Grundläggande statistik

| Portföljvärde | $ 49 593 003 |

| Aktuella positioner | 349 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

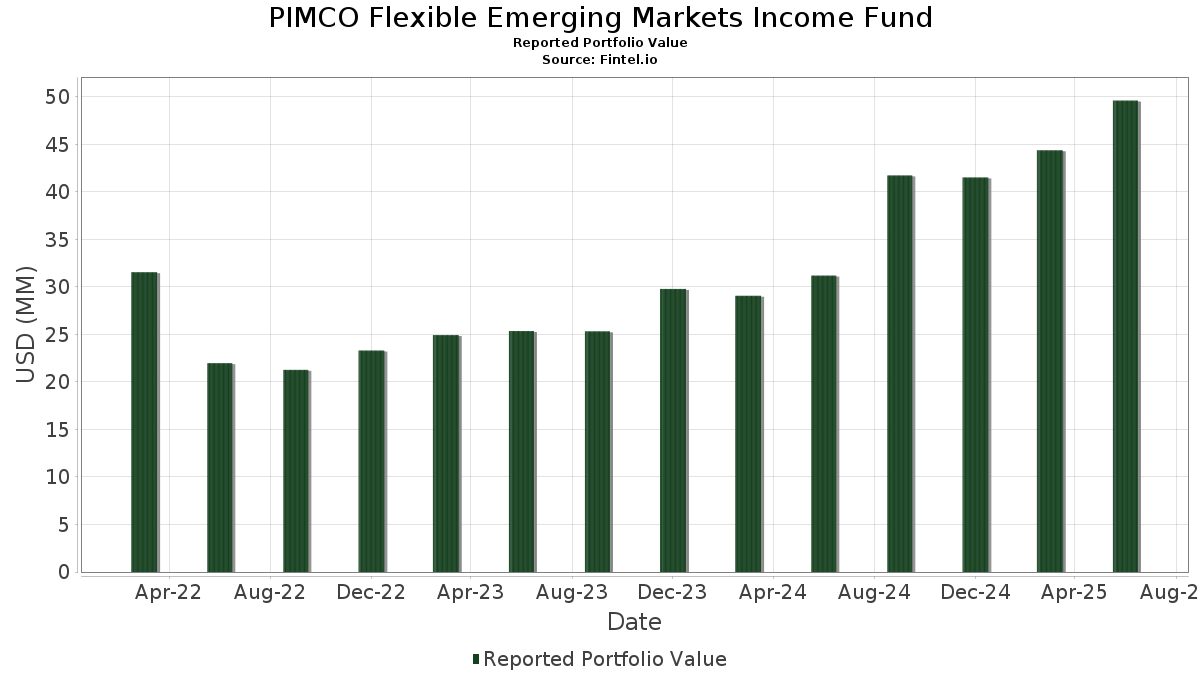

PIMCO Flexible Emerging Markets Income Fund har redovisat 349 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 49 593 003 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). PIMCO Flexible Emerging Markets Income Funds största innehav är PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , Ecuador Government International Bond (EC:XS2214237807) , Petroleos Mexicanos (MX:US71654QDF63) , VALE SA SUBORDINATED 12/49 VAR (BR:BRVALEDBS028) , and Republic of Cameroon International Bond (CM:XS2360598630) . PIMCO Flexible Emerging Markets Income Funds nya positioner inkluderar PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , Ecuador Government International Bond (EC:XS2214237807) , Petroleos Mexicanos (MX:US71654QDF63) , VALE SA SUBORDINATED 12/49 VAR (BR:BRVALEDBS028) , and Republic of Cameroon International Bond (CM:XS2360598630) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 3,15 | 6,1631 | 2,4505 | ||

| 1,00 | 1,9600 | 1,9600 | ||

| 0,74 | 1,4407 | 1,4407 | ||

| 0,65 | 1,2711 | 1,2711 | ||

| 0,65 | 1,2693 | 1,2693 | ||

| 0,56 | 1,0885 | 1,0885 | ||

| 0,55 | 1,0838 | 1,0838 | ||

| 0,55 | 1,0833 | 1,0833 | ||

| 0,52 | 1,0196 | 1,0196 | ||

| 0,83 | 1,6242 | 0,9046 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| −3,43 | −6,7184 | −6,7184 | ||

| −0,88 | −1,7287 | −1,7287 | ||

| −0,67 | −1,3138 | −1,3138 | ||

| −0,61 | −1,1851 | −1,1851 | ||

| −0,55 | −1,0691 | −1,0691 | ||

| −0,52 | −1,0163 | −1,0163 | ||

| −0,48 | −0,9387 | −0,9387 | ||

| −0,44 | −0,8560 | −0,8560 | ||

| 0,06 | 0,1127 | −0,5476 | ||

| −0,27 | −0,5292 | −0,5292 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-29 för rapporteringsperioden 2025-06-30. Denna investerare har inte offentliggjort värdepapper som räknas i aktier, så de aktierelaterade kolumnerna i tabellen nedan har utelämnats. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|

| DOMINICAN REPUBLIC SR UNSECURED 144A 03/37 10.5 / DBT (US25714PFD50) | 4,10 | 5,46 | 8,0262 | 0,0723 | ||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 3,15 | 73,52 | 6,1631 | 2,4505 | ||

| 88WE / Angolan Government International Bond | 1,70 | 0,00 | 3,3315 | −0,1481 | ||

| XS2214237807 / Ecuador Government International Bond | 1,46 | 45,60 | 2,8523 | 0,8044 | ||

| US71654QDF63 / Petroleos Mexicanos | 1,15 | 5,22 | 2,2540 | 0,0168 | ||

| XS2262961076 / ZF Finance GmbH | 1,00 | 1,9600 | 1,9600 | |||

| BRVALEDBS028 / VALE SA SUBORDINATED 12/49 VAR | 0,92 | 3,94 | 1,8100 | −0,0103 | ||

| XS2360598630 / Republic of Cameroon International Bond | 0,92 | 8,72 | 1,8089 | 0,0710 | ||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 0,92 | −1,82 | 1,7999 | −0,1149 | ||

