Grundläggande statistik

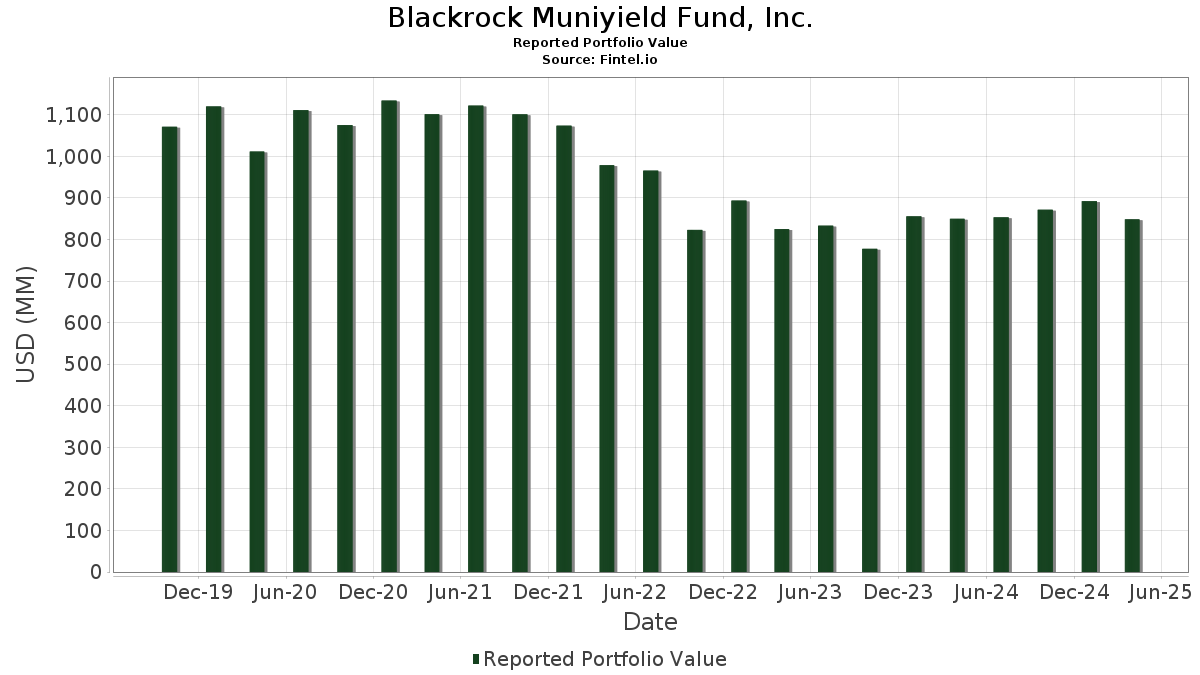

| Portföljvärde | $ 848 467 603 |

| Aktuella positioner | 264 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

Blackrock Muniyield Fund, Inc. har redovisat 264 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 848 467 603 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). Blackrock Muniyield Fund, Inc.s största innehav är Hudson Yards Infrastructure Corporation, New York, Revenue Bonds, Second Indenture Fiscal 2017 Series A (US:US44420RBE99) , NEW JERSEY ST ECON DEV AUTH REVENUE (US:US64577B5G55) , Omaha Public Power District (US:US682001GZ98) , Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB (US:US74529JPX71) , and BLACK BELT ENE 0% 10/1/2054 (US:US09182TDB08) . Blackrock Muniyield Fund, Inc.s nya positioner inkluderar Hudson Yards Infrastructure Corporation, New York, Revenue Bonds, Second Indenture Fiscal 2017 Series A (US:US44420RBE99) , NEW JERSEY ST ECON DEV AUTH REVENUE (US:US64577B5G55) , Omaha Public Power District (US:US682001GZ98) , Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB (US:US74529JPX71) , and BLACK BELT ENE 0% 10/1/2054 (US:US09182TDB08) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 10,45 | 2,0423 | 2,0423 | ||

| 7,72 | 1,5073 | 1,3204 | ||

| 6,67 | 1,3022 | 1,3022 | ||

| 5,74 | 1,1214 | 1,1214 | ||

| 5,71 | 1,1147 | 1,1147 | ||

| 5,67 | 1,1069 | 1,1069 | ||

| 5,56 | 1,0861 | 1,0861 | ||

| 4,86 | 0,9502 | 0,9502 | ||

| 7,19 | 1,4039 | 0,7409 | ||

| 3,76 | 0,7351 | 0,7351 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 4,37 | 4,37 | 0,8532 | −3,8496 | |

| 0,00 | 0,0000 | −1,9596 | ||

| 0,00 | 0,0000 | −1,1602 | ||

| 2,08 | 0,4060 | −1,0691 | ||

| 0,67 | 0,1307 | −0,2416 | ||

| 8,68 | 1,6963 | −0,2061 | ||

| 2,00 | 0,3905 | −0,1594 | ||

| 2,73 | 0,5332 | −0,0540 | ||

| 8,81 | 1,7220 | −0,0525 | ||

| 4,47 | 0,8733 | −0,0311 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-06-26 för rapporteringsperioden 2025-04-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US44420RBE99 / Hudson Yards Infrastructure Corporation, New York, Revenue Bonds, Second Indenture Fiscal 2017 Series A | 12,72 | −0,93 | 2,4847 | 0,1068 | |||||

| US64577B5G55 / NEW JERSEY ST ECON DEV AUTH REVENUE | 12,41 | −2,08 | 2,4237 | 0,0770 | |||||

| US682001GZ98 / Omaha Public Power District | 12,32 | −2,10 | 2,4064 | 0,0760 | |||||

| US74529JPX71 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 11,56 | −4,68 | 2,2577 | 0,0122 | |||||

