Grundläggande statistik

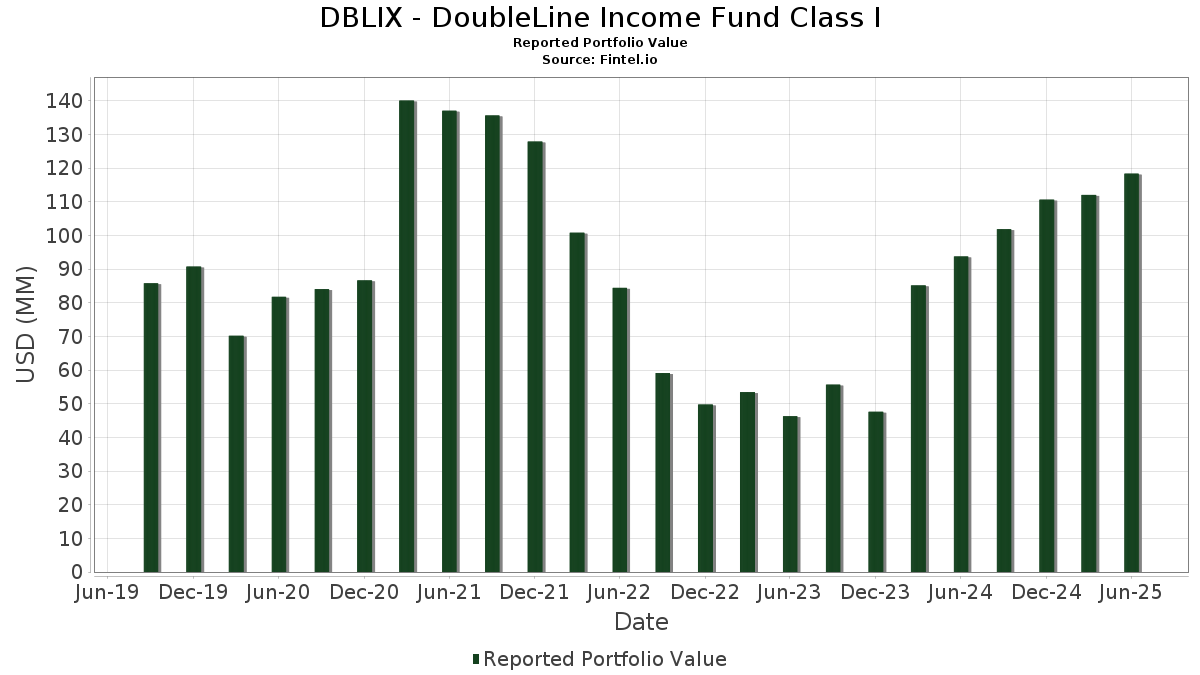

| Portföljvärde | $ 118 353 353 |

| Aktuella positioner | 219 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

DBLIX - DoubleLine Income Fund Class I har redovisat 219 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 118 353 353 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). DBLIX - DoubleLine Income Fund Class Is största innehav är Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class (US:US61747C7074) , JPMorgan Trust II - JPMorgan U.S. Government Money Market Fund IM (US:MGMXX) , FIRST AM GOV OBLIG-U (US:US31846V2117) , Connecticut Avenue Securities Trust 2023-R01 (US:US207932AB01) , and Verus Securitization Trust, Series 2020-5, Class B2 (US:US92538CAF86) . DBLIX - DoubleLine Income Fund Class Is nya positioner inkluderar Connecticut Avenue Securities Trust 2023-R01 (US:US207932AB01) , Verus Securitization Trust, Series 2020-5, Class B2 (US:US92538CAF86) , Fannie Mae Connecticut Avenue Securities (US:US20754LAB53) , VOLT XCVI LLC (US:US92873FAB31) , and Verus Securitization Trust 2021-3 (US:US92539LAF76) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 4,05 | 4,05 | 3,5144 | 2,6995 | |

| 4,05 | 4,05 | 3,5144 | 2,6995 | |

| 4,05 | 4,05 | 3,5144 | 2,6995 | |

| 1,27 | 1,1003 | 1,1003 | ||

| 1,27 | 1,0999 | 1,0999 | ||

| 1,22 | 1,0567 | 1,0567 | ||

| 1,00 | 0,8688 | 0,8688 | ||

| 0,58 | 0,5031 | 0,5031 | ||

| 0,58 | 0,5028 | 0,5028 | ||

| 0,58 | 0,5014 | 0,5014 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 1,66 | 1,4388 | −0,2700 | ||