| XS2348767083 / BOI Finance BV | 0,90 | 10,96 | 1,7663 | 0,1041 | ||

| ECOPET / Ecopetrol SA | 0,83 | 136,18 | 1,6242 | 0,9046 | ||

| USY51478AA66 / LLPL Capital Pte Ltd | 0,82 | 1,62 | 1,5989 | −0,0450 | ||

| XS2330514899 / Romanian Government International Bond | 0,74 | 1,4407 | 1,4407 | |||

| REPUBLIC OF KENYA 02/31 11 / DBT (XS2764839945) | 0,71 | 3,64 | 1,3939 | −0,0102 | ||

| XS2477752260 / SOCAR Turkey Enerji AS via Steas Funding 1 DAC | 0,70 | −0,71 | 1,3621 | −0,0707 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 0,65 | 1,2711 | 1,2711 | |||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 0,65 | 1,2693 | 1,2693 | |||

| USG7150PAA87 / POINSETTIA FINANCE LTD SR SECURED REGS 06/31 6.625 | 0,64 | 0,79 | 1,2466 | −0,0463 | ||

| XS2330503694 / Romanian Government International Bond | 0,63 | 12,23 | 1,2399 | 0,0854 | ||

| REP OF SEN MINI OF FIN AND BUD 2023 EUR 1ST LIEN TERM LOAN / LON (BA0000GC3) | 0,62 | 9,56 | 1,2139 | 0,0570 | ||

| US195325EL56 / Colombia Government International Bond | 0,60 | 0,00 | 1,1832 | −0,0535 | ||

| REPUBLIC OF PANAMA EUR TERM LOAN / LON (BA000GRH5) | 0,59 | 10,02 | 1,1620 | 0,0576 | ||

| US898339AB22 / Trust Fibra Uno | 0,59 | 3,72 | 1,1464 | −0,0087 | ||

| US195325DP79 / Colombia Government International Bond | 0,57 | 0,88 | 1,1184 | −0,0409 | ||

| XS1567906059 / Kuwait Projects Co SPC Ltd | 0,57 | 0,88 | 1,1174 | −0,0392 | ||

| US224939AA67 / Credicorp Capital Sociedad Titulizadora SA | 0,57 | 2,71 | 1,1162 | −0,0191 | ||

| USP40689AA21 / Fideicomiso PA Pacifico Tres | 0,57 | −0,35 | 1,1152 | −0,0548 | ||

| PANAMA INFRASTRUCTURE SR SECURED 144A 04/32 0.00000 / DBT (US69828QAD97) | 0,57 | 0,89 | 1,1151 | −0,0397 | ||

| USN6000DAA11 / Mong Duong Finance Holdings BV | 0,56 | −10,35 | 1,1030 | −0,1835 | ||

| XS1807299331 / KazMunayGas National Co JSC | 0,56 | 1,0885 | 1,0885 | |||

| XS1796266754 / Ivory Coast Government International Bond | 0,55 | 1,0838 | 1,0838 | |||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 0,55 | 1,0833 | 1,0833 | |||

| YINSON BORONIA PRODUCTIO SR SECURED 144A 07/42 8.947 / DBT (US98584XAA37) | 0,53 | 0,96 | 1,0343 | −0,0374 | ||

| PANAMA / Panama Government International Bond | 0,52 | 1,0196 | 1,0196 | |||

| CHILE ELECTRICITY LUX GOVT GUARANT 144A 10/35 5.672 / DBT (US16882LAB80) | 0,50 | 0,80 | 0,9872 | −0,0369 | ||

| XS2391398174 / EGYPT GOVERNMENT INTERNATIONAL BOND MTN 8.750000% 09/30/2051 | 0,49 | 7,17 | 0,9659 | 0,0224 | ||

| XS2357132849 / Fortune Star BVI Ltd | 0,46 | 10,39 | 0,8952 | 0,0465 | ||

| USL3500LAA72 / FEL Energy VI Sarl | 0,45 | −1,10 | 0,8829 | −0,0493 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 0,45 | 3,96 | 0,8741 | −0,0041 | ||

| US71654QBR20 / Petroleos Mexicanos Bond | 0,43 | 5,20 | 0,8332 | 0,0051 | ||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PP64) | 0,40 | 0,7884 | 0,7884 | |||

| GHGGOG069915 / Ghana Government Bond | 0,40 | 60,40 | 0,7863 | 0,2726 | ||

| PEP01000C5I0 / BONOS DE TESORERIA | 0,40 | 7,24 | 0,7843 | 0,0194 | ||

| MUTHOOTFIN / Muthoot Finance Limited | 0,40 | 1,53 | 0,7822 | −0,0238 | ||

| REPUBLIC OF KENYA 2024 TERM LOAN A / LON (BA000C8P7) | 0,40 | 1,27 | 0,7816 | −0,0253 | ||

| US912810TA60 / U.S. Treasury Bonds | 0,40 | −1,97 | 0,7806 | −0,0522 | ||

| TRT061124T11 / Turkey Government Bond | 0,39 | 12,24 | 0,7548 | 0,0507 | ||

| US67091TAE55 / OCP SA | 0,38 | −1,30 | 0,7448 | −0,0433 | ||

| PTAVDAOT0001 / Republic of Angola Via Avenir Issuer II Ireland DAC | 0,38 | −0,26 | 0,7387 | −0,0369 | ||

| TURKIYE VAKIFLAR BANKASI TAO I 2024 EUR DDTL / LON (BA0008CR7) | 0,35 | 10,28 | 0,6948 | 0,0357 | ||

| 941WJKII0 / SOCAR TURKEY ENERJI AS EUR TERM LOAN | 0,35 | 8,64 | 0,6909 | 0,0273 | ||

| REPUBLIC OF COTE DIVOIRE THE 2024 EUR UPSIZE TERM LOAN / LON (BA0003TP4) | 0,35 | 9,32 | 0,6896 | 0,0304 | ||

| XS0781029698 / Peru Payroll Deduction Finance Ltd. | 0,34 | −4,47 | 0,6704 | −0,0632 | ||

