Grundläggande statistik

| Portföljvärde | $ 328 716 886 |

| Aktuella positioner | 105 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

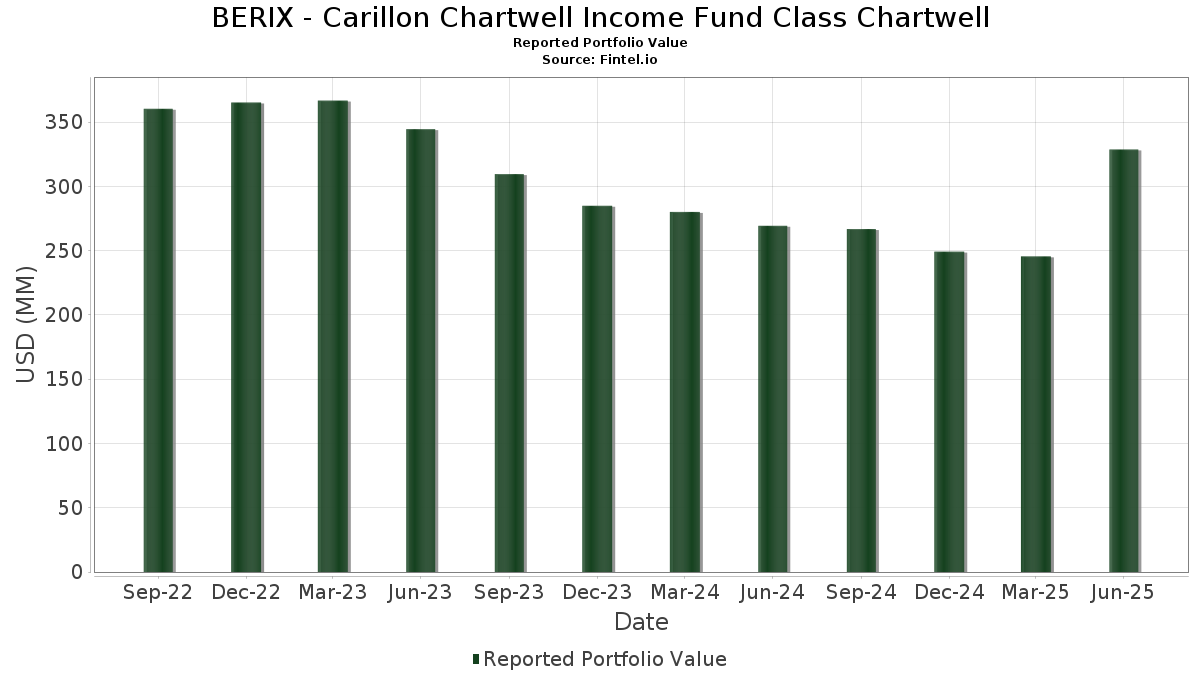

BERIX - Carillon Chartwell Income Fund Class Chartwell har redovisat 105 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 328 716 886 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). BERIX - Carillon Chartwell Income Fund Class Chartwells största innehav är United States Treasury Inflation Indexed Bonds (US:US912810PS15) , United States Treasury Inflation Indexed Bonds (US:US91282CCA71) , United States Treasury Inflation Indexed Bonds (US:US912810FS25) , United States Treasury Inflation Indexed Bonds (US:US912810PV44) , and United States Treasury Inflation Indexed Bonds (US:US91282CEJ62) . BERIX - Carillon Chartwell Income Fund Class Chartwells nya positioner inkluderar United States Treasury Inflation Indexed Bonds (US:US912810PS15) , United States Treasury Inflation Indexed Bonds (US:US91282CCA71) , United States Treasury Inflation Indexed Bonds (US:US912810FS25) , United States Treasury Inflation Indexed Bonds (US:US912810PV44) , and United States Treasury Inflation Indexed Bonds (US:US91282CEJ62) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 4,93 | 1,9519 | 1,9519 | ||

