Grundläggande statistik

| Portföljvärde | $ 877 593 954 |

| Aktuella positioner | 1 202 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

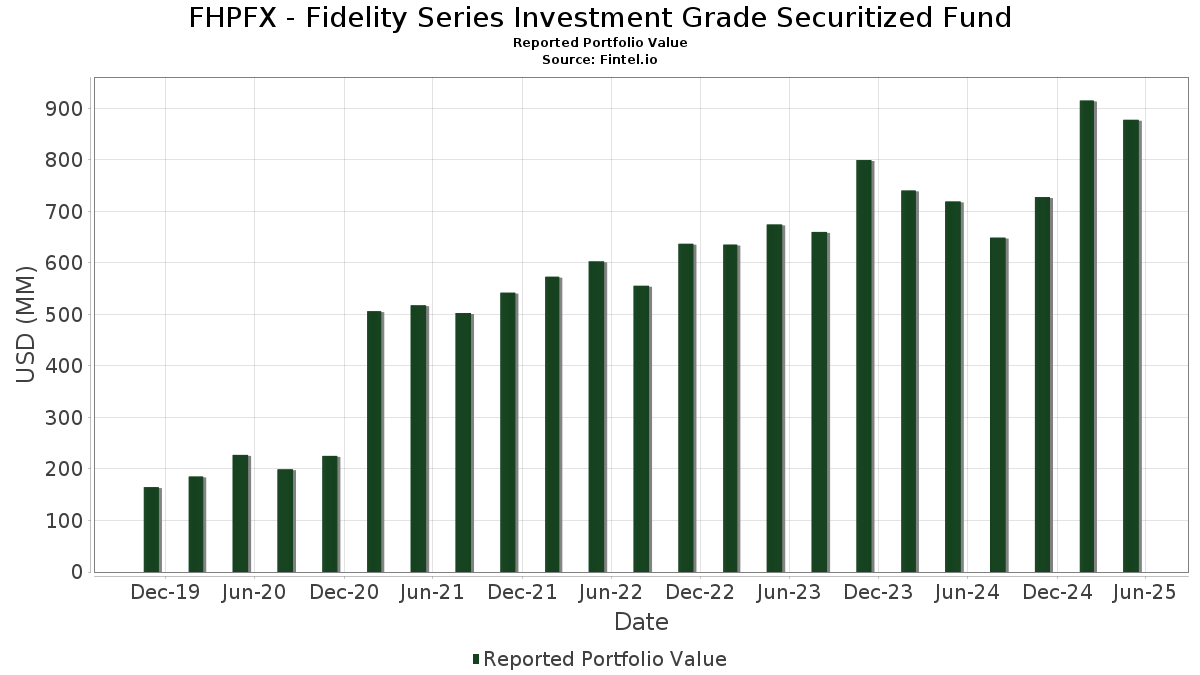

FHPFX - Fidelity Series Investment Grade Securitized Fund har redovisat 1 202 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 877 593 954 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). FHPFX - Fidelity Series Investment Grade Securitized Funds största innehav är UMBS, 30 Year, Single Family (US:US01F0206791) , Fidelity Cash Central Fund (US:US31635A1051) , Ginnie Mae (US:US21H0606630) , Ginnie Mae (US:US21H0606713) , and G2SF 2.0 TBA 06-01-51 (US:US21H0206670) . FHPFX - Fidelity Series Investment Grade Securitized Funds nya positioner inkluderar UMBS, 30 Year, Single Family (US:US01F0206791) , Ginnie Mae (US:US21H0606630) , Ginnie Mae (US:US21H0606713) , G2SF 2.0 TBA 06-01-51 (US:US21H0206670) , and Ginnie Mae II pool (US:US21H0306660) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 17,64 | 2,4180 | 6,4832 | ||

| 8,87 | 1,2156 | 5,1271 | ||

| 9,27 | 1,2705 | 4,0901 | ||

| 31,66 | 4,3384 | 3,2296 | ||

| 15,92 | 2,1821 | 3,2104 | ||

| 13,04 | 1,7870 | 3,1715 | ||

| 31,70 | 4,3449 | 2,8700 | ||

| 7,53 | 1,0314 | 2,6838 | ||

| −50,27 | −6,8894 | 2,6732 | ||

| 9,14 | 1,2521 | 2,3644 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| −36,11 | −4,9484 | −10,5364 | ||

| 36,10 | 36,11 | 4,9486 | −6,1857 | |

| −10,39 | −1,4239 | −4,1851 | ||

| −10,10 | −1,3845 | −3,7323 | ||

| −7,75 | −1,0623 | −3,2444 | ||

| −9,27 | −1,2705 | −2,5410 | ||

| 20,99 | 2,8765 | −2,5226 | ||

| −9,14 | −1,2521 | −2,5043 | ||

| −14,17 | −1,9420 | −2,2546 | ||

| −12,06 | −1,6523 | −1,4477 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-07-24 för rapporteringsperioden 2025-05-31. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US01F0206791 / UMBS, 30 Year, Single Family | 47,34 | 25,59 | 6,4882 | −0,3311 | |||||

| US31635A1051 / Fidelity Cash Central Fund | 36,10 | −51,60 | 36,11 | −51,60 | 4,9486 | −6,1857 | |||

| US21H0606630 / Ginnie Mae | 31,70 | 288,86 | 4,3449 | 2,8700 | |||||

| US21H0606713 / Ginnie Mae | 31,66 | 416,51 | 4,3384 | 3,2296 | |||||

| US21H0206670 / G2SF 2.0 TBA 06-01-51 | 20,99 | −29,67 | 2,8765 | −2,5226 | |||||

| US21H0306660 / Ginnie Mae II pool | 19,89 | 0,24 | 2,7260 | −0,8639 | |||||

| US01F0226674 / Uniform Mortgage-Backed Security, TBA | 17,64 | −178,51 | 2,4180 | 6,4832 | |||||

| US21H0226637 / Ginnie Mae | 15,92 | −380,12 | 2,1821 | 3,2104 | |||||

| US36179WXH68 / Ginnie Mae II Pool | 13,73 | −4,16 | 1,8823 | −0,2565 | |||||

| US21H0326627 / GNMA | 13,04 | −229,07 | 1,7870 | 3,1715 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 12,47 | 1,7084 | 1,7084 | ||||||

| EW / Edwards Lifesciences Corporation | 11,53 | 31,37 | 1,5802 | −0,0077 | |||||

| UNITED STATES TREASURY BOND 4.625% 11/15/2044 / DBT (US912810UF39) | 10,47 | 1,4347 | 1,4347 | ||||||

| US21H0326700 / GNMA2 30YR TBA(REG C) 3.5 TBA 07-01-50 | 10,10 | 66,41 | 1,3839 | 0,2861 | |||||

| US21H0506640 / Ginnie Mae | 9,92 | 8,82 | 1,3597 | −0,2897 | |||||

| US01F0426654 / Uniform Mortgage-Backed Security, TBA | 9,27 | −159,48 | 1,2705 | 4,0901 | |||||

| US01F0506687 / Fannie Mae or Freddie Mac | 9,20 | −297,93 | 1,2606 | 1,8975 | |||||

| US21H0526606 / Ginnie Mae | 9,14 | −248,60 | 1,2521 | 2,3644 | |||||

| US21H0526788 / Ginnie Mae | 9,13 | 48,62 | 1,2510 | 0,1398 | |||||

| US36179V4U15 / Ginnie Mae II Pool | 8,88 | −17,53 | 1,2166 | −0,3898 | |||||

| US01F0326664 / Uniform Mortgage-Backed Security, TBA | 8,87 | −141,02 | 1,2156 | 5,1271 | |||||

| GNII II 5% 11/20/2054#MB0025 / ABS-MBS (US3618N5A332) | 8,33 | −2,61 | 1,1411 | −0,1348 | |||||

| US21H0226710 / GNII II 2.5% 07/01/2050 #TBA | 7,75 | 36,70 | 1,0619 | 0,0366 | |||||

| BMO 2025-5C9 MTG TR 5.7785% 04/15/2058 / ABS-MBS (US096933AC06) | 7,67 | 1,0510 | 1,0510 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 7,55 | 1,0351 | 1,0351 | ||||||

| US01F0526644 / Uniform Mortgage-Backed Security, TBA | 7,53 | −162,42 | 1,0314 | 2,6838 | |||||

| US21H0206753 / GINNIE MAE II POOL 30YR TBA (JULY) | 6,99 | −11,01 | 0,9578 | −0,4630 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 6,28 | 0,8609 | 0,8609 | ||||||

| US3128MMWQ29 / Freddie Mac Gold Pool | 5,78 | −5,13 | 0,7926 | −0,1171 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 5,44 | 0,7451 | 0,7451 | ||||||

| US3132DWBG78 / Freddie Mac Pool | 5,13 | −4,34 | 0,7032 | −0,0974 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 5,02 | 0,6874 | 0,6874 | ||||||

| US3132DVLW36 / Freddie Mac Pool | 4,81 | −4,36 | 0,6590 | −0,0913 | |||||

| GNII II 4.5% 04/20/2055#MB0306 / ABS-MBS (US3618N5KU27) | 4,44 | 0,6082 | 0,6082 | ||||||

| US3132DVLC71 / FR SD7523 | 4,43 | −4,46 | 0,6075 | −0,0849 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 4,23 | 0,5804 | 0,5804 | ||||||

| US3140QNVZ28 / Fannie Mae Pool | 4,20 | −4,85 | 0,5755 | −0,0832 | |||||

| EW / Edwards Lifesciences Corporation | 4,17 | −63,85 | 0,5712 | −1,0090 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 4,02 | 0,5514 | 0,5514 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 4,00 | 0,5475 | 0,5475 | ||||||

| US36179VVX53 / GNMA II, 30 Year | 3,92 | −4,23 | 0,5373 | −0,0736 | |||||

| US3133AJ3F86 / FEDERAL HOME LOAN MORTGAGE CORPORATION | 3,90 | −3,99 | 0,5343 | −0,0717 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 3,83 | 0,5253 | 0,5253 | ||||||

| US31418D7G15 / Fannie Mae Pool | 3,76 | −4,86 | 0,5156 | −0,0746 | |||||

| US01F0406698 / UMBS TBA | 3,76 | −61,26 | 0,5152 | −1,2404 | |||||

| US21H0406650 / GNMA | 3,76 | 41,08 | 0,5149 | 0,0332 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 3,75 | −1,42 | 0,5137 | −0,0538 | |||||

| US36179WVU97 / Ginnie Mae II Pool | 3,74 | −4,60 | 0,5120 | −0,0724 | |||||

| STELLANTIS FINANCIAL UNDERWRITTEN ENHANCED LEASE TRUST 2025-A 4.63% 07/20/2027 144A / ABS-CBDO (US858928AB07) | 3,70 | 0,5072 | 0,5072 | ||||||

| US36179VZQ66 / Ginnie Mae II Pool | 3,69 | −4,21 | 0,5052 | −0,0692 | |||||

| US36179XHX75 / GINNIE MAE II POOL | 3,54 | −4,94 | 0,4850 | −0,0707 | |||||

| US31418DN731 / Fannie Mae Pool | 3,52 | −4,34 | 0,4831 | −0,0669 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 3,52 | −2,95 | 0,4819 | −0,0589 | |||||

| GNII II 4.5% 11/20/2054#MB0024 / ABS-MBS (US3618N5A258) | 3,36 | −3,01 | 0,4598 | −0,0565 | |||||

| US3140QKNW40 / Fannie Mae Pool | 3,33 | −4,82 | 0,4569 | −0,0659 | |||||

| US01F0626717 / Uniform Mortgage-Backed Security, TBA | 3,33 | −192,20 | 0,4569 | 0,9525 | |||||

| BX COML MTG TR 2024-XL5 A TSFR1M+139.165 03/15/2039 144A / ABS-MBS (US05612GAA13) | 3,26 | 157,30 | 0,4468 | 0,2576 | |||||

| US3137H65B77 / FEDERAL HOME LN MTG MLT CTF GT 3% 02/25/2048 | 3,20 | −3,94 | 0,4382 | −0,0586 | |||||

| US3140QN3T75 / Fannie Mae Pool | 3,15 | −4,72 | 0,4317 | −0,0617 | |||||

| US3132DV7B53 / Freddie Mac Pool | 3,13 | −4,01 | 0,4295 | −0,0578 | |||||

| US36250SAD18 / GS Mortgage Securities Corp II | 3,09 | 0,52 | 0,4231 | −0,0353 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 2,88 | −6,40 | 0,3949 | −0,0645 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 2,86 | 0,3920 | 0,3920 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,80 | −3,71 | 0,3841 | −0,0503 | |||||

| USTN TII 2.375% 02/15/2055 / DBT (US912810UH94) | 2,79 | 0,3819 | 0,3819 | ||||||

| US31418CCK80 / Fannie Mae Pool | 2,75 | −3,78 | 0,3766 | −0,0496 | |||||

| US3622ABDF64 / GNMA II 2.5% 08/20/2051#785602 | 2,73 | −4,07 | 0,3748 | −0,0506 | |||||

| US34532JAA25 / Ford Credit Auto Owner Trust 2020-REV2 | 2,71 | 0,82 | 0,3719 | −0,0299 | |||||

| GNII II 6% 12/20/2054#MB0093 / ABS-MBS (US3618N5C726) | 2,69 | −1,46 | 0,3688 | −0,0389 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 2,63 | 0,3601 | 0,3601 | ||||||

| US3132DVMG76 / FHLG 30YR 5.5% 03/01/2053#SD7559 | 2,62 | −4,45 | 0,3593 | −0,0502 | |||||

| US34528QHV95 / FORDF_23-1 | 2,60 | 227,90 | 0,3559 | 0,2376 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,57 | −8,77 | 0,3520 | −0,0681 | |||||

| US34528QGA67 / Ford Credit Floorplan Master Owner Trust A | 2,54 | −0,31 | 0,3475 | −0,0322 | |||||

| US3140Q7U967 / Fannie Mae Pool | 2,46 | −4,32 | 0,3372 | −0,0466 | |||||

| US36179WXJ25 / GNII II 2.5% 02/20/2052#MA7881 | 2,43 | −4,47 | 0,3336 | −0,0468 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,38 | −2,22 | 0,3257 | −0,0371 | |||||

