Grundläggande statistik

| Portföljvärde | $ 65 562 955 |

| Aktuella positioner | 94 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

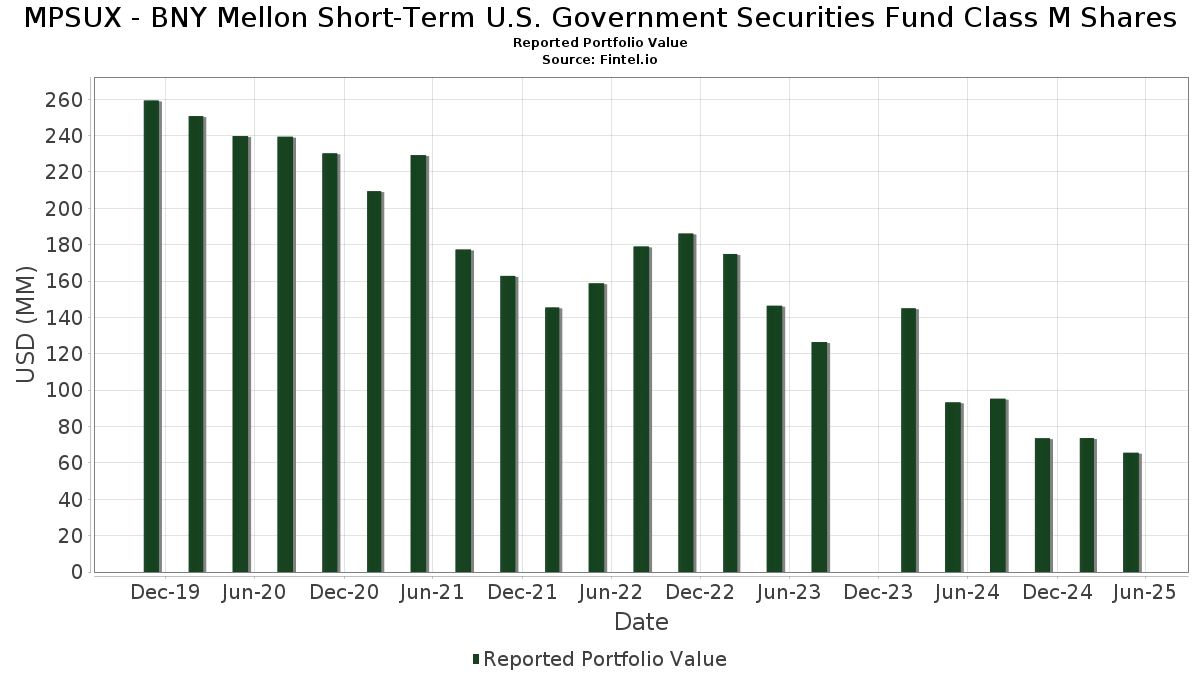

MPSUX - BNY Mellon Short-Term U.S. Government Securities Fund Class M Shares har redovisat 94 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 65 562 955 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). MPSUX - BNY Mellon Short-Term U.S. Government Securities Fund Class M Sharess största innehav är United States Treasury Note/Bond (US:US91282CHK09) , United States Treasury Note/Bond (US:US9128282A70) , GOVERNMENT NATIONAL MORTGAGE ASSOCIATION GNR 2022-53 AE (US:US38381E2Z00) , FRESB 2017-SB41 MORTGAGE TRUST FRESB 2017-SB41 A10F (US:US35803BAG59) , and Freddie Mac Multifamily Structured Pass Through Certificates (US:US3137FKWD40) . MPSUX - BNY Mellon Short-Term U.S. Government Securities Fund Class M Sharess nya positioner inkluderar United States Treasury Note/Bond (US:US91282CHK09) , United States Treasury Note/Bond (US:US9128282A70) , GOVERNMENT NATIONAL MORTGAGE ASSOCIATION GNR 2022-53 AE (US:US38381E2Z00) , FRESB 2017-SB41 MORTGAGE TRUST FRESB 2017-SB41 A10F (US:US35803BAG59) , and Freddie Mac Multifamily Structured Pass Through Certificates (US:US3137FKWD40) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 2,77 | 4,2126 | 4,2126 | ||

