Grundläggande statistik

| Portföljvärde | $ 71 260 332 |

| Aktuella positioner | 139 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

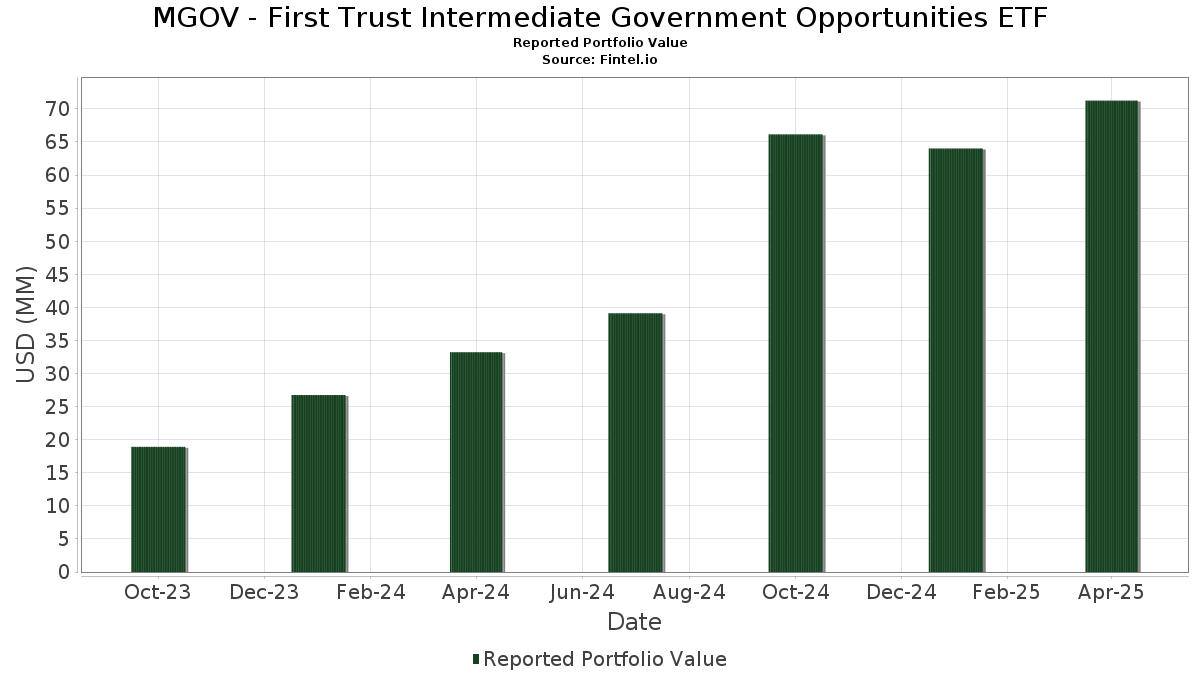

MGOV - First Trust Intermediate Government Opportunities ETF har redovisat 139 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 71 260 332 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). MGOV - First Trust Intermediate Government Opportunities ETFs största innehav är FNMA TBA 30YR 3.0% MAY 20 TO BE ANNOUNCED 3.00000000 (US:US01F0306526) , Fannie Mae REMICS (US:US3136ALDV04) , Government National Mortgage Association (US:US38383LHV53) , FANNIE MAE REMICS FNR 2012-118 VZ (US:US3136A92R82) , and Federal Home Loan Mortgage Corp. Fixed Rate Participation Certificates (US:US3132DVKW45) . MGOV - First Trust Intermediate Government Opportunities ETFs nya positioner inkluderar FNMA TBA 30YR 3.0% MAY 20 TO BE ANNOUNCED 3.00000000 (US:US01F0306526) , Fannie Mae REMICS (US:US3136ALDV04) , Government National Mortgage Association (US:US38383LHV53) , FANNIE MAE REMICS FNR 2012-118 VZ (US:US3136A92R82) , and Federal Home Loan Mortgage Corp. Fixed Rate Participation Certificates (US:US3132DVKW45) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 1,26 | 1,9171 | 1,9171 | ||

