Grundläggande statistik

| Portföljvärde | $ 1 126 159 487 |

| Aktuella positioner | 1 999 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

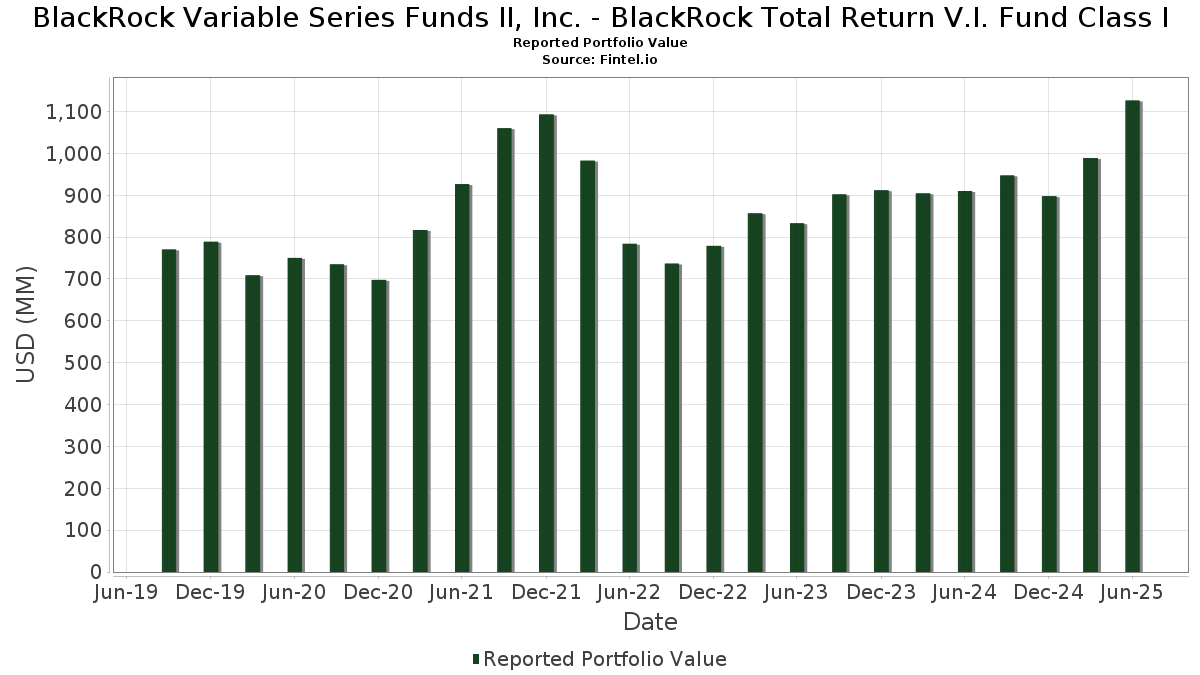

BlackRock Variable Series Funds II, Inc. - BlackRock Total Return V.I. Fund Class I har redovisat 1 999 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 1 126 159 487 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). BlackRock Variable Series Funds II, Inc. - BlackRock Total Return V.I. Fund Class Is största innehav är Series A Portfolio (US:US0924807060) , Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , BlackRock Liquidity Funds: T-Fund, Institutional Shares (US:US09248U7182) , and Edwards Lifesciences Corporation (US:EW) . BlackRock Variable Series Funds II, Inc. - BlackRock Total Return V.I. Fund Class Is nya positioner inkluderar Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , Edwards Lifesciences Corporation (US:EW) , Edwards Lifesciences Corporation (US:EW) , and European Union (XX:EU000A3K4DY4) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 87,97 | 9,8477 | 12,1037 | ||

| 71,74 | 8,0307 | 8,0973 | ||

| 12,07 | 1,3509 | 1,6154 | ||

| −17,50 | −1,9587 | 1,2983 | ||

| 12,07 | 1,3509 | 1,1259 | ||

| 22,51 | 22,51 | 2,5196 | 0,8613 | |

| 7,68 | 0,8599 | 0,8599 | ||

| 6,73 | 0,7537 | 0,7537 | ||

| 6,37 | 0,7132 | 0,7132 | ||

| 5,67 | 0,6352 | 0,6403 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| −3,58 | −0,4004 | −10,2482 | ||

| −20,46 | −2,2909 | −3,6418 | ||

| 2,02 | 0,2260 | −1,1248 | ||

| 1,12 | 0,1259 | −0,6629 | ||

| −0,05 | −0,0050 | −0,6600 | ||

| 3,36 | 0,3761 | −0,5694 | ||

| 0,31 | 0,0347 | −0,3611 | ||

| 0,28 | 0,0312 | −0,3511 | ||

| 2,08 | 0,2330 | −0,3309 | ||

| −0,98 | −0,1100 | −0,2953 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-28 för rapporteringsperioden 2025-06-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US0924807060 / Series A Portfolio | 14,41 | 0,00 | 137,60 | 0,31 | 15,4037 | −0,0760 | |||

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 87,97 | −550,27 | 9,8477 | 12,1037 | |||||

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | 71,74 | −12 532,93 | 8,0307 | 8,0973 | |||||

| US09248U7182 / BlackRock Liquidity Funds: T-Fund, Institutional Shares | 22,51 | 53,17 | 22,51 | 53,17 | 2,5196 | 0,8613 | |||

| EW / Edwards Lifesciences Corporation | 12,07 | 500,35 | 1,3509 | 1,1259 | |||||

| EW / Edwards Lifesciences Corporation | 12,07 | −626,94 | 1,3509 | 1,6154 | |||||

| U.S. Treasury Notes / DBT (US91282CMK44) | 8,91 | 0,60 | 0,9976 | −0,0021 | |||||

| U.S. Treasury Notes / DBT (US91282CLR06) | 8,83 | 0,70 | 0,9884 | −0,0012 | |||||

| U.S. Treasury Bonds / DBT (US912810UK24) | 7,68 | 0,8599 | 0,8599 | ||||||

| U.S. Treasury Notes / DBT (US91282CNC19) | 6,73 | 0,7537 | 0,7537 | ||||||

| EU000A3K4DY4 / European Union | 6,45 | 9,90 | 0,7217 | 0,0596 | |||||

| Buoni Poliennali del Tesoro / DBT (IT0005631590) | 6,37 | 0,7132 | 0,7132 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 6,11 | −5,31 | 0,6841 | −0,0442 | |||||

| US91282CFZ95 / TREASURY NOTE | 6,08 | 0,43 | 0,6807 | −0,0026 | |||||

| US21H0526788 / Ginnie Mae | 5,67 | −12 708,89 | 0,6352 | 0,6403 | |||||

| US21H0506723 / Ginnie Mae | 5,07 | 38,86 | 0,5678 | 0,1460 | |||||

| US55903VBA08 / Warnermedia Holdings Inc | 4,88 | 28,92 | 0,5465 | 0,1192 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 4,76 | 619,18 | 0,5331 | 0,4583 | |||||

| US3140XGWN54 / FN FS1552 | 4,73 | −2,35 | 0,5299 | −0,0171 | |||||

| US31418ES506 / Fannie Mae Pool | 4,47 | −2,91 | 0,5003 | −0,0193 | |||||

| US21H0206753 / GINNIE MAE II POOL 30YR TBA (JULY) | 4,44 | −5 089,89 | 0,4972 | 0,5076 | |||||

| US91282CGR60 / United States Treasury Note/Bond | 4,41 | −0,16 | 0,4938 | −0,0048 | |||||

| US91282CAH43 / United States Treasury Note/Bond | 4,27 | 1,21 | 0,4783 | 0,0019 | |||||

| US01F0206791 / UMBS, 30 Year, Single Family | 4,20 | −1 213,79 | 0,4701 | 0,5137 | |||||

| US91282CGJ45 / United States Treasury Note/Bond | 4,18 | 0,82 | 0,4678 | 0,0001 | |||||

| US3140XBNR72 / Fannie Mae Pool | 4,13 | −2,18 | 0,4623 | −0,0142 | |||||

| US91282CCP41 / United States Treasury Note/Bond - When Issued | 4,05 | 0,82 | 0,4530 | 0,0001 | |||||

| US91282CGP05 / United States Treasury Note/Bond | 4,02 | 0,4502 | 0,4502 | ||||||

| US91282CCE93 / United States Treasury Note/Bond | 4,02 | 1,18 | 0,4500 | 0,0017 | |||||

| US91282CJP77 / United States Treasury Note/Bond | 4,01 | 0,05 | 0,4492 | −0,0034 | |||||

| US91282CJG78 / U.S. Treasury Notes | 4,00 | 0,63 | 0,4478 | −0,0008 | |||||

| EQT / EQT Corporation | 3,86 | 0,4321 | 0,4321 | ||||||

| US91282CCY57 / UNITED STATES TREASURY NOTE 1.25000000 | 3,86 | 1,26 | 0,4318 | 0,0019 | |||||

| US91282CHX20 / United States Treasury Note/Bond | 3,78 | 0,4233 | 0,4233 | ||||||

| U.S. Treasury Notes / DBT (US91282CKW00) | 3,74 | 0,4182 | 0,4182 | ||||||

| US912810TV08 / US TREASURY N/B 4.75% 11-15-53 | 3,73 | −3,07 | 0,4177 | −0,0166 | |||||

| US25278XAM11 / Diamondback Energy Inc. | 3,72 | 0,49 | 0,4166 | −0,0013 | |||||

| US21H0606713 / Ginnie Mae | 3,71 | −9 156,10 | 0,4157 | 0,4205 | |||||

| US91282CHM64 / U.S. Treasury Notes | 3,70 | −0,11 | 0,4139 | −0,0038 | |||||

| US91282CHF14 / United States Treasury Note/Bond | 3,52 | 0,83 | 0,3939 | 0,0001 | |||||

| US21H0426799 / Ginnie Mae | 3,51 | −11 075,00 | 0,3932 | 0,3968 | |||||

| US91282CJR34 / United States Treasury Note/Bond - When Issued | 3,49 | 0,69 | 0,3911 | −0,0005 | |||||

| US01F0306781 / UMBS TBA | 3,39 | −23,64 | 0,3791 | −0,1330 | |||||

| US3132DWBP77 / UMBS | 3,36 | −59,91 | 0,3761 | −0,5694 | |||||

| US3140XFK675 / Uniform Mortgage-Backed Securities | 3,26 | −2,92 | 0,3646 | −0,0140 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 3,20 | 148,87 | 0,3581 | 0,2130 | |||||

| US3132DVMD46 / Freddie Mac Pool | 3,20 | −2,74 | 0,3577 | −0,0130 | |||||

| US9128282R06 / United States Treasury Note/Bond | 3,13 | 0,74 | 0,3505 | −0,0003 | |||||

| US3132DWA522 / UMBS Freddie Mac Pool | 3,08 | −1,88 | 0,3451 | −0,0095 | |||||

| US912810RZ30 / United States Treas Bds Bond | 3,02 | −2,52 | 0,3376 | −0,0115 | |||||

| EQT / EQT Corporation | 3,01 | 0,3365 | 0,3365 | ||||||

| U.S. Treasury Notes / DBT (US91282CMC28) | 3,00 | 0,3355 | 0,3355 | ||||||

| US912810RK60 / United States Treas Bds Bond | 2,99 | −2,36 | 0,3342 | −0,0108 | |||||

| US912810TQ13 / United States Treasury Note/Bond | 2,95 | −2,22 | 0,3308 | −0,0102 | |||||

| U.S. Treasury Notes / DBT (US91282CLM19) | 2,95 | 0,3307 | 0,3307 | ||||||

| US91282CEM91 / United States Treasury Note/Bond - When Issued | 2,88 | 0,91 | 0,3224 | 0,0003 | |||||

| US21H0226710 / GNII II 2.5% 07/01/2050 #TBA | 2,83 | −22,58 | 0,3170 | −0,1054 | |||||

| US912810TJ79 / United States Treasury Note/Bond | 2,82 | −3,06 | 0,3159 | −0,0126 | |||||

| US912810TN81 / United States Treasury Note/Bond | 2,67 | −3,05 | 0,2990 | −0,0120 | |||||

| U.S. Treasury Notes / DBT (US91282CJZ59) | 2,62 | 0,31 | 0,2932 | −0,0014 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,59 | −4,71 | 0,2896 | −0,0168 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,58 | −2,05 | 0,2888 | −0,0085 | |||||

| US25278XAN93 / Diamondback Energy Inc | 2,58 | 1,14 | 0,2883 | 0,0009 | |||||

| US91282CFU09 / United States Treasury Note/Bond - When Issued | 2,56 | 0,35 | 0,2860 | −0,0013 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2,53 | 0,2832 | 0,2832 | ||||||

| US31418DV742 / Fannie Mae Pool | 2,46 | −2,34 | 0,2759 | −0,0089 | |||||

| US21H0306744 / Ginnie Mae | 2,41 | −3 867,19 | 0,2700 | 0,2774 | |||||

| EXEEZ / Expand Energy Corporation - Equity Warrant | 2,38 | 34,86 | 0,2664 | 0,0673 | |||||

| US92763MAA36 / Viper Energy Partners LP 5.375% 11/01/2027 144A | 2,32 | 1,62 | 0,2599 | 0,0021 | |||||

| US912810SJ88 / United States Treas Bds Bond | 2,28 | −2,77 | 0,2552 | −0,0094 | |||||

| US91282CEV90 / United States Treasury Note/Bond | 2,27 | 0,85 | 0,2538 | 0,0001 | |||||

| US3132DVMB89 / FNCL UMBS 2.5 SD7554 04-01-52 | 2,26 | −2,80 | 0,2528 | −0,0094 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 2,23 | −27,20 | 0,2499 | −0,0961 | |||||

| US912810TR95 / United States Treasury Note/Bond | 2,22 | −3,18 | 0,2489 | −0,0102 | |||||

