Grundläggande statistik

| Portföljvärde | $ 294 952 462 |

| Aktuella positioner | 122 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

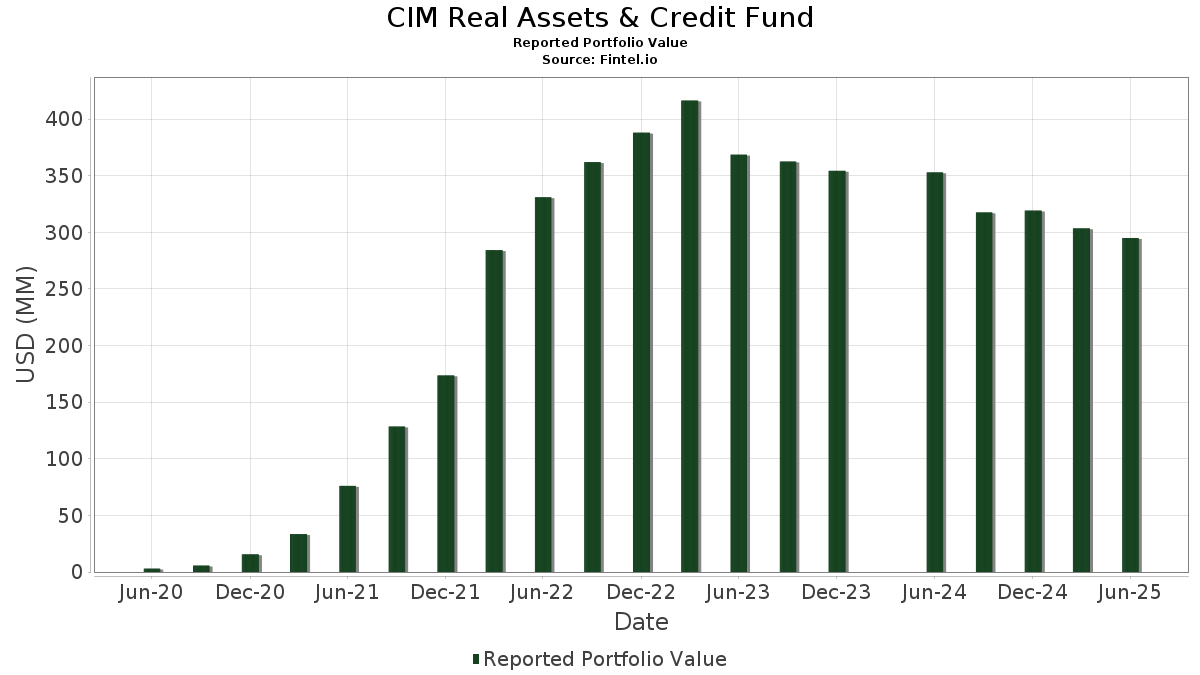

CIM Real Assets & Credit Fund har redovisat 122 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 294 952 462 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). CIM Real Assets & Credit Funds största innehav är First American Treasury Obligations Fund Class Z (US:US31846V5425) , Elevation CLO 2022-16, Ltd. (KY:US28624BAA08) , Extended Stay America Trust (US:US30227FAN06) , WMRK Commercial Mortgage Trust 2022-WMRK (US:US929342AE35) , and LCM 38 A, Class E-R Note (US:US501965AG28) . CIM Real Assets & Credit Funds nya positioner inkluderar First American Treasury Obligations Fund Class Z (US:US31846V5425) , Elevation CLO 2022-16, Ltd. (KY:US28624BAA08) , Extended Stay America Trust (US:US30227FAN06) , WMRK Commercial Mortgage Trust 2022-WMRK (US:US929342AE35) , and LCM 38 A, Class E-R Note (US:US501965AG28) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 0,02 | 21,92 | 8,3539 | 8,3539 | |

| 21,23 | 8,0903 | 8,0903 | ||

| 3,77 | 16,73 | 6,3765 | 6,3765 | |

| 14,27 | 5,4366 | 5,4366 | ||

| 12,26 | 4,6713 | 4,6713 | ||

| 11,48 | 4,3734 | 4,3734 | ||

| 10,16 | 3,8720 | 3,8720 | ||

| 5,83 | 2,2227 | 2,2227 | ||

| 5,80 | 2,2099 | 2,2099 | ||

| 5,14 | 1,9593 | 1,9593 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| −6,33 | −2,4139 | −2,4139 | ||

