Grundläggande statistik

| Portföljvärde | $ 1 073 624 131 |

| Aktuella positioner | 246 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

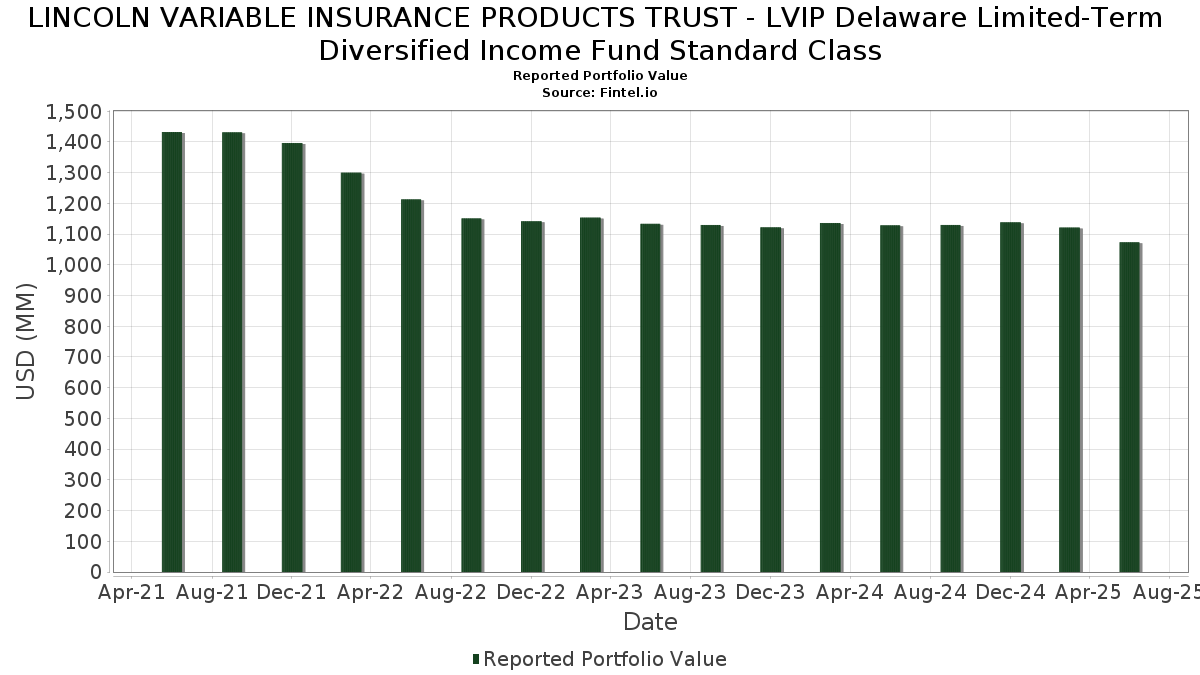

LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Delaware Limited-Term Diversified Income Fund Standard Class har redovisat 246 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 1 073 624 131 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Delaware Limited-Term Diversified Income Fund Standard Classs största innehav är State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls (US:GVMXX) , Morgan Stanley (US:US61747YEX94) , Toyota Auto Loan Extended Note Trust 2022-1 (US:US89231EAA10) , Royalty Pharma PLC (GB:US78081BAH69) , and UMBS (US:US31418B3U80) . LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Delaware Limited-Term Diversified Income Fund Standard Classs nya positioner inkluderar Morgan Stanley (US:US61747YEX94) , Toyota Auto Loan Extended Note Trust 2022-1 (US:US89231EAA10) , Royalty Pharma PLC (GB:US78081BAH69) , UMBS (US:US31418B3U80) , and Federal National Mortgage Association, Inc. (US:US31418BVJ24) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 85,14 | 85,14 | 7,9216 | 4,6895 |

| 28,46 | 2,6481 | 2,6481 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 10,37 | 0,9652 | 0,9652 | |

| US31418B3U80 / UMBS | 9,52 | 0,8859 | 0,8859 | |

| US31418BVJ24 / Federal National Mortgage Association, Inc. | 9,19 | 0,8549 | 0,8549 | |

| US3136ANUP09 / Fannie Mae REMICS | 8,36 | 0,7776 | 0,7776 | |

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 7,29 | 0,6784 | 0,6784 | |

| US31418BWG75 / Fannie Mae Pool | 7,11 | 0,6619 | 0,6619 | |

| FMCC / Federal Home Loan Mortgage Corporation | 5,65 | 0,5260 | 0,5260 | |

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 5,64 | 0,5247 | 0,5247 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 98,47 | 9,1620 | −8,9101 | ||

