California Edison 6.65% Notes 4/1/29 | 0,21 | 1,94 | 0,0371 | −0,0020 | ||

| USP78024AF61 / REPUBLIC OF PERU SR UNSECURED REGS 08/32 6.15 | 0,20 | 6,81 | 0,0361 | −0,0001 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0,20 | 0,0357 | 0,0357 | |||

| 43AB / Rolls-Royce plc - Corporate Bond/Note | 0,20 | 0,00 | 0,0353 | −0,0025 | ||

| US11120VAH69 / Brixmor Operating Partnership LP | 0,20 | 1,03 | 0,0347 | −0,0020 | ||

| US842400FC28 / Southern California Edison 5.625% Due 2/1/36 | 0,19 | −1,52 | 0,0344 | −0,0030 | ||

| SPTR TRS EQUITY SOFR+62 RBC / DE (000000000) | 0,19 | 0,0343 | 0,0343 | |||

| SPTR TRS EQUITY SOFR+62 RBC / DE (000000000) | 0,19 | 0,0343 | 0,0343 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,19 | 0,0336 | 0,0336 | |||

| CDX HY37 5Y 25-35% SP MYC / DCR (EZB0HT0S0LW0) | 0,19 | 0,0330 | 0,0330 | |||

| US639057AD02 / Natwest Group PLC | 0,18 | 4,14 | 0,0311 | −0,0010 | ||

| US59020UL524 / Merrill Lynch Mortgage Investors Trust, Series 2005-3, Class 3A | 0,17 | −4,44 | 0,0305 | −0,0037 | ||

| US89352HAE99 / Trans-canada Pipelines 7.25% Senior Notes 8/15/38 | 0,17 | 0,59 | 0,0300 | −0,0020 | ||

| US830867AA59 / Delta Air Lines Inc / SkyMiles IP Ltd | 0,17 | −33,33 | 0,0294 | −0,0178 | ||

| US969457BM15 / Williams Companies 8.75% Notes 3/15/32 | 0,16 | 0,00 | 0,0291 | −0,0021 | ||

| US912834FB91 / United States Treasury Strip Coupon | 0,15 | −1,33 | 0,0262 | −0,0022 | ||

| US912810SH23 / United States Treas Bds Bond | 0,14 | −2,72 | 0,0254 | −0,0026 | ||

| US02377CAA27 / American Airlines Pass Through Trust, Series 2017-2, Class A | 0,14 | −5,30 | 0,0254 | −0,0034 | ||

| US842400GT44 / SOUTHERN CAL EDISON 1ST MORTGAGE 02/50 3.65 | 0,13 | −4,35 | 0,0234 | −0,0029 | ||

| RFR USD SOFR/3.50000 06/20/24-30Y LCH / DIR (EZV8ZC6L7CY8) | 0,13 | 12,93 | 0,0233 | 0,0012 | ||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,12 | 0,0215 | 0,0215 | |||

| US81376EAC93 / SECURITIZED ASSET BACKED RECEI SABR 2006 NC2 A3 | 0,12 | −17,12 | 0,0214 | −0,0063 | ||

| US46626LBK52 / JP MORGAN MORTGAGE ACQUISITION JPMAC 2005 WMC1 M3 | 0,11 | −6,61 | 0,0200 | −0,0031 | ||

| CDX IG43 5Y ICE / DCR (EZ10N17RBN04) | 0,11 | −84,94 | 0,0198 | −0,1198 | ||

| US64830KAA51 / New Residential Mortgage Loan Trust 2018-3 | 0,10 | −3,77 | 0,0182 | −0,0021 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,10 | 0,99 | 0,0180 | −0,0012 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,10 | 0,99 | 0,0180 | −0,0012 | ||

| IRS AUD 4.50000 09/18/24-10Y LCH / DIR (EZLG541MMLX8) | 0,10 | 117,78 | 0,0173 | 0,0087 | ||

| US36179TZ577 / Ginnie Mae II Pool | 0,09 | −3,19 | 0,0161 | −0,0017 | ||

| US84858DAA63 / Spirit Airlines Pass Through Trust 2015-1A | 0,09 | −6,25 | 0,0159 | −0,0023 | ||

| US3140HFGX12 / FNMA POOL BK2013 FN 04/48 FIXED 4 | 0,08 | −1,18 | 0,0150 | −0,0013 | ||

| FCT / Fincantieri S.p.A. | 0,08 | 10,53 | 0,0149 | 0,0004 | ||

| US863587AE14 / Structured Asset Investment Loan Trust | 0,08 | −14,43 | 0,0147 | −0,0037 | ||

| IRS AUD 4.50000 09/20/23-10Y LCH / DIR (EZGXS4F4YYN6) | 0,08 | 100,00 | 0,0146 | 0,0068 | ||

| US62854AAP93 / Mylan NV | 0,08 | 1,25 | 0,0143 | −0,0008 | ||

| SPTR TRS EQUITY SOFR+47 CIB / DE (000000000) | 0,08 | 0,0142 | 0,0142 | |||

| WILLIAMS COS INC SNR S* ICE / DCR (EZSPH70WS147) | 0,08 | −9,30 | 0,0138 | −0,0026 | ||

| TREASURY BILL 09/25 0.00000 / DBT (US912797PW16) | 0,08 | 0,0138 | 0,0138 | |||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0,08 | 0,0135 | 0,0135 | |||