| 0,29 | 0,2479 | −0,2050 | ||

| 1,22 | 1,0578 | −0,1868 | ||

| 3,47 | 3,0142 | −0,1811 | ||

| 0,09 | 0,0762 | −0,1633 | ||

| 0,12 | 0,1034 | −0,1360 | ||

| 0,40 | 0,3491 | −0,1298 | ||

| 1,91 | 1,6591 | −0,1210 | ||

| 1,49 | 1,2960 | −0,1148 | ||

| 0,39 | 0,3368 | −0,1129 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-22 för rapporteringsperioden 2025-06-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 4,05 | 343,62 | 4,05 | 344,02 | 3,5144 | 2,6995 | |||

| US31846V2117 / FIRST AM GOV OBLIG-U | 4,05 | 343,62 | 4,05 | 344,02 | 3,5144 | 2,6995 | |||

| MGMXX / JPMorgan Trust II - JPMorgan U.S. Government Money Market Fund IM | 4,05 | 343,62 | 4,05 | 344,02 | 3,5144 | 2,6995 | |||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3,47 | −2,97 | 3,0142 | −0,1811 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,08 | −0,53 | 1,8050 | −0,0614 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,91 | −4,12 | 1,6591 | −0,1210 | |||||

| VCAT 2025-NPL1 LLC / ABS-MBS (US921962AA43) | 1,66 | −13,39 | 1,4388 | −0,2700 | |||||

| Connecticut Avenue Securities Trust 2024-R05 / ABS-MBS (US20754XAC74) | 1,51 | 0,33 | 1,3098 | −0,0330 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,49 | −5,51 | 1,2960 | −0,1148 | |||||

| US207932AB01 / Connecticut Avenue Securities Trust 2023-R01 | 1,32 | 0,15 | 1,1467 | −0,0304 | |||||

| US92538CAF86 / Verus Securitization Trust, Series 2020-5, Class B2 | 1,32 | 0,08 | 1,1435 | −0,0318 | |||||

| Connecticut Avenue Securities Trust 2024-R01 / ABS-MBS (US20753UAB61) | 1,32 | 0,77 | 1,1430 | −0,0236 | |||||

| PRPM 2024-4 LLC / ABS-MBS (US74390EAA01) | 1,31 | −4,92 | 1,1409 | −0,0940 | |||||

| US20754LAB53 / Fannie Mae Connecticut Avenue Securities | 1,31 | −0,08 | 1,1393 | −0,0334 | |||||

| Connecticut Avenue Securities Trust 2024-R04 / ABS-MBS (US20753GAG64) | 1,27 | 0,56 | 1,1015 | −0,0248 | |||||

| EFMT 2025-NQM2 / ABS-MBS (US281917AE44) | 1,27 | 1,1003 | 1,1003 | ||||||

| EFMT 2025-NQM2 / ABS-MBS (US281917AF19) | 1,27 | 1,0999 | 1,0999 | ||||||

| Verus Securitization Trust 2024-6 / ABS-MBS (US92540JAD46) | 1,26 | 0,32 | 1,0914 | −0,0281 | |||||

| Freddie Mac STACR REMIC Trust 2024-DNA1 / ABS-MBS (US35564NBA00) | 1,22 | 1,25 | 1,0589 | −0,0168 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,22 | −12,57 | 1,0578 | −0,1868 | |||||

| PRPM 2025-4 LLC / ABS-MBS (US69382KAA60) | 1,22 | 1,0567 | 1,0567 | ||||||

| Connecticut Avenue Securities Trust 2024-R03 / ABS-MBS (US207941AB18) | 1,21 | 0,58 | 1,0526 | −0,0238 | |||||

| US92873FAB31 / VOLT XCVI LLC | 1,19 | 2,05 | 1,0374 | −0,0085 | |||||

| Pret 2025-NPL2 LLC / ABS-MBS (US69392JAA79) | 1,16 | −2,61 | 1,0067 | −0,0563 | |||||

| Government National Mortgage Association / ABS-MBS (US38379QQR91) | 1,12 | −4,11 | 0,9729 | −0,0703 | |||||

| Progress Residential 2024-SFR2 Trust / ABS-O (US74290XAG60) | 1,12 | 1,55 | 0,9689 | −0,0128 | |||||

| PRET 2024-NPL4 LLC / ABS-MBS (US74143RAA14) | 1,10 | −6,91 | 0,9600 | −0,1006 | |||||

| US92539LAF76 / Verus Securitization Trust 2021-3 | 1,08 | −1,10 | 0,9416 | −0,0372 | |||||

| US12659PAF09 / Credit Suisse Mortgage Capital Certificates | 1,05 | 0,29 | 0,9139 | −0,0230 | |||||

| Connecticut Avenue Securities Trust 2024-R02 / ABS-MBS (US20754GAF72) | 1,02 | 0,49 | 0,8855 | −0,0209 | |||||

