Grundläggande statistik

| Portföljvärde | $ 3 469 975 108 |

| Aktuella positioner | 1 464 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

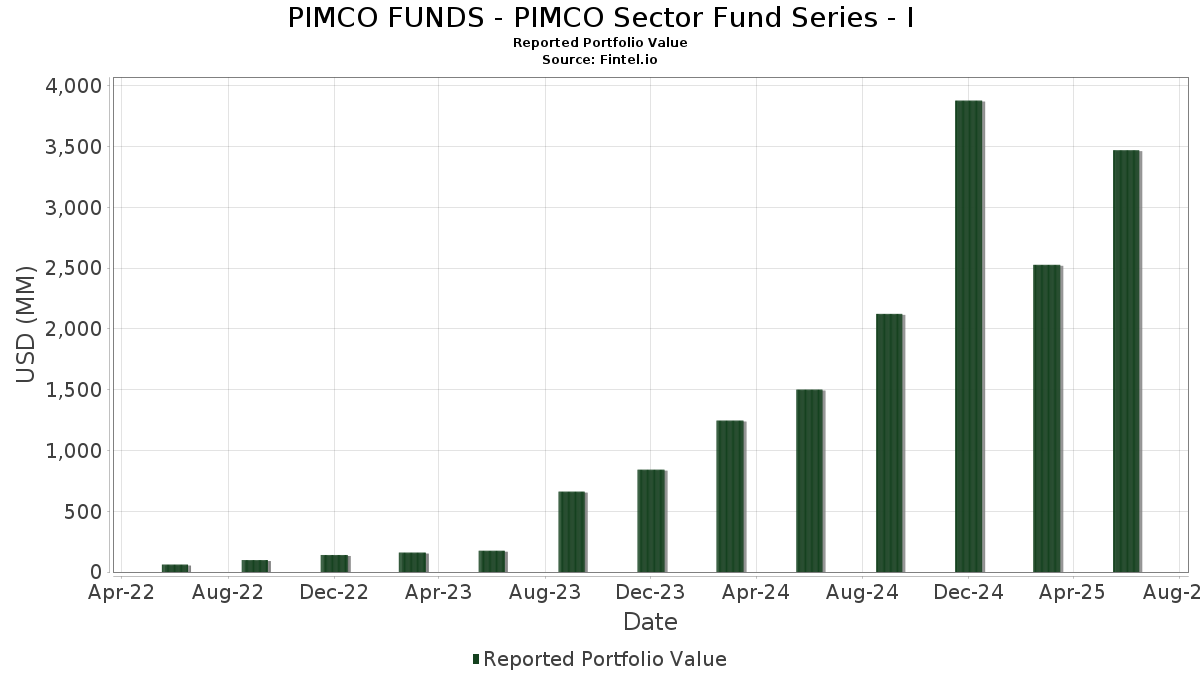

PIMCO FUNDS - PIMCO Sector Fund Series - I har redovisat 1 464 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 3 469 975 108 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). PIMCO FUNDS - PIMCO Sector Fund Series - Is största innehav är UMBS TBA (US:US01F0426811) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , UMBS TBA (US:US01F0406854) , United States Treasury Note/Bond (US:US91282CHN48) , and Edwards Lifesciences Corporation (US:EW) . PIMCO FUNDS - PIMCO Sector Fund Series - Is nya positioner inkluderar UMBS TBA (US:US01F0426811) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , UMBS TBA (US:US01F0406854) , United States Treasury Note/Bond (US:US91282CHN48) , and Edwards Lifesciences Corporation (US:EW) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 78,41 | 2,7277 | 2,7277 | ||

| 68,33 | 2,3771 | 2,3771 | ||

| 46,67 | 1,6237 | 1,6237 | ||

| 40,02 | 1,3923 | 1,2502 | ||

| 17,67 | 0,6147 | 1,1604 | ||

| 21,23 | 0,7387 | 0,7387 | ||

| 14,22 | 0,4948 | 0,4948 | ||

| 14,22 | 0,4946 | 0,3573 | ||

| 8,94 | 0,3110 | 0,3110 | ||

| 7,05 | 0,2454 | 0,2454 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 33,40 | 1,1620 | −1,4172 | ||

| −36,86 | −1,2824 | −1,2824 | ||

| −21,24 | −0,7389 | −0,7389 | ||

| 2,55 | 0,0887 | −0,5018 | ||

| −10,08 | −0,3508 | −0,3508 | ||

| −9,46 | −0,3292 | −0,3292 | ||

| −9,38 | −0,3264 | −0,3264 | ||

| −8,93 | −0,3105 | −0,3105 | ||

| −6,50 | −0,2261 | −0,2261 | ||

| 137,28 | 4,7759 | −0,1763 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-28 för rapporteringsperioden 2025-06-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US TREASURY N/B 09/29 3.5 / DBT (US91282CLN91) | 180,60 | 0,83 | 6,2830 | −0,0354 | |||||

| US TREASURY N/B 08/44 4.125 / DBT (US912810UD80) | 137,28 | −2,21 | 4,7759 | −0,1763 | |||||

| US TREASURY N/B 11/34 4.25 / DBT (US91282CLW90) | 116,62 | 0,05 | 4,0569 | −0,0547 | |||||

| US TREASURY N/B 12/29 4.375 / DBT (US91282CMD01) | 83,13 | 0,66 | 2,8920 | −0,0212 | |||||

| US01F0426811 / UMBS TBA | 78,41 | 2,7277 | 2,7277 | ||||||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 68,33 | 2,3771 | 2,3771 | ||||||

| US TREASURY N/B 08/54 4.25 / DBT (US912810UC08) | 52,62 | −3,25 | 1,8305 | −0,0879 | |||||

| US01F0406854 / UMBS TBA | 46,67 | 1,6237 | 1,6237 | ||||||

| US TREASURY N/B 02/35 4.625 / DBT (US91282CMM00) | 43,04 | −0,11 | 1,4971 | −0,0226 | |||||

| US TREASURY N/B 02/55 4.625 / DBT (US912810UG12) | 40,02 | 893,82 | 1,3923 | 1,2502 | |||||

| TSY INFL IX N/B 04/29 2.125 / DBT (US91282CKL45) | 35,15 | 0,72 | 1,2228 | −0,0081 | |||||

| US TREASURY N/B 08/34 3.875 / DBT (US91282CLF67) | 33,40 | −54,32 | 1,1620 | −1,4172 | |||||

| US TREASURY N/B 01/30 4.25 / DBT (US91282CMG32) | 25,50 | 0,69 | 0,8871 | −0,0062 | |||||

| US TREASURY N/B 05/35 4.25 / DBT (US91282CNC19) | 21,23 | 0,7387 | 0,7387 | ||||||

| TSY INFL IX N/B 01/34 1.75 / DBT (US91282CJY84) | 19,35 | 0,30 | 0,6733 | −0,0073 | |||||

| US91282CHN48 / United States Treasury Note/Bond | 18,00 | −20,67 | 0,6262 | −0,1742 | |||||

| EW / Edwards Lifesciences Corporation | 17,67 | −1 904,80 | 0,6147 | 1,1604 | |||||

| US TREASURY N/B 05/32 4.125 / DBT (US91282CNF40) | 14,22 | 0,4948 | 0,4948 | ||||||

| CITADEL FINANCE LLC COMPANY GUAR 144A 02/30 5.9 / DBT (US17287HAD26) | 14,22 | 1,35 | 0,4947 | −0,0002 | |||||

| CDX IG44 5Y ICE / DCR (EZPF6RHH0ZV8) | 14,22 | 265,19 | 0,4946 | 0,3573 | |||||

| US06051GLH01 / Bank of America Corp. | 13,37 | 1,53 | 0,4650 | 0,0006 | |||||

| US912810TU25 / United States Treasury Note/Bond | 12,71 | −2,19 | 0,4422 | −0,0162 | |||||

| US912810SD19 / United States Treas Bds Bond | 12,58 | −2,60 | 0,4376 | −0,0180 | |||||

| US TREASURY N/B 11/54 4.5 / DBT (US912810UE63) | 12,11 | −3,28 | 0,4212 | −0,0204 | |||||

| US TREASURY N/B 11/44 4.625 / DBT (US912810UF39) | 10,58 | −2,23 | 0,3679 | −0,0136 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 10,18 | 1,15 | 0,3543 | −0,0009 | |||||

| TPRY34 / Tapestry, Inc. - Depositary Receipt (Common Stock) | 10,14 | 1,58 | 0,3529 | 0,0006 | |||||

| US281020AM97 / Edison International | 9,66 | 0,38 | 0,3359 | −0,0034 | |||||

| UNITED AIR 2024 1 AA PTT PASS THRU CE 08/38 5.45 / DBT (US90932WAA18) | 9,64 | 0,14 | 0,3353 | −0,0042 | |||||

| US TREASURY N/B 05/45 5 / DBT (US912810UL07) | 8,94 | 0,3110 | 0,3110 | ||||||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 8,80 | 1,62 | 0,3060 | 0,0007 | |||||

| CROWN POINT CLO 7, LTD CRNPT 2018 7A AR 144A / ABS-CBDO (US22846MAJ27) | 8,65 | −32,08 | 0,3008 | −0,1483 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 8,58 | 1,11 | 0,2986 | −0,0008 | |||||

| US05964HAQ83 / Banco Santander SA | 8,55 | 0,43 | 0,2975 | −0,0029 | |||||

| HCA INC HCA INC / DBT (US404121AK12) | 8,27 | 1,75 | 0,2879 | 0,0010 | |||||

| MARS INC SR UNSECURED 144A 03/35 5.2 / DBT (US571676BA26) | 8,20 | 0,71 | 0,2853 | −0,0020 | |||||

| US06051GLG28 / Bank of America Corp | 7,92 | 0,58 | 0,2755 | −0,0022 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 7,86 | 1,22 | 0,2733 | −0,0005 | |||||

| GMZB / Ally Financial Inc. - Preferred Stock | 7,81 | 2,64 | 0,2718 | 0,0033 | |||||

| US46647PDX15 / JPMorgan Chase & Co | 7,78 | 0,39 | 0,2706 | −0,0027 | |||||

| S1MF34 / Sumitomo Mitsui Financial Group, Inc. - Depositary Receipt (Common Stock) | 7,77 | 0,78 | 0,2701 | −0,0016 | |||||

| US55903VBC63 / Warnermedia Holdings Inc | 7,63 | −4,40 | 0,2653 | −0,0161 | |||||

| MUFG / Mitsubishi UFJ Financial Group, Inc. - Depositary Receipt (Common Stock) | 7,61 | 0,50 | 0,2646 | −0,0023 | |||||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 7,17 | 0,42 | 0,2494 | −0,0024 | |||||

| ACA / Crédit Agricole S.A. | 7,16 | 1,33 | 0,2489 | −0,0002 | |||||

| SRG / Snam S.p.A. | 7,05 | 0,2454 | 0,2454 | ||||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 6,68 | 1,15 | 0,2324 | −0,0006 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 6,60 | 0,2298 | 0,2298 | ||||||

| CHEVRON PHILLIPS CHEM CO SR UNSECURED 144A 05/30 4.75 / DBT (US166754AX99) | 6,59 | 1,51 | 0,2292 | 0,0002 | |||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 6,58 | 0,2288 | 0,2288 | ||||||

| BANK OF AMERICA CORP JR SUBORDINA 12/99 VAR / EP (US06055HAH66) | 6,30 | 6,52 | 0,2268 | 0,2268 | |||||

| US29082HAA05 / Embraer Netherlands Finance BV | 6,50 | 235,94 | 0,2261 | 0,1578 | |||||

| US912810SC36 / United States Treas Bds Bond | 6,45 | −2,52 | 0,2244 | −0,0090 | |||||

| US404280DR76 / HSBC Holdings PLC | 6,37 | −0,06 | 0,2217 | −0,0033 | |||||

| BNP / BNP Paribas SA | 6,32 | 0,86 | 0,2199 | −0,0012 | |||||

| PHILLIPS 66 CO SR UNSECURED 03/35 4.95 / DBT (US718547AY80) | 6,21 | 0,75 | 0,2161 | −0,0014 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 6,21 | 2,04 | 0,2161 | 0,0014 | |||||

| VB DPR FINANCE COMPANY VAKIFBANK DPR 2025 E 4A2 SR SE / DBT (US009A9XTEG5) | 6,18 | −3,92 | 0,2149 | −0,0119 | |||||

| MUFG / Mitsubishi UFJ Financial Group, Inc. - Depositary Receipt (Common Stock) | 6,17 | 0,2147 | 0,2147 | ||||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 6,12 | 1,06 | 0,2130 | −0,0007 | |||||

| US95000U2S19 / Wells Fargo & Co | 6,07 | 0,98 | 0,2112 | −0,0009 | |||||

| STELLANTIS FIN US INC COMPANY GUAR 144A 03/35 6.45 / DBT (US85855CAL46) | 6,03 | 1,21 | 0,2098 | −0,0004 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 6,02 | 1,36 | 0,2094 | −0,0000 | |||||

| GIB.A / CGI Inc. | 5,96 | 0,98 | 0,2074 | −0,0008 | |||||

| EXTRA SPACE STORAGE LP COMPANY GUAR 06/35 5.4 / DBT (US30225VAU17) | 5,93 | 1,12 | 0,2064 | −0,0006 | |||||

| US95000U3F88 / Wells Fargo & Co. | 5,88 | 1,41 | 0,2047 | 0,0001 | |||||

| CHILE ELECTRICITY LUX GOVT GUARANT 144A 10/35 5.58 / DBT (US16882LAA08) | 5,87 | −2,15 | 0,2044 | −0,0074 | |||||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 5,85 | 0,2034 | 0,2034 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 5,60 | 0,00 | 5,78 | 0,73 | 0,2012 | −0,0013 | |||

