Grundläggande statistik

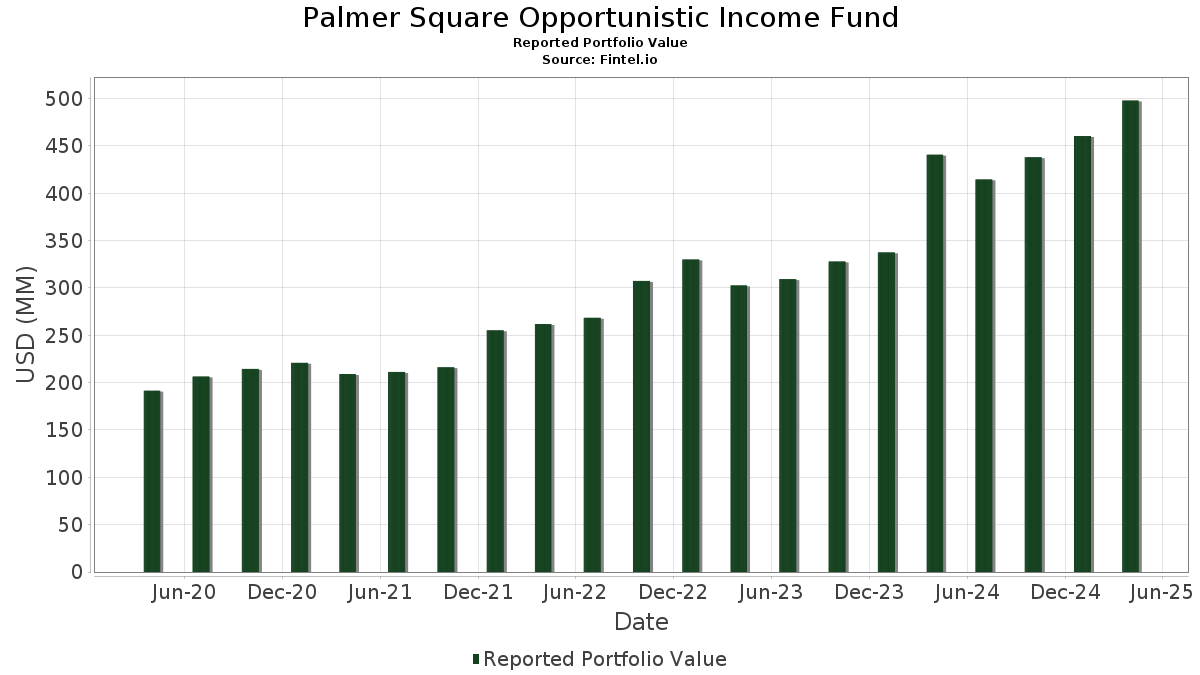

| Portföljvärde | $ 497 940 262 |

| Aktuella positioner | 415 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

Palmer Square Opportunistic Income Fund har redovisat 415 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 497 940 262 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). Palmer Square Opportunistic Income Funds största innehav är Fidelity Treasury Portfolio (US:US3161755042) , GS Mortgage Securities Corp II (US:US36192RAA05) , Dryden 30 Senior Loan Fund (KY:US26249BAW19) , Regatta VII Funding Ltd (KY:US75888ABE55) , and FLAT 2018-1A SUB MTGE 04/ PREFERRED STOCK (US:USG3554KAB82) . Palmer Square Opportunistic Income Funds nya positioner inkluderar Fidelity Treasury Portfolio (US:US3161755042) , GS Mortgage Securities Corp II (US:US36192RAA05) , Dryden 30 Senior Loan Fund (KY:US26249BAW19) , Regatta VII Funding Ltd (KY:US75888ABE55) , and FLAT 2018-1A SUB MTGE 04/ PREFERRED STOCK (US:USG3554KAB82) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 94,10 | 20,0893 | 11,5986 | ||

| 4,01 | 0,8557 | 0,8557 | ||

| 3,00 | 0,6398 | 0,6398 | ||

| 2,28 | 0,4876 | 0,4876 | ||

| 2,03 | 0,4337 | 0,4337 | ||

| 2,00 | 0,4270 | 0,4270 | ||

| 2,00 | 0,4261 | 0,4261 | ||

| 1,99 | 0,4245 | 0,4245 | ||

| 1,98 | 0,4226 | 0,4226 | ||

| 1,97 | 0,4203 | 0,4203 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| −2,98 | −0,6364 | −0,6364 | ||

| −2,29 | −0,4888 | −0,4888 | ||

| −2,27 | −0,4855 | −0,4855 | ||

| −2,27 | −0,4840 | −0,4840 | ||

| −2,05 | −0,4377 | −0,4377 | ||

| −1,99 | −0,4242 | −0,4242 | ||

| 1,00 | 0,2141 | −0,3665 | ||

| −1,71 | −0,3647 | −0,3647 | ||

| −1,15 | −0,2464 | −0,2464 | ||

| −1,14 | −0,2427 | −0,2427 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-06-30 för rapporteringsperioden 2025-04-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US3161755042 / Fidelity Treasury Portfolio | 94,10 | 155,35 | 20,0893 | 11,5986 | |||||

| Oaktree CLO 2024-25 Ltd. / ABS-CBDO (US67402PAA57) | 4,01 | 0,8557 | 0,8557 | ||||||

| Elmwood CLO IV Ltd. / ABS-CBDO (US29002GAL59) | 3,50 | −0,23 | 0,7482 | −0,0611 | |||||

| US36192RAA05 / GS Mortgage Securities Corp II | 3,04 | 14,04 | 0,6484 | 0,0346 | |||||

| US26249BAW19 / Dryden 30 Senior Loan Fund | 3,01 | −0,07 | 0,6419 | −0,0513 | |||||

| US75888ABE55 / Regatta VII Funding Ltd | 3,01 | −14,21 | 0,6418 | −0,1657 | |||||

| Voya CLO 2017-3 Ltd. / ABS-CBDO (US92915QBN25) | 3,00 | 0,6398 | 0,6398 | ||||||

| USG3554KAB82 / FLAT 2018-1A SUB MTGE 04/ PREFERRED STOCK | 2,99 | −17,70 | 0,6374 | −0,1984 | |||||

| DRYDEN LEVERAGED CLO 5.15% 01/19/2038 / / ABS-MBS (G284ACAL9) | 2,98 | 8,78 | 0,6352 | 0,0049 | |||||

| Empower CLO 2022-1 Ltd. / ABS-CBDO (US29246AAL44) | 2,51 | −0,12 | 0,5352 | −0,0431 | |||||

| US06760XAJ37 / Barings CLO Ltd 2018-IV | 2,50 | −0,32 | 0,5347 | −0,0443 | |||||

| Elmwood CLO VI Ltd. / ABS-CBDO (US29001VAU35) | 2,49 | −0,68 | 0,5320 | −0,0462 | |||||

| CBAM 2018-5 Ltd. / ABS-CBDO (US12481QAL95) | 2,47 | −1,60 | 0,5267 | −0,0510 | |||||

| US29003XAA19 / Elmwood CLO 14 Ltd | 2,46 | −2,61 | 0,5262 | −0,0569 | |||||

| US92915HAU77 / Voya CLO Ltd., Series 2016-3A, Class CR | 2,43 | −3,57 | 0,5185 | −0,0618 | |||||

| US88432ABC36 / THL Credit Wind River 2013-2 CLO Ltd | 2,35 | −0,21 | 0,5017 | −0,0409 | |||||

| Voya Euro CLO I DAC / ABS-CBDO (XS2913982190) | 2,30 | 8,96 | 0,4910 | 0,0047 | |||||

| Sixth Street CLO XXII Ltd. / ABS-CBDO (US83011LAQ95) | 2,28 | 0,4876 | 0,4876 | ||||||

| XS2274531412 / CIFC European Funding CLO III DAC | 2,27 | 8,68 | 0,4840 | 0,0033 | |||||

| US03767CAE03 / Apidos CLO XXVIII | 2,25 | −0,62 | 0,4796 | −0,0413 | |||||

| Cumulus Static CLO 2024-1 DAC / ABS-CBDO (XS2797422651) | 2,24 | 7,34 | 0,4776 | −0,0026 | |||||

| RR 36 Ltd. / ABS-CBDO (US74989AAG22) | 2,21 | −1,91 | 0,4712 | −0,0472 | |||||

| US27830CAJ18 / Eaton Vance CLO 2013-1, Ltd. | 2,17 | −4,32 | 0,4633 | −0,0595 | |||||

