Grundläggande statistik

| Portföljvärde | $ 105 588 313 |

| Aktuella positioner | 111 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

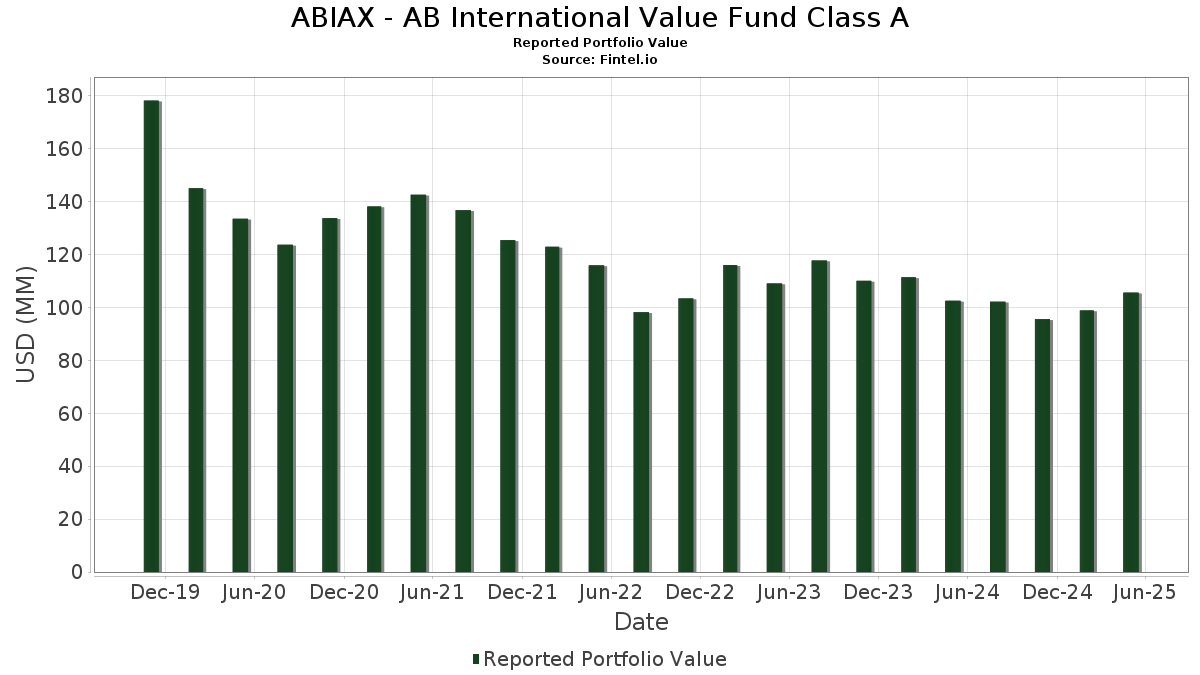

ABIAX - AB International Value Fund Class A har redovisat 111 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 105 588 313 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). ABIAX - AB International Value Fund Class As största innehav är Roche Holding AG - Depositary Receipt (Common Stock) (US:RHHBY) , Shell plc (NL:SHELL) , Resona Holdings, Inc. (US:RSNHF) , Airbus SE (FR:AIR) , and AXA SA (FR:CS) . ABIAX - AB International Value Fund Class As nya positioner inkluderar NTT DATA Group Corporation (US:NTTDF) , Mitsubishi Electric Corporation (MX:MITS N) , Persol Holdings Co.,Ltd. (JP:2181) , Toyo Suisan Kaisha, Ltd. (US:TSUKF) , and Keisei Electric Railway Co., Ltd. (JP:9009) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 0,08 | 2,30 | 2,0884 | 2,0884 | |

| 0,08 | 1,65 | 1,5003 | 1,5003 | |

| 0,86 | 1,61 | 1,4620 | 1,4620 | |

| 0,02 | 1,56 | 1,4155 | 1,4155 | |

| 0,15 | 1,39 | 1,2596 | 1,2596 | |

| 0,01 | 1,08 | 0,9790 | 0,9790 | |

| 0,04 | 2,32 | 2,1071 | 0,6336 | |

| 0,04 | 1,80 | 1,6347 | 0,5330 | |

| 0,09 | 2,20 | 2,0007 | 0,4509 | |

| 0,16 | 1,86 | 1,6884 | 0,4185 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 0,05 | 1,78 | 1,6201 | −1,1251 | |