| US3140X6J856 / FNMA 30YR UMBS SUPER | 2,33 | −3,77 | 0,3187 | −0,0419 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,29 | 0,3138 | 0,3138 | ||||||

| US31418DQ700 / Fannie Mae Pool | 2,28 | −4,33 | 0,3123 | −0,0432 | |||||

| US3140XDBT23 / FNMA 30YR 3% 10/01/2051#FM9049 | 2,28 | −4,12 | 0,3123 | −0,0424 | |||||

| US3137F4D414 / Freddie Mac Multifamily Structured Pass Through Certificates | 2,26 | 0,22 | 0,3100 | −0,0269 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 2,24 | −1,93 | 0,3068 | −0,0339 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 2,18 | 0,2985 | 0,2985 | ||||||

| US3140X42P09 / Fannie Mae Pool | 2,17 | −5,52 | 0,2979 | −0,0455 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 2,13 | 0,2922 | 0,2922 | ||||||

| TOYOTA AUTO RECEIVABLES 2025-B OWNER TR 4.34% 11/15/2029 / ABS-CBDO (US89231HAD89) | 2,10 | 0,2880 | 0,2880 | ||||||

| US3133KNSM64 / Freddie Mac Pool | 2,00 | −4,02 | 0,2745 | −0,0371 | |||||

| US3133KNSL81 / Freddie Mac Pool | 1,98 | −4,29 | 0,2720 | −0,0374 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,95 | −1,42 | 0,2672 | −0,0281 | |||||

| US3140XFJ859 / Fannie Mae Pool | 1,94 | −4,63 | 0,2655 | −0,0378 | |||||

| USAA AUTO OWNER TR 2024-A 5.03% 03/15/2029 144A / ABS-CBDO (US90327VAC28) | 1,91 | −0,36 | 0,2620 | −0,0245 | |||||

| US74969CAA53 / RLGH Trust 2021-TROT | 1,89 | 0,16 | 0,2596 | −0,0227 | |||||

| US31418CEE03 / Fannie Mae Pool | 1,89 | −4,06 | 0,2589 | −0,0350 | |||||

| US3132DVLK97 / Freddie Mac Pool | 1,88 | −4,23 | 0,2574 | −0,0353 | |||||

| US3140X5JX21 / FNMA 30YR 3% 12/01/2049#FM2077 | 1,87 | −3,86 | 0,2559 | −0,0339 | |||||

| US31418DU835 / FNCI UMBS 2.0 MA4206 12-01-35 | 1,87 | −3,32 | 0,2558 | −0,0323 | |||||

| US065404BB01 / BANK 2018-BNK10 | 1,86 | 0,71 | 0,2543 | −0,0206 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,85 | 0,2531 | 0,2531 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,84 | −1,87 | 0,2524 | −0,0276 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,84 | −4,22 | 0,2523 | −0,0345 | |||||

| US78472UAA60 / SREIT Trust 2021-MFP | 1,83 | −6,36 | 0,2502 | −0,0408 | |||||

| US31418D6C10 / FN MA4466 | 1,80 | −4,10 | 0,2470 | −0,0335 | |||||

| GNII II 6% 01/20/2055#MB0148 / ABS-MBS (US3618N5EW56) | 1,80 | −1,43 | 0,2462 | −0,0258 | |||||

| US31418DUA89 / FN 10/40 FIXED 2 | 1,79 | −3,03 | 0,2455 | −0,0302 | |||||

| US36179WY855 / GNII II 2% 03/20/2052# | 1,79 | −4,28 | 0,2452 | −0,0338 | |||||

| US36179VXX36 / Ginnie Mae II Pool | 1,78 | −4,20 | 0,2437 | −0,0334 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,78 | −2,42 | 0,2433 | −0,0282 | |||||

| US89237MAA71 / Toyota Auto Loan Extended Note Trust 2021-1 | 1,75 | 0,75 | 0,2405 | −0,0194 | |||||

| BANK 2025-BNK49 5.623% 03/15/2058 / ABS-MBS (US05494FBT49) | 1,75 | 0,2394 | 0,2394 | ||||||

| US05592DAA28 / BPR Trust 2022-OANA | 1,68 | −0,18 | 0,2302 | −0,0209 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,66 | −3,32 | 0,2278 | −0,0289 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,65 | 9,34 | 0,2262 | 0,0009 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,63 | 0,2227 | 0,2227 | ||||||

| US3133KGJQ29 / Freddie Mac Pool | 1,61 | −4,10 | 0,2213 | −0,0299 | |||||

| US3132DVLD54 / Federal Home Loan Mortgage Corporation | 1,61 | −4,80 | 0,2200 | −0,0317 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,60 | −3,95 | 0,2197 | −0,0294 | |||||

| US3133B9K523 / Freddie Mac Pool | 1,60 | −2,68 | 0,2191 | −0,0262 | |||||

| ALA TRUST 2025-OANA A 6.04263% 06/15/2030 144A / ABS-MBS (US009920AA71) | 1,59 | 0,2174 | 0,2174 | ||||||

| US3137H5BQ92 / FEDERAL HOME LN MTG MLT CTF GT 5182 A 2.5% 10/25/2048 | 1,59 | −3,70 | 0,2174 | −0,0284 | |||||

| US31418D4Y57 / FNMA, 30 Year | 1,58 | −4,41 | 0,2170 | −0,0302 | |||||

| US3137FG6X87 / FHLMC, Multifamily Structured Pass-Through Certificates, Series K077, Class A2 | 1,58 | 0,32 | 0,2168 | −0,0186 | |||||

| US3140X7B992 / FNMA POOL FM3663 FN 03/50 FIXED VAR | 1,57 | −4,79 | 0,2153 | −0,0310 | |||||

| US31418D6K36 / Fannie Mae Pool | 1,56 | −2,86 | 0,2145 | −0,0260 | |||||

| US3140XBJ684 / FN FM7484 | 1,56 | −4,75 | 0,2143 | −0,0307 | |||||

| US3136BLES56 / FEDERAL NAT MTG ASN GTD REM PA 2% 10/25/2047 | 1,56 | −4,76 | 0,2138 | −0,0306 | |||||

| US3140XFG210 / FN FS0216 | 1,56 | −3,77 | 0,2133 | −0,0281 | |||||

| US3132DNB362 / Freddie Mac Pool | 1,54 | −3,99 | 0,2111 | −0,0284 | |||||

| US3140XDRX60 / Fannie Mae Pool | 1,53 | −4,08 | 0,2097 | −0,0284 | |||||

| US3140QMAB06 / FNMA 30YR 2% 10/01/2051#CB1801 | 1,51 | −3,69 | 0,2075 | −0,0270 | |||||

| US3140K0JB52 / FNMA 30YR 3% 11/01/2049#BO4757 | 1,51 | −5,33 | 0,2068 | −0,0312 | |||||

| US3133KMXD28 / FHLG 30YR 2% 10/01/2051#RA6076 | 1,50 | −4,28 | 0,2057 | −0,0282 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,50 | −4,40 | 0,2057 | −0,0286 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,49 | −3,68 | 0,2048 | −0,0268 | |||||

| US3140XDT226 / Fannie Mae Pool | 1,49 | −4,55 | 0,2044 | −0,0288 | |||||

| US36179WG365 / Ginnie Mae II Pool | 1,48 | −4,32 | 0,2032 | −0,0282 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,47 | 0,2020 | 0,2020 | ||||||

| DLLAA 2025-1 LLC 4.95% 09/20/2029 144A / ABS-CBDO (US233249AC53) | 1,47 | −0,34 | 0,2008 | −0,0186 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,46 | −3,63 | 0,2000 | −0,0260 | |||||

| US3140XBKV12 / Fannie Mae Pool | 1,45 | −4,59 | 0,1993 | −0,0283 | |||||

| US3131XG3A42 / FHLG 30YR 4.5% 07/01/2041#ZL1693 | 1,45 | −2,15 | 0,1992 | −0,0225 | |||||

| US36179WTX64 / Ginnie Mae II Pool | 1,44 | −4,38 | 0,1977 | −0,0274 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,44 | −3,55 | 0,1974 | −0,0255 | |||||

| US3132DVLM53 / Freddie Mac Pool | 1,44 | −4,45 | 0,1969 | −0,0276 | |||||

| US36179VTV26 / Ginnie Mae II Pool | 1,44 | 0,1969 | 0,1969 | ||||||

| US89179YAR45 / TOWD POINT MORTGAGE TRUST 2021-1 VAR 11/25/2061 144A | 1,43 | −5,60 | 0,1965 | −0,0302 | |||||

| BX Trust 2025-ROIC VAR 03/15/2030 144A / ABS-MBS (US05593VAA17) | 1,43 | 4,85 | 0,1956 | −0,0076 | |||||

| US3132DVLQ67 / FR SD7535 | 1,42 | −4,38 | 0,1943 | −0,0271 | |||||

| MORGAN STANLEY CAP I TR 2024-NSTB A VAR 07/20/2032 144A / ABS-MBS (US61690BAA08) | 1,41 | −1,19 | 0,1936 | −0,0197 | |||||

| US3132DWAF05 / Freddie Mac Pool | 1,40 | 0,1916 | 0,1916 | ||||||

| US3140QMTF19 / FNMA 30YR 2% 12/01/2051#CB2349 | 1,39 | −3,60 | 0,1910 | −0,0249 | |||||

| US3140QLM780 / FNMA 30YR 2.5% 08/01/2051#CB1281 | 1,39 | −4,21 | 0,1904 | −0,0260 | |||||

| US3132D9GT58 / FHLG 20YR 2.5% 11/01/2041#SC0210 | 1,39 | −3,74 | 0,1903 | −0,0250 | |||||

| US3133KM5A90 / FHLG 30YR 2% 11/01/2051#RA6241 | 1,37 | −4,75 | 0,1871 | −0,0269 | |||||

| US3140XAHS47 / FNMA 30YR 2.5% 04/01/2051#FM6540 | 1,36 | −6,02 | 0,1862 | −0,0295 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,35 | −3,09 | 0,1847 | −0,0228 | |||||

| US3140XEAV60 / FNMA 30YR 3% 12/01/2051#FM9919 | 1,34 | −5,05 | 0,1831 | −0,0268 | |||||

| US3140XDGU41 / FNMA 30YR 3% 10/01/2051#FM9210 | 1,33 | −4,03 | 0,1826 | −0,0247 | |||||

| US3140J84L42 / FNMA 30YR 3.5% 06/01/2048#BM4426 | 1,32 | −3,92 | 0,1816 | −0,0242 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,32 | −2,95 | 0,1805 | −0,0219 | |||||

| US3133AYBJ83 / Freddie Mac Pool | 1,31 | −3,81 | 0,1801 | −0,0238 | |||||

| HYUNDAI AUTO LEASE SECURITIZATION TRUST 2024-C 4.62% 04/17/2028 144A / ABS-CBDO (US448984AD63) | 1,30 | 0,1786 | 0,1786 | ||||||

| US90353DAW56 / UBS Commercial Mortgage Trust | 1,30 | −7,08 | 0,1782 | −0,0307 | |||||

| US31418DYB27 / FN MA4305 | 1,30 | −4,20 | 0,1781 | −0,0243 | |||||

| GNMA II 5.5% 03/20/2054#787292 / ABS-MBS (US3622AC7D65) | 1,30 | 0,1778 | 0,1778 | ||||||

| US3132D9FB59 / FHLG 20YR 2% 07/01/2041#SC0162 | 1,29 | −3,66 | 0,1770 | −0,0231 | |||||

| GNII II 5.5% 12/20/2054#787741 / ABS-MBS (US3622ADP286) | 1,29 | 0,1767 | 0,1767 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,27 | −3,70 | 0,1746 | −0,0229 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,26 | −4,26 | 0,1728 | −0,0237 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,25 | −3,02 | 0,1715 | −0,0211 | |||||

| US3133KPDQ81 / Freddie Mac Pool | 1,25 | −5,16 | 0,1713 | −0,0254 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,25 | −4,58 | 0,1713 | −0,0242 | |||||

| US3132DVLV52 / Freddie Mac Pool | 1,24 | −4,33 | 0,1696 | −0,0235 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,24 | 0,1694 | 0,1694 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,23 | 0,1681 | 0,1681 | ||||||

| US3622ABDV15 / Ginnie Mae II Pool | 1,22 | −4,90 | 0,1678 | −0,0243 | |||||

| US3133KRVL58 / FHLM 30YR 5.5% 08/01/2053#RA9619 | 1,22 | −3,86 | 0,1671 | −0,0222 | |||||

| BMO 2024-5C6 MTG TR 5.3161% 09/15/2057 / ABS-MBS (US05593QAC87) | 1,22 | −0,49 | 0,1670 | −0,0157 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,22 | −5,51 | 0,1668 | −0,0255 | |||||

| US3140XF7L97 / FNMA 30YR UMBS SUPER | 1,21 | −4,20 | 0,1658 | −0,0227 | |||||

| GREENSKY HOME IMPROVEMENT TRUST 2024-2 5.25% 10/27/2059 144A / ABS-CBDO (US39571XAB01) | 1,21 | −39,30 | 0,1656 | −0,1315 | |||||

| HYUNDAI AUTO LEASE SECURITIZATION TRUST 2025-B 4.58% 09/15/2027 144A / ABS-CBDO (US44935DAB55) | 1,20 | 0,1647 | 0,1647 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,20 | −4,08 | 0,1645 | −0,0223 | |||||

| US36179XX434 / GOVERNMENT NATIONAL MORTGAGE CORPORATION | 1,19 | −4,56 | 0,1634 | −0,0230 | |||||

| FHLMC REMI 30YR 5.5% 04/01/2055#RJ4005 / ABS-MBS (US3142GUNX70) | 1,19 | 0,1630 | 0,1630 | ||||||

| US3137H4N304 / FEDERAL HOME LN MTG MLT CTF GT 5175 CB 2.5% 04/25/2050 | 1,19 | −3,27 | 0,1625 | −0,0203 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,18 | 0,1619 | 0,1619 | ||||||

| US36262MAA62 / GSMS 2021-IP A 1ML+105 10/15/2036 144A | 1,16 | 0,00 | 0,1587 | −0,0141 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,16 | −2,20 | 0,1585 | −0,0179 | |||||

