Grundläggande statistik

| Portföljvärde | $ 1 181 988 579 |

| Aktuella positioner | 286 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

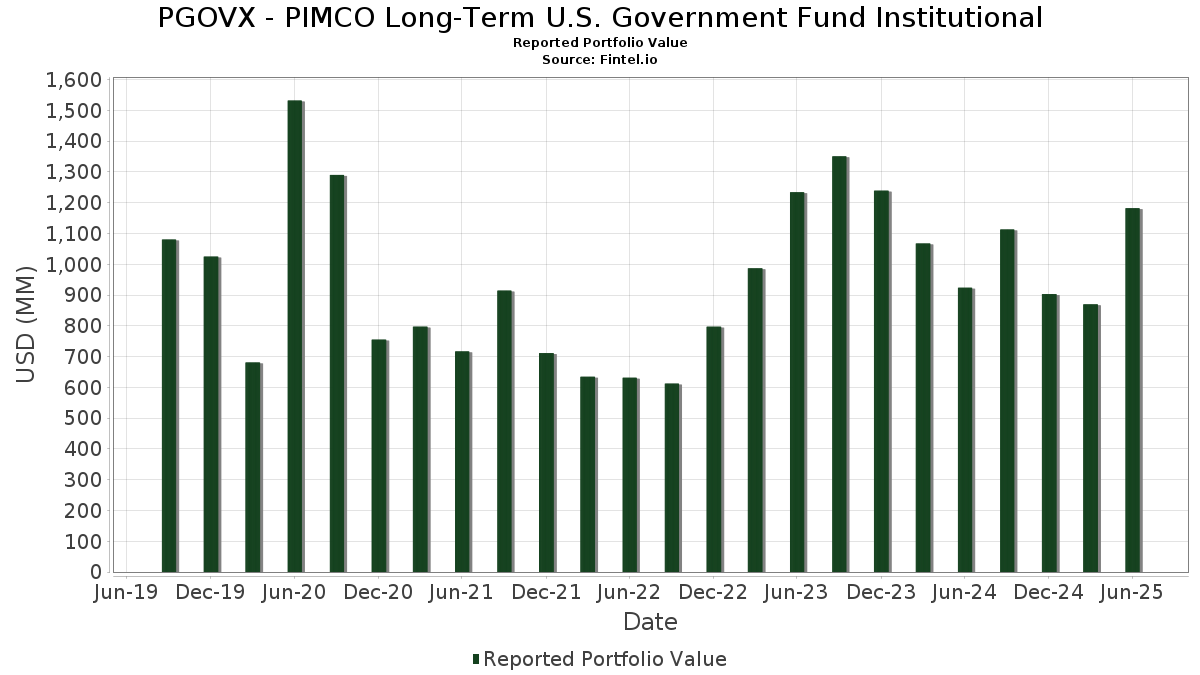

PGOVX - PIMCO Long-Term U.S. Government Fund Institutional har redovisat 286 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 1 181 988 579 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). PGOVX - PIMCO Long-Term U.S. Government Fund Institutionals största innehav är United States Treasury Note/Bond (US:US912810TM09) , United States Treasury Note/Bond (US:US912810TU25) , United States Treasury Note/Bond (US:US912810SQ22) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , and United States Treasury Note/Bond (US:US912810TS78) . PGOVX - PIMCO Long-Term U.S. Government Fund Institutionals nya positioner inkluderar United States Treasury Note/Bond (US:US912810TM09) , United States Treasury Note/Bond (US:US912810TU25) , United States Treasury Note/Bond (US:US912810SQ22) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , and United States Treasury Note/Bond (US:US912810TS78) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 60,00 | 8,1066 | 5,9265 | ||

| 34,77 | 4,6980 | 4,0738 | ||

| 23,38 | 3,1590 | 2,4452 | ||

| 21,81 | 2,9468 | 1,1947 | ||

| 53,46 | 7,2221 | 0,8105 | ||

| 65,71 | 8,8772 | 0,7577 | ||

| 51,47 | 6,9541 | 0,7545 | ||

| 61,40 | 8,2956 | 0,7361 | ||

| 53,97 | 7,2911 | 0,6265 | ||

| 47,95 | 6,4777 | 0,5639 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| −71,65 | −9,6797 | −9,6797 | ||

| −61,35 | −8,2884 | −8,2884 | ||

| 2,75 | 0,3711 | −5,8137 | ||

| −41,56 | −5,6151 | −5,6151 | ||

| −23,60 | −3,1887 | −3,1887 | ||

| 0,70 | 0,0945 | −3,1476 | ||

| 0,76 | 0,1023 | −3,0598 | ||

| −21,87 | −2,9552 | −2,9552 | ||

| 65,22 | 8,8111 | −2,2152 | ||

| 7,08 | 0,9559 | −1,5100 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-28 för rapporteringsperioden 2025-06-30. Denna investerare har inte offentliggjort värdepapper som räknas i aktier, så de aktierelaterade kolumnerna i tabellen nedan har utelämnats. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|

| US912810TM09 / United States Treasury Note/Bond | 65,71 | −2,21 | 8,8772 | 0,7577 | ||

| US912810TU25 / United States Treasury Note/Bond | 65,22 | −28,52 | 8,8111 | −2,2152 | ||

| US912810SQ22 / United States Treasury Note/Bond | 61,40 | −1,84 | 8,2956 | 0,7361 | ||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 60,00 | 178,41 | 8,1066 | 5,9265 | ||

| US912810TS78 / United States Treasury Note/Bond | 53,97 | −2,15 | 7,2911 | 0,6265 | ||

| US91282CFL00 / Treasury, United States Department of | 53,46 | 0,75 | 7,2221 | 0,8105 | ||

| US TREASURY N/B 02/34 4 / DBT (US91282CJZ59) | 51,47 | 0,33 | 6,9541 | 0,7545 | ||

| US912810QZ49 / United States Treas Bds Bond | 47,95 | −2,03 | 6,4777 | 0,5639 | ||

| US912810TJ79 / United States Treasury Note/Bond | 47,88 | −3,06 | 6,4684 | 0,5003 | ||