| BGC / BGC Group, Inc. | 5,78 | 1,81 | 0,2011 | 0,0008 | |||||

| DAI ICHI LIFE INSURANCE SUBORDINATED 144A 12/99 VAR / DBT (US23381LAA26) | 5,77 | 0,58 | 0,2006 | −0,0016 | |||||

| US61747YFF79 / Morgan Stanley | 5,76 | 0,56 | 0,2004 | −0,0017 | |||||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 RPL2 A1A 144A / ABS-MBS (US161930AB85) | 5,74 | −1,86 | 0,1998 | −0,0066 | |||||

| US61747YFG52 / Morgan Stanley | 5,74 | 1,25 | 0,1996 | −0,0003 | |||||

| US745310AJ12 / PUGET ENERGY INC NEW 4.1% 06/15/2030 144A | 5,74 | 0,76 | 0,1996 | −0,0013 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 5,72 | 1,85 | 0,1991 | 0,0009 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 5,66 | 0,68 | 0,1970 | −0,0014 | |||||

| T MOBILE USA INC T MOBILE USA INC / DBT (US87264ADL61) | 5,62 | 1,13 | 0,1956 | −0,0005 | |||||

| US034863AW07 / Anglo American Capital PLC | 5,58 | 1,83 | 0,1941 | 0,0008 | |||||

| CAPITAL POWER US HOLDING COMPANY GUAR 144A 06/35 6.189 / DBT (US14041TAB44) | 5,58 | 0,1940 | 0,1940 | ||||||

| ATHENE GLOBAL FUNDING SECURED 144A 11/31 5.322 / DBT (US04685A4D06) | 5,55 | 0,74 | 0,1930 | −0,0012 | |||||

| D1TE34 / DTE Energy Company - Depositary Receipt (Common Stock) | 5,53 | 1,04 | 0,1923 | −0,0007 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 5,40 | 0,00 | 5,52 | 2,30 | 0,1920 | 0,0017 | |||

| FR00140063V5 / ELECTRICITE DE FRANCE RT SCRIP 12/31/49 | 5,50 | 0,20 | 0,1913 | −0,0023 | |||||

| US88732JBB35 / Time Warner Cable Inc. 5.50% 09/01/41 | 5,48 | 0,1908 | 0,1908 | ||||||

| STANFORD UNIVERSITY SR UNSECURED 03/35 4.679 / DBT (US85440KAE47) | 5,47 | 0,39 | 0,1903 | −0,0019 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 5,45 | 1,76 | 0,1895 | 0,0007 | |||||

| US912810SA79 / United States Treas Bds Bond | 5,43 | −2,52 | 0,1888 | −0,0076 | |||||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 5,41 | 0,1882 | 0,1882 | ||||||

| US912810TS78 / United States Treasury Note/Bond | 5,36 | −2,14 | 0,1865 | −0,0067 | |||||

| BNP / BNP Paribas SA | 5,25 | 2,06 | 0,1826 | 0,0012 | |||||

| GLP CAPITAL LP / FIN II GLP CAPITAL LP / FIN II / DBT (US361841AT63) | 5,23 | 1,32 | 0,1821 | −0,0002 | |||||

| SAN DIEGO G + E 1ST MORTGAGE 04/35 5.4 / DBT (US797440CG74) | 5,21 | 1,36 | 0,1812 | −0,0001 | |||||

| A1ES34 / The AES Corporation - Depositary Receipt (Common Stock) | 5,18 | 0,48 | 0,1802 | −0,0016 | |||||

| X1EL34 / Xcel Energy Inc. - Depositary Receipt (Common Stock) | 5,11 | 1,65 | 0,1777 | 0,0005 | |||||

| US912810TW80 / United States Treasury Note/Bond | 5,10 | −2,21 | 0,1773 | −0,0066 | |||||

| US126650DT42 / CVS Health Corp | 5,09 | 1,13 | 0,1771 | −0,0004 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 5,08 | 1,58 | 0,1767 | 0,0003 | |||||

| US37046US851 / General Motors Financial Co Inc | 5,04 | 0,66 | 0,1753 | −0,0013 | |||||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 5,01 | 0,00 | 0,1744 | −0,0024 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 5,01 | 0,99 | 0,1743 | −0,0007 | |||||

| US097023CY98 / BOEING CO 5.15 5/30 | 4,99 | 1,16 | 0,1736 | −0,0004 | |||||

| A5G / AIB Group plc | 4,99 | 0,1735 | 0,1735 | ||||||

| HARBOUR ENERGY PLC SR UNSECURED 144A 04/35 6.327 / DBT (US411618AD32) | 4,98 | −0,12 | 0,1731 | −0,0026 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 4,96 | 1,20 | 0,1726 | −0,0003 | |||||

| 4020 / Saudi Real Estate Company | 4,93 | 9,92 | 0,1716 | 0,0133 | |||||

| US114259AX24 / Brooklyn Union Gas Co/The | 4,90 | 0,99 | 0,1706 | −0,0007 | |||||

| MORGAN STANLEY BANK NA SR UNSECURED 01/29 VAR / DBT (US61690DK726) | 4,88 | 0,35 | 0,1696 | −0,0018 | |||||

| US172967MP39 / CITIGROUP INC SR UNSECURED 03/31 VAR | 4,85 | 1,53 | 0,1687 | 0,0002 | |||||

| US15135BAY74 / Centene Corp | 4,83 | 82,48 | 0,1681 | 0,0747 | |||||

| GRUMA B / Gruma, S.A.B. de C.V. | 4,83 | 0,65 | 0,1681 | −0,0012 | |||||

| SAFEHOLD GL HOLDINGS LLC COMPANY GUAR 01/35 5.65 / DBT (US785931AB23) | 4,80 | 0,36 | 0,1669 | −0,0017 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 4,73 | 0,92 | 0,1645 | −0,0008 | |||||

| US87264ADC62 / T-Mobile USA, Inc. | 4,71 | 0,53 | 0,1640 | −0,0014 | |||||

| LYB INT FINANCE III COMPANY GUAR 05/35 6.15 / DBT (US50249AAP84) | 4,67 | 0,1626 | 0,1626 | ||||||

| MARICOPA CNTY AZ INDL DEV AUTH MAREDU 10/29 FIXED 7.375 / DBT (US56681NJD03) | 4,66 | 0,34 | 0,1622 | −0,0017 | |||||

| US00130HCC79 / AES CORP 3.95% 07/15/2030 144A | 4,66 | 1,39 | 0,1622 | −0,0000 | |||||

| US00206RKG64 / AT&T Inc | 4,60 | 1,41 | 0,1600 | 0,0000 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 4,60 | 0,97 | 0,1599 | −0,0007 | |||||

| US803014AB57 / Santos Finance Ltd | 4,59 | 1,91 | 0,1596 | 0,0008 | |||||

| GOODMAN US FINANCE SIX COMPANY GUAR 144A 10/34 5.125 / DBT (US38239EAC66) | 4,59 | 0,77 | 0,1596 | −0,0010 | |||||

| US29273RAJ86 / Energy Transfer Partners 7.5% Senior Notes 7/1/38 | 4,58 | 0,42 | 0,1594 | −0,0016 | |||||

| US07274EAK91 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.375% 11-21-30 | 4,57 | 1,49 | 0,1590 | 0,0001 | |||||

| D1VN34 / Devon Energy Corporation - Depositary Receipt (Common Stock) | 4,57 | 0,71 | 0,1589 | −0,0011 | |||||

| US674599EF81 / Occidental Petroleum Corp | 4,56 | 0,71 | 0,1586 | −0,0011 | |||||

| US69047QAC69 / Ovintiv Inc | 4,55 | −0,02 | 0,1581 | −0,0023 | |||||

| US95000U3E14 / Wells Fargo & Co. | 4,54 | 0,51 | 0,1581 | −0,0014 | |||||

| US88731EAJ91 / Time Warner Entmt Co Lp Srsubdb 8.375% 07/15/33 | 4,54 | 2,02 | 0,1581 | 0,0010 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 4,53 | 0,1575 | 0,1575 | ||||||

| PACIFIC LIFE GF II SECURED 144A 08/29 4.5 / DBT (US6944PL3C15) | 4,53 | 0,85 | 0,1574 | −0,0009 | |||||

| SIXTH STREET LENDING PAR SR UNSECURED 01/30 5.75 / DBT (US829932AD42) | 4,51 | 1,23 | 0,1570 | −0,0003 | |||||

| SYY / Sysco Corporation - Depositary Receipt (Common Stock) | 4,48 | 1,02 | 0,1558 | −0,0006 | |||||

| HOLCIM FINANCE US LLC COMPANY GUAR 144A 04/28 4.7 / DBT (US43475RAB24) | 4,44 | 0,1545 | 0,1545 | ||||||

| ASHTEAD CAPITAL INC ASHTEAD CAPITAL INC / DBT (US045054AS24) | 4,40 | 1,76 | 0,1532 | 0,0005 | |||||

| HYUNDAI CAPITAL AMERICA SR UNSECURED 144A 03/27 VAR / DBT (US44891ACZ84) | 4,40 | −0,18 | 0,1529 | −0,0024 | |||||

| US49427RAR30 / KILROY REALTY 2.65 11/33 | 4,36 | 0,97 | 0,1518 | −0,0006 | |||||

| AVIATION CAPITAL GROUP SR UNSECURED 144A 04/30 5.125 / DBT (US05369AAS06) | 4,34 | 1,50 | 0,1511 | 0,0002 | |||||

| US251526CS67 / Deutsche Bank AG/New York NY | 4,34 | 0,35 | 0,1510 | −0,0016 | |||||

| US853254CW88 / STANDARD CHARTERED PLC REGD 144A P/P 6.75000000 | 4,34 | −0,14 | 0,1509 | −0,0023 | |||||

| EQUINIX EU 2 FINANCING C COMPANY GUAR 03/31 3.25 / DBT (XS2941363553) | 4,32 | 9,95 | 0,1503 | 0,0117 | |||||

| N1TA34 / NetApp, Inc. - Depositary Receipt (Common Stock) | 4,31 | 2,84 | 0,1501 | 0,0021 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 4,29 | 7,78 | 0,1494 | 0,0089 | |||||

| US46647PBE51 / JPMorgan Chase & Co | 4,29 | 1,61 | 0,1492 | 0,0003 | |||||

| US00774MAV72 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 4,29 | 0,85 | 0,1492 | −0,0008 | |||||

| MERCEDES BENZ FIN NA COMPANY GUAR 144A 11/27 4.9 / DBT (US58769JAZ03) | 4,25 | 0,66 | 0,1478 | −0,0011 | |||||

| CNQ / Canadian Natural Resources Limited | 4,24 | 0,95 | 0,1475 | −0,0006 | |||||

| US46647PDR47 / JPMorgan Chase & Co | 4,22 | 1,22 | 0,1468 | −0,0002 | |||||

| SNX / TD SYNNEX Corporation | 4,21 | 2,33 | 0,1465 | 0,0013 | |||||

| US161175CC60 / CHARTER COMMUNICATIONS OPERATING LLC / CHARTER COMMUNICATIONS OPERATING CAPITAL 4.4% 12/01/2061 | 4,21 | 5,59 | 0,1465 | 0,0058 | |||||

| US26884UAF66 / EPR Properties | 4,19 | 1,55 | 0,1458 | 0,0002 | |||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 4,18 | 0,1453 | 0,1453 | ||||||

| US06675FBB22 / Banque Federative du Credit Mutuel SA | 4,15 | 0,48 | 0,1445 | −0,0013 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 4,15 | 9,70 | 0,1444 | 0,0109 | |||||

| US06051GGR48 / Bank Of America C Var 28 Bond | 4,14 | 0,63 | 0,1439 | −0,0011 | |||||

| BACARDI MARTINI BV SR UNSECURED 144A 02/35 6 / DBT (US05634WAB81) | 4,13 | 2,35 | 0,1438 | 0,0013 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 4,10 | 0,00 | 4,13 | 1,95 | 0,1437 | 0,0008 | |||

| FCNCO / First Citizens BancShares, Inc. - Preferred Stock | 4,12 | 0,41 | 0,1434 | −0,0014 | |||||

| PKN / Orlen S.A. | 4,11 | 0,07 | 0,1430 | −0,0019 | |||||

| US25731VAA26 / DOMINION ENERGY SOUTH CAROLINA INC | 4,09 | 1,09 | 0,1424 | −0,0004 | |||||

| AU3FN0029609 / AAI Ltd | 4,07 | 0,1417 | 0,1417 | ||||||

| SYSTEM ENERGY RESOURCES 1ST REF MORT 12/34 5.3 / DBT (US871911AV54) | 4,05 | −0,02 | 0,1410 | −0,0020 | |||||

| REPUBLIC OF PANAMA SR UNSECURED 03/31 7.5 / DBT (US698299BX19) | 4,05 | 2,95 | 0,1410 | 0,0022 | |||||

| US46647PDG81 / JPMorgan Chase & Co. | 4,04 | 0,40 | 0,1406 | −0,0014 | |||||

| AS MILEAGE PLAN IP LTD SR SECURED 144A 10/31 5.308 / DBT (US00218QAB68) | 4,04 | 0,65 | 0,1404 | −0,0011 | |||||

| US47216QAC78 / JDE PEETS BV 2.25% 09/24/2031 144A | 4,01 | 1,75 | 0,1395 | 0,0005 | |||||

| XS2675884733 / Volkswagen International Finance NV | 4,00 | 10,52 | 0,1393 | 0,0115 | |||||

| US19075Q6070 / COBANK ACB | 3,90 | 0,00 | 4,00 | 0,76 | 0,1391 | −0,0009 | |||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 3,99 | 0,03 | 0,1387 | −0,0019 | |||||