| 79,84 | 7,4292 | −4,3503 | ||

| US98163VAD01 / WORLD OMNI AUTO RECEIVABLES TRUST 2022-D WOART 2022-D A3 | 0,03 | 0,0024 | −0,2173 | |

| 7,39 | 0,6881 | −0,1659 | ||

| −1,65 | −0,1534 | −0,1534 | ||

| 4,59 | 0,4270 | −0,0769 | ||

| US674921AB70 / OCCU Auto Receivables Trust 2023-1 | 0,20 | 0,0187 | −0,0553 | |

| US29374LAB62 / Enterprise Fleet Financing 2023-3 LLC | 3,50 | 0,3255 | −0,0385 | |

| US14314LAC90 / Carlyle Global Market Strategies CLO 2014-2R Ltd | 0,74 | 0,0689 | −0,0361 | |

| 1,38 | 0,1288 | −0,0346 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-06 för rapporteringsperioden 2025-06-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| U.S. Treasury Notes / DBT (US91282CMN82) | 98,47 | −50,65 | 9,1620 | −8,9101 | |||||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 85,14 | 138,58 | 85,14 | 138,59 | 7,9216 | 4,6895 | |||

| U.S. Treasury Notes / DBT (US91282CMP31) | 79,84 | −38,61 | 7,4292 | −4,3503 | |||||

| U.S. Treasury Bills / STIV (US912797QN08) | 28,46 | 2,6481 | 2,6481 | ||||||

| US61747YEX94 / Morgan Stanley | 12,45 | −0,34 | 1,1587 | 0,0268 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 11,55 | −4,86 | 1,0749 | −0,0249 | |||||

| PFS Financing Corp / ABS-O (US69335PFS92) | 11,49 | 0,03 | 1,0695 | 0,0287 | |||||

| US89231EAA10 / Toyota Auto Loan Extended Note Trust 2022-1 | 11,41 | 0,40 | 1,0616 | 0,0324 | |||||

| NextGear Floorplan Master Owner Trust / ABS-O (US65341KBY10) | 11,03 | −0,22 | 1,0260 | 0,0250 | |||||

| US78081BAH69 / Royalty Pharma PLC | 10,62 | 0,90 | 0,9881 | 0,0348 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 10,37 | 0,9652 | 0,9652 | ||||||

| Huntington Auto Trust 2024-1 / ABS-O (US446144AE71) | 10,09 | −0,10 | 0,9387 | 0,0240 | |||||

| US31418B3U80 / UMBS | 9,52 | 0,8859 | 0,8859 | ||||||

| US31418BVJ24 / Federal National Mortgage Association, Inc. | 9,19 | 0,8549 | 0,8549 | ||||||

| US34528QGA67 / Ford Credit Floorplan Master Owner Trust A | 9,16 | 0,03 | 0,8522 | 0,0229 | |||||

| PFS Financing Corp / ABS-O (US69335PFE07) | 8,99 | 0,27 | 0,8362 | 0,0244 | |||||

| US3136ANUP09 / Fannie Mae REMICS | 8,36 | 0,7776 | 0,7776 | ||||||

| Virginia Power Fuel Securitization LLC / DBT (US92808VAA08) | 7,39 | −21,57 | 0,6881 | −0,1659 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 7,29 | 0,6784 | 0,6784 | ||||||

| US31418BWG75 / Fannie Mae Pool | 7,11 | 0,6619 | 0,6619 | ||||||

| US12511AAA25 / CBAM 2020-13 Ltd | 7,00 | 0,04 | 0,6518 | 0,0177 | |||||

| US3137FYEU60 / Freddie Mac REMICS | 6,77 | −6,62 | 0,6297 | −0,0268 | |||||

| Santander Drive Auto Receivables Trust 2025-1 / ABS-O (US80288DAF33) | 6,65 | 0,38 | 0,6192 | 0,0187 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBJ36) | 5,92 | 0,89 | 0,5512 | 0,0194 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 5,65 | 0,5260 | 0,5260 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 5,64 | 0,5247 | 0,5247 | ||||||

| Verizon Master Trust / ABS-O (US92348KCQ40) | 5,62 | 0,07 | 0,5225 | 0,0143 | |||||

