Grundläggande statistik

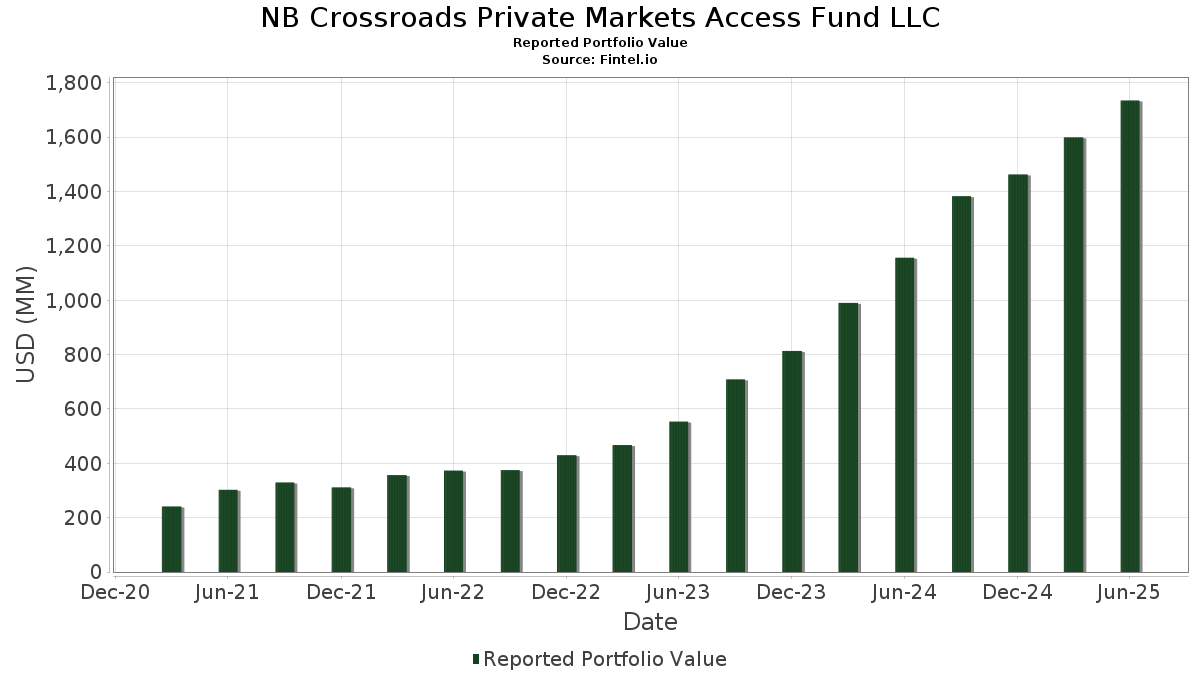

| Portföljvärde | $ 1 734 765 536 |

| Aktuella positioner | 98 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

NB Crossroads Private Markets Access Fund LLC har redovisat 98 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 1 734 765 536 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). NB Crossroads Private Markets Access Fund LLCs största innehav är SSGA Active Trust - SPDR Blackstone Senior Loan ETF (US:SRLN) , Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class (US:US61747C7074) , AFC Acquisitions, Inc. (BM:US826359AD34) , FLOODSMART RE LTD UNSECURED 144A 03/24 VAR (BM:US33975CAG06) , and CAPE LOOKOUT RE LTD (US:US13947LAC63) . NB Crossroads Private Markets Access Fund LLCs nya positioner inkluderar AFC Acquisitions, Inc. (BM:US826359AD34) , FLOODSMART RE LTD UNSECURED 144A 03/24 VAR (BM:US33975CAG06) , CAPE LOOKOUT RE LTD (US:US13947LAC63) , URSA RE II LTD (US:US91734PAC05) , and COSAINT RE PTE LTD BONDS 144A 04/28 VAR (SG:US22112CAA09) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 74,79 | 4,4066 | 4,4066 | ||

