Grundläggande statistik

| Portföljvärde | $ 100 800 818 |

| Aktuella positioner | 52 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

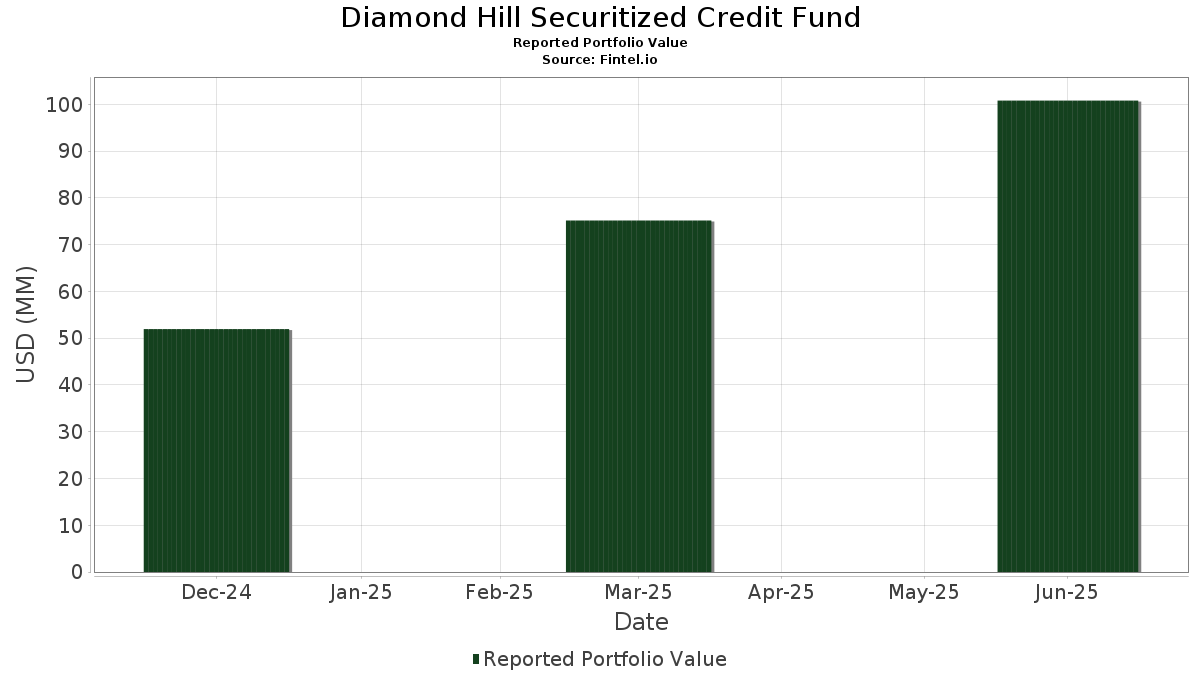

Diamond Hill Securitized Credit Fund har redovisat 52 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 100 800 818 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). Diamond Hill Securitized Credit Funds största innehav är State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls (US:GVMXX) , BAMLL Commercial Mortgage Securities Trust 2020-BOC (US:US05551JAJ97) , RPIT 2022-3 M3 (US:US74970FAD96) , FHLMC, Multi-Family Structured Pass-Through Certificates, Series 2021-MN2, Class B1 (US:US35563JAC71) , and PROGRESS RESIDENTIAL TRUST (US:USU7434QAD26) . Diamond Hill Securitized Credit Funds nya positioner inkluderar BAMLL Commercial Mortgage Securities Trust 2020-BOC (US:US05551JAJ97) , RPIT 2022-3 M3 (US:US74970FAD96) , FHLMC, Multi-Family Structured Pass-Through Certificates, Series 2021-MN2, Class B1 (US:US35563JAC71) , PROGRESS RESIDENTIAL TRUST (US:USU7434QAD26) , and BXMT 2021-FL4 Ltd (US:US05609GAJ76) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 6,00 | 5,9213 | 5,9213 | ||

| 4,11 | 4,0549 | 4,0549 | ||

| 3,52 | 3,4790 | 3,4790 | ||

| 3,05 | 3,0106 | 3,0106 | ||

| 2,56 | 2,5256 | 2,5256 | ||

| 2,21 | 2,1809 | 2,1809 | ||

| 1,84 | 1,8186 | 1,8186 | ||

| 1,40 | 1,3831 | 1,3831 | ||

| 1,33 | 1,3164 | 1,3164 | ||

| 1,00 | 0,9842 | 0,9842 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 3,27 | 3,2282 | −0,9592 | ||

