Grundläggande statistik

| Portföljvärde | $ 53 947 082 602 |

| Aktuella positioner | 650 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

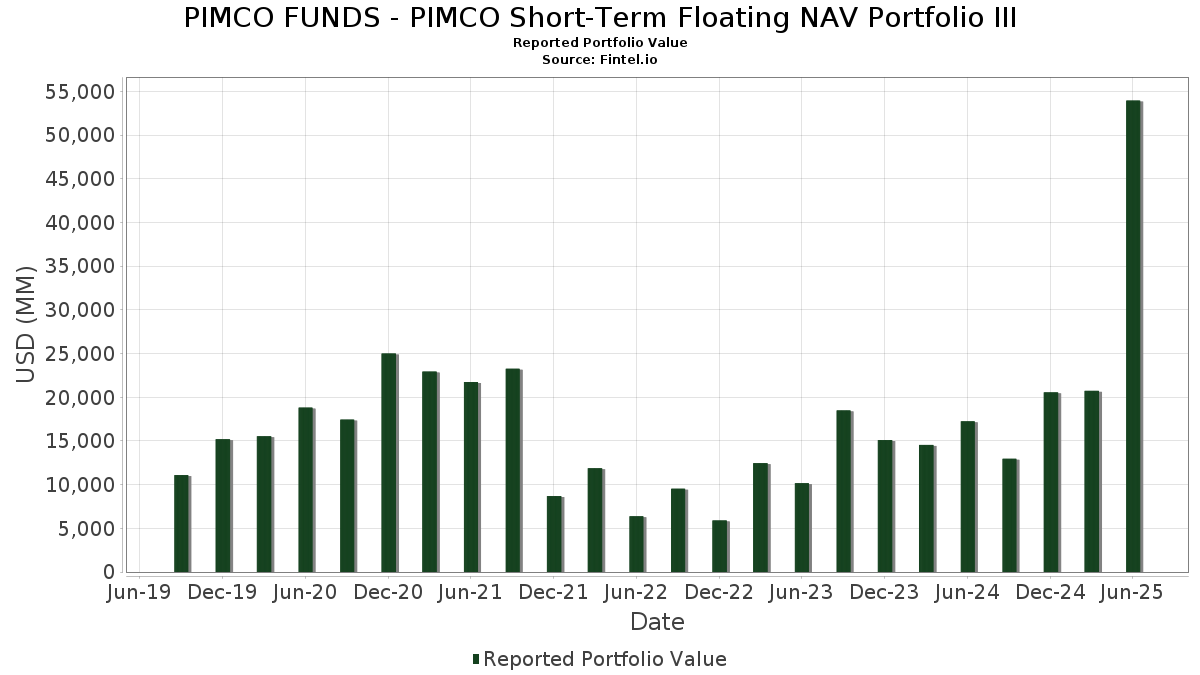

PIMCO FUNDS - PIMCO Short-Term Floating NAV Portfolio III har redovisat 650 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 53 947 082 602 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). PIMCO FUNDS - PIMCO Short-Term Floating NAV Portfolio IIIs största innehav är UNITED STATES TREASURY NOTE 0.75000000 (US:US91282CCW91) , United States Treasury Note/Bond (US:US91282CCZ23) , United States Treasury Note/Bond (US:US9128286S43) , United States Treasury Note/Bond (US:US91282CCF68) , and U.S. Treasury Notes (US:US91282CHM64) . PIMCO FUNDS - PIMCO Short-Term Floating NAV Portfolio IIIs nya positioner inkluderar UNITED STATES TREASURY NOTE 0.75000000 (US:US91282CCW91) , United States Treasury Note/Bond (US:US91282CCZ23) , United States Treasury Note/Bond (US:US9128286S43) , United States Treasury Note/Bond (US:US91282CCF68) , and U.S. Treasury Notes (US:US91282CHM64) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 1 505,00 | 4,5675 | 4,5675 | ||

| 1 474,00 | 4,4734 | 4,4734 | ||

| 1 300,00 | 3,9453 | 3,9453 | ||

| 1 300,00 | 3,9453 | 3,9453 | ||

| 1 129,00 | 3,4264 | 3,4264 | ||

| 1 129,00 | 3,4264 | 3,4264 | ||

| 1 129,00 | 3,4264 | 3,4264 | ||

| 1 100,00 | 3,3384 | 3,3384 | ||

| 1 000,00 | 3,0349 | 3,0349 | ||

| 1 000,00 | 3,0349 | 3,0349 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 351,46 | 1,0666 | −1,9991 | ||

| 351,46 | 1,0666 | −1,9991 | ||

| 351,46 | 1,0666 | −1,9991 | ||

| 351,46 | 1,0666 | −1,9991 | ||

| 301,79 | 0,9159 | −0,7565 | ||

| 301,79 | 0,9159 | −0,7565 | ||

| 301,79 | 0,9159 | −0,7565 | ||

| 301,79 | 0,9159 | −0,7565 | ||

| 249,44 | 0,7570 | −0,6253 | ||

| 249,44 | 0,7570 | −0,6253 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-28 för rapporteringsperioden 2025-06-30. Denna investerare har inte offentliggjort värdepapper som räknas i aktier, så de aktierelaterade kolumnerna i tabellen nedan har utelämnats. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|

| REPO BANK AMERICA REPO / RA (000000000) | 1 505,00 | 4,5675 | 4,5675 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1 474,00 | 4,4734 | 4,4734 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1 300,00 | 3,9453 | 3,9453 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1 300,00 | 3,9453 | 3,9453 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1 129,00 | 3,4264 | 3,4264 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1 129,00 | 3,4264 | 3,4264 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1 129,00 | 3,4264 | 3,4264 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1 100,00 | 3,3384 | 3,3384 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1 000,00 | 3,0349 | 3,0349 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1 000,00 | 3,0349 | 3,0349 | |||

| MILLENIUM REPO / RA (000000000) | 950,00 | 2,8831 | 2,8831 | |||

| MILLENIUM REPO / RA (000000000) | 950,00 | 2,8831 | 2,8831 | |||

| MILLENIUM REPO / RA (000000000) | 950,00 | 2,8831 | 2,8831 | |||

| RVPO STATE STREET GLOBAL MARKE USD RVPO FICC SSGM / RA (000000000) | 919,80 | 2,7915 | 2,7915 | |||

| RVPO STATE STREET GLOBAL MARKE USD RVPO FICC SSGM / RA (000000000) | 919,80 | 2,7915 | 2,7915 | |||

| REPO BANK OF MONTREAL ZCP / RA (000000000) | 881,22 | 2,6744 | 2,6744 | |||

| REPO BANK OF MONTREAL ZCP / RA (000000000) | 881,22 | 2,6744 | 2,6744 | |||

| REPO BANK OF MONTREAL ZCP / RA (000000000) | 881,22 | 2,6744 | 2,6744 | |||

| REPO BANK OF MONTREAL ZCP / RA (000000000) | 881,22 | 2,6744 | 2,6744 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 800,00 | 2,4279 | 2,4279 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 800,00 | 2,4279 | 2,4279 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 734,35 | 2,2287 | 2,2287 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 734,35 | 2,2287 | 2,2287 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 734,35 | 2,2287 | 2,2287 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 660,91 | 2,0058 | 2,0058 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 660,91 | 2,0058 | 2,0058 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 660,91 | 2,0058 | 2,0058 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 660,91 | 2,0058 | 2,0058 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 600,00 | 1,8209 | 1,8209 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 600,00 | 1,8209 | 1,8209 | |||

| RVPO BANK OF NOVA SCOTIA / RA (000000000) | 587,48 | 1,7829 | 1,7829 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 500,00 | 1,5174 | 1,5174 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 484,67 | 1,4709 | 1,4709 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 484,67 | 1,4709 | 1,4709 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 484,67 | 1,4709 | 1,4709 | |||

| US91282CCW91 / UNITED STATES TREASURY NOTE 0.75000000 | 481,97 | 1,4627 | 1,4627 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 400,00 | 1,2140 | 1,2140 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 400,00 | 1,2140 | 1,2140 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 400,00 | 1,2140 | 1,2140 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 400,00 | 1,2140 | 1,2140 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 400,00 | 1,2140 | 1,2140 | |||

| RVPO BANK OF NOVA SCOTIA / RA (000000000) | 367,17 | 1,1143 | 1,1143 | |||

| RVPO BANK OF NOVA SCOTIA / RA (000000000) | 367,17 | 1,1143 | 1,1143 | |||

| RVPO BANK OF NOVA SCOTIA / RA (000000000) | 367,17 | 1,1143 | 1,1143 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 367,17 | 1,1143 | 1,1143 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 367,17 | 1,1143 | 1,1143 | |||

| RVPO BANK OF NOVA SCOTIA / RA (000000000) | 367,17 | 1,1143 | 1,1143 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 367,17 | 1,1143 | 1,1143 | |||

