Grundläggande statistik

| Portföljvärde | $ 19 531 564 |

| Aktuella positioner | 120 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

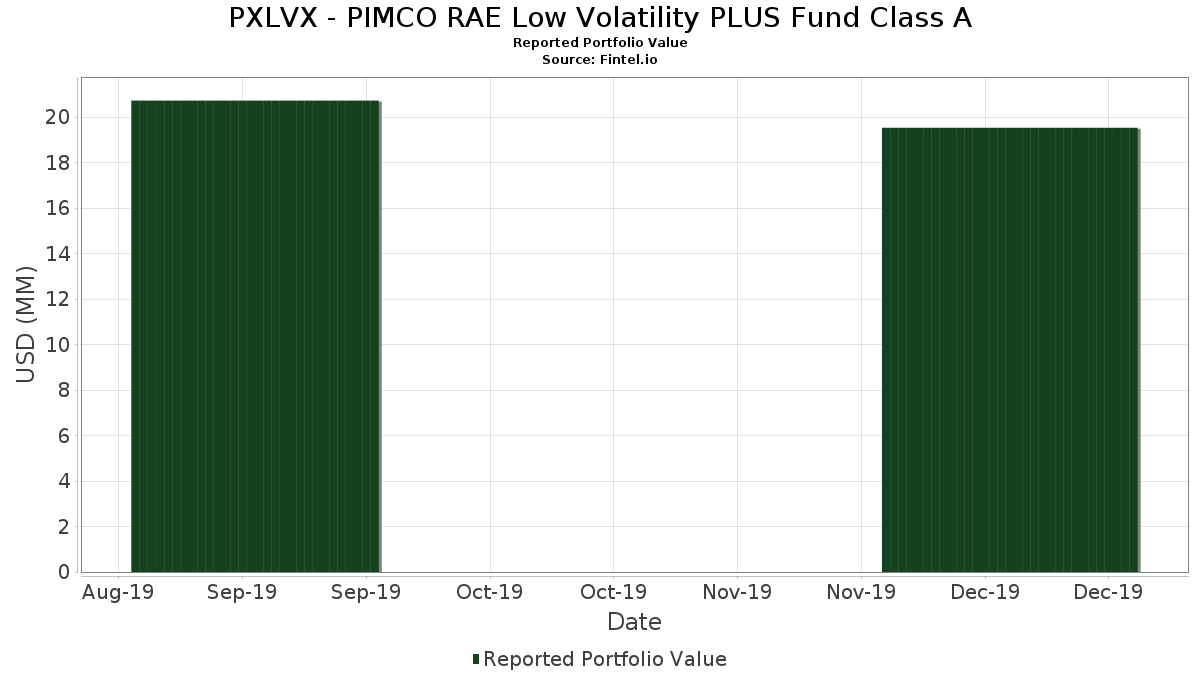

PXLVX - PIMCO RAE Low Volatility PLUS Fund Class A har redovisat 120 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 19 531 564 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). PXLVX - PIMCO RAE Low Volatility PLUS Fund Class As största innehav är Uniform Mortgage-Backed Security, TBA (US:US01F0306294) , United States Treasury Inflation Indexed Bonds (US:US912828X398) , Fannie Mae Pool (US:US31418DBG60) , United States Treasury Note/Bond (US:US912828YE44) , and Us Treasury Bond (US:US912810SF66) . PXLVX - PIMCO RAE Low Volatility PLUS Fund Class As nya positioner inkluderar Uniform Mortgage-Backed Security, TBA (US:US01F0306294) , United States Treasury Inflation Indexed Bonds (US:US912828X398) , Fannie Mae Pool (US:US31418DBG60) , United States Treasury Note/Bond (US:US912828YE44) , and Us Treasury Bond (US:US912810SF66) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 4,65 | 30,2579 | 30,2579 | ||

| 1,92 | 12,5199 | 12,5199 | ||

| 1,89 | 12,2712 | 12,2712 | ||

| 1,46 | 9,4657 | 9,4657 | ||

| 1,80 | 11,6858 | 4,6154 | ||

| 0,51 | 3,3443 | 3,3443 | ||

| 0,22 | 1,4050 | 1,4050 | ||

| 0,21 | 1,3705 | 1,3705 | ||

| 0,10 | 0,6432 | 0,6432 | ||

| 0,10 | 0,6431 | 0,6431 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| −0,40 | −2,5752 | −2,5752 | ||

