Grundläggande statistik

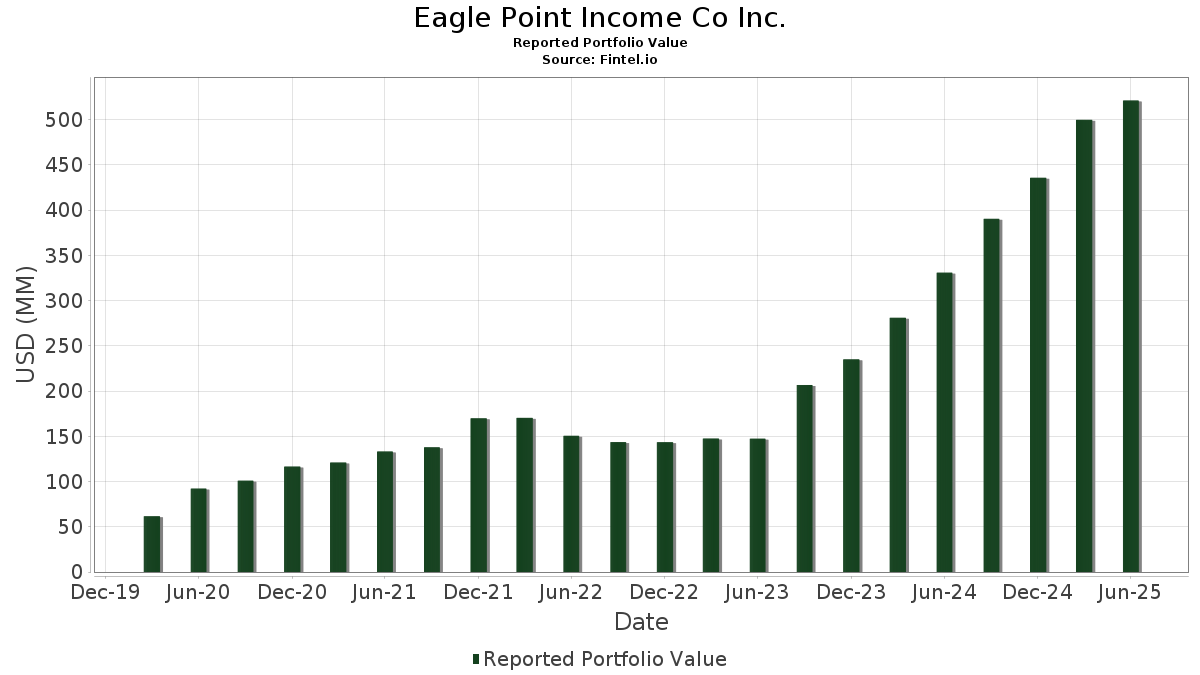

| Portföljvärde | $ 520 951 687 |

| Aktuella positioner | 170 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

Eagle Point Income Co Inc. har redovisat 170 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 520 951 687 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). Eagle Point Income Co Inc.s största innehav är Madison Park Funding XXXVII, Ltd. (US:US55817FAC77) , CLO Subordinated Note (KY:US14316PAC86) , Southwick Park CLO LLC 0.000 20 Jul 2032 Class E 144A (KY:US84604YAK55) , Octagon 56 Ltd (KY:US67577PAA49) , and Dryden 68 CLO Ltd (KY:US26252RAE09) . Eagle Point Income Co Inc.s nya positioner inkluderar Madison Park Funding XXXVII, Ltd. (US:US55817FAC77) , CLO Subordinated Note (KY:US14316PAC86) , Southwick Park CLO LLC 0.000 20 Jul 2032 Class E 144A (KY:US84604YAK55) , Octagon 56 Ltd (KY:US67577PAA49) , and Dryden 68 CLO Ltd (KY:US26252RAE09) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 4,97 | 1,3328 | 1,3328 | ||