| US09182TDB08 / BLACK BELT ENE 0% 10/1/2054 | 11,22 | −1,92 | 2,1912 | 0,0732 | |||||

| US592643BA71 / MET WASHINGTON DC ARPTS AUTH DULLES TOLL ROAD REVENUE | 11,20 | −2,06 | 2,1889 | 0,0699 | |||||

| NEW YORK NY CITY TRANSITIONAL FIN AUTH REV / DBT (US64972JGW27) | 10,45 | 2,0423 | 2,0423 | ||||||

| HILLSBOROUGH CNTY FL AVIATION AUTH / DBT (US432308W915) | 10,45 | −3,18 | 2,0415 | 0,0423 | |||||

| US93974EJ494 / WASHINGTON ST-A | 10,36 | −2,68 | 2,0230 | 0,0523 | |||||

| CHICAGO IL O'HARE INTERNATIONAL ARPT REVENUE / DBT (US1675934S88) | 10,34 | −3,01 | 2,0194 | 0,0455 | |||||

| US875291BN54 / TAMPA FL WTR & WSTWTR | 10,27 | −3,40 | 2,0065 | 0,0372 | |||||

| US64985TES69 / NEW YORK ST URBAN DEV CORP SALES TAX REVENUE | 10,27 | −3,27 | 2,0057 | 0,0398 | |||||

| US59334PKX41 / MIAMI-DADE CNTY FL TRANSIT SALES SURTAX REVENUE | 10,15 | −3,00 | 1,9824 | 0,0448 | |||||

| US739247AA20 / PWR CNTY ID INDL DEV CORP SOL REGD B/E AMT 6.45000000 | 10,02 | −0,03 | 1,9573 | 0,1012 | |||||

| US84136FBT30 / Southeast Energy Authority A Cooperative District | 9,78 | −0,75 | 1,9101 | 0,0854 | |||||

| US592643BB54 / MET WASHINGTON DC ARPTS AUTH DULLES TOLL ROAD REVENUE | 9,55 | −2,43 | 1,8665 | 0,0527 | |||||

| COLUMBUS OH REGL ARPT AUTH REVENUE / DBT (US199546DC38) | 9,37 | −2,94 | 1,8311 | 0,0424 | |||||

| US89602RDY80 / Triborough Bridge and Tunnel Authority, New York, General Purpose Revenue Bonds, MTA Bridges & Tunnels, Series 2018A | 8,88 | −1,59 | 1,7346 | 0,0636 | |||||

| US64972GE424 / New York City Municipal Water Finance Authority | 8,84 | −4,94 | 1,7277 | 0,0046 | |||||

| US592248BE76 / MET PIER & EXPOSITION AUTH IL DEDICATED ST TAX REVENUE | 8,81 | −8,00 | 1,7220 | −0,0525 | |||||

| US254768SQ88 / District of Columbia Housing Finance Agency | 8,68 | −15,46 | 1,6963 | −0,2061 | |||||

| PORT OF SEATTLE WA REVENUE / DBT (US7353892S60) | 8,61 | −4,12 | 1,6813 | 0,0188 | |||||

| US649519DA03 / New York Liberty Development Corp. (3 World Trade Center), Series 2014, Class 1, Ref. RB | 8,09 | −0,65 | 1,5813 | 0,0723 | |||||

| US56035DEE85 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 8,04 | −0,80 | 1,5703 | 0,0695 | |||||

| PENNSYLVANIA ST HSG FIN AGY SF MTGE REVENUE / DBT (US70879QWL30) | 7,73 | −1,90 | 1,5099 | 0,0505 | |||||

| US79575EAR99 / Salt Verde Arizona Fc Bond | 7,72 | −1,03 | 1,5087 | 0,0635 | |||||

| US59335KFB89 / Miami-Dade County, FL Seaport Rev. Refg. | 7,72 | 664,62 | 1,5073 | 1,3204 | |||||

| US880443JF46 / TENNESSEE ST ENERGY ACQUISITION CORP GAS REVENUE | 7,45 | −0,89 | 1,4560 | 0,0632 | |||||

| SOUTHEAST ENERGY AUTH COOPERATIVE DIST AL ENERGY SUPPLY REVE / DBT (US84136HBC60) | 7,19 | 100,78 | 1,4039 | 0,7409 | |||||

| US64990FYQ17 / NY ST DORM DASNY PIT 20A 4.0% 03-15-47 | 7,17 | −5,77 | 1,4012 | −0,0085 | |||||

| US01728LHD73 / FX.RT. MUNI BOND | 7,01 | −2,71 | 1,3690 | 0,0350 | |||||

| US79642GQL94 / SAN ANTONIO WATER SYSTEM 5.25% 05-15-48 | 6,67 | 1,3022 | 1,3022 | ||||||

| US592643AZ32 / MET WASHINGTON DC ARPTS AUTH DULLES TOLL ROAD REVENUE | 6,53 | −1,64 | 1,2758 | 0,0461 | |||||

| HILLSBOROUGH CNTY FLA INDL DEVAUTH HEALTH SYS REVENUE / DBT (US43233KAV61) | 6,36 | −3,85 | 1,2430 | 0,0175 | |||||

| US66285WXM36 / N TX TOLLWAY AUTH REVENUE | 6,23 | −1,30 | 1,2167 | 0,0479 | |||||

| US64990ASR76 / NEW YORK ST DORM AUTH SALES TAX REVENUE | 5,85 | −2,56 | 1,1437 | 0,0308 | |||||

| US052398GY47 / Austin (City of), Series 2019 B, RB | 5,77 | −2,22 | 1,1279 | 0,0343 | |||||

| S E ALABAMA ST GAS SPLY DIST GAS SPLY REVENUE / DBT (US84131TBT88) | 5,74 | 1,1214 | 1,1214 | ||||||

| MIAMI-DADE CNTY FL WTR & SWR REVENUE / DBT (US59334DNW01) | 5,72 | −7,26 | 1,1177 | −0,0250 | |||||

| US167736V381 / City of Chicago IL Waterworks Revenue | 5,71 | 1,1147 | 1,1147 | ||||||

| US74529JRL16 / PUERTO RICO SALES TAX FING CORP SALES TAX REVENUE | 5,70 | −7,30 | 1,1132 | −0,0255 | |||||

| US79625GGT40 / City of San Antonio TX Electric & Gas Systems Revenue, Series 2023, RB | 5,67 | 1,1069 | 1,1069 | ||||||

| NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE / DBT (US650116HA79) | 5,58 | −2,87 | 1,0896 | 0,0260 | |||||

| US7352403J08 / Port of Portland OR Airport Revenue | 5,56 | 38,68 | 1,0865 | 0,3438 | |||||

