Grundläggande statistik

| Portföljvärde | $ 2 690 424 326 |

| Aktuella positioner | 648 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

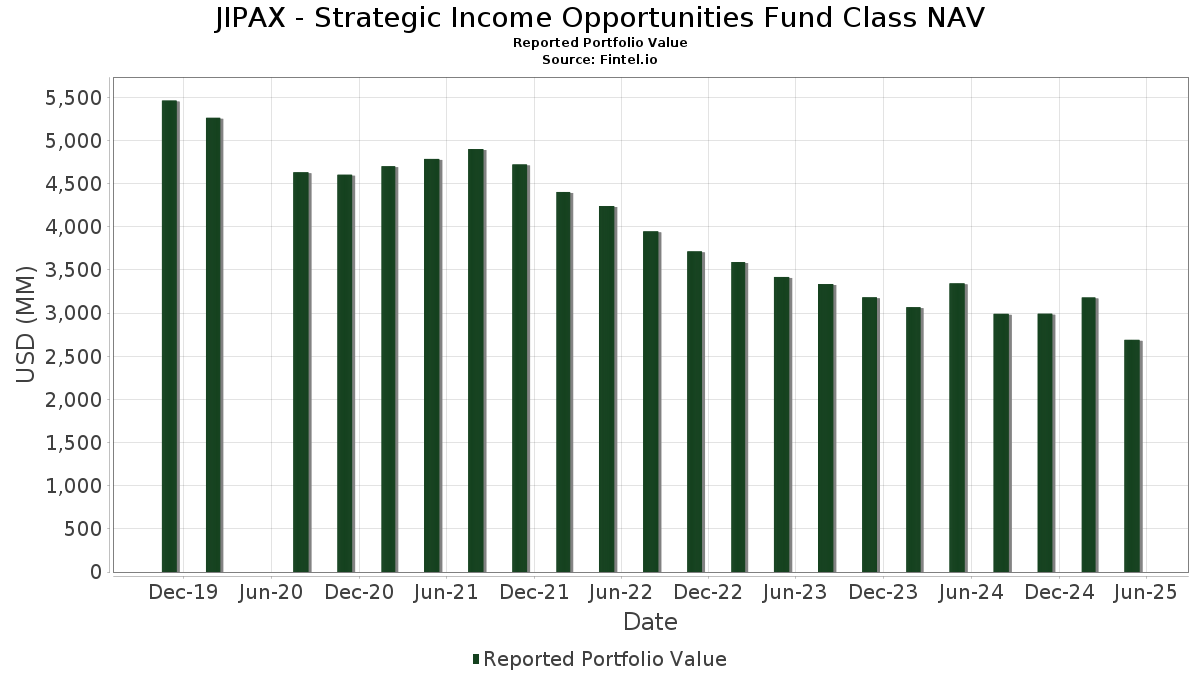

JIPAX - Strategic Income Opportunities Fund Class NAV har redovisat 648 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 2 690 424 326 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). JIPAX - Strategic Income Opportunities Fund Class NAVs största innehav är Brazil Notas do Tesouro Nacional Serie F (BR:BRSTNCNTF1P8) , Us Treasury Bond (US:US912810SF66) , Japan Government Twenty Year Bond (JP:JP12008315C1) , United States Treasury Note/Bond (US:US91282CGM73) , and United States Treasury Note/Bond (US:US91282CFF32) . JIPAX - Strategic Income Opportunities Fund Class NAVs nya positioner inkluderar Brazil Notas do Tesouro Nacional Serie F (BR:BRSTNCNTF1P8) , Us Treasury Bond (US:US912810SF66) , Japan Government Twenty Year Bond (JP:JP12008315C1) , United States Treasury Note/Bond (US:US91282CGM73) , and United States Treasury Note/Bond (US:US91282CFF32) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 4,69 | 46,92 | 1,7524 | 1,7524 | |

| 13,83 | 0,5167 | 0,5167 | ||

| 13,10 | 0,4894 | 0,4894 | ||

| 12,68 | 0,4735 | 0,4735 | ||

| 0,23 | 12,02 | 0,4488 | 0,4488 | |

| 11,12 | 0,4154 | 0,4154 | ||

| 10,68 | 0,3988 | 0,3988 | ||

| 15,12 | 0,5649 | 0,3726 | ||

| 8,51 | 0,3180 | 0,3180 | ||

| 8,34 | 0,3114 | 0,3114 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 12,43 | 0,4641 | −0,4652 | ||

| 0,50 | 0,0186 | −0,2775 | ||

| 9,70 | 0,3622 | −0,1872 | ||

| −4,72 | −0,1764 | −0,1764 | ||

| 0,08 | 5,54 | 0,2068 | −0,1440 | |

| −3,84 | −0,1433 | −0,1433 | ||

| −3,58 | −0,1335 | −0,1335 | ||

| 8,26 | 0,3085 | −0,1276 | ||

| −2,84 | −0,1063 | −0,1063 | ||

| −2,49 | −0,0932 | −0,0932 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-07-29 för rapporteringsperioden 2025-05-31. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JH COLLATERAL / STIV (N/A) | 4,69 | 46,92 | 1,7524 | 1,7524 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 44,55 | 4,63 | 1,6642 | 0,1480 | |||||

| US912810SF66 / Us Treasury Bond | 34,31 | −6,08 | 1,2815 | −0,0192 | |||||

| JP12008315C1 / Japan Government Twenty Year Bond | 27,07 | −3,72 | 1,0112 | 0,0100 | |||||

| US91282CGM73 / United States Treasury Note/Bond | 25,73 | −5,41 | 0,9609 | −0,0075 | |||||

| US91282CFF32 / United States Treasury Note/Bond | 25,70 | −9,76 | 0,9601 | −0,0542 | |||||

| US345370DA55 / Ford Motor Co | 24,21 | −1,14 | 0,9041 | 0,0324 | |||||

| A1ES34 / The AES Corporation - Depositary Receipt (Common Stock) | 22,81 | 5,84 | 0,8521 | 0,0846 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 19,35 | −7,75 | 0,7229 | −0,0242 | |||||

| NZGOVDT534C4 / New Zealand Government Bond | 18,81 | 6,46 | 0,7026 | 0,0735 | |||||

| US15135UAF66 / Cenovus Energy Inc Senior Notes 6.75% 11/15/2039 | 18,02 | −4,24 | 0,6731 | 0,0031 | |||||

| NEE.PRT / NextEra Energy, Inc. - Debt/Equity Composite Units | 0,38 | 0,00 | 16,97 | 0,11 | 0,6339 | 0,0303 | |||

| GREAT OUTDOORS GROUP LLC 2025 TERM LOAN B / LON (US07014QAP63) | 16,84 | 55,96 | 0,6292 | 0,2446 | |||||

| US026874BS54 / American Intl Group 8.175% Jr Sub Debs 05/15/58 | 16,30 | −6,70 | 0,6089 | −0,0132 | |||||

| IN0020220011 / India Government Bond | 15,94 | 48,73 | 0,5955 | 0,2138 | |||||

| JETD / MAX Airlines -3X Inverse Leveraged ETNs due May 28, 2043 - Structured Product | 15,34 | −0,94 | 0,5731 | 0,0216 | |||||

| QUIKRETE HOLDINGS INC 2025 TERM LOAN B / LON (US74839XAL38) | 15,12 | 180,13 | 0,5649 | 0,3726 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 15,03 | −14,93 | 0,5613 | −0,0677 | |||||

| US35671DBC83 / Freeport-McMoRan Inc. Bond | 14,72 | −8,15 | 0,5500 | −0,0208 | |||||

| US854502AM31 / Stanley Black & Decker Inc | 14,52 | −2,68 | 0,5424 | 0,0111 | |||||

| NO0012440397 / NORWAY KINGDOM OF 2.125% 05/18/2032 144A REGS | 14,50 | 9,93 | 0,5415 | 0,0720 | |||||

| MEDLINE BORROWER LP 2024 USD ADD ON TERM LOAN B / LON (US58503UAF03) | 14,40 | −6,60 | 0,5380 | −0,0111 | |||||

| IDG000015207 / Indonesia Treasury Bond | 14,27 | −1,77 | 0,5331 | 0,0158 | |||||

| US097023CY98 / BOEING CO 5.15 5/30 | 13,92 | −18,76 | 0,5200 | −0,0901 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 13,86 | −11,89 | 0,5179 | −0,0424 | |||||

| PHILIPPINE GOVERNMENT BOND BONDS 07/30 6.375 / DBT (PH0000057218) | 13,83 | 0,5167 | 0,5167 | ||||||

| US26884LAN91 / EQT CORP 3.625% 05/15/2031 144A | 13,83 | −0,35 | 0,5165 | 0,0225 | |||||

| RYBD34 / Royal Bank of Canada (Brasil) S.A. - Depositary Receipt (Common Stock) | 13,72 | 0,41 | 0,5124 | 0,0259 | |||||

| US988498AN16 / Yum! Brands, Inc. | 13,58 | −4,54 | 0,5074 | 0,0007 | |||||

| US893647BT37 / TransDigm Inc | 13,50 | 0,32 | 0,5042 | 0,0251 | |||||

| OPAL BIDCO SAS USD TERM LOAN B / LON (XAF7000QAB77) | 13,10 | 0,4894 | 0,4894 | ||||||

| IDG000018706 / Indonesia Treasury Bond | 13,00 | 2,47 | 0,4855 | 0,0339 | |||||

| BANK OF AMERICA CORP JR SUBORDINA 12/99 VAR / DBT (US06055HAH66) | 12,68 | 0,4735 | 0,4735 | ||||||

| US16411QAK76 / CORP. NOTE | 12,55 | −7,45 | 0,4686 | −0,0140 | |||||

| US404119CA57 / HCA Inc | 12,43 | −52,39 | 0,4641 | −0,4652 | |||||

| AAL / American Airlines Group Inc. | 12,34 | −7,44 | 0,4611 | −0,0138 | |||||

| US212015AV31 / Continental Resources Inc/OK | 12,34 | −2,60 | 0,4609 | 0,0098 | |||||

| 1011778 BC UNLIMITED LBLTY CO 2024 TERM LOAN B6 / LON (XAC6901LAM90) | 12,22 | −13,69 | 0,4564 | −0,0477 | |||||

| IDG000020702 / INDONESIA GOVERNMENT BONDS 08/28 6.375 | 12,18 | −6,12 | 0,4551 | −0,0070 | |||||

| US058498AW66 / Ball Corp | 12,09 | −13,52 | 0,4516 | −0,0462 | |||||

| QXO.PRB / QXO, Inc. - Preferred Security | 0,23 | 12,02 | 0,4488 | 0,4488 | |||||