| US TREASURY N/B 01/27 4.125 / DBT (US91282CMH15) | 351,65 | 1,0672 | 1,0672 | |||

| US TREASURY N/B 07/26 4.375 / DBT (US91282CLB53) | 351,46 | −36,43 | 1,0666 | −1,9991 | ||

| US TREASURY N/B 07/26 4.375 / DBT (US91282CLB53) | 351,46 | −36,43 | 1,0666 | −1,9991 | ||

| US TREASURY N/B 07/26 4.375 / DBT (US91282CLB53) | 351,46 | −36,43 | 1,0666 | −1,9991 | ||

| US TREASURY N/B 07/26 4.375 / DBT (US91282CLB53) | 351,46 | −36,43 | 1,0666 | −1,9991 | ||

| US91282CCZ23 / United States Treasury Note/Bond | 337,20 | 1,0234 | 1,0234 | |||

| US TREASURY N/B 12/26 4.25 / DBT (US91282CME83) | 301,79 | 0,07 | 0,9159 | −0,7565 | ||

| US TREASURY N/B 12/26 4.25 / DBT (US91282CME83) | 301,79 | 0,07 | 0,9159 | −0,7565 | ||

| US TREASURY N/B 12/26 4.25 / DBT (US91282CME83) | 301,79 | 0,07 | 0,9159 | −0,7565 | ||

| US TREASURY N/B 12/26 4.25 / DBT (US91282CME83) | 301,79 | 0,07 | 0,9159 | −0,7565 | ||

| TORONTO DOMINION BANK REPO DUMMY ASSET / RA (000000000) | 301,08 | 0,9137 | 0,9137 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 301,08 | 0,9137 | 0,9137 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 301,08 | 0,9137 | 0,9137 | |||

| TORONTO DOMINION BANK REPO DUMMY ASSET / RA (000000000) | 301,08 | 0,9137 | 0,9137 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 301,08 | 0,9137 | 0,9137 | |||

| US TREASURY N/B 09/26 3.5 / DBT (US91282CLP40) | 298,50 | 0,9059 | 0,9059 | |||

| US TREASURY N/B 09/26 3.5 / DBT (US91282CLP40) | 298,50 | 0,9059 | 0,9059 | |||

| US TREASURY N/B 09/26 3.5 / DBT (US91282CLP40) | 298,50 | 0,9059 | 0,9059 | |||

| US TREASURY N/B 09/26 3.5 / DBT (US91282CLP40) | 298,50 | 0,9059 | 0,9059 | |||

| RVPO BANK OF NOVA SCOTIA / RA (000000000) | 264,37 | 0,8023 | 0,8023 | |||

| RVPO BANK OF NOVA SCOTIA / RA (000000000) | 264,37 | 0,8023 | 0,8023 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 264,37 | 0,8023 | 0,8023 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 264,37 | 0,8023 | 0,8023 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 264,37 | 0,8023 | 0,8023 | |||

| MERRILL LYNCH REPO CAD REPO / RA (000000000) | 257,02 | 0,7800 | 0,7800 | |||

| MERRILL LYNCH REPO CAD REPO / RA (000000000) | 257,02 | 0,7800 | 0,7800 | |||

| MERRILL LYNCH REPO CAD REPO / RA (000000000) | 257,02 | 0,7800 | 0,7800 | |||

| MERRILL LYNCH REPO CAD REPO / RA (000000000) | 257,02 | 0,7800 | 0,7800 | |||

| US TREASURY N/B 11/26 4.25 / DBT (US91282CLY56) | 251,33 | 0,7627 | 0,7627 | |||

| US TREASURY N/B 11/26 4.25 / DBT (US91282CLY56) | 251,33 | 0,7627 | 0,7627 | |||

| PARIBAS REPO / RA (000000000) | 251,00 | 0,7618 | 0,7618 | |||

| PARIBAS REPO / RA (000000000) | 251,00 | 0,7618 | 0,7618 | |||

| PARIBAS REPO / RA (000000000) | 251,00 | 0,7618 | 0,7618 | |||

| PARIBAS REPO / RA (000000000) | 251,00 | 0,7618 | 0,7618 | |||

| MORGAN STANLEY REPO 9W08 / RA (000000000) | 250,00 | 0,7587 | 0,7587 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 250,00 | 0,7587 | 0,7587 | |||

| MORGAN STANLEY REPO 9W08 / RA (000000000) | 250,00 | 0,7587 | 0,7587 | |||

| US TREASURY N/B 08/26 3.75 / DBT (US91282CLH24) | 249,44 | 0,07 | 0,7570 | −0,6253 | ||

| US TREASURY N/B 08/26 3.75 / DBT (US91282CLH24) | 249,44 | 0,07 | 0,7570 | −0,6253 | ||

| US TREASURY N/B 08/26 3.75 / DBT (US91282CLH24) | 249,44 | 0,07 | 0,7570 | −0,6253 | ||

| US TREASURY N/B 08/26 3.75 / DBT (US91282CLH24) | 249,44 | 0,07 | 0,7570 | −0,6253 | ||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 242,34 | 0,7355 | 0,7355 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 242,34 | 0,7355 | 0,7355 | |||

| US TREASURY N/B 02/27 4.125 / DBT (US91282CMP31) | 201,07 | 0,6102 | 0,6102 | |||

| US TREASURY N/B 02/27 4.125 / DBT (US91282CMP31) | 201,07 | 0,6102 | 0,6102 | |||

| US TREASURY N/B 02/27 4.125 / DBT (US91282CMP31) | 201,07 | 0,6102 | 0,6102 | |||

| US TREASURY N/B 02/27 4.125 / DBT (US91282CMP31) | 201,07 | 0,6102 | 0,6102 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 200,00 | 0,6070 | 0,6070 | |||

| US9128286S43 / United States Treasury Note/Bond | 197,23 | 0,5986 | 0,5986 | |||

| US91282CCF68 / United States Treasury Note/Bond | 194,13 | 0,5892 | 0,5892 | |||

| US91282CHM64 / U.S. Treasury Notes | 150,80 | 0,4577 | 0,4577 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 150,00 | 0,4552 | 0,4552 | |||

| US68389XCC74 / Oracle Corp | 127,82 | 108,37 | 0,3879 | 0,0477 | ||

| US05530QAN07 / BAT International Finance PLC | 125,54 | 79,17 | 0,3810 | −0,0076 | ||

| REPO BANK AMERICA REPO / RA (000000000) | 100,00 | 0,3035 | 0,3035 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 100,00 | 0,3035 | 0,3035 | |||

| US694308JP35 / PACIFIC GAS + ELECTRIC 1ST MORTGAGE 01/26 3.15 | 90,83 | 113,67 | 0,2757 | 0,0399 | ||

| US24023KAK43 / DBS GROUP HOLDINGS LTD SR UNSECURED 144A 09/25 VAR | 73,73 | −0,09 | 0,2238 | −0,1855 | ||

| US06051GLE79 / Bank of America Corporation | 68,03 | 4,12 | 0,2065 | −0,1559 | ||

| US06738ECF07 / Barclays PLC | 67,14 | 0,2038 | 0,2038 | |||

| US46647PBA30 / JPMorgan Chase & Co | 63,01 | 0,23 | 0,1912 | −0,1574 | ||

| SUMITOMO MITSUI SYD CERT OF DEPO 02/26 VAR / DBT (AU3FN0075313) | 58,41 | 5,30 | 0,1773 | −0,1304 | ||

| SUMITOMO MITSUI SYD CERT OF DEPO 02/26 VAR / DBT (AU3FN0075313) | 58,41 | 5,30 | 0,1773 | −0,1304 | ||

| RTX / RTX Corporation - Depositary Receipt (Common Stock) | 53,29 | 0,1617 | 0,1617 | |||

| RTX / RTX Corporation - Depositary Receipt (Common Stock) | 53,29 | 0,1617 | 0,1617 | |||

| US61747YEZ43 / Morgan Stanley | 51,85 | −0,05 | 0,1573 | −0,1303 | ||

| US29874QEN07 / European Bank for Reconstruction & Development | 51,26 | 0,02 | 0,1556 | −0,1286 | ||

| COOPERATIEVE RABOBANK UA COOPERATIEVE RABOBANK UA / DBT (US21688ABB70) | 49,90 | 7,82 | 0,1514 | −0,1052 | ||

| COOPERATIEVE RABOBANK UA COOPERATIEVE RABOBANK UA / DBT (US21688ABB70) | 49,90 | 7,82 | 0,1514 | −0,1052 | ||

| COOPERATIEVE RABOBANK UA COOPERATIEVE RABOBANK UA / DBT (US21688ABB70) | 49,90 | 7,82 | 0,1514 | −0,1052 | ||

| COOPERATIEVE RABOBANK UA COOPERATIEVE RABOBANK UA / DBT (US21688ABB70) | 49,90 | 7,82 | 0,1514 | −0,1052 | ||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 45,06 | 0,00 | 0,1368 | −0,1131 | ||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 45,06 | 0,00 | 0,1368 | −0,1131 | ||

