Grundläggande statistik

| Portföljvärde | $ 163 938 828 |

| Aktuella positioner | 179 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

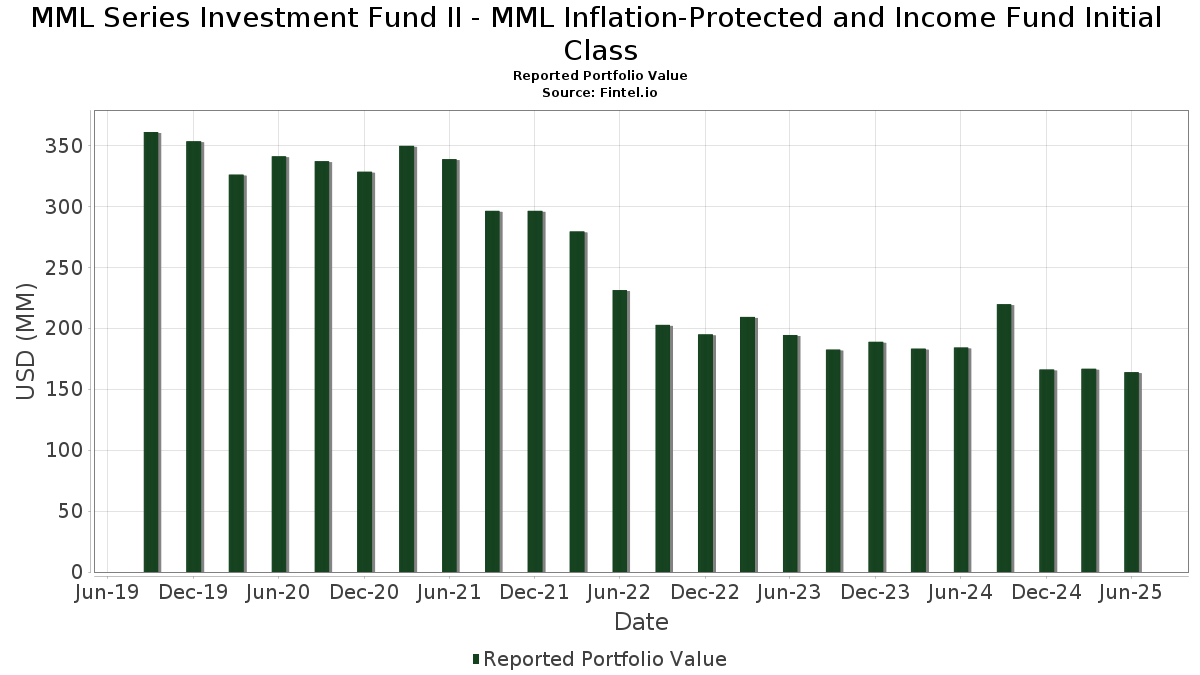

MML Series Investment Fund II - MML Inflation-Protected and Income Fund Initial Class har redovisat 179 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 163 938 828 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). MML Series Investment Fund II - MML Inflation-Protected and Income Fund Initial Classs största innehav är COLT 2022-1 Mortgage Loan Trust (US:US19688HAA95) , US TREASURY I/L 2.375% 10-15-28 (US:US91282CJH51) , American Honda Finance Corp (US:US02665JVJ68) , Oak Street Investment Grade Net Lease Fund Series (US:US67190AAA43) , and AESOP_20-2A (US:US05377RDY71) . MML Series Investment Fund II - MML Inflation-Protected and Income Fund Initial Classs nya positioner inkluderar COLT 2022-1 Mortgage Loan Trust (US:US19688HAA95) , US TREASURY I/L 2.375% 10-15-28 (US:US91282CJH51) , American Honda Finance Corp (US:US02665JVJ68) , Oak Street Investment Grade Net Lease Fund Series (US:US67190AAA43) , and AESOP_20-2A (US:US05377RDY71) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 4,00 | 2,4571 | 2,4571 | ||