| 1,04 | 1,5843 | 1,5843 | ||

| 1,02 | 1,5475 | 1,5475 | ||

| 1,01 | 1,5398 | 1,5398 | ||

| 0,92 | 1,3960 | 1,3960 | ||

| 0,84 | 1,2745 | 1,2745 | ||

| 0,81 | 1,2354 | 1,2354 | ||

| 0,53 | 0,7987 | 0,7987 | ||

| 0,51 | 0,7695 | 0,7695 | ||

| 0,41 | 0,6275 | 0,6275 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 0,56 | 0,8508 | −1,8084 | ||

| 0,60 | 0,9062 | −1,2253 | ||

| −1,46 | −2,2278 | −0,7075 | ||

| 1,71 | 2,6004 | −0,4587 | ||

| 2,54 | 3,8557 | −0,3548 | ||

| 1,05 | 1,6025 | −0,2557 | ||

| 1,80 | 2,7335 | −0,2451 | ||

| 0,65 | 0,65 | 0,9936 | −0,2314 | |

| 1,55 | 2,3529 | −0,2098 | ||

| −0,13 | −0,2023 | −0,2023 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-06-25 för rapporteringsperioden 2025-04-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2,54 | −0,67 | 3,8557 | −0,3548 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,80 | −0,44 | 2,7335 | −0,2451 | |||||

| US01F0306526 / FNMA TBA 30YR 3.0% MAY 20 TO BE ANNOUNCED 3.00000000 | 1,71 | 79,14 | 2,6004 | −0,4587 | |||||

| US3136ALDV04 / Fannie Mae REMICS | 1,66 | 3,69 | 2,5249 | −0,1166 | |||||

| US38383LHV53 / Government National Mortgage Association | 1,66 | 2,22 | 2,5196 | −0,1530 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,64 | 2,50 | 2,4940 | −0,1466 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,64 | 1,99 | 2,4924 | −0,1579 | |||||

| US3136A92R82 / FANNIE MAE REMICS FNR 2012-118 VZ | 1,55 | −0,39 | 2,3529 | −0,2098 | |||||

| Government National Mortgage Association / ABS-MBS (US38379QDE26) | 1,30 | 3,93 | 1,9730 | −0,0870 | |||||

| TVC / Tennessee Valley Authority - Preferred Stock | 1,26 | 1,9171 | 1,9171 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,26 | 0,88 | 1,9097 | −0,1427 | |||||

| US3132DVKW45 / Federal Home Loan Mortgage Corp. Fixed Rate Participation Certificates | 1,24 | 0,08 | 1,8903 | −0,1590 | |||||

| US3137BPVM80 / Freddie Mac Multifamily Structured Pass Through Certificates | 1,22 | −0,08 | 1,8615 | −0,1605 | |||||

| US3138WHS456 / Fannie Mae Pool | 1,22 | 1,50 | 1,8562 | −0,1279 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,22 | 2,62 | 1,8479 | −0,1064 | |||||

| US3137FL2L77 / FEDERAL HOME LN MTG MLT CTF GT 3.718% 01/25/2031 | 1,17 | 2,72 | 1,7792 | −0,1010 | |||||

| US3137FHQ713 / Freddie Mac Multifamily Structured Pass Through Certificates | 1,16 | 2,94 | 1,7587 | −0,0953 | |||||

| US3137B8YJ03 / Freddie Mac REMICS | 1,15 | 3,90 | 1,7419 | −0,0776 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,13 | 3,47 | 1,7255 | −0,0835 | |||||

| US3137B32M96 / Freddie Mac REMICS | 1,13 | 1,99 | 1,7134 | −0,1091 | |||||

| US3136AAWE13 / Fannie Mae REMICS | 1,11 | 4,62 | 1,6892 | −0,0622 | |||||

| US3137FCBP82 / Freddie Mac REMICS | 1,07 | 3,37 | 1,6320 | −0,0807 | |||||

| Government National Mortgage Association / ABS-MBS (US38384BJS16) | 1,07 | 2,68 | 1,6304 | −0,0922 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,05 | −6,48 | 1,6025 | −0,2557 | |||||