| US04018LAG05 / ARES 18-50A D CLO 144A FRN (TSFR3M+316.2) 01-15-32 | 2,16 | 0,05 | 0,4609 | −0,0365 | |||||

| US67102SAS32 / OCP CLO 2014-5 Ltd | 2,05 | −0,44 | 0,4380 | −0,0368 | |||||

| Regatta XVIII Funding Ltd. / ABS-CBDO (US75884EAW21) | 2,03 | 0,4337 | 0,4337 | ||||||

| Post CLO 2023-1 Ltd. / ABS-CBDO (US73743DAA81) | 2,01 | −1,18 | 0,4296 | −0,0396 | |||||

| Generate CLO 3 Ltd. / ABS-CBDO (US98625UBJ07) | 2,01 | −2,85 | 0,4291 | −0,0476 | |||||

| Trinitas CLO XXV Ltd. / ABS-CBDO (US89640BAL80) | 2,01 | −1,33 | 0,4285 | −0,0401 | |||||

| Magnetite XXIX Ltd. / ABS-CBDO (US55955KAL89) | 2,01 | −0,35 | 0,4283 | −0,0356 | |||||

| Regatta X Funding Ltd. / ABS-CBDO (US75884BAL27) | 2,00 | −0,65 | 0,4273 | −0,0369 | |||||

| CBAM 2017-4 Ltd. / ABS-CBDO (US12481NAF96) | 2,00 | −0,45 | 0,4273 | −0,0358 | |||||

| US04016VAJ44 / Ares XLVII CLO Ltd., Series 2018-47A, Class D | 2,00 | −0,50 | 0,4273 | −0,0361 | |||||

| Whitebox CLO IV Ltd. / ABS-CBDO (US96467KAU34) | 2,00 | 0,4270 | 0,4270 | ||||||

| Golub Capital Partners CLO 74 B Ltd. / ABS-CBDO (US38190BAA35) | 2,00 | 31,82 | 0,4265 | 0,0773 | |||||

| Post CLO VI Ltd. / ABS-CBDO (US73742RAA86) | 2,00 | −0,65 | 0,4264 | −0,0369 | |||||

| HPS Loan Management 15-2019 Ltd. / ABS-CBDO (US40439EAJ55) | 2,00 | −0,89 | 0,4262 | −0,0381 | |||||

| ACCESSION RISK MGMT DELAYED TL 11/01/29 / / LON (999999999) | 2,00 | 0,4261 | 0,4261 | ||||||

| Trinitas CLO XXIX Ltd. / ABS-CBDO (US89643BAA98) | 2,00 | −0,99 | 0,4260 | −0,0383 | |||||

| Voya CLO 2018-3 Ltd. / ABS-CBDO (US92917KAE47) | 1,99 | 13,12 | 0,4255 | 0,0196 | |||||

| Benefit Street Partners Clo XXXVII Ltd. / ABS-CBDO (US08182TAA79) | 1,99 | −0,90 | 0,4254 | −0,0380 | |||||

| US12551KAA16 / CIFC Funding 2017-IV Ltd | 1,99 | −1,34 | 0,4251 | −0,0399 | |||||

| Neuberger Berman CLO XVI-S Ltd. / ABS-CBDO (US64131TAY01) | 1,99 | 0,4245 | 0,4245 | ||||||

| US14314LAL99 / CARLYLE GLOBAL MARKET STRATEGIES CLO 2014-2R LTD CGMS 2014-2RA C | 1,99 | −1,05 | 0,4242 | −0,0382 | |||||

| Dartry Park CLO DAC / ABS-CBDO (XS2303850767) | 1,98 | 8,26 | 0,4227 | 0,0014 | |||||

| Cedar Funding XII CLO Ltd. / ABS-CBDO (US15033TBA25) | 1,98 | 0,4226 | 0,4226 | ||||||

| Cedar Funding VII Clo Ltd. / ABS-CBDO (US15032FAP18) | 1,97 | −1,60 | 0,4214 | −0,0408 | |||||

| Benefit Street Partners CLO Ltd. / ABS-CBDO (US08182DAU81) | 1,97 | 0,4203 | 0,4203 | ||||||

| OHA Credit Funding 8 Ltd. / ABS-CBDO (US67707GBA67) | 1,97 | −3,30 | 0,4197 | −0,0486 | |||||

| TRESTLES CLO II Ltd. / ABS-CBDO (US89531MAJ18) | 1,96 | −0,66 | 0,4181 | −0,0361 | |||||

| Elmwood CLO IX Ltd. / ABS-CBDO (US29003UAQ22) | 1,95 | 0,4169 | 0,4169 | ||||||

| Magnetite XXVI Ltd. / ABS-CBDO (US55954YBC84) | 1,95 | −2,75 | 0,4153 | −0,0455 | |||||

| Battalion Clo XV Ltd. / ABS-CBDO (US07131AAM62) | 1,88 | 0,4013 | 0,4013 | ||||||

| US67590GBQ10 / OCT17 2013-1A DR2 | 1,80 | −0,77 | 0,3836 | −0,0335 | |||||

| US55819MAN65 / Madison Park Funding XXXV Ltd | 1,79 | 0,3823 | 0,3823 | ||||||

| US92917AAG13 / Voya CLO 2018-1 Ltd | 1,78 | −1,55 | 0,3801 | −0,0366 | |||||

| OZLM VI Ltd. / ABS-CBDO (US67108LBR33) | 1,75 | −0,34 | 0,3741 | −0,0310 | |||||

| APID / Apidos CLO XX | 1,75 | −0,80 | 0,3731 | −0,0327 | |||||

| Neuberger Berman CLO XVI-S Ltd. / ABS-CBDO (US64131TBG85) | 1,72 | 0,3677 | 0,3677 | ||||||

| Barings Euro CLO 2015-1 DAC / ABS-CBDO (XS2425515082) | 1,70 | 9,17 | 0,3634 | 0,0042 | |||||

| US67570RAE99 / OCP CLO 2019-16 Ltd | 1,70 | −0,99 | 0,3623 | −0,0326 | |||||

| US460599AE31 / International Game Technology PLC | 1,62 | 98,90 | 0,3461 | 0,1582 | |||||

| Recette Clo Ltd. / ABS-CBDO (US75620RAG74) | 1,58 | 2,53 | 0,3374 | −0,0177 | |||||

| US27830KBA16 / Eaton Vance Clo 2015-1 Ltd. | 1,56 | −1,20 | 0,3334 | −0,0307 | |||||

| XS2351480996 / Deuce Finco Plc | 1,53 | 8,20 | 0,3268 | 0,0010 | |||||

| OCP CLO 2023-30 Ltd. / ABS-CBDO (US67117QAA94) | 1,51 | −1,24 | 0,3234 | −0,0300 | |||||

| US87230BAH78 / TCI-Flatiron CLO 2016-1 Ltd | 1,51 | 0,00 | 0,3225 | −0,0256 | |||||

| Empower CLO 2022-1 Ltd. / ABS-CBDO (US29246AAW09) | 1,51 | −1,50 | 0,3222 | −0,0309 | |||||

| Post CLO 2023-1 Ltd. / ABS-CBDO (US73743CAG78) | 1,51 | 0,3218 | 0,3218 | ||||||

| US38137TAD46 / GoldenTree Loan Opportunities XII Ltd., Series 2016-12A, Class ER | 1,51 | 0,07 | 0,3217 | −0,0253 | |||||

| US67112MAG06 / OZLM XX Ltd | 1,51 | −0,27 | 0,3214 | −0,0263 | |||||

| US67112AAG67 / OZLM XXI Ltd | 1,50 | −0,13 | 0,3211 | −0,0260 | |||||

| OCP CLO 2021-22 Ltd. / ABS-CBDO (US67117TAU97) | 1,50 | −1,83 | 0,3211 | −0,0318 | |||||

| Benefit Street Partners CLO XXXVI Ltd. / ABS-CBDO (US081922AJ53) | 1,50 | −1,89 | 0,3209 | −0,0322 | |||||

| US12551YAG89 / CIFC Funding 2018-III Ltd | 1,50 | −0,53 | 0,3206 | −0,0272 | |||||

| Menlo CLO I Ltd. / ABS-CBDO (US586915AA83) | 1,50 | −0,73 | 0,3203 | −0,0281 | |||||

| Menlo Clo II Ltd. / ABS-CBDO (US586916AE88) | 1,50 | 0,3202 | 0,3202 | ||||||

| Apidos CLO XXX / ABS-CBDO (US03768CAW91) | 1,50 | −0,33 | 0,3202 | −0,0267 | |||||

