Grundläggande statistik

| Portföljvärde | $ 479 384 053 |

| Aktuella positioner | 227 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

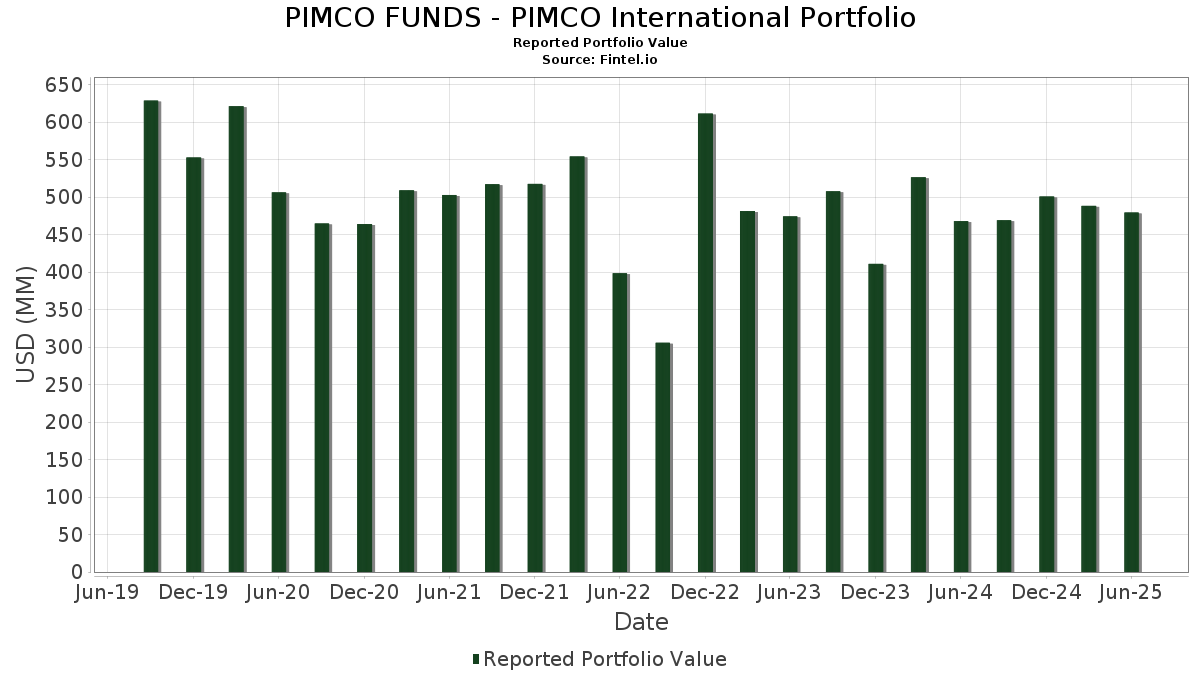

PIMCO FUNDS - PIMCO International Portfolio har redovisat 227 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 479 384 053 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). PIMCO FUNDS - PIMCO International Portfolios största innehav är PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , Province of Quebec Canada (CA:CA74814ZFS70) , CORP CMO (US:US12668RAA68) , MORGAN STANLEY CAPITAL INC MSAC 2007 NC1 A2B (US:US617505AC64) , and CHL Mortgage Pass-Through Trust 2005-2 (US:US12669GPN50) . PIMCO FUNDS - PIMCO International Portfolios nya positioner inkluderar PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , Province of Quebec Canada (CA:CA74814ZFS70) , CORP CMO (US:US12668RAA68) , MORGAN STANLEY CAPITAL INC MSAC 2007 NC1 A2B (US:US617505AC64) , and CHL Mortgage Pass-Through Trust 2005-2 (US:US12669GPN50) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 38,60 | 7,5543 | 7,5543 | ||

| 22,70 | 4,4425 | 4,4425 | ||

| 18,76 | 3,6708 | 3,6708 | ||

| 13,98 | 2,7363 | 2,7363 | ||

| 9,76 | 1,9106 | 1,9106 | ||

| 9,10 | 1,7813 | 1,7813 | ||

| 4,57 | 0,8951 | 0,8951 | ||

| 37,60 | 7,3581 | 0,5299 | ||

| 11,22 | 2,1951 | 0,4590 | ||

| 172,92 | 33,8414 | 0,4536 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| −1,87 | −0,3657 | −0,3657 | ||