| US3136AULL39 / Fannie Mae REMICS | 1,05 | 3,36 | 1,5896 | −0,0789 | |||||

| US01F0406698 / UMBS TBA | 1,04 | 1,5843 | 1,5843 | ||||||

| United States Treasury Note/Bond / DBT (US91282CMN82) | 1,02 | 1,5475 | 1,5475 | ||||||

| United States Treasury Inflation Indexed Bonds / DBT (US91282CNB36) | 1,01 | 1,5398 | 1,5398 | ||||||

| United States Treasury Note/Bond / DBT (US91282CLS88) | 1,01 | 0,70 | 1,5296 | −0,1178 | |||||

| US35563PHF99 / Seasoned Credit Risk Transfer Trust | 1,01 | −2,71 | 1,5291 | −0,1753 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,00 | −0,20 | 1,5245 | −0,1326 | |||||

| Seasoned Loans Structured Transaction Trust Series 2024-2 / ABS-MBS (US35564CSK44) | 0,97 | −2,12 | 1,4756 | −0,1600 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,96 | −0,42 | 1,4591 | −0,1305 | |||||

| US3137F5MU06 / Freddie Mac REMICS | 0,93 | −2,00 | 1,4129 | −0,1525 | |||||

| US3132AA2H60 / Freddie Mac Pool | 0,92 | 0,33 | 1,4004 | −0,1128 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,92 | −4,47 | 1,3984 | −0,1902 | |||||

| US01F0226591 / FNMA 30YR TBA 2.5% 4/25/50 TO BE ANNOUNCED 2.50000000 | 0,92 | 1,3960 | 1,3960 | ||||||

| US3137FPKK08 / Freddie Mac REMICS | 0,90 | −2,81 | 1,3687 | −0,1603 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,90 | 0,67 | 1,3654 | −0,1049 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,89 | 1,72 | 1,3474 | −0,0906 | |||||

| US01F0506505 / Uniform Mortgage-Backed Security, TBA | 0,84 | 1,2745 | 1,2745 | ||||||

| US3137F9Z614 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,83 | 0,98 | 1,2560 | −0,0934 | |||||

| US3137B9AH85 / FREDDIE MAC REMICS SER 4316 CL XZ 4.50000000 | 0,82 | 0,00 | 1,2490 | −0,1055 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,82 | 0,49 | 1,2478 | −0,0998 | |||||

| US01F0326581 / Uniform Mortgage-Backed Security, TBA | 0,81 | 1,2354 | 1,2354 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,78 | −5,01 | 1,1827 | −0,1676 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,76 | 0,26 | 1,1574 | −0,0951 | |||||

| US61747C5821 / Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio | 0,65 | −12,01 | 0,65 | −11,99 | 0,9936 | −0,2314 | |||

| US01F0506687 / Fannie Mae or Freddie Mac | 0,60 | −10,53 | 0,9062 | −1,2253 | |||||

| US912810RT79 / United States Treas Bds Bond | 0,57 | 2,15 | 0,8656 | −0,0548 | |||||

| US3137FDBN18 / Freddie Mac REMICS | 0,56 | 4,25 | 0,8581 | −0,0355 | |||||

| US01F0326664 / Uniform Mortgage-Backed Security, TBA | 0,56 | −32,57 | 0,8508 | −1,8084 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,56 | 0,36 | 0,8500 | −0,0680 | |||||