| US17327CAM55 / Citigroup Inc | 44,59 | 0,93 | 0,1353 | −0,1097 | ||

| PROTECTIVE LIFE GLOBAL SECURED 144A 07/26 VAR / DBT (US743672AG20) | 43,85 | −0,03 | 0,1331 | −0,1102 | ||

| PROTECTIVE LIFE GLOBAL SECURED 144A 07/26 VAR / DBT (US743672AG20) | 43,85 | −0,03 | 0,1331 | −0,1102 | ||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 40,51 | 0,1229 | 0,1229 | |||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 40,51 | 0,1229 | 0,1229 | |||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 40,51 | 0,1229 | 0,1229 | |||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 40,51 | 0,1229 | 0,1229 | |||

| VOLKSWAGEN GROUP OF AM / DBT (US92866BU298) | 40,19 | 0,1220 | 0,1220 | |||

| US98956PAS11 / Zimmer Biomet Holdings Inc | 37,39 | 0,38 | 0,1135 | −0,0931 | ||

| RVPO BANK OF NOVA SCOTIA / RA (000000000) | 36,72 | 0,1114 | 0,1114 | |||

| L BANK BW FOERDERBANK L BANK BW FOERDERBANK / DBT (XS2816702984) | 35,03 | −0,15 | 0,1063 | −0,0882 | ||

| L BANK BW FOERDERBANK L BANK BW FOERDERBANK / DBT (XS2816702984) | 35,03 | −0,15 | 0,1063 | −0,0882 | ||

| L BANK BW FOERDERBANK L BANK BW FOERDERBANK / DBT (XS2816702984) | 35,03 | −0,15 | 0,1063 | −0,0882 | ||

| L BANK BW FOERDERBANK L BANK BW FOERDERBANK / DBT (XS2816702984) | 35,03 | −0,15 | 0,1063 | −0,0882 | ||

| CITIBANK NA SR UNSECURED 08/26 VAR / DBT (US17325FBH01) | 33,59 | −0,15 | 0,1019 | −0,0846 | ||

| CITIBANK NA SR UNSECURED 08/26 VAR / DBT (US17325FBH01) | 33,59 | −0,15 | 0,1019 | −0,0846 | ||

| CITIBANK NA SR UNSECURED 08/26 VAR / DBT (US17325FBH01) | 33,59 | −0,15 | 0,1019 | −0,0846 | ||

| J P MORGAN TERM REPO / RA (000000000) | 33,20 | 0,1008 | 0,1008 | |||

| J P MORGAN TERM REPO / RA (000000000) | 33,20 | 0,1008 | 0,1008 | |||

| J P MORGAN TERM REPO / RA (000000000) | 33,20 | 0,1008 | 0,1008 | |||

| J P MORGAN TERM REPO / RA (000000000) | 33,20 | 0,1008 | 0,1008 | |||

| US89233FHN15 / Toyota Motor Credit Corporation | 32,54 | 0,12 | 0,0988 | −0,0815 | ||

| US89233FHN15 / Toyota Motor Credit Corporation | 32,54 | 0,12 | 0,0988 | −0,0815 | ||

| US89233FHN15 / Toyota Motor Credit Corporation | 32,54 | 0,12 | 0,0988 | −0,0815 | ||

| US89233FHN15 / Toyota Motor Credit Corporation | 32,54 | 0,12 | 0,0988 | −0,0815 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 08/26 VAR / DBT (US04685A4B40) | 32,13 | 0,01 | 0,0975 | −0,0807 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 08/26 VAR / DBT (US04685A4B40) | 32,13 | 0,01 | 0,0975 | −0,0807 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 08/26 VAR / DBT (US04685A4B40) | 32,13 | 0,01 | 0,0975 | −0,0807 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 08/26 VAR / DBT (US04685A4B40) | 32,13 | 0,01 | 0,0975 | −0,0807 | ||

| HSBC26C / HSBC Holdings PLC | 31,97 | 0,12 | 0,0970 | −0,0801 | ||

| ING BANK (AUSTRALIA) LTD COVERED 12/25 VAR / DBT (AU3FN0074175) | 29,11 | 5,20 | 0,0883 | −0,0651 | ||

| ING BANK (AUSTRALIA) LTD COVERED 12/25 VAR / DBT (AU3FN0074175) | 29,11 | 5,20 | 0,0883 | −0,0651 | ||

| ING BANK (AUSTRALIA) LTD COVERED 12/25 VAR / DBT (AU3FN0074175) | 29,11 | 5,20 | 0,0883 | −0,0651 | ||

| ING BANK (AUSTRALIA) LTD COVERED 12/25 VAR / DBT (AU3FN0074175) | 29,11 | 5,20 | 0,0883 | −0,0651 | ||

| D05 / DBS Group Holdings Ltd | 29,01 | −0,09 | 0,0880 | −0,0730 | ||

| D05 / DBS Group Holdings Ltd | 29,01 | −0,09 | 0,0880 | −0,0730 | ||

| D05 / DBS Group Holdings Ltd | 29,01 | −0,09 | 0,0880 | −0,0730 | ||

| US845437BS08 / Southwestern Electric Power Co | 28,63 | 52,46 | 0,0869 | −0,0172 | ||

| US06738EBZ79 / Barclays PLC | 27,73 | 19,31 | 0,0842 | −0,0447 | ||

| MUFG BK LTD 12/25 VAR / DBT (US55381BFG86) | 26,60 | 0,02 | 0,0807 | −0,0668 | ||

| MUFG BK LTD 12/25 VAR / DBT (US55381BFG86) | 26,60 | 0,02 | 0,0807 | −0,0668 | ||

| MUFG BK LTD 12/25 VAR / DBT (US55381BFG86) | 26,60 | 0,02 | 0,0807 | −0,0668 | ||

| MUFG BK LTD 12/25 VAR / DBT (US55381BFG86) | 26,60 | 0,02 | 0,0807 | −0,0668 | ||

| ATHENE GLOBAL FUNDING ATHENE GLOBAL FUNDING / DBT (US04685A3S83) | 25,38 | −0,32 | 0,0770 | −0,0642 | ||

| BACR / Barclays Bank PLC - Corporate Bond/Note | 24,28 | 0,09 | 0,0737 | −0,0608 | ||

| US06428CAD65 / Bank of America NA | 23,12 | −0,09 | 0,0702 | −0,0582 | ||

| US74460WAJ62 / VAR.RT. CORP. BONDS | 22,79 | −0,09 | 0,0692 | −0,0573 | ||

| ARI FLEET LEASE TRUST ARIFL 2025 B A1 144A / ABS-O (US00193GAA94) | 21,92 | 0,0665 | 0,0665 | |||

| ARI FLEET LEASE TRUST ARIFL 2025 B A1 144A / ABS-O (US00193GAA94) | 21,92 | 0,0665 | 0,0665 | |||

| ARI FLEET LEASE TRUST ARIFL 2025 B A1 144A / ABS-O (US00193GAA94) | 21,92 | 0,0665 | 0,0665 | |||

| ARI FLEET LEASE TRUST ARIFL 2025 B A1 144A / ABS-O (US00193GAA94) | 21,92 | 0,0665 | 0,0665 | |||

| US78016EZP59 / Royal Bank of Canada | 21,80 | −0,04 | 0,0662 | −0,0548 | ||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 20,71 | 164,72 | 0,0629 | 0,0195 | ||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 20,71 | 164,72 | 0,0629 | 0,0195 | ||

| US21688AAX00 / COOPERATIEVE RABOBANK UA/NY | 20,61 | −0,14 | 0,0626 | −0,0519 | ||

| US55336VBR06 / MPLX LP | 20,22 | 0,70 | 0,0614 | −0,0500 | ||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 20,10 | 0,0610 | 0,0610 | |||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 20,10 | 0,0610 | 0,0610 | |||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 20,10 | 0,0610 | 0,0610 | |||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 20,09 | 0,0610 | 0,0610 | |||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 20,09 | 0,0610 | 0,0610 | |||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 20,09 | 0,0610 | 0,0610 | |||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 19,88 | 28,43 | 0,0603 | −0,0255 | ||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 19,88 | 28,43 | 0,0603 | −0,0255 | ||

