Grundläggande statistik

| Portföljvärde | $ 5 000 702 631 |

| Aktuella positioner | 630 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

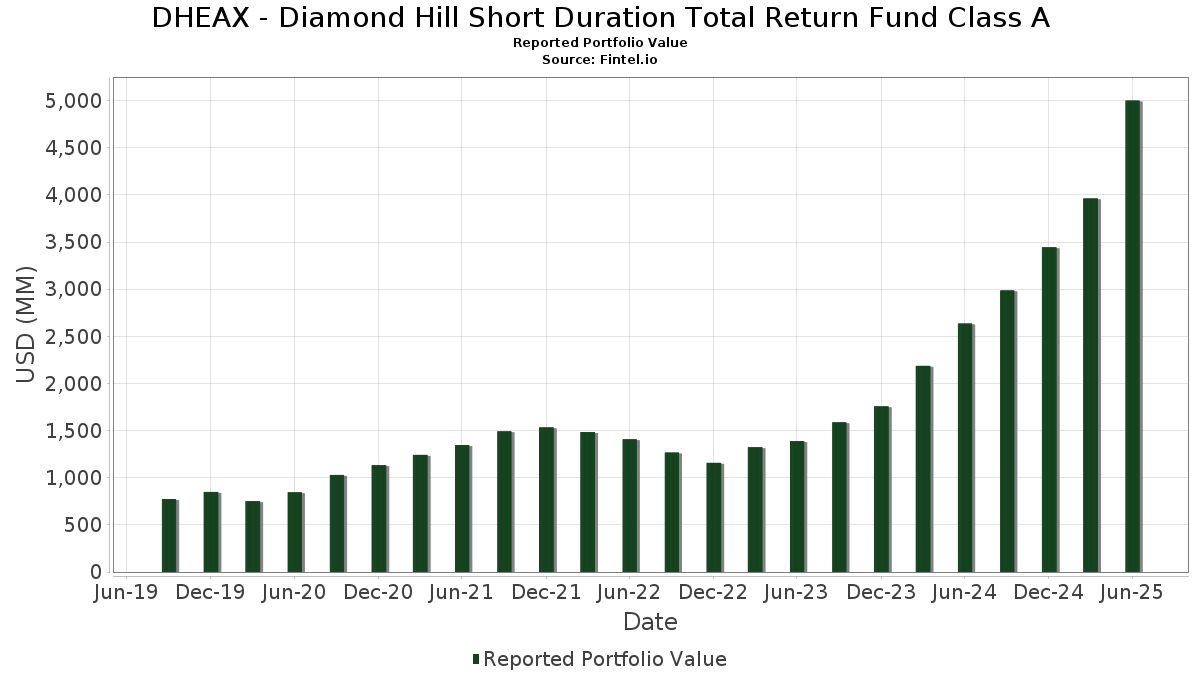

DHEAX - Diamond Hill Short Duration Total Return Fund Class A har redovisat 630 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 5 000 702 631 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). DHEAX - Diamond Hill Short Duration Total Return Fund Class As största innehav är State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls (US:GVMXX) , FirstKey Homes 2020-SFR2 Trust (US:US33767JAA07) , United States Treasury Note/Bond (US:US9128282R06) , FirstKey Homes Trust, Series 2020-SFR1, Class A (US:US33767MAA36) , and Freddie Mac Multifamily Structured Credit Risk (US:US35563JAB98) . DHEAX - Diamond Hill Short Duration Total Return Fund Class As nya positioner inkluderar FirstKey Homes 2020-SFR2 Trust (US:US33767JAA07) , United States Treasury Note/Bond (US:US9128282R06) , FirstKey Homes Trust, Series 2020-SFR1, Class A (US:US33767MAA36) , Freddie Mac Multifamily Structured Credit Risk (US:US35563JAB98) , and LIFE_22-BMR2 (US:US53218DAA63) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 88,85 | 2,1354 | 0,9440 | ||

| 37,22 | 0,8946 | 0,8946 | ||

| 37,22 | 0,8946 | 0,8946 | ||

| 34,00 | 0,8172 | 0,8172 | ||

| 29,79 | 0,7160 | 0,7160 | ||

| 29,22 | 0,7022 | 0,7022 | ||

| 48,50 | 1,1657 | 0,6797 | ||

| 27,24 | 0,6547 | 0,6547 | ||

| 26,03 | 0,6255 | 0,6255 | ||

| 21,41 | 0,5145 | 0,5145 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 273,52 | 6,5739 | −6,5837 | ||

| 14,62 | 0,3514 | −0,1810 | ||

| 13,06 | 0,3140 | −0,1627 | ||

| 13,06 | 0,3140 | −0,1627 | ||

| 12,25 | 0,2945 | −0,1468 | ||

| 27,40 | 0,6584 | −0,1385 | ||

| 4,34 | 0,1042 | −0,1385 | ||

| 52,41 | 1,2597 | −0,1275 | ||

| 6,36 | 0,1529 | −0,1190 | ||

| 25,87 | 0,6219 | −0,1144 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-29 för rapporteringsperioden 2025-06-30. Denna investerare har inte offentliggjort värdepapper som räknas i aktier, så de aktierelaterade kolumnerna i tabellen nedan har utelämnats. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 273,52 | −47,55 | 6,5739 | −6,5837 | ||

| US33767JAA07 / FirstKey Homes 2020-SFR2 Trust | 88,85 | 88,15 | 2,1354 | 0,9440 | ||

| Research-Driven Pagaya Motor Asset Trust Series 2025-1A, Class A / ABS-O (US76089YAA73) | 52,41 | −4,68 | 1,2597 | −0,1275 | ||

| US9128282R06 / United States Treasury Note/Bond | 48,50 | 151,80 | 1,1657 | 0,6797 | ||

| US33767MAA36 / FirstKey Homes Trust, Series 2020-SFR1, Class A | 42,17 | 3,14 | 1,0134 | −0,0180 | ||

| HTAP Trust Series 2024-2, Class A / ABS-O (US40444WAA71) | 41,74 | −2,07 | 1,0032 | −0,0721 | ||

| Government National Mortgage Association Pool DH9776 / ABS-MBS (US3618KJ2H43) | 37,22 | 0,8946 | 0,8946 | |||

| Government National Mortgage Association Pool DH9776 / ABS-MBS (US3618KJ2H43) | 37,22 | 0,8946 | 0,8946 | |||

| Homeward Opportunities Funding Trust Series 2024-RTL1, Class A1 / ABS-O (US43789FAA12) | 36,17 | −0,17 | 0,8694 | −0,0447 | ||

| BX Trust Series 2025-VLT6, Class D / ABS-O (US12433KAG22) | 34,76 | 17,19 | 0,8355 | 0,0872 | ||

| LHOME Mortgage Trust Series 2025-RTL1, Class A1 / ABS-O (US50205UAA97) | 34,10 | 0,06 | 0,8197 | −0,0402 | ||

| Redwood Funding Trust Series 2025-RR1, Class A1 / ABS-O (US749433AA64) | 34,00 | 0,8172 | 0,8172 | |||

| US35563JAB98 / Freddie Mac Multifamily Structured Credit Risk | 33,25 | 0,00 | 0,7992 | −0,0397 | ||

| US53218DAA63 / LIFE_22-BMR2 | 30,41 | −0,01 | 0,7310 | −0,0364 | ||

| COLT Funding, LLC Series 2025-6, Class A1 / ABS-O (US19689BAA17) | 29,79 | 0,7160 | 0,7160 | |||

| Government National Mortgage Association Pool G2 DJ1126 / ABS-MBS (US3618KMHB40) | 29,22 | 0,7022 | 0,7022 | |||

| BX Trust Series 2024-AIRC, Class D / ABS-O (US12433CAG06) | 28,25 | 49,27 | 0,6791 | 0,2015 | ||

| US05609GAA67 / BXMT 2021-FL4 Ltd | 27,40 | −13,28 | 0,6584 | −0,1385 | ||

| Government National Mortgage Association Pool 787873 / ABS-MBS (US3622ADT650) | 27,24 | 0,6547 | 0,6547 | |||

| LHOME Mortgage Trust Series 2024-RTL3, Class A2 / ABS-O (US50205GAA04) | 26,30 | −0,04 | 0,6321 | −0,0317 | ||

| LHOME Mortgage Trust Series 2024-RTL3, Class A2 / ABS-O (US50205GAA04) | 26,30 | −0,04 | 0,6321 | −0,0317 | ||

| Fidelis Mortgage Trust Series 25-RTL1 Class A1 / ABS-O (US31575LAC72) | 26,13 | 0,06 | 0,6281 | −0,0308 | ||

| US03880RAJ86 / Arbor Realty Commercial Real Estate Notes 2021-FL4 Ltd | 26,03 | 0,6255 | 0,6255 | |||

| Saluda Grade Alternative Mortgage Trust Series 2025-NPL1, Class A1 / ABS-O (US79582BAA35) | 25,87 | −11,34 | 0,6219 | −0,1144 | ||

| Saluda Grade Alternative Mortgage Trust Series 2025-NPL1, Class A1 / ABS-O (US79582BAA35) | 25,87 | −11,34 | 0,6219 | −0,1144 | ||

| LHOME Mortgage Trust Series 2024-RTL2, Class A1 / ABS-O (US50205JAA43) | 25,27 | −0,13 | 0,6073 | −0,0310 | ||

| ROC Securities Trust Series 2025-RTL1, Class A1 / ABS-O (US77119RAA41) | 25,05 | −0,44 | 0,6021 | −0,0327 | ||

| ROC Securities Trust Series 2025-RTL1, Class A1 / ABS-O (US77119RAA41) | 25,05 | −0,44 | 0,6021 | −0,0327 | ||

| US33767JAC62 / FKH 2020-SFR2 B | 24,15 | 0,69 | 0,5805 | −0,0246 | ||

| Homeward Opportunities Funding Trust Series 2024-RRTL2, Class A1 / ABS-O (US43789GAA94) | 24,05 | −0,05 | 0,5781 | −0,0290 | ||

| Redwood Funding Trust Series 2024-2, Class A1 / ABS-O (US76201AAC80) | 23,53 | −0,34 | 0,5656 | −0,0301 | ||

| Redwood Funding Trust Series 2024-2, Class A1 / ABS-O (US76201AAC80) | 23,53 | −0,34 | 0,5656 | −0,0301 | ||

| Genesis Sales Finance Master Trust Series 2024-B, Class C / ABS-O (US37186XAZ87) | 23,48 | −0,10 | 0,5644 | −0,0287 | ||

| Government National Mortgage Association Series 2025-4, Class MA / ABS-O (US38385CBT45) | 22,57 | −11,96 | 0,5423 | −0,1043 | ||

| Government National Mortgage Association Series 2025-4, Class MA / ABS-O (US38385CBT45) | 22,57 | −11,96 | 0,5423 | −0,1043 | ||

| Research-Driven Pagaya Motor Asset Trust Series 2025-1A, Class C / ABS-O (US76089YAC30) | 21,95 | −0,28 | 0,5276 | −0,0278 | ||

| Saluda Grade Alternative Mortgage Trust Series 2025-NPL2, Class A1 / ABS-O (US79589BAA61) | 21,41 | 0,5145 | 0,5145 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 21,05 | −5,12 | 0,5059 | −0,0538 | ||

| Research-Driven Pagaya Motor Asset Trust Series 2025-1A, Class B / ABS-O (US76089YAB56) | 20,97 | −0,29 | 0,5039 | −0,0266 | ||

| Research-Driven Pagaya Motor Asset Trust Series 2025-1A, Class B / ABS-O (US76089YAB56) | 20,97 | −0,29 | 0,5039 | −0,0266 | ||

| Progress Residential Trust Series 2024-SFR5, Class E1 / ABS-O (US74332HAJ59) | 20,61 | 1,49 | 0,4954 | −0,0170 | ||

| Progress Residential Trust Series 2024-SFR5, Class E1 / ABS-O (US74332HAJ59) | 20,61 | 1,49 | 0,4954 | −0,0170 | ||

| Genesis Sales Finance Master Trust Series 2024-B, Class F / ABS-O (US37186XBC83) | 20,48 | −0,73 | 0,4922 | −0,0282 | ||

| U.S. Treasury Notes 4.5%, Due 5/15/2027 / DBT (US91282CKR15) | 20,26 | 0,13 | 0,4870 | −0,0235 | ||

| DailyPay Securitization Trust Series 2025-1A, Class A / ABS-O (US233824AA90) | 20,14 | 0,4841 | 0,4841 | |||

| DailyPay Securitization Trust Series 2025-1A, Class A / ABS-O (US233824AA90) | 20,14 | 0,4841 | 0,4841 | |||

| Genesis Sales Finance Master Trust Series 2024-B, Class E / ABS-O (US37186XBB01) | 20,10 | −0,55 | 0,4831 | −0,0268 | ||

| U.S. Treasury Notes 3.875%, Due 10/15/2027 / DBT (US91282CLQ23) | 20,07 | 0,40 | 0,4824 | −0,0220 | ||

| U.S. Treasury Notes 3.875%, Due 10/15/2027 / DBT (US91282CLQ23) | 20,07 | 0,40 | 0,4824 | −0,0220 | ||