| −1,37 | −0,2681 | −0,2681 | ||

| −1,37 | −0,2681 | −0,2681 | ||

| 34,01 | 6,6569 | −0,1763 | ||

| −0,61 | −0,1203 | −0,1203 | ||

| −0,60 | −0,1169 | −0,1169 | ||

| −0,54 | −0,1050 | −0,1050 | ||

| −0,48 | −0,0944 | −0,0944 | ||

| 0,87 | 0,1702 | −0,0773 | ||

| −0,33 | −0,0654 | −0,0654 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-28 för rapporteringsperioden 2025-06-30. Denna investerare har inte offentliggjort värdepapper som räknas i aktier, så de aktierelaterade kolumnerna i tabellen nedan har utelämnats. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 172,92 | 0,11 | 33,8414 | 0,4536 | ||

| REPO BANK AMERICA REPO / RA (000000000) | 38,60 | 7,5543 | 7,5543 | |||

| GB00BMV7TC88 / United Kingdom Gilt | 37,60 | 6,43 | 7,3581 | 0,5299 | ||

| EUROPEAN UNION SR UNSECURED REGS 10/29 2.875 / DBT (EU000A3L1CN4) | 34,01 | −3,78 | 6,6569 | −0,1763 | ||

| 5831 / Shizuoka Financial Group,Inc. | 24,20 | 1,76 | 4,7357 | 0,1394 | ||

| CITIGROUP REPO REPO 5807 / RA (000000000) | 22,70 | 4,4425 | 4,4425 | |||

| BRITISH COLUMBIA PROV OF UNSECURED 06/34 4.15 / DBT (CA110709AK82) | 21,97 | 4,35 | 4,2993 | 0,2296 | ||

| 5831 / Shizuoka Financial Group,Inc. | 18,76 | 3,6708 | 3,6708 | |||

| 5831 / Shizuoka Financial Group,Inc. | 17,48 | −2,73 | 3,4207 | −0,0529 | ||

| CA74814ZFS70 / Province of Quebec Canada | 15,71 | 4,50 | 3,0740 | 0,1684 | ||

| 5831 / Shizuoka Financial Group,Inc. | 13,98 | 2,7363 | 2,7363 | |||

| IRS EUR 2.25000 09/17/25-30Y LCH / DIR (EZV4L1QCFM97) | 11,22 | 24,89 | 2,1951 | 0,4590 | ||

| Q / Quetzal Copper Corp. | 10,51 | 4,16 | 2,0573 | 0,1064 | ||

| ONTARIO (PROVINCE OF) SR UNSECURED 12/34 3.8 / DBT (CA68333ZBG15) | 9,76 | 1,9106 | 1,9106 | |||

| 5831 / Shizuoka Financial Group,Inc. | 9,10 | 1,7813 | 1,7813 | |||

| CPPIB CAPITAL INC COMPANY GUAR REGS 06/34 4.3 / DBT (CA12593CAY71) | 9,04 | 4,06 | 1,7689 | 0,0900 | ||

| EIB / EUROPEAN INVESTMENT BANK SR UNSECURED 03/21 9 | 4,57 | 0,8951 | 0,8951 | |||

| IRS AUD 4.50000 09/18/24-10Y LCH / DIR (EZLG541MMLX8) | 2,06 | 115,18 | 0,4023 | 0,2177 | ||

| US12668RAA68 / CORP CMO | 1,95 | −2,35 | 0,3821 | −0,0043 | ||

| US617505AC64 / MORGAN STANLEY CAPITAL INC MSAC 2007 NC1 A2B | 1,90 | −1,91 | 0,3723 | −0,0026 | ||

| IRS AUD 4.50000 09/20/23-10Y LCH / DIR (EZGXS4F4YYN6) | 1,35 | 100,15 | 0,2638 | 0,1336 | ||

| US12669GPN50 / CHL Mortgage Pass-Through Trust 2005-2 | 1,17 | −0,17 | 0,2284 | 0,0024 | ||