| Verus Securitization Trust 2024-1 / ABS-MBS (US92540EAD58) | 1,01 | 0,20 | 0,8765 | −0,0234 | |||||

| US48585JAJ97 / Katayma CLO I Ltd | 1,00 | −0,69 | 0,8726 | −0,0315 | |||||

| Rockford Tower CLO 2024-1 Ltd / ABS-CBDO (US77342BAA89) | 1,00 | 0,40 | 0,8725 | −0,0217 | |||||

| US07134WAG87 / Battalion CLO Ltd., Series 2021-21A, Class B | 1,00 | 0,80 | 0,8718 | −0,0182 | |||||

| Goldentree Loan Management US Clo 14 Ltd / ABS-CBDO (US38136RAY36) | 1,00 | 0,60 | 0,8711 | −0,0193 | |||||

| Benefit Street Partners Clo 41 Ltd / ABS-CBDO (US08186GAA13) | 1,00 | 0,8688 | 0,8688 | ||||||

| CarVal CLO IX-C Ltd / ABS-CBDO (US14688HAJ14) | 1,00 | −1,68 | 0,8652 | −0,0393 | |||||

| ALTDE 2025-1 Trust / ABS-O (US00166NAB55) | 0,98 | −3,64 | 0,8516 | −0,0580 | |||||

| US78109RAJ59 / RR 2 Ltd | 0,97 | 2,21 | 0,8441 | −0,0057 | |||||

| US44148JAB52 / Hotwire Funding LLC | 0,96 | 1,05 | 0,8382 | −0,0149 | |||||

| US83615BAJ70 / Sound Point CLO XXVI Ltd | 0,96 | 4,14 | 0,8312 | 0,0100 | |||||

| US784212AF97 / SG Residential Mortgage Trust 2021-1 | 0,93 | 0,54 | 0,8041 | −0,0189 | |||||

| US46651CAS70 / JP Morgan Chase Commercial Mortgage Securities Cor | 0,91 | 5,68 | 0,7925 | 0,0204 | |||||

| US92539BAA08 / Verus Securitization Trust 2023-1 | 0,79 | −3,29 | 0,6890 | −0,0440 | |||||

| OBX 2024-NQM10 Trust / ABS-MBS (US67119MAA62) | 0,78 | −7,48 | 0,6773 | −0,0756 | |||||

| Switch ABS Issuer LLC / ABS-O (US871044AJ27) | 0,78 | −0,26 | 0,6761 | −0,0213 | |||||

| Cross 2024-H1 Mortgage Trust / ABS-MBS (US22757AAA43) | 0,77 | −10,73 | 0,6730 | −0,1027 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,58 | 0,5031 | 0,5031 | ||||||

| Government National Mortgage Association / ABS-MBS (US38381LTU60) | 0,58 | 0,5028 | 0,5028 | ||||||

| US38382LNX54 / Government National Mortgage Association | 0,58 | 0,5014 | 0,5014 | ||||||

| US3137H1F769 / FHLMC CMO IO | 0,58 | 0,5000 | 0,5000 | ||||||

| Freddie Mac Multiclass Certificates Series 2020-P010 / ABS-MBS (US3137H1M526) | 0,57 | 0,4994 | 0,4994 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,57 | 0,4990 | 0,4990 | ||||||

| US38382LAK70 / Government National Mortgage Association | 0,57 | 0,4983 | 0,4983 | ||||||

| APL Finance 2023-1 DAC / ABS-O (US03790CAC55) | 0,56 | −0,18 | 0,4865 | −0,0145 | |||||

| Government National Mortgage Association / ABS-MBS (US38384GZ784) | 0,54 | −1,63 | 0,4720 | −0,0223 | |||||

| BBCMS Mortgage Trust 2025-C32 / ABS-MBS (US07337AAM80) | 0,54 | −1,81 | 0,4704 | −0,0224 | |||||

| Government National Mortgage Association / ABS-MBS (US38384JX585) | 0,54 | −2,17 | 0,4703 | −0,0245 | |||||

| Compass Datacenters Issuer II LLC / ABS-O (US20469AAC36) | 0,51 | 0,78 | 0,4469 | −0,0089 | |||||

| Uniti Fiber Abs Issuer Llc / ABS-O (US91326EAB11) | 0,51 | 0,39 | 0,4435 | −0,0113 | |||||

| Hardee's Funding LLC / ABS-O (US411707AM41) | 0,51 | 0,20 | 0,4434 | −0,0121 | |||||

| Elmwood CLO 28 Ltd / ABS-CBDO (US29003PAA84) | 0,51 | 0,59 | 0,4425 | −0,0099 | |||||

| Katayma CLO II Ltd / ABS-CBDO (US485862AG10) | 0,51 | 0,59 | 0,4417 | −0,0102 | |||||