| 3,96 | 1,0612 | 1,0612 | ||

| 3,95 | 1,0581 | 1,0581 | ||

| 3,92 | 1,0515 | 1,0515 | ||

| 3,47 | 0,9283 | 0,9283 | ||

| 6,08 | 1,6278 | 0,8878 | ||

| 5,26 | 1,4079 | 0,8379 | ||

| 2,71 | 0,7249 | 0,7249 | ||

| 2,00 | 0,5358 | 0,5358 | ||

| 1,98 | 0,5292 | 0,5292 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 2,25 | 0,6039 | −0,5661 | ||

| 2,93 | 0,7843 | −0,3057 | ||

| 3,27 | 0,8754 | −0,1346 | ||

| 4,31 | 1,1544 | −0,1156 | ||

| 4,33 | 1,1611 | −0,0989 | ||

| 0,47 | 0,1254 | −0,0946 | ||

| 4,62 | 1,2370 | −0,0930 | ||

| 4,51 | 1,2078 | −0,0922 | ||

| 1,65 | 0,4433 | −0,0867 | ||

| 4,53 | 1,2148 | −0,0852 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-25 för rapporteringsperioden 2025-06-30. Denna investerare har inte offentliggjort värdepapper som räknas i aktier, så de aktierelaterade kolumnerna i tabellen nedan har utelämnats. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|

| US55817FAC77 / Madison Park Funding XXXVII, Ltd. | 6,08 | 127,91 | 1,6278 | 0,8878 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US482938AA54) | 5,45 | −1,14 | 1,4608 | −0,0692 | ||

| US14316PAC86 / CLO Subordinated Note | 5,26 | 155,47 | 1,4079 | 0,8379 | ||

| US84604YAK55 / Southwick Park CLO LLC 0.000 20 Jul 2032 Class E 144A | 5,24 | 0,81 | 1,4030 | −0,0370 | ||

| US67577PAA49 / Octagon 56 Ltd | 5,15 | 0,74 | 1,3789 | −0,0411 | ||

| US26252RAE09 / Dryden 68 CLO Ltd | 5,13 | 1,24 | 1,3747 | −0,0353 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US04017UAE64) | 5,13 | 1,20 | 1,3746 | −0,0354 | ||

| CLO Secured Note - Class E-R2 / ABS-CBDO (US03330QAG29) | 5,08 | 2,03 | 1,3610 | −0,0190 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US14318EAG26) | 5,08 | 2,13 | 1,3596 | −0,0204 | ||

| CLO Secured Note - Class E / ABS-CBDO (US29001NAA54) | 5,03 | −0,49 | 1,3474 | −0,0626 | ||

| CLO Secured Note - Class D-R2 / ABS-CBDO (US83012WAA99) | 5,02 | 0,72 | 1,3457 | −0,0443 | ||

| CLO Secured Note - Class E-RR / ABS-CBDO (US04009FAG46) | 5,02 | 1,43 | 1,3454 | −0,0346 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US00177KAE29) | 5,02 | 0,74 | 1,3446 | −0,0454 | ||

| US48252VAA35 / KKR CLO Ltd 22 | 5,02 | −0,69 | 1,3436 | −0,0564 | ||

| US12548NAQ60 / CIFC Funding 2015-I, Ltd. | 5,01 | 0,62 | 1,3419 | −0,0381 | ||

| CLO Secured Note - Class E-RR / ABS-CBDO (US17181QAA58) | 5,00 | −0,26 | 1,3397 | −0,0503 | ||

| US55821HAA14 / Madison Park Funding LI Ltd | 5,00 | 0,91 | 1,3382 | −0,0418 | ||

| CLO Secured Note - Class E / ABS-CBDO (US75009WAA09) | 4,99 | −0,32 | 1,3362 | −0,0538 | ||

| US74980WAA62 / RR15 Ltd | 4,98 | 0,28 | 1,3346 | −0,0454 | ||

| US05684QAA22 / Bain Capital Credit CLO 2022-3 Ltd | 4,97 | 1,3328 | 1,3328 | |||

| CLO Secured Note - Class E-R2 / ABS-CBDO (US64132WAN65) | 4,97 | −0,32 | 1,3310 | −0,0590 | ||

