Grundläggande statistik

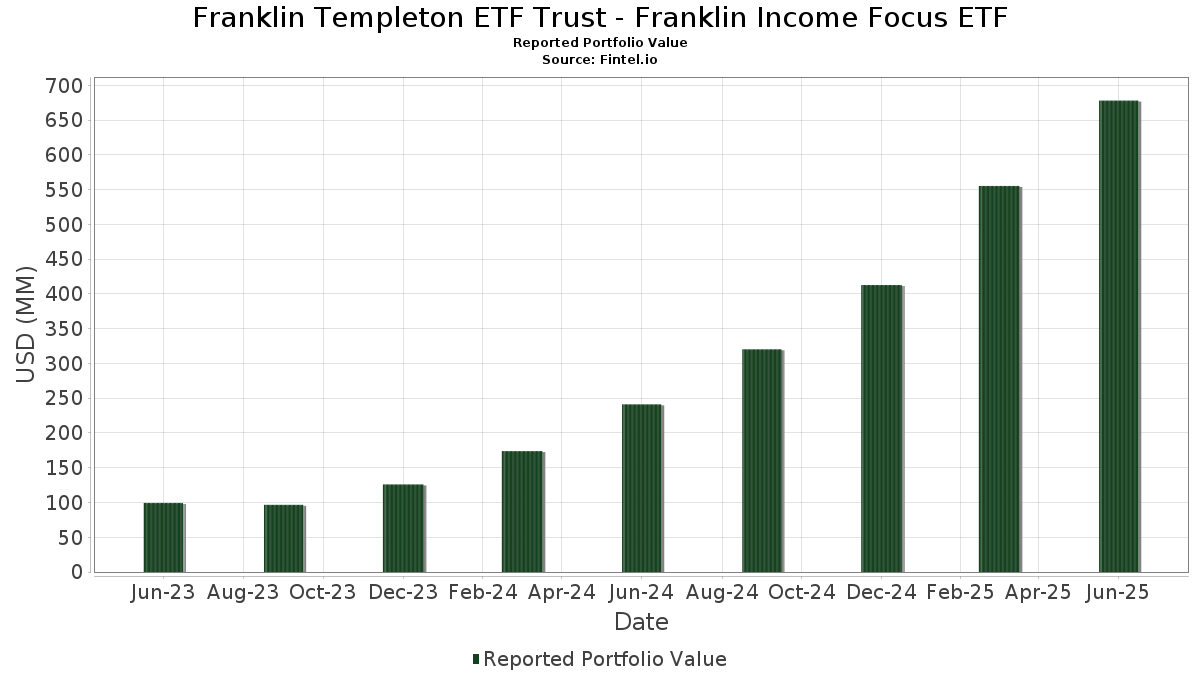

| Portföljvärde | $ 678 081 054 |

| Aktuella positioner | 296 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

Franklin Templeton ETF Trust - Franklin Income Focus ETF har redovisat 296 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 678 081 054 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). Franklin Templeton ETF Trust - Franklin Income Focus ETFs största innehav är Institutional Fiduciary Trust - Institutional Fiduciary Trust Money Market Portfolio (US:INFXX) , Johnson & Johnson (US:JNJ) , Chevron Corporation (US:CVX) , JPMorgan Chase & Co. (US:JPM) , and Exxon Mobil Corporation (US:XOM) . Franklin Templeton ETF Trust - Franklin Income Focus ETFs nya positioner inkluderar CHS/Community Health Systems Inc (US:US12543DBN93) , American Airlines, Inc. (US:US023771T402) , Venture Global LNG, Inc. (US:US92332YAA91) , CORP. NOTE (US:US88033GDQ01) , and Lowe's Companies, Inc. (US:LOW) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 10,02 | 1,4640 | 1,4640 | ||

| 0,08 | 6,30 | 0,9201 | 0,9179 | |

| 10,61 | 1,5509 | 0,9110 | ||

| 6,12 | 0,8947 | 0,8947 | ||

| 6,11 | 0,8929 | 0,8929 | ||

| 5,68 | 0,8297 | 0,8297 | ||

| 5,11 | 0,7470 | 0,7470 | ||

| 4,94 | 0,7217 | 0,7217 | ||

| 3,92 | 0,5734 | 0,5734 | ||

| 0,02 | 3,45 | 0,5049 | 0,5049 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 0,01 | 2,21 | 0,3233 | −0,6352 | |

| 0,05 | 2,28 | 0,3333 | −0,5590 | |

| 0,10 | 13,88 | 2,0288 | −0,3760 | |

| 6,96 | 1,0180 | −0,2579 | ||

| 4,81 | 0,7023 | −0,2427 | ||

| 7,14 | 1,0435 | −0,2255 | ||

| 18,14 | 18,14 | 2,6513 | −0,2242 | |

| 0,09 | 14,25 | 2,0834 | −0,2111 | |

| 0,10 | 10,90 | 1,5932 | −0,1906 | |

| 0,06 | 8,44 | 1,2343 | −0,1878 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-26 för rapporteringsperioden 2025-06-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| INFXX / Institutional Fiduciary Trust - Institutional Fiduciary Trust Money Market Portfolio | 18,14 | 12,90 | 18,14 | 12,90 | 2,6513 | −0,2242 | |||

| JNJ / Johnson & Johnson | 0,09 | 20,71 | 14,25 | 11,19 | 2,0834 | −0,2111 | |||

| CVX / Chevron Corporation | 0,10 | 20,69 | 13,88 | 3,30 | 2,0288 | −0,3760 | |||

