Grundläggande statistik

| Portföljvärde | $ 125 407 811 |

| Aktuella positioner | 141 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

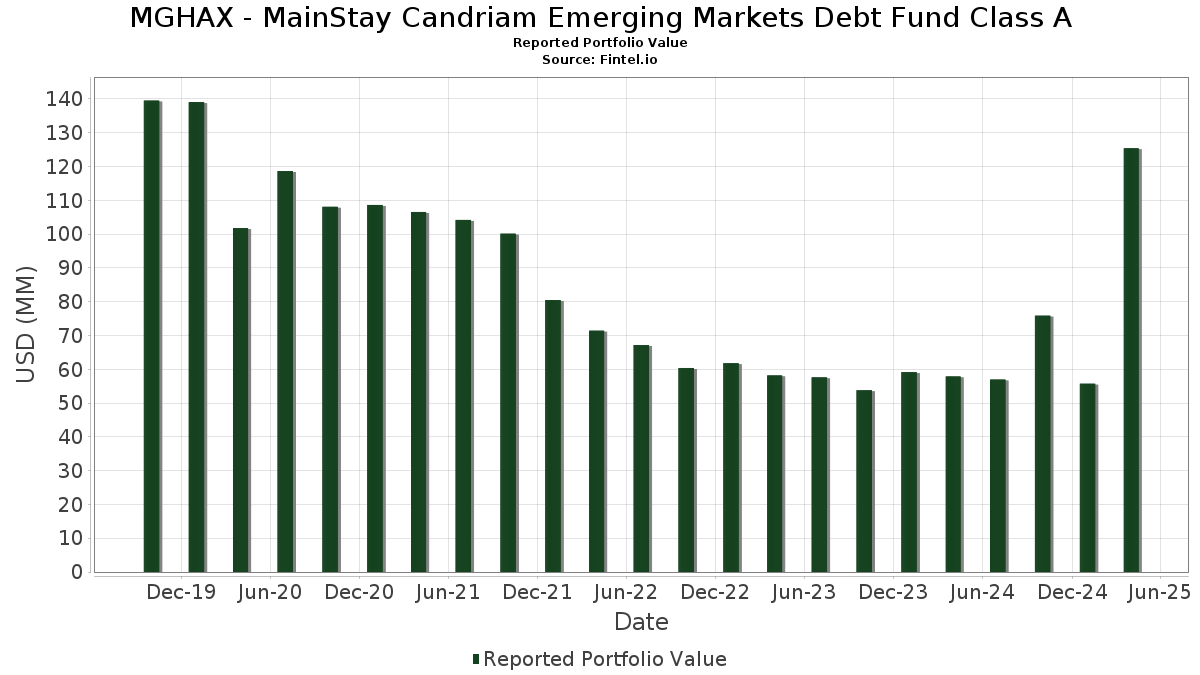

MGHAX - MainStay Candriam Emerging Markets Debt Fund Class A har redovisat 141 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 125 407 811 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). MGHAX - MainStay Candriam Emerging Markets Debt Fund Class As största innehav är Invesco Government & Agency Portfolio, Institutional Class (US:US8252528851) , North Macedonia Government International Bond (MK:XS2582522681) , Oman Government International Bond (OM:XS1750114396) , Republic of Indonesia (ID:US455780DN36) , and Turkey Government International Bond (TR:US900123CB40) . MGHAX - MainStay Candriam Emerging Markets Debt Fund Class As nya positioner inkluderar North Macedonia Government International Bond (MK:XS2582522681) , Oman Government International Bond (OM:XS1750114396) , Republic of Indonesia (ID:US455780DN36) , Turkey Government International Bond (TR:US900123CB40) , and Egypt Government International Bond (EG:XS2176899701) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 3,54 | 2,7665 | 2,7665 | ||

| 1,77 | 1,3864 | 1,3864 | ||

| 2,23 | 1,7477 | 0,9300 | ||

| 1,08 | 0,8446 | 0,8446 | ||

| 1,67 | 1,3033 | 0,8193 | ||

| 1,39 | 1,0839 | 0,7404 | ||

| 2,13 | 1,6648 | 0,7197 | ||

| 0,84 | 0,6598 | 0,6598 | ||

| 0,79 | 0,6151 | 0,6151 | ||

| 1,53 | 1,2001 | 0,5964 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 1,00 | 1,00 | 0,7823 | −1,8060 | |