| U.S. Treasury Notes 3.75%, Due 08/31/2026 / DBT (US91282CLH24) | 19,95 | 0,07 | 0,4795 | −0,0235 | ||

| Continental Finance Credit Card LLC Series 2024-A, Class E / ABS-O (US66981PAU21) | 19,95 | −1,49 | 0,4794 | −0,0314 | ||

| US912828P469 / United States Treasury Note/Bond | 19,69 | 0,57 | 0,4731 | −0,0207 | ||

| Cascade Funding Mortgage Trust Series 2024-HB14, Class A / ABS-O (US12530XAA90) | 18,89 | −4,80 | 0,4539 | −0,0466 | ||

| Unlock HEA Trust Series 24-2 Class A / ABS-O (US91528AAA79) | 18,87 | −0,45 | 0,4534 | −0,0247 | ||

| Unlock HEA Trust Series 24-2 Class A / ABS-O (US91528AAA79) | 18,87 | −0,45 | 0,4534 | −0,0247 | ||

| Unlock HEA Trust Series 2025-1, Class A / ABS-O (US91528BAA52) | 18,86 | 0,4532 | 0,4532 | |||

| Unlock HEA Trust Series 2025-1, Class A / ABS-O (US91528BAA52) | 18,86 | 0,4532 | 0,4532 | |||

| US30227FAL40 / Extended Stay America Trust | 18,77 | 253,10 | 0,4512 | 0,3170 | ||

| Government National Mortgage Association Pool 788003 / ABS-MBS (US3622ADX868) | 18,58 | 0,4465 | 0,4465 | |||

| Cherry Securitization Trust Series 2025-1A, Class A / ABS-O (US16473RAA23) | 18,38 | 0,4419 | 0,4419 | |||

| Multifamily Connecticut Avenue Series 2025-1, Class M1 / ABS-O (US62549CAA99) | 18,36 | 0,4412 | 0,4412 | |||

| US26210YAG17 / DROP_21-FILE | 18,30 | −8,83 | 0,4399 | −0,0666 | ||

| Brean Asset Backed Securities Series 2025-RM10, Class A1 / ABS-O (US10638FAA30) | 17,46 | −2,31 | 0,4197 | −0,0313 | ||

| Brean Asset Backed Securities Series 2025-RM10, Class A1 / ABS-O (US10638FAA30) | 17,46 | −2,31 | 0,4197 | −0,0313 | ||

| Upgrade Master Pass-Thru Trust Series 2025-ST2, Class A / ABS-O (US91534JAB89) | 17,44 | 0,4193 | 0,4193 | |||

| Upgrade Master Pass-Thru Trust Series 2025-ST2, Class A / ABS-O (US91534JAB89) | 17,44 | 0,4193 | 0,4193 | |||

| ACHV / Achieve Life Sciences, Inc. | 17,43 | −12,25 | 0,4188 | −0,0822 | ||

| US30227FAJ93 / Extended Stay America Trust | 17,40 | 105,36 | 0,4182 | 0,2044 | ||

| Government National Mortgage Association Series 2024-43, Class NV / ABS-O (US38384KQL88) | 16,69 | −1,39 | 0,4012 | −0,0259 | ||

| Vista Point Securitization Trust Series 2024-CES2, Class A1 / ABS-O (US92841YAA38) | 16,66 | −8,31 | 0,4004 | −0,0580 | ||

| US35563JAC71 / FHLMC, Multi-Family Structured Pass-Through Certificates, Series 2021-MN2, Class B1 | 16,54 | 0,00 | 0,3976 | −0,0198 | ||

| Mercury Financial Credit Card Master Trust Series 2024-2A, Class D / ABS-O (US58940BBD73) | 16,26 | 0,02 | 0,3908 | −0,0193 | ||

| Mercury Financial Credit Card Master Trust Series 2024-2A, Class D / ABS-O (US58940BBD73) | 16,26 | 0,02 | 0,3908 | −0,0193 | ||

| TVC Mortgage Trust Series 2024-RRTL1, Class A1 / ABS-O (US87306WAA53) | 15,98 | −0,29 | 0,3842 | −0,0203 | ||

| TVC Mortgage Trust Series 2024-RRTL1, Class A1 / ABS-O (US87306WAA53) | 15,98 | −0,29 | 0,3842 | −0,0203 | ||

| US66981PAG37 / Continental Credit Card LLC Series 2021-A, Class D | 15,96 | 0,58 | 0,3835 | −0,0167 | ||

| US35563GAA76 / FHLMC, Multi-Family Structured Credit Risk, Series 2021-MN3, Class M1 | 15,82 | −2,45 | 0,3802 | −0,0289 | ||

| Newtek Alternative Loan Program Series 2024-1, Class A / DBT (US629863AA91) | 15,78 | −2,54 | 0,3793 | −0,0292 | ||

| Government National Mortgage Association Pool DI0037 / ABS-MBS (US3618NHBE21) | 15,66 | 0,3764 | 0,3764 | |||

| Pagaya AI Debt Selection Trust Series 24-11 Class D / ABS-O (US69544AAD72) | 15,60 | −0,08 | 0,3749 | −0,0189 | ||

| Pagaya AI Debt Selection Trust Series 24-11 Class D / ABS-O (US69544AAD72) | 15,60 | −0,08 | 0,3749 | −0,0189 | ||

| FinBe Series 2025-1A, Class A / ABS-O (US317967AA56) | 15,51 | 0,3727 | 0,3727 | |||

| Multifamily Connecticut Avenue Series 2024-01, Class M7 / ABS-O (US62548RAA77) | 15,49 | −1,61 | 0,3724 | −0,0249 | ||

| US38384CW210 / Government National Mortgage Association Series 2023-112, Class ET | 15,13 | −9,64 | 0,3637 | −0,0588 | ||

| US91282CJP77 / United States Treasury Note/Bond | 15,11 | 0,04 | 0,3632 | −0,0179 | ||

| US91282CFE66 / United States Treasury Note/Bond | 14,97 | 0,26 | 0,3599 | −0,0169 | ||

| US91282CHB00 / TREASURY NOTE | 14,94 | 0,07 | 0,3592 | −0,0176 | ||

| GCAT Series 2023-NQM4, Class A1 / ABS-O (US36171FAA12) | 14,68 | −1,25 | 0,3528 | −0,0222 | ||

| GCAT Series 2023-NQM4, Class A1 / ABS-O (US36171FAA12) | 14,68 | −1,25 | 0,3528 | −0,0222 | ||

| US62548QAF81 / MCAS 2020-01 CE | 14,64 | −0,20 | 0,3518 | −0,0182 | ||

| BX Trust Series 2024-BIO2, Class D / ABS-O (US05613GAG73) | 14,64 | 0,34 | 0,3518 | −0,0162 | ||

| US35634JAD00 / FREED ABS Trust 2022-4FP | 14,62 | −30,73 | 0,3514 | −0,1810 | ||

| Pagaya Point of Sale Holdings Series 25-1 Class A / ABS-O (US694952AA06) | 14,49 | 0,3482 | 0,3482 | |||

| Pagaya Point of Sale Holdings Series 25-1 Class A / ABS-O (US694952AA06) | 14,49 | 0,3482 | 0,3482 | |||

| US75525AAC99 / Reach ABS Trust 2023-1 | 14,38 | −0,53 | 0,3456 | −0,0191 | ||

| Cherry Securitization Trust Series 2025-1A, Class D / ABS-O (US16473RAD61) | 14,34 | 0,3446 | 0,3446 | |||

| Cherry Securitization Trust Series 2025-1A, Class D / ABS-O (US16473RAD61) | 14,34 | 0,3446 | 0,3446 | |||

| US35563GAC33 / FHLMC, Multi-Family Structured Pass-Through Certificates, Series 2021-MN3, Class B1 | 14,29 | −0,12 | 0,3435 | −0,0175 | ||

| NYSEG Storm Funding LLC 4.713%, Due 05/01/2031 / DBT (US67122QAA22) | 14,07 | 0,19 | 0,3381 | −0,0161 | ||

| Progress Residential Trust Series 2024-SFR4, Class D / ABS-O (US74334JAG58) | 13,78 | 1,43 | 0,3313 | −0,0116 | ||

| Achieve Mortgage Series 2025-HE1, Class A / ABS-O (US00449SAA50) | 13,78 | −4,99 | 0,3311 | −0,0347 | ||

| US30259RAK14 / FMC GMSR Issuer Trust | 13,58 | 0,63 | 0,3264 | −0,0141 | ||

| INTOWN Mortgage Trust Series 2025-STAY, Class D / ABS-O (US46117WAG78) | 13,58 | 0,57 | 0,3263 | −0,0143 | ||

| INTOWN Mortgage Trust Series 2025-STAY, Class D / ABS-O (US46117WAG78) | 13,58 | 0,57 | 0,3263 | −0,0143 | ||

| Cascade Funding Mortgage Trust Series 2024-HB13, Class M4 / ABS-O (US12530VAE56) | 13,48 | 6,08 | 0,3241 | 0,0034 | ||

| Cherry Securitization Trust Series 2024-1A, Class A / ABS-O (US164737AA69) | 13,43 | 0,34 | 0,3229 | −0,0149 | ||

| US30331GAG64 / First Help Financial LLC Series 2023-1A, Class C | 13,27 | −0,44 | 0,3189 | −0,0173 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 13,11 | −0,94 | 0,3151 | −0,0188 | ||

| Easy 2025-RTL1 Series 25-RTL1 Class A1 / ABS-O (US27786FAA75) | 13,10 | 0,3149 | 0,3149 | |||

| Easy 2025-RTL1 Series 25-RTL1 Class A1 / ABS-O (US27786FAA75) | 13,10 | 0,3149 | 0,3149 | |||

| Pagaya AI Debt Selection Trust Series 2025-4, Class C / ABS-O (US69547DAD84) | 13,10 | 0,3148 | 0,3148 | |||

| AMCR ABS Trust Series 2023-1A, Class B / ABS-O (US00178CAB54) | 13,06 | −30,87 | 0,3140 | −0,1627 | ||

| AMCR ABS Trust Series 2023-1A, Class B / ABS-O (US00178CAB54) | 13,06 | −30,87 | 0,3140 | −0,1627 | ||

| Achieve Mortgage Series 2024-HE2, Class A / ABS-O (US00112DAA46) | 12,93 | −5,47 | 0,3108 | −0,0343 | ||

| Woodward Capital Management Series 24-CES3 Class A1A / ABS-O (US74942AAA16) | 12,91 | −9,16 | 0,3104 | −0,0483 | ||

| Woodward Capital Management Series 24-CES3 Class A1A / ABS-O (US74942AAA16) | 12,91 | −9,16 | 0,3104 | −0,0483 | ||

| Oportun Funding LLC Series 2024-1A, Class D / ABS-O (US68377JAG58) | 12,75 | 0,79 | 0,3065 | −0,0127 | ||

| Oportun Funding LLC Series 2024-1A, Class D / ABS-O (US68377JAG58) | 12,75 | 0,79 | 0,3065 | −0,0127 | ||

| US748956AA71 / RCKT Mortgage Trust 2023-CES2 | 12,74 | −10,18 | 0,3062 | −0,0516 | ||

| US66981PAE88 / Continental Credit Card LLC Series 2021-A, Class B | 12,62 | −23,66 | 0,3034 | −0,1138 | ||

| Cascade Funding Mortgage Trust Series 2024-HB13, Class A / ABS-O (US12530VAA35) | 12,49 | −10,30 | 0,3003 | −0,0511 | ||

| US05609GAJ76 / BXMT 2021-FL4 Ltd | 12,46 | 5,54 | 0,2995 | 0,0016 | ||

| US66981PAF53 / Continental Credit Card LLC Series 2021-A, Class C | 12,45 | 1,67 | 0,2992 | −0,0097 | ||

| AMCR ABS Trust Series 2024-A Class A / ABS-O (US00178EAA38) | 12,25 | −29,95 | 0,2945 | −0,1468 | ||

| US91282CCA71 / United States Treasury Inflation Indexed Bonds | 12,10 | 0,57 | 0,2907 | −0,0127 | ||

| CPS Auto Trust Series 2024-D, Class A / ABS-O (US22411JAA34) | 11,89 | −22,87 | 0,2858 | −0,1032 | ||

| CPS Auto Trust Series 2024-D, Class A / ABS-O (US22411JAA34) | 11,89 | −22,87 | 0,2858 | −0,1032 | ||

| Pagaya AI Debt Selection Trust Series 2025-1, Class D / ABS-O (US69544NAE76) | 11,84 | 0,11 | 0,2845 | −0,0138 | ||

| Cherry Securitization Trust Series 2024-1A, Class D / ABS-O (US164737AD09) | 11,57 | 53,10 | 0,2782 | 0,0874 | ||

| Government National Mortgage Association Series 2023-154, Class V / ABS-O (US38384DDS36) | 11,46 | −1,78 | 0,2755 | −0,0189 | ||

| Government National Mortgage Association Series 2023-154, Class V / ABS-O (US38384DDS36) | 11,46 | −1,78 | 0,2755 | −0,0189 | ||

| Progress Residential Trust Series 2024-SFR4, Class E1 / ABS-O (US74334JAJ97) | 11,32 | 1,33 | 0,2721 | −0,0098 | ||