| HCA INC COMPANY GUAR 04/34 5.6 / DBT (US404119CU12) | 11,97 | −5,73 | 0,4471 | −0,0050 | |||||

| AU3SG0002710 / TREASURY CORP OF VICTORIA | 11,91 | 40,91 | 0,4449 | 0,1439 | |||||

| XS1864034365 / International Bank for Reconstruction & Development | 11,87 | 1,52 | 0,4434 | 0,0270 | |||||

| A1EP34 / American Electric Power Company, Inc. - Depositary Receipt (Common Stock) | 11,85 | −5,34 | 0,4427 | −0,0031 | |||||

| US185899AN14 / Cleveland-Cliffs Inc | 11,75 | −10,32 | 0,4388 | −0,0276 | |||||

| US988498AL59 / YUM! Brands Inc. | 11,66 | −4,55 | 0,4356 | 0,0006 | |||||

| PHILIP / Philippine Government International Bond | 11,64 | 2,95 | 0,4346 | 0,0322 | |||||

| US65249BAA70 / News Corp | 11,63 | 0,29 | 0,4345 | 0,0215 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 11,55 | −5,28 | 0,4316 | −0,0028 | |||||

| COREWEAVE INC COMPANY GUAR 144A 06/30 9.25 / DBT (US21873SAB43) | 11,12 | 0,4154 | 0,4154 | ||||||

| NEW ZEALAND GOVERNMENT BOND UNSECURED 05/35 4.5 / DBT (NZGOVDT535C1) | 11,02 | 6,45 | 0,4116 | 0,0430 | |||||

| SOCG / Société Générale Société anonyme - Depositary Receipt (Common Stock) | 11,00 | 285,16 | 0,4110 | 0,3093 | |||||

| CLARIOS GLOBAL LP 2025 USD TERM LOAN B / LON (XAC8000CAP86) | 10,75 | −11,47 | 0,4015 | −0,0308 | |||||

| / Emera Inc. | 10,75 | −0,31 | 0,4014 | 0,0176 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 10,68 | 0,3988 | 0,3988 | ||||||

| RYBD34 / Royal Bank of Canada (Brasil) S.A. - Depositary Receipt (Common Stock) | 10,58 | 35,74 | 0,3953 | 0,1177 | |||||

| CA68333ZAN74 / Province of Ontario Canada | 10,56 | −11,57 | 0,3944 | −0,0308 | |||||

| US237266AJ06 / Darling Ingredients Inc | 10,55 | −6,26 | 0,3942 | −0,0067 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 10,46 | −3,64 | 0,3906 | 0,0042 | |||||

| TNL / Travel + Leisure Co. | 10,37 | −11,35 | 0,3873 | −0,0292 | |||||

| POST / Post Holdings, Inc. | 10,26 | −0,44 | 0,3834 | 0,0163 | |||||

| US55354GAK67 / MSCI Inc | 10,22 | −8,52 | 0,3816 | −0,0161 | |||||

| US92858RAA86 / Vmed O2 UK Financing I PLC | 10,21 | −4,58 | 0,3813 | 0,0004 | |||||

| C2AC34 / CACI International Inc - Depositary Receipt (Common Stock) | 10,04 | −8,21 | 0,3752 | −0,0144 | |||||

| FREDDIE MAC STACR REMIC TRUST STACR 2024 HQA1 M2 144A / ABS-MBS (US35564NCA90) | 9,96 | −0,64 | 0,3719 | 0,0151 | |||||

| AU3SG0002868 / Queensland Treasury Corp | 9,93 | −2,21 | 0,3710 | 0,0094 | |||||

| US89117F8Z56 / Toronto-Dominion Bank/The | 9,83 | −4,76 | 0,3671 | −0,0003 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 9,75 | −0,76 | 0,3641 | 0,0144 | |||||

| US78410GAD60 / SBA Communications Corp | 9,70 | −37,16 | 0,3622 | −0,1872 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 9,63 | −15,02 | 0,3598 | −0,0438 | |||||

| US82967NBG25 / SIRIUS XM RADIO INC COMPANY GUAR 144A 07/30 4.125 | 9,62 | 1,17 | 0,3592 | 0,0207 | |||||

| AU3CB0296580 / Queensland Treasury Corp | 9,50 | 4,96 | 0,3548 | 0,0326 | |||||

| LBTYB / Liberty Global Ltd. | 9,42 | 1,65 | 0,3519 | 0,0219 | |||||

| US161175BS22 / Charter Communications Operating LLC / Charter Communications Operating Capital | 9,36 | −1,04 | 0,3495 | 0,0128 | |||||

| US674599ED34 / Occidental Petroleum Corp | 9,33 | −1,46 | 0,3483 | 0,0114 | |||||

| US05765WAA18 / TIBCO Software Inc | 9,28 | −0,82 | 0,3465 | 0,0135 | |||||

| FI4000550249 / Republic of Finland | 9,19 | −0,23 | 0,3433 | 0,0153 | |||||

| N1RG34 / NRG Energy, Inc. - Depositary Receipt (Common Stock) | 9,12 | −0,18 | 0,3407 | 0,0154 | |||||

| US53218DAE85 / LIFE_22-BMR2 | 9,07 | −3,96 | 0,3389 | 0,0025 | |||||

| E1XC34 / Exelon Corporation - Depositary Receipt (Common Stock) | 9,04 | 184,60 | 0,3376 | 0,2245 | |||||

| US92933BAR50 / WMG Acquisition Corp | 9,03 | −16,98 | 0,3372 | −0,0500 | |||||

| US50077LAB27 / Kraft Heinz Foods Co | 9,00 | −5,60 | 0,3362 | −0,0033 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 8,95 | 39,18 | 0,3343 | 0,1053 | |||||

| US15135BAW19 / Centene Corp | 8,81 | 0,59 | 0,3289 | 0,0172 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 8,80 | −15,90 | 0,3286 | −0,0439 | |||||

| VENTURE GLOBAL LNG INC JR SUBORDINA 144A 12/99 VAR / DBT (US92332YAF88) | 8,62 | 39,05 | 0,3220 | 0,1013 | |||||

| CLF / Cleveland-Cliffs Inc. | 8,57 | −8,76 | 0,3200 | −0,0143 | |||||

| US0641598S88 / Bank of Nova Scotia/The | 8,53 | −0,08 | 0,3185 | 0,0146 | |||||

| FHN.PRF / First Horizon Corporation - Preferred Stock | 8,51 | 0,3180 | 0,3180 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 8,48 | −3,54 | 0,3169 | 0,0037 | |||||

| BIMBO BAKERIES USA INC COMPANY GUAR 144A 01/36 5.375 / DBT (US09031WAE30) | 8,44 | −2,89 | 0,3154 | 0,0058 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 8,44 | −3,40 | 0,3153 | 0,0042 | |||||

| CA06368D8W71 / BANK OF MONTREAL | 8,38 | 3,64 | 0,3131 | 0,0251 | |||||

| C1NP34 / CenterPoint Energy, Inc. - Depositary Receipt (Common Stock) | 8,34 | −10,36 | 0,3116 | −0,0198 | |||||

| US957638AD14 / Western Alliance Bancorp | 8,34 | 0,3114 | 0,3114 | ||||||

| QSR / Restaurant Brands International Inc. | 8,26 | −32,57 | 0,3085 | −0,1276 | |||||

| US68329AAJ79 / Ontario Teachers' Finance Trust | 8,26 | −10,86 | 0,3084 | −0,0214 | |||||

| UMBFO / UMB Financial Corporation - Preferred Stock | 0,32 | 8,15 | 0,3043 | 0,3043 | |||||

| NZGOVDT433C9 / New Zealand Government Bond | 8,05 | 27,95 | 0,3008 | 0,0767 | |||||

| CITY OF OSLO NORWAY SR UNSECURED 06/29 3.99 / DBT (NO0013120485) | 8,02 | 9,86 | 0,2997 | 0,0397 | |||||

| US212015AT84 / Continental Resources Inc/OK | 8,00 | −1,90 | 0,2986 | 0,0084 | |||||

| JBLU / JetBlue Airways Corporation | 7,97 | −3,26 | 0,2979 | 0,0044 | |||||

| US292505AD65 / Encana Corp 6.5% Bonds 8/15/34 | 7,97 | −5,20 | 0,2978 | −0,0017 | |||||

| 30064K105 / Exacttarget, Inc. | 7,94 | −1,42 | 0,2966 | 0,0098 | |||||

| ROCK TRUST 2024-CNTR ROCC 2024 CNTR D 144A / ABS-MBS (US74970WAG50) | 7,90 | −1,10 | 0,2952 | 0,0107 | |||||

| US15135BAV36 / CENTENE CORP 3.375% 02/15/2030 | 7,88 | −7,22 | 0,2945 | −0,0081 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 7,88 | −21,42 | 0,2943 | −0,0627 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 7,86 | −3,09 | 0,2936 | 0,0048 | |||||

| ACM / AECOM | 7,84 | −14,76 | 0,2928 | −0,0346 | |||||

| PHILIPPINE GOVERNMENT BOND BONDS 02/29 6.25 / DBT (PH0000058281) | 7,83 | 4,50 | 0,2925 | 0,0257 | |||||

| US78410GAG91 / SBA Communications Corp | 7,81 | −6,68 | 0,2915 | −0,0063 | |||||

| US29273VAM28 / Energy Transfer LP | 7,72 | −1,19 | 0,2883 | 0,0101 | |||||

| AU3SG0002082 / New South Wales Treasury Corp | 7,70 | 5,16 | 0,2876 | 0,0269 | |||||

| US87342RAC88 / Taco Bell Funding LLC | 7,68 | −14,99 | 0,2867 | −0,0348 | |||||

| SG3261987691 / Singapore Government Bond | 7,62 | −1,88 | 0,2848 | 0,0081 | |||||

| US912810QY73 / United States Treas Bds Bond | 7,61 | −4,83 | 0,2842 | −0,0005 | |||||

| CLYDESDALE ACQUISTN HLDGS INC 2025 TERM LOAN B / LON (US18972FAE25) | 7,60 | 0,2840 | 0,2840 | ||||||

| US911363AM11 / United Rentals North America Inc | 7,57 | 0,95 | 0,2828 | 0,0158 | |||||

| US29250NBT19 / Enbridge, Inc. | 7,56 | −2,10 | 0,2825 | 0,0074 | |||||

| UFC HOLDINGS LLC 2024 TERM LOAN B / LON (US90266UAK97) | 7,55 | −0,03 | 0,2819 | 0,0131 | |||||

| GLOVES BUYER INC 2025 TERM LOAN / LON (US37987UAG76) | 7,53 | 0,2812 | 0,2812 | ||||||

| UNITED KINGDOM GILT BONDS REGS 07/54 4.375 / DBT (GB00BPSNBB36) | 7,51 | 0,2804 | 0,2804 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 7,44 | −14,70 | 0,2779 | −0,0326 | |||||