| JPM / JPMorgan Chase & Co. | 0,04 | 20,67 | 12,52 | 42,62 | 1,8296 | 0,2587 | |||

| XOM / Exxon Mobil Corporation | 0,10 | 20,66 | 10,90 | 9,36 | 1,5932 | −0,1906 | |||

| U.S. Treasury Bonds / DBT (US912810UG12) | 10,71 | 51,97 | 1,5656 | 0,3042 | |||||

| US12543DBN93 / CHS/Community Health Systems Inc | 10,61 | 196,81 | 1,5509 | 0,9110 | |||||

| U.S. Treasury Notes / DBT (US91282CNC19) | 10,02 | 1,4640 | 1,4640 | ||||||

| PM / Philip Morris International Inc. | 0,05 | 20,70 | 9,06 | 38,50 | 1,3236 | 0,1533 | |||

| PEP / PepsiCo, Inc. | 0,06 | 20,68 | 8,44 | 6,27 | 1,2343 | −0,1878 | |||

| DUK / Duke Energy Corporation | 0,07 | 20,71 | 8,14 | 16,79 | 1,1893 | −0,0577 | |||

| U.S. Treasury Notes / DBT (US91282CMG32) | 7,14 | 0,69 | 1,0435 | −0,2255 | |||||

| VZ / Verizon Communications Inc. | 0,16 | 20,67 | 7,12 | 15,10 | 1,0406 | −0,0663 | |||

| LMT / Lockheed Martin Corporation | 0,02 | 20,63 | 7,07 | 25,05 | 1,0332 | 0,0216 | |||

| U.S. Treasury Bonds / DBT (US912810UJ50) | 6,96 | −2,30 | 1,0180 | −0,2579 | |||||

| ABBV / AbbVie Inc. | 0,04 | 20,67 | 6,79 | 6,90 | 0,9921 | −0,1442 | |||

| PG / The Procter & Gamble Company | 0,04 | 20,65 | 6,72 | 12,79 | 0,9825 | −0,0841 | |||

| TYIA / Johnson Controls International plc | 0,06 | 20,69 | 6,54 | 59,15 | 0,9556 | 0,2203 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0,09 | 20,63 | 6,33 | 14,68 | 0,9248 | −0,0626 | |||

| MRK / Merck & Co., Inc. | 0,08 | 57 111,51 | 6,30 | 52 358,33 | 0,9201 | 0,9179 | |||

| UNP / Union Pacific Corporation | 0,03 | 20,50 | 6,23 | 17,36 | 0,9113 | −0,0395 | |||

| Mizuho Markets Cayman LP / SN (US60701E3606) | 6,12 | 0,8947 | 0,8947 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 6,11 | 0,8929 | 0,8929 | ||||||

| HON / Honeywell International Inc. | 0,02 | 20,62 | 5,81 | 32,65 | 0,8487 | 0,0653 | |||

| SO / The Southern Company | 0,06 | 20,67 | 5,78 | 20,53 | 0,8451 | −0,0135 | |||

| KO / The Coca-Cola Company | 0,08 | 20,68 | 5,75 | 19,24 | 0,8399 | −0,0227 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0,08 | 20,71 | 5,71 | 15,98 | 0,8348 | −0,0465 | |||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 5,68 | 0,8297 | 0,8297 | ||||||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0,13 | 20,69 | 5,36 | 19,55 | 0,7831 | −0,0190 | |||

| US023771T402 / American Airlines, Inc. | 5,25 | 56,47 | 0,7667 | 0,1668 | |||||

| BNP / BNP Paribas SA | 5,11 | 0,7470 | 0,7470 | ||||||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0,09 | 20,67 | 4,98 | 17,16 | 0,7275 | −0,0329 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 4,94 | 0,7217 | 0,7217 | ||||||

| APD / Air Products and Chemicals, Inc. | 0,02 | 20,48 | 4,91 | 15,21 | 0,7173 | −0,0449 | |||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 4,81 | −9,00 | 0,7023 | −0,2427 | |||||

| RTX / RTX Corporation | 0,03 | 20,63 | 4,68 | 32,99 | 0,6841 | 0,0542 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 4,37 | −1,78 | 0,6386 | −0,1575 | |||||

| BA.PRA / The Boeing Company - Preferred Security | 0,06 | 20,57 | 4,33 | 37,07 | 0,6335 | 0,0674 | |||

| CommScope LLC / DBT (US20338MAA09) | 4,30 | 160,52 | 0,6280 | 0,3328 | |||||

| CSCO / Cisco Systems, Inc. | 0,06 | 20,70 | 4,26 | 35,72 | 0,6225 | 0,0608 | |||

| Mizuho Markets Cayman LP / STIV (US60701E2129) | 4,16 | 5,78 | 0,6075 | −0,0957 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618N5JE04) | 4,15 | 25,81 | 0,6070 | 0,0161 | |||||

| TFC / Truist Financial Corporation | 0,10 | 20,71 | 4,14 | 26,09 | 0,6055 | 0,0176 | |||

| U.S. Treasury Notes / DBT (US91282CLW90) | 4,01 | 0,05 | 0,5867 | −0,1314 | |||||

| U.S. Treasury Notes / DBT (US91282CJZ59) | 3,96 | 0,33 | 0,5787 | −0,1276 | |||||

| Mizuho Markets Cayman LP / SN (US60701E3523) | 3,92 | 0,5734 | 0,5734 | ||||||

| IBM / International Business Machines Corporation | 0,01 | 20,50 | 3,92 | 42,82 | 0,5729 | 0,0818 | |||

| ITW / Illinois Tool Works Inc. | 0,02 | 20,52 | 3,79 | 20,13 | 0,5541 | −0,0106 | |||