| US639057AG33 / NatWest Group PLC | 19,78 | 83,53 | 0,0600 | 0,0003 | ||

| US694308HP52 / PACIFIC GAS + ELECTRIC SR UNSECURED 03/26 2.95 | 18,21 | 138,91 | 0,0553 | 0,0130 | ||

| US04517PBE16 / Asian Development Bank | 17,54 | −0,18 | 0,0532 | −0,0442 | ||

| US02209SBC61 / Altria Group, Inc. | 15,68 | 0,03 | 0,0476 | −0,0393 | ||

| SUMITOMO MITSUI BKG CORP 12/25 VAR / DBT (US86565GLG37) | 15,40 | 0,02 | 0,0467 | −0,0387 | ||

| US80281LAS43 / SANTANDER UK GROUP HOLDINGS PLC | 15,37 | 0,0466 | 0,0466 | |||

| KFW GOVT GUARANT REGS 10/26 VAR / DBT (XS2710913380) | 15,16 | 0,0460 | 0,0460 | |||

| KFW GOVT GUARANT REGS 10/26 VAR / DBT (XS2710913380) | 15,16 | 0,0460 | 0,0460 | |||

| KFW GOVT GUARANT REGS 10/26 VAR / DBT (XS2710913380) | 15,16 | 0,0460 | 0,0460 | |||

| KFW GOVT GUARANT REGS 10/26 VAR / DBT (XS2710913380) | 15,16 | 0,0460 | 0,0460 | |||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 14,68 | 0,0446 | 0,0446 | |||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 14,68 | 0,0446 | 0,0446 | |||

| US38145GAM24 / Goldman Sachs Group Inc/The | 14,13 | 0,0429 | 0,0429 | |||

| US37940XAE22 / Global Payments Inc | 13,38 | 0,83 | 0,0406 | −0,0330 | ||

| SUMITOMO MITSUI SYD CERT OF DEPO 11/25 VAR / DBT (AU3FN0073045) | 13,33 | 5,19 | 0,0405 | −0,0298 | ||

| SUMITOMO MITSUI SYD CERT OF DEPO 11/25 VAR / DBT (AU3FN0073045) | 13,33 | 5,19 | 0,0405 | −0,0298 | ||

| SUMITOMO MITSUI SYD CERT OF DEPO 11/25 VAR / DBT (AU3FN0073045) | 13,33 | 5,19 | 0,0405 | −0,0298 | ||

| SUMITOMO MITSUI SYD CERT OF DEPO 11/25 VAR / DBT (AU3FN0073045) | 13,33 | 5,19 | 0,0405 | −0,0298 | ||

| GPJA / Georgia Power Company - Preferred Security | 13,06 | −0,17 | 0,0396 | −0,0329 | ||

| GPJA / Georgia Power Company - Preferred Security | 13,06 | −0,17 | 0,0396 | −0,0329 | ||

| US962166CC62 / WEYERHAEUSER COMPANY | 13,05 | 41,61 | 0,0396 | −0,0115 | ||

| NEW YORK LIFE GLOBAL FDG SECURED 144A 01/26 VAR / DBT (US64953BBK35) | 13,03 | −0,07 | 0,0395 | −0,0328 | ||

| MUFG BANK LTD SYDNEY CERT OF DEPO 02/26 VAR / DBT (AU3FN0075198) | 13,01 | 5,29 | 0,0395 | −0,0290 | ||

| MUFG BANK LTD SYDNEY CERT OF DEPO 02/26 VAR / DBT (AU3FN0075198) | 13,01 | 5,29 | 0,0395 | −0,0290 | ||

| MUFG BANK LTD SYDNEY CERT OF DEPO 02/26 VAR / DBT (AU3FN0075198) | 13,01 | 5,29 | 0,0395 | −0,0290 | ||

| MUFG BANK LTD SYDNEY CERT OF DEPO 02/26 VAR / DBT (AU3FN0075198) | 13,01 | 5,29 | 0,0395 | −0,0290 | ||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 2 A1 144A / ABS-O (US29375TAA07) | 12,95 | 0,0393 | 0,0393 | |||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 2 A1 144A / ABS-O (US29375TAA07) | 12,95 | 0,0393 | 0,0393 | |||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 2 A1 144A / ABS-O (US29375TAA07) | 12,95 | 0,0393 | 0,0393 | |||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 2 A1 144A / ABS-O (US29375TAA07) | 12,95 | 0,0393 | 0,0393 | |||

| US06368LWT96 / Bank of Montreal | 12,71 | −0,36 | 0,0386 | −0,0322 | ||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PP64) | 12,61 | 0,0383 | 0,0383 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PP64) | 12,61 | 0,0383 | 0,0383 | |||

| AU3FN0058608 / UBS AG AUSTRALIA SR UNSECURED REGS 02/26 VAR | 12,58 | 5,38 | 0,0382 | −0,0280 | ||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PN17) | 12,42 | 0,0377 | 0,0377 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PN17) | 12,42 | 0,0377 | 0,0377 | |||

| US89114TZD70 / Toronto-Dominion Bank/The | 10,48 | 0,0318 | 0,0318 | |||

| US65339KBS87 / NextEra Energy Capital Holdings Inc | 10,39 | −0,27 | 0,0315 | −0,0262 | ||

| AU3FN0055299 / UBS AG AUSTRALIA | 10,21 | 5,23 | 0,0310 | −0,0228 | ||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 10,13 | 65,70 | 0,0307 | −0,0032 | ||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 10,13 | 65,70 | 0,0307 | −0,0032 | ||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 10,13 | 65,70 | 0,0307 | −0,0032 | ||

| US24422EWU99 / DEERE JOHN CAPITAL CORP FRN SOFR+57 03/03/2026 | 9,75 | −0,15 | 0,0296 | −0,0246 | ||

| US345397XL24 / FORD MOTOR CREDIT CO LLC | 9,59 | 0,47 | 0,0291 | −0,0238 | ||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 9,49 | 166,31 | 0,0288 | 0,0090 | ||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 9,49 | 166,31 | 0,0288 | 0,0090 | ||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 9,49 | 166,31 | 0,0288 | 0,0090 | ||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 9,49 | 166,31 | 0,0288 | 0,0090 | ||

| US87264ABR59 / T-MOBILE USA INC 2.25% 02/15/2026 | 8,52 | 0,0259 | 0,0259 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUG52) | 8,48 | 0,0257 | 0,0257 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUG52) | 8,48 | 0,0257 | 0,0257 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUG52) | 8,48 | 0,0257 | 0,0257 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUG52) | 8,48 | 0,0257 | 0,0257 | |||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 8,44 | 5,16 | 0,0256 | −0,0189 | ||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 8,44 | 5,16 | 0,0256 | −0,0189 | ||

| AU3CB0273407 / UBS AG/Australia | 8,43 | 6,25 | 0,0256 | −0,0184 | ||

| US38145GAN07 / Goldman Sachs Group Inc/The | 8,16 | 0,0248 | 0,0248 | |||

| US25160PAJ66 / Deutsche Bank AG/New York NY | 7,80 | −0,28 | 0,0237 | −0,0197 | ||

| US29273RBG39 / Energy Transfer Partners LP | 7,77 | 0,03 | 0,0236 | −0,0195 | ||

| US63906EB929 / NatWest Markets PLC | 7,74 | 5,25 | 0,0235 | −0,0173 | ||

| US63906EB929 / NatWest Markets PLC | 7,74 | 5,25 | 0,0235 | −0,0173 | ||

| WELLS FARGO BANK NA WELLS FARGO BANK NA / DBT (US94988J6J16) | 7,29 | 48,22 | 0,0221 | −0,0051 | ||

| WELLS FARGO BANK NA WELLS FARGO BANK NA / DBT (US94988J6J16) | 7,29 | 48,22 | 0,0221 | −0,0051 | ||

| WELLS FARGO BANK NA WELLS FARGO BANK NA / DBT (US94988J6J16) | 7,29 | 48,22 | 0,0221 | −0,0051 | ||

| WELLS FARGO BANK NA WELLS FARGO BANK NA / DBT (US94988J6J16) | 7,29 | 48,22 | 0,0221 | −0,0051 | ||

| US87264ABU88 / T-Mobile USA Inc | 7,15 | 102,38 | 0,0217 | 0,0021 | ||

| US172967NX53 / Citigroup, Inc. | 7,09 | −0,25 | 0,0215 | −0,0179 | ||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 6,90 | 14,93 | 0,0210 | −0,0124 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 6,88 | 0,0209 | 0,0209 | |||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 6,88 | 0,0209 | 0,0209 | |||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 6,88 | 0,0209 | 0,0209 | |||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 6,88 | 0,0209 | 0,0209 | |||