| US058498AY23 / Ball Corp | 7,44 | −14,40 | 0,2777 | −0,0316 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 7,40 | 374,84 | 0,2763 | 0,2208 | |||||

| US20754DAB38 / CAS_22-R05 | 7,31 | −16,27 | 0,2729 | −0,0378 | |||||

| US748148SE43 / Province of Quebec Canada | 7,31 | −0,65 | 0,2729 | 0,0110 | |||||

| UNITED AIRLINES INC 2024 1ST LIEN TERM LOAN B / LON (US90932RAP91) | 7,23 | −0,07 | 0,2699 | 0,0124 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 7,20 | −0,40 | 0,2691 | 0,0115 | |||||

| US17888HAB96 / Civitas Resources Inc | 7,20 | −6,34 | 0,2688 | −0,0048 | |||||

| NZLGFDT017C3 / NZ LGFA BOND | 7,17 | 7,50 | 0,2678 | 0,0303 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 7,15 | −2,00 | 0,2669 | 0,0073 | |||||

| KASEYA INC 2025 1L TERM LOAN B / LON (US48578AAB44) | 7,12 | 0,2661 | 0,2661 | ||||||

| US92564RAE53 / VICI PROPERTIES / NOTE 4.125% 08/15/2030 144A | 7,11 | −8,84 | 0,2657 | −0,0121 | |||||

| PHY6972HMW34 / Philippine Government Bond | 7,10 | 3,62 | 0,2651 | 0,0212 | |||||

| AERCAP IRELAND CAPITAL DAC / A COMPANY GUAR 03/55 VAR / DBT (US00774MBK09) | 7,10 | −0,48 | 0,2651 | 0,0112 | |||||

| INDONESIA TREASURY BOND BONDS 07/30 6.5 / DBT (IDG000024605) | 7,05 | 3,45 | 0,2632 | 0,0207 | |||||

| T1SO34 / The Southern Company - Depositary Receipt (Common Stock) | 7,03 | 0,2626 | 0,2626 | ||||||

| FCNCO / First Citizens BancShares, Inc. - Preferred Stock | 7,01 | 0,2617 | 0,2617 | ||||||

| US566007AC41 / MARB BondCo PLC | 7,00 | 2,28 | 0,2616 | 0,0178 | |||||

| HILCORP ENERGY I LP TERM LOAN B / LON (US431319AH53) | 6,99 | −0,30 | 0,2613 | 0,0115 | |||||

| AU3CB0294072 / Airservices Australia | 6,98 | 4,98 | 0,2608 | 0,0240 | |||||

| US78403DAZ33 / SBA TOWER TRUST | 6,94 | −0,27 | 0,2593 | 0,0114 | |||||

| AMERICAN WATER CAPITAL CORP COMPANY GUAR 06/26 3.625 / DBT (US03040WBE49) | 6,88 | 1,15 | 0,2569 | 0,0148 | |||||

| JERSEY MIKE'S FUNDING LLC JMIKE 2024 1A A2 144A / ABS-O (US476681AD37) | 6,87 | −1,22 | 0,2565 | 0,0090 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 6,81 | −4,31 | 0,2543 | 0,0010 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 6,78 | −4,55 | 0,2532 | 0,0003 | |||||

| MARS INC SR UNSECURED 144A 03/35 5.2 / DBT (US571676BA26) | 6,76 | 0,2527 | 0,2527 | ||||||

| BAUSCH HEALTH COMPANIES INC 2025 TERM LOAN B / LON (XAC6903HAB06) | 6,73 | 0,2515 | 0,2515 | ||||||

| IDG000011701 / Indonesia Treasury Bond | 6,70 | 1,75 | 0,2503 | 0,0158 | |||||

| BARCLAYS PLC JR SUBORDINA 12/99 VAR / DBT (US06738EDC66) | 6,69 | 163,81 | 0,2497 | 0,1594 | |||||

| CLEARWATER ANALYTICS LLC 2025 TERM LOAN B / LON (US18512EAF97) | 6,68 | 0,2495 | 0,2495 | ||||||

| NZGOVDT541C9 / New Zealand Government Bond | 6,68 | 0,2494 | 0,2494 | ||||||

| US89352HBA68 / TransCanada PipeLines Ltd | 6,66 | −29,56 | 0,2487 | −0,0878 | |||||

| AU3CB0249928 / BNG Bank NV | 6,65 | −4,79 | 0,2483 | −0,0003 | |||||

| JETBLUE AIRWAYS CORP / JETBLUE SR SECURED 144A 09/31 9.875 / DBT (US476920AA15) | 6,64 | 64,81 | 0,2479 | 0,1045 | |||||

| US733174AL01 / Popular Inc | 6,62 | 1,25 | 0,2472 | 0,0145 | |||||

| US53218DAA63 / LIFE_22-BMR2 | 6,61 | −1,02 | 0,2469 | 0,0091 | |||||

| QSR / Restaurant Brands International Inc. | 6,55 | −8,62 | 0,2447 | −0,0106 | |||||

| VICI PROPERTIES LP SR UNSECURED 04/35 5.625 / DBT (US925650AK98) | 6,54 | 0,2444 | 0,2444 | ||||||

| US894164AA06 / Travel + Leisure Co | 6,53 | −0,26 | 0,2441 | 0,0108 | |||||

| US43289DAK90 / HILTON HOTELS 11/30/30 | 6,46 | −0,05 | 0,2415 | 0,0112 | |||||

| ARAMARK SERVICES INC. 2024 TERM LOAN B8 / LON (US03852JAV35) | 6,45 | 38,29 | 0,2410 | 0,0748 | |||||

| US912810TN81 / United States Treasury Note/Bond | 6,42 | −6,81 | 0,2398 | −0,0055 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 6,42 | 6,12 | 0,2398 | 0,0244 | |||||

| US925650AD55 / VICI Properties LP | 6,39 | −0,54 | 0,2388 | 0,0099 | |||||

| AMERICAN AIRLINES INC 2025 TERM LOAN B / LON (US02376CBT18) | 6,38 | 0,2384 | 0,2384 | ||||||

| UNITED KINGDOM GILT BONDS REGS 07/29 4.125 / DBT (GB00BQC82B83) | 6,38 | −3,11 | 0,2382 | 0,0038 | |||||

| T1SO34 / The Southern Company - Depositary Receipt (Common Stock) | 6,35 | 0,97 | 0,2371 | 0,0133 | |||||

| BURLINGTON STORES INC SR UNSECURED 12/27 1.25 / DBT (US122017AD81) | 6,32 | −6,06 | 0,2362 | −0,0035 | |||||

| US912810SL35 / United States Treasury Note/Bond | 6,28 | −6,92 | 0,2346 | −0,0057 | |||||

| CA89117F3M90 / TORONTO DOM BANK | 6,28 | −13,60 | 0,2344 | −0,0242 | |||||

| US03027WAM47 / American Tower Trust #1 | 6,20 | −0,59 | 0,2315 | 0,0095 | |||||

| LONG RIDGE ENERGY LLC TERM LOAN B / LON (BA000FWX6) | 6,16 | −2,27 | 0,2301 | 0,0057 | |||||

| US24703TAK25 / CORPORATE BONDS | 6,06 | −4,55 | 0,2262 | 0,0003 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 6,05 | −0,80 | 0,2261 | 0,0088 | |||||

| VAR ENERGI ASA SR UNSECURED 144A 05/35 6.5 / DBT (US92212WAG50) | 5,99 | 0,2236 | 0,2236 | ||||||

| US35564KWT23 / STACR_22-DNA4 | 5,97 | −0,86 | 0,2228 | 0,0086 | |||||

| RYBD34 / Royal Bank of Canada (Brasil) S.A. - Depositary Receipt (Common Stock) | 5,94 | −2,40 | 0,2220 | 0,0052 | |||||

| TXNM / TXNM Energy, Inc. | 5,84 | 4,08 | 0,2182 | 0,0183 | |||||

| FREDDIE MAC STACR REMIC TRUST STACR 2025 HQA1 M1 144A / ABS-MBS (US35564NGZ06) | 5,79 | −12,49 | 0,2164 | −0,0193 | |||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 5,79 | −2,15 | 0,2161 | 0,0056 | |||||

| CONNECTICUT AVENUE SECURITIES CAS 2025 R02 1M2 144A / ABS-MBS (US20754TAD46) | 5,77 | 0,2157 | 0,2157 | ||||||

| US432833AF84 / Hilton Domestic Operating Co Inc | 5,77 | −13,47 | 0,2155 | −0,0219 | |||||

| INRCIN / Indian Railway Finance Corporation Limited - Corporate Bond/Note | 5,72 | 0,21 | 0,2138 | 0,0104 | |||||

| BUNDESREPUBLIK DEUTSCHLAND BUN BONDS REGS 02/34 2.2 / DBT (DE000BU2Z023) | 5,69 | −12,19 | 0,2126 | −0,0182 | |||||

| US89356BAG32 / Transcanada Trust | 5,68 | 0,58 | 0,2122 | 0,0111 | |||||

| PHILIPPINE GOVERNMENT BOND SR UNSECURED 05/29 6.5 / DBT (PHY6972HMC79) | 5,64 | −12,82 | 0,2106 | −0,0197 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 5,63 | −3,46 | 0,2104 | 0,0027 | |||||

| BOH.PRB / Bank of Hawaii Corporation - Preferred Security | 0,22 | 0,00 | 5,57 | −1,56 | 0,2079 | 0,0066 | |||

| GB00BMV7TC88 / United Kingdom Gilt | 5,56 | −13,99 | 0,2078 | −0,0225 | |||||

| US55354GAM24 / MSCI INC MSCI 3 5/8 11/01/31 | 5,56 | −0,07 | 0,2077 | 0,0096 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 5,56 | −0,94 | 0,2076 | 0,0078 | |||||

| BA.PRA / The Boeing Company - Preferred Security | 0,08 | −50,02 | 5,54 | −43,80 | 0,2068 | −0,1440 | |||

| US15135BAX91 / Centene Corp | 5,52 | −12,51 | 0,2063 | −0,0185 | |||||

| HPE.PRC / Hewlett Packard Enterprise Company - Preferred Security | 0,11 | 0,00 | 5,52 | −9,75 | 0,2061 | −0,0116 | |||

| CLEAN HARBORS INC 2024 TERM LOAN B / LON (US18449EAH36) | 5,51 | −16,79 | 0,2057 | −0,0300 | |||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 5,50 | −13,06 | 0,2054 | −0,0198 | |||||

| US74730DAC74 / Qatar Petroleum | 5,47 | 1,28 | 0,2044 | 0,0120 | |||||

| NZGOVDT532C8 / NEW ZEALAND GVT | 5,45 | 0,2035 | 0,2035 | ||||||

| US00973RAD52 / Aker BP ASA | 5,38 | −2,22 | 0,2009 | 0,0050 | |||||

| BUSEP / First Busey Corporation - Preferred Stock | 0,22 | 5,37 | 0,2007 | 0,2007 | |||||