| XS1450864779 / China Government Bond - JPMorgan Chase | 3,79 | 9,64 | 0,5538 | −0,0647 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 3,77 | 0,08 | 0,5516 | −0,1232 | |||||

| ALB.PRA / Albemarle Corporation - Preferred Stock | 0,12 | 20,65 | 3,75 | 8,66 | 0,5484 | −0,0697 | |||

| BAC / Bank of America Corporation | 0,08 | 20,68 | 3,75 | 36,85 | 0,5477 | 0,0576 | |||

| DTE / DTE Energy Company | 0,03 | 20,63 | 3,71 | 15,56 | 0,5417 | −0,0323 | |||

| HPE / Hewlett Packard Enterprise Company | 0,18 | 20,70 | 3,69 | 59,97 | 0,5397 | 0,1266 | |||

| MDT / Medtronic plc | 0,04 | 20,67 | 3,63 | 17,06 | 0,5306 | −0,0244 | |||

| US92332YAA91 / Venture Global LNG, Inc. | 3,62 | 136,07 | 0,5290 | 0,2546 | |||||

| D / Dominion Energy, Inc. | 0,06 | 407,18 | 3,62 | 510,29 | 0,5290 | 0,0717 | |||

| US88033GDQ01 / CORP. NOTE | 3,57 | 2,21 | 0,5211 | −0,1032 | |||||

| LOW / Lowe's Companies, Inc. | 0,02 | 3,45 | 0,5049 | 0,5049 | |||||

| Merrill Lynch BV / SN (XS2887845159) | 3,43 | 0,5010 | 0,5010 | ||||||

| US88033GDK31 / Tenet Healthcare Corp | 3,38 | 0,60 | 0,4943 | −0,1073 | |||||

| Wells Fargo Bank NA / DBT (US95003X5591) | 3,26 | 0,4760 | 0,4760 | ||||||

| NEE / NextEra Energy, Inc. | 0,05 | 20,62 | 3,25 | 18,10 | 0,4750 | −0,0174 | |||

| Ginnie Mae II Pool / ABS-MBS (US3618N5JD21) | 3,24 | −0,74 | 0,4729 | −0,1105 | |||||

| SIE / Siemens Aktiengesellschaft | 0,01 | 0,00 | 3,18 | 11,92 | 0,4653 | −0,0439 | |||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 3,16 | −4,90 | 0,4624 | −0,1330 | |||||

| Mizuho Markets Cayman LP / SN (US60701E2871) | 3,14 | 26,55 | 0,4585 | 0,0149 | |||||

| US097023CY98 / BOEING CO 5.15 5/30 | 3,12 | 1,17 | 0,4556 | −0,0958 | |||||

| NEE.PRS / NextEra Energy, Inc. - Debt/Equity Composite Units | 0,07 | 20,65 | 3,11 | 18,83 | 0,4548 | −0,0138 | |||

| NEE.PRT / NextEra Energy, Inc. - Debt/Equity Composite Units | 0,07 | 20,69 | 3,08 | 17,27 | 0,4496 | −0,0199 | |||

| US404121AJ49 / HCA Inc | 3,02 | 0,67 | 0,4417 | −0,0956 | |||||

| ACN / Accenture plc | 0,01 | 3,01 | 0,4402 | 0,4402 | |||||

| US57763RAC16 / Mauser Packaging Solutions Holding Co. | 2,98 | 5,22 | 0,4357 | −0,0714 | |||||

| Caesars Entertainment Inc / DBT (US12769GAD25) | 2,94 | 215,20 | 0,4303 | 0,2630 | |||||

| Venture Global LNG Inc / DBT (US92332YAF88) | 2,92 | 207,59 | 0,4267 | 0,2567 | |||||

| MDLZ / Mondelez International, Inc. | 0,04 | 20,66 | 2,91 | 19,93 | 0,4256 | −0,0089 | |||

| MS / Morgan Stanley | 0,02 | 20,66 | 2,86 | 45,65 | 0,4185 | 0,0667 | |||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 2,83 | 9,93 | 0,4141 | −0,0471 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 2,74 | 5,19 | 0,4000 | −0,0656 | |||||

| US15089QAP90 / Celanese US Holdings LLC | 2,62 | 2,06 | 0,3833 | −0,0765 | |||||

| US131477AV34 / Calumet Specialty Products Partners LP / Calumet Finance Corp | 2,61 | 7,67 | 0,3817 | −0,0525 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 2,61 | 2,59 | 0,3816 | −0,0738 | |||||

| Beach Acquisition Bidco LLC / DBT (US07337JAC18) | 2,60 | 0,3797 | 0,3797 | ||||||

| THC / Tenet Healthcare Corporation | 2,59 | 1,97 | 0,3783 | −0,0760 | |||||

| U.S. Treasury Notes / DBT (US91282CKP58) | 2,58 | 0,51 | 0,3769 | −0,0823 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 2,57 | 11,35 | 0,3757 | −0,0374 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,56 | −3,98 | 0,3742 | −0,1030 | |||||

| US12429TAD63 / Mauser Packaging Solutions Holding Co | 2,54 | 143,44 | 0,3718 | 0,1848 | |||||

| Wells Fargo Bank NA / DBT (US95003X8801) | 2,54 | 14,61 | 0,3714 | −0,0255 | |||||

| TransDigm Inc / DBT (US893647BW65) | 2,52 | 0,3676 | 0,3676 | ||||||

| Ginnie Mae II Pool / ABS-MBS (US3618N5EW56) | 2,48 | −1,12 | 0,3619 | −0,0862 | |||||