| 2,98 | 1,8328 | 1,8328 | ||

| 2,67 | 1,6395 | 1,6395 | ||

| 4,20 | 2,5846 | 1,5721 | ||

| 2,51 | 1,5407 | 1,5407 | ||

| 2,33 | 1,4345 | 1,4345 | ||

| 2,06 | 1,2640 | 1,2640 | ||

| 2,02 | 1,2418 | 1,2418 | ||

| 2,00 | 1,2310 | 1,2310 | ||

| 2,00 | 1,2282 | 1,2282 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 0,06 | 0,0355 | −1,1373 | ||

| −0,83 | −0,83 | −0,5103 | −0,5103 | |

| 0,77 | 0,4732 | −0,4744 | ||

| 0,90 | 0,5507 | −0,3831 | ||

| 0,92 | 0,5675 | −0,2967 | ||

| 0,00 | 0,0000 | −0,2244 | ||

| 0,26 | 0,1618 | −0,1948 | ||

| 1,85 | 1,1378 | −0,1835 | ||

| 0,15 | 0,0909 | −0,1420 | ||

| 1,43 | 0,8788 | −0,1211 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-25 för rapporteringsperioden 2025-06-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US19688HAA95 / COLT 2022-1 Mortgage Loan Trust | 4,62 | −2,24 | 2,8419 | 0,0184 | |||||

| US91282CJH51 / US TREASURY I/L 2.375% 10-15-28 | 4,20 | 147,96 | 2,5846 | 1,5721 | |||||

| 84858MDD7 / SPIRE INC | 4,00 | 2,4571 | 2,4571 | ||||||

| T / TELUS Corporation | 3,99 | 1,17 | 2,4558 | 0,0980 | |||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CLV18) | 3,54 | 0,80 | 2,1763 | 0,0796 | |||||

| Pagaya Ai Debt Trust 2024-4 / ABS-O (US69548CAB37) | 3,37 | −0,44 | 2,0716 | 0,0502 | |||||

| US02665JVJ68 / American Honda Finance Corp | 2,98 | 1,8328 | 1,8328 | ||||||

| US67190AAA43 / Oak Street Investment Grade Net Lease Fund Series | 2,97 | −1,98 | 1,8279 | 0,0165 | |||||

| US05377RDY71 / AESOP_20-2A | 2,67 | 1,6395 | 1,6395 | ||||||

| CPS Auto Receivables Trust 2024-A / ABS-O (US22411CAB63) | 2,51 | 1,5407 | 1,5407 | ||||||

| US91282CHP95 / United States Treasury Inflation Indexed Bonds | 2,41 | 105,46 | 1,4818 | 0,7813 | |||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CNB36) | 2,33 | 1,4345 | 1,4345 | ||||||

| SMB Asset-Backed Repackaging Trust 2024-R1 / ABS-O (US78450BAA44) | 2,28 | −8,84 | 1,4023 | −0,0916 | |||||

| American Credit Acceptance Receivables Trust 2024-2 / ABS-O (US02531BAE92) | 2,23 | −0,22 | 1,3681 | 0,0360 | |||||

| US00792FAD06 / Affirm Asset Securitization Trust 2023-B | 2,22 | −0,72 | 1,3657 | 0,0292 | |||||

| US67181DAA90 / OAK STREET INVESTMENT GRADE NET LEASE FUND SERIES 2 SER 2020-1A CL A1 REGD 144A P/P 1.85000000 | 2,17 | −2,38 | 1,3344 | 0,0065 | |||||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 2,06 | 1,2640 | 1,2640 | ||||||

| US67578XAC20 / Octane Receivables Trust 2022-2 | 2,02 | 1,2418 | 1,2418 | ||||||

| US88167QAE61 / Tesla Auto Lease Trust 2023-B | 2,01 | −0,59 | 1,2373 | 0,0281 | |||||

| US96042VAG41 / Westlake Automobile Receivables Trust 2022-2 | 2,00 | −0,50 | 1,2317 | 0,0294 | |||||

| Tricolor Auto Securitization Trust / ABS-O (US89617QAA85) | 2,00 | 1,2310 | 1,2310 | ||||||

| American Credit Acceptance Receivables Trust 2024-1 / ABS-O (US02531AAE10) | 2,00 | −0,35 | 1,2309 | 0,0306 | |||||