| 2,47 | 2,4361 | −0,8388 | ||

| 4,49 | 4,4333 | −0,8356 | ||

| 2,55 | 2,5180 | −0,8134 | ||

| 2,38 | 2,3491 | −0,8096 | ||

| 2,51 | 2,4748 | −0,7987 | ||

| 2,19 | 2,1587 | −0,7584 | ||

| 2,10 | 2,0697 | −0,7242 | ||

| 1,64 | 1,6192 | −0,6906 | ||

| 2,19 | 2,1671 | −0,6708 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-29 för rapporteringsperioden 2025-06-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 6,24 | 52,82 | 6,24 | 52,80 | 6,1618 | 0,8287 | |||

| Perimeter Master Note Business Trust Series 2025-1A, Class D / ABS-O (US71384PBF71) | 6,00 | 5,9213 | 5,9213 | ||||||

| Brean Asset Backed Securities Series 2023-RM7, Class M4 / ABS-O (US10638BAG95) | 4,49 | 11,31 | 4,4333 | −0,8356 | |||||

| Freedom Financial Series 2022-4FP, Class CERT / ABS-O (US35634JAE82) | 4,21 | 21,83 | 4,1556 | −0,3570 | |||||

| Cherry Securitization Trust Series 2025-1A, Class D / ABS-O (US16473RAD61) | 4,11 | 4,0549 | 4,0549 | ||||||

| AMCR ABS Trust Series 2024-A Class C / ABS-O (US00178EAC93) | 4,10 | 33,52 | 4,0526 | 0,0383 | |||||

| US05551JAJ97 / BAMLL Commercial Mortgage Securities Trust 2020-BOC | 3,52 | 3,4790 | 3,4790 | ||||||

| US74970FAD96 / RPIT 2022-3 M3 | 3,27 | 2,00 | 3,2282 | −0,9592 | |||||

| Banc of America Merrill Lynch Large Loan Inc. Series 2016-SS1, Class A / ABS-O (US05525JAA16) | 3,06 | 61,83 | 3,0191 | 0,5506 | |||||

| Cherry Securitization Trust Series 2024-1A, Class D / ABS-O (US164737AD09) | 3,05 | 3,0106 | 3,0106 | ||||||

| Pagaya AI Debt Selection Trust Series 2025-3, Class E / ABS-O (US69547GAA76) | 2,56 | 2,5256 | 2,5256 | ||||||

| Mulligan Asset Securitization Loans Series 24-1 Class C / DBT (US62534LAC28) | 2,55 | −0,04 | 2,5180 | −0,8134 | |||||

| US35563JAC71 / FHLMC, Multi-Family Structured Pass-Through Certificates, Series 2021-MN2, Class B1 | 2,51 | 0,00 | 2,4748 | −0,7987 | |||||

| USU7434QAD26 / PROGRESS RESIDENTIAL TRUST | 2,49 | 65,91 | 2,4609 | 0,4987 | |||||

| LHOME Mortgage Trust Series 2024-RTL5, Class M2 / ABS-O (US50205WAD92) | 2,47 | −1,64 | 2,4361 | −0,8388 | |||||

| ROC Securities Trust Series 2025-RTL1, Class M2 / ABS-O (US77119RAD89) | 2,38 | −1,65 | 2,3491 | −0,8096 | |||||

| US05609GAJ76 / BXMT 2021-FL4 Ltd | 2,35 | 5,52 | 2,3216 | −0,5881 | |||||

| Finance of America HECM Buyout Series 2024-HB1, Class M5 / ABS-O (US31737DAG16) | 2,25 | 1,81 | 2,2253 | −0,6655 | |||||

| US10638CAB81 / BREAN ASSET BACKED SECURITIES TRUST 2021-RM1 | 2,21 | 2,1809 | 2,1809 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,19 | 1,01 | 2,1671 | −0,6708 | |||||

| US05551JAA88 / BAMLL Commercial Mortgage Securities Trust 2020-BOC | 2,19 | −2,15 | 2,1587 | −0,7584 | |||||

| Kapitus Asset Securitization, LLC Series 2024-1A, Class D / DBT (US48555MAD11) | 2,10 | −2,01 | 2,0697 | −0,7242 | |||||

| Genesis Sales Finance Master Trust Series 2024-B, Class F / ABS-O (US37186XBC83) | 2,03 | −0,73 | 2,0056 | −0,6666 | |||||

