Grundläggande statistik

| Portföljvärde | $ 254 151 029 |

| Aktuella positioner | 190 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

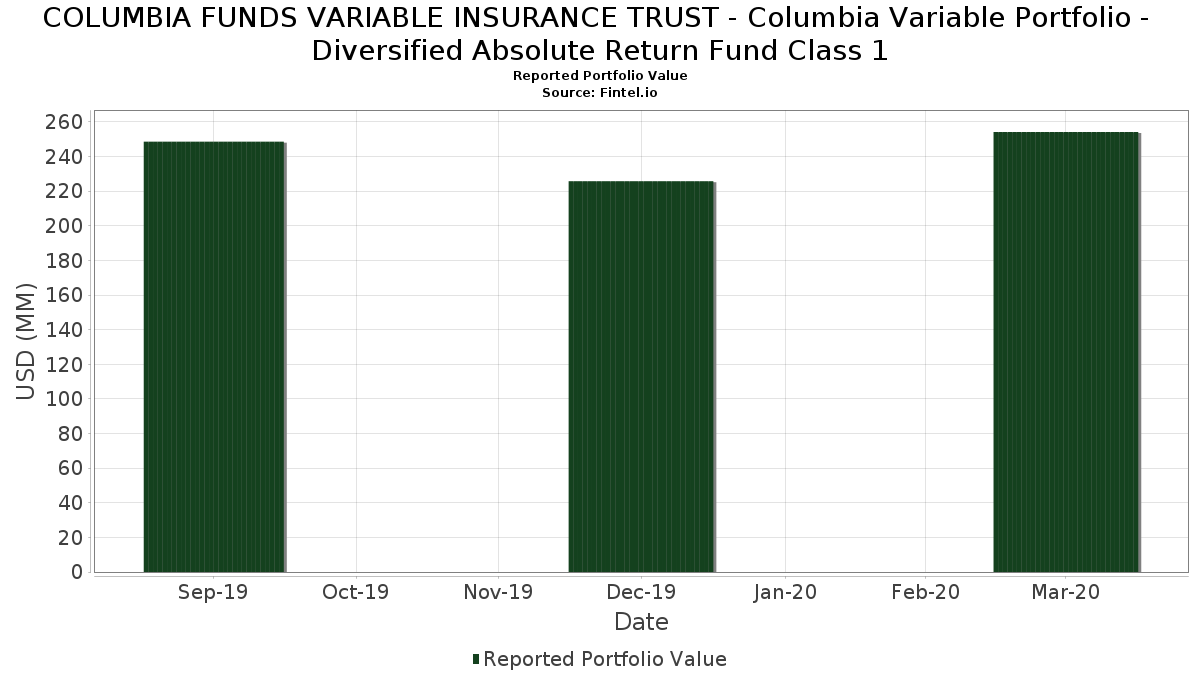

COLUMBIA FUNDS VARIABLE INSURANCE TRUST - Columbia Variable Portfolio - Diversified Absolute Return Fund Class 1 har redovisat 190 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 254 151 029 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). COLUMBIA FUNDS VARIABLE INSURANCE TRUST - Columbia Variable Portfolio - Diversified Absolute Return Fund Class 1s största innehav är COLUMBIA SHORT TERM CASH FUND (US:19766H239) , iShares Trust - iShares Short Treasury Bond ETF (US:SHV) , United States Treasury Note/Bond (US:US912828Z948) , United States Treasury Note/Bond (US:US9128282R06) , and United States Treasury Note/Bond (US:US9128285M81) . COLUMBIA FUNDS VARIABLE INSURANCE TRUST - Columbia Variable Portfolio - Diversified Absolute Return Fund Class 1s nya positioner inkluderar United States Treasury Note/Bond (US:US912828Z948) , United States Treasury Note/Bond (US:US9128282R06) , United States Treasury Note/Bond (US:US9128285M81) , United States Treasury Note/Bond (US:US9128283F58) , and U.S. Treasury Notes 2.875%, due 08/15/2028 (US:US9128284V99) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 124,19 | 124,13 | 48,5782 | 5,8342 | |