| Trinitas CLO XXXIV Ltd. / ABS-CBDO (US89643KAG67) | 1,50 | 0,3202 | 0,3202 | ||||||

| US03767MAL28 / Apidos CLO XXIX | 1,50 | −0,46 | 0,3202 | −0,0270 | |||||

| Empower CLO 2023-1 Ltd. / ABS-CBDO (US29244CAQ15) | 1,50 | 0,3202 | 0,3202 | ||||||

| Silver Point CLO 2 Ltd. / ABS-CBDO (US82808EAY77) | 1,50 | 0,3202 | 0,3202 | ||||||

| OCP CLO 2022-25 Ltd. / ABS-CBDO (US67115CAL81) | 1,50 | −0,47 | 0,3199 | −0,0269 | |||||

| Ares XXXIX CLO Ltd. / ABS-CBDO (US04015WBL72) | 1,50 | 0,3198 | 0,3198 | ||||||

| Carlyle Global Market Strategies CLO 2012-4 Ltd. / ABS-CBDO (US14309YCJ10) | 1,50 | −0,40 | 0,3198 | −0,0267 | |||||

| US08186TAE55 / Benefit Street Partners CLO XXI Ltd | 1,50 | −1,06 | 0,3197 | −0,0289 | |||||

| Elmwood CLO 21 Ltd. / ABS-CBDO (US29002DAJ72) | 1,49 | −1,32 | 0,3191 | −0,0298 | |||||

| Voya CLO 2020-3 Ltd. / ABS-CBDO (US92918NAY31) | 1,49 | −25,67 | 0,3190 | −0,1442 | |||||

| New Mountain CLO 1 Ltd. / ABS-CBDO (US64755RBJ14) | 1,49 | −0,40 | 0,3190 | −0,0266 | |||||

| Cedar Funding IV CLO Ltd. / ABS-CBDO (US150323BL64) | 1,49 | −25,94 | 0,3182 | −0,1453 | |||||

| US67591VAJ44 / Octagon Investment Partners 37 Ltd | 1,49 | −1,46 | 0,3171 | −0,0304 | |||||

| Magnetite XXXIX Ltd. / ABS-CBDO (US559924AQ81) | 1,48 | −2,88 | 0,3166 | −0,0350 | |||||

| CHG Healthcare Services, Inc. / LON (US12541HAW34) | 1,48 | 97,07 | 0,3165 | 0,1432 | |||||

| US74980XAG16 / RR15 Ltd | 1,48 | −1,86 | 0,3163 | −0,0315 | |||||

| DWOLF / Dewolf Park CLO Ltd | 1,48 | −1,73 | 0,3161 | −0,0309 | |||||

| Alinea CLO 2018-1 Ltd. / ABS-CBDO (US016269AL64) | 1,48 | −1,53 | 0,3154 | −0,0302 | |||||

| US26835CAC38 / EAB Global, Inc. - Senior | 1,47 | 100,00 | 0,3143 | 0,1006 | |||||

| Morgan Stanley Eaton Vance CLO 2022-18 Ltd. / ABS-CBDO (US617925AE23) | 1,47 | −5,22 | 0,3139 | −0,0436 | |||||

| Symphony CLO XXI Ltd. / ABS-CBDO (US87166RGE18) | 1,47 | 0,3137 | 0,3137 | ||||||

| THL Credit Wind River 2015-1 CLO Ltd. / ABS-CBDO (US87246LAG95) | 1,47 | 46,85 | 0,3133 | 0,0831 | |||||

| US33829UAA16 / 522 Funding CLO 2019-5 Ltd | 1,46 | −1,68 | 0,3119 | −0,0303 | |||||

| US65023QAA67 / Newark BSL CLO 2 Ltd | 1,44 | −4,50 | 0,3080 | −0,0400 | |||||

| Menlo CLO I Ltd. / ABS-CBDO (US586915AG53) | 1,38 | −1,92 | 0,2952 | −0,0295 | |||||

| US26246AAC09 / Dryden 86 CLO Ltd | 1,38 | −15,32 | 0,2951 | −0,0812 | |||||

| US67108PAG90 / OZLM VI LTD | 1,35 | −4,52 | 0,2890 | −0,0376 | |||||

| US47049AAA97 / Jamestown CLO XI, Ltd. | 1,32 | 0,2810 | 0,2810 | ||||||

| OCP CLO 2020-18 Ltd. / ABS-CBDO (US67570TAN54) | 1,30 | −3,49 | 0,2773 | −0,0327 | |||||

| Generate CLO 7 Ltd. / ABS-CBDO (US37149LAU17) | 1,26 | −2,18 | 0,2682 | −0,0278 | |||||

| Crestline Denali CLO XV Ltd. / ABS-CBDO (US22616CAG87) | 1,25 | −0,32 | 0,2679 | −0,0222 | |||||

| US38137MAT45 / Goldentree Loan Opportunities XII Ltd | 1,25 | 0,00 | 0,2676 | −0,0211 | |||||

| US26245JAW80 / Dryden 80 CLO Ltd., Series 2019-80A, Class DR | 1,25 | 25,05 | 0,2676 | 0,0366 | |||||

| US721283AA72 / PIKE CORP 5.5% 09/01/2028 144A | 1,25 | 108,85 | 0,2671 | 0,0632 | |||||

| US29244CAG33 / Empower CLO 2023-1, Ltd. | 1,25 | 0,2669 | 0,2669 | ||||||

| US03766YAA10 / Apidos CLO XXVIII | 1,25 | −0,79 | 0,2669 | −0,0234 | |||||

| Regatta XI Funding Ltd. / ABS-CBDO (US75887YAL92) | 1,24 | −2,20 | 0,2657 | −0,0276 | |||||

| Empower CLO 2023-1 Ltd. / ABS-CBDO (US29244NAE40) | 1,24 | 0,2642 | 0,2642 | ||||||

| US65023PAU49 / Newark BSL CLO 2 Ltd | 1,24 | −1,59 | 0,2641 | −0,0256 | |||||

| Apidos CLO XXIII / ABS-CBDO (US03765YBN31) | 1,24 | 0,2639 | 0,2639 | ||||||

| Neuberger Berman Loan Advisers CLO 55 Ltd. / ABS-CBDO (US640982AA29) | 1,24 | −4,49 | 0,2638 | −0,0342 | |||||

| US75887TAN63 / Regatta VII Funding Ltd. | 1,23 | 22,32 | 0,2633 | 0,0311 | |||||

| Highbridge Loan Management 5-2015 Ltd. / ABS-CBDO (US44331DAY58) | 1,23 | −1,91 | 0,2630 | −0,0264 | |||||

| AI Aqua Merger Sub, Inc. / LON (US00132UAP93) | 1,22 | −1,37 | 0,2610 | −0,0246 | |||||

| Morgan Stanley Eaton Vance CLO 2022-16 LLC / ABS-CBDO (US61774KAA97) | 1,20 | −5,05 | 0,2569 | −0,0351 | |||||

| US15032DAX93 / Cedar Funding VI CLO Ltd | 1,20 | 0,2562 | 0,2562 | ||||||

| Ellucian Holdings, Inc. / DBT (US289178AA37) | 1,18 | 0,2515 | 0,2515 | ||||||

| Neuberger Berman Loan Advisers CLO 27 Ltd. / ABS-CBDO (US64131UAL52) | 1,15 | −4,24 | 0,2462 | −0,0313 | |||||

| OCP Euro 2025-12 DAC / ABS-CBDO (XS3002399270) | 1,14 | 0,2430 | 0,2430 | ||||||

| XS1903440029 / Griffith Park CLO DAC | 1,14 | 8,60 | 0,2428 | 0,0014 | |||||

| Voya CLO 2022-3 Ltd. / ABS-CBDO (US92919WAF32) | 1,13 | −2,67 | 0,2417 | −0,0262 | |||||

| XS2293735010 / Neuberger Berman Loan Advisers Euro CLO | 1,13 | 7,84 | 0,2408 | −0,0003 | |||||

| Bryant Park Funding 2021-17R Ltd. / ABS-CBDO (US11766MAL63) | 1,12 | −1,15 | 0,2393 | −0,0219 | |||||

| Dryden 29 Euro CLO 2013 DAC / ABS-CBDO (XS1735591940) | 1,12 | 10,14 | 0,2391 | 0,0049 | |||||