| Hyundai Auto Lease Securitization Trust 2024-C / ABS-O (US448984AD63) | 5,53 | 0,22 | 0,5141 | 0,0147 | |||||

| US75513ECT64 / RTX CORP SR UNSEC 5.75% 11-08-26 | 5,45 | 0,00 | 0,5075 | 0,0135 | |||||

| US98164FAD42 / WOART 23-C A3 5.15% 11-15-28 | 5,43 | −5,94 | 0,5057 | −0,0176 | |||||

| Hyundai Capital America / DBT (US44891ADV61) | 5,38 | 0,5004 | 0,5004 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 5,19 | 0,4832 | 0,4832 | ||||||

| US3137B6HC86 / FHLMC, Series 4283, Class TZ | 5,18 | 0,4816 | 0,4816 | ||||||

| Wheels Fleet Lease Funding 1 LLC / ABS-O (US96328GBZ90) | 5,12 | 0,12 | 0,4768 | 0,0133 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 5,11 | 0,4753 | 0,4753 | ||||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 5,06 | 0,4711 | 0,4711 | ||||||

| US06051GKW86 / Bank of America Corp. | 5,06 | 0,4706 | 0,4706 | ||||||

| US63906EB929 / NatWest Markets PLC | 5,06 | 0,4704 | 0,4704 | ||||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 5,05 | 0,4702 | 0,4702 | ||||||

| Verizon Master Trust / ABS-O (US92348KDT79) | 5,04 | −0,02 | 0,4694 | 0,0123 | |||||

| US95000U3A91 / Wells Fargo & Co. | 5,04 | 53,44 | 0,4691 | 0,1833 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 5,04 | 0,4689 | 0,4689 | ||||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 5,04 | 0,4686 | 0,4686 | ||||||

| US902613AP31 / UBS Group AG | 5,03 | 0,4679 | 0,4679 | ||||||

| BNP / BNP Paribas SA | 5,03 | 0,4676 | 0,4676 | ||||||

| Magnetite XL Ltd / ABS-CBDO (US55955RAA77) | 5,02 | 0,04 | 0,4667 | 0,0125 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 5,01 | 0,4665 | 0,4665 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 4,94 | 0,4599 | 0,4599 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 4,92 | 0,4578 | 0,4578 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 4,92 | 0,4575 | 0,4575 | ||||||

| US842587DQ78 / Southern Co/The | 4,91 | 0,53 | 0,4567 | 0,0145 | |||||

| Carvana Auto Receivables Trust 2024-N3 / ABS-O (US14687WAD20) | 4,86 | 0,4526 | 0,4526 | ||||||

| US29273VAP58 / Energy Transfer LP | 4,86 | 0,52 | 0,4518 | 0,0142 | |||||

| US87264ABD63 / CORP. NOTE | 4,80 | 0,42 | 0,4466 | 0,0136 | |||||

| US92539XAA28 / Verus Securitization Trust 2023-6 | 4,79 | −8,01 | 0,4454 | −0,0259 | |||||

| US30313PAS20 / FREMF Mortgage Trust, Series 2019-K100, Class B | 4,77 | 1,66 | 0,4434 | 0,0188 | |||||

| Dryden 83 CLO Ltd / ABS-CBDO (US26246EAL20) | 4,77 | 0,19 | 0,4434 | 0,0126 | |||||

| U.S. Treasury Notes / DBT (US91282CMY48) | 4,74 | 0,4414 | 0,4414 | ||||||

| US345286AE81 / Ford Credit Auto Owner Trust 2022-A | 4,74 | 0,62 | 0,4411 | 0,0143 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 4,70 | 0,4375 | 0,4375 | ||||||

| Government National Mortgage Association / ABS-MBS (US38384NTX39) | 4,68 | 0,4359 | 0,4359 | ||||||

| ARI Fleet Lease Trust 2024-B / ABS-O (US04033HAB15) | 4,59 | −17,53 | 0,4270 | −0,0769 | |||||

| US12515BAE83 / CD 2019-CD8 Mortgage Trust | 4,58 | 2,12 | 0,4266 | 0,0199 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 4,57 | 1,02 | 0,4249 | 0,0154 | |||||

| US22822VAV36 / Crown Castle International Corp | 4,57 | 1,04 | 0,4248 | 0,0155 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 4,56 | 0,4247 | 0,4247 | ||||||