| 4,76 | 1,8644 | 1,8644 | ||

| 4,74 | 1,8542 | 1,8542 | ||

| 3,70 | 1,4479 | 1,4479 | ||

| 4,70 | 1,8412 | 1,1997 | ||

| 4,22 | 1,6526 | 1,0513 | ||

| 2,58 | 1,0088 | 1,0088 | ||

| 4,11 | 1,6098 | 0,9869 | ||

| 3,87 | 1,5132 | 0,9284 | ||

| 2,21 | 0,8630 | 0,8630 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 0,12 | 1,92 | 0,7534 | −4,5150 | |

| 0,03 | 1,81 | 0,7065 | −1,1153 | |

| −1,96 | −0,7673 | −0,7673 | ||

| −1,73 | −0,6756 | −0,6756 | ||

| −1,51 | −0,5907 | −0,5907 | ||

| −1,41 | −0,5521 | −0,5521 | ||

| −1,33 | −0,5210 | −0,5210 | ||

| −1,24 | −0,4847 | −0,4847 | ||

| −1,12 | −0,4366 | −0,4366 | ||

| 0,59 | 0,2312 | −0,2201 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2020-05-28 för rapporteringsperioden 2020-03-31. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 19766H239 / COLUMBIA SHORT TERM CASH FUND | 124,19 | 11,71 | 124,13 | 11,67 | 48,5782 | 5,8342 | |||

| SHV / iShares Trust - iShares Short Treasury Bond ETF | 0,36 | 0,00 | 40,13 | 0,51 | 15,7069 | 0,3516 | |||

| US912828Z948 / United States Treasury Note/Bond | 4,76 | 1,8644 | 1,8644 | ||||||

| US ULTRA T-BOND JUN 20 / DIR (000000000) | 4,74 | 18 848,00 | 1,8542 | 1,8542 | |||||

| US9128282R06 / United States Treasury Note/Bond | 4,70 | 182,01 | 1,8412 | 1,1997 | |||||

| US9128285M81 / United States Treasury Note/Bond | 4,22 | 174,51 | 1,6526 | 1,0513 | |||||

| US9128283F58 / United States Treasury Note/Bond | 4,11 | 154,05 | 1,6098 | 0,9869 | |||||

| US9128284V99 / U.S. Treasury Notes 2.875%, due 08/15/2028 | 3,87 | 154,34 | 1,5132 | 0,9284 | |||||

| US912828YS30 / United States Treasury Note/Bond | 3,70 | 1,4479 | 1,4479 | ||||||

| US9128286T26 / United States Treasury Note/Bond | 3,55 | 155,72 | 1,3903 | 0,8559 | |||||

| US912828YB05 / Us Treasury N/b 1.625000% 08/15/2029 Bond | 3,39 | 157,06 | 1,3260 | 0,8191 | |||||

| VGM0 / EURO STOXX 50 Index | 2,58 | 1,0088 | 1,0088 | ||||||

| US DOLLARS / DFE (000000000) | 2,21 | 8 720,00 | 0,8630 | 0,8630 | |||||

| US DOLLARS / DFE (000000000) | 2,09 | 8 276,00 | 0,8197 | 0,8197 | |||||

| DJP / iPath Bloomberg Commodity Index Total Return ETN - Structured Product | 0,12 | −80,59 | 1,92 | −85,96 | 0,7534 | −4,5150 | |||

| SWP: USD 1.769950 04-DEC-2029 / DIR (000000000) | 1,87 | 7 392,00 | 0,7333 | 0,7333 | |||||

| US912828B253 / United States Treasury Inflation Indexed Bonds | 1,82 | −0,44 | 0,7124 | 0,0094 | |||||

| S&P500 EMINI JUN 20 / DE (000000000) | 1,82 | 7 176,00 | 0,7119 | 0,7119 | |||||

| JP1201711L13 / Japan Government Twenty Year Bond | 1,81 | 0,7090 | 0,7090 | ||||||