| Carlyle US CLO 2024-2 Ltd / ABS-CBDO (US14318VAG41) | 0,51 | 0,80 | 0,4410 | −0,0088 | |||||

| Bain Capital CLO 2024-1 Ltd / ABS-CBDO (US056920AJ08) | 0,51 | 0,60 | 0,4410 | −0,0095 | |||||

| GoldenTree Loan Management US CLO 19 Ltd / ABS-CBDO (US38138WAJ36) | 0,51 | 0,40 | 0,4399 | −0,0108 | |||||

| Switch ABS Issuer LLC / ABS-O (US871044AC73) | 0,51 | 0,80 | 0,4397 | −0,0092 | |||||

| Harvest US CLO 2024-1 Ltd / ABS-CBDO (US41755WAJ99) | 0,51 | 0,20 | 0,4396 | −0,0124 | |||||

| Empower CLO 2024-1 Ltd / ABS-CBDO (US29244RAG02) | 0,51 | 0,40 | 0,4394 | −0,0101 | |||||

| Upstart Securitization Trust 2025-2 / ABS-O (US91679EAD04) | 0,51 | 0,4388 | 0,4388 | ||||||

| CarVal CLO IX-C Ltd / ABS-CBDO (US14688HAE27) | 0,50 | 0,60 | 0,4379 | −0,0102 | |||||

| US13877FAA75 / Canyon Capital CLO 2021-1 Ltd | 0,50 | 3,93 | 0,4378 | 0,0047 | |||||

| US00792FAD06 / Affirm Asset Securitization Trust 2023-B | 0,50 | −0,79 | 0,4373 | −0,0167 | |||||

| US94950NAU63 / Wellfleet Clo 2019-1 Ltd | 0,50 | 0,40 | 0,4372 | −0,0112 | |||||

| CARLYLE US CLO 2018-4 LTD / ABS-CBDO (US14315RAW16) | 0,50 | 0,00 | 0,4370 | −0,0117 | |||||

| Katayma CLO II Ltd / ABS-CBDO (US485862AA40) | 0,50 | 0,40 | 0,4366 | −0,0105 | |||||

| Clover CLO 2018-1 LLC / ABS-CBDO (US18914GAC50) | 0,50 | 0,20 | 0,4361 | −0,0117 | |||||

| US59802MAJ62 / Midocean Credit CLO IX | 0,50 | 0,00 | 0,4359 | −0,0119 | |||||

| Wellfleet CLO 2021-3 Ltd / ABS-CBDO (US94951JAG58) | 0,50 | 0,00 | 0,4356 | −0,0122 | |||||

| US76134KAC80 / Retained Vantage Data Centers Issuer LLC | 0,50 | 0,40 | 0,4343 | −0,0100 | |||||

| US85236WCE49 / STWD Trust | 0,50 | 0,40 | 0,4343 | −0,0100 | |||||

| US13875NAA28 / Canyon CLO 2021-3 Ltd | 0,50 | −0,60 | 0,4339 | −0,0149 | |||||

| AASET 2025-1 / ABS-O (US00258PAB94) | 0,50 | −0,60 | 0,4327 | −0,0156 | |||||

| US83438LAC54 / Lunar 2021-1 Structured Aircraft Portfolio Notes | 0,50 | −13,44 | 0,4311 | −0,0815 | |||||

| US73052WAA18 / Point Au Roche Park CLO Ltd | 0,50 | 1,43 | 0,4309 | −0,0054 | |||||

| US12594CBJ80 / COMM 2016-DC2 Mortgage Trust | 0,49 | 0,4288 | 0,4288 | ||||||

| AASET 2024-2 Ltd / ABS-O (US00038QAB41) | 0,49 | −0,61 | 0,4278 | −0,0153 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,49 | −1,41 | 0,4274 | −0,0183 | |||||

| US86745LAB80 / SUNNOVA HELIOS II ISSUER LLC 2019-A | 0,49 | −1,61 | 0,4260 | −0,0192 | |||||

| US83614NAU72 / Sound Point CLO XXIV | 0,49 | 3,81 | 0,4258 | 0,0035 | |||||

| AASET 2024-1 / ABS-O (US00255JAC45) | 0,49 | −3,96 | 0,4217 | −0,0298 | |||||

| US83615PAG28 / Sound Point Clo XXXI Ltd | 0,49 | 2,11 | 0,4217 | −0,0030 | |||||

| Government National Mortgage Association / ABS-MBS (US38383LNL08) | 0,49 | −2,81 | 0,4217 | −0,0244 | |||||

| US67592UAA43 / Octagon 53 Ltd | 0,47 | 2,16 | 0,4120 | −0,0030 | |||||

| US95001XBA37 / Wells Fargo Commercial Mortgage Trust 2019-C50 | 0,47 | 1,07 | 0,4114 | −0,0077 | |||||

