Grundläggande statistik

| Portföljvärde | $ 55 059 760 |

| Aktuella positioner | 242 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

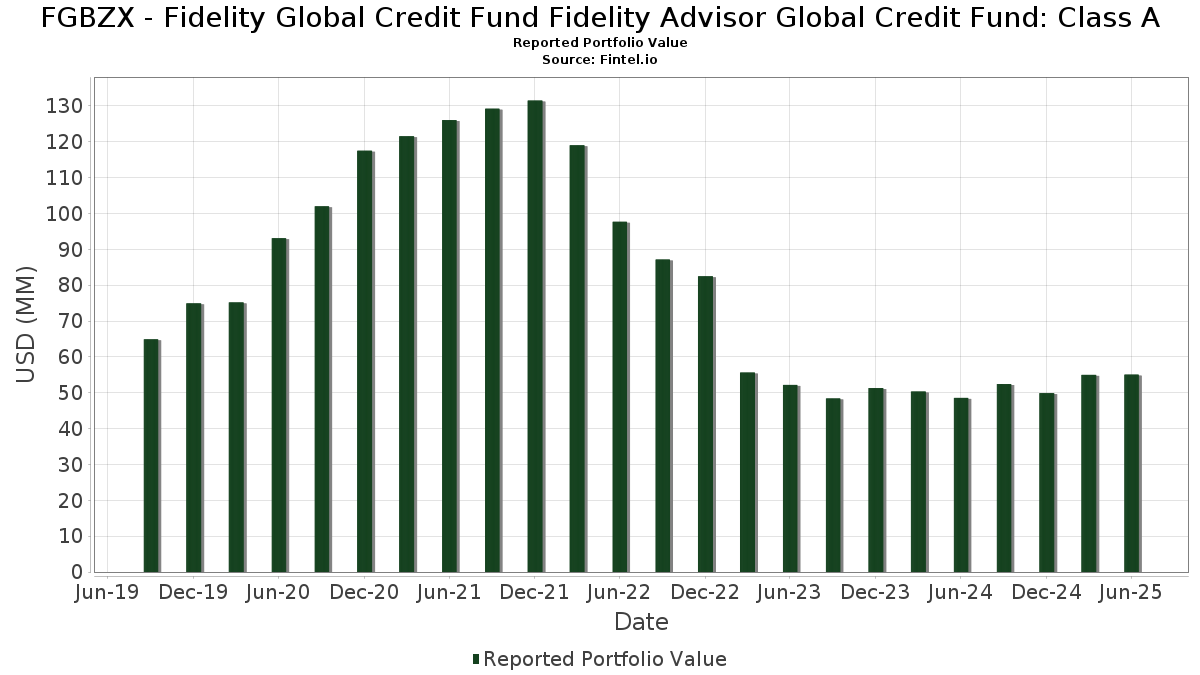

FGBZX - Fidelity Global Credit Fund Fidelity Advisor Global Credit Fund: Class A har redovisat 242 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 55 059 760 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). FGBZX - Fidelity Global Credit Fund Fidelity Advisor Global Credit Fund: Class As största innehav är Fidelity Cash Central Fund (US:US31635A1051) , Aroundtown SA (LU:XS2055106210) , United States Treasury Note/Bond (US:US912810SQ22) , United States Treasury Note/Bond (US:US912810TR95) , and United States Treasury Note/Bond (US:US912810TS78) . FGBZX - Fidelity Global Credit Fund Fidelity Advisor Global Credit Fund: Class As nya positioner inkluderar Aroundtown SA (LU:XS2055106210) , United States Treasury Note/Bond (US:US912810SQ22) , United States Treasury Note/Bond (US:US912810TR95) , United States Treasury Note/Bond (US:US912810TS78) , and US TREASURY NOTE 4.5% 11-15-33 (US:US91282CJJ18) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 0,88 | 1,5670 | 1,5670 | ||

| 0,49 | 0,8797 | 0,8797 | ||

| 0,47 | 0,8390 | 0,8390 | ||

| 0,65 | 1,1678 | 0,7932 | ||

| 0,38 | 0,6864 | 0,6864 | ||

| 0,31 | 0,5543 | 0,5543 | ||

| 0,30 | 0,5285 | 0,5285 | ||

| 0,28 | 0,5025 | 0,5025 | ||

| 0,24 | 0,4254 | 0,4254 | ||

| 0,24 | 0,4248 | 0,4248 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| −0,83 | −1,4729 | −1,4729 | ||