| CITIBANK NA CITIBANK NA / DBT (US17325FBE79) | 6,83 | 6,38 | 0,0207 | −0,0149 | ||

| CITIBANK NA CITIBANK NA / DBT (US17325FBE79) | 6,83 | 6,38 | 0,0207 | −0,0149 | ||

| US6935A2K126 / PPL ELECTRIC UTILITIES | 6,69 | 0,0203 | 0,0203 | |||

| US6935A2K126 / PPL ELECTRIC UTILITIES | 6,69 | 0,0203 | 0,0203 | |||

| US6935A2K126 / PPL ELECTRIC UTILITIES | 6,69 | 0,0203 | 0,0203 | |||

| MIZUHO BANK LTD/SYDNEY CERT OF DEPO 08/25 VAR / DBT (AU3FN0070918) | 6,65 | 5,19 | 0,0202 | −0,0149 | ||

| MIZUHO BANK LTD/SYDNEY CERT OF DEPO 08/25 VAR / DBT (AU3FN0070918) | 6,65 | 5,19 | 0,0202 | −0,0149 | ||

| US62954WAJ45 / NTT Finance Corp | 6,61 | 0,08 | 0,0201 | −0,0166 | ||

| TOYOTA LEASE OWNER TRUST TLOT 2025 A A1 144A / ABS-O (US89239NAA37) | 6,57 | −82,54 | 0,0199 | −0,1888 | ||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 6,55 | 5,19 | 0,0199 | −0,0147 | ||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 6,55 | 5,19 | 0,0199 | −0,0147 | ||

| AU3CB0276509 / NBN Co. Ltd. | 6,50 | 6,38 | 0,0197 | −0,0142 | ||

| C1PB34 / The Campbell's Company - Depositary Receipt (Common Stock) | 6,46 | −0,20 | 0,0196 | −0,0163 | ||

| C1PB34 / The Campbell's Company - Depositary Receipt (Common Stock) | 6,46 | −0,20 | 0,0196 | −0,0163 | ||

| C1PB34 / The Campbell's Company - Depositary Receipt (Common Stock) | 6,46 | −0,20 | 0,0196 | −0,0163 | ||

| C1PB34 / The Campbell's Company - Depositary Receipt (Common Stock) | 6,46 | −0,20 | 0,0196 | −0,0163 | ||

| US46647PBW59 / JPMorgan Chase & Co | 6,37 | 0,87 | 0,0193 | −0,0157 | ||

| US744573AP19 / Public Service Enterprise Group Inc | 6,35 | 0,97 | 0,0193 | −0,0156 | ||

| US961214FM04 / WESTPAC BANKING CORP FRN SOFR+ 11/17/2025 | 6,30 | −0,13 | 0,0191 | −0,0159 | ||

| US2027A0KE81 / COMMONWEALTH BANK OF AUSTRALIA | 6,22 | −0,03 | 0,0189 | −0,0156 | ||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 6,02 | −0,15 | 0,0183 | −0,0152 | ||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 6,02 | −0,15 | 0,0183 | −0,0152 | ||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 6,02 | −0,15 | 0,0183 | −0,0152 | ||

| US718172CY31 / Philip Morris International Inc | 5,81 | 0,0176 | 0,0176 | |||

| US06368LWV43 / Bank of Montreal | 5,79 | −0,21 | 0,0176 | −0,0146 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 5,69 | 0,0173 | 0,0173 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 5,69 | 0,0173 | 0,0173 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 5,69 | 0,0173 | 0,0173 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 5,69 | 0,0173 | 0,0173 | |||

| US24703TAD81 / CORP. NOTE | 5,65 | 0,0172 | 0,0172 | |||

| TRS P SOFRRATE+8/91282CME8 MYC / DCR (000000000) | 5,58 | 0,0169 | 0,0169 | |||

| US78016EZR16 / Royal Bank of Canada | 5,15 | −0,04 | 0,0156 | −0,0129 | ||

| US775109BE00 / Rogers Communications Inc | 5,12 | 0,43 | 0,0155 | −0,0127 | ||

| US874054AJ85 / Take-Two Interactive Software Inc | 5,11 | 27,23 | 0,0155 | −0,0068 | ||

| US928668BU57 / Volkswagen Group of America, Inc. | 5,01 | −0,28 | 0,0152 | −0,0127 | ||

| US06051GLA57 / Bank of America Corp. | 4,97 | −0,04 | 0,0151 | −0,0125 | ||

| US22822VAB71 / Crown Castle International Corp | 4,81 | 0,0146 | 0,0146 | |||

| US02665WES61 / American Honda Finance Corp. | 4,77 | −0,06 | 0,0145 | −0,0120 | ||

| US60871RAG56 / Molson Coors Brewing Co | 4,74 | 0,0144 | 0,0144 | |||

| US92939UAK25 / WEC Energy Group Inc | 4,35 | 0,0132 | 0,0132 | |||

| US17325FAZ18 / Citibank NA | 4,23 | 134,39 | 0,0128 | 0,0028 | ||

| US21684AAC09 / Cooperatieve Rabobank UA | 4,16 | 0,0126 | 0,0126 | |||

| US19767QAQ82 / Columbia/hca 7.58% Senior Notes 09/15/25 | 4,12 | −0,63 | 0,0125 | −0,0105 | ||

| US2027A0KG30 / Commonwealth Bank of Australia | 4,08 | −0,05 | 0,0124 | −0,0102 | ||

| CPPIB CAPITAL INC COMPANY GUAR 144A 07/26 VAR / DBT (US22411VBB36) | 4,01 | 0,05 | 0,0122 | −0,0101 | ||

| CPPIB CAPITAL INC COMPANY GUAR 144A 07/26 VAR / DBT (US22411VBB36) | 4,01 | 0,05 | 0,0122 | −0,0101 | ||

| CPPIB CAPITAL INC COMPANY GUAR 144A 07/26 VAR / DBT (US22411VBB36) | 4,01 | 0,05 | 0,0122 | −0,0101 | ||

| HCA INC DISC COML PAPER 4/A2 Y 07/25 ZCP / DBT (US40412BUP65) | 3,99 | 0,0121 | 0,0121 | |||

| HCA INC DISC COML PAPER 4/A2 Y 07/25 ZCP / DBT (US40412BUP65) | 3,99 | 0,0121 | 0,0121 | |||

| HCA INC DISC COML PAPER 4/A2 Y 07/25 ZCP / DBT (US40412BUP65) | 3,99 | 0,0121 | 0,0121 | |||

| HCA INC DISC COML PAPER 4/A2 Y 07/25 ZCP / DBT (US40412BUP65) | 3,99 | 0,0121 | 0,0121 | |||

| US573874AC88 / Marvell Technology Inc | 3,92 | 0,72 | 0,0119 | −0,0097 | ||

| LLOYDS BANK PLC SR UNSECURED REGS 08/25 4.25 / DBT (AU3CB0232346) | 3,83 | 5,45 | 0,0116 | −0,0085 | ||

| LLOYDS BANK PLC SR UNSECURED REGS 08/25 4.25 / DBT (AU3CB0232346) | 3,83 | 5,45 | 0,0116 | −0,0085 | ||

| LLOYDS BANK PLC SR UNSECURED REGS 08/25 4.25 / DBT (AU3CB0232346) | 3,83 | 5,45 | 0,0116 | −0,0085 | ||

| LLOYDS BANK PLC SR UNSECURED REGS 08/25 4.25 / DBT (AU3CB0232346) | 3,83 | 5,45 | 0,0116 | −0,0085 | ||

| US07274NAJ28 / Bayer US Finance II LLC | 3,79 | 0,16 | 0,0115 | −0,0095 | ||

| HSBC26D / HSBC Holdings PLC | 3,71 | 309,94 | 0,0113 | 0,0062 | ||

| US53944YAT01 / Lloyds Banking Group PLC | 3,50 | 0,00 | 0,0106 | −0,0088 | ||

| CNRCN / Canadian National Railway Co | 3,48 | 0,0106 | 0,0106 | |||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 3,38 | 0,0103 | 0,0103 | |||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 3,38 | 0,0103 | 0,0103 | |||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 3,38 | 0,0103 | 0,0103 | |||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 3,38 | 0,0103 | 0,0103 | |||

| US38141GXM13 / Goldman Sachs Group Inc/The | 3,27 | 0,0099 | 0,0099 | |||

| XS2408621238 / Kommunalbanken AS | 3,22 | −0,22 | 0,0098 | −0,0081 | ||

| US902674ZX12 / UBS AG | 3,19 | 7,71 | 0,0097 | −0,0067 | ||

| US025816CL12 / AMERICAN EXPRESS CO REGD V/R 0.70000300 | 3,11 | 0,0094 | 0,0094 | |||

| US225401AY40 / Credit Suisse Group AG | 3,10 | −0,32 | 0,0094 | −0,0078 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 07/26 VAR / DBT (US04685A4J75) | 3,05 | 0,0093 | 0,0093 | |||