| 0,08 | 2,19 | 1,9927 | −1,0211 | |

| 0,00 | 0,00 | −0,6164 | ||

| 0,13 | 1,40 | 1,2687 | −0,6041 | |

| 0,03 | 1,38 | 1,2518 | −0,5793 | |

| 0,01 | 3,58 | 3,2514 | −0,5782 | |

| 0,02 | 1,41 | 1,2811 | −0,5503 | |

| 0,82 | 0,82 | 0,7464 | −0,4503 | |

| 0,02 | 1,93 | 1,7550 | −0,4363 | |

| 0,10 | 3,20 | 2,9023 | −0,4208 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-07-25 för rapporteringsperioden 2025-05-31. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0,01 | −3,00 | 3,58 | −5,64 | 3,2514 | −0,5782 | |||

| SHELL / Shell plc | 0,10 | −1,80 | 3,20 | −2,95 | 2,9023 | −0,4208 | |||

| RSNHF / Resona Holdings, Inc. | 0,31 | −2,13 | 2,73 | 10,86 | 2,4752 | −0,0060 | |||

| AIR / Airbus SE | 0,01 | −1,05 | 2,59 | 5,03 | 2,3530 | −0,1369 | |||

| CS / AXA SA | 0,05 | −2,18 | 2,50 | 17,90 | 2,2670 | 0,1307 | |||

| TKY / Tokyo Electron Limited | 0,02 | 20,92 | 2,47 | 27,28 | 2,2460 | 0,2846 | |||

| H6D0 / Haleon plc | 0,43 | −2,62 | 2,38 | 7,95 | 2,1569 | −0,0636 | |||

| CCJ / Cameco Corporation | 0,04 | 19,52 | 2,32 | 58,90 | 2,1071 | 0,6336 | |||

| NTTDF / NTT DATA Group Corporation | 0,08 | 2,30 | 2,0884 | 2,0884 | |||||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0,02 | −7,89 | 2,28 | 1,65 | 2,0742 | −0,1935 | |||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 0,09 | 0,00 | 2,26 | 36,35 | 2,0505 | 0,3789 | |||

| 27M / Melrose Industries PLC | 0,35 | 31,01 | 2,22 | 2,26 | 2,0136 | −0,1748 | |||

| BA. / BAE Systems plc | 0,09 | 0,05 | 2,20 | 43,42 | 2,0007 | 0,4509 | |||

| SNEJF / Sony Group Corporation | 0,08 | −31,32 | 2,19 | −26,52 | 1,9927 | −1,0211 | |||

| RYSD / NatWest Group plc | 0,31 | −2,65 | 2,19 | 14,06 | 1,9898 | 0,0513 | |||

| IDEXY / Industria de Diseño Textil, S.A. - Depositary Receipt (Common Stock) | 0,04 | 6,35 | 2,03 | 7,26 | 1,8385 | −0,0671 | |||

| ENLAY / Enel SpA - Depositary Receipt (Common Stock) | 0,21 | −0,01 | 1,94 | 25,55 | 1,7581 | 0,2014 | |||

| CRH / CRH plc | 0,02 | 0,09 | 1,93 | −10,96 | 1,7550 | −0,4363 | |||

| TYIDY / Toyota Industries Corporation - Depositary Receipt (Common Stock) | 0,02 | −10,47 | 1,93 | 28,85 | 1,7481 | 0,2399 | |||

| CCEP / COCA COLA EUROPACIFIC COMPANY GUAR REGS 11/27 1.5 | 0,02 | −2,61 | 1,92 | 3,61 | 1,7447 | −0,1261 | |||

| PRU / Prudential plc | 0,16 | 19,60 | 1,86 | 47,77 | 1,6884 | 0,4185 | |||

| VCISY / Vinci SA - Depositary Receipt (Common Stock) | 0,01 | −2,64 | 1,86 | 20,91 | 1,6858 | 0,1364 | |||

| BBVA / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 0,12 | −2,87 | 1,83 | 10,04 | 1,6625 | −0,0171 | |||

| SSNLF / Samsung Electronics Co., Ltd. | 0,04 | 52,07 | 1,80 | 64,99 | 1,6347 | 0,5330 | |||

| EDPFY / EDP - Energias de Portugal, S.A. - Depositary Receipt (Common Stock) | 0,45 | −3,67 | 1,80 | 19,31 | 1,6328 | 0,1123 | |||

| HNDAF / Honda Motor Co., Ltd. | 0,18 | 26,59 | 1,78 | 38,19 | 1,6205 | 0,3177 | |||

| DTEGY / Deutsche Telekom AG - Depositary Receipt (Common Stock) | 0,05 | −37,50 | 1,78 | −34,41 | 1,6201 | −1,1251 | |||