| 1,95 | 1,5291 | −0,8789 | ||

| 0,69 | 0,5420 | −0,8684 | ||

| 1,45 | 1,1304 | −0,7378 | ||

| 0,52 | 0,4073 | −0,6744 | ||

| 0,83 | 0,6473 | −0,6651 | ||

| 0,57 | 0,4443 | −0,5714 | ||

| −0,70 | −0,5503 | −0,5503 | ||

| 2,02 | 1,5813 | −0,5492 | ||

| 0,18 | 0,1388 | −0,5344 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-06-24 för rapporteringsperioden 2025-04-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Poland Government Bond / DBT (US857524AH50) | 3,54 | 2,7665 | 2,7665 | ||||||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 2,89 | 79,50 | 2,89 | 79,48 | 2,2579 | −0,4335 | |||

| XS2582522681 / North Macedonia Government International Bond | 2,23 | 357,79 | 1,7477 | 0,9300 | |||||

| Bulgaria Government Bond / DBT (XS2890436087) | 2,13 | 277,30 | 1,6648 | 0,7197 | |||||

| XS1750114396 / Oman Government International Bond | 2,02 | 58,88 | 1,5813 | −0,5492 | |||||

| US455780DN36 / Republic of Indonesia | 1,95 | 35,88 | 1,5291 | −0,8789 | |||||

| US900123CB40 / Turkey Government International Bond | 1,86 | 136,69 | 1,4542 | 0,1401 | |||||

| XS2176899701 / Egypt Government International Bond | 1,79 | 67,16 | 1,4024 | −0,3926 | |||||

| US195325EF88 / Colombia Government International Bond | 1,78 | 147,49 | 1,3902 | 0,1876 | |||||

| XS1807299331 / KazMunayGas National Co JSC | 1,78 | 140,51 | 1,3892 | 0,1540 | |||||

| USP3699PGF82 / Costa Rica Government International Bond | 1,77 | 1,3864 | 1,3864 | ||||||

| Bank Gospodarstwa Krajowego / DBT (XS2778274410) | 1,71 | 172,41 | 1,3365 | 0,2857 | |||||

| USP5015VAE67 / Guatemala Government Bond | 1,67 | 476,47 | 1,3033 | 0,8193 | |||||

| XS2388586401 / Hungary Government International Bond | 1,62 | 102,75 | 1,2712 | −0,0703 | |||||

| XS1508675508 / Saudi Government International Bond | 1,62 | 296,08 | 1,2648 | 0,5815 | |||||

| Africa Finance Corp. / DBT (XS2913968363) | 1,58 | 100,51 | 1,2363 | −0,0831 | |||||

| US01609WAV46 / Alibaba Group Holding Ltd | 1,57 | 145,92 | 1,2276 | 0,1593 | |||||

| XS1944412748 / Oman Government International Bond | 1,55 | 153,28 | 1,2088 | 0,1870 | |||||

| USG95448AA75 / WE Soda Investments Holding PLC | 1,53 | 326,11 | 1,2001 | 0,5964 | |||||

| US040114HV54 / Argentine Republic Government International Bond | 1,51 | 138,61 | 1,1803 | 0,1213 | |||||

| XS2270577344 / Morocco Government International Bond | 1,49 | 143,84 | 1,1617 | 0,1418 | |||||

| XS1678623734 / Republic of Azerbaijan International Bond | 1,48 | 145,29 | 1,1610 | 0,1482 | |||||

| XS2636412210 / Albania Government International Bond | 1,47 | 173,05 | 1,1497 | 0,2482 | |||||

| US040114HS26 / Argentine Republic Government International Bond | 1,45 | 142,38 | 1,1322 | 0,1316 | |||||

| US900123CM05 / Turkey Government International Bond | 1,45 | 29,48 | 1,1304 | −0,7378 | |||||

| Dominican Republic Government Bond / DBT (USP3579ECU93) | 1,43 | 305,98 | 1,1149 | 0,5270 | |||||

| XS2010026305 / Hungary Government International Bond | 1,40 | 101,73 | 1,0941 | −0,0661 | |||||

| Ukraine Government Bond / DBT (XS2895056526) | 1,39 | 575,61 | 1,0839 | 0,7404 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 1,38 | 102,49 | 1,0824 | −0,0610 | |||||

| XS2270576700 / Montenegro Government International Bond | 1,38 | 176,31 | 1,0768 | 0,2430 | |||||

| USP3579ECH82 / Dominican Republic International Bond | 1,35 | 149,07 | 1,0522 | 0,1474 | |||||

| XS1796266754 / Ivory Coast Government International Bond | 1,28 | 152,48 | 0,9980 | 0,1526 | |||||

| TAVHL / TAV Havalimanlari Holding A.S. | 1,27 | 146,42 | 0,9972 | 0,1317 | |||||