| US912810SF66 / Us Treasury Bond | 47,28 | −2,56 | 6,3877 | 0,5241 | ||

| US TREASURY N/B 02/44 4.5 / DBT (US912810TZ12) | 46,49 | −25,69 | 6,2810 | −1,2793 | ||

| US912810TL26 / TREASURY BOND | 45,19 | −3,02 | 6,1048 | 0,4743 | ||

| US912810TN81 / United States Treasury Note/Bond | 42,30 | −3,07 | 5,7150 | 0,4411 | ||

| US912810TA60 / U.S. Treasury Bonds | 40,12 | −2,05 | 5,4200 | 0,4705 | ||

| US912810SD19 / United States Treas Bds Bond | 34,77 | 573,26 | 4,6980 | 4,0738 | ||

| US912810SJ88 / United States Treas Bds Bond | 32,69 | −2,74 | 4,4168 | 0,3547 | ||

| US912810TC27 / United States Treasury Note/Bond | 31,10 | −2,11 | 4,2016 | 0,3625 | ||

| US912810TQ13 / United States Treasury Note/Bond | 29,64 | −2,20 | 4,0044 | 0,3420 | ||

| US912810QQ40 / United States Treas Bds Bond | 28,68 | −1,71 | 3,8740 | 0,3487 | ||

| US TREASURY N/B 02/45 4.75 / DBT (US912810UJ50) | 23,38 | 295,90 | 3,1590 | 2,4452 | ||

| US91282CEE75 / United States Treasury Note/Bond | 23,35 | 1,04 | 3,1545 | 0,3620 | ||

| US91282CGK18 / U.S. Treasury Inflation Linked Notes | 21,89 | 0,74 | 2,9569 | 0,3315 | ||

| US TREASURY N/B 02/55 4.625 / DBT (US912810UG12) | 21,81 | 50,44 | 2,9468 | 1,1947 | ||

| US91282CEV90 / United States Treasury Note/Bond | 20,42 | 0,86 | 2,7593 | 0,3123 | ||

| US912810TF57 / TREASURY BOND | 20,38 | −1,99 | 2,7532 | 0,2407 | ||

| US91282CDL28 / UNITED STATES TREASURY NOTE 1.50000000 | 19,24 | 1,21 | 2,5997 | 0,3022 | ||

| US912810TH14 / United States Treasury Note/Bond | 18,87 | −2,10 | 2,5493 | 0,2201 | ||

| TSY INFL IX N/B 01/34 1.75 / DBT (US91282CJY84) | 17,90 | 0,30 | 2,4189 | 0,2618 | ||

| US TREASURY N/B 02/54 4.25 / DBT (US912810TX63) | 16,70 | −22,63 | 2,2560 | −0,3522 | ||

| US912810TR95 / United States Treasury Note/Bond | 15,83 | −3,17 | 2,1385 | 0,1631 | ||

| US91282CEZ05 / U.S. Treasury Inflation Linked Notes | 14,63 | 0,92 | 1,9764 | 0,2246 | ||

| US912810TG31 / U.S. Treasury Bonds | 14,36 | −3,07 | 1,9404 | 0,1498 | ||

| US912810RC45 / United States Treas Bds Bond | 13,17 | −2,13 | 1,7789 | 0,1531 | ||

| US912810TT51 / United States Treasury Note/Bond | 11,62 | −3,06 | 1,5694 | 0,1213 | ||

| US912810QN19 / United Sates Treasury Bond Bond | 10,89 | −1,73 | 1,4717 | 0,1320 | ||

| US912810SU34 / United States Treasury Note/Bond | 10,73 | −3,11 | 1,4503 | 0,1114 | ||

| US01F0506844 / UMBS TBA | 10,68 | 11,59 | 1,4424 | 0,4747 | ||

| US91282CDX65 / United States Treasury Inflation Indexed Bonds | 10,60 | 1,15 | 1,4317 | 0,1655 | ||

| US TREASURY N/B 11/44 4.625 / DBT (US912810UF39) | 10,28 | −51,81 | 1,3891 | −1,1889 | ||

| US3137FDBN18 / Freddie Mac REMICS | 9,67 | 0,75 | 1,3062 | 0,1465 | ||

| US912810SE91 / United States Treas Bds Bond | 8,15 | −2,52 | 1,1012 | 0,0906 | ||

| US21H0406734 / Ginnie Mae | 7,44 | 0,62 | 1,0051 | 0,2572 | ||

| US01F0426811 / UMBS TBA | 7,08 | −70,98 | 0,9559 | −1,5100 | ||

| US91282CHJ36 / United States Treasury Note/Bond | 6,58 | 0,86 | 0,8896 | 0,1007 | ||

| US912810SR05 / United States Treasury Note/Bond - When Issued | 6,51 | −1,76 | 0,8799 | 0,0787 | ||

| US31395V3N79 / FREDDIE MAC FHR 2990 LT | 6,28 | 1,72 | 0,8490 | 0,1024 | ||

| US88059FBG54 / Tennessee Valley Authority Principal Strip | 6,14 | 2,44 | 0,8295 | 0,1052 | ||

| US912810ST60 / TREASURY BOND | 5,77 | −1,99 | 0,7802 | 0,0682 | ||

| US76116EHL74 / Resol Fnd Ser B 2030 Bonds Int Comp 10/15/28 | 5,61 | 1,26 | 0,7575 | 0,0884 | ||

| US TREASURY N/B 11/54 4.5 / DBT (US912810UE63) | 5,53 | −3,27 | 0,7470 | 0,0562 | ||

| US91282CJM47 / United States Treasury Note/Bond | 5,44 | 0,76 | 0,7347 | 0,0824 | ||

| US35563CAJ71 / Freddie Mac Military Housing Bonds Resecuritization Trust Certificates | 5,27 | −1,42 | 0,7115 | 0,0658 | ||

| US3137AQRS98 / FREDDIE MAC FHR 4047 KB | 4,87 | 0,14 | 0,6577 | 0,0703 | ||

| US3137BCU483 / FREDDIE MAC FHR 4376 KZ | 4,85 | 0,83 | 0,6554 | 0,0740 | ||

| US TREASURY N/B 05/54 4.625 / DBT (US912810UA42) | 4,47 | −3,18 | 0,6038 | 0,0459 | ||

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 4,02 | 1,36 | 0,5433 | 0,1420 | ||