| US86563VBG32 / Sumitomo Mitsui Trust Bank Ltd | 3,98 | 0,56 | 0,1386 | −0,0012 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 3,97 | 10,45 | 0,1382 | 0,0114 | |||||

| US46647PDA12 / JPMorgan Chase & Co. | 3,97 | 42,90 | 0,1380 | 0,0401 | |||||

| AS MILEAGE PLAN IP LTD SR SECURED 144A 10/29 5.021 / DBT (US00218QAA85) | 3,96 | 1,05 | 0,1378 | −0,0005 | |||||

| HOST HOTELS + RESORTS LP SR UNSECURED 06/32 5.7 / DBT (US44107TBD72) | 3,96 | 0,1377 | 0,1377 | ||||||

| YALE UNIVERSITY SR UNSECURED 04/32 4.701 / DBT (US98459LAD55) | 3,96 | 0,1377 | 0,1377 | ||||||

| BCSF / Bain Capital Specialty Finance, Inc. | 3,96 | 0,61 | 0,1376 | −0,0011 | |||||

| MU / Micron Technology, Inc. - Depositary Receipt (Common Stock) | 3,93 | 1,00 | 0,1368 | −0,0005 | |||||

| US46647PDY97 / JPMorgan Chase & Co | 3,91 | 1,22 | 0,1362 | −0,0003 | |||||

| FLORIDA GAS TRANSMISSION SR UNSECURED 144A 07/35 5.75 / DBT (US340711BC39) | 3,89 | 0,1353 | 0,1353 | ||||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 3,87 | −1,10 | 0,1348 | −0,0034 | |||||

| Z1BH34 / Zimmer Biomet Holdings, Inc. - Depositary Receipt (Common Stock) | 3,87 | 9,81 | 0,1347 | 0,0103 | |||||

| V1MC34 / Vulcan Materials Company - Depositary Receipt (Common Stock) | 3,83 | 1,08 | 0,1331 | −0,0004 | |||||

| HCA INC COMPANY GUAR 04/31 5.45 / DBT (US404119CT49) | 3,82 | 1,52 | 0,1328 | 0,0002 | |||||

| LGENERGYSOLUTION SR UNSECURED 144A 04/35 5.875 / DBT (US50205MAJ80) | 3,79 | −0,63 | 0,1318 | −0,0027 | |||||

| US92212WAE03 / VAR ENERGI ASA | 3,77 | 0,69 | 0,1313 | −0,0009 | |||||

| CITADEL LP SR UNSECURED 144A 01/32 6.375 / DBT (US17288XAC83) | 3,76 | 1,79 | 0,1308 | 0,0005 | |||||

| US097023CV59 / BOEING CO 5.705% 05/01/2040 | 3,76 | 1,62 | 0,1307 | 0,0003 | |||||

| SBL HOLDINGS INC SR UNSECURED 144A 10/34 7.2 / DBT (US78397DAD03) | 3,73 | 1,39 | 0,1298 | −0,0000 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 3,72 | 0,11 | 0,1295 | −0,0017 | |||||

| NYSEG STORM FUNDING LLC SR SECURED 05/29 4.713 / DBT (US67122QAA22) | 3,72 | 0,27 | 0,1295 | −0,0015 | |||||

| US406216BK61 / Halliburton Co | 3,72 | 0,1294 | 0,1294 | ||||||

| ANTARES HOLDINGS SR UNSECURED 144A 02/29 6.5 / DBT (US03666HAG65) | 3,70 | 53,23 | 0,1287 | 0,0435 | |||||

| D1RI34 / Darden Restaurants, Inc. - Depositary Receipt (Common Stock) | 3,69 | 0,96 | 0,1284 | −0,0006 | |||||

| US29717PAQ00 / Essex Portfolio LP | 3,66 | 1,27 | 0,1272 | −0,0002 | |||||

| US418751AL75 / HAT HOLDINGS I LLC/HAT REGD 144A P/P 8.00000000 | 3,65 | 0,63 | 0,1270 | −0,0010 | |||||

| US682680BN20 / ONEOK Inc | 3,64 | −0,66 | 0,1266 | −0,0026 | |||||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 3,64 | 0,36 | 0,1266 | −0,0013 | |||||

| COLUMBIA PIPELINES OPCO SR UNSECURED 144A 02/35 5.439 / DBT (US19828TAG13) | 3,62 | 1,74 | 0,1260 | 0,0004 | |||||

| US49456BAX91 / Kinder Morgan, Inc. | 3,62 | 1,37 | 0,1259 | −0,0000 | |||||

| E1IX34 / Edison International - Depositary Receipt (Common Stock) | 3,61 | −8,73 | 0,1255 | −0,0139 | |||||

| XS2291692890 / Chile Government International Bond | 3,60 | 11,23 | 0,1254 | 0,0111 | |||||

| CARLYLE GLOBAL MARKET STRATEGI CGMS 2016 3A ARRR / ABS-CBDO (US14311UBA51) | 3,60 | 0,47 | 0,1254 | −0,0011 | |||||

| BNH / Brookfield Finance Inc. - Corporate Bond/Note | 3,59 | 0,1250 | 0,1250 | ||||||

| TRUST FIBRAUNO SR UNSECURED 144A 01/37 8.25 / DBT (US89834JAC71) | 3,59 | 3,01 | 0,1248 | 0,0020 | |||||

| CONSTELLATION PHARMACEUTICAL 4 / DBT (948VXEII3) | 3,59 | −0,53 | 0,1248 | −0,0024 | |||||

| US12803RAB06 / CaixaBank SA | 3,59 | −0,39 | 0,1247 | −0,0022 | |||||

| WHISTLER PIPELINE LLC WHISTLER PIPELINE LLC / DBT (US96337RAB87) | 3,57 | 0,79 | 0,1242 | −0,0008 | |||||

| US78574MAA18 / Sabra Health Care LP | 3,57 | 0,1241 | 0,1241 | ||||||

| DGZ / DB Gold Short ETN | 3,56 | 0,65 | 0,1239 | −0,0009 | |||||

| IMB / Imperial Brands PLC | 3,56 | 0,94 | 0,1238 | −0,0006 | |||||

| COX COMMUNICATIONS INC COX COMMUNICATIONS INC / DBT (US224044CU97) | 3,55 | 0,94 | 0,1236 | −0,0005 | |||||

| MARS INC SR UNSECURED 144A 03/30 4.8 / DBT (US571676AY11) | 3,55 | 0,77 | 0,1234 | −0,0008 | |||||

| BANK OF AMERICA CORP BANK OF AMERICA CORP / DBT (US06051GMA49) | 3,55 | 1,26 | 0,1233 | −0,0002 | |||||

| LPL HOLDINGS INC COMPANY GUAR 06/30 5.15 / DBT (US50212YAP97) | 3,54 | 0,1233 | 0,1233 | ||||||

| BMW US CAPITAL LLC COMPANY GUAR 144A 03/28 4.75 / DBT (US05565ECW30) | 3,54 | 0,94 | 0,1232 | −0,0006 | |||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 3,53 | −0,03 | 0,1228 | −0,0018 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 3,52 | 1,03 | 0,1226 | −0,0005 | |||||

| COUSINS PROPERTIES LP COMPANY GUAR 02/32 5.375 / DBT (US222793AB73) | 3,52 | 1,50 | 0,1226 | 0,0001 | |||||

| US912810RN00 / United States Treas Bds Bond | 3,52 | −2,39 | 0,1223 | −0,0047 | |||||

| US833636AN33 / Sociedad Quimica y Minera de Chile SA | 3,51 | 0,40 | 0,1220 | −0,0012 | |||||

| AU3FN0029609 / AAI Ltd | 3,47 | 1,55 | 0,1206 | 0,0002 | |||||

| ENEL FINANCE INTL NV ENEL FINANCE INTL NV / DBT (US29278GBD97) | 3,46 | 0,79 | 0,1205 | −0,0007 | |||||

| 2914 / Japan Tobacco Inc. | 3,45 | 0,1201 | 0,1201 | ||||||

| US07274NAN30 / Bayer US Finance II LLC | 3,45 | 2,46 | 0,1201 | 0,0012 | |||||

| PUBLIC SERVICE COLORADO 1ST MORTGAGE 05/34 5.35 / DBT (US744448CZ26) | 3,45 | 0,91 | 0,1200 | −0,0006 | |||||

| US37046US851 / General Motors Financial Co Inc | 3,45 | 0,1200 | 0,1200 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 3,43 | 0,68 | 0,1192 | −0,0009 | |||||

| USAA CAPITAL CORP SR UNSECURED 144A 06/28 4.375 / DBT (US90327QDA40) | 3,42 | 0,1191 | 0,1191 | ||||||

| US09261HAC16 / Blackstone Private Credit Fund | 3,42 | 1,42 | 0,1190 | 0,0000 | |||||

| CDX ITRAXX XOV42 5Y 35-100% SP JPM / DCR (EZ2BLZ4YH9B3) | 3,42 | 0,1189 | 0,1189 | ||||||

| HPS CORPORATE LENDING FU SR UNSECURED 144A 06/27 5.3 / DBT (US40440VAL99) | 3,41 | 0,1185 | 0,1185 | ||||||

| US06738ECE32 / Barclays PLC | 3,41 | 1,67 | 0,1185 | 0,0003 | |||||

| F+G ANNUITIES + LIFE INC F+G ANNUITIES + LIFE INC / DBT (US30190AAF12) | 3,40 | 1,28 | 0,1184 | −0,0001 | |||||

| US501889AD16 / LKQ Corp | 3,40 | 0,80 | 0,1183 | −0,0007 | |||||

| US694308KL02 / Pacific Gas and Electric Co | 3,38 | 0,27 | 0,1177 | −0,0013 | |||||

| US38141GYB49 / Goldman Sachs Group Inc/The | 3,37 | 1,78 | 0,1173 | 0,0005 | |||||

| PLAINS ALL AMER PIPELINE PLAINS ALL AMER PIPELINE / DBT (US72650RBP64) | 3,37 | 0,96 | 0,1171 | −0,0005 | |||||

| WEIR GROUP INC COMPANY GUAR 144A 05/30 5.35 / DBT (US94877DAA28) | 3,35 | 0,1164 | 0,1164 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 3,33 | 0,06 | 0,1157 | −0,0016 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 3,32 | 2,50 | 0,1154 | 0,0013 | |||||

| INWI / Inwido AB (publ) | 3,30 | 1,44 | 0,1149 | 0,0001 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 3,20 | 0,00 | 3,30 | 0,79 | 0,1149 | −0,0007 | |||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 3,30 | 1,10 | 0,1148 | −0,0004 | |||||

| STAB / Standard Chartered PLC - Preferred Security | 3,29 | 2,02 | 0,1145 | 0,0007 | |||||

| VLTO / Veralto Corporation | 3,29 | −0,03 | 0,1144 | −0,0016 | |||||

| H / Hyatt Hotels Corporation | 3,29 | 0,1143 | 0,1143 | ||||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 3,28 | −37,78 | 0,1141 | −0,0718 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 3,27 | 1,21 | 0,1137 | −0,0002 | |||||

| MSD INVESTMENT CORP SR UNSECURED 144A 05/30 6.25 / DBT (US55354LAA70) | 3,27 | −0,06 | 0,1136 | −0,0016 | |||||

| US15135BAZ40 / SENIOR UNSECURED GLOBAL NOTES | 3,26 | 1,94 | 0,1134 | 0,0006 | |||||

| GLENCORE FUNDING LLC GLENCORE FUNDING LLC / DBT (US378272BR82) | 3,25 | 0,12 | 0,1129 | −0,0014 | |||||

| AEP TRANSMISSION CO LLC AEP TRANSMISSION CO LLC / DBT (US00115AAR05) | 3,24 | 1,31 | 0,1128 | −0,0001 | |||||

| F2RT34 / First Industrial Realty Trust, Inc. - Depositary Receipt (Common Stock) | 3,24 | 0,1127 | 0,1127 | ||||||

| ARCOS DORADOS BV COMPANY GUAR 144A 01/32 6.375 / DBT (US03965TAC71) | 3,23 | 1,73 | 0,1123 | 0,0004 | |||||

| US37046US851 / General Motors Financial Co Inc | 3,22 | 1,48 | 0,1120 | 0,0001 | |||||

| US161175CP73 / CHARTER COMMUNICATIONS OPERATING LLC SR SEC 1ST LIEN 6.65% 02-01-34 | 3,21 | 3,28 | 0,1118 | 0,0021 | |||||

| PROTECTIVE LIFE GLOBAL SECURED 144A 01/32 5.432 / DBT (US74368CCB81) | 3,20 | 0,63 | 0,1115 | −0,0008 | |||||

| US29670VAA70 / Essential Properties LP | 3,20 | 2,53 | 0,1114 | 0,0013 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 3,20 | 0,00 | 3,20 | 2,17 | 0,1113 | 0,0009 | |||

| PHILLIPS EDISON GROCERY PHILLIPS EDISON GROCERY / DBT (US71845JAC27) | 3,20 | 1,98 | 0,1112 | 0,0006 | |||||

| BBVA BANCOMER SA TEXAS SUBORDINATED 144A 02/35 VAR / DBT (US072912AA61) | 3,19 | 1,69 | 0,1110 | 0,0003 | |||||

| US361841AK54 / GLP Capital LP / GLP Financing II Inc | 3,18 | 0,70 | 0,1106 | −0,0008 | |||||

| RIO TINTO FIN USA PLC COMPANY GUAR 03/35 5.25 / DBT (US76720AAU07) | 3,16 | 0,99 | 0,1098 | −0,0004 | |||||

| CASSA DEPOSITI E PRESTIT SR UNSECURED 144A 04/29 5.875 / DBT (US147918AC06) | 3,14 | 0,71 | 0,1092 | −0,0008 | |||||

| US257375AJ44 / Dominion Energy Gas Holdings LLC | 3,12 | 0,84 | 0,1087 | −0,0006 | |||||