| 0,11 | 0,7147 | −1,0561 | ||

| 0,35 | 2,2556 | −0,6242 | ||

| −0,09 | −0,5886 | −0,5886 | ||

| −0,03 | −0,1941 | −0,1941 | ||

| 0,42 | 2,7505 | −0,1646 | ||

| −0,02 | −0,1187 | −0,1187 | ||

| 0,54 | 3,5252 | −0,1102 | ||

| −0,01 | −0,0815 | −0,0815 | ||

| −0,01 | −0,0808 | −0,0808 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2020-02-27 för rapporteringsperioden 2019-12-31. Denna investerare har inte offentliggjort värdepapper som räknas i aktier, så de aktierelaterade kolumnerna i tabellen nedan har utelämnats. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|

| PIMCO PRV SHORT TERM FLT III MUTUAL FUND / STIV (000000000) | 4,65 | 30,2579 | 30,2579 | |||

| US01F0306294 / Uniform Mortgage-Backed Security, TBA | 1,92 | 12,5199 | 12,5199 | |||

| RALVEIUT TRS EQUITY 1ML+20 *BULLET* MYI / DE (000000000) | 1,89 | 12,2712 | 12,2712 | |||

| US912828X398 / United States Treasury Inflation Indexed Bonds | 1,80 | 56,31 | 11,6858 | 4,6154 | ||

| US31418DBG60 / Fannie Mae Pool | 1,46 | 9,4657 | 9,4657 | |||

| US912828YE44 / United States Treasury Note/Bond | 1,27 | −0,62 | 8,2885 | 0,4010 | ||

| US912810SF66 / Us Treasury Bond | 1,01 | −5,59 | 6,5991 | −0,0091 | ||

| US912828YB05 / Us Treasury N/b 1.625000% 08/15/2029 Bond | 0,97 | −2,21 | 6,3334 | 0,2074 | ||

| US3140Q9C847 / FNMA POOL CA1894 FN 06/48 FIXED 4 | 0,54 | −8,31 | 3,5252 | −0,1102 | ||

| US01F0326177 / Uniform Mortgage-Backed Security, TBA | 0,51 | 3,3443 | 3,3443 | |||

| US3138WKW353 / FNMA POOL AS9665 FN 05/47 FIXED 4 | 0,42 | −10,78 | 2,7505 | −0,1646 | ||

| ACI12NZL6 / JAPAN GOVT CPI LINKED BONDS 03/28 0.1 | 0,38 | −1,54 | 2,4932 | 0,0998 | ||

| US912810SB52 / United States Treasury Inflation Indexed Bonds | 0,35 | −26,07 | 2,2556 | −0,6242 | ||

| US61760JAA88 / MORGAN STANLEY REREMIC TRUST MSRR 2011 R2 1A 144A | 0,33 | −7,54 | 2,1575 | −0,0469 | ||

| US05533XAA00 / BCAP LLC 2011-RR4-I Trust | 0,31 | −6,06 | 2,0228 | −0,0109 | ||

| XS1791937441 / SAUDI INTERNATIONAL BOND SR UNSECURED REGS 04/25 4 | 0,22 | 1,4050 | 1,4050 | |||

| US01F0426241 / Uniform Mortgage-Backed Security, TBA | 0,21 | 1,3705 | 1,3705 | |||

| US912810RR14 / United States Treasury Inflation Indexed Bonds | 0,12 | −0,83 | 0,7776 | 0,0336 | ||

| US02151JAC53 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2007 HY6 A3 | 0,11 | −62,02 | 0,7147 | −1,0561 | ||