| 2,28 | 2,28 | 4,0754 | −0,8670 | |

| 0,57 | 1,0188 | −0,8022 | ||

| 0,11 | 0,2024 | −0,6677 | ||

| −0,17 | −0,3124 | −0,3124 | ||

| 0,13 | 0,2405 | −0,2086 | ||

| 0,15 | 0,2656 | −0,1496 | ||

| 0,72 | 1,2840 | −0,1354 | ||

| 0,08 | 0,1474 | −0,0725 | ||

| 0,98 | 1,7474 | −0,0542 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-22 för rapporteringsperioden 2025-06-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US31635A1051 / Fidelity Cash Central Fund | 2,28 | −17,68 | 2,28 | −17,68 | 4,0754 | −0,8670 | |||

| XS2055106210 / Aroundtown SA | 1,20 | 11,79 | 2,1503 | 0,2291 | |||||

| US912810SQ22 / United States Treasury Note/Bond | 1,11 | −1,86 | 1,9770 | −0,0335 | |||||

| US912810TR95 / United States Treasury Note/Bond | 0,98 | −3,17 | 1,7474 | −0,0542 | |||||

| US912810TS78 / United States Treasury Note/Bond | 0,96 | −2,15 | 1,7051 | −0,0354 | |||||

| ING / ING Groep N.V. - Depositary Receipt (Common Stock) | 0,93 | 10,57 | 1,6634 | 0,1621 | |||||

| UST NOTES 4.125% 03/31/2032 / DBT (US91282CMT52) | 0,88 | 1,5670 | 1,5670 | ||||||

| US91282CJJ18 / US TREASURY NOTE 4.5% 11-15-33 | 0,78 | 0,26 | 1,3846 | 0,0067 | |||||

| CH1255915014 / UBS GROUP AG 4.75%/VAR 03/17/2032 REGS | 0,76 | 10,80 | 1,3552 | 0,1342 | |||||

| UST NOTES 3.75% 08/31/2031 / DBT (US91282CLJ89) | 0,75 | 0,80 | 1,3442 | 0,0134 | |||||

| UST NOTES 4.125% 02/29/2032 / DBT (US91282CMR96) | 0,75 | 0,67 | 1,3332 | 0,0108 | |||||

| UNITED STATES TREASURY BOND 4.125% 08/15/2044 / DBT (US912810UD80) | 0,72 | −9,67 | 1,2840 | −0,1354 | |||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 0,70 | 11,06 | 1,2565 | 0,1273 | |||||

| XS2403426427 / PRUDENTIAL PLC 2.95%/VAR 11/03/2033 REGS | 0,69 | 0,87 | 1,2389 | 0,0139 | |||||

| US07274EAL74 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.5% 11-21-33 | 0,65 | 211,43 | 1,1678 | 0,7932 | |||||

| US928881AD35 / Vontier Corp | 0,65 | 1,72 | 1,1656 | 0,0230 | |||||

| US18551PAE97 / Cleco Corporate Holdings LLC | 0,65 | 0,16 | 1,1537 | 0,0036 | |||||

| XS2346516250 / Natwest Group PLC | 0,64 | 7,71 | 1,1492 | 0,0841 | |||||

| XS2290533020 / CPI PROPERTY GROUP SA 3.75%/VAR PERP REGS | 0,63 | 16,18 | 1,1291 | 0,1583 | |||||

| US913903AW04 / Universal Health Services Inc | 0,62 | 1,64 | 1,1063 | 0,0205 | |||||

| XS2271225281 / Grand City Properties SA | 0,57 | −44,17 | 1,0188 | −0,8022 | |||||

| XS2187689380 / Volkswagen International Finance NV | 0,56 | 11,02 | 1,0081 | 0,1014 | |||||

| DANSKE / Danske Bank A/S | 0,56 | 9,94 | 1,0076 | 0,0926 | |||||

| TITANIUM 2L BONDCO SARL PIK 6.25% 01/14/2031 / DBT (DE000A3L3AG9) | 0,52 | 0,58 | 0,9234 | 0,0072 | |||||

| UST NOTES 4.125% 07/31/2031 / DBT (US91282CLD10) | 0,51 | 0,80 | 0,9027 | 0,0081 | |||||

| US745310AK84 / Puget Energy Inc | 0,50 | 1,21 | 0,8985 | 0,0116 | |||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 0,49 | 0,8797 | 0,8797 | ||||||

| UST NOTES 3.625% 09/30/2031 / DBT (US91282CLM19) | 0,49 | 0,82 | 0,8777 | 0,0088 | |||||

| VIE / Veolia Environnement SA | 0,47 | 0,8390 | 0,8390 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | 0,47 | 11,14 | 0,8384 | 0,0862 | |||||

| US44409MAA45 / HUDSON PACIFIC PROPERTIE COMPANY GUAR 11/27 3.95 | 0,47 | 8,62 | 0,8321 | 0,0662 | |||||

| XS2391779134 / British American Tobacco PLC | 0,45 | 10,19 | 0,8107 | 0,0754 | |||||