| US03674XAS53 / ANTERO RESOURCES CORP 5.375% 03/01/2030 144A | 2,21 | 32,99 | 0,2473 | 0,0598 | |||||

| US912828ZS21 / UST NOTES 0.5% 05/31/2027 | 2,20 | 1,15 | 0,2464 | 0,0008 | |||||

| U.S. Treasury Bonds / DBT (US912810UD80) | 2,19 | −2,23 | 0,2450 | −0,0076 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 2,18 | 2,73 | 0,2442 | 0,0045 | |||||

| US01F0626717 / Uniform Mortgage-Backed Security, TBA | 2,15 | −200,00 | 0,2412 | 0,4824 | |||||

| LNG / Cheniere Energy, Inc. | 2,15 | 27,58 | 0,2409 | 0,0506 | |||||

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 2,15 | 0,2409 | 0,2409 | ||||||

| US26884LAN91 / EQT CORP 3.625% 05/15/2031 144A | 2,15 | 4,17 | 0,2405 | 0,0078 | |||||

| U.S. Treasury Notes / DBT (US91282CKE02) | 2,11 | 0,14 | 0,2363 | −0,0016 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 2,11 | −30,45 | 0,2358 | −0,1060 | |||||

| U.S. Treasury Notes / DBT (US91282CJT99) | 2,10 | 0,10 | 0,2351 | −0,0016 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 2,08 | −58,35 | 0,2330 | −0,3309 | |||||

| US912810SF66 / Us Treasury Bond | 2,07 | −2,54 | 0,2318 | −0,0080 | |||||

| S1YF34 / Synchrony Financial - Depositary Receipt (Common Stock) | 2,06 | 48,52 | 0,2303 | 0,0739 | |||||

| US925650AC72 / VICI Properties LP | 2,03 | 20,08 | 0,2277 | 0,0366 | |||||

| EW / Edwards Lifesciences Corporation | 2,02 | −83,27 | 0,2260 | −1,1248 | |||||

| EW / Edwards Lifesciences Corporation | 2,01 | −0,45 | 0,2250 | −0,0010 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1,98 | 0,2214 | 0,2214 | ||||||

| US054989AD07 / BAT CAPITAL CORP 7.081000% 08/02/2053 | 1,98 | −1,69 | 0,2212 | −0,0055 | |||||

| US91087BAV27 / United Mexican States | 1,96 | −7,54 | 0,2198 | −0,0198 | |||||

| BE0000358672 / BELGIUM KINGDOM EUR 144A LIFE/REG S 3.3% 06-22-54 | 1,89 | 9,42 | 0,2119 | 0,0167 | |||||

| US92763MAB19 / Viper Energy Partners LP | 1,89 | 63,92 | 0,2117 | 0,0815 | |||||

| US91282CEE75 / United States Treasury Note/Bond | 1,89 | 1,02 | 0,2116 | 0,0005 | |||||

| US21H0626778 / Ginnie Mae | 1,89 | −10,06 | 0,2112 | −0,0310 | |||||

| US912810RD28 / United States Treas Bds Bond | 1,86 | −2,15 | 0,2086 | −0,0063 | |||||

| US36179V4U15 / Ginnie Mae II Pool | 1,85 | −2,68 | 0,2077 | −0,0074 | |||||

| US3132DVMA07 / FNCL UMBS 3.0 SD7553 03-01-52 | 1,85 | −2,47 | 0,2075 | −0,0069 | |||||

| US25278XAR08 / Diamondback Energy Inc | 1,85 | 1,20 | 0,2069 | 0,0008 | |||||

| US912810RC45 / United States Treas Bds Bond | 1,84 | −2,13 | 0,2054 | −0,0062 | |||||

| US91282CCV19 / UNITED STATES TREASURY NOTE 1.12500000 | 1,83 | 1,27 | 0,2048 | 0,0009 | |||||

| US3133KLUA33 / Freddie Mac Pool | 1,81 | −2,33 | 0,2021 | −0,0066 | |||||

| US912810SH23 / United States Treas Bds Bond | 1,79 | −2,61 | 0,2002 | −0,0070 | |||||

| US36179WLQ95 / Ginnie Mae II Pool | 1,74 | −2,79 | 0,1948 | −0,0072 | |||||

| Towd Point Mortgage Trust, Series 2025-CRM1, Class A1 / ABS-MBS (US891946AA31) | 1,69 | −4,90 | 0,1889 | −0,0113 | |||||

| US3132DVL604 / Freddie Mac Pool | 1,68 | −2,15 | 0,1882 | −0,0057 | |||||

| US785592AX43 / Sabine Pass Liquefaction LLC | 1,68 | 124,17 | 0,1880 | 0,1033 | |||||

| US31418EAA82 / Fannie Mae Pool | 1,67 | −2,97 | 0,1867 | −0,0074 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,66 | −8,04 | 0,1858 | −0,0178 | |||||

| FIGRE Trust, Series 2025-HE1, Class A / ABS-O (US30191LAA70) | 1,64 | −3,98 | 0,1838 | −0,0091 | |||||

| Vistra Operations Co. LLC / DBT (US92840VAU61) | 1,64 | 19,64 | 0,1835 | 0,0288 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1,63 | 0,1829 | 0,1829 | ||||||

| US26884LAL36 / EQT Corporation | 1,62 | 0,19 | 0,1818 | −0,0011 | |||||

| US3132DVL521 / UMBS | 1,62 | −2,59 | 0,1812 | −0,0063 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 1,60 | 17,20 | 0,1793 | 0,0250 | |||||

| US16411QAK76 / CORP. NOTE | 1,60 | 1,46 | 0,1793 | 0,0012 | |||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 1,58 | 8,99 | 0,1765 | 0,0133 | |||||

| US91282CAL54 / United States Treasury Note/Bond | 1,55 | 1,24 | 0,1739 | 0,0007 | |||||

| US912810SX72 / UNITED STATES TREASURY BOND 2.375% 05/15/2051 | 1,55 | −3,06 | 0,1736 | −0,0069 | |||||

| US366651AC11 / Gartner Inc | 1,55 | −45,30 | 0,1733 | −0,1460 | |||||

| FCT / Fincantieri S.p.A. | 1,54 | 1,72 | 0,1719 | 0,0015 | |||||

| US3140QMZQ00 / Uniform Mortgage-Backed Securities | 1,52 | −2,70 | 0,1698 | −0,0061 | |||||

| US629377CT71 / NRG Energy Inc | 1,51 | −4,44 | 0,1686 | −0,0093 | |||||

| BAHA Trust, Series 2024-MAR, Class A / ABS-MBS (US05493XAA81) | 1,49 | 18,54 | 0,1669 | 0,0250 | |||||

| Vistra Operations Co. LLC / DBT (US92840VAS16) | 1,48 | −0,27 | 0,1655 | −0,0018 | |||||

| US172967NN71 / C 3.785 03/17/33 | 1,46 | 22,86 | 0,1638 | 0,0295 | |||||

| S1YF34 / Synchrony Financial - Depositary Receipt (Common Stock) | 1,46 | 8,54 | 0,1636 | 0,0117 | |||||

| US36179XND48 / Ginnie Mae II Pool | 1,42 | −2,07 | 0,1591 | −0,0046 | |||||

| EQT / EQT Corporation | 1,42 | 98,32 | 0,1586 | 0,0779 | |||||

| US87264ABF12 / CORP. NOTE | 1,41 | 287,40 | 0,1583 | 0,1171 | |||||

| US91282CBS98 / United States Treasury Note/Bond | 1,39 | 1,09 | 0,1557 | 0,0005 | |||||

| VEGAS, Series 2024-GCS, Class D / ABS-MBS (US92254BAC90) | 1,37 | 0,88 | 0,1532 | 0,0002 | |||||

| US61747YFE05 / Morgan Stanley | 1,37 | 169,96 | 0,1529 | 0,0891 | |||||

| VICI / VICI Properties Inc. | 1,35 | 646,41 | 0,1513 | 0,1308 | |||||

| US06051GKK49 / Bank of America Corp | 1,35 | 21,22 | 0,1510 | 0,0254 | |||||

| US912810RH32 / United States Treas Bds Bond | 1,33 | −2,29 | 0,1484 | −0,0046 | |||||

| US17308CC539 / Citigroup Inc | 1,33 | 665,90 | 0,1484 | 0,1283 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 1,31 | 0,1469 | 0,1469 | ||||||

| GoldenTree Loan Management US CLO 23 Ltd., Series 2024-23A, Class B / ABS-CBDO (US38139KAG40) | 1,31 | 0,54 | 0,1469 | −0,0005 | |||||

| US366651AE76 / Gartner Inc | 1,31 | 0,1463 | 0,1463 | ||||||

| COL17CT03748 / Colombian TES | 1,30 | 0,1456 | 0,1456 | ||||||

| US912810RX81 / United States Treas Bds Bond | 1,29 | −2,49 | 0,1449 | −0,0050 | |||||

| US01F0424758 / Fannie Mae or Freddie Mac | 1,29 | −8 720,00 | 0,1448 | 0,1466 | |||||

| US912810SA79 / United States Treas Bds Bond | 1,29 | −2,57 | 0,1444 | −0,0049 | |||||

| EQT / EQT Corporation | 1,27 | 0,1423 | 0,1423 | ||||||

| U.S. Treasury Bonds / DBT (US912810UF39) | 1,27 | −2,24 | 0,1418 | −0,0044 | |||||

| US13063DGE22 / California (State of), Series 2018, Ref. GO Bonds | 1,24 | 4,31 | 0,1383 | 0,0046 | |||||

| US38141GZU11 / Goldman Sachs Group Inc/The | 1,23 | 149,19 | 0,1379 | 0,0790 | |||||

| US3140QST681 / Uniform Mortgage-Backed Securities | 1,23 | −3,09 | 0,1372 | −0,0055 | |||||

| US912810SC36 / United States Treas Bds Bond | 1,21 | −2,57 | 0,1359 | −0,0047 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 1,21 | 0,1354 | 0,1354 | ||||||

| US36179W5B07 / Government National Mortgage Association | 1,20 | −2,82 | 0,1348 | −0,0051 | |||||

| US3132DNAY94 / Federal Home Loan Mortgage Corp. | 1,20 | −2,20 | 0,1347 | −0,0042 | |||||

| US31418ECG35 / FNCT UMBS 2.0 MA4570 03-01-42 | 1,19 | −1,16 | 0,1335 | −0,0027 | |||||

| US36179VSF84 / Ginnie Mae II Pool | 1,18 | −2,73 | 0,1316 | −0,0047 | |||||

| US36179WDR60 / Ginnie Mae II Pool | 1,17 | −2,82 | 0,1314 | −0,0049 | |||||

| US912828X885 / United States Treasury Note/Bond | 1,17 | 0,69 | 0,1305 | −0,0002 | |||||

| US92564RAK14 / VICI PROPERTIES LP/VICI NOTE CO | 1,16 | −31,44 | 0,1300 | −0,0610 | |||||

| US3140XKEQ99 / Fannie Mae Pool | 1,15 | −0,86 | 0,1285 | −0,0022 | |||||

| US38141GYN86 / Goldman Sachs Group Inc/The | 1,15 | −49,09 | 0,1283 | −0,1258 | |||||

| US29444UBU97 / 3.9% 15 Apr 2032 | 1,14 | 378,66 | 0,1281 | 0,1010 | |||||

| US337932AH00 / FirstEnergy Corp | 1,14 | 0,62 | 0,1277 | −0,0003 | |||||

| FirstEnergy Transmission LLC / DBT (US33767BAH24) | 1,13 | 37,23 | 0,1264 | 0,0335 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1,12 | −83,55 | 0,1259 | −0,6629 | |||||

| BX Trust, Series 2025-VLT6, Class A / ABS-MBS (US12433KAA51) | 1,12 | −14,99 | 0,1257 | −0,0234 | |||||

| US912828U246 / United States Treasury Note/Bond | 1,12 | 0,54 | 0,1250 | −0,0003 | |||||

| US161175CA05 / Charter Communications Operating LLC / Charter Communications Operating Capital | 1,10 | 90,14 | 0,1231 | 0,0578 | |||||

| US37045XEF96 / General Motors Financial Co Inc | 1,09 | 0,00 | 0,1220 | −0,0009 | |||||

| US21H0326882 / Ginnie Mae | 1,09 | −60,78 | 0,1218 | −0,2318 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 1,07 | 254,82 | 0,1196 | 0,0857 | |||||

| US3140QLZ824 / Fannie Mae Pool | 1,07 | −2,29 | 0,1196 | −0,0038 | |||||

| US912810ST60 / TREASURY BOND | 1,06 | −2,03 | 0,1191 | −0,0034 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1,06 | 0,1189 | 0,1189 | ||||||

| US16412XAL91 / Cheniere Corpus Christi Holdings LLC | 1,05 | 9,47 | 0,1178 | 0,0093 | |||||

| BRSTNCNTF1Q6 / Brazil Notas do Tesouro Nacional Serie F | 1,05 | 10,56 | 0,1172 | 0,0103 | |||||

| US30303M8K14 / Meta Platforms Inc | 1,04 | 13,85 | 0,1169 | 0,0134 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 1,04 | 38,38 | 0,1167 | 0,0316 | |||||

| US785592AV86 / Sabine Pass Liquefaction LLC | 1,04 | −21,30 | 0,1163 | −0,0326 | |||||

| US912810SR05 / United States Treasury Note/Bond - When Issued | 1,04 | −1,70 | 0,1162 | −0,0030 | |||||

| US912810SQ22 / United States Treasury Note/Bond | 1,03 | −1,82 | 0,1150 | −0,0031 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 1,03 | 0,1148 | 0,1148 | ||||||

| CDI / DCR (N/A) | 1,02 | 0,1146 | 0,1146 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1,02 | 240,00 | 0,1143 | 0,0784 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,02 | −9,44 | 0,1139 | −0,0129 | |||||

| US912810TB44 / T 1 7/8 11/15/51 | 1,02 | −3,33 | 0,1137 | −0,0048 | |||||

| US845467AT68 / Southwestern Energy Co | 1,02 | 2,84 | 0,1136 | 0,0022 | |||||

| Benefit Street Partners CLO XXXVII Ltd., Series 2024-37A, Class A / ABS-CBDO (US08182TAA79) | 1,00 | 0,50 | 0,1123 | −0,0003 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1,00 | 0,1122 | 0,1122 | ||||||