| 4,93 | 1,9519 | 1,9519 | ||

| 4,93 | 1,9519 | 1,9519 | ||

| 8,11 | 8,11 | 3,2094 | 1,5971 | |

| 3,01 | 1,1887 | 1,1887 | ||

| 3,01 | 1,1887 | 1,1887 | ||

| 3,01 | 1,1887 | 1,1887 | ||

| 2,74 | 1,0853 | 1,0853 | ||

| 2,74 | 1,0853 | 1,0853 | ||

| 2,74 | 1,0853 | 1,0853 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 1,44 | 0,5711 | −2,0763 | ||

| 2,58 | 1,0213 | −1,5697 | ||

| 0,00 | 0,00 | −0,9801 | ||

| 5,05 | 1,9967 | −0,7623 | ||

| 0,00 | 0,00 | −0,6210 | ||

| 0,01 | 2,74 | 1,0852 | −0,4403 | |

| 0,07 | 1,29 | 0,5100 | −0,1810 | |

| 0,04 | 2,33 | 0,9228 | −0,1434 | |

| 6,22 | 2,4604 | −0,1350 | ||

| 2,05 | 0,8093 | −0,1279 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-27 för rapporteringsperioden 2025-06-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US912810PS15 / United States Treasury Inflation Indexed Bonds | 11,32 | 0,12 | 4,4784 | −0,1265 | |||||

| US91282CCA71 / United States Treasury Inflation Indexed Bonds | 9,89 | 14,58 | 3,9116 | 0,3969 | |||||

| US912810FS25 / United States Treasury Inflation Indexed Bonds | 9,31 | 0,14 | 3,6825 | −0,1034 | |||||

| US912810PV44 / United States Treasury Inflation Indexed Bonds | 9,30 | 0,62 | 3,6806 | −0,0854 | |||||

| US91282CEJ62 / United States Treasury Inflation Indexed Bonds | 9,18 | 32,96 | 3,6301 | 0,8189 | |||||

| US91282CGW55 / United States Treasury Inflation Indexed Bonds | 9,18 | 0,77 | 3,6293 | −0,0787 | |||||

| US9128285W63 / United States Treasury Inflation Indexed Bonds | 8,94 | 0,99 | 3,5348 | −0,0686 | |||||

| US9128283R96 / United States Treasury Inflation Indexed Bonds | 8,93 | 41,27 | 3,5340 | 0,9585 | |||||

| US912828N712 / United States Treasury Inflation Indexed Bonds | 8,65 | 0,49 | 3,4230 | −0,0838 | |||||

| United States Treasury Inflation Indexed Bonds / DBT (US91282CKL45) | 8,52 | 0,72 | 3,3702 | −0,0748 | |||||

| United States Treasury Inflation Indexed Bonds / DBT (US91282CKL45) | 8,52 | 0,72 | 3,3702 | −0,0748 | |||||

| United States Treasury Inflation Indexed Bonds / DBT (US91282CKL45) | 8,52 | 0,72 | 3,3702 | −0,0748 | |||||

| US91282CBF77 / United States Treasury Inflation Indexed Bonds | 8,28 | 1,31 | 3,2765 | −0,0533 | |||||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 8,11 | 104,93 | 8,11 | 104,93 | 3,2094 | 1,5971 | |||

| US912828V491 / United States Treasury Inflation Indexed Bonds | 7,86 | 0,65 | 3,1088 | −0,0713 | |||||

| US912810FH69 / Usa Treasury Notes 3 7/8% 30yr Notes 04/15/2029 | 7,69 | 0,33 | 3,0421 | −0,0795 | |||||

| US91282CGK18 / U.S. Treasury Inflation Linked Notes | 7,45 | 0,73 | 2,9471 | −0,0651 | |||||

| US912810FD55 / Usa Treasury Bonds 3 5/8% Tii 30yr Bd 4/15/28 | 7,36 | 0,20 | 2,9115 | −0,0801 | |||||

| US912828Z377 / United States Treasury Inflation Indexed Bonds | 6,90 | 1,31 | 2,7298 | −0,0446 | |||||

| SLV / iShares Silver Trust | 0,20 | 14,29 | 6,56 | 21,00 | 2,5957 | 0,3871 | |||

| US912810RA88 / United States Treasury Inflation Indexed Bonds | 6,22 | −2,40 | 2,4604 | −0,1350 | |||||