| GOLDMAN SACHS BANK USA GOLDMAN SACHS BANK USA / DBT (US38151LAH33) | 3,11 | −0,03 | 0,1082 | −0,0015 | |||||

| GOLDMAN SACHS BANK USA SR UNSECURED 03/27 VAR / DBT (US38151LAE02) | 3,11 | 0,06 | 0,1081 | −0,0014 | |||||

| W1MB34 / The Williams Companies, Inc. - Depositary Receipt (Common Stock) | 3,10 | 0,1080 | 0,1080 | ||||||

| AERCAP IRELAND CAP/GLOBA COMPANY GUAR 04/27 6.45 / DBT (US00774MBG96) | 3,10 | 0,03 | 0,1078 | −0,0015 | |||||

| SIXTH STREET LENDING PAR SR UNSECURED 03/29 6.5 / DBT (US829932AB85) | 3,10 | 0,98 | 0,1078 | −0,0004 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 3,09 | 1,11 | 0,1075 | −0,0003 | |||||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 3,09 | 0,1073 | 0,1073 | ||||||

| ATLASSIAN CORPORATION SR UNSECURED 05/29 5.25 / DBT (US049468AA91) | 3,08 | 0,85 | 0,1072 | −0,0006 | |||||

| AZOI34 / AutoZone, Inc. - Depositary Receipt (Common Stock) | 3,08 | 0,1070 | 0,1070 | ||||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 3,07 | 1,39 | 0,1067 | 0,0000 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 3,07 | 1,66 | 0,1067 | 0,0003 | |||||

| D1HI34 / D.R. Horton, Inc. - Depositary Receipt (Common Stock) | 3,07 | 1,46 | 0,1067 | 0,0001 | |||||

| AVIATION CAPITAL GROUP AVIATION CAPITAL GROUP / DBT (US05369AAQ40) | 3,06 | 1,02 | 0,1063 | −0,0004 | |||||

| BMW US CAPITAL LLC COMPANY GUAR 144A 03/30 5.05 / DBT (US05565ECY95) | 3,06 | 1,33 | 0,1063 | −0,0001 | |||||

| US797440BH66 / San Diego Gas & Electric 6% 1st Mtg 6/1/26 | 3,06 | −0,16 | 0,1063 | −0,0016 | |||||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 3,04 | 0,80 | 0,1058 | −0,0006 | |||||

| US49803XAA19 / Kite Realty Group, L.P. | 3,03 | 0,1053 | 0,1053 | ||||||

| MARVELL TECHNOLOGY INC SR UNSECURED 07/35 5.45 / DBT (US573874AS31) | 3,02 | 0,1051 | 0,1051 | ||||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 3,02 | 0,80 | 0,1050 | −0,0006 | |||||

| DUKE ENERGY PROGRESS LLC 1ST MORTGAGE 03/35 5.05 / DBT (US26442UAU88) | 3,01 | 0,90 | 0,1049 | −0,0005 | |||||

| HYUNDAI CAPITAL AMERICA SR UNSECURED 144A 03/27 4.85 / DBT (US44891ADP93) | 3,01 | 0,47 | 0,1049 | −0,0010 | |||||

| US55336V3087 / MPLX LP | 3,01 | 0,77 | 0,1048 | −0,0006 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 3,01 | 1,07 | 0,1048 | −0,0003 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 3,01 | 1,01 | 0,1047 | −0,0004 | |||||

| US30225VAK35 / Extra Space Storage LP | 3,01 | 1,18 | 0,1047 | −0,0002 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 3,00 | 0,1044 | 0,1044 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 3,00 | 0,1044 | 0,1044 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 3,00 | 0,1044 | 0,1044 | ||||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 2,99 | 1,01 | 0,1041 | −0,0004 | |||||

| SWEPCO STORM RECOVERY FU SR SECURED 09/41 4.88 / DBT (US870696AA94) | 2,98 | −0,47 | 0,1038 | −0,0020 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 2,98 | 1,26 | 0,1037 | −0,0002 | |||||

| US00973RAD52 / Aker BP ASA | 2,98 | 0,64 | 0,1036 | −0,0008 | |||||

| AMEREN MISSOURI SEC FU I SR SECURED 10/41 4.85 / DBT (US023940AA78) | 2,98 | −0,37 | 0,1036 | −0,0018 | |||||

| F+G ANNUITIES + LIFE INC COMPANY GUAR 10/34 6.25 / DBT (US30190AAG94) | 2,97 | 2,20 | 0,1034 | 0,0008 | |||||

| US92840VAQ59 / Vistra Operations Co. LLC | 2,97 | 2,24 | 0,1032 | 0,0008 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 2,95 | −1,44 | 0,1025 | −0,0029 | |||||

| MERCEDES BENZ FIN NA COMPANY GUAR 144A 04/30 5 / DBT (US58769JBG13) | 2,94 | 1,62 | 0,1024 | 0,0002 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 2,94 | 0,75 | 0,1023 | −0,0007 | |||||

| 30064K105 / Exacttarget, Inc. | 2,94 | 1,31 | 0,1022 | −0,0001 | |||||

| US361841AP42 / GLP Capital LP / GLP Financing II Inc | 2,93 | 1,66 | 0,1020 | 0,0003 | |||||

| MU / Micron Technology, Inc. - Depositary Receipt (Common Stock) | 2,93 | 0,1020 | 0,1020 | ||||||

| US845467AT68 / Southwestern Energy Co | 2,92 | 2,78 | 0,1016 | 0,0014 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 2,91 | −0,31 | 0,1014 | −0,0017 | |||||

| US87264ABF12 / CORP. NOTE | 2,91 | 1,32 | 0,1014 | −0,0001 | |||||

| XS2262961076 / ZF Finance GmbH | 2,91 | −0,58 | 0,1014 | −0,0020 | |||||

| US86563VBG32 / Sumitomo Mitsui Trust Bank Ltd | 2,91 | 0,90 | 0,1013 | −0,0005 | |||||

| KILROY REALTY LP COMPANY GUAR 01/36 6.25 / DBT (US49427RAS13) | 2,89 | 0,56 | 0,1006 | −0,0008 | |||||

| US92564RAL96 / VICI Properties LP / VICI Note Co., Inc. | 2,89 | 1,23 | 0,1005 | −0,0002 | |||||

| PTPP / PT PP (Persero) Tbk | 2,89 | 12,74 | 0,1004 | 0,0101 | |||||

| US031162DJ62 / Amgen Inc | 2,88 | 1,23 | 0,1002 | −0,0001 | |||||

| NIAGARA ENERGY SAC SR UNSECURED 144A 10/34 5.746 / DBT (US65345YAA01) | 2,87 | 0,14 | 0,1000 | −0,0013 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 2,86 | 1,56 | 0,0994 | 0,0002 | |||||

| US86562MBP41 / Sumitomo Mitsui Financial Group Inc | 2,84 | 1,35 | 0,0990 | −0,0000 | |||||

| M1PC34 / Marathon Petroleum Corporation - Depositary Receipt (Common Stock) | 2,84 | 1,86 | 0,0989 | 0,0004 | |||||

| H / Hyatt Hotels Corporation | 2,83 | 0,64 | 0,0985 | −0,0007 | |||||

| DELOITTE LLP SR UNSEC / DBT (938WPEII2) | 2,80 | 1,05 | 0,0973 | −0,0003 | |||||

| US03027XBJ81 / American Tower Corp | 2,80 | 1,45 | 0,0972 | 0,0000 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 2,78 | −1,59 | 0,0967 | −0,0029 | |||||

| T1OW34 / American Tower Corporation - Depositary Receipt (Common Stock) | 2,78 | 1,13 | 0,0967 | −0,0003 | |||||

| NISSAN MOTOR ACCEPTANCE SR UNSECURED 144A 09/27 5.3 / DBT (US65480CAG06) | 2,76 | −0,68 | 0,0961 | −0,0020 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 2,75 | 1,10 | 0,0957 | −0,0003 | |||||

| DT MIDSTREAM INC COMPANY GUAR 144A 12/34 5.8 / DBT (US23345MAD92) | 2,75 | 1,40 | 0,0957 | −0,0000 | |||||

| US674599EA94 / Occidental Petroleum Corp | 2,74 | −0,22 | 0,0955 | −0,0015 | |||||

| US46188BAF94 / Invitation Homes Operating Partnership L.P. | 2,74 | 0,92 | 0,0954 | −0,0005 | |||||

| US674599DJ13 / Occidental Petroleum Corp | 2,74 | −1,08 | 0,0954 | −0,0024 | |||||

| HANWHA FUTUREPROOF CORP COMPANY GUAR 144A 04/28 4.75 / DBT (US41090AAA07) | 2,74 | 0,0952 | 0,0952 | ||||||

| US361841AL38 / GLP Capital LP / GLP Financing II Inc | 2,73 | 0,92 | 0,0950 | −0,0004 | |||||

| TOWD POINT MORTGAGE TRUST TPMT 2024 5 A1A 144A / ABS-MBS (US891944AA82) | 2,71 | −4,44 | 0,0943 | −0,0057 | |||||

| FCT / Fincantieri S.p.A. | 2,69 | 1,43 | 0,0937 | 0,0000 | |||||

| ENTERPRISE PRODUCTS OPER ENTERPRISE PRODUCTS OPER / DBT (US29379VCG68) | 2,69 | 1,05 | 0,0936 | −0,0003 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 2,69 | 0,83 | 0,0935 | −0,0005 | |||||

| US87264ACB98 / T-Mobile USA Inc | 2,69 | 1,59 | 0,0935 | 0,0002 | |||||

| US05401AAS06 / Avolon Holdings Funding Ltd | 2,69 | 0,79 | 0,0935 | −0,0006 | |||||

| SAMMONS FINANCIAL GROUP SAMMONS FINANCIAL GROUP / DBT (US79588TAF75) | 2,68 | 0,45 | 0,0933 | −0,0009 | |||||

| A19QHV / Plains All American Pipeline, L.P. - Preferred Security | 2,67 | 0,87 | 0,0930 | −0,0005 | |||||

| H1UM34 / Humana Inc. - Depositary Receipt (Common Stock) | 2,66 | 1,49 | 0,0926 | 0,0001 | |||||

| MO / Altria Group, Inc. - Depositary Receipt (Common Stock) | 2,65 | 1,07 | 0,0923 | −0,0003 | |||||

| US912834LK27 / United States Treasury Strip Coupon | 2,65 | −1,96 | 0,0922 | −0,0032 | |||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 2,65 | 0,68 | 0,0922 | −0,0006 | |||||

| APA CORP COMPANY GUAR 144A 02/35 6.1 / DBT (US03743QAQ10) | 2,65 | −1,49 | 0,0922 | −0,0027 | |||||

| US92212WAD20 / VAR ENERGI ASA | 2,65 | −0,04 | 0,0921 | −0,0013 | |||||

| XS2291692890 / Chile Government International Bond | 2,64 | 0,69 | 0,0919 | −0,0006 | |||||

| US780097BG51 / NatWest Group PLC | 2,64 | 0,80 | 0,0918 | −0,0005 | |||||

| X5S8VL105 / Nordea Bank Abp | 2,64 | 1,03 | 0,0917 | −0,0003 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 2,63 | 0,92 | 0,0917 | −0,0004 | |||||

| MACQUARIE AIRFINANCE HLD SR UNSECURED 144A 03/28 5.2 / DBT (US55609NAF50) | 2,63 | 1,00 | 0,0915 | −0,0003 | |||||

| US16144KAC27 / Chase Auto Owner Trust 2023-A | 2,63 | −0,27 | 0,0915 | −0,0015 | |||||

| ARMT34 / ArcelorMittal S.A. - Depositary Receipt (Common Stock) | 2,62 | 2,42 | 0,0912 | 0,0009 | |||||

| DAVINCIRE HOLDINGS LTD SR UNSECURED 144A 04/35 5.95 / DBT (US23879AAA51) | 2,62 | 0,35 | 0,0911 | −0,0010 | |||||

| 01626P148 / Alimentation Couche-Tard Inc | 2,60 | 1,24 | 0,0906 | −0,0001 | |||||

| US87166FAE34 / Synchrony Bank | 2,60 | 0,54 | 0,0905 | −0,0008 | |||||

| HYUNDAI CAPITAL AMERICA SR UNSECURED 144A 03/27 VAR / DBT (US44891ADS33) | 2,60 | −0,08 | 0,0903 | −0,0013 | |||||

| INDIGO CREDIT MANAGEMENT INDI 2A A 144A / ABS-CBDO (XS2916992865) | 2,60 | 9,17 | 0,0903 | 0,0064 | |||||

| US925650AD55 / VICI Properties LP | 2,59 | 1,77 | 0,0902 | 0,0003 | |||||

| MDLZ / Mondelez International, Inc. - Depositary Receipt (Common Stock) | 2,59 | 4,86 | 0,0900 | 0,0030 | |||||

| OCSL / Oaktree Specialty Lending Corporation | 2,58 | −0,50 | 0,0897 | −0,0017 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 2,57 | 0,74 | 0,0896 | −0,0006 | |||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 2,57 | 0,98 | 0,0896 | −0,0004 | |||||

| US225401BC11 / UBS Group AG | 2,57 | −0,04 | 0,0893 | −0,0013 | |||||

| XS1883352764 / JT INTL FIN SERVICES BV COMPANY GUAR REGS 09/28 3.875 | 2,56 | 1,07 | 0,0891 | −0,0003 | |||||

| GMZB / Ally Financial Inc. - Preferred Stock | 2,56 | 1,59 | 0,0890 | 0,0002 | |||||