| 74,58 | 4,3944 | 4,3944 | ||

| 70,71 | 4,1665 | 4,1665 | ||

| 59,20 | 3,4882 | 3,4882 | ||

| 58,37 | 3,4394 | 3,4394 | ||

| 40,82 | 2,4052 | 2,4052 | ||

| 40,50 | 2,3863 | 2,3863 | ||

| 34,74 | 2,0469 | 2,0469 | ||

| 34,51 | 2,0333 | 2,0333 | ||

| 34,16 | 2,0125 | 2,0125 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 47,40 | 47,40 | 2,7927 | −9,7556 | |

| 10,31 | 0,6073 | −0,1173 | ||

| 11,45 | 0,6748 | −0,0561 | ||

| 13,78 | 0,8120 | −0,0558 | ||

| 10,37 | 0,6111 | −0,0245 | ||

| 4,97 | 0,2928 | −0,0189 | ||

| 5,76 | 0,3394 | −0,0166 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-28 för rapporteringsperioden 2025-06-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SRLN / SSGA Active Trust - SPDR Blackstone Senior Loan ETF | 2,30 | 26,60 | 95,75 | 28,02 | 5,6420 | 0,8136 | |||

| NB Vault Aggregator LP (Veeam Software) / (999999999) | 74,79 | 4,4066 | 4,4066 | ||||||

| NB Mariner Aggregator LP (Mariner) / (999999999) | 74,58 | 4,3944 | 4,3944 | ||||||

| NB Aggregator (Minerva) LP (Nord Anglia) / (999999999) | 70,71 | 4,1665 | 4,1665 | ||||||

| FS Equity Partners CV1, L.P. (Secondary) / (999999999) | 59,20 | 3,4882 | 3,4882 | ||||||

| TREASURY BILL / DBT (US912797QW07) | 58,37 | 3,4394 | 3,4394 | ||||||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 47,40 | −75,62 | 47,40 | −75,62 | 2,7927 | −9,7556 | |||

| TREASURY BILL / DBT (US912797MG92) | 40,82 | 2,4052 | 2,4052 | ||||||

| KKR Metro Co-Invest L.P. (MetroNet Holdings, LLC) / (999999999) | 40,50 | 2,3863 | 2,3863 | ||||||

| TREASURY BILL / DBT (US912797QM25) | 34,74 | 2,0469 | 2,0469 | ||||||

| TREASURY BILL / DBT (US912797NA14) | 34,51 | 2,0333 | 2,0333 | ||||||

| NB Electron Aggregator LP (ENTRUST Solutions Group) / (999999999) | 34,16 | 2,0125 | 2,0125 | ||||||

| HCI Equity Partners EV I, L.P. (Secondary) / (999999999) | 33,67 | 1,9836 | 1,9836 | ||||||

| Lightyear AMP CV, L.P. / (999999999) | 30,59 | 1,8026 | 1,8026 | ||||||

| Vector Capital Partners V, L.P. (Secondary) / (999999999) | 30,32 | 1,7867 | 1,7867 | ||||||

| NB Franklin LP (OMNIA Partners Inc) / (999999999) | 28,49 | 1,6790 | 1,6790 | ||||||

| CD&R Ferdinand Co-Investor, L.P. (Focus Financial Partners Inc) / (999999999) | 25,80 | 1,5204 | 1,5204 | ||||||

| Providence Equity Partners (Unity) S.C.Sp (Secondary) / (999999999) | 25,49 | 1,5019 | 1,5019 | ||||||

| ACON Strategic Partners II-B, L.P. (New Era) / (999999999) | 25,05 | 1,4758 | 1,4758 | ||||||

| EQT X Co-Investment (A) SCSp (Avetta) / (999999999) | 24,86 | 1,4650 | 1,4650 | ||||||

| KKR Abacus Co-Invest L.P. (Accountor) / (999999999) | 24,46 | 1,4412 | 1,4412 | ||||||

