Grundläggande statistik

| Portföljvärde | $ 255 188 885 |

| Aktuella positioner | 345 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

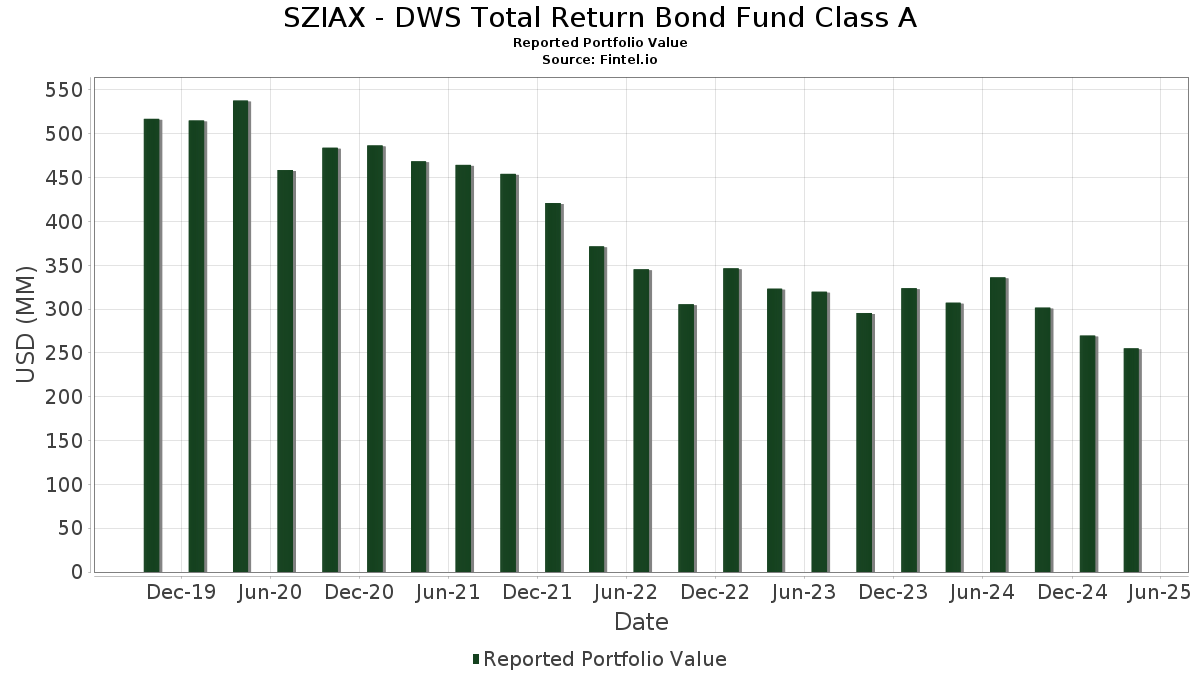

SZIAX - DWS Total Return Bond Fund Class A har redovisat 345 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 255 188 885 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). SZIAX - DWS Total Return Bond Fund Class As största innehav är Ginnie Mae (US:US21H0526523) , DWS Central Cash Management Government Fund (US:US25160K3068) , United States Treasury Note/Bond (US:US91282CGQ87) , CCO Holdings LLC / CCO Holdings Capital Corp (US:US1248EPBT92) , and Fannie Mae Pool (US:US3140QN3Y60) . SZIAX - DWS Total Return Bond Fund Class As nya positioner inkluderar Ginnie Mae (US:US21H0526523) , United States Treasury Note/Bond (US:US91282CGQ87) , CCO Holdings LLC / CCO Holdings Capital Corp (US:US1248EPBT92) , Fannie Mae Pool (US:US3140QN3Y60) , and Fannie Mae Pool (US:US3140MHSH35) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 13,75 | 5,6108 | 5,6108 | ||

| 5,72 | 2,3347 | 2,3347 | ||

| 5,02 | 2,0472 | 2,0472 | ||

| 4,90 | 2,0003 | 2,0003 | ||

| 5,99 | 2,4458 | 1,6787 | ||

| 3,11 | 1,2702 | 1,2702 | ||

| 2,86 | 1,1653 | 1,1653 | ||

| 2,47 | 1,0079 | 1,0079 | ||

| 2,41 | 0,9844 | 0,9844 | ||

| 2,21 | 0,9019 | 0,9019 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 1,09 | 0,4454 | −1,8397 | ||

| 1,31 | 0,5342 | −1,7099 | ||

| 4,09 | 4,09 | 1,6681 | −0,9076 | |

| 0,43 | 0,1755 | −0,5325 | ||

| 0,72 | 0,2954 | −0,3987 | ||

| 1,20 | 0,4896 | −0,3977 | ||

| 0,42 | 0,1714 | −0,3400 | ||

| 0,69 | 0,2808 | −0,3285 | ||

| 0,70 | 0,2838 | −0,2671 | ||

| 0,32 | 0,1285 | −0,2459 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-06-11 för rapporteringsperioden 2025-04-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 13,75 | 5,6108 | 5,6108 | ||||||

| US21H0526523 / Ginnie Mae | 5,99 | 191,11 | 2,4458 | 1,6787 | |||||

| U.S. Treasury Bonds / DBT (US912810UJ50) | 5,72 | 2,3347 | 2,3347 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 5,03 | −0,38 | 2,0537 | 0,0213 | |||||

| U.S. Treasury Notes / DBT (US91282CMS79) | 5,02 | 2,0472 | 2,0472 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 4,90 | 2,0003 | 2,0003 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 4,47 | −1,30 | 1,8234 | 0,0024 | |||||

| US25160K3068 / DWS Central Cash Management Government Fund | 4,09 | −36,16 | 4,09 | −36,15 | 1,6681 | −0,9076 | |||

| U.S. Treasury Notes / DBT (US91282CMR96) | 3,11 | 1,2702 | 1,2702 | ||||||

| U.S. Treasury Notes / DBT (US91282CMM00) | 2,86 | 1,1653 | 1,1653 | ||||||

| US91282CGQ87 / United States Treasury Note/Bond | 2,55 | 42,56 | 1,0404 | 0,4105 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,47 | 1,0079 | 1,0079 | ||||||

