Grundläggande statistik

| Portföljvärde | $ 229 512 265 |

| Aktuella positioner | 142 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

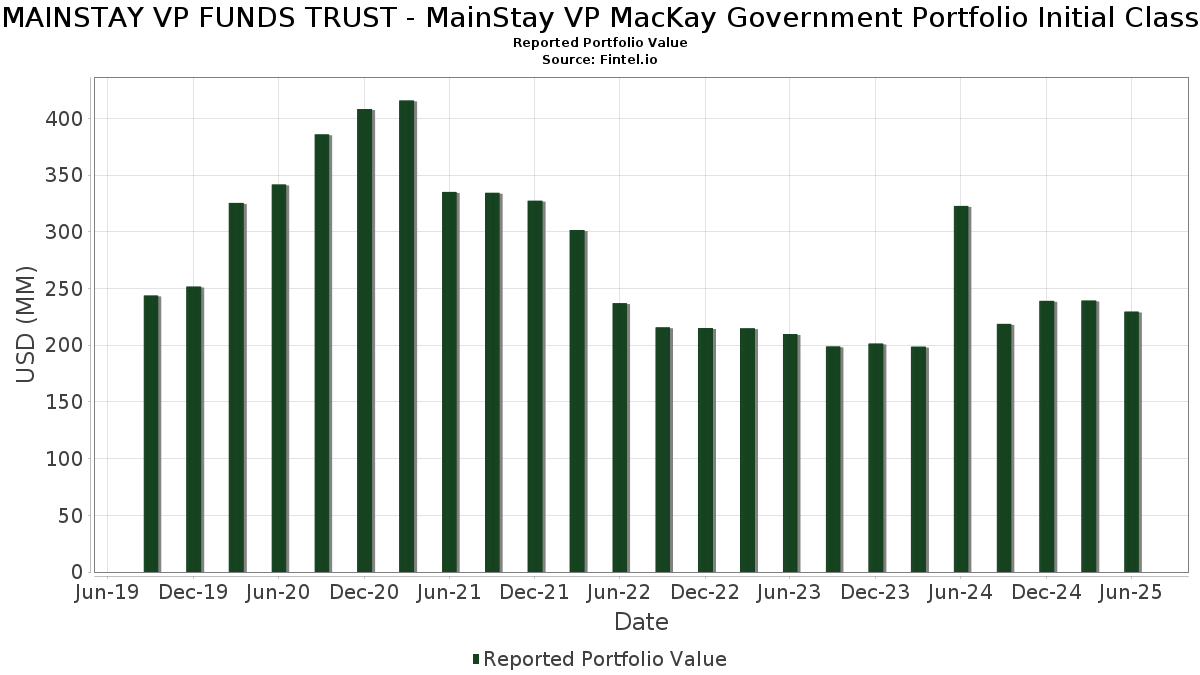

MAINSTAY VP FUNDS TRUST - MainStay VP MacKay Government Portfolio Initial Class har redovisat 142 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 229 512 265 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). MAINSTAY VP FUNDS TRUST - MainStay VP MacKay Government Portfolio Initial Classs största innehav är TEXAS NATURAL GAS SECURITIZTN FIN CORP REVENUE (US:US88258MAA36) , NEW YORK CITY NY TRANSITIONAL FIN AUTH REVENUE (US:US64971XUX47) , CALIFORNIA ST (US:US13063A5G50) , University of California (US:US91412HGG20) , and HAWAII ST (US:US419792YX80) . MAINSTAY VP FUNDS TRUST - MainStay VP MacKay Government Portfolio Initial Classs nya positioner inkluderar TEXAS NATURAL GAS SECURITIZTN FIN CORP REVENUE (US:US88258MAA36) , NEW YORK CITY NY TRANSITIONAL FIN AUTH REVENUE (US:US64971XUX47) , CALIFORNIA ST (US:US13063A5G50) , University of California (US:US91412HGG20) , and HAWAII ST (US:US419792YX80) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 7,08 | 7,08 | 3,0512 | 3,0512 | |

| 5,60 | 2,4151 | 2,4151 | ||

| 4,08 | 1,7603 | 1,7603 | ||

| 3,17 | 1,3683 | 1,3683 | ||

| 2,59 | 1,1159 | 1,1159 | ||

| 2,07 | 0,8913 | 0,8913 | ||

| 2,05 | 0,8831 | 0,8831 | ||

| 1,65 | 0,7109 | 0,7109 | ||

| 1,63 | 0,7007 | 0,7007 | ||

| 1,54 | 0,6646 | 0,6646 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 0,95 | 0,4108 | −0,5288 | ||