| CH1142754311 / CREDIT SUISSE GRP AG 2.125%/VAR 11/15/2029 REGS | 0,44 | 8,66 | 0,7850 | 0,0637 | |||||

| US00130HCG83 / CORP. NOTE | 0,43 | 2,36 | 0,7757 | 0,0185 | |||||

| UST NOTES 4.125% 10/31/2031 / DBT (US91282CLU35) | 0,42 | 0,72 | 0,7486 | 0,0066 | |||||

| XS2387675395 / SOUTHERN COMPANY EUSA5 1.875/VAR 09/15/2081 | 0,41 | 9,92 | 0,7324 | 0,0661 | |||||

| UST NOTES 4.25% 06/30/2031 / DBT (US91282CKW00) | 0,41 | 0,74 | 0,7273 | 0,0065 | |||||

| XS2586739729 / Imperial Brands Finance Netherlands BV | 0,40 | 9,72 | 0,7054 | 0,0625 | |||||

| US15135BAR24 / Centene Corp | 0,39 | 0,78 | 0,6963 | 0,0076 | |||||

| NOVO NORDISK FINANCE NETHERLANDS BV 3.625% 05/27/2037 REGS / DBT (XS3002555822) | 0,38 | 0,6864 | 0,6864 | ||||||

| XS2010045511 / NGG Finance plc | 0,38 | 10,20 | 0,6753 | 0,0633 | |||||

| XS2195190876 / SSE PLC 3.74%/VAR PERP REGS | 0,38 | 6,80 | 0,6731 | 0,0425 | |||||

| US71654QDE98 / Petroleos Mexicanos | 0,37 | 6,41 | 0,6519 | 0,0405 | |||||

| KBC / KBC Group NV | 0,36 | 66,05 | 0,6386 | 0,2551 | |||||

| AMPRION GMBH 3.125% 08/27/2030 REGS / DBT (DE000A383QQ2) | 0,35 | 9,97 | 0,6316 | 0,0580 | |||||

| US161175BK95 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0,34 | 0,88 | 0,6141 | 0,0076 | |||||

| SE0016589105 / HEIMSTADEN AB 4.375% 03/06/2027 REGS | 0,34 | 11,04 | 0,6120 | 0,0627 | |||||

| XS2690137299 / Lloyds Banking Group PLC | 0,34 | 10,39 | 0,6087 | 0,0595 | |||||

| XS2381272207 / ENBW ENERGIE BADEN-WUERTTEM AG 1.375%/VAR 08/31/2081 REGS | 0,33 | 11,11 | 0,5894 | 0,0590 | |||||

| EOAN / E.ON SE | 0,33 | 10,85 | 0,5840 | 0,0572 | |||||

| US097023CY98 / BOEING CO 5.15 5/30 | 0,32 | 1,27 | 0,5689 | 0,0076 | |||||

| XS1991126431 / Cooperatieve Rabobank UA | 0,32 | 11,27 | 0,5648 | 0,0572 | |||||

| UST NOTES 4.25% 05/15/2035 / DBT (US91282CNC19) | 0,31 | 0,5543 | 0,5543 | ||||||

| XS2051670300 / Blackstone Property Partners Europe Holdings Sarl | 0,31 | 11,15 | 0,5519 | 0,0554 | |||||

| BAT INTL FINANCE PLC 4.125% 04/12/2032 REGS / DBT (XS2801975991) | 0,30 | 11,03 | 0,5398 | 0,0537 | |||||

| DHL / Deutsche Post AG | 0,30 | 0,5285 | 0,5285 | ||||||

| ENBW INTERNATIONAL FINANCE BV 3.75% 11/20/2035 REGS / DBT (XS2942479044) | 0,30 | 10,90 | 0,5269 | 0,0512 | |||||

| XS2492482828 / Barclays PLC | 0,29 | 7,43 | 0,5166 | 0,0371 | |||||

| XS2592017300 / Deutsche Bank AG | 0,29 | 7,95 | 0,5104 | 0,0391 | |||||

| HYLN / Hyliion Holdings Corp. | 0,29 | 11,76 | 0,5100 | 0,0540 | |||||

| XS2468125609 / BLACKSTONE PRIVATE CREDIT FUND 4.875% 04/14/2026 REGS | 0,28 | 6,79 | 0,5070 | 0,0331 | |||||

| RY.PRM / Royal Bank of Canada - Preferred Stock | 0,28 | 0,5025 | 0,5025 | ||||||