| U.S. Treasury Notes / DBT (US91282CMP31) | 2,41 | 0,9844 | 0,9844 | ||||||

| Government National Mortgage Association / ABS-MBS (US38384CTB53) | 2,21 | 0,9019 | 0,9019 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2,02 | 0,8249 | 0,8249 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,01 | 0,8219 | 0,8219 | ||||||

| US1248EPBT92 / CCO Holdings LLC / CCO Holdings Capital Corp | 1,97 | 0,46 | 0,8049 | 0,0153 | |||||

| US3140QN3Y60 / Fannie Mae Pool | 1,85 | 0,7547 | 0,7547 | ||||||

| US3140MHSH35 / Fannie Mae Pool | 1,85 | 0,7542 | 0,7542 | ||||||

| US30296VAS07 / FREMF Mortgage Trust, Series 2018-K77, Class B | 1,81 | 0,7383 | 0,7383 | ||||||

| US1475396701 / DWS Gov&Agency Sec Portfolio DWS Gov Cash Inst Shs | 1,78 | 9,19 | 1,78 | 9,23 | 0,7248 | 0,0704 | |||

| US00206RMT67 / AT&T Inc | 1,74 | 1,58 | 0,7083 | 0,0209 | |||||

| US3134A4AA29 / Federal Home Loan Mortgage Corp. | 1,72 | 2,38 | 0,7019 | 0,0258 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 1,72 | 1,18 | 0,6999 | 0,0177 | |||||

| US46650FAA03 / J.P. MORGAN CHASE COMMERCIAL MORTGAGE SECURITIES T JPMCC 2018-PHH A | 1,67 | −1,71 | 0,6810 | −0,0021 | |||||

| US42806MBU27 / Hertz Vehicle Financing III LLC, Series 2023-1A, Class C | 1,65 | −0,36 | 0,6745 | 0,0073 | |||||

| US680665AK27 / Olin Corp | 1,64 | −0,42 | 0,6706 | 0,0069 | |||||

| US064159VJ25 / Bank of Nova Scotia/The | 1,49 | −0,13 | 0,6095 | 0,0080 | |||||

| US042853AA99 / Arroyo Mortgage Trust 2021-1R | 1,47 | −5,72 | 0,5985 | −0,0272 | |||||

| Government National Mortgage Association / ABS-MBS (US38382MA664) | 1,44 | 0,5876 | 0,5876 | ||||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 1,44 | −1,17 | 0,5875 | 0,0015 | |||||

| US46654BAA52 / JP Morgan Chase Commercial Mortgage Securities Trust 2021-1MEM | 1,44 | 46,98 | 0,5862 | 0,1931 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,43 | 0,77 | 0,5849 | 0,0129 | |||||

| S1MF34 / Sumitomo Mitsui Financial Group, Inc. - Depositary Receipt (Common Stock) | 1,43 | 0,5823 | 0,5823 | ||||||

| US599191AA16 / Mileage Plus Holdings LLC / Mileage Plus Intellectual Property Assets Ltd | 1,35 | −10,51 | 0,5526 | −0,0561 | |||||

| ROCK Trust 2024-CNTR / ABS-MBS (US74970WAA80) | 1,32 | 65,45 | 0,5374 | 0,2169 | |||||

| US3137FNQZ64 / Freddie Mac REMICS | 1,31 | −76,53 | 0,5342 | −1,7099 | |||||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 1,27 | 0,5164 | 0,5164 | ||||||

| LEX 2024-BBG Mortgage Trust / ABS-MBS (US52885AAA60) | 1,26 | 408,10 | 0,5121 | 0,4126 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 1,22 | 0,4996 | 0,4996 | ||||||

| US26251LAG95 / Dryden 64 CLO Ltd | 1,20 | −45,60 | 0,4896 | −0,3977 | |||||

| U.S. Treasury Bills / STIV (US912797PW16) | 1,18 | 0,4822 | 0,4822 | ||||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 1,18 | 0,4808 | 0,4808 | ||||||

| Hudson Yards 2025-SPRL Mortgage Trust / ABS-MBS (US44855PAE88) | 1,17 | 756,62 | 0,4757 | 0,4208 | |||||

| U.S. Treasury Bonds / DBT (US912810UG12) | 1,16 | 0,4726 | 0,4726 | ||||||

| US808513AR62 / Charles Schwab Corp/The | 1,16 | −3,99 | 0,4714 | −0,0129 | |||||

| RY.PRM / Royal Bank of Canada - Preferred Stock | 1,15 | −4,10 | 0,4679 | −0,0129 | |||||

| US95763PNC13 / Western Mortgage Reference Notes Series 2021-CL2 | 1,13 | −4,40 | 0,4617 | −0,0144 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 1,12 | 0,4578 | 0,4578 | ||||||

| US674599EA94 / Occidental Petroleum Corp | 1,12 | −34,73 | 0,4572 | −0,2331 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 1,11 | −3,48 | 0,4524 | −0,0096 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,09 | −4,79 | 0,4464 | −0,0158 | |||||

| RCKT Mortgage Trust 2024-INV2 / ABS-MBS (US749425AB06) | 1,09 | −80,80 | 0,4454 | −1,8397 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 1,08 | −3,49 | 0,4397 | −0,0094 | |||||

| Bell Telephone Co of Canada or Bell Canada / DBT (US0778FPAP47) | 1,07 | 0,4373 | 0,4373 | ||||||

| Prologis LP / DBT (US74340XCN93) | 1,06 | 0,4316 | 0,4316 | ||||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 1,03 | 1,38 | 0,4212 | 0,0114 | |||||

| ROCK Trust 2024-CNTR / ABS-MBS (US74970WAC47) | 1,03 | 1,58 | 0,4204 | 0,0122 | |||||

| Macquarie Airfinance Holdings Ltd / DBT (US55609NAC20) | 1,03 | −0,39 | 0,4188 | 0,0043 | |||||

| Government National Mortgage Association / ABS-MBS (US38383FVU47) | 1,02 | 0,4182 | 0,4182 | ||||||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 1,02 | −2,01 | 0,4175 | −0,0027 | |||||

| US35564KRF83 / Freddie Mac Structured Agency Credit Risk Debt Notes | 1,02 | −0,39 | 0,4165 | 0,0045 | |||||