| Merrill Lynch BV / SN (US59027W3108) | 2,44 | 23,14 | 0,3572 | 0,0020 | |||||

| BNP PARIBAS ISSUANCE B.V. / STIV (XS2817274199) | 0,06 | 0,00 | 2,43 | 12,53 | 0,3545 | −0,0312 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 2,36 | −4,34 | 0,3450 | −0,0966 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 2,36 | 0,3446 | 0,3446 | ||||||

| ADI / Analog Devices, Inc. | 0,01 | 20,49 | 2,31 | 42,22 | 0,3382 | 0,0470 | |||

| US345370DB39 / Ford Motor Co. | 2,30 | 1,82 | 0,3358 | −0,0679 | |||||

| USB / U.S. Bancorp | 0,05 | −35,17 | 2,28 | −38,68 | 0,3333 | −0,5590 | |||

| Wells Fargo Bank NA / DBT (US95003X3778) | 2,26 | 0,3305 | 0,3305 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 2,25 | 0,3285 | 0,3285 | ||||||

| COP / ConocoPhillips | 0,02 | 20,61 | 2,24 | 3,04 | 0,3272 | −0,0615 | |||

| TXN / Texas Instruments Incorporated | 0,01 | 9,38 | 2,21 | 30,37 | 0,3233 | −0,6352 | |||

| Merrill Lynch BV / SN (US59027W3280) | 2,19 | 14,36 | 0,3202 | −0,0227 | |||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AB20) | 2,17 | 0,3167 | 0,3167 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 2,12 | 7,96 | 0,3091 | −0,0415 | |||||

| US37045XED49 / General Motors Financial Co., Inc. | 2,11 | 2,04 | 0,3077 | −0,0616 | |||||

| US947075AU14 / Weatherford International Ltd | 2,10 | 99,24 | 0,3075 | 0,1184 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 2,08 | 10,50 | 0,3047 | −0,0330 | |||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 2,07 | 0,3020 | 0,3020 | ||||||

| US92840MAB81 / Vistra Corp | 2,05 | −0,49 | 0,2996 | −0,0689 | |||||

| XS2066744231 / Carnival PLC | 2,05 | 0,2993 | 0,2993 | ||||||

| OPAL BIDCO / DBT (US68348BAA17) | 2,04 | 0,2985 | 0,2985 | ||||||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0,02 | 20,57 | 2,03 | 18,41 | 0,2961 | −0,0102 | |||

| XEL / Xcel Energy Inc. | 0,03 | 20,66 | 2,01 | 16,09 | 0,2933 | −0,0161 | |||

| US1248EPBT92 / CCO Holdings LLC / CCO Holdings Capital Corp | 1,99 | 1,17 | 0,2916 | −0,0612 | |||||

| Twitter Inc Term Loan / LON (US90184NAG34) | 1,95 | −2,21 | 0,2845 | −0,0717 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,94 | −2,31 | 0,2842 | −0,0721 | |||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 1,93 | 7,23 | 0,2817 | −0,0401 | |||||

| U.S. Treasury Bonds / DBT (US912810UE63) | 1,91 | −3,30 | 0,2787 | −0,0741 | |||||

| US830867AB33 / Delta Air Lines Inc / SkyMiles IP Ltd | 1,91 | 0,69 | 0,2785 | −0,0603 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,89 | −2,57 | 0,2766 | −0,0710 | |||||

| US579063AB46 / Condor Merger Sub Inc | 1,89 | 278,00 | 0,2763 | 0,1868 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,87 | −2,45 | 0,2739 | −0,0698 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 1,82 | 8,29 | 0,2655 | −0,0347 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618N5MQ96) | 1,80 | 0,2631 | 0,2631 | ||||||

| US694308JP35 / PACIFIC GAS + ELECTRIC 1ST MORTGAGE 01/26 3.15 | 1,78 | 0,34 | 0,2606 | −0,0574 | |||||

| US15135BAX91 / Centene Corp | 1,75 | 2,10 | 0,2557 | −0,0510 | |||||

| US06738ECE32 / Barclays PLC | 1,66 | 1,71 | 0,2431 | −0,0497 | |||||

| SRE / Sempra | 0,02 | 20,70 | 1,65 | 28,16 | 0,2416 | 0,0108 | |||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 1,65 | 8,27 | 0,2411 | −0,0316 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 1,64 | 1,42 | 0,2396 | −0,0496 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 1,63 | 1,37 | 0,2384 | −0,0494 | |||||

| US20338QAA13 / CommScope, Inc. | 1,60 | 5,14 | 0,2331 | −0,0384 | |||||

| Clydesdale Acquisition Holdings Inc / DBT (US18972EAD76) | 1,54 | 1,92 | 0,2251 | −0,0454 | |||||

| N1RG34 / NRG Energy, Inc. - Depositary Receipt (Common Stock) | 1,53 | 3,52 | 0,2235 | −0,0410 | |||||

| US969457BX79 / WILLIAMS COS INC 3.5% 11/15/2030 | 1,51 | 1,20 | 0,2212 | −0,0465 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1,51 | −3,71 | 0,2200 | −0,0598 | |||||

| US257867BA88 / Rr Donnelley & Sons Bond | 1,50 | 0,2194 | 0,2194 | ||||||

| US131347CN48 / Calpine Corp | 1,50 | 1,49 | 0,2191 | −0,0452 | |||||

| US06051GKQ19 / Bank of America Corp | 1,48 | 1,86 | 0,2158 | −0,0437 | |||||

| US345370DA55 / Ford Motor Co | 1,48 | 2,29 | 0,2157 | −0,0425 | |||||

| Vistra Operations Co LLC / DBT (US92840VAR33) | 1,46 | 2,52 | 0,2141 | −0,0415 | |||||