| ATHENE GLOBAL FUNDING SECURED 144A 07/26 VAR / DBT (US04685A4J75) | 3,05 | 0,0093 | 0,0093 | |||

| ATHENE GLOBAL FUNDING SECURED 144A 07/26 VAR / DBT (US04685A4J75) | 3,05 | 0,0093 | 0,0093 | |||

| ATHENE GLOBAL FUNDING SECURED 144A 07/26 VAR / DBT (US04685A4J75) | 3,05 | 0,0093 | 0,0093 | |||

| US404119BS74 / Hca Inc Bond | 3,00 | −0,30 | 0,0091 | −0,0076 | ||

| AU3FN0056446 / SHINHAN BANK SR UNSECURED REGS 09/25 VAR | 2,96 | 5,22 | 0,0090 | −0,0066 | ||

| XS1395052639 / Standard Chartered PLC | 2,84 | 0,04 | 0,0086 | −0,0071 | ||

| US62954WAC91 / NTT Finance Corp | 2,82 | 0,0086 | 0,0086 | |||

| US00138CAN83 / AIG GLOBAL FUNDING | 2,78 | 0,91 | 0,0084 | −0,0068 | ||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 2,62 | 0,89 | 0,0080 | −0,0065 | ||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 2,62 | 0,89 | 0,0080 | −0,0065 | ||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 2,62 | 0,89 | 0,0080 | −0,0065 | ||

| US21688AAW27 / Cooperatieve Rabobank UA | 2,50 | 0,0076 | 0,0076 | |||

| HARLEY DAVIDSON FND CP / DBT (US41282JUM16) | 2,49 | 0,0076 | 0,0076 | |||

| HARLEY DAVIDSON FND CP / DBT (US41282JUM16) | 2,49 | 0,0076 | 0,0076 | |||

| HARLEY DAVIDSON FND CP / DBT (US41282JUM16) | 2,49 | 0,0076 | 0,0076 | |||

| HARLEY DAVIDSON FND CP / DBT (US41282JUM16) | 2,49 | 0,0076 | 0,0076 | |||

| US23341CAC73 / DNB Bank ASA | 2,46 | −0,20 | 0,0075 | −0,0062 | ||

| VW CR INC / DBT (US91842JU988) | 2,40 | 0,0073 | 0,0073 | |||

| VW CR INC / DBT (US91842JU988) | 2,40 | 0,0073 | 0,0073 | |||

| VW CR INC / DBT (US91842JU988) | 2,40 | 0,0073 | 0,0073 | |||

| VW CR INC / DBT (US91842JU988) | 2,40 | 0,0073 | 0,0073 | |||

| US36143L2A26 / GA Global Funding Trust | 2,38 | 0,0072 | 0,0072 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | 2,17 | 0,0066 | 0,0066 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | 2,17 | 0,0066 | 0,0066 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | 2,17 | 0,0066 | 0,0066 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | 2,17 | 0,0066 | 0,0066 | |||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 2,12 | 0,0064 | 0,0064 | |||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 2,12 | 0,0064 | 0,0064 | |||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 2,12 | 0,0064 | 0,0064 | |||

| US25179MAV54 / Devon Energy Corp Bond | 2,11 | 0,0064 | 0,0064 | |||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 2,06 | 5,22 | 0,0062 | −0,0046 | ||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 2,06 | 5,22 | 0,0062 | −0,0046 | ||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 2,06 | 5,22 | 0,0062 | −0,0046 | ||

| US46115HBU05 / INTESA SANPAOLO SPA | 2,02 | −0,49 | 0,0061 | −0,0051 | ||

| US46849LUX71 / Jackson National Life Global Funding | 2,01 | 0,0061 | 0,0061 | |||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/26 VAR / DBT (US928668CD24) | 2,00 | 0,0061 | 0,0061 | |||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/26 VAR / DBT (US928668CD24) | 2,00 | 0,0061 | 0,0061 | |||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/26 VAR / DBT (US928668CD24) | 2,00 | 0,0061 | 0,0061 | |||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/26 VAR / DBT (US928668CD24) | 2,00 | 0,0061 | 0,0061 | |||

| ATHENE GLOBAL FUNDING SR SECURED 144A 05/26 5.62 / DBT (US04685A3V13) | 1,97 | 0,0060 | 0,0060 | |||

| ATHENE GLOBAL FUNDING SR SECURED 144A 05/26 5.62 / DBT (US04685A3V13) | 1,97 | 0,0060 | 0,0060 | |||

| US65535HAR03 / Nomura Holdings Inc | 1,97 | 0,67 | 0,0060 | −0,0049 | ||

| US03027XBB55 / American Tower Corp | 1,89 | 0,0057 | 0,0057 | |||

| US02665WEE75 / American Honda Finance Corp | 1,86 | 0,0056 | 0,0056 | |||

| US638602BP66 / Nationwide Building Society | 1,80 | 0,17 | 0,0055 | −0,0045 | ||

| US855244AK58 / Starbucks Corp | 1,77 | 0,0054 | 0,0054 | |||

| US125523CP36 / Cigna Corp | 1,75 | 0,0053 | 0,0053 | |||

| CA14913LAA85 / CATERP FIN S LTD | 1,75 | −0,06 | 0,0053 | −0,0044 | ||

| CA14913LAA85 / CATERP FIN S LTD | 1,75 | −0,06 | 0,0053 | −0,0044 | ||

| CA14913LAA85 / CATERP FIN S LTD | 1,75 | −0,06 | 0,0053 | −0,0044 | ||

| CA14913LAA85 / CATERP FIN S LTD | 1,75 | −0,06 | 0,0053 | −0,0044 | ||

| US05252ADG31 / Australia & New Zealand Banking Group Ltd | 1,70 | −0,12 | 0,0052 | −0,0043 | ||

| US38141GXN95 / Goldman Sachs Group Inc/The | 1,70 | 0,0052 | 0,0052 | |||

| US04685A2U49 / Athene Global Funding | 1,67 | 0,0051 | 0,0051 | |||

| US25466AAE10 / Discover Bank 2.0% 02/21/18 Bond | 1,65 | 0,0050 | 0,0050 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PG65) | 1,53 | 0,0046 | 0,0046 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PG65) | 1,53 | 0,0046 | 0,0046 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PG65) | 1,53 | 0,0046 | 0,0046 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PG65) | 1,53 | 0,0046 | 0,0046 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | 1,43 | 0,0043 | 0,0043 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | 1,43 | 0,0043 | 0,0043 | |||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 1 A1 144A / ABS-O (US29390HAA77) | 1,39 | −38,24 | 0,0042 | −0,0083 | ||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 1 A1 144A / ABS-O (US29390HAA77) | 1,39 | −38,24 | 0,0042 | −0,0083 | ||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 1 A1 144A / ABS-O (US29390HAA77) | 1,39 | −38,24 | 0,0042 | −0,0083 | ||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 1 A1 144A / ABS-O (US29390HAA77) | 1,39 | −38,24 | 0,0042 | −0,0083 | ||

| US06051GJQ38 / Bank of America Corp | 1,32 | 0,0040 | 0,0040 | |||

| US902613AU26 / UBS Group AG | 1,31 | −0,23 | 0,0040 | −0,0033 | ||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 1,30 | 0,0039 | 0,0039 | |||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 1,30 | 0,0039 | 0,0039 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 1,30 | 0,0039 | 0,0039 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 1,30 | 0,0039 | 0,0039 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 1,30 | 0,0039 | 0,0039 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 1,30 | 0,0039 | 0,0039 | |||

| US02557TAD19 / American Electric Power Co Inc | 1,27 | −0,24 | 0,0039 | −0,0032 | ||

| ANZ / ANZ Group Holdings Limited | 1,24 | −0,08 | 0,0038 | −0,0031 | ||

| ANZ / ANZ Group Holdings Limited | 1,24 | −0,08 | 0,0038 | −0,0031 | ||

| ANZ / ANZ Group Holdings Limited | 1,24 | −0,08 | 0,0038 | −0,0031 | ||

| ANZ / ANZ Group Holdings Limited | 1,24 | −0,08 | 0,0038 | −0,0031 | ||

| US709599BL72 / Penske Truck Leasing Co Lp / PTL Finance Corp | 1,23 | 0,0037 | 0,0037 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797MG92) | 1,22 | 0,0037 | 0,0037 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797MG92) | 1,22 | 0,0037 | 0,0037 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797MG92) | 1,22 | 0,0037 | 0,0037 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797MG92) | 1,22 | 0,0037 | 0,0037 | |||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 1,18 | 0,0036 | 0,0036 | |||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 1,18 | 0,0036 | 0,0036 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PU59) | 1,10 | 0,0033 | 0,0033 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PU59) | 1,10 | 0,0033 | 0,0033 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PU59) | 1,10 | 0,0033 | 0,0033 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PU59) | 1,10 | 0,0033 | 0,0033 | |||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 1,06 | 580,65 | 0,0032 | 0,0023 | ||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 1,06 | 580,65 | 0,0032 | 0,0023 | ||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 1,06 | 580,65 | 0,0032 | 0,0023 | ||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 1,06 | 580,65 | 0,0032 | 0,0023 | ||

| WBCPM / Westpac Banking Corporation - Preferred Stock | 1,04 | 0,0031 | 0,0031 | |||

| WBCPM / Westpac Banking Corporation - Preferred Stock | 1,04 | 0,0031 | 0,0031 | |||

| WBCPM / Westpac Banking Corporation - Preferred Stock | 1,04 | 0,0031 | 0,0031 | |||