| Hess Midstream Operations LP / DBT (US428102AG28) | 1,02 | −0,49 | 0,4144 | 0,0040 | |||||

| Government National Mortgage Association / ABS-MBS (US38384DKM82) | 1,01 | 0,4116 | 0,4116 | ||||||

| US37046US851 / General Motors Financial Co Inc | 1,00 | 0,30 | 0,4091 | 0,0071 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 1,00 | 0,4089 | 0,4089 | ||||||

| Bank of America Corp / DBT (US06055HAH66) | 1,00 | 0,4082 | 0,4082 | ||||||

| US05567SAA06 / Bnsf Funding Tru 6.613 12/15 Bond | 1,00 | −0,20 | 0,4081 | 0,0050 | |||||

| US577081BD37 / Mattel Inc | 0,99 | 0,4054 | 0,4054 | ||||||

| JW Commercial Mortgage Trust 2024-MRCO / ABS-MBS (US46657XAC02) | 0,99 | −1,00 | 0,4040 | 0,0016 | |||||

| Sixth Street CLO XIV Ltd / ABS-CBDO (US83013NAE04) | 0,99 | 0,4037 | 0,4037 | ||||||

| SOCG / Société Générale Société anonyme - Depositary Receipt (Common Stock) | 0,99 | −0,90 | 0,4028 | 0,0018 | |||||

| US30296PAS39 / FREMF 2018-K75 Mortgage Trust | 0,98 | 0,4012 | 0,4012 | ||||||

| US37046US851 / General Motors Financial Co Inc | 0,98 | −0,41 | 0,4007 | 0,0039 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 0,98 | 0,3995 | 0,3995 | ||||||

| AERCAP IRELAND CAP/GLOBA / DBT (US00774MBQ78) | 0,97 | 0,3962 | 0,3962 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,97 | 0,3956 | 0,3956 | ||||||

| CyrusOne Data Centers Issuer I LLC / ABS-O (US23284BAG95) | 0,97 | 1,05 | 0,3945 | 0,0097 | |||||

| BGC / BGC Group, Inc. | 0,96 | 0,3906 | 0,3906 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0,96 | 0,3903 | 0,3903 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,95 | −3,27 | 0,3866 | −0,0074 | |||||

| US12530MAC91 / CF Hippolyta LLC, Series 2020-1, Class B1 | 0,94 | −32,71 | 0,3839 | −0,1782 | |||||

| US29336TAD28 / EnLink Midstream LLC | 0,94 | 0,43 | 0,3837 | 0,0070 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 0,93 | −1,28 | 0,3783 | 0,0004 | |||||

| US816851BM02 / Sempra Energy | 0,92 | −3,27 | 0,3739 | −0,0074 | |||||

| K1SG34 / Keysight Technologies, Inc. - Depositary Receipt (Common Stock) | 0,92 | 0,3737 | 0,3737 | ||||||

| BHP Billiton Finance USA Ltd / DBT (US055451BL10) | 0,91 | 0,3704 | 0,3704 | ||||||

| JBS USA Holding Lux Sarl/ JBS USA Food Co/ JBS Lux Co Sarl / DBT (US47214BAC28) | 0,90 | 1,81 | 0,3676 | 0,0117 | |||||

| FCT / Fincantieri S.p.A. | 0,90 | 0,79 | 0,3653 | 0,0080 | |||||

| US78449RAA32 / SLG Office Trust 2021-OVA | 0,87 | 2,95 | 0,3563 | 0,0151 | |||||

| Government National Mortgage Association / ABS-MBS (US38382WBQ96) | 0,87 | 0,3558 | 0,3558 | ||||||

| C1RR34 / Carrier Global Corporation - Depositary Receipt (Common Stock) | 0,86 | 1,65 | 0,3522 | 0,0107 | |||||

| BAHA Trust 2024-MAR / ABS-MBS (US05493XAA81) | 0,86 | 1,53 | 0,3521 | 0,0101 | |||||

| US3140J7UN33 / Fannie Mae Pool | 0,84 | −0,71 | 0,3411 | 0,0024 | |||||

| US3140QMCC60 / Fannie Mae Pool | 0,82 | 0,3327 | 0,3327 | ||||||

| V1RS34 / Verisk Analytics, Inc. - Depositary Receipt (Common Stock) | 0,81 | 0,3301 | 0,3301 | ||||||

| US87612BBG68 / Targa Resources Partners LP / Targa Resources Partners Finance Corp | 0,80 | 0,38 | 0,3263 | 0,0058 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,80 | 1,02 | 0,3244 | 0,0076 | |||||

| JP Morgan Mortgage Trust Series 2024-6 / ABS-MBS (US46657YAP97) | 0,79 | −7,93 | 0,3225 | −0,0229 | |||||

| STAB / Standard Chartered PLC - Preferred Security | 0,78 | 1,56 | 0,3185 | 0,0095 | |||||

| US3131XKDL05 / Freddie Mac Pool | 0,77 | −3,38 | 0,3148 | −0,0065 | |||||

| US35104AAD00 / Foursight Capital Automobile Receivables Trust 2023-2 | 0,77 | 0,66 | 0,3136 | 0,0064 | |||||

| Race Point X CLO Ltd / ABS-CBDO (US74983DAW74) | 0,76 | 0,3103 | 0,3103 | ||||||

| Fannie Mae Connecticut Avenue Securities / ABS-MBS (US207941AF22) | 0,76 | −2,20 | 0,3091 | −0,0023 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RJH84) | 0,76 | 0,3082 | 0,3082 | ||||||

| US92852LAD10 / VITERRA FINANCE B.V. | 0,76 | 3,00 | 0,3081 | 0,0132 | |||||

| Mission Lane Credit Card Master Trust / ABS-O (US60510MBE75) | 0,75 | 0,53 | 0,3079 | 0,0060 | |||||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 0,75 | −26,18 | 0,3073 | −0,1031 | |||||

| IRV Trust 2025-200P / ABS-MBS (US45006HAA95) | 0,75 | 0,3065 | 0,3065 | ||||||

| Allegro CLO XV Ltd / ABS-CBDO (US01749WAQ69) | 0,75 | 0,3047 | 0,3047 | ||||||

| EQT / EQT Corporation | 0,74 | −36,68 | 0,3039 | −0,1689 | |||||

| Jane Street Group / JSG Finance Inc / DBT (US47077WAE84) | 0,73 | 0,2976 | 0,2976 | ||||||