| US92840VAH50 / VISTRA OPERATIONS CO LLC 4.375% 05/01/2029 144A | 1,46 | 2,60 | 0,2138 | −0,0413 | |||||

| US23918KAS78 / DaVita Inc | 1,46 | 4,07 | 0,2130 | −0,0376 | |||||

| US61747YFE05 / Morgan Stanley | 1,42 | 1,64 | 0,2082 | −0,0426 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,40 | −2,16 | 0,2052 | −0,0515 | |||||

| US03969AAR14 / Ardagh Packaging Finance PLC / Ardagh Holdings USA Inc | 1,40 | −6,48 | 0,2047 | −0,0633 | |||||

| Merrill Lynch BV / SN (US59027W2373) | 1,38 | 19,34 | 0,2021 | −0,0052 | |||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 1,37 | 3,24 | 0,2001 | −0,0373 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618N5PJ27) | 1,35 | 0,1978 | 0,1978 | ||||||

| US1248EPBX05 / CCO Holdings LLC / CCO Holdings Capital Corp | 1,34 | 2,06 | 0,1956 | −0,0390 | |||||

| US345397C684 / Ford Motor Credit Co. LLC | 1,33 | 0,83 | 0,1945 | −0,0416 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618N5PK99) | 1,32 | 0,1930 | 0,1930 | ||||||

| Wells Fargo Bank NA / DBT (US95003X2036) | 1,30 | −17,20 | 0,1893 | −0,0907 | |||||

| US03027XCD03 / American Tower Corp | 1,29 | 0,94 | 0,1885 | −0,0402 | |||||

| US31556TAA79 / Fertitta Entertainment LLC / Fertitta Entertainment Finance Co Inc | 1,26 | 3,96 | 0,1842 | −0,0327 | |||||

| US61747YEY77 / Morgan Stanley | 1,25 | 1,14 | 0,1822 | −0,0383 | |||||

| US1248EPCB75 / CCO Holdings LLC / CCO Holdings Capital Corp 5.375% 06/01/2029 144A | 1,25 | 2,98 | 0,1822 | −0,0345 | |||||

| BNP / BNP Paribas SA | 1,23 | 18,79 | 0,1802 | −0,0056 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,22 | −2,47 | 0,1788 | −0,0457 | |||||

| US78433BAB45 / SCIH Salt Holdings Inc | 1,22 | 1,75 | 0,1788 | −0,0364 | |||||

| US629377CR16 / NRG ENERGY INC 3.625% 02/15/2031 144A | 1,22 | 3,85 | 0,1777 | −0,0317 | |||||

| EIX / Edison International | 0,02 | 20,58 | 1,21 | 5,59 | 0,1768 | −0,0282 | |||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1,19 | −5,70 | 0,1741 | −0,0521 | |||||

| US11135FBL40 / Broadcom Inc | 1,18 | 1,47 | 0,1718 | −0,0355 | |||||

| US1248EPCD32 / CCO Holdings LLC / CCO Holdings Capital Corp. | 1,16 | 4,40 | 0,1701 | −0,0293 | |||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 1,16 | −36,24 | 0,1698 | −0,1563 | |||||

| Merrill Lynch BV / SN (US59027W2944) | 1,15 | 18,92 | 0,1682 | −0,0051 | |||||

| US95000U3D31 / Wells Fargo & Co | 1,13 | 1,71 | 0,1647 | −0,0337 | |||||

| US78433BAA61 / CORP. NOTE | 1,13 | 2,46 | 0,1646 | −0,0322 | |||||

| US62482BAA08 / Mozart Debt Merger Sub Inc | 1,09 | 2,64 | 0,1592 | −0,0308 | |||||

| US72147KAK43 / Pilgrim's Pride Corp 6.250%, Due 07/01/33 | 1,06 | 2,12 | 0,1547 | −0,0308 | |||||

| US674599ED34 / Occidental Petroleum Corp | 1,06 | 0,67 | 0,1546 | −0,0335 | |||||

| US03969YAB48 / Ardagh Metal Packaging Finance USA LLC / Ardagh Metal Packaging Finance PLC | 1,05 | 7,14 | 0,1536 | −0,0219 | |||||

| HRI / Herc Holdings Inc. | 1,04 | 0,1527 | 0,1527 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1,04 | 0,98 | 0,1513 | −0,0323 | |||||

| US90932LAH06 / United Airlines Inc | 1,03 | 2,58 | 0,1512 | −0,0293 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 1,03 | 0,1512 | 0,1512 | ||||||

| DVAI34 / DaVita Inc. - Depositary Receipt (Common Stock) | 1,03 | 0,1510 | 0,1510 | ||||||

| US14040HCY99 / Capital One Financial Corp. | 1,03 | 2,38 | 0,1508 | −0,0296 | |||||

| T1SO34 / The Southern Company - Depositary Receipt (Common Stock) | 1,03 | 0,49 | 0,1508 | −0,0329 | |||||

| Quikrete Holdings Inc / DBT (US74843PAA84) | 1,03 | 2,09 | 0,1504 | −0,0299 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 1,03 | 1,78 | 0,1502 | −0,0306 | |||||

| US548661EL74 / Lowe's Cos., Inc. | 1,01 | 1,51 | 0,1478 | −0,0305 | |||||

| US126650DU15 / CVS Health Corp. | 1,01 | 2,03 | 0,1472 | −0,0296 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 1,01 | 0,1472 | 0,1472 | ||||||