| 2,85 | 1,2283 | −0,0908 | ||

| −0,14 | −0,0586 | −0,0586 | ||

| 5,08 | 2,1886 | −0,0541 | ||

| 1,68 | 0,7253 | −0,0478 | ||

| 1,73 | 0,7437 | −0,0025 | ||

| 0,30 | 0,1290 | −0,0015 | ||

| 0,80 | 0,3450 | −0,0002 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-25 för rapporteringsperioden 2025-06-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Dreyfus Government Cash Management - Institutional Shares / STIV (N/A) | 7,08 | 7,08 | 3,0512 | 3,0512 | |||||

| Massachusetts Educational Financing Authority, Series A / DBT (US57563RUF45) | 5,60 | 2,4151 | 2,4151 | ||||||

| US88258MAA36 / TEXAS NATURAL GAS SECURITIZTN FIN CORP REVENUE | 5,08 | −3,90 | 2,1886 | −0,0541 | |||||

| US64971XUX47 / NEW YORK CITY NY TRANSITIONAL FIN AUTH REVENUE | 4,77 | 23,55 | 2,0562 | 0,4172 | |||||

| State of Illinois, Series A / DBT (US452153JC47) | 4,16 | 0,56 | 1,7923 | 0,0367 | |||||

| US13063A5G50 / CALIFORNIA ST | 4,13 | 39,68 | 1,7792 | 0,5247 | |||||

| New York State Dormitory Authority, Series B / DBT (US64985SFE81) | 4,08 | 1,7603 | 1,7603 | ||||||

| US91412HGG20 / University of California | 3,80 | 2,12 | 1,6377 | 0,0587 | |||||

| US419792YX80 / HAWAII ST | 3,78 | 1,78 | 1,6289 | 0,0525 | |||||

| US79467BDH50 / SALES TAX SECURITIZATION CORP IL | 3,51 | 1,24 | 1,5142 | 0,0412 | |||||

| US167593T448 / Chicago O'Hare International Airport | 3,50 | 1,30 | 1,5078 | 0,0421 | |||||

| City of New York, Series D / DBT (US64966SFB79) | 3,47 | 1,20 | 1,4967 | 0,0400 | |||||

| Oregon State Lottery, Series B / DBT (US68607V7D14) | 3,17 | 1,3683 | 1,3683 | ||||||

| US576004HE85 / MASSACHUSETTS ST SPL OBLG REVENUE | 2,98 | 1,36 | 1,2845 | 0,0363 | |||||

| US576000ZJ58 / Massachusetts School Building Authority | 2,92 | 1,14 | 1,2606 | 0,0334 | |||||

| US67910HRZ54 / Oklahoma Municipal Power Authority | 2,88 | 2,27 | 1,2423 | 0,0458 | |||||

| US452152FA44 / State of Illinois General Obligation Unlimited | 2,85 | −8,31 | 1,2283 | −0,0908 | |||||

| Great Lakes Water Authority Sewage Disposal System, Series A / DBT (US39081HCT77) | 2,59 | −1,07 | 1,1178 | 0,0052 | |||||

| State of California / DBT (US13063EHU38) | 2,59 | 1,1159 | 1,1159 | ||||||

| US667826AJ07 / NORTHWEST TX INDEP SCH DIST NORTHWEST INDEPENDENT SCHOOL DISTRICT | 2,57 | 1,78 | 1,1074 | 0,0358 | |||||

| New York City Housing Development Corp., Class A / DBT (US64966TGS78) | 2,57 | 100,78 | 1,1072 | 0,5640 | |||||

| US49474FG618 / County of King, Series C | 2,56 | 1,39 | 1,1035 | 0,0315 | |||||

| City of Phoenix Civic Improvement Corp., Series C / DBT (US71883RRU94) | 2,51 | 1,62 | 1,0816 | 0,0336 | |||||

| US57582RYN06 / MASSACHUSETTS ST | 2,41 | 1,05 | 1,0410 | 0,0264 | |||||

| US64577B8H02 / NEW JERSEY ECONOMIC DEVELOPMENT AUTHORITY | 2,41 | 1,69 | 1,0406 | 0,0328 | |||||

| US57563RTM15 / Massachusetts Educational Financing Authority | 2,27 | −1,31 | 0,9778 | 0,0020 | |||||