| Government National Mortgage Association / ABS-MBS (US38383V3N60) | 0,46 | −2,53 | 0,4027 | −0,0221 | |||||

| Ready Capital Mortgage Financing 2023-FL11 LLC / ABS-CBDO (US75575RAE71) | 0,45 | −0,22 | 0,3924 | −0,0124 | |||||

| US30227FAA84 / Extended Stay America Trust | 0,43 | −0,69 | 0,3729 | −0,0140 | |||||

| US46590KAG94 / JP Morgan Chase Commercial Mortgage Securities Trust | 0,41 | 0,74 | 0,3579 | −0,0068 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,41 | −3,79 | 0,3534 | −0,0243 | |||||

| US94989TAZ75 / Wells Fargo Commercial Mortgage Trust 2015-LC22 | 0,40 | −25,05 | 0,3491 | −0,1298 | |||||

| US90353KBC27 / UBS Commercial Mortgage Trust 2018-C13 | 0,40 | 0,25 | 0,3473 | −0,0092 | |||||

| US78485KAG04 / STWD 2022-FL3 Ltd | 0,39 | 0,26 | 0,3418 | −0,0086 | |||||

| US57109NAC39 / Marlette Funding Trust, Series 2022-3A, Class C | 0,39 | −23,06 | 0,3368 | −0,1129 | |||||

| US39809PAJ49 / Greystone CRE Notes 2021-FL3 Ltd | 0,38 | 0,3283 | 0,3283 | ||||||

| BMO 2025-5C11 Mortgage Trust / ABS-MBS (US096941AD13) | 0,37 | 0,3256 | 0,3256 | ||||||

| US38382J4E34 / Government National Mortgage Association | 0,37 | −9,51 | 0,3231 | −0,0439 | |||||

| US08163BBF76 / Benchmark 2020-B22 Mortgage Trust | 0,37 | 0,3228 | 0,3228 | ||||||

| Government National Mortgage Association / ABS-MBS (US38382M3B32) | 0,37 | −3,15 | 0,3213 | −0,0200 | |||||

| US78485KAE55 / STWD 2022-FL3 Ltd | 0,37 | 0,3180 | 0,3180 | ||||||

| US36198EBB02 / GS Mortgage Securities Trust, Series 2013-GC13, Class D | 0,36 | 0,3158 | 0,3158 | ||||||

| Benchmark 2024-V9 Mortgage Trust / ABS-MBS (US081919AN29) | 0,36 | 0,56 | 0,3147 | −0,0072 | |||||

| US12595FAD42 / CSAIL 17-CX9 A4 3.1755% 09-15-50/04-16-27 | 0,36 | 1,12 | 0,3134 | −0,0052 | |||||

| BANK5 2024-5YR9 / ABS-MBS (US06644VBX73) | 0,36 | −0,28 | 0,3123 | −0,0100 | |||||

| US08162DAD03 / Benchmark 2019-B13 Mortgage Trust | 0,35 | 1,74 | 0,3045 | −0,0033 | |||||

| Wells Fargo Commercial Mortgage Trust 2025-5C3 / ABS-MBS (US95004JAD63) | 0,35 | −4,96 | 0,3002 | −0,0246 | |||||

| US38382JZ410 / Government National Mortgage Association | 0,34 | −3,11 | 0,2987 | −0,0183 | |||||

| US12524AAA79 / CEDR TRUST | 0,34 | 1,80 | 0,2961 | −0,0031 | |||||

| US40441LAG14 / HGI CRE CLO 2021-FL1 Ltd | 0,34 | 0,29 | 0,2957 | −0,0074 | |||||

| US12630DBD57 / Commercial Mortgage Trust, Series 2014-CR14, Class C | 0,33 | 0,30 | 0,2891 | −0,0071 | |||||

| Wells Fargo Commercial Mortgage Trust 2024-C63 / ABS-MBS (US94990FAL58) | 0,33 | −1,79 | 0,2874 | −0,0137 | |||||

| US06540WBC64 / Bank 2019-BNK19 | 0,33 | 1,85 | 0,2873 | −0,0023 | |||||

| BANK 2021-BNK34 / ABS-MBS (US06541JAD37) | 0,33 | 0,93 | 0,2828 | −0,0051 | |||||

| BBCMS Mortgage Trust 2024-5C27 / ABS-MBS (US05555FAH73) | 0,32 | −5,88 | 0,2783 | −0,0263 | |||||

| Government National Mortgage Association / ABS-MBS (US38384GR856) | 0,31 | −2,21 | 0,2694 | −0,0142 | |||||