| Vale Overseas Ltd / DBT (US91911TAS24) | 0,72 | 45,09 | 0,2956 | 0,1230 | |||||

| INWI / Inwido AB (publ) | 0,72 | −58,09 | 0,2954 | −0,3987 | |||||

| Hilton Grand Vacations Trust 2024-2 / ABS-O (US43283JAB26) | 0,72 | −7,43 | 0,2953 | −0,0193 | |||||

| E1SE34 / Eversource Energy - Depositary Receipt (Common Stock) | 0,71 | 0,71 | 0,2897 | 0,0058 | |||||

| US124857AZ68 / ViacomCBS Inc | 0,70 | 1,60 | 0,2856 | 0,0085 | |||||

| US63874HAA14 / Natixis Commercial Mortgage Securities Trust 2018-OSS | 0,70 | 2,34 | 0,2853 | 0,0103 | |||||

| US05606FAG81 / BX TRUST BX 2019 OC11 B 144A | 0,70 | 0,2852 | 0,2852 | ||||||

| US05606FAL76 / BX TRUST BX 2019 OC11 D 144A | 0,70 | −49,23 | 0,2838 | −0,2671 | |||||

| US064058AL44 / Bank of New York Mellon Corp/The | 0,69 | −0,86 | 0,2812 | 0,0012 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 0,69 | −54,56 | 0,2808 | −0,3285 | |||||

| HCA Inc / DBT (US404119DB22) | 0,68 | 0,2779 | 0,2779 | ||||||

| Fortitude Group Holdings LLC / DBT (US34966XAA63) | 0,68 | 0,2774 | 0,2774 | ||||||

| BAHA Trust 2024-MAR / ABS-MBS (US05493XAE04) | 0,66 | 0,2711 | 0,2711 | ||||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0,66 | 0,46 | 0,2703 | 0,0051 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,66 | 0,2680 | 0,2680 | ||||||

| S1YK34 / Stryker Corporation - Depositary Receipt (Common Stock) | 0,65 | 1,56 | 0,2656 | 0,0076 | |||||

| 30064K105 / Exacttarget, Inc. | 0,65 | 0,2653 | 0,2653 | ||||||

| HINNT 2024-A LLC / ABS-O (US40472QAB32) | 0,65 | −11,37 | 0,2644 | −0,0296 | |||||

| Saks Global Enterprises LLC / DBT (US79380MAA36) | 0,64 | −36,69 | 0,2594 | −0,1443 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0,63 | −1,25 | 0,2584 | 0,0004 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0,63 | 212,94 | 0,2568 | 0,1759 | |||||

| Apidos CLO XLVII Ltd / ABS-CBDO (US03770QAG91) | 0,62 | −1,42 | 0,2546 | 0,0003 | |||||

| TPRY34 / Tapestry, Inc. - Depositary Receipt (Common Stock) | 0,61 | 3,74 | 0,2492 | 0,0125 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0,61 | 0,2473 | 0,2473 | ||||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 0,60 | 1,01 | 0,2453 | 0,0057 | |||||

| Vistra Operations Co LLC / DBT (US92840VAU61) | 0,60 | 0,84 | 0,2449 | 0,0054 | |||||

| RR 35 LTD / ABS-CBDO (US74988DAE22) | 0,60 | −0,66 | 0,2442 | 0,0020 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 0,59 | 0,2425 | 0,2425 | ||||||

| Charter Communications Operating LLC / Charter Communications Operating Capital / DBT (US161175CQ56) | 0,59 | 1,37 | 0,2409 | 0,0064 | |||||

| Golub Capital Partners CLO 53B Ltd / ABS-CBDO (US38177YAQ52) | 0,59 | 0,2396 | 0,2396 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,58 | −5,36 | 0,2381 | −0,0097 | |||||

| RR 37 LTD / ABS-CBDO (US78110XAG51) | 0,58 | −2,83 | 0,2379 | −0,0036 | |||||

| US845467AR03 / CORP. NOTE | 0,58 | 0,87 | 0,2376 | 0,0051 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,58 | 0,2367 | 0,2367 | ||||||

| Mars Inc / DBT (US571676BA26) | 0,57 | 0,2343 | 0,2343 | ||||||

| P1DT34 / Prudential Financial, Inc. - Depositary Receipt (Common Stock) | 0,55 | 0,2229 | 0,2229 | ||||||

| US49461MAB63 / Kinetik Holdings LP | 0,54 | 0,2203 | 0,2203 | ||||||

| SCE.PRK / SCE Trust V - Preferred Security | 0,52 | 0,2137 | 0,2137 | ||||||

| US35910EAA29 / Frontier Issuer LLC | 0,51 | −0,39 | 0,2072 | 0,0023 | |||||

| US655844CU03 / NORFOLK SOUTHERN CORP | 0,51 | −0,78 | 0,2066 | 0,0012 | |||||

| Mercury Financial Credit Card Master Trust / ABS-O (US58940BAZ94) | 0,51 | 0,00 | 0,2065 | 0,0027 | |||||

| IBM / International Business Machines Corporation - Depositary Receipt (Common Stock) | 0,51 | 0,2061 | 0,2061 | ||||||

| Brex Commercial Charge Card Master Trust / ABS-O (US05601DAE31) | 0,50 | −0,20 | 0,2059 | 0,0025 | |||||

| CHI Commercial Mortgage Trust 2025-SFT / ABS-MBS (US16706GAG29) | 0,50 | 0,2050 | 0,2050 | ||||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RFX70) | 0,50 | −0,40 | 0,2043 | 0,0020 | |||||

| Apidos Clo XL Ltd / ABS-CBDO (US03769RAN52) | 0,50 | −0,60 | 0,2041 | 0,0016 | |||||

| Galaxy 34 Clo Ltd / ABS-CBDO (US36322AAA07) | 0,50 | −0,40 | 0,2039 | 0,0021 | |||||

| Carlyle Global Market Strategies CLO 2012-4 Ltd / ABS-CBDO (US14309YCE23) | 0,50 | −0,20 | 0,2037 | 0,0022 | |||||