| HTHROW / Heathrow Funding Ltd | 0,28 | 8,20 | 0,4953 | 0,0378 | |||||

| US15135BAT89 / CORPORATE BONDS | 0,27 | 1,49 | 0,4880 | 0,0081 | |||||

| UNITED STATES TREASURY BOND 4.625% 11/15/2044 / DBT (US912810UF39) | 0,27 | −2,18 | 0,4806 | −0,0101 | |||||

| US88732JAY47 / Time Warner Cable Inc. 5.875% 11/15/40 | 0,27 | 4,72 | 0,4765 | 0,0222 | |||||

| FR001400FDG9 / Electricite de France SA | 0,27 | 8,57 | 0,4764 | 0,0393 | |||||

| XS2010032618 / SAMHALLSBYGGNADSBOLAGET I NORDEN AB 2.624/VAR PERP REGS | 0,26 | 22,07 | 0,4643 | 0,0842 | |||||

| US04010LAY92 / ARES CAPITAL CORP | 0,26 | 0,39 | 0,4639 | 0,0024 | |||||

| AU3FN0029609 / AAI Ltd | 0,26 | 1,18 | 0,4595 | 0,0053 | |||||

| XS2621539910 / HSBC Holdings plc | 0,25 | 10,43 | 0,4545 | 0,0433 | |||||

| US28414HAG83 / Elanco Animal Health Inc | 0,25 | 2,86 | 0,4513 | 0,0128 | |||||

| US958667AC17 / WESTERN MIDSTREAM OPERAT SR UNSECURED 02/30 4.05 | 0,25 | 0,80 | 0,4481 | 0,0042 | |||||

| XS1423777215 / Argentum Netherlands BV for Swiss Re Ltd | 0,25 | 0,00 | 0,4460 | 0,0022 | |||||

| XS2630465875 / WERFENLIFE SA 4.625% 06/06/2028 REGS | 0,25 | 9,82 | 0,4400 | 0,0394 | |||||

| UST NOTES 4.375% 01/31/2032 / DBT (US91282CMK44) | 0,25 | 0,41 | 0,4386 | 0,0033 | |||||

| XS2370445921 / THE BERKELEY GROUP PLC 2.5% 08/11/2031 REGS | 0,24 | 10,41 | 0,4360 | 0,0410 | |||||

| AROUNDTOWN FINANCE SARL 7.875%/VAR PERP / EP (XS2812484728) | 0,24 | 3,42 | 0,4329 | 0,0148 | |||||

| XS2488626883 / Duke Energy Corp | 0,24 | 10,55 | 0,4320 | 0,0422 | |||||

| STAB / Standard Chartered PLC - Preferred Security | 0,24 | 10,70 | 0,4260 | 0,0425 | |||||

| SHA0 / Schaeffler AG | 0,24 | 10,70 | 0,4259 | 0,0418 | |||||

| CABK / CaixaBank, S.A. | 0,24 | 11,21 | 0,4256 | 0,0424 | |||||

| FLUXYS SA 4% 11/28/2030 REGS / DBT (BE0390222884) | 0,24 | 0,4254 | 0,4254 | ||||||

| XS2264968665 / Ivory Coast Government International Bond | 0,24 | 0,4248 | 0,4248 | ||||||

| FR00140066D6 / ENGIE - Loyalty Line 2024 | 0,24 | 10,75 | 0,4247 | 0,0417 | |||||

| MCD / McDonald's Corporation - Depositary Receipt (Common Stock) | 0,24 | 0,4241 | 0,4241 | ||||||

| BARRY CALLEBAUT SVCS NV 4.25% 08/19/2031 REGS / DBT (BE6360449621) | 0,24 | 116,51 | 0,4228 | 0,2283 | |||||

| PTFIDBOM0009 / FIDELIDADE COMPANHIA 4.25%/VAR 09/04/2031 REGS | 0,24 | 9,26 | 0,4225 | 0,0361 | |||||

| MOTABILITY OPERATIONS GRP PLC 3.625% 01/22/2033 REGS / DBT (XS2978917156) | 0,24 | 10,28 | 0,4218 | 0,0400 | |||||

| SHURGARD LUXEMBOURG SARL 4% 05/27/2035 REGS / DBT (BE6364767150) | 0,23 | 0,4195 | 0,4195 | ||||||

| PUB / Publicis Groupe S.A. | 0,23 | 0,4195 | 0,4195 | ||||||

| R1IN34 / Realty Income Corporation - Depositary Receipt (Common Stock) | 0,23 | 0,4194 | 0,4194 | ||||||