| IYR / iShares Trust - iShares U.S. Real Estate ETF | 0,03 | −49,02 | 1,81 | −61,90 | 0,7065 | −1,1153 | |||

| US912828YD60 / US TREASURY N/B 08/26 1.375 | 1,80 | 8,19 | 0,7034 | 0,0644 | |||||

| BRITISH POUND / DFE (000000000) | 1,69 | 6 648,00 | 0,6605 | 0,6605 | |||||

| IDG000013806 / Indonesia Treasury Bond | 1,33 | 0,5197 | 0,5197 | ||||||

| US912828H458 / United States Treasury Inflation Indexed Bonds | 1,31 | 0,08 | 0,5115 | 0,0093 | |||||

| BTPCL / Bonos de la Tesoreria de la Republica en pesos | 1,28 | 0,5012 | 0,5012 | ||||||

| US01F0326417 / UMBS 30YR 3.5% 04/01/2050 #TBA | 1,24 | 0,4860 | 0,4860 | ||||||

| GB00B73ZYW09 / United Kingdom Gilt Inflation Linked | 1,19 | −15,47 | 0,4645 | −0,0843 | |||||

| US01F0306450 / Uniform Mortgage-Backed Security, TBA | 1,18 | 0,4636 | 0,4636 | ||||||

| JP1300651L15 / Japan Government Thirty Year Bond | 1,13 | 0,4437 | 0,4437 | ||||||

| US21H0326478 / Ginnie Mae | 1,11 | 0,4331 | 0,4331 | ||||||

| S&P/TSE 60 INDEX JUN 20 / DE (000000000) | 1,04 | 4 068,00 | 0,4082 | 0,4082 | |||||

| US01F0406441 / Uniform Mortgage-Backed Security, TBA | 1,04 | 0,4069 | 0,4069 | ||||||

| EURO COUNTRIES / DFE (000000000) | 0,93 | 3 636,00 | 0,3657 | 0,3657 | |||||

| ZAG000016320 / Republic of South Africa Government Bond | 0,92 | 3 588,00 | 0,3611 | 0,3611 | |||||

| US9128282L36 / United States Treasury Inflation Indexed Bonds | 0,90 | 1,12 | 0,3527 | 0,0098 | |||||

| US912828SA95 / United States Treasury Inflation Indexed Bonds | 0,87 | −1,14 | 0,3409 | 0,0017 | |||||

| US DOLLARS / DFE (000000000) | 0,87 | 3 380,00 | 0,3406 | 0,3406 | |||||

| SWP: SEK 0.197500 07-OCT-2029 / DIR (000000000) | 0,86 | 3 344,00 | 0,3371 | 0,3371 | |||||

| US9128283R96 / United States Treasury Inflation Indexed Bonds | 0,85 | 1,55 | 0,3338 | 0,0110 | |||||

| US9128285W63 / United States Treasury Inflation Indexed Bonds | 0,83 | −21,05 | 0,3232 | −0,0790 | |||||

| ES0000012E51 / Spain Government Bond | 0,81 | 3 124,00 | 0,3156 | 0,3156 | |||||

| KR103502G8C0 / KOREA TREASURY BOND BONDS 12/28 2.375 | 0,75 | 25,21 | 0,2916 | 0,0589 | |||||

| GB00B3Y1JG82 / United Kingdom Gilt Inflation Linked | 0,74 | −3,40 | 0,2893 | −0,0099 | |||||

| SAGB / Republic of South Africa Government Bond | 0,74 | 7,30 | 0,2879 | 0,0200 | |||||

| SWP: SEK 0.245000 04-MAR-2030 / DIR (000000000) | 0,72 | 2 764,00 | 0,2804 | 0,2804 | |||||

| MX0MGO0000H9 / Mexican Bonos | 0,71 | 2 740,00 | 0,2781 | 0,2781 | |||||

| SWP: EUR -0.209000 04-MAR-2030 / DIR (000000000) | 0,70 | 2 708,00 | 0,2749 | 0,2749 | |||||

| GB00B46CGH68 / United Kingdom Gilt Inflation Linked | 0,70 | 14,92 | 0,2745 | 0,0358 | |||||