| US55284AAG31 / MF1 2021-FL7 Ltd | 0,31 | 0,33 | 0,2652 | −0,0069 | |||||

| US38383DPV46 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION | 0,30 | −2,56 | 0,2648 | −0,0141 | |||||

| ACREC 2023-FL2 LLC / ABS-CBDO (US00501BAE92) | 0,30 | −0,33 | 0,2623 | −0,0077 | |||||

| MF1 2024-FL14 LLC / ABS-CBDO (US55416AAA79) | 0,30 | 0,00 | 0,2618 | −0,0076 | |||||

| US87276WAE30 / TRTX 2021-FL4 Issuer Ltd | 0,30 | 0,00 | 0,2605 | −0,0073 | |||||

| US50203JAE82 / LFT CRE 2021 FL1 06/39 1 | 0,30 | −0,66 | 0,2605 | −0,0086 | |||||

| US05608RAG02 / BX Trust | 0,30 | 0,00 | 0,2604 | −0,0069 | |||||

| US53947XAE22 / LoanCore 2021-CRE5 Issuer Ltd | 0,30 | −0,33 | 0,2601 | −0,0085 | |||||

| PFP 2024-11 Ltd / ABS-CBDO (US69291WAE21) | 0,30 | 0,00 | 0,2600 | −0,0074 | |||||

| US46643AAQ67 / JPMBB 2014-C23 UH5 4.7094% 09/15/2047 144A | 0,30 | 0,68 | 0,2597 | −0,0056 | |||||

| US48275RAA59 / KREF, Series 2021-FL2, Class A | 0,30 | −15,38 | 0,2587 | −0,0550 | |||||

| Morgan Stanley Capital I Trust 2016-UBS11 / ABS-MBS (US61767FBD24) | 0,29 | 0,69 | 0,2543 | −0,0054 | |||||

| GPMT 2021-FL4 Ltd / ABS-CBDO (US36262TAE38) | 0,29 | −1,02 | 0,2543 | −0,0102 | |||||

| USG4451BAD67 / HGI CRE CLO 2021-FL2 LTD | 0,29 | 0,35 | 0,2516 | −0,0062 | |||||

| US12595KAA97 / CSMC Trust 2017-PFHP | 0,29 | −43,68 | 0,2479 | −0,2050 | |||||

| US30323CAA80 / FS Rialto 2021-FL3 | 0,28 | −11,53 | 0,2471 | −0,0402 | |||||

| US55285AAA51 / MF1 2022-FL9 LLC SER 2022-FL9 CL A V/R REGD 144A P/P 2.96000000 | 0,28 | −4,71 | 0,2466 | −0,0189 | |||||

| Wells Fargo Commercial Mortgage Trust 2025-VTT / ABS-MBS (US94990GAE98) | 0,28 | 1,08 | 0,2454 | −0,0047 | |||||

| US38382L4G38 / Government National Mortgage Association | 0,28 | −1,40 | 0,2442 | −0,0112 | |||||

| BX Trust 2025-ROIC / ABS-MBS (US05593VAJ26) | 0,28 | 0,00 | 0,2416 | −0,0076 | |||||

| US36249KAJ97 / GS Mortgage Securities Trust 2010-C1 | 0,28 | 0,00 | 0,2405 | −0,0070 | |||||

| Government National Mortgage Association / ABS-MBS (US38384AZ308) | 0,28 | −2,13 | 0,2404 | −0,0123 | |||||

| US97064FAC95 / Willis Engine Structured Trust V | 0,26 | −10,18 | 0,2225 | −0,0325 | |||||

| BMO 2024-5C6 Mortgage Trust / ABS-MBS (US05593QAC87) | 0,26 | 0,79 | 0,2225 | −0,0047 | |||||

| US05609KAG40 / BX Commercial Mortgage Trust 2021-XL2 | 0,25 | 0,2190 | 0,2190 | ||||||

| BSPRT 2023-FL10 Issuer Ltd / ABS-CBDO (US05610VAE20) | 0,25 | 0,00 | 0,2184 | −0,0063 | |||||

| MF1 2024-FL15 / ABS-CBDO (US58003MAE66) | 0,25 | 0,00 | 0,2182 | −0,0063 | |||||

| SSI ABS-2025-1 Issuer LLC / ABS-O (US78475CAA36) | 0,25 | 0,2180 | 0,2180 | ||||||

| US12516WAA99 / CENT Trust 2023-CITY | 0,25 | 0,00 | 0,2179 | −0,0064 | |||||

| US87277JAC53 / TRTX 2022-FL5 Issuer Ltd | 0,25 | 0,00 | 0,2169 | −0,0061 | |||||