| US912810QV35 / United States Treasury Inflation Indexed Bonds | 5,05 | −25,49 | 1,9967 | −0,7623 | |||||

| United States Treasury Bill / DBT (US912797RD17) | 4,93 | 1,9519 | 1,9519 | ||||||

| United States Treasury Bill / DBT (US912797RD17) | 4,93 | 1,9519 | 1,9519 | ||||||

| United States Treasury Bill / DBT (US912797RD17) | 4,93 | 1,9519 | 1,9519 | ||||||

| CDE / Coeur Mining, Inc. | 0,42 | −5,56 | 3,77 | 41,33 | 1,4895 | 0,4046 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 3,01 | −0,23 | 1,1918 | −0,0377 | |||||

| United States Treasury Inflation Indexed Bonds / DBT (US91282CJY84) | 3,01 | 1,1887 | 1,1887 | ||||||

| United States Treasury Inflation Indexed Bonds / DBT (US91282CJY84) | 3,01 | 1,1887 | 1,1887 | ||||||

| United States Treasury Inflation Indexed Bonds / DBT (US91282CJY84) | 3,01 | 1,1887 | 1,1887 | ||||||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 2,74 | 1,0853 | 1,0853 | ||||||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 2,74 | 1,0853 | 1,0853 | ||||||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 2,74 | 1,0853 | 1,0853 | ||||||

| GLD / SPDR Gold Trust | 0,01 | −30,77 | 2,74 | −26,76 | 1,0852 | −0,4403 | |||

| TRMLF / Tourmaline Oil Corp. | 0,06 | 10,00 | 2,65 | 10,04 | 1,0496 | 0,0677 | |||

| TEVA / Teva Pharmaceutical Industries Limited - Depositary Receipt (Common Stock) | 0,15 | 0,00 | 2,60 | 9,03 | 1,0276 | 0,0574 | |||

| US912810SB52 / United States Treasury Inflation Indexed Bonds | 2,58 | −59,43 | 1,0213 | −1,5697 | |||||

| GS Mortgage-Backed Securities Trust 2023-PJ5 / ABS-MBS (US36268ABJ60) | 2,41 | 0,00 | 0,9548 | −0,0281 | |||||

| GS Mortgage-Backed Securities Trust 2023-PJ5 / ABS-MBS (US36268ABJ60) | 2,41 | 0,00 | 0,9548 | −0,0281 | |||||

| EQT / EQT Corporation | 0,04 | −18,37 | 2,33 | −10,92 | 0,9228 | −0,1434 | |||

| NTR / Nutrien Ltd. | 0,04 | −13,04 | 2,33 | 1,97 | 0,9215 | −0,0090 | |||

| US30259RAE53 / FMC GMSR Issuer Trust | 2,21 | 0,14 | 0,8754 | −0,0244 | |||||

| CNQ / Canadian Natural Resources Limited | 0,07 | 2,20 | 0,8694 | 0,8694 | |||||

| DGX / Quest Diagnostics Incorporated | 0,01 | 0,00 | 2,19 | 6,15 | 0,8669 | 0,0262 | |||

| US91282CDX65 / United States Treasury Inflation Indexed Bonds | 2,10 | 0,8298 | 0,8298 | ||||||

| AAVVF / Advantage Energy Ltd. | 0,24 | 20,00 | 2,08 | 38,38 | 0,8247 | 0,2112 | |||

| US36270FAD50 / GS MORTAGE BACKED SECURITIES TRUST | 2,05 | −3,97 | 0,8127 | −0,0584 | |||||

| JP Morgan Mortgage Trust 2023-10 / ABS-MBS (US465986AD99) | 2,05 | −11,08 | 0,8093 | −0,1279 | |||||

| JP Morgan Mortgage Trust 2023-10 / ABS-MBS (US465986AD99) | 2,05 | −11,08 | 0,8093 | −0,1279 | |||||

| JP Morgan Mortgage Trust 2023-10 / ABS-MBS (US465986AD99) | 2,05 | −11,08 | 0,8093 | −0,1279 | |||||