| TANZANIA USD TERM LOAN / LON (949BJZII5) | 0,33 | −12,79 | 0,6547 | −0,1299 | ||

| SB12AGO32 / Peru - Sovereign or Government Agency Debt | 0,32 | 7,00 | 0,6291 | 0,0134 | ||

| TURKISH AIRLN 15 1 A PTT PASS THRU CE REGS 09/28 4.2 / DBT (USU0567PAA40) | 0,31 | 0,00 | 0,6166 | −0,0276 | ||

| XS2587708624 / FIN DEPT GOVT SHARJAH 6.500000% 11/23/2032 | 0,31 | 0,6146 | 0,6146 | |||

| US25714PEW41 / Dominican Republic International Bond | 0,31 | 5,17 | 0,5988 | 0,0050 | ||

| YINSON BERGENIA PRODUCTI YINSON BERGENIA PRODUCTI / DBT (US98585VAA61) | 0,30 | 0,5955 | 0,5955 | |||

| XS2260457754 / Ipoteka-Bank ATIB | 0,30 | 0,34 | 0,5861 | −0,0239 | ||

| VB DPR FINANCE COMPANY VAKIFBANK DPR 2025 E 4A2 SR SE / DBT (US009A9XTEG5) | 0,29 | −3,92 | 0,5761 | −0,0504 | ||

| USY6142NAF51 / MONGOLIA INTL BOND 3.500000% 07/07/2027 | 0,28 | 0,36 | 0,5515 | −0,0217 | ||

| XS2010026727 / Uzbekneftegaz JSC | 0,28 | 2,23 | 0,5396 | −0,0119 | ||

| USP9406GAB43 / Trust Fibra Uno | 0,27 | 2,30 | 0,5231 | −0,0120 | ||

| XS1577950311 / Jordan Government International Bond | 0,27 | 50,28 | 0,5215 | −0,0808 | ||

| GACI FIRST INVESTMENT COMPANY GUAR REGS 01/54 5.375 / DBT (XS2755904872) | 0,27 | −1,49 | 0,5207 | −0,0299 | ||

| CIMA FINANCE LTD SECURED REGS 09/29 2.95 / DBT (XS2244822560) | 0,26 | 0,38 | 0,5123 | −0,0205 | ||

| US698299BB98 / Panama Government International Bond | 0,26 | 6,15 | 0,5081 | 0,0072 | ||

| UGANDA GOVERNMENT BOND BONDS 06/39 15.8 / DBT (UG12K2306393) | 0,26 | 0,5047 | 0,5047 | |||

| US59132VAB45 / Metalsa SA de CV | 0,25 | 3,80 | 0,4833 | −0,0025 | ||

| XS2689949043 / Romania Government International Bonds | 0,24 | 10,00 | 0,4757 | 0,0239 | ||

| REPUBLIC OF PARAGUAY SR UNSECURED 144A 03/35 8.5 / DBT (US699149BX76) | 0,24 | −2,06 | 0,4674 | −0,0300 | ||

| XS2337670421 / Development Bank of Kazakhstan JSC | 0,24 | −2,48 | 0,4630 | −0,0329 | ||

| REPUBLIC OF COTE D IVOIRE THE 2025 EUR 12 M SHRT SYNDCATD TL / LON (BA000JHT4) | 0,23 | 0,4578 | 0,4578 | |||

| US25714PES39 / Dominican Republic International Bond | 0,23 | 5,43 | 0,4568 | 0,0040 | ||

| US698299BL70 / Panama Government International Bond | 0,23 | 6,51 | 0,4486 | 0,0073 | ||

| XS2355172482 / OCP SA | 0,23 | −1,30 | 0,4469 | −0,0260 | ||

| US836205BB97 / Republic of South Africa Government International Bond | 0,23 | 0,4430 | 0,4430 | |||

| US195325BR53 / Colombia Government International Bond | 0,22 | −0,89 | 0,4357 | −0,0240 | ||

| US71568QAP28 / Perusahaan Perseroan Persero PT Perusahaan Listrik Negara | 0,21 | 1,44 | 0,4142 | −0,0130 | ||

| XS0992645274 / Transnet SOC Ltd | 0,21 | 3,94 | 0,4139 | −0,0029 | ||

| UZBEK INDUSTRIAL AND CON UZBEK INDUSTRIAL AND CON / DBT (US917935AA60) | 0,21 | 0,96 | 0,4129 | −0,0133 | ||

| 945BMMII4 / NMC OPCO LTD AED TERM LOAN | 0,21 | 0,00 | 0,4119 | −0,0185 | ||

| 70GD / Antofagasta plc - Preferred Security | 0,21 | 1,46 | 0,4110 | −0,0123 | ||

| REPUBLIC OF COLOMBIA SR UNSECURED 04/35 8.5 / DBT (US195325ES00) | 0,21 | 0,4074 | 0,4074 | |||

| PKN / Orlen S.A. | 0,21 | 0,00 | 0,4026 | −0,0179 | ||

| TCELL / Turkcell Iletisim Hizmetleri A.S. | 0,20 | 0,50 | 0,3994 | −0,0141 | ||

| DOMINICAN REPUBLIC SR UNSECURED 144A 03/37 6.95 / DBT (US25714PFB94) | 0,20 | 0,50 | 0,3989 | −0,0150 | ||

| US401494AW96 / Guatemala Government Bond | 0,20 | 2,01 | 0,3987 | −0,0096 | ||

| US401494AW96 / Guatemala Government Bond | 0,20 | 1,00 | 0,3983 | −0,0143 | ||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 0,20 | 6,88 | 0,3969 | 0,0101 | ||