| −5,24 | −1,9981 | −1,9981 | ||

| −3,16 | −1,2027 | −1,2027 | ||

| −3,02 | −1,1502 | −1,1502 | ||

| −3,02 | −1,1490 | −1,1490 | ||

| −3,00 | −1,1425 | −1,1425 | ||

| −2,99 | −1,1406 | −1,1406 | ||

| −2,56 | −0,9741 | −0,9741 | ||

| −2,23 | −0,8518 | −0,8518 | ||

| −2,10 | −0,7984 | −0,7984 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-29 för rapporteringsperioden 2025-06-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| CIM REAL ASSETS & CREDIT FUND SPV . / DCR (N/A) | 0,02 | 21,92 | 8,3539 | 8,3539 | |||||

| Sora Multifamily Residential Property Indirect / RE (N/A) | 21,23 | 8,0903 | 8,0903 | ||||||

| IENTC 1, LLC / EC (N/A) | 3,77 | 16,73 | 6,3765 | 6,3765 | |||||

| 127 165 171 S. La Brea / RE (N/A) | 14,27 | 5,4366 | 5,4366 | ||||||

| EPIC Dallas Indirect / RE (N/A) | 12,26 | 4,6713 | 4,6713 | ||||||

| Del Mar Terrace - Phoenix, AZ Indirect / RE (N/A) | 11,48 | 4,3734 | 4,3734 | ||||||

| Society Las Olas - PMG Greybook Riverfront I LLC / LON (N/A) | 10,16 | 3,8720 | 3,8720 | ||||||

| US31846V5425 / First American Treasury Obligations Fund Class Z | 9,14 | 75,76 | 3,4820 | 1,5564 | |||||

| US28624BAA08 / Elevation CLO 2022-16, Ltd. | 9,12 | 0,16 | 3,4751 | 0,1029 | |||||

| US30227FAN06 / Extended Stay America Trust | 8,45 | −1,03 | 3,2206 | 0,0576 | |||||

| US929342AE35 / WMRK Commercial Mortgage Trust 2022-WMRK | 7,50 | 0,08 | 2,8568 | 0,0822 | |||||

| 1902 Park Avenue (Los Angeles) Owner, L.P. INDIRECT / RE (N/A) | 5,83 | 2,2227 | 2,2227 | ||||||

| 101 145 S. La Brea / RE (N/A) | 5,80 | 2,2099 | 2,2099 | ||||||

| US501965AG28 / LCM 38 A, Class E-R Note | 5,40 | 0,52 | 2,0586 | 0,0681 | |||||

| US12528HAG56 / CFIP CLO 2017-1, Ltd. | 5,18 | 3,10 | 1,9752 | 0,1131 | |||||

| EMPWR 2024-2A / ABS-O (US29248KAC09) | 5,15 | −10,55 | 1,9612 | −0,1701 | |||||

| Society Las Olas 301 - S 1st Avenue Holdings LLC / LON (N/A) | 5,14 | 1,9593 | 1,9593 | ||||||

| 4901 W Jefferson Blvd - Los Angeles, CA Indirect / RE (N/A) | 4,89 | 1,8649 | 1,8649 | ||||||

| Vale at the Parks - DC Indirect / RE (N/A) | 4,77 | 1,8169 | 1,8169 | ||||||

| Carlyle US CLO 2022-4 Ltd / ABS-CBDO (US14317EAG35) | 4,36 | 0,90 | 1,6604 | 0,0610 | |||||

| Boca Home Care Holdings, Inc. DDTL / LON (N/A) | 4,15 | 1,5834 | 1,5834 | ||||||

| US449652AJ58 / ILPT COML MTG TR 2022-LPF2 TSFR1M+594 10/15/2039 144A | 4,03 | 0,25 | 1,5348 | 0,0466 | |||||

| WCORE Commercial Mortgage Trust 2024-CORE / ABS-MBS (US951913AJ17) | 4,00 | −0,17 | 1,5229 | 0,0397 | |||||

| Spectrum Vision Partners, LLC / LON (N/A) | 3,99 | 1,5216 | 1,5216 | ||||||

| US95003EAG17 / WELLS FARGO COMMERCIAL MORTGAGE TRUST | 3,96 | −1,17 | 1,5093 | 0,0249 | |||||

| 24 Seven, Inc., Term Loan / LON (N/A) | 3,76 | 1,4322 | 1,4322 | ||||||

| 3816-3822 W Jefferson Blvd Indirect / RE (N/A) | 3,75 | 1,4275 | 1,4275 | ||||||

| US516681AG86 / LAQ 2023-LAQ Mortgage Trust | 3,74 | 0,32 | 1,4270 | 0,0442 | |||||