| KR103502G966 / Korea Treasury Bond | 0,70 | 2 684,00 | 0,2726 | 0,2726 | |||||

| GB00B1L6W962 / UK 1.125% 11/22/2037 (FTIPS) | 0,68 | 32,49 | 0,2667 | 0,0654 | |||||

| SWP: AUD 1.460000 03-JAN-2030 / DIR (000000000) | 0,67 | 2 588,00 | 0,2630 | 0,2630 | |||||

| GB00B7RN0G65 / United Kingdom Gilt Inflation Linked | 0,66 | −6,64 | 0,2589 | −0,0181 | |||||

| SWP: USD 1.542000 04-OCT-2029 / DIR (000000000) | 0,62 | 2 388,00 | 0,2434 | 0,2434 | |||||

| SWP: NZD 1.650000 08-JAN-2030 / DIR (000000000) | 0,62 | 2 360,00 | 0,2407 | 0,2407 | |||||

| GB00BYVP4K94 / UK .125% 11/22/2056 (FTIPS) | 0,61 | −14,29 | 0,2398 | −0,0393 | |||||

| GB00BFX0ZL78 / United Kingdom Gilt | 0,59 | −48,87 | 0,2312 | −0,2201 | |||||

| NZTB / New Zealand Government Bond | 0,55 | 2 100,00 | 0,2154 | 0,2154 | |||||

| JP1120221H48 / Japanese Government CPI Linked Bond | 0,55 | −3,01 | 0,2146 | −0,0064 | |||||

| FR0011317783 / French Republic Government Bond OAT | 0,54 | 2 076,00 | 0,2133 | 0,2133 | |||||

| SWP: USD 1.615600 05-NOV-2029 / DIR (000000000) | 0,54 | 2 056,00 | 0,2110 | 0,2110 | |||||

| US912828Y388 / United States Treasury Inflation Indexed Bonds | 0,52 | 1,76 | 0,2043 | 0,0072 | |||||

| US01F0426407 / Uniform Mortgage-Backed Security, TBA | 0,51 | 0,2000 | 0,2000 | ||||||

| Z M0 / FTSE 100 Index | 0,47 | 1 772,00 | 0,1834 | 0,1834 | |||||

| JP1300591J79 / Japan Government Thirty Year Bond | 0,46 | −1,51 | 0,1789 | −0,0025 | |||||

| SWP: AUD 1.332000 04-NOV-2029 / DIR (000000000) | 0,46 | 1 720,00 | 0,1782 | 0,1782 | |||||

| GB00B85SFQ54 / United Kingdom Inflation-Linked Gilt | 0,42 | −2,77 | 0,1650 | −0,0046 | |||||

| SWP: CAD 1.447500 02-MAR-2030 / DIR (000000000) | 0,42 | 1 568,00 | 0,1633 | 0,1633 | |||||

| US01F0224448 / Uniform Mortgage-Backed Security, TBA | 0,39 | 0,1542 | 0,1542 | ||||||

| CA135087VS05 / Canadian Government Real Return Bond | 0,37 | −22,50 | 0,1459 | −0,0388 | |||||

| US01N0326429 / Ginnie Mae | 0,37 | 0,1457 | 0,1457 | ||||||

| US01N0406452 / GNMA | 0,37 | 0,1455 | 0,1455 | ||||||

| US01F0304471 / FNMA 15YR TBA(REG B) | 0,37 | 0,1433 | 0,1433 | ||||||

| NZGOVDT437C0 / New Zealand Government Bond | 0,37 | 1 360,00 | 0,1431 | 0,1431 | |||||

| GB0004893086 / United Kingdom Gilt | 0,37 | 0,83 | 0,1431 | 0,0016 | |||||

| FR0011427848 / French Republic Government Bond OAT | 0,34 | −3,46 | 0,1314 | −0,0043 | |||||