| US715638BE14 / Peruvian Government International Bond | 0,07 | −16,09 | 0,0130 | −0,0035 | ||

| RFR GBP SONIO/3.50000 03/19/25-5Y LCH / DIR (EZ4P0PH8GZ40) | 0,07 | −58,48 | 0,0126 | −0,0199 | ||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0,07 | 0,0124 | 0,0124 | |||

| SPTR TRS EQUITY FEDL01+68 CIB / DE (000000000) | 0,07 | 0,0121 | 0,0121 | |||

| SPTR TRS EQUITY FEDL01+64 TOR / DE (000000000) | 0,07 | 0,0118 | 0,0118 | |||

| US89177HAA05 / Towd Point Mortgage Trust, Series 2019-HY2, Class A1 | 0,06 | −7,25 | 0,0115 | −0,0018 | ||

| GENERAL MOTORS COMPANY SNR S* ICE / DCR (EZ0F3ZJ20784) | 0,06 | −4,48 | 0,0113 | −0,0015 | ||

| THAMES SSNM 144A UNFUNDED COMM / DBT (955RVLII8) | 0,06 | 0,0104 | 0,0104 | |||

| RFR USD SOFR/3.25000 06/18/25-5Y LCH / DIR (EZH1N8KH2K02) | 0,05 | 0,0092 | 0,0092 | |||

| US89177XAA54 / TOWD POINT MORTGAGE TRUST 2019-HY3 SER 2019-HY3 CL A1A V/R REGD 144A P/P 2.70800000 | 0,05 | −9,09 | 0,0090 | −0,0016 | ||

| IRS AUD 4.50000 03/20/24-10Y LCH / DIR (EZJLKSMVQPQ8) | 0,05 | 113,04 | 0,0087 | 0,0042 | ||

| RFR USD SOFR/3.15600 03/10/28-5Y LCH / DIR (EZCP0B73YN50) | 0,04 | −14,58 | 0,0073 | −0,0018 | ||

| US92922FTJ74 / WAMU MORTGAGE PASS THROUGH CER WAMU 2004 AR8 A1 | 0,04 | −2,44 | 0,0072 | −0,0006 | ||

| BOUGHT PLN SOLD USD 20250710 / DFE (000000000) | 0,04 | 0,0067 | 0,0067 | |||

| US45670LAA52 / IndyMac IMSC Mortgage Loan Trust, Series 2007-HOA1, Class A11 | 0,04 | −2,70 | 0,0064 | −0,0006 | ||

| THAMES WATER SUPER SEN SR SECURED 144A 10/27 9.75 / DBT (XS3017976054) | 0,04 | 0,0064 | 0,0064 | |||

| US86360KAE82 / Structured Asset Mortgage Investments II Trust 2006-AR3 | 0,04 | −2,78 | 0,0063 | −0,0006 | ||

| THAMES WATER SUPER SEN SR SECURED 144A 10/27 9.75 / DBT (XS3060649830) | 0,03 | 0,0058 | 0,0058 | |||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0,03 | 0,0057 | 0,0057 | |||

| VERIZON COMMUNICATIONS INC SNR S* ICE / DCR (EZL1DNFTYLG9) | 0,03 | −13,89 | 0,0055 | −0,0014 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,03 | 0,0050 | 0,0050 | |||

| EZWLHWP69KK1 / GENERAL MOTORS COMPANY SNR S* ICE | 0,03 | −16,67 | 0,0046 | −0,0012 | ||

| BOUGHT PLN SOLD USD 20250710 / DFE (000000000) | 0,03 | 0,0045 | 0,0045 | |||

| 952NPG907 / CREDIT SUISSE GROUP AG JR SUB REGS | 0,02 | 0,00 | 0,0042 | −0,0003 | ||

| XS2280833133 / Country Garden Holdings Co Ltd | 0,02 | −20,69 | 0,0042 | −0,0014 | ||

| US31397T2X94 / FREDDIE MAC FHR 3440 EM | 0,02 | −4,35 | 0,0040 | −0,0004 | ||

| US3132A5J632 / Freddie Mac Pool | 0,02 | 0,00 | 0,0040 | −0,0004 | ||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0040 | 0,0040 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0040 | 0,0040 | |||

| EZZVSNMRWDZ0 / GENERAL ELECTRIC COMPANY SNR S* ICE | 0,02 | −22,22 | 0,0038 | −0,0013 | ||

| BOEING CO/THE SNR S* ICE / DCR (EZ8LJVJQFWV8) | 0,02 | 233,33 | 0,0036 | 0,0023 | ||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0,02 | 0,0035 | 0,0035 | |||