| US53226GAK76 / LIGHTSTONE HOLDCO LLC TLB 5.75 | 1,11 | −1,51 | 0,2371 | −0,0227 | |||||

| US131347CM64 / Calpine Corp | 1,11 | −12,55 | 0,2366 | −0,0554 | |||||

| Ballyrock CLO 23 Ltd. / ABS-CBDO (US05875RAA95) | 1,11 | −1,34 | 0,2365 | −0,0222 | |||||

| Star Holding LLC / DBT (US85513AAA60) | 1,10 | 15,89 | 0,2351 | 0,0161 | |||||

| US03959KAC45 / Archrock Partners LP / Archrock Partners Finance Corp | 1,08 | 0,2298 | 0,2298 | ||||||

| Annisa CLO Ltd. 2016-2 / ABS-CBDO (US036011AW45) | 1,04 | −0,85 | 0,2230 | −0,0199 | |||||

| US21871DAD57 / CoreLogic Inc | 1,04 | 1,07 | 0,2225 | −0,0151 | |||||

| US57665RAN61 / Match Group Inc | 1,04 | −0,38 | 0,2212 | −0,0185 | |||||

| OCP CLO 2020-18 Ltd. / ABS-CBDO (US671078AW31) | 1,02 | −0,58 | 0,2183 | −0,0187 | |||||

| OCP CLO 2024-32 Ltd. / ABS-CBDO (US67570CAL63) | 1,02 | −0,29 | 0,2169 | −0,0180 | |||||

| US29362UAC80 / ENTEGRIS INC 4.375% 04/15/2028 144A | 1,01 | −0,10 | 0,2163 | −0,0174 | |||||

| US07378WAS70 / Bean Creek CLO Ltd 3.27 | 1,01 | 0,60 | 0,2159 | −0,0159 | |||||

| Zegona Finance PLC / DBT (US98927UAA51) | 1,01 | 26,57 | 0,2157 | 0,0074 | |||||

| Morgan Stanley Eaton Vance CLO 2023-19 Ltd. / ABS-CBDO (US617926AA83) | 1,01 | −2,42 | 0,2157 | −0,0229 | |||||

| Bryant Park Funding 2024-22 Ltd. / ABS-CBDO (US11766EAA82) | 1,01 | −1,66 | 0,2156 | −0,0209 | |||||

| Galaxy 32 CLO Ltd. / ABS-CBDO (US362941AA46) | 1,01 | −2,23 | 0,2156 | −0,0222 | |||||

| US671002AA12 / OCP CLO 2023-28 Ltd | 1,01 | −2,04 | 0,2150 | −0,0218 | |||||

| TCI-Flatiron Clo 2018-1 Ltd. / ABS-CBDO (USG87023AC40) | 1,01 | −0,40 | 0,2149 | −0,0179 | |||||

| Voya CLO 2019-1 Ltd. / ABS-CBDO (US92917NBC11) | 1,01 | −1,28 | 0,2148 | −0,0201 | |||||

| Regatta XXVI Funding Ltd. / ABS-CBDO (US75900QAJ40) | 1,01 | −2,42 | 0,2148 | −0,0229 | |||||

| Neuberger Berman Loan Advisers CLO 27 Ltd. / ABS-CBDO (US64131WAY30) | 1,01 | −0,99 | 0,2147 | −0,0194 | |||||

| Benefit Street Partners CLO XVII Ltd. / ABS-CBDO (US08182BBE74) | 1,01 | −0,50 | 0,2146 | −0,0182 | |||||

| New Mountain CLO 5 Ltd. / ABS-CBDO (US64754XAA90) | 1,01 | −0,69 | 0,2146 | −0,0186 | |||||

| Mountain View Clo XV Ltd. / ABS-CBDO (US62432PBC59) | 1,01 | −1,08 | 0,2146 | −0,0195 | |||||

| US92915PAR64 / Voya CLO Ltd., Series 2014-1A, Class CR2 | 1,00 | 0,00 | 0,2145 | −0,0170 | |||||

| Morgan Stanley Eaton Vance CLO 2022-18 Ltd. / ABS-CBDO (US617924AU99) | 1,00 | −1,76 | 0,2145 | −0,0211 | |||||

| Creeksource 2024-1 Dunes Creek Clo Ltd. / ABS-CBDO (US225914AJ98) | 1,00 | −1,67 | 0,2144 | −0,0211 | |||||

| Regatta XVI Funding Ltd. / ABS-CBDO (US75888QAL59) | 1,00 | −0,40 | 0,2142 | −0,0178 | |||||

| AIMCO CLO 10 Ltd. / ABS-CBDO (US00901AAS69) | 1,00 | −0,10 | 0,2141 | −0,0172 | |||||

| TRESTLES CLO 2017-1 Ltd. / ABS-CBDO (US89531FAY34) | 1,00 | −60,22 | 0,2141 | −0,3665 | |||||

| Barings CLO Ltd. 2024-V / ABS-CBDO (US06763YAL39) | 1,00 | −2,15 | 0,2140 | −0,0222 | |||||

| HPS Loan Management 13-2018 Ltd. / ABS-CBDO (US40437LAW28) | 1,00 | −0,30 | 0,2138 | −0,0176 | |||||

| US88390AAZ30 / THL Credit Wind River 2014-2 CLO Ltd | 1,00 | −0,50 | 0,2136 | −0,0181 | |||||

| US70016RAJ41 / Park Avenue Institutional Advisers CLO Ltd 2018-1 3.52 | 1,00 | −0,50 | 0,2136 | −0,0181 | |||||

| US12548FAS92 / CIFC Funding 2013-I Ltd | 1,00 | 0,00 | 0,2135 | −0,0170 | |||||

| Empower CLO 2025-1 Ltd. / ABS-CBDO (US29249DAJ00) | 1,00 | 0,2135 | 0,2135 | ||||||

| Regatta VIII Funding Ltd. / ABS-CBDO (US75888KAU88) | 1,00 | −1,87 | 0,2134 | −0,0211 | |||||

| Elmwood CLO IX Ltd. / ABS-CBDO (US29003UAS87) | 1,00 | 0,2133 | 0,2133 | ||||||

| Neuberger Berman Loan Advisers CLO 33 Ltd. / ABS-CBDO (US64132TBC62) | 1,00 | 0,2133 | 0,2133 | ||||||

| New Mountain CLO 3 Ltd. / ABS-CBDO (US647549AA20) | 1,00 | −0,99 | 0,2131 | −0,0192 | |||||

| Symphony CLO XVIII Ltd. / ABS-CBDO (US87154GFG55) | 1,00 | −0,60 | 0,2131 | −0,0183 | |||||

| Bryant Park Funding 2021-17R Ltd. / ABS-CBDO (US11766LAA26) | 1,00 | −3,01 | 0,2131 | −0,0240 | |||||

| Goldentree Loan Management U.S. CLO 5 Ltd. / ABS-CBDO (US38138DBE58) | 1,00 | −0,60 | 0,2131 | −0,0182 | |||||

| Verdelite Static CLO 2024-1 Ltd. / ABS-CBDO (US92338VAG68) | 1,00 | −0,99 | 0,2130 | −0,0190 | |||||

| Goldentree Loan Management U.S. Clo 9 Ltd. / ABS-CBDO (US38138HAJ68) | 1,00 | −1,09 | 0,2128 | −0,0194 | |||||

| US08186PAS20 / Benefit Street Partners CLO XVIII Ltd | 1,00 | −1,09 | 0,2127 | −0,0194 | |||||

| CIFC Funding 2021-IV Ltd. / ABS-CBDO (US12547DAL01) | 1,00 | −0,80 | 0,2126 | −0,0186 | |||||

| Post CLO 2024-1 Ltd. / ABS-CBDO (US73743FAA30) | 1,00 | −3,30 | 0,2126 | −0,0246 | |||||

| Bryant Park Funding 2024-23 Ltd. / ABS-CBDO (US11765DAA19) | 1,00 | −2,64 | 0,2126 | −0,0230 | |||||

| Shackleton 2013-IV-R CLO Ltd. / ABS-CBDO (US81882HAG02) | 1,00 | −1,00 | 0,2125 | −0,0192 | |||||

| Carlyle Global Market Strategies CLO 2013-1 Ltd. / ABS-CBDO (US14310CAU36) | 0,99 | −1,09 | 0,2124 | −0,0195 | |||||

| US55955BAA26 / Magnetite XX Ltd | 0,99 | −1,00 | 0,2124 | −0,0191 | |||||

| US83611JAG04 / Sound Point Clo XX Ltd | 0,99 | −0,30 | 0,2122 | −0,0177 | |||||