| JP1120211G41 / Japanese Government CPI Linked Bond | 0,32 | −2,45 | 0,1248 | −0,0029 | |||||

| JP1201691K75 / Japan Government Twenty Year Bond | 0,31 | −64,14 | 0,1208 | −0,2153 | |||||

| CA135087H235 / Canadian Government Bond | 0,30 | −0,33 | 0,1180 | 0,0018 | |||||

| US9128287D64 / United States Treasury Inflation Indexed Bonds | 0,29 | 2,87 | 0,1127 | 0,0052 | |||||

| AU0000XCLWP8 / Australia Government Bond | 0,28 | −26,91 | 0,1087 | −0,0398 | |||||

| GB00BN65R313 / United Kingdom Gilt | 0,28 | 15,97 | 0,1080 | 0,0146 | |||||

| MSCI EAFE INDEX JUN 20 / DE (000000000) | 0,27 | 996,00 | 0,1073 | 0,1073 | |||||

| US912810RA88 / United States Treasury Inflation Indexed Bonds | 0,26 | 57,32 | 0,1013 | 0,0381 | |||||

| US912810QV35 / United States Treasury Inflation Indexed Bonds | 0,25 | 7,33 | 0,0976 | 0,0083 | |||||

| CA135087WV25 / Canadian Government Real Return Bond | 0,24 | −18,18 | 0,0955 | −0,0188 | |||||

| FR0013341682 / French Republic Government Bond OAT | 0,22 | −65,27 | 0,0848 | −0,1587 | |||||

| JP1300631K78 / Japan Government Thirty Year Bond | 0,21 | −62,79 | 0,0829 | −0,1390 | |||||

| US912810RL44 / United States Treasury Inflation Indexed Bonds | 0,21 | 19,88 | 0,0803 | 0,0144 | |||||

| US912810SB52 / United States Treasury Inflation Indexed Bonds | 0,18 | 10,91 | 0,0716 | 0,0081 | |||||

| SWP: AUD 1.300000 03-DEC-2029 / DIR (000000000) | 0,17 | 592,00 | 0,0678 | 0,0678 | |||||

| CA135087XQ21 / Canadian Government Real Return Bond | 0,17 | −19,81 | 0,0669 | −0,0149 | |||||

| IT0005162828 / Italy Buoni Poliennali Del Tesoro | 0,16 | −31,20 | 0,0631 | −0,0284 | |||||

| IT0005246134 / Italy Buoni Poliennali Del Tesoro | 0,16 | 29,84 | 0,0631 | 0,0143 | |||||

| BRSTNCNTB4U6 / BRAZIL 6.0% 8/15/2026 (FTIPS) | 0,16 | −22,28 | 0,0615 | −0,0177 | |||||

| FR0011982776 / French Republic Government Bond OAT | 0,15 | −5,73 | 0,0581 | −0,0035 | |||||

| IT0004735152 / Italy Buoni Poliennali Del Tesoro | 0,15 | −6,92 | 0,0581 | −0,0043 | |||||

| FR0000188799 / FRANCE 3.15% 7/25/2032 (FTIPS) | 0,14 | −6,80 | 0,0536 | −0,0041 | |||||

| JP1300621K47 / Japan Government Thirty Year Bond | 0,13 | −64,99 | 0,0517 | −0,0960 | |||||

| GB00BD9MZZ71 / United Kingdom Gilt Inflation Linked | 0,13 | −31,05 | 0,0514 | −0,0230 | |||||

| US DOLLARS / DFE (000000000) | 0,12 | 376,00 | 0,0469 | 0,0469 | |||||

| JP1300611K15 / JAPAN (30 YEAR ISSUE) BONDS 12/48 0.7 | 0,12 | −0,83 | 0,0467 | −0,0005 | |||||

| CANADIAN DOLLAR / DFE (000000000) | 0,11 | 356,00 | 0,0446 | 0,0446 | |||||

| BRITISH POUND / DFE (000000000) | 0,11 | 336,00 | 0,0429 | 0,0429 | |||||

| US DOLLARS / DFE (000000000) | 0,11 | 324,00 | 0,0419 | 0,0419 | |||||

| AU000XCLWAV1 / Australia Government Bond | 0,11 | −23,36 | 0,0414 | −0,0125 | |||||