| US91087BAM28 / Mexico Government International Bond | 1,00 | 2,56 | 0,1121 | 0,0019 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 1,00 | −68,50 | 0,1119 | −0,2460 | |||||

| Cross Mortgage Trust, Series 2025-H1, Class A1 / ABS-MBS (US22758NAA54) | 1,00 | −3,30 | 0,1117 | −0,0048 | |||||

| US26884LAM19 / EQT CORP 3.125% 05/15/2026 144A | 0,99 | 0,20 | 0,1106 | −0,0006 | |||||

| US21H0406817 / Ginnie Mae | 0,98 | 0,1100 | 0,1100 | ||||||

| US61747YFA82 / Morgan Stanley | 0,98 | 0,1099 | 0,1099 | ||||||

| US361841AR08 / GLP Capital LP / GLP Financing II Inc | 0,98 | −22,23 | 0,1094 | −0,0324 | |||||

| US00206RLV23 / AT&T Inc | 0,98 | 6,90 | 0,1094 | 0,0063 | |||||

| US46647PCJ30 / JPMORGAN CHASE and CO 2.069/VAR 06/01/2029 | 0,97 | 640,46 | 0,1087 | 0,0938 | |||||

| US06051GHD43 / Bank of America Corp | 0,97 | 1 155,84 | 0,1083 | 0,0997 | |||||

| US337932AM94 / FIRSTENERGY CORP 3.4% 03/01/2050 | 0,97 | 38,25 | 0,1081 | 0,0293 | |||||

| US3133KNCZ42 / FREDDIE MAC POOL UMBS P#RA6388 2.50000000 | 0,96 | −2,63 | 0,1080 | −0,0038 | |||||

| US87165BAU70 / Synchrony Financial | 0,96 | −45,84 | 0,1079 | −0,0929 | |||||

| US3132DVL943 / Uniform Mortgage-Backed Securities | 0,96 | −2,45 | 0,1070 | −0,0036 | |||||

| US91087BAR15 / Mexican Government International Bond | 0,95 | 2,82 | 0,1061 | 0,0021 | |||||

| US69331CAJ71 / PG&E Corp | 0,95 | −38,45 | 0,1060 | −0,0676 | |||||

| US226373AT56 / Crestwood Midstream Partners LP | 0,94 | −0,11 | 0,1055 | −0,0011 | |||||

| US912810QW18 / United States Treas Bds Bond | 0,94 | −1,88 | 0,1051 | −0,0030 | |||||

| EQT / EQT Corporation | 0,93 | 0,1037 | 0,1037 | ||||||

| SoFi Consumer Loan Program Trust, Series 2025-1, Class A / ABS-O (US83406YAA91) | 0,92 | −27,66 | 0,1034 | −0,0407 | |||||

| US912810SZ21 / United States Treasury Note/Bond | 0,92 | −3,15 | 0,1033 | −0,0043 | |||||

| US133434AC43 / Cameron LNG LLC | 0,92 | 1,43 | 0,1029 | 0,0006 | |||||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 0,92 | 0,1029 | 0,1029 | ||||||

| US761713BB19 / Reynolds American Inc | 0,92 | 20,82 | 0,1027 | 0,0170 | |||||

| US91087BAG59 / Mexico Government International Bond | 0,91 | 1,22 | 0,1024 | 0,0005 | |||||

| AT&T Reign II Multi-Property Lease-Backed Pass-Through Trust / DBT (US046912AA99) | 0,91 | −1,83 | 0,1019 | −0,0027 | |||||

| Velocity Commercial Capital Loan Trust, Series 2025-1, Class M1 / ABS-MBS (US922955AD13) | 0,91 | 0,89 | 0,1018 | 0,0001 | |||||

| Northwind Midstream, 1st Lien Term Loan / LON (N/A) | 0,90 | 0,1012 | 0,1012 | ||||||

| US06051GKW86 / Bank of America Corp. | 0,90 | 0,1002 | 0,1002 | ||||||

| US912810TF57 / TREASURY BOND | 0,89 | −1,98 | 0,0998 | −0,0028 | |||||

| Petroleos Mexicanos / DBT (XS2966423472) | 0,89 | −1,11 | 0,0998 | −0,0020 | |||||

| US3140QLN440 / Fannie Mae Pool | 0,89 | −1,99 | 0,0994 | −0,0029 | |||||

| US452151LF83 / ILLINOIS ST | 0,89 | −6,73 | 0,0994 | −0,0081 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0,89 | −44,42 | 0,0993 | −0,0808 | |||||

| US124857AR43 / ViacomCBS Inc | 0,88 | 1 893,18 | 0,0983 | 0,0933 | |||||

| US694308KH99 / Pacific Gas and Electric Co | 0,87 | 47,14 | 0,0979 | 0,0308 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,87 | −7,42 | 0,0978 | −0,0086 | |||||

| EQT Trust, Series 2024-EXTR, Class A / ABS-MBS (US29439DAA90) | 0,87 | 1,64 | 0,0970 | 0,0008 | |||||

| T1OW34 / American Tower Corporation - Depositary Receipt (Common Stock) | 0,87 | 1,41 | 0,0969 | 0,0006 | |||||

| US87612GAE17 / Targa Resources Corp | 0,86 | 457,42 | 0,0968 | 0,0782 | |||||

| CIFC Funding Ltd., Series 2018-1A, Class BR / ABS-CBDO (US17181NAG97) | 0,86 | 0,23 | 0,0964 | −0,0006 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 0,86 | −15,35 | 0,0963 | −0,0184 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,86 | 0,0963 | 0,0963 | ||||||

| US912810SW99 / United States Treasury Note/Bond | 0,86 | −1,94 | 0,0962 | −0,0027 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0,86 | 0,0961 | 0,0961 | ||||||

| US925650AD55 / VICI Properties LP | 0,86 | −49,88 | 0,0959 | −0,0969 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0,85 | 232,30 | 0,0957 | 0,0660 | |||||

| US36179W7J15 / Ginnie Mae II Pool | 0,85 | −3,19 | 0,0953 | −0,0039 | |||||

| Regatta IX Funding Ltd., Series 2017-1A, Class B1R / ABS-CBDO (US75887VAN10) | 0,85 | 0,24 | 0,0952 | −0,0006 | |||||

| Store Capital LLC / DBT (US862123AA45) | 0,85 | 97,21 | 0,0949 | 0,0463 | |||||

| Dryden 40 Senior Loan Fund, Series 2015-40A, Class AR2 / ABS-CBDO (US26244GAS49) | 0,84 | −6,95 | 0,0944 | −0,0079 | |||||

| US3140XJXF50 / Fannie Mae Pool | 0,84 | −2,22 | 0,0938 | −0,0028 | |||||

| US62928CAA09 / NGPL PipeCo LLC | 0,84 | 1,71 | 0,0935 | 0,0008 | |||||

| US01F0224778 / UMBS TBA | 0,83 | −29,94 | 0,0933 | −0,0440 | |||||

| US87264ACX19 / T-Mobile USA Inc | 0,83 | 78,11 | 0,0930 | 0,0404 | |||||

| US36179V4W70 / GNMA | 0,83 | −2,82 | 0,0928 | −0,0035 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,82 | 1 482,69 | 0,0922 | 0,0863 | |||||

| US845467AR03 / CORP. NOTE | 0,82 | 25,73 | 0,0920 | 0,0183 | |||||

| GoldenTree Loan Management US CLO 23 Ltd., Series 2024-23A, Class A / ABS-CBDO (US38139KAC36) | 0,82 | 0,49 | 0,0919 | −0,0003 | |||||

| US3140QNN990 / Uniform Mortgage-Backed Securities | 0,81 | −2,76 | 0,0906 | −0,0033 | |||||

| US912810SS87 / T 1 5/8 11/15/50 | 0,81 | −3,11 | 0,0906 | −0,0038 | |||||

| US26884LAG41 / EQT Corp | 0,81 | 0,50 | 0,0903 | −0,0003 | |||||

| US95000U3D31 / Wells Fargo & Co | 0,81 | 1 085,29 | 0,0903 | 0,0821 | |||||

| Regatta 30 Funding Ltd., Series 2024-4A, Class A1 / ABS-CBDO (US75903UAA16) | 0,80 | 0,38 | 0,0899 | −0,0004 | |||||

| US912828Z948 / United States Treasury Note/Bond | 0,80 | 1,40 | 0,0890 | 0,0006 | |||||

| US912810SP49 / United States Treasury Note/Bond | 0,79 | −3,31 | 0,0883 | −0,0037 | |||||

| US912810QC53 / United States Treas Bds Bond | 0,78 | −1,39 | 0,0878 | −0,0019 | |||||

| US785592AZ90 / Sabine Pass Liquefaction LLC | 0,78 | 11,86 | 0,0877 | 0,0086 | |||||

| MidOcean Credit CLO XI Ltd., Series 2022-11A, Class A1R2 / ABS-CBDO (US59801ABA16) | 0,78 | 0,39 | 0,0873 | −0,0004 | |||||

| US3140QNEL25 / Uniform Mortgage-Backed Securities | 0,78 | −2,02 | 0,0869 | −0,0026 | |||||

| US49327M3H53 / KeyBank NA | 0,78 | 1,31 | 0,0868 | 0,0004 | |||||

| US36179R7J23 / Ginnie Mae II Pool | 0,77 | −2,15 | 0,0865 | −0,0027 | |||||

| US11135FBP53 / SR UNSECURED 144A 11/35 3.137 | 0,77 | 1,72 | 0,0863 | 0,0008 | |||||

| US3140QANL03 / Fannie Mae Pool | 0,77 | −2,91 | 0,0860 | −0,0033 | |||||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 0,77 | 21,14 | 0,0860 | 0,0143 | |||||

| 4755 / Rakuten Group, Inc. | 0,77 | 0,79 | 0,0858 | 0,0001 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,77 | 0,0858 | 0,0858 | ||||||

| Warnermedia Holdings, Inc. / DBT (US55903VBL62) | 0,77 | 0,0857 | 0,0857 | ||||||

| US3140QLN366 / Fannie Mae Pool | 0,76 | −2,44 | 0,0853 | −0,0028 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,76 | −4,42 | 0,0848 | −0,0046 | |||||

| USV28479AA77 / DIAMOND II LTD 7.950000% 07/28/2026 | 0,76 | 0,00 | 0,0846 | −0,0007 | |||||

| US36179WG449 / G2SF 3.0 MA7419 06-20-51 | 0,75 | −2,71 | 0,0844 | −0,0031 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0,75 | 38,19 | 0,0839 | 0,0227 | |||||

| Madison Park Funding XXIX Ltd., Series 2018-29A, Class A1R2 / ABS-CBDO (US55820CAW55) | 0,75 | 0,0839 | 0,0839 | ||||||

| US61772BAB99 / Morgan Stanley | 0,74 | 22,11 | 0,0829 | 0,0056 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,74 | 1 579,55 | 0,0828 | 0,0778 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0,74 | 41,00 | 0,0825 | 0,0235 | |||||

| 30064K105 / Exacttarget, Inc. | 0,74 | −17,79 | 0,0823 | −0,0187 | |||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 0,73 | 127,95 | 0,0822 | 0,0458 | |||||

| US3140QEP895 / Fannie Mae Pool | 0,73 | −2,15 | 0,0816 | −0,0024 | |||||

| 2282 / MGM China Holdings Limited | 0,72 | 1,40 | 0,0811 | 0,0004 | |||||

| US3140QM4G63 / Fannie Mae Pool | 0,72 | −2,04 | 0,0808 | −0,0023 | |||||

| US87612GAA94 / Targa Resources Corp | 0,72 | 45,05 | 0,0805 | 0,0245 | |||||

| U.S. Treasury 2-Year Note / DIR (N/A) | 0,72 | 0,0802 | 0,0802 | ||||||

| US26442UAK07 / Duke Energy Progress LLC | 0,71 | −8,47 | 0,0799 | −0,0081 | |||||

| Flourishing Trade & Investment Ltd. / DBT (US343427AA80) | 0,71 | 0,0796 | 0,0796 | ||||||

| US11135FBL40 / Broadcom Inc | 0,71 | 94,25 | 0,0794 | 0,0382 | |||||

| US3140QA4A56 / Fannie Mae Pool | 0,71 | −2,61 | 0,0793 | −0,0028 | |||||

| Continuum Green Energy India Pvt / DBT (USY8987LAA45) | 0,70 | 0,00 | 0,0788 | −0,0007 | |||||

| IRB / IRB Infrastructure Developers Limited | 0,70 | −0,43 | 0,0786 | −0,0009 | |||||

| US92735LAA08 / Vine Energy Holdings, LLC | 0,70 | 69,73 | 0,0785 | 0,0319 | |||||

| USY7279WAA90 / ReNew Power Pvt Ltd | 0,69 | 0,87 | 0,0777 | 0,0000 | |||||

| HCA, Inc. / DBT (US404119DB22) | 0,69 | 0,0777 | 0,0777 | ||||||

| US87165BAR42 / Synchrony Financial | 0,69 | 9,68 | 0,0774 | 0,0062 | |||||

| US3132DMYM18 / Freddie Mac Pool | 0,69 | −2,55 | 0,0771 | −0,0027 | |||||

| US912810SU34 / United States Treasury Note/Bond | 0,69 | −3,10 | 0,0771 | −0,0031 | |||||

| Golub Capital Partners CLO 43B Ltd., Series 2019-43A, Class A1R / ABS-CBDO (US38180PAA49) | 0,69 | −21,93 | 0,0769 | −0,0224 | |||||

| US3133KMW843 / Freddie Mac Pool | 0,68 | −1,72 | 0,0766 | −0,0020 | |||||

| JPM / JPMorgan Chase & Co. | 0,00 | −7,49 | 0,68 | 9,28 | 0,0765 | 0,0060 | |||