| US91282CGQ87 / United States Treasury Note/Bond | 3,94 | 0,74 | 0,5321 | 0,0597 | ||

| US91282CHF14 / United States Treasury Note/Bond | 3,89 | 0,86 | 0,5258 | 0,0594 | ||

| US91282CGS44 / United States Treasury Note/Bond | 3,87 | 0,83 | 0,5232 | 0,0591 | ||

| US01F0406854 / UMBS TBA | 3,81 | 1 938,50 | 0,5150 | 0,4987 | ||

| US08160JAE73 / Benchmark 2019-B9 Mortgage Trust | 3,60 | 1,01 | 0,4870 | 0,0558 | ||

| US38379E2Z46 / GOVERNMENT NATIONAL MORTGAGE A GNR 2014 131 EZ | 3,45 | −0,46 | 0,4656 | 0,0472 | ||

| US3136AKE740 / FANNIE MAE FNR 2014 52 AZ | 3,37 | −3,19 | 0,4558 | 0,0347 | ||

| US3136AKAL75 / FANNIE MAE FNR 2014 33 PZ | 3,21 | 1,68 | 0,4337 | 0,0522 | ||

| US01F0306781 / UMBS TBA | 3,20 | 0,4326 | 0,4326 | |||

| INVITATION HOMES TRUST IHSFR 2024 SFR1 A 144A / ABS-MBS (US46188DAA63) | 3,12 | 1,04 | 0,4209 | 0,0483 | ||

| CROWL / VESSEL MANAGEMENT SERVIC US GOVT GUAR 08/36 3.432 | 2,84 | 0,99 | 0,3842 | 0,0440 | ||

| US91282CJG78 / U.S. Treasury Notes | 2,83 | 0,64 | 0,3830 | 0,0426 | ||

| US91282CHZ77 / United States Treasury Note/Bond | 2,80 | 0,68 | 0,3786 | 0,0422 | ||

| US912810TD00 / United States Treasury Note/Bond | 2,75 | −3,13 | 0,3715 | 0,0284 | ||

| US TREASURY N/B 05/44 4.625 / DBT (US912810UB25) | 2,75 | −94,63 | 0,3711 | −5,8137 | ||

| US91282CHW47 / US TREASURY N/B 4.125000% 08/31/2030 | 2,74 | 0,81 | 0,3701 | 0,0417 | ||

| US12636GAA94 / COMM 2016-667M Mortgage Trust | 2,60 | 6,11 | 0,3518 | 0,0552 | ||

| US91282CAQ42 / USTN TII 0.125% 10/15/2025 | 2,46 | 0,53 | 0,3329 | 0,0368 | ||

| US38379EGM84 / GOVERNMENT NATIONAL MORTGAGE A GNR 2014 118 PZ | 2,40 | −1,20 | 0,3239 | 0,0307 | ||

| US21H0426799 / Ginnie Mae | 2,39 | 0,3234 | 0,3234 | |||

| US3136ALFG19 / FANNIE MAE FNR 2014 66 QZ | 2,35 | −0,51 | 0,3180 | 0,0321 | ||

| OIS USD SOFR/1.75000 10/23/23-30Y CME / DIR (EZYB2MXL5F96) | 2,24 | 6,41 | 0,3029 | 0,0482 | ||

| US91282CET45 / U.S. Treasury Notes | 2,15 | 0,56 | 0,2911 | 0,0323 | ||

| US43300LAA89 / Hilton USA Trust 2016-HHV | 2,10 | 0,34 | 0,2830 | 0,0307 | ||

| BENCHMARK MORTGAGE TRUST BMARK 2024 V6 A3 / ABS-MBS (US081927AB15) | 2,09 | 0,58 | 0,2821 | 0,0312 | ||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 2,06 | 0,2789 | 0,2789 | |||

| US05610QAC78 / BMO 2023-5C2 Mortgage Trust | 1,93 | 0,21 | 0,2609 | 0,0279 | ||

| US05377RHM97 / Avis Budget Rental Car Funding AESOP LLC | 1,78 | 0,11 | 0,2405 | 0,0257 | ||

| US912810SX72 / UNITED STATES TREASURY BOND 2.375% 05/15/2051 | 1,52 | −3,06 | 0,2057 | 0,0160 | ||

| RFRF USD SF+26.161/0.7* 03/30/21-10Y LCH / DIR (EZP7M2L0Q084) | 1,47 | −10,54 | 0,1983 | −0,0000 | ||

| US30227FAA84 / Extended Stay America Trust | 1,46 | −0,88 | 0,1972 | 0,0193 | ||

| US3137BXHP02 / FREDDIE MAC FHR 4677 KT | 1,42 | 1,72 | 0,1917 | 0,0232 | ||

| US912810RS96 / United States Treas Bds Bond | 1,40 | −2,51 | 0,1893 | 0,0156 | ||

| US31395UZZ73 / FREDDIE MAC FHR 2990 DZ | 1,36 | −10,01 | 0,1835 | 0,0012 | ||

| US42806MAN92 / Hertz Vehicle Financing LLC | 1,15 | 0,70 | 0,1558 | 0,0174 | ||

| US98162JAA43 / Worldwide Plaza Trust 2017-WWP | 1,14 | 2,80 | 0,1537 | 0,0200 | ||

| US3137F5BX63 / Freddie Mac REMICS | 1,12 | −3,45 | 0,1511 | 0,0112 | ||

| SLAM LLC SLAM 2025 1A A 144A / ABS-O (US78450TAA51) | 1,02 | 0,1377 | 0,1377 | |||

| RFRF USD SF+26.161/1.4* 07/21/21-10Y LCH / DIR (EZZMCMLRYMY7) | 0,87 | −12,73 | 0,1178 | −0,0029 | ||

| US89178WBB37 / Towd Point Mortgage Trust 2020-1 | 0,82 | 1,11 | 0,1110 | 0,0129 | ||