| US126694BS68 / COUNTRYWIDE HOME LOANS CWHL 2005 HYB6 5A1 | 0,11 | −0,94 | 0,6875 | 0,0350 | ||

| US61750SAA06 / MORGAN STANLEY CAPITAL INC MSAC 2006 HE8 A1 | 0,10 | −4,63 | 0,6763 | 0,0104 | ||

| US31418DHK19 / Fannie Mae Pool | 0,10 | 0,6432 | 0,6432 | |||

| US31418DJQ60 / Fannie Mae Pool | 0,10 | 0,6431 | 0,6431 | |||

| IRS USD 1.50000 12/18/19-10Y LCH / DIR (000000000) | 0,09 | 0,6177 | 0,6177 | |||

| ARGPOM / REPUBLIC OF ARGENTINA BONDS 06/20 VAR | 0,09 | 19,23 | 0,6067 | 0,1264 | ||

| IRS USD 2.50000 12/18/19-5Y CME / DIR (000000000) | 0,08 | 0,5498 | 0,5498 | |||

| US45661ECM49 / INDX 06-AR5 2A1 ARH10 FRN 05-25-36 | 0,08 | −4,65 | 0,5361 | 0,0038 | ||

| US07400NAA81 / BEAR STEARNS MORTGAGE FUNDING TRUST 2007-AR5 BSMF 2007-AR5 1A1A | 0,07 | −2,78 | 0,4612 | 0,0175 | ||

| US83612HAC25 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2006 3 A3 | 0,06 | −8,96 | 0,3997 | −0,0150 | ||

| US36242DKL63 / GSAMP TRUST GSAMP 2004 WF M2 | 0,06 | −4,84 | 0,3857 | 0,0028 | ||

| US07384MZQ85 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2003 8 1A1 | 0,06 | −1,75 | 0,3708 | 0,0146 | ||

| US12668AUS22 / Alternative Loan Trust 2005-60T1 | 0,05 | −3,57 | 0,3577 | 0,0089 | ||

| US12669GXF35 / Reperforming Loan REMIC Trust 2005-R1 | 0,05 | −6,00 | 0,3108 | 0,0014 | ||

| CDX IG33 5Y ICE / DCR (000000000) | 0,05 | 0,3079 | 0,3079 | |||

| US040114HQ69 / Argentine Republic Government International Bond | 0,05 | 17,50 | 0,3076 | 0,0561 | ||

| CDX HY33 5Y ICE / DCR (000000000) | 0,04 | 0,2529 | 0,2529 | |||

| US92925CDA71 / WaMu Mortgage Pass-Through Certificates Series 2006-AR3 Trust | 0,04 | −2,63 | 0,2421 | 0,0025 | ||

| US ULTRA BOND CBT MAR20 XCBT 20200320 / DIR (000000000) | 0,04 | 0,2333 | 0,2333 | |||

| US22540VKM36 / CREDIT SUISSE FIRST BOSTON MOR CSFB 2001 28 1A1 | 0,03 | −3,23 | 0,2000 | 0,0080 | ||

| ARARGE5207W0 / ARGENT LETRAS DEL TESORO BILLS 05/20 0.00000 | 0,02 | 22,22 | 0,1494 | 0,0382 | ||

| ARARGE520890 / REPUBLIC OF ARGENTINA BILLS 06/20 VAR | 0,02 | 0,1491 | 0,1491 | |||

| US12668AVP73 / Alternative Loan Trust 2005-61 | 0,02 | 0,00 | 0,1464 | 0,0059 | ||

| BOUGHT BRL/SOLD USD / DFE (000000000) | 0,02 | 0,1394 | 0,1394 | |||

| BOUGHT COP/SOLD USD / DFE (000000000) | 0,02 | 0,1379 | 0,1379 | |||

| RALVEIUT TRS EQUITY 1ML+30 BPS / DE (000000000) | 0,02 | 0,1297 | 0,1297 | |||

| US61750MAB19 / MORGAN STANLEY CAPITAL INC MSAC 2006 HE7 A2FP | 0,02 | −5,56 | 0,1143 | 0,0021 | ||

| US88522XAC56 / Thornburg Mortgage Securities Trust 2007-3 | 0,02 | −11,11 | 0,1094 | −0,0026 | ||

| US46629CAB37 / JP MORGAN MORTGAGE TRUST JPMMT 2006 A5 2A1 | 0,02 | −6,25 | 0,1020 | −0,0017 | ||

| US073879PT96 / BEAR STEARNS ASSET BACKED SECU BSABS 2005 HE1 M3 | 0,01 | 0,00 | 0,0874 | 0,0045 | ||

| CMLTI / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2003 HE3 A | 0,01 | −7,69 | 0,0845 | −0,0014 | ||

| US12669F6Z19 / CWMBS, Inc. | 0,01 | −7,69 | 0,0832 | −0,0018 | ||

| US86359LPF03 / Structured Asset Mortgage Investments II Trust, Series 2005-AR5, Class A3 | 0,01 | 0,00 | 0,0652 | −0,0015 | ||

| US585525EN47 / MRFC Mortgage Pass-Through Trust Series 2000-TBC3 | 0,01 | 0,00 | 0,0394 | −0,0022 | ||