| Foundry JV Holdco LLC / DBT (US350930AG89) | 0,68 | 0,0764 | 0,0764 | ||||||

| Warwick Capital CLO 5 Ltd., Series 2024-5A, Class A1 / ABS-CBDO (US93656FAA66) | 0,68 | 0,15 | 0,0762 | −0,0004 | |||||

| USN57445AB99 / Minejesa Capital BV | 0,68 | 44,56 | 0,0759 | 0,0230 | |||||

| USV4605MAA63 / INDIA CLEAN ENERGY HOLDINGS 4.5% 04/18/2027 REGS | 0,68 | 1,81 | 0,0756 | 0,0006 | |||||

| US95000U2U64 / Wells Fargo & Co | 0,67 | 373,94 | 0,0754 | 0,0565 | |||||

| Affirm Master Trust, Series 2025-1A, Class A / ABS-O (US00833BAA61) | 0,66 | 0,30 | 0,0738 | −0,0004 | |||||

| HCA, Inc. / DBT (US404119CT49) | 0,66 | 147,37 | 0,0738 | 0,0437 | |||||

| US3140QCLT13 / Fannie Mae Pool | 0,65 | −9,17 | 0,0733 | −0,0080 | |||||

| US46647PDW32 / JPMorgan Chase & Co | 0,65 | 0,0732 | 0,0732 | ||||||

| US3132DVLP84 / FR SD7534 | 0,65 | −2,69 | 0,0729 | −0,0026 | |||||

| Greenko Wind Projects Mauritius Ltd. / DBT (USV3856JAB99) | 0,65 | 107,01 | 0,0728 | 0,0373 | |||||

| US3140QRWZ23 / Fannie Mae Pool | 0,65 | −5,93 | 0,0728 | −0,0053 | |||||

| KSL Commercial Mortgage Trust, Series 2024-HT2, Class A / ABS-MBS (US500937AA54) | 0,65 | −0,15 | 0,0726 | −0,0006 | |||||

| BX Commercial Mortgage Trust, Series 2024-MDHS, Class A / ABS-MBS (US12433BAA52) | 0,64 | −4,45 | 0,0722 | −0,0039 | |||||

| US05526DBQ79 / BAT Capital Corp | 0,64 | 0,47 | 0,0721 | −0,0002 | |||||

| US92564RAD70 / VICI PROPERTIES / NOTE 3.75% 02/15/2027 144A | 0,64 | 1 324,44 | 0,0718 | 0,0667 | |||||

| US3132DWBB81 / FHLG 30YR 2% 03/01/2051# | 0,64 | −2,44 | 0,0717 | −0,0023 | |||||

| US61747YEK73 / Morgan Stanley | 0,64 | −53,32 | 0,0717 | −0,1110 | |||||

| US161175BY99 / CHARTER COMM OPER LLC/CAP CORP 3.85% 04/01/2061 | 0,64 | 12,13 | 0,0714 | 0,0071 | |||||

| US912810QL52 / United States Treas Bds Bond | 0,64 | −1,70 | 0,0711 | −0,0018 | |||||

| US02209SBM44 / ALTRIA GROUP INC 3.4% 02/04/2041 | 0,64 | −5,37 | 0,0711 | −0,0046 | |||||

| US361841AP42 / GLP Capital LP / GLP Financing II Inc | 0,63 | −7,32 | 0,0709 | −0,0062 | |||||

| VEGAS, Series 2024-GCS, Class C / ABS-MBS (US92254BAA35) | 0,63 | 0,80 | 0,0706 | 0,0000 | |||||

| ORL Trust, Series 2024-GLKS, Class A / ABS-MBS (US67120DAA37) | 0,63 | 0,00 | 0,0705 | −0,0005 | |||||

| US36179WQA98 / Government National Mortgage Association | 0,63 | −2,79 | 0,0703 | −0,0026 | |||||

| U.S. Treasury Long Bond / DIR (N/A) | 0,62 | 0,0698 | 0,0698 | ||||||

| US00206RMN97 / AT&T Inc | 0,62 | 23,26 | 0,0695 | 0,0127 | |||||

| US36179XBQ88 / GNMA | 0,62 | −3,28 | 0,0694 | −0,0030 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0,62 | 0,0694 | 0,0694 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,62 | 0,0694 | 0,0694 | ||||||

| US912810QS06 / United States Treas Bds Bond | 0,62 | 0,0692 | 0,0692 | ||||||

| US361841AK54 / GLP Capital LP / GLP Financing II Inc | 0,62 | −36,03 | 0,0691 | −0,0397 | |||||

| US91282CEP23 / WI TREASURY N/B REGD 2.87500000 | 0,62 | 0,82 | 0,0690 | 0,0000 | |||||

| US3132XCSC08 / Federal Home Loan Mortgage Corp. | 0,62 | −3,15 | 0,0689 | −0,0028 | |||||

| US3132DNTW38 / FHLG 30YR 5% 08/01/2052#SD1465 | 0,61 | −3,77 | 0,0687 | −0,0033 | |||||

| US3140Q83N34 / Fannie Mae Pool | 0,61 | −4,23 | 0,0686 | −0,0035 | |||||

| US36179R4E62 / Ginnie Mae II Pool | 0,61 | −2,70 | 0,0685 | −0,0025 | |||||

| US54627RAM25 / LOUISIANA ST LOCAL GOVT ENVRNMNTL FACS & CMNTY DEV AUTH | 0,61 | 0,66 | 0,0685 | −0,0001 | |||||

| US3132CWSB18 / Freddie Mac Pool | 0,61 | −3,34 | 0,0681 | −0,0029 | |||||

| US3140XMEK85 / FNMA 30YR 6.5% 08/01/2053#FS5537 | 0,61 | −3,65 | 0,0680 | −0,0031 | |||||

| US3140XFGT26 / Fannie Mae Pool | 0,61 | −3,51 | 0,0678 | −0,0030 | |||||

| US629377CL46 / NRG Energy Inc | 0,60 | 186,26 | 0,0676 | 0,0437 | |||||

| Homes Trust, Series 2024-NQM2, Class A1 / ABS-MBS (US43761CAA09) | 0,60 | −6,22 | 0,0676 | −0,0051 | |||||

| J.P. Morgan Mortgage Trust, Series 2025-NQM2, Class A1 / ABS-MBS (US46590SAC17) | 0,60 | 0,0674 | 0,0674 | ||||||

| US29444UBS42 / EQUINIX INC 2.5% 05/15/2031 | 0,60 | 1,53 | 0,0671 | 0,0005 | |||||

| Bank of America Corp., Series FIX / DBT (US06051GML04) | 0,60 | 73,62 | 0,0671 | 0,0281 | |||||

| US337932AJ65 / FirstEnergy Corp | 0,60 | 27,62 | 0,0668 | 0,0140 | |||||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 0,59 | 24,79 | 0,0666 | 0,0116 | |||||

| GoodLeap Home Improvement Solutions Trust, Series 2025-1A, Class A / ABS-O (US38237EAA29) | 0,59 | −8,06 | 0,0664 | −0,0064 | |||||

| US3132DMRS60 / Freddie Mac Pool | 0,59 | −2,49 | 0,0658 | −0,0023 | |||||

| USY4S71YAA27 / JSW Hydro Energy Ltd | 0,58 | −1,68 | 0,0655 | −0,0016 | |||||

| US3140QSAX95 / Fannie Mae Pool | 0,58 | −2,54 | 0,0645 | −0,0023 | |||||

| FS Trust, Series 2024-HULA, Class A / ABS-MBS (US30338DAA90) | 0,57 | 0,00 | 0,0643 | −0,0004 | |||||

| US3140QSQK01 / Fannie Mae Pool | 0,57 | −4,02 | 0,0642 | −0,0032 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,57 | −75,76 | 0,0641 | −0,2022 | |||||

| US01F0204713 / UMBS 15YR TBA(REG B) 2.0 UMBS TBA 07-01-35 | 0,57 | −1 067,80 | 0,0640 | 0,0709 | |||||

| AP Grange Holdings LLC / DBT (N/A) | 0,57 | 0,0640 | 0,0640 | ||||||

| US3132DMSG14 / Freddie Mac Pool | 0,57 | −2,23 | 0,0638 | −0,0020 | |||||

| US3140QEJX19 / Federal National Mortgage Association | 0,57 | −3,23 | 0,0638 | −0,0026 | |||||

| BAHA Trust, Series 2024-MAR, Class C / ABS-MBS (US05493XAG51) | 0,57 | 0,89 | 0,0638 | 0,0001 | |||||

| US3140QRBU64 / Fannie Mae Pool | 0,57 | −2,58 | 0,0634 | −0,0021 | |||||

| US35906ABF49 / Frontier Communications Corp | 0,56 | 0,0629 | 0,0629 | ||||||

| US87612BBS07 / Targa Resources Partners LP / Targa Resources Partners Finance Corp | 0,56 | −40,19 | 0,0629 | −0,0431 | |||||

| US3140XFM408 / Fannie Mae Pool | 0,56 | −2,77 | 0,0628 | −0,0024 | |||||

| US92564RAL96 / VICI Properties LP / VICI Note Co., Inc. | 0,56 | 45,08 | 0,0627 | 0,0181 | |||||

| US46647PAJ57 / JPMorgan Chase & Co | 0,56 | 461,62 | 0,0623 | 0,0469 | |||||

| US3133KRB861 / Freddie Mac Pool | 0,55 | −2,98 | 0,0620 | −0,0025 | |||||

| US3140XCGT94 / Fannie Mae Pool | 0,55 | −2,30 | 0,0619 | −0,0020 | |||||

| US25470DAF69 / Discovery Communications Bond | 0,54 | 0,0602 | 0,0602 | ||||||

| PRPM Trust, Series 2025-NQM2, Class A1 / ABS-MBS (US693983AA68) | 0,54 | 0,0600 | 0,0600 | ||||||

| US3132DM7D19 / Uniform Mortgage-Backed Securities | 0,53 | −2,74 | 0,0596 | −0,0021 | |||||

| HCA, Inc. / DBT (US404119DC05) | 0,53 | 187,50 | 0,0593 | 0,0385 | |||||

| US3132DMKJ35 / Freddie Mac Pool | 0,53 | −2,76 | 0,0593 | −0,0022 | |||||

| Fontainebleau Miami Beach Mortgage Trust, Series 2024-FBLU, Class A / ABS-MBS (US34461WAA80) | 0,52 | 23,58 | 0,0588 | 0,0108 | |||||

| US00108WAR16 / AEP Texas Inc | 0,52 | 146,23 | 0,0585 | 0,0345 | |||||

| US87168BAC46 / Symphony CLO XXVIII Ltd., Series 2021-28A, Class A | 0,52 | 0,00 | 0,0583 | −0,0004 | |||||

| HOMES Trust, Series 2025-NQM2, Class A1 / ABS-MBS (US403966AA22) | 0,52 | 0,0582 | 0,0582 | ||||||

| EQT / EQT Corporation | 0,52 | 0,0578 | 0,0578 | ||||||

| US3140QNNU23 / Fannie Mae Pool | 0,52 | −2,28 | 0,0577 | −0,0018 | |||||

| RR 20 Ltd., Series 2022-20A, Class A1R / ABS-CBDO (US74989UAJ25) | 0,52 | 0,0577 | 0,0577 | ||||||

| US61747YFD22 / Morgan Stanley | 0,51 | −53,06 | 0,0576 | −0,0660 | |||||

| US30225VAP22 / EXTRA SPACE STORAGE LP | 0,51 | 0,0573 | 0,0573 | ||||||

| US912810TT51 / United States Treasury Note/Bond | 0,51 | −3,04 | 0,0572 | −0,0023 | |||||

| US373334KT78 / Georgia Power Co. | 0,51 | 94,27 | 0,0571 | 0,0275 | |||||

| Regatta XVIII Funding Ltd., Series 2021-1A, Class A1R / ABS-CBDO (US75884EAN22) | 0,51 | 104,02 | 0,0570 | 0,0288 | |||||

| US38141GWZ35 / Goldman Sachs Group Inc/The | 0,51 | −39,86 | 0,0568 | −0,0406 | |||||

| US26885BAH33 / EQM MIDSTREAM PARTNERS L SR UNSECURED 144A 07/27 6.5 | 0,51 | 0,0567 | 0,0567 | ||||||

| US3140QNE650 / Uniform Mortgage-Backed Securities | 0,50 | −2,91 | 0,0562 | −0,0020 | |||||

| Elmwood CLO 36 Ltd., Series 2024-12RA, Class AR / ABS-CBDO (US29004MAA45) | 0,50 | 0,20 | 0,0562 | −0,0003 | |||||

| RR 24 Ltd., Series 2022-24A, Class A1A2 / ABS-CBDO (US75000HBA14) | 0,50 | 0,20 | 0,0562 | −0,0003 | |||||

| PRKCM Trust, Series 2023-AFC1, Class B1 / ABS-MBS (US693981AE25) | 0,50 | 0,20 | 0,0560 | −0,0004 | |||||

| US718286CC97 / Philippine Government International Bond | 0,50 | 1,01 | 0,0558 | 0,0001 | |||||

| EQT / EQT Corporation | 0,50 | 0,0557 | 0,0557 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,50 | −59,59 | 0,0555 | −0,0828 | |||||

| USN6000DAA11 / Mong Duong Finance Holdings BV | 0,50 | −10,49 | 0,0555 | −0,0069 | |||||

| US26243EAA91 / Dryden 53 CLO Ltd | 0,49 | −13,03 | 0,0553 | −0,0089 | |||||

| US760942BA98 / Uruguay Government International Bond | 0,49 | −0,40 | 0,0551 | −0,0007 | |||||

| Dowson plc, Series 2024-1, Class F / ABS-O (XS2919894381) | 0,49 | 6,28 | 0,0550 | 0,0028 | |||||