| CDX IG43 5Y ICE / DCR (EZ10N17RBN04) | 2,55 | −84,77 | 0,0887 | −0,5018 | |||||

| US138616AM99 / Cantor Fitzgerald LP | 2,55 | 0,59 | 0,0887 | −0,0007 | |||||

| US67116NAA72 / OCI NV | 2,55 | 3,83 | 0,0886 | 0,0021 | |||||

| V1MC34 / Vulcan Materials Company - Depositary Receipt (Common Stock) | 2,55 | 0,91 | 0,0886 | −0,0004 | |||||

| DAIMLER TRUCK FINAN NA COMPANY GUAR 144A 01/35 5.625 / DBT (US233853BF64) | 2,55 | 1,43 | 0,0886 | 0,0001 | |||||

| LPL HOLDINGS INC COMPANY GUAR 03/30 5.2 / DBT (US50212YAL83) | 2,54 | 1,20 | 0,0884 | −0,0002 | |||||

| VZ / Verizon Communications Inc. - Depositary Receipt (Common Stock) | 2,53 | 0,0881 | 0,0881 | ||||||

| US682680BL63 / CORPORATE BONDS | 2,52 | 0,80 | 0,0876 | −0,0005 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 2,40 | 0,00 | 2,52 | 1,08 | 0,0876 | −0,0003 | |||

| 72018QAB7 / Piedmont Natl Gas Inc Mtn Be Fr 6.87% 10/06/23 | 2,52 | 1,57 | 0,0875 | 0,0001 | |||||

| CITADEL SECURITIES GLOBA SR SECURED 144A 06/35 6.2 / DBT (US17289RAB24) | 2,51 | 0,0875 | 0,0875 | ||||||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 2,50 | 0,0870 | 0,0870 | ||||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 2,50 | 1,22 | 0,0870 | −0,0002 | |||||

| VOYA CLO LTD VOYA 2017 3A A1RR 144A / ABS-CBDO (US92915QBG73) | 2,49 | −0,36 | 0,0866 | −0,0015 | |||||

| C1OG34 / Coterra Energy Inc. - Depositary Receipt (Common Stock) | 2,48 | 0,61 | 0,0861 | −0,0007 | |||||

| K1SG34 / Keysight Technologies, Inc. - Depositary Receipt (Common Stock) | 2,48 | 0,0861 | 0,0861 | ||||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 2,47 | 2,06 | 0,0860 | 0,0006 | |||||

| HAYFIN EMERALD CLO HAYEM 5A AR 144A / ABS-CBDO (XS2904562746) | 2,47 | 8,67 | 0,0860 | 0,0058 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2,47 | 1,60 | 0,0860 | 0,0002 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 2,47 | 0,53 | 0,0858 | −0,0007 | |||||

| US49456BAH42 / Kinder Morgan Inc/DE | 2,46 | 0,70 | 0,0854 | −0,0006 | |||||

| NFG / National Fuel Gas Company | 2,46 | 0,33 | 0,0854 | −0,0009 | |||||

| US61747YFA82 / Morgan Stanley | 2,44 | 0,37 | 0,0850 | −0,0009 | |||||

| GA GLOBAL FUNDING TRUST SECURED 144A 01/35 5.9 / DBT (US36143L2S34) | 2,44 | 0,00 | 0,0847 | −0,0012 | |||||

| US105340AQ63 / Brandywine Operating Partnership LP | 2,44 | 2,96 | 0,0847 | 0,0013 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 2,43 | 0,83 | 0,0846 | −0,0005 | |||||

| US09951LAA17 / Booz Allen Hamilton Inc | 2,43 | 2,11 | 0,0844 | 0,0006 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2,30 | 0,00 | 2,43 | 0,04 | 0,0844 | −0,0011 | |||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2,42 | 1,34 | 0,0843 | −0,0000 | |||||

| CZECHOSLOVAK GROUP CZECHOSLOVAK GROUP / DBT (XS3105190816) | 2,40 | 0,0836 | 0,0836 | ||||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2,39 | 0,88 | 0,0833 | −0,0004 | |||||

| US06051GJB68 / Bank of America Corp | 2,38 | 0,0827 | 0,0827 | ||||||

| COX COMMUNICATIONS INC COMPANY GUAR 144A 12/53 5.8 / DBT (US224044CT25) | 2,37 | −0,04 | 0,0823 | −0,0012 | |||||

| US91282CEV90 / United States Treasury Note/Bond | 2,36 | 0,86 | 0,0820 | −0,0004 | |||||

| TIKEHAU CLO IX DAC TIKEH 9A AR 144A / ABS-CBDO (XS2931965672) | 2,36 | 8,87 | 0,0820 | 0,0056 | |||||

| US62954HAJ77 / NXP BV / NXP Funding LLC / NXP USA Inc | 2,35 | 1,73 | 0,0818 | 0,0003 | |||||

| US639057AF59 / NatWest Group PLC | 2,35 | 0,30 | 0,0817 | −0,0009 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 2,35 | 0,09 | 0,0817 | −0,0011 | |||||

| 30064K105 / Exacttarget, Inc. | 2,34 | 1,08 | 0,0815 | −0,0002 | |||||

| US780097BP50 / Natwest Group PLC | 2,34 | 0,82 | 0,0814 | −0,0005 | |||||

| HARLEY DAVIDSON FINL SER HARLEY DAVIDSON FINL SER / DBT (US41283LBB09) | 2,34 | 0,82 | 0,0814 | −0,0005 | |||||

| US61747YFE05 / Morgan Stanley | 2,34 | 1,65 | 0,0814 | 0,0002 | |||||

| NSARO / NSTAR Electric Company - Preferred Stock | 2,34 | 0,82 | 0,0814 | −0,0005 | |||||

| US95000U2G70 / Wells Fargo & Co | 2,34 | 1,34 | 0,0813 | −0,0000 | |||||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 2,33 | 0,0812 | 0,0812 | ||||||

| HYUNDAI CAPITAL AMERICA SR UNSECURED 144A 03/30 5.15 / DBT (US44891ADQ76) | 2,33 | 1,57 | 0,0810 | 0,0001 | |||||

| FLEX / Flex Ltd. | 2,33 | 1,75 | 0,0809 | 0,0003 | |||||

| HUNTSMAN INTERNATIONAL L SR UNSECURED 10/34 5.7 / DBT (US44701QBG64) | 2,33 | −1,73 | 0,0809 | −0,0026 | |||||

| US38141GZM94 / Goldman Sachs Group Inc/The | 2,32 | 2,11 | 0,0806 | 0,0006 | |||||

| REPUBLIC OF POLAND REPUBLIC OF POLAND / DBT (US731011AY80) | 2,31 | 1,40 | 0,0805 | 0,0000 | |||||

| US958667AF48 / Western Midstream Operating LP | 2,30 | 0,30 | 0,0802 | −0,0009 | |||||

| MU / Micron Technology, Inc. - Depositary Receipt (Common Stock) | 2,29 | 0,0796 | 0,0796 | ||||||

| BANQUE FED CRED MUTUEL 144A 01/30 5.538 / DBT (US06675DCN03) | 2,28 | 0,62 | 0,0794 | −0,0006 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 2,28 | 1,20 | 0,0791 | −0,0002 | |||||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 2,27 | 127,30 | 0,0791 | 0,0438 | |||||

| US05946KAN19 / BANCO BILBAO VIZCAYA ARGENTARIA SA | 2,27 | 0,98 | 0,0791 | −0,0003 | |||||

| US87165BAM54 / Synchrony Financial | 2,26 | 0,85 | 0,0787 | −0,0004 | |||||

| US225401AT54 / Credit Suisse Group AG | 2,26 | 0,89 | 0,0785 | −0,0004 | |||||

| US46647PAM86 / JPMorgan Chase & Co | 2,25 | 0,81 | 0,0784 | −0,0005 | |||||

| US29717PAQ00 / Essex Portfolio LP | 2,25 | 1,17 | 0,0782 | −0,0002 | |||||

| GROSVENOR PLACE CLO GROSV 2024 2A A 144A / ABS-CBDO (XS2925040128) | 2,24 | 8,75 | 0,0778 | 0,0053 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 2,24 | 0,04 | 0,0778 | −0,0011 | |||||

| NORINCHUKIN BANK SR UNSECURED 144A 10/29 5.094 / DBT (US656029AN58) | 2,23 | 0,54 | 0,0777 | −0,0006 | |||||

| FCT / Fincantieri S.p.A. | 2,23 | 0,0775 | 0,0775 | ||||||

| MRX / Marex Group plc | 2,23 | 0,0775 | 0,0775 | ||||||

| US95000U2F97 / Wells Fargo & Co | 2,22 | 0,41 | 0,0774 | −0,0008 | |||||

| US36264FAK75 / CORP. NOTE | 2,22 | 0,59 | 0,0772 | −0,0006 | |||||

| W1EL34 / Welltower Inc. - Depositary Receipt (Common Stock) | 2,21 | 0,0769 | 0,0769 | ||||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 2,10 | 0,00 | 2,21 | 1,42 | 0,0768 | 0,0000 | |||

| US12513GBH11 / CDW LLC / CDW Finance Corp | 2,20 | 1,29 | 0,0765 | −0,0001 | |||||

| US682680BK80 / ONEOK Inc | 2,20 | 0,64 | 0,0765 | −0,0006 | |||||

| HPS CORPORATE LENDING FU SR UNSECURED 04/32 5.95 / DBT (US40440VAK17) | 2,19 | 0,0762 | 0,0762 | ||||||

| US842587DJ36 / Southern Co/The | 2,17 | 1,49 | 0,0756 | 0,0001 | |||||

| US75513ECW93 / RTX CORP SR UNSEC 6.1% 03-15-34 | 2,16 | 0,84 | 0,0753 | −0,0004 | |||||

| MRX / Marex Group plc | 2,16 | 1,26 | 0,0752 | −0,0001 | |||||

| F+G GLOBAL FUNDING SECURED 144A 01/30 5.875 / DBT (US30321L2J09) | 2,16 | 1,03 | 0,0752 | −0,0002 | |||||

| H1II34 / Huntington Ingalls Industries, Inc. - Depositary Receipt (Common Stock) | 2,16 | 1,41 | 0,0751 | 0,0000 | |||||

| US928563AF20 / VMware Inc | 2,16 | 0,0750 | 0,0750 | ||||||

| AMERICOLD REALTY OPER PA AMERICOLD REALTY OPER PA / DBT (US03063UAA97) | 2,15 | 0,23 | 0,0750 | −0,0008 | |||||

| US143658BQ44 / Carnival Corp | 2,15 | 2,28 | 0,0750 | 0,0007 | |||||

| US63861VAJ61 / Nationwide Building Society | 2,15 | −0,19 | 0,0749 | −0,0012 | |||||

| 67705BA36 / Oglethorpe Power Corp | 2,15 | 0,0748 | 0,0748 | ||||||

| US83088MAK80 / Skyworks Solutions Inc | 2,14 | 1,04 | 0,0745 | −0,0003 | |||||

| BATBC / British American Tobacco Bangladesh Company Limited | 2,14 | 1,33 | 0,0744 | −0,0000 | |||||

| US45262BAB99 / IMPERIAL BRANDS FIN PLC REGD 144A P/P 3.50000000 | 2,13 | 0,23 | 0,0743 | −0,0008 | |||||

| FCT / Fincantieri S.p.A. | 2,13 | 0,0743 | 0,0743 | ||||||

| T MOBILE USA INC COMPANY GUAR 01/29 4.85 / DBT (US87264ADE29) | 2,13 | 0,80 | 0,0742 | −0,0004 | |||||

| CIMIC FINANCE USA PTY LT CIMIC FINANCE USA PTY LT / DBT (US171873AB83) | 2,13 | 0,09 | 0,0742 | −0,0010 | |||||

| US37046US851 / General Motors Financial Co Inc | 2,13 | 1,38 | 0,0740 | −0,0000 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 2,12 | 0,86 | 0,0737 | −0,0004 | |||||

| BELL CANADA COMPANY GUAR 02/34 5.2 / DBT (US0778FPAM16) | 2,10 | 0,14 | 0,0732 | −0,0009 | |||||

| MADISON PARK FUNDING LTD MDPK 2020 46A ARR 144A / ABS-CBDO (US55822AAW71) | 2,10 | 0,67 | 0,0731 | −0,0005 | |||||

| BAIN CAPITAL CREDIT CLO, LIMIT BCC 2019 4A A1RR 144A / ABS-CBDO (US05684AAY55) | 2,09 | −0,29 | 0,0728 | −0,0012 | |||||

| DIAGEO INVESTMENT CORP COMPANY GUAR 04/35 5.625 / DBT (US25245BAE74) | 2,09 | 0,0728 | 0,0728 | ||||||

| US55336V3087 / MPLX LP | 2,09 | 1,02 | 0,0726 | −0,0003 | |||||

| NUVEEN LLC NUVEEN LLC / DBT (US67080LAC90) | 2,08 | 1,07 | 0,0725 | −0,0003 | |||||

| US609935AA97 / Monongahela Power Co. | 2,08 | 0,73 | 0,0724 | −0,0005 | |||||

| ROGERS COMMUNICATIONS IN ROGERS COMMUNICATIONS IN / DBT (US775109DE81) | 2,08 | 1,32 | 0,0723 | −0,0001 | |||||

| AU3FN0029609 / AAI Ltd | 2,08 | 1,27 | 0,0722 | −0,0001 | |||||

| US212015AS02 / Continental Resources Inc/OK | 2,07 | 0,63 | 0,0721 | −0,0006 | |||||