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 0,53 | 0,7987 | 0,7987 | ||||||

| US3137H1YX82 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,51 | −0,19 | 0,7797 | −0,0673 | |||||

| United States Treasury Note/Bond / DBT (US91282CMT52) | 0,51 | 0,7695 | 0,7695 | ||||||

| US3137H13T13 / FHLMC Multifamily Structured Pass-Through Certificates, Series K129, Class XAM | 0,50 | −2,53 | 0,7617 | −0,0850 | |||||

| US30297TAU97 / FREMF Mortgage Trust, Series 2019-KL4F, Class BAS | 0,50 | 0,41 | 0,7532 | −0,0614 | |||||

| US3137F84T76 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,49 | −3,35 | 0,7462 | −0,0907 | |||||

| US912810SD19 / United States Treas Bds Bond | 0,49 | 1,89 | 0,7388 | −0,0473 | |||||

| US35564CJU27 / Seasoned Loans Structured Transaction Trust Series 2021-1 | 0,48 | −2,24 | 0,7294 | −0,0804 | |||||

| United States Treasury Note/Bond / DBT (US91282CMC28) | 0,46 | 3,17 | 0,6921 | −0,0363 | |||||

| US3140JB2M73 / Fannie Mae Pool | 0,42 | 0,48 | 0,6326 | −0,0512 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,41 | −0,48 | 0,6300 | −0,0569 | |||||

| US3140XFYA33 / Fannie Mae Pool | 0,41 | 0,6275 | 0,6275 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,41 | 4,65 | 0,6163 | −0,0233 | |||||

| US91282CGQ87 / United States Treasury Note/Bond | 0,41 | 0,6163 | 0,6163 | ||||||

| United States Treasury Note/Bond / DBT (US91282CMR96) | 0,40 | 0,6156 | 0,6156 | ||||||

| US3140JB4P86 / Fannie Mae Pool | 0,40 | −1,73 | 0,6048 | −0,0619 | |||||

| US3132AAP738 / Freddie Mac Pool | 0,40 | −0,75 | 0,6010 | −0,0571 | |||||

| US3131XQ6T88 / Freddie Mac Pool | 0,39 | 0,00 | 0,5937 | −0,0509 | |||||

| US3132E0NW85 / Freddie Mac Pool | 0,39 | −0,26 | 0,5903 | −0,0525 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,39 | −1,28 | 0,5888 | −0,0592 | |||||

| US3140JBPS93 / Fannie Mae Pool | 0,38 | −0,78 | 0,5810 | −0,0543 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,37 | −1,61 | 0,5583 | −0,0571 | |||||

| US35563PKG36 / Seasoned Credit Risk Transfer Trust Series 2019-2 | 0,36 | −1,62 | 0,5542 | −0,0572 | |||||

| US01F0406516 / Uniform Mortgage-Backed Security, TBA | 0,36 | 109,41 | 0,5415 | −0,0060 | |||||

| US3137FMTU67 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,33 | −1,77 | 0,5073 | −0,0523 | |||||

| US3137FFXM45 / FHMS KG05 X1 | 0,33 | −3,24 | 0,5015 | −0,0595 | |||||

| US01F0526560 / FNMA TBA 30 YR 5.5 SINGLE FAMILY MORTGAGE | 0,33 | 0,4978 | 0,4978 | ||||||

| US3137FRV993 / Freddie Mac Multiclass Certificates Series 2015-P001 | 0,32 | −2,17 | 0,4799 | −0,0517 | |||||

| United States Treasury Note/Bond / DBT (US91282CMM00) | 0,31 | 0,4734 | 0,4734 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,31 | 2,99 | 0,4721 | −0,0246 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,29 | 0,34 | 0,4445 | −0,0360 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,28 | 0,4315 | 0,4315 | ||||||

| US38383M3M86 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION GNR 2022-139 AL | 0,27 | 0,4129 | 0,4129 | ||||||

| Government National Mortgage Association / ABS-MBS (US38381J2J58) | 0,26 | 1,19 | 0,3886 | −0,0273 | |||||

| US912810SF66 / Us Treasury Bond | 0,25 | 0,3737 | 0,3737 | ||||||

| US912810RV26 / United States Treas Bds Bond | 0,22 | 1,83 | 0,3403 | −0,0219 | |||||

| United States Treasury Note/Bond / DBT (US91282CME83) | 0,21 | 0,48 | 0,3223 | −0,0244 | |||||