| US3140XFGS43 / Fannie Mae Pool | 0,49 | −2,39 | 0,0549 | −0,0018 | |||||

| US3140QM4F80 / Fannie Mae Pool | 0,48 | −2,45 | 0,0536 | −0,0017 | |||||

| US3140QMMP63 / Federal National Mortgage Association | 0,48 | −3,06 | 0,0533 | −0,0021 | |||||

| US3132DQGA85 / Freddie Mac Pool | 0,48 | −2,46 | 0,0532 | −0,0019 | |||||

| VZ / Verizon Communications Inc. - Depositary Receipt (Common Stock) | 0,47 | 0,0532 | 0,0532 | ||||||

| US46647PBN50 / JPMorgan Chase & Co | 0,47 | 26,13 | 0,0530 | 0,0106 | |||||

| Republic Finance Issuance Trust, Series 2024-B, Class A / ABS-O (US76042GAA22) | 0,47 | 0,21 | 0,0528 | −0,0002 | |||||

| US6174468U61 / MORGAN STANLEY 1.794%/VAR 02/13/2032 | 0,47 | −19,76 | 0,0528 | −0,0135 | |||||

| US3140QELS95 / Federal National Mortgage Association | 0,47 | −3,50 | 0,0526 | −0,0023 | |||||

| PANAMA / Panama Government International Bond | 0,47 | 6,39 | 0,0522 | 0,0027 | |||||

| US31418D6B37 / Fannie Mae Pool | 0,47 | −77,22 | 0,0522 | −0,1787 | |||||

| US3140QK2B31 / Fannie Mae Pool | 0,47 | −1,06 | 0,0521 | −0,0009 | |||||

| US33767BAC37 / FIRSTENERGY TRANSMISSION SR UNSECURED 144A 04/49 4.55 | 0,46 | −49,12 | 0,0520 | −0,0510 | |||||

| EU000A3K4DT4 / European Union | 0,46 | 10,26 | 0,0518 | 0,0044 | |||||

| Trimaran CAVU Ltd., Series 2024-1A, Class A / ABS-CBDO (US895971AA71) | 0,46 | 0,43 | 0,0517 | −0,0003 | |||||

| BXMT / Blackstone Mortgage Trust, Inc. | 0,02 | 0,00 | 0,46 | −3,76 | 0,0517 | −0,0024 | |||

| SFTB / SoftBank Group Corp. - Depositary Receipt (Common Stock) | 0,46 | −40,18 | 0,0516 | −0,0353 | |||||

| US31418DXJ61 / FN MA4280 | 0,46 | −2,13 | 0,0516 | −0,0015 | |||||

| Port of Beaumont Navigation District, Series 2024B / DBT (US73360CAS35) | 0,46 | −0,43 | 0,0516 | −0,0006 | |||||

| US3133KQWT92 / Freddie Mac Pool | 0,46 | −3,36 | 0,0515 | −0,0023 | |||||

| US87165BAM54 / Synchrony Financial | 0,46 | 6,76 | 0,0513 | 0,0028 | |||||

| US072024NV09 / BAY AREA CA TOLL AUTH TOLL BRIDGE REVENUE | 0,46 | −2,76 | 0,0513 | −0,0019 | |||||

| US00206RKJ04 / AT&T Inc | 0,46 | 62,86 | 0,0511 | 0,0194 | |||||

| US3140XLEB04 / Fannie Mae Pool | 0,46 | −2,15 | 0,0510 | −0,0015 | |||||

| US87165BAP85 / SYNCHRONY FINANCIAL SR UNSECURED 03/29 5.15 | 0,45 | 0,89 | 0,0508 | 0,0000 | |||||

| US3133KRCJ14 / Freddie Mac Pool | 0,45 | −3,84 | 0,0506 | −0,0024 | |||||

| US3140QSA764 / Fannie Mae Pool | 0,45 | −3,02 | 0,0504 | −0,0020 | |||||

| SMB Private Education Loan Trust, Series 2024-A, Class A1B / ABS-O (US831943AB13) | 0,45 | −3,03 | 0,0502 | −0,0020 | |||||

| GLP Capital LP / DBT (US361841AU37) | 0,45 | −43,07 | 0,0502 | −0,0387 | |||||

| US3132DMRK35 / Freddie Mac Pool | 0,45 | −2,83 | 0,0501 | −0,0018 | |||||

| US3140XBG953 / Fannie Mae Pool | 0,45 | −2,62 | 0,0500 | −0,0018 | |||||

| US3140QMJZ82 / Fannie Mae Pool | 0,45 | −2,41 | 0,0499 | −0,0017 | |||||

| US3140QEBM36 / Federal National Mortgage Association | 0,45 | −2,63 | 0,0499 | −0,0018 | |||||

| US3132DMRG23 / Freddie Mac Pool | 0,45 | −3,05 | 0,0498 | −0,0020 | |||||

| US87229WAQ42 / TCI-Symphony CLO Ltd., Series 2016-1A, Class AR2 | 0,44 | −5,53 | 0,0497 | −0,0034 | |||||

| US3140QEBK79 / Federal National Mortgage Association | 0,44 | −1,99 | 0,0496 | −0,0014 | |||||

| Continuum Energy Pte. Ltd. / DBT (US211926AA85) | 0,44 | −0,23 | 0,0496 | −0,0005 | |||||

| US694308KD85 / Pacific Gas and Electric Co | 0,44 | 4,99 | 0,0496 | 0,0019 | |||||

| US87303TAN72 / TTAN 2021-MHC | 0,44 | 0,45 | 0,0495 | −0,0002 | |||||

| US718286CP01 / Philippine Government International Bond | 0,44 | 0,68 | 0,0495 | −0,0002 | |||||

| Morgan Stanley Residential Mortgage Loan Trust, Series 2025-NQM1, Class M1 / ABS-MBS (US617932AF56) | 0,44 | −0,45 | 0,0495 | −0,0006 | |||||

| TCO Commercial Mortgage Trust, Series 2024-DPM, Class A / ABS-MBS (US87231EAA55) | 0,44 | 0,23 | 0,0491 | −0,0003 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0,44 | 52,26 | 0,0490 | 0,0165 | |||||

| US3132DMUR41 / Freddie Mac Pool | 0,44 | −2,46 | 0,0489 | −0,0016 | |||||

| US715638DT64 / Peruvian Government International Bond | 0,44 | −0,23 | 0,0488 | −0,0005 | |||||

| US845467AS85 / Southwestern Energy Co | 0,43 | 1,18 | 0,0482 | 0,0001 | |||||

| US161175CC60 / CHARTER COMMUNICATIONS OPERATING LLC / CHARTER COMMUNICATIONS OPERATING CAPITAL 4.4% 12/01/2061 | 0,43 | 123,44 | 0,0480 | 0,0263 | |||||

| US3133KJUF73 / Freddie Mac Pool | 0,43 | −2,06 | 0,0480 | −0,0014 | |||||

| US3140QEBL52 / Federal National Mortgage Association | 0,43 | −2,95 | 0,0480 | −0,0018 | |||||

| US3140QMH804 / Fannie Mae Pool | 0,43 | −2,07 | 0,0478 | −0,0014 | |||||

| US36179WTY48 / Ginnie Mae II Pool | 0,42 | −2,75 | 0,0475 | −0,0017 | |||||

| US455780CW44 / Indonesia Government International Bond | 0,42 | 2,67 | 0,0474 | 0,0008 | |||||

| US3140QNE577 / Uniform Mortgage-Backed Securities | 0,42 | −2,76 | 0,0474 | −0,0018 | |||||

| US694308JN86 / PACIFIC GAS and ELECTRIC CO 4.95% 07/01/2050 | 0,42 | −3,42 | 0,0474 | −0,0021 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 0,42 | 1,93 | 0,0473 | 0,0006 | |||||

| US785592AS57 / SABINE PASS LIQUEFACTION LLC SR SECURED 03/27 5 | 0,42 | 0,24 | 0,0472 | −0,0003 | |||||

| FNA 8 LLC, Series 2025-1, Class A / ABS-O (US30340WAA36) | 0,42 | −6,50 | 0,0467 | −0,0036 | |||||

| US61747YED31 / Morgan Stanley | 0,42 | 3,99 | 0,0467 | 0,0015 | |||||

| US03027XBM11 / CORPORATE BONDS | 0,42 | 153,66 | 0,0466 | 0,0280 | |||||

| US05875CAB00 / TWIN RIVER WORLDWIDE HLDGS INC | 0,42 | −0,95 | 0,0465 | −0,0008 | |||||

| SURA Asset Management SA / DBT (US78486LAB80) | 0,42 | 0,0465 | 0,0465 | ||||||

| US26884LAQ23 / EQT Corp. | 0,41 | 0,00 | 0,0464 | −0,0003 | |||||

| VIH1 / VIB Vermögen AG | 0,41 | 0,0463 | 0,0463 | ||||||

| US30225VAK35 / Extra Space Storage LP | 0,41 | 0,98 | 0,0463 | 0,0002 | |||||

| US36179SLS40 / Ginnie Mae II Pool | 0,41 | −2,13 | 0,0463 | −0,0014 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,41 | −71,21 | 0,0461 | −0,1192 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,41 | −8,07 | 0,0460 | −0,0044 | |||||

| KSPI / Joint Stock Company Kaspi.kz | 0,41 | 0,0459 | 0,0459 | ||||||

| MVM Energetika Zrt. / DBT (XS2783579704) | 0,41 | 0,0459 | 0,0459 | ||||||

| US378272BP27 / Glencore Funding LLC | 0,41 | −48,03 | 0,0459 | −0,0430 | |||||

| CH0384125065 / PFAND SCHWZ HYPO | 0,41 | 1,49 | 0,0459 | 0,0003 | |||||

| XS2459127739 / Cassia 2022-1 SRL | 0,41 | 6,23 | 0,0458 | 0,0023 | |||||

| USN7163RAX19 / Prosus NV | 0,41 | 0,0458 | 0,0458 | ||||||

| Angel Oak Mortgage Trust, Series 2025-1, Class A1 / ABS-MBS (US034934AA73) | 0,41 | −2,86 | 0,0458 | −0,0017 | |||||

| PKN / Orlen S.A. | 0,41 | 0,0457 | 0,0457 | ||||||

| Vale Overseas Ltd. / DBT (US91911TAS24) | 0,41 | 1 303,45 | 0,0456 | 0,0422 | |||||

| Greensaif Pipelines Bidco SARL / DBT (XS2850687620) | 0,41 | 0,0455 | 0,0455 | ||||||

| US38141GXR00 / Goldman Sachs Group Inc/The | 0,41 | 15,01 | 0,0455 | 0,0055 | |||||

| USP3143NBK92 / Corp Nacional del Cobre de Chile | 0,41 | 0,0454 | 0,0454 | ||||||

| HILT Commercial Mortgage Trust, Series 2024-ORL, Class C / ABS-MBS (US403956AE53) | 0,41 | 0,25 | 0,0454 | −0,0003 | |||||

| USP9401CAB83 / Trust Fibra Uno | 0,41 | 0,0454 | 0,0454 | ||||||

| US3140X7CB30 / FNMA POOL FM3665 FN 09/49 FIXED VAR | 0,41 | −1,70 | 0,0454 | −0,0012 | |||||

| XS0308427581 / DP World PLC | 0,40 | 0,0452 | 0,0452 | ||||||

| S56431109 / Northam Platinum Holdings Ltd | 0,40 | 1,00 | 0,0451 | 0,0001 | |||||

| US666807CJ91 / Northrop Grumman Corp | 0,40 | 146,63 | 0,0451 | 0,0255 | |||||

| US3140XKHJ20 / Fannie Mae Pool | 0,40 | −5,63 | 0,0450 | −0,0031 | |||||

| US3140X83A30 / Fannie Mae Pool | 0,40 | −2,43 | 0,0450 | −0,0014 | |||||

| US3133BUJD01 / Freddie Mac Pool | 0,40 | −1,96 | 0,0450 | −0,0012 | |||||

| USG8539EAC96 / STUDIO CITY CO LTD 7.000000% 02/15/2027 | 0,40 | −0,50 | 0,0449 | −0,0005 | |||||

| US3132DMX756 / Federal Home Loan Mortgage Corp. | 0,40 | −2,45 | 0,0446 | −0,0015 | |||||

| US3132DMSH96 / Freddie Mac Pool | 0,40 | −3,64 | 0,0445 | −0,0020 | |||||

| USY59500AA95 / Medco Laurel Tree Pte Ltd | 0,40 | 0,51 | 0,0443 | −0,0001 | |||||

| US3132Y4AU60 / Freddie Mac Gold Pool | 0,40 | −2,23 | 0,0443 | −0,0013 | |||||

| US3140QM4E16 / Fannie Mae Pool | 0,39 | −2,72 | 0,0442 | −0,0016 | |||||

| US126650CN80 / CVS Health Corp | 0,39 | 36,33 | 0,0441 | 0,0115 | |||||

| US06051GHM42 / Bank of America Corp | 0,39 | −40,81 | 0,0441 | −0,0353 | |||||

| USG98149AH33 / Wynn Macau Ltd | 0,39 | 2,08 | 0,0439 | 0,0005 | |||||

| US31418DTP77 / Fannie Mae Pool | 0,39 | −2,25 | 0,0439 | −0,0014 | |||||

| USG5975LAF34 / Melco Resorts Finance Ltd | 0,39 | 1,56 | 0,0438 | 0,0004 | |||||

| US3133KNDA81 / Federal Home Loan Mortgage Corp. | 0,39 | −2,26 | 0,0437 | −0,0014 | |||||

| GENI / Genius Sports Limited | 0,04 | 0,00 | 0,39 | 3,73 | 0,0436 | 0,0013 | |||

| US3132DM7F66 / Uniform Mortgage-Backed Securities | 0,39 | −2,51 | 0,0436 | −0,0015 | |||||

| US3140QGKA45 / Fannie Mae Pool | 0,39 | −3,27 | 0,0432 | −0,0017 | |||||

| BRAVO Residential Funding Trust, Series 2025-NQM2, Class A1 / ABS-MBS (US10569NAC56) | 0,38 | −6,13 | 0,0429 | −0,0032 | |||||