| Creeksource 2024-1 Dunes Creek Clo Ltd. / ABS-CBDO (US225917AA11) | 0,99 | −1,78 | 0,2122 | −0,0208 | |||||

| Silver Point CLO 6 Ltd. / ABS-CBDO (US82808MAJ27) | 0,99 | −2,93 | 0,2121 | −0,0238 | |||||

| Benefit Street Partners CLO XXVII Ltd. / ABS-CBDO (US08179PAW23) | 0,99 | −2,74 | 0,2120 | −0,0234 | |||||

| Anchorage Capital Clo 16 Ltd. / ABS-CBDO (US03330WAU80) | 0,99 | −0,80 | 0,2119 | −0,0185 | |||||

| BlueMountain CLO XXIX Ltd. / ABS-CBDO (US09630KAU88) | 0,99 | −1,20 | 0,2119 | −0,0197 | |||||

| Bain Capital Credit CLO 2018-2 / ABS-CBDO (US05682VAU98) | 0,99 | −1,20 | 0,2119 | −0,0196 | |||||

| Bryant Park Funding 2024-22 Ltd. / ABS-CBDO (US11766CAJ36) | 0,99 | −1,88 | 0,2116 | −0,0211 | |||||

| Voya CLO 2020-3 Ltd. / ABS-CBDO (US92918NBG16) | 0,99 | −4,17 | 0,2113 | −0,0267 | |||||

| Cedar Funding IV CLO Ltd. / ABS-CBDO (US150323BS18) | 0,99 | −3,70 | 0,2113 | −0,0254 | |||||

| US89686QAB23 / Trivium Packaging Finance BV | 0,99 | −1,20 | 0,2113 | −0,0194 | |||||

| US77340HAE99 / Rockford Tower CLO 2017-2 Ltd | 0,99 | −6,61 | 0,2112 | −0,1494 | |||||

| US26244QAU76 / Dryden 49 Senior Loan Fund | 0,99 | −1,59 | 0,2111 | −0,0203 | |||||

| US36321MAC10 / GALAXY XXVI CLO LTD GALXY 2018-26A F | 0,99 | −1,30 | 0,2111 | −0,0197 | |||||

| US12552NAA46 / CIFC Funding 2013-III-R, Ltd. | 0,99 | −2,28 | 0,2108 | −0,0221 | |||||

| US08186QAE17 / Benefit Street Partners CLO XVIII Ltd | 0,99 | −2,47 | 0,2108 | −0,0226 | |||||

| Voya CLO 2020-3 Ltd. / ABS-CBDO (US92918NBE67) | 0,99 | −2,95 | 0,2105 | −0,0236 | |||||

| Flatiron CLO 20 Ltd. / ABS-CBDO (US33883NAE22) | 0,99 | −2,67 | 0,2105 | −0,0229 | |||||

| Signal Peak CLO 5 Ltd. / ABS-CBDO (US82666VAJ35) | 0,99 | −4,00 | 0,2103 | −0,0263 | |||||

| Whitebox CLO IV Ltd. / ABS-CBDO (US96467LAE74) | 0,98 | 0,2103 | 0,2103 | ||||||

| WEC U.S. Holdings, Inc. / LON (US92943LAC46) | 0,98 | −1,40 | 0,2102 | −0,0199 | |||||

| Trestles CLO VI Ltd. / ABS-CBDO (US894940AQ82) | 0,98 | 0,2102 | 0,2102 | ||||||

| Aimco CLO 11 Ltd. / ABS-CBDO (US00140NBE94) | 0,98 | −3,24 | 0,2102 | −0,0243 | |||||

| Goldentree Loan Management U.S. Clo 7 Ltd. / ABS-CBDO (US38138MAG15) | 0,98 | −1,70 | 0,2100 | −0,0204 | |||||

| US03764FAD87 / Apidos CLO XII | 0,98 | −2,48 | 0,2100 | −0,0225 | |||||

| US67576FAJ84 / Octagon Investment Partners 18-R Ltd., Series 2018-18A, Class C | 0,98 | −2,19 | 0,2098 | −0,0217 | |||||

| Ares LXXVI CLO Ltd. / ABS-CBDO (US04021KAA07) | 0,98 | 0,2092 | 0,2092 | ||||||

| Regatta XXIV Funding Ltd. / ABS-CBDO (US75889HAW07) | 0,98 | −5,15 | 0,2086 | −0,0289 | |||||

| Magnetite XXVIII Ltd. / ABS-CBDO (US55955LBA98) | 0,98 | −4,03 | 0,2086 | −0,0258 | |||||

| Voya CLO 2020-2 Ltd. / ABS-CBDO (US92918HBD17) | 0,98 | −5,24 | 0,2085 | −0,0289 | |||||

| US61773LAA89 / Morgan Stanley Eaton Vance Clo 2021-1 Ltd | 0,98 | −3,47 | 0,2082 | −0,0246 | |||||

| Invesco U.S. CLO 2023-2 Ltd. / ABS-CBDO (US46147LAE02) | 0,97 | 0,2071 | 0,2071 | ||||||

| Apidos CLO XLII Ltd. / ABS-CBDO (US03770GAU04) | 0,97 | 0,2068 | 0,2068 | ||||||

| SOPHLN / Surf Holdings, LLC USD Term Loan | 0,97 | −1,12 | 0,2067 | −0,0189 | |||||

| Dryden 45 Senior Loan Fund / ABS-CBDO (US26244MBE12) | 0,97 | −1,23 | 0,2066 | −0,0190 | |||||

| Eaton Vance CLO 2020-2 Ltd. / ABS-CBDO (US27830RAG48) | 0,97 | −6,03 | 0,2064 | −0,0307 | |||||

| 522 Funding CLO 2020-6 Ltd. / ABS-CBDO (US33835BAG23) | 0,96 | −2,13 | 0,2058 | −0,0211 | |||||

| US83614NAU72 / Sound Point CLO XXIV | 0,96 | −1,03 | 0,2050 | −0,0187 | |||||

| Ballyrock CLO 14 Ltd. / ABS-CBDO (US05874YAE77) | 0,95 | −6,30 | 0,2033 | −0,0308 | |||||

| 40467AAH2 / Help At Home, Inc. | 0,94 | −4,55 | 0,2013 | −0,0264 | |||||

| US88330PAG54 / Thayer Park CLO Ltd | 0,92 | −3,15 | 0,1972 | −0,0225 | |||||

| Primo Water Holdings, Inc. / Triton Water Holdings, Inc. / DBT (US74168RAC79) | 0,92 | 0,1967 | 0,1967 | ||||||

| US78397UAA88 / SCIL IV LLC / SCIL USA Holdings LLC | 0,91 | 31,37 | 0,1950 | 0,0349 | |||||

| Dedalus Finance GmbH / LON (999999999) | 0,90 | 0,1928 | 0,1928 | ||||||

| Dryden 77 CLO Ltd. / ABS-CBDO (US26252YAG08) | 0,89 | −3,05 | 0,1900 | −0,0213 | |||||

| US89435TAB08 / Traverse Midstream Partners LLC 2017 Term Loan | 0,88 | −0,79 | 0,1885 | −0,0167 | |||||

| OCP CLO 2024-32 Ltd. / ABS-CBDO (US67570DAA81) | 0,88 | −51,17 | 0,1877 | −0,2272 | |||||

| US00150LAB71 / AHP Health Partners Inc | 0,87 | 41,20 | 0,1866 | −0,0364 | |||||

| US40436XAJ63 / Highbridge Loan Management 3-2014 | 0,85 | −0,23 | 0,1821 | −0,0149 | |||||

| US049362AA49 / Allied Universal Holdco LLC/Allied Universal Finance Corp/Atlas Luxco 4 Sarl | 0,84 | 0,84 | 0,1797 | −0,0126 | |||||

| US670001AE60 / Novelis Corp | 0,84 | 60,54 | 0,1789 | −0,0659 | |||||

| GoldenTree Loan Management EUR CLO 5 DAC / ABS-CBDO (XS2308303713) | 0,83 | 5,73 | 0,1772 | −0,0039 | |||||

| US56846YAE59 / SPEAK 2017-4A SUB 10/26/2034 | 0,82 | −29,26 | 0,1746 | −0,0916 | |||||

| US915328AU24 / UPLND 16-1 A1AR 144A FRN (L+102) 04-20-31 | 0,81 | −28,09 | 0,1729 | −0,0864 | |||||

| THL Credit Wind River 2019-3 Clo Ltd. / ABS-CBDO (US97314JAJ43) | 0,79 | −33,47 | 0,1695 | −0,1054 | |||||