| XS2207514063 / Finance Department Government of Sharjah | 1,27 | 147,56 | 0,9940 | 0,1346 | |||||

| USP3579ECJ49 / Dominican Republic International Bond | 1,25 | 186,21 | 0,9741 | 0,2676 | |||||

| US195325EG61 / Colombia Government International Bond | 1,22 | 146,15 | 0,9519 | 0,1237 | |||||

| US168863DU93 / Chile Government International Bond | 1,19 | 151,69 | 0,9296 | 0,1381 | |||||

| US105756CG37 / Brazilian Government International Bond | 1,17 | 100,00 | 0,9141 | −0,0650 | |||||

| US105756CC23 / Brazilian Government International Bond | 1,17 | 160,04 | 0,9117 | 0,1612 | |||||

| Poland Government Bond / DBT (US731011AZ55) | 1,16 | 154,05 | 0,9089 | 0,1439 | |||||

| XS1777972511 / Nigeria Government International Bond | 1,10 | 138,26 | 0,8576 | 0,0866 | |||||

| 91087BAP5 / UTD MEX ST GVT GLOBAL 3.75% 04-19-71 | 1,09 | 146,82 | 0,8496 | 0,1119 | |||||

| Albania Government Bond / DBT (XS3004338557) | 1,08 | 0,8446 | 0,8446 | ||||||

| XS2176897754 / Egypt Government International Bond | 1,06 | 136,22 | 0,8323 | 0,0784 | |||||

| XS1910826996 / Nigeria Government International Bond | 1,05 | 161,10 | 0,8192 | 0,1467 | |||||

| Bahrain Government Bond / DBT (XS2764424813) | 1,02 | 146,27 | 0,7996 | 0,1048 | |||||

| Aragvi Finance International DAC / DBT (XS2932787687) | 1,02 | 141,37 | 0,7994 | 0,0910 | |||||

| US91087BAR15 / Mexican Government International Bond | 1,02 | 155,89 | 0,7989 | 0,1303 | |||||

| Montenegro Government Bond / DBT (XS2779850630) | 1,01 | 230,16 | 0,7878 | 0,2922 | |||||

| AGTXX / Allspring Funds Trust - Allspring Government Money Market Fd USD - Tribal Inclusion Cls | 1,00 | −58,42 | 1,00 | −58,42 | 0,7823 | −1,8060 | |||

| US105756CF53 / Brazilian Government International Bond | 0,98 | 105,43 | 0,7705 | −0,0320 | |||||

| Kenya Government Bond / DBT (XS2764839945) | 0,98 | 130,82 | 0,7678 | 0,0548 | |||||

| XS2214239175 / Ecuador Government International Bond | 0,96 | 36,93 | 0,7545 | −0,4247 | |||||

| Benin Government Bond / DBT (XS2759982064) | 0,95 | 382,74 | 0,7445 | 0,4146 | |||||

| 70GD / Antofagasta plc - Preferred Security | 0,95 | 179,65 | 0,7417 | 0,1742 | |||||

| US91086QAZ19 / Mexico Government International Bond | 0,94 | 145,83 | 0,7388 | 0,0957 | |||||

| Energo-Pro A/S / DBT (XS2706258352) | 0,94 | 191,64 | 0,7374 | 0,1963 | |||||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 0,94 | 38,05 | 0,7323 | −0,4032 | |||||

| US91087BAL45 / Mexico Government International Bond | 0,93 | 148,00 | 0,7279 | 0,0997 | |||||

| XS2719137965 / Magyar Export-Import Bank Zrt. | 0,91 | 169,53 | 0,7132 | 0,1472 | |||||

| FCT / Fincantieri S.p.A. | 0,90 | 173,94 | 0,7078 | 0,1543 | |||||

| US401494AW96 / Guatemala Government Bond | 0,89 | 202,71 | 0,6992 | 0,2049 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 0,87 | 95,06 | 0,6794 | −0,0655 | |||||

| XS2010026487 / Hungary Government International Bond | 0,87 | 200,00 | 0,6788 | 0,1949 | |||||

| XS1566179039 / Nigeria Government International Bond | 0,87 | 88,67 | 0,6777 | −0,0912 | |||||

| Costa Rica Government Bond / DBT (USP3699PGN17) | 0,86 | 232,82 | 0,6749 | 0,2403 | |||||

| US836205AU87 / Republic of South Africa Government International Bond | 0,85 | 202,49 | 0,6657 | 0,1949 | |||||

| Hungary Government Bond / DBT (XS2744128369) | 0,85 | 198,25 | 0,6652 | 0,1879 | |||||