| US29245JAJ16 / Empresa Nacional del Petroleo | 0,20 | 0,00 | 0,3968 | −0,0182 | ||

| KINGDOM OF BAHRAIN SR UNSECURED 144A 07/37 7.5 / DBT (US05674RAR57) | 0,20 | 0,3965 | 0,3965 | |||

| XS1864523300 / Eskom Holdings SOC Ltd | 0,20 | 2,02 | 0,3964 | −0,0108 | ||

| XS1910826996 / Nigeria Government International Bond | 0,20 | 0,50 | 0,3951 | −0,0160 | ||

| DOMINICAN REPUBLIC 06/36 0 / DBT (US25714PEZ71) | 0,20 | 1,01 | 0,3950 | −0,0132 | ||

| IIFL / IIFL Finance Limited | 0,20 | 0,50 | 0,3944 | −0,0157 | ||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 0,20 | 0,3940 | 0,3940 | |||

| IRB / IRB Infrastructure Developers Limited | 0,20 | −0,99 | 0,3932 | −0,0205 | ||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 0,20 | 0,3925 | 0,3925 | |||

| US67091TAA34 / OCP SA | 0,20 | −2,44 | 0,3923 | −0,0277 | ||

| GREENSAIF PIPELINES BIDC SR SECURED 144A 08/42 6.1027 / DBT (US39541EAE32) | 0,20 | 0,00 | 0,3923 | −0,0187 | ||

| REPUBLIC OF PARAGUAY SR UNSECURED 144A 03/55 6.65 / DBT (US699149BY59) | 0,20 | 0,00 | 0,3922 | −0,0192 | ||

| VEON AMSTERDAM TERM LOAN / LON (BA000HL48) | 0,20 | 1,52 | 0,3919 | −0,0113 | ||

| UZBEK INDUSTRIAL AND CON UZBEK INDUSTRIAL AND CON / DBT (US917935AB44) | 0,20 | 0,50 | 0,3918 | −0,0175 | ||

| TRT061124T11 / Turkey Government Bond | 0,20 | 0,3916 | 0,3916 | |||

| DOMINICAN REPUBLIC SR UNSECURED 144A 02/55 7.15 / DBT (US25714PFC77) | 0,20 | −0,50 | 0,3916 | −0,0192 | ||

| US195325EG61 / Colombia Government International Bond | 0,20 | 0,51 | 0,3905 | −0,0155 | ||

| BANK GOSPODARSTWA KRAJOW GOVT GUARANT 144A 07/54 6.25 / DBT (US06237MAD56) | 0,20 | −1,49 | 0,3895 | −0,0236 | ||

| RAIZEN FUELS FINANCE RAIZEN FUELS FINANCE / DBT (US75102XAF33) | 0,20 | 0,3893 | 0,3893 | |||

| IVORY COAST SR UNSECURED 144A 01/33 7.625 / DBT (US221625AT38) | 0,20 | 1,55 | 0,3873 | −0,0115 | ||

| STANDARD CHARTERED BANK STANDARD CHARTERED BANK / DBT (XS2954919069) | 0,20 | 1,55 | 0,3851 | −0,0103 | ||

| US86074QAP72 / Stillwater Mining Co | 0,20 | 2,09 | 0,3830 | −0,0094 | ||

| IVORY COAST SR UNSECURED REGS 04/36 8.075 / DBT (XS3030237120) | 0,19 | 0,3786 | 0,3786 | |||

| US836205BA15 / Republic of South Africa Government International Bond | 0,19 | 2,66 | 0,3781 | −0,0079 | ||

| REPUBLIC OF COLOMBIA SR UNSECURED 11/54 8.375 / DBT (US195325EQ44) | 0,19 | −0,52 | 0,3732 | −0,0187 | ||

| REPUBLIC OF KENYA SR UNSECURED 144A 03/36 9.5 / DBT (US491798AN42) | 0,19 | 2,73 | 0,3700 | −0,0060 | ||

| XS2176897754 / Egypt Government International Bond | 0,19 | 6,94 | 0,3633 | 0,0091 | ||

| XS2337067792 / AFRICA FINANCE CORP 2.875000% 04/28/2028 | 0,19 | 0,00 | 0,3629 | −0,0173 | ||

| XS2388562139 / SERBIA INTERNATIONAL BOND MTN 2.050000% 09/23/2036 | 0,18 | 14,01 | 0,3512 | 0,0285 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 0,18 | 0,3500 | 0,3500 | |||

| XS2322319638 / Pakistan Government International Bond | 0,18 | 4,71 | 0,3490 | −0,0007 | ||

| XS2446175577 / Angolan Government International Bond | 0,18 | 2,33 | 0,3465 | −0,0063 | ||

| STANDARD CHARTERED BANK SR UNSECURED 144A 11/25 0.0000 / DBT (XS2934650537) | 0,17 | 1,76 | 0,3404 | −0,0085 | ||

| US195325DR36 / Colombia Government International Bond | 0,17 | 1,76 | 0,3396 | −0,0084 | ||

| USG34072AC59 / INTEROCEANICA FINANCE V SR SECURED REGS 05/30 0.00000 | 0,17 | −7,98 | 0,3394 | −0,0473 | ||

| XS2322321964 / Pakistan Government International Bond | 0,16 | 4,46 | 0,3221 | 0,0006 | ||

| XS2034834064 / BANCO DO BRASIL SA/LONDO SR UNSECURED REGS 07/26 8.5 | 0,16 | 10,34 | 0,3142 | 0,0156 | ||

| USL21779AJ97 / CSN Resources SA | 0,16 | 1,29 | 0,3087 | −0,0088 | ||

| XS2214238441 / Ecuador Government International Bond | 0,16 | 48,11 | 0,3085 | 0,0900 | ||