| US09257WAD20 / Blackstone Mortgage Trust Inc | 0,79 | −0,38 | 0,1676 | −0,0140 | |||||

| US02154CAF05 / Altice Financing SA | 0,78 | 28,67 | 0,1669 | 0,0269 | |||||

| US60162QAC42 / Milos CLO Ltd | 0,76 | −4,74 | 0,1630 | −0,0217 | |||||

| Howden UK Refinance PLC / Howden UK Refinance 2 PLC / Howden U.S. Refinance LLC / DBT (US44287DAA19) | 0,76 | −1,04 | 0,1626 | −0,0147 | |||||

| US55954UAE38 / Magnetite XXXV Ltd | 0,76 | −2,20 | 0,1617 | −0,0166 | |||||

| Bryant Park Funding 2023-21 Ltd. / ABS-CBDO (US11766BAA44) | 0,76 | −2,45 | 0,1615 | −0,0171 | |||||

| Mountain View Clo XIV Ltd. / ABS-CBDO (US62432MAW91) | 0,75 | 1,48 | 0,1607 | −0,0101 | |||||

| US88432DBL73 / Wind River 2014-3 CLO Ltd | 0,75 | −0,40 | 0,1604 | −0,0134 | |||||

| US26881KAD63 / EP Purchaser, LLC 2023 Term Loan B | 0,75 | −0,13 | 0,1603 | −0,0130 | |||||

| US073685AD12 / Beacon Roofing Supply Inc 4.875% 11/01/2025 144a Bond | 0,75 | 0,1602 | 0,1602 | ||||||

| US14310MBE66 / Carlyle Global Market Strategies CLO Ltd., Series 2014-1A, Class DR | 0,75 | −0,40 | 0,1601 | −0,0134 | |||||

| TCP Sunbelt Acquisition Co. / LON (US87233DAB38) | 0,75 | 0,1601 | 0,1601 | ||||||

| A-AP Buyer, Inc. / LON (US00036FAB04) | 0,75 | −1,06 | 0,1597 | −0,0146 | |||||

| Aspire Bakeries Holdings LLC / LON (02106XAH9) | 0,75 | −1,71 | 0,1597 | −0,0157 | |||||

| Kestrel Acquisition LLC / LON (US44579UAB89) | 0,75 | −0,80 | 0,1596 | −0,0140 | |||||

| THL Credit Wind River 2019-3 Clo Ltd. / ABS-CBDO (US97314JAQ85) | 0,75 | −0,80 | 0,1595 | −0,0141 | |||||

| Leia Finco U.S. LLC / LON (US52526CAB54) | 0,75 | −0,67 | 0,1594 | −0,0138 | |||||

| Peer Holding III B.V. / LON (XAN6872NAN65) | 0,75 | 0,1593 | 0,1593 | ||||||

| Nexus Buyer LLC / LON (US65343UAH59) | 0,75 | 0,1591 | 0,1591 | ||||||

| Opal U.S. LLC / LON (XAF7000QAB77) | 0,74 | 0,1590 | 0,1590 | ||||||

| 743424AA1 / Proofpoint, Inc. 1.25% Convertible Bond due 2018-12-15 | 0,74 | −1,46 | 0,1589 | −0,0151 | |||||

| VS Buyer LLC / LON (US91834WAF77) | 0,74 | −1,33 | 0,1588 | −0,0147 | |||||

| US56846TAD81 / MARINER WEALTH ADVISORS LLC | 0,74 | −1,07 | 0,1588 | −0,0144 | |||||

| AssuredPartners, Inc. / LON (US04621HAW34) | 0,74 | −0,27 | 0,1587 | −0,0131 | |||||

| Grant Thornton Advisors Holdings LLC / LON (US38821UAD28) | 0,74 | −1,33 | 0,1583 | −0,0148 | |||||

| US26251YAJ55 / Dryden 65 CLO Ltd | 0,74 | −1,59 | 0,1582 | −0,0154 | |||||

| Project Alpha Intermediate Holding, Inc. / LON (US74339DAN84) | 0,74 | −1,60 | 0,1581 | −0,0153 | |||||

| Howden Group Holdings Ltd. / LON (XAG4712JAY82) | 0,74 | −0,54 | 0,1580 | −0,0135 | |||||

| Project Boost Purchaser LLC / LON (US74339NAG16) | 0,74 | −1,73 | 0,1578 | −0,0157 | |||||

| Phoenix Guarantor, Inc. / LON (US71913BAK89) | 0,74 | −1,34 | 0,1577 | −0,0147 | |||||

| IVI America LLC / LON (US45073SAB16) | 0,74 | 0,1575 | 0,1575 | ||||||

| Elmwood CLO 22 Ltd. / ABS-CBDO (US29001YAS28) | 0,74 | 0,1575 | 0,1575 | ||||||

| Mitchell International, Inc. / LON (US60662WAW29) | 0,74 | −1,47 | 0,1574 | −0,0150 | |||||

| Touchdown Acquirer, Inc. / LON (US89157NAJ28) | 0,74 | 0,1574 | 0,1574 | ||||||

| Ensemble RCM LLC / LON (US29359BAE11) | 0,74 | −1,07 | 0,1573 | −0,0145 | |||||

| Filtration Group Corp. / LON (US31732FAV85) | 0,74 | 0,1573 | 0,1573 | ||||||

| Trinitas CLO XXXIV Ltd. / ABS-CBDO (US89643LAA70) | 0,73 | 0,1569 | 0,1569 | ||||||

| US77313DAW11 / Rocket Software, Inc. - Term Loan B | 0,73 | −2,13 | 0,1569 | −0,0161 | |||||

| Creative Artists Agency LLC / LON (US22526WAS70) | 0,73 | −1,08 | 0,1568 | −0,0142 | |||||

| OneDigital Borrower LLC / LON (US68277FAN96) | 0,73 | 0,1567 | 0,1567 | ||||||

| US85236FAA12 / SRM Escrow Issuer, LLC | 0,73 | −1,74 | 0,1567 | −0,0154 | |||||

| Hudson River Trading LLC / LON (US44413EAJ73) | 0,73 | −0,81 | 0,1565 | −0,0138 | |||||

| Fortress Intermediate 3, Inc. / LON (US34966LAB09) | 0,73 | −2,40 | 0,1563 | −0,0166 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 0,73 | −1,08 | 0,1561 | −0,0144 | |||||

| Zelis Payments Buyer, Inc. / LON (US98932TAG85) | 0,73 | −2,81 | 0,1552 | −0,0170 | |||||

| Edgewater Generation LLC / LON (US28031FAM23) | 0,73 | 0,1551 | 0,1551 | ||||||

| Whatabrands LLC / LON (US96244UAJ60) | 0,73 | −1,09 | 0,1551 | −0,0143 | |||||

| Flexera Software LLC / LON (US33937KAX28) | 0,73 | −1,49 | 0,1549 | −0,0148 | |||||

| Arini U.S. Clo I Ltd. / ABS-CBDO (US04039AAG94) | 0,72 | 0,1548 | 0,1548 | ||||||

| Acrisure LLC / LON (US00488PAV76) | 0,72 | −1,50 | 0,1546 | −0,0149 | |||||

| NorthAB LLC / LON (US66345FAB76) | 0,72 | 0,1544 | 0,1544 | ||||||

| HireRight Holdings Corp. / LON (US37190DAN30) | 0,72 | 0,1543 | 0,1543 | ||||||

| US74006LAS16 / Pre-Paid Legal Services, Inc., First Lien Term Loan | 0,72 | −1,90 | 0,1541 | −0,0153 | |||||

| US75605VAD47 / REALPAGE INC | 0,72 | −1,10 | 0,1540 | −0,0141 | |||||

| Gloves Buyer, Inc. / LON (999999999) | 0,72 | 0,1538 | 0,1538 | ||||||

| Autokiniton U.S. Holdings, Inc. / LON (US05278HAC07) | 0,72 | −1,64 | 0,1535 | −0,0150 | |||||

| Grinding Media, Inc. / LON (US39854KAC45) | 0,72 | −4,52 | 0,1533 | −0,0200 | |||||

| ECI Macola/Max Holding LLC / LON (US26825UAM36) | 0,72 | −1,65 | 0,1531 | −0,0148 | |||||