| US64989KFD37 / New York Power Authority | 2,26 | −0,18 | 0,9765 | 0,0134 | |||||

| US47770VAY65 / JOBSOHIO BEVERAGE SYS STWD LIQUOR PROFITS REVENUE | 2,25 | 0,76 | 0,9684 | 0,0217 | |||||

| US64990FE428 / New York State Dormitory Authority | 2,17 | 1,35 | 0,9372 | 0,0266 | |||||

| Evansville Waterworks District / DBT (US299488FV31) | 2,14 | 1,57 | 0,9219 | 0,0278 | |||||

| Alameda Corridor Transportation Authority, Series C / DBT (US010869LL76) | 2,14 | 0,57 | 0,9208 | 0,0191 | |||||

| US605581NH66 / Mississippi (State of), Series 2020 A, Ref. GO Bonds | 2,11 | 1,89 | 0,9083 | 0,0305 | |||||

| Rutgers The State University of New Jersey, Series S / DBT (US783186UR85) | 2,09 | 1,21 | 0,9027 | 0,0244 | |||||

| Idaho Housing & Finance Association, Series A / DBT (US45129Y7Z31) | 2,08 | −0,62 | 0,8968 | 0,0079 | |||||

| Colorado Housing and Finance Authority, Series E-1 / DBT (US19648GMY51) | 2,07 | −0,81 | 0,8931 | 0,0064 | |||||

| Oregon State Lottery, Series B / DBT (US68607V5U56) | 2,07 | 1,22 | 0,8923 | 0,0241 | |||||

| California Community Choice Financing Authority, Series B / DBT (US13013JEA07) | 2,07 | 0,8913 | 0,8913 | ||||||

| Alameda Corridor Transportation Authority, Series C / DBT (US010869CH65) | 2,06 | 5,92 | 0,8872 | 0,0626 | |||||

| Kentucky Higher Education Student Loan Corp., Series A-2 / DBT (US49130NHA00) | 2,05 | 0,8831 | 0,8831 | ||||||

| State of Connecticut, Series A / DBT (US20772KXL87) | 2,04 | 0,69 | 0,8799 | 0,0189 | |||||

| US44244CTQ05 / HOUSTON TX UTILITY SYS REVENUE HOUUTL 11/31 FIXED 3.973 | 1,98 | 2,11 | 0,8539 | 0,0304 | |||||

| City of San Francisco, Series A / DBT (US79771FFJ12) | 1,88 | 0,64 | 0,8114 | 0,0173 | |||||

| Palomar Community College District / DBT (US697511GB30) | 1,81 | 1,46 | 0,7796 | 0,0226 | |||||

| US797412DS99 / SAN DIEGO CNTY CA WTR AUTH | 1,78 | 2,07 | 0,7673 | 0,0269 | |||||

| District of Columbia, Series B / DBT (US25483VC852) | 1,73 | −1,82 | 0,7437 | −0,0025 | |||||

| US452227JN20 / State of Illinois Sales Tax Revenue | 1,68 | −7,58 | 0,7253 | −0,0478 | |||||

| Antelope Valley Community College District / DBT (US03667PHP09) | 1,66 | 1,16 | 0,7169 | 0,0189 | |||||

| Lifespan Corp., Series 2025 / DBT (US53229UAA51) | 1,65 | 0,7109 | 0,7109 | ||||||

| US57582RL612 / COMMONWEALTH OF MASSACHUSETTS 57582RL61 1.67 11/1/2031 | 1,64 | 1,30 | 0,7081 | 0,0198 | |||||

| DUKEU / DUKE UNIVERSITY UNSECURED 10/38 3.199 | 1,63 | −1,33 | 0,7020 | 0,0010 | |||||

| Keller Independent School District / DBT (US487694VD00) | 1,63 | 0,7007 | 0,7007 | ||||||

| New Hampshire Business Finance Authority, Series A / DBT (US63610HAA05) | 1,55 | −0,32 | 0,6679 | 0,0080 | |||||

| United Nations Development Corp., Series A / DBT (US911157MA03) | 1,54 | 0,6646 | 0,6646 | ||||||

| Sutter Health, Series 2025 / DBT (US86944BAP85) | 1,54 | 0,6644 | 0,6644 | ||||||

| Marshfield Clinic Health System, Inc., Series 2024 / DBT (US57284PAD33) | 1,54 | 0,13 | 0,6622 | 0,0109 | |||||