| XS2597114284 / HSBC Holdings PLC | 0,23 | 10,19 | 0,4067 | 0,0380 | |||||

| US09659W2R48 / BNP Paribas SA | 0,23 | 1,35 | 0,4022 | 0,0062 | |||||

| UST NOTES 4.125% 05/31/2032 / DBT (US91282CNF40) | 0,22 | 0,3960 | 0,3960 | ||||||

| ZF EUROPE FINANCE BV 4.75% 01/31/2029 REGS / DBT (XS2757520965) | 0,22 | 6,76 | 0,3954 | 0,0250 | |||||

| XS2416978190 / ZURICH FINANCE (IRELAND) DAC 3.5%/VAR 05/02/2052 REGS | 0,22 | 1,85 | 0,3934 | 0,0080 | |||||

| XS2552367687 / BARCLAYS PLC (UNGTD) 8.407%/VAR 11/14/2032 REGS | 0,22 | 7,32 | 0,3929 | 0,0260 | |||||

| XS2356311139 / AIA GROUP LTD 0.88%/VAR 09/09/2033 REGS | 0,22 | 10,15 | 0,3888 | 0,0372 | |||||

| XS2385390724 / HIME SARLU 0.625% 09/16/2028 REGS | 0,22 | 11,98 | 0,3842 | 0,0417 | |||||

| US83368RBS04 / Societe Generale SA | 0,21 | 1,43 | 0,3811 | 0,0063 | |||||

| US07274EAK91 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.375% 11-21-30 | 0,21 | 1,44 | 0,3795 | 0,0062 | |||||

| XS2356450846 / ANGLIAN WATER (OSPREY) FINANCING PLC 2% 07/31/2028 REGS | 0,21 | 8,76 | 0,3769 | 0,0297 | |||||

| ANGLIAN WATER SVCS FINANC PLC 5.875% 06/20/2031 REGS / DBT (XS2638380506) | 0,21 | 8,25 | 0,3761 | 0,0301 | |||||

| RWE FINANCE US LLC 5.875% 04/16/2034 144A / DBT (US749983AA01) | 0,21 | 1,46 | 0,3731 | 0,0064 | |||||

| BBV / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 0,21 | 1,46 | 0,3723 | 0,0060 | |||||

| WESSEX WATER SERVS FIN PLC 6.125% 09/19/2034 REGS / DBT (XS3025173710) | 0,21 | 8,38 | 0,3713 | 0,0307 | |||||

| UST NOTES 4.625% 04/30/2031 / DBT (US91282CKN01) | 0,21 | 0,49 | 0,3707 | 0,0031 | |||||

| T1OW34 / American Tower Corporation - Depositary Receipt (Common Stock) | 0,21 | 0,3706 | 0,3706 | ||||||

| SOUTHERN GAS NETWORKS PLC 3.5% 10/16/2030 REGS / DBT (XS2914661843) | 0,21 | 10,11 | 0,3703 | 0,0345 | |||||

| XS2180916525 / SOUTHERN WATER SERVICES FIN LTD | 0,20 | 8,51 | 0,3650 | 0,0284 | |||||

| SRG / Snam S.p.A. | 0,20 | 0,3644 | 0,3644 | ||||||

| US04010LBA08 / Ares Capital Corp. | 0,20 | 1,00 | 0,3619 | 0,0043 | |||||

| STELLANTIS FINANCE US INC 5.75% 03/18/2030 144A / DBT (US85855CAK62) | 0,20 | 1,01 | 0,3603 | 0,0040 | |||||

| XS2289852522 / WHITBREAD GROUP PLC 2.375% 05/31/2027 REGS | 0,20 | 7,69 | 0,3503 | 0,0249 | |||||

| WARNERMEDIA HOLDINGS INC 4.693% 05/17/2033 / DBT (XS2721621154) | 0,19 | 4,86 | 0,3470 | 0,0166 | |||||

| XS2384289554 / QBE INS GROUP LTD 2.5%/VAR 09/13/2038 REGS | 0,19 | 8,62 | 0,3382 | 0,0268 | |||||

| XS2595035234 / FORD MTR CR CO LLC 6.86% 06/05/2026 | 0,18 | 6,47 | 0,3235 | 0,0197 | |||||

| US00914AAK88 / Air Lease Corp. | 0,18 | 2,33 | 0,3151 | 0,0069 | |||||

| CARLSBERG BREWERIES A/S 3.25% 02/28/2032 REGS / DBT (XS3002420498) | 0,18 | 10,69 | 0,3147 | 0,0302 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 0,18 | 0,3145 | 0,3145 | ||||||

| XS1040508167 / Imperial Brands Finance plc | 0,17 | 10,19 | 0,3102 | 0,0286 | |||||

| XS2397251807 / HEIMSTADEN BOSTAD AB 3.625/VAR PERP REGS | 0,17 | 12,42 | 0,3080 | 0,0341 | |||||

| XS2240494711 / InterContinental Hotels Group plc | 0,17 | 7,59 | 0,3050 | 0,0230 | |||||

