Grundläggande statistik

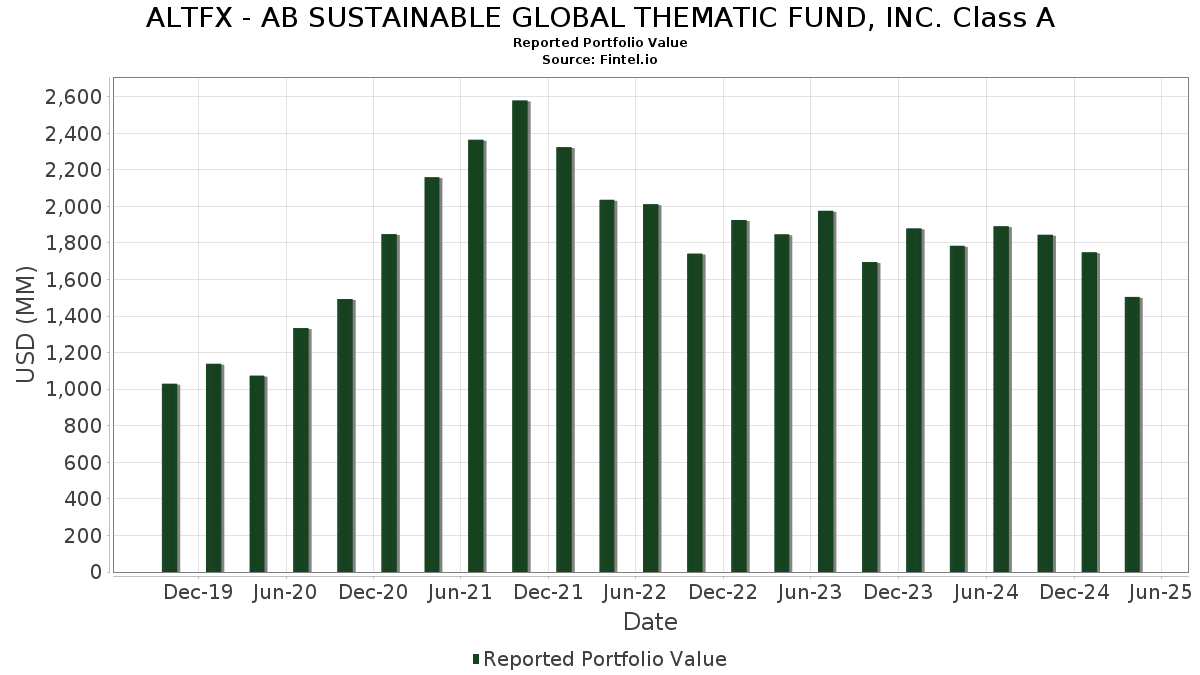

| Portföljvärde | $ 1 504 544 923 |

| Aktuella positioner | 86 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

ALTFX - AB SUSTAINABLE GLOBAL THEMATIC FUND, INC. Class A har redovisat 86 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 1 504 544 923 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). ALTFX - AB SUSTAINABLE GLOBAL THEMATIC FUND, INC. Class As största innehav är Microsoft Corporation (US:MSFT) , London Stock Exchange Group plc (US:LDNXF) , MercadoLibre, Inc. (US:MELI) , Taiwan Semiconductor Manufacturing Company Limited (TW:2330) , and Alcon Inc. (CH:ALC) . ALTFX - AB SUSTAINABLE GLOBAL THEMATIC FUND, INC. Class As nya positioner inkluderar LPL Financial Holdings Inc. (US:LPLA) , SAP SE (US:SAPGF) , Broadcom Inc. (US:AVGO) , .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 0,09 | 28,90 | 1,9054 | 1,9054 | |

| 0,13 | 28,40 | 1,8723 | 1,8723 | |

| 0,09 | 24,91 | 1,6423 | 1,6423 | |

| 0,11 | 20,92 | 1,3790 | 1,3790 | |

| 1,94 | 39,02 | 2,5722 | 1,1938 | |

| 39,34 | 39,34 | 2,5933 | 1,0401 | |

| 0,91 | 40,94 | 2,6993 | 0,7183 | |

| 0,43 | 41,35 | 2,7262 | 0,5769 | |

| 0,30 | 46,01 | 3,0333 | 0,3495 | |

| 0,52 | 28,21 | 1,8595 | 0,2931 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 0,08 | 23,44 | 1,5454 | −0,8972 | |

| 0,09 | 31,98 | 2,1080 | −0,7430 | |

| 0,41 | 19,23 | 1,2678 | −0,6635 | |

| 0,22 | 17,85 | 1,1765 | −0,5730 | |

| 0,08 | 12,66 | 0,8348 | −0,5468 | |

| 0,13 | 34,33 | 2,2632 | −0,3972 | |

| 0,24 | 20,13 | 1,3268 | −0,3937 | |

| 1,19 | 40,85 | 2,6933 | −0,3311 | |

| 2,51 | 31,21 | 2,0573 | −0,3239 | |

| 1,50 | 42,39 | 2,7945 | −0,3217 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-06-26 för rapporteringsperioden 2025-04-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0,14 | −6,31 | 56,59 | −10,78 | 3,7306 | 0,1039 | |||

| LDNXF / London Stock Exchange Group plc | 0,30 | −6,32 | 46,01 | −1,97 | 3,0333 | 0,3495 | |||

| MELI / MercadoLibre, Inc. | 0,02 | −22,68 | 43,00 | −6,24 | 2,8346 | 0,2125 | |||