| CLO Secured Note - Class E / ABS-CBDO (US749973AA11) | 4,97 | −0,28 | 1,3308 | −0,0492 | ||

| US74971JAA60 / RRAM_21-16A | 4,97 | −0,52 | 1,3308 | −0,0592 | ||

| CLO Secured Note - Class E / ABS-CBDO (US26253PAA12) | 4,97 | 0,91 | 1,3303 | −0,0397 | ||

| CLO Secured Note - Class E / ABS-CBDO (US51219AAA51) | 4,96 | 0,81 | 1,3288 | −0,0412 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US29003DAE76) | 4,94 | −1,44 | 1,3240 | −0,0660 | ||

| US32010GAA31 / FIRST EAGLE BSL CLO 2019-1 LTD SER 2019-1A CL D V/R REGD 144A P/P 9.57493000 | 4,94 | 0,32 | 1,3235 | −0,0465 | ||

| US26245BAC90 / Dryden 43 Senior Loan Fund | 4,92 | 1,84 | 1,3172 | −0,0228 | ||

| CLO Secured Note - Class E-R2 / ABS-CBDO (US64133TAN28) | 4,91 | −0,79 | 1,3164 | −0,0636 | ||

| CLO Secured Note - Class ER / ABS-CBDO (US884886AJ13) | 4,91 | −1,17 | 1,3141 | −0,0659 | ||

| US67592GAE70 / CLO Secured Note - Class E | 4,90 | −0,55 | 1,3127 | −0,0573 | ||

| CLO Secured Note - Class D / ABS-CBDO (US758981AA20) | 4,90 | −1,29 | 1,3122 | −0,0678 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US00120RAE53) | 4,88 | 0,99 | 1,3071 | −0,0329 | ||

| CLO Subordinated Note / ABS-CBDO (US58286RAC79) | 4,88 | 3,63 | 1,3068 | −0,0032 | ||

| CLO Secured Note - Class E-RR / ABS-CBDO (US39310AAN00) | 4,87 | −0,96 | 1,3051 | −0,0649 | ||

| CLO Secured Note - Class E / ABS-CBDO (US03769NAA28) | 4,85 | −0,25 | 1,2992 | −0,0508 | ||

| US77342LAA61 / CLO Secured Note - Class E | 4,83 | 0,60 | 1,2941 | −0,0359 | ||

| CLO Secured Note - Class E-R2 / ABS-CBDO (US14686CAJ45) | 4,82 | 0,90 | 1,2918 | −0,0382 | ||

| US87230XAD84 / TCI-Symphony CLO 2016-1 Ltd | 4,78 | 0,82 | 1,2811 | −0,0389 | ||

| US46091GAA58 / Invesco CLO Ltd., Series 2022-1A, Class E | 4,78 | −1,38 | 1,2800 | −0,0700 | ||

| US12552BAA08 / CIFC Funding 2018-III Ltd | 4,78 | 0,84 | 1,2793 | −0,0407 | ||

| CLO Secured Note - Class D-R / ABS-CBDO (US67591XAE13) | 4,77 | −0,75 | 1,2789 | −0,0611 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US00120EAE41) | 4,77 | −0,75 | 1,2767 | −0,0533 | ||

| US26248CAA80 / Dryden 98 CLO Ltd | 4,71 | 0,32 | 1,2611 | −0,0389 | ||

| US07134XAA90 / Battalion CLO, Ltd. | 4,62 | −3,23 | 1,2370 | −0,0930 | ||

| US12556CAC01 / CLO Subordinated Note | 4,55 | 0,31 | 1,2198 | −0,0402 | ||

| US21623RAA14 / Cook Park CLO Ltd | 4,54 | 0,11 | 1,2170 | −0,0430 | ||

| CLO Subordinated Note / ABS-CBDO (US04020PAC68) | 4,53 | −3,16 | 1,2148 | −0,0852 | ||

| CLO Income Note / ABS-CBDO (US617940AA93) | 4,51 | −3,30 | 1,2078 | −0,0922 | ||

| CLO Subordinated Note / ABS-CBDO (US37149UAC18) | 4,44 | −2,72 | 1,1897 | −0,0803 | ||