| US85917AAC45 / Sterling Bancorp/DE | 5,36 | −0,54 | 0,2004 | 0,0083 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 5,36 | 239,24 | 0,2002 | 0,1440 | |||||

| US11070TAM09 / Province of British Columbia Canada | 5,34 | −20,33 | 0,1993 | −0,0392 | |||||

| AIRSERVICES AUSTRALIA SR UNSECURED 05/30 2.2 / DBT (AU3CB0272292) | 5,27 | 5,72 | 0,1967 | 0,0194 | |||||

| GOOGL / Alphabet Inc. - Depositary Receipt (Common Stock) | 5,24 | 0,1959 | 0,1959 | ||||||

| US07586PAA93 / Becle SAB de CV | 5,22 | −9,87 | 0,1951 | −0,0113 | |||||

| AU3SG0001175 / TREASURY CORP VICTORIA LOCAL GOVT G 12/32 4.25 | 5,21 | −17,37 | 0,1946 | −0,0299 | |||||

| VAC / Marriott Vacations Worldwide Corporation | 5,21 | −9,98 | 0,1945 | −0,0115 | |||||

| CONNECTICUT AVENUE SECURITIES CAS 2024 R02 1M1 144A / ABS-MBS (US20754GAA85) | 5,18 | −22,04 | 0,1935 | −0,0431 | |||||

| US674599EF81 / Occidental Petroleum Corp | 5,14 | −1,91 | 0,1920 | 0,0054 | |||||

| US87264ABW45 / T-Mobile USA Inc | 5,10 | −20,49 | 0,1904 | −0,0378 | |||||

| PHY6972HNU68 / PHILIPPINES (REPUBLIC OF) | 5,06 | −17,73 | 0,1892 | −0,0300 | |||||

| IDG000010406 / Indonesia Treasury Bond | 5,05 | 1,73 | 0,1887 | 0,0119 | |||||

| XS2014278944 / BERKSHIRE HATHAWAY FINANCE COR COMPANY GUAR 06/39 2.375 | 5,05 | −7,75 | 0,1885 | −0,0063 | |||||

| XS2358483332 / Vmed O2 UK Financing I PLC | 5,02 | 10,34 | 0,1873 | 0,0255 | |||||

| US19828TAB26 / Columbia Pipelines Operating Co LLC | 5,00 | −15,38 | 0,1869 | −0,0236 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 4,99 | 8,35 | 0,1865 | 0,0224 | |||||

| XS2245488775 / Asian Infrastructure Investment Bank/The | 4,99 | −7,75 | 0,1864 | −0,0062 | |||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | 4,97 | 0,1857 | 0,1857 | ||||||

| USP3143NBK92 / Corp Nacional del Cobre de Chile | 4,96 | −1,51 | 0,1853 | 0,0060 | |||||

| US097023CW33 / BOEING CO 5.805 5/50 | 4,94 | −2,93 | 0,1845 | 0,0033 | |||||

| AU3SG0002447 / South Australian Government Financing Authority | 4,92 | −7,90 | 0,1837 | −0,0064 | |||||

| ONT / Province of Ontario Canada | 4,91 | 1,34 | 0,1836 | 0,0109 | |||||

| FREDDIE MAC STACR REMIC TRUST STACR 2025 HQA1 M2 144A / ABS-MBS (US35564NHA46) | 4,90 | 0,06 | 0,1831 | 0,0087 | |||||

| US292505AG96 / Encana Corp 6.5% Notes 2/1/38 | 4,90 | −17,82 | 0,1829 | −0,0293 | |||||

| US00912XBK90 / Air Lease Corp | 4,90 | 0,49 | 0,1829 | 0,0094 | |||||

| CVE47 / Cenovus Energy Inc | 4,89 | −5,60 | 0,1825 | −0,0018 | |||||

| PROVIDENT FINANCIAL SERVICES I SUBORDINATED 05/34 VAR / DBT (US74386TAA34) | 4,88 | 0,06 | 0,1822 | 0,0086 | |||||

| US72584DAF15 / KFC Holding Co | 4,87 | −23,06 | 0,1818 | −0,0435 | |||||

| US988498AP63 / Yum! Brands Inc | 4,85 | 0,83 | 0,1812 | 0,0099 | |||||

| PROVINCE OF ONTARIO CANADA SR UNSECURED REGS 01/34 3.1 / DBT (XS2757519017) | 4,83 | 8,19 | 0,1805 | 0,0215 | |||||

| WTFCN / Wintrust Financial Corporation - Preferred Stock | 0,18 | 4,72 | 0,1765 | 0,1765 | |||||

| CNOB / ConnectOne Bancorp, Inc. | 4,72 | 0,1764 | 0,1764 | ||||||

| AERCAP IRELAND CAPITAL DAC / A COMPANY GUAR 01/56 VAR / DBT (US00774MBQ78) | 4,68 | 0,1747 | 0,1747 | ||||||

| US74727PBB67 / Qatar Government International Bond | 4,67 | −4,33 | 0,1743 | 0,0007 | |||||

| US30216JAC99 / Export-Import Bank of India | 4,63 | 0,09 | 0,1730 | 0,0082 | |||||

| TRANSCANADA PIPELINES LTD JR SUBORDINA 06/65 VAR / DBT (US89352HBG39) | 4,61 | 0,00 | 0,1722 | 0,0080 | |||||

| US36179XNE21 / Ginnie Mae II Pool | 4,60 | 0,1719 | 0,1719 | ||||||

| US05609XAA90 / BX Trust 2022-CLS | 4,51 | −0,31 | 0,1686 | 0,0074 | |||||

| AS MILEAGE PLAN IP LIMITED TERM LOAN B / LON (XAG0541TAB17) | 4,48 | −0,20 | 0,1675 | 0,0075 | |||||

| US71677WAA09 / PETRORIO LUXEMBOURG SARL SR SECURED 144A 06/26 6.125 | 4,48 | 0,58 | 0,1674 | 0,0087 | |||||

| IDG000023607 / INDONESIA GOVERNMENT IDR 6.625% 02-15-34 | 4,48 | 2,82 | 0,1673 | 0,0122 | |||||

| US911365BN33 / United Rentals North America Inc | 4,44 | −17,04 | 0,1658 | −0,0247 | |||||

| US233046AK74 / DB Master Finance LLC | 4,43 | −0,38 | 0,1656 | 0,0071 | |||||

| XS2066744231 / Carnival PLC | 4,40 | 9,07 | 0,1644 | 0,0207 | |||||

| INTOWN 2025-STAY MORTGAGE TRUS TOWN 2025 STAY B 144A / ABS-MBS (US46117WAC64) | 4,37 | 0,1631 | 0,1631 | ||||||

| S1RE34 / Sempra - Depositary Receipt (Common Stock) | 4,35 | −3,64 | 0,1623 | 0,0018 | |||||

| T1SO34 / The Southern Company - Depositary Receipt (Common Stock) | 4,29 | 0,1601 | 0,1601 | ||||||

| US55292WAA80 / MC Brazil Downstream Trading SARL | 4,27 | −7,66 | 0,1594 | −0,0051 | |||||

| BX TRUST 2024-BIO BX 2024 BIO D 144A / ABS-MBS (US05612AAL08) | 4,26 | −0,16 | 0,1590 | 0,0072 | |||||

| US25755TAE01 / Domino's Pizza Master Issuer LLC | 4,23 | −0,05 | 0,1578 | 0,0073 | |||||

| US20754EAB11 / Connecticut Avenue Securities Trust, Series 2023-R06, Class 1M2 | 4,19 | −0,10 | 0,1567 | 0,0072 | |||||

| US161175BN35 / Charter Communications Operating LLC / Charter Communications Operating Capital | 4,19 | −0,88 | 0,1565 | 0,0060 | |||||

| XS1909193317 / Allergan Funding SCS | 4,17 | 9,87 | 0,1559 | 0,0207 | |||||

| US46590XAU00 / JBS USA LUX SA / JBS USA Food Co / JBS USA Finance Inc | 4,17 | −27,87 | 0,1556 | −0,0501 | |||||

| BOCA COMMERCIAL MORTGAGE TRUST BOCA 2024 BOCA A 144A / ABS-MBS (US096817AA90) | 4,15 | −0,29 | 0,1551 | 0,0068 | |||||

| CND10004GNL8 / China Government Bond | 4,14 | 0,98 | 0,1547 | 0,0087 | |||||

| US05609VAA35 / BX Commercial Mortgage Trust 2021-VOLT | 4,11 | 0,12 | 0,1537 | 0,0074 | |||||

| US718286BM88 / Philippine Government International Bond | 4,10 | 2,76 | 0,1532 | 0,0111 | |||||

| XS2385393587 / Cellnex Finance Co. SA | 4,10 | −5,46 | 0,1531 | −0,0013 | |||||

| US55354GAL41 / MSCI Inc | 4,07 | −18,83 | 0,1520 | −0,0265 | |||||

| UNITED RENTALS INC 2024 TERM LOAN B / LON (US91136EAL92) | 4,05 | −14,38 | 0,1512 | −0,0172 | |||||

| QUEENSLAND TREASURY CORP LOCAL GOVT G 144A 05/35 3.25 / DBT (XS3047457117) | 4,04 | 0,1509 | 0,1509 | ||||||

| BX COMMERCIAL MORTGAGE TRUST 2 BX 2024 XL5 A 144A / ABS-MBS (US05612GAA13) | 4,03 | −3,13 | 0,1504 | 0,0024 | |||||

| LBTYB / Liberty Global Ltd. | 4,03 | 3,79 | 0,1504 | 0,0123 | |||||

| CDP FINANCIAL INC COMPANY GUAR REGS 12/30 4.2 / DBT (CAC23264AW10) | 4,02 | −10,68 | 0,1500 | −0,0101 | |||||

| NORWAY GOVERNMENT BOND SR UNSECURED 144A REGS 06/35 3 / DBT (NO0013475558) | 4,01 | −16,22 | 0,1497 | −0,0207 | |||||

| US35564KTB51 / Freddie Mac STACR REMIC Trust 2022-HQA1 | 3,97 | −0,20 | 0,1484 | 0,0066 | |||||

| US12434FAA57 / BX Commercial Mortgage Trust 2021-CIP | 3,96 | −12,79 | 0,1477 | −0,0137 | |||||