| LOWER COLORADO RIVER TX AUTH TRANSMISSION CONTRACT REVENUE / DBT (US54811BL331) | 5,56 | 1,0861 | 1,0861 | ||||||

| US87638TGQ04 / TARRANT CNTY TX CULTURAL EDU FACS FIN CORP REVENUE | 5,52 | −1,75 | 1,0777 | 0,0377 | |||||

| US60637AMF65 / Missouri Health and Educational Facilities Authority, Health Facilities Revenue Bonds, Mercy Health, Series 2017C | 5,49 | −1,72 | 1,0724 | 0,0379 | |||||

| US682001JU74 / OMAHA NE PUBLIC PWR DIST ELEC REVENUE | 5,27 | −3,18 | 1,0286 | 0,0214 | |||||

| US79575EAS72 / Salt Verde Arizona Fc Bond | 5,20 | −3,47 | 1,0150 | 0,0180 | |||||

| US57604TKJ42 / MASSACHUSETTS ST TRANSPRTN FUND REVENUE | 5,17 | −2,71 | 1,0104 | 0,0258 | |||||

| US70252AAW53 / County of Pasco FL | 5,09 | −3,52 | 0,9950 | 0,0172 | |||||

| US888808HT28 / TOBACCO SETTLEMENT FING CORP NJ | 5,06 | −4,54 | 0,9894 | 0,0068 | |||||

| US09182TCQ85 / BLACK BELT ENERGY GAS DIST AL GAS PROJECT REVENUE | 4,91 | −1,23 | 0,9583 | 0,0385 | |||||

| MARYLAND STADIUM AUTH BUILT TO LEARN REVENUE / DBT (US574294CV42) | 4,86 | 0,9502 | 0,9502 | ||||||

| MESQUITE TX HSG FIN CORP MF HSG REVENUE / DBT (US590747AA97) | 4,81 | −3,10 | 0,9397 | 0,0201 | |||||

| US60637APW61 / Missouri Health and Educational Facilities Authority, Health Facilities Revenue Bonds, Mosaic Health System, Series 2019A | 4,79 | −6,20 | 0,9364 | −0,0101 | |||||

| US646136EY37 / New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Refunding Series 2006C | 4,78 | −1,28 | 0,9339 | 0,0370 | |||||

| US795576KB20 / City of Salt Lake City UT Airport Revenue | 4,75 | −2,46 | 0,9280 | 0,0260 | |||||

| BLACK BELT ENERGY GAS DIST AL GAS PROJECT REVENUE / DBT (US09182TDL89) | 4,71 | 127,93 | 0,9201 | 0,5374 | |||||

| US167593F801 / Chicago (City of) (O'Hare International Airport), Series 2017 D, RB | 4,53 | −2,56 | 0,8856 | 0,0240 | |||||

| US04108WCD20 / ARKANSAS ST DEV FIN AUTH INDL DEV REVENUE | 4,47 | −8,46 | 0,8733 | −0,0311 | |||||

| US407272V346 / Hamilton County, Ohio, Hospital Facilities Revenue Bonds, TriHealth, Inc Obligated Group Project, Series 2017A | 4,38 | −1,22 | 0,8558 | 0,0345 | |||||

| US09248U8412 / BlackRock Liquidity Funds: MuniCash, Institutional Shares | 4,37 | −82,80 | 4,37 | −82,80 | 0,8532 | −3,8496 | |||

| US88044TAL35 / TENNESSEE ENERGY ACQUISITION CORP COMMODITY PROJECT REVENUE | 4,36 | −1,56 | 0,8518 | 0,0314 | |||||

| US409328AU51 / HAMPTON ROADS VA TRANSPRTN ACCOUNTABILITY COMMISSION | 4,35 | −4,57 | 0,8489 | 0,0055 | |||||

| WISCONSIN ST HSG & ECON DEV AUTH HOME OWNERSHIP REVENUE / DBT (US97689QTT30) | 4,30 | −2,54 | 0,8396 | 0,0229 | |||||

| US592248BB38 / Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion Project, Capital Appreciation Refunding Series 2010B-1 | 4,26 | −7,03 | 0,8323 | −0,0164 | |||||

| IOWA ST FIN AUTH SF MTGE REVENUE / DBT (US46247EBQ70) | 4,19 | −4,94 | 0,8195 | 0,0022 | |||||

| US59447TVE09 / Michigan Finance Authority | 4,17 | −2,57 | 0,8148 | 0,0219 | |||||

| US87638TGP21 / TARRANT CNTY TX CULTURAL EDU FACS FIN CORP REVENUE | 4,11 | −2,40 | 0,8030 | 0,0229 | |||||

| LOUISIANA PUB FACS AUTH REVENUE / DBT (US546399RQ10) | 4,08 | −2,67 | 0,7965 | 0,0206 | |||||

| BEXAR MGMT & DEV CORP TX MF HSG REVENUE / DBT (US08857FAA12) | 4,07 | 1,34 | 0,7957 | 0,0512 | |||||

| US592041YQ41 / MET GOVT NASHVILLE & DAVIDSONCNTY TN HLTH & EDUCTNL FAC BRD | 4,00 | −1,55 | 0,7810 | 0,0290 | |||||

| OREGON ST HSG & CMNTY SVCS DEPT MF REVENUE / DBT (US68608ENJ72) | 4,00 | −0,99 | 0,7806 | 0,0332 | |||||

| FLORIDA ST DEV FIN CORP / DBT (US340618DR59) | 3,76 | 0,7351 | 0,7351 | ||||||

| US64577XED49 / New Jersey Economic Development Authority | 3,68 | −4,32 | 0,7188 | 0,0066 | |||||

| US442349GV27 / City of Houston TX Airport System Revenue | 3,67 | −2,75 | 0,7174 | 0,0180 | |||||

| US295095BB81 / Erie Tobacco Asset Securitization Corp., Series 2005 A, RB | 3,64 | −4,98 | 0,7119 | 0,0016 | |||||

| PIMA CNTY AZ INDL DEV AUTH SFMTGE / DBT (US721905SG33) | 3,63 | 0,28 | 0,7101 | 0,0388 | |||||

| US575579QA85 / MASSACHUSETTS ST BAY TRANSPRTN AUTH SALES TAX REVENUE | 3,54 | −1,67 | 0,6920 | 0,0247 | |||||

| US74529JPW98 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 3,52 | −5,76 | 0,6872 | −0,0041 | |||||