| E1SE34 / Eversource Energy - Depositary Receipt (Common Stock) | 2,00 | 1,2282 | 1,2282 | ||||||

| DTE Electric Co / STIV (US23336GUM13) | 1,99 | 1,2264 | 1,2264 | ||||||

| US12598CAJ53 / CPS Auto Trust, Series 2021-C, Class E | 1,98 | 1,2159 | 1,2159 | ||||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CLE92) | 1,94 | 0,10 | 1,1950 | 0,0359 | |||||

| Pagaya AI Debt Grantor Trust 2024-8 / ABS-O (US69544QAA85) | 1,85 | −16,37 | 1,1378 | −0,1835 | |||||

| Affirm Asset Securitization Trust 2025-X1 / ABS-O (US00834MAA18) | 1,85 | 1,1356 | 1,1356 | ||||||

| US9128283R96 / United States Treasury Inflation Indexed Bonds | 1,81 | 0,95 | 1,1142 | 0,0418 | |||||

| US91282CGW55 / United States Treasury Inflation Indexed Bonds | 1,79 | 0,79 | 1,1025 | 0,0399 | |||||

| Tricolor Auto Securitization Trust 2025-1 / ABS-O (US89617CAA99) | 1,75 | 1,0785 | 1,0785 | ||||||

| Oportun Funding Trust 2024-3 / ABS-O (US68377NAA90) | 1,72 | 1,0562 | 1,0562 | ||||||

| US36263DAD93 / GLS Auto Receivables Issuer Trust, Series 2021-4A, Class D | 1,70 | 1,0431 | 1,0431 | ||||||

| US91282CEZ05 / U.S. Treasury Inflation Linked Notes | 1,65 | 0,92 | 1,0129 | 0,0380 | |||||

| US30166AAF12 / EART_21-3A | 1,64 | 1,0054 | 1,0054 | ||||||

| US85573GAC69 / STAR 2021 1 A3 144A | 1,60 | −7,35 | 0,9846 | −0,0476 | |||||

| Alterna Funding III LLC / ABS-O (US02157JAA34) | 1,57 | 0,13 | 0,9672 | 0,0289 | |||||

| SoFi Consumer Loan Program 2025-1 Trust / ABS-O (US83406YAA91) | 1,57 | 0,9656 | 0,9656 | ||||||

| US200474AE49 / COMMERCIAL MORTGAGE BACKED SECURITIES | 1,56 | 1,56 | 0,9608 | 0,0424 | |||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CJY84) | 1,55 | 0,26 | 0,9539 | 0,0300 | |||||

| US912828Y388 / United States Treasury Inflation Indexed Bonds | 1,55 | 0,98 | 0,9507 | 0,0360 | |||||

| US03464PAA57 / Angel Oak Mortgage Trust, Series 2022-2, Class A1 | 1,54 | −1,79 | 0,9472 | 0,0104 | |||||

| US20754MBZ95 / Connecticut Avenue Securities Trust 2022-R07 | 1,50 | −7,31 | 0,9202 | −0,0441 | |||||

| RAM 2024-1 LLC / ABS-O (US751313AA57) | 1,43 | −14,64 | 0,8788 | −0,1211 | |||||

| Oportun Funding Trust 2025-1 / ABS-O (US68377PAA49) | 1,39 | 0,8539 | 0,8539 | ||||||

| Long: BGS32PMH9 TRS USD R F .00000 TRS RF / Short: BGS32PMH9 TRS USD P V 00MFEDL TRS PV FEDL01 + 2BPS / DIR (000000000) | 1,34 | 0,8248 | 0,8248 | ||||||

| US30166QAF63 / Exeter Automobile Receivables Trust 2022-2 | 1,25 | 0,16 | 0,7709 | 0,0235 | |||||

| US36261AAJ43 / GLS Auto Receivables Issuer Trust 2021-1 | 1,25 | 0,7666 | 0,7666 | ||||||

| US912828Z377 / United States Treasury Inflation Indexed Bonds | 1,18 | 1,29 | 0,7233 | 0,0298 | |||||