| Mercury Financial Credit Card Master Trust Series 2024-2A, Class C / ABS-O (US58940BBC90) | 11,17 | −0,06 | 0,2684 | −0,0135 | ||

| US78472JAE38 / SPS Servicer Advance Receivables Trust, Series 2020-T2, Class A | 11,15 | 0,59 | 0,2680 | −0,0117 | ||

| Mission Lane Credit Card Master Trust Series 2024-A, Class C / ABS-O (US60510MBB37) | 11,09 | −0,81 | 0,2664 | −0,0155 | ||

| Kapitus Asset Securitization LLC Series 2024-1A, Class 1A / DBT (US48555MAE93) | 10,99 | −0,34 | 0,2641 | −0,0141 | ||

| Kapitus Asset Securitization LLC Series 2024-1A, Class 1A / DBT (US48555MAE93) | 10,99 | −0,34 | 0,2641 | −0,0141 | ||

| Vista Point Securitization Trust Series 2024-CES3, Class A1 / ABS-O (US92841WAA71) | 10,97 | −5,07 | 0,2636 | −0,0279 | ||

| US74333TAL35 / Progress Residential 2021-SFR8 Trust | 10,95 | 0,2631 | 0,2631 | |||

| Unlock HEA Trust Series 24-1 Class A / ABS-O (US91530QAA85) | 10,91 | −1,57 | 0,2623 | −0,0174 | ||

| Unlock HEA Trust Series 24-1 Class A / ABS-O (US91530QAA85) | 10,91 | −1,57 | 0,2623 | −0,0174 | ||

| US53218CAN02 / Life 2021-BMR Mortgage Trust | 10,80 | 91,75 | 0,2596 | 0,1175 | ||

| Progress Residential Trust Series 2024-SFR3, Class D / ABS-O (US74331VAG14) | 10,68 | 1,28 | 0,2566 | −0,0093 | ||

| HTAP Trust Series 2024-1, Class A / ABS-O (US40445NAA63) | 10,45 | 0,01 | 0,2513 | −0,0124 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 10,38 | −3,29 | 0,2496 | −0,0213 | ||

| US42806MCH07 / HERTZ 23-4 D 144A 9.44% 03-25-30/03-26-29 | 10,27 | −1,51 | 0,2468 | −0,0162 | ||

| US30322JAC09 / First Help Financial LLC Series 21-2A Class A | 10,02 | −6,79 | 0,2408 | −0,0304 | ||

| Affirm Incorporated Series 2025-X1, Class D / ABS-O (US00834MAD56) | 10,01 | 0,2406 | 0,2406 | |||

| US55285BAC90 / MF1 LLC, Series 2022-FL10, Class AS | 10,00 | −0,12 | 0,2404 | −0,0122 | ||

| Builders Capital Loan Acquisition Trust Series 2024-NPL1, Class A1B / ABS-O (US12007KAF03) | 9,99 | 0,55 | 0,2402 | −0,0106 | ||

| Kapitus Asset Securitization, LLC Series 2024-1A, Class A / DBT (US48555MAA71) | 9,99 | −0,35 | 0,2401 | −0,0128 | ||

| Brean Asset Backed Securities Series 2024-RM8, Class A1 / ABS-O (US10637YAA38) | 9,98 | −3,67 | 0,2398 | −0,0215 | ||

| Brean Asset Backed Securities Series 2024-RM8, Class A1 / ABS-O (US10637YAA38) | 9,98 | −3,67 | 0,2398 | −0,0215 | ||

| Progress Residential Trust Series 25-SFR1 Class E2 / ABS-O (US74334NAL55) | 9,94 | 2,60 | 0,2390 | −0,0055 | ||

| Progress Residential Trust Series 25-SFR1 Class E2 / ABS-O (US74334NAL55) | 9,94 | 2,60 | 0,2390 | −0,0055 | ||

| US42704RAG65 / HERA Commercial Mortgage 2021-FL1 Ltd | 9,88 | 0,58 | 0,2374 | −0,0103 | ||

| US588926AE58 / Merchants Fleet Funding LLC | 9,85 | −0,52 | 0,2367 | −0,0131 | ||

| US68377WAA99 / Oportun Issuance Trust 2021-C | 9,83 | −20,65 | 0,2364 | −0,0763 | ||

| US42806MBQ15 / HERTZ 22-5 D 144A 6.78% 09-25-28/09-27-27 | 9,78 | −0,20 | 0,2350 | −0,0122 | ||

| US912828V988 / United States Treasury Note/Bond | 9,76 | 0,58 | 0,2345 | −0,0102 | ||

| ROC Securities Trust Series 2025-RTL1, Class M2 / ABS-O (US77119RAD89) | 9,71 | −1,63 | 0,2335 | −0,0157 | ||

| US62890MAD65 / NMEF Funding 2022-B LLC | 9,71 | −0,16 | 0,2333 | −0,0120 | ||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 9,62 | −5,62 | 0,2312 | −0,0259 | ||

| Brean Asset Backed Securities Trust Series 2024-RM9, Class A1 / ABS-O (US10638DAA81) | 9,50 | −1,73 | 0,2284 | −0,0156 | ||

| LHOME Mortgage Trust Series 2024-RTL4, Class A2 / ABS-O (US50205PAB85) | 9,50 | −0,78 | 0,2282 | −0,0132 | ||

| Arbor Realty Collateralized Loan Obligation Ltd. Series 2025-BTR1, Class C / ABS-CBDO (US03881UAL52) | 9,48 | 0,2278 | 0,2278 | |||

| Anchor Mortgage Trust Series 2025-RTL1, Class A1 / ABS-O (US03290CAA45) | 9,40 | 0,2259 | 0,2259 | |||

| US30259RAH84 / FMC GMSR Issuer Trust | 9,38 | 0,69 | 0,2254 | −0,0096 | ||

| Pagaya AI Debt Selection Trust Series 24-2 Class C / ABS-O (US694961AC78) | 9,33 | 463,91 | 0,2242 | 0,1824 | ||

| JP Morgan Chase Commercial Mortgage Trust Series 2025-BMS, Class D / ABS-O (US46596CAG15) | 9,23 | 0,73 | 0,2218 | −0,0093 | ||

| JP Morgan Chase Commercial Mortgage Trust Series 2025-BMS, Class D / ABS-O (US46596CAG15) | 9,23 | 0,73 | 0,2218 | −0,0093 | ||

| State Street Navigator Securities Lending Portfolio I / STIV (N/A) | 9,14 | 0,2197 | 0,2197 | |||

| Credibility Asset Securitization Series 2024-1A, Class A / DBT (US22534NAD03) | 9,11 | −0,16 | 0,2190 | −0,0113 | ||

| Credibility Asset Securitization Series 2024-1A, Class A / DBT (US22534NAD03) | 9,11 | −0,16 | 0,2190 | −0,0113 | ||

| COLT Funding, LLC Series 2024-7, Class A1 / ABS-O (US19688YAA29) | 9,11 | −3,90 | 0,2189 | −0,0202 | ||

| COLT Funding, LLC Series 2024-7, Class A1 / ABS-O (US19688YAA29) | 9,11 | −3,90 | 0,2189 | −0,0202 | ||

| Hertz Vehicle Financing LLC Series 2024-1A, Class C / ABS-O (US42806MCR88) | 9,09 | −0,60 | 0,2186 | −0,0122 | ||

| MCR Mortgage Trust Series 2024-TWA, Class D / ABS-O (US582923AD06) | 9,09 | 0,00 | 0,2185 | −0,0109 | ||

| Government National Mortgage Association Series 2024-20, Class KV / ABS-O (US38384JE262) | 9,01 | −1,46 | 0,2164 | −0,0141 | ||

| Upgrade Receivables Trust Series 2024-1A, Class C / ABS-O (US91533NAC83) | 8,96 | −0,13 | 0,2152 | −0,0110 | ||

| FOR A Financial Asset Securitization Series 2024-1A, Class E / DBT (US34512PAE43) | 8,95 | −0,04 | 0,2152 | −0,0108 | ||

| FOR A Financial Asset Securitization Series 2024-1A, Class E / DBT (US34512PAE43) | 8,95 | −0,04 | 0,2152 | −0,0108 | ||

| Purchasing Power Funding Series 2024-A, Class C / ABS-O (US745935AC06) | 8,89 | −0,53 | 0,2136 | −0,0118 | ||

| Purchasing Power Funding Series 2024-A, Class C / ABS-O (US745935AC06) | 8,89 | −0,53 | 0,2136 | −0,0118 | ||

| US38384BBT70 / Government National Mortgage Association Series 2023-81, Class MV | 8,83 | −1,48 | 0,2123 | −0,0139 | ||

| Research-Drive Pagaya Motor Asset Trust I Series 2024-1A, Class A / ABS-O (US76088YAA82) | 8,83 | −15,50 | 0,2121 | −0,0514 | ||

| Research-Drive Pagaya Motor Asset Trust I Series 2024-1A, Class A / ABS-O (US76088YAA82) | 8,83 | −15,50 | 0,2121 | −0,0514 | ||

| US35563HAA59 / FHLMC, Multi-family Structured Pass-Through Certificates, Series 2022-MN4, Class M1 | 8,75 | −1,59 | 0,2104 | −0,0140 | ||

| US30259RAE53 / FMC GMSR Issuer Trust | 8,65 | 0,15 | 0,2078 | −0,0100 | ||

| TVC Mortgage Trust Series 2024-RRTL1, Class M2 / ABS-O (US87306WAD92) | 8,62 | −1,68 | 0,2071 | −0,0140 | ||

| TVC Mortgage Trust Series 2024-RRTL1, Class M2 / ABS-O (US87306WAD92) | 8,62 | −1,68 | 0,2071 | −0,0140 | ||

| Opportun Funding, LLC Series 2024-3, Class D / ABS-O (US68377NAD30) | 8,60 | −22,82 | 0,2068 | −0,0744 | ||

| Opportun Funding, LLC Series 2024-3, Class D / ABS-O (US68377NAD30) | 8,60 | −22,82 | 0,2068 | −0,0744 | ||

| US67578KAD81 / Ocwen Loan Investment Trust Series 2023-HB1, Class M3 | 8,52 | 1,37 | 0,2048 | −0,0073 | ||

| Oportun Funding, LLC Series 2025-A, Class E / ABS-O (US68377TAE82) | 8,46 | −0,12 | 0,2034 | −0,0103 | ||

| Oportun Funding LLC Series 2024-2, Class D / ABS-O (US68377KAD90) | 8,39 | 0,87 | 0,2016 | −0,0082 | ||

| US53218DAG34 / Life Mortgage Trust US | 8,32 | −1,09 | 0,2001 | −0,0123 | ||

| Government National Mortgage Assocation Series 2023-167, Class VC / ABS-O (US38384FAK84) | 8,27 | −1,84 | 0,1989 | −0,0138 | ||

| US55283TAG31 / MF1 Multifamily Housing Mortgage Loan Trust | 8,24 | 9,93 | 0,1981 | 0,0089 | ||

| Government National Mortgage Association Series 2023-154, Class VA / ABS-O (US38384DDE40) | 8,20 | −1,65 | 0,1972 | −0,0133 | ||

| US74969VAA35 / RMF Proprietary Issuance Trust | 8,12 | 1,49 | 0,1952 | −0,0067 | ||

| US38237VAA44 / GOODLEAP SUSTAINABLE HOME SOLUTIONS TRUST 2023-1 GOOD 2023-1GS A | 8,02 | 0,48 | 0,1929 | −0,0086 | ||

| US858558AA70 / STELR 21-1 A 144A 3.967% 10-15-41/03-15-28 | 7,98 | −17,51 | 0,1919 | −0,0523 | ||

| US77118TAB98 / ROC Securities Trust Series 2021-RLT1, Class A2 | 7,87 | −0,03 | 0,1893 | −0,0094 | ||

| Saluda Grade Alternative Mortgage Trust Series 2025-NPL1, Class A2 / ABS-O (US79582BAB18) | 7,81 | 0,00 | 0,1877 | −0,0093 | ||

| Saluda Grade Alternative Mortgage Trust Series 2025-NPL1, Class A2 / ABS-O (US79582BAB18) | 7,81 | 0,00 | 0,1877 | −0,0093 | ||

| US68378NAC48 / Oportun Issuance Trust, Series 2022-A, Class C | 7,73 | −0,03 | 0,1859 | −0,0093 | ||

| ROC Securities Trust Series 2025-RTL1, Class M1 / ABS-O (US77119RAC07) | 7,71 | −0,57 | 0,1854 | −0,0103 | ||

| Cascade Funding Mortgage Trust Series 2024-HB14, Class M4 / ABS-O (US12530XAE13) | 7,68 | 5,92 | 0,1845 | 0,0017 | ||

| Pagaya AI Debt Selection Trust Series 2025-3, Class E / ABS-O (US69547GAA76) | 7,67 | 0,1844 | 0,1844 | |||

| ACHV / Achieve Life Sciences, Inc. | 7,61 | 0,49 | 0,1828 | −0,0081 | ||

| US61945WAC38 / Mosaic Solar Loan Trust | 7,52 | −3,70 | 0,1808 | −0,0163 | ||

| MF1 Multifamily Housing Mortgage Loan Trust Series 2024-FL15, Class C / ABS-CBDO (US58003MAG15) | 7,51 | −0,01 | 0,1805 | −0,0090 | ||