| US35564KE476 / STACR_22-HQA3 | 3,95 | −22,31 | 0,1476 | −0,0335 | |||||

| ASIAN DEVELOPMENT BANK SR UNSECURED 01/29 3.625 / DBT (XS2749527417) | 3,95 | 10,06 | 0,1475 | 0,0197 | |||||

| US42307TAH14 / Kraft Heinz Foods Co | 3,94 | −20,25 | 0,1472 | −0,0288 | |||||

| IDG000013509 / Indonesia Treasury Bond | 3,92 | 3,13 | 0,1465 | 0,0111 | |||||

| US366651AE76 / Gartner Inc | 3,91 | −19,04 | 0,1462 | −0,0259 | |||||

| NZIFCDT012C3 / INTERNATIONAL FINANCE CORP | 3,91 | −31,72 | 0,1461 | −0,0579 | |||||

| SOUTH BOW CANADIAN INFRASTRUCT COMPANY GUAR 144A 03/55 VAR / DBT (US836720AH56) | 3,87 | −3,22 | 0,1447 | 0,0022 | |||||

| US902973BC96 / US Bancorp | 3,86 | −26,25 | 0,1442 | −0,0422 | |||||

| C2AC34 / CACI International Inc - Depositary Receipt (Common Stock) | 3,82 | 0,1426 | 0,1426 | ||||||

| NBN CO LTD SR UNSECURED REGS 03/35 5.35 / DBT (AU3CB0319200) | 3,78 | 0,1410 | 0,1410 | ||||||

| AU3SG0002165 / New South Wales Treasury Corp | 3,74 | 4,30 | 0,1397 | 0,0120 | |||||

| TREASURY CORP OF VICTORIA LOCAL GOVT G 11/40 5 / DBT (AU0000XVGHH6) | 3,68 | 3,95 | 0,1376 | 0,0114 | |||||

| CANADIAN GOVERNMENT BOND BONDS 09/29 3.5 / DBT (CA135087R895) | 3,66 | −23,70 | 0,1368 | −0,0341 | |||||

| US43731QAC24 / HPA_19-1 | 3,65 | −0,08 | 0,1363 | 0,0063 | |||||

| ZAYO ISSUER LLC ZAYO 2025 1A A2 144A / ABS-O (US98919WAA18) | 3,64 | −1,17 | 0,1360 | 0,0048 | |||||

| US71376LAE02 / Performance Food Group, Inc. | 3,64 | 1,14 | 0,1358 | 0,0078 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 3,64 | −0,55 | 0,1358 | 0,0056 | |||||

| US36179XLF14 / Ginnie Mae II Pool | 3,63 | −5,02 | 0,1356 | −0,0005 | |||||

| US455780CW44 / Indonesia Government International Bond | 3,63 | −4,60 | 0,1355 | 0,0001 | |||||

| US17291NAA90 / Citigroup Commercial Mortgage Trust 2023-SMRT | 3,62 | −0,17 | 0,1351 | 0,0061 | |||||

| DELTA 2 LUX SARL 2024 TERM LOAN B1 / LON (XAL2465BAW62) | 3,62 | −0,17 | 0,1350 | 0,0061 | |||||

| US36179XHX75 / GINNIE MAE II POOL | 3,61 | −4,97 | 0,1350 | −0,0004 | |||||

| AT0000A324S8 / REP OF AUSTRIA | 3,61 | 9,13 | 0,1348 | 0,0171 | |||||

| EUSHI FINANCE INC COMPANY GUAR 12/54 VAR / DBT (US29882DAB91) | 3,54 | −2,26 | 0,1323 | 0,0033 | |||||

| IN0020200112 / Republic of India | 3,53 | −25,60 | 0,1320 | −0,0371 | |||||

| XS2077546682 / E.ON SE | 3,53 | 10,21 | 0,1319 | 0,0178 | |||||

| AU3CB0271989 / QUEENSLAND TREAS | 3,53 | 4,07 | 0,1318 | 0,0111 | |||||

| US03969YAA64 / Ardagh Metal Packaging Finance USA LLC / Ardagh Metal Packaging Finance PLC | 3,52 | 0,92 | 0,1316 | 0,0073 | |||||

| INDOGB / Indonesia Treasury Bond | 3,51 | −20,29 | 0,1309 | −0,0256 | |||||

| IN0020220037 / INDIA GOVT INR 7.38% 06-20-27 | 3,50 | 3,79 | 0,1308 | 0,0107 | |||||

| XS2066744231 / Carnival PLC | 3,49 | −0,09 | 0,1305 | 0,0060 | |||||

| US50076QAR74 / Kraft Heinz Foods Co. | 3,47 | −21,79 | 0,1296 | −0,0284 | |||||

| US81211KBA79 / Sealed Air Corp | 3,46 | 0,70 | 0,1293 | 0,0069 | |||||

| US23371DAG97 / DAE Funding LLC | 3,41 | −27,33 | 0,1272 | −0,0397 | |||||

| US23802WAL54 / COLO_23-1 | 3,38 | −0,68 | 0,1262 | 0,0051 | |||||

| US75735GAA67 / Rede D'or Finance Sarl | 3,27 | 1,71 | 0,1220 | 0,0077 | |||||

| NYC COMMERCIAL MORTGAGE TRUST NYC 2025 3BP A 144A / ABS-MBS (US67120UAA51) | 3,26 | 0,09 | 0,1218 | 0,0058 | |||||

| US10554TAE55 / Braskem Netherlands Finance BV | 3,25 | −5,90 | 0,1216 | −0,0016 | |||||

| PHY6972FML13 / Philippine Government Bond | 3,22 | 2,81 | 0,1204 | 0,0088 | |||||

| VICI / VICI Properties Inc. | 3,22 | −0,19 | 0,1203 | 0,0054 | |||||

| CDEL / Corp Nacional del Cobre de Chile | 3,22 | −3,68 | 0,1202 | 0,0012 | |||||

| LONG RIDGE ENERGY LLC SR SECURED 144A 02/32 8.75 / DBT (US54288CAA18) | 3,21 | 0,38 | 0,1199 | 0,0061 | |||||

| US92539JAA34 / VERUS_22-INV1 | 3,20 | −24,24 | 0,1196 | −0,0309 | |||||

| US92212WAD20 / VAR ENERGI ASA | 3,20 | −1,11 | 0,1193 | 0,0043 | |||||

| AU3CB0301240 / NEW ZEALAND LOCAL GOVT FUNDING | 3,16 | 5,12 | 0,1180 | 0,0110 | |||||

| US20753AAA25 / Connecticut Avenue Securities Trust 2023-R03 | 3,15 | −0,76 | 0,1175 | 0,0046 | |||||

| UBER TECHNOLOGIES INC SR UNSECURED 09/34 4.8 / DBT (US90353TAP57) | 3,12 | −24,04 | 0,1166 | −0,0297 | |||||

| OMERS FINANCE TRUST COMPANY GUAR 144A 03/31 4.75 / DBT (US682142AL82) | 3,10 | −17,35 | 0,1157 | −0,0177 | |||||

| US12482HAA23 / CAMB Commercial Mortgage Trust 2019-LIFE | 3,08 | −0,06 | 0,1150 | 0,0053 | |||||

| US674599DD43 / OCCIDENTAL PETROLEUM CORP | 3,05 | −2,83 | 0,1140 | 0,0021 | |||||

| US36179XDD57 / Ginnie Mae II Pool | 3,05 | −5,01 | 0,1139 | −0,0004 | |||||

| DE0001102531 / Bundesrepublik Deutschland Bundesanleihe | 3,05 | −24,15 | 0,1138 | −0,0292 | |||||

| AU0000048274 / Treasury Corp of Victoria | 3,02 | 5,40 | 0,1129 | 0,0108 | |||||

| NEW ZEALAND GOVERNMENT BOND UNSECURED 05/36 4.25 / DBT (NZGOVDT536C9) | 3,01 | 6,33 | 0,1124 | 0,0116 | |||||

| CA12593CAR21 / CPPIB CAPITAL INC | 3,00 | −14,64 | 0,1122 | −0,0131 | |||||

| NO0012837642 / Norway Government Bond | 3,00 | −43,08 | 0,1120 | −0,0755 | |||||

| SOUTH STATE BANK NA SUBORDINATED 08/34 VAR / DBT (US45384BAD82) | 3,00 | −3,10 | 0,1119 | 0,0018 | |||||

| IN0020190362 / India Government Bond | 2,98 | 5,26 | 0,1114 | 0,0105 | |||||

| DYNASTY ACQUISITION CO INC 2024 1ST LIEN TERM LOAN B1 / LON (US26812CAN65) | 2,97 | −0,23 | 0,1111 | 0,0049 | |||||

| US87264ACQ67 / T-Mobile USA Inc | 2,97 | 0,54 | 0,1110 | 0,0057 | |||||

| US35564KWS40 / STACR_22-DNA4 | 2,97 | −9,32 | 0,1108 | −0,0057 | |||||

| US810064AE58 / SCOTT_23-SFS | 2,95 | −0,37 | 0,1102 | 0,0047 | |||||

| XS2622275969 / American Tower Corp | 2,93 | 9,24 | 0,1095 | 0,0140 | |||||

| VMED O2 UK FINANCING I PLC SR SECURED 144A 04/32 5.625 / DBT (XS2797211872) | 2,87 | 11,61 | 0,1074 | 0,0157 | |||||

| CA15135UAT66 / CENOVUS ENERGY INC SR UNSECURED 02/28 3.5 | 2,84 | 5,07 | 0,1061 | 0,0098 | |||||

| US35671DBJ37 / Freeport-McMoRan Inc | 2,83 | −19,58 | 0,1056 | −0,0196 | |||||

| OMERS FINANCE TRUST OMERS FINANCE TRUST / DBT (XS2989340943) | 2,82 | 7,95 | 0,1054 | 0,0123 | |||||

| US432833AN19 / HILTON DOMESTIC OPERATING CO INC 3.625% 02/15/2032 144A | 2,80 | −19,50 | 0,1046 | −0,0193 | |||||

| US57665RAL06 / Match Group Inc | 2,77 | 2,02 | 0,1036 | 0,0068 | |||||

| NZLGFDT009C0 / New Zealand Local Government Funding Agency Bond | 2,75 | 7,08 | 0,1029 | 0,0113 | |||||

| QUIKRETE HOLDINGS INC SR SECURED 144A 03/32 6.375 / DBT (US74843PAA84) | 2,75 | 0,1027 | 0,1027 | ||||||

| US912828Z781 / United States Treasury Note/Bond | 2,74 | −32,48 | 0,1024 | −0,0422 | |||||

| US20754KAJ07 / CAS_21-R02 | 2,74 | −0,18 | 0,1023 | 0,0046 | |||||

| AU3CB0222529 / Kommunalbanken AS | 2,73 | −17,11 | 0,1021 | −0,0153 | |||||

| EQT / EQT Corporation | 2,73 | −1,48 | 0,1019 | 0,0033 | |||||

| US29135LAJ98 / Abu Dhabi Government International Bond | 2,72 | −3,68 | 0,1016 | 0,0010 | |||||

| AU3CB0229227 / Inter-American Development Bank | 2,70 | 4,41 | 0,1009 | 0,0087 | |||||