| Exeter Automobile Receivables Trust 2025-2 / ABS-O (US30168JAE38) | 4,48 | 0,4173 | 0,4173 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 4,47 | 0,4158 | 0,4158 | ||||||

| US701094AR58 / Parker-Hannifin Corp | 4,47 | 0,45 | 0,4155 | 0,0129 | |||||

| US30308RAN61 / FREMF Mortgage Trust, Series 2018-K86, Class B | 4,29 | 1,08 | 0,3990 | 0,0147 | |||||

| US31418AAV08 / Fannie Mae Pool | 4,28 | 0,3980 | 0,3980 | ||||||

| Drive Auto Receivables Trust / ABS-O (US262102AD81) | 4,27 | 0,3976 | 0,3976 | ||||||

| US00135TAD63 / AIB Group PLC | 4,23 | 0,3937 | 0,3937 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 4,13 | 0,3839 | 0,3839 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 4,05 | 0,3768 | 0,3768 | ||||||

| American Credit Acceptance Receivables Trust 2025-2 / ABS-O (US024938AE27) | 4,03 | 0,3748 | 0,3748 | ||||||

| Oportun Issuance Trust 2025-B / ABS-O (US68378QAA13) | 4,02 | 0,3740 | 0,3740 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 4,02 | 0,3739 | 0,3739 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 4,01 | 0,3732 | 0,3732 | ||||||

| US406371AA24 / HALSEYPOINT CLO 5 LTD SER 2021-5A CL A1A V/R REGD 144A P/P 0.00000000 | 4,01 | 0,10 | 0,3727 | 0,0102 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 3,87 | 0,3604 | 0,3604 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 3,86 | 0,3594 | 0,3594 | ||||||

| Prestige Auto Receivables Trust 2024-2 / ABS-O (US74113SAD99) | 3,81 | 0,3544 | 0,3544 | ||||||

| Accenture Capital Inc / DBT (US00440KAB98) | 3,81 | 0,79 | 0,3541 | 0,0120 | |||||

| GLS Auto Receivables Issuer Trust 2025-2 / ABS-O (US37989BAJ17) | 3,79 | 0,3528 | 0,3528 | ||||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MDB28) | 3,77 | 0,3504 | 0,3504 | ||||||

| Mutual of Omaha Cos Global Funding / DBT (US62829D2G44) | 3,76 | 0,3494 | 0,3494 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 3,70 | 0,3446 | 0,3446 | ||||||

| US05369AAK79 / Aviation Capital Group LLC | 3,62 | 0,78 | 0,3370 | 0,0115 | |||||

| US3138EQDZ25 / FNMA 30YR 5.0% 06/01/39#AL7319 | 3,60 | 0,3350 | 0,3350 | ||||||

| Freddie Mac STACR REMIC Trust 2025-DNA1 / ABS-MBS (US35564NGA54) | 3,60 | 0,33 | 0,3346 | 0,0100 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 3,55 | 0,3304 | 0,3304 | ||||||

| Mariner Finance Issuance Trust 2025-A / ABS-O (US567920AA11) | 3,55 | 0,3301 | 0,3301 | ||||||

| US591894CE82 / Metropolitan Edison Co | 3,53 | 0,48 | 0,3289 | 0,0103 | |||||

| American Credit Acceptance Receivables Trust 2025-1 / ABS-O (US02528DAE04) | 3,53 | 0,3287 | 0,3287 | ||||||

| CABK / CaixaBank, S.A. | 3,53 | 0,3283 | 0,3283 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 3,52 | 0,3278 | 0,3278 | ||||||

| Westlake Automobile Receivables Trust 2024-3 / ABS-O (US96043CAF77) | 3,52 | 0,3272 | 0,3272 | ||||||

| US29374LAB62 / Enterprise Fleet Financing 2023-3 LLC | 3,50 | −12,97 | 0,3255 | −0,0385 | |||||

| Bunge Ltd Finance Corp / DBT (US120568BE94) | 3,41 | 0,59 | 0,3175 | 0,0103 | |||||

| Freddie Mac STACR REMIC Trust 2025-DNA2 / ABS-MBS (US35564NHY22) | 3,37 | 0,3139 | 0,3139 | ||||||

| Stream Innovations 2025-1 Issuer Trust / ABS-O (US86324XAA37) | 3,36 | 0,3125 | 0,3125 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 3,32 | 0,3091 | 0,3091 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 3,23 | 0,3001 | 0,3001 | ||||||