| MF1 Multifamily Housing Mortgage Loan Trust Series 2024-FL15, Class C / ABS-CBDO (US58003MAG15) | 7,51 | −0,01 | 0,1805 | −0,0090 | ||

| Redwood Funding Trust Series 2024-2, Class A2 / ABS-O (US76201AAD63) | 7,50 | −0,36 | 0,1803 | −0,0096 | ||

| Cascade Funding Mortgage Trust Series 2024-HB13, Class M1 / ABS-O (US12530VAB18) | 7,48 | 0,84 | 0,1798 | −0,0074 | ||

| Government National Mortgage Assocation Series 2024-42, Class DV / ABS-O (US38384KJA07) | 7,38 | −1,55 | 0,1774 | −0,0118 | ||

| Government National Mortgage Assocation Series 2024-42, Class DV / ABS-O (US38384KJA07) | 7,38 | −1,55 | 0,1774 | −0,0118 | ||

| US68377WAB72 / Oportun Issuance Trust 2021-C | 7,32 | −20,77 | 0,1758 | −0,0571 | ||

| Pagaya AI Debt Selection Trust Series 24-2 Class B / ABS-O (US694961AB95) | 7,27 | −15,25 | 0,1747 | −0,0417 | ||

| US04681EAL11 / A10 Securitization Series 2021-D, Class D | 7,23 | 4,63 | 0,1737 | −0,0006 | ||

| Oportun Funding, LLC Series 2025-B, Class E / ABS-O (US68378QAE35) | 7,23 | 0,1737 | 0,1737 | |||

| Oportun Funding, LLC Series 2025-B, Class E / ABS-O (US68378QAE35) | 7,23 | 0,1737 | 0,1737 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 7,18 | −0,94 | 0,1725 | −0,0103 | ||

| Cascade Funding Mortgage Trust Series 2024-HB14, Class M1 / ABS-O (US12530XAB73) | 7,17 | 0,94 | 0,1723 | −0,0069 | ||

| Cascade Funding Mortgage Trust Series 2024-HB14, Class M1 / ABS-O (US12530XAB73) | 7,17 | 0,94 | 0,1723 | −0,0069 | ||

| RMF Proprietary Issuance Trust Series 2022-2, Class A / ABS-O (US74970CAA27) | 7,11 | −1,51 | 0,1709 | −0,0112 | ||

| LHOME Mortgage Trust Series 2024-RTL1, Class A1 / ABS-O (US50205DAA72) | 7,11 | −0,24 | 0,1709 | −0,0089 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 7,07 | −9,36 | 0,1699 | −0,0269 | ||

| Pagaya AI Debt Selection Trust Series 2025-1, Class E / ABS-O (US69548VAA35) | 7,06 | 0,60 | 0,1698 | −0,0074 | ||

| Pagaya AI Debt Selection Trust Series 2025-1, Class E / ABS-O (US69548VAA35) | 7,06 | 0,60 | 0,1698 | −0,0074 | ||

| US26210YAA47 / DROP Mortgage Trust, Series 2021-FILE, Class A | 7,01 | 2,10 | 0,1685 | −0,0047 | ||

| Homeward Opportunities Fund Series 24-RRTL2 Class A2 / ABS-O (US43789GAD34) | 7,01 | 0,10 | 0,1685 | −0,0082 | ||

| US35634EAD13 / Freedom Financial Series 2022-3FP, Class D | 6,96 | −23,70 | 0,1673 | −0,0628 | ||

| Pagaya AI Debt Selection Trust Series 2025-4, Class D / ABS-O (US69547DAE67) | 6,93 | 0,1666 | 0,1666 | |||

| CPF IV, LLC Series 2023-1A, Class C / ABS-O (US224092AC01) | 6,91 | 0,82 | 0,1662 | −0,0068 | ||

| Government National Mortgage Association Series 2024-184, Class PA / ABS-O (US38384XE339) | 6,88 | −36,39 | 0,1654 | −0,1075 | ||

| Government National Mortgage Association Series 2024-184, Class PA / ABS-O (US38384XE339) | 6,88 | −36,39 | 0,1654 | −0,1075 | ||

| US3133CAQK97 / Federal Home Loan Mortgage Corporation Pool FR QG9458 | 6,88 | −18,67 | 0,1653 | −0,0480 | ||

| Government National Mortgage Association Series 2023-151, Class BZ / ABS-O (US38384DKG15) | 6,86 | 2,19 | 0,1649 | −0,0045 | ||

| US77118TAC71 / Roc Mortgage Trust 2021-RTL1 | 6,68 | 1,40 | 0,1606 | −0,0056 | ||

| Continental Finance Credit Card LLC Series 24-A Class D / ABS-O (US66981PAT57) | 6,56 | 0,26 | 0,1577 | −0,0074 | ||

| Continental Finance Credit Card LLC Series 24-A Class D / ABS-O (US66981PAT57) | 6,56 | 0,26 | 0,1577 | −0,0074 | ||

| Brean Asset Backed Securities Series 2023-RM7, Class A1 / ABS-O (US10638BAA26) | 6,55 | −1,28 | 0,1574 | −0,0100 | ||

| Brean Asset Backed Securities Series 2023-RM7, Class A1 / ABS-O (US10638BAA26) | 6,55 | −1,28 | 0,1574 | −0,0100 | ||

| MF1 Multifamily Housing Mortgage Loan Trust Series 2024-FL15, Class D / ABS-CBDO (US58003MAJ53) | 6,50 | 0,00 | 0,1562 | −0,0078 | ||

| Oportun Funding, LLC Series 2025-A, Class D / ABS-O (US68377TAD00) | 6,49 | 1,82 | 0,1560 | −0,0048 | ||

| Oportun Funding, LLC Series 2025-A, Class D / ABS-O (US68377TAD00) | 6,49 | 1,82 | 0,1560 | −0,0048 | ||

| Arbor Realty Collateralized Loan Obligation Ltd. Series 2025-BTR1, Class B / ABS-CBDO (US03881UAJ07) | 6,48 | 0,1558 | 0,1558 | |||

| Ondeck Asset Securitization Trust Series 2024-2A, Class B / DBT (US67108SAE81) | 6,46 | −0,11 | 0,1553 | −0,0079 | ||

| US10637WAA71 / Brean Asset Backed Securities Trust 2022-RM5 | 6,40 | −1,24 | 0,1538 | −0,0097 | ||

| US91680YBE05 / Upstart Structured Pass-Through Trust, Series 2022-4A, Class B | 6,36 | −40,96 | 0,1529 | −0,1190 | ||

| Point Securitization Trust Series 2024-1, Class A1 / ABS-O (US73071KAA43) | 6,32 | 0,78 | 0,1519 | −0,0063 | ||

| Point Securitization Trust Series 2024-1, Class A1 / ABS-O (US73071KAA43) | 6,32 | 0,78 | 0,1519 | −0,0063 | ||

| Point Securitization Trust Series 2025-1, Class A1 / ABS-O (US73072DAA90) | 6,26 | 0,1506 | 0,1506 | |||

| STEAV / Stora Enso Oyj | 6,23 | −6,95 | 0,1497 | −0,0192 | ||

| STEAV / Stora Enso Oyj | 6,23 | −6,95 | 0,1497 | −0,0192 | ||

| BX Trust Series 2024-AIRC, Class B / ABS-O (US12433CAC91) | 6,22 | −2,69 | 0,1496 | −0,0118 | ||

| Kapitus Asset Securitization LLC Series 2024-1A, Class 1D / DBT (US48555MAH25) | 6,21 | −2,02 | 0,1492 | −0,0106 | ||

| US12434LAJ35 / BXMT 2020-FL2 LTD | 6,13 | −19,68 | 0,1474 | −0,0452 | ||

| Tricolor Auto Securitization Trust Series 2024-2A, Class D / ABS-O (US89616PAD50) | 6,11 | −0,65 | 0,1469 | −0,0083 | ||

| US3140JB4Y93 / Federal National Mortgage Association Pool BM7138 | 6,09 | −1,18 | 0,1464 | −0,0091 | ||

| US05608XAA00 / BXMT LTD BXMT 2020 FL3 A 144A | 6,07 | −2,80 | 0,1458 | −0,0117 | ||

| US38384BBX82 / Government National Mortgage Association Series 2023-81, Class QV | 6,03 | −1,53 | 0,1450 | −0,0096 | ||

| AMCR ABS Trust Series 2024-A Class C / ABS-O (US00178EAC93) | 6,03 | −1,85 | 0,1450 | −0,0101 | ||

| Finance of America HECM Buyout Series 2024-HB1, Class M5 / ABS-O (US31737DAG16) | 6,01 | 1,83 | 0,1444 | −0,0045 | ||

| US55285BAE56 / MF1 LLC, Series 2022-FL10, Class B | 6,00 | −0,12 | 0,1442 | −0,0073 | ||

| Progress Residential Trust Series 25-SFR1 Class D / ABS-O (US74334NAG60) | 6,00 | 1,85 | 0,1441 | −0,0044 | ||

| AgoraCapital Auto Securities Trust Series 2025-1A, Class B / ABS-O (US008483AB55) | 5,98 | 0,1438 | 0,1438 | |||

| US55283TAC27 / MF1 2021-FL6 Ltd | 5,98 | 0,1438 | 0,1438 | |||

| PFP III Series 2024-11, Class D / ABS-CBDO (US69291WAJ18) | 5,97 | −0,58 | 0,1434 | −0,0080 | ||

| US74969TAE01 / RMF Buyout Issuance Trust 2021-HB1 | 5,95 | 1,14 | 0,1431 | −0,0054 | ||

| Mission Lane Credit Card Master Trust Series 2024-B, Class E / ABS-O (US60510MBJ62) | 5,95 | −0,25 | 0,1430 | −0,0075 | ||

| US04047JAC99 / Arivo Acceptance Auto Loan Receivables Trust 2022-2 | 5,92 | 2,40 | 0,1424 | −0,0036 | ||

| US00489TAJ51 / ACRE Commercial Mortgage 2021-FL4 Ltd | 5,89 | 0,03 | 0,1416 | −0,0070 | ||

| US38384AMQ30 / Government National Mortgage Association Series 2023-67, Class AC | 5,84 | −27,14 | 0,1404 | −0,0619 | ||

| Tricolor Auto Securitization Trust Series 2024-2A, Class B / ABS-O (US89616PAB94) | 5,81 | −0,70 | 0,1395 | −0,0080 | ||

| US588926AD75 / MERCHANTS FLEET FUNDING LLC MFF 2023-1A D | 5,80 | −0,38 | 0,1393 | −0,0075 | ||

| Research-Driven Pagaya Motor Asset Trust Series 2024-3A, Class C / ABS-O (US76089HAC07) | 5,77 | 0,02 | 0,1386 | −0,0068 | ||

| BX Trust Series 2025-VLT6, Class C / ABS-O (US12433KAE73) | 5,74 | 0,1379 | 0,1379 | |||

| Reach Financial LLC Series 2025-1A, Class B / ABS-O (US75525PAB85) | 5,72 | −0,24 | 0,1376 | −0,0072 | ||

| US95003LAN01 / WELLS FARGO COML MTG TR 2021-SAVE E 1ML+365 02/15/2040 144A | 5,68 | −0,21 | 0,1364 | −0,0071 | ||

| Tricon Residential Series 2025-SFR1, Class C / ABS-O (US895974AC76) | 5,65 | 0,00 | 0,1358 | −0,0067 | ||

| Vista Point Securitization Trust Series 2024-CES1, Class A1 / ABS-O (US92839HAA41) | 5,65 | −9,69 | 0,1357 | −0,0220 | ||

| Banc of America Merrill Lynch Large Loan Inc. Series 2016-SS1, Class A / ABS-O (US05525JAA16) | 5,64 | 32,74 | 0,1357 | 0,0284 | ||

| ACHV / Achieve Life Sciences, Inc. | 5,64 | −0,46 | 0,1354 | −0,0074 | ||

| Hertz Vehicle Financing LLC Series 2024-2A, Class D / ABS-O (US42806MCP23) | 5,63 | −2,10 | 0,1354 | −0,0098 | ||

| Hertz Vehicle Financing LLC Series 2024-2A, Class D / ABS-O (US42806MCP23) | 5,63 | −2,10 | 0,1354 | −0,0098 | ||

| RFS Asset Securitization II LLC Series 2024-1, Class E / ABS-O (US74969DAQ88) | 5,61 | 0,18 | 0,1349 | −0,0065 | ||

| RFS Asset Securitization II LLC Series 2024-1, Class E / ABS-O (US74969DAQ88) | 5,61 | 0,18 | 0,1349 | −0,0065 | ||

| Genesis Sales Finance Master Trust Series 2024-B, Class D / ABS-O (US37186XBA28) | 5,54 | −0,14 | 0,1331 | −0,0068 | ||

| Hertz Vehicle Financing LLC Series 2024-2A, Class C / ABS-O (US42806MCN74) | 5,45 | −0,95 | 0,1310 | −0,0078 | ||