| CLO Subordinated Note / ABS-CBDO (US03165YAC49) | 4,33 | −3,99 | 1,1611 | −0,0989 | ||

| US07134HAA41 / CLO Secured Note - Class E | 4,31 | −5,46 | 1,1544 | −0,1156 | ||

| Class C Loan, Delayed Draw / ABS-O (US00165VAE20) | 4,21 | 1,01 | 1,1276 | −0,0324 | ||

| CLO Subordinated Note / ABS-CBDO (US14317EAC21) | 3,97 | 21,64 | 1,0633 | 0,1533 | ||

| CLO Secured Note - Class ER2 / ABS-CBDO (US64131XAN57) | 3,96 | 1,0612 | 1,0612 | |||

| US67570RAE99 / OCP CLO 2019-16 Ltd | 3,95 | 1,0581 | 1,0581 | |||

| US00120CAA62 / CLO Secured Note - Class E | 3,95 | 45,25 | 1,0569 | 0,2969 | ||

| CLO Secured Note - Class ER / ABS-CBDO (US29002WAG15) | 3,92 | 1,0515 | 1,0515 | |||

| CLO Secured Note - Class E / ABS-CBDO (US00192XAA37) | 3,85 | 0,73 | 1,0318 | −0,0282 | ||

| US67112EAA10 / OZLM XXI Ltd | 3,82 | 0,95 | 1,0246 | −0,0254 | ||

| CLO Secured Note - Class E / ABS-CBDO (US81124GAA31) | 3,80 | 1,15 | 1,0172 | −0,0228 | ||

| US12565BAA52 / CLO Secured Note - Class E-1 | 3,75 | 0,89 | 1,0045 | −0,0255 | ||

| US04018GAA40 / Ares LIX CLO Ltd | 3,70 | 1,04 | 0,9911 | −0,0289 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US72133MAE03) | 3,66 | 0,99 | 0,9814 | −0,0286 | ||

| US88330PAE07 / Thayer Park CLO, Ltd. | 3,62 | 1,03 | 0,9702 | −0,0298 | ||

| US09202UAA88 / CLO Secured Note - Class D | 3,60 | 0,08 | 0,9644 | −0,0356 | ||

| US14316DAA90 / CARLYLE US CLO 2019-1 LTD | 3,47 | 0,87 | 0,9309 | −0,0291 | ||

| CLO Secured Note - Class E / ABS-CBDO (US03990JAA25) | 3,47 | 0,41 | 0,9295 | −0,0305 | ||

| Subordinated Note / ABS-O (N/A) | 3,47 | 0,9283 | 0,9283 | |||

| US143113AC24 / CLO Income Note | 3,46 | 7,65 | 0,9275 | 0,0375 | ||

| US56579BAA61 / CLO Secured Note - Class D | 3,39 | 0,62 | 0,9074 | −0,0326 | ||

| US04965TAA97 / Atrium XIII | 3,37 | 0,33 | 0,9026 | −0,0274 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US12567QAJ13) | 3,29 | −0,33 | 0,8801 | −0,0399 | ||

| Subordinated Loan, DD / ABS-O (US00165VAG77) | 3,27 | −10,39 | 0,8754 | −0,1346 | ||

| CLO Subordinated Note / ABS-CBDO (US00140WBE93) | 3,26 | 0,34 | 0,8725 | −0,0275 | ||

| US67578DAC65 / Octagon Investment Partners 49 Ltd | 3,20 | 6,20 | 0,8584 | 0,0184 | ||

| CLO Subordinated Note / ABS-CBDO (US14318NAC11) | 3,20 | 8,73 | 0,8576 | 0,0376 | ||

| CLO Secured Note - Class E-1R / ABS-CBDO (US750097AE73) | 3,19 | 0,85 | 0,8556 | −0,0244 | ||

| CLO Secured Note - Class E / ABS-CBDO (US37149UAA51) | 3,15 | −0,16 | 0,8451 | −0,0349 | ||