| Searchlight Capital III CVL Co-Invest Partners II, L.P. (Consolidated Communications Inc) / (999999999) | 24,34 | 1,4341 | 1,4341 | ||||||

| NB Mavis Aggregator LP (Mavis Discount Tire Inc) / (999999999) | 24,26 | 1,4293 | 1,4293 | ||||||

| Aquiline Madonna Co-Invest L.P. (Isio) / (999999999) | 23,49 | 1,3843 | 1,3843 | ||||||

| NB Geyser Aggregator LP (Yellowstone Landscape) / (999999999) | 23,23 | 1,3686 | 1,3686 | ||||||

| NB Convert Elevate Aggregator LP (Colibri Group) / (999999999) | 21,39 | 1,2601 | 1,2601 | ||||||

| Sprinkler 2024 Co-Investment I (Feeder) SCSp (Minimax Viking) / (999999999) | 20,13 | 1,1859 | 1,1859 | ||||||

| Searchlight Capital CF SPK, L.P. (Secondary) / (999999999) | 17,89 | 1,0542 | 1,0542 | ||||||

| KMNOCH Investor, L.P. (USIC LLC) / (999999999) | 17,44 | 1,0273 | 1,0273 | ||||||

| KKR Quartz Co-Invest L.P. (Depot Connect International) / (999999999) | 16,90 | 0,9958 | 0,9958 | ||||||

| NC Harp Co-Invest Beta, L.P. (Hargreaves Lansdown) / (999999999) | 16,81 | 0,9908 | 0,9908 | ||||||

| Itelyum Co-Investment LP (Diamond) / (999999999) | 16,26 | 0,9578 | 0,9578 | ||||||

| Vistria Soliant Holdings, LP (Soliant Health) / (999999999) | 15,73 | 0,9268 | 0,9268 | ||||||

| CD&R Value Building Partners I, L.P. (Belron) / (999999999) | 14,80 | 0,8718 | 0,8718 | ||||||

| TPG IX Evergreen CI II, L.P. (Forcepoint G2CI) / (999999999) | 14,41 | 0,8488 | 0,8488 | ||||||

| TPG IX Charger CI II, L.P. (Classic Collision) / (999999999) | 14,40 | 0,8483 | 0,8483 | ||||||

| LDS Group Holdings, L.P. (Lanter Delivery Systems) / (999999999) | 14,16 | 0,8343 | 0,8343 | ||||||

| SPI Parent Holding Company, LLC (Specialty Products & Insulation Co.) / (999999999) | 14,09 | 0,8304 | 0,8304 | ||||||

| Amulet Vault Co-Invest, L.P. (GIVF Fertility) / (999999999) | 13,93 | 0,8206 | 0,8206 | ||||||

| US826359AD34 / AFC Acquisitions, Inc. | 13,78 | 2,51 | 0,8120 | −0,0558 | |||||

| FitzWalter Capital Partners Coinvest I, LP (Onyx) / (999999999) | 13,05 | 0,7686 | 0,7686 | ||||||

| EQT X Co-Investment (F) SCSp (ZEUS) / (999999999) | 12,86 | 0,7580 | 0,7580 | ||||||

| DSS Holdings I LP (Dana Safety Supply) / (999999999) | 12,56 | 0,7399 | 0,7399 | ||||||

| DIG Holdings, LLC (Duke's Root Control) / (999999999) | 12,56 | 0,7398 | 0,7398 | ||||||

| SCW Holdings I LP (Splash Car Wash) / (999999999) | 12,20 | 0,7188 | 0,7188 | ||||||

| Aurelia Co-Invest SCSp (Adevinta) / (999999999) | 12,20 | 0,7188 | 0,7188 | ||||||

| NB Pref Harp Aggregator LP (HSI) / (999999999) | 12,20 | 0,7188 | 0,7188 | ||||||