| Morocco Government Bond / DBT (XS3041322051) | 0,84 | 0,6598 | 0,6598 | ||||||

| US445545AF36 / Hungary Government International Bond | 0,83 | 146,43 | 0,6478 | 0,0853 | |||||

| US91087BAT70 / Mexico Government International Bond | 0,83 | 207,81 | 0,6478 | 0,1961 | |||||

| XS2294322818 / Saudi Government International Bond | 0,83 | 1,97 | 0,6473 | −0,6651 | |||||

| USY6726SAP66 / Papua New Guinea Government International Bond | 0,81 | 88,58 | 0,6336 | −0,0847 | |||||

| Benin Government Bond / DBT (XS2976334222) | 0,81 | 258,67 | 0,6320 | 0,2541 | |||||

| XS2264555744 / Serbia International Bond | 0,79 | 93,17 | 0,6200 | −0,0664 | |||||

| US715638DR09 / Peruvian Government International Bond | 0,79 | 147,96 | 0,6188 | 0,0836 | |||||

| US715638DP43 / Peruvian Government International Bond | 0,79 | 0,6151 | 0,6151 | ||||||

| US195325EL56 / Colombia Government International Bond | 0,79 | 288,61 | 0,6144 | 0,2753 | |||||

| XS2446175577 / Angolan Government International Bond | 0,78 | 76,98 | 0,6136 | −0,1294 | |||||

| US195325BM66 / Colombia Government International Bond | 0,78 | 140,49 | 0,6134 | 0,0671 | |||||

| US195325EM30 / Colombia Government International Bond | 0,77 | 274,15 | 0,6004 | 0,2561 | |||||

| USP3579ECR64 / DOMINICAN REPUBLIC 7.050000% 02/03/2031 | 0,77 | 152,48 | 0,5990 | 0,0913 | |||||

| US279158AS81 / Ecopetrol SA | 0,75 | 142,72 | 0,5873 | 0,0697 | |||||

| Ivory Coast Government Bond / DBT (XS3030237120) | 0,74 | 0,5785 | 0,5785 | ||||||

| US040114HX11 / Argentine Republic Government International Bond | 0,72 | 104,82 | 0,5660 | −0,0253 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 0,72 | 112,06 | 0,5647 | −0,0059 | |||||

| USY6142NAE86 / Mongolia Government Bond | 0,72 | 229,95 | 0,5605 | 0,1959 | |||||

| XS2340149439 / Georgian Railway JSC | 0,71 | 306,32 | 0,5537 | 0,2612 | |||||

| 900123CY / Turkey Government International Bond | 0,69 | −17,81 | 0,5420 | −0,8684 | |||||

| US698299BL70 / Panama Government International Bond | 0,67 | 151,49 | 0,5279 | 0,0783 | |||||

| Ghana Government Bond / DBT (XS2893151287) | 0,63 | 127,24 | 0,4962 | 0,0285 | |||||

| US836205BB97 / Republic of South Africa Government International Bond | 0,63 | 69,71 | 0,4953 | −0,1302 | |||||

| US105756CB40 / Brazilian Government International Bond | 0,63 | 205,31 | 0,4948 | 0,1473 | |||||

| PANAMA / Panama Government International Bond | 0,61 | 149,59 | 0,4771 | 0,0677 | |||||

| US715638DW93 / Peruvian Government International Bond | 0,61 | 148,16 | 0,4758 | 0,0657 | |||||

| XS2278994418 / BENIN INTL GOV BOND 4.875000% 01/19/2032 | 0,59 | 233,15 | 0,4645 | 0,1660 | |||||

| US195325CU73 / Colombia Government International Bond | 0,58 | 187,68 | 0,4575 | 0,1176 | |||||

| US195325DQ52 / Colombia Government International Bond | 0,58 | 187,13 | 0,4545 | 0,1154 | |||||

| XS1558078496 / Egypt Government International Bond | 0,58 | 262,50 | 0,4540 | 0,1862 | |||||

| Ghana Government Bond / DBT (XS2893147251) | 0,57 | 139,66 | 0,4448 | 0,0477 | |||||

| XS2322321964 / Pakistan Government International Bond | 0,57 | −6,27 | 0,4443 | −0,5714 | |||||

| 94YZ / Egypt Government International Bond | 0,55 | 35,63 | 0,4322 | −0,2498 | |||||

| 88WE / Angolan Government International Bond | 0,55 | 50,14 | 0,4267 | −0,1815 | |||||

| XS2264871828 / Ivory Coast Government International Bond | 0,52 | −19,50 | 0,4073 | −0,6744 | |||||

| USP3579ECP09 / Dominican Republic International Bond | 0,49 | 67,92 | 0,3852 | −0,1059 | |||||