| 2,14 | 2,14 | 3,2553 | 3,2553 | |

| 3,25 | 4,9508 | 3,2017 | ||

| 1,99 | 3,0334 | 3,0334 | ||

| 3,26 | 4,9645 | 0,4216 | ||

| 3,27 | 4,9703 | 0,4074 | ||

| 3,24 | 4,9248 | 0,4041 | ||

| 2,43 | 3,6894 | 0,3208 | ||

| 2,23 | 3,3859 | 0,2876 | ||

| 2,13 | 3,2381 | 0,2670 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 2,27 | 3,4559 | −1,4769 | ||

| 2,74 | 4,1711 | −0,6922 | ||

| 0,16 | 0,2393 | −0,5475 | ||

| 0,25 | 0,3779 | −0,1856 | ||

| 0,24 | 0,3614 | −0,1017 | ||

| 0,06 | 0,0864 | −0,0886 | ||

| 0,74 | 1,1270 | −0,0867 | ||

| 0,05 | 0,0790 | −0,0553 | ||

| 0,44 | 0,6710 | −0,0500 | ||

| 0,01 | 0,0185 | −0,0491 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-07-29 för rapporteringsperioden 2025-05-31. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| United States Treasury Note/Bond / DBT (US91282CKE02) | 3,27 | 0,03 | 4,9703 | 0,4074 | |||||

| US91282CHK09 / United States Treasury Note/Bond | 3,26 | 0,34 | 4,9645 | 0,4216 | |||||

| United States Treasury Note/Bond / DBT (US91282CLS88) | 3,25 | 159,90 | 4,9508 | 3,2017 | |||||

| United States Treasury Note/Bond / DBT (US91282CLH24) | 3,24 | 0,03 | 4,9248 | 0,4041 | |||||

| United States Treasury Note/Bond / DBT (US91282CKS97) | 2,77 | 4,2126 | 4,2126 | ||||||

| United States Treasury Note/Bond / DBT (US91282CLG41) | 2,74 | −21,26 | 4,1711 | −0,6922 | |||||

| US9128282A70 / United States Treasury Note/Bond | 2,43 | 0,58 | 3,6894 | 0,3208 | |||||

| US38381E2Z00 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION GNR 2022-53 AE | 2,32 | −1,36 | 3,5256 | 0,2437 | |||||

| United States Treasury Note/Bond / DBT (US91282CKZ31) | 2,27 | −35,68 | 3,4559 | −1,4769 | |||||

| United States Treasury Note/Bond / DBT (US91282CLL36) | 2,23 | 0,32 | 3,3859 | 0,2876 | |||||

| DREYFUS INSTITUTIONAL PREFERRED GOVERNMENT PLUS MONEY MARKET FUND / STIV (000000000) | 2,14 | 2,14 | 3,2553 | 3,2553 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2,13 | 0,05 | 3,2381 | 0,2670 | |||||

| United States Treasury Note/Bond / DBT (US91282CMB45) | 2,01 | 0,25 | 3,0527 | 0,2563 | |||||

| United States Treasury Note/Bond / DBT (US91282CMY48) | 1,99 | 3,0334 | 3,0334 | ||||||

| Government National Mortgage Association / ABS-MBS (US38381HMT58) | 1,70 | −1,84 | 2,5925 | 0,1664 | |||||

| Government National Mortgage Association / ABS-MBS (US38381HCJ86) | 1,63 | −1,09 | 2,4873 | 0,1784 | |||||

| US35803BAG59 / FRESB 2017-SB41 MORTGAGE TRUST FRESB 2017-SB41 A10F | 1,36 | −0,22 | 2,0675 | 0,1639 | |||||

| US3137FKWD40 / Freddie Mac Multifamily Structured Pass Through Certificates | 1,17 | −0,26 | 1,7802 | 0,1408 | |||||

| US38380MT684 / GNMA, Series 2019-34, Class AL | 1,10 | −1,79 | 1,6671 | 0,1095 | |||||

| US38378NFL29 / Government National Mortgage Association | 1,07 | −2,20 | 1,6224 | 0,0995 | |||||