| US254840DA69 / DIST OF COLUMBIA TAX INCR REVENUE | 3,49 | 0,00 | 0,6825 | 0,0355 | |||||

| US7962536U17 / SAN ANTONIO TX ELEC & GAS REVENUE | 3,43 | −0,64 | 0,6702 | 0,0308 | |||||

| US83703EMQ51 / FX.RT. MUNI BOND | 3,35 | −9,42 | 0,6539 | −0,0305 | |||||

| US71885FFG72 / PHOENIX AZ INDL DEV AUTH EDU REVENUE | 3,34 | −3,25 | 0,6520 | 0,0131 | |||||

| US679111D279 / OKLAHOMA ST TURNPIKE AUTH | 3,33 | −2,35 | 0,6505 | 0,0189 | |||||

| US59261AG351 / MET TRANSPRTN AUTH NY REVENUE | 3,32 | −2,87 | 0,6487 | 0,0156 | |||||

| US130923BH74 / California (State of) Statewide Finance Authority (Pooled Tobacco Securitization), Series 2002, RB | 3,29 | 0,00 | 0,6420 | 0,0333 | |||||

| US052398FD19 / AUSTIN TX ARPT SYS REVENUE | 3,27 | −1,15 | 0,6394 | 0,0262 | |||||

| US593490NG65 / City of Miami FL, Series 2023, RB | 3,26 | 0,6376 | 0,6376 | ||||||

| US592643DF41 / Metropolitan Washington Airports Authority Dulles Toll Road Revenue | 3,26 | −6,44 | 0,6361 | −0,0085 | |||||

| PENNSYLVANIA ST HSG FIN AGY MF HSG REVENUE / DBT (US708797BF15) | 3,25 | −0,91 | 0,6357 | 0,0275 | |||||

| US62947YAL56 / NEW YORK CNTYS NY TOBACCO TRUST IV | 3,20 | 0,00 | 0,6251 | 0,0325 | |||||

| US708686DZ05 / Pennsylvania (State of) Economic Development Financing Authority (National Gypson Co.), Series 2014, Ref. RB | 3,19 | −0,65 | 0,6231 | 0,0285 | |||||

| US70879QTX15 / PENNSYLVANIA H7(PA-WL 4/1/82) 5% 10/1/43 | 3,17 | −2,19 | 0,6194 | 0,0190 | |||||

| US2322655Q77 / CUYAHOGA CNTY OH HOSP REVENUE | 3,15 | −1,69 | 0,6147 | 0,0219 | |||||

| US26444CHF23 / DULUTH MN ECON DEV AUTH HLTH CARE FACS REVENUE | 3,13 | −1,23 | 0,6107 | 0,0246 | |||||

| US45203MQB09 / Illinois Housing Development Authority | 3,13 | −0,54 | 0,6106 | 0,0286 | |||||

| US74529JQG30 / Puerto Rico Sales Tax Fing Corp Sales 0.00 8/1/2056 Bond DBT | 3,10 | −2,18 | 0,6051 | 0,0186 | |||||

| US167505QP42 / CHICAGO IL BRD OF EDU | 3,10 | −0,03 | 0,6047 | 0,0312 | |||||

| FLORIDA ST HSG FIN CORP REVENUE / DBT (US34074M3P41) | 3,09 | −2,61 | 0,6039 | 0,0160 | |||||

| US79739GNY88 / SAN DIEGO CNTY CA REGL ARPT AUTH | 3,09 | −5,01 | 0,6038 | 0,0013 | |||||

| US5465892B71 / LOUISVILLE & JEFFERSON CNTY KY MET SWR DIST SWR & DRAIN SYS | 3,09 | −3,11 | 0,6035 | 0,0130 | |||||

| US875301FP31 / Tampa-Hillsborough County Expressway Authority | 3,08 | −1,60 | 0,6025 | 0,0219 | |||||

| US74514L3H80 / PUERTO RICO CMWLTH | 3,02 | −4,34 | 0,5904 | 0,0054 | |||||

| US896035CD29 / Sales Tax RB Series 2023A | 3,00 | 0,5858 | 0,5858 | ||||||

| US61075TUV87 / MONROE NY IDC 4% 7/1/2050 | 3,00 | −5,49 | 0,5852 | −0,0018 | |||||

| NATIONAL FIN AUTH NH MUNI CTFS / DBT (US63607WAQ78) | 2,96 | −2,82 | 0,5791 | 0,0142 | |||||

| US57582RY599 / Commonwealth of Massachusetts | 2,91 | −2,38 | 0,5678 | 0,0163 | |||||

| US392274X352 / Greater Orlando Aviation Authority | 2,87 | 0,5603 | 0,5603 | ||||||

| US57584XD571 / Massachusetts (State of) Development Finance Agency (Emerson College), Series 2016 A, RB | 2,85 | −5,82 | 0,5565 | −0,0037 | |||||

| US57582RY268 / Massachusetts State, General Obligation Bonds, Consolidated Loan, Series 2022C | 2,83 | −2,68 | 0,5530 | 0,0143 | |||||

| US246317GV79 / Delaware River and Bay Authority, Delaware and New Jersey, Revenue Bonds, Series 2019 | 2,83 | −5,20 | 0,5519 | −0,0001 | |||||

| US546410CY53 / Louisiana Stadium & Exposition District | 2,82 | 0,5517 | 0,5517 | ||||||

| US491397AU97 / KENTUCKY PUB TRANSPRTN INFRASTRUCTURE AUTH TOLL REVENUE | 2,82 | −1,85 | 0,5501 | 0,0189 | |||||

| US74514L3J47 / PUERTO RICO CMWLTH | 2,79 | −4,49 | 0,5441 | 0,0039 | |||||

| HOUSTON TX / DBT (US442332EE86) | 2,77 | −7,36 | 0,5414 | −0,0128 | |||||

| US167505WC64 / CHICAGO IL BRD OF EDU | 2,77 | −3,62 | 0,5408 | 0,0087 | |||||

| US118217CZ97 / BUCKEYE OH TOBACCO SETTLEMENT FING AUTH | 2,73 | −13,88 | 0,5332 | −0,0540 | |||||

| TEXAS ST UNIV SYS FING REVENUE / DBT (US88278PJ881) | 2,67 | −6,39 | 0,5207 | −0,0067 | |||||

| US586111PM27 / Memphis-Shelby County Airport Authority | 2,66 | −2,92 | 0,5195 | 0,0121 | |||||