| CLO Subordinated Note / ABS-CBDO (US039938AC92) | 3,11 | 0,65 | 0,8323 | −0,0277 | ||

| CLO Subordinated Note / ABS-CBDO (US67119NAC02) | 3,08 | −1,06 | 0,8251 | −0,0449 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US12548KAE91) | 3,01 | 0,30 | 0,8060 | −0,0240 | ||

| US74980CAJ18 / RR 7 Ltd | 2,98 | −0,07 | 0,7979 | −0,0321 | ||

| US04018CAC91 / Ares LVIII CLO Ltd | 2,95 | 11,69 | 0,7910 | 0,0510 | ||

| US04016NAJ28 / CLO Subordinated Note | 2,95 | 1,31 | 0,7892 | −0,0208 | ||

| US77341FAE25 / CLO Secured Note - Class E | 2,94 | 0,03 | 0,7877 | −0,0323 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US149918AQ71) | 2,94 | −0,61 | 0,7870 | −0,0330 | ||

| US92332MAA53 / Venture 36 Clo Ltd | 2,93 | −25,22 | 0,7843 | −0,3057 | ||

| CLO Subordinated Note / ABS-CBDO (US78111FAE88) | 2,92 | 0,69 | 0,7814 | −0,0286 | ||

| CLO Secured Note - Class E-R2 / ABS-CBDO (US48254AAG40) | 2,90 | −2,91 | 0,7776 | −0,0524 | ||

| OCT16 / Octagon Investment Partners XV Ltd | 2,88 | 0,28 | 0,7728 | −0,0272 | ||

| CLO Secured Note - Class E-R2 / ABS-CBDO (US370911AA78) | 2,83 | −0,84 | 0,7569 | −0,0331 | ||

| US73052WAC73 / Point Au Roche Park CLO Ltd | 2,81 | 1,04 | 0,7517 | −0,0183 | ||

| US87167CAW91 / Symphony CLO XXI, Ltd. | 2,75 | 0,22 | 0,7378 | −0,0222 | ||

| US55821BAE65 / Madison Park Funding XXVIII, Ltd. | 2,71 | 0,7249 | 0,7249 | |||

| US48254KAE73 / KKR CLO 29, Ltd. | 2,67 | −3,54 | 0,7153 | −0,0547 | ||

| US48251GAC33 / KKR Clo 17 Ltd | 2,65 | −1,56 | 0,7106 | −0,0394 | ||

| US48251AAD46 / KKR CLO 14 Ltd | 2,63 | −1,90 | 0,7050 | −0,0450 | ||

| US48253PAE79 / KKR CLO 26 LTD KKR 26 ER | 2,61 | −1,25 | 0,6981 | −0,0319 | ||

| US05682JAC62 / CLO Subordinated Note | 2,57 | −1,42 | 0,6882 | −0,0318 | ||

| US14318AAE55 / CARLYGLE GLOBAL MARKET STRATEGIES SERIES: 21-5A CLASS: SUB | 2,53 | 19,34 | 0,6779 | 0,0879 | ||

| CLO Subordinated Note / ABS-CBDO (US04019GAC96) | 2,51 | 0,44 | 0,6726 | −0,0174 | ||

| CLO Subordinated Note / ABS-CBDO (US29002DAE85) | 2,43 | −0,90 | 0,6514 | −0,0286 | ||

| US04017XAA81 / Ares LIV CLO Ltd | 2,42 | 70,18 | 0,6497 | 0,2497 | ||

| US143134AC86 / CARLYLE US CLO 2021-6, Ltd. | 2,40 | 4,54 | 0,6419 | 0,0019 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US55820EAG61) | 2,35 | −0,59 | 0,6302 | −0,0298 | ||

| CLO Secured Note - Class E-R2 / ABS-CBDO (US64130KAL89) | 2,35 | −0,04 | 0,6292 | −0,0208 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US08187AAE55) | 2,34 | 1,39 | 0,6257 | −0,0143 | ||

| CLO Secured Note - Class E / ABS-CBDO (US14016UAA43) | 2,30 | −0,69 | 0,6169 | −0,0231 | ||