| CVAUSA Management, LLC, Term Loan / LON (N/A) | 3,70 | 1,4109 | 1,4109 | ||||||

| US68249DAE94 / One New York Plaza Trust 2020-1NYP | 3,55 | 2,63 | 1,3540 | 0,0716 | |||||

| 4707 W Jefferson Blvd Indirect / RE (N/A) | 3,34 | 1,2735 | 1,2735 | ||||||

| EOS-Metasource Intermediate, Inc., TL / LON (N/A) | 3,23 | 1,2310 | 1,2310 | ||||||

| AHPT 2024-ATRM D / ABS-MBS (US04963XAJ37) | 3,05 | −0,78 | 1,1617 | 0,0234 | |||||

| US70806KAA25 / PennantPark CLO, Ltd. | 3,04 | 0,93 | 1,1582 | 0,0425 | |||||

| Gallatin CLO XI 2024-1 Ltd / ABS-CBDO (US36362JAA25) | 3,03 | −3,04 | 1,1545 | −0,0028 | |||||

| Atlas Senior Loan Fund XX Ltd / ABS-CBDO (US04943KAE73) | 3,02 | −0,62 | 1,1520 | 0,0255 | |||||

| US05610BAQ95 / BXSC 2022-WSS F 5.579% 03/15/2035 144A | 3,02 | −0,36 | 1,1508 | 0,0282 | |||||

| MCR 2024-HF1 Mortgage Trust / ABS-MBS (US55287FAJ30) | 2,98 | −1,65 | 1,1372 | 0,0134 | |||||

| US01749KAC36 / Allegro CLO XV, Ltd. | 2,95 | 9,13 | 1,1254 | 0,1232 | |||||

| US26248CAC47 / Dryden 98 CLO, Ltd. | 2,84 | −3,85 | 1,0842 | −0,0119 | |||||

| US05606DAL29 / BX Trust 2022-PSB | 2,80 | −1,06 | 1,0683 | 0,0187 | |||||

| Exponential Power, Inc., TL / LON (N/A) | 2,70 | 1,0278 | 1,0278 | ||||||

| EMPWR 2024-1A SUB / ABS-O (US29244YAC49) | 2,60 | −15,63 | 0,9897 | −0,1506 | |||||

| HTL Commercial Mortgage Trust / ABS-MBS (US404300AG03) | 2,58 | 1,14 | 0,9845 | 0,0382 | |||||

| US92326HAA41 / VENTURE 45 CLO SERIES: 22-45A CLASS: E | 2,54 | −6,24 | 0,9681 | −0,0354 | |||||

| US55281FAS92 / MCF CLO VII LLC SER 2017-3A CL ER V/R REGD 144A P/P 9.29143000 | 2,54 | 1,20 | 0,9672 | 0,0383 | |||||

| US13467UAA07 / Campus Drive Secured Lease-Backed Pass-Through Trust Series C | 2,51 | −4,96 | 0,9566 | −0,0220 | |||||

| Allegro CLO XVII Ltd. / ABS-O (US01751WAE84) | 2,50 | 0,9527 | 0,9527 | ||||||

| Bardin Hill CLO 2021-2 Ltd. / ABS-CBDO (US06744BAJ26) | 2,45 | 0,29 | 0,9351 | 0,0289 | |||||

| AIDC Intermediate Co. 2, TL / LON (N/A) | 2,44 | 0,9304 | 0,9304 | ||||||

| US85816HAC16 / Steele Creek CLO 2022-1, Ltd. | 2,27 | 1 999,07 | 0,8641 | 0,8240 | |||||

| US66860WAA71 / Northwoods Capital 25, Ltd. | 2,20 | −2,30 | 0,8400 | 0,0042 | |||||

| Shiftkey, Term Loan / LON (N/A) | 2,14 | 0,8145 | 0,8145 | ||||||

| HARUS 2024-2A / ABS-CBDO (US41756XAA54) | 2,04 | 0,74 | 0,7783 | 0,0271 | |||||

| Kreg LLC, Term Loan / LON (N/A) | 2,04 | 0,7756 | 0,7756 | ||||||

| US14317NAG34 / Carlyle US CLO 2022-6 Ltd | 2,03 | 1,00 | 0,7724 | 0,0293 | |||||

| Prudential PLC / ABS-CBDO (US693976AA00) | 2,02 | 0,85 | 0,7705 | 0,0281 | |||||

| US108929AC47 / Brightwood Capital MM CLO 2023-1, Ltd. | 2,02 | −0,35 | 0,7686 | 0,0190 | |||||