| US2322655T17 / CUYAHOGA CNTY OH HOSP REVENUE | 2,59 | −6,00 | 0,5054 | −0,0044 | |||||

| US240523A347 / DE KALB CNTY GA WTR & SWR REVENUE | 2,58 | 0,5034 | 0,5034 | ||||||

| US64972JAX63 / NEW YORK NY CITY TRANSITIONAL FIN AUTH REV | 2,57 | −2,95 | 0,5019 | 0,0116 | |||||

| ILLINOIS ST FIN AUTH REVENUE / DBT (US45204FYG44) | 2,55 | −3,62 | 0,4989 | 0,0081 | |||||

| US544445WQ87 / LOS ANGELES CA DEPT OF ARPTS ARPT REVENUE | 2,55 | −6,86 | 0,4985 | −0,0090 | |||||

| HAWAII ST ARPTS SYS REVENUE / DBT (US419794J373) | 2,55 | 0,4973 | 0,4973 | ||||||

| CANUTILLO TX INDEP SCH DIST / DBT (US138735YV13) | 2,54 | −6,00 | 0,4962 | −0,0042 | |||||

| CALIFORNIA ST INFRASTRUCTURE & ECON DEV BANK REVENUE / DBT (US13034A6B14) | 2,49 | 0,4866 | 0,4866 | ||||||

| US646080WQ07 / NEW JERSEY ST HGR EDU ASSISTANCE AUTH STUDENT LOAN REVENUE | 2,46 | −5,78 | 0,4809 | −0,0030 | |||||

| US88034WKJ26 / TENDER OPTION BOND TRUST RECEIPTS / CTFS VARIOUS STATES | 2,45 | −5,81 | 0,4786 | −0,0030 | |||||

| US544445S678 / City of Los Angeles Department of Airports | 2,44 | −3,45 | 0,4763 | 0,0088 | |||||

| US888808HQ88 / TOBACCO SETTLEMENT FING CORP NJ | 2,42 | −1,47 | 0,4727 | 0,0179 | |||||

| LOS ANGELES CA DEPT OF ARPTS ARPT REVENUE / DBT (US5444453D91) | 2,41 | 0,4708 | 0,4708 | ||||||

| US882667AN81 / TEXAS ST PRIV ACTIVITY BOND SURFACE TRANSPRTN CORP REVENUE | 2,39 | −3,09 | 0,4660 | 0,0102 | |||||

| ORANGE CNTY FL HLTH FACS AUTH REVENUE / DBT (US68450LJQ95) | 2,38 | −3,99 | 0,4656 | 0,0058 | |||||

| US575896YJ82 / Massachusetts Port Authority | 2,33 | −3,56 | 0,4559 | 0,0077 | |||||

| CMNTY DEV ADMIN MD MF DEV REVENUE / DBT (US20364NCJ46) | 2,30 | −5,70 | 0,4490 | −0,0025 | |||||

| US89602RGQ20 / Triborough Bridge and Tunnel Authority, New York, General Revenue Bonds, MTA Bridges & Tunnels, Series 2021A | 2,29 | −1,63 | 0,4480 | 0,0162 | |||||

| COOK CNTY IL CMNTY CONSOL SCHDIST #64 PARK RIDGE / DBT (US213669LC61) | 2,26 | 0,4422 | 0,4422 | ||||||

| US650116CY01 / New York Transportation Development Corp. | 2,26 | −2,79 | 0,4417 | 0,0108 | |||||

| US594698QT24 / Michigan Strategic Fund | 2,25 | −1,14 | 0,4405 | 0,0182 | |||||

| US452153HR34 / ILLINOIS ST REGD B/E 5.00000000 | 2,24 | −4,56 | 0,4376 | 0,0029 | |||||

| IOWA ST FIN AUTH SF MTGE REVENUE / DBT (US4624677X38) | 2,23 | −0,49 | 0,4360 | 0,0206 | |||||

| NATIONAL FIN AUTH NH MUNI CTFS / DBT (US63607WAW47) | 2,18 | −2,72 | 0,4257 | 0,0108 | |||||

| US64990FYM03 / NEW YORK ST DORM AUTH ST PERSONAL INCOME TAX REVENUE | 2,12 | −4,84 | 0,4146 | 0,0016 | |||||

| HARRIS CNTY TX TOLL ROAD REVENUE / DBT (US41423PDY07) | 2,12 | −5,99 | 0,4139 | −0,0035 | |||||

| US56035DBW11 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 2,11 | −5,33 | 0,4126 | −0,0007 | |||||

| US49126PGE43 / Kentucky Economic Development Finance Authority, Revenue Bonds, CommonSpirit Health, Series 2019A-1 | 2,10 | −4,11 | 0,4102 | 0,0047 | |||||

| US167727C539 / City of Chicago IL Wastewater Transmission Revenue | 2,08 | −73,91 | 0,4060 | −1,0691 | |||||

| US66285WHD11 / North Texas Tollway Authority, Series 2011 B, RB | 2,06 | −3,43 | 0,4016 | 0,0074 | |||||

| US93878YDR71 / WASHINGTON DC MET AREA TRANSIT AUTH DEDICATED REVENUE | 2,03 | 0,3959 | 0,3959 | ||||||

| PENNSYLVANIA ST HGR EDUCTNL FACS AUTH REVENUE / DBT (US70917TRU78) | 2,00 | −32,68 | 0,3905 | −0,1594 | |||||

| US5946954R69 / MI ST TRUNK FD 5.50% 11/15/2049 | 1,99 | −3,68 | 0,3890 | 0,0061 | |||||

| US646080WP24 / NEW JERSEY ST HGR EDU ASSISTANCE AUTH STUDENT LOAN REVENUE | 1,94 | 0,99 | 0,3797 | 0,0232 | |||||

| US26444CHB19 / DULUTH MN ECON DEV AUTH HLTH CARE FACS REVENUE | 1,92 | −6,44 | 0,3750 | −0,0049 | |||||

| NORTH RIDGEVILLE OH CITY SCH DIST / DBT (US661870LV55) | 1,91 | −1,60 | 0,3724 | 0,0135 | |||||

| US254845MX58 / District of Columbia Water & Sewer Authority (Green Bonds), Series 2017 A, RB | 1,88 | −0,79 | 0,3680 | 0,0165 | |||||