| US00253XAB73 / American Airlines Inc/AAdvantage Loyalty IP Ltd | 1,00 | 2,04 | 0,1461 | −0,0292 | |||||

| US64110LAT35 / Netflix Inc | 1,00 | 0,81 | 0,1456 | −0,0313 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,99 | 0,10 | 0,1446 | −0,0323 | |||||

| US05526DBX21 / BATSLN 7 3/4 10/19/32 | 0,98 | 1,03 | 0,1439 | −0,0306 | |||||

| Rivian Holdings LLC/Rivian LLC/Rivian Automotive LLC / DBT (US76954LAD10) | 0,98 | 0,1437 | 0,1437 | ||||||

| US98313RAG11 / Wynn Macau Ltd | 0,98 | 0,72 | 0,1434 | −0,0309 | |||||

| US25830JAA97 / Dornoch Debt Merger Sub Inc | 0,97 | 1,79 | 0,1417 | −0,0287 | |||||

| US185899AN14 / Cleveland-Cliffs Inc | 0,97 | −0,10 | 0,1415 | −0,0320 | |||||

| US69331CAJ71 / PG&E Corp | 0,95 | −0,83 | 0,1393 | −0,0327 | |||||

| US131347CR51 / Calpine Corp | 0,95 | 4,06 | 0,1388 | −0,0246 | |||||

| CLF / Cleveland-Cliffs Inc. | 0,94 | 0,1380 | 0,1380 | ||||||

| US3132DWG800 / Freddie Mac Pool | 0,94 | −2,09 | 0,1372 | −0,0343 | |||||

| US30251GBC06 / FMG Resources August 2006 Pty Ltd | 0,94 | 3,43 | 0,1367 | −0,0251 | |||||

| US31418ER771 / UMBS | 0,93 | −2,42 | 0,1355 | −0,0345 | |||||

| US38141GA534 / Goldman Sachs Group, Inc. (The) | 0,91 | 1,33 | 0,1334 | −0,0278 | |||||

| US88632QAE35 / Picard Midco, Inc. | 0,91 | 3,77 | 0,1329 | −0,0238 | |||||

| US87264ACY91 / T-Mobile USA Inc | 0,91 | 1,34 | 0,1325 | −0,0276 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618N5MR79) | 0,89 | 0,1296 | 0,1296 | ||||||

| US92840VAQ59 / Vistra Operations Co. LLC | 0,88 | 2,33 | 0,1285 | −0,0254 | |||||

| US37045XEN21 / General Motors Financial Co Inc | 0,88 | 1,04 | 0,1280 | −0,0270 | |||||

| BNP Paribas Issuance BV / SN (XS2804852924) | 0,85 | −7,30 | 0,1244 | −0,0400 | |||||

| US629377CT71 / NRG Energy Inc | 0,82 | 1,73 | 0,1204 | −0,0244 | |||||

| US12769GAA85 / Caesars Entertainment Inc | 0,82 | 3,82 | 0,1194 | −0,0214 | |||||

| US18453HAA41 / Clear Channel Worldwide Holdings Inc 5.125% 08/15/2027 144A | 0,81 | 2,27 | 0,1186 | −0,0234 | |||||

| Wynn Resorts Finance LLC / Wynn Resorts Capital Corp / DBT (US983133AD10) | 0,81 | 3,34 | 0,1178 | −0,0218 | |||||

| US925650AD55 / VICI Properties LP | 0,80 | 1,79 | 0,1166 | −0,0237 | |||||

| US14448CAQ78 / Carrier Global Corp | 0,79 | 1,67 | 0,1155 | −0,0237 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0,79 | 0,1154 | 0,1154 | ||||||

| US35671DBJ37 / Freeport-McMoRan Inc | 0,79 | 1,55 | 0,1151 | −0,0238 | |||||

| US013822AG68 / Alcoa Nederland Holding BV | 0,79 | 2,75 | 0,1150 | −0,0220 | |||||

| US18453HAE62 / Clear Channel Outdoor Holdings Inc | 0,79 | 1,95 | 0,1149 | −0,0231 | |||||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 0,79 | 1,42 | 0,1148 | −0,0239 | |||||

| US30251GBE61 / FMG RESOURCES AUGUST 2006 | 0,78 | 3,03 | 0,1146 | −0,0215 | |||||

| US68389XCJ28 / Oracle Corp | 0,78 | 1,43 | 0,1139 | −0,0236 | |||||

| US983130AX35 / Wynn Las Vegas LLC / Wynn Las Vegas Capital Corp | 0,78 | 1,17 | 0,1134 | −0,0239 | |||||

| US16412XAJ46 / Cheniere Corpus Christi Holdings LLC | 0,77 | 0,92 | 0,1128 | −0,0239 | |||||

| US14040HCS22 / CAPITAL ONE FINANCIAL CORPORATION | 0,77 | 0,39 | 0,1127 | −0,0247 | |||||

| US40434LAN55 / HP Inc | 0,77 | 0,66 | 0,1119 | −0,0242 | |||||

| US983133AC37 / Wynn Resorts Finance LLC / Wynn Resorts Capital Corp | 0,75 | 3,04 | 0,1092 | −0,0205 | |||||

| US131347CP95 / Calpine Corp | 0,74 | 2,92 | 0,1083 | −0,0206 | |||||

| US31556TAC36 / Fertitta Entertainment LLC / Fertitta Entertainment Finance Co Inc | 0,74 | 6,65 | 0,1080 | −0,0159 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBM64) | 0,73 | 1,66 | 0,1073 | −0,0221 | |||||