| WBCPM / Westpac Banking Corporation - Preferred Stock | 1,04 | 0,0031 | 0,0031 | |||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 1,04 | −0,38 | 0,0031 | −0,0026 | ||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 1,04 | −0,38 | 0,0031 | −0,0026 | ||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 1,04 | −0,38 | 0,0031 | −0,0026 | ||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 1,04 | −0,38 | 0,0031 | −0,0026 | ||

| TREASURY BILL 09/25 0.00000 / DBT (US912797QU41) | 1,03 | 0,0031 | 0,0031 | |||

| TREASURY BILL 09/25 0.00000 / DBT (US912797QU41) | 1,03 | 0,0031 | 0,0031 | |||

| TREASURY BILL 09/25 0.00000 / DBT (US912797QU41) | 1,03 | 0,0031 | 0,0031 | |||

| US020002BH30 / Allstate Corp/The | 1,00 | 0,91 | 0,0030 | −0,0025 | ||

| US0641593V62 / Bank of Nova Scotia/The | 1,00 | 0,00 | 0,0030 | −0,0025 | ||

| US313385HP48 / Federal Home Loan Bank Discount Notes | 0,90 | 0,0027 | 0,0027 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0,90 | 0,0027 | 0,0027 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0,90 | 0,0027 | 0,0027 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0,90 | 0,0027 | 0,0027 | |||

| US05565ECD58 / BMW US Capital LLC | 0,89 | −0,11 | 0,0027 | −0,0022 | ||

| US75513ECQ26 / Raytheon Technologies Corp | 0,85 | 0,0026 | 0,0026 | |||

| CA14913LAA85 / CATERP FIN S LTD | 0,83 | −0,12 | 0,0025 | −0,0021 | ||

| CA14913LAA85 / CATERP FIN S LTD | 0,83 | −0,12 | 0,0025 | −0,0021 | ||

| CA14913LAA85 / CATERP FIN S LTD | 0,83 | −0,12 | 0,0025 | −0,0021 | ||

| CA14913LAA85 / CATERP FIN S LTD | 0,83 | −0,12 | 0,0025 | −0,0021 | ||

| NAB / National Australia Bank Limited | 0,80 | 0,0024 | 0,0024 | |||

| NAB / National Australia Bank Limited | 0,80 | 0,0024 | 0,0024 | |||

| US13607HVE97 / Canadian Imperial Bank of Commerce | 0,78 | 0,0024 | 0,0024 | |||

| LAD AUTO RECEIVABLES TRUST LADAR 2025 1A A1 144A / ABS-O (US505712AA70) | 0,76 | −89,89 | 0,0023 | −0,0392 | ||

| LAD AUTO RECEIVABLES TRUST LADAR 2025 1A A1 144A / ABS-O (US505712AA70) | 0,76 | −89,89 | 0,0023 | −0,0392 | ||

| LAD AUTO RECEIVABLES TRUST LADAR 2025 1A A1 144A / ABS-O (US505712AA70) | 0,76 | −89,89 | 0,0023 | −0,0392 | ||

| US03027XAJ90 / American Tower Co Bond | 0,72 | 0,0022 | 0,0022 | |||

| US6944PL2G38 / PACIFIC LIFE GF II REGD V/R 144A P/P 0.00000000 | 0,70 | 0,00 | 0,0021 | −0,0018 | ||

| US404119BT57 / HCA Inc | 0,70 | 0,0021 | 0,0021 | |||

| US20600GU123 / Conagra Foods, Inc. | 0,70 | 0,0021 | 0,0021 | |||

| US928668AT93 / VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 11/25 4.625 | 0,70 | 0,14 | 0,0021 | −0,0018 | ||

| US26441CBJ36 / Duke Energy Corp. | 0,67 | 0,90 | 0,0020 | −0,0017 | ||

| BMW US CAPITAL LLC BMW US CAPITAL LLC / DBT (US05565ECN31) | 0,66 | 0,31 | 0,0020 | −0,0016 | ||

| BMW US CAPITAL LLC BMW US CAPITAL LLC / DBT (US05565ECN31) | 0,66 | 0,31 | 0,0020 | −0,0016 | ||

| BMW US CAPITAL LLC BMW US CAPITAL LLC / DBT (US05565ECN31) | 0,66 | 0,31 | 0,0020 | −0,0016 | ||

| BMW US CAPITAL LLC BMW US CAPITAL LLC / DBT (US05565ECN31) | 0,66 | 0,31 | 0,0020 | −0,0016 | ||

| US928668BL58 / VOLKSWAGEN GROUP AMER FIN LLC 1.25% 11/24/2025 144A | 0,63 | 0,96 | 0,0019 | −0,0016 | ||

| US25746UCE73 / Dominion Energy Inc | 0,63 | 0,0019 | 0,0019 | |||

| US05523UAP57 / BAE Systems Holdings, Inc. | 0,60 | 0,0018 | 0,0018 | |||

| US842400GN73 / Southern California Edison Co | 0,60 | 0,34 | 0,0018 | −0,0015 | ||

| US205887CB65 / Conagra Brands Inc | 0,58 | 0,00 | 0,0017 | −0,0014 | ||

| US406216BG59 / Halliburton Co Bond | 0,54 | 0,00 | 0,0016 | −0,0014 | ||

| US17325FBD96 / Citibank NA | 0,50 | 0,0015 | 0,0015 | |||

| US06428CAB00 / Bank of America NA | 0,50 | 0,0015 | 0,0015 | |||

| US713448FP87 / PepsiCo, Inc. | 0,50 | 0,00 | 0,0015 | −0,0013 | ||

| US3130AK6H44 / Federal Home Loan Banks | 0,50 | 0,0015 | 0,0015 | |||

| US3130AK6H44 / Federal Home Loan Banks | 0,50 | 0,0015 | 0,0015 | |||

| NAB / National Australia Bank Limited | 0,46 | 0,0014 | 0,0014 | |||

| NAB / National Australia Bank Limited | 0,46 | 0,0014 | 0,0014 | |||

| US89236TLA15 / TOYOTA MOTOR CREDIT CORP | 0,40 | 0,0012 | 0,0012 | |||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0,35 | 0,00 | 0,0011 | −0,0009 | ||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0,35 | 0,00 | 0,0011 | −0,0009 | ||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0,35 | 0,00 | 0,0011 | −0,0009 | ||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0,35 | 0,00 | 0,0011 | −0,0009 | ||

| US94988J6C62 / Wells Fargo Bank NA | 0,25 | 0,00 | 0,0008 | −0,0006 | ||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR REGS 11/25 1.25 / DBT (USU9273ADE20) | 0,25 | 0,82 | 0,0007 | −0,0006 | ||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR REGS 11/25 1.25 / DBT (USU9273ADE20) | 0,25 | 0,82 | 0,0007 | −0,0006 | ||

| US44891ACS42 / Hyundai Capital America | 0,20 | 0,0006 | 0,0006 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,18 | 0,0005 | 0,0005 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,18 | 0,0005 | 0,0005 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,18 | 0,0005 | 0,0005 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,16 | 0,0005 | 0,0005 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,16 | 0,0005 | 0,0005 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,16 | 0,0005 | 0,0005 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,16 | 0,0005 | 0,0005 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,16 | 0,0005 | 0,0005 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,13 | 0,0004 | 0,0004 | |||

| US46625HQW33 / JPMorgan Chase & Co. | 0,11 | 0,93 | 0,0003 | −0,0003 | ||

| US595017BA15 / CORP. NOTE | 0,10 | 0,00 | 0,0003 | −0,0003 | ||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 0,05 | 0,0002 | 0,0002 | |||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 0,05 | 0,0002 | 0,0002 | |||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 0,05 | 0,0002 | 0,0002 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,05 | 0,0001 | 0,0001 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0001 | 0,0001 | |||

| BOUGHT DKK SOLD USD 20250804 / DFE (000000000) | 0,02 | 0,0001 | 0,0001 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,02 | 0,0001 | 0,0001 | |||