| Cascade Funding Mortgage Trust Series 2024-HB15, Class M4 / ABS-O (US15723AAF84) | 5,43 | 5,56 | 0,1305 | 0,0007 | ||

| Cascade Funding Mortgage Trust Series 2024-HB15, Class M4 / ABS-O (US15723AAF84) | 5,43 | 5,56 | 0,1305 | 0,0007 | ||

| RMF Proprietary Issuance Trust Series 2022-3, Class M1 / ABS-O (US74970FAB31) | 5,42 | 1,61 | 0,1302 | −0,0043 | ||

| RMF Proprietary Issuance Trust Series 2022-3, Class M1 / ABS-O (US74970FAB31) | 5,42 | 1,61 | 0,1302 | −0,0043 | ||

| TVC Mortgage Trust Series 2024-RRTL1, Class A2 / ABS-O (US87306WAB37) | 5,41 | 0,06 | 0,1301 | −0,0064 | ||

| US05609VAG05 / BX Commercial Mortgage Trust 2021-VOLT | 5,37 | −2,54 | 0,1291 | −0,0099 | ||

| US53218CAG50 / LIFE 2021-BMR MTG TR 1ML+140 03/15/2026 144A | 5,30 | 49,75 | 0,1275 | 0,0381 | ||

| Mercury Financial Credit Card Master Trust Series 2024-2A, Class B / ABS-O (US58940BBB18) | 5,28 | −0,70 | 0,1269 | −0,0072 | ||

| Pagaya AI Debt Selection Trust Series 2024-3, Class C / ABS-O (US69547XAC65) | 5,27 | −14,71 | 0,1266 | −0,0292 | ||

| US12434LAE48 / BXMT 2020-FL2 LTD | 5,18 | 0,14 | 0,1245 | −0,0060 | ||

| Avant Credit Card Master Trust Series 2024-1A, Class E / ABS-O (US05351KAJ88) | 5,10 | −1,12 | 0,1226 | −0,0075 | ||

| Mission Lane Credit Card Master Trust Series 2024-A, Class E / ABS-O (US60510MBD92) | 5,09 | −0,62 | 0,1224 | −0,0069 | ||

| Ocwen Loan Investmetn Trust Series 24-HB1 Class M4 / ABS-O (US675952AE50) | 5,09 | 1,86 | 0,1223 | −0,0037 | ||

| US74970FAD96 / RPIT 2022-3 M3 | 5,06 | 1,98 | 0,1215 | −0,0036 | ||

| AMCR ABS Trust Series 2024-A Class B / ABS-O (US00178EAB11) | 5,05 | −0,67 | 0,1213 | −0,0069 | ||

| AMCR ABS Trust Series 2024-A Class B / ABS-O (US00178EAB11) | 5,05 | −0,67 | 0,1213 | −0,0069 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 5,04 | 0,24 | 0,1211 | −0,0057 | ||

| Homeward Opportunities Funding Trust Series 2024-RTL1, Class A2 / ABS-O (US43789FAB94) | 5,02 | 0,04 | 0,1208 | −0,0060 | ||

| Homeward Opportunities Funding Trust Series 2024-RTL1, Class A2 / ABS-O (US43789FAB94) | 5,02 | 0,04 | 0,1208 | −0,0060 | ||

| PFP III Series 2025-12, Class B / ABS-CBDO (US69382JAC53) | 4,99 | 0,1199 | 0,1199 | |||

| PFP III Series 2025-12, Class B / ABS-CBDO (US69382JAC53) | 4,99 | 0,1199 | 0,1199 | |||

| Easy 2025-RTL1 Series 25-RTL1 Class A2 / ABS-O (US27786FAB58) | 4,97 | 0,1195 | 0,1195 | |||

| Easy 2025-RTL1 Series 25-RTL1 Class A2 / ABS-O (US27786FAB58) | 4,97 | 0,1195 | 0,1195 | |||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 4,93 | 7,66 | 0,1185 | 0,0030 | ||

| US30259RAP01 / FMC GMSR Issuer Trust, Series 2022-GT2, Class A | 4,91 | −0,43 | 0,1180 | −0,0064 | ||

| Woodward Capital Management Series 2024-CES5, Class A1A / ABS-O (US74938KAA51) | 4,91 | −8,33 | 0,1179 | −0,0171 | ||

| Research-Drive Pagaya Motor Asset Trust I Series 2024-1A, Class C / ABS-O (US76088YAC49) | 4,87 | 0,02 | 0,1170 | −0,0058 | ||

| US74333FAE97 / PROG_21-SFR5 | 4,84 | 0,1164 | 0,1164 | |||

| First Help Financial LLC Series 2023-2A, Class D / ABS-O (US30333LAE83) | 4,83 | −0,39 | 0,1162 | −0,0062 | ||

| First Help Financial LLC Series 2023-2A, Class D / ABS-O (US30333LAE83) | 4,83 | −0,39 | 0,1162 | −0,0062 | ||

| US68377WAC55 / Oportun Issuance Trust 2021-C | 4,81 | −20,76 | 0,1155 | −0,0375 | ||

| Kapitus Asset Securitization LLC Series 2024-1A, Class 2A / DBT (US48555MAF68) | 4,78 | −0,44 | 0,1150 | −0,0063 | ||

| US10638RAC34 / Brean Asset Backed Securities Series 2023-SRM1, Class M2 | 4,76 | 1,82 | 0,1144 | −0,0035 | ||

| US224092AA45 / CP EF Asset Securitization II LLC | 4,75 | −23,42 | 0,1141 | −0,0423 | ||

| Newtek Alternative Loan Program Series 2024-1, Class B / DBT (US629863AB74) | 4,73 | −2,37 | 0,1138 | −0,0086 | ||

| JP Morgan Chase Commerical Mortgage Trust Series 2025-BMS, Class C / ABS-O (US46596CAE66) | 4,66 | 0,1121 | 0,1121 | |||

| JP Morgan Chase Commerical Mortgage Trust Series 2025-BMS, Class C / ABS-O (US46596CAE66) | 4,66 | 0,1121 | 0,1121 | |||

| US12530JAD46 / CFMT 2022-AB2 M3 | 4,64 | 2,09 | 0,1115 | −0,0032 | ||

| US62890QAD79 / NMEF Funding LLC, Series 2023-A, Class C | 4,64 | 0,65 | 0,1114 | −0,0048 | ||

| Arivo Acceptance Auto Loan Receivables Trust Series 2024-1A, Class A / ABS-O (US039943AA30) | 4,63 | −23,57 | 0,1114 | −0,0416 | ||

| Arivo Acceptance Auto Loan Receivables Trust Series 2024-1A, Class A / ABS-O (US039943AA30) | 4,63 | −23,57 | 0,1114 | −0,0416 | ||

| NYC Commerical Mortgage Trust Series 2025-3BP, Class D / ABS-O (US67120UAG22) | 4,62 | −1,01 | 0,1110 | −0,0067 | ||

| NYC Commerical Mortgage Trust Series 2025-3BP, Class D / ABS-O (US67120UAG22) | 4,62 | −1,01 | 0,1110 | −0,0067 | ||

| US91681EAA29 / UPSTART PASS THROUGH TRUST UPSPT 2022 ST3 A 144A | 4,61 | −16,86 | 0,1107 | −0,0291 | ||

| US75907VAC19 / Regional Management Issuance Trust, Series 2021-1, Class C | 4,59 | 0,64 | 0,1103 | −0,0048 | ||

| US56848MAD11 / Mariner Finance Issuance Trust 2020-A | 4,58 | −44,35 | 0,1101 | −0,0976 | ||

| US95003LAG59 / WELLS FARGO COMMERCIAL MORTGAGE TRUST SER 2021-SAVE CL B V/R REGD 144A P/P 1.60000000 | 4,55 | −0,11 | 0,1093 | −0,0056 | ||

| Oportun Funding LLC Series 2025-1, Class D / ABS-O (US68377PAD87) | 4,52 | 0,38 | 0,1086 | −0,0050 | ||

| Pagaya AI Debt Selection Trust Series 2024-1, Class C / ABS-O (US69548AAC53) | 4,51 | −16,04 | 0,1084 | −0,0271 | ||

| MF1 Multifamily Housing Mortgage Loan Trust Series 2024-FL15, Class B / ABS-CBDO (US58003MAE66) | 4,50 | 0,00 | 0,1083 | −0,0054 | ||

| US61945VAA98 / Mosaic Solar Loan Trust 2023-1 | 4,41 | 0,1060 | 0,1060 | |||

| US3617YTKJ52 / Ginnie Mae II Pool | 4,38 | −11,37 | 0,1053 | −0,0194 | ||

| US35563JAA16 / Freddie Mac Multifamily Structured Credit Risk | 4,34 | −54,93 | 0,1042 | −0,1385 | ||

| US65254RAB24 / Newtek Small Business Loan Trust Series 23-1 Class B | 4,34 | −4,81 | 0,1042 | −0,0107 | ||

| US74970FAA57 / RMF Proprietary Issuance Trust 2022-3 | 4,31 | 0,40 | 0,1036 | −0,0047 | ||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 4,30 | −5,85 | 0,1034 | −0,0119 | ||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 4,28 | 0,14 | 0,1030 | −0,0050 | ||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 4,28 | 0,14 | 0,1030 | −0,0050 | ||

| US525919AC02 / Lendingpoint 2022-C Asset Securitization Trust | 4,27 | 0,80 | 0,1026 | −0,0042 | ||

| US68377GAD88 / Oportun Issuance Trust, Series 2021-B, Class D | 4,25 | −23,50 | 0,1022 | −0,0380 | ||

| ACM Auto Trust Series 2024-1A, Class B / ABS-O (US00161CAB46) | 4,20 | −13,98 | 0,1010 | −0,0223 | ||

| ACM Auto Trust Series 2024-1A, Class B / ABS-O (US00161CAB46) | 4,20 | −13,98 | 0,1010 | −0,0223 | ||

| Colem 2021-HLNE Mortgage Trust Series 22-HLNE Class B / ABS-O (US12659JAE73) | 4,16 | −3,12 | 0,0999 | −0,0084 | ||

| Government National Mortgage Association Pool MA9367 / ABS-MBS (US36179YMQ43) | 4,15 | −36,00 | 0,0999 | −0,0639 | ||

| Government National Mortgage Association Pool MA9367 / ABS-MBS (US36179YMQ43) | 4,15 | −36,00 | 0,0999 | −0,0639 | ||

| Credibility Asset Securitization Series 2024-1A, Class D / DBT (US22534NAG34) | 4,08 | −0,24 | 0,0981 | −0,0051 | ||

| Credibility Asset Securitization Series 2024-1A, Class D / DBT (US22534NAG34) | 4,08 | −0,24 | 0,0981 | −0,0051 | ||

| Mariner Finance Issuance Trust Series 2024-AA, Class B / ABS-O (US567928AB20) | 4,08 | −0,12 | 0,0980 | −0,0050 | ||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 4,07 | 0,20 | 0,0979 | −0,0046 | ||

| US78472JAH68 / SPS Servicer Advance Receivables Series 2020-T2, Class D | 4,06 | 0,69 | 0,0976 | −0,0042 | ||

| Progress Residential Trust Series 2024-SFR4, Class E2 / ABS-O (US74334JAL44) | 4,03 | 1,77 | 0,0968 | −0,0030 | ||

| FOR A Financial Asset Securitization Series 2024-1A, Class D / DBT (US34512PAD69) | 4,02 | −1,08 | 0,0967 | −0,0059 | ||

| US05551JAA88 / BAMLL Commercial Mortgage Securities Trust 2020-BOC | 4,02 | −2,12 | 0,0967 | −0,0070 | ||

| Tricon Residential Series 2025-SFR1, Class D / ABS-O (US895974AD59) | 4,00 | 0,05 | 0,0962 | −0,0047 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 3,99 | 5,89 | 0,0959 | 0,0009 | ||

| US89612LAE65 / Tricon American Homes Trust, Series 2019-SFR1, Class E | 3,95 | 0,0950 | 0,0950 | |||

| Research-Drive Pagaya Motor Asset Trust I Series 2024-1A, Class B / ABS-O (US76088YAB65) | 3,94 | −0,48 | 0,0947 | −0,0052 | ||

| Research-Drive Pagaya Motor Asset Trust I Series 2024-1A, Class B / ABS-O (US76088YAB65) | 3,94 | −0,48 | 0,0947 | −0,0052 | ||

| US30308EAG08 / FREMF Mortgage Trust, Series 2018-KF48, Class B | 3,92 | 0,15 | 0,0942 | −0,0045 | ||

| Brean Asset Backed Securities Series 2023-RM7, Class M1 / ABS-O (US10638BAD64) | 3,83 | 4,11 | 0,0919 | −0,0008 | ||

| Brean Asset Backed Securities Series 2023-RM7, Class M1 / ABS-O (US10638BAD64) | 3,83 | 4,11 | 0,0919 | −0,0008 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 3,81 | 0,00 | 0,0916 | −0,0046 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 3,81 | 0,00 | 0,0916 | −0,0046 | ||

| OnDeck Asset Securitization Trust Series 2024-1A, Class B / DBT (US67118NAB38) | 3,81 | −0,26 | 0,0915 | −0,0048 | ||