| MSRM 2025-NQM3 VAR 05/25/2070 144A / ABS-CBDO (US61778LAA35) | 1,15 | 0,1580 | 0,1580 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,14 | −2,32 | 0,1559 | −0,0179 | |||||

| US3140QL7M23 / FNMA 30YR 2% 10/01/2051#CB1799 | 1,14 | −4,53 | 0,1558 | −0,0219 | |||||

| US361886CR36 / GMF Floorplan Owner Revolving Trust | 1,13 | −0,35 | 0,1555 | −0,0144 | |||||

| WHEELS FLEET LEASE FUNDING 1 LLC 24-1A A1 5.49% 02/18/2039 144A / ABS-CBDO (US96328GBM87) | 1,13 | −12,66 | 0,1543 | −0,0381 | |||||

| US3140QLPR10 / Fannie Mae Pool | 1,12 | −3,77 | 0,1539 | −0,0203 | |||||

| US3140QQVS16 / FN CB5124 | 1,11 | −3,75 | 0,1515 | −0,0199 | |||||

| WELLS FARGO COML MTG TR 2024-GRP TSFR1M+229.06 10/15/2041 144A / ABS-MBS (US95003YAC66) | 1,10 | 0,00 | 0,1514 | −0,0134 | |||||

| FHLMC REMI 30YR 6.5% 03/01/2055#RJ3704 / ABS-MBS (US3142GUDJ96) | 1,10 | 0,1509 | 0,1509 | ||||||

| US3133KH6N11 / Freddie Mac Pool | 1,10 | −4,44 | 0,1505 | −0,0210 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,10 | −2,06 | 0,1503 | −0,0168 | |||||

| US3140KDGZ74 / FNMA 15YR 2% 06/01/2035#BP5615 | 1,10 | −3,95 | 0,1501 | −0,0201 | |||||

| US3140QLM608 / FANNIE MAE POOL | 1,09 | −3,38 | 0,1490 | −0,0189 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,08 | −2,88 | 0,1481 | −0,0181 | |||||

| US31418DMN92 / Fannie Mae Pool | 1,08 | −4,10 | 0,1477 | −0,0199 | |||||

| US3140QQNK71 / FNMA 30YR 5% 10/01/2052#CB4893 | 1,06 | −3,55 | 0,1452 | −0,0187 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,06 | −2,04 | 0,1447 | −0,0161 | |||||

| US3137F6YK78 / Federal Home Loan Mortgage Corporation | 1,06 | −4,26 | 0,1446 | −0,0198 | |||||

| US3140XDV370 / Fannie Mae Pool | 1,05 | −3,30 | 0,1445 | −0,0182 | |||||

| GNII II 5.5% 01/20/2055#787767 / ABS-MBS (US3622ADQU50) | 1,05 | 0,1445 | 0,1445 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,05 | 0,1445 | 0,1445 | ||||||

| US3132DWB850 / FHLMC UMBS, 30 Year | 1,05 | −3,32 | 0,1435 | −0,0182 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,04 | −4,48 | 0,1431 | −0,0201 | |||||

| US3137BNGT50 / Freddie Mac Multifamily Structured Pass Through Certificates | 1,04 | −2,62 | 0,1429 | −0,0169 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,04 | −2,26 | 0,1423 | −0,0163 | |||||

| US3140QDYC24 / FNMA POOL CA6106 FN 06/50 FIXED 4 | 1,04 | −4,78 | 0,1419 | −0,0205 | |||||

| US3140QMRK22 / Fannie Mae Pool | 1,03 | −4,63 | 0,1413 | −0,0200 | |||||

| US31418DES71 / Fannie Mae Pool | 1,03 | −4,47 | 0,1408 | −0,0196 | |||||

| FHLMC REMI 30YR 6.5% 03/01/2055#RJ3703 / ABS-MBS (US3142GUDH31) | 1,03 | 0,1407 | 0,1407 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,01 | −8,66 | 0,1389 | −0,0267 | |||||

| CARMX 2025-2 4.59% 07/17/2028 / ABS-CBDO (US14320AAB70) | 1,01 | 0,1385 | 0,1385 | ||||||

| US3132DVLE38 / Freddie Mac Pool | 1,00 | −4,40 | 0,1371 | −0,0191 | |||||

| MERCEDES-BENZ AUTO LEASE TR 2024-B 4.89% 02/15/2028 / ABS-CBDO (US58769GAD51) | 1,00 | −0,20 | 0,1366 | −0,0124 | |||||

| US3140X4PY64 / FNMA 30YR 4.5% 08/01/2049#FM1338 | 0,99 | −4,15 | 0,1360 | −0,0185 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,98 | −2,97 | 0,1342 | −0,0165 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,97 | −86,94 | 0,1333 | −1,1029 | |||||

| US009740AA95 / Ajax Mortgage Loan Trust 2021-E | 0,97 | −2,80 | 0,1332 | −0,0162 | |||||

| US3132DPD546 / FHLG 30YR 5% 12/01/2052#SD1924 | 0,96 | −4,28 | 0,1319 | −0,0183 | |||||

| US466317AA25 / J.P. MORGAN CHASE COMMERCIAL MORTGAGE SECURI SER 2022-NLP CL A V/R REGD 144A P/P 1.28650000 | 0,96 | −0,21 | 0,1315 | −0,0121 | |||||

| US62955VAA44 / NYMT Loan Trust 2022-CP1 | 0,95 | −5,27 | 0,1306 | −0,0196 | |||||

| US3128MJ3B44 / Freddie Mac Gold Pool | 0,95 | −4,71 | 0,1302 | −0,0186 | |||||

| US26863LAA26 / ELP Commercial Mortgage Trust 2021-ELP | 0,95 | 0,11 | 0,1297 | −0,0114 | |||||

| US3140XDS566 / Fannie Mae Pool | 0,95 | −4,55 | 0,1296 | −0,0183 | |||||

| GNII II 4.5% 03/20/2055#MB0257 / ABS-MBS (US3618N5JB64) | 0,94 | 0,1294 | 0,1294 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,94 | 0,1283 | 0,1283 | ||||||

| US3136BKXA54 / Fannie Mae REMICS | 0,93 | −3,93 | 0,1273 | −0,0170 | |||||

| US31418DVW90 / FNCI UMBS 1.5 MA4228 01-01-36 | 0,92 | −3,45 | 0,1267 | −0,0163 | |||||

| BENCHMARK 2024-V9 MORTGAGE TRUST 5.6019% 08/15/2057 / ABS-MBS (US081919AN29) | 0,92 | −0,43 | 0,1267 | −0,0119 | |||||

| US3140HFQB81 / FNMA 30YR 3% 04/01/2050#BK2249 | 0,91 | −4,80 | 0,1251 | −0,0179 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,91 | 0,1250 | 0,1250 | ||||||

| US3140XJBR37 / FNMA 15YR 1.5% 01/01/2037#FS2747 | 0,91 | −3,40 | 0,1247 | −0,0159 | |||||

| US3133KMFP59 / Freddie Mac Pool | 0,91 | −4,32 | 0,1245 | −0,0172 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,90 | −2,71 | 0,1231 | −0,0146 | |||||

| JOHN DEERE OWNER TRUST 2025 4.23% 03/15/2028 REGS / ABS-CBDO (US47800DAB01) | 0,90 | 0,1231 | 0,1231 | ||||||

| WELLS FARGO COML MORTAGE TR 2024-MGP A12 TSFR1M+179.1 08/15/2041 144A / ABS-MBS (US95003TAS24) | 0,90 | −1,10 | 0,1227 | −0,0124 | |||||

| US3140QSHQ71 / FNMA 30YR 6% 06/01/2053#CB6538 | 0,89 | −3,90 | 0,1218 | −0,0162 | |||||

| US3132DVKU88 / UMBS Pool | 0,89 | −4,42 | 0,1216 | −0,0169 | |||||

| US3140K9NC98 / FNMA 30YR 3% 03/01/2050#BP2186 | 0,89 | −4,83 | 0,1216 | −0,0176 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,89 | −2,74 | 0,1215 | −0,0145 | |||||

| US3140QEDW99 / Fannie Mae Pool | 0,89 | −4,63 | 0,1215 | −0,0173 | |||||

| US3138EQD259 / Fannie Mae Pool | 0,88 | −9,35 | 0,1209 | −0,0243 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,88 | 0,1209 | 0,1209 | ||||||

| US3137FCJK14 / FHMS K070 A2 (MF) 3.303% 11-25-27 | 0,88 | 0,34 | 0,1206 | −0,0103 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,88 | 0,1200 | 0,1200 | ||||||

| US125039AD96 / CD Mortgage Trust, Series 2017-CD6, Class ASB | 0,88 | −9,98 | 0,1200 | −0,0252 | |||||

| US3132DN4S96 / FHLG 30YR 5% 10/01/2052#SD1733 | 0,87 | −3,86 | 0,1194 | −0,0159 | |||||

| US61692AAA07 / Morgan Stanley Capital I Inc | 0,86 | 0,70 | 0,1184 | −0,0096 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,85 | −4,37 | 0,1170 | −0,0163 | |||||

| US3137F72B05 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,85 | 0,83 | 0,1159 | −0,0093 | |||||

| US3137H4BY51 / FHMS K746 A2 | 0,84 | 0,84 | 0,1151 | −0,0091 | |||||

| US3137H6RT41 / FEDERAL HOME LN MTG MLT CTF GT 3.25% 04/25/2052 | 0,84 | −3,01 | 0,1150 | −0,0142 | |||||

| US95003EAA47 / WFCM_21-FCMT | 0,84 | −0,36 | 0,1149 | −0,0106 | |||||

| US3140XJL501 / FNMA 30YR 5% 10/01/2052#FS3047 | 0,84 | −4,34 | 0,1148 | −0,0158 | |||||

| BANKERS HEALTHCARE GROUP SECURITIZATION TRUST 4.82% 04/17/2036 144A / ABS-CBDO (US08860AAA79) | 0,84 | 0,1146 | 0,1146 | ||||||

| US3140X6W982 / Fannie Mae Pool | 0,83 | −3,38 | 0,1138 | −0,0146 | |||||

| US06540JBA97 / BANK, Series 2020-BN26, Class ASB | 0,83 | −2,81 | 0,1136 | −0,0137 | |||||

| US3132DWBA09 / FR SD8133 | 0,82 | −4,21 | 0,1124 | −0,0154 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,81 | 0,1106 | 0,1106 | ||||||

| US3137F64V68 / Federal Home Loan Mortgage Corporation | 0,80 | −4,53 | 0,1098 | −0,0154 | |||||

| WORLD OMNI AUTOMOBILE LEASE SECURITIZATION TR 2025-A 4.35% 12/15/2027 / ABS-CBDO (US98164PAB67) | 0,80 | 0,1095 | 0,1095 | ||||||

| US10569XAA72 / BRAVO 22-RPL1 A1 144A 2.75% 09-25-61 | 0,79 | −3,65 | 0,1086 | −0,0140 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,79 | −5,75 | 0,1079 | −0,0168 | |||||

| US3132DWA456 / Freddie Mac Pool | 0,78 | −4,27 | 0,1076 | −0,0147 | |||||

| US17324DAU81 / CITIGROUP COMMERCIAL MORTGAGE TRUST 2015-P1 SER 2015-P1 CL A5 REGD 3.71700000 | 0,78 | −27,73 | 0,1073 | −0,0544 | |||||

| AMUR EQUIP FIN RECEIVABLES XV LLC 4.7% 09/22/2031 144A / ABS-CBDO (US03237FAB13) | 0,78 | 0,1071 | 0,1071 | ||||||

| US3137FUAS39 / Freddie Mac REMICS | 0,78 | −2,62 | 0,1071 | −0,0126 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,78 | −6,59 | 0,1070 | −0,0176 | |||||

| US31418DVD10 / Fannie Mae Pool | 0,78 | −4,53 | 0,1069 | −0,0150 | |||||

| US31418DV668 / Fannie Mae Pool | 0,78 | −4,18 | 0,1068 | −0,0146 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,78 | −3,83 | 0,1068 | −0,0142 | |||||

| US3133KNEF69 / Freddie Mac Pool | 0,78 | −5,24 | 0,1066 | −0,0159 | |||||

| US3132DWAV54 / FREDDIE MAC POOL | 0,77 | −4,22 | 0,1059 | −0,0145 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,77 | −7,44 | 0,1057 | −0,0187 | |||||

| US3140XBE222 / Fannie Mae Pool | 0,77 | −4,00 | 0,1053 | −0,0142 | |||||

| US31418EDE77 / Fannie Mae Pool | 0,77 | −4,12 | 0,1052 | −0,0143 | |||||

| US3622ABKS03 / Ginnie Mae II Pool | 0,75 | −4,69 | 0,1031 | −0,0147 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,75 | −4,71 | 0,1025 | −0,0147 | |||||

| OWN EQUIPMENT FUND I LLC 5.7% 12/20/2032 144A / ABS-CBDO (US69121NAA63) | 0,75 | −6,52 | 0,1021 | −0,0170 | |||||

| US3133KNAB91 / Freddie Mac Pool | 0,74 | −4,29 | 0,1009 | −0,0139 | |||||

| US3140QK5L85 / FNMA 30YR 3% 06/01/2051#CB0850 | 0,73 | −4,58 | 0,1000 | −0,0141 | |||||

| US96328GBG10 / Wheels Fleet Lease Funding 1 LLC | 0,73 | −15,74 | 0,0998 | −0,0292 | |||||

| US3133AJHB27 / FHLG 30YR 1.5% 03/01/2051#QC0226 | 0,73 | −4,23 | 0,0994 | −0,0136 | |||||

| US31335APZ56 / Federal Home Loan Mortgage Corp. | 0,72 | −4,49 | 0,0992 | −0,0138 | |||||

| US86190BAA26 / STORE MASTER FUNDING 2.12% 06/20/2051 144A | 0,72 | 0,42 | 0,0989 | −0,0084 | |||||

| AFFIRM ASSET SECURITIZATION TR 2025-X1 A 5.24% 04/15/2030 144A / ABS-CBDO (US00834MAA18) | 0,72 | 0,0986 | 0,0986 | ||||||

| US3140XDNN25 / FNMA 20YR 2% 10/01/2041#FM9396 | 0,72 | −2,98 | 0,0982 | −0,0121 | |||||

| GM FINANCIAL REVOLVING RECEIVABLES TRUST 2024-1 4.98% 12/11/2036 144A / ABS-CBDO (US36269KAA34) | 0,72 | −0,14 | 0,0981 | −0,0089 | |||||