| US06540TAD28 / BANK 2018-BNK11 | 0,79 | 1,02 | 0,1069 | 0,0121 | ||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 0,76 | −97,11 | 0,1023 | −3,0598 | ||

| US31331VEG77 / Federal Farm Credit Banks | 0,70 | 0,14 | 0,0952 | 0,0102 | ||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 0,70 | −97,82 | 0,0945 | −3,1476 | ||

| US57643LFN10 / MASTR ASSET BACKED SECURITIES MABS 2004 WMC3 M1 | 0,61 | −2,54 | 0,0830 | 0,0068 | ||

| US64828XAA19 / NEW RESIDENTIAL MORTGAGE LOAN TRUST 2020-RPL1 SER 2020-RPL1 CL A1 V/R REGD 144A P/P 2.75000000 | 0,61 | −4,11 | 0,0820 | 0,0055 | ||

| US04965JAA16 / Atrium Hotel Portfolio Trust 2017-ATRM | 0,60 | −0,50 | 0,0815 | 0,0082 | ||

| US31395HHV50 / Freddie Mac Structured Pass-Through Certificates | 0,60 | −3,07 | 0,0812 | 0,0063 | ||

| SANTANDER DRIVE AUTO RECEIVABL SDART 2024 4 A2 / ABS-O (US802919AB63) | 0,57 | −47,26 | 0,0768 | −0,0534 | ||

| US45254NQG50 / Impac CMB Trust, Series 2005-6, Class 1A1 | 0,54 | −3,91 | 0,0732 | 0,0050 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2024 3 A 144A / ABS-O (US69547XAA00) | 0,54 | −16,54 | 0,0730 | −0,0052 | ||

| US912810RP57 / United States Treas Bds Bond | 0,52 | −2,45 | 0,0700 | 0,0058 | ||

| US TREASURY N/B 10/29 4.125 / DBT (US91282CLR06) | 0,51 | 0,80 | 0,0685 | 0,0077 | ||

| RFR USD SOFR/3.30000 12/02/24-29Y* CME / DIR (EZ4L37MKCDC8) | 0,50 | 24,19 | 0,0673 | 0,0188 | ||

| RFRF USD SF+26.161/0.400 03/30/21-5Y LCH / DIR (EZJHD7L3BS84) | 0,47 | −26,33 | 0,0636 | −0,0136 | ||

| US38374BRG04 / GOVERNMENT NATIONAL MORTGAGE A GNR 2003 65 ZA | 0,45 | −5,72 | 0,0601 | 0,0031 | ||

| US59020UMF92 / MERRILL LYNCH MORTGAGE INVESTO MLMI 2004 WMC5 M1 | 0,42 | −2,53 | 0,0574 | 0,0048 | ||

| US26828HAA59 / ECMC Group Student Loan Trust 2018-1 | 0,42 | −1,43 | 0,0561 | 0,0052 | ||

| US65535VPU60 / NAA 2005-AR5 2A1 | 0,40 | −1,00 | 0,0536 | 0,0052 | ||

| RFR USD SOFR/3.46382 09/03/24-25Y* CME / DIR (EZKW32HGZY54) | 0,35 | 134,00 | 0,0475 | 0,0293 | ||

| US86363LAB99 / Structured Adjustable Rate Mortgage Loan Trust Series 2007-4 | 0,33 | −1,79 | 0,0445 | 0,0040 | ||

| US31392DJ785 / FANNIEMAE WHOLE LOAN FNW 2002 W5 A11 | 0,30 | −3,28 | 0,0400 | 0,0030 | ||

| US31395MLM90 / FREDDIE MAC FHR 2927 YZ | 0,27 | −0,36 | 0,0371 | 0,0038 | ||

| US92925CDA71 / WaMu Mortgage Pass-Through Certificates Series 2006-AR3 Trust | 0,26 | −2,63 | 0,0350 | 0,0027 | ||

| US748940AA13 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2006 QS7 A1 | 0,21 | −2,74 | 0,0288 | 0,0023 | ||

| US12669GPN50 / CHL Mortgage Pass-Through Trust 2005-2 | 0,21 | −0,48 | 0,0283 | 0,0029 | ||

| US TREASURY N/B 11/27 4.125 / DBT (US91282CLX73) | 0,20 | 0,00 | 0,0273 | 0,0030 | ||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | 0,19 | 0,0257 | 0,0257 | |||

| RFR USD SOFR/3.36832 09/03/24-25Y* CME / DIR (EZKW32HGZY54) | 0,18 | 21,33 | 0,0247 | 0,0065 | ||

| US912810SL35 / United States Treasury Note/Bond | 0,18 | −2,67 | 0,0246 | 0,0019 | ||

| US31395A3J20 / Freddie Mac Structured Pass-Through Certificates | 0,15 | −2,56 | 0,0206 | 0,0016 | ||

| US12667GCB77 / Alternative Loan Trust 2005-14 | 0,14 | −1,40 | 0,0192 | 0,0018 | ||

| US93363DAB38 / WaMu Mortgage Pass-Through Certificates Series 2006-AR9 Trust | 0,14 | −0,72 | 0,0186 | 0,0019 | ||

| US41161PLR28 / HARBORVIEW MORTGAGE LOAN TRUST 2005-2 SER 2005-2 CL 2A1A V/R REGD 2.17325000 | 0,11 | −5,00 | 0,0155 | 0,0009 | ||

| US31396VHC54 / FANNIE MAE FNR 2007 30 MZ | 0,11 | −10,32 | 0,0154 | 0,0001 | ||

| US912810SA79 / United States Treas Bds Bond | 0,11 | 0,0151 | 0,0151 | |||

| US912810RY64 / United States Treas Bds Bond | 0,11 | 0,0145 | 0,0145 | |||

| US313920DM96 / FANNIE MAE FNR 2001 28 PZ | 0,11 | −12,50 | 0,0143 | −0,0003 | ||

| US04410RAA41 / Ashford Hospitality Trust 2018-ASHF | 0,10 | 0,00 | 0,0133 | 0,0014 | ||

| US07386HVS74 / BEAR STEARNS ALT A TRUST BALTA 2005 7 22A1 | 0,09 | −4,12 | 0,0127 | 0,0009 | ||

| US761118EN47 / RALI Series 2005-QO1 Trust | 0,09 | −5,21 | 0,0123 | 0,0007 | ||