| US26863LAG95 / ELP Commercial Mortgage Trust | 0,25 | 0,2168 | 0,2168 | ||||||

| US12434DAG79 / BX Trust, Series 2021-LGCY, Class B | 0,25 | 0,81 | 0,2167 | −0,0043 | |||||

| US78432WAA18 / SFO Commercial Mortgage Trust 2021-555 | 0,25 | 1,22 | 0,2164 | −0,0040 | |||||

| US55284AAE82 / MF1 MULTIFAMILY HOUSING MORTGA MF1 2021 FL7 B 144A | 0,25 | 0,40 | 0,2155 | −0,0053 | |||||

| US90205FAA84 / 280 Park Avenue 2017-280P Mortgage Trust | 0,25 | 0,82 | 0,2153 | −0,0041 | |||||

| US46645JAF93 / JPMBB Commercial Mortgage Securities Trust 2015-C33 | 0,25 | 0,00 | 0,2143 | −0,0060 | |||||

| US04002BAA35 / AREIT_23-CRE8 | 0,25 | −0,81 | 0,2140 | −0,0078 | |||||

| US05608VAJ52 / BX_21-MFM1 | 0,24 | 0,41 | 0,2128 | −0,0047 | |||||

| US91835RAE09 / VMC_21-FL4 | 0,24 | −1,22 | 0,2115 | −0,0088 | |||||

| US38381DDS62 / GNMA, Series 2021-80 | 0,23 | −1,30 | 0,1976 | −0,0084 | |||||

| US78485KAA34 / STWD 2022-FL3 Ltd | 0,23 | −10,71 | 0,1958 | −0,0296 | |||||

| BMO 2025-5C11 Mortgage Trust / ABS-MBS (US096941AS81) | 0,22 | 0,1899 | 0,1899 | ||||||

| US38382JPV25 / The Government National Mortgage Association Guaranteed REMIC Pass-Through Securities | 0,21 | 0,47 | 0,1855 | −0,0043 | |||||

| US12434EAG52 / BX Trust, Series 2021-RISE, Class D | 0,21 | 0,96 | 0,1833 | −0,0034 | |||||

| US03880XAA46 / Arbor Realty Collateralized Loan Obligation Ltd., Series 2022-FL1, Class A | 0,21 | −11,21 | 0,1795 | −0,0281 | |||||

| US78485GAL86 / SREIT TRUST | 0,20 | 0,51 | 0,1736 | −0,0040 | |||||

| WHARF Commercial Mortgage Trust 2025-DC / ABS-MBS (US92987LAA52) | 0,19 | 0,1685 | 0,1685 | ||||||

| US30319YAA64 / FS RIALTO | 0,19 | −21,01 | 0,1634 | −0,0502 | |||||

| US38382TB451 / Government National Mortgage Association | 0,18 | 0,00 | 0,1557 | −0,0046 | |||||

| VEGAS Trust 2024-TI / ABS-MBS (US92254AAA51) | 0,18 | 0,57 | 0,1542 | −0,0034 | |||||

| US75575WAA45 / Ready Capital Mortgage Financing 2021-FL7 LLC | 0,17 | −36,60 | 0,1465 | −0,0905 | |||||

| BANK5 2025-5YR15 / ABS-MBS (US065924BG64) | 0,16 | 0,1405 | 0,1405 | ||||||

| US38380RNM87 / Government National Mortgage Association | 0,16 | −1,27 | 0,1360 | −0,0057 | |||||

| US50203JAA60 / LFT CRE 2021-FL1 Ltd | 0,15 | −22,73 | 0,1337 | −0,0440 | |||||

| US3137FVB922 / FHLMC, Series 5004, Class LS | 0,15 | −1,32 | 0,1311 | −0,0048 | |||||

| US39809PAA30 / Greystone CRE Notes 2021-FL3 Ltd | 0,14 | −26,60 | 0,1204 | −0,0484 | |||||

| US05610HAA14 / BX Commercial Mortgage Trust 2022-LP2 | 0,14 | −13,84 | 0,1197 | −0,0227 | |||||

| Government National Mortgage Association / ABS-MBS (US38383TNP48) | 0,14 | 0,1192 | 0,1192 | ||||||

| Government National Mortgage Association / ABS-MBS (US38381D7S30) | 0,13 | −8,22 | 0,1168 | −0,0144 | |||||

| US46642EBE59 / JPMBB Commercial Mortgage Securities Trust 2014-C21 | 0,13 | −5,07 | 0,1143 | −0,0096 | |||||

| US85573LAC54 / START Ireland | 0,13 | −10,96 | 0,1134 | −0,0176 | |||||

| US53948HAA41 / LoanCore 2021-CRE6 Issuer Ltd | 0,13 | −8,70 | 0,1099 | −0,0140 | |||||