| TREASURY BILL 10/25 0.00000 / DBT (US912797RD17) | 1,05 | 0,2049 | 0,2049 | |||

| GB00BMBL1D50 / United Kingdom Gilt | 1,04 | 0,68 | 0,2034 | 0,0039 | ||

| TREASURY BILL 10/25 0.00000 / DBT (US912797RB50) | 0,88 | 0,1726 | 0,1726 | |||

| IRS NZD 3.75000 06/15/22-5Y LCH / DIR (EZ329Y2MS4V2) | 0,87 | −32,11 | 0,1702 | −0,0773 | ||

| CAN 10YR BOND FUT SEP25 XMOD 20250918 / DIR (000000000) | 0,74 | 0,1440 | 0,1440 | |||

| US41161PYZ07 / HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2005 16 3A1A | 0,73 | −0,55 | 0,1422 | 0,0010 | ||

| EURO-BUND FUTURE SEP25 XEUR 20250908 / DIR (DE000F1NGF53) | 0,69 | 0,1356 | 0,1356 | |||

| RFR GBP SONIO/3.75000 03/19/25-30Y LCH / DIR (EZ0141M3RG43) | 0,68 | 26,53 | 0,1336 | 0,0293 | ||

| TREASURY BILL 08/25 0.00000 / DBT (US912797QK68) | 0,67 | 0,1304 | 0,1304 | |||

| US617526AD01 / MORGAN STANLEY CAPITAL INC MSAC 2007 HE1 A2B | 0,66 | −1,35 | 0,1291 | −0,0001 | ||

| IRS AUD 4.50000 03/20/24-10Y LCH / DIR (EZJLKSMVQPQ8) | 0,66 | 107,26 | 0,1287 | 0,0675 | ||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,61 | 0,1199 | 0,1199 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,60 | 0,1170 | 0,1170 | |||

| US41161PA868 / HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2006 1 2A1A | 0,55 | −4,37 | 0,1072 | −0,0035 | ||

| US23332UFF66 / DSLA Mortgage Loan Trust 2005-AR5 | 0,49 | 0,00 | 0,0951 | 0,0011 | ||

| US39538RBB42 / GreenPoint MTA Trust 2005-AR2 | 0,46 | −0,22 | 0,0909 | 0,0009 | ||

| US12667GZ303 / CORP CMO | 0,46 | −1,91 | 0,0903 | −0,0007 | ||

| US35562QAB41 / FREDDIE MAC WHOLE LOAN FHW 2005 S001 1A2 | 0,44 | −2,64 | 0,0866 | −0,0013 | ||

| LONG GILT FUTURE SEP25 IFLL 20250926 / DIR (GB00MP6FM953) | 0,43 | 0,0846 | 0,0846 | |||

| US12668ATN53 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 62 1A1 | 0,43 | −0,23 | 0,0840 | 0,0008 | ||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0,33 | 0,0653 | 0,0653 | |||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0,33 | 0,0653 | 0,0653 | |||

| US04012MAP41 / ARGENT SECURITIES INC. ARSI 2006 M1 A2B | 0,31 | −0,63 | 0,0613 | 0,0004 | ||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,24 | 0,0467 | 0,0467 | |||

| US07386HZJ30 / Bear Stearns ALT-A Trust 2005-10 | 0,21 | −4,07 | 0,0416 | −0,0012 | ||

| US12669GRQ63 / COUNTRYWIDE HOME LOANS CWHL 2005 1 2A1 | 0,21 | −1,89 | 0,0408 | −0,0003 | ||

| US04542BJY92 / ABFC 2004-OPT5 Trust | 0,19 | −3,98 | 0,0378 | −0,0011 | ||

| US126694A329 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 OA1 2A1 | 0,18 | 4,05 | 0,0353 | 0,0019 | ||

| US93363QAC24 / WAMU MORTGAGE PASS THROUGH CER WAMU 2006 AR15 2A | 0,18 | 0,57 | 0,0345 | 0,0005 | ||

| US12667GZB21 / Alternative Loan Trust 2005-31 | 0,15 | −0,67 | 0,0292 | 0,0001 | ||

| US38374HVU12 / Government National Mortgage Association | 0,13 | −5,26 | 0,0248 | −0,0010 | ||

| US81743PBW59 / Sequoia Mortgage Trust 2003-4 | 0,12 | −2,36 | 0,0243 | −0,0003 | ||

| IRS AUD 3.75000 03/19/25-5Y LCH / DIR (EZ1SKCYFPQ26) | 0,12 | −168,57 | 0,0236 | 0,0576 | ||

| US12668AVP73 / Alternative Loan Trust 2005-61 | 0,12 | −7,20 | 0,0228 | −0,0015 | ||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,10 | 0,0188 | 0,0188 | |||