| US89602HGG65 / TRIBOROUGH BRIDGE & TUNNEL AUTHORITY | 1,80 | −3,33 | 0,3515 | 0,0068 | |||||

| US153457AX48 / CENTRL FALLS RI DETENTION FAC CORP DETENTION FAC REVENUE | 1,77 | 10,11 | 0,3450 | 0,0480 | |||||

| US4423487H50 / HOUSTON TX ARPT SYS REVENUE | 1,77 | 0,00 | 0,3449 | 0,0179 | |||||

| US71883PMN41 / CITY OF PHOENIX AZ WASTEWATER REVENUE 5.25% 07-01-47 | 1,76 | −3,19 | 0,3445 | 0,0071 | |||||

| US649519DC68 / NEW YORK ST LIBERTY DEV CORP LIBERTY REVENUE | 1,76 | −0,06 | 0,3438 | 0,0178 | |||||

| US592250CL63 / MET PIER & EXPOSITION AUTH IL REVENUE | 1,74 | −6,30 | 0,3402 | −0,0040 | |||||

| US70869PHX87 / PENNSYLVANIA ST ECON DEV FINGAUTH REVENUE | 1,74 | −2,47 | 0,3396 | 0,0095 | |||||

| US292723AY90 / ENERGY S E AL A COOPERATIVE DIST ENERGY SPLY REVENUE | 1,73 | −1,14 | 0,3377 | 0,0139 | |||||

| US56035DGB29 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 1,73 | −2,04 | 0,3372 | 0,0107 | |||||

| US896035BD38 / TRIBOROUGH NY BRIDGE & TUNNEL AUTH SALES TAX REVENUE | 1,69 | −2,65 | 0,3309 | 0,0087 | |||||

| US650036AP19 / New York State Urban Development Corp | 1,68 | −5,85 | 0,3274 | −0,0022 | |||||

| WATERBURY CT HSG AUTH MF HSG REVENUE / DBT (US941260AB72) | 1,65 | 0,3227 | 0,3227 | ||||||

| US59261AG500 / MET TRANSPRTN AUTH NY REVENUE | 1,63 | −2,33 | 0,3189 | 0,0093 | |||||

| US13054WAC10 / California Pollution Control Financing Authority, Water Furnishing Revenue Bonds, Poseidon Resources Channelside LP Desalination Project, Series 2012 | 1,62 | −1,94 | 0,3162 | 0,0105 | |||||

| US727199C906 / PLANO ISD | 1,62 | −3,29 | 0,3159 | 0,0062 | |||||

| HOUSTON TX ARPT SYS REVENUE / DBT (US442349HZ22) | 1,60 | 0,3130 | 0,3130 | ||||||

| SOUTH CAROLINA ST PUBLIC SVC AUTH REVENUE / DBT (US8371514Y20) | 1,58 | 0,3092 | 0,3092 | ||||||

| NEW JERSEY ST TRANSPRTN TRUSTFUND AUTH / DBT (US64613CFG87) | 1,58 | −2,11 | 0,3085 | 0,0099 | |||||

| US59447TVA86 / Michigan Finance Authority, Hospital Revenue Bonds, McLaren Health Care, Refunding Series 2019A | 1,54 | −4,28 | 0,3013 | 0,0028 | |||||

| US64577HMN88 / NEW JERSEY ST ECON DEV AUTH ECON DEV REVENUE | 1,53 | −11,30 | 0,2992 | −0,0206 | |||||

| US650116AR77 / New York Transportation Development Corp. (LaGuardia Airport Terminal B Redevelopment), Series 2016 A, RB | 1,50 | −1,31 | 0,2940 | 0,0116 | |||||

| US64966QG792 / City of New York | 1,49 | −5,27 | 0,2914 | −0,0002 | |||||

| US84136FBL04 / MUNI PUT BOND ACT | 1,49 | −0,73 | 0,2909 | 0,0131 | |||||

| TEXAS ST A & M UNIV PERM UNIV FUND / DBT (US8821178Q05) | 1,48 | 0,2890 | 0,2890 | ||||||

| KANSAS CITY MO INDL DEV AUTH MF / DBT (US48504RAA86) | 1,48 | −6,35 | 0,2883 | −0,0035 | |||||

| ILLINOIS ST / DBT (US452153KF58) | 1,46 | 0,2856 | 0,2856 | ||||||

| NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE / DBT (US650116HR05) | 1,46 | 0,2843 | 0,2843 | ||||||

| US64990AJC09 / New York State Dormitory Authority Revenue | 1,44 | −3,75 | 0,2809 | 0,0043 | |||||

| VOLUSIA CNTY FL EDUCTNL FAC AUTH / DBT (US928836NY72) | 1,42 | −4,39 | 0,2770 | 0,0025 | |||||

| US48504NBF50 / KANSAS CITY MO INDL DEV AUTH ARPT SPL OBLIG | 1,33 | 0,2606 | 0,2606 | ||||||

| US48504NBD03 / KANSAS CITY MO INDL DEV AUTH ARPT SPL OBLIG | 1,32 | 0,2587 | 0,2587 | ||||||

| US84136GAK13 / Southeast Energy Authority A Cooperative District, Series 2023 B | 1,28 | −1,39 | 0,2496 | 0,0098 | |||||

| US25476FA572 / DIST OF COLUMBIA | 1,27 | 0,2490 | 0,2490 | ||||||

| US88034NGN84 / Tender Option Bond Trust Receipts/Certificates | 1,25 | −1,26 | 0,2449 | 0,0097 | |||||

| DIST OF COLUMBIA HSG FIN AGY MF TAX EXEMPT MTGE BACKED BONDS / DBT (US25477UAD63) | 1,25 | −4,44 | 0,2438 | 0,0021 | |||||