| US10638RAD17 / Brean Asset Backed Securities Series 2023-SRM1, Class M3 | 3,81 | 1,76 | 0,0915 | −0,0029 | ||

| PowerPay Issuance Trust Series 2024-1A, Class A / ABS-O (US73934RAA68) | 3,78 | −7,87 | 0,0908 | −0,0127 | ||

| PowerPay Issuance Trust Series 2024-1A, Class A / ABS-O (US73934RAA68) | 3,78 | −7,87 | 0,0908 | −0,0127 | ||

| LHOME Mortgage Trust Series 2025-RTL1, Class M2 / ABS-O (US50205UAD37) | 3,70 | −2,09 | 0,0890 | −0,0064 | ||

| LHOME Mortgage Trust Series 2025-RTL1, Class M2 / ABS-O (US50205UAD37) | 3,70 | −2,09 | 0,0890 | −0,0064 | ||

| US30298NAG25 / FREMF 2019-KF67 B | 3,69 | −0,30 | 0,0886 | −0,0047 | ||

| US46591HBK59 / J.P. MORGAN WEALTH MANAGEMENT JPMWM 2021-CL1 M1 | 3,68 | −1,10 | 0,0885 | −0,0054 | ||

| US46647PCP99 / JPMorgan Chase & Co | 3,67 | 0,88 | 0,0881 | −0,0036 | ||

| Bankers Healthcare Group Securitization Trust Series 2023-B, Class C / ABS-O (US08862GAC87) | 3,65 | −0,84 | 0,0876 | −0,0051 | ||

| BX Trust Series 2025-VLT6, Class B / ABS-O (US12433KAC18) | 3,64 | 0,0875 | 0,0875 | |||

| BX Trust Series 2025-VLT6, Class B / ABS-O (US12433KAC18) | 3,64 | 0,0875 | 0,0875 | |||

| US37045XDD57 / General Motors Financial Co Inc | 3,63 | 0,89 | 0,0873 | −0,0035 | ||

| Government National Mortgage Association Series 2023-133, Class GV / ABS-O (US38384EPF69) | 3,61 | −1,45 | 0,0868 | −0,0057 | ||

| Reach Financial LLC Series 2024-1A, Class C / ABS-O (US75526PAC59) | 3,56 | 0,14 | 0,0855 | −0,0041 | ||

| US62954PAN06 / BF 2019-NYT Mortgage Trust | 3,56 | −2,47 | 0,0855 | −0,0065 | ||

| US33767MAC91 / FirstKey Homes 2020-SFR1 Trust | 3,55 | 0,65 | 0,0854 | −0,0037 | ||

| US68377WAD39 / Oportun Issuance Trust 2021-C | 3,55 | −20,29 | 0,0854 | −0,0271 | ||

| ACM Auto Trust Series 2025-1A, Class B / ABS-O (US00161EAC84) | 3,55 | −0,11 | 0,0853 | −0,0043 | ||

| Reach Financial LLC Series 2024-1A, Class B / ABS-O (US75526PAB76) | 3,54 | −0,31 | 0,0850 | −0,0045 | ||

| Mulligan Asset Securitization Loans Series 2024-1, Class CC / DBT (US62534LAF58) | 3,51 | −0,03 | 0,0843 | −0,0042 | ||

| US60510MAT53 / Mission Lane Credit Card Master Trust | 3,49 | −0,26 | 0,0840 | −0,0044 | ||

| US35563FAA93 / FHLMC, Multifamily Structured Pass-Through Certificates, Series 2021-MN1, Class M1 | 3,49 | −31,72 | 0,0838 | −0,0450 | ||

| US74969XAC56 / RMF Proprietary Issuance Trust 2022-1 | 3,48 | 1,81 | 0,0836 | −0,0026 | ||

| US12529KAB89 / Cascade Funding Mortgage Trust Series 2021-GRN1, Class B | 3,45 | 1,47 | 0,0830 | −0,0029 | ||

| Ascent Career Funding Trust Series 2024-1A, Class A / ABS-O (US04363LAA44) | 3,43 | −12,96 | 0,0825 | −0,0170 | ||

| US3136A2TR42 / FNR 2011-127 ZU | 3,43 | −1,41 | 0,0824 | −0,0053 | ||

| US04681EAN76 / A10 Securitization Series 2021-D, Class E | 3,40 | 6,36 | 0,0816 | 0,0011 | ||

| US55282XAC48 / MF1 Multifamily Housing Mortgage Loan Trust | 3,39 | −4,72 | 0,0815 | −0,0083 | ||

| Onity Loan Investment Trust Series 2024-HB2, Class M4 / ABS-O (US68278DAE31) | 3,31 | 1,59 | 0,0797 | −0,0026 | ||

| Redwood Funding Trust Series 2025-2, Class A / ABS-O (US75806EAA55) | 3,31 | 0,0796 | 0,0796 | |||

| RFS Asset Securitization II LLC Series 2024-1, Class D / ABS-O (US74969DAP06) | 3,29 | 0,61 | 0,0792 | −0,0034 | ||

| US31288QQF09 / Federal Home Loan Mortgage Corp. | 3,29 | −5,62 | 0,0791 | −0,0089 | ||

| Crockett Partners Equipment Company Series 2024-1C, Class B / ABS-O (US22689LAB18) | 3,23 | −4,59 | 0,0775 | −0,0078 | ||

| Crockett Partners Equipment Company Series 2024-1C, Class B / ABS-O (US22689LAB18) | 3,23 | −4,59 | 0,0775 | −0,0078 | ||

| Jackson National Life Global Funding 5.55%, Due 07/02/2027 / DBT (US46849LVA69) | 3,21 | 0,16 | 0,0773 | −0,0037 | ||

| US30310WAF86 / FREMF Mortgage Trust, Series 2019-KF62, Class B | 3,17 | 0,64 | 0,0761 | −0,0033 | ||

| Oportun Funding LLC Series 2025-1, Class B / ABS-O (US68377PAB22) | 3,13 | 0,03 | 0,0752 | −0,0037 | ||

| Cascade Funding Mortgage Trust Series 2024-HB15, Class M2 / ABS-O (US15723AAC53) | 3,12 | 0,91 | 0,0749 | −0,0030 | ||

| RMF Proprietary Issuance Trust Series 2022-2, Class M1 / ABS-O (US74970CAB00) | 3,10 | 1,37 | 0,0745 | −0,0026 | ||

| US00092CAE21 / ACHV ABS TRUST, Series 2023-4CP, Class E | 3,09 | −45,85 | 0,0743 | −0,0698 | ||

| Reach Financial LLC Series 2024-2A, Class C / ABS-O (US75525HAC43) | 3,07 | 0,62 | 0,0737 | −0,0032 | ||

| Mariner Finance Issuance Trust Series 2024-AA, Class C / ABS-O (US567928AC03) | 3,06 | 0,56 | 0,0736 | −0,0032 | ||

| US74331GAJ85 / Progress Residential 2023-SFR2 Trust | 3,05 | 2,80 | 0,0732 | −0,0015 | ||

| Merchants Fleet Funding LLC Series 2024-1A, Class E / ABS-O (US588926AK19) | 3,04 | 0,03 | 0,0731 | −0,0036 | ||

| Merchants Fleet Funding LLC Series 2024-1A, Class E / ABS-O (US588926AK19) | 3,04 | 0,03 | 0,0731 | −0,0036 | ||

| US95003LAJ98 / Wells Fargo Commercial Mortgage Trust 2021-SAVE | 3,04 | 0,13 | 0,0730 | −0,0035 | ||

| US12434LAL80 / BXMT Ltd Series 2020-FL2 Class E | 3,04 | 1,17 | 0,0730 | −0,0027 | ||

| Pagaya AI Debt Selection Trust Series 2025-R1, Class E / ABS-O (US69548DAA37) | 3,02 | 0,0726 | 0,0726 | |||

| PNC Bank NA 4.775%, Due 01/15/2027 / DBT (US69353RFX17) | 3,00 | 0,07 | 0,0722 | −0,0035 | ||

| US33767MAG06 / FirstKey Homes Trust, Series 2020-SFR1, Class D | 2,98 | 0,0716 | 0,0716 | |||

| ACM Auto Trust Series 2024-2A, Class A / ABS-O (US00461WAA99) | 2,97 | −31,76 | 0,0715 | −0,0385 | ||

| ACM Auto Trust Series 2024-2A, Class A / ABS-O (US00461WAA99) | 2,97 | −31,76 | 0,0715 | −0,0385 | ||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 2,97 | 0,27 | 0,0713 | −0,0034 | ||

| ACM Auto Trust Series 2024-2A, Class B / ABS-O (US00461WAC55) | 2,96 | −1,10 | 0,0711 | −0,0044 | ||

| ACM Auto Trust Series 2024-2A, Class B / ABS-O (US00461WAC55) | 2,96 | −1,10 | 0,0711 | −0,0044 | ||

| US89612LAF31 / Tricon American Homes Trust, Series 2019-SFR1, Class F | 2,95 | 0,34 | 0,0710 | −0,0033 | ||

| US00489TAG13 / ACRE Commercial Mortgage 2021-FL4 Ltd | 2,95 | 0,03 | 0,0709 | −0,0035 | ||

| Tricolor Auto Securitization Trust Series 2024-3A, Class D / ABS-O (US89617AAD72) | 2,94 | −1,01 | 0,0706 | −0,0043 | ||

| US858558AB53 / Stellar Jay Ireland DAC | 2,92 | −18,61 | 0,0701 | −0,0203 | ||

| Tricolor Auto Securitization Trust Series 2024-3A, Class B / ABS-O (US89617AAB17) | 2,88 | −0,38 | 0,0693 | −0,0037 | ||

| Tricolor Auto Securitization Trust Series 2024-3A, Class B / ABS-O (US89617AAB17) | 2,88 | −0,38 | 0,0693 | −0,0037 | ||

| US74969TAD28 / RMF Buyout Issuance Trust 2021-HB1 | 2,84 | 0,67 | 0,0682 | −0,0029 | ||

| US30297VAA89 / FREMF Mortgage Trust Series 2019-KF57 CLASS B | 2,82 | 0,00 | 0,0677 | −0,0034 | ||

| Cherry Securitization Trust Series 2024-1A, Class C / ABS-O (US164737AC26) | 2,81 | 39,28 | 0,0674 | 0,0166 | ||

| Ascent Career Funding Trust Series 2024-1A, Class B / ABS-O (US04363LAB27) | 2,72 | −0,07 | 0,0653 | −0,0033 | ||

| Ascent Career Funding Trust Series 2024-1A, Class B / ABS-O (US04363LAB27) | 2,72 | −0,07 | 0,0653 | −0,0033 | ||

| Pagaya Point of Sale Holdings Series 25-1 Class E / ABS-O (US694951AA23) | 2,70 | 0,0648 | 0,0648 | |||

| Pagaya Point of Sale Holdings Series 25-1 Class E / ABS-O (US694951AA23) | 2,70 | 0,0648 | 0,0648 | |||

| US12659JAJ60 / COLEM 2022-HLNE Mortgage Trust | 2,66 | 0,0639 | 0,0639 | |||

| US3133CAQJ25 / Federal Home Loan Mortgage Corporation Pool FR QG9457 | 2,64 | −6,25 | 0,0635 | −0,0076 | ||

| First Help Financial LLC Series 2024-1A, Class C / ABS-O (US31568AAD81) | 2,62 | 0,11 | 0,0630 | −0,0031 | ||

| US51889RAC34 / Laurel Road Prime Student Loan Series 2019-A Class BFX | 2,58 | 0,62 | 0,0620 | −0,0027 | ||

| Tricolor Auto Securitization Trust Series 2024-2A, Class C / ABS-O (US89616PAC77) | 2,53 | −0,63 | 0,0608 | −0,0034 | ||

| Tricolor Auto Securitization Trust Series 2024-2A, Class C / ABS-O (US89616PAC77) | 2,53 | −0,63 | 0,0608 | −0,0034 | ||

| LHOME Mortgage Trust Series 2024-RTL1, Class A2 / ABS-O (US50205DAB55) | 2,52 | −0,67 | 0,0606 | −0,0035 | ||

| LHOME Mortgage Trust Series 2024-RTL1, Class A2 / ABS-O (US50205DAB55) | 2,52 | −0,67 | 0,0606 | −0,0035 | ||

| Reach Financial LLC Series 2025-1A, Class C / ABS-O (US75525PAC68) | 2,52 | −0,20 | 0,0606 | −0,0031 | ||

| Reach Financial LLC Series 2025-1A, Class C / ABS-O (US75525PAC68) | 2,52 | −0,20 | 0,0606 | −0,0031 | ||

| New York Mortgage Trust Series 2024-BPL1, Class A2 / ABS-O (US62956MAB19) | 2,52 | −0,59 | 0,0605 | −0,0034 | ||

| US68378NAD21 / Opportunity Funding LLC Series 2022-A, Class D | 2,50 | 1,38 | 0,0602 | −0,0021 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 2,45 | 0,99 | 0,0589 | −0,0023 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 2,45 | 0,99 | 0,0589 | −0,0023 | ||

| ACM Auto Trust Series 2025-2A, Class B / ABS-O (US00161TAC53) | 2,44 | 0,0586 | 0,0586 | |||