| US3622ABB926 / GNMA II 2.5% 08/20/2051#785564 | 0,72 | −3,90 | 0,0981 | −0,0130 | |||||

| US3140X7AM13 / Federal National Mortgage Association, Inc. | 0,71 | −4,67 | 0,0979 | −0,0139 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,71 | −3,53 | 0,0975 | −0,0126 | |||||

| US3140QKNE42 / Fannie Mae Pool | 0,71 | −3,55 | 0,0969 | −0,0125 | |||||

| US3622ABDY53 / GNMA II 2.5% 09/20/2051#785619 | 0,71 | −4,34 | 0,0966 | −0,0134 | |||||

| SANTANDER DRIVE AUTO RECEIVABLES TRUST 2025-2 4.67% 08/15/2029 / ABS-CBDO (US80287NAC92) | 0,70 | 0,0962 | 0,0962 | ||||||

| CROSS 2025-H4 MTG TR A1 VAR 06/25/2070 144A / ABS-CBDO (US22790AAA34) | 0,70 | 0,0961 | 0,0961 | ||||||

| US3140QQN357 / FNMA 30YR 5.5% 10/01/2052#CB4909 | 0,70 | −6,17 | 0,0960 | −0,0154 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,69 | 0,0951 | 0,0951 | ||||||

| US12593JBF21 / COMM 2015-CCRE24 Mortgage Trust | 0,69 | −30,75 | 0,0945 | −0,0540 | |||||

| US3132CW4V37 / Federal Home Loan Mortgage Corporation | 0,69 | −5,50 | 0,0942 | −0,0144 | |||||

| US3140KSP500 / FNMA 20YR 2% 11/01/2041#BQ6743 | 0,69 | −3,52 | 0,0941 | −0,0120 | |||||

| US06539LBB53 / BANK 2018-BNK13 | 0,69 | 0,00 | 0,0941 | −0,0083 | |||||

| US3140XHHS99 / Fannie Mae Pool | 0,68 | −4,07 | 0,0938 | −0,0127 | |||||

| US3137FETN09 / FHLMC, Multifamily Structured Pass-Through Certificates, Series K073, Class A2 | 0,68 | 0,29 | 0,0938 | −0,0080 | |||||

| US61691JAU88 / Morgan Stanley Capital I Trust 2017-H1 | 0,68 | 0,59 | 0,0936 | −0,0078 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,68 | 0,0936 | 0,0936 | ||||||

| BX 2024-CNYN TSFR1M+144.188 04/15/2029 144A / ABS-MBS (US05612HAA95) | 0,68 | −0,73 | 0,0935 | −0,0091 | |||||

| US02582JJZ49 / American Express Credit Account Master Trust 2023-1 | 0,68 | −0,29 | 0,0934 | −0,0085 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,68 | −3,82 | 0,0931 | −0,0124 | |||||

| US3140QSMX67 / FNMA 30YR 5.5% 07/01/2053#CB6673 | 0,68 | −4,37 | 0,0930 | −0,0128 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,68 | −2,31 | 0,0928 | −0,0106 | |||||

| US3140QQVW28 / FNMA 30YR 5% 11/01/2052#CB5128 | 0,68 | −5,32 | 0,0927 | −0,0140 | |||||

| US3133KPDR64 / Freddie Mac Pool | 0,68 | −5,46 | 0,0925 | −0,0141 | |||||

| US12532CAZ86 / CFCRE Commercial Mortgage Trust 2017-C8 | 0,67 | 0,60 | 0,0925 | −0,0076 | |||||

| US3137FBU791 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,67 | −0,15 | 0,0921 | −0,0084 | |||||

| GNII II 5% 12/20/2054#MB0091 / ABS-MBS (US3618N5C569) | 0,67 | −2,47 | 0,0920 | −0,0107 | |||||

| US55285TAA43 / MFA 2022-RPL1 Trust | 0,67 | −3,60 | 0,0919 | −0,0120 | |||||

| US3140XAWE85 / FNMA 30YR 2% 04/01/2051#FM6944 | 0,66 | −4,46 | 0,0911 | −0,0127 | |||||

| US3136BLHG81 / Federal National Mortgage Association, Inc. | 0,66 | −3,64 | 0,0908 | −0,0117 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,66 | −2,94 | 0,0907 | −0,0110 | |||||

| US3140XFVZ11 / Fannie Mae Pool | 0,66 | −4,48 | 0,0906 | −0,0128 | |||||

| BOFA AUTO TRUST 2025-1 4.52% 11/22/2027 144A / ABS-CBDO (US05594BAB27) | 0,66 | 0,0904 | 0,0904 | ||||||

| US26863LAE48 / ELP COMMERCIAL MORTGAGE TRUST 2021-ELP 1ML+112.02 11/15/2036 144A | 0,66 | 0,00 | 0,0903 | −0,0080 | |||||

| US3140QSHR54 / FNMA 30YR 6% 06/01/2053#CB6539 | 0,66 | −3,10 | 0,0900 | −0,0112 | |||||

| US3140XJTE32 / FNMA 30YR 5% 11/01/2052#FS3248 | 0,66 | −3,53 | 0,0898 | −0,0115 | |||||

| PRPM 2024-RCF3 LLC 4% 05/25/2054 144A / ABS-CBDO (US74390BAA61) | 0,65 | −4,39 | 0,0896 | −0,0125 | |||||

| US3140XDV297 / FNCL UMBS 3.0 FM9632 11-01-51 | 0,65 | −4,81 | 0,0895 | −0,0129 | |||||

| US12482HAA23 / CAMB Commercial Mortgage Trust 2019-LIFE | 0,65 | −0,15 | 0,0893 | −0,0080 | |||||

| US3140X5V911 / FNMA 30YR 3% 02/01/2050#FM2439 | 0,65 | −3,70 | 0,0891 | −0,0118 | |||||

| WELLS FARGO COML MTG 2024-GRP A TSFR1M+179.132 10/15/2041 144A / ABS-MBS (US95003YAA01) | 0,64 | 0,00 | 0,0877 | −0,0078 | |||||

| US3140QSLS81 / FNMA 30YR 5.5% 06/01/2053#CB6636 | 0,64 | −3,33 | 0,0876 | −0,0112 | |||||

| US31418DV742 / Fannie Mae Pool | 0,64 | −4,21 | 0,0874 | −0,0120 | |||||

| US3136BM7C64 / FANNIE MAE 4.5% 07/25/2048 | 0,64 | −3,64 | 0,0871 | −0,0113 | |||||

| US31418DYY20 / Fannie Mae Pool | 0,63 | −4,24 | 0,0867 | −0,0119 | |||||

| US3132DV5J08 / Freddie Mac Pool | 0,63 | −3,68 | 0,0863 | −0,0113 | |||||

| US31418DWQ14 / Fannie Mae Pool | 0,63 | −4,26 | 0,0863 | −0,0118 | |||||

| US3140QMKN34 / FNMA 30YR 3.5% 11/01/2051# | 0,63 | −5,42 | 0,0862 | −0,0131 | |||||

| US94989YBG70 / WELLS FARGO COMMERCIAL MORTGAGE TRUST 2016-C32 A3FL 1ML+142 01/15/2059 | 0,63 | −28,42 | 0,0860 | −0,0448 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,63 | −4,13 | 0,0858 | −0,0118 | |||||

| US63875DAA90 / Natixis Commercial Mortgage Securities Trust 2020-2PAC | 0,63 | −15,52 | 0,0858 | −0,0248 | |||||

| US3133KMUX19 / FHLG 30YR 3% 10/01/2051#RA5998 | 0,62 | −5,92 | 0,0851 | −0,0134 | |||||

| FHLMC REMI 30YR 6% 03/01/2055#RJ3645 / ABS-MBS (US3142GUBP74) | 0,62 | −2,06 | 0,0848 | −0,0094 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,62 | 0,0846 | 0,0846 | ||||||

| US3136BKND04 / FEDERAL NAT MTG ASN GTD REM PA 2.5% 06/25/2049 | 0,61 | −5,42 | 0,0838 | −0,0126 | |||||

| US3136BLRR37 / FEDERAL NAT MTG ASN GTD REM PA 2.5% 11/25/2047 | 0,61 | −4,69 | 0,0837 | −0,0119 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,61 | 0,0835 | 0,0835 | ||||||

| US3140QS4U21 / Federal National Mortgage Association, Inc. | 0,61 | −3,81 | 0,0831 | −0,0111 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,61 | −6,92 | 0,0829 | −0,0142 | |||||

| US90276GAQ55 / UBS Commercial Mortgage Trust 2017-C3 | 0,60 | −11,60 | 0,0826 | −0,0191 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,60 | 0,0825 | 0,0825 | ||||||

| JP MORGAN MORTGAGE TRUST SERIES 2025-NQM2 A1 VAR 09/25/2065 144A / ABS-CBDO (US46590SAC17) | 0,60 | 0,0823 | 0,0823 | ||||||

| BRAVO RESIDENTIAL FDG TR 2025-NQM5 STEP 02/25/2065 144A / ABS-CBDO (US10569RAC60) | 0,60 | 0,0823 | 0,0823 | ||||||

| GS MTG-BACKED SECS TR 2024-RPL2 A1 3.75% 07/25/2061 144A / ABS-CBDO (US36269MAA99) | 0,60 | −1,81 | 0,0818 | −0,0090 | |||||

| AVIS BUDGET RENTCAR FDG AE LLC 5.12% 08/20/2031 144A / ABS-CBDO (US05377RKQ64) | 0,60 | 0,0818 | 0,0818 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,59 | 0,0815 | 0,0815 | ||||||

| US46652BAY56 / JP Morgan Chase Commercial Mortgage Securities Trust 2020-NNN | 0,59 | −0,67 | 0,0813 | −0,0078 | |||||

| US3132DN6H14 / FHLG 30YR 4% 10/01/2052#SD1772 | 0,59 | −3,90 | 0,0812 | −0,0107 | |||||

| US05608WAA27 / BX Trust | 0,59 | 0,17 | 0,0811 | −0,0070 | |||||

| PRMI SECURITIZATION TR 2024-CMG1 SOFR30A+130 07/25/2054 144A / ABS-CBDO (US74275VAA26) | 0,59 | −3,91 | 0,0810 | −0,0108 | |||||

| US3140XDR329 / FN FM9505 | 0,59 | −4,38 | 0,0809 | −0,0113 | |||||

| US61691RAE62 / Morgan Stanley Capital I Trust 2018-H4 | 0,59 | 0,00 | 0,0808 | −0,0071 | |||||

| US06035RAS58 / BANK 2018-BNK14 | 0,59 | 0,17 | 0,0808 | −0,0070 | |||||

| US46591ABB08 / JPMDB COMMERCIAL MORTGAGE SECURITIES TRUST 2018-C8 JPMDB 2018-C8 ASB | 0,59 | −8,70 | 0,0806 | −0,0155 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,59 | −2,81 | 0,0805 | −0,0097 | |||||

| US06541WAX02 / BANK 2017-BNK5 | 0,58 | 0,34 | 0,0801 | −0,0069 | |||||

| US3140XGZM45 / FNMA 30YR 4% 04/01/2052#FS1647 | 0,58 | −4,43 | 0,0798 | −0,0112 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,58 | −2,68 | 0,0797 | −0,0094 | |||||

| BX COML MTG TR 2024-MDHS 6.8415% 05/15/2041 144A / ABS-MBS (US12433BAA52) | 0,58 | −1,19 | 0,0797 | −0,0081 | |||||

| US31418DU751 / FNCI UMBS 1.5 MA4205 12-01-35 | 0,58 | −3,66 | 0,0794 | −0,0104 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,58 | 0,0792 | 0,0792 | ||||||

| US3132D9HN79 / FHLG 20YR 2.5% 05/01/2041#SC0237 | 0,57 | −2,56 | 0,0781 | −0,0092 | |||||

| US3136BLFC95 / FEDERAL NAT MTG ASN GTD REM PA 2% 02/25/2048 | 0,57 | −4,21 | 0,0781 | −0,0106 | |||||

| US3131YDH640 / FED HM LN PC POOL ZN6553 FR 03/49 FIXED 4 | 0,57 | −4,85 | 0,0780 | −0,0113 | |||||

| US3128P77E71 / Freddie Mac Gold Pool | 0,57 | −4,39 | 0,0776 | −0,0108 | |||||

| US43815QAC15 / HAROT 23-3 A3 5.41% 02-18-28/11-18-26 | 0,56 | −7,11 | 0,0771 | −0,0133 | |||||

| US3140X4V450 / Fannie Mae Pool | 0,56 | −5,09 | 0,0767 | −0,0112 | |||||

| US3132D56P22 / FNCI UMBS 1.5 SB8078 12-01-35 | 0,56 | −3,63 | 0,0765 | −0,0099 | |||||

| US3140XDTQ91 / FNMA 20YR 2.5% 11/01/2041#FM9558 | 0,56 | −2,11 | 0,0764 | −0,0087 | |||||

| US3140KSAU11 / FNMA 15YR 1.5% 11/01/2035#BQ6318 | 0,56 | −3,47 | 0,0762 | −0,0098 | |||||

| US36191YAE86 / GS MTG SECS TR 2011-GC5 5.209% 08/10/2044 144A | 0,55 | −0,72 | 0,0759 | −0,0074 | |||||

| US3132DPNB03 / FHLG 30YR 5% 01/01/2053#SD2186 | 0,55 | −5,00 | 0,0756 | −0,0110 | |||||

| US3138EHBH46 / Fannie Mae Pool | 0,55 | −4,01 | 0,0754 | −0,0102 | |||||

| US3140QB5W40 / Fannie Mae Pool | 0,55 | −6,14 | 0,0754 | −0,0122 | |||||

| PRET 2024-RPL1 TR 3.9% 10/25/2063 144A / ABS-CBDO (US693989AA39) | 0,55 | −4,54 | 0,0751 | −0,0105 | |||||

| US3140Q9V268 / FANNIE MAE POOL FN CA2432 | 0,55 | −6,66 | 0,0751 | −0,0124 | |||||

| US3137H5KC06 / FEDERAL HOME LN MTG MLT CTF GT 2.5% 11/25/2047 | 0,54 | −3,55 | 0,0745 | −0,0096 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,54 | −3,22 | 0,0742 | −0,0093 | |||||