| US87276WAA18 / TPG Real Estate Finance Issuer LTD | 0,13 | −5,26 | 0,1098 | −0,0091 | |||||

| US38382MGH60 / Government National Mortgage Association | 0,13 | 1,61 | 0,1095 | −0,0020 | |||||

| US36262MAE84 / GSMS 2021-IP B 1ML+170 10/15/2036 144A | 0,12 | 0,81 | 0,1080 | −0,0024 | |||||

| GS Mortgage Securities Corp Trust 2021-STAR / ABS-MBS (US36264LAN82) | 0,12 | 0,82 | 0,1076 | −0,0016 | |||||

| US3136BBGH91 / FNMA, REMIC, Series 2020-54, Class AS | 0,12 | −0,81 | 0,1076 | −0,0039 | |||||

| US92257CAE03 / Velocity Commercial Capital Loan Trust 2019-1 | 0,12 | −6,87 | 0,1066 | −0,0107 | |||||

| US12658WAC38 / CSMC 2021-B33 SER 2021-B33 CL A2 REGD 144A P/P 3.16710000 | 0,12 | 0,83 | 0,1060 | −0,0029 | |||||

| US05609CAA53 / BX Commercial Mortgage Trust 2021-21M | 0,12 | −55,43 | 0,1034 | −0,1360 | |||||

| US78486BAA26 / STARWOOD COMMERCIAL MORTGAGE T STWD 2021 FL2 A 144A | 0,11 | −27,85 | 0,0995 | −0,0425 | |||||

| US3136BCUR90 / Fannie Mae REMICS | 0,11 | 12,63 | 0,0930 | 0,0079 | |||||

| ROCK Trust 2024-CNTR / ABS-MBS (US74970WAG50) | 0,10 | 0,97 | 0,0909 | −0,0018 | |||||

| US55283TAA60 / MF1 Multifamily Housing Mortgage Loan Trust | 0,10 | −30,28 | 0,0869 | −0,0408 | |||||

| US92257CAG50 / Velocity Commercial Capital Loan Trust 2019-1 | 0,10 | −7,48 | 0,0861 | −0,0100 | |||||

| US05591XAA90 / BRSP 2021-FL1 Ltd | 0,09 | −1,05 | 0,0818 | −0,0039 | |||||

| US46644YAU47 / JPMBB Commercial Mortgage Securities Trust 2015-C31 | 0,09 | −67,54 | 0,0762 | −0,1633 | |||||

| US05609RAJ32 / BX TRUST BX 2021 BXMF C 144A | 0,08 | 0,00 | 0,0701 | −0,0017 | |||||

| Government National Mortgage Association / ABS-MBS (US38381LVU33) | 0,08 | 0,0700 | 0,0700 | ||||||

| US38383L7F18 / Government National Mortgage Association | 0,07 | 0,0594 | 0,0594 | ||||||

| US92257CAF77 / Velocity Commercial Capital Loan Trust 2019-1 | 0,07 | −6,85 | 0,0593 | −0,0065 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,07 | 0,0589 | 0,0589 | ||||||

| US05609KAA79 / BX Commercial Mortgage Trust 2021-XL2 | 0,06 | −26,25 | 0,0517 | −0,0207 | |||||

| US3136BCVA56 / FNMA, Series 2020-77, Class S | 0,06 | 9,62 | 0,0500 | 0,0030 | |||||

| US3136B9DV60 / Fannie Mae-Aces | 0,05 | −5,36 | 0,0469 | −0,0036 | |||||

| Government National Mortgage Association / ABS-MBS (US38381LWG30) | 0,05 | 0,0461 | 0,0461 | ||||||

| US55316VAA26 / MHC Commercial Mortgage Trust 2021-MHC | 0,04 | −59,63 | 0,0386 | −0,0592 | |||||

| US38382WHF77 / Government National Mortgage Association | 0,04 | −18,87 | 0,0381 | −0,0095 | |||||

| US38382RPN25 / Government National Mortgage Association | 0,03 | −33,33 | 0,0233 | −0,0117 | |||||

| US75575AAA25 / Ready Capital Mortgage Financing 2023-FL12, LLC | 0,02 | −56,86 | 0,0195 | −0,0261 | |||||

| US38382P2Z46 / Government National Mortgage Association | 0,02 | 40,00 | 0,0186 | 0,0044 | |||||

| US3137H0RN01 / Freddie Mac REMICS | 0,01 | −35,71 | 0,0085 | −0,0045 | |||||

| US55292RAC51 / MAPS Trust | 0,01 | −40,00 | 0,0081 | −0,0060 | |||||

| US46644ABF84 / JPMBB Commercial Mortgage Securities Trust 2015-C27 | 0,01 | −82,22 | 0,0073 | −0,0334 |