| US35709BAC90 / FREMF Mortgage Trust, Series 2018-KF50, Class B | 2,40 | 0,04 | 0,0577 | −0,0028 | ||

| Pagaya Point of Sale Holdings Series 25-1 Class F / ABS-O (US694951AB06) | 2,39 | 0,0575 | 0,0575 | |||

| Ocwen Loan Investmetn Trust Series 24-HB1 Class M1 / ABS-O (US675952AB12) | 2,37 | 0,94 | 0,0570 | −0,0023 | ||

| Ocwen Loan Investmetn Trust Series 24-HB1 Class M1 / ABS-O (US675952AB12) | 2,37 | 0,94 | 0,0570 | −0,0023 | ||

| US74969VAC90 / RMF Proprietary Issuance Trust Series 2021-2, Class M2 | 2,32 | 3,07 | 0,0558 | −0,0010 | ||

| Progress Residential Trust Series 2024-SFR2, Class E1 / ABS-O (US74290XAJ00) | 2,30 | 2,13 | 0,0554 | −0,0015 | ||

| Ondeck Asset Securitization Trust Series 2024-2A, Class C / DBT (US67108SAF56) | 2,29 | −0,52 | 0,0551 | −0,0030 | ||

| US74970CAD65 / RMF Proprietary Issuance Trust Series 2022-2, Class M3 | 2,28 | 1,70 | 0,0547 | −0,0018 | ||

| LHOME Mortgage Trust Series 2024-RTL1, Class M / ABS-O (US50205DAC39) | 2,27 | −1,09 | 0,0547 | −0,0033 | ||

| LHOME Mortgage Trust Series 2024-RTL1, Class M / ABS-O (US50205DAC39) | 2,27 | −1,09 | 0,0547 | −0,0033 | ||

| Dext ABS Series 2023-2, Class D / ABS-O (US25216CAE03) | 2,26 | −0,22 | 0,0544 | −0,0028 | ||

| Dext ABS Series 2023-2, Class D / ABS-O (US25216CAE03) | 2,26 | −0,22 | 0,0544 | −0,0028 | ||

| Arivo Acceptance Auto Loan Receivables Trust Series 2024-1A, Class B / ABS-O (US039943AB13) | 2,25 | −0,40 | 0,0542 | −0,0029 | ||

| Arivo Acceptance Auto Loan Receivables Trust Series 2024-1A, Class B / ABS-O (US039943AB13) | 2,25 | −0,40 | 0,0542 | −0,0029 | ||

| Purchasing Power Funding Series 2024-A, Class E / ABS-O (US745935AE61) | 2,23 | −1,02 | 0,0535 | −0,0032 | ||

| US95003LAA89 / WELLS FARGO COMMERCIAL MORTGAGE TRUST SER 2021-SAVE CL A V/R REGD 144A P/P 1.30000000 | 2,20 | −17,26 | 0,0529 | −0,0142 | ||

| US43731QAC24 / HPA_19-1 | 2,20 | 0,87 | 0,0529 | −0,0022 | ||

| US78472JAF03 / SPS Servicer Advance Receivables Series 2020-T2, Class B | 2,18 | 0,60 | 0,0525 | −0,0023 | ||

| US30296DAG60 / FREMF Mortgage Trust, Series 2018-KF43, Class B | 2,18 | 0,09 | 0,0523 | −0,0026 | ||

| US02079YAA55 / AFLOW_21-WL1 | 2,16 | −4,17 | 0,0519 | −0,0050 | ||

| US35708AAG31 / FREMF Mortgage Trust, Series 2018-KF53, Class B | 2,12 | 0,47 | 0,0510 | −0,0023 | ||

| Pagaya AI Debt Selection Trust Series 24-2 Class A / ABS-O (US694961AA13) | 2,12 | −17,69 | 0,0510 | −0,0140 | ||

| US68377GAA40 / OPTN_21-B | 2,09 | −23,93 | 0,0502 | −0,0191 | ||

| US95003LAL45 / WELLS FARGO COML MTG TR 2021-SAVE D 1ML+250 02/15/2040 144A | 2,08 | −0,19 | 0,0500 | −0,0026 | ||

| US49327M3F97 / KEYBANK NATIONAL ASSOCIATION | 2,06 | 0,49 | 0,0496 | −0,0022 | ||

| Tricolor Auto Securitization Trust Series 2025-1A, Class E / ABS-O (US89617CAE12) | 2,02 | 0,00 | 0,0486 | −0,0024 | ||

| Tricolor Auto Securitization Trust Series 2025-1A, Class E / ABS-O (US89617CAE12) | 2,02 | 0,00 | 0,0486 | −0,0024 | ||

| US37046US851 / General Motors Financial Co Inc | 2,02 | 0,65 | 0,0484 | −0,0021 | ||

| US43731QAA67 / Home Partners of America Trust | 2,01 | −1,08 | 0,0484 | −0,0030 | ||

| Kapitus Asset Securitization, LLC Series 2024-1A, Class C / DBT (US48555MAC38) | 2,00 | −0,99 | 0,0480 | −0,0029 | ||

| US00833PAB31 / Affirm Incorporated Series 22-Z1 Class B | 1,99 | −20,94 | 0,0477 | −0,0156 | ||

| US74390NAG79 / Prosper Marketplace Issuance Trust Series 2023-1A, Class D | 1,98 | −0,85 | 0,0477 | −0,0028 | ||

| US12468RAC43 / CAFL 2021-RTL1 Issuer LLC | 1,96 | −31,99 | 0,0471 | −0,0256 | ||

| US30297XAG16 / FREMF Mortgage Trust, Series 2019-KF59, Class B | 1,96 | −0,05 | 0,0470 | −0,0024 | ||

| US00489TAL08 / Acre Mortgage Trust Series 21-FL4 Class E | 1,95 | 0,10 | 0,0470 | −0,0023 | ||

| US51507KAB26 / Lending Funding Trust, Series 2020-2A, Class B | 1,95 | 0,83 | 0,0467 | −0,0019 | ||

| US3137BRZK45 / Freddie Mac REMICS | 1,93 | −4,13 | 0,0463 | −0,0044 | ||

| Brean Asset Backed Securities Series 2023-RM7, Class A2 / ABS-O (US10638BAB09) | 1,92 | 3,11 | 0,0462 | −0,0008 | ||

| Crockett Partners Equipment Company Series 2024-1C, Class C / ABS-O (US22689LAC90) | 1,90 | −4,96 | 0,0456 | −0,0048 | ||

| US50205NAA54 / LHOME Mortgage Trust, Series 2023-RTL1, Class A1 | 1,89 | −53,25 | 0,0455 | −0,0567 | ||

| Cascade Funding Mortgage Trust Series 2024-HB13, Class M2 / ABS-O (US12530VAC90) | 1,89 | 0,96 | 0,0455 | −0,0018 | ||

| Cascade Funding Mortgage Trust Series 2024-HB13, Class M2 / ABS-O (US12530VAC90) | 1,89 | 0,96 | 0,0455 | −0,0018 | ||

| US62954PAL40 / BF 2019-NYT Mortgage Trust | 1,87 | 0,0449 | 0,0449 | |||

| Progress Residential Trust Series 2024-SFR3, Class E2 / ABS-O (US74331VAL09) | 1,86 | 1,92 | 0,0447 | −0,0013 | ||

| Progress Residential Trust Series 2024-SFR3, Class E2 / ABS-O (US74331VAL09) | 1,86 | 1,92 | 0,0447 | −0,0013 | ||

| US3140KEKW70 / Federal National Mortgage Association Pool FN BP6608 | 1,86 | −0,11 | 0,0446 | −0,0023 | ||

| LHOME Mortgage Trust Series 2024-RTL2, Class M / ABS-O (US50205JAC09) | 1,82 | −1,09 | 0,0437 | −0,0027 | ||

| LHOME Mortgage Trust Series 2024-RTL2, Class M / ABS-O (US50205JAC09) | 1,82 | −1,09 | 0,0437 | −0,0027 | ||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,80 | 0,06 | 0,0432 | −0,0021 | ||

| US46591HBZ29 / Chase Mortgage Finance Corp | 1,80 | −2,34 | 0,0432 | −0,0032 | ||

| US000876AD48 / ACHV ABS TRUST 2023-3PL | 1,78 | −0,67 | 0,0427 | −0,0024 | ||

| US56848DAD12 / MFIT 2021 AA D 144A | 1,77 | 0,80 | 0,0426 | −0,0018 | ||

| Tricolor Auto Securitization Trust Series 2024-2A, Class A / ABS-O (US89616PAA12) | 1,77 | −41,45 | 0,0426 | −0,0337 | ||

| Tricolor Auto Securitization Trust Series 2024-2A, Class A / ABS-O (US89616PAA12) | 1,77 | −41,45 | 0,0426 | −0,0337 | ||

| US74969XAA90 / RMF Proprietary Issuance Trust Series 2022-1, Class A1 | 1,77 | 1,14 | 0,0425 | −0,0016 | ||

| Citibank NA 4.876%, Due 11/19/2027 / DBT (US17325FBL13) | 1,76 | 0,11 | 0,0423 | −0,0020 | ||

| LHOME Mortgage Trust Series 2024-RTL3, Class M / ABS-O (US50205GAC69) | 1,76 | −0,28 | 0,0423 | −0,0022 | ||

| US3618F8LP59 / Government National Mortgage Association Pool G2 CW0334 | 1,75 | −7,66 | 0,0420 | −0,0057 | ||

| US19421UAD63 / College Avenue Student Loans Series 2019-A Class C | 1,75 | −4,69 | 0,0420 | −0,0042 | ||

| US33830CAG50 / DBGS Mortgage Trust, Series 2018-5BP, Class D | 1,75 | 1,16 | 0,0419 | −0,0016 | ||

| US53948PAA66 / Loanpal Solar Loan 2021-1 Ltd | 1,69 | −0,24 | 0,0406 | −0,0021 | ||

| US86744WAC38 / SUNNOVA HELIOS X ISSUER LLC SNVA 2022-C C | 1,68 | −49,87 | 0,0403 | −0,0440 | ||

| US3136ADQF90 / Federal National Mortgage Association Series 2013-34 Class GP | 1,67 | −3,20 | 0,0400 | −0,0034 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 1,65 | −1,14 | 0,0398 | −0,0024 | ||

| US65254BAB71 / Newtek Small Business Loan Trust Series 2022-1, Class B | 1,60 | −6,69 | 0,0386 | −0,0048 | ||

| US49306SAA42 / KeyBank NA/Cleveland OH | 1,60 | 0,82 | 0,0385 | −0,0016 | ||

| Tricolor Auto Securitization Trust Series 2024-1A, Class A / ABS-O (US89616LAA08) | 1,58 | −43,32 | 0,0379 | −0,0322 | ||

| Tricolor Auto Securitization Trust Series 2024-1A, Class A / ABS-O (US89616LAA08) | 1,58 | −43,32 | 0,0379 | −0,0322 | ||

| Government National Mortgage Association Pool G2 CW0526 / ABS-MBS (US3618F8SP86) | 1,57 | −36,92 | 0,0378 | −0,0251 | ||

| Government National Mortgage Association Pool G2 CW0526 / ABS-MBS (US3618F8SP86) | 1,57 | −36,92 | 0,0378 | −0,0251 | ||

| US95000U2F97 / Wells Fargo & Co | 1,48 | 0,47 | 0,0356 | −0,0016 | ||

| Brean Asset Backed Securities Series 2024-RM8, Class M1 / ABS-O (US10637YAD76) | 1,43 | 3,78 | 0,0343 | −0,0004 | ||

| US74969XAB73 / RPIT 2022-1 M1 | 1,42 | 1,57 | 0,0342 | −0,0011 | ||

| Cascade Funding Mortgage Trust Series 2024-HB13, Class M3 / ABS-O (US12530VAD73) | 1,40 | 1,09 | 0,0336 | −0,0013 | ||

| Cascade Funding Mortgage Trust Series 2024-HB13, Class M3 / ABS-O (US12530VAD73) | 1,40 | 1,09 | 0,0336 | −0,0013 | ||

| Progress Residential Trust Series 2024-SFR2, Class E2 / ABS-O (US74290XAL55) | 1,38 | 2,76 | 0,0331 | −0,0007 | ||

| Progress Residential Trust Series 2024-SFR2, Class E2 / ABS-O (US74290XAL55) | 1,38 | 2,76 | 0,0331 | −0,0007 | ||

| Brean Asset Backed Securities Series 2024-RM8, Class M2 / ABS-O (US10637YAE59) | 1,37 | 4,02 | 0,0330 | −0,0003 | ||

| Brean Asset Backed Securities Series 2024-RM8, Class M2 / ABS-O (US10637YAE59) | 1,37 | 4,02 | 0,0330 | −0,0003 | ||

| US10638JAD90 / Brean Asset Backed Securites Series 22-RM4 Class M1 | 1,37 | 5,65 | 0,0328 | 0,0002 | ||

| US53948QAA40 / Loanpal Solar Loan 2021-2 Ltd | 1,28 | 0,47 | 0,0308 | −0,0014 | ||