| US64830NAA90 / New Residential Mortgage Loan Trust 2019-RPL3 | 0,09 | −5,32 | 0,0121 | 0,0007 | ||

| US3138WJFL75 / Fannie Mae Pool | 0,09 | −1,12 | 0,0120 | 0,0012 | ||

| US07384YGX85 / BEAR STEARNS ASSET BACKED SECU BSABS 2003 1 A1 | 0,08 | −5,75 | 0,0112 | 0,0006 | ||

| RFR USD SOFR/3.52738 09/03/24-25Y* CME / DIR (EZKW32HGZY54) | 0,07 | −55,33 | 0,0092 | −0,0090 | ||

| RFR USD SOFR/3.9914* 06/02/25-28Y* LCH / DIR (EZB5X6DXL3D2) | 0,07 | 0,0091 | 0,0091 | |||

| US31395W6J13 / FREDDIE MAC FHR 3001 BZ | 0,06 | −4,55 | 0,0085 | 0,0005 | ||

| US31395WBB28 / FREDDIE MAC FHR 3001 YZ | 0,06 | −4,55 | 0,0085 | 0,0005 | ||

| RFR USD SOFR/3.23200 09/10/24-10Y LCH / DIR (EZ7VRSSQ00Z9) | 0,06 | −11,76 | 0,0082 | −0,0001 | ||

| RFR USD SOFR/3.28000 09/16/24-10Y LCH / DIR (EZH06W9H2QV9) | 0,05 | −6,12 | 0,0063 | 0,0003 | ||

| US86360KAE82 / Structured Asset Mortgage Investments II Trust 2006-AR3 | 0,04 | −2,22 | 0,0061 | 0,0005 | ||

| US81743PBW59 / Sequoia Mortgage Trust 2003-4 | 0,04 | −2,27 | 0,0059 | 0,0005 | ||

| US31404Q5M78 / Fannie Mae Pool | 0,04 | −4,44 | 0,0059 | 0,0004 | ||

| RFR USD SOFR/3.27750 09/16/24-10Y LCH / DIR (EZH06W9H2QV9) | 0,04 | −12,24 | 0,0058 | −0,0002 | ||

| US31402LPB26 / FANNIE MAE 2.757% 06/01/2043 FAR FNARM | 0,04 | −4,88 | 0,0054 | 0,0004 | ||

| US83611DAA63 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2006 NLC1 A1 144A | 0,03 | −2,86 | 0,0047 | 0,0004 | ||

| US31396V4Q81 / Fannie Mae REMICS | 0,03 | 0,00 | 0,0045 | 0,0004 | ||

| US57563NAA63 / MASSACHUSETTS EDUCATIONAL FINANCING AUTHORITY SER 2008-1 CL A1 V/R 2.88963000 | 0,03 | −2,94 | 0,0045 | 0,0003 | ||

| US86358HRX97 / STRUCTURED ASSET MORTGAGE INVE SAMI 2003 AR1 A3 | 0,03 | −3,23 | 0,0041 | 0,0003 | ||

| US31394PPQ09 / FHLMC STRUCTURED PASS THROUGH FSPC T 59 1A1 | 0,03 | 0,00 | 0,0037 | 0,0003 | ||

| US93934XAB91 / WASHINGTON MUTUAL ASSET BACKED WMABS 2006 HE5 2A1 | 0,02 | 0,00 | 0,0033 | 0,0003 | ||

| US36225CN281 / Government National Mortgage Association | 0,02 | −8,33 | 0,0030 | 0,0000 | ||

| US46630GAV77 / JP Morgan Mortgage Trust, Series 2007-A1, Class 5A5 | 0,02 | −4,35 | 0,0030 | 0,0002 | ||

| RFR USD SOFR/3.24000 09/16/24-10Y LCH / DIR (EZH06W9H2QV9) | 0,02 | −57,14 | 0,0029 | −0,0031 | ||

| RFR USD SOFR/3.53200 08/20/24-10Y LCH / DIR (EZ4ZGS2N23W5) | 0,02 | −25,93 | 0,0027 | −0,0006 | ||

| US31405XQU09 / FANNIE MAE 3.516% 11/01/2034 FAR FNARM | 0,02 | 0,00 | 0,0021 | 0,0002 | ||

| RFR USD SOFR/3.59900 08/28/24-10Y LCH / DIR (EZT3B05TS4Z8) | 0,01 | 180,00 | 0,0020 | 0,0013 | ||

| US12669GTV31 / CWHL 2005-3 2A1 V/R 4/25/35 2.28800000 | 0,01 | 0,00 | 0,0015 | 0,0001 | ||

| US31411AH320 / FNMA POOL 902150 FN 10/36 FIXED 6.5 | 0,01 | 0,00 | 0,0014 | 0,0001 | ||

| US31393JAZ12 / Freddie Mac REMICS | 0,01 | −10,00 | 0,0013 | 0,0001 | ||

| US92922F5T14 / WaMu Mortgage Pass-Through Certificates Series 2005-AR15 Trust | 0,01 | 0,00 | 0,0013 | 0,0001 | ||

| US31407BXK06 / FNMA POOL 826082 FN 07/35 FLOATING VAR | 0,01 | 0,00 | 0,0008 | 0,0001 | ||

| US31414MQZ22 / FNMA POOL 970372 FN 02/38 FIXED 7 | 0,01 | 0,00 | 0,0007 | 0,0001 | ||

| RFR USD SOFR/3.43091 09/03/24-7Y* LCH / DIR (EZPDSL9DRNN3) | 0,01 | −84,37 | 0,0007 | −0,0032 | ||

| US31374GW524 / Fannie Mae Pool | 0,01 | 0,00 | 0,0007 | 0,0000 | ||

| US36225CEF95 / GNMA II POOL 080133 G2 11/27 FLOATING VAR | 0,01 | −16,67 | 0,0007 | −0,0000 | ||

| US3133TDV944 / FREDDIE MAC FHR 2059 C | 0,00 | 0,00 | 0,0006 | 0,0000 | ||

| US31393MH614 / FREDDIE MAC REMICS SER 2585 CL FD V/R 2.52750000 | 0,00 | 0,00 | 0,0006 | 0,0000 | ||

| US12465MAA27 / C-BASS 2006-CB9 TRUST | 0,00 | 0,00 | 0,0006 | 0,0001 | ||

| US31392PU943 / FHLMC, REMIC, Series 2477, Class FZ | 0,00 | 0,00 | 0,0005 | 0,0000 | ||