| US23332UDC53 / DSLA MORTGAGE LOAN TRUST 2005-AR2 DSLA 2005-AR2 2A1A | 0,09 | 0,00 | 0,0174 | 0,0000 | ||

| US81744FDW41 / SEQUOIA MORTGAGE TRUST 2004-9 SER 2004-9 CL A2 V/R REGD 2.80150000 | 0,09 | −2,25 | 0,0172 | −0,0002 | ||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,08 | 0,0153 | 0,0153 | |||

| US41161PMG53 / HARBORVIEW MORTGAGE LOAN TRUST 2005-3 SER 2005-3 CL 2A1A V/R REGD 2.21325000 | 0,08 | −3,85 | 0,0148 | −0,0004 | ||

| US1248MGAJ39 / C-BASS 2007-CB1 TRUST | 0,07 | −1,41 | 0,0138 | −0,0000 | ||

| US86358RMY08 / AMORTIZING RESIDENTIAL COLLATE ARC 2001 BC6 A | 0,07 | −6,85 | 0,0135 | −0,0008 | ||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,07 | 0,0129 | 0,0129 | |||

| US23332UEM27 / DSLA Mortgage Loan Trust, Series 2005-AR4, Class 2A1A | 0,06 | 0,00 | 0,0124 | 0,0001 | ||

| US83611DAA63 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2006 NLC1 A1 144A | 0,06 | −1,67 | 0,0116 | −0,0001 | ||

| IRS EUR 2.45000 05/05/25-10Y LCH / DIR (EZCDFQCSBVM0) | 0,05 | 0,0107 | 0,0107 | |||

| US12669GZQ71 / CHL MORTGAGE PASS-THROUGH TRUST 2005-9 SER 2005-9 CL 1A3 V/R REGD 2.16800000 | 0,05 | −1,82 | 0,0106 | −0,0001 | ||

| US12668BBN29 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 81 A1 | 0,05 | −3,92 | 0,0097 | −0,0002 | ||

| US36225CN364 / Ginnie Mae II Pool | 0,05 | −9,62 | 0,0094 | −0,0009 | ||

| US23245PAA93 / ALTERNATIVE LOAN TRUST 2006-OA22 | 0,05 | −2,08 | 0,0094 | −0,0000 | ||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,05 | 0,0094 | 0,0094 | |||

| OIS CAD CAONREPO/3.2500 06/18/25-10Y LCH / DIR (EZZS88NMZ4T2) | 0,05 | 0,0089 | 0,0089 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,04 | 0,0087 | 0,0087 | |||

| US92925DAB64 / WaMu Mortgage Pass-Through Certificates Series 2006-AR17 Trust | 0,04 | −4,55 | 0,0084 | −0,0002 | ||

| BOUGHT NZD SOLD USD 20250702 / DFE (000000000) | 0,04 | 0,0077 | 0,0077 | |||

| US41161PTN32 / HarborView Mortgage Loan Trust 2005-10 | 0,04 | −5,26 | 0,0072 | −0,0002 | ||

| IRS EUR 2.51000 04/09/25-10Y LCH / DIR (EZTHL4ZCB733) | 0,03 | 0,0061 | 0,0061 | |||

| US61755CAA09 / MORGAN STANLEY CAPITAL INC MSAC 2007 HE6 A1 | 0,03 | −3,23 | 0,0060 | −0,0000 | ||

| US761118WP92 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2006 QO3 A1 | 0,03 | 0,00 | 0,0058 | 0,0001 | ||

| US22540A7A01 / CREDIT SUISSE FIRST BOSTON MOR CSFB 2001 HE17 A1 | 0,03 | −3,45 | 0,0056 | −0,0001 | ||

| IRS EUR 2.00000 09/17/25-2Y LCH / DIR (EZR89VG8W7K1) | 0,03 | −105,87 | 0,0055 | 0,0946 | ||

| US3133TER551 / FREDDIE MAC FHR 2073 PH | 0,03 | −12,90 | 0,0053 | −0,0007 | ||

| IRS EUR 2.53000 04/23/25-10Y LCH / DIR (EZP376MT1B98) | 0,03 | 0,0052 | 0,0052 | |||

| US41161PSK02 / HarborView Mortgage Loan Trust 2005-9 | 0,02 | −4,00 | 0,0049 | −0,0001 | ||