| XS1819680528 / Angolan Government International Bond | 0,49 | −1,01 | 0,3838 | −0,4453 | |||||

| US279158AP43 / Ecopetrol SA | 0,49 | 96,00 | 0,3833 | −0,0362 | |||||

| USP01012AN67 / El Salvador Government International Bond | 0,46 | 151,09 | 0,3618 | 0,0537 | |||||

| Ivory Coast Government Bond / DBT (XS2752065479) | 0,46 | 28,57 | 0,3591 | −0,2398 | |||||

| Sri Lanka Government Bond / DBT (XS2966241445) | 0,45 | 157,95 | 0,3558 | 0,0603 | |||||

| XS2214238441 / Ecuador Government International Bond | 0,42 | 6,89 | 0,3282 | −0,3294 | |||||

| XS2290957732 / Bahrain Government International Bond | 0,41 | −18,74 | 0,3223 | −0,5275 | |||||

| USP3579ECG00 / Dominican Republic International Bond | 0,41 | −4,20 | 0,3215 | −0,3972 | |||||

| US105756BY51 / Brazilian Government International Bond | 0,41 | −52,57 | 0,3183 | −0,4092 | |||||

| Ivory Coast Government Bond / DBT (XS2752065040) | 0,39 | −3,48 | 0,3042 | −0,3690 | |||||

| US91086QBB32 / Mexico Government International Bond | 0,38 | 149,67 | 0,2955 | 0,0412 | |||||

| XS2364200514 / Romanian Government International Bond | 0,37 | 0,2915 | 0,2915 | ||||||

| XS2330514899 / Romanian Government International Bond | 0,37 | 0,2905 | 0,2905 | ||||||

| XS2258400162 / Romanian Government International Bond | 0,37 | −26,73 | 0,2901 | −0,1509 | |||||

| Sri Lanka Government Bond / DBT (XS2966242096) | 0,36 | 109,94 | 0,2814 | −0,0062 | |||||

| US698299AK07 / Panama Government International Bond | 0,33 | 50,68 | 0,2611 | −0,1093 | |||||

| Sri Lanka Government Bond / DBT (XS2966242179) | 0,28 | 166,98 | 0,2221 | 0,0440 | |||||

| Sri Lanka Government Bond / DBT (XS2966241361) | 0,25 | 157,14 | 0,1977 | 0,0320 | |||||

| USP7807HAT25 / Petroleos de Venezuela SA | 0,23 | −3,33 | 0,1815 | −0,2202 | |||||

| XS0294364954 / Petroleos de Venezuela SA | 0,23 | 0,1815 | 0,1815 | ||||||

| XS0334989000 / Congolese International Bond | 0,21 | −2,80 | 0,1634 | −0,1956 | |||||

| Ivory Coast Government Bond / DBT (XS2752065040) | 0,18 | −55,97 | 0,1388 | −0,5344 | |||||

| Ukraine Government Bond / DBT (XS2895056369) | 0,17 | −11,86 | 0,1339 | −0,1919 | |||||

| Sri Lanka Government Bond / DBT (XS2966242500) | 0,17 | 31,75 | 0,1301 | −0,0820 | |||||

| U.S. Treasury 5 Year Notes / DIR (N/A) | 0,12 | 0,0926 | 0,0926 | ||||||

| USP7807HAR68 / Petroleos de Venezuela SA | 0,12 | −3,33 | 0,0907 | −0,1101 | |||||

| Ukraine Government Bond / DBT (XS2895056013) | 0,10 | −11,97 | 0,0810 | −0,1153 | |||||

| Sri Lanka Government Bond / DBT (XS2966241957) | 0,09 | 8,33 | 0,0714 | −0,0706 | |||||

| U.S. Treasury 2 Year Notes / DIR (N/A) | 0,07 | 0,0533 | 0,0533 | ||||||

| Ghana Government Bond / DBT (XS2893147681) | 0,05 | −4,17 | 0,0367 | −0,0437 | |||||

| Ghana Government Bond / DBT (XS2893146873) | 0,02 | 0,00 | 0,0195 | −0,0218 | |||||

| Euro-Bund / DIR (DE000F1B2NG7) | 0,00 | 0,0028 | 0,0028 | ||||||

| USG54897AB28 / Lima Metro Line 2 Finance Ltd | 0,00 | 0,0000 | −0,0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | −0,01 | −0,0049 | −0,0049 | ||||||

| U.S. Treasury 10 Year Ultra Bonds / DIR (N/A) | −0,01 | −0,0077 | −0,0077 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | −0,70 | −0,5503 | −0,5503 |