| RFR USD SOFR/3.60500 08/28/24-10Y LCH / DIR (EZT3B05TS4Z8) | 0,00 | −40,00 | 0,0005 | −0,0002 | ||

| RFR USD SOFR/3.64300 08/28/24-10Y LCH / DIR (EZT3B05TS4Z8) | 0,00 | −40,00 | 0,0005 | −0,0002 | ||

| US31359PXL56 / FANNIE MAE FNR 1997 38 PH | 0,00 | −50,00 | 0,0004 | −0,0004 | ||

| US929227QB55 / WaMu Mortgage Pass-Through Certificates Series 2002-AR6 Trust | 0,00 | 0,00 | 0,0004 | 0,0000 | ||

| US36290TAZ21 / GNMA II POOL 616624 G2 09/34 FIXED 6.5 | 0,00 | 0,00 | 0,0004 | 0,0000 | ||

| US36225CE280 / GNMA II | 0,00 | 0,00 | 0,0004 | −0,0000 | ||

| US31392RDQ11 / FREDDIE MAC FHR 2469 FV | 0,00 | 0,00 | 0,0004 | 0,0000 | ||

| US31348SW424 / FED HM LN PC POOL 786067 FH 01/28 FLOATING VAR | 0,00 | 0,00 | 0,0004 | 0,0000 | ||

| US31408GUG09 / FNMA POOL 851183 FN 04/36 FIXED 6.5 | 0,00 | 0,00 | 0,0004 | 0,0000 | ||

| US31410YQJ63 / FNMA POOL 901457 FN 10/36 FIXED 6.5 | 0,00 | 0,00 | 0,0004 | 0,0000 | ||

| US07384MTK89 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2003 1 3A1 | 0,00 | 0,00 | 0,0003 | 0,0000 | ||

| RFR USD SOFR/3.60000 01/17/24-10Y LCH / DIR (EZ3PH80XK7T0) | 0,00 | −60,00 | 0,0003 | −0,0004 | ||

| US31389FJ604 / FNMA POOL 624085 FN 01/32 FIXED 6.5 | 0,00 | 0,00 | 0,0003 | 0,0000 | ||

| RFR USD SOFR/3.71500 08/07/24-10Y LCH / DIR (EZ2H268MSWS8) | 0,00 | −71,43 | 0,0003 | −0,0006 | ||

| US36202K6D25 / Ginnie Mae II Pool | 0,00 | 0,00 | 0,0003 | −0,0000 | ||

| US31348SWZ37 / Freddie Mac Non Gold Pool | 0,00 | 0,00 | 0,0003 | 0,0000 | ||

| RFR USD SOFR/3.61000 12/12/22-10Y LCH / DIR (EZ9QNGWF95R1) | 0,00 | −95,65 | 0,0003 | −0,0025 | ||

| US36225CBY12 / GNMA II POOL 080054 G2 03/27 FLOATING VAR | 0,00 | −50,00 | 0,0002 | −0,0000 | ||

| US81743WAA99 / Sequoia Mortgage Trust 5 | 0,00 | 0,00 | 0,0002 | 0,0000 | ||

| US31410CVF66 / FNMA POOL 885414 FN 06/36 FIXED 6.5 | 0,00 | 0,00 | 0,0002 | 0,0000 | ||

| US31359QCR39 / FANNIE MAE FNR 1997 55 Z | 0,00 | 0,00 | 0,0002 | −0,0000 | ||

| US31409TS586 / Fannie Mae Pool | 0,00 | 0,00 | 0,0002 | 0,0000 | ||

| US31383KUW51 / FNMA POOL 505597 FN 04/28 FLOATING VAR | 0,00 | 0,00 | 0,0002 | −0,0000 | ||

| US31392CRD82 / FANNIE MAE FNR 2002 21 FD | 0,00 | 0,00 | 0,0001 | −0,0000 | ||

| US31297UVE71 / FED HM LN PC POOL A38713 FG 01/35 FIXED 6.5 | 0,00 | 0,0001 | 0,0000 | |||

| US86358HNX34 / Structured Asset Mortgage Investments Trust 2002-AR3 | 0,00 | 0,0001 | 0,0000 | |||