| New York City Transitional Finance Authority, Series G-3 / DBT (US64972JHC53) | 1,53 | 0,26 | 0,6594 | 0,0119 | |||||

| Connecticut Housing Finance Authority, Series A-2 / DBT (US20775H5P47) | 1,53 | −0,13 | 0,6591 | 0,0093 | |||||

| State of Connecticut, Series A / DBT (US20772KTQ21) | 1,51 | 0,67 | 0,6514 | 0,0142 | |||||

| Denton Independent School District, Series A / DBT (US249002HU32) | 1,48 | 1,72 | 0,6372 | 0,0205 | |||||

| Sumter Landing Community Development District / DBT (US86657MCC82) | 1,44 | 1,27 | 0,6210 | 0,0169 | |||||

| Metro Water Recovery, Series B / DBT (US59164GEV05) | 1,38 | 1,47 | 0,5942 | 0,0176 | |||||

| Port of Morrow / DBT (US73474TAD28) | 1,37 | 0,44 | 0,5904 | 0,0116 | |||||

| Commonwealth Financing Authority, Series C / DBT (US20281PMT65) | 1,35 | −0,07 | 0,5827 | 0,0085 | |||||

| US544495VY79 / Los Angeles Department of Water and Power, California, Power System Revenue Bonds, Federally Taxable - Direct Payment - Build America Bonds, Series 20 | 1,31 | −0,68 | 0,5668 | 0,0047 | |||||

| Port of Morrow / DBT (US73474TAW09) | 1,29 | 0,78 | 0,5564 | 0,0125 | |||||

| South Carolina Public Service Authority, Series C / DBT (US8371513C19) | 1,26 | −0,63 | 0,5442 | 0,0050 | |||||

| US59259NZH96 / MET TRANSPRTN AUTH NY DEDICATED TAX FUND | 1,18 | −0,08 | 0,5092 | 0,0072 | |||||

| Los Angeles Department of Water & Power, Series B / DBT (US544532PZ14) | 1,09 | 0,4688 | 0,4688 | ||||||

| San Diego Community College District, Series A-2 / DBT (US797272TK72) | 1,08 | 0,94 | 0,4639 | 0,0115 | |||||

| Utah Housing Corp., Series D / DBT (US917437TY15) | 1,07 | 0,00 | 0,4616 | 0,0073 | |||||

| US67732PAE88 / OHIO CNTY WV CNTY COMMISSION S COUNTY OF OHIO WV SPECIAL DISTRICT EXCISE TAX REVE | 1,07 | −0,09 | 0,4615 | 0,0065 | |||||

| US89837LAB18 / Princeton University | 1,07 | 0,28 | 0,4614 | 0,0080 | |||||

| Colorado Housing and Finance Authority, Series D-1, Class I / DBT (US19648GWC22) | 1,06 | 0,19 | 0,4567 | 0,0078 | |||||

| City of Los Angeles, Series A / DBT (US544351RS01) | 1,06 | 0,86 | 0,4559 | 0,0106 | |||||

| US927688FZ98 / Virgin Islands (Government of) Water & Power Authority, Series 2010, RB | 1,06 | 0,09 | 0,4559 | 0,0074 | |||||

| Idaho Housing & Finance Association, Series B / DBT (US45129Y5Q59) | 1,05 | −0,09 | 0,4547 | 0,0066 | |||||

| Minnesota Housing Finance Agency, Series J / DBT (US60416UDL61) | 1,05 | −0,57 | 0,4544 | 0,0046 | |||||

| Minnesota Housing Finance Agency, Series A / DBT (US60416UQK42) | 1,05 | 0,10 | 0,4541 | 0,0072 | |||||

| City of Boise City / DBT (US097428FJ04) | 1,05 | 0,67 | 0,4537 | 0,0099 | |||||

| Rhode Island Housing & Mortgage Finance Corp., Series 85-T / DBT (US76221SJP74) | 1,05 | −0,66 | 0,4534 | 0,0040 | |||||

| State of New York Mortgage Agency Homeowner Mortgage, Series 268 / DBT (US64988YJ992) | 1,05 | −0,76 | 0,4527 | 0,0035 | |||||

| State of Oregon, Series B / DBT (US68609UNN18) | 1,05 | 0,4511 | 0,4511 | ||||||

| State of Oregon, Series B / DBT (US68609UNQ49) | 1,05 | 0,4510 | 0,4510 | ||||||