| US57165KAB26 / Red Planet Borrower LLC, First Lien Initial Term Loan | 0,71 | −1,11 | 0,1520 | −0,0138 | |||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 0,71 | −4,06 | 0,1514 | −0,0190 | |||||

| LBM Acquisition LLC / LON (50179JAH1) | 0,71 | −4,21 | 0,1509 | −0,0191 | |||||

| HP PHRG Borrower LLC / LON (US40445XAC02) | 0,70 | 0,1493 | 0,1493 | ||||||

| Raven Acquisition Holdings LLC / LON (US75419XAC83) | 0,69 | −1,42 | 0,1481 | −0,0140 | |||||

| Dotdash Meredith, Inc. / LON (US25849KAE73) | 0,69 | −3,62 | 0,1480 | −0,0178 | |||||

| US26249BBA89 / Dryden 30 Senior Loan Fund | 0,69 | −5,21 | 0,1479 | −0,0205 | |||||

| US92837TAA07 / Austin BidCo Inc | 0,69 | −21,72 | 0,1478 | −0,0560 | |||||

| US04626LAE92 / Astoria Energy LLC 2020 Term Loan B | 0,69 | −1,57 | 0,1477 | −0,0142 | |||||

| Renaissance Holdings Corp. / LON (US75972JAK07) | 0,69 | −6,62 | 0,1475 | −0,0232 | |||||

| US34555QAF72 / Forest City Enterprises, L.P. 2019 Term Loan B | 0,68 | −0,59 | 0,1448 | −0,0123 | |||||

| US73044EAB02 / PODS T/L (3/21) | 0,68 | 1,20 | 0,1444 | −0,0096 | |||||

| US69355BAE11 / PPM CLO 3 Ltd. | 0,66 | −8,31 | 0,1415 | −0,0250 | |||||

| US65341BAG14 / NextEra Energy Partners LP | 0,66 | −30,63 | 0,1408 | −0,0780 | |||||

| US71360HAB33 / PERATON CORP | 0,66 | −3,82 | 0,1400 | −0,0171 | |||||

| US92332YAA91 / Venture Global LNG, Inc. | 0,66 | −38,90 | 0,1400 | −0,1071 | |||||

| US39843UAA07 / Grifols Escrow Issuer SA | 0,65 | −0,15 | 0,1385 | −0,0112 | |||||

| Medline Borrower LP / LON (US58503UAF03) | 0,64 | −5,17 | 0,1371 | −0,0189 | |||||

| US38869AAB35 / Graphic Packaging International LLC | 0,64 | 0,00 | 0,1364 | −0,0108 | |||||

| US71601HAB24 / Petco Health and Wellness Company, Inc., 1st Lien Term Loan | 0,63 | −9,00 | 0,1339 | −0,0251 | |||||

| US06832FAB31 / Barracuda Networks, Inc., 1st Lien Term Loan | 0,61 | −5,39 | 0,1313 | −0,0184 | |||||

| Ovg Business Services LLC / LON (US62955EAJ38) | 0,61 | −1,61 | 0,1306 | −0,0127 | |||||

| Summer BC Holdco B SARL / DBT (XS2998755040) | 0,60 | 0,1289 | 0,1289 | ||||||

| Alliant Holdings Intermediate LLC / LON (US01881UAM71) | 0,60 | −1,33 | 0,1272 | −0,0118 | |||||

| US76761TAJ43 / Riserva Clo Ltd | 0,57 | 3,10 | 0,1210 | −0,0057 | |||||

| Great Outdoors Group LLC / LON (US07014QAP63) | 0,56 | 0,1203 | 0,1203 | ||||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AA47) | 0,55 | 0,1183 | 0,1183 | ||||||

| VFH Parent LLC / LON (US91820UAV26) | 0,55 | 0,1171 | 0,1171 | ||||||

| Rohm Holding GmbH / LON (XAD7000LAC81) | 0,54 | 7,97 | 0,1157 | 0,0000 | |||||

| US70477BAE20 / Vision Solutions, Inc. 2021 Incremental Term Loan | 0,54 | −6,42 | 0,1153 | −0,0176 | |||||

| US77314EAA64 / Rocket Software Inc | 0,52 | 0,39 | 0,1100 | −0,0082 | |||||

| US682189AQ81 / ON Semiconductor Corp | 0,51 | 0,1099 | 0,1099 | ||||||

| Acrisure LLC / Acrisure Finance, Inc. / DBT (US00489LAL71) | 0,51 | −1,55 | 0,1088 | −0,0104 | |||||

| Regatta VIII Funding Ltd. / ABS-CBDO (US75888KAW45) | 0,50 | −1,96 | 0,1071 | −0,0106 | |||||

| US92917CAN20 / Voya CLO 2013-1 Ltd | 0,50 | −0,40 | 0,1070 | −0,0088 | |||||

| Elmwood CLO III Ltd. / ABS-CBDO (US29002HAW97) | 0,50 | −50,30 | 0,1068 | −0,1251 | |||||

| New Mountain CLO 4 Ltd. / ABS-CBDO (US64754PAA66) | 0,50 | −1,77 | 0,1067 | −0,0107 | |||||

| TK Elevator U.S. Newco, Inc. / LON (XAD9000BAJ17) | 0,50 | 0,1065 | 0,1065 | ||||||

| Red Planet Borrower LLC / LON (US57165KAD81) | 0,50 | 0,1063 | 0,1063 | ||||||

| GTCR Everest Borrower LLC / LON (US36269YAC93) | 0,50 | −1,00 | 0,1060 | −0,0096 | |||||

| Propulsion BC Newco LLC / LON (74347UAD2) | 0,50 | −1,20 | 0,1059 | −0,0097 | |||||

| US13875LAU26 / Canyon Capital CLO 2014-1 Ltd | 0,50 | −1,39 | 0,1058 | −0,0100 | |||||

| Century DE Buyer LLC / LON (US15651FAD87) | 0,50 | −1,39 | 0,1057 | −0,0100 | |||||

| Zacapa SARL / LON (XAL9901EAG25) | 0,49 | −1,40 | 0,1057 | −0,0098 | |||||

| OMNIA Partners LLC / LON (68218HAE7) | 0,49 | −1,20 | 0,1057 | −0,0096 | |||||

| Outcomes Group Holdings, Inc. / LON (US69002CAD83) | 0,49 | −1,98 | 0,1057 | −0,0105 | |||||

| Cengage Learning, Inc. / LON (US15131YAQ89) | 0,49 | −1,20 | 0,1056 | −0,0097 | |||||

| Amynta Agency Borrower, Inc. / LON (US57810JAL26) | 0,49 | −0,60 | 0,1055 | −0,0091 | |||||

| Ahead DB Holdings LLC / LON (US00866HAH84) | 0,49 | −1,79 | 0,1054 | −0,0103 | |||||

| Aretec Group, Inc. / LON (US04009DAH70) | 0,49 | −1,21 | 0,1050 | −0,0097 | |||||

| US44332EAP16 / Hub International Ltd., Term Loan | 0,49 | 0,1049 | 0,1049 | ||||||

| XAC8000CAB90 / Panther BF Aggregator 2 LP USD Term Loan B | 0,49 | −2,00 | 0,1048 | −0,0108 | |||||

| US12552BAA08 / CIFC Funding 2018-III Ltd | 0,49 | −1,81 | 0,1046 | −0,0103 | |||||

| US39729TAA25 / Greenwood Park CLO, Ltd. | 0,49 | −2,78 | 0,1044 | −0,0115 | |||||

| US07132JBJ25 / Battalion CLO X Ltd. | 0,49 | −1,01 | 0,1042 | −0,0095 | |||||

| Hunter Douglas, Inc. / LON (XAN8137FAE06) | 0,49 | −3,18 | 0,1041 | −0,0119 | |||||

| Hamilton Projects Acquiror LLC / LON (40444KAB1) | 0,48 | −2,23 | 0,1032 | −0,0107 | |||||

| US01883LAB99 / Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer | 0,48 | −0,41 | 0,1031 | −0,0084 | |||||

| US08180YAE05 / Benefit Street Partners CLO VIII Ltd | 0,48 | −3,79 | 0,1031 | −0,0124 | |||||

| Project Alpha Intermediate Holding, Inc. / LON (999999999) | 0,48 | 0,1027 | 0,1027 | ||||||

| Nouryon Finance B.V. / LON (XAN8232NAL19) | 0,48 | −2,64 | 0,1025 | −0,0111 | |||||

| US12620BAR15 / CPM Holdings, Inc. 2023 Term Loan | 0,48 | 1,48 | 0,1023 | −0,0067 | |||||