| US11135FBH38 / Broadcom Inc | 0,17 | 1,20 | 0,3033 | 0,0054 | |||||

| 2914 / Japan Tobacco Inc. | 0,17 | 0,2987 | 0,2987 | ||||||

| AU3CB0299816 / AUSNET SERVICES | 0,17 | 0,2982 | 0,2982 | ||||||

| US446150BC73 / Huntington Bancshares Inc/OH | 0,16 | 0,64 | 0,2810 | 0,0027 | |||||

| SAMHALLSBYGGNADSBOLAGET I NORDEN HOLDING AB 2.25% 07/12/2027 REGS / DBT (XS2962827312) | 0,16 | 11,35 | 0,2808 | 0,0291 | |||||

| XS2643776680 / ADMIRAL GROUP PLC 8.5% 01/06/2034 REGS | 0,16 | 9,09 | 0,2789 | 0,0228 | |||||

| UST NOTES 4.625% 05/31/2031 / DBT (US91282CKU44) | 0,16 | 0,65 | 0,2780 | 0,0023 | |||||

| XS2553549903 / HSBC HOLDINGS PLC 8.201%/VAR 11/16/2034 REGS | 0,15 | 7,86 | 0,2705 | 0,0196 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,15 | 10,37 | 0,2669 | 0,0247 | |||||

| JYSK / Jyske Bank A/S | 0,15 | 10,37 | 0,2668 | 0,0246 | |||||

| XS2346973741 / CIMIC GROUP LTD 1.5% 05/28/2029 REGS | 0,15 | −36,21 | 0,2656 | −0,1496 | |||||

| XS2685873908 / HSBC Holdings plc | 0,15 | 8,03 | 0,2647 | 0,0204 | |||||

| XS2560994381 / COMMERZBANK AG 8.625%/VAR 02/28/2033 REGS | 0,15 | 6,52 | 0,2635 | 0,0173 | |||||

| LONDON POWER NETWORKS PLC 3.837% 06/11/2037 REGS / DBT (XS3090913883) | 0,15 | 0,2627 | 0,2627 | ||||||

| SCOTTISH HYDRO ELECTRIC TRANSMISSION PLC 3.375% 09/04/2032 REGS / DBT (XS2894895684) | 0,15 | 9,77 | 0,2618 | 0,0242 | |||||

| UNITED UTILITIES WATER FINANCE PLC 3.5% 02/27/2033 REGS / DBT (XS3011736108) | 0,15 | 10,61 | 0,2610 | 0,0254 | |||||

| US LONG BOND(CBT) FUT SEP25 USU5 / DIR (N/A) | 0,14 | 0,2568 | 0,2568 | ||||||

| XS2693304813 / Mobico Group plc | 0,14 | −10,06 | 0,2554 | −0,0284 | |||||

| XS0093312550 / ANGLIAN WAT FIN | 0,14 | 0,2552 | 0,2552 | ||||||

| JYSK / Jyske Bank A/S | 0,14 | 10,08 | 0,2551 | 0,0237 | |||||

| GPEF / Great Portland Estates Plc - Equity Right | 0,14 | 8,73 | 0,2449 | 0,0193 | |||||

| XS1888180996 / Vodafone Group PLC | 0,14 | 7,03 | 0,2448 | 0,0155 | |||||

| US00774MAX39 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0,14 | 2,27 | 0,2426 | 0,0058 | |||||

| XS2254262285 / Travis Perkins PLC | 0,13 | −46,61 | 0,2405 | −0,2086 | |||||

| DE000A254YS5 / ACCENTRO REAL ESTATE AG 3.625% 02/13/2023 REGS | 0,13 | −12,99 | 0,2401 | −0,0361 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 0,13 | 5,00 | 0,2259 | 0,0110 | |||||

| FR0013283371 / RCI Banque SA | 0,12 | 9,82 | 0,2212 | 0,0206 | |||||

| XS2624976077 / ING Groep NV | 0,12 | 9,82 | 0,2203 | 0,0198 | |||||

| K8553U105 / Sunlands Online Education Group | 0,12 | 9,01 | 0,2175 | 0,0184 | |||||

| PROLOGIS INTL FDG II SA 4.375% 07/01/2036 REGS / DBT (XS2847688251) | 0,12 | 11,01 | 0,2170 | 0,0220 | |||||

| CECV / Ceconomy AG | 0,12 | 12,04 | 0,2167 | 0,0230 | |||||

| LOGICOR FINANCING SARL 4.25% 07/18/2029 REGS / DBT (XS2860968085) | 0,12 | 10,00 | 0,2166 | 0,0204 | |||||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 0,12 | 11,01 | 0,2165 | 0,0217 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,12 | 0,2152 | 0,2152 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,12 | 11,11 | 0,2150 | 0,0222 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,12 | 11,11 | 0,2144 | 0,0210 | |||||