| FORT BEND TX INDEP SCH DIST / DBT (US346843WQ44) | 1,20 | −4,16 | 0,2342 | 0,0025 | |||||

| US39081HEL24 / GREAT LAKES MI WTR AUTH SEWAGE DISPOSAL SYS REVENUE | 1,18 | −1,50 | 0,2305 | 0,0088 | |||||

| US407272W252 / Hamilton (County of), OH (Cincinnati Childrens Hospital), Series 2019 CC, RB | 1,17 | −5,20 | 0,2279 | 0,0000 | |||||

| SOUTH CAROLINA ST JOBS-ECON DEV AUTH HLTH FACS REVENUE / DBT (US837032CF65) | 1,14 | −3,56 | 0,2221 | 0,0036 | |||||

| US87638TGV98 / TARRANT CNTY TX CULTURAL EDU FACS FIN CORP REVENUE | 1,13 | −3,25 | 0,2209 | 0,0044 | |||||

| JEFFERSON CNTY AL SWR REVENUE WARRANTS / DBT (US472682ZR71) | 1,11 | 0,2161 | 0,2161 | ||||||

| US59261AG435 / MET TRANSPRTN AUTH NY REVENUE | 1,09 | −2,42 | 0,2129 | 0,0062 | |||||

| US5742187N73 / Maryland Health and Higher Educational Facilities Authority, Revenue Bonds, University of Pittsburgh Medical Center, Series 2020B | 1,08 | −5,42 | 0,2114 | −0,0006 | |||||

| US167505PL47 / CHICAGO BOARD OF EDUCATION | 1,07 | −3,59 | 0,2099 | 0,0034 | |||||

| NORTH DAKOTA ST HSG FIN AGY / DBT (US6589098C37) | 1,07 | −2,11 | 0,2082 | 0,0066 | |||||

| US167505WB81 / CHICAGO IL BRD OF EDU | 1,05 | −4,87 | 0,2060 | 0,0006 | |||||

| US01728LGH96 / Allegheny County Airport Authority | 1,05 | −8,62 | 0,2051 | −0,0076 | |||||

| NATIONAL FIN AUTH NH MF AFFORDABLE HSG / DBT (US63610CAA18) | 1,03 | 0,2018 | 0,2018 | ||||||

| US167505SX57 / CHICAGO IL BRD OF EDU | 1,00 | −0,99 | 0,1961 | 0,0085 | |||||

| US650116GP57 / NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE | 1,00 | −3,38 | 0,1953 | 0,0037 | |||||

| US42934AAQ31 / HIDALGO CNTY TX REGL MOBILITY AUTH TOLL & VEHICLE REGISTRATI | 1,00 | −1,19 | 0,1949 | 0,0079 | |||||

| TEXAS ST DEPT OF HSG & CMNTY AFFAIRS RESDL MTG REVENUE / DBT (US882750XW73) | 0,97 | −1,43 | 0,1888 | 0,0073 | |||||

| SAN ANTONIO TX HSG TRUST PUBLIC FAC CORP MF TAX EXEMPT BDS / DBT (US79626WAC10) | 0,95 | −3,07 | 0,1853 | 0,0041 | |||||

| US353202FY53 / FRANKLIN CNTY OH REVENUE FRAGEN 12/44 FIXED 4 | 0,95 | −7,17 | 0,1847 | −0,0040 | |||||

| US362762QR03 / Gainesville (City of) & Hall (County of), GA Hospital Authority (Northeast Georgia Health System, Inc.), Series 2021 A, RB | 0,94 | −8,06 | 0,1829 | −0,0057 | |||||

| US249182TM89 / DENVER CITY & CNTY CO ARPT REVENUE | 0,93 | −2,94 | 0,1810 | 0,0042 | |||||

| TWO LAKES CDD FL SPL ASSMNT / DBT (US90207EAV39) | 0,92 | −4,85 | 0,1802 | 0,0007 | |||||

| KNOX CNTY TN HLTH EDUCTNL & HSG FAC BRD STUDENT HSG REVENUE / DBT (US499526AS07) | 0,92 | −0,65 | 0,1789 | 0,0081 | |||||

| US613603B658 / THOMAS JEFFERSON UNIV PA SF 4.0% 09-01-51 | 0,92 | −7,48 | 0,1788 | −0,0045 | |||||

| FLORIDA ST DEV FIN CORP / DBT (US340618DW45) | 0,90 | 0,1765 | 0,1765 | ||||||

| US04110FAB13 / Arkansas Development Finance Authority, Series 2023 | 0,90 | −3,64 | 0,1759 | 0,0028 | |||||

| NEW JERSEY ST TRANSPRTN TRUSTFUND AUTH / DBT (US64613CFC73) | 0,90 | −1,32 | 0,1759 | 0,0068 | |||||

| NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE / DBT (US650116HW99) | 0,90 | 0,1756 | 0,1756 | ||||||

| HOUSTON TX / DBT (US442332ED04) | 0,89 | 0,1743 | 0,1743 | ||||||

| MISSISSIPPI ST HOME CORP MF REVENUE / DBT (US60535NDQ79) | 0,89 | 0,1732 | 0,1732 | ||||||

| US09182TBT34 / BLACK BELT ENERGY GAS DIST AL GAS PROJECT REVENUE | 0,87 | −0,69 | 0,1696 | 0,0076 | |||||

| HILLSBOROUGH CNTY FLA INDL DEVAUTH HEALTH SYS REVENUE / DBT (US43233KAU88) | 0,87 | 0,1690 | 0,1690 | ||||||

| US041807CF34 / ARLINGTON TX HGR EDU FIN CORP EDU REVENUE | 0,85 | −4,39 | 0,1661 | 0,0013 | |||||

| US353202FP47 / Franklin County, Ohio, Revenue Bonds, Trinity Health Credit Group, Series 2017A | 0,84 | −1,18 | 0,1645 | 0,0067 | |||||