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 0,06 | −3,30 | 1,77 | 1,14 | 1,6100 | −0,1595 | |||

| DSN / Danske Bank A/S | 0,05 | −3,23 | 1,75 | 10,25 | 1,5933 | −0,0127 | |||

| RYAAY / Ryanair Holdings plc - Depositary Receipt (Common Stock) | 0,03 | −3,56 | 1,70 | 10,47 | 1,5429 | −0,0089 | |||

| ASRNL / ASR Nederland N.V. | 0,03 | −3,22 | 1,69 | 17,00 | 1,5312 | 0,0763 | |||

| 8801 / Mitsui Fudosan Co., Ltd. | 0,17 | 0,40 | 1,67 | 10,57 | 1,5200 | −0,0081 | |||

| MITS N / Mitsubishi Electric Corporation | 0,08 | 1,65 | 1,5003 | 1,5003 | |||||

| TLS / Telstra Group Limited | 0,53 | −3,56 | 1,62 | 15,06 | 1,4716 | 0,0506 | |||

| KPN / Koninklijke KPN N.V. | 0,34 | −2,92 | 1,61 | 19,50 | 1,4644 | 0,1033 | |||

| 2181 / Persol Holdings Co.,Ltd. | 0,86 | 1,61 | 1,4620 | 1,4620 | |||||

| CNH / CNH Industrial N.V. | 0,13 | 13,25 | 1,60 | 10,03 | 1,4546 | −0,0150 | |||

| LUNMF / Lundin Mining Corporation | 0,17 | −3,77 | 1,57 | 13,73 | 1,4223 | 0,0322 | |||

| TSUKF / Toyo Suisan Kaisha, Ltd. | 0,02 | 1,56 | 1,4155 | 1,4155 | |||||

| REPYY / Repsol, S.A. - Depositary Receipt (Common Stock) | 0,11 | −3,78 | 1,42 | 1,79 | 1,2924 | −0,1188 | |||

| EBS / Erste Group Bank AG | 0,02 | −35,16 | 1,41 | −22,26 | 1,2811 | −0,5503 | |||

| KURRF / Kuraray Co., Ltd. | 0,11 | 40,20 | 1,40 | 41,11 | 1,2748 | 0,2707 | |||

| XSZ / Shimizu Corporation | 0,13 | −36,86 | 1,40 | −24,73 | 1,2687 | −0,6041 | |||

| TOS / Tosoh Corporation | 0,09 | 0,21 | 1,40 | 8,55 | 1,2684 | −0,0304 | |||

| 9009 / Keisei Electric Railway Co., Ltd. | 0,15 | 1,39 | 1,2596 | 1,2596 | |||||

| MRL / Marlowe plc | 0,11 | 29,23 | 1,38 | 48,55 | 1,2530 | 0,3153 | |||

| FRE / Frendy Energy S.p.A. | 0,03 | −38,02 | 1,38 | −24,04 | 1,2518 | −0,5793 | |||

| VK / Vallourec S.A. | 0,08 | −3,21 | 1,34 | −16,28 | 1,2140 | −0,3973 | |||

| SHL / Siemens Healthineers AG | 0,02 | 0,00 | 1,32 | −5,31 | 1,1983 | −0,2081 | |||

| GSK1 N / GSK plc | 0,06 | 0,00 | 1,32 | 10,11 | 1,1974 | −0,0113 | |||

| BB2 / Burberry Group plc | 0,09 | −5,36 | 1,31 | −3,76 | 1,1872 | −0,1836 | |||

| MRK / Marks Electrical Group PLC | 0,01 | −3,51 | 1,21 | −10,97 | 1,0982 | −0,2725 | |||

| KWHIF / Kawasaki Heavy Industries, Ltd. | 0,02 | −36,33 | 1,09 | −11,57 | 0,9932 | −0,2543 | |||