| Porsche Innovative Lease Owner Trust 2024-1 / ABS-O (US73328AAD19) | 3,21 | −0,03 | 0,2987 | 0,0078 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 3,18 | 0,2958 | 0,2958 | ||||||

| US31396NRF59 / Freddie Mac Reference REMIC | 3,16 | 0,2939 | 0,2939 | ||||||

| Zais Clo 16 Ltd / ABS-CBDO (US98875JBJ25) | 3,09 | 0,19 | 0,2872 | 0,0082 | |||||

| US3138EREA48 / UMBS, 30 Year | 3,06 | −1,92 | 0,2849 | 0,0021 | |||||

| Westlake Automobile Receivables Trust 2025-1 / ABS-O (US96043VAH15) | 3,05 | 0,2834 | 0,2834 | ||||||

| US3137BYAF75 / Freddie Mac REMICS | 3,03 | 0,2819 | 0,2819 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 3,03 | 0,2817 | 0,2817 | ||||||

| Jamestown CLO XVII Ltd / ABS-CBDO (US47048UAL26) | 3,00 | 0,2791 | 0,2791 | ||||||

| US314382AA01 / Fells Point Funding Trust | 3,00 | 0,98 | 0,2790 | 0,0100 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 2,98 | 0,2769 | 0,2769 | ||||||

| US30307RAE71 / FREMF Mortgage Trust, Series 2018-K80, Class B | 2,95 | 0,75 | 0,2742 | 0,0093 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 2,92 | 0,2716 | 0,2716 | ||||||

| US05377REJ95 / Avis Budget Rental Car Funding AESOP LLC | 2,91 | 0,2707 | 0,2707 | ||||||

| US3136A8CD09 / Fannie Mae REMICS | 2,91 | 0,2707 | 0,2707 | ||||||

| US67118CAA99 / OBX 2023-NQM8 Trust | 2,85 | −7,87 | 0,2647 | −0,0151 | |||||

| Fifth Third Bank NA / DBT (US31677QBU22) | 2,83 | 0,18 | 0,2634 | 0,0074 | |||||

| Jackson National Life Global Funding / DBT (US46849CJP77) | 2,80 | 0,2608 | 0,2608 | ||||||

| US68389XCF06 / Oracle Corp | 2,79 | −0,36 | 0,2597 | 0,0060 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,79 | 0,2593 | 0,2593 | ||||||

| US06051GLS65 / Bank of America Corp | 2,78 | 0,54 | 0,2588 | 0,0082 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 2,77 | 0,2581 | 0,2581 | ||||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 2,74 | 0,88 | 0,2550 | 0,0089 | |||||

| RIO TINTO FIN USA PLC / DBT (US76720AAR77) | 2,72 | 0,22 | 0,2532 | 0,0072 | |||||

| Hilton Grand Vacations Trust 2025-1 / ABS-O (US43283CAA99) | 2,72 | 0,2527 | 0,2527 | ||||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 2,69 | 0,67 | 0,2505 | 0,0083 | |||||

| US05583JAC62 / BPCE SA | 2,68 | 0,2498 | 0,2498 | ||||||

| US3138ESAD06 / Fannie Mae Pool | 2,68 | −3,56 | 0,2497 | −0,0024 | |||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 2,67 | 0,2489 | 0,2489 | ||||||

| Fannie Mae Connecticut Avenue Securities / ABS-MBS (US20754TAD46) | 2,65 | 0,42 | 0,2464 | 0,0075 | |||||

| US64953BBF40 / New York Life Global Funding | 2,62 | −0,23 | 0,2436 | 0,0060 | |||||

| Bain Capital Credit CLO 2021-7 Ltd / ABS-CBDO (US05682NAL73) | 2,61 | 0,89 | 0,2426 | 0,0085 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2,60 | 0,2423 | 0,2423 | ||||||

| Mars Inc / DBT (US571676AY11) | 2,59 | 0,74 | 0,2413 | 0,0081 | |||||

| Bank of America Corp / DBT (US06051GML04) | 2,54 | 1,08 | 0,2360 | 0,0088 | |||||

| ARI Fleet Lease Trust 2025-A / ABS-O (US04033CAD83) | 2,50 | 0,12 | 0,2322 | 0,0065 | |||||