| US36225CBV72 / GNMA II POOL 080051 G2 03/27 FLOATING VAR | 0,00 | 0,0001 | −0,0000 | |||

| US36225CA890 / GNMA II POOL 080030 G2 01/27 FLOATING VAR | 0,00 | 0,0001 | −0,0000 | |||

| US3133TKM237 / FREDDIE MAC FHR 2143 FG | 0,00 | 0,0001 | −0,0000 | |||

| US31358SSV42 / Fannie Mae REMICS | 0,00 | 0,0001 | 0,0000 | |||

| US36225CD522 / GNMA II POOL 080123 G2 10/27 FLOATING VAR | 0,00 | 0,0001 | −0,0000 | |||

| US36225CAA45 / GNMA II POOL 080000 G2 10/26 FLOATING VAR | 0,00 | 0,0001 | −0,0000 | |||

| US36290S6G12 / GNMA II 6.50% 8/34 #616571 | 0,00 | 0,0001 | 0,0000 | |||

| US31413FHC95 / FNMA POOL 944027 FN 08/37 FIXED 6.5 | 0,00 | 0,0001 | 0,0000 | |||

| US36202KZ659 / GNMA II POOL 008865 G2 05/26 FLOATING VAR | 0,00 | 0,0000 | −0,0000 | |||

| US36202K3B95 / Ginnie Mae II Pool | 0,00 | 0,0000 | −0,0000 | |||

| US31386EBE77 / FNMA POOL 560837 FN 10/30 FIXED 9 | 0,00 | 0,0000 | 0,0000 | |||

| US22541NX200 / CS FIRST BOSTON MORTGAGE SECURITIES CORP. | 0,00 | 0,0000 | 0,0000 | |||

| US36202K5U58 / GNMA II POOL 008959 G2 08/26 FLOATING VAR | 0,00 | 0,0000 | −0,0000 | |||

| US36225CB542 / Ginnie Mae II Pool | 0,00 | 0,0000 | −0,0000 | |||

| US36202KZP38 / GNMA II POOL 008850 G2 04/26 FLOATING VAR | 0,00 | 0,0000 | −0,0000 | |||

| US36202KXJ95 / GNMA II POOL 008781 G2 01/26 FLOATING VAR | 0,00 | 0,0000 | −0,0000 | |||

| US36202K6Z37 / GNMA II POOL 008988 G2 10/26 FLOATING VAR | 0,00 | 0,0000 | −0,0000 | |||

| US36202K6G55 / Ginnie Mae II Pool | 0,00 | 0,0000 | −0,0000 | |||

| US36202KY330 / GNMA II POOL 008830 G2 03/26 FLOATING VAR | 0,00 | 0,0000 | −0,0000 | |||

| US36202KUY99 / Ginnie Mae II Pool | 0,00 | 0,0000 | −0,0000 | |||

| US073914WC36 / BEAR STEARNS MORTGAGE SECURITI BSMSI 1997 6 3A | 0,00 | 0,0000 | −0,0000 | |||

| US36228FNB84 / GSR MORTGAGE LOAN TRUST | 0,00 | 0,0000 | 0,0000 | |||

| US31386H4B47 / FNMA POOL 564318 FN 11/30 FIXED 9 | 0,00 | 0,0000 | 0,0000 | |||

| US36202KWF82 / GNMA II | 0,00 | 0,0000 | −0,0000 | |||

| US36202KVP73 / Ginnie Mae II Pool | 0,00 | 0,0000 | −0,0000 | |||

| US36202K7A76 / GOVT NATL MORTG ASSN 3.125% 10/20/2026 GN CMT+150 | 0,00 | 0,0000 | −0,0000 | |||

| US36202KUH66 / Ginnie Mae II Pool | 0,00 | 0,0000 | −0,0000 | |||

| 317U9G6A0 PIMCO SWAPTION 4.065 PUT USD 2025070 / DIR (EZJQZP36X547) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9EGA4 PIMCO SWAPTION 4.135 PUT USD 2025063 / DIR (EZXJWB9HGZH3) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9EOA5 PIMCO SWAPTION 4.101 PUT USD 2025063 / DIR (EZXJWB9HGZH3) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9GEA1 PIMCO SWAPTION 4.075 PUT USD 2025070 / DIR (EZ78N9X8M3Y4) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9HMA0 PIMCO SWAPTION 4.019 PUT USD 2025070 / DIR (EZY1VWC6W1B5) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9JKA8 PIMCO SWAPTION 4.14 PUT USD 20250709 / DIR (EZYG54DQ9CL7) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9JRA1 PIMCO SWAPTION 4.12 PUT USD 20250709 / DIR (EZYG54DQ9CL7) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9N3A8 PIMCO SWAPTION 3.905 PUT USD 2025072 / DIR (EZBGX0TQ91B3) | −0,00 | −0,0001 | −0,0001 | |||

| 317U9LLA2 PIMCO SWAPTION 4.095 PUT USD 2025071 / DIR (EZBYVN1N6JS0) | −0,00 | −0,0001 | −0,0001 | |||

| 317U9O2A7 PIMCO SWAPTION 3.895 PUT USD 2025072 / DIR (EZHZLXVZP143) | −0,00 | −0,0001 | −0,0001 | |||

| US 10YR FUT OPTN AUG25P 110.2 EXP 07/25/2025 / DIR (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| 317U9EHA3 PIMCO SWAPTION 3.735 CALL USD 202506 / DIR (EZY1GXGHBZM5) | −0,00 | −0,0002 | −0,0002 | |||

| 317U9N4A7 PIMCO SWAPTION 3.555 CALL USD 202507 / DIR (EZMYNDCY8F38) | −0,00 | −0,0002 | −0,0002 | |||

| 317U9O3A6 PIMCO SWAPTION 3.545 CALL USD 202507 / DIR (EZ24N26H1YR9) | −0,00 | −0,0002 | −0,0002 | |||

| 317U9MJA3 PIMCO SWAPTION 4.05 PUT USD 20250721 / DIR (EZPXSH8F93Y9) | −0,00 | −0,0002 | −0,0002 | |||

| 317U9EPA4 PIMCO SWAPTION 3.701 CALL USD 202506 / DIR (EZY1GXGHBZM5) | −0,00 | −0,0003 | −0,0003 | |||

| RFR USD SOFR/4.00000 02/26/25-10Y LCH / DIR (EZ02007F7Y72) | −0,00 | 100,00 | −0,0003 | −0,0001 | ||

| US 10YR FUT OPTN AUG25C 112.7 EXP 07/25/2025 / DIR (000000000) | −0,00 | −0,0005 | −0,0005 | |||

| 317U9O6A3 PIMCO SWAPTION 3.875 PUT USD 2025072 / DIR (EZHZLXVZP143) | −0,00 | −0,0006 | −0,0006 | |||

| 317U9MPA6 PIMCO SWAPTION 3.933 PUT USD 2025072 / DIR (EZTRLD6PX319) | −0,00 | −0,0006 | −0,0006 | |||

| RFR USD SOFR/3.84200 12/26/23-10Y LCH / DIR (EZXF72WB6QT0) | −0,01 | 150,00 | −0,0008 | −0,0005 | ||

| 317U9O7A2 PIMCO SWAPTION 3.525 CALL USD 202507 / DIR (EZ24N26H1YR9) | −0,01 | −0,0008 | −0,0008 | |||

| 317U9HNA9 PIMCO SWAPTION 3.669 CALL USD 202507 / DIR (EZJFGPMJB918) | −0,01 | −0,0010 | −0,0010 | |||

| 317U9G7A9 PIMCO SWAPTION 3.715 CALL USD 202507 / DIR (EZL4V0T519J1) | −0,01 | −0,0011 | −0,0011 | |||

| RFR USD SOFR/3.90750 03/04/25-10Y LCH / DIR (EZP5RC766JJ0) | −0,01 | 60,00 | −0,0012 | −0,0005 | ||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | −0,01 | −0,0014 | −0,0014 | |||