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 1,50 | −8,39 | 42,39 | −22,22 | 2,7945 | −0,3217 | |||

| ALC / Alcon Inc. | 0,43 | 3,32 | 41,35 | 10,01 | 2,7262 | 0,5769 | |||

| CCJ / Cameco Corporation | 0,91 | 29,41 | 40,94 | 18,18 | 2,6993 | 0,7183 | |||

| FLEX / Flex Ltd. | 1,19 | −6,32 | 40,85 | −22,76 | 2,6933 | −0,3311 | |||

| US0186167484 / AB Fixed Income Shares, Inc. - Government Money Market Portfolio | 39,34 | 44,82 | 39,34 | 44,81 | 2,5933 | 1,0401 | |||

| SBSP3 / Companhia de Saneamento Básico do Estado de São Paulo - SABESP | 1,94 | 30,51 | 39,02 | 61,85 | 2,5722 | 1,1938 | |||

| VLTO / Veralto Corporation | 0,39 | −6,32 | 37,71 | −13,11 | 2,4861 | 0,0046 | |||

| FI / Fiserv, Inc. | 0,20 | −6,32 | 36,86 | −19,97 | 2,4298 | −0,2033 | |||

| WM / Waste Management, Inc. | 0,15 | −23,30 | 35,54 | −18,74 | 2,3430 | −0,1578 | |||

| NEE / NextEra Energy, Inc. | 0,53 | −6,32 | 35,50 | −12,45 | 2,3406 | 0,0219 | |||

| CRM / Salesforce, Inc. | 0,13 | −6,18 | 34,33 | −26,22 | 2,2632 | −0,3972 | |||

| TUO / Terumo Corporation | 1,74 | −5,42 | 33,39 | −3,57 | 2,2012 | 0,2214 | |||

| AAGIY / AIA Group Limited - Depositary Receipt (Common Stock) | 4,40 | −6,32 | 32,95 | −0,15 | 2,1722 | 0,2853 | |||

| CDNS / Cadence Design Systems, Inc. | 0,11 | −6,32 | 32,45 | −6,28 | 2,1392 | 0,1595 | |||

| V / Visa Inc. | 0,09 | −36,56 | 31,98 | −35,87 | 2,1080 | −0,7430 | |||

| CH1134540470 / On Holding AG | 0,65 | −6,32 | 31,46 | −24,73 | 2,0739 | −0,3159 | |||

| NU / Nu Holdings Ltd. | 2,51 | −20,18 | 31,21 | −25,07 | 2,0573 | −0,3239 | |||

| ROK / Rockwell Automation, Inc. | 0,13 | −6,32 | 31,08 | −16,66 | 2,0490 | −0,0835 | |||

| KEE / Keyence Corporation | 0,07 | −5,36 | 31,02 | −8,13 | 2,0452 | 0,1144 | |||

| ACM / AECOM | 0,30 | −6,32 | 29,81 | −12,35 | 1,9655 | 0,0205 | |||

| BDX / Becton, Dickinson and Company | 0,14 | −6,32 | 29,54 | −21,65 | 1,9474 | −0,2084 | |||

| GEHC / GE HealthCare Technologies Inc. | 0,42 | −6,32 | 29,42 | −25,38 | 1,9396 | −0,3150 | |||

| LPLA / LPL Financial Holdings Inc. | 0,09 | 28,90 | 1,9054 | 1,9054 | |||||

| H11 / Halma plc | 0,78 | −6,32 | 28,72 | −7,69 | 1,8937 | 0,1144 | |||

| AAPL / Apple Inc. | 0,13 | 28,40 | 1,8723 | 1,8723 | |||||

| RDEB / RELX PLC | 0,52 | −6,32 | 28,21 | 2,96 | 1,8595 | 0,2931 | |||

| EMR / Emerson Electric Co. | 0,26 | −6,32 | 27,74 | −24,23 | 1,8285 | −0,2645 | |||

| NXPI / NXP Semiconductors N.V. | 0,15 | 8,68 | 27,71 | −3,95 | 1,8267 | 0,1772 | |||

| EXPGY / Experian plc - Depositary Receipt (Common Stock) | 0,53 | −6,32 | 26,58 | −5,38 | 1,7521 | 0,1460 | |||

| PRY / Tion Renewables AG | 0,46 | 21,59 | 25,11 | −3,98 | 1,6555 | 0,1602 | |||

| WSP / WSP Global Inc. | 0,14 | −6,32 | 25,05 | −2,14 | 1,6514 | 0,1877 | |||

| SAPGF / SAP SE | 0,09 | 24,91 | 1,6423 | 1,6423 | |||||

| TTEK / Tetra Tech, Inc. | 0,78 | −5,96 | 24,40 | −20,29 | 1,6088 | −0,1418 | |||