| US3133KYWB19 / Freddie Mac Pool | 0,54 | −2,88 | 0,0741 | −0,0090 | |||||

| US3133KLCL99 / FHLG 30YR 2.5% 02/01/2051#RA4575 | 0,54 | −4,09 | 0,0740 | −0,0101 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,54 | −3,92 | 0,0740 | −0,0098 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,54 | −3,93 | 0,0738 | −0,0099 | |||||

| US588926AA37 / Merchants Fleet Funding LLC | 0,54 | −15,03 | 0,0737 | −0,0207 | |||||

| US3140QMMQ47 / FNMA 30YR 3% 11/01/2051#CB2166 | 0,53 | −4,13 | 0,0732 | −0,0100 | |||||

| BX COML MTG TR 2024-XL4 A TSFR1M+144.203 02/15/2039 144A / ABS-MBS (US05611VAA98) | 0,53 | −2,74 | 0,0732 | −0,0086 | |||||

| PRPM 2024-RPL2 A1 LLC VAR 05/25/2054 144A / ABS-CBDO (US69381DAA37) | 0,53 | −4,16 | 0,0727 | −0,0098 | |||||

| US3140QNF491 / Federal National Mortgage Association, Inc. | 0,53 | −5,20 | 0,0726 | −0,0108 | |||||

| US3133KPMY15 / Freddie Mac Pool | 0,53 | −3,29 | 0,0726 | −0,0092 | |||||

| US3132DQ2W53 / Freddie Mac | 0,53 | 0,0723 | 0,0723 | ||||||

| TAUBMAN CENTERS COMMERCIAL MORTGAGE TRUST 24-DPM A TSFR1M+139.27 12/15/2039 144A / ABS-MBS (US87231EAA55) | 0,53 | −0,19 | 0,0723 | −0,0065 | |||||

| US3140KRNY13 / FNMA 15YR 1.5% 11/01/2035#BQ5806 | 0,53 | −4,18 | 0,0723 | −0,0098 | |||||

| US3140QNCB60 / FN CB2765 | 0,53 | −4,55 | 0,0721 | −0,0101 | |||||

| US055522AA43 / BLOX TRUST 2021 BLOX | 0,52 | 0,96 | 0,0718 | −0,0058 | |||||

| US3140XJJE42 / FNMA 30YR 5.5% 09/01/2052#FS2960 | 0,52 | −4,42 | 0,0713 | −0,0098 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,52 | 0,0709 | 0,0709 | ||||||

| US36179RGA14 / Ginnie Mae II Pool | 0,52 | −3,92 | 0,0707 | −0,0094 | |||||

| US3133KNLC55 / Freddie Mac Pool | 0,51 | 0,0703 | 0,0703 | ||||||

| BMO 2022-C3 MTG TR 22-C3 ASB VAR 09/15/2054 / ABS-MBS (US05602QAZ63) | 0,51 | −0,39 | 0,0703 | −0,0064 | |||||

| US3622ABKD34 / G2SF 2.5 785792 12-20-51 | 0,51 | −4,48 | 0,0702 | −0,0099 | |||||

| US3133KN5B55 / FHLG 30YR 2% 04/01/2052#RA7142 | 0,51 | −3,77 | 0,0700 | −0,0092 | |||||

| US3133KLH267 / FHLG 30YR 2.5% 03/01/2051#RA4749 | 0,51 | −5,39 | 0,0698 | −0,0106 | |||||

| US3140QFD559 / Fannie Mae Pool | 0,51 | −4,51 | 0,0698 | −0,0098 | |||||

| US3132D56U17 / Freddie Mac Pool | 0,51 | −3,43 | 0,0696 | −0,0088 | |||||

| US36179S2Q92 / Ginnie Mae II Pool | 0,50 | −5,08 | 0,0691 | −0,0102 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,50 | −2,14 | 0,0688 | −0,0078 | |||||

| US3132D9CS12 / Freddie Mac Pool | 0,50 | −3,10 | 0,0686 | −0,0085 | |||||

| BOFA AUTO TRUST 2025-1 4.35% 11/20/2029 144A / ABS-CBDO (US05594BAD82) | 0,50 | 0,0685 | 0,0685 | ||||||

| GREAT AMERICA LEASING RECEIVABLES FUNDING LLC SERIES 2025-1 4.52% 10/15/2027 144A / ABS-CBDO (US39154GAH92) | 0,50 | 0,0684 | 0,0684 | ||||||

| VOLVO FINANCIAL EQUIPMENT LLC SERIES 2024-1 4.41% 11/15/2027 144A / ABS-CBDO (US92887TAB70) | 0,50 | 0,0684 | 0,0684 | ||||||

| GREAT AMERICA LEASING RECEIVABLES FUNDING LLC SERIES 2025-1 4.49% 04/16/2029 144A / ABS-CBDO (US39154GAJ58) | 0,50 | 0,0684 | 0,0684 | ||||||

| US3132A5H735 / Freddie Mac Pool | 0,50 | −3,69 | 0,0680 | −0,0089 | |||||

| US3133KQF849 / FHLG 30YR 5% 12/01/2052#RA8291 | 0,50 | −5,88 | 0,0680 | −0,0107 | |||||

| US3137FEZU77 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,50 | 0,20 | 0,0679 | −0,0059 | |||||

| GNII II 2.5% 12/20/2053#MA9356 / ABS-MBS (US36179YMD30) | 0,49 | −6,11 | 0,0675 | −0,0108 | |||||

| US3133KRJV78 / FHLM 30YR 6% 06/01/2053#RA9276 | 0,49 | −5,03 | 0,0673 | −0,0099 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,49 | −3,16 | 0,0672 | −0,0084 | |||||

| US3137FEBQ22 / FHLMC, Multifamily Structured Pass-Through Certificates, Series K072, Class A2 | 0,49 | 0,41 | 0,0672 | −0,0057 | |||||

| US3137FCLD43 / Freddie Mac Multifamily Structured Pass Through Ctfs., Series K071, Class A2 | 0,49 | 0,41 | 0,0670 | −0,0057 | |||||

| US3622ABLL41 / Ginnie Mae II Pool | 0,49 | −3,94 | 0,0669 | −0,0090 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,49 | −3,39 | 0,0666 | −0,0084 | |||||

| US3136BASY14 / Fannie Mae REMICS | 0,48 | −3,59 | 0,0664 | −0,0087 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,48 | −4,93 | 0,0661 | −0,0096 | |||||

| US3133KRJX35 / FHLM 30YR 6% 06/01/2053#RA9278 | 0,48 | −5,33 | 0,0659 | −0,0098 | |||||

| US3132DPYP79 / Freddie Mac Pool | 0,48 | −4,59 | 0,0656 | −0,0092 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,47 | −3,07 | 0,0649 | −0,0080 | |||||

| US05609PAA66 / BX 2021-LBA3 Mortgage Trust, Series 2021-PAC, Class A | 0,47 | 0,00 | 0,0648 | −0,0057 | |||||

| US3140QMSJ40 / FNMA 30YR 2.5% 12/01/2051#CB2320 | 0,47 | −4,84 | 0,0647 | −0,0093 | |||||

| GNII II 4.5% 05/20/2055#MB0364 / ABS-MBS (US3618N5MN65) | 0,47 | 0,0647 | 0,0647 | ||||||

| US3140QSVD03 / FNMA 30YR 5.5% 08/01/2053#CB6911 | 0,47 | −3,29 | 0,0644 | −0,0081 | |||||

| US3140M2MT69 / FNMA 30YR 2% 10/01/2051#BU1269 | 0,47 | −4,67 | 0,0643 | −0,0091 | |||||

| US3140XCZQ45 / FN FM8850 | 0,47 | −2,50 | 0,0643 | −0,0074 | |||||

| US233258AC69 / DLLAD 2023-1 LLC | 0,47 | −6,99 | 0,0640 | −0,0108 | |||||

| US36179VHS25 / Ginnie Mae II Pool | 0,47 | −4,52 | 0,0638 | −0,0090 | |||||

| US3140X93D50 / FNMA 30YR 3% 03/01/2050#FM6195 | 0,46 | −3,94 | 0,0635 | −0,0084 | |||||

| US3133KQF922 / FHLG 30YR 5% 12/01/2052#RA8292 | 0,46 | −3,35 | 0,0633 | −0,0080 | |||||

| GNII II 2.5% 07/20/2054#MA9773 / ABS-MBS (US36179Y2E37) | 0,46 | −4,57 | 0,0630 | −0,0089 | |||||

| US3132DWAQ69 / FR SD8115 | 0,46 | −4,78 | 0,0628 | −0,0091 | |||||

| HYUNDAI AUTO LEASE SECURITIZATION TRUST 2024-B 5.41% 05/17/2027 144A / ABS-CBDO (US44934FAD78) | 0,46 | −0,44 | 0,0626 | −0,0058 | |||||

| US3136BBQQ80 / Fannie Mae REMICS | 0,45 | −5,68 | 0,0614 | −0,0096 | |||||

| USU4330LAD56 / HILTON USA TRUST 2016-HHV | 0,44 | 0,0601 | 0,0601 | ||||||

| US69380RAA32 / PRPM 2023-RCF2 LLC 4% 11/25/2053 144A | 0,44 | −5,81 | 0,0600 | −0,0094 | |||||

| BX TRUST 2025-DIME A TSFR1M+115 02/15/2035 144A / ABS-MBS (US05613UAA97) | 0,44 | −0,23 | 0,0597 | −0,0054 | |||||

| US3140QMTG91 / FNMA 30YR 2% 12/01/2051#CB2350 | 0,43 | −4,82 | 0,0596 | −0,0085 | |||||

| US3140XCKF45 / FNMA 20YR 2% 08/01/2041#FM8393 | 0,43 | −2,47 | 0,0595 | −0,0070 | |||||

| US3133KRM769 / FHLM 30YR 6% 07/01/2053#RA9382 | 0,43 | −2,48 | 0,0593 | −0,0070 | |||||

| US12532BAC19 / CFCRE Commercial Mortgage Trust 2016-C7 | 0,43 | 0,47 | 0,0592 | −0,0050 | |||||

| US61768HAV87 / Morgan Stanley Capital I Trust 2019-L2 | 0,43 | −0,23 | 0,0592 | −0,0054 | |||||

| US3622ABCL42 / G2SF 2.5 785575 08-20-51 | 0,43 | −4,43 | 0,0592 | −0,0083 | |||||

| US31418DV908 / FANNIE MAE POOL UMBS P#MA4239 3.00000000 | 0,43 | −3,37 | 0,0590 | −0,0075 | |||||

| US36179W2U15 / Ginnie Mae II Pool | 0,43 | −4,67 | 0,0589 | −0,0084 | |||||

| US3132DPB722 / FHLG 30YR 5% 11/01/2052#SD1862 | 0,42 | −2,75 | 0,0582 | −0,0069 | |||||

| US3132D55E83 / Freddie Mac Pool | 0,42 | −4,11 | 0,0576 | −0,0078 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,42 | −4,12 | 0,0575 | −0,0077 | |||||

| US3133KRJW51 / FHLM 30YR 6% 06/01/2053#RA9277 | 0,42 | −3,68 | 0,0575 | −0,0075 | |||||

| US3140QQ2F18 / FNMA 30YR 5% 12/01/2052#CB5273 | 0,42 | −4,34 | 0,0574 | −0,0080 | |||||

| US3140XJUV38 / FNMA 30YR 5% 11/01/2052#FS3295 | 0,42 | −3,47 | 0,0572 | −0,0073 | |||||

| WELLS FARGO COML MTG TR 2025-VTT A VAR 03/15/2038 144A / ABS-MBS (US94990GAA76) | 0,42 | 0,0571 | 0,0571 | ||||||

| US3136BKUC48 / FEDERAL NAT MTG ASN GTD REM PA 2.5% 09/25/2048 | 0,42 | −3,04 | 0,0570 | −0,0070 | |||||

| US3140J5MF35 / Fannie Mae Pool | 0,42 | −3,26 | 0,0570 | −0,0072 | |||||

| US3133KNGT46 / FHLG 30YR 2% 12/01/2051#RA6510 | 0,41 | −4,41 | 0,0565 | −0,0080 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,41 | 0,0564 | 0,0564 | ||||||

| US3132DPPC67 / FHLG 30YR 3% 03/01/2052#SD2219 | 0,40 | −3,82 | 0,0552 | −0,0073 | |||||

| WHEELS FLEET LEASE FUNDING 1 LLC 4.87% 06/21/2039 144A / ABS-CBDO (US96328GBT31) | 0,40 | 0,00 | 0,0552 | −0,0051 | |||||

| HPEFS EQUIP TR 2024-2 5.36% 10/20/2031 144A / ABS-CBDO (US40444MAE12) | 0,40 | −0,50 | 0,0552 | −0,0051 | |||||

| DELL EQUIP FIN TR 2025-1 4.61% 02/24/2031 144A / ABS-CBDO (US24703UAE38) | 0,40 | 0,0551 | 0,0551 | ||||||

| AFFIRM ASSET SECURITIZATION TRUST 2024-A 5.61% 02/15/2029 144A / ABS-CBDO (US00834BAF40) | 0,40 | −0,50 | 0,0550 | −0,0051 | |||||

| US3133KYVP14 / FR RB5122 | 0,40 | −2,91 | 0,0550 | −0,0067 | |||||

| US06541BBK35 / BANK 2023-BNK45 | 0,40 | −1,48 | 0,0548 | −0,0057 | |||||

| RCO VIII MORTGAGE LLC 2025-3 A1 VAR 05/25/2030 144A / ABS-CBDO (US74939GAA31) | 0,40 | 0,0547 | 0,0547 | ||||||

| WELLS FARGO COML MORTAGE TR 2024-MGP TSFR1M+199.073 08/15/2041 144A / ABS-MBS (US95003TAA16) | 0,40 | −0,75 | 0,0547 | −0,0053 | |||||