| TICP CLO XI Ltd / ABS-CBDO (US87249QAL41) | 0,50 | 0,2036 | 0,2036 | ||||||

| CLF / Cleveland-Cliffs Inc. | 0,50 | −3,49 | 0,2035 | −0,0043 | |||||

| Elmwood CLO II Ltd / ABS-CBDO (US29001LAY74) | 0,50 | −0,60 | 0,2035 | 0,0020 | |||||

| Lewey Park CLO Ltd / ABS-CBDO (US527911AC55) | 0,50 | −0,80 | 0,2034 | 0,0013 | |||||

| OCP CLO 2024-36 Ltd / ABS-CBDO (US67570EAN85) | 0,50 | −1,19 | 0,2032 | 0,0003 | |||||

| Apidos CLO XVIII-R / ABS-CBDO (US03767NAY22) | 0,50 | −0,80 | 0,2032 | 0,0012 | |||||

| Switch ABS Issuer LLC / ABS-O (US871044AE30) | 0,50 | 0,40 | 0,2026 | 0,0036 | |||||

| Apidos CLO LI Ltd / ABS-CBDO (US03771JAG40) | 0,49 | −1,20 | 0,2016 | 0,0004 | |||||

| T-Mobile USA Inc / DBT (US87264ADU60) | 0,49 | 0,2010 | 0,2010 | ||||||

| SWCH Commercial Mortgage Trust 2025-DATA / ABS-MBS (US78489CAA71) | 0,49 | 0,2004 | 0,2004 | ||||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,49 | −2,00 | 0,2003 | −0,0012 | |||||

| K1RC34 / The Kroger Co. - Depositary Receipt (Common Stock) | 0,49 | 1,03 | 0,2000 | 0,0048 | |||||

| Towd Point Mortgage Trust 2025-CRM1 / ABS-MBS (US891946AA31) | 0,49 | 0,1997 | 0,1997 | ||||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 0,49 | 2,09 | 0,1996 | 0,0066 | |||||

| US482606AA89 / KNDR Trust 21-KIND Class A | 0,49 | −0,41 | 0,1993 | 0,0022 | |||||

| US09261HAC16 / Blackstone Private Credit Fund | 0,49 | 0,00 | 0,1988 | 0,0026 | |||||

| US46646GAA58 / J.P. MORGAN CHASE COMMERCIAL MORTGAGE SE SER 2016-NINE CL A V/R REGD 144A P/P 2.94923700 | 0,49 | 0,83 | 0,1983 | 0,0042 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,48 | 0,1975 | 0,1975 | ||||||

| US12636MAJ71 / CSAIL 2016-C6 Commercial Mortgage Trust | 0,48 | 0,84 | 0,1971 | 0,0046 | |||||

| Tyco Electronics Group SA / DBT (US902133BD84) | 0,48 | 0,1969 | 0,1969 | ||||||

| TXN / Texas Instruments Incorporated - Depositary Receipt (Common Stock) | 0,48 | −0,62 | 0,1954 | 0,0018 | |||||

| US09261HAC16 / Blackstone Private Credit Fund | 0,48 | −1,85 | 0,1947 | −0,0009 | |||||

| IRV Trust 2025-200P / ABS-MBS (US45006HAE18) | 0,47 | 0,1917 | 0,1917 | ||||||

| ROCK Trust 2024-CNTR / ABS-MBS (US74970WAE03) | 0,47 | 0,1906 | 0,1906 | ||||||

| 2914 / Japan Tobacco Inc. | 0,46 | 0,1894 | 0,1894 | ||||||

| EAI / Entergy Arkansas, LLC - Corporate Bond/Note | 0,46 | −0,65 | 0,1883 | 0,0017 | |||||

| CBRE Services Inc / DBT (US12505BAK61) | 0,46 | 0,1866 | 0,1866 | ||||||

| Jane Street Group / JSG Finance Inc / DBT (US47077WAD02) | 0,45 | 239,85 | 0,1845 | 0,1334 | |||||

| Cloud Capital Holdco LP / ABS-O (US102104AA49) | 0,45 | −0,44 | 0,1841 | 0,0018 | |||||

| H1FC34 / HF Sinclair Corporation - Depositary Receipt (Common Stock) | 0,45 | −0,88 | 0,1834 | 0,0010 | |||||

| RCKT Mortgage Trust 2024-CES7 / ABS-MBS (US749414AA67) | 0,45 | −4,89 | 0,1828 | −0,0065 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,45 | 0,1825 | 0,1825 | ||||||

| Ares LIX CLO Ltd / ABS-CBDO (US04018EAL56) | 0,45 | −0,67 | 0,1816 | 0,0013 | |||||

| CIFC Funding 2022-VII Ltd / ABS-CBDO (US12569EAU10) | 0,44 | −1,35 | 0,1799 | 0,0002 | |||||

| Constellation Energy Generation LLC / DBT (US210385AF78) | 0,44 | −21,18 | 0,1792 | −0,0136 | |||||

| US84574TP340 / SOUTHWESTERN PUBLIC SERVICE CO. | 0,44 | 0,00 | 0,1778 | 0,0024 | |||||

| US08162QAE98 / BENCHMARK 2020-IG3 MORTGAGE TRUST BMARK 2020-IG3 A4 | 0,43 | 2,87 | 0,1755 | 0,0071 | |||||

| US90137LAC46 / 20 Times Square Trust 2018-20TS | 0,43 | −75,55 | 0,1755 | −0,5325 | |||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 0,43 | 0,1753 | 0,1753 | ||||||

| US61946KAC80 / Mosaic Solar Loan Trust 2022-3 | 0,42 | −29,29 | 0,1714 | −0,0678 | |||||

| US90137LAE02 / 20 Times Square Trust 2018-20TS | 0,42 | −66,96 | 0,1714 | −0,3400 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 0,42 | 0,1714 | 0,1714 | ||||||

| GOOGL / Alphabet Inc. - Depositary Receipt (Common Stock) | 0,42 | 0,1712 | 0,1712 | ||||||

| Bank of America Corp / DBT (US06051GMA49) | 0,42 | 1,22 | 0,1697 | 0,0044 | |||||