| US542514HN71 / Long Beach Mortgage Loan Trust 2004-4 | 0,02 | 0,00 | 0,0048 | −0,0000 | ||

| US04544TAB70 / Asset Backed Securities Corp Home Equity Loan Trust Series AMQ 2007-HE2 | 0,02 | 0,00 | 0,0046 | 0,0001 | ||

| BOUGHT NZD SOLD USD 20250804 / DFE (000000000) | 0,02 | 0,0045 | 0,0045 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | 0,02 | 0,0045 | 0,0045 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | 0,02 | 0,0045 | 0,0045 | |||

| US31395HHV50 / Freddie Mac Structured Pass-Through Certificates | 0,02 | −4,76 | 0,0041 | −0,0001 | ||

| OIS CAD CAONREPO/3.00000 06/18/25-5Y LCH / DIR (EZ272ZNDWLQ3) | 0,02 | 0,0040 | 0,0040 | |||

| US12668AVL69 / Alternative Loan Trust, Series 2005-61, Class 1A1 | 0,02 | −5,26 | 0,0037 | −0,0002 | ||

| IRS EUR 2.25000 09/17/25-5Y LCH / DIR (EZ3YW7100S99) | 0,02 | −81,63 | 0,0036 | −0,0154 | ||

| US885220ET68 / THORNBURG MORTGAGE SECURITIES TMST 2004 1 I1A | 0,02 | −5,56 | 0,0035 | −0,0002 | ||

| US12669GUX77 / CHL Mortgage Pass-Through Trust 2005-11 | 0,02 | 0,00 | 0,0032 | −0,0000 | ||

| US36225CPC46 / GNMA II POOL 080418 G2 06/30 FLOATING VAR | 0,02 | −16,67 | 0,0031 | −0,0005 | ||

| US93363RAB24 / WaMu Mortgage Pass-Through Certificates Series 2006-AR13 Trust | 0,01 | 0,00 | 0,0028 | 0,0000 | ||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0028 | 0,0028 | |||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0028 | 0,0028 | |||

| EURO-BOBL FUTURE SEP25 XEUR 20250908 / DIR (DE000F1NGF61) | 0,01 | 0,0025 | 0,0025 | |||

| US36225CNP76 / Ginnie Mae II Pool | 0,01 | −7,69 | 0,0025 | −0,0001 | ||

| US12465MAA27 / C-BASS 2006-CB9 TRUST | 0,01 | 0,00 | 0,0024 | 0,0000 | ||

| US31393BX754 / Fannie Mae Trust 2003-W6 | 0,01 | −8,33 | 0,0023 | −0,0001 | ||

| US073871AN55 / Bear Stearns ALT-A Trust Mortgage Pass-Through Certificates Series 2006-4 | 0,01 | 0,00 | 0,0023 | −0,0000 | ||

| US31395M2F53 / Freddie Mac Structured Pass-Through Certificates | 0,01 | 0,00 | 0,0021 | −0,0001 | ||

| IRS EUR 2.61000 03/24/25-10Y LCH / DIR (EZPS73SKDR02) | 0,01 | −164,29 | 0,0018 | 0,0046 | ||

| US41161PYW75 / HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2005 16 2A1A | 0,01 | −11,11 | 0,0017 | −0,0000 | ||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0017 | 0,0017 | |||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0017 | 0,0017 | |||

| US12669GPR64 / CHL Mortgage Pass-Through Trust 2005-2 | 0,01 | 0,00 | 0,0016 | 0,0000 | ||

| US3128QS3K03 / FED HM LN PC POOL 1G2602 FH 10/36 FLOATING VAR | 0,01 | 0,00 | 0,0015 | −0,0000 | ||

| US93934XAB91 / WASHINGTON MUTUAL ASSET BACKED WMABS 2006 HE5 2A1 | 0,01 | 0,00 | 0,0014 | −0,0000 | ||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0014 | 0,0014 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0014 | 0,0014 | |||

| US44328AAB61 / HSI Asset Securitization Corp Trust 2006-HE1 | 0,01 | −14,29 | 0,0014 | 0,0000 | ||