| RGA GLOBAL FUNDING SECURED 144A 01/31 5.5 / DBT (US76209PAD50) | 2,06 | 0,29 | 0,0718 | −0,0008 | |||||

| H1AS34 / Hasbro, Inc. - Depositary Receipt (Common Stock) | 2,06 | 0,44 | 0,0718 | −0,0007 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 2,06 | 1,28 | 0,0717 | −0,0001 | |||||

| NLG GLOBAL FUNDING SECURED 144A 01/30 5.4 / DBT (US62915W2A05) | 2,06 | 1,08 | 0,0717 | −0,0002 | |||||

| RNR / RenaissanceRe Holdings Ltd. | 2,06 | 0,29 | 0,0715 | −0,0008 | |||||

| NGG / National Grid plc - Depositary Receipt (Common Stock) | 2,06 | 1,78 | 0,0715 | 0,0003 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2,05 | 1,13 | 0,0714 | −0,0002 | |||||

| CNLHN / The Connecticut Light and Power Company - Preferred Stock | 2,05 | 1,04 | 0,0713 | −0,0003 | |||||

| L1HX34 / L3Harris Technologies, Inc. - Depositary Receipt (Common Stock) | 2,05 | 1,04 | 0,0712 | −0,0003 | |||||

| VICI PROPERTIES LP SR UNSECURED 04/34 5.75 / DBT (US925650AF04) | 2,05 | 1,64 | 0,0712 | 0,0002 | |||||

| US33939HAA77 / FLEX INTERMEDIATE HOLDCO LLC | 2,05 | 0,89 | 0,0712 | −0,0003 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 2,04 | 0,59 | 0,0711 | −0,0006 | |||||

| USU5009LAZ32 / Kraft Heinz Foods Co | 2,04 | 9,13 | 0,0711 | 0,0051 | |||||

| MUFG / Mitsubishi UFJ Financial Group, Inc. - Depositary Receipt (Common Stock) | 2,04 | 0,94 | 0,0711 | −0,0003 | |||||

| ARCC / Ares Capital Corporation | 2,04 | 0,39 | 0,0710 | −0,0007 | |||||

| ONCOR ELECTRIC DELIVERY SR SECURED 144A 04/35 5.35 / DBT (US68233JCZ57) | 2,04 | 0,74 | 0,0709 | −0,0005 | |||||

| W1BD34 / Warner Bros. Discovery, Inc. - Depositary Receipt (Common Stock) | 2,04 | 0,0709 | 0,0709 | ||||||

| RIO TINTO FIN USA PLC COMPANY GUAR 03/32 5 / DBT (US76720AAT34) | 2,04 | 1,34 | 0,0708 | −0,0001 | |||||

| NATIONAL FOOTBAL LEAGUE 4.5YR / DBT (902EZU906) | 2,04 | 0,74 | 0,0708 | −0,0005 | |||||

| NATIONAL FOOTBAL LEAGUE 4.5YR / DBT (902EYJ902) | 2,04 | 0,74 | 0,0708 | −0,0005 | |||||

| 081437AG0 / Bemis Inc Notes 5.65% 08/01/14 | 2,03 | 0,84 | 0,0708 | −0,0004 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 2,03 | 1,00 | 0,0706 | −0,0003 | |||||

| US05635JAA88 / Bacardi Ltd / Bacardi-Martini BV | 2,03 | 0,69 | 0,0706 | −0,0005 | |||||

| HOLCIM FINANCE US LLC COMPANY GUAR 144A 04/30 4.95 / DBT (US43475RAC07) | 2,03 | 0,0705 | 0,0705 | ||||||

| US251526CU14 / DEUTSCHE BANK AG SR NON PREF 6.819% 11-20-29/28 | 2,03 | 0,60 | 0,0705 | −0,0005 | |||||

| STORE CAPITAL LLC SR UNSECURED 144A 04/30 5.4 / DBT (US862123AA45) | 2,03 | 1,20 | 0,0705 | −0,0002 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 2,03 | 0,45 | 0,0705 | −0,0007 | |||||

| US462613AP51 / CORP. NOTE | 2,02 | 0,85 | 0,0702 | −0,0004 | |||||

| BMW VEHICLE LEASE TRUST BMWLT 2025 1 A3 / ABS-O (US096912AD26) | 2,01 | 0,0700 | 0,0700 | ||||||

| US86563VBG32 / Sumitomo Mitsui Trust Bank Ltd | 2,01 | 0,50 | 0,0699 | −0,0006 | |||||

| US00084DBC39 / ABN AMRO Bank NV | 2,01 | −0,45 | 0,0699 | −0,0013 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 2,01 | −0,05 | 0,0699 | −0,0010 | |||||

| WELLS FARGO BANK NA WELLS FARGO BANK NA / DBT (US94988J6J16) | 2,00 | −0,10 | 0,0697 | −0,0010 | |||||

| US125523AH38 / Cigna Corp. | 2,00 | 0,86 | 0,0697 | −0,0004 | |||||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 2,00 | 0,0696 | 0,0696 | ||||||

| NAVESINK CLO, LIMITED NAVS 2024 2A A1 144A / ABS-CBDO (US63942YAA29) | 2,00 | 0,20 | 0,0696 | −0,0009 | |||||

| TRYSAIL CLO LTD TRYSL 2022 1A A 144A / ABS-CBDO (US89856JAA43) | 2,00 | 0,20 | 0,0696 | −0,0008 | |||||

| BAIN CAPITAL CREDIT CLO, LIMIT BCC 2022 2A A1R 144A / ABS-CBDO (US05682GAQ10) | 2,00 | 0,0696 | 0,0696 | ||||||

| US47216QAB95 / JDE Peet's NV | 2,00 | 1,22 | 0,0695 | −0,0001 | |||||

| W1MB34 / The Williams Companies, Inc. - Depositary Receipt (Common Stock) | 2,00 | 1,11 | 0,0695 | −0,0002 | |||||

| US785592AU04 / Sabine Pass Liquefaction LLC | 1,99 | 0,56 | 0,0692 | −0,0005 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 1,99 | 1,02 | 0,0691 | −0,0002 | |||||

| US46625HRY89 / JPMorgan Chase & Co. | 1,98 | 0,51 | 0,0690 | −0,0006 | |||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 1,98 | −0,90 | 0,0690 | −0,0016 | |||||

| US345397C353 / Ford Motor Credit Co LLC | 1,97 | 0,20 | 0,0687 | −0,0008 | |||||

| HORIZON MUTUAL HOLDINGS SR UNSECURED 144A 11/34 6.2 / DBT (US43990FAA66) | 1,97 | 1,03 | 0,0685 | −0,0003 | |||||

| HOST HOTELS + RESORTS LP HOST HOTELS + RESORTS LP / DBT (US44107TBB17) | 1,96 | 0,56 | 0,0683 | −0,0005 | |||||

| US345397A860 / Ford Motor Credit Co LLC | 1,96 | 1,19 | 0,0682 | −0,0001 | |||||

| 2914 / Japan Tobacco Inc. | 1,96 | 0,0680 | 0,0680 | ||||||

| APEX CREDIT CLO LLC APEXC 2024 1A A1 144A / ABS-CBDO (US03753AAA88) | 1,96 | −0,56 | 0,0680 | −0,0013 | |||||

| COUSINS PROPERTIES LP 10/34 5.875 / DBT (US222793AA90) | 1,96 | 2,04 | 0,0680 | 0,0004 | |||||

| US928563AL97 / VMware Inc | 1,95 | 2,09 | 0,0680 | 0,0005 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 1,94 | 1,68 | 0,0676 | 0,0002 | |||||

| US06738ECJ29 / Barclays PLC | 1,94 | −0,21 | 0,0676 | −0,0011 | |||||

| US925650AE39 / VICI Properties LP | 1,94 | 1,30 | 0,0675 | −0,0001 | |||||

| R1IN34 / Realty Income Corporation - Depositary Receipt (Common Stock) | 1,94 | 8,51 | 0,0675 | 0,0044 | |||||

| USU5009LAZ32 / Kraft Heinz Foods Co | 1,94 | 0,73 | 0,0673 | −0,0004 | |||||

| H / Hyatt Hotels Corporation | 1,93 | 0,73 | 0,0673 | −0,0004 | |||||

| MUTUAL OF OMAHA GLOBAL MUTUAL OF OMAHA GLOBAL / DBT (US62829D2D13) | 1,93 | 0,26 | 0,0672 | −0,0008 | |||||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 1,93 | 0,73 | 0,0671 | −0,0004 | |||||

| US94988J6F93 / Wells Fargo Bank NA | 1,93 | 0,00 | 0,0671 | −0,0009 | |||||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 1,93 | 1,42 | 0,0670 | −0,0000 | |||||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/29 5.25 / DBT (US928668CG54) | 1,92 | 1,32 | 0,0669 | −0,0000 | |||||

| US91282CGW55 / United States Treasury Inflation Indexed Bonds | 1,92 | 0,79 | 0,0669 | −0,0004 | |||||

| SBUX / Starbucks Corporation - Depositary Receipt (Common Stock) | 1,92 | 0,16 | 0,0667 | −0,0008 | |||||

| MORGAN STANLEY BANK NA MORGAN STANLEY BANK NA / DBT (US61690U8A11) | 1,92 | 0,16 | 0,0667 | −0,0008 | |||||

| US05369AAP66 / Aviation Capital Group LLC | 1,91 | 0,74 | 0,0666 | −0,0005 | |||||

| US23636ABE01 / Danske Bank A/S | 1,91 | −0,42 | 0,0663 | −0,0012 | |||||

| US15135BAX91 / Centene Corp | 1,90 | 2,10 | 0,0659 | 0,0004 | |||||

| DRYDEN SENIOR LOAN FUND DRSLF 2021 95A AR 144A / ABS-CBDO (US262487AJ07) | 1,90 | −0,21 | 0,0659 | −0,0011 | |||||

| NBN CO LTD NBN CO LTD / DBT (US62878U2J00) | 1,89 | 0,64 | 0,0659 | −0,0005 | |||||

| APA CORP COMPANY GUAR 144A 02/55 6.75 / DBT (US03743QAS75) | 1,89 | −3,37 | 0,0658 | −0,0033 | |||||

| UNILEVER CAPITAL CORP UNILEVER CAPITAL CORP / DBT (US904764BV84) | 1,89 | 0,91 | 0,0656 | −0,0003 | |||||

| US55354GAK67 / MSCI Inc | 1,88 | 1,40 | 0,0653 | −0,0000 | |||||

| US03027XBZ24 / American Tower Corp | 1,87 | 1,13 | 0,0652 | −0,0002 | |||||

| MORGAN STANLEY BANK NA MORGAN STANLEY BANK NA / DBT (US61690U8E33) | 1,87 | 0,32 | 0,0651 | −0,0007 | |||||

| US19075Q6070 / COBANK ACB | 1,80 | 0,00 | 1,85 | 1,48 | 0,0645 | 0,0000 | |||

| US718172DC02 / Philip Morris International, Inc. | 1,85 | 0,43 | 0,0644 | −0,0006 | |||||

| PROLOGIS TARGETED US PROLOGIS TARGETED US / DBT (US74350LAA26) | 1,85 | 0,65 | 0,0644 | −0,0005 | |||||

| US29444UBQ85 / EQUINIX INC 1.45% 05/15/2026 | 1,85 | 0,65 | 0,0643 | −0,0005 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1,85 | 0,98 | 0,0642 | −0,0003 | |||||

| US404280CV97 / HSBC HOLDINGS PLC | 1,84 | 1,65 | 0,0642 | 0,0002 | |||||

| INWI / Inwido AB (publ) | 1,84 | 0,16 | 0,0642 | −0,0008 | |||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 1,84 | 0,0641 | 0,0641 | ||||||

| CPPIB CAPITAL INC COMPANY GUAR REGS 06/34 4.3 / DBT (CA12593CAY71) | 1,84 | 4,08 | 0,0640 | 0,0016 | |||||

| US088929AC82 / BGC Group Inc | 1,84 | 0,16 | 0,0640 | −0,0008 | |||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 1,83 | 1,78 | 0,0638 | 0,0002 | |||||

| BANQUE FED CRED MUTUEL BANQUE FED CRED MUTUEL / DBT (US06675DCM20) | 1,83 | 0,33 | 0,0638 | −0,0007 | |||||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/30 5.35 / DBT (US928668CQ37) | 1,83 | 2,01 | 0,0637 | 0,0004 | |||||

| VIRGINIA POWER FUEL SEC SR SECURED 05/33 4.877 / DBT (US92808VAB80) | 1,83 | 0,55 | 0,0637 | −0,0005 | |||||

| AU3FN0029609 / AAI Ltd | 1,83 | 0,38 | 0,0635 | −0,0007 | |||||

| US28504DAC74 / Electricite de France SA | 1,82 | 1,28 | 0,0634 | −0,0001 | |||||

| ANTX / AN2 Therapeutics, Inc. | 1,82 | 0,72 | 0,0633 | −0,0004 | |||||

| US26884UAG40 / EPR Properties | 1,82 | 1,74 | 0,0632 | 0,0002 | |||||

| US133434AA86 / Cameron LNG LLC | 1,82 | 2,48 | 0,0632 | 0,0007 | |||||

| US37046US851 / General Motors Financial Co Inc | 1,81 | 0,0630 | 0,0630 | ||||||

| US14040HDC60 / Capital One Financial Corp | 1,81 | 1,46 | 0,0629 | 0,0000 | |||||

| HPS CORPORATE LENDING FU SR UNSECURED 01/28 5.45 / DBT (US40440VAH87) | 1,81 | 0,0628 | 0,0628 | ||||||

| E1IX34 / Edison International - Depositary Receipt (Common Stock) | 1,80 | −0,83 | 0,0627 | −0,0014 | |||||