| Point Securitization Trust 2024-1 / ABS-O (US73071KAA43) | 1,17 | 0,60 | 0,7190 | 0,0249 | |||||

| US30165XAF24 / Exeter Automobile Receivables Trust, Series 2021-2A, Class D | 1,15 | 31,95 | 0,7064 | 0,1867 | |||||

| US38014QAE61 / GLS Auto Receivables Issuer Trust 2022-3 | 1,11 | 0,6852 | 0,6852 | ||||||

| US63942BAA26 / Navient Private Education Refi Loan Trust 2021-A | 1,05 | −5,92 | 0,6455 | −0,0207 | |||||

| US91282CCM10 / United States Treasury Inflation Indexed Bonds | 1,05 | 1,26 | 0,6432 | 0,0260 | |||||

| US34411YAA55 / FNA VI LLC | 1,04 | −10,77 | 0,6423 | −0,0567 | |||||

| US30227FAN06 / Extended Stay America Trust | 1,03 | −0,48 | 0,6328 | 0,0152 | |||||

| Affirm Asset Securitization Trust 2024-A / ABS-O (US00834BAF40) | 1,00 | 0,6178 | 0,6178 | ||||||

| American Credit Acceptance Receivables Trust 2024-3 / ABS-O (US02490BAC28) | 1,00 | 0,6178 | 0,6178 | ||||||

| SBNA Auto Receivables Trust 2025-SF1 / ABS-O (US78437XAB29) | 1,00 | 0,6149 | 0,6149 | ||||||

| Exeter Select Automobile Receivables Trust 2025-1 / ABS-O (US30185AAB70) | 1,00 | 0,6146 | 0,6146 | ||||||

| US05549GAG64 / BHMS 2018 ATLS B 144A | 1,00 | 0,71 | 0,6146 | 0,0216 | |||||

| G1PC34 / Genuine Parts Company - Depositary Receipt (Common Stock) | 1,00 | 0,6136 | 0,6136 | ||||||

| Bunge Ltd Finance Corp / STIV (US12057AUW25) | 1,00 | 0,6124 | 0,6124 | ||||||

| VW Credit Inc / STIV (US91842JVS58) | 0,99 | 0,6103 | 0,6103 | ||||||

| US30165JAF30 / Exeter Automobile Receivables Trust, Series 2021-4A, Class D | 0,98 | 0,6047 | 0,6047 | ||||||

| US23802WAA99 / DATABANK ISSUER LLC | 0,98 | 0,72 | 0,6014 | 0,0209 | |||||

| US91282CGK18 / U.S. Treasury Inflation Linked Notes | 0,93 | 0,76 | 0,5694 | 0,0205 | |||||

| Pagaya AI Debt Grantor Trust 2024-10 / ABS-O (US69544MAA71) | 0,92 | −36,21 | 0,5675 | −0,2967 | |||||

| Drive Auto Receivables Trust / ABS-O (US262102AB26) | 0,90 | 0,5541 | 0,5541 | ||||||

| GreenSky Home Improvement Trust 2024-1 / ABS-O (US39571MAB46) | 0,90 | −42,74 | 0,5507 | −0,3831 | |||||

| US670857AB76 / OBX 2021 NQM2 A2 144A | 0,89 | −1,22 | 0,5488 | 0,0092 | |||||

| US68785AAD72 / OSCAR_21-1A | 0,87 | 0,5359 | 0,5359 | ||||||

| US35564KRE19 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0,86 | −16,54 | 0,5307 | −0,0869 | |||||

| US64031QBE08 / Nelnet Student Loan Trust 2004-3 | 0,86 | 0,00 | 0,5296 | 0,0151 | |||||

| US912810FH69 / Usa Treasury Notes 3 7/8% 30yr Notes 04/15/2029 | 0,85 | 0,35 | 0,5239 | 0,0168 | |||||

| Alterna Funding III LLC / ABS-O (US02157JAC99) | 0,85 | 0,12 | 0,5201 | 0,0158 | |||||

| US64031QBY61 / Nelnet Student Loan Trust 2005-2 | 0,83 | 0,12 | 0,5100 | 0,0152 | |||||