| US31394A6Y70 / FNW 2004-W12 1A1 6% 7/25/44 6.00000000 | 0,01 | 0,00 | 0,0013 | −0,0000 | ||

| US65535VPU60 / NAA 2005-AR5 2A1 | 0,01 | 0,00 | 0,0013 | 0,0000 | ||

| US92922F4M79 / WaMu Mortgage Pass-Through Certificates Series 2005-AR13 Trust | 0,01 | 0,00 | 0,0012 | −0,0000 | ||

| US31395A3J20 / Freddie Mac Structured Pass-Through Certificates | 0,01 | 0,00 | 0,0012 | −0,0000 | ||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,01 | 0,0010 | 0,0010 | |||

| US17307GTJ75 / CITIGROUP MORTGAGE LOAN TRUST, INC. | 0,00 | −20,00 | 0,0009 | −0,0001 | ||

| US31407UMR58 / Fannie Mae Pool | 0,00 | 0,00 | 0,0009 | −0,0000 | ||

| RFR EUR ESTRON/2.06280 11/14/24-5Y* LCH / DIR (EZ64KXLFNMN4) | 0,00 | −98,33 | 0,0009 | −0,0456 | ||

| BOUGHT AUD SOLD USD 20250805 / DFE (000000000) | 0,00 | 0,0009 | 0,0009 | |||

| BOUGHT AUD SOLD USD 20250805 / DFE (000000000) | 0,00 | 0,0009 | 0,0009 | |||

| US12669GJY89 / COUNTRYWIDE HOME LOANS CWHL 2004 25 1A1 | 0,00 | 0,00 | 0,0009 | −0,0000 | ||

| US939336X409 / WaMu Mortgage Pass-Through Certificates Series 2005-AR1 Trust | 0,00 | 0,00 | 0,0009 | −0,0000 | ||

| US41161PQU02 / HarborView Mortgage Loan Trust, Series 2005-8, Class 1A2A | 0,00 | 0,00 | 0,0008 | −0,0001 | ||

| US313398VT33 / FSPC T-35 A V/R 9/25/31 1.84800000 | 0,00 | −20,00 | 0,0008 | −0,0001 | ||

| US59023QAB77 / MERRILL LYNCH MORTGAGE INVESTORS TRUST SERIES 2006-RM4 | 0,00 | 0,00 | 0,0008 | −0,0000 | ||

| US92922FU480 / WaMu Mortgage Pass-Through Certificates Series 2005-AR9 Trust | 0,00 | −25,00 | 0,0008 | −0,0000 | ||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0008 | 0,0008 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0007 | 0,0007 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | |||

| US92922FD213 / WAMU_05-AR2 | 0,00 | −33,33 | 0,0006 | −0,0000 | ||

| US9393357P40 / WAMU 02-AR9 1A V/R 8/25/42 3.72644500 | 0,00 | 0,00 | 0,0005 | −0,0000 | ||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| US12669FY239 / COUNTRYWIDE HOME LOANS CWHL 2004 16 1A4A | 0,00 | 0,00 | 0,0005 | −0,0000 | ||

| BOUGHT EUR SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| US22541NX200 / CS FIRST BOSTON MORTGAGE SECURITIES CORP. | 0,00 | 0,00 | 0,0003 | −0,0000 | ||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| US929227LE40 / WAMU MORTGAGE PASS-THROUGH CERTIFICATES SERIES 2002-AR2 SER 2002-AR2 CL A V/R REGD 2.37700000 | 0,00 | 0,00 | 0,0003 | −0,0000 | ||

| US81743WAA99 / Sequoia Mortgage Trust 5 | 0,00 | 0,00 | 0,0002 | −0,0000 | ||

| US22541NAD12 / Home Equity Asset Trust | 0,00 | 0,00 | 0,0002 | 0,0000 | ||

| US31405U6G90 / Fannie Mae Pool | 0,00 | 0,00 | 0,0002 | −0,0000 | ||

| US36202KZ659 / GNMA II POOL 008865 G2 05/26 FLOATING VAR | 0,00 | 0,00 | 0,0002 | −0,0001 | ||

| US251513AR81 / Deutsche Alt-B Securities Mortgage Loan Trust Series 2006-AB4 | 0,00 | 0,00 | 0,0002 | −0,0000 | ||