| US26442CBC73 / Duke Energy Carolinas LLC | 0,38 | −5,90 | 0,0429 | −0,0031 | |||||

| US161175CG74 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0,38 | 229,31 | 0,0428 | 0,0297 | |||||

| SEI / Solaris Energy Infrastructure, Inc. | 0,01 | −11,72 | 0,38 | 14,71 | 0,0428 | 0,0052 | |||

| US3140XFRT07 / Uniform Mortgage-Backed Securities | 0,38 | −3,57 | 0,0424 | −0,0019 | |||||

| US646139W353 / NEW JERSEY ST TURNPIKE AUTH | 0,38 | −0,53 | 0,0424 | −0,0006 | |||||

| US3132DV6T70 / Freddie Mac Pool | 0,38 | −2,08 | 0,0422 | −0,0013 | |||||

| US3133KPKT48 / Freddie Mac Pool | 0,38 | −4,08 | 0,0421 | −0,0021 | |||||

| US20030NDW83 / Comcast Corp | 0,37 | 769,77 | 0,0419 | 0,0370 | |||||

| USV3855MAA54 / GREENKO POWER II LTD MTN 4.300000% 12/13/2028 | 0,37 | −2,60 | 0,0419 | −0,0015 | |||||

| US912810QE10 / United States Treas Bds Bond | 0,37 | −1,32 | 0,0419 | −0,0010 | |||||

| US694308JQ18 / PACIFIC GAS + ELECTRIC 1ST MORTGAGE 07/40 4.5 | 0,37 | 0,0419 | 0,0419 | ||||||

| US3132DQQ587 / Freddie Mac Pool | 0,37 | −4,11 | 0,0418 | −0,0022 | |||||

| US31418DTQ50 / Fannie Mae Pool | 0,37 | −2,36 | 0,0417 | −0,0013 | |||||

| US404119CQ00 / HCA Inc | 0,37 | 0,0417 | 0,0417 | ||||||

| US3140XFGB18 / Fannie Mae Pool | 0,37 | −2,11 | 0,0416 | −0,0012 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,37 | −2,62 | 0,0416 | −0,0015 | |||||

| CSTL Commercial Mortgage Trust, Series 2024-GATE, Class A / ABS-MBS (US22945JAA88) | 0,37 | 1,65 | 0,0414 | 0,0004 | |||||

| CVR CHC LP, 1st Lien Term Loan / LON (US12663SAB79) | 0,37 | −21,96 | 0,0410 | −0,0120 | |||||

| US1248EPCN14 / CORPORATE BONDS | 0,37 | 0,0410 | 0,0410 | ||||||

| US455780CQ75 / Indonesia Government International Bond | 0,37 | 2,53 | 0,0409 | 0,0007 | |||||

| US26442CAT18 / Duke Energy Carolinas LLC | 0,36 | 0,28 | 0,0408 | −0,0002 | |||||

| US912810QZ49 / United States Treas Bds Bond | 0,36 | −1,89 | 0,0407 | −0,0012 | |||||

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2024-IGLG, Class A / ABS-MBS (US46593KAA97) | 0,36 | 0,28 | 0,0406 | −0,0002 | |||||

| US35908MAA80 / FRONTIER COMMUNICATIONS HOLDINGS LLC 5.875% 11/01/2029 | 0,36 | 0,0405 | 0,0405 | ||||||

| US3140XGPU70 / Fannie Mae Pool | 0,36 | −2,17 | 0,0405 | −0,0013 | |||||

| US3133L8GG48 / Freddie Mac Pool | 0,36 | −3,23 | 0,0402 | −0,0016 | |||||

| HCA, Inc. / DBT (US404121AK12) | 0,36 | 1,99 | 0,0401 | 0,0004 | |||||

| Morgan Stanley Residential Mortgage Loan Trust, Series 2025-NQM1, Class A1 / ABS-MBS (US617932AA69) | 0,36 | −5,05 | 0,0401 | −0,0024 | |||||

| T1SO34 / The Southern Company - Depositary Receipt (Common Stock) | 0,36 | −22,22 | 0,0401 | −0,0118 | |||||

| Atrium Hotel Portfolio Trust, Series 2024-ATRM, Class A / ABS-MBS (US04963XAA28) | 0,36 | 2,01 | 0,0400 | 0,0005 | |||||

| US882722KF74 / TEXAS ST | 0,36 | 0,28 | 0,0397 | −0,0003 | |||||

| US3140QSFD86 / Fannie Mae Pool | 0,35 | −2,75 | 0,0395 | −0,0015 | |||||

| US3132DMRF40 / Freddie Mac Pool | 0,35 | −1,41 | 0,0392 | −0,0009 | |||||

| US38145GAH39 / The Goldman Sachs Bond | 0,35 | 38,10 | 0,0391 | −0,0010 | |||||

| US3133L8JQ92 / Freddie Mac Pool | 0,35 | −2,25 | 0,0390 | −0,0013 | |||||

| US3140QNEK42 / Uniform Mortgage-Backed Securities | 0,35 | −2,53 | 0,0389 | −0,0014 | |||||

| US161175CP73 / CHARTER COMMUNICATIONS OPERATING LLC SR SEC 1ST LIEN 6.65% 02-01-34 | 0,35 | 0,0388 | 0,0388 | ||||||

| US87612GAB77 / Targa Resources Corp | 0,35 | −14,81 | 0,0387 | −0,0071 | |||||

| US3140XGPQ68 / FN FS1330 | 0,34 | −2,56 | 0,0384 | −0,0014 | |||||

| US912810QK79 / United States Treas Bds Bond | 0,34 | −1,44 | 0,0383 | −0,0009 | |||||

| Mariner Finance issuance Trust, Series 2024-BA, Class A / ABS-O (US56847GAA13) | 0,34 | 0,29 | 0,0382 | −0,0001 | |||||

| US3140QMZU12 / FN CB2554 | 0,34 | −2,57 | 0,0382 | −0,0013 | |||||

| US31418DUF76 / FANNIE MAE POOL FN MA4181 | 0,34 | −2,01 | 0,0382 | −0,0011 | |||||

| D1HI34 / D.R. Horton, Inc. - Depositary Receipt (Common Stock) | 0,34 | −30,69 | 0,0382 | −0,0174 | |||||

| US3140QGJ992 / Fannie Mae Pool | 0,34 | −3,13 | 0,0381 | −0,0015 | |||||

| FLG / Flagstar Financial, Inc. | 0,03 | 253,75 | 0,34 | 222,86 | 0,0380 | 0,0261 | |||

| US3132DVLU79 / Freddie Mac Pool | 0,34 | −2,60 | 0,0378 | −0,0013 | |||||

| LTM / LATAM Airlines Group S.A. | 0,34 | 0,0378 | 0,0378 | ||||||

| US00115AAL35 / AEP Transmission Co. LLC | 0,34 | −0,30 | 0,0378 | −0,0005 | |||||

| US698299BF03 / Panama Government International Bond | 0,34 | 1,82 | 0,0377 | 0,0004 | |||||

| US3140NAYE77 / Fannie Mae Pool | 0,34 | −3,72 | 0,0376 | −0,0018 | |||||

| US92343VCQ59 / Verizon Communications Inc | 0,34 | 661,36 | 0,0376 | 0,0326 | |||||

| USV4819LAA09 / India Green Power Holdings | 0,34 | 1,82 | 0,0376 | 0,0004 | |||||

| Dowson plc, Series 2024-1, Class E / ABS-O (XS2919892252) | 0,34 | 6,01 | 0,0376 | 0,0019 | |||||

| US3132DPF863 / Freddie Mac Pool | 0,33 | −1,47 | 0,0374 | −0,0008 | |||||

| USU85969AF71 / Stillwater Mining Co | 0,33 | 0,0373 | 0,0373 | ||||||

| AKBNK / Akbank T.A.S. | 0,33 | 0,0372 | 0,0372 | ||||||

| US67091TAA34 / OCP SA | 0,33 | 0,0372 | 0,0372 | ||||||

| IHS / IHS Holding Limited | 0,33 | 0,0372 | 0,0372 | ||||||

| Canyon CLO Ltd., Series 2020-3A, Class A1R / ABS-CBDO (US13876RAN44) | 0,33 | 0,0371 | 0,0371 | ||||||

| UK Logistics DAC, Series 2025-1X, Class D / ABS-MBS (XS3028549478) | 0,33 | 0,0370 | 0,0370 | ||||||

| CX / CEMEX, S.A.B. de C.V. - Preferred Security | 0,33 | 0,0370 | 0,0370 | ||||||

| Vedanta Resources Finance II plc / DBT (USG9T27HAG93) | 0,33 | 0,0370 | 0,0370 | ||||||

| TTKOM / Türk Telekomünikasyon Anonim Sirketi | 0,33 | 0,0370 | 0,0370 | ||||||

| TAVHL / TAV Havalimanlari Holding A.S. | 0,33 | 0,0370 | 0,0370 | ||||||

| US01F0404792 / UMBS TBA | 0,33 | −6 680,00 | 0,0369 | 0,0376 | |||||

| Vista Energy Argentina SAU / DBT (US92841RAB69) | 0,33 | 0,0369 | 0,0369 | ||||||

| TECO2 / Telecom Argentina S.A. | 0,33 | 0,0368 | 0,0368 | ||||||

| T-Mobile USA, Inc. / DBT (US87264ADS15) | 0,33 | −22,27 | 0,0368 | −0,0109 | |||||

| US3140QFNP04 / Federal National Mortgage Association | 0,33 | −3,25 | 0,0367 | −0,0015 | |||||

| USU8035UAC63 / Sasol Financing USA LLC | 0,33 | 0,0366 | 0,0366 | ||||||

| US3140KYYM07 / Federal National Mortgage Association | 0,33 | −1,51 | 0,0365 | −0,0009 | |||||

| HCA, Inc. / DBT (US404119CW77) | 0,33 | −48,00 | 0,0365 | −0,0341 | |||||

| US33767BAA70 / FirstEnergy Transmission LLC | 0,32 | −2,11 | 0,0363 | −0,0011 | |||||

| US06051GKQ19 / Bank of America Corp | 0,32 | −4,72 | 0,0362 | −0,0020 | |||||

| Samarco Mineracao SA / DBT (USP8405QAA78) | 0,32 | 147,69 | 0,0361 | 0,0214 | |||||

| SOLV / Solventum Corporation | 0,32 | 0,0361 | 0,0361 | ||||||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 0,32 | 517,31 | 0,0360 | 0,0301 | |||||

| US3132DMR493 / Freddie Mac Pool | 0,32 | −3,02 | 0,0360 | −0,0014 | |||||

| Nelnet Student Loan Trust, Series 2025-AA, Class A1B / ABS-O (US64033XAE40) | 0,32 | −3,34 | 0,0356 | −0,0016 | |||||

| CNX Resources Corp. / DBT (US12653CAL28) | 0,32 | 1,61 | 0,0355 | 0,0004 | |||||

| US3140XFGV71 / Fannie Mae Pool | 0,32 | −1,86 | 0,0354 | −0,0010 | |||||

| US3140XHKM82 / FNMA 30YR 1.5% 04/01/2052#FS2099 | 0,32 | −1,86 | 0,0354 | −0,0010 | |||||

| Duke Energy Progress LLC / DBT (US26442UAU88) | 0,32 | 0,0353 | 0,0353 | ||||||

| US3132CWTB09 / Freddie Mac Pool | 0,31 | −3,12 | 0,0349 | −0,0014 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0,31 | 1,30 | 0,0349 | 0,0002 | |||||

| US3140QQTM73 / Fannie Mae Pool | 0,31 | −2,81 | 0,0349 | −0,0013 | |||||

| Cali, Series 2024-SUN, Class A / ABS-MBS (US12988DAA00) | 0,31 | 0,00 | 0,0349 | −0,0002 | |||||

| Angel Oak Mortgage Trust, Series 2025-2, Class A1 / ABS-MBS (US03466QAA13) | 0,31 | −2,82 | 0,0347 | −0,0013 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,31 | −91,34 | 0,0347 | −0,3611 | |||||

| US3140XFGW54 / Fannie Mae Pool | 0,31 | −3,74 | 0,0347 | −0,0015 | |||||

| EFMT, Series 2025-INV2, Class A1 / ABS-MBS (US281914AA90) | 0,31 | 0,0345 | 0,0345 | ||||||

| US36179XQR07 / Ginnie Mae II Pool | 0,31 | −3,79 | 0,0342 | −0,0016 | |||||

| US378272BE79 / Glencore Funding LLC | 0,30 | −19,58 | 0,0341 | −0,0085 | |||||

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2024-IGLG, Class E / ABS-MBS (US46593KAJ07) | 0,30 | 0,00 | 0,0341 | −0,0003 | |||||

| US3132DMKH78 / Freddie Mac Pool | 0,30 | −1,94 | 0,0340 | −0,0010 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0,30 | −52,14 | 0,0339 | −0,0360 | |||||

| US86964WAK80 / Suzano Austria GmbH | 0,30 | 310,96 | 0,0337 | 0,0247 | |||||

| US3132DPML93 / Freddie Mac Pool | 0,30 | −3,85 | 0,0336 | −0,0017 | |||||

| Huntington Bank Auto Credit-Linked Notes, Series 2024-2, Class B2 / ABS-O (US44644NAH26) | 0,30 | −8,31 | 0,0334 | −0,0033 | |||||

| USD Currency / DFE (N/A) | 0,30 | 0,0332 | 0,0332 | ||||||

| Taurus UK DAC, Series 2025-UK2X, Class D / ABS-MBS (XS3025431191) | 0,30 | 5,34 | 0,0332 | 0,0014 | |||||

| US3132M8NA03 / Federal Home Loan Mortgage Corp. | 0,30 | −1,01 | 0,0331 | −0,0006 | |||||