| US36170HAA86 / GCAT_22-NQM4 | 2,65 | −2,14 | 0,0991 | 0,0026 | |||||

| US35564KH362 / Freddie Mac STACR REMIC Trust 2022-DNA6 | 2,65 | −14,65 | 0,0990 | −0,0116 | |||||

| C1MS34 / CMS Energy Corporation - Depositary Receipt (Common Stock) | 2,63 | 0,0982 | 0,0982 | ||||||

| US20753VBT44 / CORP CMO | 2,62 | −1,21 | 0,0978 | 0,0034 | |||||

| DE0001102515 / Bundesrepublik Deutschland Bundesanleihe | 2,59 | 8,73 | 0,0967 | 0,0119 | |||||

| US44107TAY29 / Host Hotels & Resorts LP | 2,58 | −24,44 | 0,0963 | −0,0252 | |||||

| US35564KL315 / Freddie Mac STACR REMIC Trust 2022-DNA7 | 2,54 | −13,18 | 0,0950 | −0,0093 | |||||

| IDG000018607 / Indonesia Treasury Bond | 2,54 | 1,77 | 0,0947 | 0,0060 | |||||

| US37045XDB91 / General Motors Financial Co Inc | 2,53 | 28,31 | 0,0945 | 0,0243 | |||||

| US247361ZW11 / Delta Air Lines 2020-1 Class A Pass Through Trust | 2,53 | −24,29 | 0,0944 | −0,0245 | |||||

| XS2280331898 / Indonesia Government International Bond | 2,52 | 8,82 | 0,0940 | 0,0117 | |||||

| US89364MCA09 / TRANSDIGM INC | 2,48 | −0,28 | 0,0928 | 0,0041 | |||||

| US67115YAC03 / OCCU_22-1 | 2,47 | −31,59 | 0,0922 | −0,0362 | |||||

| US207932AA28 / Fannie Mae Connecticut Avenue Securities | 2,46 | −5,34 | 0,0920 | −0,0007 | |||||

| QUIKRETE HOLDINGS INC SR UNSECURED 144A 03/33 6.75 / DBT (US74843PAB67) | 2,44 | −0,04 | 0,0910 | 0,0042 | |||||

| US20753DAA63 / Connecticut Avenue Securities Trust 2022-R09 | 2,43 | −9,53 | 0,0908 | −0,0049 | |||||

| US35671DCH61 / Freeport-McMoRan Inc | 2,40 | −22,69 | 0,0895 | −0,0209 | |||||

| US924922AC10 / VERUS_22-8 | 2,37 | −2,11 | 0,0884 | 0,0023 | |||||

| IDG000011107 / Indonesia Treasury Bond | 2,36 | 1,77 | 0,0881 | 0,0056 | |||||

| US958667AC17 / WESTERN MIDSTREAM OPERAT SR UNSECURED 02/30 4.05 | 2,34 | −37,07 | 0,0873 | −0,0449 | |||||

| PHILIPPINE GOVERNMENT BOND BONDS 04/35 6.375 / DBT (PH0000060345) | 2,31 | 0,0864 | 0,0864 | ||||||

| US33767JAA07 / FirstKey Homes 2020-SFR2 Trust | 2,30 | −2,54 | 0,0859 | 0,0019 | |||||

| US20754NAB10 / Connecticut Avenue Securities Trust 2022-R06 | 2,30 | −7,00 | 0,0858 | −0,0021 | |||||

| US90932LAH06 / United Airlines Inc | 2,29 | −1,46 | 0,0855 | 0,0028 | |||||

| US10554TAD72 / Braskem Netherlands Finance BV | 2,25 | −3,84 | 0,0842 | 0,0007 | |||||

| IN0020210095 / INDIA (REPUBLIC OF) | 2,23 | 6,33 | 0,0834 | 0,0086 | |||||

| AMERICAN AIRLINES INC 2025 TERM LOAN / LON (US02376CBS35) | 2,20 | 0,0822 | 0,0822 | ||||||

| US46590XAY22 / JBS USA LUX SA / JBS USA Food Co. / JBS USA Finance, Inc. | 2,18 | −0,36 | 0,0816 | 0,0035 | |||||

| US87264ABT16 / T-MOBILE USA INC 2.875% 02/15/2031 | 2,17 | 0,88 | 0,0812 | 0,0045 | |||||

| US33830TAC71 / Five Star Bancorp | 2,11 | 2,33 | 0,0789 | 0,0054 | |||||

| BW REAL ESTATE INC 144A 12/99 VAR / DBT (US05614HAA77) | 2,11 | 0,0787 | 0,0787 | ||||||

| US75735KAA79 / Rede D'or Finance Sarl | 2,11 | 1,54 | 0,0787 | 0,0048 | |||||

| TRANSDIGM INC 2024 TERM LOAN / LON (US89364MCD48) | 2,10 | −21,02 | 0,0785 | −0,0162 | |||||

| XS2231330965 / JOHNSON CONTROLS INTERNATIONAL SR UNSECURED 09/27 0.375 | 2,08 | −18,00 | 0,0776 | −0,0126 | |||||

| US87267WAA27 / T MOBILE US TRUST 2022 1 TMUST 2022 1A A 144A | 2,06 | −42,14 | 0,0770 | −0,0498 | |||||

| US37045XCM65 / General Motors Financial Co., Inc., Series B | 2,02 | −1,51 | 0,0756 | 0,0024 | |||||

| US19688LAA08 / COLT_22-5 | 2,01 | −33,45 | 0,0750 | −0,0324 | |||||

| US042859AA69 / Arroyo Mortgage Trust 2019-1 | 1,99 | −1,34 | 0,0744 | 0,0025 | |||||

| US345397B512 / Ford Motor Credit Co LLC | 1,97 | −0,66 | 0,0734 | 0,0030 | |||||

| US36179XFH44 / Government National Mortgage Association (GNMA) | 1,92 | −29,05 | 0,0715 | −0,0246 | |||||

| AUTONATION FIN TR 2025 1 12/30 FIXED 5.83 / ABS-O (US05330QAF90) | 1,87 | 0,0700 | 0,0700 | ||||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 1,86 | 27,87 | 0,0694 | 0,0177 | |||||

| XS2066744231 / Carnival PLC | 1,82 | −26,81 | 0,0681 | −0,0206 | |||||

| DELTA 2 LUX SARL 2024 TERM LOAN B2 / LON (XAL2465BAX46) | 1,81 | −0,17 | 0,0675 | 0,0030 | |||||

| XS2317058720 / International Bank for Reconstruction & Development | 1,80 | 10,88 | 0,0674 | 0,0095 | |||||

| US15135BAT89 / CORPORATE BONDS | 1,77 | 0,28 | 0,0660 | 0,0033 | |||||

| INTOWN 2025-STAY MORTGAGE TRUS TOWN 2025 STAY C 144A / ABS-MBS (US46117WAE21) | 1,74 | 0,0649 | 0,0649 | ||||||

| US36179XDE31 / GNMA II, 30 Year | 1,72 | 0,0641 | 0,0641 | ||||||

| XS2401848341 / INTL DEVELOPMENT ASSOCIATION | 1,66 | 10,69 | 0,0619 | 0,0086 | |||||

| NORDIC INVESTMENT BANK SR UNSECURED 11/26 4 / DBT (XS0702014027) | 1,66 | 10,10 | 0,0619 | 0,0083 | |||||

| ORGANON + CO 2024 USD TERM LOAN / LON (US68621XAG88) | 1,64 | −2,33 | 0,0612 | 0,0015 | |||||

| US44107TAZ93 / Host Hotels & Resorts LP | 1,63 | −1,16 | 0,0607 | 0,0022 | |||||

| ARAMARK SERVICES INC 2024 TERM LOAN B7 / LON (US03852JAU51) | 1,62 | −0,12 | 0,0604 | 0,0027 | |||||

| US345397B363 / Ford Motor Credit Co LLC | 1,59 | −2,16 | 0,0592 | 0,0015 | |||||

| US737446AR57 / Post Holdings, Inc. | 1,57 | −33,92 | 0,0586 | −0,0259 | |||||

| US737446AP91 / Post Holdings Inc | 1,53 | −34,15 | 0,0570 | −0,0255 | |||||

| EIB / EUROPEAN INVESTMENT BANK SR UNSECURED 03/21 9 | 1,52 | −35,28 | 0,0566 | −0,0267 | |||||

| US74730DAD57 / Qatar Petroleum | 1,50 | −5,53 | 0,0562 | −0,0005 | |||||

| US91282CET45 / U.S. Treasury Notes | 1,39 | −57,23 | 0,0517 | −0,0636 | |||||

| US674599DF90 / Occidental Petroleum Corp | 1,38 | −5,95 | 0,0514 | −0,0007 | |||||

| XS2185867913 / Airbus SE | 1,31 | −29,02 | 0,0488 | −0,0167 | |||||

| US912810TF57 / TREASURY BOND | 1,26 | −4,76 | 0,0471 | −0,0000 | |||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 1,23 | 0,0459 | 0,0459 | ||||||

| AUTONATION FIN TR 2025 1 09/32 5.63 / ABS-O (US05330QAG73) | 1,20 | 0,0448 | 0,0448 | ||||||

| CA135087L443 / Canadian Government Bond | 1,18 | 4,81 | 0,0439 | 0,0040 | |||||

| TRANSDIGM INC 2024 TERM LOAN K / LON (US89364MCB81) | 1,15 | −0,09 | 0,0430 | 0,0020 | |||||

| US20753YCH36 / Connecticut Avenue Securities Trust 2022-R04 | 1,15 | −7,64 | 0,0429 | −0,0014 | |||||

| DYNASTY ACQUISITION CO INC 2024 1ST LIEN TERM LOAN B2 / LON (US26812CAP14) | 1,13 | −0,18 | 0,0422 | 0,0019 | |||||

| VERUS SECURITIZATION TRUST 202 VERUS 2024 1 A1 144A / ABS-MBS (US92540EAA10) | 1,07 | −11,70 | 0,0401 | −0,0032 | |||||

| US35564KUW79 / Freddie Mac STACR REMIC Trust 2022-DNA3 | 1,02 | −59,48 | 0,0382 | −0,0516 | |||||

| US912810TJ79 / United States Treasury Note/Bond | 1,01 | −6,93 | 0,0377 | −0,0009 | |||||

| US12513GBJ76 / CDW LLC / CDW Finance Corp | 0,93 | 0,32 | 0,0347 | 0,0017 | |||||

| BOUGHT MXN/SOLD USD / DFE (N/A) | 0,85 | 0,0316 | 0,0316 | ||||||

| US20754LAA70 / Fannie Mae Connecticut Avenue Securities | 0,68 | −16,48 | 0,0254 | −0,0036 | |||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,63 | 0,0236 | 0,0236 | ||||||