| ZCS BRL 13.2914 05/08/25-01/02/29 CME / DIR (EZYLW2ZWVNG8) | 0,02 | 0,0035 | 0,0035 | |||

| US86360UAF30 / STRUCTURED ASSET MORTGAGE INVE SAMI 2006 AR6 2A1 | 0,02 | −5,26 | 0,0032 | −0,0004 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,02 | 0,0032 | 0,0032 | |||

| RFR USD SOFR/3.77578 03/25/25-30Y* LCH / DIR (EZGJ99MVMFL2) | 0,02 | 800,00 | 0,0032 | 0,0027 | ||

| US17307GEC87 / CITIGROUP MORTGAGE LOAN TRUST 2004-HYB2 SER 2004-HYB2 CL 2A V/R REGD 5.13268700 | 0,02 | 0,00 | 0,0030 | −0,0002 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,02 | 0,0030 | 0,0030 | |||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0029 | 0,0029 | |||

| AT&T INC SNR S* ICE / DCR (EZDHDX5VLR00) | 0,02 | −6,25 | 0,0028 | −0,0002 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,02 | 0,0028 | 0,0028 | |||

| US3140X4GR15 / FNMA POOL FM1107 FN 06/49 FIXED VAR | 0,01 | −6,67 | 0,0026 | −0,0002 | ||

| RFR USD SOFR/3.55500 08/28/24-10Y LCH / DIR (EZT3B05TS4Z8) | 0,01 | −30,00 | 0,0025 | −0,0013 | ||

| RFR USD SOFR/3.52500 09/04/24-10Y LCH / DIR (EZSXZYY2VD17) | 0,01 | 133,33 | 0,0025 | 0,0013 | ||

| TREASURY BILL 07/25 0.00000 / DBT (US912797LW51) | 0,01 | 0,0023 | 0,0023 | |||

| METLIFE INC SNR S* ICE / DCR (EZ77GRVT9L20) | 0,01 | 9,09 | 0,0022 | 0,0000 | ||

| DEVON ENERGY CORPORATION SNR S* ICE / DCR (EZK9PL058X54) | 0,01 | −20,00 | 0,0022 | −0,0007 | ||

| US83162CRL99 / United States Small Business Administration | 0,01 | −20,00 | 0,0021 | −0,0007 | ||

| VERIZON COMMUNICATIONS INC SNR S* ICE / DCR (EZKBMTL78RT9) | 0,01 | 0,00 | 0,0021 | −0,0000 | ||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0021 | 0,0021 | |||

| US23332UBF03 / DSLA Mortgage Loan Trust 2004-AR3 | 0,01 | 0,00 | 0,0021 | −0,0002 | ||

| AT&T INC SNR S* ICE / DCR (EZZ2S2FBCRZ4) | 0,01 | −8,33 | 0,0020 | −0,0003 | ||

| US3140J6GM33 / FANNIE MAE 4% 10/01/2047 FNL | 0,01 | −9,09 | 0,0019 | −0,0002 | ||

| 31750R594 PIMCO FXVAN PUT EUR USD 1.09750000 / DFE (EZXSNMVYWSL9) | 0,01 | 0,0018 | 0,0018 | |||

| 31750R5B9 PIMCO FXVAN PUT EUR USD 1.10000000 / DFE (EZ0X1GXSRXF6) | 0,01 | 0,0018 | 0,0018 | |||

| BOUGHT TRY SOLD USD 20250808 / DFE (000000000) | 0,01 | 0,0017 | 0,0017 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0017 | 0,0017 | |||

| VERIZON COMMUNICATIONS INC SNR S* ICE / DCR (EZL2Z9F4XSP5) | 0,01 | 0,00 | 0,0016 | −0,0002 | ||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,01 | 0,0015 | 0,0015 | |||

| ROLLS-ROYCE PLC SNR SE ICE / DCR (EZ6TZSNBRC59) | 0,01 | 0,0015 | 0,0015 | |||

| 31750R5C7 PIMCO FXVAN PUT EUR USD 1.11000000 / DFE (EZ6LHMHGSW79) | 0,01 | 0,0015 | 0,0015 | |||

| VOLKSWAGEN INTERNATIONAL FINA SNR SE ICE / DCR (EZ7728G77FY7) | 0,01 | 0,0014 | 0,0014 | |||

| THAMES WATER UTIL LTD SR SECURED 144A 03/27 0.00000 / DBT (XS3002255787) | 0,01 | 0,00 | 0,0014 | 0,0000 | ||

| GOLDMAN SACHS GROUP INC SNR S* ICE / DCR (EZC75LZ075F3) | 0,01 | 0,0013 | 0,0013 | |||

| AMERICAN INTERNATIONAL GROUP SNR S* ICE / DCR (EZVXJ1J79CN5) | 0,01 | −14,29 | 0,0012 | −0,0002 | ||

| BRAZIL LA SP MYC / DCR (EZKZKSJNRZR4) | 0,01 | 500,00 | 0,0012 | 0,0009 | ||

| RFR JPY MUTK/2.00000 06/18/25-20Y LCH / DIR (EZPZ8KYD2B68) | 0,01 | −53,85 | 0,0012 | −0,0013 | ||

| BOUGHT TRY SOLD USD 20250813 / DFE (000000000) | 0,01 | 0,0011 | 0,0011 | |||

| BOUGHT TRY SOLD USD 20250813 / DFE (000000000) | 0,01 | 0,0011 | 0,0011 | |||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0,01 | 0,0011 | 0,0011 | |||