| US11135FBK66 / BROADCOM INC 3.419% 04/15/2033 144A | 0,30 | 36,57 | 0,0331 | 0,0081 | |||||

| US46647PBU93 / JPMorgan Chase & Co | 0,29 | −52,35 | 0,0330 | −0,0383 | |||||

| US3133KYWH88 / Freddie Mac Pool | 0,29 | −1,68 | 0,0329 | −0,0008 | |||||

| BAY Mortgage Trust, Series 2025-LIVN, Class A / ABS-MBS (US072925AA82) | 0,29 | 0,0328 | 0,0328 | ||||||

| US61747YEL56 / Morgan Stanley | 0,29 | 1,75 | 0,0327 | 0,0003 | |||||

| US3140QM3K84 / Fannie Mae Pool | 0,29 | −2,35 | 0,0326 | −0,0011 | |||||

| SEI / Solaris Energy Infrastructure, Inc. | 0,29 | 0,0326 | 0,0326 | ||||||

| Verus Securitization Trust, Series 2023-2, Class B1 / ABS-MBS (US92539DAE85) | 0,29 | 0,00 | 0,0323 | −0,0003 | |||||

| US161175AZ73 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0,29 | 925,00 | 0,0322 | 0,0288 | |||||

| US3140QRXY49 / Fannie Mae Pool | 0,29 | −4,68 | 0,0320 | −0,0018 | |||||

| US3140QEB507 / Federal National Mortgage Association | 0,29 | −2,73 | 0,0319 | −0,0012 | |||||

| GoodLeap Home Improvement Solutions Trust, Series 2024-1A, Class A / ABS-O (US381935AA36) | 0,28 | −9,27 | 0,0319 | −0,0034 | |||||

| US337932AL12 / FIRSTENERGY CORP SR UNSEC 2.65% 03-01-30 | 0,28 | 118,46 | 0,0319 | 0,0152 | |||||

| US3140XAY552 / Uniform Mortgage-Backed Securities | 0,28 | −2,41 | 0,0318 | −0,0010 | |||||

| US3132DMRJ61 / Freddie Mac Pool | 0,28 | −4,07 | 0,0317 | −0,0016 | |||||

| US373334KR13 / GEORGIA POWER COMPANY | 0,28 | −2,75 | 0,0317 | −0,0012 | |||||

| US3140QNNT59 / Fannie Mae Pool | 0,28 | −1,74 | 0,0317 | −0,0008 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,28 | 11,02 | 0,0316 | 0,0029 | |||||

| US31418EAB65 / FN MA4501 | 0,28 | −1,40 | 0,0316 | −0,0007 | |||||

| US341081FU66 / Florida Power & Light Co. | 0,28 | −1,06 | 0,0315 | −0,0005 | |||||

| Foundry JV Holdco LLC / DBT (US350930AH62) | 0,28 | −41,82 | 0,0315 | −0,0230 | |||||

| Ohio Edison Co. / DBT (US677347CJ38) | 0,28 | 0,0314 | 0,0314 | ||||||

| US1248EPCP61 / CCO Holdings LLC / CCO Holdings Capital Corp | 0,28 | 0,0313 | 0,0313 | ||||||

| US06051GLH01 / Bank of America Corp. | 0,28 | 4,49 | 0,0313 | −0,0006 | |||||

| US3140HBFN35 / Fannie Mae Pool | 0,28 | −3,79 | 0,0312 | −0,0015 | |||||

| SVC / Service Properties Trust | 0,28 | 3,73 | 0,0312 | 0,0009 | |||||

| US61747YFH36 / Morgan Stanley | 0,28 | −91,60 | 0,0312 | −0,3511 | |||||

| US26442EAH36 / Duke Energy Ohio Inc | 0,28 | 89,12 | 0,0311 | 0,0106 | |||||

| US3138EKF596 / Fannie Mae Pool | 0,28 | −1,77 | 0,0311 | −0,0008 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 0,28 | −60,14 | 0,0311 | −0,0474 | |||||

| US054989AC24 / BAT CAPITAL CORP 7.079000% 08/02/2043 | 0,28 | 82,24 | 0,0311 | 0,0138 | |||||

| US3132DMRR87 / Freddie Mac Pool | 0,28 | −2,81 | 0,0310 | −0,0012 | |||||

| US141312AA60 / Carbone Clo Ltd | 0,28 | −16,11 | 0,0310 | −0,0062 | |||||

| US68389XBY04 / Oracle Corp | 0,28 | −8,31 | 0,0309 | −0,0031 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,28 | 0,0309 | 0,0309 | ||||||

| SVC / Service Properties Trust | 0,27 | 4,21 | 0,0305 | 0,0010 | |||||

| US00206RKB77 / AT&T INC 3.850000% 06/01/2060 | 0,27 | 53,98 | 0,0304 | 0,0101 | |||||

| US3133B2Y297 / FHLG 30YR 1.5% 01/01/2052# | 0,27 | −1,09 | 0,0304 | −0,0006 | |||||

| US3140X8XE23 / Fannie Mae Pool | 0,27 | −2,17 | 0,0304 | −0,0009 | |||||

| US161175BN35 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0,27 | 187,23 | 0,0303 | 0,0174 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0,27 | 0,0302 | 0,0302 | ||||||

| US3140QFZC62 / Fannie Mae Pool | 0,27 | −3,24 | 0,0302 | −0,0012 | |||||

| US036752AS28 / Anthem Inc | 0,27 | −6,92 | 0,0302 | −0,0025 | |||||

| US3132DMRT44 / Freddie Mac Pool | 0,27 | −2,18 | 0,0302 | −0,0009 | |||||

| US3132D9B869 / Freddie Mac Pool | 0,27 | −5,30 | 0,0301 | −0,0018 | |||||

| U.S. Treasury 5-Year Note / DIR (N/A) | 0,27 | 0,0301 | 0,0301 | ||||||

| US694308HH37 / PACIFIC GAS + ELECTRIC SR UNSECURED 02/44 4.75 | 0,27 | 0,0300 | 0,0300 | ||||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0,27 | −4,30 | 0,0299 | −0,0016 | |||||

| US161636AA34 / Chase Mortgage Finance Trust Series 2007-S6 | 0,26 | −0,76 | 0,0293 | −0,0004 | |||||

| US912810SK51 / United States Treasury Note/Bond | 0,26 | −2,61 | 0,0292 | −0,0011 | |||||

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2024-IGLG, Class F / ABS-MBS (US46593KAL52) | 0,26 | −0,77 | 0,0290 | −0,0005 | |||||

| US172967MY46 / Citigroup Inc | 0,26 | −70,65 | 0,0290 | −0,0726 | |||||

| US3140XDS491 / FANNIE MAE POOL UMBS P#FM9538 2.00000000 | 0,26 | −2,64 | 0,0289 | −0,0010 | |||||

| US02209SAV51 / Altria Group Inc | 0,26 | 1,18 | 0,0288 | 0,0000 | |||||

| US3140XFKC45 / Uniform Mortgage-Backed Securities | 0,26 | −2,30 | 0,0286 | −0,0009 | |||||

| 1345T, Series 2025-AOA, Class A / ABS-MBS (US68271CAA09) | 0,26 | 0,0286 | 0,0286 | ||||||

| US031162DC10 / Amgen Inc | 0,25 | 0,0285 | 0,0285 | ||||||

| US3132DNNR07 / Freddie Mac Pool | 0,25 | −3,07 | 0,0284 | −0,0011 | |||||

| US677415CR01 / Ohio Power Co. | 0,25 | −5,62 | 0,0283 | −0,0020 | |||||

| US06051GFG91 / Bank of America Corp. | 0,25 | 10,57 | 0,0281 | 0,0024 | |||||

| Regatta XI Funding Ltd., Series 2018-1A, Class AR / ABS-CBDO (US75887XAN75) | 0,25 | 0,0281 | 0,0281 | ||||||

| Sagard-Halseypoint CLO 8 Ltd., Series 2024-8A, Class A1 / ABS-CBDO (US78662AAA07) | 0,25 | 0,0281 | 0,0281 | ||||||

| Silver Point CLO 7 Ltd., Series 2024-7A, Class A1 / ABS-CBDO (US82808UAA34) | 0,25 | 0,00 | 0,0281 | −0,0002 | |||||

| J.P. Morgan Mortgage Trust, Series 2025-VIS1, Class M1 / ABS-MBS (US46659BAF94) | 0,25 | 0,00 | 0,0280 | −0,0002 | |||||

| Symphony CLO 46 Ltd., Series 2024-46A, Class A2 / ABS-CBDO (US87170WAC47) | 0,25 | 0,40 | 0,0280 | −0,0002 | |||||

| OCP CLO Ltd., Series 2020-8RA, Class AR / ABS-CBDO (US670898AQ88) | 0,25 | −50,88 | 0,0280 | −0,0294 | |||||

| Golub Capital Partners 48 LP, Series 2020-48A, Class A1R / ABS-CBDO (US38177DAQ16) | 0,25 | 0,0280 | 0,0280 | ||||||

| US3132D6NY22 / FR SB8507 | 0,25 | −3,10 | 0,0280 | −0,0011 | |||||

| LCM 36 Ltd., Series 36A, Class A1R / ABS-CBDO (US50190LAL27) | 0,25 | 0,40 | 0,0280 | −0,0002 | |||||

| OCP Aegis CLO Ltd., Series 2024-39A, Class A1 / ABS-CBDO (US67120EAA10) | 0,25 | 0,40 | 0,0280 | −0,0002 | |||||

| GoldenTree Loan Management US CLO 7 Ltd., Series 2020-7A, Class ARR / ABS-CBDO (US38138LAW81) | 0,25 | 0,40 | 0,0280 | −0,0002 | |||||

| 1988 CLO 2 Ltd., Series 2023-2A, Class A1R / ABS-CBDO (US653947AJ01) | 0,25 | 0,0280 | 0,0280 | ||||||

| BBAM US CLO I Ltd., Series 2022-1A, Class AR / ABS-CBDO (US054978AL59) | 0,25 | 0,00 | 0,0280 | −0,0002 | |||||

| Sixth Street CLO XIV Ltd., Series 2019-14A, Class A1R2 / ABS-CBDO (US83013NAC48) | 0,25 | 0,00 | 0,0280 | −0,0001 | |||||

| Milford Park CLO Ltd., Series 2022-1A, Class AR / ABS-CBDO (US59966PAN24) | 0,25 | 0,40 | 0,0280 | −0,0001 | |||||

| Neuberger Berman CLO XX Ltd., Series 2015-20A, Class A1R3 / ABS-CBDO (US64130TBJ34) | 0,25 | 0,0280 | 0,0280 | ||||||

| Oaktree CLO Ltd., Series 2021-2A, Class AR / ABS-CBDO (US67389BAQ86) | 0,25 | 0,40 | 0,0280 | −0,0001 | |||||

| OHA Credit Partners VII Ltd., Series 2012-7A, Class AR4 / ABS-CBDO (US67102QBK31) | 0,25 | 0,0280 | 0,0280 | ||||||

| Elmwood CLO 38 Ltd., Series 2025-1A, Class A / ABS-CBDO (US289908AA34) | 0,25 | 0,0280 | 0,0280 | ||||||

| GoldenTree Loan Management US CLO 16 Ltd., Series 2022-16A, Class ARR / ABS-CBDO (US38090AAQ13) | 0,25 | 0,0280 | 0,0280 | ||||||

| Ellington Financial Mortgage Trust, Series 2025-INV1, Class A1 / ABS-MBS (US26846XAA81) | 0,25 | −3,86 | 0,0280 | −0,0013 | |||||

| Wellington Management CLO 4 Ltd., Series 2025-4A, Class A / ABS-CBDO (US94957LAA70) | 0,25 | −0,40 | 0,0279 | −0,0003 | |||||

| CIFC Funding Ltd., Series 2025-2A, Class A / ABS-CBDO (US17181DAA46) | 0,25 | 0,40 | 0,0279 | −0,0001 | |||||

| Madison Park Funding LXXI Ltd., Series 2025-71A, Class A1 / ABS-CBDO (US55817DAA63) | 0,25 | −0,40 | 0,0279 | −0,0003 | |||||

| OCP CLO Ltd., Series 2025-40A, Class A / ABS-CBDO (US67570FAA30) | 0,25 | −0,40 | 0,0279 | −0,0003 | |||||

| US373334KQ30 / Georgia Power Co | 0,25 | −41,78 | 0,0279 | −0,0202 | |||||

| Symphony CLO XXI Ltd., Series 2019-21A, Class AR2 / ABS-CBDO (US87166RGE18) | 0,25 | 0,0276 | 0,0276 | ||||||

| US3140XGPR42 / FN FS1331 | 0,25 | −3,16 | 0,0275 | −0,0011 | |||||

| U.S. Treasury Bonds / DBT (US912810UC08) | 0,25 | −3,16 | 0,0275 | −0,0012 | |||||

| US694308KM84 / Pacific Gas and Electric Co. | 0,25 | 0,00 | 0,0275 | −0,0002 | |||||

| US717081FA61 / PFIZER INC 2.7% 05/28/2050 | 0,24 | 67,12 | 0,0274 | 0,0109 | |||||

| US3140QRB855 / Fannie Mae Pool | 0,24 | −4,69 | 0,0274 | −0,0016 | |||||

| US666807BU55 / Northrop Grumman Corp | 0,24 | −48,08 | 0,0273 | −0,0255 | |||||

| Cross Mortgage Trust, Series 2024-H7, Class A1 / ABS-MBS (US22757CAA09) | 0,24 | −6,18 | 0,0273 | −0,0021 | |||||

| New Residential Mortgage Loan Trust, Series 2025-NQM1, Class A1 / ABS-MBS (US64832DAC56) | 0,24 | −1,22 | 0,0273 | −0,0005 | |||||

| Prime Investments LLC / DBT (74167YAA7) | 0,24 | 0,0271 | 0,0271 | ||||||

| US3140XFAD38 / FN FS0003 | 0,24 | −2,82 | 0,0271 | −0,0009 | |||||

| US03674XAQ97 / Antero Resources Corp | 0,24 | −45,10 | 0,0270 | −0,0226 | |||||