| Government National Mortgage Association / ABS-MBS (US38383YEV02) | 1,05 | −7,81 | 1,5991 | 0,0059 | |||||

| Government National Mortgage Association / ABS-MBS (US38380MLA70) | 1,03 | −1,43 | 1,5728 | 0,1082 | |||||

| US3138LCJ970 / FNMA, Other | 0,99 | 0,30 | 1,5080 | 0,1278 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,98 | −6,69 | 1,4878 | 0,0250 | |||||

| Government National Mortgage Association / ABS-MBS (US38379RC921) | 0,95 | −1,45 | 1,4494 | 0,0990 | |||||

| Government National Mortgage Association / ABS-MBS (US38383RE945) | 0,94 | −7,06 | 1,4226 | 0,0173 | |||||

| Government National Mortgage Association / ABS-MBS (US38380M7A33) | 0,91 | −1,08 | 1,3874 | 0,0993 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,91 | −9,40 | 1,3788 | −0,0185 | |||||

| Government National Mortgage Association / ABS-MBS (US38378BR685) | 0,89 | −2,10 | 1,3489 | 0,0837 | |||||

| US3138ERJB75 / Fannie Mae 3.50 02/01/2031 | 0,81 | −10,19 | 1,2340 | −0,0280 | |||||

| Government National Mortgage Association / ABS-MBS (US38381ETR98) | 0,76 | −0,78 | 1,1570 | 0,0862 | |||||

| Government National Mortgage Association / ABS-MBS (US38383RYL58) | 0,74 | −14,75 | 1,1270 | −0,0867 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,67 | −6,96 | 1,0174 | 0,0142 | |||||

| FRESB 2019-SB67 Mortgage Trust / ABS-MBS (US30314KAT07) | 0,64 | −1,54 | 0,9749 | 0,0666 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,63 | −5,86 | 0,9531 | 0,0242 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,48 | −12,70 | 0,7323 | −0,0379 | |||||

| FRESB 2018-SB51 Mortgage Trust / ABS-MBS (US30296UAA16) | 0,47 | −0,64 | 0,7139 | 0,0544 | |||||

| Government National Mortgage Association / ABS-MBS (US38378B2T59) | 0,46 | −1,52 | 0,6932 | 0,0474 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,45 | −9,66 | 0,6844 | −0,0108 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,44 | −14,53 | 0,6710 | −0,0500 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,40 | −6,09 | 0,6114 | 0,0142 | |||||

| Government National Mortgage Association / ABS-MBS (US38376G2W99) | 0,32 | −3,02 | 0,4892 | 0,0263 | |||||

| US31306XQR79 / Freddie Mac Gold Pool | 0,31 | −15,80 | 0,4713 | −0,0420 | |||||

| FRESB 2019-SB68 Mortgage Trust / ABS-MBS (US30298WAE75) | 0,29 | −6,41 | 0,4448 | 0,0087 | |||||

| Government National Mortgage Association / ABS-MBS (US38379RBN26) | 0,29 | −6,17 | 0,4409 | 0,0102 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,27 | −11,80 | 0,4100 | −0,0171 | |||||

| US20772KNW52 / Connecticut (State of), Series 2021 A, GO Bonds | 0,25 | 1,21 | 0,3803 | 0,0341 | |||||

| US3137BYLC26 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,25 | −38,46 | 0,3779 | −0,1856 | |||||

| Government National Mortgage Association / ABS-MBS (US38378XBR17) | 0,24 | −28,40 | 0,3614 | −0,1017 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,22 | −18,42 | 0,3308 | −0,0420 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,22 | −14,62 | 0,3297 | −0,0244 | |||||

| Government National Mortgage Association / ABS-MBS (US38380MTV36) | 0,22 | −2,26 | 0,3288 | 0,0193 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,19 | −15,42 | 0,2927 | −0,0246 | |||||

| US3132CWBE30 / FHLMC 15YR UMBS SUPER | 0,18 | −17,49 | 0,2810 | −0,0315 | |||||

| Government National Mortgage Association / ABS-MBS (US38375GSL67) | 0,18 | −10,45 | 0,2740 | −0,0072 | |||||