| USP7721BAE13 / Peru LNG Srl | 0,16 | 1,30 | 0,3073 | −0,0096 | ||

| TREASURY BILL 10/25 0.00000 / DBT (US912797RD17) | 0,15 | 0,2958 | 0,2958 | |||

| CREDICORP CAPITAL SOCIED LOCAL GOVT G 144A 03/45 9.7 / DBT (US224939AB41) | 0,15 | 0,2887 | 0,2887 | |||

| US715638BE14 / Peruvian Government International Bond | 0,15 | −15,52 | 0,2886 | −0,0689 | ||

| US01538TAA34 / Alfa Desarrollo SpA | 0,15 | −3,97 | 0,2850 | −0,0257 | ||

| US922646AS37 / Venezuela Government International Bond | 0,14 | −2,74 | 0,2794 | −0,0215 | ||

| PANAMA INFRASTRUCTURE SR SECURED REGS 04/32 0.00000 / DBT (USG6883RAB80) | 0,14 | 0,71 | 0,2788 | −0,0099 | ||

| USP0092AAG42 / AEROPUERTO INTERNACIONAL DE TOCUMEN SA 5.125000% 08/11/2061 | 0,14 | 0,00 | 0,2762 | −0,0141 | ||

| XS2207514063 / Finance Department Government of Sharjah | 0,13 | −1,54 | 0,2510 | −0,0154 | ||

| TREASURY BILL 08/25 0.00000 / DBT (US912797QK68) | 0,13 | 0,2492 | 0,2492 | |||

| US195325EA91 / Colombia Government International Bond | 0,13 | 0,79 | 0,2488 | −0,0105 | ||

| USP7808BAB38 / Petroleos del Peru SA | 0,13 | 0,00 | 0,2481 | −0,0103 | ||

| US716564AB55 / Petroleos del Peru SA | 0,13 | 0,00 | 0,2481 | −0,0103 | ||

| XS1790134362 / Senegal Government International Bond | 0,12 | −6,92 | 0,2373 | −0,0298 | ||

| CZECHOSLOVAK GROUP CZECHOSLOVAK GROUP / DBT (XS3105190816) | 0,12 | 0,2353 | 0,2353 | |||

| XS2264968665 / Ivory Coast Government International Bond | 0,12 | 11,54 | 0,2274 | 0,0139 | ||

| XS2264968665 / Ivory Coast Government International Bond | 0,11 | 13,27 | 0,2175 | 0,0153 | ||

| SB12AGO34 / Peru - Corporate Bond/Note | 0,11 | 7,07 | 0,2094 | 0,0060 | ||

| GHGGOG069956 / Ghana Government Bond | 0,11 | 70,97 | 0,2092 | 0,0812 | ||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PG65) | 0,10 | 0,1991 | 0,1991 | |||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 0,10 | 4,12 | 0,1983 | −0,0009 | ||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,10 | 0,1881 | 0,1881 | |||

| USP7807HAQ85 / Petroleos de Venezuela SA | 0,09 | −5,38 | 0,1739 | −0,0164 | ||

| XS2214238102 / Ecuador Government International Bond | 0,09 | 47,46 | 0,1704 | 0,0481 | ||

| GHGGOG069931 / Ghana Government Bond | 0,08 | 72,73 | 0,1494 | 0,0573 | ||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 0,07 | 0,00 | 0,1326 | −0,0065 | ||

| REPUBLIC OF SRI LANKA SR UNSECURED 144A 02/38 VAR / DBT (XS2966242252) | 0,06 | 3,33 | 0,1216 | −0,0019 | ||

| US715638AV48 / REPUBLIC OF PERU SR UNSECURED 144A 08/37 6.9 | 0,06 | −82,30 | 0,1127 | −0,5476 | ||

| IRS EUR 2.25000 09/17/25-10Y LCH / DIR (EZNLCZXFPVL3) | 0,06 | −32,14 | 0,1124 | −0,0598 | ||

| BOUGHT EGP SOLD USD 20250721 / DFE (000000000) | 0,05 | 0,1076 | 0,1076 | |||

| XS2425979312 / STRATTON BTL MORTGAGE FUNDING STRAB 2022 1 A REGS | 0,05 | −4,26 | 0,0891 | −0,0074 | ||

| REPUBLIC OF SRI LANKA SR UNSECURED 144A 06/35 VAR / DBT (XS2966242336) | 0,04 | 0,00 | 0,0740 | −0,0027 | ||

| REPUBLIC OF SRI LANKA SR UNSECURED 144A 05/36 VAR / DBT (XS2966241874) | 0,03 | 6,90 | 0,0609 | −0,0002 | ||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/34 VAR / DBT (US903724CE02) | 0,03 | −3,85 | 0,0501 | −0,0035 | ||

| BOUGHT TRY SOLD USD 20250811 / DFE (000000000) | 0,02 | 0,0480 | 0,0480 | |||

| BOUGHT ILS SOLD USD 20250718 / DFE (000000000) | 0,02 | 0,0300 | 0,0300 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797LW51) | 0,01 | 0,0254 | 0,0254 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0175 | 0,0175 | |||

| SOLD DOP BOUGHT USD 20250922 / DFE (000000000) | 0,01 | 0,0149 | 0,0149 | |||

| SOLD KWD BOUGHT USD 20300509 / DFE (000000000) | 0,01 | 0,0141 | 0,0141 | |||

| SOLD KWD BOUGHT USD 20300513 / DFE (000000000) | 0,01 | 0,0141 | 0,0141 | |||

| SOLD KWD BOUGHT USD 20300514 / DFE (000000000) | 0,01 | 0,0141 | 0,0141 | |||

| SOLD KWD BOUGHT USD 20300516 / DFE (000000000) | 0,01 | 0,0141 | 0,0141 | |||

| SOLD KWD BOUGHT USD 20300515 / DFE (000000000) | 0,01 | 0,0141 | 0,0141 | |||

| OIBR4 / Oi S.A. - Preferred Stock | 0,01 | 0,00 | 0,0129 | −0,0006 | ||

| US10010YAA01 / TURKISH AIRLN 15 1 A PTT PASS THRU CE 144A 09/28 4.2 | 0,01 | 0,00 | 0,0128 | −0,0006 | ||

| BOUGHT BRL SOLD USD 20251002 / DFE (000000000) | 0,01 | 0,0122 | 0,0122 | |||

| STATE OIL COMPANY OF THE AZERB EM SP JPM / DCR (EZGNY2BNRG78) | 0,01 | −14,29 | 0,0119 | −0,0031 | ||

| BOUGHT TRY SOLD USD 20250814 / DFE (000000000) | 0,01 | 0,0100 | 0,0100 | |||

| SOLD DOP BOUGHT USD 20250807 / DFE (000000000) | 0,00 | 0,0094 | 0,0094 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0089 | 0,0089 | |||