| US529043AF83 / LXP INDUSTRIAL TRUST 6.75% 11/15/2028 | 1,80 | 0,11 | 0,0627 | −0,0008 | |||||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 1,80 | 1,81 | 0,0627 | 0,0003 | |||||

| CONOCOPHILLIPS COMPANY COMPANY GUAR 01/35 5 / DBT (US20826FBL94) | 1,80 | 0,95 | 0,0626 | −0,0003 | |||||

| US361841AQ25 / GLP Capital LP / GLP Financing II Inc | 1,79 | 1,13 | 0,0624 | −0,0002 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 1,79 | 1,53 | 0,0623 | 0,0001 | |||||

| US91911TAR41 / Vale Overseas Ltd | 1,78 | 2,42 | 0,0620 | 0,0006 | |||||

| US06051GHD43 / Bank of America Corp | 1,78 | 0,85 | 0,0619 | −0,0003 | |||||

| RAIZEN FUELS FINANCE RAIZEN FUELS FINANCE / DBT (US75102XAD84) | 1,78 | −1,44 | 0,0619 | −0,0018 | |||||

| NISSAN MOTOR ACCEPTANCE SR UNSECURED 144A 09/27 VAR / DBT (US65480CAJ45) | 1,78 | −1,06 | 0,0619 | −0,0015 | |||||

| PROLOGIS LP SR UNSECURED 02/33 4.2 / DBT (CA74340XCP48) | 1,77 | 5,78 | 0,0617 | 0,0026 | |||||

| 4020 / Saudi Real Estate Company | 1,76 | 1,20 | 0,0614 | −0,0001 | |||||

| BGC / BGC Group, Inc. | 1,76 | 0,86 | 0,0613 | −0,0003 | |||||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 1,76 | 0,86 | 0,0613 | −0,0003 | |||||

| US257375AJ44 / Dominion Energy Gas Holdings LLC | 1,76 | −1,12 | 0,0612 | −0,0016 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 1,75 | 0,75 | 0,0608 | −0,0004 | |||||

| US842434CU45 / SOUTHERN CALIF GAS CO 1ST MORTGAGE 02/30 2.55 | 1,75 | 1,28 | 0,0608 | −0,0001 | |||||

| US233853AT77 / DAIMLER TRUCKS FINANCE NA | 1,75 | 0,75 | 0,0607 | −0,0004 | |||||

| IQVIA INC SR SECURED 05/28 5.7 / DBT (US46266TAC27) | 1,74 | 0,75 | 0,0607 | −0,0004 | |||||

| JOHN DEERE CAPITAL CORP JOHN DEERE CAPITAL CORP / DBT (US24422EXP95) | 1,74 | 1,10 | 0,0605 | −0,0002 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 1,73 | 0,82 | 0,0601 | −0,0003 | |||||

| US210385AD21 / Constellation Energy Generation LLC | 1,72 | 2,19 | 0,0600 | 0,0005 | |||||

| USU5009LAZ32 / Kraft Heinz Foods Co | 1,72 | −67,14 | 0,0600 | −0,1250 | |||||

| US912834LB28 / United States Treasury Strip Coupon | 1,72 | −1,83 | 0,0599 | −0,0020 | |||||

| US48020QAB32 / JONES LANG LASALLE INCORPORATED | 1,72 | 1,12 | 0,0598 | −0,0002 | |||||

| NUE / Nucor Corporation - Depositary Receipt (Common Stock) | 1,71 | 1,12 | 0,0596 | −0,0002 | |||||

| US11135FBF71 / Broadcom, Inc. | 1,71 | 1,48 | 0,0595 | 0,0001 | |||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 1,71 | 0,95 | 0,0595 | −0,0003 | |||||

| 29364W405 / Entergy Louisiana LLC, 5.875% Series First Mortgage Bonds due 6/15/2041 | 1,70 | 0,59 | 0,0592 | −0,0005 | |||||

| IL0060004004 / Israel Electric Corp Ltd | 1,70 | 0,24 | 0,0592 | −0,0007 | |||||

| US31429KAK97 / Federation des Caisses Desjardins du Quebec | 1,70 | 0,06 | 0,0592 | −0,0008 | |||||

| US053332BG66 / AutoZone Inc | 1,70 | 0,65 | 0,0590 | −0,0004 | |||||

| OCTAGON INVESTMENT PARTNERS 40 OCT40 2019 1A A1RR 144A / ABS-CBDO (US67592BAY48) | 1,69 | −0,47 | 0,0588 | −0,0011 | |||||

| US25389JAV89 / Digital Realty Trust LP | 1,68 | 0,18 | 0,0585 | −0,0007 | |||||

| US682680BJ18 / ONEOK Inc | 1,67 | 0,60 | 0,0582 | −0,0005 | |||||

| RAIZEN FUELS FINANCE COMPANY GUAR 144A 02/37 6.7 / DBT (US75102XAE67) | 1,67 | −38,24 | 0,0581 | −0,0373 | |||||

| US06738ECN31 / BARCLAYS PLC 9.625%/VAR PERP | 1,67 | 1,21 | 0,0581 | −0,0001 | |||||

| US31418EW557 / FNMA POOL MA5167 FN 10/53 FIXED 6.5 | 1,66 | −7,71 | 0,0579 | −0,0057 | |||||

| US11135FBQ37 / Broadcom Inc | 1,66 | 0,97 | 0,0577 | −0,0002 | |||||

| US80282KBF21 / Santander Holdings USA, Inc. | 1,64 | 1,92 | 0,0572 | 0,0003 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 1,64 | 0,86 | 0,0571 | −0,0003 | |||||

| MUFG / Mitsubishi UFJ Financial Group, Inc. - Depositary Receipt (Common Stock) | 1,64 | 0,86 | 0,0570 | −0,0003 | |||||

| TRUSTEES PRINCETON UNIV SR UNSECURED 07/30 4.647 / DBT (US89837LAJ44) | 1,64 | 0,0570 | 0,0570 | ||||||

| P1EG34 / Public Service Enterprise Group Incorporated - Depositary Receipt (Common Stock) | 1,63 | 1,24 | 0,0566 | −0,0001 | |||||

| US126650EA42 / CVS HEALTH CORP | 1,63 | 1,31 | 0,0566 | −0,0001 | |||||

| US842400GS60 / Southern California Edison Co | 1,62 | 0,75 | 0,0564 | −0,0004 | |||||

| US694308KP16 / PACIFIC GAS AND ELECTRIC CO SR SEC 1ST LIEN 6.95% 03-15-34 | 1,62 | −0,68 | 0,0562 | −0,0012 | |||||

| SRG / Snam S.p.A. | 1,61 | 0,0562 | 0,0562 | ||||||

| STZB34 / Constellation Brands, Inc. - Depositary Receipt (Common Stock) | 1,61 | 0,0561 | 0,0561 | ||||||

| MORGAN STANLEY BANK NA MORGAN STANLEY BANK NA / DBT (US61690U7Z70) | 1,61 | −0,19 | 0,0560 | −0,0009 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 1,61 | −0,25 | 0,0560 | −0,0009 | |||||

| LPL HOLDINGS INC COMPANY GUAR 03/35 5.65 / DBT (US50212YAM66) | 1,61 | 1,51 | 0,0560 | 0,0001 | |||||

| LGENERGYSOLUTION SR UNSECURED 144A 04/28 5.25 / DBT (US50205MAF68) | 1,61 | 0,63 | 0,0559 | −0,0004 | |||||

| SOUTH BOW USA INFRA HLDS COMPANY GUAR 144A 10/29 5.026 / DBT (US83007CAC64) | 1,61 | 1,07 | 0,0559 | −0,0002 | |||||

| IL0011920878 / Israel Discount Bank Ltd | 1,60 | 0,00 | 0,0558 | −0,0008 | |||||

| I1LM34 / Illumina, Inc. - Depositary Receipt (Common Stock) | 1,60 | 0,19 | 0,0557 | −0,0007 | |||||

| ARES CLO LTD ARES 2013 2A AR3 144A / ABS-CBDO (US00190YBP97) | 1,60 | 0,44 | 0,0557 | −0,0005 | |||||

| US61747YET82 / Morgan Stanley | 1,60 | 0,00 | 0,0557 | −0,0008 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 1,60 | 0,38 | 0,0555 | −0,0005 | |||||

| US07274NAJ28 / Bayer US Finance II LLC | 1,60 | 0,13 | 0,0555 | −0,0007 | |||||

| US233331BF33 / DTE Energy Co. | 1,59 | 1,73 | 0,0552 | 0,0002 | |||||

| US03666HAF82 / ANTARES HOLDINGS LP | 1,58 | 0,00 | 0,0551 | −0,0007 | |||||

| AU3CB0261576 / INCITEC PIVOT | 1,58 | 5,83 | 0,0549 | 0,0023 | |||||

| US22535WAJ62 / Credit Agricole SA | 1,58 | 0,51 | 0,0549 | −0,0005 | |||||

| US06051GJL41 / Bank of America Corp | 1,57 | 1,95 | 0,0546 | 0,0003 | |||||

| US46647PAF36 / JPMorgan Chase & Co | 1,57 | 0,51 | 0,0546 | −0,0005 | |||||

| T1TW34 / Take-Two Interactive Software, Inc. - Depositary Receipt (Common Stock) | 1,56 | 1,57 | 0,0542 | 0,0001 | |||||

| US11135FBV22 / Broadcom, Inc. | 1,55 | 0,91 | 0,0540 | −0,0002 | |||||

| HPS CORPORATE LENDING FU SR UNSECURED 01/29 6.75 / DBT (US40440VAF22) | 1,55 | 0,26 | 0,0539 | −0,0006 | |||||

| ATLANTIC AVENUE LTD MCCP 2024 3A A 144A / ABS-CBDO (US04822JAA43) | 1,55 | 0,13 | 0,0539 | −0,0007 | |||||

| BRO / Brown & Brown, Inc. | 1,55 | 0,0538 | 0,0538 | ||||||

| BANK GOSPODARSTWA KRAJOW BANK GOSPODARSTWA KRAJOW / DBT (US06237MAC73) | 1,55 | 0,98 | 0,0538 | −0,0002 | |||||

| PHILLIPS EDISON GROCERY PHILLIPS EDISON GROCERY / DBT (US71845JAB44) | 1,54 | 1,98 | 0,0537 | 0,0003 | |||||

| US842400HY20 / Southern California Edison Co. | 1,54 | 0,07 | 0,0535 | −0,0007 | |||||

| US00774MBD65 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 1,53 | −0,07 | 0,0534 | −0,0008 | |||||

| TRUST FIBRAUNO TRUST FIBRAUNO / DBT (US89834JAA16) | 1,53 | 1,33 | 0,0532 | −0,0000 | |||||

| CPRL34 / Canadian Pacific Kansas City Limited - Depositary Receipt (Common Stock) | 1,52 | 1,20 | 0,0530 | −0,0001 | |||||

| NWE / NorthWestern Energy Group, Inc. | 1,52 | 0,86 | 0,0530 | −0,0003 | |||||

| US15135BAW19 / Centene Corp | 1,52 | 2,15 | 0,0529 | 0,0004 | |||||

| GREENSAIF PIPELINES BIDC SR SECURED 144A 02/36 5.8528 / DBT (US39541EAD58) | 1,52 | −0,13 | 0,0528 | −0,0008 | |||||

| US65480CAE57 / Nissan Motor Acceptance Co LLC | 1,52 | −0,39 | 0,0528 | −0,0010 | |||||

| PENSKE TRUCK LEASING/PTL PENSKE TRUCK LEASING/PTL / DBT (US709599BY93) | 1,52 | 0,13 | 0,0528 | −0,0007 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 1,51 | 1,14 | 0,0527 | −0,0001 | |||||

| US458140CG35 / Intel Corp | 1,51 | 2,16 | 0,0526 | 0,0004 | |||||

| US95000U3A91 / Wells Fargo & Co. | 1,51 | 0,47 | 0,0526 | −0,0005 | |||||

| MERCEDES BENZ FIN NA MERCEDES BENZ FIN NA / DBT (US58769JAW71) | 1,51 | 1,14 | 0,0526 | −0,0001 | |||||

| XS2262961076 / ZF Finance GmbH | 1,51 | 0,0525 | 0,0525 | ||||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 1,50 | 0,47 | 0,0523 | −0,0005 | |||||

| US172967NN71 / C 3.785 03/17/33 | 1,50 | 2,19 | 0,0520 | 0,0004 | |||||

| US29365TAH77 / Entergy Texas Inc. | 1,49 | 0,95 | 0,0519 | −0,0002 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 1,48 | −1,40 | 0,0517 | −0,0014 | |||||

| E1IX34 / Edison International - Depositary Receipt (Common Stock) | 1,48 | 0,27 | 0,0516 | −0,0006 | |||||

| US097023DG73 / Boeing Co/The | 1,48 | 0,61 | 0,0514 | −0,0004 | |||||

| LAZARD GROUP LLC 03/31 6 / DBT (US52107QAL95) | 1,47 | 1,03 | 0,0512 | −0,0002 | |||||

| US91324PEV04 / UnitedHealth Group Inc | 1,46 | 0,76 | 0,0509 | −0,0003 | |||||

| US46115HCD70 / Intesa Sanpaolo SpA | 1,46 | 1,25 | 0,0508 | −0,0001 | |||||

| US031162DU18 / Amgen Inc | 1,46 | −0,21 | 0,0508 | −0,0008 | |||||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 1,45 | 0,0505 | 0,0505 | ||||||

| TSNF34 / Tyson Foods, Inc. - Depositary Receipt (Common Stock) | 1,45 | 1,05 | 0,0504 | −0,0002 | |||||

| CITADEL LP SR UNSECURED 144A 01/30 6 / DBT (US17288XAD66) | 1,45 | 1,76 | 0,0504 | 0,0002 | |||||

| A2RW34 / Arrow Electronics, Inc. - Depositary Receipt (Common Stock) | 1,45 | 2,05 | 0,0503 | 0,0003 | |||||