| US 10YR NOTE JUN 20 / DIR (000000000) | 0,10 | 316,00 | 0,0408 | 0,0408 | |||||

| AU000XCLWAF4 / AUSTRALIA 2.0 08/21/2035 (FTIPS) | 0,10 | −13,51 | 0,0377 | −0,0061 | |||||

| JGBI / JAPAN GOVT CPI LINKED BONDS 03/28 0.1 | 0,09 | 276,00 | 0,0369 | 0,0369 | |||||

| FR0010447367 / French Republic Government Bond OAT | 0,08 | 59,62 | 0,0327 | 0,0121 | |||||

| SWEDISH KRONA / DFE (000000000) | 0,08 | 220,00 | 0,0315 | 0,0315 | |||||

| SWP: AUD 1.071000 03-OCT-2029 / DIR (000000000) | 0,08 | 204,00 | 0,0301 | 0,0301 | |||||

| JP1300601JA9 / JAPAN (GOVT OF) #60 | 0,08 | −1,32 | 0,0294 | −0,0004 | |||||

| US ULTRA 10YR NOTE JUN 20 / DIR (000000000) | 0,06 | 144,00 | 0,0242 | 0,0242 | |||||

| AU000XCLWAO6 / Australia Government Bond | 0,05 | −37,93 | 0,0215 | −0,0128 | |||||

| US DOLLARS / DFE (000000000) | 0,05 | 88,00 | 0,0186 | 0,0186 | |||||

| MSCI EMER MKT INDEX (ICE) JUN 20 / DE (000000000) | 0,05 | 84,00 | 0,0183 | 0,0183 | |||||

| NORWAY KRONA / DFE (000000000) | 0,05 | 84,00 | 0,0182 | 0,0182 | |||||

| ZAG000096603 / SOUTH AFRICA 2.5% 12/31/2050 FTIPS | 0,05 | 84,00 | 0,0182 | 0,0182 | |||||

| IT0003745541 / ITALY 2.35% 9/15/2035 (FTIPS) | 0,05 | −39,47 | 0,0181 | −0,0117 | |||||

| US 5YR NOTE JUN 20 / DIR (000000000) | 0,05 | 80,00 | 0,0177 | 0,0177 | |||||

| G M0 / LONG GILT FUTURE JUN20 IFLL 20200626 | 0,04 | 76,00 | 0,0173 | 0,0173 | |||||

| US DOLLARS / DFE (000000000) | 0,04 | 52,00 | 0,0151 | 0,0151 | |||||

| IT0004545890 / Italy Buoni Poliennali Del Tesoro | 0,03 | −44,07 | 0,0130 | −0,0101 | |||||