| FCCU Auto Receivables Trust 2025-1 / ABS-O (US31424YAB48) | 0,80 | 0,4925 | 0,4925 | ||||||

| US68269DAD66 / ONEMAIN DIRECT AUTO RECEIVABLE ODART 2022 1A C 144A | 0,80 | 0,00 | 0,4914 | 0,0142 | |||||

| US30227FAJ93 / Extended Stay America Trust | 0,77 | −0,90 | 0,4752 | 0,0097 | |||||

| US33844WAE03 / Flagship Credit Auto Trust 2021-2 | 0,77 | −51,51 | 0,4732 | −0,4744 | |||||

| US912810RF75 / United States Treasury Inflation Indexed Bonds | 0,75 | −2,60 | 0,4617 | 0,0013 | |||||

| US9128285W63 / United States Treasury Inflation Indexed Bonds | 0,75 | 1,08 | 0,4613 | 0,0177 | |||||

| FCI Funding 2024-1 LLC / ABS-O (US31425BAA52) | 0,74 | −21,70 | 0,4528 | −0,1090 | |||||

| US35564KMA42 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0,72 | −20,29 | 0,4445 | −0,0973 | |||||

| US9128287D64 / United States Treasury Inflation Indexed Bonds | 0,72 | 1,26 | 0,4442 | 0,0181 | |||||

| SoFi Consumer Loan Program 2025-2 Trust / ABS-O (US83407HAA59) | 0,70 | 0,4310 | 0,4310 | ||||||

| US48275RAJ68 / KREF, Series 2021-FL2, Class D | 0,69 | −0,14 | 0,4239 | 0,0116 | |||||

| Oportun Issuance Trust 2024-2 / ABS-O (US68377KAA51) | 0,68 | 0,4170 | 0,4170 | ||||||

| US03465AAA79 / Angel Oak Mortgage Trust 2020-6 | 0,63 | −0,47 | 0,3899 | 0,0091 | |||||

| Pagaya AI Debt Grantor Trust 2024-5 / ABS-O (US69544LAA98) | 0,63 | −16,07 | 0,3889 | −0,0610 | |||||

| US207942AA18 / Fannie Mae Connecticut Avenue Securities | 0,63 | −9,26 | 0,3859 | −0,0271 | |||||

| US12557LBK08 / CIM Trust 2019-INV3 | 0,60 | −5,35 | 0,3701 | −0,0099 | |||||

| US08861YAA47 / BHG Securitization Trust | 0,57 | −22,05 | 0,3502 | −0,0860 | |||||

| US682687AA60 / OneMain Direct Auto Receivables Trust 2021-1 | 0,56 | 0,3454 | 0,3454 | ||||||

| US20753ACJ16 / Connecticut Avenue Securities Trust, Series 2023-R03, Class 2M1 | 0,56 | −11,89 | 0,3424 | −0,0350 | |||||

| US437084QY54 / Home Equity Asset Trust 2005-9 | 0,54 | −11,69 | 0,3348 | −0,0333 | |||||

| US75525AAB17 / REACH_23-1A | 0,53 | 0,3258 | 0,3258 | ||||||

| US05377RDV33 / AVIS BUDGET RENTAL CAR FUNDING AESOP LLC | 0,53 | 0,3241 | 0,3241 | ||||||

| US91282CDX65 / United States Treasury Inflation Indexed Bonds | 0,52 | 1,16 | 0,3224 | 0,0128 | |||||

| US91282CBF77 / United States Treasury Inflation Indexed Bonds | 0,52 | 1,37 | 0,3194 | 0,0132 | |||||

| US912810QP66 / United States Treasury Inflation Indexed Bonds | 0,52 | −1,90 | 0,3173 | 0,0030 | |||||

| US912810FQ68 / United States Treas Bds Treas Bond | 0,50 | 0,60 | 0,3092 | 0,0107 | |||||

| Affirm Asset Securitization Trust 2024-X1 / ABS-O (US00834XAB55) | 0,50 | 0,3079 | 0,3079 | ||||||