| 31750R5R4 PIMCO FXVAN CALL USD SEK 10.20000000 / DFE (EZR5HRN9R6R0) | 0,01 | 0,0011 | 0,0011 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0009 | 0,0009 | |||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0,01 | 0,0009 | 0,0009 | |||

| BOUGHT TRY SOLD USD 20250811 / DFE (000000000) | 0,01 | 0,0009 | 0,0009 | |||

| EZBLK0RXQ2F2 / AT&T INC SNR S* ICE | 0,00 | −20,00 | 0,0009 | −0,0002 | ||

| BOUGHT TRY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0008 | 0,0008 | |||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0,00 | 0,0008 | 0,0008 | |||

| EZBXJKS0JJY3 / BRITISH TELECOMMUNICATIONS PL SNR SE ICE | 0,00 | 0,00 | 0,0008 | 0,0000 | ||

| EZJYH6W51Q87 / BRITISH TELECOMMUNICATIONS PL SNR SE ICE | 0,00 | −20,00 | 0,0008 | −0,0003 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0007 | 0,0007 | |||

| EZW8XKN63668 / GENERAL ELECTRIC COMPANY SNR S* ICE | 0,00 | −25,00 | 0,0007 | −0,0002 | ||

| VERIZON COMMUNICATIONS INC SNR S* ICE / DCR (EZSQ5BJRJBN9) | 0,00 | 0,00 | 0,0006 | 0,0000 | ||

| BOUGHT EUR SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | |||

| US90783TAA88 / UNP RR CO 2004 PASS TRST PASS THRU CE 07/25 5.404 | 0,00 | 0,00 | 0,0006 | −0,0000 | ||

| BOUGHT MXN SOLD USD 20251217 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | |||

| BOUGHT PLN SOLD USD 20250710 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | |||

| AT&T INC SNR S* ICE / DCR (EZVHX8BNGL14) | 0,00 | 0,00 | 0,0006 | 0,0000 | ||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | |||

| EZ65GBV58FC9 / MEXICO LA SP MYC | 0,00 | 50,00 | 0,0005 | 0,0001 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| MEXICO LA SP MYC / DCR (EZDKNKQB19P7) | 0,00 | 0,0005 | 0,0006 | |||

| BOUGHT TRY SOLD USD 20250729 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| EZ6MPW8FKYP3 / CDX EM36 ICE | 0,00 | 0,0005 | 0,0004 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| BOUGHT TRY SOLD USD 20250725 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| OIBR4 / Oi S.A. - Preferred Stock | 0,00 | 0,00 | 0,0003 | −0,0000 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| US86359BGF22 / Structured Adjustable Rate Mortgage Loan Trust | 0,00 | 0,00 | 0,0003 | −0,0000 | ||

| ZCS BRL 13.32 05/08/25-01/02/29 CME / DIR (EZYLW2ZWVNG8) | 0,00 | 0,0003 | 0,0003 | |||

| ZCS BRL 13.3537 05/12/25-01/02/29 CME / DIR (EZSPJ72GL6V3) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT TRY SOLD USD 20250724 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT KRW SOLD USD 20250708 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| RFR USD SOFR/3.71500 08/07/24-10Y LCH / DIR (EZ2H268MSWS8) | 0,00 | −83,33 | 0,0003 | −0,0009 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| 31750R5N3 PIMCO FXVAN PUT EUR USD 1.11000000 / DFE (EZ7LNGTTZ444) | 0,00 | 0,0003 | 0,0003 | |||

| OIS MXN TIIE1/7.75000 04/07/25-5Y* CME / DIR (EZYVT7M6F4C6) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT TRY SOLD USD 20250731 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT TRY SOLD USD 20250701 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT MXN SOLD USD 20250818 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT TRY SOLD USD 20250814 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT MXN SOLD USD 20250818 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| EZ89MT0WHJP2 / MEXICO LA SP MYC | 0,00 | 0,0002 | 0,0001 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| EZJGYSSMZ0P0 / MEXICO LA SP MYC | 0,00 | 0,0002 | 0,0000 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| US07384M4E98 / BEAR STEARNS ADJUSTABLE RATE MORTGAGE TRUST 2004 | 0,00 | −100,00 | 0,0001 | −0,0000 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT NZD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| MEXICO LA SP GST / DCR (EZDKNKQB19P7) | 0,00 | 0,0001 | 0,0002 | |||