| BOUGHT PEN SOLD USD 20251105 / DFE (000000000) | 0,00 | 0,0084 | 0,0084 | |||

| SOLD DOP BOUGHT USD 20250905 / DFE (000000000) | 0,00 | 0,0082 | 0,0082 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0075 | 0,0075 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0074 | 0,0074 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0066 | 0,0066 | |||

| BOUGHT TRY SOLD USD 20260109 / DFE (000000000) | 0,00 | 0,0057 | 0,0057 | |||

| BOUGHT EGP SOLD USD 20250826 / DFE (000000000) | 0,00 | 0,0055 | 0,0055 | |||

| BOUGHT EGP SOLD USD 20251217 / DFE (000000000) | 0,00 | 0,0051 | 0,0051 | |||

| BOUGHT TRY SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0049 | 0,0049 | |||

| BOUGHT ILS SOLD USD 20250718 / DFE (000000000) | 0,00 | 0,0043 | 0,0043 | |||

| BOUGHT PEN SOLD USD 20251031 / DFE (000000000) | 0,00 | 0,0042 | 0,0042 | |||

| BOUGHT DOP SOLD USD 20250908 / DFE (000000000) | 0,00 | 0,0041 | 0,0041 | |||

| PEMEX LCDS SP DUB / DCR (000000000) | 0,00 | 0,0040 | 0,0040 | |||

| SOLD DOP BOUGHT USD 20250711 / DFE (000000000) | 0,00 | 0,0036 | 0,0036 | |||

| SOLD DOP BOUGHT USD 20250922 / DFE (000000000) | 0,00 | 0,0035 | 0,0035 | |||

| BOUGHT TRY SOLD USD 20260108 / DFE (000000000) | 0,00 | 0,0035 | 0,0035 | |||

| SOLD DOP BOUGHT USD 20250728 / DFE (000000000) | 0,00 | 0,0034 | 0,0034 | |||

| SOLD DOP BOUGHT USD 20250728 / DFE (000000000) | 0,00 | 0,0034 | 0,0034 | |||

| SOLD DOP BOUGHT USD 20250905 / DFE (000000000) | 0,00 | 0,0030 | 0,0030 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0027 | 0,0027 | |||

| SOLD DOP BOUGHT USD 20250922 / DFE (000000000) | 0,00 | 0,0026 | 0,0026 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0026 | 0,0026 | |||

| BOUGHT TRY SOLD USD 20250812 / DFE (000000000) | 0,00 | 0,0025 | 0,0025 | |||

| BOUGHT TRY SOLD USD 20251113 / DFE (000000000) | 0,00 | 0,0023 | 0,0023 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0022 | 0,0022 | |||

| BOUGHT PEN SOLD USD 20250711 / DFE (000000000) | 0,00 | 0,0021 | 0,0021 | |||

| ISRAEL GOVT EM SP GST / DCR (EZP3MQXJKP51) | 0,00 | −100,00 | 0,0018 | −0,0011 | ||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0015 | 0,0015 | |||

| SOLD DOP BOUGHT USD 20250828 / DFE (000000000) | 0,00 | 0,0013 | 0,0013 | |||

| BOUGHT AZN SOLD USD 20261029 / DFE (000000000) | 0,00 | 0,0013 | 0,0013 | |||

| SOLD DOP BOUGHT USD 20251120 / DFE (000000000) | 0,00 | 0,0012 | 0,0012 | |||

| OIBR4 / Oi S.A. - Preferred Stock | 0,00 | 0,0011 | −0,0001 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0011 | 0,0011 | |||

| BOUGHT ILS SOLD USD 20250709 / DFE (000000000) | 0,00 | 0,0011 | 0,0011 | |||

| SOLD DOP BOUGHT USD 20250711 / DFE (000000000) | 0,00 | 0,0009 | 0,0009 | |||

| BOUGHT PEN SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0009 | 0,0009 | |||

| SOLD DOP BOUGHT USD 20250811 / DFE (000000000) | 0,00 | 0,0008 | 0,0008 | |||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0008 | 0,0008 | |||

| BOUGHT TRY SOLD USD 20250818 / DFE (000000000) | 0,00 | 0,0007 | 0,0007 | |||

| BOUGHT TRY SOLD USD 20250717 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| BOUGHT COP SOLD USD 20250811 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT PEN SOLD USD 20250825 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT TRY SOLD USD 20250805 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT PEN SOLD USD 20250707 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| ISRAEL GOVT EM SP CBK / DCR (EZV6L6KG0CJ6) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT EGP SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT ILS SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT ILS SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT PEN SOLD USD 20250707 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT PEN SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT EGP SOLD USD 20260317 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| SOLD DOP BOUGHT USD 20251120 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT KWD SOLD USD 20260521 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT TRY SOLD USD 20250728 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT KWD SOLD USD 20260518 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD AED BOUGHT USD 20250917 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT KZT SOLD USD 20250917 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD CZK BOUGHT USD 20250822 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| 31750PIZ6 PIMCO FXVAN PUT USD TRY 39.75000000 / DFE (EZYP4979H2H4) | −0,00 | −0,0001 | 0,0015 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | |||

| SOLD KZT BOUGHT USD 20250911 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0003 | −0,0003 | |||