| US92539LAC46 / Verus Securitization Trust 2021-3 | 0,50 | −2,72 | 0,3078 | 0,0005 | |||||

| US78403DAP50 / SBA Tower Trust | 0,48 | 0,2963 | 0,2963 | ||||||

| US912810TP30 / US TREASURY I/L 1.5% 02-15-53 | 0,47 | −3,89 | 0,2888 | −0,0031 | |||||

| US784428AG96 / SLC Student Loan Trust 2006-2 | 0,46 | −2,36 | 0,2804 | 0,0011 | |||||

| US693699AA89 / PVONE 2023 2A A 144A | 0,45 | −21,22 | 0,2789 | −0,0645 | |||||

| US693652AB59 / PSMC 2020-2 TRUST PSMC 2020-2 A2 | 0,44 | −3,48 | 0,2733 | −0,0017 | |||||

| ACHV ABS TRUST 2024-1PL / ABS-O (US00092BAA26) | 0,44 | −26,64 | 0,2675 | −0,0872 | |||||

| US912810RW09 / United States Treasury Inflation Indexed Bonds | 0,43 | −3,13 | 0,2663 | −0,0012 | |||||

| Long: BGS3F1W46 TRS USD R F .00000 TRS RF / Short: BGS3F1W46 TRS USD P V 00MFEDL TRS PV FEDL01 +23BPS / DIR (000000000) | 0,42 | 0,2593 | 0,2593 | ||||||

| US20754DAA54 / CAS_22-R05 | 0,42 | −19,81 | 0,2589 | −0,0548 | |||||

| US14687GAC96 / CARVANA AUTO RECEIVABLES TRUST CRVNA 2021-N3 B | 0,42 | −12,97 | 0,2564 | −0,0297 | |||||

| US05603KAE55 / BOF URSA FUNDING | 0,41 | −16,09 | 0,2536 | −0,0400 | |||||

| US912810RL44 / United States Treasury Inflation Indexed Bonds | 0,40 | −2,93 | 0,2445 | 0,0001 | |||||

| US912810PZ57 / United States Treasury Inflation Indexed Bonds | 0,39 | 0,52 | 0,2389 | 0,0081 | |||||

| US08860FAA66 / BANKERS HEALTHCARE GROUP SECURITIZATION TRUST | 0,37 | −29,62 | 0,2254 | −0,0853 | |||||

| US64033LAD29 / NSLT 2014 2A B 144A | 0,37 | 0,00 | 0,2252 | 0,0065 | |||||

| Long: BGS35UMN2 TRS USD R F .00000 TRS RF / Short: BGS35UMN2 TRS USD P V 00MFEDL TRS PV FEDL01 +23BPS / DIR (000000000) | 0,37 | 0,2249 | 0,2249 | ||||||

| US912810RR14 / United States Treasury Inflation Indexed Bonds | 0,36 | −2,98 | 0,2206 | −0,0003 | |||||

| SWAP CCPC GOLDMAN SACHS COC / STIV (000000000) | 0,35 | 0,35 | 0,2152 | 0,2152 | |||||

| US912810TE82 / United States Treasury Inflation Indexed Bonds | 0,34 | −4,79 | 0,2079 | −0,0042 | |||||

| US912810SB52 / United States Treasury Inflation Indexed Bonds | 0,33 | −3,47 | 0,2058 | −0,0010 | |||||

| U.S. Treasury Inflation-Indexed Bonds / DBT (US912810TY47) | 0,33 | −3,75 | 0,2057 | −0,0019 | |||||

| US912810QV35 / United States Treasury Inflation Indexed Bonds | 0,33 | −2,37 | 0,2033 | 0,0010 | |||||

| US78449TAC53 / SMB 2019 A A2B 144A | 0,33 | −12,57 | 0,2017 | −0,0219 | |||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CKL45) | 0,32 | 0,63 | 0,1964 | 0,0070 | |||||

| US35564KYN35 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0,30 | −10,65 | 0,1857 | −0,0163 | |||||

| US85572JAC18 / Starwood Mortgage Residential Trust 2019-INV1 | 0,30 | −20,58 | 0,1855 | −0,0412 | |||||