| US641423CG18 / Nevada Power Co. | 0,42 | −0,72 | 0,1694 | 0,0012 | |||||

| CBRE Services Inc / DBT (US12505BAJ98) | 0,41 | 0,1692 | 0,1692 | ||||||

| Expedia Group Inc / DBT (US30212PBL85) | 0,41 | 0,1675 | 0,1675 | ||||||

| Beacon Funding Trust / DBT (US073952AB93) | 0,41 | 0,50 | 0,1655 | 0,0032 | |||||

| Huntington Bank Auto Credit-Linked Notes Series 2024-2 / ABS-O (US44644NAG43) | 0,40 | −11,04 | 0,1648 | −0,0177 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RKK94) | 0,40 | 0,1644 | 0,1644 | ||||||

| CPRL34 / Canadian Pacific Kansas City Limited - Depositary Receipt (Common Stock) | 0,40 | 0,1638 | 0,1638 | ||||||

| US3137F6K554 / Federal Home Loan Mortgage Corp. REMICS | 0,40 | −5,91 | 0,1628 | −0,0075 | |||||

| AB BSL CLO 5 Ltd / ABS-CBDO (US00038GAE08) | 0,40 | −1,24 | 0,1627 | 0,0004 | |||||

| E1XC34 / Exelon Corporation - Depositary Receipt (Common Stock) | 0,40 | 0,1623 | 0,1623 | ||||||

| T-Mobile USA Inc / DBT (US87264ADS15) | 0,39 | 0,1609 | 0,1609 | ||||||

| XS2262961076 / ZF Finance GmbH | 0,38 | −1,03 | 0,1570 | 0,0006 | |||||

| US12189LBK61 / Burlington Northern Santa Fe LLC | 0,38 | −0,78 | 0,1565 | 0,0009 | |||||

| RIO TINTO FIN USA PLC / DBT (US76720AAU07) | 0,38 | 0,1552 | 0,1552 | ||||||

| E1IX34 / Edison International - Depositary Receipt (Common Stock) | 0,38 | 5,00 | 0,1546 | 0,0095 | |||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 0,38 | 0,1533 | 0,1533 | ||||||

| Foundry JV Holdco LLC / DBT (US350930AH62) | 0,37 | 0,1509 | 0,1509 | ||||||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 0,37 | 1,65 | 0,1506 | 0,0044 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0,36 | 0,00 | 0,1485 | 0,0020 | |||||

| Enterprise Fleet Financing 2025-2 LLC / ABS-O (US29375TAD46) | 0,36 | 0,1473 | 0,1473 | ||||||

| Neuberger Berman Loan Advisers Clo 44 Ltd / ABS-CBDO (US64133VAN73) | 0,36 | −1,91 | 0,1472 | −0,0007 | |||||

| W1MC34 / Waste Management, Inc. - Depositary Receipt (Common Stock) | 0,36 | 1,70 | 0,1467 | 0,0046 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,36 | 0,85 | 0,1451 | 0,0033 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,35 | −0,56 | 0,1438 | 0,0014 | |||||

| BlackRock Funding Inc / DBT (US09290DAK72) | 0,35 | 0,00 | 0,1435 | 0,0022 | |||||

| US3138ERHZ61 / Fannie Mae Pool | 0,35 | 0,29 | 0,1433 | 0,0023 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,35 | −39,34 | 0,1431 | −0,0892 | |||||

| 29364W405 / Entergy Louisiana LLC, 5.875% Series First Mortgage Bonds due 6/15/2041 | 0,35 | −0,29 | 0,1409 | 0,0018 | |||||

| US65246QAA76 / NZES_21-GNT1 | 0,34 | −4,76 | 0,1391 | −0,0048 | |||||

| Ally Bank Auto Credit-Linked Notes Series 2024-A / ABS-O (US02007GZ635) | 0,34 | −11,29 | 0,1383 | −0,0151 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0,34 | 0,00 | 0,1374 | 0,0021 | |||||

| RCKT Mortgage Trust 2024-CES9 / ABS-MBS (US749426AB88) | 0,34 | −3,17 | 0,1372 | −0,0025 | |||||

| SOCG / Société Générale Société anonyme - Depositary Receipt (Common Stock) | 0,33 | −39,27 | 0,1365 | −0,0849 | |||||

| OT Midco Ltd / DBT (US68877AAA25) | 0,33 | 0,1364 | 0,1364 | ||||||

| Mars Inc / DBT (US571676BC81) | 0,33 | 0,1343 | 0,1343 | ||||||

| Jersey Mike's Funding LLC / ABS-O (US476681AD37) | 0,33 | 0,00 | 0,1340 | 0,0019 | |||||

| XS2262961076 / ZF Finance GmbH | 0,33 | −0,61 | 0,1327 | 0,0010 | |||||

| RIO TINTO FIN USA PLC / DBT (US76720AAW62) | 0,32 | 0,1314 | 0,1314 | ||||||

| LNG / Cheniere Energy, Inc. | 0,32 | −0,31 | 0,1300 | 0,0014 | |||||

| C1OG34 / Coterra Energy Inc. - Depositary Receipt (Common Stock) | 0,32 | −3,64 | 0,1299 | −0,0030 | |||||

| US09261HAC16 / Blackstone Private Credit Fund | 0,32 | −35,96 | 0,1295 | −0,0696 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0,32 | 0,64 | 0,1293 | 0,0027 | |||||

| Daimler Truck Finance North America LLC / DBT (US233853BF64) | 0,32 | −66,13 | 0,1285 | −0,2459 | |||||

| ROCK Trust 2024-CNTR / ABS-MBS (US74970WAJ99) | 0,31 | 0,1280 | 0,1280 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0,31 | 0,1274 | 0,1274 | ||||||

| Celanese US Holdings LLC / DBT (US15089QAZ72) | 0,31 | 0,1268 | 0,1268 | ||||||

| SYY / Sysco Corporation - Depositary Receipt (Common Stock) | 0,31 | 0,1262 | 0,1262 | ||||||

| US594918CE21 / Microsoft Corp | 0,31 | 0,65 | 0,1259 | 0,0027 | |||||

| US031162DT45 / Amgen Inc | 0,31 | −0,65 | 0,1245 | 0,0009 | |||||

| Wingstop Funding LLC / ABS-O (US974153AE88) | 0,30 | 0,66 | 0,1241 | 0,0026 | |||||