| US38382TBX19 / GNMA CMO IO | 0,24 | −2,43 | 0,0270 | −0,0009 | |||||

| US26441CBU80 / Duke Energy Corp | 0,24 | 129,52 | 0,0270 | 0,0151 | |||||

| W1BD34 / Warner Bros. Discovery, Inc. - Depositary Receipt (Common Stock) | 0,24 | 0,0270 | 0,0270 | ||||||

| US06051GJM24 / Bank of America Corp | 0,24 | −49,68 | 0,0268 | −0,0269 | |||||

| Last Mile Securities PE DAC, Series 2021-1X, Class D / ABS-MBS (XS2320421683) | 0,24 | 9,13 | 0,0268 | 0,0021 | |||||

| US36179WTZ13 / GINNIE MAE II POOL P#MA7768 3.00000000 | 0,24 | −2,85 | 0,0268 | −0,0011 | |||||

| US37045XEP78 / General Motors Financial Co Inc | 0,24 | 2,59 | 0,0267 | 0,0004 | |||||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 0,24 | 0,0265 | 0,0265 | ||||||

| Vistra Operations Co. LLC / DBT (US92840VAT98) | 0,24 | 0,43 | 0,0264 | −0,0002 | |||||

| CSMC Trust, Series 2022-NQM6, Class PT / ABS-MBS (US12663YAM03) | 0,23 | −6,40 | 0,0263 | −0,0019 | |||||

| US38382VHH50 / Government National Mortgage Association, Series 2021-97, Class LI | 0,23 | −5,67 | 0,0262 | −0,0018 | |||||

| OBX Trust, Series 2025-NQM3, Class A1 / ABS-MBS (US67448YAC84) | 0,23 | −3,32 | 0,0261 | −0,0011 | |||||

| US06051GHV41 / Bank of America Corp | 0,23 | −38,36 | 0,0261 | −0,0221 | |||||

| BAHA Trust, Series 2024-MAR, Class B / ABS-MBS (US05493XAE04) | 0,23 | 1,30 | 0,0261 | 0,0000 | |||||

| US35908MAE03 / Frontier Communications Holdings LLC | 0,23 | 0,0260 | 0,0260 | ||||||

| US03027XBA72 / CORPORATE BONDS | 0,23 | −38,79 | 0,0260 | −0,0178 | |||||

| US3140J6D469 / Fannie Mae Pool | 0,23 | −3,36 | 0,0258 | −0,0011 | |||||

| US87264ABX28 / T-Mobile USA Inc | 0,23 | 0,0257 | 0,0257 | ||||||

| US87303TAQ04 / TTAN 2021-MHC | 0,23 | 0,44 | 0,0257 | −0,0001 | |||||

| US22822VBD29 / Crown Castle Inc | 0,23 | −14,23 | 0,0257 | −0,0046 | |||||

| US3140QDYC24 / FNMA POOL CA6106 FN 06/50 FIXED 4 | 0,23 | −3,39 | 0,0256 | −0,0011 | |||||

| Angel Oak Mortgage Trust, Series 2023-7, Class A1 / ABS-MBS (US03466DAA00) | 0,23 | −3,80 | 0,0256 | −0,0012 | |||||

| US31335BEU61 / Freddie Mac Gold Pool | 0,23 | −2,58 | 0,0255 | −0,0009 | |||||

| US3128MFF947 / Freddie Mac Gold Pool | 0,23 | −5,04 | 0,0254 | −0,0015 | |||||

| MFA Trust, Series 2024-NPL1, Class A1 / ABS-MBS (US58004YAA73) | 0,22 | −4,68 | 0,0252 | −0,0014 | |||||

| ROCK Trust, Series 2024-CNTR, Class E / ABS-MBS (US74970WAJ99) | 0,22 | 0,00 | 0,0251 | −0,0002 | |||||

| NOCG34 / Northrop Grumman Corporation - Depositary Receipt (Common Stock) | 0,22 | −36,83 | 0,0250 | −0,0148 | |||||

| US3140XFFP13 / Fannie Mae Pool | 0,22 | −2,19 | 0,0250 | −0,0008 | |||||

| US3132DMRN73 / Freddie Mac Pool | 0,22 | −2,63 | 0,0249 | −0,0009 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,22 | −4,31 | 0,0249 | −0,0014 | |||||

| US3132DM2T16 / Uniform Mortgage-Backed Securities | 0,22 | −2,63 | 0,0249 | −0,0008 | |||||

| US32028KAE64 / FIRST FRANKLIN MORTGAGE LOAN TRUST 2006-FF17 SER 2006-FF17 CL A5 V/R REGD 1.85800000 | 0,22 | −2,21 | 0,0248 | −0,0007 | |||||

| US00108WAF77 / AEP Texas Inc. | 0,22 | −16,67 | 0,0247 | −0,0051 | |||||

| US3140QM4T84 / Fannie Mae Pool | 0,22 | −3,10 | 0,0246 | −0,0009 | |||||

| INV Mortgage Trust, Series 2024-IND, Class A / ABS-MBS (US45000DAA46) | 0,22 | 0,00 | 0,0246 | −0,0002 | |||||

| Foundry JV Holdco LLC / DBT (US350930AK91) | 0,22 | 0,0246 | 0,0246 | ||||||

| US073852AD76 / Bear Stearns Asset Backed Securities I Trust 2007-HE3 | 0,22 | 0,92 | 0,0245 | 0,0000 | |||||

| US26884LAF67 / EQT Corp. | 0,22 | 0,46 | 0,0244 | −0,0001 | |||||

| US3140XHXB80 / FNMA 30YR 5% 07/01/2052#FS2473 | 0,22 | −3,12 | 0,0244 | −0,0009 | |||||

| US796253Y307 / San Antonio, Texas, Electric and Gas System Revenue Bonds, Junior Lien, Build America Taxable Bond Series 2010A | 0,22 | −2,26 | 0,0243 | −0,0007 | |||||

| US023551AJ38 / Amerada Hess Corp 7.300% Notes 08/15/31 | 0,22 | 0,00 | 0,0242 | −0,0001 | |||||

| BX Commercial Mortgage Trust, Series 2024-GPA3, Class A / ABS-MBS (US123910AA98) | 0,22 | 0,00 | 0,0242 | −0,0001 | |||||

| Stream Innovations Issuer Trust, Series 2025-1A, Class A / ABS-O (US86324XAA37) | 0,22 | 0,0241 | 0,0241 | ||||||

| CSMC, Series 2022-ATH3, Class B1 / ABS-MBS (US12664AAH23) | 0,22 | 0,0241 | 0,0241 | ||||||

| US3132DMRM90 / Freddie Mac Pool | 0,21 | −3,17 | 0,0240 | −0,0010 | |||||

| US031162DG24 / Amgen Inc | 0,21 | −17,44 | 0,0239 | −0,0053 | |||||

| US693304BA44 / PECO Energy Co | 0,21 | −29,57 | 0,0237 | −0,0102 | |||||

| US06051GHX07 / Bank of America Corp | 0,21 | 0,0237 | 0,0237 | ||||||

| US31418DSH60 / Fannie Mae Pool | 0,21 | −2,31 | 0,0237 | −0,0008 | |||||

| US3133B2ME64 / Freddie Mac Pool | 0,21 | −3,23 | 0,0236 | −0,0010 | |||||

| Raizen Fuels Finance SA / DBT (US75102XAF33) | 0,21 | 0,0235 | 0,0235 | ||||||

| US59259YBY41 / MET TRANSPRTN AUTH NY REVENUE | 0,21 | −1,88 | 0,0235 | −0,0006 | |||||

| FS Rialto Issuer LLC, Series 2024-FL9, Class A / ABS-CBDO (US30338WAL37) | 0,21 | 0,48 | 0,0235 | −0,0001 | |||||

| US3133KQKR64 / Freddie Mac Pool | 0,21 | −0,95 | 0,0234 | −0,0004 | |||||

| US3140QMVL58 / Federal National Mortgage Association | 0,21 | −3,70 | 0,0234 | −0,0010 | |||||

| ECL Entertainment LLC, Facility 1st Lien Term Loan B / LON (US26826TAL70) | 0,21 | 0,00 | 0,0233 | −0,0002 | |||||

| US3140XATV48 / Federal National Mortgage Association | 0,21 | −2,80 | 0,0233 | −0,0009 | |||||

| US3132DQB548 / FREDDIE MAC POOL UMBS P#SD2760 6.00000000 | 0,21 | −2,80 | 0,0233 | −0,0009 | |||||

| US3140XEA380 / Fannie Mae Pool | 0,21 | −1,89 | 0,0233 | −0,0007 | |||||

| CWABS Asset-Backed Certificates Trust, Series 2006-14, Class M1 / ABS-O (US23243LAE20) | 0,21 | −3,27 | 0,0233 | −0,0009 | |||||

| US87264ACV52 / T-Mobile USA, Inc. | 0,21 | 65,60 | 0,0233 | 0,0078 | |||||

| US38382QQP80 / Government National Mortgage Association | 0,21 | −2,36 | 0,0232 | −0,0008 | |||||

| US3140X83E51 / Fannie Mae Pool | 0,21 | −2,82 | 0,0232 | −0,0009 | |||||

| US3132DVLW36 / Freddie Mac Pool | 0,21 | −2,36 | 0,0232 | −0,0008 | |||||

| US67091TAA34 / OCP SA | 0,21 | 0,49 | 0,0232 | −0,0000 | |||||

| PRPM Trust, Series 2025-NQM1, Class A1 / ABS-MBS (US74391EAA91) | 0,21 | −5,96 | 0,0230 | −0,0017 | |||||

| US29082HAA05 / Embraer Netherlands Finance BV | 0,21 | 0,0230 | 0,0230 | ||||||

| US02209SBG75 / Altria Group, Inc. | 0,20 | 2,00 | 0,0229 | 0,0002 | |||||

| US3132DMY580 / Freddie Mac Pool | 0,20 | −2,40 | 0,0228 | −0,0007 | |||||

| US161175BT05 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0,20 | 12,15 | 0,0227 | −0,0001 | |||||

| US694308JH19 / Pacific Gas and Electric Co | 0,20 | 0,0227 | 0,0227 | ||||||

| US3133KQGC42 / Freddie Mac Pool | 0,20 | −2,43 | 0,0226 | −0,0007 | |||||

| INVH / Invitation Homes Inc. | 0,01 | 0,00 | 0,20 | −6,07 | 0,0226 | −0,0016 | |||

| FIGRE Trust, Series 2024-SL1, Class A1 / ABS-O (US31684JAA43) | 0,20 | −7,37 | 0,0225 | −0,0021 | |||||

| US3132DM2S33 / Uniform Mortgage-Backed Securities | 0,20 | −1,96 | 0,0225 | −0,0007 | |||||

| US92343VFL36 / Verizon Communications Inc | 0,20 | −70,63 | 0,0224 | −0,0545 | |||||

| US320275AD21 / First Franklin Mortgage Loan Trust 2006-FF16 | 0,20 | −1,49 | 0,0223 | −0,0005 | |||||

| US26441CBN48 / Duke Energy Corp | 0,20 | 0,0223 | 0,0223 | ||||||

| Raizen Fuels Finance SA / DBT (USL7909CAC12) | 0,20 | 0,0223 | 0,0223 | ||||||

| US3140QNNX61 / Fannie Mae Pool | 0,20 | −1,49 | 0,0222 | −0,0005 | |||||

| US05526DBK00 / BAT Capital Corp. | 0,20 | 358,14 | 0,0221 | 0,0172 | |||||

| US3140J57D52 / Fannie Mae Pool | 0,20 | −5,74 | 0,0221 | −0,0015 | |||||

| US599191AA16 / Mileage Plus Holdings LLC / Mileage Plus Intellectual Property Assets Ltd | 0,20 | −11,31 | 0,0220 | −0,0030 | |||||

| US01F0304703 / UMBS 15YR TBA(REG B) 3.0 UMBS TBA 07-01-35 | 0,19 | −50,39 | 0,0217 | −0,0233 | |||||

| US031162DU18 / Amgen Inc | 0,19 | −56,53 | 0,0217 | −0,0285 | |||||

| WBD / Warner Bros. Discovery, Inc. | 0,02 | 166,04 | 0,19 | 188,06 | 0,0216 | 0,0139 | |||

| US38382RHG65 / Government National Mortgage Association, Series 2021-58, Class IY | 0,19 | −5,88 | 0,0216 | −0,0015 | |||||

| US3140XFA437 / Uniform Mortgage-Backed Securities | 0,19 | −3,52 | 0,0215 | −0,0010 | |||||

| US3140XJVT72 / Fannie Mae Pool | 0,19 | −2,54 | 0,0215 | −0,0008 | |||||

| US31418CR890 / Fannie Mae Pool | 0,19 | −2,05 | 0,0215 | −0,0005 | |||||

| US31418CRC00 / FANNIE MAE 3.50% 11/01/2047 FNMA | 0,19 | −1,55 | 0,0215 | −0,0005 | |||||

| ACRA Trust, Series 2024-NQM1, Class A1 / ABS-MBS (US00112EAA29) | 0,19 | −2,55 | 0,0214 | −0,0008 | |||||

| US36179UPB25 / Ginnie Mae II Pool | 0,19 | −2,05 | 0,0214 | −0,0007 | |||||

| US46647PBX33 / JPMorgan Chase & Co | 0,19 | −83,14 | 0,0213 | −0,1053 | |||||

| US056083AL23 / BXP_17-GM | 0,19 | 0,53 | 0,0213 | −0,0001 | |||||

| US31418ECY41 / FNCT UMBS 2.0 MA4586 03-01-42 | 0,19 | −1,05 | 0,0212 | −0,0004 | |||||

| US90187LAN91 / 245 Park Avenue Trust 2017-245P | 0,19 | 1,09 | 0,0209 | 0,0001 | |||||

| US3132D9DQ47 / Freddie Mac Pool | 0,19 | −3,12 | 0,0209 | −0,0009 | |||||