| US55285BAJ44 / MF1 Multifamily Housing Series 2022-FL10, Class D | 1,25 | 0,00 | 0,0301 | −0,0015 | ||

| US89612LAA44 / Tricon American Homes Trust, Series 2019-SFR1, Class A | 1,21 | 0,08 | 0,0291 | −0,0014 | ||

| NCL Business Loan Trust Series 2022-1, Class A / DBT (US62887RAA68) | 1,21 | −56,62 | 0,0291 | −0,0413 | ||

| NCL Business Loan Trust Series 2022-1, Class A / DBT (US62887RAA68) | 1,21 | −56,62 | 0,0291 | −0,0413 | ||

| US05608XAJ19 / BXMT Ltd. | 1,21 | 3,08 | 0,0290 | −0,0005 | ||

| US46591HBM16 / J.P. Morgan Wealth Management | 1,20 | −2,75 | 0,0289 | −0,0023 | ||

| US023765AA88 / American Airlines 2016-2 Class AA Pass Through Trust | 1,16 | −2,92 | 0,0280 | −0,0023 | ||

| US316773DD98 / Fifth Third Bancorp | 1,16 | 1,22 | 0,0278 | −0,0010 | ||

| US30296TAG13 / FREMF Mortgage Trust, Series 2018-KF45, Class B | 1,13 | 0,53 | 0,0271 | −0,0012 | ||

| US40439HAE99 / HIN Timeshare Trust 2020-A | 1,10 | −14,22 | 0,0266 | −0,0059 | ||

| US19424KAC71 / CASL 2021 A B 144A | 1,06 | −4,15 | 0,0256 | −0,0024 | ||

| US14732FAC68 / CMHAT 2019-MH1 M | 1,06 | 1,05 | 0,0254 | −0,0010 | ||

| Pagaya AI Debt Selection Trust Series 2024-1, Class A / ABS-O (US69548AAA97) | 1,04 | −18,31 | 0,0249 | −0,0071 | ||

| US29278NAN30 / Energy Transfer Operating LP | 1,02 | 0,20 | 0,0245 | −0,0011 | ||

| Oportun Funding LLC Series 2024-1A, Class C / ABS-O (US68377JAE01) | 1,01 | −0,49 | 0,0242 | −0,0013 | ||

| US025816DL03 / American Express Co | 1,01 | −0,40 | 0,0242 | −0,0013 | ||

| Pricoa Global Funding 4.40%, Due 008/27/2027 / DBT (US74153WCU18) | 1,00 | 0,40 | 0,0241 | −0,0011 | ||

| US10084LAC54 / Boston Lending Trust 2022-1 | 0,99 | 2,50 | 0,0237 | −0,0006 | ||

| SPS Servicer Advance Receivables Trust Series 2020-T2, Class C / ABS-O (US78472JAG85) | 0,99 | 0,72 | 0,0237 | −0,0010 | ||

| US51507KAC09 / Lending Funding Trust 2020-2 | 0,98 | 0,41 | 0,0234 | −0,0011 | ||

| US91159HJP64 / US Bancorp | 0,93 | −0,32 | 0,0223 | −0,0012 | ||

| US44891ACG04 / Hyundai Capital America | 0,91 | 0,00 | 0,0218 | −0,0011 | ||

| US55389TAD37 / MVW LLC, Series 2021-1WA, Class D | 0,90 | −8,96 | 0,0217 | −0,0033 | ||

| US44891ACQ85 / Hyundai Capital America | 0,90 | −0,44 | 0,0217 | −0,0012 | ||

| US90357PAV67 / US Bank NA | 0,90 | −19,61 | 0,0217 | −0,0066 | ||

| US716973AB84 / Pfizer Investment Enterprises Pte Ltd | 0,90 | −0,11 | 0,0217 | −0,0011 | ||

| US75907VAB36 / Regional Management Issuance Trust, Series 2021-1, Class B | 0,89 | 0,91 | 0,0214 | −0,0009 | ||

| US91680YAY77 / UPSTART STRUCTURED PASS THROUG USPTT 2022 2A A 144A | 0,88 | −18,28 | 0,0211 | −0,0060 | ||

| US76971EAE41 / RMF Buyout Issuance Trust 2020-HB1 | 0,86 | −4,13 | 0,0207 | −0,0020 | ||

| US525919AD84 / LendingPoint Asset Securitization Series 2022-C, Class D | 0,84 | −9,82 | 0,0201 | −0,0033 | ||

| Volkswagen Group America 4.90%, Due 08/17/2026 / DBT (US928668CK66) | 0,80 | 0,13 | 0,0193 | −0,0009 | ||

| Volkswagen Group America 4.90%, Due 08/17/2026 / DBT (US928668CK66) | 0,80 | 0,13 | 0,0193 | −0,0009 | ||

| US25466AAJ07 / Discover Bank | 0,79 | 0,64 | 0,0190 | −0,0008 | ||

| US76209PAA12 / RGA Global Funding | 0,77 | 0,65 | 0,0186 | −0,0008 | ||

| US50203YAC93 / LL ABS Trust 2022-1 | 0,76 | −70,61 | 0,0182 | −0,0467 | ||

| US75973LAA61 / Renew 2017-1 | 0,75 | −1,44 | 0,0181 | −0,0012 | ||

| US61946NAB47 / Mosaic Solar Loan Trust 2020-1 | 0,73 | −2,92 | 0,0176 | −0,0014 | ||

| US3137H4KF61 / Federal Home Loan Mortgage Corporation Series 5171, Class UK | 0,60 | −2,45 | 0,0144 | −0,0011 | ||

| US91534HAA41 / Upstart Pass-Through Trust, Series 2021-ST4, Class A | 0,57 | −46,77 | 0,0137 | −0,0133 | ||

| US19424KAE38 / CASL 2021 A D 144A | 0,56 | −3,63 | 0,0134 | −0,0012 | ||

| US3136AWFA04 / Federal National Mortgage Assocation Series 2017-28, Class LK | 0,54 | −11,11 | 0,0131 | −0,0024 | ||

| US25273CAB63 / DIAMOND RESORTS OWNER TRUST 2021-1 | 0,54 | −8,74 | 0,0131 | −0,0020 | ||

| US19423DAC48 / College Avenue Student Loans Series 2018-A Class B | 0,53 | −5,20 | 0,0127 | −0,0014 | ||

| US75526GAC50 / LL ABS Trust 2022-2 | 0,52 | −80,37 | 0,0124 | −0,0539 | ||

| US29273VAR15 / Energy Transfer LP | 0,51 | 0,00 | 0,0123 | −0,0006 | ||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0,51 | 0,00 | 0,0122 | −0,0006 | ||

| US43732TAA97 / HOME PARTNERS OF AMERICA 2019-2 TRUST HPA 2019-2 A | 0,50 | −26,57 | 0,0121 | −0,0052 | ||

| Principal Life Global Funding II 4.60%, Due 08/19/2027 / DBT (US74256LFA26) | 0,50 | 0,20 | 0,0121 | −0,0006 | ||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0,50 | 0,80 | 0,0121 | −0,0005 | ||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0,50 | 0,80 | 0,0121 | −0,0005 | ||

| US025816CS64 / American Express Co | 0,49 | 0,62 | 0,0117 | −0,0005 | ||

| US90931GAA76 / United Airlines 2020-1 Class A Pass Through Trust | 0,49 | −6,54 | 0,0117 | −0,0014 | ||

| US74333EAA01 / Progress Residential, Series 2021-SFR4, Class A | 0,45 | −2,20 | 0,0107 | −0,0008 | ||

| US40439HAC34 / HIN Timeshare Trust 2020-A | 0,42 | −14,23 | 0,0102 | −0,0023 | ||

| Progress Residential Trust Series 2021-SFR5, Class A / ABS-O (US74333FAA75) | 0,42 | −0,94 | 0,0102 | −0,0006 | ||

| US742855AA76 / Prodigy Finance CM2021-1 Designated Activity Co | 0,42 | −8,93 | 0,0100 | −0,0015 | ||

| US38375BXT42 / Government National Mortgage Association | 0,33 | −37,76 | 0,0080 | −0,0055 | ||

| US61947DAD12 / MOSAIC SOLAR LOAN TRUST 2021-1 SER 2021-1A CL D REGD 144A P/P 3.71000000 | 0,33 | −8,82 | 0,0080 | −0,0012 | ||

| US53949FAA75 / Lobel Automobile Receivables Trust 2023-2 | 0,33 | −68,09 | 0,0079 | −0,0181 | ||

| US01166VAA70 / Alaska Airlines 2020-1 Class A Pass Through Trust | 0,32 | 0,31 | 0,0078 | −0,0004 | ||

| US19423DAD21 / College Avenue Student Loans Series 2018-A Class C | 0,31 | −8,80 | 0,0075 | −0,0011 | ||

| US31395NXE20 / FNMA, REMIC, Series 2006-56, Class DC | 0,31 | −5,57 | 0,0073 | −0,0008 | ||

| US24703TAE64 / Dell International LLC / EMC Corp | 0,30 | 0,00 | 0,0072 | −0,0004 | ||

| US31335AJA79 / Federal Home Loan Mortgage Corporation Pool #G60257 | 0,29 | −2,01 | 0,0070 | −0,0005 | ||

| US924933AA27 / Veros Auto Receivables Trust, Series 2023-1, Class A | 0,26 | −65,91 | 0,0061 | −0,0127 | ||

| US61946GAB95 / MOSAIC SOLAR LOANS 2017-2 LLC MSAIC 2017-2A B | 0,25 | −3,50 | 0,0060 | −0,0005 | ||

| US31395UML25 / Federal Home Loan Mortgage Corporation Series 2979 Class FP | 0,21 | −4,65 | 0,0049 | −0,0005 | ||

| US40439HAD17 / HIN TIMESHARE TRUST 2020-A SER 2020-A CL D REGD 144A P/P 5.50000000 | 0,20 | −14,41 | 0,0047 | −0,0011 | ||

| US20268KAD28 / Commonbond Student Loan Trust 2017-B-GS | 0,20 | 1,55 | 0,0047 | −0,0002 | ||

| ACHV / Achieve Life Sciences, Inc. | 0,18 | −93,04 | 0,0043 | −0,0602 | ||

| ACHV / Achieve Life Sciences, Inc. | 0,18 | −93,04 | 0,0043 | −0,0602 | ||

| US38375BZS41 / Government National Mortgage Association Series 12-H29 Class SA | 0,17 | −5,62 | 0,0041 | −0,0004 | ||

| US31396JFX81 / Federal Home Loan Mortgage Association Series 3121 Class FM | 0,16 | −2,99 | 0,0039 | −0,0003 | ||

| US25273CAD20 / Diamond Resorts Owner Trust 2021-1 | 0,16 | −8,82 | 0,0037 | −0,0006 | ||

| US31398STC79 / Federal National Mortgage Association Series 2010-136 Class FA | 0,15 | −3,85 | 0,0036 | −0,0003 | ||

| US31396LTA88 / Federal National Mortgage Association Series 2006-108 Class FD | 0,14 | −6,12 | 0,0033 | −0,0004 | ||

| US3137ACUF45 / Federal Home Loan Mortgage Corporation Series 3895 Class BF | 0,13 | −5,80 | 0,0031 | −0,0004 | ||

| US75973LAB45 / Renew, Series 2017-1A, Class B | 0,09 | 0,00 | 0,0022 | −0,0001 | ||

| US3136A5TH90 / Fannie Mae REMICS | 0,08 | −2,60 | 0,0018 | −0,0001 | ||

| US31364JZN61 / Federal National Mortgage Assoication Series 301 Class 1 | 0,07 | −10,13 | 0,0017 | −0,0003 | ||

| US02079YAB39 / AlphaFlow Transitional Mortgage Trust 2021-WL1 | 0,07 | −86,09 | 0,0017 | −0,0108 | ||

| US3136AKUA90 / Federal National Mortgage Association Series 2014-45 Class IO | 0,06 | 0,00 | 0,0015 | −0,0001 | ||

| US3137B9GS86 / Federal Home Loan Mortgage Association Series 4314 Class PF | 0,05 | −6,12 | 0,0011 | −0,0001 | ||

| US31282YEU91 / Federal Home Loan Mortgage Corporation Series 237 Class S14 | 0,04 | −5,26 | 0,0009 | −0,0001 | ||

| US38375UWR75 / GNMA, Series 2016-H11, Class FD | 0,04 | −14,29 | 0,0009 | −0,0002 | ||

| US31398PWQ89 / Federal National Mortgage Association Series 2010-44 Class CS | 0,02 | 0,00 | 0,0006 | −0,0000 | ||

| US3137AFGG15 / FHLMC, REMIC, Series 3925, Class FL | 0,02 | −8,00 | 0,0006 | −0,0001 | ||

| US3136ABNP44 / Federal National Mortgage Association Series 2012-148 Class IA | 0,01 | −30,00 | 0,0002 | −0,0001 | ||

| US17307GLA49 / Citigroup Mortgage Loan Trust, Inc., Series 2004-UST1, Class A3 | 0,00 | 0,00 | 0,0001 | −0,0000 | ||

| US38379JUK59 / Government National Mortgage Association Series 2015-16 Class IL | 0,00 | −100,00 | 0,0000 | −0,0000 |