| BOUGHT CAD SOLD USD 20250805 / DFE (000000000) | 0,02 | 0,0001 | 0,0001 | |||

| BOUGHT CAD SOLD USD 20250805 / DFE (000000000) | 0,02 | 0,0001 | 0,0001 | |||

| BOUGHT CAD SOLD USD 20250805 / DFE (000000000) | 0,02 | 0,0001 | 0,0001 | |||

| BOUGHT DKK SOLD USD 20250804 / DFE (000000000) | 0,02 | 0,0001 | 0,0001 | |||

| BOUGHT DKK SOLD USD 20250804 / DFE (000000000) | 0,02 | 0,0001 | 0,0001 | |||

| BOUGHT DKK SOLD USD 20250804 / DFE (000000000) | 0,02 | 0,0001 | 0,0001 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0001 | 0,0001 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0001 | 0,0001 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,01 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,01 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,01 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,01 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,01 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,01 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,01 | 0,0000 | 0,0000 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,01 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,01 | −0,0000 | −0,0000 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,01 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,01 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,01 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,01 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,01 | −0,0000 | −0,0000 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | −0,01 | −0,0000 | −0,0000 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | −0,01 | −0,0000 | −0,0000 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | −0,01 | −0,0000 | −0,0000 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | −0,01 | −0,0000 | −0,0000 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,01 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | −0,02 | −0,0001 | −0,0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,02 | −0,0001 | −0,0001 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | −0,02 | −0,0001 | −0,0001 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | −0,02 | −0,0001 | −0,0001 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | −0,02 | −0,0001 | −0,0001 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | −0,02 | −0,0001 | −0,0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,03 | −0,0001 | −0,0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,03 | −0,0001 | −0,0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,04 | −0,0001 | −0,0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,04 | −0,0001 | −0,0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,04 | −0,0001 | −0,0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,04 | −0,0001 | −0,0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,04 | −0,0001 | −0,0001 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | −0,05 | −0,0001 | −0,0001 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | −0,05 | −0,0001 | −0,0001 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | −0,05 | −0,0001 | −0,0001 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | −0,05 | −0,0001 | −0,0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,06 | −0,0002 | −0,0002 | |||

| SOLD CAD BOUGHT USD 20250711 / DFE (000000000) | −0,07 | −0,0002 | −0,0002 | |||

| SOLD CAD BOUGHT USD 20250711 / DFE (000000000) | −0,07 | −0,0002 | −0,0002 | |||

| SOLD CAD BOUGHT USD 20250711 / DFE (000000000) | −0,07 | −0,0002 | −0,0002 | |||

| SOLD CAD BOUGHT USD 20250711 / DFE (000000000) | −0,07 | −0,0002 | −0,0002 | |||

| SOLD CAD BOUGHT USD 20250805 / DFE (000000000) | −0,13 | −0,0004 | −0,0004 | |||

| SOLD CAD BOUGHT USD 20250805 / DFE (000000000) | −0,13 | −0,0004 | −0,0004 | |||

| SOLD CAD BOUGHT USD 20250805 / DFE (000000000) | −0,13 | −0,0004 | −0,0004 | |||

| TRS P SOFRRATE+9/91282CMP3 MYC / DCR (000000000) | −0,13 | −0,0004 | −0,0004 | |||

| TRS P SOFRRATE+9/91282CMP3 MYC / DCR (000000000) | −0,13 | −0,0004 | −0,0004 | |||

| TRS P SOFRRATE+9/91282CMP3 MYC / DCR (000000000) | −0,13 | −0,0004 | −0,0004 | |||

| TRS P SOFRRATE+9/91282CMH1 MYC / DCR (000000000) | −0,14 | −0,0004 | −0,0004 | |||

| TRS P SOFRRATE+9/91282CMH1 MYC / DCR (000000000) | −0,14 | −0,0004 | −0,0004 | |||

| TRS P SOFRRATE+9/91282CMH1 MYC / DCR (000000000) | −0,14 | −0,0004 | −0,0004 | |||

| TRS P SOFRRATE+8/9128286S4 MYC / DCR (000000000) | −0,16 | −0,0005 | −0,0005 | |||

| TRS P SOFRRATE+8/9128286S4 MYC / DCR (000000000) | −0,16 | −0,0005 | −0,0005 | |||

| TRS P SOFRRATE+8/91282CCF6 MYC / DCR (000000000) | −0,19 | −0,0006 | −0,0006 | |||

| TRS P SOFRRATE+8/91282CCF6 MYC / DCR (000000000) | −0,19 | −0,0006 | −0,0006 | |||

| TRS P SOFRRATE+8/91282CHM6 MYC / DCR (000000000) | −0,20 | −0,0006 | −0,0006 | |||

| TRS P SOFRRATE+8/91282CLY5 MYC / DCR (000000000) | −0,22 | −0,0007 | −0,0007 | |||

| TRS P SOFRRATE+8/91282CLY5 MYC / DCR (000000000) | −0,22 | −0,0007 | −0,0007 | |||

| TRS P SOFRRATE+8/91282CLY5 MYC / DCR (000000000) | −0,22 | −0,0007 | −0,0007 | |||

| TRS P SOFRRATE+8/91282CLY5 MYC / DCR (000000000) | −0,22 | −0,0007 | −0,0007 | |||

| TRS P SOFRRATE+9/91282CLY5 MYC / DCR (000000000) | −0,22 | −0,0007 | −0,0007 | |||

| TRS P SOFRRATE+9/91282CLY5 MYC / DCR (000000000) | −0,22 | −0,0007 | −0,0007 | |||

| TRS P SOFRRATE+9/91282CLY5 MYC / DCR (000000000) | −0,22 | −0,0007 | −0,0007 | |||

| TRS P SOFRRATE+9/91282CLY5 MYC / DCR (000000000) | −0,22 | −0,0007 | −0,0007 | |||

| TRS P SOFRRATE+9/91282CMH1 MYC / DCR (000000000) | −0,27 | −0,0008 | −0,0008 | |||

| TRS P SOFRRATE+9/91282CMH1 MYC / DCR (000000000) | −0,27 | −0,0008 | −0,0008 | |||

| TRS P SOFRRATE+9/91282CMH1 MYC / DCR (000000000) | −0,27 | −0,0008 | −0,0008 | |||

| TRS P SOFRRATE+9/91282CMH1 MYC / DCR (000000000) | −0,27 | −0,0008 | −0,0008 | |||

| TRS P SOFRRATE+9/91282CMH1 MYC / DCR (000000000) | −0,27 | −0,0008 | −0,0008 | |||

| TRS P SOFRRATE+8/91282CLB5 MYC / DCR (000000000) | −0,31 | −0,0009 | −0,0009 | |||

| TRS P SOFRRATE+8/91282CLH2 MYC / DCR (000000000) | −0,35 | −0,0011 | −0,0011 | |||

| TRS P SOFRRATE+8/91282CLP4 MYC / DCR (000000000) | −0,39 | −0,0012 | −0,0012 | |||

| TRS P SOFRRATE+8/91282CLP4 MYC / DCR (000000000) | −0,39 | −0,0012 | −0,0012 | |||

| TRS P SOFRRATE+8/91282CLP4 MYC / DCR (000000000) | −0,39 | −0,0012 | −0,0012 | |||

| TRS P SOFRRATE+8/91282CLP4 MYC / DCR (000000000) | −0,39 | −0,0012 | −0,0012 | |||

| TRS P SOFRRATE+9/91282CCZ2 MYC / DCR (000000000) | −0,64 | −0,0019 | −0,0019 | |||

| TRS P SOFRRATE+9/91282CCW9 MYC / DCR (000000000) | −0,88 | −0,0027 | −0,0027 | |||

| TRS P SOFRRATE+9/91282CCW9 MYC / DCR (000000000) | −0,88 | −0,0027 | −0,0027 | |||

| TRS P SOFRRATE+9/91282CCW9 MYC / DCR (000000000) | −0,88 | −0,0027 | −0,0027 | |||

| TRS P SOFRRATE+9/91282CCW9 MYC / DCR (000000000) | −0,88 | −0,0027 | −0,0027 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | −1,01 | −0,0031 | −0,0031 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | −1,01 | −0,0031 | −0,0031 | |||

| SOLD AUD BOUGHT USD 20250805 / DFE (000000000) | −1,18 | −0,0036 | −0,0036 | |||

| SOLD AUD BOUGHT USD 20250805 / DFE (000000000) | −1,18 | −0,0036 | −0,0036 | |||

| SOLD AUD BOUGHT USD 20250805 / DFE (000000000) | −1,18 | −0,0036 | −0,0036 | |||

| SOLD AUD BOUGHT USD 20250805 / DFE (000000000) | −1,18 | −0,0036 | −0,0036 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | −1,73 | −0,0053 | −0,0053 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | −1,73 | −0,0053 | −0,0053 | |||

| SOLD CAD BOUGHT USD 20250708 / DFE (000000000) | −2,13 | −0,0065 | −0,0065 | |||

| SOLD CAD BOUGHT USD 20250707 / DFE (000000000) | −2,16 | −0,0065 | −0,0065 | |||

| SOLD CAD BOUGHT USD 20250707 / DFE (000000000) | −2,16 | −0,0065 | −0,0065 | |||

| SOLD CAD BOUGHT USD 20250708 / DFE (000000000) | −2,38 | −0,0072 | −0,0072 | |||

| SOLD CAD BOUGHT USD 20250708 / DFE (000000000) | −2,38 | −0,0072 | −0,0072 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | −3,58 | −0,0109 | −0,0109 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | −3,58 | −0,0109 | −0,0109 | |||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | −3,83 | −0,0116 | −0,0116 | |||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | −3,83 | −0,0116 | −0,0116 | |||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | −3,83 | −0,0116 | −0,0116 |