| BOUGHT MXN/SOLD USD / DFE (N/A) | 0,62 | 0,0230 | 0,0230 | ||||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,60 | 0,0225 | 0,0225 | ||||||

| US20753XAA28 / Fannie Mae Connecticut Avenue Securities | 0,58 | −7,38 | 0,0216 | −0,0006 | |||||

| BOUGHT GBP/SOLD USD / DFE (N/A) | 0,57 | 0,0214 | 0,0214 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,57 | 0,0212 | 0,0212 | ||||||

| US61748HFT32 / Morgan Stanley Mortgage Loan Trust, Series 2004-9, Class 1A | 0,56 | −3,77 | 0,0210 | 0,0002 | |||||

| BOUGHT AUD/SOLD USD / DFE (N/A) | 0,55 | 0,0205 | 0,0205 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,52 | 0,0193 | 0,0193 | ||||||

| XS2433363509 / EUROPEAN INVT BK EUR REG S SR UNSEC 0.25% 01-20-32 | 0,50 | −94,02 | 0,0186 | −0,2775 | |||||

| US62877VAA98 / NBM US Holdings Inc | 0,49 | −0,20 | 0,0184 | 0,0008 | |||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,45 | 0,0169 | 0,0169 | ||||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,40 | 0,0149 | 0,0149 | ||||||

| BOUGHT GBP/SOLD USD / DFE (N/A) | 0,40 | 0,0149 | 0,0149 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,40 | 0,0148 | 0,0148 | ||||||

| BOUGHT NZD/SOLD USD / DFE (N/A) | 0,38 | 0,0141 | 0,0141 | ||||||

| US12655VAA26 / CSMC_19-NQM1 | 0,35 | −10,83 | 0,0133 | −0,0009 | |||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,33 | 0,0124 | 0,0124 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,33 | 0,0123 | 0,0123 | ||||||

| AU3CB0287910 / INTER-AMERICAN DEVELOPMENT BANK | 0,33 | −86,31 | 0,0122 | −0,0728 | |||||

| BOUGHT NOK/SOLD EUR / DFE (N/A) | 0,28 | 0,0104 | 0,0104 | ||||||

| US161175BU77 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0,25 | −76,81 | 0,0093 | −0,0291 | |||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,24 | 0,0091 | 0,0091 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,23 | 0,0087 | 0,0087 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | 0,21 | 0,0078 | 0,0078 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,21 | 0,0077 | 0,0077 | ||||||

| EURO-BUND FUTURE 0625 / DIR (DE000F1B2NG7) | 0,20 | 0,0076 | 0,0076 | ||||||

| BOUGHT NOK/SOLD EUR / DFE (N/A) | 0,18 | 0,0068 | 0,0068 | ||||||

| BOUGHT CAD/SOLD MXN / DFE (N/A) | 0,18 | 0,0066 | 0,0066 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,17 | 0,0065 | 0,0065 | ||||||

| BOUGHT CAD/SOLD MXN / DFE (N/A) | 0,17 | 0,0065 | 0,0065 | ||||||

| BOUGHT NOK/SOLD USD / DFE (N/A) | 0,16 | 0,0059 | 0,0059 | ||||||

| BOUGHT GBP/SOLD USD / DFE (N/A) | 0,16 | 0,0059 | 0,0059 | ||||||

| BOUGHT NOK/SOLD EUR / DFE (N/A) | 0,15 | 0,0056 | 0,0056 | ||||||

| BOUGHT NOK/SOLD EUR / DFE (N/A) | 0,15 | 0,0056 | 0,0056 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | 0,14 | 0,0054 | 0,0054 | ||||||

| BOUGHT NOK/SOLD USD / DFE (N/A) | 0,14 | 0,0053 | 0,0053 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | 0,13 | 0,0050 | 0,0050 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | 0,13 | 0,0048 | 0,0048 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | 0,13 | 0,0047 | 0,0047 | ||||||

| CANADIAN GOVERNMENT BOND BONDS 02/26 4.5 / DBT (CA135087R226) | 0,13 | 0,0047 | 0,0047 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | 0,13 | 0,0047 | 0,0047 | ||||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,12 | 0,0046 | 0,0046 | ||||||

| BOUGHT CAD/SOLD USD / DFE (N/A) | 0,12 | 0,0045 | 0,0045 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | 0,11 | 0,0042 | 0,0042 | ||||||

| BOUGHT NOK/SOLD USD / DFE (N/A) | 0,11 | 0,0042 | 0,0042 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,11 | 0,0041 | 0,0041 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,11 | 0,0040 | 0,0040 | ||||||

| BOUGHT GBP/SOLD USD / DFE (N/A) | 0,10 | 0,0037 | 0,0037 | ||||||

| BOUGHT GBP/SOLD USD / DFE (N/A) | 0,10 | 0,0037 | 0,0037 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | 0,10 | 0,0036 | 0,0036 | ||||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,10 | 0,0036 | 0,0036 | ||||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,10 | 0,0036 | 0,0036 | ||||||

| BOUGHT GBP/SOLD USD / DFE (N/A) | 0,09 | 0,0035 | 0,0035 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | 0,09 | 0,0034 | 0,0034 | ||||||

| BOUGHT MXN/SOLD USD / DFE (N/A) | 0,09 | 0,0032 | 0,0032 | ||||||

| USDCALL/CNHPUT 7.40 FXVANILLAOPTION---20251104 / DFE (N/A) | 0,08 | 0,0031 | 0,0031 | ||||||

| BOUGHT NOK/SOLD USD / DFE (N/A) | 0,08 | 0,0031 | 0,0031 | ||||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,08 | 0,0030 | 0,0030 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,08 | 0,0030 | 0,0030 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,08 | 0,0029 | 0,0029 | ||||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,08 | 0,0029 | 0,0029 | ||||||

| BOUGHT GBP/SOLD USD / DFE (N/A) | 0,08 | 0,0029 | 0,0029 | ||||||

| BOUGHT MXN/SOLD USD / DFE (N/A) | 0,08 | 0,0028 | 0,0028 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,07 | 0,0027 | 0,0027 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,07 | 0,0027 | 0,0027 | ||||||

| BOUGHT CAD/SOLD USD / DFE (N/A) | 0,07 | 0,0026 | 0,0026 | ||||||

| BOUGHT CAD/SOLD USD / DFE (N/A) | 0,07 | 0,0026 | 0,0026 | ||||||

| BOUGHT NOK/SOLD USD / DFE (N/A) | 0,07 | 0,0025 | 0,0025 | ||||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,07 | 0,0025 | 0,0025 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,07 | 0,0025 | 0,0025 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,06 | 0,0024 | 0,0024 | ||||||

| BOUGHT NOK/SOLD USD / DFE (N/A) | 0,06 | 0,0024 | 0,0024 | ||||||

| BOUGHT NOK/SOLD USD / DFE (N/A) | 0,06 | 0,0024 | 0,0024 | ||||||

| BOUGHT NOK/SOLD USD / DFE (N/A) | 0,06 | 0,0023 | 0,0023 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,06 | 0,0022 | 0,0022 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,06 | 0,0022 | 0,0022 | ||||||

| SOLD NOK/BOUGHT USD / DFE (N/A) | 0,06 | 0,0022 | 0,0022 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,06 | 0,0021 | 0,0021 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,06 | 0,0021 | 0,0021 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,06 | 0,0021 | 0,0021 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,05 | 0,0019 | 0,0019 | ||||||

| HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2007 6 ES 144A / ABS-MBS (US41165BAS97) | 0,05 | −5,77 | 0,0018 | −0,0000 | |||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,05 | 0,0017 | 0,0017 | ||||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,05 | 0,0017 | 0,0017 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | 0,04 | 0,0017 | 0,0017 | ||||||

| HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2007 4 ES / ABS-MBS (US41164YAQ44) | 0,04 | 18,92 | 0,0016 | 0,0003 | |||||

| SOLD SGD/BOUGHT USD / DFE (N/A) | 0,04 | 0,0016 | 0,0016 | ||||||

| SOLD SGD/BOUGHT USD / DFE (N/A) | 0,04 | 0,0016 | 0,0016 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,04 | 0,0016 | 0,0016 | ||||||

| BOUGHT CAD/SOLD USD / DFE (N/A) | 0,04 | 0,0016 | 0,0016 | ||||||

| HVMLT / HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2007 3 ES 144A | 0,04 | 0,00 | 0,0015 | 0,0001 | |||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,04 | 0,0013 | 0,0013 | ||||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,03 | 0,0013 | 0,0013 | ||||||

| BOUGHT NZD/SOLD USD / DFE (N/A) | 0,03 | 0,0011 | 0,0011 | ||||||

| BOUGHT CAD/SOLD USD / DFE (N/A) | 0,03 | 0,0011 | 0,0011 | ||||||

| BOUGHT AUD/SOLD USD / DFE (N/A) | 0,03 | 0,0010 | 0,0010 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,03 | 0,0010 | 0,0010 | ||||||

| BOUGHT CAD/SOLD USD / DFE (N/A) | 0,03 | 0,0010 | 0,0010 | ||||||

| BOUGHT MXN/SOLD USD / DFE (N/A) | 0,03 | 0,0010 | 0,0010 | ||||||

| BOUGHT MXN/SOLD USD / DFE (N/A) | 0,03 | 0,0010 | 0,0010 | ||||||

| BOUGHT GBP/SOLD USD / DFE (N/A) | 0,02 | 0,0009 | 0,0009 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,02 | 0,0009 | 0,0009 | ||||||

| BOUGHT CAD/SOLD USD / DFE (N/A) | 0,02 | 0,0009 | 0,0009 | ||||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,02 | 0,0009 | 0,0009 | ||||||

| BOUGHT GBP/SOLD USD / DFE (N/A) | 0,02 | 0,0008 | 0,0008 | ||||||

| SOLD NOK/BOUGHT USD / DFE (N/A) | 0,02 | 0,0008 | 0,0008 | ||||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,02 | 0,0008 | 0,0008 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,02 | 0,0007 | 0,0007 | ||||||

| BOUGHT GBP/SOLD USD / DFE (N/A) | 0,02 | 0,0007 | 0,0007 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,02 | 0,0006 | 0,0006 | ||||||

| BOUGHT MXN/SOLD USD / DFE (N/A) | 0,02 | 0,0006 | 0,0006 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,02 | 0,0006 | 0,0006 | ||||||

| BOUGHT NZD/SOLD USD / DFE (N/A) | 0,02 | 0,0006 | 0,0006 | ||||||

| BOUGHT NOK/SOLD USD / DFE (N/A) | 0,02 | 0,0006 | 0,0006 | ||||||

| BOUGHT GBP/SOLD USD / DFE (N/A) | 0,01 | 0,0005 | 0,0005 | ||||||

| BOUGHT AUD/SOLD USD / DFE (N/A) | 0,01 | 0,0005 | 0,0005 | ||||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,01 | 0,0005 | 0,0005 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,01 | 0,0005 | 0,0005 | ||||||