| IRS EUR 2.61000 03/24/25-10Y LCH / DIR (EZPS73SKDR02) | 0,00 | −100,00 | 0,0001 | 0,0003 | ||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| EZ6ZWC9MVX60 / MEXICO LA SP JPM | 0,00 | 0,0001 | −0,0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| EZWHY2KRQV17 / BRAZIL LA SP GST | 0,00 | 0,0001 | 0,0000 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT ILS SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT TRY SOLD USD 20250807 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT TRY SOLD USD 20250728 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| OIBR4 / Oi S.A. - Preferred Stock | 0,00 | 0,0000 | −0,0000 | |||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT NOK SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD NOK BOUGHT USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9EGA4 PIMCO SWAPTION 4.135 PUT USD 2025063 / DIR (EZXJWB9HGZH3) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9FTA7 PIMCO SWAPTION 4.05 PUT USD 20250630 / DIR (EZXJWB9HGZH3) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9IZA4 PIMCO SWAPTION 4.125 PUT USD 2025070 / DIR (EZY1VWC6W1B5) | 0,00 | −0,0000 | −0,0000 | |||

| 317U9GEA1 PIMCO SWAPTION 4.075 PUT USD 2025070 / DIR (EZ78N9X8M3Y4) | 0,00 | −0,0000 | −0,0000 | |||

| 317U9EOA5 PIMCO SWAPTION 4.101 PUT USD 2025063 / DIR (EZXJWB9HGZH3) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9ELA8 PIMCO SWAPTION 2.1 CALL EUR 20250630 / DIR (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | 0,00 | −0,0000 | −0,0000 | |||

| 317U9G6A0 PIMCO SWAPTION 4.065 PUT USD 2025070 / DIR (EZJQZP36X547) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9EKA9 PIMCO SWAPTION 2.36 PUT EUR 20250630 / DIR (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9GBA4 PIMCO SWAPTION 2.38 CALL EUR 2025070 / DIR (EZ8HHXRGV1D7) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9IEA7 PIMCO SWAPTION 4.03 PUT USD 20250707 / DIR (EZY1VWC6W1B5) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD IDR BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9JRA1 PIMCO SWAPTION 4.12 PUT USD 20250709 / DIR (EZYG54DQ9CL7) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9HMA0 PIMCO SWAPTION 4.019 PUT USD 2025070 / DIR (EZY1VWC6W1B5) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9JSA0 PIMCO SWAPTION 4.122 PUT USD 2025071 / DIR (EZMLYZSNFH30) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD MXN BOUGHT USD 20250917 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT IDR SOLD USD 20250708 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT NOK SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| 31750QMA4 PIMCO CDSOPT PUT USD 1.0 20250716 / DCR (EZ967XY50V92) | −0,00 | −100,00 | −0,0000 | 0,0004 | ||

| SOLD IDR BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| 31750QN05 PIMCO CDSOPT PUT USD 0.85 20250716 / DCR (EZ967XY50V92) | −0,00 | −100,00 | −0,0000 | 0,0004 | ||

| 317U9LGA8 PIMCO SWAPTION 4.097 PUT USD 2025071 / DIR (EZHBWHSTV570) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9L5A0 PIMCO SWAPTION 4.064 PUT USD 2025071 / DIR (EZQM9CB4TVR9) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9L5A0 PIMCO SWAPTION 4.064 PUT USD 2025071 / DIR (EZQM9CB4TVR9) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9LLA2 PIMCO SWAPTION 4.095 PUT USD 2025071 / DIR (EZBYVN1N6JS0) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD ILS BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT IDR SOLD USD 20250708 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD NOK BOUGHT USD 20250804 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD IDR BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| 31750QM06 PIMCO CDSOPT PUT USD 0.9 20250716 / DCR (EZ967XY50V92) | −0,00 | −100,00 | −0,0000 | 0,0003 | ||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD KRW BOUGHT USD 20250714 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD KRW BOUGHT USD 20250714 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9M3A0 PIMCO SWAPTION 4.037 PUT USD 2025071 / DIR (EZ1JLHJ8JY10) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9MJA3 PIMCO SWAPTION 4.05 PUT USD 20250721 / DIR (EZPXSH8F93Y9) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9LFA9 PIMCO SWAPTION 2.46 CALL EUR 2025071 / DIR (EZLXC2V2MYF7) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9GAA5 PIMCO SWAPTION 2.64 PUT EUR 20250703 / DIR (EZL9GW5599J4) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9MPA6 PIMCO SWAPTION 3.933 PUT USD 2025072 / DIR (EZTRLD6PX319) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| ZCS BRL 14.0087 05/12/25-01/04/27 CME / DIR (EZHTRBH6Z688) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD EUR BOUGHT USD 20250724 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD EUR BOUGHT USD 20250724 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| EURO-BUND OPTION AUG25C 132.5 EXP 07/25/2025 / DIR (DE000F1674Y7) | −0,00 | −0,0001 | −0,0001 | |||