| EDR Co-Invest Aggregator, L.P. (EverDriven) / (999999999) | 12,20 | 0,7186 | 0,7186 | ||||||

| THL Fund Investors (Iconic), L.P. (Intelligent Medical Objects Inc) / (999999999) | 12,09 | 0,7125 | 0,7125 | ||||||

| Material Co-Invest LP (Genesis Research) / (999999999) | 11,91 | 0,7019 | 0,7019 | ||||||

| Shamrock ND Holdco, L.P. (Nth Degree) / (999999999) | 11,62 | 0,6848 | 0,6848 | ||||||

| CGI Acquisitions, Inc. (Cogency) / (999999999) | 11,54 | 0,6797 | 0,6797 | ||||||

| US33975CAG06 / FLOODSMART RE LTD UNSECURED 144A 03/24 VAR | 11,45 | 1,16 | 0,6748 | −0,0561 | |||||

| Five Arrows Galliera Co-Invest SCSp (Groupe EDH) / (999999999) | 11,32 | 0,6668 | 0,6668 | ||||||

| KKR Malaga Co-Invest L.P. (Educa Group) / (999999999) | 11,31 | 0,6663 | 0,6663 | ||||||

| Project Alpine Co-Invest Fund, L.P. (Anaplan Inc) / (999999999) | 11,26 | 0,6637 | 0,6637 | ||||||

| THL Fund IX Investors (Plymouth II), L.P. (Standish Management) / (999999999) | 11,04 | 0,6505 | 0,6505 | ||||||

| Platinum Equity Vulcan Co-Investors, L.P. (US LBM Holdings LLC) / (999999999) | 10,91 | 0,6430 | 0,6430 | ||||||

| NB Convert Harp Aggregator LP (HSI) / (999999999) | 10,70 | 0,6302 | 0,6302 | ||||||

| Rothwell Ventures UltimateFeeder I (Cayman) L.P. / (999999999) | 10,51 | 0,6194 | 0,6194 | ||||||

| TA Spartan Parent, LLC (Netwrix) / (999999999) | 10,50 | 0,6184 | 0,6184 | ||||||

| US13947LAC63 / CAPE LOOKOUT RE LTD | 10,37 | 5,33 | 0,6111 | −0,0245 | |||||

| US91734PAC05 / URSA RE II LTD | 10,31 | −8,19 | 0,6073 | −0,1173 | |||||

| Truelink-Vista A, L.P. (Trulite Glass & Aluminum Solutions LLC) / (999999999) | 10,19 | 0,6002 | 0,6002 | ||||||

| DGS Group Holdings, L.P. (Disa Global Solutions, Inc.) / (999999999) | 9,89 | 0,5826 | 0,5826 | ||||||

| Aechelon InvestCo LP (Aechelon) / (999999999) | 9,75 | 0,5745 | 0,5745 | ||||||

| True Wind Capital Continuation, L.P. (Secondary) / (999999999) | 9,63 | 0,5677 | 0,5677 | ||||||

| WWEC Holdings LP (Worldwide Electric) / (999999999) | 9,52 | 0,5609 | 0,5609 | ||||||

| WP Irving Co-Invest L.P. (Ensemble Health Partners) / (999999999) | 9,42 | 0,5548 | 0,5548 | ||||||

| BC Partners Galileo (1) L.P. (Springer Nature) (Secondary) / (999999999) | 9,04 | 0,5327 | 0,5327 | ||||||

| Project Stream Co-Invest Fund, L.P. (Auctane) / (999999999) | 8,96 | 0,5281 | 0,5281 | ||||||

| Centerbridge Seaport Acquisition Fund, L.P. (Sevita) / (999999999) | 8,70 | 0,5124 | 0,5124 | ||||||

| NB Credit Opps Co-Investment (Vetcor) LP (VetCor) / (999999999) | 8,60 | 0,5066 | 0,5066 | ||||||

| CB Catalyst Co-Invest, L.P. (CSI) / (999999999) | 8,32 | 0,4903 | 0,4903 | ||||||