| JetBlue Airways Corp / JetBlue Loyalty LP / DBT (US476920AA15) | 0,73 | −1,35 | 0,1067 | −0,0259 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0,73 | −0,41 | 0,1064 | −0,0244 | |||||

| POST / Post Holdings, Inc. | 0,72 | 2,27 | 0,1053 | −0,0209 | |||||

| BLCO / Bausch + Lomb Corporation | 0,71 | 0,57 | 0,1031 | −0,0224 | |||||

| T1SO34 / The Southern Company - Depositary Receipt (Common Stock) | 0,71 | 0,1031 | 0,1031 | ||||||

| ARES.PRB / Ares Management Corporation - Preferred Security | 0,01 | 20,57 | 0,68 | 32,61 | 0,0988 | 0,0075 | |||

| US599191AA16 / Mileage Plus Holdings LLC / Mileage Plus Intellectual Property Assets Ltd | 0,67 | −11,33 | 0,0972 | −0,0371 | |||||

| BBD.A / Bombardier Inc. | 0,63 | 4,65 | 0,0922 | −0,0157 | |||||

| US88167AAK79 / Teva Pharmaceutical Finance Netherlands III BV | 0,62 | 1,30 | 0,0911 | −0,0191 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,62 | 1,98 | 0,0902 | −0,0182 | |||||

| US893647BR70 / TransDigm, Inc. | 0,61 | 0,66 | 0,0897 | −0,0194 | |||||

| US161175AY09 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0,60 | 0,00 | 0,0877 | −0,0197 | |||||

| US14040HBK05 / Capital One Financial Corp | 0,59 | 0,51 | 0,0869 | −0,0190 | |||||

| US49327V2C76 / KeyBank NA/Cleveland OH | 0,59 | 0,85 | 0,0868 | −0,0185 | |||||

| US68389XCE31 / Oracle Corp | 0,59 | 1,89 | 0,0867 | −0,0175 | |||||

| US35805BAB45 / Fresenius Medical Care US Finance III Inc | 0,56 | 2,39 | 0,0816 | −0,0161 | |||||

| US46590XAY22 / JBS USA LUX SA / JBS USA Food Co. / JBS USA Finance, Inc. | 0,55 | 1,30 | 0,0797 | −0,0167 | |||||

| US054989AB41 / BAT CAPITAL CORP 6.421000% 08/02/2033 | 0,54 | 1,88 | 0,0794 | −0,0161 | |||||

| US115236AC57 / Brown & Brown, Inc. | 0,54 | 2,46 | 0,0792 | −0,0154 | |||||

| US045054AL70 / Ashtead Capital Inc | 0,54 | 1,70 | 0,0788 | −0,0161 | |||||

| US172967PA33 / CITIGROUP INC | 0,54 | 1,51 | 0,0787 | −0,0163 | |||||

| US75079LAB71 / Rain Carbon, Inc. | 0,54 | 0,94 | 0,0785 | −0,0167 | |||||

| US03938LBF04 / ArcelorMittal SA | 0,53 | 2,11 | 0,0780 | −0,0155 | |||||

| US92840VAP76 / Vistra Operations Co. LLC | 0,53 | 1,34 | 0,0777 | −0,0161 | |||||

| US808513CJ29 / Charles Schwab Corp. (The) | 0,53 | 0,57 | 0,0776 | −0,0169 | |||||

| Endo Finance Holdings Inc / DBT (US29281RAA77) | 0,53 | 1,54 | 0,0775 | −0,0160 | |||||

| R2RX34 / Regal Rexnord Corporation - Depositary Receipt (Common Stock) | 0,53 | 1,73 | 0,0772 | −0,0157 | |||||

| US92840VAG77 / Vistra Operations Co LLC | 0,53 | 0,96 | 0,0772 | −0,0165 | |||||

| US89788NAA81 / Truist Financial Corp. | 0,53 | 2,33 | 0,0770 | −0,0152 | |||||

| Macquarie Airfinance Holdings Ltd / DBT (US55609NAC20) | 0,52 | 0,97 | 0,0763 | −0,0162 | |||||

| US808513CE32 / Charles Schwab Corp/The | 0,52 | 1,56 | 0,0761 | −0,0155 | |||||

| US914906AU68 / Univision Communications Inc | 0,52 | 0,58 | 0,0759 | −0,0165 | |||||

| DVAI34 / DaVita Inc. - Depositary Receipt (Common Stock) | 0,52 | 2,98 | 0,0758 | −0,0143 | |||||

| US17327CAR43 / Citigroup Inc | 0,52 | 2,17 | 0,0758 | −0,0151 | |||||

| US49456BAX91 / Kinder Morgan, Inc. | 0,52 | 1,37 | 0,0757 | −0,0157 | |||||

| US00774MBC82 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0,52 | 0,58 | 0,0756 | −0,0164 | |||||

| US30212PAP09 / Expedia Group Inc | 0,52 | 0,98 | 0,0756 | −0,0160 | |||||

| US718172DB29 / PHILIP MORRIS INTERNATIONAL INC | 0,52 | 1,18 | 0,0755 | −0,0158 | |||||

| US62947QBC15 / NXP BV / NXP Funding LLC | 0,52 | 0,78 | 0,0755 | −0,0162 | |||||

| US91324PER91 / UnitedHealth Group Inc | 0,52 | 0,59 | 0,0753 | −0,0165 | |||||

| US693475BM68 / PNC Financial Services Group Inc/The | 0,51 | 1,39 | 0,0749 | −0,0154 | |||||

| US29103CAA62 / Emerald Debt Merger Sub LLC | 0,51 | 2,20 | 0,0748 | −0,0148 | |||||