| State of Oregon, Series B / DBT (US68609UNP65) | 1,05 | 0,4510 | 0,4510 | ||||||

| City of Los Angeles, Series B / DBT (US53945CLS79) | 1,04 | 0,4494 | 0,4494 | ||||||

| District of Columbia, Series B / DBT (US25484JDK34) | 1,04 | 0,4466 | 0,4466 | ||||||

| US67704LAA98 / Oglethorpe Power Corp., Series 2006 | 1,03 | 0,29 | 0,4458 | 0,0079 | |||||

| Sutter Health, Series 2025 / DBT (US86944BAQ68) | 1,03 | 0,4455 | 0,4455 | ||||||

| City of Columbus, Series C / DBT (US1994925T26) | 1,03 | 0,98 | 0,4448 | 0,0110 | |||||

| President and Fellows of Harvard College / DBT (US740816AS29) | 1,03 | 0,4429 | 0,4429 | ||||||

| Pennsylvania Turnpike Commission, Series B / DBT (US709221TF27) | 1,03 | −1,44 | 0,4429 | 0,0003 | |||||

| New York City Housing Development Corp., Class B / DBT (US64966TGT51) | 1,03 | 0,4428 | 0,4428 | ||||||

| New York City Transitional Finance Authority, Series G-2 / DBT (US64972JHA97) | 1,02 | 0,59 | 0,4418 | 0,0094 | |||||

| City of Philadelphia, Series B / DBT (US717813E215) | 1,02 | 0,4410 | 0,4410 | ||||||

| US89602NUN29 / Triborough Bridge & Tunnel Authority, Series 2009 B, RB | 1,02 | 0,4399 | 0,4399 | ||||||

| US79467BGA70 / SALES TAX SECURITIZATION CORP SALES TAX SECURITIZATION CORP | 1,02 | 0,99 | 0,4397 | 0,0112 | |||||

| Illinois Housing Development Authority, Series B / DBT (US45203MM577) | 1,02 | 0,69 | 0,4386 | 0,0094 | |||||

| District of Columbia Income Tax, Series B / DBT (US25477GXH37) | 1,02 | 0,4381 | 0,4381 | ||||||

| Columbus Metropolitan Housing Authority / DBT (US19951AAT34) | 1,01 | −0,69 | 0,4373 | 0,0038 | |||||

| Maryland Department of Housing & Community Development, Series D / DBT (US57419UVH84) | 1,01 | 0,4372 | 0,4372 | ||||||

| Illinois Housing Development Authority, Series B / DBT (US45203MM650) | 1,01 | 0,00 | 0,4363 | 0,0070 | |||||

| New York City Housing Development Corp., Series B / DBT (US64966WLE56) | 1,01 | 0,4358 | 0,4358 | ||||||

| Illinois Housing Development Authority, Series B / DBT (US45203MM734) | 1,01 | −0,20 | 0,4351 | 0,0058 | |||||

| South Carolina Public Service Authority, Series C / DBT (US8371516W46) | 1,01 | −0,40 | 0,4347 | 0,0047 | |||||

| Pennsylvania Higher Educational Facilities Authority, Series C / DBT (US70917TSP74) | 1,00 | −1,08 | 0,4330 | 0,0018 | |||||

| State of Hawaii, Series GN / DBT (US419792Q745) | 1,00 | 0,40 | 0,4328 | 0,0085 | |||||

| US64971W6D74 / NEW YORK CITY TRANSITIONAL FINANCE AUTHORITY FUTURE TAX SECURED REVENUE | 1,00 | 0,40 | 0,4320 | 0,0085 | |||||

| US79623PQQ18 / SAN ANTONIO TX CITY OF SAN ANTONIO TX | 1,00 | −0,10 | 0,4317 | 0,0062 | |||||

| Rhode Island Student Loan Authority, Series 1 / DBT (US762323DU48) | 1,00 | 0,4303 | 0,4303 | ||||||

| New Hampshire Health and Education Facilities Authority Act, Series A / DBT (US64461XKB00) | 0,99 | 0,91 | 0,4282 | 0,0101 | |||||

| Iowa Student Loan Liquidity Corp., Series A / DBT (US462590NZ93) | 0,99 | 0,41 | 0,4275 | 0,0084 | |||||

| US186352SJ00 / CLEVELAND OH AIRPORT SYSTEM REVENUE | 0,99 | 0,41 | 0,4271 | 0,0081 | |||||

| Rutgers The State University of New Jersey, Series R / DBT (US783186UD99) | 0,99 | 0,51 | 0,4249 | 0,0084 | |||||