| IAG / IAMGOLD Corporation | 0,26 | 0,00 | 1,91 | 17,60 | 0,7559 | 0,0941 | |||

| CTVA / Corteva, Inc. | 0,03 | 1,86 | 0,7370 | 0,7370 | |||||

| JP Morgan Mortgage Trust 2023-10 / ABS-MBS (US465986AW70) | 1,76 | −0,28 | 0,6976 | −0,0227 | |||||

| JP Morgan Mortgage Trust 2023-10 / ABS-MBS (US465986AW70) | 1,76 | −0,28 | 0,6976 | −0,0227 | |||||

| JP Morgan Mortgage Trust 2023-10 / ABS-MBS (US465986AW70) | 1,76 | −0,28 | 0,6976 | −0,0227 | |||||

| SOIL / Saturn Oil & Gas Inc. | 1,70 | 38,39 | 0,6719 | 0,1721 | |||||

| SOIL / Saturn Oil & Gas Inc. | 1,70 | 38,39 | 0,6719 | 0,1721 | |||||

| SOIL / Saturn Oil & Gas Inc. | 1,70 | 38,39 | 0,6719 | 0,1721 | |||||

| UDM / Taseko Mines Limited | 0,52 | 1,62 | 0,6417 | 0,6417 | |||||

| US35910EAA29 / Frontier Issuer LLC | 1,62 | −0,25 | 0,6389 | −0,0206 | |||||

| INTC / Intel Corporation | 0,07 | 1,57 | 0,6202 | 0,6202 | |||||

| OBX 2023-J2 Trust / ABS-MBS (US673920AL89) | 1,52 | −0,13 | 0,6000 | −0,0183 | |||||

| OBX 2023-J2 Trust / ABS-MBS (US673920AL89) | 1,52 | −0,13 | 0,6000 | −0,0183 | |||||

| OBX 2023-J2 Trust / ABS-MBS (US673920AL89) | 1,52 | −0,13 | 0,6000 | −0,0183 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 1,49 | 0,61 | 0,5904 | −0,0139 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 1,49 | 0,61 | 0,5904 | −0,0139 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 1,49 | 0,61 | 0,5904 | −0,0139 | |||||

| KD / Kyndryl Holdings, Inc. | 0,04 | 0,00 | 1,47 | 33,58 | 0,5809 | 0,1334 | |||

| US46657CAG78 / J.P. Morgan Mortgage Trust 2023-8 | 1,47 | −0,14 | 0,5795 | −0,0180 | |||||

| US3132E0JA12 / FEDERAL HOME LOAN MORTGAGE CORP | 1,45 | −3,02 | 0,5726 | −0,0351 | |||||

| US912810RW09 / United States Treasury Inflation Indexed Bonds | 1,44 | −77,80 | 0,5711 | −2,0763 | |||||

| 1LRC / Equinox Gold Corp. | 0,25 | 1,44 | 0,5686 | 0,5686 | |||||

| BIREF / Birchcliff Energy Ltd. | 0,25 | 1,37 | 0,5425 | 0,5425 | |||||

| KeHE Distributors LLC / KeHE Finance Corp / NextWave Distribution Inc / DBT (US487526AC91) | 1,35 | 0,67 | 0,5326 | −0,0120 | |||||

| KeHE Distributors LLC / KeHE Finance Corp / NextWave Distribution Inc / DBT (US487526AC91) | 1,35 | 0,67 | 0,5326 | −0,0120 | |||||

| KeHE Distributors LLC / KeHE Finance Corp / NextWave Distribution Inc / DBT (US487526AC91) | 1,35 | 0,67 | 0,5326 | −0,0120 | |||||

| Rate Mortgage Trust 2024-J4 / ABS-MBS (US75408TAD81) | 1,33 | −3,50 | 0,5244 | −0,0349 | |||||

| Rate Mortgage Trust 2024-J4 / ABS-MBS (US75408TAD81) | 1,33 | −3,50 | 0,5244 | −0,0349 | |||||

| Rate Mortgage Trust 2024-J4 / ABS-MBS (US75408TAD81) | 1,33 | −3,50 | 0,5244 | −0,0349 | |||||

| PNFP / Pinnacle Financial Partners, Inc. | 0,01 | −20,00 | 1,32 | −16,73 | 0,5241 | −0,1237 | |||