| R2RX34 / Regal Rexnord Corporation - Depositary Receipt (Common Stock) | 1,44 | 0,49 | 0,0502 | −0,0005 | |||||

| BBV / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 1,44 | 0,49 | 0,0502 | −0,0005 | |||||

| US693475BT12 / PNC Financial Services Group Inc/The | 1,44 | −0,28 | 0,0501 | −0,0008 | |||||

| Z1BH34 / Zimmer Biomet Holdings, Inc. - Depositary Receipt (Common Stock) | 1,44 | 0,77 | 0,0500 | −0,0003 | |||||

| US00287YBX67 / CORP. NOTE | 1,44 | 1,27 | 0,0499 | −0,0001 | |||||

| US29278NAN30 / Energy Transfer Operating LP | 1,43 | 0,28 | 0,0496 | −0,0006 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 1,41 | 0,43 | 0,0492 | −0,0005 | |||||

| GEHC34 / GE HealthCare Technologies Inc. - Depositary Receipt (Common Stock) | 1,41 | 0,0491 | 0,0491 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 1,41 | 0,36 | 0,0491 | −0,0005 | |||||

| US694308KH99 / Pacific Gas and Electric Co | 1,41 | −3,62 | 0,0491 | −0,0026 | |||||

| VICI PROPERTIES LP SR UNSECURED 11/31 5.125 / DBT (US925650AH69) | 1,40 | 1,52 | 0,0488 | 0,0001 | |||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 1,40 | 38,61 | 0,0487 | 0,0131 | |||||

| US26884UAE91 / EPR Properties | 1,40 | 0,79 | 0,0486 | −0,0003 | |||||

| US07274EAL74 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.5% 11-21-33 | 1,39 | 2,05 | 0,0485 | 0,0003 | |||||

| US44107TAZ93 / Host Hotels & Resorts LP | 1,39 | 1,31 | 0,0485 | −0,0000 | |||||

| KD / Kyndryl Holdings, Inc. | 1,39 | 3,04 | 0,0483 | 0,0008 | |||||

| US46647PAR73 / JPMorgan Chase & Co. | 1,39 | 0,80 | 0,0483 | −0,0003 | |||||

| US07274NAL73 / Bayer Us Finance Ii Llc 4.375% 12/15/2028 144a Bond | 1,39 | 1,69 | 0,0483 | 0,0001 | |||||

| FCT / Fincantieri S.p.A. | 1,39 | 2,21 | 0,0482 | 0,0004 | |||||

| C1RR34 / Carrier Global Corporation - Depositary Receipt (Common Stock) | 1,38 | 9,61 | 0,0480 | 0,0036 | |||||

| US06738ECD58 / Barclays PLC | 1,38 | −0,07 | 0,0480 | −0,0007 | |||||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | 1,37 | 0,0478 | 0,0478 | ||||||

| US62878U2F87 / NBN Co Ltd | 1,36 | 0,59 | 0,0473 | −0,0004 | |||||

| US38141GYM04 / Goldman Sachs Group Inc/The | 1,36 | 0,89 | 0,0472 | −0,0002 | |||||

| XS2689949555 / Romanian Government International Bond | 1,35 | 9,48 | 0,0470 | 0,0035 | |||||

| APIDOS CLO LTD APID 2012 11A AR4 144A / ABS-CBDO (US03763YBY14) | 1,35 | −0,07 | 0,0469 | −0,0007 | |||||

| US78448TAK88 / SMBC Aviation Capital Finance DAC | 1,33 | 0,60 | 0,0464 | −0,0004 | |||||

| GLOBAL ATLANTIC FIN CO COMPANY GUAR 144A 03/54 6.75 / DBT (US37959GAF46) | 1,33 | 0,98 | 0,0464 | −0,0002 | |||||

| US097023CD51 / Boeing Co/The | 1,33 | 1,37 | 0,0464 | −0,0000 | |||||

| UCB / UCB SA | 1,33 | 9,02 | 0,0463 | 0,0033 | |||||

| US37046US851 / General Motors Financial Co Inc | 1,33 | 1,37 | 0,0462 | −0,0000 | |||||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 1,33 | 0,0462 | 0,0462 | ||||||

| AMERICAN MEDICAL SYST EU COMPANY GUAR 03/32 3.5 / DBT (XS2772266693) | 1,32 | 11,08 | 0,0460 | 0,0040 | |||||

| JAB HOLDINGS BV COMPANY GUAR REGS 04/34 4.375 / DBT (DE000A3LXSR7) | 1,32 | 9,63 | 0,0459 | 0,0034 | |||||

| US631005BJ39 / Narragansett Electric Co/The | 1,32 | 0,92 | 0,0459 | −0,0002 | |||||

| EXEEZ / Expand Energy Corporation - Equity Warrant | 1,32 | 1,07 | 0,0459 | −0,0002 | |||||

| US06051GHX07 / Bank of America Corp | 1,31 | 1,47 | 0,0456 | 0,0001 | |||||

| US195325EL56 / Colombia Government International Bond | 1,31 | −0,08 | 0,0455 | −0,0006 | |||||

| US06051GKW86 / Bank of America Corp. | 1,30 | 0,39 | 0,0453 | −0,0005 | |||||

| OCEAN TRAILS CLO OCTR 2021 11A AR 144A / ABS-CBDO (US67514VAL36) | 1,30 | 0,46 | 0,0452 | −0,0004 | |||||

| US097023CR48 / Boeing Co. | 1,30 | 0,39 | 0,0452 | −0,0005 | |||||

| US37046US851 / General Motors Financial Co Inc | 1,30 | 1,49 | 0,0452 | 0,0000 | |||||

| FERGUSON ENTERPRISES INC COMPANY GUAR 10/34 5 / DBT (US31488VAA52) | 1,29 | 1,90 | 0,0449 | 0,0002 | |||||

| DU0000100962 / Janus Henderson Cash Liquidity Fund | 1,29 | 2,46 | 0,0449 | 0,0005 | |||||

| US06051GGF00 / Bank of America Corp | 1,29 | 0,47 | 0,0448 | −0,0004 | |||||

| SOUTH BOW USA INFRA HLDS COMPANY GUAR 144A 10/34 5.584 / DBT (US83007CAE21) | 1,29 | 1,02 | 0,0448 | −0,0001 | |||||

| US38141GZR81 / Goldman Sachs Group Inc/The | 1,28 | 0,47 | 0,0446 | −0,0004 | |||||

| US04002BAA35 / AREIT_23-CRE8 | 1,28 | −0,70 | 0,0445 | −0,0009 | |||||

| BNP / BNP Paribas SA | 1,27 | 1,76 | 0,0442 | 0,0002 | |||||

| US22160NAA72 / CoStar Group Inc | 1,27 | 1,60 | 0,0441 | 0,0001 | |||||

| ANTARES HOLDINGS SR UNSECURED 144A 10/29 6.35 / DBT (US03666HAH49) | 1,26 | 0,96 | 0,0440 | −0,0002 | |||||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/28 5.05 / DBT (US928668CP53) | 1,26 | 0,64 | 0,0437 | −0,0003 | |||||

| US36264FAL58 / GSK Consumer Healthcare Capital US LLC | 1,26 | 1,21 | 0,0437 | −0,0001 | |||||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/27 4.95 / DBT (US928668CN06) | 1,25 | 0,16 | 0,0436 | −0,0005 | |||||

| TOWD POINT MORTGAGE TRUST TPMT 2024 CES6 A1 144A / ABS-MBS (US891947AA14) | 1,25 | −5,88 | 0,0435 | −0,0033 | |||||

| US431282AU67 / HIGHWOODS REALTY LP 7.65% 02/01/2034 | 1,24 | 1,30 | 0,0433 | −0,0000 | |||||

| HCA INC COMPANY GUAR 03/32 5.5 / DBT (US404119DA49) | 1,24 | 2,23 | 0,0431 | 0,0004 | |||||

| L1HX34 / L3Harris Technologies, Inc. - Depositary Receipt (Common Stock) | 1,24 | 1,31 | 0,0431 | −0,0000 | |||||

| US124857AX11 / ViacomCBS Inc | 1,24 | 0,73 | 0,0431 | −0,0003 | |||||

| XS2438026440 / Thames Water Utilities Finance PLC | 1,24 | −5,28 | 0,0430 | −0,0031 | |||||

| US69120VAU52 / BLUE OWL CREDIT 7.75 1/29 | 1,24 | 0,0430 | 0,0430 | ||||||

| US281020AZ01 / Edison International | 1,23 | −1,59 | 0,0430 | −0,0013 | |||||

| US31429KAK97 / Federation des Caisses Desjardins du Quebec | 1,23 | 0,65 | 0,0429 | −0,0003 | |||||

| US46647PDU75 / JPMorgan Chase & Co. | 1,23 | 0,65 | 0,0429 | −0,0003 | |||||

| MG / Magna International Inc. | 1,23 | 0,0429 | 0,0429 | ||||||

| MU / Micron Technology, Inc. - Depositary Receipt (Common Stock) | 1,23 | 1,32 | 0,0428 | −0,0000 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 1,23 | 1,07 | 0,0427 | −0,0001 | |||||

| US3132DWG230 / Freddie Mac Pool | 1,23 | −3,69 | 0,0427 | −0,0022 | |||||

| MORGAN STANLEY BANK NA MORGAN STANLEY BANK NA / DBT (US61690U8B93) | 1,23 | 0,25 | 0,0426 | −0,0005 | |||||

| US00130HCG83 / CORP. NOTE | 1,22 | 2,26 | 0,0426 | 0,0004 | |||||

| FLUTTER TREASURY DAC FLUTTER TREASURY DAC / DBT (XS2805235426) | 1,22 | 10,28 | 0,0426 | 0,0034 | |||||

| US912810TV08 / US TREASURY N/B 4.75% 11-15-53 | 1,22 | −61,41 | 0,0426 | −0,0692 | |||||

| CA125491AG54 / CI FINANCIAL CO | 1,21 | 0,58 | 0,0422 | −0,0003 | |||||

| US21036PBH01 / Constellation Brands, Inc. | 1,21 | 2,28 | 0,0422 | 0,0003 | |||||

| SWISS RE SUB FIN PLC COMPANY GUAR 144A 04/35 VAR / DBT (US87088QAA22) | 1,21 | 0,17 | 0,0422 | −0,0005 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 1,21 | 0,33 | 0,0421 | −0,0005 | |||||

| US00206RLV23 / AT&T Inc | 1,21 | −0,49 | 0,0420 | −0,0008 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 1,21 | 0,25 | 0,0420 | −0,0005 | |||||

| COLUMBIA PIPELINE HOLDCO COLUMBIA PIPELINE HOLDCO / DBT (US19828AAD90) | 1,21 | 1,69 | 0,0420 | 0,0001 | |||||

| US95000U3H45 / Wells Fargo & Co | 1,20 | 1,26 | 0,0418 | −0,0000 | |||||

| BAIN CAPITAL CREDIT CLO, LIMIT BCC 2022 3A A1R 144A / ABS-CBDO (US05684NAL55) | 1,20 | 0,0418 | 0,0418 | ||||||

| ICG US CLO LTD ICG 2021 3A AR 144A / ABS-CBDO (US449249AS08) | 1,20 | 0,25 | 0,0418 | −0,0005 | |||||

| TRINITAS CLO LTD TRNTS 2022 19A A1R 144A / ABS-CBDO (US89642FAN33) | 1,20 | 0,17 | 0,0418 | −0,0005 | |||||

| AGL CLO 14, LTD. AGL 2021 14A AR 144A / ABS-CBDO (US00851WAL37) | 1,20 | 0,00 | 0,0418 | −0,0006 | |||||

| US292480AK65 / Enable Midstream Partners LP | 1,20 | 0,33 | 0,0418 | −0,0004 | |||||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2021 18A A1R 144A / ABS-CBDO (US04943EAQ44) | 1,20 | −0,08 | 0,0417 | −0,0006 | |||||

| US16411RAK59 / Cheniere Energy Inc | 1,20 | 0,93 | 0,0417 | −0,0002 | |||||

| MADISON PARK FUNDING LTD MDPK 2021 49A AR 144A / ABS-CBDO (US55820VAL71) | 1,20 | 0,25 | 0,0417 | −0,0005 | |||||

| US595112BV48 / Micron Technology Inc | 1,19 | 0,76 | 0,0414 | −0,0003 | |||||

| US458140BW93 / Intel Corp | 1,19 | 0,0414 | 0,0414 | ||||||

| US054989AA67 / BAT CAPITAL CORP 6.343000% 08/02/2030 | 1,19 | 1,45 | 0,0413 | 0,0000 | |||||

| US91159HJP64 / US Bancorp | 1,18 | −0,34 | 0,0412 | −0,0007 | |||||

| D1VN34 / Devon Energy Corporation - Depositary Receipt (Common Stock) | 1,17 | −1,68 | 0,0408 | −0,0013 | |||||

| US097023CM50 / Boing Company (The) 2.70%, Due 02/01/2027 | 1,17 | 0,78 | 0,0406 | −0,0002 | |||||

| FREDDIE MAC FHR 5499 FH / ABS-MBS (US3137HJWY95) | 1,16 | −9,04 | 0,0403 | −0,0046 | |||||

| US87612GAE17 / Targa Resources Corp | 1,16 | 0,61 | 0,0403 | −0,0003 | |||||

| US19828AAB35 / Columbia Pipelines Holding Co LLC | 1,15 | 0,62 | 0,0399 | −0,0003 | |||||

| BNP / BNP Paribas SA | 1,15 | 1,78 | 0,0398 | 0,0001 | |||||