| BOUGHT NZD/SOLD USD / DFE (N/A) | 0,01 | 0,0004 | 0,0004 | ||||||

| BOUGHT NZD/SOLD USD / DFE (N/A) | 0,01 | 0,0004 | 0,0004 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,01 | 0,0004 | 0,0004 | ||||||

| BOUGHT AUD/SOLD USD / DFE (N/A) | 0,01 | 0,0004 | 0,0004 | ||||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,01 | 0,0004 | 0,0004 | ||||||

| HBANP / Huntington Bancshares Incorporated - Preferred Stock | 0,00 | 0,00 | 0,01 | −9,09 | 0,0004 | −0,0000 | |||

| BOUGHT SGD/SOLD USD / DFE (N/A) | 0,01 | 0,0004 | 0,0004 | ||||||

| BOUGHT AUD/SOLD USD / DFE (N/A) | 0,01 | 0,0004 | 0,0004 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,01 | 0,0003 | 0,0003 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | 0,01 | 0,0002 | 0,0002 | ||||||

| BOUGHT CAD/SOLD USD / DFE (N/A) | 0,01 | 0,0002 | 0,0002 | ||||||

| CLYDESDALE ACQ HOLDINGS INC 2025 DELAYED DRAW TERM LOAN / LON (US18972FAF99) | 0,00 | 0,0001 | 0,0001 | ||||||

| BOUGHT GBP/SOLD USD / DFE (N/A) | 0,00 | 0,0001 | 0,0001 | ||||||

| BOUGHT AUD/SOLD USD / DFE (N/A) | 0,00 | 0,0001 | 0,0001 | ||||||

| BOUGHT AUD/SOLD USD / DFE (N/A) | 0,00 | 0,0001 | 0,0001 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,00 | 0,0001 | 0,0001 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | 0,00 | 0,0001 | 0,0001 | ||||||

| BOUGHT NOK/SOLD USD / DFE (N/A) | 0,00 | 0,0001 | 0,0001 | ||||||

| SOLD NOK/BOUGHT USD / DFE (N/A) | 0,00 | 0,0001 | 0,0001 | ||||||

| BOUGHT NZD/SOLD USD / DFE (N/A) | 0,00 | 0,0001 | 0,0001 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | −0,01 | −0,0003 | −0,0003 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | −0,01 | −0,0004 | −0,0004 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | −0,01 | −0,0004 | −0,0004 | ||||||

| SOLD SGD/BOUGHT USD / DFE (N/A) | −0,02 | −0,0006 | −0,0006 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | −0,02 | −0,0006 | −0,0006 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | −0,02 | −0,0006 | −0,0006 | ||||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | −0,02 | −0,0007 | −0,0007 | ||||||

| BOUGHT SGD/SOLD USD / DFE (N/A) | −0,02 | −0,0007 | −0,0007 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | −0,02 | −0,0007 | −0,0007 | ||||||

| SOLD SGD/BOUGHT USD / DFE (N/A) | −0,02 | −0,0008 | −0,0008 | ||||||

| USDCALL/CNHPUT 7.65 FXVANILLAOPTION---20251104 / DFE (N/A) | −0,03 | −0,0010 | −0,0010 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | −0,03 | −0,0012 | −0,0012 | ||||||

| BOUGHT NZD/SOLD USD / DFE (N/A) | −0,03 | −0,0013 | −0,0013 | ||||||

| BOUGHT AUD/SOLD USD / DFE (N/A) | −0,03 | −0,0013 | −0,0013 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | −0,04 | −0,0013 | −0,0013 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | −0,04 | −0,0014 | −0,0014 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | −0,04 | −0,0014 | −0,0014 | ||||||

| SOLD EUR/BOUGHT USD / DFE (N/A) | −0,04 | −0,0014 | −0,0014 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | −0,04 | −0,0017 | −0,0017 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | −0,05 | −0,0018 | −0,0018 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | −0,05 | −0,0019 | −0,0019 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | −0,05 | −0,0020 | −0,0020 | ||||||

| SOLD CAD/BOUGHT USD / DFE (N/A) | −0,05 | −0,0020 | −0,0020 | ||||||

| BOUGHT EUR/SOLD NOK / DFE (N/A) | −0,06 | −0,0024 | −0,0024 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | −0,07 | −0,0025 | −0,0025 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | −0,07 | −0,0025 | −0,0025 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | −0,07 | −0,0027 | −0,0027 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | −0,07 | −0,0027 | −0,0027 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | −0,08 | −0,0028 | −0,0028 | ||||||

| SOLD NZD/BOUGHT USD / DFE (N/A) | −0,08 | −0,0028 | −0,0028 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | −0,08 | −0,0029 | −0,0029 | ||||||

| SOLD NOK/BOUGHT USD / DFE (N/A) | −0,08 | −0,0029 | −0,0029 | ||||||

| BOUGHT MXN/SOLD CAD / DFE (N/A) | −0,08 | −0,0029 | −0,0029 | ||||||

| BOUGHT MXN/SOLD CAD / DFE (N/A) | −0,08 | −0,0029 | −0,0029 | ||||||

| US912810TW80 / United States Treasury Note/Bond | −0,08 | −0,0031 | −0,0031 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | −0,08 | −0,0031 | −0,0031 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | −0,08 | −0,0031 | −0,0031 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | −0,08 | −0,0032 | −0,0032 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | −0,09 | −0,0034 | −0,0034 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | −0,09 | −0,0034 | −0,0034 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | −0,10 | −0,0036 | −0,0036 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | −0,12 | −0,0043 | −0,0043 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | −0,12 | −0,0045 | −0,0045 | ||||||

| SOLD NOK/BOUGHT USD / DFE (N/A) | −0,12 | −0,0046 | −0,0046 | ||||||

| BOUGHT JPY/SOLD USD / DFE (N/A) | −0,12 | −0,0047 | −0,0047 | ||||||

| SOLD GBP/BOUGHT USD / DFE (N/A) | −0,13 | −0,0048 | −0,0048 | ||||||

| SOLD MXN/BOUGHT USD / DFE (N/A) | −0,14 | −0,0051 | −0,0051 | ||||||

| BOUGHT EUR/SOLD USD / DFE (N/A) | −0,14 | −0,0053 | −0,0053 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | −0,14 | −0,0053 | −0,0053 | ||||||

| SOLD AUD/BOUGHT USD / DFE (N/A) | −0,16 | −0,0059 | −0,0059 | ||||||

| SOLD AUD/BOUGHT USD / DFE (N/A) | −0,16 | −0,0059 | −0,0059 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | −0,16 | −0,0059 | −0,0059 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | −0,18 | −0,0067 | −0,0067 | ||||||

| SOLD AUD/BOUGHT USD / DFE (N/A) | −0,19 | −0,0070 | −0,0070 | ||||||

| SOLD EUR/BOUGHT USD / DFE (N/A) | −0,19 | −0,0070 | −0,0070 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | −0,19 | −0,0073 | −0,0073 | ||||||

| SOLD EUR/BOUGHT USD / DFE (N/A) | −0,20 | −0,0075 | −0,0075 | ||||||

| SOLD NZD/BOUGHT USD / DFE (N/A) | −0,21 | −0,0077 | −0,0077 | ||||||

| SOLD EUR/BOUGHT USD / DFE (N/A) | −0,21 | −0,0078 | −0,0078 | ||||||

| SOLD EUR/BOUGHT USD / DFE (N/A) | −0,21 | −0,0078 | −0,0078 | ||||||

| CA135087Q723 / Canadian Government Bond | −0,22 | −0,0081 | −0,0081 | ||||||

| SOLD EUR/BOUGHT USD / DFE (N/A) | −0,24 | −0,0090 | −0,0090 | ||||||

| BOUGHT EUR/SOLD NOK / DFE (N/A) | −0,30 | −0,0111 | −0,0111 | ||||||

| SOLD GBP/BOUGHT USD / DFE (N/A) | −0,31 | −0,0116 | −0,0116 | ||||||

| SOLD GBP/BOUGHT USD / DFE (N/A) | −0,35 | −0,0129 | −0,0129 | ||||||

| SOLD GBP/BOUGHT USD / DFE (N/A) | −0,35 | −0,0129 | −0,0129 | ||||||

| SOLD MXN/BOUGHT USD / DFE (N/A) | −0,35 | −0,0129 | −0,0129 | ||||||

| BOUGHT EUR/SOLD NOK / DFE (N/A) | −0,36 | −0,0135 | −0,0135 | ||||||

| BOUGHT EUR/SOLD NOK / DFE (N/A) | −0,36 | −0,0135 | −0,0135 | ||||||

| BOUGHT EUR/SOLD NOK / DFE (N/A) | −0,41 | −0,0155 | −0,0155 | ||||||

| SOLD EUR/BOUGHT USD / DFE (N/A) | −0,42 | −0,0158 | −0,0158 | ||||||

| SOLD SGD/BOUGHT USD / DFE (N/A) | −0,44 | −0,0164 | −0,0164 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | −0,46 | −0,0173 | −0,0173 | ||||||

| US 10YR NOTE CBT 0925 / DIR (US91282CNF40) | −0,54 | −0,0201 | −0,0201 | ||||||

| BOUGHT MXN/SOLD CAD / DFE (N/A) | −0,59 | −0,0221 | −0,0221 | ||||||

| SOLD MXN/BOUGHT USD / DFE (N/A) | −0,64 | −0,0240 | −0,0240 | ||||||

| Euro-BTP Future Jun 17 0625 / DIR (DE000F1B2NF9) | −0,74 | −0,0276 | −0,0276 | ||||||

| SOLD EUR/BOUGHT USD / DFE (N/A) | −1,10 | −0,0411 | −0,0411 | ||||||

| SOLD NZD/BOUGHT USD / DFE (N/A) | −1,28 | −0,0479 | −0,0479 | ||||||

| SOLD NZD/BOUGHT USD / DFE (N/A) | −1,28 | −0,0479 | −0,0479 | ||||||

| SOLD NOK/BOUGHT USD / DFE (N/A) | −1,48 | −0,0554 | −0,0554 | ||||||

| SOLD MXN/BOUGHT USD / DFE (N/A) | −2,49 | −0,0932 | −0,0932 | ||||||

| SOLD CAD/BOUGHT USD / DFE (N/A) | −2,84 | −0,1063 | −0,1063 | ||||||

| SOLD EUR/BOUGHT USD / DFE (N/A) | −3,58 | −0,1335 | −0,1335 | ||||||

| SOLD EUR/BOUGHT USD / DFE (N/A) | −3,84 | −0,1433 | −0,1433 | ||||||

| SOLD SGD/BOUGHT USD / DFE (N/A) | −4,72 | −0,1764 | −0,1764 |