| US06744BAL71 / CLO Subordinated Note | 2,27 | 2,86 | 0,6078 | −0,0022 | ||

| CLO Subordinated Note / ABS-CBDO (US14987UAC53) | 2,25 | 21,71 | 0,6041 | 0,0841 | ||

| US41154YAA10 / Harbor Park CLO 18-1 Ltd | 2,25 | −46,64 | 0,6039 | −0,5661 | ||

| US14318KAA16 / Carlyle Global Market Strategies | 2,25 | 0,72 | 0,6027 | −0,0173 | ||

| US88432CBK18 / Wind River 2014-1 CLO, Ltd. | 2,23 | −0,13 | 0,5979 | −0,0221 | ||

| US77342HAA59 / CLO Secured Note - Class E | 2,17 | 0,60 | 0,5810 | −0,0190 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US675946AA53) | 2,15 | 0,23 | 0,5754 | −0,0246 | ||

| US92332BAA98 / CLO Secured Note - Class E | 2,13 | −1,79 | 0,5718 | −0,0282 | ||

| CLO Subordinated Note / ABS-CBDO (US75901QAC87) | 2,13 | −3,96 | 0,5718 | −0,0482 | ||

| US75009QAA31 / Rad CLO 12 Ltd | 2,13 | 0,00 | 0,5695 | −0,0205 | ||

| US81880YAG52 / Shackleton 2019-XIV Clo Ltd | 2,02 | 99,12 | 0,5425 | 0,2625 | ||

| CLO Secured Note - Class ER / ABS-CBDO (US874779AJ06) | 2,00 | 0,5358 | 0,5358 | |||

| CLO Secured Note - Class E-R3 / ABS-CBDO (US00191CAL63) | 2,00 | 0,55 | 0,5358 | −0,0142 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US29002EAG17) | 1,99 | 1,27 | 0,5322 | −0,0178 | ||

| CLO Secured Note - Class D / ABS-CBDO (US74980NAA63) | 1,98 | 0,5292 | 0,5292 | |||

| CLO Secured Note - Class ER / ABS-CBDO (US48254KAG22) | 1,97 | 0,5276 | 0,5276 | |||

| US75884HAB15 / Regatta XVIII Funding Ltd | 1,93 | −5,80 | 0,5177 | −0,0523 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US481940AG98) | 1,91 | −0,93 | 0,5117 | −0,0283 | ||

| US67573NAA37 / CLO Income Note | 1,90 | 3,38 | 0,5083 | −0,0017 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US29002BAG77) | 1,87 | 0,16 | 0,5017 | −0,0183 | ||

| US05684TAC27 / Bain Capital Credit CLO 2021-2, Ltd. | 1,87 | −5,46 | 0,5009 | −0,0491 | ||

| US26253FAA30 / Dryden 113 CLO Ltd | 1,86 | 0,32 | 0,4987 | −0,0213 | ||

| US06762FAC59 / CLO Subordinated Note | 1,85 | 2,78 | 0,4954 | −0,0046 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US617925AE23) | 1,84 | 0,49 | 0,4924 | −0,0176 | ||

| Class C Loan / ABS-O (N/A) | 1,80 | 0,4811 | 0,4811 | |||

| CLO Subordinated Note / ABS-CBDO (US402564AC28) | 1,79 | 5,37 | 0,4786 | 0,0086 | ||

| US92557RAA23 / CLO Secured Note - Class D | 1,75 | 4,04 | 0,4688 | −0,0012 | ||

| US06762UAC27 / CLO Subordinated Note | 1,70 | 1,19 | 0,4554 | −0,0146 | ||

| US97316GAC33 / CLO Income Note | 1,68 | 9,71 | 0,4512 | 0,0212 | ||

| US98625MAC47 / York CLO-5 Ltd | 1,65 | −12,44 | 0,4433 | −0,0867 | ||

| US103226AC06 / Boyce Park Clo Ltd | 1,63 | 0,87 | 0,4374 | −0,0126 | ||

| CLO Subordinated Note / ABS-CBDO (US48254JAC45) | 1,59 | −3,34 | 0,4272 | −0,0328 | ||