| 317U9LEA0 PIMCO SWAPTION 2.72 PUT EUR 20250716 / DIR (EZMWVGHPD033) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| EURO-BOBL OPTION AUG25C 118.5 EXP 07/25/2025 / DIR (DE000F167SZ1) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD MXN BOUGHT USD 20250917 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD ILS BOUGHT USD 20250709 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD ILS BOUGHT USD 20250709 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| 317U9MNA8 PIMCO SWAPTION 3.955 PUT USD 2025072 / DIR (EZTRLD6PX319) | −0,00 | −0,0001 | −0,0001 | |||

| 317U9FUA5 PIMCO SWAPTION 3.7 CALL USD 20250630 / DIR (EZY1GXGHBZM5) | −0,00 | −0,0001 | −0,0001 | |||

| RFR USD SOFR/3.90500 03/12/25-10Y LCH / DIR (EZ2V6Q3C4Q52) | −0,00 | −100,00 | −0,0001 | 0,0008 | ||

| 317U9EPA4 PIMCO SWAPTION 3.701 CALL USD 202506 / DIR (EZY1GXGHBZM5) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD KRW BOUGHT USD 20250708 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD EUR BOUGHT USD 20250724 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| RFR USD SOFR/3.67000 01/08/24-10Y LCH / DIR (EZG7FCZ335H8) | −0,00 | −100,00 | −0,0001 | −0,0010 | ||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| EURO-BOBL OPTION AUG25P 117.2 EXP 07/25/2025 / DIR (DE000F167SF3) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| 317U9N1A0 PIMCO SWAPTION 3.914 PUT USD 2025072 / DIR (EZBGX0TQ91B3) | −0,00 | −0,0001 | −0,0001 | |||

| 317U9N3A8 PIMCO SWAPTION 3.905 PUT USD 2025072 / DIR (EZBGX0TQ91B3) | −0,00 | −0,0001 | −0,0001 | |||

| 317U9IFA6 PIMCO SWAPTION 3.68 CALL USD 2025070 / DIR (EZJFGPMJB918) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD NZD BOUGHT USD 20250804 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| EURO-BUND OPTION AUG25P 129 EXP 07/25/2025 / DIR (DE000F167368) | −0,00 | −0,0001 | −0,0001 | |||

| 317U9MQA5 PIMCO SWAPTION 3.583 CALL USD 202507 / DIR (EZCLF3R2NG23) | −0,00 | −0,0001 | −0,0001 | |||

| IRS EUR 2.41000 11/05/24-10Y LCH / DIR (EZXB852VHRN9) | −0,00 | −100,00 | −0,0001 | 0,0016 | ||

| SOLD IDR BOUGHT USD 20250708 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| CDX EM40 ICE / DCR (EZXWTK5G6C61) | −0,00 | −100,00 | −0,0002 | 0,0004 | ||

| SOLD NOK BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| SOLD NOK BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| SOLD IDR BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| 317U9O6A3 PIMCO SWAPTION 3.875 PUT USD 2025072 / DIR (EZHZLXVZP143) | −0,00 | −0,0002 | −0,0002 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| ZCS BRL 13.9255 05/08/25-01/04/27 CME / DIR (EZ6MPDHN98L0) | −0,00 | −0,0002 | −0,0002 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| SOLD IDR BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| 317U9O7A2 PIMCO SWAPTION 3.525 CALL USD 202507 / DIR (EZ24N26H1YR9) | −0,00 | −0,0002 | −0,0002 | |||

| SOLD NZD BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| IRS EUR 2.52000 03/27/25-10Y LCH / DIR (EZ84ZR69LPH2) | −0,00 | −66,67 | −0,0002 | 0,0004 | ||

| 317U9N2A9 PIMCO SWAPTION 3.564 CALL USD 202507 / DIR (EZMYNDCY8F38) | −0,00 | −0,0003 | −0,0003 | |||

| 317U9N2A9 PIMCO SWAPTION 3.564 CALL USD 202507 / DIR (EZMYNDCY8F38) | −0,00 | −0,0003 | −0,0003 | |||

| SOLD ZAR BOUGHT USD 20250723 / DFE (000000000) | −0,00 | −0,0003 | −0,0003 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0003 | −0,0003 | |||

| 317U9HNA9 PIMCO SWAPTION 3.669 CALL USD 202507 / DIR (EZJFGPMJB918) | −0,00 | −0,0003 | −0,0003 | |||

| IRS EUR 2.35000 04/29/25-5Y LCH / DIR (EZ74X71XY4J2) | −0,00 | −0,0003 | −0,0003 | |||

| IRS EUR 2.35000 04/29/25-5Y LCH / DIR (EZ74X71XY4J2) | −0,00 | −0,0003 | −0,0003 | |||

| SOLD ILS BOUGHT USD 20250718 / DFE (000000000) | −0,00 | −0,0003 | −0,0003 | |||

| 317U9MOA7 PIMCO SWAPTION 3.605 CALL USD 202507 / DIR (EZCLF3R2NG23) | −0,00 | −0,0003 | −0,0003 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0003 | −0,0003 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0003 | −0,0003 | |||