| US33830GAA94 / Five Corners Funding Trust III | 0,51 | 0,79 | 0,0745 | −0,0160 | |||||

| US42250PAE34 / Healthpeak Properties Inc | 0,51 | 1,39 | 0,0744 | −0,0155 | |||||

| US36267VAK98 / GE HealthCare Technologies Inc | 0,51 | 0,80 | 0,0738 | −0,0159 | |||||

| US00287YCY32 / ABBVIE INC 4.55% 03/15/2035 | 0,51 | 0,60 | 0,0738 | −0,0161 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0,51 | 1,00 | 0,0738 | −0,0158 | |||||

| US842587DL81 / Southern Co. (The) | 0,50 | 1,00 | 0,0738 | −0,0156 | |||||

| US131477AW17 / Calumet Specialty Products Partners LP / Calumet Finance Corp. | 0,50 | 12,16 | 0,0729 | −0,0066 | |||||

| US911365BQ63 / United Rentals North America, Inc. | 0,50 | 0,81 | 0,0727 | −0,0156 | |||||

| Hilcorp Energy I LP / Hilcorp Finance Co / DBT (US431318BG88) | 0,49 | 2,30 | 0,0715 | −0,0140 | |||||

| US85207UAK16 / Sprint Corp | 0,47 | −0,63 | 0,0694 | −0,0161 | |||||

| Medline Borrower LP/Medline Co-Issuer Inc / DBT (US58506DAA63) | 0,46 | 1,32 | 0,0676 | −0,0140 | |||||

| US3132DWJR51 / FHLG 30YR 5.5% 11/01/2053#SD8372 | 0,46 | −2,54 | 0,0674 | −0,0173 | |||||

| US3132DWHT36 / FEDERAL HOME LOAN MORTGAGE CORP | 0,46 | −2,34 | 0,0671 | −0,0171 | |||||

| MTDR / Matador Resources Company | 0,45 | 0,90 | 0,0658 | −0,0140 | |||||

| US337738BE73 / Fiserv Inc | 0,41 | 0,73 | 0,0606 | −0,0129 | |||||

| US410345AQ54 / Hanesbrands Inc | 0,37 | 0,27 | 0,0542 | −0,0119 | |||||

| US595112BN22 / MICRON TECHNOLOGY INC SR UNSECURED 02/29 5.327 | 0,36 | 0,85 | 0,0524 | −0,0112 | |||||

| US24703DBL47 / Dell International LLC/EMC Corp. | 0,32 | 0,96 | 0,0461 | −0,0098 | |||||

| US91159HJN17 / US Bancorp | 0,32 | 1,94 | 0,0461 | −0,0093 | |||||

| US025537AX91 / American Electric Power Co Inc | 0,31 | 1,63 | 0,0456 | −0,0095 | |||||

| Calumet Specialty Products Partners LP / Calumet Finance Corp / DBT (US131477AX99) | 0,31 | −0,32 | 0,0452 | −0,0103 | |||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 0,31 | 3,38 | 0,0448 | −0,0082 | |||||

| US22822VBC46 / Crown Castle Inc | 0,30 | 1,71 | 0,0437 | −0,0088 | |||||

| US25746UDG13 / DOMINION ENERGY INC | 0,29 | 1,79 | 0,0417 | −0,0085 | |||||

| CTEV / Claritev Corporation | 0,16 | −0,61 | 0,0238 | −0,0056 | |||||

| US28470RAK86 / COLT MERGER SUB INC SR UNSECURED 144A 07/27 8.125 | 0,16 | −0,62 | 0,0236 | −0,0055 | |||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 0,00 | 0,0000 | 0,0000 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0000 | 0,0000 | ||||||

| MIZUHO MARKETS CAYMAN / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 0,00 | 0,0000 | 0,0000 | ||||||

| MIZUHO MARKETS CAYMAN LP / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| MERRILL LYNCH B V / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0,00 | 0,0000 | 0,0000 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,00 | 0,0000 | 0,0000 | ||||||

| BNP PARIBAS ISSUANCE B.V / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| BNP PARIBAS / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,00 | 0,0000 | 0,0000 | ||||||

| WELLS FARGO BANK / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0,00 | 0,0000 | 0,0000 | ||||||

| MIZUHO MARKETS CAYMAN LP / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,00 | 0,0000 | 0,0000 | ||||||

| WELLS FARGO BANK NA / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0,00 | 0,0000 | 0,0000 | ||||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 0,00 | 0,0000 | 0,0000 | ||||||

| ROYAL BK CDA / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| WELLS FARGO BANK / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| MIZUHO MARKETS CAYMAN LP / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0000 | 0,0000 | ||||||

| BNP PARIBAS ISSUANCE B.V. / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0000 | 0,0000 | ||||||

| CITIGROUP GLOBAL MKTS / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| MERRILL LYNCH B.V. / DBT (957HDZII7) | 0,00 | 0,0000 | 0,0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0000 | 0,0000 | ||||||

| CITIGROUP GLOBAL MKTS / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| CITIGROUP GLOBAL MARKETS / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0000 | 0,0000 | ||||||

| MERRILL LYNCH B V / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0000 | 0,0000 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,00 | 0,0000 | 0,0000 | ||||||

| BOFA FIN LLC / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0000 | 0,0000 | ||||||

| BNP PARIBAS ISSUANCE B.V. / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| ROYAL BK CDA / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| MERRILL LYNCH B V / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| WELLS FARGO BANK NA / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| CITIGROUP GLOBAL MKTS / DBT (000000000) | 0,00 | 0,0000 | 0,0000 |