| US3137A4PR26 / Freddie Mac REMICS | 0,17 | −3,33 | 0,2647 | 0,0128 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,16 | −72,11 | 0,2393 | −0,5475 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,15 | −18,99 | 0,2209 | −0,0296 | |||||

| US3140J7TY17 / FNCN UMBS 3.0 BM3266 01-01-28 | 0,11 | −15,79 | 0,1716 | −0,0148 | |||||

| US31306YA921 / Freddie Mac Gold Pool | 0,11 | −12,60 | 0,1695 | −0,0090 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,11 | −23,78 | 0,1670 | −0,0328 | |||||

| US3140X6XS52 / FEDERAL NATIONAL MORTGAGE ASSOCIATION POOL #AA3388 | 0,10 | −27,27 | 0,1582 | −0,0421 | |||||

| US3137BWFV15 / Federal Home Loan Mortgage Corp. Agency REMIC/CMO | 0,10 | −16,26 | 0,1567 | −0,0158 | |||||

| US31418CDF86 / FNMA 10YR 2.5% 11/01/2026#MA2801 | 0,10 | −20,93 | 0,1557 | −0,0255 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,10 | −6,54 | 0,1536 | 0,0041 | |||||

| US38378KXW43 / Government National Mortgage Association | 0,09 | −22,69 | 0,1405 | −0,0268 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,09 | −32,03 | 0,1327 | −0,0462 | |||||

| Government National Mortgage Association / ABS-MBS (US38376TTT96) | 0,08 | −22,64 | 0,1250 | −0,0232 | |||||

| US31306XQS52 / Freddie Mac Gold Pool | 0,08 | −16,49 | 0,1245 | −0,0116 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,08 | −12,09 | 0,1222 | −0,0058 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,07 | −11,25 | 0,1088 | −0,0039 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,07 | −19,05 | 0,1044 | −0,0137 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,06 | −17,81 | 0,0917 | −0,0116 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,06 | −7,94 | 0,0897 | 0,0008 | |||||

| US3137B6XD85 / FREDDIE MAC 2.00%, DUE 12/15/2026 | 0,06 | −10,77 | 0,0894 | −0,0021 | |||||

| US3136AKFG36 / Fannie Mae REMICS | 0,06 | −22,97 | 0,0877 | −0,0168 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,06 | −17,39 | 0,0869 | −0,0107 | |||||

| US38378KAB52 / Government National Mortgage Association | 0,06 | −55,20 | 0,0864 | −0,0886 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,05 | −35,80 | 0,0793 | −0,0341 | |||||

| US3137A6QZ80 / FHLMC, REMIC, Series 3816, Class HA | 0,05 | −46,87 | 0,0790 | −0,0553 | |||||

| US3138ETZM13 / UMBS | 0,04 | −24,07 | 0,0637 | −0,0126 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,03 | −31,71 | 0,0436 | −0,0149 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,03 | −38,64 | 0,0420 | −0,0200 | |||||

| US31417BRN90 / Fannie Mae Pool | 0,02 | −15,38 | 0,0343 | −0,0034 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,02 | −26,92 | 0,0299 | −0,0068 | |||||

| US38379VRN63 / GOVERNMENT NATIONAL MORTGAGE A GNR 2016 23 KA | 0,02 | −17,39 | 0,0298 | −0,0023 | |||||

| Ginnie Mae II Pool / ABS-MBS (US36202FQ336) | 0,01 | −36,36 | 0,0225 | −0,0084 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,01 | −50,00 | 0,0222 | −0,0180 | |||||

| US3138L92Q47 / Federal National Mortgage Association Agency REMIC/CMO | 0,01 | −75,00 | 0,0185 | −0,0491 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,01 | −52,17 | 0,0171 | −0,0155 | |||||

| Ginnie Mae I Pool / ABS-MBS (US3622A2A932) | 0,01 | −20,00 | 0,0126 | −0,0024 | |||||

| US38379RYK30 / Government National Mortgage Association | 0,01 | −78,79 | 0,0110 | −0,0353 | |||||

| US3140J7XL40 / Fannie Mae Pool | 0,00 | −50,00 | 0,0028 | −0,0008 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,00 | 0,0000 | −0,0000 |