| US12669GTV31 / CWHL 2005-3 2A1 V/R 4/25/35 2.28800000 | 0,00 | 0,0001 | −0,0000 | |||

| US86359LBY48 / STRUCTURED ASSET MORTGAGE INVE SAMI 2004 AR3 1A2 | 0,00 | 0,0001 | −0,0000 | |||

| US929227XB72 / WAMU MORTGAGE PASS-THROUGH CERTIFICATES SERIES 2002-AR17 SER 2002-AR17 CL 1A V/R REGD 3.52644500 | 0,00 | 0,0001 | −0,0000 | |||

| US31393T7H31 / Fannie Mae REMICS | 0,00 | 0,0001 | −0,0000 | |||

| US31387UEQ04 / FNMA POOL 594243 FN 12/30 FLOATING VAR | 0,00 | 0,0001 | −0,0000 | |||

| US36202KZN89 / GOVT NATL MORTG ASSN 2.625% 04/20/2026 GNMA ARM | 0,00 | 0,0001 | −0,0000 | |||

| US86359B7K13 / Structured Asset Securities Corp Mortgage Loan Trust 2005-7XS | 0,00 | 0,0001 | −0,0000 | |||

| US31394ANT96 / Fannie Mae REMICS | 0,00 | 0,0001 | −0,0000 | |||

| US31359V6Z11 / FANNIE MAE FNR 1999 37 F | 0,00 | 0,0001 | −0,0000 | |||

| US31339LMA51 / Freddie Mac REMICS | 0,00 | 0,0001 | −0,0000 | |||

| BOUGHT DKK SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT DKK SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| US83162CPV99 / Small Business Administration Participation Certs | 0,00 | 0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US36228FNB84 / GSR MORTGAGE LOAN TRUST | 0,00 | 0,0000 | −0,0000 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US36202KUY99 / Ginnie Mae II Pool | 0,00 | 0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US36202KUV50 / GNMA II POOL 008696 G2 09/25 FLOATING VAR | 0,00 | 0,0000 | −0,0000 | |||

| BOUGHT CAD SOLD USD 20250805 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT CAD SOLD USD 20250805 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US36202KTG03 / Ginnie Mae II Pool | 0,00 | 0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9ELA8 PIMCO SWAPTION 2.1 CALL EUR 20250630 / DIR (000000000) | 0,00 | −0,0000 | −0,0000 | |||

| 317U9EKA9 PIMCO SWAPTION 2.36 PUT EUR 20250630 / DIR (000000000) | 0,00 | −0,0000 | −0,0000 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0006 | −0,0006 | |||

| 317U9LFA9 PIMCO SWAPTION 2.46 CALL EUR 2025071 / DIR (EZLXC2V2MYF7) | −0,00 | −0,0008 | −0,0008 | |||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0009 | −0,0009 | |||

| EURO-BUND OPTION AUG25C 132.5 EXP 07/25/2025 / DIR (DE000F1674Y7) | −0,00 | −0,0009 | −0,0009 | |||

| EURO-BOBL OPTION AUG25C 118.5 EXP 07/25/2025 / DIR (DE000F167SZ1) | −0,01 | −0,0011 | −0,0011 | |||

| 317U9LEA0 PIMCO SWAPTION 2.72 PUT EUR 20250716 / DIR (EZMWVGHPD033) | −0,01 | −0,0012 | −0,0012 | |||

| SOLD MXN BOUGHT USD 20250917 / DFE (000000000) | −0,01 | −0,0012 | −0,0012 | |||

| IRS EUR 2.28000 03/04/25-5Y LCH / DIR (EZQH3P2675Q7) | −0,01 | −127,27 | −0,0013 | −0,0057 | ||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | −0,01 | −0,0014 | −0,0014 | |||

| EURO-BOBL OPTION AUG25P 117.2 EXP 07/25/2025 / DIR (DE000F167SF3) | −0,01 | −0,0017 | −0,0017 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,01 | −0,0018 | −0,0018 | |||

| EURO-BUND OPTION AUG25P 129 EXP 07/25/2025 / DIR (DE000F167368) | −0,01 | −0,0022 | −0,0022 | |||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | −0,01 | −0,0028 | −0,0028 | |||