| Sierra Timeshare 2024-2 Receivables Funding LLC / ABS-O (US82650DAB82) | 2,44 | 0,2269 | 0,2269 | ||||||

| US3137FES500 / FHLMC, REMIC, Series 4767, Class LA | 2,43 | 0,2259 | 0,2259 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 2,41 | 0,2241 | 0,2241 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,37 | 0,2202 | 0,2202 | ||||||

| US05369AAA97 / Aviation Capital Group LLC | 2,35 | 0,86 | 0,2185 | 0,0076 | |||||

| Octagon Investment Partners 51 Ltd / ABS-CBDO (US675943AA23) | 2,31 | 0,92 | 0,2146 | 0,0075 | |||||

| Drive Auto Receivables Trust 2024-2 / ABS-O (US26207AAF03) | 2,30 | 0,2143 | 0,2143 | ||||||

| US35564K3F46 / Freddie Mac Stacr Remic Trust 2023-Hqa3 | 2,29 | −1,84 | 0,2134 | 0,0018 | |||||

| Bridgecrest Lending Auto Securitization Trust 2025-2 / ABS-O (US10807HAF38) | 2,28 | 0,2118 | 0,2118 | ||||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 2,27 | 0,13 | 0,2116 | 0,0059 | |||||

| US30300SAU69 / FREMF, Series 2020-K737, Class C | 2,26 | 0,2104 | 0,2104 | ||||||

| US06406RBL06 / Bank of New York Mellon Corp/The | 2,24 | 0,22 | 0,2088 | 0,0061 | |||||

| US31418D3N02 / Fannie Mae Pool | 2,22 | −2,55 | 0,2061 | 0,0002 | |||||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 2,18 | 0,97 | 0,2032 | 0,0073 | |||||

| AGL CLO 17 Ltd / ABS-CBDO (US00120DAJ54) | 2,15 | 0,61 | 0,2004 | 0,0066 | |||||

| U.S. Treasury Bills / STIV (US912797PF82) | 2,15 | 0,1997 | 0,1997 | ||||||

| SWED A / Swedbank AB (publ) | 2,12 | 0,1972 | 0,1972 | ||||||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 2,11 | 0,14 | 0,1963 | 0,0055 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 2,09 | 0,1944 | 0,1944 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 2,05 | 0,1910 | 0,1910 | ||||||

| US63743HFH03 / National Rural Utilities Cooperative Finance Corp | 2,05 | 0,00 | 0,1904 | 0,0051 | |||||

| Morgan Stanley Bank NA / DBT (US61690U8B93) | 2,03 | 0,25 | 0,1886 | 0,0055 | |||||

| Verdant Receivables 2025-1 LLC / ABS-O (US92340GAC42) | 2,02 | 0,1883 | 0,1883 | ||||||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 2,02 | 0,1878 | 0,1878 | ||||||

| Bridgecrest Lending Auto Securitization Trust 2025-2 / ABS-O (US10807HAD89) | 2,01 | 0,1868 | 0,1868 | ||||||

| FHF Issuer Trust 2025-1 / ABS-O (US30340RAB24) | 2,01 | 0,1867 | 0,1867 | ||||||

| BK / The Bank of New York Mellon Corporation - Depositary Receipt (Common Stock) | 2,00 | 1,22 | 0,1858 | 0,0071 | |||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 1,99 | 1,02 | 0,1847 | 0,0066 | |||||

| US3140J5EJ49 / UMBS, 15 Year | 1,97 | 0,1833 | 0,1833 | ||||||

| Exeter Automobile Receivables Trust / ABS-O (US30166XAD66) | 1,93 | 0,1797 | 0,1797 | ||||||

| US64831KAC09 / New Residential Mortgage Loan Trust, Series 2022-SFR1, Class B | 1,93 | 0,1797 | 0,1797 | ||||||

| US61747YEV39 / Morgan Stanley | 1,93 | 0,16 | 0,1797 | 0,0051 | |||||

| Veros Auto Receivables Trust 2025-1 / ABS-O (US92511BAA26) | 1,84 | 0,1712 | 0,1712 | ||||||

| US05609MCC73 / BMO 2022-C1 MORTGAGE TRUST SER 2022-C1 CL A5 REGD 3.37400000 | 1,82 | 2,76 | 0,1697 | 0,0089 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,79 | 0,1663 | 0,1663 | ||||||