| SYK / Stryker Corporation | 0,06 | −7,49 | 23,87 | −11,60 | 1,5737 | 0,0297 | |||

| ACN / Accenture plc | 0,08 | −29,39 | 23,44 | −45,13 | 1,5454 | −0,8972 | |||

| NVDA / NVIDIA Corporation | 0,21 | −6,17 | 22,66 | −14,89 | 1,4938 | −0,0284 | |||

| Aptiv PLC / EC (JE00BTDN8H13) | 0,39 | −6,32 | 22,41 | −14,36 | 1,4771 | −0,0189 | |||

| RGA / Reinsurance Group of America, Incorporated | 0,12 | −6,32 | 22,02 | −22,99 | 1,4514 | −0,1833 | |||

| PANW / Palo Alto Networks, Inc. | 0,12 | −6,31 | 21,75 | −5,04 | 1,4336 | 0,1242 | |||

| AVGO / Broadcom Inc. | 0,11 | 20,92 | 1,3790 | 1,3790 | |||||

| ANET / Arista Networks Inc | 0,24 | −6,32 | 20,13 | −33,11 | 1,3268 | −0,3937 | |||

| MPWR / Monolithic Power Systems, Inc. | 0,03 | −6,32 | 20,05 | −12,82 | 1,3220 | 0,0067 | |||

| JEF / Jefferies Financial Group Inc. | 0,41 | −6,32 | 19,23 | −43,07 | 1,2678 | −0,6635 | |||

| PGHN / Partners Group Holding AG | 0,01 | −6,32 | 17,87 | −19,20 | 1,1780 | −0,0865 | |||

| APOLLOHOSP / Apollo Hospitals Enterprise Limited | 0,22 | −44,43 | 17,85 | −41,68 | 1,1765 | −0,5730 | |||

| HOLX / Hologic, Inc. | 0,30 | −6,32 | 17,29 | −24,42 | 1,1396 | −0,1682 | |||

| ICLR / ICON Public Limited Company | 0,08 | −31,11 | 12,66 | −47,60 | 0,8348 | −0,5468 | |||

| TMRA / Tomra Systems ASA | 0,77 | −36,11 | 12,20 | −31,81 | 0,8046 | −0,2188 | |||

| BRKR / Bruker Corporation | 0,21 | −5,69 | 8,45 | −35,03 | 0,5568 | −0,1865 | |||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 1,55 | 0,1025 | 0,1025 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,45 | 0,0297 | 0,0297 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,33 | 0,0215 | 0,0215 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0,23 | 0,0153 | 0,0153 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,17 | 0,0114 | 0,0114 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,15 | 0,0100 | 0,0100 | ||||||

| PURCHASED SEK / SOLD USD / DFE (000000000) | 0,15 | 0,0099 | 0,0099 | ||||||

| PURCHASED ZAR / SOLD USD / DFE (000000000) | 0,13 | 0,0088 | 0,0088 | ||||||

| PURCHASED TWD / SOLD USD / DFE (000000000) | 0,12 | 0,0079 | 0,0079 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,12 | 0,0076 | 0,0076 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,08 | 0,0050 | 0,0050 | ||||||

| PURCHASED KRW / SOLD USD / DFE (000000000) | 0,06 | 0,0042 | 0,0042 | ||||||

| PURCHASED USD / SOLD SEK / DFE (000000000) | 0,03 | 0,0019 | 0,0019 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,02 | 0,0013 | 0,0013 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,02 | 0,0013 | 0,0013 | ||||||

| PURCHASED USD / SOLD HKD / DFE (000000000) | 0,01 | 0,0007 | 0,0007 | ||||||

| BNP / BNP Paribas SA | 0,01 | 0,0004 | 0,0004 | ||||||

| BNP / BNP Paribas SA | −0,01 | −0,0004 | −0,0004 | ||||||

| BNP / BNP Paribas SA | −0,01 | −0,0004 | −0,0004 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | −0,03 | −0,0017 | −0,0017 | ||||||

| DGZ / DB Gold Short ETN | −0,10 | −0,0066 | −0,0066 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,12 | −0,0080 | −0,0080 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | −0,13 | −0,0088 | −0,0088 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,15 | −0,0101 | −0,0101 | ||||||

| PURCHASED USD / SOLD NOK / DFE (000000000) | −0,17 | −0,0109 | −0,0109 | ||||||

| DGZ / DB Gold Short ETN | −0,17 | −0,0114 | −0,0114 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | −0,23 | −0,0151 | −0,0151 | ||||||

| DGZ / DB Gold Short ETN | −0,23 | −0,0152 | −0,0152 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | −0,33 | −0,0217 | −0,0217 | ||||||

| PURCHASED USD / SOLD TWD / DFE (000000000) | −0,48 | −0,0318 | −0,0318 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,54 | −0,0358 | −0,0358 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −2,26 | −0,1488 | −0,1488 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −2,26 | −0,1488 | −0,1488 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −4,12 | −0,2717 | −0,2717 |