| US3137FFWL70 / FEDERAL HOME LN MTG MLT CTF GT 1% 08/15/2038 | 0,40 | −16,39 | 0,0546 | −0,0166 | |||||

| US3140QS4H10 / FNMA 30YR UMBS | 0,40 | −3,41 | 0,0545 | −0,0068 | |||||

| US3137FJXV65 / FHMS K083 A2 (MF) 4.05% 09-25-28 | 0,40 | 0,25 | 0,0544 | −0,0047 | |||||

| GNII II 5.5% 12/20/2054#MB0092 / ABS-MBS (US3618N5C643) | 0,39 | 0,0540 | 0,0540 | ||||||

| US3622ABKC50 / Ginnie Mae II Pool | 0,39 | −4,84 | 0,0540 | −0,0077 | |||||

| US31418DQG06 / FANNIE MAE POOL FN MA4054 | 0,39 | −2,97 | 0,0538 | −0,0066 | |||||

| US3140XECK87 / Fannie Mae Pool | 0,39 | −4,85 | 0,0537 | −0,0078 | |||||

| US3137FBBX34 / FHMS K068 A2 3.244% 08/25/2027 | 0,39 | 0,26 | 0,0536 | −0,0046 | |||||

| UNITED STATES TREASURY BOND 4.625% 02/15/2055 / DBT (US912810UG12) | 0,39 | −78,89 | 0,0536 | −0,2229 | |||||

| US3133ASJM62 / FHLG 30YR 2% 09/01/2051#QC7468 | 0,39 | −4,65 | 0,0535 | −0,0076 | |||||

| US3133KJJV52 / Freddie Mac Pool | 0,39 | −4,66 | 0,0533 | −0,0076 | |||||

| US3132D56J61 / FNCI UMBS 1.5 SB8073 11-01-35 | 0,38 | −3,76 | 0,0527 | −0,0069 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,38 | −2,30 | 0,0526 | −0,0060 | |||||

| US3133KRM843 / FHLM 30YR 6% 07/01/2053#RA9383 | 0,38 | −2,30 | 0,0525 | −0,0061 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,38 | −4,51 | 0,0523 | −0,0073 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,38 | −4,27 | 0,0523 | −0,0071 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,38 | 0,0520 | 0,0520 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,38 | −4,82 | 0,0515 | −0,0073 | |||||

| US36179V7D62 / GNII II 2% 02/20/2051#MA7192 | 0,38 | −4,34 | 0,0515 | −0,0070 | |||||

| US3131Y1Q944 / FED HM LN PC POOL ZM6780 FR 06/48 FIXED 4 | 0,37 | −5,56 | 0,0513 | −0,0079 | |||||

| US3140X4KG04 / Fannie Mae Pool | 0,37 | −5,08 | 0,0513 | −0,0075 | |||||

| US3132DNCP69 / FHLG 30YR 2.5% 04/01/2047#SD0978 | 0,37 | −2,86 | 0,0511 | −0,0063 | |||||

| US36261PAT93 / GS Mortgage Securities Trust 2019-GSA1 | 0,37 | 0,27 | 0,0511 | −0,0043 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,37 | 0,0511 | 0,0511 | ||||||

| US3132DQGL41 / Freddie Mac Pool | 0,37 | 804,88 | 0,0509 | 0,0447 | |||||

| US3131XDBE47 / FHLG 15YR 3% 11/32#ZK9037 | 0,37 | −7,48 | 0,0509 | −0,0090 | |||||

| US3142GQAC68 / Federal Home Loan Mortgage Corporation | 0,37 | −3,92 | 0,0505 | −0,0067 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,37 | 0,0504 | 0,0504 | ||||||

| US3140XFDL27 / FNMA 20YR 2% 11/01/2041#FS0106 | 0,37 | −2,93 | 0,0501 | −0,0061 | |||||

| US3133KNXR96 / FHLG 30YR 3% 03/01/2052#RA6988 | 0,37 | −5,93 | 0,0500 | −0,0079 | |||||

| US53218DAE85 / LIFE_22-BMR2 | 0,36 | −3,96 | 0,0499 | −0,0067 | |||||

| US3142GQAB85 / Federal Home Loan Mortgage Corporation | 0,36 | −2,69 | 0,0497 | −0,0059 | |||||

| US31418D6M91 / Fannie Mae Pool | 0,36 | −2,96 | 0,0496 | −0,0059 | |||||

| ENTERPRISE FLEET FINANCING 2024-4 LLC 4.56% 11/20/2028 144A / ABS-CBDO (US29374MAC29) | 0,36 | 0,00 | 0,0495 | −0,0045 | |||||

| US31418DRR51 / Fannie Mae Pool | 0,36 | −3,22 | 0,0495 | −0,0062 | |||||

| US3140M82Z19 / FNMA 20YR 2% 12/01/2041#BU7091 | 0,36 | −2,96 | 0,0495 | −0,0061 | |||||

| US36179RLQ01 / Ginnie Mae II Pool | 0,36 | −5,29 | 0,0492 | −0,0073 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,35 | 0,0482 | 0,0482 | ||||||

| US3140QLFK76 / FNMA 20YR 2% 07/01/2041#CB1069 | 0,35 | −3,31 | 0,0482 | −0,0060 | |||||

| US3140XCHL59 / Fannie Mae Pool | 0,35 | −2,78 | 0,0480 | −0,0058 | |||||

| US3133KRVG63 / FHLM 30YR 5% 08/01/2053#RA9615 | 0,35 | −2,79 | 0,0478 | −0,0057 | |||||

| US3140QLFM33 / FNMA 20YR 2% 07/01/2041#CB1071 | 0,35 | −3,08 | 0,0474 | −0,0060 | |||||

| US3137H6W847 / FEDERAL HOME LN MTG MLT CTF GT 5210 AB 3% 01/25/2042 | 0,34 | −3,40 | 0,0469 | −0,0059 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,33 | −2,62 | 0,0459 | −0,0054 | |||||

| US3140QD6M13 / Fannie Mae Pool | 0,33 | −4,60 | 0,0456 | −0,0065 | |||||

| US3140QSHD68 / FNMA 30YR 5.5% 06/01/2053#CB6527 | 0,33 | −4,61 | 0,0455 | −0,0063 | |||||

| US61691NAE58 / Morgan Stanley Capital I 2017-HR2 | 0,33 | 0,30 | 0,0452 | −0,0039 | |||||

| US89170VAA61 / Towd Point Mortgage Trust 2022-1 | 0,33 | −3,24 | 0,0451 | −0,0057 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,33 | 0,0447 | 0,0447 | ||||||

| FHLMC REMI 30YR 6.5% 03/01/2055#RJ3700 / ABS-MBS (US3142GUDE00) | 0,33 | 0,0446 | 0,0446 | ||||||

| NYMT LOAN TRUST 2024-CP1 3.75% 02/25/2068 144A / ABS-CBDO (US67118PAA03) | 0,32 | −3,87 | 0,0443 | −0,0059 | |||||

| US3140LNLL96 / FNMA 30YR 2.5% 05/01/2051#BT0330 | 0,32 | −3,59 | 0,0442 | −0,0058 | |||||

| US3136BKWX66 / FEDERAL NAT MTG ASN GTD REM PA 21-96 HA 2.5% 02/25/2050 | 0,32 | −6,14 | 0,0441 | −0,0071 | |||||

| US3132DVK796 / FHLG 30YR 3% 06/01/2050#SD7518 | 0,32 | −4,49 | 0,0438 | −0,0061 | |||||

| US3140XAY552 / Uniform Mortgage-Backed Securities | 0,32 | −4,50 | 0,0436 | −0,0062 | |||||

| US3138AP5M65 / Fannie Mae Pool | 0,32 | −2,16 | 0,0435 | −0,0049 | |||||

| AUTONATION FINANCE TRUST 2025-1 4.72% 04/10/2028 144A / ABS-CBDO (US05330QAB86) | 0,32 | 0,0432 | 0,0432 | ||||||

| BROOKFIELD 2024-MF23 A TSFR1M+149.177 06/15/2041 144A / ABS-MBS (US05593JAA88) | 0,31 | 0,00 | 0,0429 | −0,0038 | |||||

| US3132D56B36 / Freddie Mac Pool | 0,31 | −3,40 | 0,0429 | −0,0056 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,31 | −4,29 | 0,0429 | −0,0058 | |||||

| US31418DVA70 / FNMA 30YR 2% 12/01/2050# | 0,31 | −4,31 | 0,0427 | −0,0059 | |||||

| US3140XLLK20 / FNMA 30YR 5% 04/01/2053#FS4829 | 0,31 | −4,92 | 0,0424 | −0,0062 | |||||

| US05609WAA18 / BX Trust, Series 2022-IND, Class A | 0,31 | −6,69 | 0,0421 | −0,0071 | |||||

| US3140J9VB42 / Fannie Mae Pool | 0,31 | −5,54 | 0,0421 | −0,0064 | |||||

| US3140QMTC87 / FNMA 30YR 2% 12/01/2051#CB2346 | 0,31 | −5,26 | 0,0420 | −0,0064 | |||||

| CITIZENS AUTO RECEIVABLES TRUST 2024-2 5.33% 08/15/2028 144A / ABS-CBDO (US17331XAD30) | 0,31 | −0,65 | 0,0419 | −0,0039 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,30 | 0,0416 | 0,0416 | ||||||

| US3140XG7B97 / Fannie Mae Pool | 0,30 | −2,89 | 0,0415 | −0,0050 | |||||

| CARMAX AUTO OWNER TRUST 2024-4 4.6% 10/15/2029 / ABS-CBDO (US14290DAC56) | 0,30 | 0,0414 | 0,0414 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,30 | −3,85 | 0,0411 | −0,0056 | |||||

| US3132DV3Z67 / Freddie Mac Pool | 0,30 | −4,19 | 0,0408 | −0,0055 | |||||

| US3137FJEH82 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,30 | 0,68 | 0,0407 | −0,0035 | |||||

| US3140QEAN28 / FNMA 30YR 3% 07/01/2050#CA6312 | 0,30 | −4,52 | 0,0406 | −0,0057 | |||||

| US36179T7K59 / Ginnie Mae II Pool | 0,29 | −5,18 | 0,0403 | −0,0059 | |||||

| US3140QMKY98 / FNMA 20YR 2% 11/01/2041#CB2110 | 0,29 | −3,62 | 0,0402 | −0,0052 | |||||

| US36255NAT28 / GS Mortgage Securities Trust 2018-GS9 | 0,29 | 0,34 | 0,0402 | −0,0035 | |||||

| US3136BLRV49 / FEDERAL NAT MTG ASN GTD REM PA 2022-7 A 3% 05/25/2048 | 0,29 | −3,93 | 0,0402 | −0,0054 | |||||

| MERCEDES-BENZ AUTO LEASE TRUST 2024-A 5.32% 01/18/2028 / ABS-CBDO (US58770JAD63) | 0,29 | 0,00 | 0,0402 | −0,0037 | |||||

| US3140QFPA17 / Fannie Mae Pool | 0,29 | −4,59 | 0,0400 | −0,0056 | |||||

| US3137H8BP58 / FEDERAL HOME LN MTG MLT CTF GT 5% 04/25/2048 | 0,29 | −5,23 | 0,0398 | −0,0060 | |||||

| US3140QFZT97 / FNMA 15YR 1.5% 11/01/2035#CA7953 | 0,29 | −3,67 | 0,0397 | −0,0052 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,29 | −2,03 | 0,0396 | −0,0045 | |||||

| US3140NMJW88 / Fannie Mae Pool | 0,29 | −2,37 | 0,0395 | −0,0045 | |||||

| US3140QRGJ64 / Federal National Mortgage Association, Inc. | 0,29 | −4,98 | 0,0393 | −0,0057 | |||||

| US61691NAD75 / Morgan Stanley Capital I 2017-HR2 | 0,29 | 0,35 | 0,0393 | −0,0034 | |||||

| US3140XBJD33 / FNMA 15YR 3.5% 12/01/2035#FM7459 | 0,29 | −5,92 | 0,0392 | −0,0062 | |||||

| US3140QMVN15 / FNMA 30YR 3% 12/01/2051#CB2420 | 0,28 | −4,38 | 0,0390 | −0,0054 | |||||

| US3133KM4Y85 / FHLG 30YR 2% 11/01/2051#RA6239 | 0,28 | −4,41 | 0,0388 | −0,0054 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,28 | −4,08 | 0,0387 | −0,0053 | |||||

| US05609BCD91 / BX Trust, Series 2021-LBA, Class AJV | 0,28 | 0,00 | 0,0386 | −0,0034 | |||||

| US3140HKKT49 / Fannie Mae Pool | 0,28 | −3,11 | 0,0384 | −0,0048 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,28 | −3,46 | 0,0383 | −0,0050 | |||||

| US3140QMTE44 / FNMA 30YR 2% 12/01/2051#CB2348 | 0,28 | −4,47 | 0,0382 | −0,0054 | |||||

| US31418EAQ35 / FANNIE MAE POOL FN MA4514 | 0,28 | −4,83 | 0,0379 | −0,0054 | |||||

| US31418EJ760 / UMBS | 0,27 | −4,55 | 0,0375 | −0,0053 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,27 | −4,55 | 0,0375 | −0,0053 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,27 | 0,0374 | 0,0374 | ||||||

| US3137H5MS30 / FEDERAL HOME LN MTG MLT CTF GT 5191 CA 2.5% 04/25/2050 | 0,27 | −4,91 | 0,0373 | −0,0053 | |||||

| HYUNDAI AUTO RECEIVABLES TR 2024-A 4.99% 02/15/2029 / ABS-CBDO (US448973AD90) | 0,27 | −0,37 | 0,0370 | −0,0034 | |||||

| US3133D4JZ76 / FHLG 20YR 2% 11/01/2041#QK1180 | 0,27 | −5,28 | 0,0370 | −0,0055 | |||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,27 | 0,0369 | 0,0369 | ||||||

| US36258YBH09 / GS MORTGAGE SECURITIES CORP II | 0,27 | −5,30 | 0,0368 | −0,0056 | |||||

| US3137H3V820 / FEDERAL HOME LN MTG CORP MULTICLASS MTG PARTN CTFS GTD 1.5% 11/25/2051 | 0,27 | −2,21 | 0,0365 | −0,0041 | |||||

| US3140J9RA15 / Fannie Mae Pool | 0,27 | −5,00 | 0,0365 | −0,0054 | |||||

| US23312JAD54 / DBJPM 17-C6 Mortgage Trust | 0,27 | −12,54 | 0,0364 | −0,0088 | |||||