| US43283GAC69 / HGVT_22-2A | 0,27 | −10,53 | 0,1675 | −0,0141 | |||||

| US912810SV17 / United States Treasury Inflation Indexed Bonds | 0,27 | −4,29 | 0,1649 | −0,0025 | |||||

| US83149EAG26 / SLMA 2006 5 B | 0,27 | 0,00 | 0,1639 | 0,0047 | |||||

| US75575AAA25 / Ready Capital Mortgage Financing 2023-FL12, LLC | 0,26 | −55,95 | 0,1618 | −0,1948 | |||||

| SWAP GOLDMAN SACHS COC / STIV (000000000) | 0,25 | 0,25 | 0,1537 | 0,1537 | |||||

| US912810SG40 / United States Treasury Inflation Indexed Bonds | 0,23 | −3,35 | 0,1421 | −0,0012 | |||||

| US63940NAC48 / NAVSL_17-1A | 0,23 | −2,58 | 0,1398 | 0,0004 | |||||

| US78449LAC28 / SMB Private Education Loan Trust 2018-B | 0,22 | −14,23 | 0,1372 | −0,0183 | |||||

| US78442GRY43 / SLM STUDENT LOAN TRUST 2006-2 | 0,22 | −3,98 | 0,1340 | −0,0013 | |||||

| US912810SM18 / US TII .25 02/15/2050 (TIPS) | 0,22 | −3,98 | 0,1336 | −0,0015 | |||||

| US67448TBF12 / OBX 2020-EXP1 TR 1ML+95 02/25/2060 144A | 0,21 | −1,40 | 0,1298 | 0,0019 | |||||

| US912810RA88 / United States Treasury Inflation Indexed Bonds | 0,21 | −2,36 | 0,1275 | 0,0006 | |||||

| US48122HAB06 / JP Morgan Student Loan Trust 2007-A | 0,20 | −0,49 | 0,1248 | 0,0032 | |||||

| US78442GMR47 / SLMA 2004 8 B | 0,20 | −3,38 | 0,1232 | −0,0004 | |||||

| US78442GQT66 / SLMA 2005 8 B | 0,19 | −3,61 | 0,1155 | −0,0006 | |||||

| Reach Abs Trust 2024-1 / ABS-O (US75526PAA93) | 0,16 | −41,18 | 0,0990 | −0,0638 | |||||

| US63935BAA17 / Navient Private Education Refi Loan Trust 2020-H | 0,16 | −9,25 | 0,0967 | −0,0066 | |||||

| US55283AAA79 / MCA Fund Holding LLC | 0,15 | −32,30 | 0,0944 | −0,0409 | |||||

| US78442GSL13 / SLM STUDENT LOAN TRUST 2006-4 | 0,15 | −3,27 | 0,0916 | −0,0002 | |||||

| US96041AAC09 / WESTLAKE AUTOMOBILE RECEIVABLES TRUST 2023-4 SER 2023-4A CL A2 REGD 144A P/P 6.23000000 | 0,15 | −62,21 | 0,0909 | −0,1420 | |||||

| US64031AAJ51 / Nelnet Student Loan Trust 2006-3 | 0,12 | 0,00 | 0,0750 | 0,0022 | |||||

| US281378AA73 / Edsouth Indenture No. 9 LLC, Series 2015-1, Class A | 0,12 | −3,23 | 0,0742 | −0,0002 | |||||

| US78442GLJ30 / SLMA 2004 3 B | 0,11 | −3,39 | 0,0707 | −0,0001 | |||||

| US46630XAF50 / JPMAC_07-CH3 | 0,09 | −8,16 | 0,0559 | −0,0031 | |||||

| US62954JAA25 / NP SPE II LLC | 0,08 | −22,00 | 0,0483 | −0,0119 | |||||

| US20268WAB00 / CBSLT 2021 AGS B 144A | 0,07 | −1,41 | 0,0434 | 0,0005 | |||||

| Affirm Asset Securitization Trust 2023-X1 / ABS-O (US00834KAB35) | 0,06 | −97,10 | 0,0355 | −1,1373 | |||||