| BGS / B&G Foods, Inc. | 0,48 | −4,61 | 0,1018 | −0,0134 | |||||

| US46583DAG43 / Ivanti Software Inc | 0,47 | 1,28 | 0,1010 | −0,0068 | |||||

| US00185NAE67 / AP Gaming I LLC, Term Loan B | 0,47 | −0,84 | 0,1010 | −0,0090 | |||||

| Brightview Landscapes LLC / LON (10801XAL1) | 0,46 | 0,0975 | 0,0975 | ||||||

| UGI Energy Services LLC / LON (US90276DAE94) | 0,46 | −1,08 | 0,0975 | −0,0088 | |||||

| US58462QAH48 / Medical Solutions L.L.C. 2021 First Lien Term Loan | 0,45 | −14,59 | 0,0952 | −0,0250 | |||||

| XAG4768PAN15 / INEOS US FINANCE LLC | 0,43 | −6,35 | 0,0914 | −0,0141 | |||||

| AIMBRIDGE RESTRUCTUR COMMON EQUITY / / (999999999) | 0,43 | 0,0911 | 0,0911 | ||||||

| US45567YAN58 / MH Sub I, LLC 2023 Term Loan | 0,42 | −43,03 | 0,0891 | −0,0797 | |||||

| US29276MAP23 / EnergySolutions LLC | 0,41 | −0,96 | 0,0883 | −0,0080 | |||||

| Wellfleet CLO 2018-2 Ltd. / ABS-CBDO (US94949JAJ43) | 0,41 | −36,63 | 0,0876 | −0,0615 | |||||

| W2EX34 / WEX Inc. - Depositary Receipt (Common Stock) | 0,39 | 0,0831 | 0,0831 | ||||||

| EURO CURRENCY / / STIV (999999999) | 0,39 | 0,0823 | 0,0823 | ||||||

| Central Parent LLC / LON (US15477BAE74) | 0,38 | 0,0803 | 0,0803 | ||||||

| XAG4770MAJ36 / INEOS US Petrochem LLC | 0,38 | −15,54 | 0,0802 | −0,0222 | |||||

| US92939GAL14 / WFLD 2014-MONT Mortgage Trust | 0,37 | 11,55 | 0,0785 | 0,0024 | |||||

| Flatiron Clo 17 Ltd. / ABS-CBDO (US33882FAB67) | 0,36 | 14,42 | 0,0762 | 0,0042 | |||||

| US18539UAC99 / Clearway Energy Operating LLC | 0,33 | −52,43 | 0,0713 | −0,0902 | |||||

| Prometric Holdings, Inc. / LON (US80358TAF30) | 0,30 | −1,32 | 0,0642 | −0,0060 | |||||

| SSP / The E.W. Scripps Company | 0,30 | 0,0631 | 0,0631 | ||||||

| US12510EAC12 / CCI Buyer, Inc. Term Loan | 0,29 | −0,69 | 0,0616 | −0,0053 | |||||

| MH Sub I LLC / LON (US45567YAP07) | 0,26 | 0,0559 | 0,0559 | ||||||

| Voya CLO 2022-4 Ltd. / ABS-CBDO (US92920MAE57) | 0,25 | −3,11 | 0,0533 | −0,0061 | |||||

| O2NS34 / ON Semiconductor Corporation - Depositary Receipt (Common Stock) | 0,24 | 0,0514 | 0,0514 | ||||||

| SSP / The E.W. Scripps Company | 0,24 | 0,0512 | 0,0512 | ||||||

| US04916WAA27 / Atlantica Sustainable Infrastructure PLC | 0,23 | −67,14 | 0,0498 | −0,1137 | |||||

| US74166MAF32 / Prime Security Services Borrower LLC / Prime Finance Inc | 0,21 | −74,00 | 0,0447 | −0,1407 | |||||

| US87422VAK44 / Talen Energy Supply, LLC | 0,15 | −72,79 | 0,0316 | −0,1535 | |||||

| US23305YAW93 / DBUBS Mortgage Trust, Series 2011-LC3A, Class PM2 | 0,15 | −6,45 | 0,0311 | −0,0046 | |||||

| PSQO / Palmer Square Funds Trust - Palmer Square Credit Opportunities ETF | 0,01 | −54,63 | 0,14 | −54,75 | 0,0295 | −0,0409 | |||

| US04649VAX82 / Asurion LLC 2020 Term Loan B8 | 0,12 | −9,85 | 0,0256 | −0,0049 | |||||

| PSQA / Palmer Square Funds Trust - Palmer Square CLO Senior Debt ETF | 0,01 | −64,59 | 0,11 | −64,69 | 0,0229 | −0,0471 | |||

| USG4133EAB05 / GRIPPEN PARK CLO LTD GRIPP 2017-1A SUB | 0,09 | 74,07 | 0,0202 | 0,0078 | |||||

| AIMBRIDGE ACQ Co., Inc. TERM LOAN 2/28/27 / / LON (00900YAG1) | 0,07 | 0,0144 | 0,0144 | ||||||

| AIMBRIDGE ACQ ROLL U TERM LOAN 07/05/2027 / / LON (999999999) | 0,07 | 0,0142 | 0,0142 | ||||||

| US53226GAL59 / LIGHTSTONE HOLDCO LLC TLC 5.75 | 0,06 | −1,59 | 0,0134 | −0,0013 | |||||

| Raven Acquisition Holdings LLC / LON (US75419XAD66) | 0,05 | −2,00 | 0,0106 | −0,0010 | |||||

| US98162JAQ94 / Worldwide Plaza Trust 2017-WWP | 0,04 | −31,75 | 0,0092 | −0,0055 | |||||

| US75620RAH57 / Recette Clo Ltd. | 0,03 | 16,67 | 0,0061 | 0,0005 | |||||

| Highbridge Loan Management 12-2018 Ltd. / ABS-CBDO (US40437CAB81) | 0,02 | −78,43 | 0,0048 | −0,0188 | |||||

| WELLPATH RECOV SOLTL PIK ACCRUAL / / LON (999999999) | 0,02 | 0,0033 | 0,0033 | ||||||

| TransDigm Group, Inc. / DE (999999999) | 0,01 | 0,0026 | 0,0026 | ||||||

| Wellpath Holdings, Inc. / LON (US12509EAE05) | 0,00 | 50,00 | 0,0006 | 0,0002 | |||||

| WELLPATH RECOV SOLUT RECOVERY SOLUTIONS / / (999999999) | 0,00 | 0,0005 | 0,0005 | ||||||

| US62704PAF09 / Murray Energy Corp | 0,00 | 0,0000 | 0,0000 | ||||||

| EUR FORWARD PALMER CONTRACT 06/25/2025 / / DFE (999999999) | −0,73 | −0,1556 | −0,1556 | ||||||

| EUR FORWARD PALMER CONTRACT 06/25/2025 / / DFE (999999999) | −0,97 | −0,2081 | −0,2081 | ||||||

| EUR FORWARD PALMER CONTRACT 06/05/2025 / / DFE (999999999) | −1,14 | −0,2424 | −0,2424 | ||||||

| EUR FORWARD PALMER CONTRACT 06/25/2025 / / DFE (999999999) | −1,14 | −0,2427 | −0,2427 | ||||||

| EUR FORWARD PALMER CONTRACT 03/27/2026 / / DFE (999999999) | −1,15 | −0,2464 | −0,2464 | ||||||

| EUR FORWARD PALMER CONTRACT 07/24/2025 / / DFE (999999999) | −1,71 | −0,3647 | −0,3647 | ||||||

| EUR FORWARD PALMER CONTRACT 06/05/2025 / / DFE (999999999) | −1,99 | −0,4242 | −0,4242 | ||||||

| EUR FORWARD PALMER CONTRACT 07/24/2025 / / DFE (999999999) | −2,05 | −0,4377 | −0,4377 | ||||||

| EUR FORWARD PALMER CONTRACT 05/08/2025 / / DFE (999999999) | −2,27 | −0,4840 | −0,4840 | ||||||

| EUR FORWARD PALMER CONTRACT 06/25/2025 / / DFE (999999999) | −2,27 | −0,4855 | −0,4855 | ||||||

| EURO FORWARD PALMER CONTRACT 10/15/2025 / / DFE (999999999) | −2,29 | −0,4888 | −0,4888 | ||||||

| EUR FORWARD PALMER CONTRACT 12/02/2025 / / DFE (999999999) | −2,98 | −0,6364 | −0,6364 |