| SOLD DKK BOUGHT USD 20250804 / DFE (000000000) | −0,00 | −0,0003 | −0,0003 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | −0,00 | −0,0004 | −0,0004 | |||

| 317U9M4A9 PIMCO SWAPTION 3.637 CALL USD 202507 / DIR (EZ7SJVNDKPC9) | −0,00 | −0,0004 | −0,0004 | |||

| 317U9G7A9 PIMCO SWAPTION 3.715 CALL USD 202507 / DIR (EZL4V0T519J1) | −0,00 | −0,0004 | −0,0004 | |||

| 317U9L4A1 PIMCO SWAPTION 3.6525 CALL USD 20250 / DIR (EZT5FL9WGCP1) | −0,00 | −0,0004 | −0,0004 | |||

| SOLD DKK BOUGHT USD 20250804 / DFE (000000000) | −0,00 | −0,0004 | −0,0004 | |||

| SOLD ZAR BOUGHT USD 20250723 / DFE (000000000) | −0,00 | −0,0004 | −0,0004 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0004 | −0,0004 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0004 | −0,0004 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0004 | −0,0004 | |||

| 317U9EHA3 PIMCO SWAPTION 3.735 CALL USD 202506 / DIR (EZY1GXGHBZM5) | −0,00 | −0,0004 | −0,0004 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0005 | −0,0005 | |||

| 317U9GFA0 PIMCO SWAPTION 3.725 CALL USD 202507 / DIR (EZ78XR7L6YX2) | −0,00 | −0,0005 | −0,0005 | |||

| 317U9GFA0 PIMCO SWAPTION 3.725 CALL USD 202507 / DIR (EZ78XR7L6YX2) | −0,00 | −0,0005 | −0,0005 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0005 | −0,0005 | |||

| 317U9LHA7 PIMCO SWAPTION 3.697 CALL USD 202507 / DIR (EZ1ZLHZPLNC3) | −0,00 | −0,0005 | −0,0005 | |||

| 317U9LMA1 PIMCO SWAPTION 3.695 CALL USD 202507 / DIR (EZSG2674R1G7) | −0,00 | −0,0005 | −0,0005 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0005 | −0,0005 | |||

| 317U9L6A9 PIMCO SWAPTION 3.664 CALL USD 202507 / DIR (EZT5FL9WGCP1) | −0,00 | −0,0005 | −0,0005 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0005 | −0,0005 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0005 | −0,0005 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0005 | −0,0005 | |||

| 317U9MKA1 PIMCO SWAPTION 3.7 CALL USD 20250721 / DIR (EZQRZMCG5093) | −0,00 | −0,0005 | −0,0005 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0006 | −0,0006 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0006 | −0,0006 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0006 | −0,0006 | |||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0006 | −0,0006 | |||

| 317U9J0A0 PIMCO SWAPTION 3.775 CALL USD 202507 / DIR (EZJFGPMJB918) | −0,00 | −0,0006 | −0,0006 | |||

| 317U9JQA2 PIMCO SWAPTION 3.77 CALL USD 2025070 / DIR (EZT76LRY6S63) | −0,00 | −0,0006 | −0,0006 | |||

| 317U9JTA9 PIMCO SWAPTION 3.772 CALL USD 202507 / DIR (EZTK0K9DDPF2) | −0,00 | −0,0007 | −0,0007 | |||

| 317U9JTA9 PIMCO SWAPTION 3.772 CALL USD 202507 / DIR (EZTK0K9DDPF2) | −0,00 | −0,0007 | −0,0007 | |||

| IRS EUR 2.40000 04/09/25-5Y LCH / DIR (EZVHX3M64G11) | −0,00 | −0,0007 | −0,0007 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0008 | −0,0008 | |||

| CDX EM43 ICE / DCR (000000000) | −0,00 | −0,0009 | −0,0009 | |||

| SOLD ZAR BOUGHT USD 20250723 / DFE (000000000) | −0,00 | −0,0009 | −0,0009 | |||

| SOLD ZAR BOUGHT USD 20250723 / DFE (000000000) | −0,00 | −0,0009 | −0,0009 | |||

| SOLD ILS BOUGHT USD 20250702 / DFE (000000000) | −0,01 | −0,0010 | −0,0010 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | −0,01 | −0,0010 | −0,0010 | |||

| RFR USD SOFR/3.85000 08/05/24-10Y LCH / DIR (EZKZ3H4L0SC3) | −0,01 | 500,00 | −0,0011 | −0,0008 | ||

| RFR USD SOFR/3.90750 03/04/25-10Y LCH / DIR (EZP5RC766JJ0) | −0,01 | 75,00 | −0,0013 | −0,0004 | ||

| RFR USD SOFR/3.87400 03/05/25-10Y LCH / DIR (EZMZ9H14KX59) | −0,01 | 600,00 | −0,0013 | −0,0010 | ||

| RFR USD SOFR/3.88400 03/25/25-10Y LCH / DIR (EZH2QB9TLWH9) | −0,01 | 75,00 | −0,0014 | −0,0005 | ||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | −0,01 | −0,0015 | −0,0015 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | −0,01 | −0,0015 | −0,0015 | |||