| Atlas Senior Loan Fund XXIII Ltd. / ABS-CBDO (US04942RAA14) | 2,01 | −1,33 | 0,7659 | 0,0115 | |||||

| Birch Grove CLO Ltd / ABS-CBDO (US09075QAE35) | 1,98 | 0,00 | 0,7546 | 0,0211 | |||||

| One GI Intermediate LLC, Tranche B DDTL / LON (N/A) | 1,60 | 0,6091 | 0,6091 | ||||||

| US03754DAG88 / Apex Credit Clo 2021, Ltd. | 1,59 | −8,21 | 0,6051 | −0,0357 | |||||

| US04942GAC15 / Atlas Senior Loan Fund XVII, Ltd. | 1,55 | −13,86 | 0,5903 | −0,0756 | |||||

| Medrina, LLC - TL / LON (N/A) | 1,49 | 0,5661 | 0,5661 | ||||||

| US05606DAJ72 / BX Trust, Series 2022-PSB, Class E | 1,40 | −0,99 | 0,5342 | 0,0099 | |||||

| US3161755042 / Fidelity Treasury Portfolio | 1,36 | 363,14 | 0,5175 | 0,4087 | |||||

| US80349BCB18 / Saratoga Investment Corp. CLO 2013-1, Ltd. | 1,26 | −7,69 | 0,4805 | −0,0253 | |||||

| LCM Ltd Partnership / ABS-CBDO (US50200UAE64) | 1,16 | −0,85 | 0,4427 | 0,0088 | |||||

| Honor HN Buyer, Inc. Term Loan / LON (N/A) | 1,11 | 0,4231 | 0,4231 | ||||||

| US70469GAC50 / ArrowMark Colorado Holdings | 1,08 | 1 932,08 | 0,4106 | 0,3908 | |||||

| US56606PAA21 / Marble Point CLO XXI, Ltd. | 1,05 | −21,27 | 0,4006 | −0,0939 | |||||

| Rumbleon, INC. TL / LON (N/A) | 1,04 | 0,3967 | 0,3967 | ||||||

| US108929AA80 / Brightwood Capital MM CLO 2023-1, Ltd. | 1,02 | 0,00 | 0,3895 | 0,0110 | |||||

| US06761EAA38 / Barings Middle Market CLO Ltd 2021-I | 1,01 | 1,00 | 0,3866 | 0,0147 | |||||

| ALLEG 2020-1A E1R / ABS-CBDO (US01750UAE38) | 1,00 | −1,28 | 0,3829 | 0,0059 | |||||

| US95003EAL02 / Wells Fargo Commercial Mortgage Trust 2021-FCMT | 0,96 | 1,37 | 0,3663 | 0,0149 | |||||

| Baart Programs, Inc., Second Lien Term Loan / LON (N/A) | 0,90 | 0,3435 | 0,3435 | ||||||

| One GI Intermediate LLC, Tranche C DDTL / LON (N/A) | 0,84 | 0,3210 | 0,3210 | ||||||

| BCPE North Star US Holdco 2, Inc. 2L TL / LON (N/A) | 0,82 | 0,3123 | 0,3123 | ||||||

| US90214FAA75 / TWO VA Repack Trust Class B-2 | 0,78 | 2,35 | 0,2988 | 0,0151 | |||||

| Honor HN Buyer DD T/L 1st Amendment / LON (N/A) | 0,78 | 0,2977 | 0,2977 | ||||||

| Honor HN Buyer, Inc. Delayed Draw Term Loan / LON (N/A) | 0,70 | 0,2676 | 0,2676 | ||||||

| Boca Home Care Holdings Revolver / LON (N/A) | 0,58 | 0,2213 | 0,2213 | ||||||

| Flatiron CLO 20 Ltd / ABS-CBDO (US33883NAE22) | 0,50 | −0,40 | 0,1909 | 0,0048 | |||||

| MedMark Services, Inc., Second Lien Term Loan / LON (N/A) | 0,33 | 0,1267 | 0,1267 | ||||||

| 24 Seven Holdco, LLC - 2023 Incremental Term Loan / LON (N/A) | 0,33 | 0,1262 | 0,1262 | ||||||

| Boca Homecare Holdings, Inc. (Equity) Common Stock / EC (N/A) | 0,58 | 0,32 | 0,1203 | 0,1203 | |||||

| One GI Intermediate LLC, Revolver Upsize / LON (N/A) | 0,31 | 0,1199 | 0,1199 | ||||||

| RumbleOn, Inc., Delayed Draw Term Loan / LON (N/A) | 0,31 | 0,1197 | 0,1197 | ||||||