| United States Treasury Note/Bond / DBT (US912810UJ50) | 0,20 | 0,3063 | 0,3063 | ||||||

| US3137FTZS90 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,20 | −9,59 | 0,3025 | −0,0602 | |||||

| United States Treasury Note/Bond / DBT (US912810UF39) | 0,20 | 2,06 | 0,3012 | −0,0192 | |||||

| United States Treasury Note/Bond / DBT (US912810UG12) | 0,20 | 0,3010 | 0,3010 | ||||||

| US3137F72F19 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,19 | −8,33 | 0,2851 | −0,0529 | |||||

| US01F0306609 / Fannie Mae or Freddie Mac | 0,13 | 0,2020 | 0,2020 | ||||||

| US3132H3XT54 / FHLMC Gold Pools, Other | 0,12 | 0,85 | 0,1816 | −0,0142 | |||||

| US3137FJZ512 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,12 | −0,84 | 0,1801 | −0,0168 | |||||

| US 2YR NOTE (CBT) / DIR (000000000) | 0,08 | 0,1288 | 0,1288 | ||||||

| US01F0526644 / Uniform Mortgage-Backed Security, TBA | 0,07 | −27,78 | 0,1001 | −0,1891 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,07 | −1,52 | 0,0992 | −0,0101 | |||||

| US3137BPCS61 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,05 | −26,03 | 0,0822 | −0,0387 | |||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,00 | −0,0006 | −0,0006 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,00 | −0,0008 | −0,0008 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,00 | −0,0009 | −0,0009 | ||||||

| US ULTRA BOND CBT / DIR (000000000) | −0,00 | −0,0011 | −0,0011 | ||||||

| ULTRA U.S. TREASURY BOND / DIR (000000000) | −0,00 | −0,0014 | −0,0014 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,00 | −0,0014 | −0,0014 | ||||||

| 5 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,00 | −0,0014 | −0,0014 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,00 | −0,0017 | −0,0017 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,00 | −0,0018 | −0,0018 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,00 | −0,0018 | −0,0018 | ||||||

| ULTRA U.S. TREASURY BOND / DIR (000000000) | −0,00 | −0,0019 | −0,0019 | ||||||

| 5 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,00 | −0,0023 | −0,0023 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,00 | −0,0025 | −0,0025 | ||||||

| 5 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,00 | −0,0027 | −0,0027 | ||||||

| 5 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,00 | −0,0034 | −0,0034 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,00 | −0,0034 | −0,0034 | ||||||

| 2 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,00 | −0,0036 | −0,0036 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,00 | −0,0040 | −0,0040 | ||||||

| 5 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,00 | −0,0040 | −0,0040 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,00 | −0,0048 | −0,0048 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,00 | −0,0058 | −0,0058 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,01 | −0,0081 | −0,0081 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,01 | −0,0086 | −0,0086 | ||||||

| US 5YR NOTE (CBT) / DIR (000000000) | −0,01 | −0,0090 | −0,0090 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,01 | −0,0109 | −0,0109 | ||||||

| 5 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,01 | −0,0122 | −0,0122 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,01 | −0,0152 | −0,0152 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,02 | −0,0263 | −0,0263 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | −0,02 | −0,0299 | −0,0299 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,02 | −0,0303 | −0,0303 | ||||||

| US 10YR NOTE (CBT) / DIR (000000000) | −0,03 | −0,0383 | −0,0383 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,03 | −0,0385 | −0,0385 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,05 | −0,0737 | −0,0737 | ||||||

| US LONG BOND(CBT) / DIR (000000000) | −0,06 | −0,0891 | −0,0891 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | −0,06 | −0,0957 | −0,0957 | ||||||

| US 10YR ULTRA / DIR (000000000) | −0,13 | −0,2023 | −0,2023 | ||||||

| US01F0606677 / Uniform Mortgage-Backed Security, TBA | −1,46 | 208,86 | −2,2278 | −0,7075 |