| SWISS FRANC / DFE (000000000) | 0,03 | 24,00 | 0,0124 | 0,0124 | |||||

| US DOLLARS / DFE (000000000) | 0,03 | 24,00 | 0,0124 | 0,0124 | |||||

| US DOLLARS / DFE (000000000) | 0,03 | 20,00 | 0,0120 | 0,0120 | |||||

| SWP: JPY 0.011000 05-FEB-2030 / DIR (000000000) | 0,03 | 16,00 | 0,0116 | 0,0116 | |||||

| US DOLLARS / DFE (000000000) | 0,03 | 0,00 | 0,0098 | 0,0098 | |||||

| US DOLLARS / DFE (000000000) | 0,02 | −12,00 | 0,0087 | 0,0087 | |||||

| CAN 10YR BOND JUN 20 / DIR (000000000) | 0,01 | −44,00 | 0,0056 | 0,0056 | |||||

| SWISS FRANC / DFE (000000000) | 0,01 | −52,00 | 0,0048 | 0,0048 | |||||

| SWP: JPY 0.012500 05-AUG-2029 / DIR (000000000) | 0,01 | −68,00 | 0,0032 | 0,0032 | |||||

| NORWAY KRONA / DFE (000000000) | 0,01 | −72,00 | 0,0029 | 0,0029 | |||||

| SWP: SEK 0.290000 06-MAR-2030 / DIR (000000000) | 0,01 | −72,00 | 0,0028 | 0,0028 | |||||

| EURO COUNTRIES / DFE (000000000) | 0,01 | −72,00 | 0,0027 | 0,0027 | |||||

| SWEDISH KRONA / DFE (000000000) | 0,01 | −76,00 | 0,0024 | 0,0024 | |||||

| US DOLLARS / DFE (000000000) | 0,01 | −80,00 | 0,0023 | 0,0023 | |||||

| US DOLLARS / DFE (000000000) | 0,00 | −84,00 | 0,0019 | 0,0019 | |||||

| AUSTRALIA DOLLAR / DFE (000000000) | 0,00 | −88,00 | 0,0014 | 0,0014 | |||||

| JAPANESE YEN / DFE (000000000) | 0,00 | −96,00 | 0,0007 | 0,0007 | |||||

| US9128283J70 / United States Treasury Note/Bond | 0,00 | 0,0001 | 0,0000 | ||||||