| OIS CAD CAONREPO/2.8500 12/19/24-8Y* LCH / DIR (EZSHQTW9QFG1) | −0,02 | −91,21 | −0,0033 | 0,0319 | ||

| IRS EUR 2.38000 12/31/24-10Y LCH / DIR (EZT9L1T84284) | −0,02 | −76,54 | −0,0039 | 0,0118 | ||

| IRS AUD 4.00000 06/18/25-5Y LCH / DIR (EZW4GW0C6PW9) | −0,02 | −0,0044 | −0,0044 | |||

| SOLD NZD BOUGHT USD 20250702 / DFE (000000000) | −0,02 | −0,0045 | −0,0045 | |||

| RFR GBP SONIO/3.75000 03/19/25-2Y LCH / DIR (EZ2P2JK7KS49) | −0,02 | −0,0048 | −0,0048 | |||

| IRS EUR 2.35000 04/29/25-5Y LCH / DIR (EZ74X71XY4J2) | −0,03 | −0,0060 | −0,0060 | |||

| OIS CAD CAONREPO/2.9000 03/31/25-8Y* LCH / DIR (EZM3GC13QTT8) | −0,04 | −87,35 | −0,0081 | 0,0547 | ||

| IRS EUR 2.40000 04/09/25-5Y LCH / DIR (EZVHX3M64G11) | −0,05 | −0,0094 | −0,0094 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | −0,05 | −0,0094 | −0,0094 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | −0,05 | −0,0094 | −0,0094 | |||

| IRS EUR 2.46000 03/13/25-10Y LCH / DIR (EZYS5KMNTTM6) | −0,05 | −27,78 | −0,0104 | 0,0036 | ||

| IRS EUR 2.42000 03/07/25-10Y LCH / DIR (EZL5KMTRTV12) | −0,07 | −21,43 | −0,0131 | 0,0032 | ||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,08 | −0,0163 | −0,0163 | |||

| RFR GBP SONIO/3.50000 03/19/25-10Y LCH / DIR (EZSRZZKW9XN0) | −0,08 | −0,0165 | −0,0165 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | −0,10 | −0,0189 | −0,0189 | |||

| IRS AUD 4.50000 06/18/25-10Y LCH / DIR (EZ3K0DGVSD24) | −0,10 | −0,0190 | −0,0190 | |||

| OIS CAD CAONREPO/3.00000 01/13/25-8Y* LC / DIR (EZKVS9DRRQP2) | −0,14 | −54,66 | −0,0276 | 0,0325 | ||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | −0,24 | −0,0468 | −0,0468 | |||

| OIS CAD CAONREPO/3.0000 01/10/25-9Y* LCH / DIR (EZGTN9JZ4G83) | −0,24 | −75,68 | −0,0475 | 0,1449 | ||

| SOLD GBP BOUGHT USD 20250804 / DFE (000000000) | −0,33 | −0,0654 | −0,0654 | |||

| RFR GBP SONIO/3.50000 03/19/25-5Y LCH / DIR (EZ4P0PH8GZ40) | −0,38 | −59,62 | −0,0741 | 0,1069 | ||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | −0,48 | −0,0944 | −0,0944 | |||

| SOLD GBP BOUGHT USD 20250702 / DFE (000000000) | −0,54 | −0,1050 | −0,1050 | |||

| SOLD EUR BOUGHT USD 20250804 / DFE (000000000) | −0,60 | −0,1169 | −0,1169 | |||

| SOLD CAD BOUGHT USD 20250805 / DFE (000000000) | −0,61 | −0,1203 | −0,1203 | |||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | −1,37 | −0,2681 | −0,2681 | |||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | −1,37 | −0,2681 | −0,2681 | |||

| OIS CAD CAONREPO/3.7500 12/20/23-10Y LCH / DIR (EZ1777XRV3N1) | −1,59 | −53,66 | −0,3112 | 0,3522 | ||

| RFR JPY MUTK/1.25000 06/18/25-7Y LCH / DIR (EZ9MYT9FCQB5) | −1,87 | −0,3657 | −0,3657 | |||

| OIS CAD CAONREPO/3.5000 03/28/24-8Y* LCH / DIR (EZ6CFT2N3TR9) | −2,89 | −20,91 | −0,5656 | 0,1407 | ||

| IRS EUR 2.25000 09/17/25-10Y LCH / DIR (EZNLCZXFPVL3) | −5,63 | −25,45 | −1,1024 | 0,3580 |