| CVAUSA Management, LLC, Revolver, TL / LON (N/A) | 0,29 | 0,1089 | 0,1089 | ||||||

| US126721AA74 / CXP Trust 2022-CXP1 | 0,28 | −9,27 | 0,1086 | −0,0076 | |||||

| Medrina, LLC - DDTL / LON (N/A) | 0,25 | 0,0950 | 0,0950 | ||||||

| Medrina, LLC - Revolver / LON (N/A) | 0,21 | 0,0811 | 0,0811 | ||||||

| Redstone HoldCo 2 LP, Second Lien Initial TL / LON (N/A) | 0,21 | 0,0796 | 0,0796 | ||||||

| Avison Young Second Out PIK TL / LON (N/A) | 0,21 | 0,0782 | 0,0782 | ||||||

| US918470AA36 / VA Gilbert AZ Subordinated Note Lease-Backed Pass-Through Trust | 0,19 | −0,53 | 0,0718 | 0,0015 | |||||

| CGA Holdings, Inc., Class A Common Stock / EC (N/A) | 0,16 | 0,16 | 0,0619 | 0,0619 | |||||

| US89641FAC86 / Trinitas Clo VIII, Ltd. | 0,16 | −15,34 | 0,0610 | −0,0092 | |||||

| Kreg LLC, Revolver / LON (N/A) | 0,16 | 0,0595 | 0,0595 | ||||||

| Shiftkey, Revolver / LON (N/A) | 0,14 | 0,0526 | 0,0526 | ||||||

| Naked Juice LLC - Third Out TL / LON (N/A) | 0,14 | 0,0515 | 0,0515 | ||||||

| Honor HN Buyer, Inc. Revolver / LON (N/A) | 0,13 | 0,0503 | 0,0503 | ||||||

| US50201VAA17 / LCM 31, Ltd. | 0,08 | −20,75 | 0,0322 | −0,0075 | |||||

| AIDC Intermediate Co. 2, LLC, Term Loan / LON (N/A) | 0,06 | 0,0218 | 0,0218 | ||||||

| Naked Juice LLC - Second Out TL / LON (N/A) | 0,06 | 0,0213 | 0,0213 | ||||||

| CMCT / Creative Media & Community Trust Corporation | 0,00 | 0,01 | 0,0049 | 0,0049 | |||||

| Avison Young Third Out PIK TL / LON (N/A) | 0,01 | 0,0045 | 0,0045 | ||||||

| RumbleON, Inc. / DE (N/A) | 0,00 | 0,0007 | 0,0007 | ||||||

| US126721AC31 / CXP Trust 2022-CXP1 | 0,00 | 0,0000 | 0,0000 | ||||||

| Avison Young Preferred Equity / EP (N/A) | 0,00 | 0,0000 | 0,0000 | ||||||

| Avison Young Common Equity / EC (N/A) | 0,00 | 0,00 | 0,0000 | 0,0000 | |||||

| JPM CMBS Reverse Repo / RA (N/A) | −0,61 | −0,2336 | −0,2336 | ||||||

| JPM CMBS Reverse Repo / RA (N/A) | −1,05 | −0,4021 | −0,4021 | ||||||

| JPM CMBS Reverse Repo / RA (N/A) | −1,97 | −0,7508 | −0,7508 | ||||||

| JPM CMBS Reverse Repo / RA (N/A) | −2,03 | −0,7736 | −0,7736 | ||||||

| JPM CMBS Reverse Repo / RA (N/A) | −2,10 | −0,7984 | −0,7984 | ||||||

| JPM CMBS Reverse Repo / RA (N/A) | −2,23 | −0,8518 | −0,8518 | ||||||

| JPM CMBS Reverse Repo / RA (N/A) | −2,56 | −0,9741 | −0,9741 | ||||||

| JPM CMBS Reverse Repo / RA (N/A) | −2,99 | −1,1406 | −1,1406 | ||||||

| JPM CMBS Reverse Repo / RA (N/A) | −3,00 | −1,1425 | −1,1425 | ||||||

| JPM CMBS Reverse Repo / RA (N/A) | −3,02 | −1,1490 | −1,1490 | ||||||

| JPM CMBS Reverse Repo / RA (N/A) | −3,02 | −1,1502 | −1,1502 | ||||||

| JPM CMBS Reverse Repo / RA (N/A) | −3,16 | −1,2027 | −1,2027 | ||||||

| JPM CMBS Reverse Repo / RA (N/A) | −5,24 | −1,9981 | −1,9981 | ||||||

| JPM CMBS Reverse Repo / RA (N/A) | −6,33 | −2,4139 | −2,4139 |