| Pagaya Point of Sale Holdings Series 25-1 Class F / ABS-O (US694951AB06) | 1,84 | 1,8186 | 1,8186 | ||||||

| Colem 2021-HLNE Mortgage Trust Series 22-HLNE Class B / ABS-O (US12659JAE73) | 1,73 | −3,13 | 1,7101 | −0,6250 | |||||

| Brean Asset Backed Securities Trust Series 2023-RM7, Class M2 / ABS-O (US10638BAE48) | 1,71 | 5,30 | 1,6887 | −0,4330 | |||||

| US26210YAG17 / DROP_21-FILE | 1,64 | −7,30 | 1,6192 | −0,6906 | |||||

| Oportun Funding, LLC Series 2025-A, Class E / ABS-O (US68377TAE82) | 1,49 | −0,13 | 1,4751 | −0,4782 | |||||

| Brean Asset Backed Securities Series 2025-RM10, Class M4 / ABS-O (US10638FAN50) | 1,43 | 17,87 | 1,4134 | −0,1732 | |||||

| US12659JAJ60 / COLEM 2022-HLNE Mortgage Trust | 1,42 | 1,86 | 1,4064 | −0,4203 | |||||

| US62954PAL40 / BF 2019-NYT Mortgage Trust | 1,40 | 1,3831 | 1,3831 | ||||||

| Tricolor Auto Securitization Trust Series 2025-2A, Class E / ABS-O (US89617QAF72) | 1,33 | 1,3164 | 1,3164 | ||||||

| US53218CAN02 / Life 2021-BMR Mortgage Trust | 1,20 | 0,75 | 1,1891 | −0,3720 | |||||

| US26210YAA47 / DROP Mortgage Trust, Series 2021-FILE, Class A | 1,03 | 2,08 | 1,0206 | −0,3015 | |||||

| Mulligan Asset Securitization Loans Series 2024-1, Class CC / DBT (US62534LAF58) | 1,02 | −0,10 | 1,0072 | −0,3254 | |||||

| Tricolor Auto Securitization Trust Series 2025-1A, Class E / ABS-O (US89617CAE12) | 1,01 | 0,00 | 0,9987 | −0,3222 | |||||

| Oportun Funding, LLC Series 2025-B, Class E / ABS-O (US68378QAE35) | 1,00 | 0,9842 | 0,9842 | ||||||

| US53218DAG34 / Life Mortgage Trust US | 0,99 | −1,10 | 0,9776 | −0,3298 | |||||

| Brean Asset Backed Securities Trust Series 2023-RM7, Class M3 / ABS-O (US10638BAF13) | 0,98 | 7,35 | 0,9672 | −0,2244 | |||||

| US62954PAN06 / BF 2019-NYT Mortgage Trust | 0,89 | −2,52 | 0,8784 | −0,3129 | |||||

| US33830CAG50 / DBGS Mortgage Trust, Series 2018-5BP, Class D | 0,87 | 1,16 | 0,8616 | −0,2650 | |||||

| US00489TAE64 / ACRE Commercial Mortgage 2021-FL4 Ltd | 0,83 | −15,96 | 0,8217 | −0,4719 | |||||

| US05608XAJ19 / BXMT Ltd. | 0,77 | 3,07 | 0,7624 | −0,2161 | |||||

| Ally Bank Auto Credit-Linked Notes Series 2024-B, Class G / ABS-O (US02007G4H32) | 0,74 | −11,15 | 0,7318 | −0,3577 | |||||

| US74333EAB83 / PROGRESS RESIDENTIAL 2021-SFR4 | 0,67 | 0,6580 | 0,6580 | ||||||

| Government National Mortgage Association Series 2021-158, Class MT / ABS-O (US38382XW350) | 0,66 | 0,61 | 0,6525 | −0,2052 | |||||

| US00439KAD81 / Accelerated 2021-1H LLC | 0,52 | −8,17 | 0,5110 | −0,2246 | |||||

| AMCR ABS Trust Series 2023-1A, Class C / ABS-O (US00178CAC38) | 0,52 | −0,58 | 0,5109 | −0,1692 | |||||

| US42806MBZ14 / Hertz Vehicle Financing III LLC | 0,26 | −1,16 | 0,2535 | −0,0856 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,25 | 0,2503 | 0,2503 | ||||||

| US74333VAA26 / Progress Residential, Series 2021-SFR3, Class A | 0,15 | 0,00 | 0,1461 | −0,0462 | |||||

| US12434LAJ35 / BXMT 2020-FL2 LTD | 0,12 | −14,29 | 0,1185 | −0,0647 |