| 669 / Techtronic Industries Company Limited | 0,10 | −0,51 | 1,08 | −20,82 | 0,9809 | −0,3958 | |||

| ICLR / ICON Public Limited Company | 0,01 | 1,08 | 0,9790 | 0,9790 | |||||

| ARKAY / Arkema S.A. - Depositary Receipt (Common Stock) | 0,02 | −4,00 | 1,08 | −16,71 | 0,9786 | −0,3265 | |||

| NXPI / NXP Semiconductors N.V. | 0,01 | 0,00 | 1,02 | −11,28 | 0,9216 | −0,2337 | |||

| JD. / JD Sports Fashion Plc | 0,80 | −5,83 | 0,90 | 8,13 | 0,8212 | −0,0230 | |||

| AA2 / Amada Co., Ltd. | 0,08 | 0,00 | 0,83 | 6,69 | 0,7533 | −0,0307 | |||

| US0186167484 / AB Fixed Income Shares, Inc. - Government Money Market Portfolio | 0,82 | −30,68 | 0,82 | −30,69 | 0,7464 | −0,4503 | |||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,38 | 0,3471 | 0,3471 | ||||||

| PURCHASED ILS / SOLD USD / DFE (000000000) | 0,06 | 0,0520 | 0,0520 | ||||||

| PURCHASED NOK / SOLD USD / DFE (000000000) | 0,03 | 0,0259 | 0,0259 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | 0,01 | 0,0081 | 0,0081 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0,01 | 0,0067 | 0,0067 | ||||||

| PURCHASED USD / SOLD HKD / DFE (000000000) | 0,01 | 0,0065 | 0,0065 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,01 | 0,0061 | 0,0061 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,01 | 0,0054 | 0,0054 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | 0,00 | 0,0037 | 0,0037 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | 0,00 | 0,0037 | 0,0037 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | 0,00 | 0,0032 | 0,0032 | ||||||

| PURCHASED CAD / SOLD USD / DFE (000000000) | 0,00 | 0,0025 | 0,0025 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | 0,00 | 0,0024 | 0,0024 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | 0,00 | 0,0023 | 0,0023 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0,00 | 0,0023 | 0,0023 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | 0,00 | 0,0019 | 0,0019 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | 0,00 | 0,0019 | 0,0019 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0,00 | 0,0018 | 0,0018 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0,00 | 0,0018 | 0,0018 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,00 | 0,0015 | 0,0015 | ||||||

| PURCHASED SEK / SOLD USD / DFE (000000000) | 0,00 | 0,0014 | 0,0014 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,00 | 0,0012 | 0,0012 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,00 | 0,0012 | 0,0012 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,00 | 0,0010 | 0,0010 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,00 | 0,0010 | 0,0010 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| PURCHASED SEK / SOLD USD / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | ||||||

| PURCHASED SEK / SOLD USD / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | ||||||

| PURCHASED NZD / SOLD USD / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | ||||||

| FELTF / Fuji Electric Co., Ltd. | 0,00 | −100,00 | 0,00 | −100,00 | −0,6164 | ||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | −0,00 | −0,0001 | −0,0001 | ||||||

| PURCHASED SGD / SOLD USD / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | −0,00 | −0,0005 | −0,0005 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | −0,00 | −0,0006 | −0,0006 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | −0,00 | −0,0010 | −0,0010 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | −0,00 | −0,0010 | −0,0010 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | −0,00 | −0,0011 | −0,0011 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | −0,00 | −0,0024 | −0,0024 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,00 | −0,0025 | −0,0025 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | −0,00 | −0,0042 | −0,0042 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | −0,00 | −0,0044 | −0,0044 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | −0,01 | −0,0053 | −0,0053 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | −0,01 | −0,0071 | −0,0071 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | −0,01 | −0,0083 | −0,0083 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,02 | −0,0153 | −0,0153 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,02 | −0,0153 | −0,0153 | ||||||

| PURCHASED USD / SOLD TWD / DFE (000000000) | −0,02 | −0,0221 | −0,0221 | ||||||

| DGZ / DB Gold Short ETN | −0,03 | −0,0255 | −0,0255 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,03 | −0,0283 | −0,0283 | ||||||

| PURCHASED USD / SOLD KRW / DFE (000000000) | −0,05 | −0,0498 | −0,0498 |