| US32028GAE52 / First Franklin Mortgage Loan Trust 2006-FF15 | 0,06 | −36,67 | 0,0352 | −0,0187 | |||||

| US3128S4HQ36 / FH 03/37 FLOATING VAR | 0,06 | −1,79 | 0,0342 | 0,0005 | |||||

| Long: BGS2QLXM1 IRS USD R V 12MUSCPI BGS2QLXP4 CCPINFLATIONZERO / Short: BGS2QLXM1 IRS USD P F 2.16350 BGS2QLXN9 CCPINFLATIONZERO / DIR (000000000) | 0,05 | 0,0330 | 0,0330 | ||||||

| Long: BGS3BV7L4 TRS USD R F .00000 TRS RF / Short: BGS3BV7L4 TRS USD P V 00MFEDL TRS PV FEDL01 +20BPS / DIR (000000000) | 0,05 | 0,0311 | 0,0311 | ||||||

| US35565HAH84 / Freddie Mac Stacr Remic Trust 2020-DNA1 | 0,04 | −71,94 | 0,0244 | −0,0591 | |||||

| US863576EH36 / Structured Asset Securities Corp Mortgage Loan Trust 2006-GEL1 | 0,03 | −60,47 | 0,0211 | −0,0305 | |||||

| Long: BGS30E4S2 IRS USD R V 12MUSCPI BGS30E4U7 CCPINFLATIONZERO / Short: BGS30E4S2 IRS USD P F 2.59900 BGS30E4T0 CCPINFLATIONZERO / DIR (000000000) | 0,03 | 0,0201 | 0,0201 | ||||||

| US88576NAE85 / HENDR 06-3A A1 144A FRN (L+20) 09-15-41 | 0,03 | 0,00 | 0,0190 | 0,0006 | |||||

| Long: BM128490 IRS USD R V 12MUSCPI BM128490_RECEIVE CCPINFLATIONZ / Short: BM128490 IRS USD P F 2.49000 BM128490_PAY CCPINFLATIONZERO / DIR (000000000) | 0,03 | 0,0161 | 0,0161 | ||||||

| US ULTRA BOND CBT SEP25 / DIR (000000000) | 0,03 | 0,0156 | 0,0156 | ||||||

| Long: BM128676 IRS USD R V 12MUSCPI BM128676_RECEIVE CCPINFLATIONZ / Short: BM128676 IRS USD P F 2.48200 BM128676_PAY CCPINFLATIONZERO / DIR (000000000) | 0,02 | 0,0150 | 0,0150 | ||||||

| US86362VAD47 / Structured Asset Securities Corp. Mortgage Loan Trust, Series 2006-BC6, Class A4 | 0,01 | −63,89 | 0,0085 | −0,0135 | |||||

| US20267XAD57 / Commonbond Student Loan Trust 2018-C-GS | 0,01 | 0,00 | 0,0073 | 0,0003 | |||||

| US 10YR ULTRA FUT SEP25 / DIR (000000000) | 0,01 | 0,0062 | 0,0062 | ||||||

| US51889RAA77 / LAUREL ROAD PRIME STUDENT LOAN TRUST 2019-A SER 2019-A CL A1FX REGD 144A P/P 2.34000000 | 0,01 | −57,89 | 0,0052 | −0,0063 | |||||

| US LONG BOND(CBT) SEP25 / DIR (000000000) | 0,01 | 0,0051 | 0,0051 | ||||||

| US00834TAA60 / AFFRM 21-Z2 A 144A 1.17% 11-16-26 | 0,01 | −72,22 | 0,0033 | −0,0080 | |||||

| US 10YR NOTE (CBT)SEP25 / DIR (000000000) | 0,00 | 0,0025 | 0,0025 | ||||||

| US640315AH04 / NSLT 2006 2 B | 0,00 | −100,00 | 0,0000 | −0,2244 | |||||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | −0,01 | −0,0048 | −0,0048 | ||||||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | −0,12 | −0,0753 | −0,0753 | ||||||

| SWAP BNP PARIBAS BOC / STIV (000000000) | Short | −0,83 | −0,83 | −0,5103 | −0,5103 |