| US DOLLARS / DFE (000000000) | 0,00 | −100,00 | 0,0000 | 0,0000 | |||||

| NEW ZEALAND DOLLAR / DFE (000000000) | −0,00 | −100,00 | −0,0000 | −0,0000 | |||||

| US DOLLARS / DFE (000000000) | −0,00 | −100,00 | −0,0000 | −0,0000 | |||||

| US DOLLARS / DFE (000000000) | −0,00 | −100,00 | −0,0001 | −0,0001 | |||||

| US DOLLARS / DFE (000000000) | −0,00 | −100,00 | −0,0001 | −0,0001 | |||||

| US DOLLARS / DFE (000000000) | −0,00 | −100,00 | −0,0001 | −0,0001 | |||||

| US DOLLARS / DFE (000000000) | −0,00 | −100,00 | −0,0001 | −0,0001 | |||||

| US DOLLARS / DFE (000000000) | −0,00 | −104,00 | −0,0005 | −0,0005 | |||||

| US DOLLARS / DFE (000000000) | −0,00 | −108,00 | −0,0008 | −0,0008 | |||||

| US DOLLARS / DFE (000000000) | −0,00 | −108,00 | −0,0010 | −0,0010 | |||||

| SPI 200 JUN 20 / DE (000000000) | −0,00 | −112,00 | −0,0013 | −0,0013 | |||||

| SOUTH AFRICA COMM. RD / DFE (000000000) | −0,01 | −120,00 | −0,0022 | −0,0022 | |||||

| US DOLLARS / DFE (000000000) | −0,01 | −128,00 | −0,0028 | −0,0028 | |||||

| RXM0 / Euro-Bund | −0,01 | −144,00 | −0,0045 | −0,0045 | |||||

| US DOLLARS / DFE (000000000) | −0,01 | −144,00 | −0,0045 | −0,0045 | |||||

| US DOLLARS / DFE (000000000) | −0,01 | −144,00 | −0,0046 | −0,0046 | |||||

| AUSTRALIA DOLLAR / DFE (000000000) | −0,01 | −152,00 | −0,0051 | −0,0051 | |||||

| US DOLLARS / DFE (000000000) | −0,02 | −160,00 | −0,0060 | −0,0060 | |||||

| ICE: (CDX.NA.IG.34.V1) / DCR (000000000) | −0,02 | −172,00 | −0,0071 | −0,0071 | |||||

| SWP: NOK 1.962500 10-JAN-2030 / DIR (000000000) | −0,02 | −176,00 | −0,0076 | −0,0076 | |||||

| HANG SENG INDEX APR 20 / DE (000000000) | −0,02 | −188,00 | −0,0088 | −0,0088 | |||||

| US DOLLARS / DFE (000000000) | −0,02 | −196,00 | −0,0097 | −0,0097 | |||||

| US DOLLARS / DFE (000000000) | −0,03 | −216,00 | −0,0117 | −0,0117 | |||||

| AUST 10YR BOND JUN 20 / DIR (000000000) | −0,04 | −252,00 | −0,0150 | −0,0150 | |||||

| IKM0 / EURO-BTP FUTURE JUN20 XEUR 20200608 | −0,04 | −272,00 | −0,0169 | −0,0169 | |||||

| OATM0 / EURO-OAT FUTURE JUN20 XEUR 20200608 | −0,05 | −284,00 | −0,0181 | −0,0181 | |||||

| US DOLLARS / DFE (000000000) | −0,05 | −308,00 | −0,0205 | −0,0205 | |||||

| US DOLLARS / DFE (000000000) | −0,06 | −356,00 | −0,0251 | −0,0251 | |||||

| US DOLLARS / DFE (000000000) | −0,08 | −412,00 | −0,0306 | −0,0306 | |||||

| GXM0 / DAX Index | −0,10 | −496,00 | −0,0391 | −0,0391 | |||||

| BJM0 / 10YR MINI JGB FUT Jun20 | −0,11 | −544,00 | −0,0435 | −0,0435 | |||||

| MSCI EMER MKT INDEX (ICE) JUN 20 / DE (000000000) | −0,12 | −568,00 | −0,0462 | −0,0462 | |||||

| US DOLLARS / DFE (000000000) | −0,12 | −592,00 | −0,0484 | −0,0484 | |||||

| US DOLLARS / DFE (000000000) | −0,14 | −664,00 | −0,0554 | −0,0554 | |||||

| US DOLLARS / DFE (000000000) | −0,18 | −816,00 | −0,0703 | −0,0703 | |||||

| ICE: (CDX.NA.HY.33.V2) / DCR (000000000) | −0,27 | −1 172,00 | −0,1050 | −0,1050 | |||||

| US DOLLARS / DFE (000000000) | −0,27 | −1 196,00 | −0,1076 | −0,1076 | |||||

| ICE: (CDX.EM.33.V1) / DCR (000000000) | −0,28 | −1 228,00 | −0,1107 | −0,1107 | |||||

| SWP: SEK 0.682000 07-JAN-2030 / DIR (000000000) | −0,31 | −1 356,00 | −0,1230 | −0,1230 | |||||

| SWISS FRANC / DFE (000000000) | −0,38 | −1 604,00 | −0,1474 | −0,1474 | |||||

| SWP: EUR 0.183590 03-JUL-2029 / DIR (000000000) | −0,39 | −1 668,00 | −0,1537 | −0,1537 | |||||

| JAPANESE YEN / DFE (000000000) | −0,54 | −2 248,00 | −0,2103 | −0,2103 | |||||

| SWEDISH KRONA / DFE (000000000) | −1,12 | −4 560,00 | −0,4366 | −0,4366 | |||||

| US DOLLARS / DFE (000000000) | −1,24 | −5 052,00 | −0,4847 | −0,4847 | |||||

| TOPIX INDEX JUN 20 / DE (000000000) | −1,33 | −5 424,00 | −0,5210 | −0,5210 | |||||

| SWP: GBP 0.998510 02-JAN-2030 / DIR (000000000) | −1,41 | −5 740,00 | −0,5521 | −0,5521 | |||||

| CANADIAN DOLLAR / DFE (000000000) | −1,51 | −6 136,00 | −0,5907 | −0,5907 | |||||

| US DOLLARS / DFE (000000000) | −1,73 | −7 004,00 | −0,6756 | −0,6756 | |||||

| AUSTRALIA DOLLAR / DFE (000000000) | −1,96 | −7 940,00 | −0,7673 | −0,7673 |