| California Public Finance Authority, Series B / DBT (US13057EJM75) | 0,95 | −56,98 | 0,4108 | −0,5288 | |||||

| Northeast Ohio Regional Sewer District / DBT (US663903KC56) | 0,94 | 1,52 | 0,4039 | 0,0122 | |||||

| City of Salt Lake City, Series B / DBT (US79560TEC27) | 0,92 | 1,43 | 0,3969 | 0,0117 | |||||

| US546462EP34 / Louisiana Energy & Power Authority | 0,91 | 1,56 | 0,3940 | 0,0119 | |||||

| US84132GAA76 / Southeast Alaska Regional Health Consortium | 0,91 | 0,78 | 0,3926 | 0,0089 | |||||

| US15953PAD15 / Chapman University | 0,90 | 1,92 | 0,3894 | 0,0131 | |||||

| US917567FN40 / Utah Transit Authority | 0,88 | 1,73 | 0,3814 | 0,0123 | |||||

| US73474TAP57 / Morrow (Port of), OR (Bonneville Cooperation), Series 2016, RB | 0,86 | 1,54 | 0,3702 | 0,0112 | |||||

| US544351PX14 / City of Los Angeles, Series A | 0,85 | 1,55 | 0,3684 | 0,0113 | |||||

| Tarrant County Cultural Education Facilities Finance Corp. / DBT (US87638QRG63) | 0,84 | 1,95 | 0,3616 | 0,0123 | |||||

| US697511GC13 / PALOMAR CA CMNTY CLG DIST | 0,83 | 1,22 | 0,3579 | 0,0094 | |||||

| US882724QP58 / State of Texas | 0,80 | −1,60 | 0,3450 | −0,0002 | |||||

| State of Hawaii, Series GE / DBT (US419792E931) | 0,79 | 1,02 | 0,3417 | 0,0085 | |||||

| US64990GY713 / New York State Dormitory Authority | 0,79 | 0,3395 | 0,3395 | ||||||

| US57604P5P55 / Massachusetts (State of) Clean Water Trust (The), Series 2010, RB | 0,76 | 0,3259 | 0,3259 | ||||||

| Alameda Corridor Transportation Authority, Series B / DBT (US010869JB23) | 0,75 | 2,47 | 0,3225 | 0,0122 | |||||

| US419792ZD18 / HAWAII ST | 0,74 | 1,09 | 0,3202 | 0,0085 | |||||

| Trustees of Princeton University (The) / DBT (US89837LAJ44) | 0,74 | 0,3199 | 0,3199 | ||||||

| William S Hart Union High School District / DBT (US969268DB49) | 0,72 | 2,26 | 0,3123 | 0,0115 | |||||

| US010869LP80 / Alameda Corridor Transportation Authority, Series B | 0,72 | 4,51 | 0,3103 | 0,0178 | |||||

| Toll Road Investors Partnership II LP / DBT (US88948ABR77) | 0,72 | 1,70 | 0,3101 | 0,0096 | |||||

| US2350368N38 / DALLAS-FORT WORTH TX INTERNATIONAL ARPT REVENUE | 0,71 | 0,3063 | 0,3063 | ||||||

| US54473ENS99 / Los Angeles County Public Works Financing Authority, California, Lease Revenue Bonds, Mulitple Capital Projects I, Build America Taxable Bond Series 2 | 0,59 | 0,2537 | 0,2537 | ||||||

| City of New York, Series H / DBT (US64966SNE27) | 0,52 | 0,2239 | 0,2239 | ||||||

| State of California / DBT (US13063EBQ89) | 0,51 | 0,20 | 0,2215 | 0,0037 | |||||

| US47770VAZ31 / JobsOhio Beverage System, Ohio, Statewide Liquor Profits Revenue Bonds, Senior Lien Taxable Series 2013B | 0,30 | 1,01 | 0,1292 | 0,0034 | |||||

| Toll Road Investors Partnership II LP / DBT (US88948ACC99) | 0,30 | −2,61 | 0,1290 | −0,0015 | |||||

| Keller Independent School District / DBT (US487694VC27) | 0,25 | 0,1074 | 0,1074 | ||||||

| U.S. Treasury 10 Year Ultra Bonds / DIR (N/A) | −0,14 | −0,0586 | −0,0586 |