| US86359LPD54 / Structured Asset Mortgage Investments II Trust 2005-AR5 | 0,01 | 0,00 | 0,0354 | 0,0008 | ||

| BOUGHT CNY/SOLD USD / DFE (000000000) | 0,00 | 0,0324 | 0,0324 | |||

| BOUGHT BRL/SOLD USD / DFE (000000000) | 0,00 | 0,0299 | 0,0299 | |||

| BOUGHT GBP/SOLD USD / DFE (000000000) | 0,00 | 0,0296 | 0,0296 | |||

| BOUGHT RUB/SOLD USD / DFE (000000000) | 0,00 | 0,0294 | 0,0294 | |||

| BOUGHT AUD/SOLD USD / DFE (000000000) | 0,00 | 0,0286 | 0,0286 | |||

| ARGB0N / REPUBLIC OF ARGENTINA BONDS 04/22 VAR | 0,00 | 0,00 | 0,0278 | −0,0006 | ||

| ARYPFS560093 / YPF SOCIEDAD ANONIMA SR UNSECURED 09/20 VAR | 0,00 | 0,0220 | 0,0220 | |||

| ARPANE560055 / PAN AMERICAN ENERGY LLC UNSECURED 11/20 VAR | 0,00 | 0,0217 | 0,0217 | |||

| INF SWAP US IT 1.669 06/19/19-5Y LCH / DIR (000000000) | 0,00 | 0,0181 | 0,0181 | |||

| US 2YR NOTE (CBT) MAR20 XCBT 20200331 / DIR (000000000) | 0,00 | 0,0178 | 0,0178 | |||

| BOUGHT INR/SOLD USD / DFE (000000000) | 0,00 | 0,0166 | 0,0166 | |||

| ARCBAS3201C0 / CITY OF BUENOS AIRES SR UNSECURED 01/22 VAR | 0,00 | 0,0163 | 0,0163 | |||

| BOUGHT MXN/SOLD USD / DFE (000000000) | 0,00 | 0,0158 | 0,0158 | |||

| BOUGHT IDR/SOLD USD / DFE (000000000) | 0,00 | 0,0135 | 0,0135 | |||

| ARARGE4502K0 / REPUBLIC OF ARGENTINA BONDS 10/26 15.5 | 0,00 | 0,0116 | 0,0116 | |||

| S03A0 / REPUBLIC OF ARGENTINA BILLS 04/20 VAR | 0,00 | 0,0116 | 0,0116 | |||

| BOUGHT KRW/SOLD USD / DFE (000000000) | 0,00 | 0,0108 | 0,0108 | |||

| BOUGHT MXN/SOLD USD / DFE (000000000) | 0,00 | 0,0091 | 0,0091 | |||

| ARGCER / Bonos de la Nacion Argentina con Ajuste por CER | 0,00 | 0,0086 | 0,0086 | |||

| BOUGHT BRL/SOLD USD / DFE (000000000) | 0,00 | 0,0055 | 0,0055 | |||

| US 5YR NOTE (CBT) MAR20 XCBT 20200331 / DIR (000000000) | 0,00 | 0,0051 | 0,0051 | |||

| BOUGHT KRW/SOLD USD / DFE (000000000) | 0,00 | 0,0039 | 0,0039 | |||

| PBA25 / Provincia de Buenos Aires - Municipal Debt | 0,00 | 0,0030 | 0,0005 | |||

| ARARGE520858 / Argentina Treasury Bill | 0,00 | 0,0028 | 0,0028 | |||

| BOUGHT CAD/SOLD USD / DFE (000000000) | 0,00 | 0,0027 | 0,0027 | |||

| BOUGHT TWD/SOLD USD / DFE (000000000) | 0,00 | 0,0020 | 0,0020 | |||

| BOUGHT EUR/SOLD USD / DFE (000000000) | 0,00 | 0,0019 | 0,0019 | |||

| US LONG BOND(CBT) MAR20 XCBT 20200320 / DIR (000000000) | 0,00 | 0,0014 | 0,0014 | |||

| BOUGHT EUR/SOLD USD / DFE (000000000) | 0,00 | 0,0012 | 0,0012 | |||

| BOUGHT MXN/SOLD USD / DFE (000000000) | 0,00 | 0,0011 | 0,0011 | |||

| SOLD GBP/BOUGHT USD / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | |||