| SIG COMBIBLOC PURCHASECO SARL 3.75% 03/19/2030 REGS / DBT (XS3017995518) | 0,12 | 9,17 | 0,2140 | 0,0195 | |||||

| CEBB / Nationwide Building Society - Preferred Security | 0,12 | 0,2124 | 0,2124 | ||||||

| CR8C5U / Commerzbank AG - Equity Warrant | 0,12 | 10,28 | 0,2120 | 0,0205 | |||||

| XS2629470761 / BOSCH (ROBERT) GMBH 4.375% 06/02/2043 REGS | 0,12 | 10,28 | 0,2117 | 0,0197 | |||||

| SEVERN TRENT WATER UTIL FIN 3.875% 08/04/2035 REGS / DBT (XS2991273462) | 0,12 | 11,32 | 0,2115 | 0,0216 | |||||

| P3 GROUP SARL 4% 04/19/2032 REGS / DBT (XS2901491261) | 0,12 | 10,28 | 0,2115 | 0,0206 | |||||

| XS0907301260 / WOLTERS KLUWER-C | 0,12 | 0,2107 | 0,2107 | ||||||

| SUPERNOVA INVEST GMBH 5% 06/24/2030 REGS / DBT (XS3103692250) | 0,12 | 0,2106 | 0,2106 | ||||||

| AMPRION GMBH 3.875% 06/05/2036 REGS / DBT (DE000A4DFUF0) | 0,12 | 0,2105 | 0,2105 | ||||||

| DEQ1 / Deutsche EuroShop AG - Depositary Receipt (Common Stock) | 0,12 | 0,2103 | 0,2103 | ||||||

| XS2617442525 / Volkswagen Bank GmbH | 0,12 | 0,2097 | 0,2097 | ||||||

| FISERV FUNDING UNLTD CO 3.5% 06/15/2032 / DBT (XS3060660050) | 0,12 | 0,2097 | 0,2097 | ||||||

| XS2412732708 / SIRIUS REAL ESTATE LTD /EUR/ REGD REG S 1.75000000 | 0,12 | 10,48 | 0,2084 | 0,0200 | |||||

| GOOGL / Alphabet Inc. - Depositary Receipt (Common Stock) | 0,12 | 0,2082 | 0,2082 | ||||||

| GOOGL / Alphabet Inc. - Depositary Receipt (Common Stock) | 0,12 | 0,2065 | 0,2065 | ||||||

| LEG / LEG Immobilien SE | 0,12 | 10,58 | 0,2060 | 0,0203 | |||||

| XS2338355014 / BLACKSTONE PROP PARTNERS EUR HOLD 1% 05/04/2028 REGS | 0,11 | −76,84 | 0,2024 | −0,6677 | |||||

| XS1140961563 / JOHN LEWIS PLC SR UNSECURED REGS 12/34 4.25 | 0,11 | 0,1989 | 0,1989 | ||||||

| XS2306517876 / DNB Bank ASA | 0,11 | 11,11 | 0,1972 | 0,0191 | |||||

| XS0989394589 / Credit Suisse Group AG | 0,09 | −10,58 | 0,1674 | −0,0183 | |||||

| US78574MAA18 / Sabra Health Care LP | 0,08 | 2,47 | 0,1496 | 0,0041 | |||||

| XS2259808702 / National Express Group PLC | 0,08 | −33,33 | 0,1474 | −0,0725 | |||||

| US14040HCY99 / Capital One Financial Corp. | 0,08 | 2,63 | 0,1400 | 0,0035 | |||||

| SW FINANCE I PLC 7.375% 12/12/2041 REGS / DBT (XS2731297235) | 0,07 | 7,25 | 0,1332 | 0,0086 | |||||

| CANADA GOVERNMENT OF 3.25% 12/01/2034 / DBT (CA135087S216) | 0,07 | 2,99 | 0,1245 | 0,0043 | |||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | 0,05 | 1,89 | 0,0966 | 0,0018 | |||||

| US023771S412 / American Airlines Pass Through Trust, Series 2016-3, Class B | 0,05 | −10,34 | 0,0932 | −0,0117 | |||||

| PTBENKOM0012 / Banco Espirito Santo SA | 0,05 | 13,33 | 0,0925 | 0,0116 | |||||

| US01626PAM86 / Alimentation Couche-Tard Inc | 0,05 | 2,04 | 0,0901 | 0,0017 | |||||

| XS2027596530 / Romanian Government International Bond | 0,05 | 0,0875 | 0,0875 | ||||||

| US 5YR NOTE (CBT) FUT SEP25 FVU5 / DIR (N/A) | 0,05 | 0,0869 | 0,0869 | ||||||

| US ULTRA BOND CBT FUT SEP25 WNU5 / DIR (N/A) | 0,05 | 0,0810 | 0,0810 | ||||||

| US14040HCX17 / Capital One Financial Corp. | 0,05 | 2,27 | 0,0804 | 0,0007 | |||||