| SOLD AUD BOUGHT USD 20250805 / DFE (000000000) | −0,00 | −0,0003 | −0,0003 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0004 | −0,0004 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0004 | −0,0004 | |||

| BOUGHT KWD SOLD USD 20260504 / DFE (000000000) | −0,00 | −0,0004 | −0,0004 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0004 | −0,0004 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0005 | −0,0005 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0006 | −0,0006 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0007 | −0,0007 | |||

| BOUGHT KWD SOLD USD 20260505 / DFE (000000000) | −0,00 | −0,0007 | −0,0007 | |||

| SOLD ZAR BOUGHT USD 20250723 / DFE (000000000) | −0,00 | −0,0008 | −0,0008 | |||

| SOLD CZK BOUGHT USD 20250822 / DFE (000000000) | −0,00 | −0,0008 | −0,0008 | |||

| SOLD GBP BOUGHT USD 20250804 / DFE (000000000) | −0,00 | −0,0008 | −0,0008 | |||

| BOUGHT KZT SOLD USD 20250911 / DFE (000000000) | −0,00 | −0,0009 | −0,0009 | |||

| BOUGHT KZT SOLD USD 20250911 / DFE (000000000) | −0,00 | −0,0009 | −0,0009 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0009 | −0,0009 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0010 | −0,0010 | |||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | −0,00 | −0,0011 | −0,0011 | |||

| SOLD ILS BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0011 | −0,0011 | |||

| RFR USD SOFR/3.25000 06/18/25-4Y LCH / DIR (EZ002TZXTPM5) | −0,00 | −100,00 | −0,0011 | 0,0015 | ||

| 31750PIY9 PIMCO FXVAN CALL USD TRY 51.75000000 / DFE (EZ0WD1TWX9Y8) | −0,00 | −100,00 | −0,0011 | 0,0060 | ||

| 31750PJ85 PIMCO FXVAN PUT USD TRY 41.60000000 / DFE (EZMGNXM4T248) | −0,00 | −100,00 | −0,0012 | 0,0016 | ||

| SOLD UGX BOUGHT USD 20251202 / DFE (000000000) | −0,00 | −0,0012 | −0,0012 | |||

| SOLD UGX BOUGHT USD 20251202 / DFE (000000000) | −0,00 | −0,0012 | −0,0012 | |||

| SOLD GBP BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0012 | −0,0012 | |||

| SOLD EGP BOUGHT USD 20250721 / DFE (000000000) | −0,00 | −0,0013 | −0,0013 | |||

| 31750PMA6 PIMCO FXVAN PUT USD TRY 40.57500000 / DFE (EZ6D60D4NDX6) | −0,00 | −100,00 | −0,0016 | 0,0026 | ||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0017 | −0,0017 | |||

| 31750PMB4 PIMCO FXVAN CALL USD TRY 52.72500000 / DFE (EZ334JPD9ZR9) | −0,00 | −100,00 | −0,0018 | 0,0092 | ||

| SOLD EGP BOUGHT USD 20250826 / DFE (000000000) | −0,00 | −0,0018 | −0,0018 | |||

| SOLD ZAR BOUGHT USD 20250723 / DFE (000000000) | −0,00 | −0,0019 | −0,0019 | |||

| SOLD ZAR BOUGHT USD 20250723 / DFE (000000000) | −0,00 | −0,0019 | −0,0019 | |||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | −0,00 | −0,0019 | −0,0019 | |||

| SOLD PLN BOUGHT USD 20250710 / DFE (000000000) | −0,00 | −0,0021 | −0,0021 | |||

| SOLD PLN BOUGHT USD 20250710 / DFE (000000000) | −0,00 | −0,0021 | −0,0021 | |||

| SOLD PEN BOUGHT USD 20250929 / DFE (000000000) | −0,00 | −0,0022 | −0,0022 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0022 | −0,0022 | |||

| BOUGHT KZT SOLD USD 20250912 / DFE (000000000) | −0,00 | −0,0026 | −0,0026 | |||

| BOUGHT KZT SOLD USD 20250912 / DFE (000000000) | −0,00 | −0,0026 | −0,0026 | |||

| BOUGHT AZN SOLD USD 20271029 / DFE (000000000) | −0,00 | −0,0028 | −0,0028 | |||

| BOUGHT KZT SOLD USD 20251215 / DFE (000000000) | −0,00 | −0,0029 | −0,0029 | |||

| SOLD ZAR BOUGHT USD 20250723 / DFE (000000000) | −0,00 | −0,0030 | −0,0030 | |||

| SOLD PLN BOUGHT USD 20250710 / DFE (000000000) | −0,00 | −0,0031 | −0,0031 | |||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | −0,00 | −0,0032 | −0,0032 | |||

| SOLD BRL BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0038 | −0,0038 | |||

| 31750PJ77 PIMCO FXVAN CALL USD TRY 56.90000000 / DFE (EZTHFXN1DFH1) | −0,00 | −66,67 | −0,0048 | 0,0082 | ||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0066 | −0,0066 | |||