| THL Fund Investors (Altar), L.P. (Brook's Semiconductor Solutions) / (999999999) | 8,31 | 0,4895 | 0,4895 | ||||||

| RL Co-Investor Aggregator L.P. (Renaissance Learning) / (999999999) | 8,23 | 0,4850 | 0,4850 | ||||||

| Magnus 2024, L.P. (PSC Group) / (999999999) | 8,15 | 0,4803 | 0,4803 | ||||||

| Pilot Holdings, LLC (Addison Group) / (999999999) | 8,13 | 0,4793 | 0,4793 | ||||||

| Horizon Co-Investment, L.P. (Tricor) / (999999999) | 8,09 | 0,4768 | 0,4768 | ||||||

| NSH Verisma Holdco II, L.P. (Verisma Systems Inc) / (999999999) | 7,19 | 0,4238 | 0,4238 | ||||||

| Sabel InvestCo LP / (999999999) | 6,72 | 0,3961 | 0,3961 | ||||||

| ZM Parent Holding LLC (Smart Care Equipment Solutions) / (999999999) | 6,22 | 0,3666 | 0,3666 | ||||||

| US22112CAA09 / COSAINT RE PTE LTD BONDS 144A 04/28 VAR | 5,76 | 4,44 | 0,3394 | −0,0166 | |||||

| Blackstone Growth Beverly Co-Invest L.P. (Dynamo) / (999999999) | 5,25 | 0,3092 | 0,3092 | ||||||

| US31971CAA18 / First Coast Re III Pte Ltd | 4,97 | 2,92 | 0,2928 | −0,0189 | |||||

| Magenta Blocker Aggregator LP (Trellix/Skyhigh) / (999999999) | 4,32 | 0,2547 | 0,2547 | ||||||

| Olympus FG Holdco, L.P. (Phaidon International) / (999999999) | 4,16 | 0,2452 | 0,2452 | ||||||

| RL Co-Investor Aggregator II L.P. (Renaissance Learning) / (999999999) | 3,62 | 0,2132 | 0,2132 | ||||||

| Project Metal Co-Invest Fund, L.P. (Medallia) / (999999999) | 3,61 | 0,2127 | 0,2127 | ||||||

| AP Safety Co-Invest, L.P. (Smart Start - Project Safety) / (999999999) | 3,51 | 0,2067 | 0,2067 | ||||||

| KKR Leo Co-Invest L.P. (Lenskart) / (999999999) | 2,81 | 0,1658 | 0,1658 | ||||||

| Summit Partners Co-Invest (Optmo), SCSp (Optimove) / (999999999) | 2,75 | 0,1622 | 0,1622 | ||||||

| Vector Capital Partners VI, L.P. / (999999999) | 2,57 | 0,1512 | 0,1512 | ||||||

| NB Credit Opps Co-Investment (Vetcor II) LP (Vetcor) / (999999999) | 2,30 | 0,1357 | 0,1357 | ||||||

| Compass Syndication L.P. (Project Good) / (999999999) | 2,25 | 0,1324 | 0,1324 | ||||||

| U / Unity Software Inc. | 0,09 | 0,00 | 2,11 | 23,56 | 0,1242 | 0,0141 | |||

| Follett Acquisition, LP (Follett Corp) / (999999999) | 2,00 | 0,1180 | 0,1180 | ||||||

| CB Starfish TopCo, L.P. (Precisely) / (999999999) | 1,36 | 0,0801 | 0,0801 | ||||||

| Tikehau Alliance 2 Fund S.L.P. / (999999999) | 0,00 | 0,0000 | 0,0000 | ||||||

| Grain Optimus Co-Invest-B, L.P. / (999999999) | 0,00 | 0,0000 | 0,0000 | ||||||

| PCP II Co-Invest Atlas LP / (999999999) | 0,00 | 0,0000 | 0,0000 |