| CANADA GOVERNMENT OF 3% 06/01/2034 / DBT (CA135087R481) | 0,04 | 5,88 | 0,0644 | 0,0022 | |||||

| ANGLIAN WATER SVCS FINANC PLC 6.293% 07/30/2030 REGS / DBT (XS0151948980) | 0,04 | 9,38 | 0,0638 | 0,0050 | |||||

| US 10YR ULTRA FUT SEP25 UXYU5 / DIR (N/A) | 0,03 | 0,0612 | 0,0612 | ||||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,02 | 0,00 | 0,0332 | 0,0003 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,02 | 0,00 | 0,0314 | 0,0005 | |||||

| US254709AS70 / Discover Financial Services | 0,02 | 0,00 | 0,0292 | 0,0005 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,01 | 0,00 | 0,0264 | 0,0003 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,01 | 8,33 | 0,0233 | 0,0004 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,01 | 0,00 | 0,0211 | 0,0002 | |||||

| EURO-BOBL FUTURE SEP25 OEU5 / DIR (DE000F1NGF61) | 0,01 | 0,0164 | 0,0164 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,01 | 0,0111 | 0,0111 | ||||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0,01 | 0,0111 | 0,0111 | ||||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0,01 | 0,0110 | 0,0110 | ||||||

| FX Forward: GBP/USD settle 2025-07-08 / DFE (N/A) | 0,01 | 0,0104 | 0,0104 | ||||||

| CAN 10YR BOND FUT SEP25 CNU5 / DIR (N/A) | 0,01 | 0,0096 | 0,0096 | ||||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0,01 | 0,0091 | 0,0091 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0087 | 0,0087 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | 0,00 | 0,0077 | 0,0077 | ||||||

| EURO-BUND FUTURE SEP25 RXU5 / DIR (DE000F1NGF53) | 0,00 | 0,0069 | 0,0069 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0064 | 0,0064 | ||||||

| FX Forward: EUR/USD settle 2025-07-08 / DFE (N/A) | 0,00 | 0,0057 | 0,0057 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0052 | 0,0052 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | 0,00 | 0,0046 | 0,0046 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | 0,00 | 0,0040 | 0,0040 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0034 | 0,0034 | ||||||

| AUST 10Y BOND FUT SEP25 XMU5 / DIR (N/A) | 0,00 | 0,0023 | 0,0023 | ||||||

| GSCM SWAP CDS 06/20/30 UCGIM B / DCR (N/A) | 0,00 | 0,0018 | 0,0018 | ||||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | −0,00 | −0,0003 | −0,0003 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | −0,00 | −0,0003 | −0,0003 | ||||||

| FX Forward: USD/AUD settle 2025-07-08 / DFE (N/A) | −0,00 | −0,0004 | −0,0004 | ||||||

| US56168P1049 / Mana Capital Acquisition Corp. | −0,00 | −0,0009 | −0,0009 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | −0,00 | −0,0013 | −0,0013 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | −0,00 | −0,0013 | −0,0013 | ||||||

| FX Forward: USD/AUD settle 2025-07-08 / DFE (N/A) | −0,00 | −0,0017 | −0,0017 | ||||||

| FX Forward: USD/EUR settle 2025-07-08 / DFE (N/A) | −0,00 | −0,0018 | −0,0018 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | −0,00 | −0,0023 | −0,0023 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | −0,00 | −0,0029 | −0,0029 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | −0,00 | −0,0029 | −0,0029 | ||||||

| US56168P1049 / Mana Capital Acquisition Corp. | −0,00 | −0,0031 | −0,0031 | ||||||

| US56168P1049 / Mana Capital Acquisition Corp. | −0,00 | −0,0037 | −0,0037 | ||||||

| US56168P1049 / Mana Capital Acquisition Corp. | −0,00 | −0,0059 | −0,0059 | ||||||

| FX Forward: USD/GBP settle 2025-07-08 / DFE (N/A) | −0,00 | −0,0062 | −0,0062 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | −0,01 | −0,0120 | −0,0120 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | −0,01 | −0,0150 | −0,0150 | ||||||

| LONG GILT FUTURE SEP25 G U5 / DIR (GB00MP6FM953) | −0,01 | −0,0202 | −0,0202 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | −0,01 | −0,0265 | −0,0265 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | −0,02 | −0,0345 | −0,0345 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | −0,17 | −0,3124 | −0,3124 | ||||||

| FX Forward: USD/EUR settle 2025-07-08 / DFE (N/A) | −0,83 | −1,4729 | −1,4729 |