| PEAC SOLUTIONS RECEIVABLES 2025-1 LLC 4.94% 10/20/2028 144A / ABS-CBDO (US69392HAB96) | 0,27 | 0,00 | 0,0364 | −0,0033 | |||||

| US3133KYVZ95 / FREDDIE MAC POOL UMBS P#RB5132 2.50000000 | 0,27 | −3,28 | 0,0363 | −0,0046 | |||||

| US3132D9HZ00 / FHLG 20YR 2.5% 02/01/2042#SC0248 | 0,26 | −3,65 | 0,0363 | −0,0047 | |||||

| US3140XFDS79 / FNMA 15YR 3% 09/01/2035#FS0112 | 0,26 | −6,05 | 0,0362 | −0,0057 | |||||

| US3138WJN537 / Fannie Mae Pool | 0,26 | −5,40 | 0,0362 | −0,0054 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,26 | −4,73 | 0,0360 | −0,0051 | |||||

| US05553WAC38 / BBCMS Mortgage Trust 2023-C21 | 0,26 | 0,00 | 0,0358 | −0,0033 | |||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,26 | 0,0357 | 0,0357 | ||||||

| SBNA AUTO LEASE TRUST 2024-B 5.56% 11/22/2027 144A / ABS-CBDO (US78437VAE02) | 0,26 | −0,38 | 0,0357 | −0,0033 | |||||

| US3132XCSD80 / Freddie Mac Gold Pool | 0,26 | −4,43 | 0,0356 | −0,0049 | |||||

| US12434GAA31 / BX Commercial Mortgage Trust 2023-XL3 | 0,26 | 0,00 | 0,0356 | −0,0031 | |||||

| ONITY LOAN INVESTMENT TRUST 2024-HB2 A 5% 08/25/2037 144A / ABS-CBDO (US68278DAA19) | 0,26 | −9,51 | 0,0352 | −0,0073 | |||||

| ALLY AUTO RECEIVABLES TRUST 2024-1 5.08% 12/15/2028 / ABS-CBDO (US02008FAC86) | 0,26 | 0,00 | 0,0351 | −0,0032 | |||||

| MFRA TRUST VAR 02/25/2066 144A / ABS-CBDO (US55287AAA34) | 0,26 | −3,77 | 0,0350 | −0,0047 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,25 | 0,0349 | 0,0349 | ||||||

| US3140LYRP02 / FNMA 30YR 2% 12/01/2051#BT9493 | 0,25 | −3,05 | 0,0349 | −0,0044 | |||||

| US3136BMER56 / FEDERAL NAT MTG ASN GTD REM PA 3% 06/25/2049 | 0,25 | −1,94 | 0,0347 | −0,0038 | |||||

| US3133KYVF32 / Freddie Mac Pool | 0,25 | −3,07 | 0,0347 | −0,0044 | |||||

| US3137H6K388 / FEDERAL HOME LN MTG MLT CTF GT 3% 04/25/2050 | 0,25 | −4,55 | 0,0347 | −0,0048 | |||||

| US3140XGXB08 / Fannie Mae Pool | 0,25 | −2,33 | 0,0346 | −0,0039 | |||||

| DELL EQUIP FIN TR 2025-1 4.68% 07/22/2027 144A / ABS-CBDO (US24703UAC71) | 0,25 | 0,0343 | 0,0343 | ||||||

| US05530SAA42 / BAMLL Commercial Mortgage Securities Trust 2022-DKLX | 0,25 | 0,00 | 0,0341 | −0,0031 | |||||

| US29374LAB62 / Enterprise Fleet Financing 2023-3 LLC | 0,25 | −12,41 | 0,0339 | −0,0083 | |||||

| US3132DPB805 / FHLG 30YR 5% 11/01/2052#SD1863 | 0,25 | −3,53 | 0,0338 | −0,0043 | |||||

| MERCHANTS FLEET FUNDING LLC 5.82% 04/20/2037 144A / ABS-CBDO (US588926AF24) | 0,25 | −6,84 | 0,0336 | −0,0057 | |||||

| US97064YAA29 / Willis Engine Structured Trust VII | 0,24 | −2,82 | 0,0331 | −0,0039 | |||||

| US3137H5BG11 / FEDERAL HOME LN MTG MLT CTF GT 5180 KA 2.5% 10/25/2047 | 0,24 | −3,98 | 0,0331 | −0,0044 | |||||

| US3140XDCE45 / FNMA, 30 Year | 0,24 | 0,0331 | 0,0331 | ||||||

| US05552CAA27 / BINOM Securitization Trust 2022-RPL1 | 0,24 | −3,21 | 0,0330 | −0,0042 | |||||

| CHASE AUTO OWNER TRUST 2024-1 5.13% 05/25/2029 144A / ABS-CBDO (US16144BAC28) | 0,24 | −0,41 | 0,0330 | −0,0031 | |||||

| US3140XLE460 / Fannie Mae Pool | 0,24 | −4,40 | 0,0328 | −0,0046 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,24 | 0,0328 | 0,0328 | ||||||

| US3136BL5X48 / FEDERAL NAT MTG ASN GTD REM PA 3% 08/25/2046 | 0,24 | −1,65 | 0,0327 | −0,0035 | |||||

| US3136BLYE41 / FEDERAL NAT MTG ASN GTD REM PA 2022-4 B 2.5% 05/25/2049 | 0,24 | −5,20 | 0,0326 | −0,0048 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,24 | −3,66 | 0,0325 | −0,0042 | |||||

| US14318XAC92 / CarMax Auto Owner Trust 2023-4 | 0,24 | −0,42 | 0,0325 | −0,0030 | |||||

| US3136BG6Y20 / FEDERAL NAT MTG ASN GTD REM PA 21-66 DM 2% 01/25/2048 | 0,24 | −2,47 | 0,0325 | −0,0039 | |||||

| US3140XFAC54 / FNMA 30YR 3% 12/01/2051#FS0002 | 0,23 | −4,10 | 0,0321 | −0,0044 | |||||

| PRPM 2024-RCF4 A1 LLC VAR 07/25/2054 144A / ABS-CBDO (US74448JAA16) | 0,23 | −6,43 | 0,0321 | −0,0051 | |||||

| US3128P8GB10 / Federal Home Loan Mortgage Corporation | 0,23 | −4,90 | 0,0320 | −0,0046 | |||||

| SBNA AUTO LEASE TRUST 2024-C 4.56% 02/22/2028 144A / ABS-CBDO (US78398DAC11) | 0,23 | −0,43 | 0,0318 | −0,0029 | |||||

| VOLKSWAGEN AUTO LSE TRUST 5.21% 06/21/2027 / ABS-CBDO (US92866EAD13) | 0,23 | −0,43 | 0,0316 | −0,0029 | |||||

| US3132DQRR91 / FHLG 30YR 5% 06/01/2053#SD3196 | 0,23 | −3,36 | 0,0316 | −0,0040 | |||||

| VERD 2025-1A A2 4.85% 03/13/2028 144A / ABS-CBDO (US92340GAB68) | 0,23 | 0,0315 | 0,0315 | ||||||

| US3140XB6C98 / FNMA 20YR 2% 07/01/2041#FM8066 | 0,23 | −2,97 | 0,0314 | −0,0039 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,23 | −4,58 | 0,0314 | −0,0045 | |||||

| US3133KNVE02 / Freddie Mac Pool | 0,23 | −3,78 | 0,0314 | −0,0042 | |||||

| US3140XCZ431 / FNMA 20YR 2% 09/01/2041#FM8862 | 0,23 | −3,83 | 0,0311 | −0,0041 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,22 | −3,45 | 0,0307 | −0,0039 | |||||

| US3136BG6S51 / FEDERAL NAT MTG ASN GTD REM PA 21-66 DA 2% 01/25/2048 | 0,22 | −2,62 | 0,0306 | −0,0037 | |||||

| US3133AUDT26 / FHLG 30YR 2% 10/01/2051#QC9114 | 0,22 | −4,72 | 0,0305 | −0,0044 | |||||

| US3131Y3CE46 / FHLG 30YR 4% 09/01/2048#ZM8169 | 0,22 | −4,33 | 0,0304 | −0,0041 | |||||

| US065404BA28 / BANK 2018-BNK10 | 0,22 | 0,91 | 0,0303 | −0,0025 | |||||

| BLP COML MTG 2024-IND2 A TSFR1M+139.208 03/15/2041 144A / ABS-MBS (US05625AAA97) | 0,22 | 0,00 | 0,0303 | −0,0027 | |||||

| US08162VAE83 / BENCHMARK 2019-B10 Mortgage Trust | 0,22 | 0,00 | 0,0301 | −0,0026 | |||||

| US3140QB3Q99 / FNMA 30YR 3% 10/01/2049#CA4406 | 0,22 | −3,96 | 0,0299 | −0,0041 | |||||

| US3136BL6J45 / FEDERAL NAT MTG ASN GTD REM PA 3% 05/25/2048 | 0,22 | −3,96 | 0,0299 | −0,0040 | |||||

| US36179TZ734 / Ginnie Mae II Pool | 0,22 | −4,85 | 0,0297 | −0,0042 | |||||

| US3140XD2K15 / FNMA 30YR 3% 12/01/2051#FM9777 | 0,22 | −4,42 | 0,0297 | −0,0040 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,22 | −5,29 | 0,0295 | −0,0045 | |||||

| US3140QNLS94 / Fannie Mae Pool | 0,21 | −4,91 | 0,0292 | −0,0043 | |||||

| US3136BJHA65 / FEDERAL NAT MTG ASN GTD REM PA 1.5% 10/25/2051 | 0,21 | −2,31 | 0,0290 | −0,0033 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,21 | −4,98 | 0,0289 | −0,0042 | |||||

| US36179WR263 / GINNIE MAE II POOL G2 MA7705 | 0,21 | −4,55 | 0,0288 | −0,0040 | |||||

| US3137H2UC64 / FEDERAL HOME LN MTG MLT CTF GT 1.5% 10/25/2051 | 0,21 | −2,34 | 0,0287 | −0,0033 | |||||

| US3133AUDS43 / FHLG 30YR 2% 10/01/2051#QC9113 | 0,21 | −4,57 | 0,0287 | −0,0041 | |||||

| US08162PAV31 / BENCHMARK 2018-B1 MORTGAGE TRUST BMARK 2018-B1 ASB | 0,21 | −8,81 | 0,0285 | −0,0055 | |||||

| US3140QNLT77 / Fannie Mae Pool | 0,21 | −5,91 | 0,0284 | −0,0044 | |||||

| US36179NDR61 / Ginnie Mae II Pool | 0,21 | −4,17 | 0,0284 | −0,0038 | |||||

| CHESAPEAKE FUNDING II LLC 5.52% 05/15/2036 144A / ABS-CBDO (US165183DE19) | 0,21 | −11,54 | 0,0284 | −0,0065 | |||||

| US3136BLMF44 / FEDERAL NAT MTG ASN GTD REM PA 2022-1 KA 3% 05/25/2048 | 0,21 | −3,72 | 0,0284 | −0,0038 | |||||

| US98164QAD07 / WOART 2023-B A3 | 0,21 | −18,25 | 0,0283 | −0,0094 | |||||

| US3132CWSY11 / FHLG 15YR 2.5% 07/01/2036#SB0535 | 0,21 | −4,21 | 0,0282 | −0,0038 | |||||

| US36267KAD90 / GM Financial Consumer Automobile Receivables Trust, Series 2023-3, Class A3 | 0,21 | −4,65 | 0,0282 | −0,0040 | |||||

| AVIS BUDGET RENTCAR FDG AE LLC 4.8% 08/20/2029 144A / ABS-CBDO (US05377RKL77) | 0,21 | 0,0281 | 0,0281 | ||||||

| US3137H2UY84 / FEDERAL HOME LN MTG MLT CTF GT 1.5% 10/25/2051 | 0,20 | −2,39 | 0,0280 | −0,0033 | |||||

| US3136BKJA11 / FEDERAL NAT MTG ASN GTD REM PA 21-85 L 2.5% 08/25/2048 | 0,20 | −4,25 | 0,0279 | −0,0037 | |||||

| US3140X4J984 / FNMA 30YR 4% 03/01/2047#FM1187 | 0,20 | −4,74 | 0,0276 | −0,0039 | |||||

| US3133KYV485 / FR RB5135 | 0,20 | −3,37 | 0,0276 | −0,0035 | |||||

| BX TR 2025-TAIL A VAR 06/15/2035 144A / ABS-MBS (US123912AA54) | 0,20 | 0,0276 | 0,0276 | ||||||

| BMW VEHICLE OWNER TRUST 2025-A 4.56% 09/25/2029 / ABS-CBDO (US096924AD71) | 0,20 | 0,0276 | 0,0276 | ||||||

| US3131Y3Q908 / FED HM LN PC POOL ZM8580 FR 10/48 FIXED 4 | 0,20 | −2,91 | 0,0274 | −0,0034 | |||||

| US36179ST317 / Ginnie Mae II Pool | 0,20 | −6,60 | 0,0273 | −0,0044 | |||||

| US62955RAA32 / NEW YORK MORTGAGE TRUST 08/51 1.6696 | 0,20 | −1,98 | 0,0272 | −0,0031 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,19 | −4,90 | 0,0267 | −0,0038 | |||||

| US3132D56A52 / FHLG 15YR 1.5% 07/01/2035#SB8065 | 0,19 | −3,48 | 0,0266 | −0,0035 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,19 | −4,90 | 0,0266 | −0,0039 | |||||

| US3133KNBQ51 / FNCL UMBS 3.0 RA6347 11-01-51 | 0,19 | −6,76 | 0,0265 | −0,0045 | |||||

| US3132D9FG47 / FHLG 20YR 2.5% 05/01/2041#SC0167 | 0,19 | −3,02 | 0,0265 | −0,0033 | |||||

| US36250SAE90 / GS MTG SECS TR 2018-GS10 A5 4.155% 07/10/2051 | 0,19 | 0,00 | 0,0264 | −0,0023 | |||||

| US3136BNE692 / FEDERAL NAT MTG ASN GTD REM PA 4% 12/25/2048 | 0,19 | −4,48 | 0,0264 | −0,0036 | |||||

| ENTERPRISE FLEET FINANCING 2024-2 5.74% 12/20/2026 144A / ABS-CBDO (US29375RAB24) | 0,19 | −20,33 | 0,0263 | −0,0098 | |||||