| US958254AA26 / Western Gas Partners 5.375% 06/01/21 | 0,30 | −46,00 | 0,1240 | −0,1026 | |||||

| Rentokil Terminix Funding LLC / DBT (US760130AB09) | 0,30 | 0,1236 | 0,1236 | ||||||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 0,30 | 0,1236 | 0,1236 | ||||||

| Hess Midstream Operations LP / DBT (US428102AH01) | 0,30 | 0,1218 | 0,1218 | ||||||

| LLY / Eli Lilly and Company - Depositary Receipt (Common Stock) | 0,30 | 1,02 | 0,1213 | 0,0030 | |||||

| US05592AAG58 / BPR Trust 2021-TY | 0,30 | −0,67 | 0,1208 | 0,0009 | |||||

| US3132A4PW20 / Freddie Mac Pool | 0,29 | −0,34 | 0,1194 | 0,0015 | |||||

| US20826FBG00 / ConocoPhillips Co | 0,29 | −2,03 | 0,1182 | −0,0007 | |||||

| R1OL34 / Rollins, Inc. - Depositary Receipt (Common Stock) | 0,29 | 0,1164 | 0,1164 | ||||||

| Mars Inc / DBT (US571676BB09) | 0,28 | 0,1143 | 0,1143 | ||||||

| IVW / Meta Platforms, Inc. - Depositary Receipt (Common Stock) | 0,28 | −0,71 | 0,1142 | 0,0007 | |||||

| US 10YR NOTE (CBT)JUN25 / DIR (000000000) | 0,27 | 0,1107 | 0,1107 | ||||||

| US61945VAC54 / Mosaic Solar Loan Trust 2023-1 | 0,27 | −3,60 | 0,1095 | −0,0027 | |||||

| US260543BC66 / Dow Chemical Co 8.850% Debentures 09/15/21 | 0,27 | 0,1083 | 0,1083 | ||||||

| US 2YR NOTE (CBT) JUN25 / DIR (000000000) | 0,26 | 0,1074 | 0,1074 | ||||||

| US902613AD01 / UBS Group AG | 0,26 | −1,91 | 0,1052 | −0,0006 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0,26 | 0,1044 | 0,1044 | ||||||

| DT Midstream Inc / DBT (US23345MAD92) | 0,25 | −0,78 | 0,1039 | 0,0007 | |||||

| Palmer Square CLO 2023-3 Ltd / ABS-CBDO (US696926AG99) | 0,25 | −0,79 | 0,1027 | 0,0007 | |||||

| Hawaii Hotel Trust 2025-MAUI / ABS-MBS (US419909AC00) | 0,25 | 0,1009 | 0,1009 | ||||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 0,25 | −42,89 | 0,1001 | −0,0724 | |||||

| US694308HY69 / Pacific Gas & Electric Co. | 0,25 | −1,61 | 0,1001 | −0,0004 | |||||

| USP3143NBK92 / Corp Nacional del Cobre de Chile | 0,24 | −0,41 | 0,0998 | 0,0010 | |||||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 0,24 | −45,41 | 0,0971 | −0,0784 | |||||

| Sierra Pacific Power Co / DBT (US826418BQ78) | 0,24 | −1,25 | 0,0971 | 0,0005 | |||||

| US67113DAW48 / OZLM XXIV Ltd | 0,24 | −23,87 | 0,0965 | −0,0284 | |||||

| SUN / Sunoco LP - Limited Partnership | 0,23 | 0,0958 | 0,0958 | ||||||

| US20030NEG25 / COMCAST CORPORATION | 0,23 | −0,43 | 0,0938 | 0,0012 | |||||

| US571748BT86 / Marsh & McLennan Cos Inc | 0,23 | 0,00 | 0,0935 | 0,0011 | |||||

| US455780DS23 / Indonesia Government International Bond | 0,23 | −0,44 | 0,0921 | 0,0008 | |||||

| US61945VAB71 / Mosaic Solar Loan Trust 2023-1 | 0,22 | −1,33 | 0,0906 | −0,0000 | |||||

| US55903VBC63 / Warnermedia Holdings Inc | 0,21 | −2,73 | 0,0873 | −0,0014 | |||||

| Huntington Bank Auto Credit-Linked Notes Series 2024-1 / ABS-O (US44644NAA72) | 0,21 | −12,45 | 0,0862 | −0,0108 | |||||

| US31416BLC09 / Fannie Mae Pool | 0,21 | −3,24 | 0,0856 | −0,0014 | |||||

| FCT / Fincantieri S.p.A. | 0,21 | 1,99 | 0,0837 | 0,0027 | |||||

| Ally Bank Auto Credit-Linked Notes Series 2024-B / ABS-O (US02007G4D28) | 0,20 | −10,67 | 0,0824 | −0,0083 | |||||

| Ally Bank Auto Credit-Linked Notes Series 2024-B / ABS-O (US02007G4E01) | 0,20 | −10,67 | 0,0820 | −0,0085 | |||||

| Hudson Yards 2025-SPRL Mortgage Trust / ABS-MBS (US44855PAA66) | 0,20 | 0,0797 | 0,0797 | ||||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0,20 | −2,01 | 0,0797 | −0,0004 | |||||

| US11135FBQ37 / Broadcom Inc | 0,18 | −79,87 | 0,0733 | −0,1449 | |||||

| US26443TAC09 / Duke Energy Indiana LLC | 0,17 | −1,15 | 0,0704 | 0,0002 | |||||

| AZOI34 / AutoZone, Inc. - Depositary Receipt (Common Stock) | 0,17 | 0,0689 | 0,0689 | ||||||

| US466247J465 / JP MORGAN MORTGAGE TRUST | 0,16 | −7,06 | 0,0648 | −0,0037 | |||||

| Evergreen Credit Card Trust / ABS-O (US30023JCY29) | 0,15 | 0,67 | 0,0616 | 0,0012 | |||||

| OLN / Olin Corporation | 0,15 | 0,0616 | 0,0616 | ||||||

| US03522AAJ97 / Anheuser-Busch Cos LLC / Anheuser-Busch InBev Worldwide Inc | 0,15 | 0,67 | 0,0614 | 0,0014 | |||||