| RFR USD SOFR/3.89900 03/11/25-10Y LCH / DIR (EZXJC61P0SN9) | −0,01 | 60,00 | −0,0015 | −0,0005 | ||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,01 | −0,0015 | −0,0015 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | −0,01 | −0,0017 | −0,0017 | |||

| IRS EUR 2.92000 12/13/23-5Y LCH / DIR (EZQCW33Q08H3) | −0,01 | 125,00 | −0,0017 | −0,0008 | ||

| ZCS BRL 13.9271 05/08/25-01/04/27 CME / DIR (EZ6MPDHN98L0) | −0,01 | −0,0018 | −0,0018 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | −0,01 | −0,0018 | −0,0018 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | −0,01 | −0,0018 | −0,0018 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | −0,01 | −0,0019 | −0,0019 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | −0,01 | −0,0019 | −0,0019 | |||

| SOLD PEN BOUGHT USD 20251219 / DFE (000000000) | −0,01 | −0,0019 | −0,0019 | |||

| SOLD PEN BOUGHT USD 20251219 / DFE (000000000) | −0,01 | −0,0019 | −0,0019 | |||

| IRS EUR 2.30000 09/25/24-5Y LCH / DIR (EZG6CLJMHV54) | −0,01 | 83,33 | −0,0020 | −0,0008 | ||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | −0,01 | −0,0021 | −0,0021 | |||

| SOLD ILS BOUGHT USD 20250718 / DFE (000000000) | −0,01 | −0,0022 | −0,0022 | |||

| RFR JPY MUTK/2.00000 06/18/25-30Y LCH / DIR (EZGXYMX8TZ55) | −0,01 | −1 400,00 | −0,0023 | −0,0026 | ||

| SOLD PEN BOUGHT USD 20250825 / DFE (000000000) | −0,01 | −0,0024 | −0,0024 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | −0,01 | −0,0026 | −0,0026 | |||

| EURO-BUND FUTURE SEP25 XEUR 20250908 / DIR (DE000F1NGF53) | −0,01 | −0,0026 | −0,0026 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,01 | −0,0026 | −0,0026 | |||

| IRS EUR 2.22000 01/08/25-10Y LCH / DIR (EZHH63XJ2WL4) | −0,02 | −6,25 | −0,0027 | 0,0004 | ||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | −0,02 | −0,0027 | −0,0027 | |||

| IRS EUR 2.76000 01/03/24-5Y LCH / DIR (EZ49DWLXMD81) | −0,02 | 50,00 | −0,0027 | −0,0007 | ||

| SOLD CHF BOUGHT USD 20250804 / DFE (000000000) | −0,02 | −0,0029 | −0,0029 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | −0,02 | −0,0030 | −0,0030 | |||

| RFR USD SOFR/3.93000 03/24/25-10Y LCH / DIR (EZKR9TWV5646) | −0,02 | 41,67 | −0,0032 | −0,0008 | ||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | −0,02 | −0,0039 | −0,0039 | |||

| SOLD CAD BOUGHT USD 20250805 / DFE (000000000) | −0,02 | −0,0040 | −0,0040 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | −0,03 | −0,0048 | −0,0048 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | −0,03 | −0,0052 | −0,0052 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | −0,03 | −0,0052 | −0,0052 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | −0,03 | −0,0053 | −0,0053 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | −0,03 | −0,0054 | −0,0054 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | −0,03 | −0,0054 | −0,0054 | |||

| SOLD AUD BOUGHT USD 20250805 / DFE (000000000) | −0,03 | −0,0057 | −0,0057 | |||

| RFR JPY MUTK/1.25000 06/18/25-7Y LCH / DIR (EZ9MYT9FCQB5) | −0,03 | −0,0058 | −0,0058 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | −0,04 | −0,0066 | −0,0066 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | −0,04 | −0,0075 | −0,0075 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | −0,04 | −0,0075 | −0,0075 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | −0,04 | −0,0076 | −0,0076 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | −0,04 | −0,0078 | −0,0078 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | −0,04 | −0,0079 | −0,0079 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | −0,04 | −0,0079 | −0,0079 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | −0,05 | −0,0081 | −0,0081 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | −0,05 | −0,0082 | −0,0082 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | −0,05 | −0,0082 | −0,0082 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | −0,05 | −0,0084 | −0,0084 | |||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | −0,05 | −0,0086 | −0,0086 | |||

| SOLD CHF BOUGHT USD 20250702 / DFE (000000000) | −0,07 | −0,0119 | −0,0119 | |||

| SOLD BRL BOUGHT USD 20250702 / DFE (000000000) | −0,07 | −0,0126 | −0,0126 | |||

| SOLD GBP BOUGHT USD 20250804 / DFE (000000000) | −0,08 | −0,0135 | −0,0135 | |||

| LONG GILT FUTURE SEP25 IFLL 20250926 / DIR (GB00MP6FM953) | −0,09 | −0,0161 | −0,0161 | |||