| US3140XHAL10 / UMBS, 20 Year | 0,19 | −2,54 | 0,0263 | −0,0031 | |||||

| US3140J8CS05 / Fannie Mae Pool | 0,19 | −5,94 | 0,0261 | −0,0041 | |||||

| US06035RAQ92 / BANK 2018-BNK14 | 0,19 | −7,32 | 0,0261 | −0,0046 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,19 | −5,00 | 0,0261 | −0,0038 | |||||

| US08162YAK82 / BENCHMARK 2019-B14 XA MORTGAGE TRUST VAR 12/15/2061 | 0,19 | −5,50 | 0,0260 | −0,0040 | |||||

| CARMAX AUTO OWNER TR 2024-2 5.5% 01/16/2029 / ABS-CBDO (US14319EAE68) | 0,19 | 0,00 | 0,0260 | −0,0024 | |||||

| US78472UAC27 / SREIT Trust 2021-MFP | 0,19 | −6,93 | 0,0259 | −0,0043 | |||||

| US3137H3SE32 / FEDERAL HOME LN MTG CORP MULTICLASS MTG PARTN CTFS GTD 5159 GC 2% 11/25/2047 | 0,19 | −4,08 | 0,0259 | −0,0034 | |||||

| US3133B0QV87 / FHLG 30YR 2% 12/01/2051#QD3168 | 0,19 | −4,12 | 0,0255 | −0,0035 | |||||

| US12594MBA53 / COMM 2016-COR1 MORTGAGE TRUST COMM 2016-COR1 ASB | 0,19 | −17,04 | 0,0254 | −0,0080 | |||||

| US3133KLZ830 / Freddie Mac Pool | 0,18 | −4,17 | 0,0253 | −0,0035 | |||||

| US3140X9H573 / FNMA 30YR 2.5% 01/01/2051#FM5651 | 0,18 | −6,12 | 0,0252 | −0,0041 | |||||

| US3137FU4N17 / Freddie Mac REMICS | 0,18 | 0,0251 | 0,0251 | ||||||

| US3132DVLA16 / FR SD7521 | 0,18 | −4,69 | 0,0251 | −0,0036 | |||||

| BX COML MTG TR 2024-XL5 B TSFR1M+169.12 03/15/2039 144A / ABS-MBS (US05612GAC78) | 0,18 | −2,67 | 0,0249 | −0,0031 | |||||

| US3136BMAC24 / FANNIE MAE 3% 05/25/2048 | 0,18 | −3,72 | 0,0248 | −0,0033 | |||||

| US3133CCJW74 / Federal Home Loan Mortgage Corporation | 0,18 | −4,76 | 0,0247 | −0,0037 | |||||

| US36253PAB85 / GS Mortgage Securities Trust 2017-GS6 | 0,18 | 0,56 | 0,0245 | −0,0021 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,18 | −3,28 | 0,0243 | −0,0031 | |||||

| US3140QCVQ63 / Fannie Mae Pool | 0,18 | −4,86 | 0,0242 | −0,0035 | |||||

| US3137H5VK03 / FEDERAL HOME LN MTG MLT CTF GT 2.5% 05/25/2049 | 0,18 | −4,35 | 0,0242 | −0,0033 | |||||

| US3617MK4F31 / Ginnie Mae II Pool | 0,18 | −5,91 | 0,0240 | −0,0039 | |||||

| US3133KKK248 / UMBS | 0,17 | −4,92 | 0,0240 | −0,0034 | |||||

| ENTERPRISE FLEET FINANCING 2024-2 5.61% 04/20/2028 144A / ABS-CBDO (US29375RAC07) | 0,17 | −0,57 | 0,0238 | −0,0023 | |||||

| US08161CAF86 / BENCHMARK MORTGAGE TRUST BMARK 2018 B2 ASB | 0,17 | −12,18 | 0,0238 | −0,0056 | |||||

| US3133CCKM73 / Federal Home Loan Mortgage Corporation | 0,17 | −4,97 | 0,0237 | −0,0034 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,17 | 0,0237 | 0,0237 | ||||||

| US08163MAE75 / Benchmark 2021-B31 Mortgage Trust | 0,17 | −0,58 | 0,0237 | −0,0022 | |||||

| US3137H3QP07 / Federal Home Loan Mortgage Corporation | 0,17 | −3,37 | 0,0236 | −0,0031 | |||||

| US95001YAF16 / Wells Fargo Commercial Mortgage Trust 2019-C54 | 0,17 | −6,04 | 0,0236 | −0,0037 | |||||

| US3622AAGN88 / Ginnie Mae II Pool | 0,17 | −4,47 | 0,0235 | −0,0033 | |||||

| US3133KMRW72 / FNCL UMBS 3.0 RA5901 09-01-51 | 0,17 | −5,03 | 0,0234 | −0,0033 | |||||

| US3132A5J632 / Freddie Mac Pool | 0,17 | −3,98 | 0,0232 | −0,0031 | |||||

| US3137H4HQ63 / Federal Home Loan Mortgage Corporation | 0,17 | −4,55 | 0,0232 | −0,0032 | |||||

| US3137H3S941 / Federal Home Loan Mortgage Corporation | 0,17 | −4,00 | 0,0231 | −0,0030 | |||||

| US3140QNLU41 / Fannie Mae Pool | 0,17 | −4,02 | 0,0229 | −0,0032 | |||||

| US3133B1XC07 / FREDDIE MAC POOL FR QD4275 | 0,17 | −3,49 | 0,0229 | −0,0029 | |||||

| US3137H9AA71 / FEDERAL HOME LN MTG MLT CTF GT 4.5% 10/25/2044 | 0,16 | −5,20 | 0,0225 | −0,0034 | |||||

| US3133KYUZ05 / Freddie Mac Pool | 0,16 | −3,55 | 0,0224 | −0,0028 | |||||

| US3132DPMY15 / FHLG 30YR 5% 12/01/2052#SD2175 | 0,16 | −2,99 | 0,0223 | −0,0026 | |||||

| US3137H5UF27 / FEDERAL HOME LN MTG MLT CTF GT 2.5% 05/25/2049 | 0,16 | −4,71 | 0,0223 | −0,0031 | |||||

| US76971EAA29 / CORP CMO | 0,16 | −7,47 | 0,0222 | −0,0039 | |||||

| US78485GAA22 / SREIT 2021-FLWR A | 0,16 | −17,86 | 0,0221 | −0,0072 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,16 | −4,22 | 0,0219 | −0,0030 | |||||

| ARI FLEET LEASE TRUST 2025-A 4.38% 01/17/2034 144A / ABS-CBDO (US04033CAB28) | 0,16 | 0,0218 | 0,0218 | ||||||

| US3137H22J22 / FEDERAL HOME LN MTG MLT CTF GT 1.5% 04/25/2051 | 0,16 | −2,50 | 0,0215 | −0,0024 | |||||

| US3133KKS753 / FREDDIE MAC POOL UMBS P#RA4142 2.50000000 | 0,16 | −4,29 | 0,0215 | −0,0030 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,16 | −3,11 | 0,0215 | −0,0027 | |||||

| LCH OIS SOFRV3.5% MAC 06/18/45 / DIR (N/A) | 0,15 | 0,0212 | 0,0212 | ||||||

| US3140M8HG73 / FNMA 20YR 2% 11/01/2041#BU6530 | 0,15 | −2,53 | 0,0211 | −0,0025 | |||||

| US3132VQBQ80 / FHLM 30YR 3.5% 05/01/2049#Q63646 | 0,15 | −5,56 | 0,0211 | −0,0032 | |||||

| US3132D9F258 / FHLG 20YR 2.5% 09/01/2041#SC0185 | 0,15 | −3,77 | 0,0210 | −0,0028 | |||||

| US3133KL2V82 / FNCL UMBS 2.0 RA5288 05-01-51 | 0,15 | −4,43 | 0,0208 | −0,0029 | |||||

| US3137H5F778 / FEDERAL HOME LN MTG MLT CTF GT 2.5% 11/25/2047 | 0,15 | −3,85 | 0,0206 | −0,0028 | |||||

| US3140KSK550 / FNMA 20YR 2% 10/01/2041#BQ6615 | 0,15 | −3,85 | 0,0206 | −0,0028 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,15 | −3,87 | 0,0205 | −0,0028 | |||||

| US3133KYVC01 / UMBS Freddie Mac Pool | 0,15 | −3,27 | 0,0204 | −0,0026 | |||||

| US3140J8DB60 / Fannie Mae Pool | 0,15 | −4,52 | 0,0204 | −0,0028 | |||||

| SFS AUTO RECEIVABLES SECURITIZATION TR 2024-2 5.33% 11/20/2029 144A / ABS-CBDO (US78397XAC83) | 0,15 | −0,67 | 0,0204 | −0,0019 | |||||

| BX COML MTG TR 2024-GPA3 A TSFR1M+149.25 12/15/2029 144A / ABS-MBS (US123910AA98) | 0,15 | −5,73 | 0,0203 | −0,0033 | |||||

| US3137H5J242 / FEDERAL HOME LN MTG MLT CTF GT 2.5% 06/25/2049 | 0,15 | −4,55 | 0,0203 | −0,0028 | |||||

| US3137H5FF91 / FEDERAL HOME LN MTG MLT CTF GT 2.5% 05/25/2049 | 0,15 | −4,55 | 0,0203 | −0,0028 | |||||

| US3138WJRY68 / FNMA 15YR 2.5% 01/01/2032#AS8602 | 0,15 | −5,16 | 0,0202 | −0,0030 | |||||

| US46590TAF21 / JPMDB COMMERCIAL MORTGAGE SECURITIES TRUST 2017-C5 JPMDB 2017-C5 ASB | 0,15 | −12,57 | 0,0201 | −0,0049 | |||||

| GSCM SWAP PAY 3.1415 09/15/2025 / DIR (N/A) | 0,15 | 0,0201 | 0,0201 | ||||||

| US3140XDZH29 / FNMA 15YR 2.5% 04/01/2036#FM9743 | 0,15 | −5,19 | 0,0200 | −0,0031 | |||||

| US3138WJD884 / FNMA 15YR 2.5% 10/01/2031#AS8226 | 0,15 | −5,84 | 0,0199 | −0,0032 | |||||

| CCG RECEIVABLES TRUST. 4.48% 10/14/2032 144A / ABS-CBDO (US12515XAB64) | 0,14 | 0,0199 | 0,0199 | ||||||

| BX COML MTG TR 2023-XL3 B TSFR1M+239.052 12/09/2040 144A / ABS-MBS (US12434GAC96) | 0,14 | 0,00 | 0,0197 | −0,0018 | |||||

| OPORTUN FUNDING TRUST 2024-3 5.26% 08/15/2029 144A / ABS-CBDO (US68377NAA90) | 0,14 | −26,67 | 0,0196 | −0,0095 | |||||

| CFMT 2024-HB13 LLC VAR 05/25/2034 144A / ABS-CBDO (US12530VAA35) | 0,14 | −9,49 | 0,0196 | −0,0041 | |||||

| US3140QNGQ93 / FN CB2906 | 0,14 | −7,19 | 0,0195 | −0,0033 | |||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,14 | 0,0194 | 0,0194 | ||||||

| POST ROAD EQUIPMENT FINANCE 2025-1 LLC 4.9% 05/15/2031 144A / ABS-CBDO (US73747LAB45) | 0,14 | 0,00 | 0,0192 | −0,0017 | |||||

| US3133A96N02 / FR QB3577 | 0,14 | −4,11 | 0,0192 | −0,0026 | |||||

| US3140J9VA68 / Fannie Mae Pool | 0,14 | −4,79 | 0,0191 | −0,0028 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,14 | −5,48 | 0,0190 | −0,0028 | |||||

| US05610HAA14 / BX Commercial Mortgage Trust 2022-LP2 | 0,14 | −14,37 | 0,0189 | −0,0050 | |||||

| US3140QSLY59 / FNMA 30YR 5.5% 06/01/2053#CB6642 | 0,14 | −4,86 | 0,0189 | −0,0027 | |||||

| MSCS SWAP PAY 4.075 04/24/30 / DIR (N/A) | 0,14 | 0,0188 | 0,0188 | ||||||

| US36179SBG12 / Ginnie Mae II Pool | 0,14 | −6,16 | 0,0188 | −0,0030 | |||||

| US61766NAY13 / MORGAN STANLEY BANK OF AMERICA MERRILL LYNCH TRUST MSBAM 2016-C30 ASB | 0,14 | −29,69 | 0,0185 | −0,0102 | |||||

| US3128M9J529 / FHLG 30YR 4% 09/42#G07184 | 0,13 | −3,60 | 0,0184 | −0,0024 | |||||

| US17328FBB04 / Citigroup Commercial Mortgage Trust 2019-GC41 | 0,13 | −6,34 | 0,0184 | −0,0028 | |||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,13 | 0,0179 | 0,0179 | ||||||

| US98164FAD42 / WOART 23-C A3 5.15% 11-15-28 | 0,13 | 0,00 | 0,0179 | −0,0017 | |||||

| MSCS SWAP PAY 3.87 11/07/29 / DIR (N/A) | 0,13 | 0,0177 | 0,0177 | ||||||

| MSCS SWAP REC 4.075 04/24/30 / DIR (N/A) | 0,13 | 0,0176 | 0,0176 | ||||||

| US3137FXBN71 / FEDERAL HOME LN MTG MLT CTF GT 3% 10/25/2040 | 0,13 | −3,79 | 0,0175 | −0,0023 | |||||

| US31418CNG59 / Fannie Mae Pool | 0,13 | −5,22 | 0,0174 | −0,0026 | |||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,13 | 0,0174 | 0,0174 | ||||||

| US31418DXR87 / Fannie Mae Pool | 0,13 | −3,08 | 0,0174 | −0,0021 | |||||

| US06541CBR60 / BANK 2021-BNK33 VAR 05/15/2064 | 0,13 | −5,26 | 0,0173 | −0,0025 | |||||

| US3140XC5A24 / FNMA 15YR UMBS SUPER | 0,13 | −6,67 | 0,0173 | −0,0029 | |||||

| US3140XBND86 / FNMA 20YR 2.5% 05/01/2041#FM7587 | 0,13 | −3,10 | 0,0172 | −0,0022 | |||||