| US3140J7RS66 / Fannie Mae Pool | 1,78 | −3,21 | 0,1655 | −0,0010 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1,76 | 0,1636 | 0,1636 | ||||||

| US3140X4W771 / Fannie Mae Pool | 1,72 | −2,76 | 0,1605 | −0,0002 | |||||

| Ballyrock CLO 27 Ltd / ABS-CBDO (US05874UAA34) | 1,70 | 0,06 | 0,1584 | 0,0043 | |||||

| US00108WAF77 / AEP Texas Inc. | 1,70 | 0,89 | 0,1580 | 0,0055 | |||||

| US3140J9FX46 / Fannie Mae Pool | 1,69 | −3,33 | 0,1569 | −0,0011 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,68 | 0,1561 | 0,1561 | ||||||

| US68389XCH61 / Oracle Corp | 1,63 | 0,80 | 0,1519 | 0,0052 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,63 | 0,1516 | 0,1516 | ||||||

| US20755CAA62 / Connecticut Avenue Securities Trust 2023-R08 | 1,60 | −12,60 | 0,1492 | −0,0170 | |||||

| US63743HFG20 / National Rural Utilities Cooperative Finance Corp | 1,60 | 0,38 | 0,1484 | 0,0044 | |||||

| Canyon CLO 2020-2 Ltd / ABS-CBDO (US13876NAW39) | 1,59 | −0,38 | 0,1480 | 0,0033 | |||||

| Aon North America Inc / DBT (US03740MAA80) | 1,58 | 0,13 | 0,1473 | 0,0041 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,57 | 0,1463 | 0,1463 | ||||||

| Connecticut Avenue Securities Series 2025-R01 / ABS-MBS (US20755JAC71) | 1,57 | 0,45 | 0,1462 | 0,0045 | |||||

| US251526CU14 / DEUTSCHE BANK AG SR NON PREF 6.819% 11-20-29/28 | 1,54 | 0,52 | 0,1429 | 0,0046 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 1,53 | 0,92 | 0,1422 | 0,0050 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,53 | 0,1421 | 0,1421 | ||||||

| Sierra Timeshare 2024-1 Receivables Funding LLC / ABS-O (US826935AB47) | 1,47 | 0,1371 | 0,1371 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,44 | 0,1336 | 0,1336 | ||||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 1,40 | 0,94 | 0,1300 | 0,0046 | |||||

| Freddie Mac STACR REMIC Trust 2024-DNA3 / ABS-MBS (US35564NEZ24) | 1,38 | −23,24 | 0,1288 | −0,0346 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,38 | 0,1282 | 0,1282 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,35 | 0,1260 | 0,1260 | ||||||

| US26442CAX20 / Duke Energy Carolinas LLC | 1,33 | 1,22 | 0,1239 | 0,0047 | |||||

| Citibank NA / DBT (US17325FBF45) | 1,33 | −0,30 | 0,1233 | 0,0029 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,29 | 0,1198 | 0,1198 | ||||||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 1,26 | 0,80 | 0,1169 | 0,0040 | |||||

| US00774MAW55 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 1,25 | 1,38 | 0,1161 | 0,0046 | |||||

| SYY / Sysco Corporation - Depositary Receipt (Common Stock) | 1,22 | 0,91 | 0,1139 | 0,0040 | |||||

| United Auto Credit Securitization Trust 2025-1 / ABS-O (US90945JAB35) | 1,22 | 0,1138 | 0,1138 | ||||||

| Toyota Auto Receivables 2024-A Owner Trust / ABS-O (US89238DAD03) | 1,21 | 0,08 | 0,1123 | 0,0030 | |||||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 1,19 | 0,1109 | 0,1109 | ||||||

| IVW / Meta Platforms, Inc. - Depositary Receipt (Common Stock) | 1,18 | 0,94 | 0,1099 | 0,0039 | |||||

| US17325FBC14 / CITIBANK NA | 1,18 | −0,08 | 0,1096 | 0,0028 | |||||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | 1,16 | 0,1081 | 0,1081 | ||||||

| Neuberger Berman Loan Advisers Clo 42 Ltd / ABS-CBDO (US64133WAL90) | 1,15 | 0,09 | 0,1067 | 0,0029 | |||||

| US31335BZT69 / Freddie Mac Gold Pool | 1,15 | −2,72 | 0,1066 | −0,0001 | |||||

| US3137BJZ487 / Freddie Mac REMICS | 1,14 | 0,1064 | 0,1064 | ||||||

| Canyon Capital CLO 2019-2 Ltd / ABS-CBDO (US13887WAS98) | 1,10 | 0,64 | 0,1024 | 0,0033 | |||||