| SOLD PEN BOUGHT USD 20250711 / DFE (000000000) | −0,00 | −0,0068 | −0,0068 | |||

| SOLD MXN BOUGHT USD 20250917 / DFE (000000000) | −0,00 | −0,0073 | −0,0073 | |||

| SOUTH AFRICA EM SP MEI / DCR (EZY7YXJC6LT7) | −0,00 | −0,0074 | −0,0074 | |||

| 31750PZ53 PIMCO FXVAN PUT USD TRY 42.63500000 / DFE (EZP2Q58DNP93) | −0,00 | −33,33 | −0,0080 | 0,0044 | ||

| SOLD GHS BOUGHT USD 20260217 / DFE (000000000) | −0,00 | −0,0081 | −0,0081 | |||

| SOLD DOP BOUGHT USD 20250822 / DFE (000000000) | −0,00 | −0,0083 | −0,0083 | |||

| SOLD DOP BOUGHT USD 20250828 / DFE (000000000) | −0,00 | −0,0096 | −0,0096 | |||

| SOLD PKR BOUGHT USD 20251112 / DFE (000000000) | −0,01 | −0,0100 | −0,0100 | |||

| SOLD GHS BOUGHT USD 20250716 / DFE (000000000) | −0,01 | −0,0113 | −0,0113 | |||

| SOLD DOP BOUGHT USD 20250828 / DFE (000000000) | −0,01 | −0,0117 | −0,0117 | |||

| RFR USD SOFR/3.25000 06/18/25-9Y LCH / DIR (EZVYZM8DK482) | −0,01 | −28,57 | −0,0117 | 0,0031 | ||

| SOLD GHS BOUGHT USD 20251113 / DFE (000000000) | −0,01 | −0,0123 | −0,0123 | |||

| 31750PZL8 PIMCO FXVAN PUT USD TRY 42.80000000 / DFE (EZBNFFN969H2) | −0,01 | −33,33 | −0,0134 | 0,0063 | ||

| SOLD TRY BOUGHT USD 20250811 / DFE (000000000) | −0,01 | −0,0167 | −0,0167 | |||

| SOLD GHS BOUGHT USD 20250714 / DFE (000000000) | −0,01 | −0,0204 | −0,0204 | |||

| SOLD DOP BOUGHT USD 20250905 / DFE (000000000) | −0,01 | −0,0217 | −0,0217 | |||

| SOLD DOP BOUGHT USD 20250915 / DFE (000000000) | −0,01 | −0,0249 | −0,0249 | |||

| SOLD PEN BOUGHT USD 20250724 / DFE (000000000) | −0,01 | −0,0268 | −0,0268 | |||

| 31750PZ46 PIMCO FXVAN CALL USD TRY 56.75000000 / DFE (EZHWNZ4KWSD5) | −0,02 | −55,56 | −0,0314 | 0,0428 | ||

| SOLD GHS BOUGHT USD 20250714 / DFE (000000000) | −0,02 | −0,0330 | −0,0330 | |||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | −0,02 | −0,0396 | −0,0396 | |||

| SOLD PEN BOUGHT USD 20250804 / DFE (000000000) | −0,02 | −0,0435 | −0,0435 | |||

| 31750PZM6 PIMCO FXVAN CALL USD TRY 56.75000000 / DFE (EZ1DBV1R2H50) | −0,02 | −57,41 | −0,0470 | 0,0636 | ||

| SOLD GHS BOUGHT USD 20251110 / DFE (000000000) | −0,03 | −0,0506 | −0,0506 | |||

| SOLD PEN BOUGHT USD 20251117 / DFE (000000000) | −0,03 | −0,0519 | −0,0519 | |||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | −0,04 | −0,0693 | −0,0693 | |||

| SOLD GHS BOUGHT USD 20250708 / DFE (000000000) | −0,04 | −0,0747 | −0,0747 | |||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | −0,04 | −0,0753 | −0,0753 | |||

| ARGENTINA LA SP GST / DCR (EZY76W8333X7) | −0,05 | −0,0921 | −0,0921 | |||

| ARGENTINA LA SP MYC / DCR (EZY76W8333X7) | −0,07 | −0,1285 | −0,1285 | |||

| RFR USD SOFR/3.25000 06/18/25-7Y CME / DIR (EZNM897HLTQ3) | −0,07 | −0,1400 | −0,1400 | |||

| TURKEY EM SP DUB / DCR (EZ1PD1ZWT8Q6) | −0,09 | −0,1713 | −0,1713 | |||

| TURKEY EM SP MEI / DCR (EZ1PD1ZWT8Q6) | −0,09 | −0,1713 | −0,1713 | |||

| SOLD EUR BOUGHT USD 20250804 / DFE (000000000) | −0,10 | −0,1879 | −0,1879 | |||

| RFR USD SOFR/3.00000 03/19/25-5Y CME / DIR (EZ9JNZJCQVZ3) | −0,11 | −26,92 | −0,2241 | 0,0963 | ||

| RFR USD SOFR/3.25000 03/19/25-10Y CME / DIR (EZG5Z5S944W5) | −0,12 | −11,54 | −0,2268 | 0,0408 | ||

| REVERSE REPO MORGAN STANLEY / RA (000000000) | −0,16 | −0,3227 | −0,3227 | |||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | −0,20 | −0,3914 | −0,3914 | |||

| RFR USD SOFR/3.25000 03/19/25-30Y LCH / DIR (EZLKBMPX51B0) | −0,22 | −38,57 | −0,4221 | 0,2947 | ||

| TRS RCKM 01/30/33 MYC / DCR (000000000) | −0,25 | −0,4952 | −0,4952 | |||

| REVERSE REPO MORGAN STANLEY / RA (000000000) | −0,27 | −0,5292 | −0,5292 | |||

| REVERSE REPO SOCIETE GENERALE REVERSE REPO / RA (000000000) | −0,44 | −0,8560 | −0,8560 | |||

| REVERSE REPO MERRILL LYNCH / RA (000000000) | −0,48 | −0,9387 | −0,9387 | |||

| REV REPO STANDARD CHARTERED BA ZCP / RA (000000000) | −0,52 | −1,0163 | −1,0163 | |||

| REVERSE REPO SOCIETE GENERALE REVERSE REPO / RA (000000000) | −0,55 | −1,0691 | −1,0691 | |||

| REVERSE REPO TORONTO DOMINIO / RA (000000000) | −0,61 | −1,1851 | −1,1851 | |||

| REVERSE REPO STANDARD CHARTERE VAR 1 / RA (000000000) | −0,67 | −1,3138 | −1,3138 | |||

| REVERSE REPO SOCIETE GENERALE REVERSE REPO / RA (000000000) | −0,88 | −1,7287 | −1,7287 | |||

| REVERSE REPO STANDARD CHARTERE VAR 1 / RA (000000000) | −3,43 | −6,7184 | −6,7184 |