| RFR USD SOFR/3.87400 03/05/25-10Y LCH / DIR (EZMZ9H14KX59) | −0,01 | 57,14 | −0,0016 | −0,0008 | ||

| 317U9MQA5 PIMCO SWAPTION 3.583 CALL USD 202507 / DIR (EZCLF3R2NG23) | −0,01 | −0,0019 | −0,0019 | |||

| 317U9GFA0 PIMCO SWAPTION 3.725 CALL USD 202507 / DIR (EZ78XR7L6YX2) | −0,02 | −0,0021 | −0,0021 | |||

| RFR USD SOFR/3.63761 03/01/24-4Y* LCH / DIR (EZ5FK37PXZM8) | −0,02 | −105,70 | −0,0023 | −0,0384 | ||

| RFR USD SOFR/3.85400 12/29/23-10Y LCH / DIR (EZ691JFCS359) | −0,02 | 125,00 | −0,0025 | −0,0014 | ||

| RFR USD SOFR/3.90500 03/12/25-10Y LCH / DIR (EZ2V6Q3C4Q52) | −0,02 | 58,33 | −0,0026 | −0,0011 | ||

| RFR USD SOFR/3.89000 03/03/25-10Y LCH / DIR (EZ6496BPGLD0) | −0,02 | 58,33 | −0,0026 | −0,0012 | ||

| RFR USD SOFR/3.80740 03/01/24-4Y* LCH / DIR (EZ5FK37PXZM8) | −0,02 | −108,05 | −0,0033 | −0,0394 | ||

| 317U9LMA1 PIMCO SWAPTION 3.695 CALL USD 202507 / DIR (EZSG2674R1G7) | −0,03 | −0,0038 | −0,0038 | |||

| 317U9MKA1 PIMCO SWAPTION 3.7 CALL USD 20250721 / DIR (EZQRZMCG5093) | −0,03 | −0,0042 | −0,0042 | |||

| RFR USD SOFR/3.84200 03/04/25-5Y LCH / DIR (EZSYJ06JDLK1) | −0,03 | 106,67 | −0,0043 | −0,0024 | ||

| RFR USD SOFR/3.65543 03/01/24-4Y* LCH / DIR (EZ5FK37PXZM8) | −0,04 | −112,42 | −0,0051 | −0,0412 | ||

| 317U9JQA2 PIMCO SWAPTION 3.77 CALL USD 2025070 / DIR (EZT76LRY6S63) | −0,04 | −0,0056 | −0,0056 | |||

| 317U9JLA7 PIMCO SWAPTION 3.79 CALL USD 2025070 / DIR (EZT76LRY6S63) | −0,05 | −0,0072 | −0,0072 | |||

| US01F0226831 / FEDERAL NATIONAL MORTGAGE ASSOCIATION 30YR TBA AUG | −0,08 | 1,23 | −0,0112 | −0,0029 | ||

| RFR USD SOFR/3.75000 09/02/25-7Y* LCH / DIR (000000000) | −0,13 | −0,0171 | −0,0171 | |||

| RFR USD SOFR/3.75000 12/18/24-5Y LCH / DIR (EZ2V74HC3Q62) | −0,15 | 329,41 | −0,0198 | −0,0156 | ||

| RFR USD SOFR/3.66213 03/01/24-4Y* LCH / DIR (EZ5FK37PXZM8) | −0,19 | −163,76 | −0,0258 | −0,0619 | ||

| RFR USD SOFR/3.69116 03/01/24-4Y* LCH / DIR (EZ5FK37PXZM8) | −0,21 | −171,81 | −0,0290 | −0,0651 | ||

| RFR USD SOFR/3.69387 03/01/24-4Y* LCH / DIR (EZ5FK37PXZM8) | −0,22 | −172,48 | −0,0293 | −0,0654 | ||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | −0,26 | −0,0347 | −0,0347 | |||

| RFR USD SOFR/4.10000 09/02/25-27Y* CME / DIR (000000000) | −0,26 | −0,0349 | −0,0349 | |||

| RFR USD SOFR/3.80000 06/03/24-7Y* LCH / DIR (EZRYBJZD4558) | −0,35 | 4,48 | −0,0474 | −0,0068 | ||

| RFR USD SOFR/3.67875 03/01/24-4Y* LCH / DIR (EZ5FK37PXZM8) | −0,38 | −228,86 | −0,0519 | −0,0880 | ||

| RFRF USD SOFR/2.39500 10/25/23-5Y CME / DIR (EZGJVXVG8Q10) | −0,67 | −63,98 | −0,0911 | 0,1350 | ||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | −1,93 | −0,2603 | −0,2603 | |||

| US 10YR ULTRA FUT SEP25 XCBT 20250919 / DIR (000000000) | −3,46 | −0,4670 | −0,4670 | |||

| US LONG BOND(CBT) SEP25 XCBT 20250919 / DIR (000000000) | −4,03 | −0,5439 | −0,5439 | |||

| REVERSE REPO WOOD GUNDY REVERSE REPO / RA (000000000) | −10,43 | −1,4090 | −1,4090 | |||

| REVERSE REPO BANK OF AMERICA REVERSE REPO / RA (000000000) | −21,87 | −2,9552 | −2,9552 | |||

| REVERSE REPO DEUTSCHE REVERSE REPO / RA (000000000) | −23,60 | −3,1887 | −3,1887 | |||

| REVERSE REPO THE BANK OF NOVA REVERSE REPO / RA (000000000) | −41,56 | −5,6151 | −5,6151 | |||

| REPU STATE STREET GLOBAL MARKE USD REPU SSB T / RA (000000000) | −61,35 | −8,2884 | −8,2884 | |||

| REVERSE REPO NATEXIS BANQUE REVERSE REPO / RA (000000000) | −71,65 | −9,6797 | −9,6797 |