| ARPBUE3204J9 / PROVINCIA DE BUENOS AIRE UNSECURED 05/22 VAR | 0,00 | 0,0005 | 0,0001 | |||

| BOUGHT KRW/SOLD USD / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| SOLD JPY/BOUGHT USD / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| SOLD JPY/BOUGHT USD / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| BOUGHT BRL/SOLD USD / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| US 10YR FUT OPTN MAR20P 117.5 EXP 02/21/2020 / DIR (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD INR/BOUGHT USD / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US 10YR FUT OPTN MAR20P 118 EXP 02/21/2020 / DIR (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD EUR/BOUGHT USD / DFE (000000000) | 0,00 | −0,0000 | −0,0000 | |||

| 3175FL906 CDX.O P 0.90 IG33 JAN20 0.9 PUT / DCR (000000000) | 0,00 | −0,0000 | −0,0000 | |||

| 3175JD553 CDX.O P 0.90 IG33 JAN20 0.9 PUT / DCR (000000000) | 0,00 | −0,0000 | −0,0000 | |||

| SOLD COP/BOUGHT USD / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| SOLD GBP/BOUGHT USD / DFE (000000000) | −0,00 | −0,0005 | −0,0005 | |||

| SOLD IDR/BOUGHT USD / DFE (000000000) | −0,00 | −0,0008 | −0,0008 | |||

| SOLD INR/BOUGHT USD / DFE (000000000) | −0,00 | −0,0013 | −0,0013 | |||

| SOLD RUB/BOUGHT USD / DFE (000000000) | −0,00 | −0,0016 | −0,0016 | |||

| SOLD COP/BOUGHT USD / DFE (000000000) | −0,00 | −0,0023 | −0,0023 | |||

| SOLD AUD/BOUGHT USD / DFE (000000000) | −0,00 | −0,0024 | −0,0024 | |||

| SOLD MXN/BOUGHT USD / DFE (000000000) | −0,00 | −0,0029 | −0,0029 | |||

| SOLD BRL/BOUGHT USD / DFE (000000000) | −0,00 | −0,0038 | −0,0038 | |||

| SOLD EUR/BOUGHT USD / DFE (000000000) | −0,00 | −0,0047 | −0,0047 | |||

| SOLD COP/BOUGHT USD / DFE (000000000) | −0,00 | −0,0056 | −0,0056 | |||

| LONG GILT FUTURE MAR20 IFLL 20200327 / DIR (000000000) | −0,00 | −0,0061 | −0,0061 | |||

| SOLD MXN/BOUGHT USD / DFE (000000000) | −0,00 | −0,0093 | −0,0093 | |||

| SOLD KRW/BOUGHT USD / DFE (000000000) | −0,00 | −0,0097 | −0,0097 | |||

| SOLD TWD/BOUGHT USD / DFE (000000000) | −0,00 | −0,0190 | −0,0190 | |||

| SOLD EUR/BOUGHT USD / DFE (000000000) | −0,00 | −0,0245 | −0,0245 | |||

| SOLD BRL/BOUGHT USD / DFE (000000000) | −0,00 | −0,0291 | −0,0291 | |||

| SOLD CAD/BOUGHT USD / DFE (000000000) | −0,01 | −0,0362 | −0,0362 | |||

| EURO-BUND FUTURE MAR20 XEUR 20200306 / DIR (000000000) | −0,01 | −0,0456 | −0,0456 | |||

| US 10YR NOTE (CBT)MAR20 XCBT 20200320 / DIR (000000000) | −0,01 | −0,0468 | −0,0468 | |||

| IRS JPY 0.38000 06/18/18-10Y LCH / DIR (000000000) | −0,01 | −0,0600 | −0,0600 | |||

| IRS USD 2.25000 03/12/20-30Y CME / DIR (000000000) | −0,01 | −0,0808 | −0,0808 | |||

| SOLD COP/BOUGHT USD / DFE (000000000) | −0,01 | −0,0815 | −0,0815 | |||

| SOLD CNH/BOUGHT USD / DFE (000000000) | −0,02 | −0,1187 | −0,1187 | |||

| IRS USD 2.50000 12/18/19-2Y CME / DIR (000000000) | −0,03 | −0,1941 | −0,1941 | |||

| SOLD BRL/BOUGHT USD / DFE (000000000) | −0,09 | −0,5886 | −0,5886 | |||

| REVERSE REPO JPM CHASE / RA (000000000) | −0,40 | −2,5752 | −2,5752 |