| UNIV OF COLORADO CO ENTERPRISE SYS REVENUE / DBT (US91417NKR51) | 0,77 | −4,25 | 0,1498 | 0,0015 | |||||

| US19648FWU47 / COLORADO ST HLTH FACS AUTH REVENUE | 0,77 | −2,92 | 0,1495 | 0,0035 | |||||

| US041807BH09 / ARLINGTON TX HGR EDU FIN CORP EDU REVENUE | 0,77 | −2,30 | 0,1495 | 0,0044 | |||||

| US13067RCZ47 / CALIFORNIA ST ENTERPRISE DEV AUTH REVENUE | 0,76 | −4,98 | 0,1494 | 0,0004 | |||||

| NATIONAL FIN AUTH NH MUNI CTFS / DBT (US63607WBD56) | 0,75 | 0,1474 | 0,1474 | ||||||

| WASHINGTON ST HSG FIN COMMISSION / DBT (US93978UAA43) | 0,74 | −5,27 | 0,1441 | −0,0000 | |||||

| US59447TVD26 / Michigan Finance Authority | 0,73 | −4,20 | 0,1427 | 0,0015 | |||||

| US613603YY94 / Montgomery (County of), PA Higher Education & Health Authority (Thomas Jefferson University), Series 2018 A, Ref. RB | 0,72 | −3,60 | 0,1412 | 0,0024 | |||||

| US97689QSN78 / WISCONSIN ST HSG & ECON DEV AUTH HOME OWNERSHIP REVENUE | 0,71 | −1,53 | 0,1382 | 0,0052 | |||||

| San Antonio Housing Trust Public Facility Corp / ABS-MBS (US79626WAB37) | 0,70 | −0,99 | 0,1362 | 0,0057 | |||||

| US25477GWB75 / District of Columbia Income Tax, Series 2023 A | 0,67 | −66,72 | 0,1307 | −0,2416 | |||||

| US20775DVR06 / Connecticut Health and Educational Facilities Authority, Revenue Bonds, Connecticut Children?s Medical Center and Subsidiaries, Series 2023E | 0,64 | −6,41 | 0,1256 | −0,0016 | |||||

| NEW YORK CITY NY MUNI WTR FIN AUTH WTR & SWR SYS REVENUE / DBT (US64972GL858) | 0,58 | 0,1131 | 0,1131 | ||||||

| US572682TH52 / Marshall Independent School District, Series 2023 | 0,57 | −5,77 | 0,1117 | −0,0008 | |||||

| TARRANT CNTY TX CULTURAL EDU FACS FIN CORP REVENUE / DBT (US87638TJK07) | 0,56 | −4,41 | 0,1103 | 0,0009 | |||||

| COLORADO HSG & FIN AUTH MF TAX-EXEMPT MTGE-BACKED SECURITIES / DBT (US19648WAD92) | 0,54 | −0,37 | 0,1055 | 0,0052 | |||||

| US414005Y857 / County of Harris, Series 2023 A | 0,52 | −6,77 | 0,1023 | −0,0017 | |||||

| WISCONSIN ST HLTH & EDUCTNL FACS AUTH REVENUE / DBT (US97712JJE47) | 0,48 | −2,26 | 0,0931 | 0,0028 | |||||

| NORTH DAKOTA ST HSG FIN AGY / DBT (US6589096Q41) | 0,47 | −3,11 | 0,0914 | 0,0020 | |||||

| NEW YORK NY / DBT (US64966SMF01) | 0,46 | 0,0906 | 0,0906 | ||||||

| US167505TG16 / CHICAGO IL BRD OF EDU | 0,45 | −1,09 | 0,0889 | 0,0038 | |||||

| US51265KFJ25 / Lakewood Ranch Stewardship District | 0,45 | −3,26 | 0,0870 | 0,0017 | |||||

| US167505TJ54 / Chicago (City of), IL Board of Education, Series 2017 H, GO Bonds | 0,43 | −6,26 | 0,0848 | −0,0010 | |||||

| US115117NH28 / BROWARD CNTY FL WTR & SWR UTILITY REVENUE | 0,41 | −5,08 | 0,0803 | −0,0000 | |||||

| VIRGINIA ST HSG DEV AUTH CMWLTH MTGE / DBT (US92812U6K97) | 0,39 | −2,75 | 0,0760 | 0,0018 | |||||

| US19648FWT73 / Colorado Health Facilities Authority | 0,37 | −4,91 | 0,0721 | 0,0003 | |||||

| NATIONAL FIN AUTH NH AFFORDABLE HSG CTFS / DBT (US63607DAB29) | 0,34 | −3,98 | 0,0662 | 0,0010 | |||||

| MISSOURI ST HSG DEV COMMISSION SF MTGE REVENUE / DBT (US60637B8G82) | 0,32 | −0,62 | 0,0625 | 0,0030 | |||||

| CONNECTICUT ST HSG FIN AUTH HSG MTGE FIN PROGRAM / DBT (US20775HM268) | 0,31 | −1,27 | 0,0608 | 0,0023 | |||||

| BLACK DESERT PUB INFRASTRUCTURE DIST UT SPL ASSMNT / DBT (US09204TAA97) | 0,30 | −3,83 | 0,0589 | 0,0010 | |||||

| NORTH CAROLINA ST MED CARE COMMISSION RETMNT FACS REVENUE / DBT (US65820YSY31) | 0,20 | −0,51 | 0,0383 | 0,0017 | |||||

| US228130KH25 / CROWLEY TX INDEP SCH DIST | 0,18 | −4,32 | 0,0347 | 0,0003 | |||||

| US378287BA35 / GLENDALE AZ ID 5% 5/15/2056 | 0,17 | −5,00 | 0,0334 | 0,0000 | |||||

| VIRGINIA ST HSG DEV AUTH CMWLTH MTGE / DBT (US92812U6J25) | 0,14 | −3,47 | 0,0273 | 0,0005 | |||||

| ILLINOIS ST FIN AUTH REVENUE / DBT (US45204FYF60) | 0,09 | −1,15 | 0,0168 | 0,0007 | |||||

| US414009HH65 / HARRIS CNTY TX CULTURAL EDU FACS FIN CORP REVENUE | 0,04 | 0,00 | 0,0078 | 0,0004 | |||||

| US13062T4G61 / California State, General Obligation Bonds, Series 2004 | 0,01 | 0,00 | 0,0020 | 0,0001 | |||||

| NEW YORK NY CITY TRANSITIONAL FIN AUTH REV / DBT (US64972JPT96) | 0,00 | −100,00 | 0,0000 | −1,9596 | |||||

| JEA FL WTR & SWR REVENUE / DBT (US46615SFP83) | 0,00 | −100,00 | 0,0000 | −1,1602 |