| US05578AAY47 / BPCE SA | 1,09 | 0,74 | 0,1010 | 0,0034 | |||||

| US91159HJP64 / US Bancorp | 1,03 | −0,39 | 0,0958 | 0,0022 | |||||

| Bridgecrest Lending Auto Securitization Trust 2025-2 / ABS-O (US10807HAE62) | 1,01 | 0,0940 | 0,0940 | ||||||

| US31394NUA44 / FHLMC, REMIC, Series 2733, Class ME | 1,01 | 0,0936 | 0,0936 | ||||||

| US00914AAJ16 / Air Lease Corp | 0,75 | 0,40 | 0,0695 | 0,0021 | |||||

| US251526CS67 / Deutsche Bank AG/New York NY | 0,74 | 0,41 | 0,0692 | 0,0021 | |||||

| US14314LAC90 / Carlyle Global Market Strategies CLO 2014-2R Ltd | 0,74 | −36,15 | 0,0689 | −0,0361 | |||||

| US61747YFH36 / Morgan Stanley | 0,74 | 0,41 | 0,0684 | 0,0021 | |||||

| Northwestern Mutual Global Funding / DBT (US66815L2U28) | 0,70 | 0,72 | 0,0651 | 0,0022 | |||||

| US3140XLL713 / Fannie Mae Pool | 0,68 | −3,39 | 0,0637 | −0,0004 | |||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 0,67 | 0,90 | 0,0623 | 0,0022 | |||||

| US3140XF5E72 / Fannie Mae Pool | 0,58 | −2,35 | 0,0541 | 0,0002 | |||||

| Marvell Technology Inc / DBT (US573874AR57) | 0,52 | 0,0481 | 0,0481 | ||||||

| US08180XAN21 / Benefit Street Partners CLO VIII Ltd | 0,45 | −24,20 | 0,0420 | −0,0119 | |||||

| US31410LFB36 / Fannie Mae Pool | 0,38 | −2,30 | 0,0357 | 0,0001 | |||||

| US3140X72U21 / Fannie Mae Pool | 0,33 | −2,94 | 0,0308 | −0,0001 | |||||

| US3140X4W698 / Fannie Mae Pool | 0,30 | −2,30 | 0,0277 | 0,0001 | |||||

| US91159HJH49 / US Bancorp | 0,24 | −0,41 | 0,0227 | 0,0005 | |||||

| US91159HJK77 / US Bancorp | 0,22 | 0,45 | 0,0209 | 0,0007 | |||||

| US674921AB70 / OCCU Auto Receivables Trust 2023-1 | 0,20 | −75,52 | 0,0187 | −0,0553 | |||||

| US3140XK2J88 / Fannie Mae Pool | 0,19 | −1,02 | 0,0181 | 0,0002 | |||||

| US31416YJD13 / Fannie Mae Pool | 0,17 | −1,79 | 0,0154 | 0,0002 | |||||

| US98163VAD01 / WORLD OMNI AUTO RECEIVABLES TRUST 2022-D WOART 2022-D A3 | 0,03 | −98,97 | 0,0024 | −0,2173 | |||||

| US29374JAB17 / Enterprise Fleet Financing 2022-2 LLC | 0,02 | −93,46 | 0,0020 | −0,0272 | |||||

| US31394JY357 / Freddie Mac Structured Pass-Through Certificates | 0,01 | −16,67 | 0,0005 | −0,0000 | |||||

| US31359SX965 / Fannie Mae 6.979719 06/01/2041 | 0,01 | 0,00 | 0,0005 | −0,0000 | |||||

| US31393LFK44 / FHLMC STRUCTURED PASS THROUGH FSPC T 54 2A | 0,00 | 0,0000 | 0,0000 | ||||||

| US 10YR ULTRA FUT SEP25 / DIR (000000000) | −0,03 | −0,0032 | −0,0032 | ||||||

| US LONG BOND(CBT) SEP25 / DIR (000000000) | −0,12 | −0,0109 | −0,0109 | ||||||

| US 10YR NOTE (CBT)SEP25 / DIR (000000000) | −0,18 | −0,0164 | −0,0164 | ||||||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | −1,65 | −0,1534 | −0,1534 |