| US00142DAL47 / CLO Income Note | 1,56 | 25,26 | 0,4173 | 0,0673 | ||

| OCT39 / Octagon Investment Partners 39 Ltd | 1,55 | 0,13 | 0,4153 | −0,0147 | ||

| US758464AC57 / Reese Park CLO, Ltd | 1,53 | 0,4090 | 0,4090 | |||

| US04015HAL15 / Ares XXXIV CLO Ltd | 1,52 | 0,60 | 0,4065 | −0,0135 | ||

| CLO Subordinated Note / ABS-CBDO (US12478FAC86) | 1,50 | 13,79 | 0,4025 | 0,0325 | ||

| CLO Secured Note - Class E / ABS-CBDO (US14319XAA28) | 1,35 | 0,3626 | 0,3626 | |||

| CLO Income Note / ABS-CBDO (US54036PAA75) | 1,21 | −4,64 | 0,3251 | −0,0249 | ||

| CLO Secured Note - Class E / ABS-CBDO (US55956DAA72) | 1,12 | 1,45 | 0,3010 | −0,0090 | ||

| CLO Secured Note - Class E / ABS-CBDO (US00121YAA73) | 1,09 | 0,74 | 0,2922 | −0,0078 | ||

| US09204VAE65 / CLO Secured Note - Class D-R | 1,03 | 0,39 | 0,2755 | −0,0045 | ||

| US77341TAA07 / Rockford Tower CLO 2017-3 Ltd | 1,00 | −1,48 | 0,2673 | −0,0127 | ||

| CLO Secured Note - Class ER / ABS-CBDO (US001202AE08) | 0,99 | 0,2653 | 0,2653 | |||

| CLO Secured Note - Class E-R3 / ABS-CBDO (US64129VAQ68) | 0,89 | 0,00 | 0,2381 | −0,0119 | ||

| US06760YAA01 / Barings CLO Ltd 2018-IV | 0,83 | −0,60 | 0,2221 | −0,0079 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US17180YAJ01) | 0,80 | −0,37 | 0,2156 | −0,0044 | ||

| US56579BAC28 / CLO Subordinated Note | 0,80 | −16,32 | 0,2130 | −0,0470 | ||

| US12567XAE76 / CIFC Funding 2022-IV, Ltd. | 0,73 | 7,05 | 0,1953 | 0,0053 | ||

| CLO Subordinated Note / ABS-CBDO (US540365AC75) | 0,71 | −4,69 | 0,1909 | −0,0191 | ||

| US378654AG27 / Subordinated Loan, Delayed Draw | 0,59 | −9,24 | 0,1579 | −0,0221 | ||

| US496097AC00 / Kings Park CLO Ltd | 0,51 | −5,19 | 0,1370 | −0,0130 | ||

| US378654AC13 / Class B Loan, Delayed Draw | 0,50 | −0,80 | 0,1336 | −0,0064 | ||

| US67591WAC73 / Octagon Investment Partners 37, Ltd. | 0,48 | −33,33 | 0,1286 | −0,0714 | ||

| US50188HAC51 / LCM XVIII LP | 0,48 | −1,04 | 0,1275 | −0,0025 | ||

| US92332JAC80 / CLO Subordinated Note | 0,47 | −40,00 | 0,1254 | −0,0946 | ||

| US26249MAW73 / Dryden 37 Senior Loan Fund | 0,47 | 0,65 | 0,1250 | −0,0050 | ||

| CLO Secured Note - Class E-RR / ABS-CBDO (US72132VAE11) | 0,42 | 0,95 | 0,1134 | −0,0066 | ||

| US378654AE78 / Class C Loan, Delayed Draw | 0,23 | −1,72 | 0,0612 | 0,0012 | ||

| US758464AG61 / Reese Park CLO, Ltd | 0,17 | 0,0464 | 0,0464 | |||

| US103226AG10 / Boyce Park Clo Ltd | 0,04 | −13,04 | 0,0109 | 0,0009 |