| CNHI / CNH Industrial N.V. | 0,10 | 1,30 | 0,5126 | 0,5126 | |||||

| CWH / Camping World Holdings, Inc. | 0,07 | −28,57 | 1,29 | −24,00 | 0,5100 | −0,1810 | |||

| Morgan Stanley Residential Mortgage Loan Trust 2023-4 / ABS-MBS (US61775WAK09) | 1,25 | 0,48 | 0,4955 | −0,0123 | |||||

| Morgan Stanley Residential Mortgage Loan Trust 2023-4 / ABS-MBS (US61775WAK09) | 1,25 | 0,48 | 0,4955 | −0,0123 | |||||

| Morgan Stanley Residential Mortgage Loan Trust 2023-4 / ABS-MBS (US61775WAK09) | 1,25 | 0,48 | 0,4955 | −0,0123 | |||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 1,22 | 2,44 | 0,4811 | −0,0024 | |||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 1,22 | 2,44 | 0,4811 | −0,0024 | |||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 1,22 | 2,44 | 0,4811 | −0,0024 | |||||

| HLF Financing Sarl LLC / Herbalife International Inc / DBT (US40390DAD75) | 1,09 | 1,21 | 0,4304 | −0,0075 | |||||

| HLF Financing Sarl LLC / Herbalife International Inc / DBT (US40390DAD75) | 1,09 | 1,21 | 0,4304 | −0,0075 | |||||

| HLF Financing Sarl LLC / Herbalife International Inc / DBT (US40390DAD75) | 1,09 | 1,21 | 0,4304 | −0,0075 | |||||

| Radian Mortgage Capital Trust LLC 2024-J1 / ABS-MBS (US75023DAF33) | 0,95 | −5,29 | 0,3755 | −0,0329 | |||||

| Radian Mortgage Capital Trust LLC 2024-J1 / ABS-MBS (US75023DAF33) | 0,95 | −5,29 | 0,3755 | −0,0329 | |||||

| Radian Mortgage Capital Trust LLC 2024-J1 / ABS-MBS (US75023DAF33) | 0,95 | −5,29 | 0,3755 | −0,0329 | |||||

| US40390DAC92 / HLF Financing Sarl LLC / Herbalife International Inc | 0,92 | 8,96 | 0,3659 | 0,0204 | |||||

| US816943BF01 / Sequoia Mortgage Trust 2023-3 | 0,90 | −1,64 | 0,3571 | −0,0166 | |||||

| US76971EAA29 / CORP CMO | 0,82 | −5,66 | 0,3234 | −0,0294 | |||||

| US36270XBB91 / GS Mortgage-Backed Securities Trust 2023-PJ4 | 0,76 | −8,37 | 0,2990 | −0,0368 | |||||

| US465989AC55 / J.P. Morgan Mortgage Trust 2023-6 | 0,74 | −8,35 | 0,2909 | −0,0359 | |||||

| US16159PAK57 / Chase Home Lending Mortgage Trust 2023-1 | 0,72 | −0,14 | 0,2862 | −0,0089 | |||||

| US65246QAA76 / NZES_21-GNT1 | 0,70 | −2,65 | 0,2762 | −0,0158 | |||||

| NRZ.PRC / New Residential Investment Corp. 6.375% Series C Fixed-to-Floating Rate Cumulative Redeemable Prefer | 0,02 | 0,00 | 0,56 | −2,43 | 0,2229 | −0,0124 | |||

| US433674AA63 / NRZ Excess Spread-Collateralized Notes Series 2020-PLS1 | 0,38 | −6,88 | 0,1500 | −0,0160 | |||||

| US00253XAA90 / American Airlines Inc/AAdvantage Loyalty IP Ltd | 0,35 | −20,05 | 0,1375 | −0,0394 | |||||

| US62955MAB28 / NRZ Excess Spread-Collateralized Notes | 0,17 | −3,93 | 0,0678 | −0,0050 | |||||

| 1AL / Alamos Gold Inc. | 0,00 | −100,00 | 0,00 | −100,00 | −0,9801 | ||||

| AA / Alcoa Corporation | 0,00 | −100,00 | 0,00 | −100,00 | −0,6210 |