| Bayview Opportunity Master Fund VII 2024-CAR1 LLC / ABS-O (US07336QAB86) | 0,15 | −12,35 | 0,0609 | −0,0078 | |||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0,15 | −1,32 | 0,0609 | −0,0001 | |||||

| US00206RLJ94 / AT&T, Inc. | 0,15 | 0,00 | 0,0601 | 0,0007 | |||||

| XS2066744231 / Carnival PLC | 0,14 | −1,39 | 0,0583 | 0,0002 | |||||

| US38379PLX32 / Government National Mortgage Association | 0,14 | −6,00 | 0,0578 | −0,0026 | |||||

| US3138X8ZV65 / Fannie Mae Pool | 0,13 | −7,75 | 0,0537 | −0,0036 | |||||

| US55348UAL26 / MRCD 2019-MARK Mortgage Trust | 0,13 | −0,77 | 0,0528 | 0,0005 | |||||

| US11135FBP53 / SR UNSECURED 144A 11/35 3.137 | 0,12 | −60,26 | 0,0500 | −0,0735 | |||||

| US92331LBC37 / VENTURE CDO LTD VENTR 2017 27A AR 144A | 0,12 | −42,23 | 0,0486 | −0,0346 | |||||

| LLY / Eli Lilly and Company - Depositary Receipt (Common Stock) | 0,11 | 0,90 | 0,0459 | 0,0011 | |||||

| US031162DC10 / Amgen Inc | 0,11 | −1,85 | 0,0435 | −0,0000 | |||||

| US92343VGL27 / Verizon Communications Inc | 0,10 | 0,00 | 0,0428 | 0,0008 | |||||

| US3138ADSK24 / Fannie Mae Pool | 0,10 | −0,98 | 0,0414 | 0,0002 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RGG39) | 0,10 | 1,00 | 0,0413 | 0,0008 | |||||

| US12669FK444 / CHL Mortgage Pass-Through Trust 2004-13 | 0,10 | 0,00 | 0,0411 | 0,0008 | |||||

| US06051GKB40 / Bank of America Corp. | 0,10 | −2,04 | 0,0396 | 0,0000 | |||||

| US92343VGC28 / Verizon Communications Inc | 0,09 | 0,00 | 0,0366 | 0,0005 | |||||

| US90276RBD98 / UBS Commercial Mortgage Trust 2017-C4 | 0,09 | 0,0364 | 0,0364 | ||||||

| US92343VFT61 / VERIZON COMMUNICATIONS INC 2.65% 11/20/2040 | 0,08 | 2,50 | 0,0336 | 0,0012 | |||||

| US31408H4P76 / Fannie Mae Pool | 0,07 | −1,45 | 0,0278 | −0,0002 | |||||

| US3131WM3D64 / Freddie Mac Pool | 0,07 | −1,47 | 0,0277 | 0,0003 | |||||

| US31385XQ915 / Fannie Mae Pool | 0,06 | −4,48 | 0,0264 | −0,0006 | |||||

| US5899294H87 / Merrill Lynch Mortgage Investors Trust Series 2003-A6 | 0,06 | −3,17 | 0,0252 | −0,0002 | |||||

| US 5YR NOTE (CBT) JUN25 / DIR (000000000) | 0,06 | 0,0251 | 0,0251 | ||||||

| US02149FAD69 / COUNTRYWIDE ALTERNATIVE LOAN TRUST | 0,05 | −3,92 | 0,0202 | −0,0003 | |||||

| US31414UW461 / Fannie Mae Pool | 0,05 | 0,00 | 0,0193 | 0,0001 | |||||

| US07387AFG58 / Bear Stearns ARM Trust 2005-11 | 0,04 | −2,22 | 0,0183 | −0,0002 | |||||

| US31368HL352 / Fannie Mae Pool | 0,04 | −4,44 | 0,0177 | −0,0007 | |||||

| US225470FM03 / CSFB Mortgage-Backed Pass-Through Certificates Series 2005-10 | 0,04 | 0,00 | 0,0176 | 0,0000 | |||||

| US3131X9HJ67 / Freddie Mac Pool | 0,04 | −7,50 | 0,0155 | −0,0009 | |||||

| US05948XT270 / Banc of America Mortgage Trust, Series 2004-A, Class 2A2 | 0,03 | −2,94 | 0,0138 | −0,0001 | |||||

| US31402C4G48 / Fannie Mae Pool | 0,03 | −3,57 | 0,0112 | −0,0003 | |||||

| US3620A5AX78 / Ginnie Mae I Pool | 0,03 | 0,00 | 0,0112 | 0,0002 | |||||

| US3131WRB951 / Freddie Mac Pool | 0,02 | 0,00 | 0,0096 | 0,0002 | |||||

| US037833EK23 / Apple Inc | 0,01 | 0,00 | 0,0041 | 0,0001 | |||||

| US037833EE62 / Apple Inc | 0,01 | 12,50 | 0,0037 | 0,0001 | |||||

| US31391PDR47 / Fannie Mae Pool | 0,01 | −27,27 | 0,0034 | −0,0011 | |||||

| US31282YED76 / Freddie Mac Strips | 0,01 | 0,00 | 0,0029 | −0,0002 | |||||

| US31402QY395 / Fannie Mae Pool | 0,01 | 0,00 | 0,0027 | −0,0000 | |||||

| US4270981164 / HERCULES TR II WTS EXP 31MAR29 | 0,00 | 0,00 | 0,00 | 50,00 | 0,0015 | 0,0006 | |||

| US38379CS804 / Government National Mortgage Association | 0,00 | −50,00 | 0,0011 | −0,0007 | |||||

| US12558MAG78 / CIT Home Equity Loan Trust 2002-1 | 0,00 | 0,0002 | −0,0002 | ||||||

| US LONG BOND(CBT) JUN25 / DIR (000000000) | −0,00 | −0,0001 | −0,0001 | ||||||

| US ULTRA BOND CBT JUN25 / DIR (000000000) | −0,18 | −0,0719 | −0,0719 | ||||||

| US 10YR ULTRA FUT JUN25 / DIR (000000000) | −0,24 | −0,0984 | −0,0984 |